Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Xylem Inc. | d540767d8k.htm |

XYLEM

INC. ELECTRICAL PRODUCTS GROUP CONFERENCE

MAY 21, 2013

Exhibit 99.1 |

XYLEM PROPRIETARY / CONFIDENTIAL

FORWARD-LOOKING STATEMENTS

2

This document contains information that may constitute “forward-looking

statements.” Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. Generally, the words “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” “believe,”

“target” and similar expressions identify forward-looking statements, which generally are

not historical in nature. However, the absence of these words or similar expressions does not

mean that a statement is not forward-looking.

These forward-looking statements include, but are not limited to, statements about the

separation of Xylem Inc. (the “Company”) from ITT Corporation in 2011,

capitalization of the Company, future strategic plans and other statements that describe the

Company’s business strategy, outlook, objectives, plans, intentions or goals, and any

discussion of future operating or financial performance. All statements that address

operating performance, events or developments that we expect or anticipate will occur in

the future — including statements relating to orders, revenues, operating margins and earnings per share growth, and

statements expressing general views about future operating results — are

forward-looking statements. Caution should be taken not to place undue reliance on any such forward-looking statements

because they involve risks, uncertainties and other factors that could cause actual

results to differ materially from those expressed or implied in, or reasonably inferred

from, such statements. The Company undertakes no obligation to publicly update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise, except

as required by law. In addition, forward-looking statements are subject to certain

risks and uncertainties that could cause actual results to differ materially from the

Company’s historical experience and our present expectations or projections. These risks and uncertainties include, but are

not limited to, those set forth in Item 1A of our Annual Report on Form 10-K, and those

described from time to time in subsequent reports filed with the Securities and Exchange

Commission. |

XYLEM PROPRIETARY / CONFIDENTIAL

3

•

Pure Water Play

•

Leading Market Positions

•

Fortress Brands & World Class

Distribution

•

Diverse Geographic & End

Market Exposure

•

Large Installed Base -

Recurring Revenue ~37%

•

Strong Cash Flow Generation

$3.8B

WHAT MAKES XYLEM UNIQUE?

GLOBAL LEADER IN WATER APPLICATION SOLUTIONS

ABILITY TO DELIVER CONSISTENT FINANCIAL PERFORMANCE |

XYLEM PROPRIETARY / CONFIDENTIAL

4

WATER IS ONE OF THE MOST COMPLEX,

CHALLENGING AND INCREASINGLY VISIBLE

ISSUES FACING SOCIETY

UNIQUELY POSITIONED TO SOLVE THE WORLD’S GROWING WATER CHALLENGES

|

XYLEM PROPRIETARY / CONFIDENTIAL

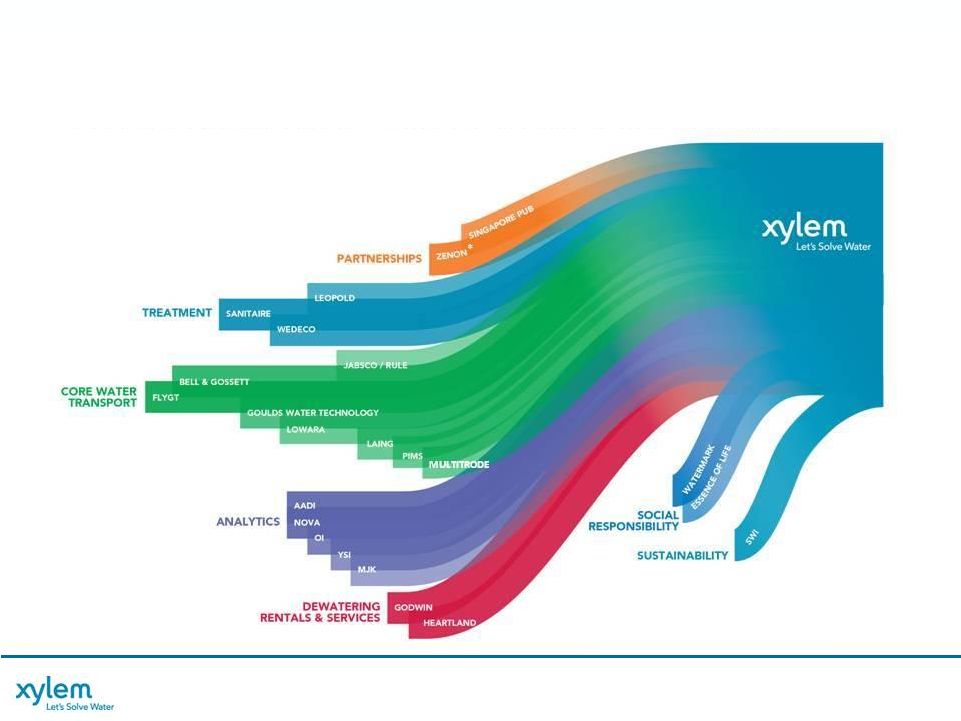

EVOLUTION TO A LEADING

GLOBAL WATER TECHNOLOGY PROVIDER

5

MULTITRODE

* Zenon is a registered trademark of GE |

XYLEM PROPRIETARY / CONFIDENTIAL

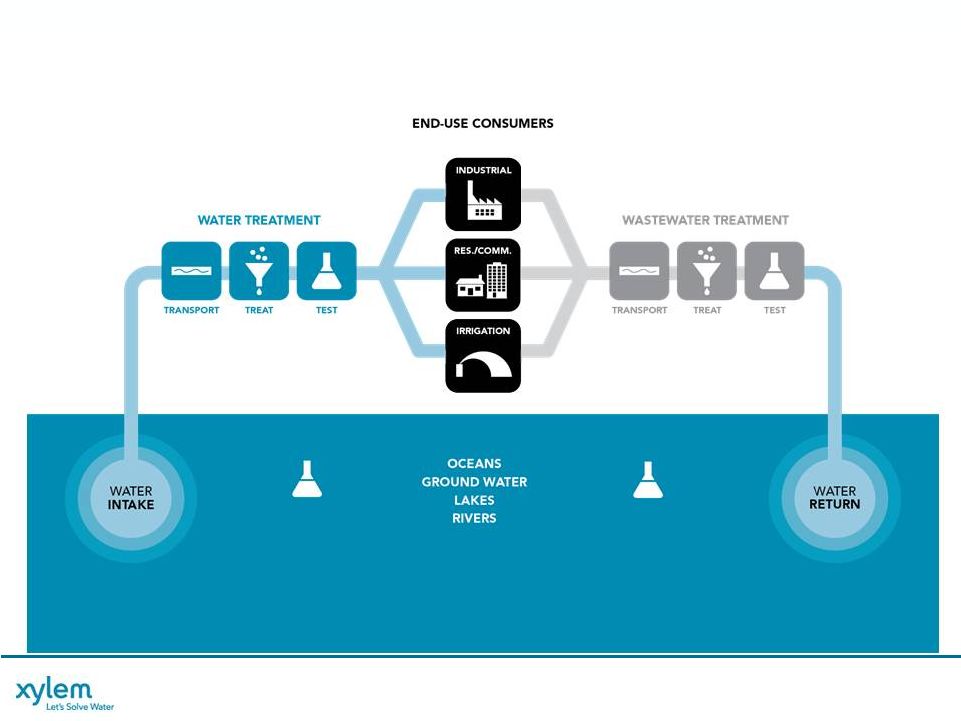

SPECIALIZED BREADTH IN THE WATER CYCLE

6

WE

WORK

TO

ANTICIPATE

OUR

CUSTOMERS’

