Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d539365d8k.htm |

The PNC

Financial Services Group, Inc. Barclays London Conference

May 21, 2013

Exhibit 99.1 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information |

3

Today’s Discussion

Overview of the PNC franchise

First quarter 2013 results

PNC’s strategic priorities for growth |

4

Corporate & Institutional

A leader in serving middle-market

customers and government entities

A top 10 U.S. bank-held wealth

manager

Asset Management

Residential Mortgage

A primary consumer product

National distribution capabilities

PNC’s Powerful Franchise

(1) Rankings source: SNL DataSource; Holding companies (for assets) or Banks (for deposits,

branches and ATMs) headquartered in U.S. Assets rank excludes Morgan Stanley and

Goldman Sachs. CO

TX

KS

OK

BlackRock

A leader in investment management, risk

management and advisory services

worldwide

December 31, 2012

U.S. Rank

1

Deposits

$213B

7

th

Assets

$305B

9

th

Branches

2,881

5

th

ATMs

7,282

5

th

Footprint covering nearly half of the U.S.

population

Retail Banking |

5

Value Creation Throughout the Economic Cycle

Peer Source: SNL DataSource. (1) Tangible book value (TBV) per share calculated as book value

per share less goodwill and certain other intangible assets. PNC’s book value per

share was $44 and $67 at December 31, 2007 and December 31, 2012, respectively. Further

information is provided in the Appendix. % change in TBV/Share

1

12/31/2007 to 12/31/2009

% change in TBV/Share

1

12/31/2009 to 12/31/2012

Financial crisis

“New normal”

$49

PNC’s TBV/Share

(1)

12/31/2007

12/31/2012

$18 |

6

Strong First Quarter Results in a Challenging

Environment

Continued growth in customers and loans

Solid revenue and disciplined expense management drove higher earnings and

returns

Significant

linked

quarter

expense

reduction

–

$700

million

continuous

improvement target remains on track

Delivered strong returns –

ROAA of 1.34%; ROACE of 10.68%

(1)

Strengthened capital levels –

Pro forma Basel III Tier 1 common capital ratio

increased to 8.0%

(2)

Increased common dividend by 10% to $.44 per share effective with May

dividend

1Q13 achievements

1Q13 financial

summary

Net income

Diluted EPS from

net income

Return on

average assets

$1.0 billion

$1.76

1.34% |

7

4Q12-1Q13

Expense growth

4Q12-1Q13

Revenue growth

Focused on Improving Earnings in 2013

4Q12-1Q13 Pretax

pre-provision earnings growth

(1)

(1)

See

Appendix

for

PNC

reconciliation.

See

Note

2

in

the

Appendix

for

further

details.

(2)

See

Note

3

in

the

Appendix

for

further

details.

Peer

Source: SNL Datasource. |

8

Effectively Managing Credit Risk

1Q13 loan loss reserves

1

to total loans

Reflects

company

data

for

1Q13

as

of

quarter-end.

Peer

source:

SNL

Datasource.

(1)

The

allowance

for

loan

and

lease

losses

includes impairment

reserves attributable to purchased impaired loans. (2) 1Q13 reserves/loans for PNC would have

been 2.45% if both reserves and loans had been adjusted to include the remaining marks

on purchased impaired loans. Further information is provided in the Appendix. Other peers have made

acquisitions and have marks on purchased impaired loans; however, no adjustments have been

made for those peers. Highlights

Strong underlying credit

trends continued to

improve |

9

Strong Capital and Liquidity Position

(1)

See Note 4 in the Appendix for further details. (2) See Note 2 on Slide 6. Pro forma Basel III

Tier 1 common capital ratio estimate not provided in 1Q12.

|

10

Well-Positioned to Drive Growth

Develop and grow in newly acquired and underpenetrated

markets

Capture

more

investable

assets

–

build

on

strong

AMG

business model

Build a stronger Residential Mortgage Banking business

Redefine the Retail Banking business

Manage expenses

Strategic Priorities |

11

Corporate

Banking

is

a

business

within

Corporate

&

Institutional

Banking.

AMG

refers

to

Asset

Management

Group.

