Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Booz Allen Hamilton Holding Corp | bah331138k.htm |

| EX-99.1 - EARNINGS RELEASE - Booz Allen Hamilton Holding Corp | bah33113exhibit991.htm |

Booz Allen Hamilton Fourth Quarter Fiscal 2013 May 22, 2013

Curt Riggle Director, Investor Relations Introduction Today’s Agenda Ralph Shrader Chairman, Chief Executive Officer and President Management Overview Sam Strickland Executive Vice President and Chief Financial Officer Financial Overview Questions and Answers 1 Horacio Rozanski Executive Vice President and Chief Operating Officer Strategic Overview

Disclaimers Forward Looking Safe Harbor Statement The following information includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including projected Revenue, Diluted EPS, and Adjusted Diluted EPS, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and other factors include: cost cutting and efficiency initiatives, budget reductions, Congressionally-mandated automatic spending cuts, and other efforts to reduce U.S. government spending, including automatic sequestration required by the Budget Control Act of 2011 (as amended by the American Taxpayer Relief Act of 2012), which could reduce or delay funding for orders for services especially in the current political environment; delayed funding of our contracts due to delays in the completion of the U.S. government’s budgeting process and the use of continuing resolutions by the U.S. government to fund its operations or related changes in the pattern or timing of government funding and spending (including potential cuts associated with sequestration or other budgetary cuts made in lieu of sequestration); current uncertainty around the timing, extent, and nature of Congressional and other U.S. government action to address budgetary constraints, the U.S. government’s ability to incur indebtedness in excess of its current limit and the U.S. deficit; any issue that compromises our relationships with the U.S. government or damages our professional reputation; changes in U.S. government spending including a continuation of efforts by the U.S. government to decrease spending for management support service contracts, and mission priorities that shift expenditures away from agencies or programs that we support; the size of our addressable markets and the amount of U.S. government spending on private contractors; failure to comply with numerous laws and regulations; our ability to compete effectively in the competitive bidding process and delays caused by competitors’ protests of major contract awards received by us; the loss of General Services Administration Multiple Award Schedule Contracts, or GSA schedules, or our position as prime contractor on Government-wide acquisition contract vehicles; changes in the mix of our contracts and our ability to accurately estimate or otherwise recover expenses, time and resources for our contracts; our ability to generate revenue under certain of our contracts; our ability to realize the full value of our backlog and the timing of our receipt of revenue under contracts included in backlog; changes in estimates used in recognizing revenue; any inability to attract, train or retain employees with the requisite skills, experience and security clearances; an inability to hire, assimilate and deploy enough employees to serve our clients under existing contracts; an inability to timely and effectively utilize our employees; failure by us or our employees to obtain and maintain necessary security clearances; the loss of members of senior management or failure to develop new leaders; misconduct or other improper activities from our employees or subcontractors; increased competition from other companies in our industry; failure to maintain strong relationships with other contractors; inherent uncertainties and potential adverse developments in legal or regulatory proceedings, including litigation, audits, reviews and investigations, which may result in materially adverse judgments, settlements, withheld payments, penalties or other unfavorable outcomes including debarment, as well as disputes over the availability of insurance or indemnification; internal system or service failures and security breaches, including, but not limited to, those resulting from external cyber attacks on our network and internal systems; risks related to changes to our operating structure, capabilities, or strategy intended to address client needs, grow our business or respond to market developments; risks associated with new relationships, clients, capabilities, and service offerings in our U.S. and international businesses; failure to comply with special U.S. government laws and regulations relating to our international operations; risks related to our indebtedness and credit facilities which contain financial and operating covenants; the adoption by the U.S. government of new laws, rules and regulations, such as those relating to organizational conflicts of interest issues; our ability to realize the expected benefits from our acquisition of the DSES division of ARINC Incorporated; risks related to future acquisitions; an inability to utilize existing or future tax benefits, including those related to stock-based compensation expense, for any reason, including a change in law; and variable purchasing patterns under U.S. government GSA schedules, blanket purchase agreements and Indefinite Delivery/Indefinite Quantity contracts. Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K, filed with the SEC on May 30, 2012. All forward-looking statements attributable to Booz Allen or persons acting on Booz Allen’s behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, Booz Allen undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non-GAAP Financial Data Information Booz Allen discloses in the following information Adjusted Operating Income, Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors should (i) evaluate each adjustment in our reconciliation of Operating and Net Income to Adjusted Operating Income, Adjusted EBITDA and Adjusted Net Income, and cash flow to free cash flow, and the explanatory footnotes regarding those adjustments, and (ii) use Adjusted EBITDA, Adjusted Net Income, Adjusted Operating Income, and Adjusted Diluted EPS in addition to, and not as an alternative to operating income, net income or Diluted EPS as a measure of operating results with cash flow in addition to and not as an alternative to net cash generated from operating activities as a measure of liquidity, each as defined under GAAP. The Financial Appendix includes a reconciliation of Adjusted Operating Income, Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these supplemental performance measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. 2

