Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLE CORPORATE INCOME TRUST, INC. | d540782d8k.htm |

Exhibit 99.1

FOR IMMEDIATE RELEASE

COLE CORPORATE INCOME TRUST ACQUIRES HEADQUARTERS FOR

THE HILLSHIRE BRANDS COMPANY IN CHICAGO FOR $97.5 MILLION

***

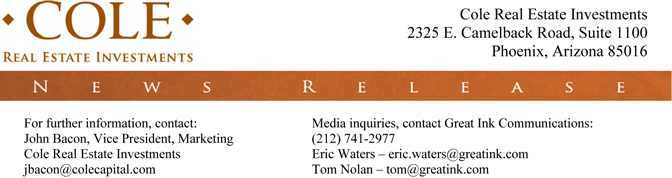

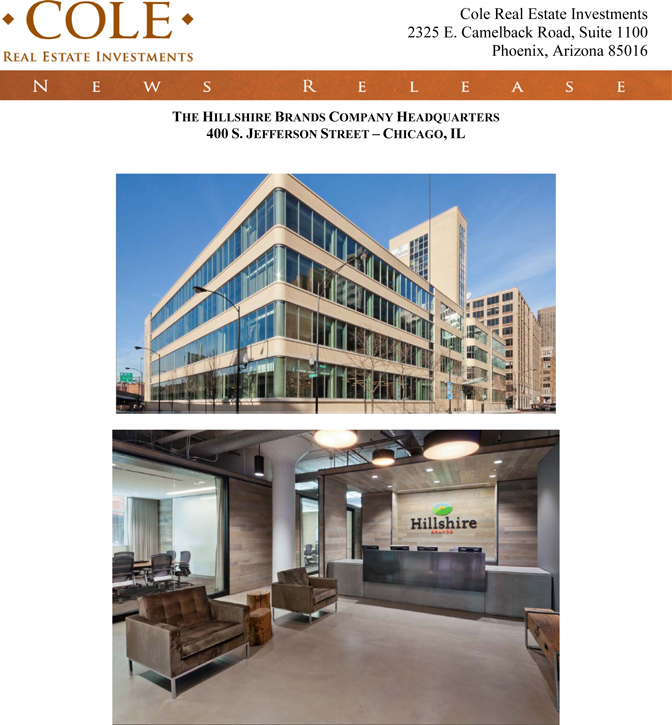

Recently Redeveloped Mission-Critical Facility Located in West Loop of Chicago’s CBD

PHOENIX, AZ: (May 21, 2013) – Cole Real Estate Investments (Cole), a diversified real estate company, announced the acquisition of The Hillshire Brands Company (Hillshire) headquarters on behalf of Cole Corporate Income Trust, Inc. (CCIT) for $97.5 million. CCIT invests primarily in strategic single-tenant, income-producing, necessity corporate properties leased to creditworthy tenants under long-term net leases.

The 233,869-square-foot mission-critical headquarters facility was recently redeveloped by Sterling Bay Companies, which entered into a long-term net lease with Hillshire (S&P ‘BBB’) early in the process. All of the infrastructure and building components were completely re-done with Hillshire’s build-out of the property, and windows were added on all four exposures, allowing for a substantial amount of natural light. The property’s location in the West Loop submarket of the Chicago Central Business District (CBD) provides excellent visibility and accessibility, including public transportation.

“This was a unique opportunity to acquire a Class A, single-tenant office in the desirable West Loop of Chicago,” said Boyd Messmann, senior vice president of office and industrial acquisitions, who represented Cole in the transaction. “One of the key factors was the long-term lease – nearly 15 years – with an investment-grade tenant.”

Hillshire is a leader in various meat products sold within the retail and foodservice markets. Hillshire offers its products primarily under the Jimmy Dean, Ball Park, Hillshire Farm, State Fair, Sara Lee, and Chef Pierre brand names, as well as artisanal brands, such as Aidells and Gallo Salame.

With this transaction, CCIT’s investment portfolio consists of 27 wholly-owned properties in 15 states, totaling approximately 4.6 million square feet with a purchase price of approximately $731.1 million. The overall weighted average credit rating of the rated tenants in the portfolio is A-, and the weighted average remaining lease term is nearly 11 years. More than 65% of CCIT’s portfolio consists of tenants rated by Standard & Poor’s, and of those tenants more than 88% are rated investment grade.

***

About Cole Real Estate Investments

Founded in 1979, Cole Real Estate Investments is one of the nation’s leading acquirers and managers of high-quality, income-producing retail, office and industrial real estate assets. Cole primarily targets net-leased single-tenant and multi-tenant retail properties under long-term leases with creditworthy tenants, as well as single-tenant office and industrial properties, using a conservative investment and financing strategy. According to Real Capital Analytics, a leading industry research firm, Cole has established itself as the No. 1 buyer of all single-tenant assets for the past 10 years. At the end of April 2013, Cole-related entities owned and managed more than 2,114 assets representing approximately 80.5 million square feet of commercial real estate in 48 states, with a combined acquisition cost of $13.4 billion. To learn more, visit www.colecapital.com.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements that reflect the current views of Cole Real Estate Investments and Cole’s management with respect to future events. Forward-looking statements about Cole’s plans, strategies and prospects are based on current information, estimates and projections; they are subject to risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Forward-looking statements are not intended to be a guarantee of any event, action, result, outcome or performance in future periods. Cole does not intend or assume any obligation to update any forward-looking statements, and the reader is cautioned not to place undue reliance on them.