Highlights

Solid growth in the Northeast

Building momentum in Midwest

markets gives us confidence as

we enter the Southeast

Regional President model key to

success in all markets

Significant cross-sell opportunities

Deeper Penetration and Cross-sell in Underpenetrated

Markets |

12

Newly Acquired Southeast Markets Provide Additional

Opportunities |

13

Investment & Retirement –

Build on Strong AMG

Business Model

A top 10 U.S. bank-held wealth

manager -

$275 billion client assets

under administration

(3)

Approaching $1 billion in annual

AMG revenues

Referral sales contributed 36% of

total sales in 2012

Investment and Retirement

investable assets opportunity -

$1.9

trillion

(4)

(1)

Highlights |

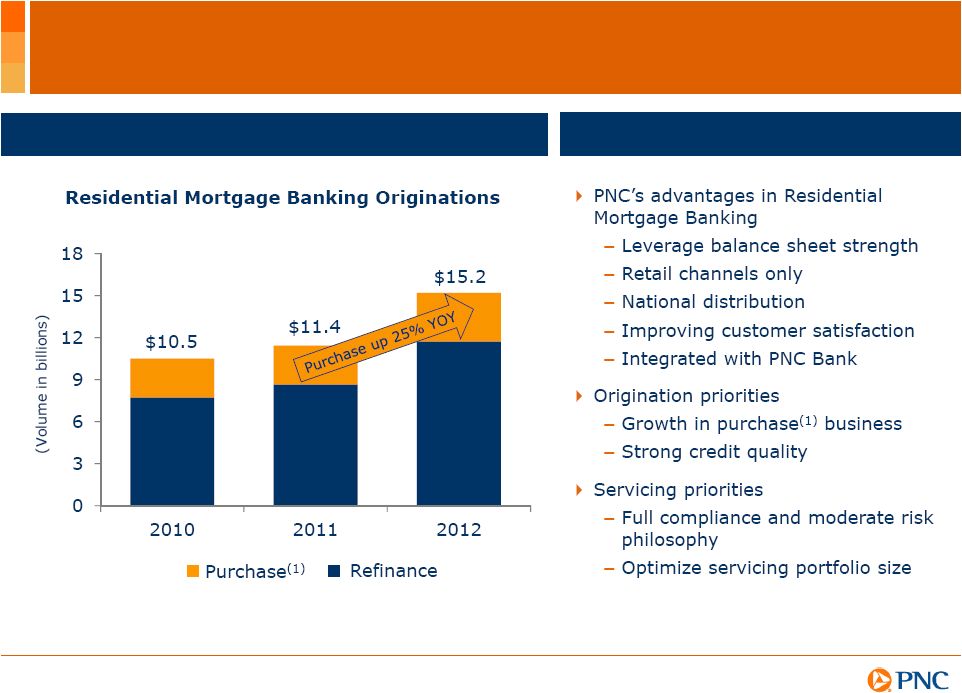

14

Building a Stronger Residential Mortgage Banking

Business

Growing the right way

Highlights

(1)

Purchase

is

defined

as

a

mortgage

with

a

borrower

as

part

of

a

residential

real

estate

purchase

transaction. |

15

(

1) Percentages reflect the proportion of PNC customers considered to be traditional branch,

primarily virtual or multi-channel customers based upon channels utilized for

transactions. See Note 6 in Appendix for further details. (2) Monthly transactions reflect

the monthly average for transactions conducted from October 2010-November 2011. Potential

in chart represents potential for ATM/Mobile channel percentage if transactions were to

migrate from Teller to ATM/Mobile channel. Serving Customers Tomorrow -

Redefining the Retail

Branch Network |

16

Managing Expenses -

2013 Expense Opportunities

(1)

Lower service

delivery costs

Branch

consolidation

Staffing and

back office

efficiencies

Enhance

staffing

model

Review loan

origination

process

Online

investment

platform

and

centralized

services

Lower

mortgage

foreclosure

compliance

costs

Staffing

efficiencies

Continued

focus on

consulting

expense

reductions

(1) Refer to Cautionary Statement in the Appendix, including economic and other assumptions.

Does not take into account the impact of potential legal and regulatory contingencies.