NEEDS

WITH

OUR

BROAD PRODUCT OFFERING & OUR APPLICATIONS EXPERTISE

TEST

TEST |

XYLEM PROPRIETARY / CONFIDENTIAL

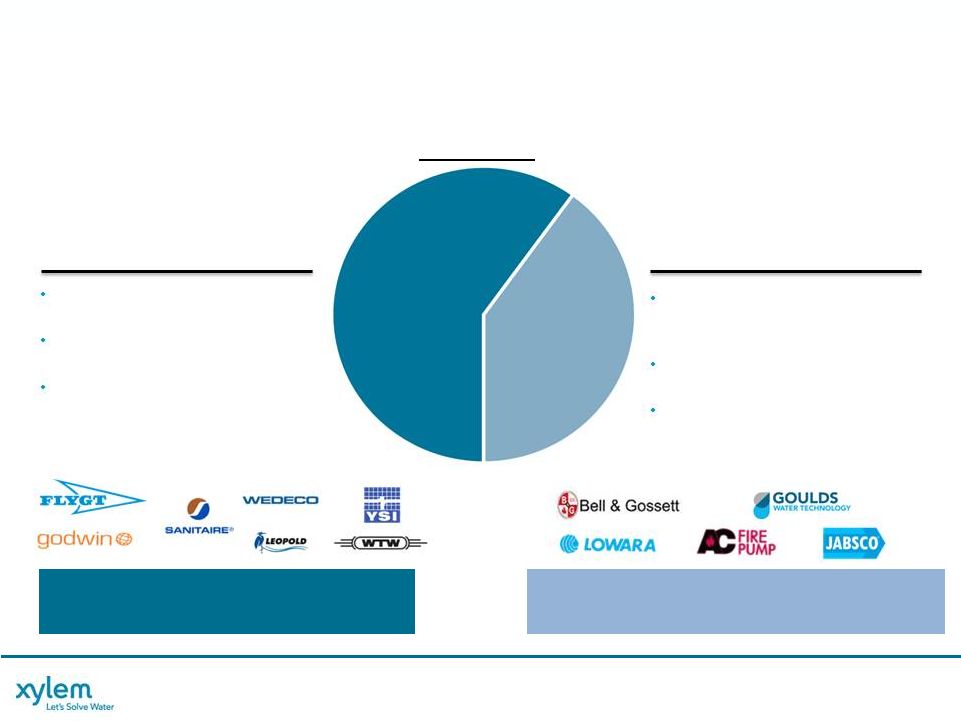

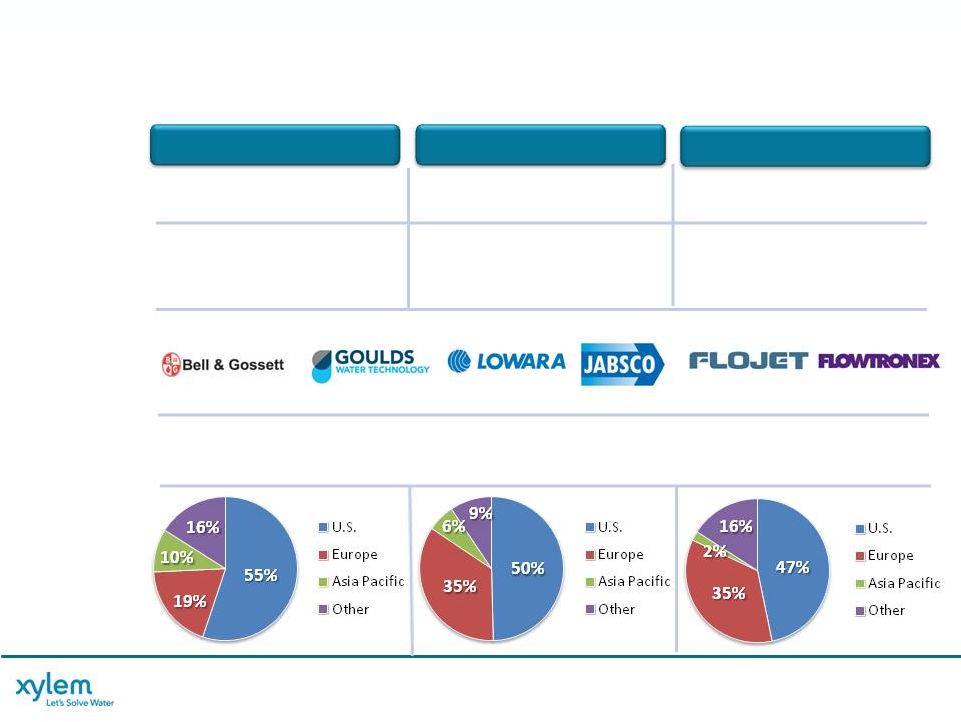

WATER INFRASTRUCTURE

Market Size: $20B

2012 Revenues: $2.4B

2012 Op Margin*: 15.1%

APPLIED WATER

Market Size: $15B

2012 Revenues: $1.4B

2011 Op Margin*: 12.4%

7

SEGMENT OVERVIEW

64%

64%

36%

Segment Split

UNIQUE PORTFOLIO PROVIDES FOR

UNIQUE PORTFOLIO PROVIDES FOR

INNOVATIVE SOLUTIONS

INNOVATIVE SOLUTIONS

BROAD PRODUCT PORTFOLIO BACKED BY

BROAD PRODUCT PORTFOLIO BACKED BY

APPLICATION EXPERTISE

APPLICATION EXPERTISE

* See Appendix for Non-GAAP Reconciliations

Industry-Leading Water &

Environment Analytics Platform

Broad Portfolio of Filtration, Biological

and Disinfection Technologies

World’s Largest Waste Water Pump &

Dewatering Services Provider

U.S. Leader in Industrial Water

Technologies

U.S. Leader in Building Services

Equipment & Solutions

Leading Global Provider of a Broad

Range of Energy-Efficient Solutions

with a Large & Diverse Customer Base |

XYLEM PROPRIETARY / CONFIDENTIAL

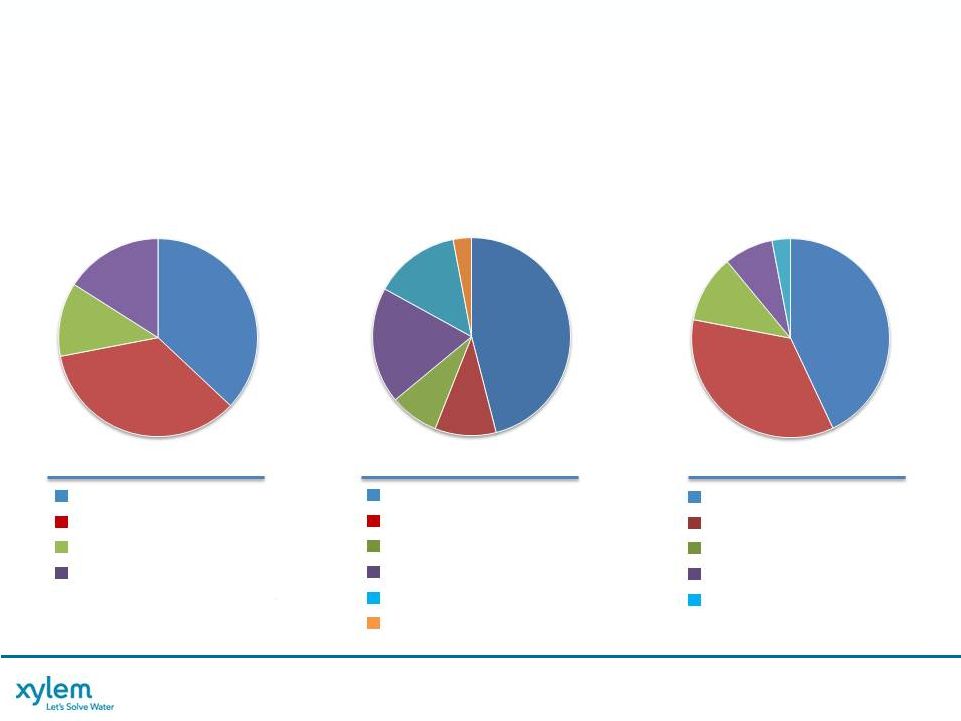

BALANCED PORTFOLIO

8

DIVERSE

CUSTOMER

BASE

SERVING

CRITICAL

NEEDS

GLOBAL

MARKET

BALANCE

BY END MARKET

Industrial

43%

Public Utility

35%

Commercial

11%

Residential

8%

Agriculture

3%

BY APPLICATION

Transport

46%

Treatment

10%

Test

8%

Building Svcs

19%

Industrial Water

14%

Irrigation

3%

BY GEOGRAPHY

United States

37%

Europe

35%

Asia Pac

12%

Rest of World

16%

A Growing Emerging Market

Presence …

Today ~20%

(2012 Revenue) |

XYLEM PROPRIETARY / CONFIDENTIAL

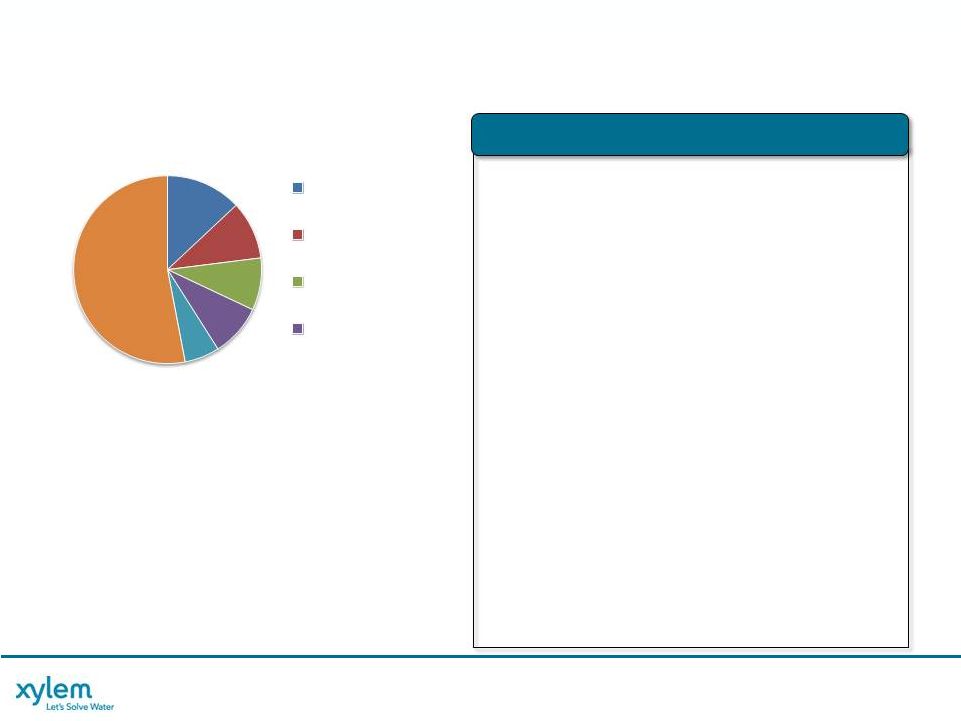

9

KEY END MARKETS

INDUSTRIAL

•

Strong Brands

•

Deep Application Knowledge

•

Broad Product Portfolio

•

Improving Vitality Index

•

Expansion of Existing Products in

Adjacent Markets