Fiscal 2013 Business Highlights ► Proactively addressed structural change in the industry ► Continued growth in margins, operating income, and adjusted earnings ► $8.36 per share in dividend payments to stockholders during fiscal 2013 ► Free Cash Flow of $431.5 million in fiscal 2013 ► Building engineering capabilities organically and via acquisitions ► Investing in capabilities for clients today and for growth in the future ► Ongoing commitment to client service and our communities 3

Fiscal 2013 Financial Highlights ► Restructuring has ongoing benefit to financial performance ► Continuing to take action today to position for long term strength – Managing staffing capacity much more closely against client demand – Reducing infrastructure spending – More carefully managing compensation ► Tightly managed business is able to adapt quickly to changes in the market ► Full year fiscal 2013 Revenue: $5.76 billion ($100.1 million inorganic) ► Q4 fiscal 2013 Revenue: $1.55 billion ($78.2 million inorganic) 4

Drivers Impacting Fiscal Year 2013 Gross Revenue 5 Sale of State & Local Transportation Business (Closed July 2011) (0.30%) DSES Acquisition (Closed November 30 2012) 1.73% Change in Billable Expenses (1.26%) Reduction in Average Headcount (2.28%) Migration to Client Sites (Estimated) (0.68%) Increased Productivity 0.72% Other 0.34% Total Change in FY13 Gross Revenue (1.73%) Revenue Impacts Full Fiscal Year 2013 Compared to Full Fiscal Year 2012

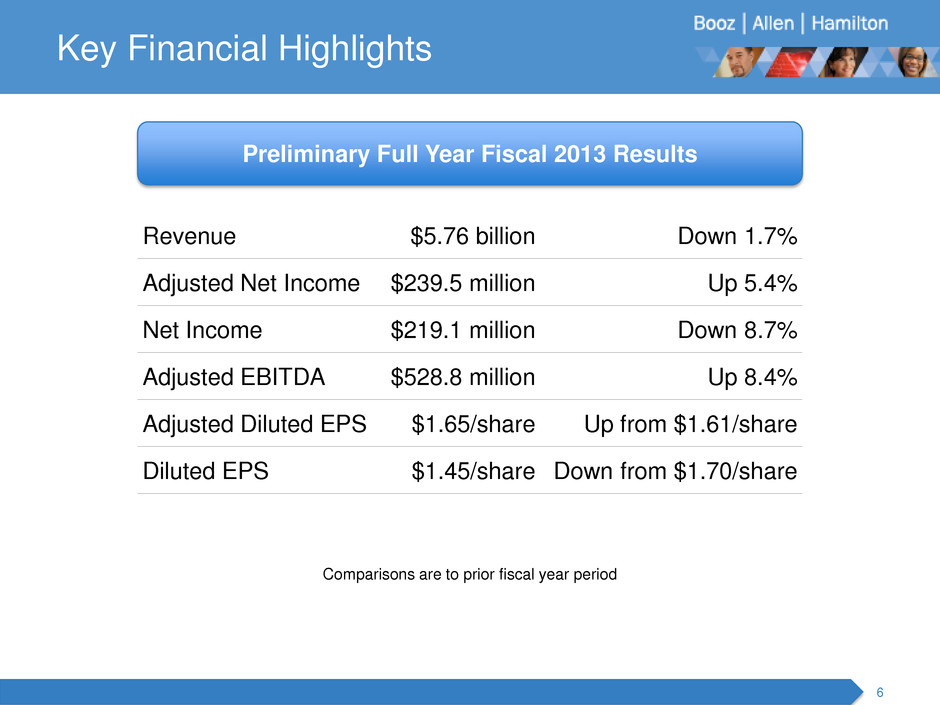

Key Financial Highlights Preliminary Full Year Fiscal 2013 Results Comparisons are to prior fiscal year period 6 Revenue $5.76 billion Down 1.7% Adjusted Net Income $239.5 million Up 5.4% Net Income $219.1 million Down 8.7% Adjusted EBITDA $528.8 million Up 8.4% Adjusted Diluted EPS $1.65/share Up from $1.61/share Diluted EPS $1.45/share Down from $1.70/share

Key Financial Highlights Preliminary Fourth Quarter Fiscal 2013 Results Comparisons are to prior fiscal year period 7 Revenue $1.55 billion Up 0.8% Adjusted Net Income $58.2 million Down 6.5% Net Income $54.8 million Up 8.3% Adjusted EBITDA $133.6 million Up 2.3% Adjusted Diluted EPS $0.40/share Down from $0.44/share Diluted EPS $0.37/share Up from $0.36/share Total Backlog $11.83 billion Up 9.5%

Vision 2020 Market Analysis ► Conducted research and analysis on how our core markets may change over time ► Maximize results for clients by leveraging: – Our premier consulting franchise – Our deep client relationships – An increased focus on engineering and technology 8 Objective Look at Internal Business ► Considered service offerings, operating model, cost structure, pricing and people model ► Launched operating model enhancements – Maintains collaborative culture with single P&L and single bonus pool – Supports commitment to entrepreneurship and delivering new and unique solutions – Enables operational authority which is important in a slower growing market Launched the Strategic Innovation Group to drive strategic consulting, emerging technologies and advanced engineering solutions across our markets

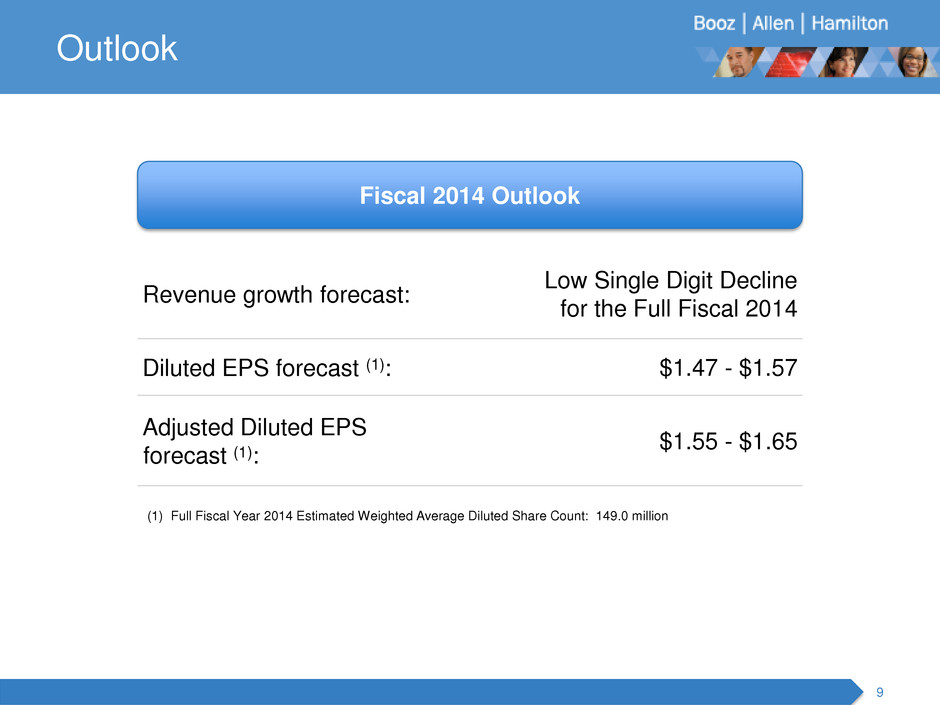

Outlook Fiscal 2014 Outlook Revenue growth forecast: Low Single Digit Decline for the Full Fiscal 2014 Diluted EPS forecast (1): $1.47 - $1.57 Adjusted Diluted EPS forecast (1): $1.55 - $1.65 9 (1) Full Fiscal Year 2014 Estimated Weighted Average Diluted Share Count: 149.0 million

Financial Appendix 10

Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information ► “Adjusted Operating Income” represents Operating Income before (i) certain stock option-based and other equity- based compensation expenses, (ii) adjustments related to the amortization of intangible assets, and (iii) any extraordinary, unusual, or non-recurring items. Booz Allen prepares Adjusted Operating Income to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. ► “Adjusted EBITDA” represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including: (i) certain stock option-based and other equity-based compensation expenses, (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, and (iii) any extraordinary, unusual or non-recurring items. Booz Allen prepares Adjusted EBITDA to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. ► “Adjusted Net Income” represents net income before: (i) certain stock option-based and other equity-based compensation expenses, (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, (iii) adjustments related to the amortization of intangible assets, (iv) amortization or write-off of debt issuance costs and write-off of original issue discount and (v) any extraordinary, unusual or non-recurring items, in each case net of the tax effect calculated using an assumed effective tax rate. Booz Allen prepares Adjusted Net Income to eliminate the impact of items, net of taxes, it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. ► “Adjusted Diluted EPS” represents Diluted EPS calculated using Adjusted Net Income as opposed to Net Income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to Net Income as required under the two-class method of calculating EPS as required in accordance with GAAP. ► “Free Cash Flow” represents the net cash generated from operating activities less the impact of purchases of property and equipment. 11

Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information 12 (Unaudited and in thousands, except share and per share data) Three Months Ended March 31, Fiscal Year Ended March 31, 2013 2012 2013 2012 Adjusted Operating Income Operating Income $112,873 $97,457 $446,234 $387,432 Certain stock-based compensation expense (a) 924 2,652 5,868 14,241 Amortization of intangible assets (b) 3,126 4,091 12,510 16,364 Net restructuring charge (c) - 11,182 - 11,182 Transaction expenses (d) - - 2,725 - Adjusted Operating Income $116,923 $115,382 $467,337 $429,219 EBITDA & Adjusted EBITDA Net income $54,813 $50,627 $219,058 $239,955 Income tax expense 38,617 35,948 149,253 103,919 Interest and other, net 19,443 10,882 77,923 43,558 Depreciation and amortization 19,766 19,281 74,009 75,205 EBITDA 132,639 116,738 520,243 462,637 Certain stock-based compensation expense (a) 924 2,652 5,868 14,241 Net restructuring charge (c) - 11,182 - 11,182 Transaction expenses (d) - - 2,725 - Adjusted EBITDA $133,563 $130,572 $528,836 $488,060 Adjusted Net Income Net income $54,813 $50,627 $219,058 $239,955 Certain stock-based compensation expense (a) 924 2,652 5,868 14,241 Net restructuring charge (c) - 11,182 - 11,182 Transaction expenses (d) - - 2,725 - Amortization of intangible assets (b) 3,126 4,091 12,510 16,364 Amortization or write-off of debt issuance costs and write-off of original issue discount 1,525 1,181 13,018 4,783 Net gain on sale of state and local transportation business (e) - - - (5,681) Release of income tax reserves (f) - 111 - (35,022) Adjustments for tax effect (g) (2,230) (7,643) (13,649) (18,628) Adjusted Net Income $58,158 $62,201 $239,530 $227,194 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 146,144,633 141,716,480 144,854,724 140,812,012 Adjusted Net Income per diluted share (h) $0.40 $0.44 $1.65 $1.61 Free Cash Flow Net cash provided by operating activities $65,720 $108,027 $464,654 $360,046 Less: Purchases of property and equipment (12,456) (11,367) (33,113) (76,925) Free Cash Flow $53,264 $96,660 $431,541 $283,121 (a) Reflects stock-based compensation expense for options for Class A Common Stock and restricted shares, in each case, issued in connection with the Acquisition of our Company by The Carlyle Group (the Acquisition) under the Officers' Rollover Stock Plan. Also reflects stock-based compensation expense for Equity Incentive Plan Class A Common Stock options issued in connection with the Acquisition under the Equity Incentive Plan. (b) Reflects amortization of intangible assets resulting from the Acquisition. (c) Reflects restructuring charges of approximately $15.7 million incurred during the three months ended March 31, 2012, net of approximately $4.5 million of revenue recognized on recoverable expenses, associated with the cost of a cost restructuring plan to reduce certain personnel and infrastructure costs. (d) Reflects debt refinancing costs incurred in connection with the Recapitalization Transaction consummated on July 31, 2012. (e) Fiscal 2012 reflects the gain on sale of our state and local transportation business, net of the associated tax benefit of $1.6 million. (f) Reflects the release of income tax reserves. (g) Reflects tax effect of adjustments at an assumed marginal tax rate of 40%. (h) Excludes an adjustment of approximately $457,000 and $9.1 million of net earnings for the three and twelve months ended March 31, 2013, respectively, associated with the application of the two-class method for computing diluted earnings per share.