Continuous improvement $700 million goal –

achieved approximately

$500 million of annualized savings in 1Q13

Retail

Banking

Corporate &

Institutional

Banking

Asset

Management

Group

Residential

Mortgage

Banking

Shared

Services |

17

Key Take-Aways

PNC has the scale and business model to win

Continued expense discipline –

strong commitment

to continuous improvement savings

Positioned in 2013 to deliver improved earnings

Strategic growth priorities to create long-term

value

Strong capital position –

greater flexibility for

capital returns in 2014 |

18

Cautionary Statement Regarding Forward-Looking

Information

This presentation includes “snapshot”

information about PNC used by way of illustration and is not intended as a full business or

financial review. It should not be viewed in isolation but rather in the context

of all of the information made available by PNC in its SEC filings. We also make

statements in this presentation, and we may from time to time make other statements, regarding our outlook for earnings,

revenues, expenses, capital levels and ratios, liquidity levels,

asset levels, asset quality, financial position, and other matters regarding or

affecting PNC and its future business and operations that are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act.

Forward-looking statements are typically identified by words such as “believe,”

“plan,”

“expect,”

“anticipate,”

“see,”

“look,”

“intend,”

“outlook,”

“project,”

“forecast,”

“estimate,”

“goal,”

“will,”

“should”

and other similar words and expressions. Forward-

looking statements are subject to numerous assumptions, risks and uncertainties, which change

over time. Forward-looking statements speak only as of the date made. We do

not assume any duty and do not undertake to update forward-looking

statements. Actual results or future events could differ, possibly materially, from

those anticipated in forward-looking statements, as well as from historical

performance. Our forward-looking statements are subject to the following principal

risks and uncertainties. •Our businesses, financial results and balance sheet

values are affected by business and economic conditions, including the following:

Changes in interest rates and valuations in debt, equity and other financial markets.

Disruptions in the liquidity and other functioning of U.S. and global financial

markets. The impact on financial markets and the economy of any changes in the credit

ratings of U.S. Treasury obligations and other U.S. government-backed

debt,

as

well

as

issues

surrounding

the

level

of

U.S.

and

European

government

debt

and

concerns

regarding

the creditworthiness of certain sovereign governments, supranationals and financial

institutions in Europe. Actions by Federal Reserve, U.S. Treasury and other government

agencies, including those that impact money supply and market interest rates.

Changes

in

customers’,

suppliers’

and

other

counterparties’

performance

and

creditworthiness.

Slowing or failure of the current moderate economic expansion.

Continued effects of aftermath of recessionary conditions and uneven spread of positive

impacts of recovery on the economy and our counterparties, including adverse impacts on

levels of unemployment, loan utilization rates, delinquencies, defaults and

counterparty ability to meet credit and other obligations.

Changes in customer preferences and behavior, whether due to changing business and economic

conditions, legislative and regulatory initiatives, or other factors.

•Our forward-looking financial statements are subject to the risk that economic and

financial market conditions will be substantially different than we are currently

expecting. These statements are based on our current view that the moderate economic expansion will persist and

interest rates will remain very low in 2013, despite drags from Federal fiscal restraint and a

European recession. These forward-looking statements also do not, unless

otherwise indicated, take into account the impact of potential legal and regulatory contingencies.

Appendix |

19

Cautionary Statement Regarding Forward-Looking

Information (continued)

•

PNC’s ability to take certain capital actions, including paying dividends and any plans

to increase common stock dividends, repurchase common stock under current or future

programs, or issue or redeem preferred stock or other regulatory capital instruments, is subject to

the review of such proposed actions by the Federal Reserve as part of PNC’s comprehensive

capital plan for the applicable period in connection

with

the

regulators’

Comprehensive

Capital

Analysis

and

Review

(CCAR)

process

and

to

the

acceptance

of

such

capital

plan

and

non-objection to such capital actions by the Federal Reserve.

•PNC’s regulatory capital ratios in the future will depend on, among other things,

the company’s financial performance, the scope and terms of final capital

regulations then in effect (particularly those implementing the Basel Capital Accords), and management actions affecting the

composition

of

PNC’s

balance

sheet.

In

addition,

PNC’s

ability

to

determine,

evaluate

and

forecast

regulatory

capital

ratios,

and

to

take

actions (such as capital distributions) based on actual or forecasted capital ratios, will be

dependent on the ongoing development, validation and regulatory approval of related

models. •Legal

and

regulatory

developments

could

have

an

impact

on

our

ability

to

operate

our

businesses,

financial

condition,

results

of

operations,

competitive

position,

reputation,

or

pursuit

of

attractive

acquisition

opportunities.