MINING

•

Commodity Demand

OIL & GAS

•

Natural Gas Fracking Activity

CONSTRUCTION

•

Commercial & Residential Construction

•

Weather

FOOD & BEVERAGE

•

Changing Dietary Habits

•

Emergence of Middle Class in EM

GENERAL INDUSTRY

•

Paper

•

Power

•

Manufacturing

Xylem 2012 Revenue: $1.6B

•

Chemicals

•

Pharma

DIVERSE MARKET DRIVERS

DIVERSE MARKET DRIVERS

13%

10%

9%

9%

6%

53%

Mining

Oil & Gas

Construction

Food &

Beverage |

XYLEM PROPRIETARY / CONFIDENTIAL

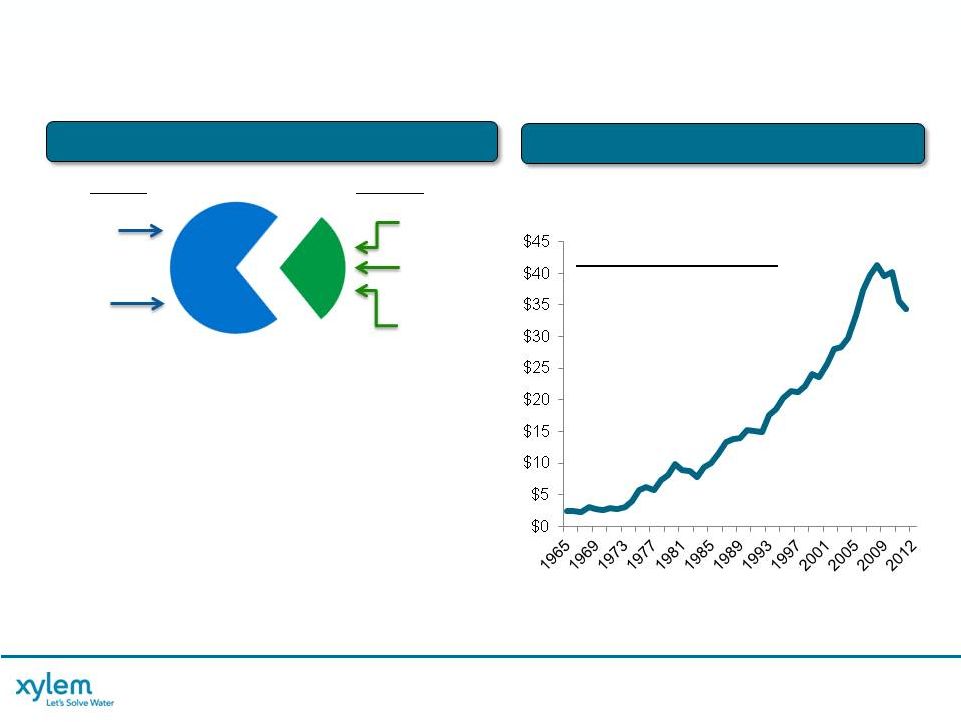

10

KEY END MARKETS

PUBLIC UTILITY

•

Large Installed Base with Loyal Customers

•

Consistent Tariff Increases

•

70-80% of Revenues from Opex

•

Capex Spending Below Historical Levels but

Bid Activity Remains Strong

~70%

~70%

~30%

~30%

Opex

Capex

Connection

Fees

Tariffs

Bonds

Gov’t

Financing

Private

Funding

•

Stable

•

Health & Economic

Necessity

•

Cyclical

•

Capacity &

Regulation Driven

Source: Strategic Analytics Inc.

U.S. Water and Sewer Construction

Spending

-

$B

Source: U.S. Census Bureau (April 2013)

PUBLIC UTILITY DYNAMICS

PUBLIC UTILITY DYNAMICS

U.S. CAPEX SPENDING

U.S. CAPEX SPENDING

•

Residential & Commercial

Real Estate Development

•

Industrial Expansion

•

Increasing Regulation

General Growth Drivers: |

XYLEM PROPRIETARY / CONFIDENTIAL

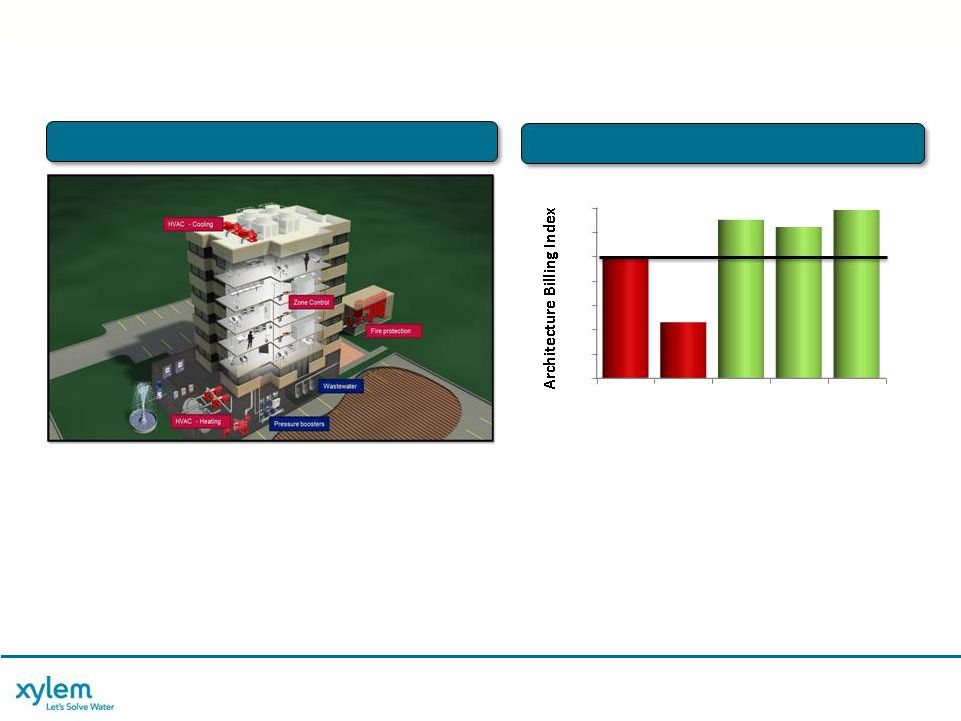

11

KEY END MARKETS

COMMERCIAL BUILDINGS

•

Products for the Heating, Cooling and Protection of Commercial Buildings

•

Broadest Offering Allows for Optimizing Interaction of Key Building Components

•

Demand for Energy Efficient Solutions has Driven Retrofit Activity During the

Recent Multi-Year New Building Construction Slowdown

•

Application Expertise Makes Xylem a Strong Partner for Specifying Engineers

INTEGRATED SOLUTIONS

ARCHITECTURE BILLING INDEX

Source: AIA. Index Value of 50=No change from previous period.

