Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - FAUQUIER BANKSHARES, INC. | pressrelease.htm |

| 8-K - CURRENT REPORT - FAUQUIER BANKSHARES, INC. | form8k052113.htm |

_____________________ FAUQUIER BANKSHARES, INC. ANNUAL SHAREHOLDERS’ MEETING Deeply rooted in our community. May 21, 2013

Safe Harbor Statement Today’s presentations may include forward-looking statements. These statements represent the company's beliefs regarding future events that, by their nature, are uncertain and outside of the company’s control. The company’s actual results and financial condition may differ, possibly materially, from what is indicated in these forward-looking statements. For a discussion of some of the risks and factors that could affect the company’s future results, please see the description of Risk Factors in our current annual report on Form 10-K for the year ended December 31, 2012. * FAUQUIER BANKSHARES, INC.

Financial Condition FAUQUIER BANKSHARES, INC. *

* Total Assets FAUQUIER BANKSHARES, INC.

* Loans, Net FAUQUIER BANKSHARES, INC. As of December 31. 4 YR - CAGR – 12/31/2008 – 12/31/2012 Source: Fauquier Bankshares Financials 4 YR - CAGR 0.58%

* Loan Portfolio Loan Portfolio At December 31, 2012 FAUQUIER BANKSHARES, INC.

* Nonperforming Loans to Period End Loans FAUQUIER BANKSHARES, INC. BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* Loan Losses (Net of Recoveries) As a Percentage of Average Total Loans FAUQUIER BANKSHARES, INC. BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* FAUQUIER BANKSHARES, INC. Allowance for Loan Loss As a Percentage of Total Loans BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* FAUQUIER BANKSHARES, INC. Allowance for Loan Loss As a Percentage of 90 Days Past Due & Nonaccrual Loans BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* Hospitality Loans (Commercial Real Estate Loan Segment) FAUQUIER BANKSHARES, INC. Source: Fauquier Bankshares Financials (In thousands) Outstanding Balance 12/31/11 Outstanding Balance 12/31/12 Outstanding Balance 3/31/13 Not Impaired $ 19,358 $ 8,885 $ 9,021 Impaired 4,199 7,230 6,789 Total hospitality loans $ 23,557 $ 16,115 $ 15,810 Performing $ 23,557 $ 8,885 $ 9,021 Non-performing - 7,230 6,789 Total hospitality loans $ 23,557 $ 16,115 $ 15,810 At March 31, 2013 hospitality loans totaled $15.8 million or 3.51% of total loans.

* Hospitality Loans (Commercial Real Estate Loan Segment) FAUQUIER BANKSHARES, INC. Source: Fauquier Bankshares Financials (In thousands) U. S. Government Guarantee 12/31/11 U. S. Government Guarantee 12/31/12 U. S. Government Guarantee 3/31/13 Not Impaired $ - $ - $ - Impaired 2,388 2,358 2,358 Total hospitality loans $ 2,388 $ 2,358 $ 2,358 Performing $ 2,388 $ - $ - Non-performing - 2,358 2,358 Total hospitality loans $ 2,388 $ 2,358 $ 2,358 At March 31, 2013 hospitality loans totaled $15.8 million or 3.51% of total loans.

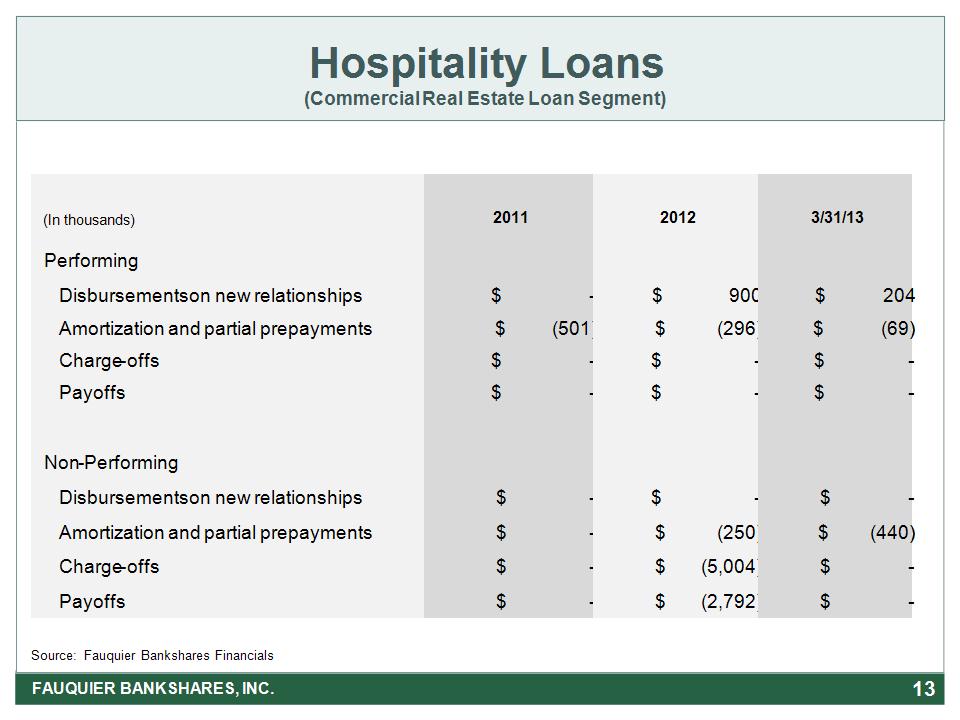

* Hospitality Loans (Commercial Real Estate Loan Segment) FAUQUIER BANKSHARES, INC. Source: Fauquier Bankshares Financials (In thousands) 2011 2012 3/31/13 Performing Disbursements on new relationships $ - $ 900 $ 204 Amortization and partial prepayments $ (501) $ (296) $ (69) Charge-offs $ - $ - $ - Payoffs $ - $ - $ - Non-Performing Disbursements on new relationships $ - $ - $ - Amortization and partial prepayments $ - $ (250) $ (440) Charge-offs $ - $ (5,004) $ - Payoffs $ - $ (2,792) $ -

* Total Deposits FAUQUIER BANKSHARES, INC. Source: Fauquier Bankshares Financials As of December 31. 4 YR - CAGR – 12/31/2008 – 12/31/2012

Deposit Portfolio FAUQUIER BANKSHARES, INC. Average Daily Balances for Twelve Months Ended December 31, 2012 Transaction Accounts (As of December 31) Transaction Accounts (As of December 31) Transaction Accounts (As of December 31) Transaction Accounts (As of December 31) Dec 2012 Dec 2011 % Change DDA $89,264 $75,311 18.53% NOW $191,039 $184,383 3.61% Totals $280,303 $259,694 7.94% Source: Fauquier Bankshares Financials CDARS are large-dollar investments of local depositors in FDIC insured CDs. Brokered CDs are used to offset interest rate risk. *

Financial Performance and Goals FAUQUIER BANKSHARES, INC. *

Return on Average Equity (ROAE) FAUQUIER BANKSHARES, INC. * BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* Net Income (ROAA) (As a Percent of Average Assets) FAUQUIER BANKSHARES, INC. BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

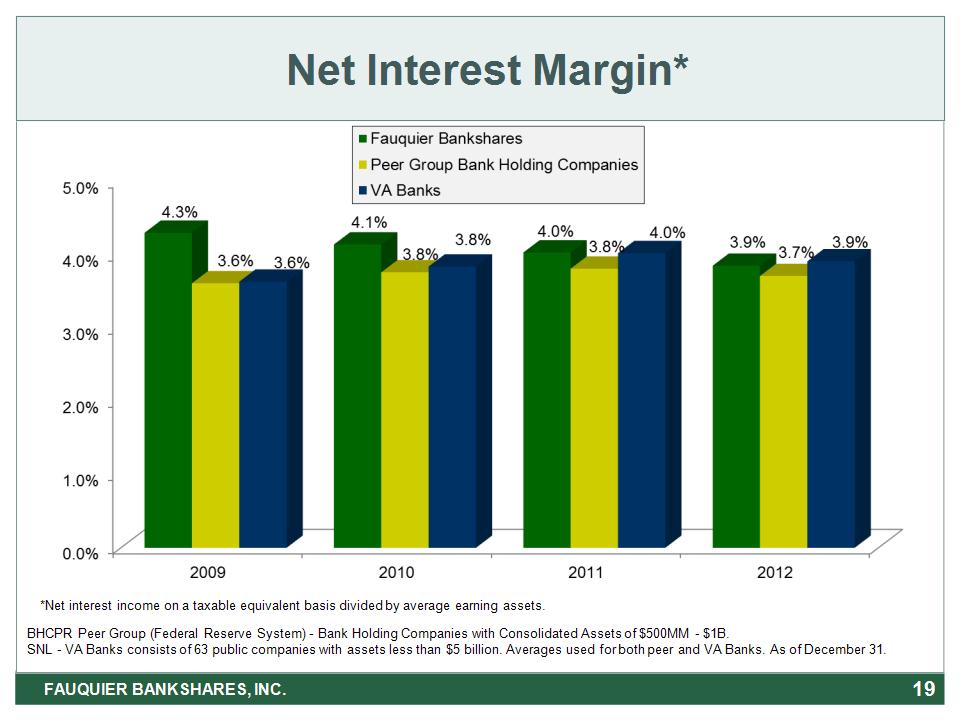

Net Interest Margin* * FAUQUIER BANKSHARES, INC. *Net interest income on a taxable equivalent basis divided by average earning assets. BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

Cost of Funds * FAUQUIER BANKSHARES, INC. BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* Assets Under Management (At Market Value) FAUQUIER BANKSHARES, INC. Source: Wealth Management Services Statement of Condition and Yahoo Finance – As of December 31. S&P 500 Index

Efficiency Ratio* FAUQUIER BANKSHARES, INC. * BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. *Efficiency ratio is computed by dividing non-interest expense by adjusted operating income on a taxable equivalent basis. Includes gains and losses on the sale or impairment of securities and OREO. Averages used for both peer and VA Banks. For the Year Ended December 31.

* FAUQUIER BANKSHARES, INC. Tangible Equity to Tangible Assets Ratio BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* FAUQUIER BANKSHARES, INC. Leverage Ratio BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* FAUQUIER BANKSHARES, INC. Tier 1 Risk-Based Capital Ratio “Well Capitalized” Threshold 6% BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

* FAUQUIER BANKSHARES, INC. Total Risk-Based Capital Ratio BHCPR Peer Group (Federal Reserve System) - Bank Holding Companies with Consolidated Assets of $500MM - $1B. SNL – VA Banks consists of 63 public companies with assets less than $5 billion. Averages used for both peer and VA Banks. As of December 31.

FAUQUIER BANKSHARES, INC. Source: SNL Financial – As of May 9, 2013 Stock Chart – Price/Tangible Book (July 1, 1997– May 8, 2013) * FBSS 94.0 SNL 108.7

Contact Information Investor Relations Contacts Randy K. Ferrell President & Chief Executive Officer randy.ferrell@fauquierbank.com Eric P. Graap Executive Vice President & Chief Financial Officer eric.graap@fauquierbank.com Valerie Barlowe Investor Relations Coordinator valerie.barlowe@fauquierbank.com www.fauquierbank.com MAIN OFFICE THE PLAINS VIEW TREE BEALETON OLD TOWN MANASSAS SUDLEY ROAD NEW BALTIMORE CATLETT FAUQUIER BANKSHARES, INC. BRISTOW * HAYMARKET