Reputational

impacts

could

affect

matters

such

as

business generation and retention, liquidity, funding, and ability to attract and retain

management. These developments could include: Changes resulting from legislative

and regulatory reforms, including major reform of the regulatory oversight structure of the

financial services industry and changes to laws and regulations involving tax, pension,

bankruptcy, consumer protection, and other industry aspects, and changes in accounting

policies and principles. We will be impacted by extensive reforms provided for in the

Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank

Act”) and otherwise growing out of the recent financial crisis, the precise

nature, extent and timing of which, and their impact on us, remains uncertain. Changes

to regulations governing bank capital and liquidity standards, including due to the Dodd-Frank Act and to Basel-related

initiatives.

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries.

In

addition

to

matters

relating

to

PNC’s

business

and

activities,

such

matters

may

include

proceedings,

claims,

investigations, or inquiries relating to pre-acquisition business and activities of

acquired companies, such as National City. These matters

may

result

in

monetary

judgments

or

settlements

or

other

remedies,

including

fines,

penalties,

restitution

or

alterations

in

our business practices, and in additional expenses and collateral costs, and may cause

reputational harm to PNC. Results of the regulatory examination and supervision

process, including our failure to satisfy requirements of agreements with governmental

agencies. Impact

on

business

and

operating

results

of

any

costs

associated

with

obtaining

rights

in

intellectual

property

claimed

by

others

and of adequacy of our intellectual property protection in general.

Appendix |

20

Cautionary Statement Regarding Forward-Looking

Information (continued)

•Business and operating results are affected by our ability to identify and effectively

manage risks inherent in our businesses, including, where

appropriate,

through

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

to

meet

evolving

regulatory capital standards. In particular, our results currently depend on our ability

to manage elevated levels of impaired assets. •Business

and

operating

results

also

include

impacts

relating

to

our

equity

interest

in

BlackRock,

Inc.

and

rely

to

a

significant

extent

on

information provided to us by BlackRock. Risks and uncertainties that could affect

BlackRock are discussed in more detail by BlackRock in its SEC filings.

•We grow our business in part by acquiring from time to time other financial services

companies, financial services assets and related deposits and other liabilities.

Acquisition risks and uncertainties include those presented by the nature of the business acquired, including

in some cases those associated with our entry into new businesses or new geographic or other

markets and risks resulting from our inexperience in those new areas, as well as risks

and uncertainties related to the acquisition transactions themselves, regulatory issues, and

the integration of the acquired businesses into PNC after closing.

•Competition can have an impact on customer acquisition, growth and retention and on

credit spreads and product pricing, which can affect market share, deposits and

revenues. Industry restructuring in the current environment could also impact our business and financial

performance

through

changes

in

counterparty

creditworthiness

and

performance

and

in

the

competitive

and

regulatory

landscape.

Our

ability to anticipate and respond to technological changes can also impact our ability to

respond to customer needs and meet competitive demands.

•Business and operating results can also be affected by widespread natural and other

disasters, dislocations, terrorist activities or international hostilities through

impacts on the economy and financial markets generally or on us or our counterparties specifically.

We provide greater detail regarding these as well as other factors in our 2012 Form 10-K

and 1st Quarter 2013 Form 10-Q, including in the Risk Factors and Risk Management

sections and the Legal Proceedings and Commitments and Guarantees Notes of the Notes To

Consolidated Financial Statements in those reports, and in our subsequent SEC filings.

Our forward-looking statements may also be subject to

other

risks

and

uncertainties,

including

those

we

may

discuss

elsewhere

in

this

presentation

or

in

SEC

filings,

accessible

on

the

SEC’s

website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have

included these web addresses as inactive textual references only. Information on

these websites is not part of this document. Any annualized, proforma, estimated, third

party or consensus numbers in this presentation are used for illustrative or comparative

purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by

analysts

who

cover

that

company.

The

analysts’

opinions,

estimates

or

forecasts

(and

therefore

the

consensus

earnings

estimates)

are

theirs alone, are not those of PNC or its management, and may not reflect PNC’s or other

company’s actual or anticipated results. Appendix |

21

Notes

Appendix

Explanatory Notes

(1) ROAA is Return on Average Assets and ROACE is Return on Average Common Equity.

(6) Transactions refer to service transactions which include deposits, withdrawals and

payments. Traditional branch customer is a customer who conducts greater than 80% of

monthly transactions in a branch. Primarily Virtual customer is a customer who conducts

the majority of monthly transactions at non-branch channels (i.e., ATM, Online, Call Center, Mobile). Multi-channel

customer is a customer who uses all the channels including branch but is not dominant in any.