45

46

47

48

49

50

51

52

Mar '12

Jun '12

Sept '12

Dec '12

Mar '13

49.9

47.3

51.5

51.2

51.9 |

XYLEM PROPRIETARY / CONFIDENTIAL

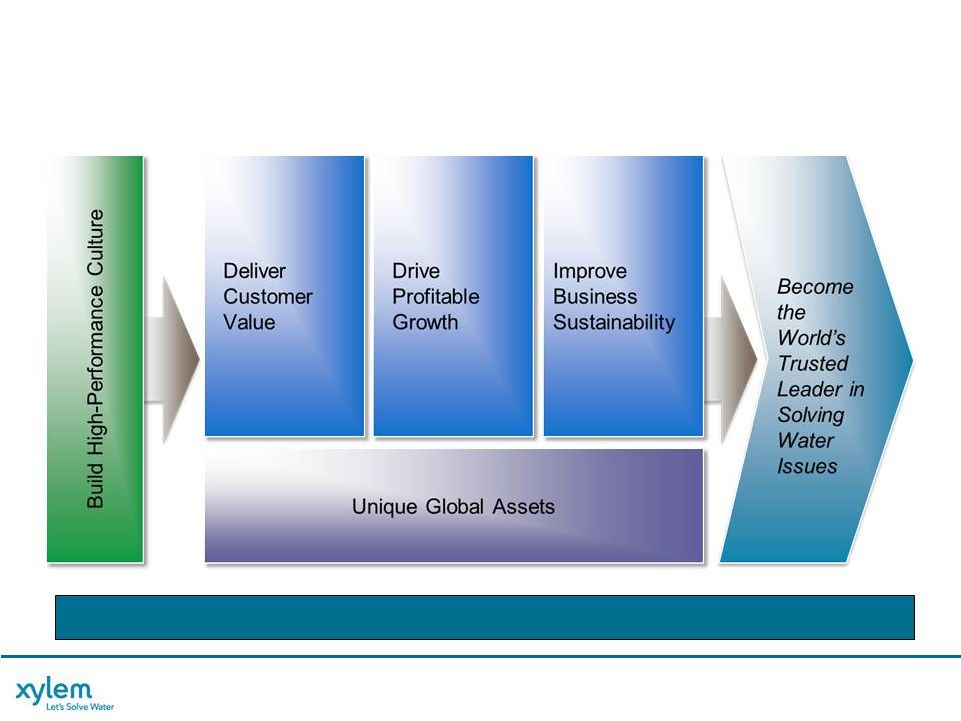

OUR STRATEGIC FRAMEWORK

12

DISCIPLINE TO ACHIEVE KEY OBJECTIVES AND INCREASE SHAREHOLDER VALUE

|

XYLEM PROPRIETARY / CONFIDENTIAL

13

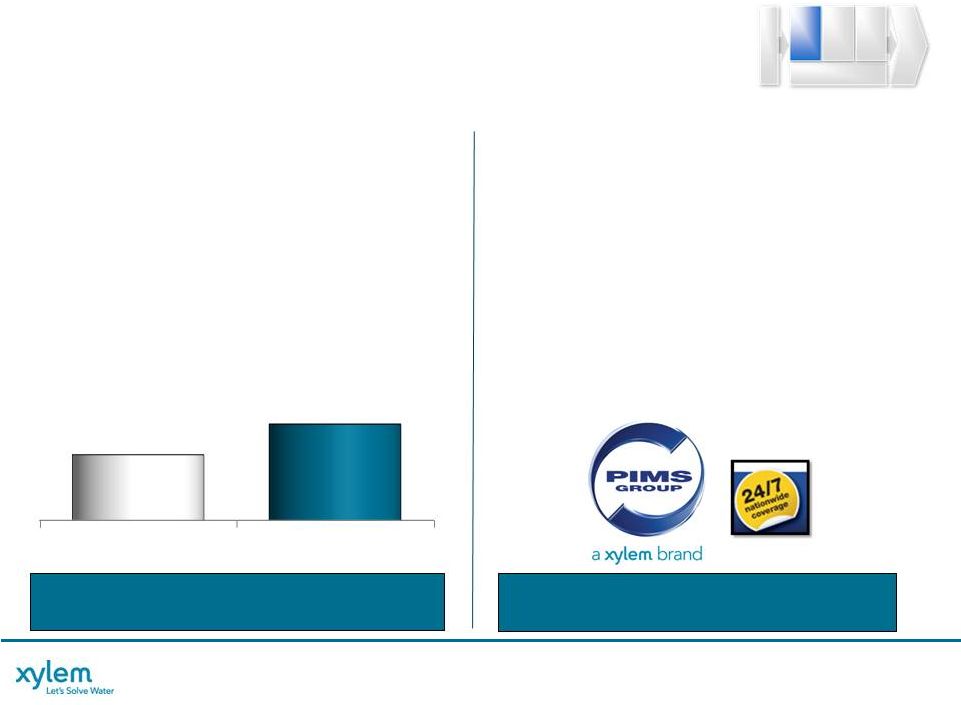

GROWING AFTERMARKET PARTS & SERVICES

INSTALLED BASE DRIVES REPLACEMENT SALES

•

Brand Loyalty Driven

•

Like-for-Like Replacement

•

Opportunity for Upgrades

•

Next-Generation Installations

INCREASING PROFITABLE

AFTERMARKET OPPORTUNITIES

DELIVER CUSTOMER VALUE

ENHANCING AFTERMARKET CAPABILITIES

INTRODUCING XYLEM TOTALCARE

•

Comprehensive Integrated Services Portfolio

•

Systems Knowledge & Application Expertise

•

Leverages World’s Largest Installed Base

•

Provides Customers with Operational Security,

Cost Savings Opportunities, and Improved

Operating Efficiencies

ACCELERATING OPPORTUNITIES THROUGH

ACQUISITIONS

~37% RECURRING REVENUE BASE

$M

2008

2012

$396

$581 |

XYLEM PROPRIETARY / CONFIDENTIAL

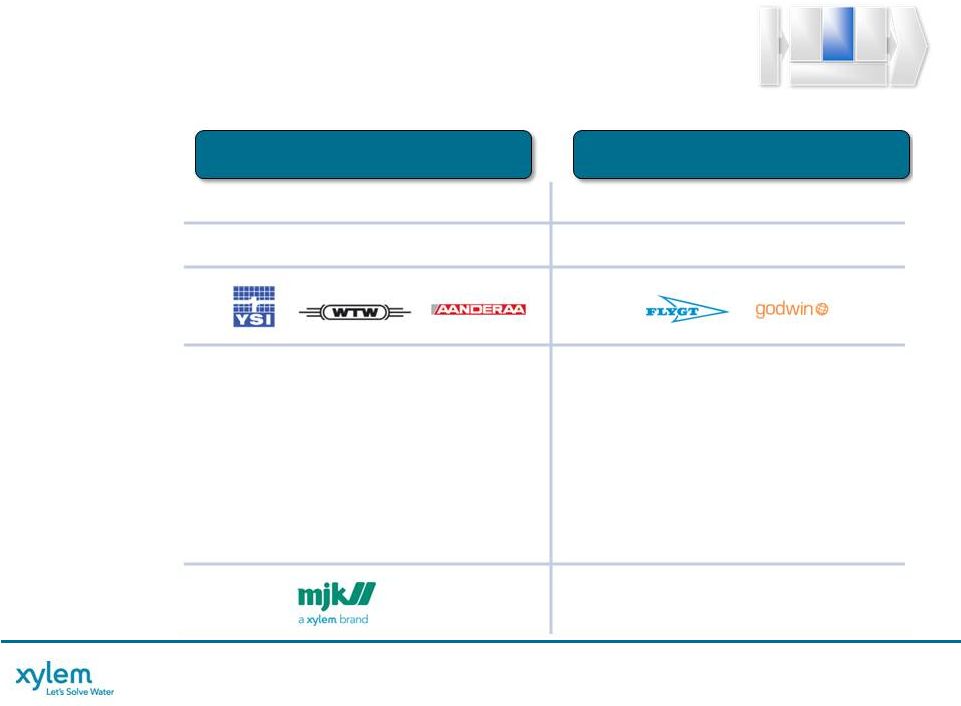

DRIVE PROFITABLE GROWTH

EXECUTING ACQUISITION STRATEGY

14

ANALYTICS

DEWATERING

Opportunity

Recent

Transactions

•

Heartland Pump

•

High ROIC Business When

Operating With Scale Advantage

•

Leverage Xylem’s Footprint and

Replicate 24/7 Service Expertise

•

International Expansion

•

Products have Higher Market

Growth Rates and Margins

•

Fill Product or Technology Gaps

and Sell Through Existing Channels

•

Drive Sustainable Water Projects

•

International Expansion

Revenue (2012)

$298M

$659M

Capital Deployed*

$732M

$614M

*Cumulative capital deployed through M&A from 2010 to Q1’13. Excludes CAPEX

expenditures. Key Brands |

XYLEM PROPRIETARY / CONFIDENTIAL

IMPROVE BUSINESS SUSTAINABILITY

OPTIMIZING OUR COST STRUCTURE

15

Complex

Structure

ONE

Organization

SUMMARY

•

Unified Xylem in Europe –

Growth & Cost Synergies

–

HQ: Schaffhausen,

Switzerland

•

Efficient Tax Structure

2013 FINANCIAL IMPACTS*

•

Restructuring & Realignment

Costs of $60M to $70M

Primarily Focused on Europe

–

Restructuring Savings of

$13M to $15M

–

Additional Net EPS Impact

of $0.03 From Realignment

EUROPEAN REALIGNMENT

ENABLING

•

Vertical Market Alignment

–

Sales Synergies & Future

Growth Opportunities

•

Sales Office Consolidations

•

Sales Administrative and

Functional Back-Office

Standardization & Synergies

•

Factory Realignments

•

Shared Services & Centers of

Excellence

* 2013 ESTIMATE BASED ON GUIDANCE AS OF APRIL 30, 2013 |

XYLEM PROPRIETARY / CONFIDENTIAL

XYLEM FINANCIAL SUMMARY

STRONG TRACK RECORD OF FINANCIAL PERFORMANCE

* See Appendix for Non-GAAP Reconciliations.

** Margin expansion includes $33M of additional Stand-Alone costs.

16

•

Resilient Portfolio …

Despite Challenging End Market Conditions

•

Continued Investment Driving Growth in Core Business

•

Key Acquisitions …

Transitioning Portfolio to Higher Profitability Levels

•

Management Discipline …

Proactive Actions

•

Operational Excellence …

Driving Productivity Initiatives

+210 Bps with Stand-Alone Costs**

Revenue Up $500M …

+15%

$M

Growth:

-13%

12% 19%

0%

Organic*:

-9%

3%

0%

REVENUE

OPERATING MARGIN *

2008

2009

2010

2011

2012

10.8%

10.8%

10.8%

10.8%

12.6%

12.6%

12.7%

12.7%

12.9%

12.9%

2008

2009

2010

2011

2012

3,291

3,291

2,849

2,849

3,202

3,202

3,803

3,803

3,791

3,791

7% |

XYLEM PROPRIETARY / CONFIDENTIAL

FINANCIAL POSITION

17

•

Strong Cash Position

•

No Significant Debt Maturities Until 2016

•

1.3x Net Debt/Adj. TTM EBITDA

•

$600M

Revolving

Credit

Facility

-

Unutilized

•

Access

to

Commercial

Paper

-

Unutilized

March 31, 2013

Cash

375

Debt

1,205

Net Debt

830

Shareholders’

Equity

2,040

Net Capital

2,870

Net Debt to Net Capital

29%

(Dollars, In Millions)

* See Appendix for Non-GAAP Reconciliations

** (AR+INV-AP-Customer Advances) / Revenue (Adjusted for Acquisitions)

*** See Xylem March 7, 2013 Investor & Analyst Day Presentation for further details.

Conversion:

100%

95%

$M

FREE CASH FLOW *

WORKING CAPITAL AS % REVENUE **

CAPITAL SUMMARY/LIQUIDITY

2012

2013E***

312

280

2012

2013E***

22.5%

22.0% |

XYLEM PROPRIETARY / CONFIDENTIAL

DISCIPLINED CAPITAL DEPLOYMENT

18

•

2.5% to 3.5% of

Revenue

•

$0.1164/share In-line

with Peers

•

Stock Buybacks to

Offset Dilution

•

$150M -

350M in 2013

•

Contributes 2% to 4%

to Revenue/Yr. on

Average

Capital Deployment Strategy

•

Balanced Organic & Inorganic Investment

•

Return Value to Shareholders

•

Maintain Solid Investment Grade Metrics

•

Debt & Pension

Organic Growth

World Class Facilities

Cash Return to

Shareholders

Cash to Meet Key

Obligations

Inorganic Investment

to Fuel Growth

Capital Deployment Evaluation

•

Fold Targeted Performance into Operating Plans

•

Quarterly / Annual Investment Review

•

Ensure Targeted Returns Achieved

FOCUSED ON LONG TERM SHAREHOLDER RETURN

FOCUSED ON LONG TERM SHAREHOLDER RETURN

Cash from

Operations

Capex

Return to

Shareholders

Financial

Obligations

Acquisition

Strategy |

XYLEM PROPRIETARY / CONFIDENTIAL

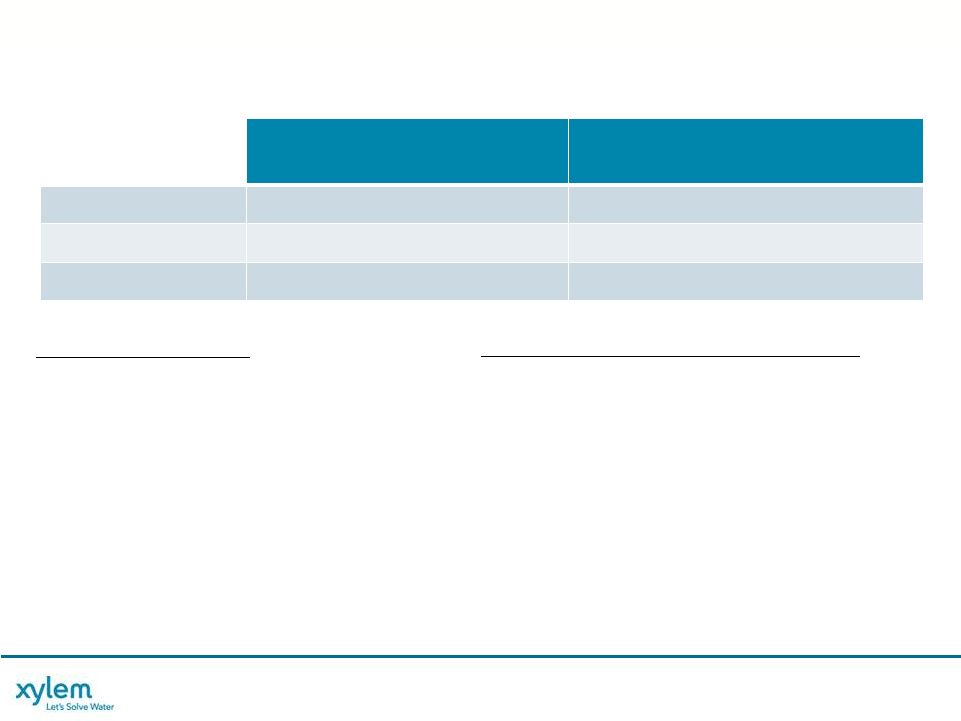

KEY FINANCIAL PROJECTIONS

19

LONG-TERM PERFORMANCE TARGETS**

•

2013-2017

Revenue

CAGR

of

5-9%

•

Core

Operating

Margin

Expands

50-75

Bps/Yr

Partially Offset by 1x Acquisition Impacts

•

2013-2017 EPS CAGR of 7-14%

•

Strong

Free

Cash

Flow

(100%

Conversion)

•

Disciplined

Capital

Deployment

•

ROIC

Accelerates

from

10.8%

in

2012

to

13%

-

14% by 2017

2013 FY Guidance

As of April 30, 2013 *

2017

Long-Term Targets **

Revenues

~$3.925B

(mid-point)

$4.7B to $5.5B

Op. Margin*

12.2% to 12.7%

14% to 15%

EPS*

$1.79 to $1.89

$2.50 to $3.40

* See Appendix for 2013 Financial Guidance Summary and non-GAAP

reconciliations. ** See Xylem March 7, 2013 Investor & Analyst Day Presentation

for further details. 2013 KEY OBJECTIVES

•

Strong Free Cash Flow (95% Conversion)

•

European

Realignment

Actions

to

Best

Position for Recovery …

$0.03 Net EPS

Benefit in ’13 …

Tax Rate Reduction to 21%

•

Restructuring

Actions

Drive

$26M

to

$30M

in

Annual Cost Savings ($13M to $15M in 2013)

•

Continuing to Invest in New Product

Launches

•

Execution

of

Acquisition

Strategy

Targeting

Deployment of $150M to $350M |

XYLEM PROPRIETARY / CONFIDENTIAL

THANK YOU FOR YOUR INTEREST

THANK YOU FOR YOUR INTEREST

20

CLOSING REMARKS |

APPENDIX |

XYLEM PROPRIETARY / CONFIDENTIAL

* See Appendix for Non-GAAP Reconciliations

22

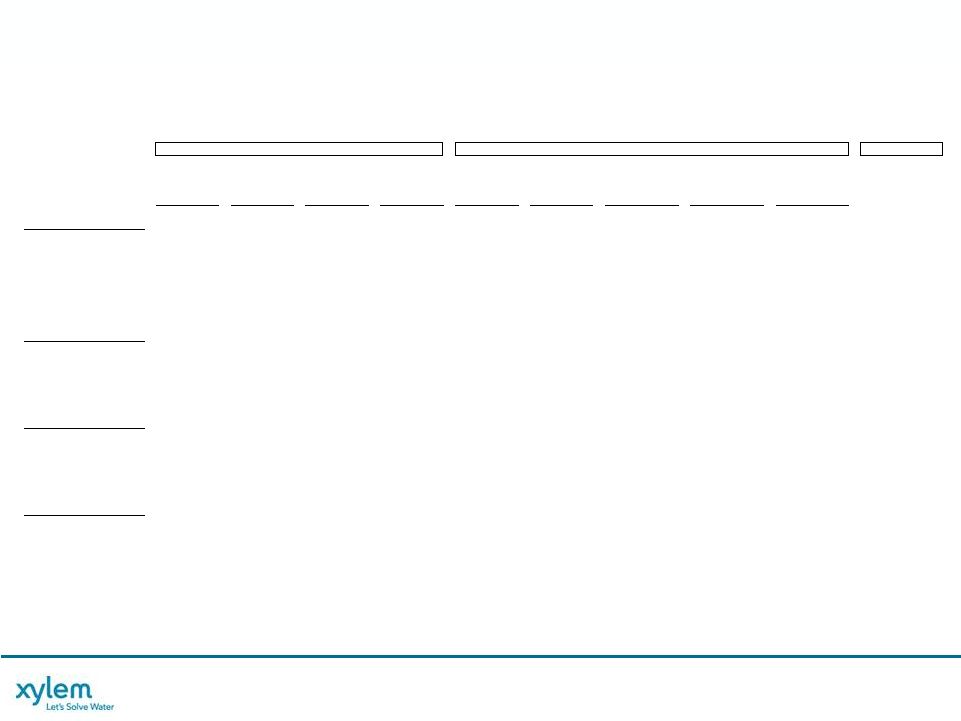

2013 FINANCIAL GUIDANCE SUMMARY

2013 FY Guidance

2013 FY Guidance

As of April 30, 2013

As of April 30, 2013

Growth

Growth

2013E vs. 2012

2013E vs. 2012

Revenue

Xylem Consolidated

Water Infrastructure

Applied Water

Segment Margin *

Operating Margin *

EPS *

Free Cash Flow Conversion

Guidance Assumptions:

Operating Tax Rate

Share Count

Items Excluded from EPS:

Restructuring &

Realignment Costs

(Mid-Point)

~$3,925M

~$2,540M

~$1,450M

13.7% -

14.2%

12.2% -

12.7%

$1.79 -

$1.89

~95%

~21%

~186.4M

~$60M -

$70M

Restructuring Costs: ~$40M to $50M

Share Repurchase Program to Maintain Current Share Count

1H’13 Rate: ~22%; 2H’13 Rate: ~20%

Restructuring Payments, Realignment Capex, & CHQ

Relocation

$1.84 Mid Point

-70 bps to -20 bps

-60 bps to -10 bps

Total Growth

Organic

Acquisition

FX

~3 to

4% 0 to 1%

2% 1%

~4 to

5% 0 to 1%

3% 1%

~1 to

2% 0 to 1%

0% 1%

|

XYLEM PROPRIETARY / CONFIDENTIAL

23

WATER INFRASTRUCTURE

BUSINESS OVERVIEW

TRANSPORT

TRANSPORT

TREATMENT

TREATMENT

Market Size:

2012 Revenues:

Key Products

& Services:

2012 Revenues

by Geography:

Key Facilities:

Key Brands:

$11B

$1,745M

$5B

$366M

Waste Water Pumps

Dewatering (Sales & Rentals)

Aftermarket Parts & Services

Emmaboda, Sweden; Baroda, India;

Shenyang, China; Bridgeport, NJ

Herford, Germany; Brown Deer, WI;

Zelienople, PA

Biological

U.V. and Ozone Disinfection

Filtration

29%

39%

14%

18%

U.S.

Europe

Asia Pacific

26%

46%

14%

14%

U.S.

Europe

Asia Pacific

Other

Other |

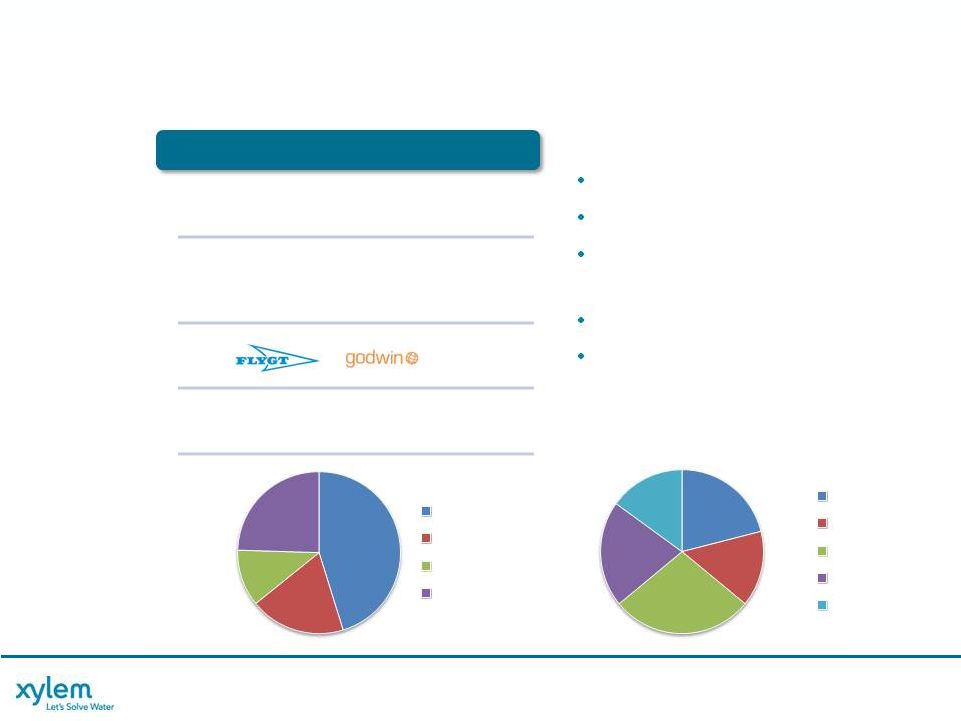

XYLEM PROPRIETARY / CONFIDENTIAL

Bridgeport, NJ; Emmaboda, Sweden;

Quenington, UK

Sales & Rentals

Dry Prime, Submersible & Slurry Pumps

Aftermarket Parts & Services

24

WATER INFRASTRUCTURE

BUSINESS OVERVIEW

DEWATERING

DEWATERING

Market Size:

2012 Revenues:

Key Products

& Services:

2012 Revenues

by Geography &

End Market:

Key Facilities:

Key Brands:

$3B

$659M

24/7 Service Capabilities

Leverages Xylem’s Footprint

High ROIC Business When

Operating with Scale Advantage

Diverse End Markets

~40% Rental Revenue

45%

19%

11%

25%

U.S.

Europe

Asia Pacific

Other

21%

15%

28%

21%

15%

Public Utilities

Oil & Gas

Mining

Construction

Oth. Industrial |

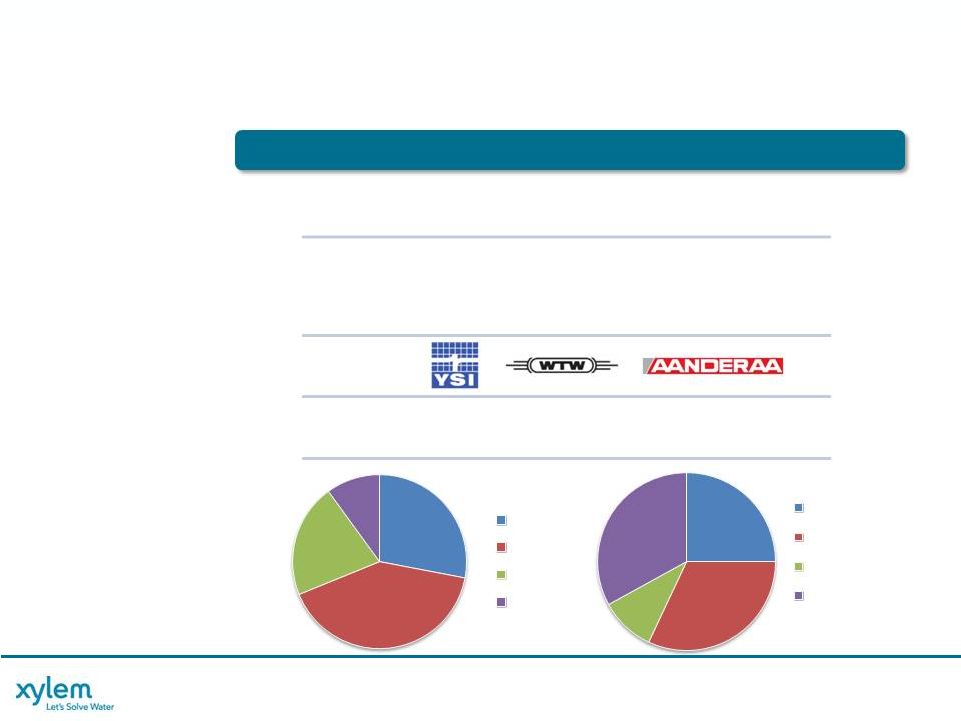

XYLEM PROPRIETARY / CONFIDENTIAL

Yellow Springs, OH; Weilheim, Germany; Bergen, Norway

Field, Online, and Laboratory Analytical Instrumentation

Meters, Sensors, Spectrophotometers, and Refractometers

Temperature, Data Loggers, Doppler and Level Measurement

Water Quality and Environmental Monitoring Systems

25

WATER INFRASTRUCTURE

BUSINESS OVERVIEW

TEST

TEST

Market Size:

2012 Revenues:

Key Products

& Services:

2012 Revenues

by Geography &

Segment:

Key Facilities:

Key Brands:

$4B

$298M

28%

41%

21%

10%

U.S.

Europe

Asia Pacific

Other

25%

32%

33%

Field Sampling

Field Monitoring

Online

Lab

10% |

XYLEM PROPRIETARY / CONFIDENTIAL

26

APPLIED WATER SYSTEMS

BUSINESS OVERVIEW

Market Size:

2012 Revenues:

Key Products

& Services:

2012 Revenues

by Geography:

Key Facilities:

Key Brands:

$9B

$736M

$4B

$550M

HVAC Pumps, Valves & Heat

Exchangers, Drives & Controls,

Waste Water Pumps, Pressure

Boosters, Fire Protection

Auburn, NY; Buffalo, NY; Cegled, Hungary; Chihuahua, Mexico; Dallas, TX; Hoddesdon, UK;

Montecchio, Italy; Morton Grove, IL; Nanjing, China; Stockerau, Austria; Strzelin,

Poland; Wolverhampton, UK Pumps & Pumping Systems

Heat Exchangers, Drives & Controls

Membrane Filtration

Fire Protection

$2B

$96M

Groundwater & Surface Pumps

Packaged Systems, Drives &

Controls

BUILDING SERVICES

BUILDING SERVICES

INDUSTRIAL WATER

INDUSTRIAL WATER

IRRIGATION

IRRIGATION |

XYLEM PROPRIETARY / CONFIDENTIAL

27

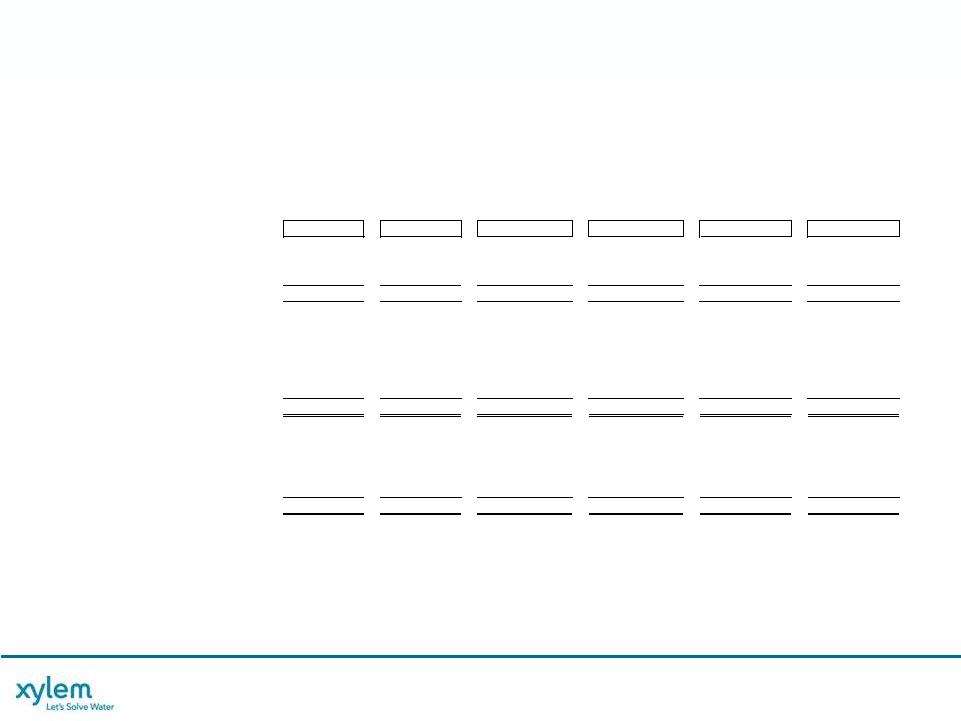

COMPETITIVE LANDSCAPE

LEADING POSITIONS IN KEY APPLICATIONS

TRANSPORT

TREATMENT

TEST

BUILDING SERVICES

INDUSTRIAL WATER

IRRIGATION

Xylem

KSB

Sulzer (ABS)

Pentair

Tsurumi

Others

Others

Grundfos

Xylem

Danaher

(Hach)

Grundfos

Xylem

Siemens

Danaher (Trojan)

Sulzer (ABS)

Ozonia

Others

Xylem

Thermo

E+H

Mettler

Others

Xylem

Wilo

Pentair

Franklin

Grundfos

Wilo

KSB

Pentair

Others

Others

Pentair

Xylem

KSB

Market: $11B

Position: 1st

Market: $5B

Position: 1st

Market: $4B

Position: 2nd

Market: $9B

Position: 2nd

Market: $4B

Position: 2nd

Market: $2B

Position: 3rd |

XYLEM PROPRIETARY / CONFIDENTIAL

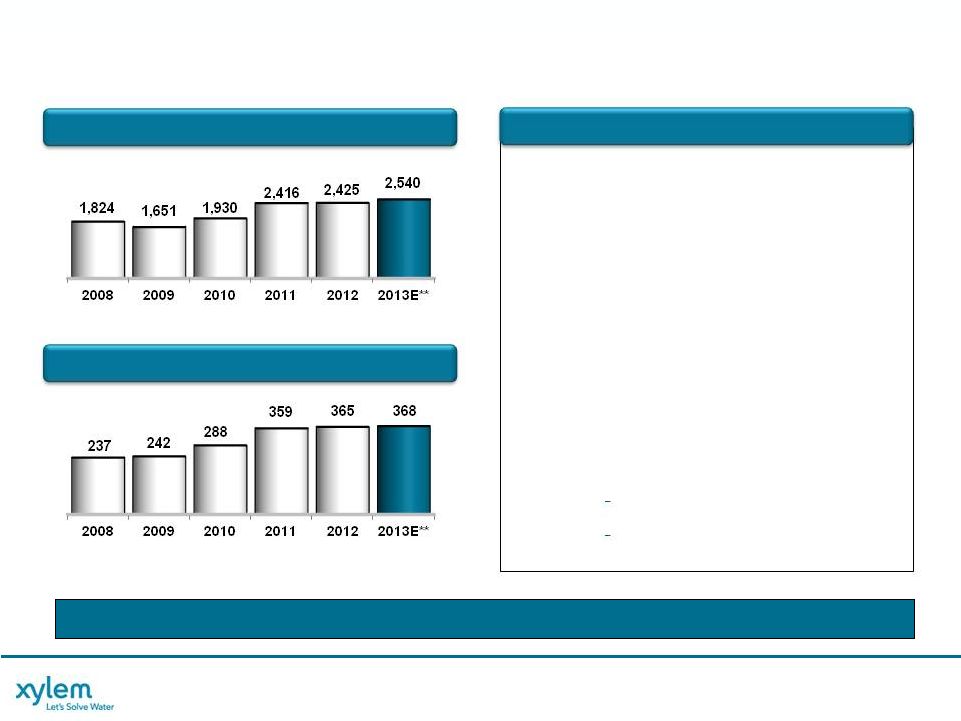

WATER INFRASTRUCTURE

Growth:

-10%

17%

25%

0%

4.7%

Organic*:

-4%

2%

7%

0%

0.5%

OM%:

13.0%

14.7%

14.9%

14.9%

15.1%

14.5%

STRONG TOP LINE GROWTH, OP MARGIN +210 BPS

STRONG TOP LINE GROWTH, OP MARGIN +210 BPS

‘08-’12 Revenue up 33%; 7% CAGR

•

Resilient Through the Downturn

•

Growth Driven by Acquisitions,

Emerging Markets & Product

Launches

•

Public Utility CAPEX Slowdown

•

European Crisis

Strong Operating Margin Expansion

•

Operating Productivity Funds

Incremental Strategic Investments

•

’13 Margin Impacts

European Realignment

FX/Acquisition Impact

* See Appendix for Non-GAAP Reconciliations

$M

$M

28

REVENUE

REVENUE

HIGHLIGHTS

HIGHLIGHTS

OP INCOME & MARGIN*

OP INCOME & MARGIN*

** 2013 ESTIMATE BASED ON GUIDANCE AS OF MARCH 7, 2013 |

XYLEM PROPRIETARY / CONFIDENTIAL

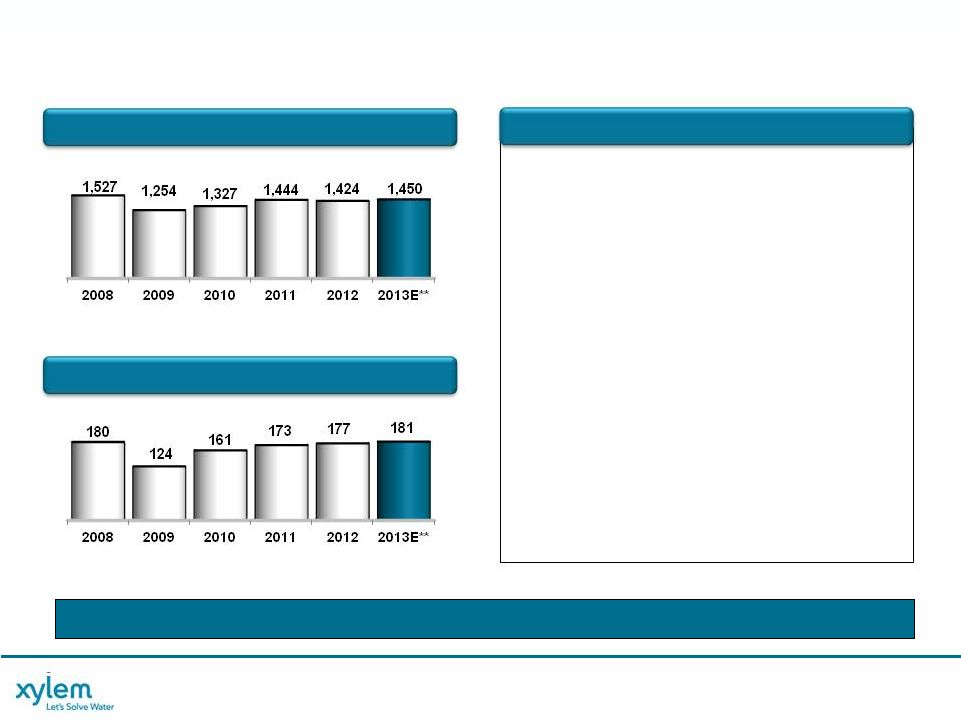

APPLIED WATER

Growth:

-18%

6%

9%

-1%

1.8%

Organic*:

-15%

6%

7%

1%

0.5%

OM%:

11.8%

9.9%

12.1%

12.0%

12.4%

12.5%

STRONG OPERATING PERFORMANCE

STRONG OPERATING PERFORMANCE

‘08-’12 Revenue Down 7%

•

Residential & Commercial Building

Decline

•

Growth Driven By New Product

Launches

–

Energy-Efficient Solutions

–

Emerging Markets Penetration

Strong Operating Performance

•

Margin Expansion Driven by Customer

& Operational Excellence Initiatives

•

Continued to Fund Future Growth

Investments

$M

$M

29

* See Appendix for Non-GAAP Reconciliations

** 2013 ESTIMATE BASED ON GUIDANCE AS OF MARCH 7, 2013

OP INCOME & MARGIN*

OP INCOME & MARGIN*

REVENUE

REVENUE

HIGHLIGHTS

HIGHLIGHTS |

XYLEM PROPRIETARY / CONFIDENTIAL

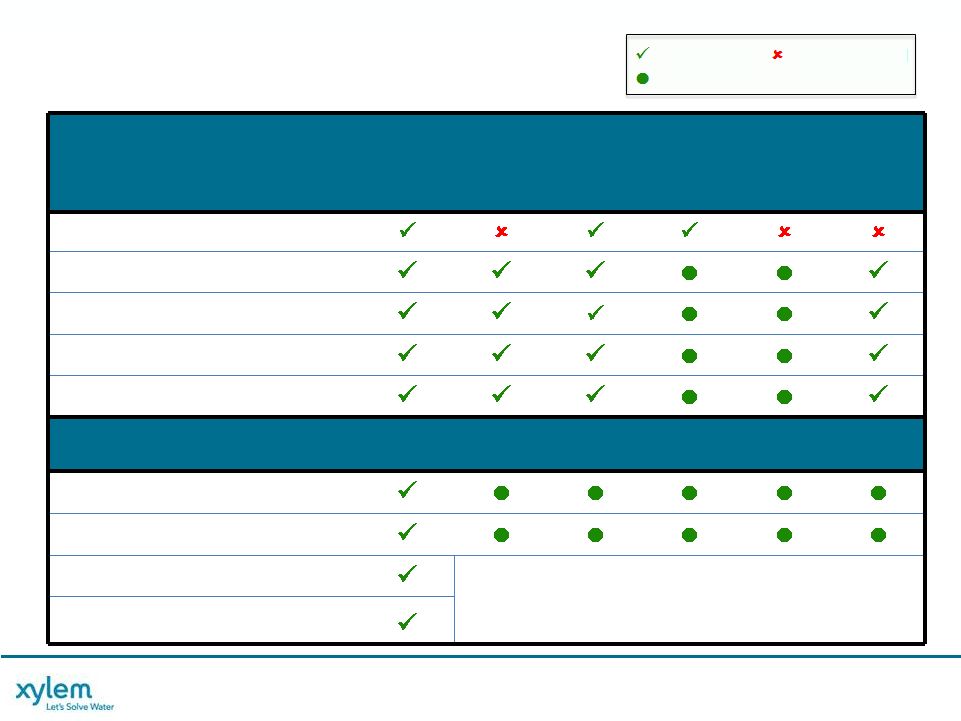

ACQUISITION SCORECARD

Acquisition

Invested

$M

Year

Completed

Strategic

Fit

Gross

Margin

Accretive

IRR >

Risk Adj.

Cost of

Capital

Mid-

Teens

ROIC

Cash

Return

7-9 Years

EPS

Accretive

After Yr 1

Laing

$30

2009

Nova

$384

2010

Godwin

$585

2010

OI

$25

2010

YSI

$310

2011

Through

2012

Added

~200 Bps

Added

~$0.45

MJK

$13

2012

Heartland

$29

2012

PIMS

$57

2013

RECENTLY ACQUIRED

MultiTrode

$26

2013

Completed

On Track

Not Achieved

30 |

XYLEM PROPRIETARY / CONFIDENTIAL

31

NON-GAAP MEASURES

Management views key performance indicators including revenue, gross margins, segment

operating income and margins, orders growth, free cash flow, working capital, and

backlog, among others. In addition, we consider certain measures to be useful to management and investors

evaluating our operating performance for the periods presented, and provide a tool for

evaluating our ongoing operations, liquidity and management of assets. This

information can assist investors in assessing our financial performance and measures our ability to generate capital

for deployment among competing strategic alternatives and initiatives. These metrics,

however, are not measures of financial performance under GAAP and should not be

considered a substitute for revenue, operating income, net income, earnings per share (basic and diluted) or net

cash from operations as determined in accordance with GAAP. We consider the following

non-GAAP measures, which may not be comparable to similarly titled measures reported

by other companies, to be key performance indicators:

defined as revenue and orders, respectively, excluding the impact of foreign currency fluctuations,

intercompany transactions, and contributions from acquisitions and divestitures.

Divestitures include sales of portions of our business that did not meet the criteria

for classification as a discontinued operation or insignificant portions of our business that we did not classify as a

discontinued operation. The period-over-period change resulting from foreign

currency fluctuations assumes no change in exchange rates from the prior period.

defined as financial results adjusted for currency translation impacts by translating current period and

prior period activity using the same currency conversion rate. This approach is

used for countries whose functional currency is not the U.S. dollar.

“EBITDA” defined as earnings before interest, taxes, depreciation, amortization expense, and share-based compensation. “Adjusted EBITDA”

reflects the adjustment to EBITDA to exclude for non-recurring separation costs associated

with the Xylem spin-off from ITT Corporation (not excluded for 2013) as well as

non-recurring restructuring and realignment costs.

defined as operating income and

earnings per share, adjusted to exclude non-recurring separation costs associated

with the Xylem spin-off from ITT Corporation (not excluded for 2013), non-

recurring restructuring and realignment costs and tax-related special items.

defined as net cash from operating activities, as reported in the Statement of Cash Flow, less capital expenditures as well as

adjustments for other significant items that impact current results which management believes

are not related to our ongoing operations and performance. Our definition of free

cash flows does not consider non-discretionary cash payments, such as debt.

“Organic revenue" and "Organic orders”

“Constant currency” "Adjusted

Operating Income", "Adjusted Segment Operating Income", and “Adjusted EPS”

“Free Cash

Flow” |

XYLEM PROPRIETARY / CONFIDENTIAL

32

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (B + D) / A

Change

% Change

Change

% Change

Revenue

Revenue

CY v. PY

CY v. PY

FX Contribution

Eliminations

Adj. CY v. PY

Adj. CY v. PY

Current Year

Prior Year

Year Ended December 31, 2012

Xylem Inc.

3,791

3,803

(12)

-0.3%

(94)

108

-

2

0.1%

2.5%

Water infrastructure

2,425

2,416

9

0.4%

(94)

80

(1)

(6)

-0.2%

3.7%

Applied Water

1,424

1,444

(20)

-1.4%

-

32

(3)

9

0.6%

0.8%

Year Ended December 31, 2011

Xylem Inc.

3,803

3,202

601

18.8%

(264)

(111)

-

226

7.1%

15.3%

Water Infrastructure

2,416

1,930

486

25.2%

(264)

(87)

2

137

7.1%

20.7%

Applied Water

1,444

1,327

117

8.8%

-

(28)

(1)

88

6.6%

6.7%

Year Ended December 31, 2010

Xylem Inc.

3,202

2,849

353

12.4%

(263)

6

-

96

3.4%

12.6%

Water infrastructure

1,930

1,651

279

16.9%

(247)

(8)

-

24

1.5%

16.4%

Applied Water

1,327

1,254

73

5.8%

(16)

15

-

72

5.7%

7.0%

Year Ended December 31, 2009

Xylem Inc.

2,849

3,291

(442)

-13.4%

(7)

158

-

(291)

-8.8%

-8.6%

Water infrastructure

1,651

1,824

(173)

-9.5%

-

109

(1)

(65)

-3.6%

-3.5%

Applied Water

1,254

1,527

(273)

-17.9%

(7)

53

-

(227)

-14.9%

-14.4%

Note: Due to rounding the sum of segment amounts may not agree to Xylem totals.

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Revenue

($ Millions)

(As Reported - GAAP)

(As Adjusted - Organic) |

XYLEM PROPRIETARY / CONFIDENTIAL

33

Mid Point Guidance

2008

2009

2010

2011

2012

2013E

Revenue

3,291

2,849

3,202

3,803

3,791

3,925

Operating Income

315

276

388

395

443

425

Operating Margin

9.6%

9.7%

12.1%

10.4%

11.7%

10.8%

Restructuring & Realignment

41

31

15

-

24

65

Separation Costs

-

-

-

87

22

-

Adjusted Operating Income

356

307

403

482

489

490

Adjusted Operating Margin

10.8%

10.8%

12.6%

12.7%

12.9%

12.5%

Standalone Costs

-

-

-

5

28

-

Adj. Operating Income, excl. Standalone

Costs 356

307

403

487

517

490

Adjusted Operating Margin, excl.

Standalone Costs 10.8%

10.8%

12.6%

12.8%

13.6%

12.5%

Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

34

2013

2012

2011

2010

2009

2008

Total Revenue

• Total Xylem

3,925

3,791

3,803

3,202

2,849

3,291

• Water Infrastructure

2,540

2,425

2,416

1,930

1,651

1,824

• Applied Water

1,450

1,424

1,444

1,327

1,254

1,527

Operating Income

• Total Xylem

425

443

395

388

276

315

• Water Infrastructure

318

342

343

276

227

220

• Applied Water

166

170

160

158

109

162

Operating Margin

• Total Xylem

10.8%

11.7%

10.4%

12.1%

9.7%

9.6%

• Water Infrastructure

12.5%

14.1%

14.2%

14.3%

13.7%

12.1%

• Applied Water

11.4%

11.9%

11.1%

11.9%

8.7%

10.6%

Separation Costs

• Total Xylem

-

22

87

-

-

-

• Water Infrastructure

-

4

16

-

-

-

• Applied Water

-

2

13

-

-

-

Restructuring & Realignment Costs

• Total Xylem

65

24

-

15

31

41

• Water Infrastructure

50

19

-

12

15

17

• Applied Water

15

5

-

3

15

18

Adjusted Operating Income*

• Total Xylem

490

489

482

403

307

356

• Water Infrastructure

368

365

359

288

242

237

• Applied Water

181

177

173

161

124

180

Adjusted Operating Margin*

• Total Xylem

12.5%

12.9%

12.7%

12.6%

10.8%

10.8%

• Water Infrastructure

14.5%

15.1%

14.9%

14.9%

14.7%

13.0%

• Applied Water

12.5%

12.4%

12.0%

12.1%

9.9%

11.8%

*Adjusted Operating Income excludes non-recurring separation, restructuring &

realignment costs Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

35

Q1

Q2

Q3

Q4

Total

Pre-Tax Net Income

51

Interest Expense (Income), net

12

Depreciation

25

Amortization

12

Stock Compensation

6

EBITDA

106

Restructuring & Realignment

12

Adjusted EBITDA

118

Revenues

879

Adjusted EBITDA Margin

13.4%

Q1

Q2

Q3

Q4

Total

Pre-Tax Net Income

84

115

100

89

388

Interest Expense (Income), net

13

13

12

13

51

Depreciation

23

21

24

26

94

Amortization

11

12

12

13

48

Stock Compensation

5

5

6

6

22

EBITDA

136

166

154

147

603

Separation Costs

5

6

4

7

22

Restructuring & Realignment

-

-

5

19

24

Adjusted EBITDA

141

172

163

173

649

Revenues

925

966

931

969

3,791

Adjusted EBITDA Margin

15.2%

17.8%

17.5%

17.9%

17.1%

2013

2012

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA by Quarter

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

36

Illustration of Mid Point Guidance

2013 Guidance

FY '12

FY '13

As Reported

Adjustments

Adjusted

As Projected

Adjustments

Adjusted

Total Revenue

3,791

3,791

3,925

3,925

Segment Operating Income

512

30

a

542

484

65

d

549

Segment Operating Margin

13.5%

14.3%

12.3%

14.0%

Corporate Expense

69

(16)

b

53

59

-

59

Operating Income

443

46

489

425

65

490

Operating Margin

11.7%

12.9%

10.8%

12.5%

Interest Expense

(55)

(55)

(55)

(55)

Other Non-Operating Income (Expense)

-

-

(2)

(2)

Income before Taxes

388

46

434

368

65

433

Provision for Income Taxes

(91)

(13)

c

(104)

(72)

(19)

c

(91)

Net Income

297

33

330

296

46

342

Diluted Shares

186.2

186.2

186.4

186.4

Diluted EPS

1.59

$

0.18

$

1.77

$

1.59

$

0.25

$

1.84

$

a

One time separation, restructuring and realignment costs incurred at the segment level

b

One time separation, restructuring and realignment costs incurred at the corporate level

c

Net tax impact of above items, plus the addition of special tax items

d

Restructuring and realignment costs incurred at the segment level

Xylem Inc. Non-GAAP Reconciliation

Guidance

($ Millions, except per share amounts) |

XYLEM PROPRIETARY / CONFIDENTIAL

37

2013E

2012

Net Cash - Operating Activities

410

396

Capital Expenditures

(130)

(112)

Free Cash Flow, including separation costs

280

284

Cash Paid for Separation Costs (incl. Capex)

-

28

Free Cash Flow, excluding separation costs

280

312

Net Income

296

297

Separation Costs, net of tax (incl. tax friction)

-

16

Net Income, excluding separation costs

296

313

Free Cash Flow Conversion

95%

100%

Xylem Inc. Non-GAAP Reconciliation

Net Cash - Operating Activities vs. Free Cash Flow

($ Millions)

Year Ended |

XYLEM PROPRIETARY / CONFIDENTIAL

38 |