(2) Pretax pre-provision earnings is defined as total revenue less noninterest

expense. We believe that pretax pre-provision earnings, a non-GAAP measure, is

a useful tool to help evaluate the ability to provide for credit costs through operations.

(5) A Corporate Banking primary client is defined as a corporate banking relationship with

annual revenue generation of $50,000 or more or, within corporate banking, a commercial

banking client relationship with annual revenue generation of $10,000 or more. An Asset

Management Group primary client is defined as a client relationship with annual revenue generation of $10,000 or more.

(3) Peer Average refers to average of the peers listed in the table. Peer information

source: SNL Datasource. (4) Basel I Tier 1 common capital

ratio is period-end Tier 1 common capital divided by period-end Basel I risk-weighted assets. |

22

Estimated Pro Forma Basel III Tier 1 Common Capital

Appendix

PNC's pro forma Basel III Tier 1 common capital ratio was estimated without the benefit of

phase-ins and is based on our current understanding of Basel III proposed

rules. PNC utilizes this estimate to assess its Basel III capital position, including

comparison to similar estimates made by other financial institutions. Tier 1 common capital as

defined under the proposed Basel III rules differs materially from Basel I. Under Basel

III, unconsolidated investments in financial institutions, mortgage servicing rights

and deferred tax assets must be deducted from capital to the extent that they individually exceed 10%, or in

the aggregate exceed 15%, of the institution’s adjusted Tier I common capital.

Also, Basel I regulatory capital excludes certain other comprehensive income related to

both available for sale securities and pension and other postretirement plans, whereas

under Basel III these items are a component of capital. Basel III risk-weighted assets were estimated under Basel

II (including the modifications to the advanced approaches proposed under Basel III) and

application of Basel II.5, and reflect credit, market and operational risk. This

Basel III capital estimate is likely to be impacted by the finalization of the Basel III

rules, further regulatory clarity relating to the capital rules, and the ongoing evolution,

validation and regulatory approval of PNC's models integral to the calculation of Basel

II risk-weighted assets. We

provide

information

below

regarding

PNC’s

pro

forma

fully

phased-in

Basel

III

Tier

1

common

capital

ratio

and

how

it

differs

from

the

Basel

I

Tier

1

common

capital

ratio

as

we

expect

the

Basel

III

ratio

to

replace

the

current

Basel

I

ratio

for

this

regulatory

metric

when

the

applicable

rules

are

finalized

and fully implemented and PNC exits the parallel run qualification phase under Basel II.

Estimated Pro forma Basel III Tier 1 Common Capital Ratio

Dollars in millions

March 31, 2013

December 31, 2012

Basel I Tier 1 common capital

$25,680

$24,951

Less regulatory capital adjustments:

Basel III quantitative limits

(2,076)

(2,330)

Accumulated other comprehensive income (a)

289

276

All other adjustments

(367)

(396)

Estimated Basel III Tier 1 common capital

$23,526

$22,501

Estimated Basel III risk-weighted assets

293,810

301,006

Pro forma Basel III Tier 1 common capital ratio

8.0%

7.5%

Basel I Tier 1 Common Capital Ratio

Dollars in millions

March 31,2013

December 31, 2012

Basel I Tier 1 common capital

$25,680

$24,951

Basel I risk-weighted assets

261,491

260,847

Basel I Tier 1 common capital ratio

9.8%

9.6%

(a) Represents net adjustments related to accumulated other comprehensive

income for available for sale securities and pension and other postretirement

benefit plans. |

Non-GAAP

to GAAP Reconcilement 23 |

24

Non-GAAP to GAAP Reconcilement

Appendix

In millions

Mar. 31, 2013

Dec. 31, 2012

% Change

Net interest income

$2,389

$2,424

Noninterest income

$1,566

$1,645

Total revenue

$3,955

$4,069

Noninterest expense

($2,395)

($2,829)

Pretax pre-provision earnings

$1,560

$1,240

26%

Net income

$1,004

$719

40%

See Note 2 on Slide 22.

In millions for full year 2012

Total noninterest expense, as reported

$10,582

Integration costs

(267)

Trust preferred securities redemption-related charges

(295)

Noninterest expense, core

$10,020

In

full

year

2013,

PNC

does

not

expect

to

incur

integration

costs

and

anticipates

the

charges

for

noncash

charges

related to redemption of trust preferred securities to be approximately $60 million or

less. Quarter Ended |

25

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC |