Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2013 |

or

| o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ______ to _____ |

| Commission File Number 000-54882 |

|

BIOLOGIX HAIR INC.

|

||||||||||||||||||||

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

27-4588540

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

82 Avenue Road, Toronto, Ontario, Canada

|

M5R 2H2

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(647) 344-5900

|

||||||||||||||||||||

|

(Registrant’s telephone number, including area code)

|

||||||||||||||||||||

|

N/A

|

||||||||||||||||||||

|

(Former name, former address and former fiscal year, if changed since last report)

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||||||||||||||||||||

|

x

|

YES

|

o

|

NO

|

|||||||||||||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

||||||||||||||||||||

|

o

|

YES

|

x

|

NO

|

|||||||||||||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|||

|

Large accelerated filer

|

o

|

Accelerated filer o | |

|

Non-accelerated filer

|

o

|

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act

|

|||

|

o

|

YES

|

x

|

NO

|

|

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court.

|

|

o

|

YES

|

o

|

NO

|

|

APPLICABLE ONLY TO CORPORATE ISSUERS

|

||||

|

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

||||

|

56,630,000 common shares issued and outstanding as of May 20, 2013.

|

TABLE OF CONTENTS

|

PART I - FINANCIAL INFORMATION

|

3

|

|

|

Item 1.

|

Financial Statements

|

3

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

4

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

16

|

|

Item 4.

|

Controls and Procedures

|

16

|

|

PART II – OTHER INFORMATION

|

16

|

|

|

Item 1.

|

Legal Proceedings

|

16

|

|

Item 1A.

|

Risk Factors

|

16

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

16

|

|

Item 3.

|

Defaults Upon Senior Securities

|

17

|

|

Item 4.

|

Mine Safety Disclosures

|

17

|

|

Item 5.

|

Other Information

|

17

|

|

Item 6.

|

Exhibits

|

19

|

|

SIGNATURES

|

21

|

|

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results for the interim period ended March 31, 2013 are not necessarily indicative of the results that can be expected for the full year.

3

|

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

THREE MONTHS ENDED MARCH 31, 2013

(As expressed in US dollars)

(Unaudited – Prepared by Management)

|

F-1

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – Prepared by Management)

INTERIM CONSOLIDATED BALANCE SHEETS

|

As at

|

March 31

2013

|

December 31

2012

|

||||||

| $ | $ | |||||||

|

ASSETS

|

||||||||

|

Current

|

||||||||

|

Cash and cash equivalents

|

67,136 | 63,755 | ||||||

|

Taxes receivable

|

- | 69,633 | ||||||

|

Prepaid expenses and deposit (Note 4)

|

175,729 | 250,682 | ||||||

|

Total current assets

|

242,865 | 384,070 | ||||||

|

Prepaid expense – long term (Note 4)

|

- | 31,270 | ||||||

|

Property and equipment (Note 5)

|

133,439 | 154,079 | ||||||

|

Website development cost (Note 6)

|

97,296 | 94,272 | ||||||

|

Total assets

|

473,600 | 663,691 | ||||||

|

LIABILITIES

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liabilities

|

494,735 | 423,876 | ||||||

|

Due to related parties (Note 8)

|

5,673 | 189,489 | ||||||

|

Current portion of promissory and convertible promissory notes (Note 7)

|

11,504,439 | 7,604,595 | ||||||

| 12,004,847 | 8,217,960 | |||||||

|

Non-current portion of promissory and convertible promissory notes (Note 7)

|

3,302,873 | 6,663,675 | ||||||

|

Total liabilities

|

15,307,720 | 14,881,635 | ||||||

|

STOCKHOLDERS’ EQUITY

|

||||||||

|

Common stock (Notes 1 and 9)

|

||||||||

|

Authorized: 900,000,000 common shares, $0.001 par value

|

||||||||

|

Issued and outstanding: 56,630,000 (December 31, 2012: 26,430,000 at $0.001 par value) common shares

|

56,630 | 26,430 | ||||||

|

Additional paid-in capital

|

13,161,857 | 11,248,754 | ||||||

|

Share subscriptions received in advance (Note 9)

|

650,000 | - | ||||||

|

Accumulated other comprehensive income

|

5,156 | 6,087 | ||||||

|

Deficit

|

(28,707,763 | ) | (25,499,215 | ) | ||||

|

Total stockholders’ equity (deficiency)

|

(14,834,120 | ) | (14,217,944 | ) | ||||

|

Total liabilities and stockholders’ equity

|

473,600 | 663,691 | ||||||

See accompanying notes to the interim consolidated financial statements

F-2

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – Prepared by Management)

INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

|

Three months

ended

March 31,

2013

|

Three months

ended

March 31,

2012

|

Cumulative

from October 4,

2011 to

March 31,

2013

|

||||||||||

| $ | $ | $ | ||||||||||

|

OPERATING EXPENSES

|

||||||||||||

|

Amortization of website development costs (Note 6)

|

11,608 | 7,306 | 46,881 | |||||||||

|

Bank charges

|

1,454 | 2,782 | 14,749 | |||||||||

|

Clinical research and reformulation

|

83,104 | - | 1,103,087 | |||||||||

|

Consulting and management fees (Note 8)

|

116,994 | 158,871 | 973,060 | |||||||||

|

Depreciation (Note 5)

|

20,640 | 18,264 | 103,189 | |||||||||

|

Foreign exchange (gain) or loss

|

(2,059 | ) | 67 | (185 | ) | |||||||

|

Insurance

|

3,785 | 2,677 | 7,110 | |||||||||

|

Interest

|

814,942 | 5,425 | 2,965,898 | |||||||||

|

IPR&D expense (Note 2b)

|

- | - | 18,679,530 | |||||||||

|

Licences and permits

|

312 | - | 6,702 | |||||||||

|

Loss on disposition of assets (Note 5)

|

- | - | 6,362 | |||||||||

|

Marketing and sales promotion

|

55,348 | - | 426,278 | |||||||||

|

Office and administrative

|

29,196 | 3,495 | 103,148 | |||||||||

|

Professional fees

|

35,883 | 22,536 | 320,494 | |||||||||

|

Relocation fees

|

8,236 | 57,435 | 79,985 | |||||||||

|

Rent

|

123,617 | 46,980 | 395,639 | |||||||||

|

Royalty

|

119,870 | - | 388,847 | |||||||||

|

Stock based compensation

|

1,615,956 | - | 2,578,484 | |||||||||

|

Telephone

|

6,000 | 1,242 | 27,998 | |||||||||

|

Transfer agent fees

|

1,651 | 1,000 | 4,857 | |||||||||

|

Travel and promotion

|

53,963 | 144,603 | 445,083 | |||||||||

|

Wages and benefits

|

52,758 | - | 113,735 | |||||||||

|

Warehousing and distribution (Note 8)

|

- | - | 10,000 | |||||||||

|

Website maintenance

|

55,290 | - | 141,220 | |||||||||

|

NET LOSS BEFORE INCOME TAXES FOR THE PERIOD

|

(3,208,548 | ) | (472,683 | ) | (28,942,151 | ) | ||||||

|

Deferred income tax recovery

|

- | - | 234,388 | |||||||||

|

NET LOSS FOR THE PERIOD

|

(3,208,548 | ) | (472,683 | ) | (28,707,763 | ) | ||||||

|

OTHER COMPREHENSIVE INCOME

|

||||||||||||

|

Currency translation adjustments

|

(931 | ) | 18,901 | 5,156 | ||||||||

|

COMPREHENSIVE LOSS FOR THE PERIOD

|

(3,209,478 | ) | (453,782 | ) | (28,702,607 | ) | ||||||

|

|

||||||||||||

|

LOSS PER SHARE – BASIC AND DILUTED

|

(0.06 | ) | (47.27 | ) | ||||||||

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING - BASIC AND DILUTED

|

53,610,000 | 10,000 | ||||||||||

See accompanying notes to the interim consolidated financial statements

F-3

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

INTERIM CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

From inception October 4, 2011 to March 31, 2013

|

Common

Shares

|

Stock

Amount

|

Additional

Paid-in

Capital

|

Accumulated

Other

Comprehensive

Income

|

Share

Subscriptions Received

In Advance

|

Deficit Accumulated in Development

Stage

|

Total

Stockholders’

Equity

(Deficiency)

|

||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

|

Balance, October 4, 2011

|

- | - | - | - | - | - | - | |||||||||||||||||||||

|

Issuance of common shares for cash

|

||||||||||||||||||||||||||||

|

- $0.01 per share

|

10,000 | 10 | 90 | - | - | - | 100 | |||||||||||||||||||||

|

Share subscriptions received in advance, net (Note 9)

|

- | - | - | - | 527,500 | - | 527,500 | |||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (131,371 | ) | (131,371 | ) | |||||||||||||||||||

|

Balance, December 31, 2011

|

10,000 | 10 | 90 | - | 527,500 | (131,371 | ) | 396,229 | ||||||||||||||||||||

|

Common shares issued for cash (Note 9)

|

||||||||||||||||||||||||||||

|

- $0.05 per share, on April 18, 2012

|

9,450,000 | 9,450 | 463,050 | - | (437,500 | ) | - | 35,000 | ||||||||||||||||||||

|

- $0.25 per share, on April 18, 2012

|

6,220,000 | 6,220 | 1,548,780 | - | (90,000 | ) | - | 1,465,000 | ||||||||||||||||||||

|

- $0.80 per share, on May 2, 2012

|

2,500,000 | 2,500 | 1,997,500 | - | - | - | 2,000,000 | |||||||||||||||||||||

|

- $1.00 per share, on June 22, 2012

|

1,500,000 | 1,500 | 1,498,500 | - | - | - | 1,500,000 | |||||||||||||||||||||

|

- $1.00 per share, on September 24, 2012

|

250,000 | 250 | 249,750 | - | - | - | 250,000 | |||||||||||||||||||||

|

Share issuance costs

|

- | - | (210,000 | ) | - | - | - | (210,000 | ) | |||||||||||||||||||

|

Common shares issued for settlement of debt

|

||||||||||||||||||||||||||||

|

- $0.25 per share (Note 2 and Note 9), on April 28, 2012

|

2,000,000 | 2,000 | 498,000 | - | - | - | 500,000 | |||||||||||||||||||||

|

- $1.00 per share (Note 7 and Note 9), on June 6, 2012

|

500,000 | 500 | 499,500 | - | - | - | 500,000 | |||||||||||||||||||||

|

$0.80 per share, acquisition of BHSL (Note 2), on May 18, 2012

|

4,000,000 | 4,000 | 3,196,000 | - | - | - | 3,200,000 | |||||||||||||||||||||

|

Stock based compensation

|

- | - | 962,528 | - | - | - | 962,528 | |||||||||||||||||||||

|

Equity component of conversion beneficiary features, net of tax impact (Note 7)

|

- | - | 278,776 | - | - | - | 278,776 | |||||||||||||||||||||

|

Allocated value of warrants, net of tax impact (Note 7)

|

- | - | 266,280 | - | - | - | 266,280 | |||||||||||||||||||||

|

Net loss for the year

|

- | - | - | - | - | (25,367,844 | ) | (25,367,844 | ) | |||||||||||||||||||

|

Currency translation adjustments

|

- | - | - | 6,087 | - | - | 6,087 | |||||||||||||||||||||

|

Balance, December 31, 2012

|

26,430,000 | 26,430 | 11,248,754 | 6,087 | - | (25,499,215 | ) | (14,217,944 | ) | |||||||||||||||||||

See accompanying notes to the interim consolidated financial statements

F-4

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

INTERIM CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

From inception October 4, 2011 to March 31, 2013

|

Common

Shares

|

Stock

Amount

|

Additional

Paid-in

Capital

|

Accumulated

Other

Comprehensive

Income

|

Share Subscriptions Received In Advance

|

Deficit Accumulated in Development

Stage

|

Total

Stockholders’

Equity

(Deficiency)

|

||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

|

Balance, December 31, 2012

|

26,430,000 | 26,430 | 11,248,754 | 6,087 | - | (25,499,215 | ) | (14,217,944 | ) | |||||||||||||||||||

|

Recapitalization – Biologix Nevada (Note 2(c) and 9)

|

30,200,000 | 30,200 | 297,147 | - | - | - | 327,347 | |||||||||||||||||||||

|

Share subscriptions received in advance, net (Note 9)

|

- | - | - | - | 650,000 | - | 650,000 | |||||||||||||||||||||

|

Stock based compensation

|

- | - | 1,615,956 | - | - | - | 1,615,956 | |||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (3,208,548 | ) | (3,208,548 | ) | |||||||||||||||||||

|

Currency translation adjustments

|

- | - | - | (931 | ) | - | - | (931 | ) | |||||||||||||||||||

|

Balance, March 31, 2013

|

56,630,000 | 56,630 | 13,161,857 | 5,156 | 650,000 | (28,707,763 | ) | (14,834,120 | ) | |||||||||||||||||||

See accompanying notes to the interim consolidated financial statements

F-5

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

|

Three

months ended

March 31,

2013

|

Three

months ended

March 31,

2012

|

Cumulative

from

October 4,

2011 to

March 31,

2013

|

||||||||||

| $ | $ | $ | ||||||||||

|

OPERATING ACTIVITIES:

|

||||||||||||

|

Net loss from operations

|

(3,208,548 | ) | (472,683 | ) | (28,707,763 | ) | ||||||

|

Items not affecting cash and cash equivalents

|

||||||||||||

|

- Amortization of website development costs (Note 6)

|

11,608 | 7,306 | 46,881 | |||||||||

|

- Depreciation (Note 5)

|

20,640 | 18,264 | 103,189 | |||||||||

|

- Accrued interest

|

814,042 | 5,425 | 2,963,941 | |||||||||

|

- IPR&D expense (Note 2)

|

- | - | 18,679,530 | |||||||||

|

- Stock based compensation

|

1,615,956 | - | 2,578,484 | |||||||||

|

- Loss on disposition of assets

|

- | - | 6,362 | |||||||||

|

- Deferred income tax recovery

|

- | - | (234,388 | ) | ||||||||

|

Changes in non-cash working capital items

|

||||||||||||

|

- Taxes receivable

|

69,633 | (16,940 | ) | - | ||||||||

|

- Prepaid expenses and deposit

|

74,953 | (41,841 | ) | (207,000 | ) | |||||||

|

- Prepaid expenses – long term

|

31,270 | - | 31,270 | |||||||||

|

- Accounts payable and accrued liabilities

|

65,691 | 69,232 | (160,278 | ) | ||||||||

|

- Due to related parties

|

(183,816 | ) | (9,347 | ) | 5,673 | |||||||

|

Net cash provided by (used in) operating activities

|

(688,571 | ) | (356,902 | ) | (4,894,099 | ) | ||||||

|

FINANCING ACTIVITIES:

|

||||||||||||

|

Proceeds from issuance of common stock

|

- | 1,065,000 | 4,640,100 | |||||||||

|

Share subscriptions received in advance

|

650,000 | - | 1,177,500 | |||||||||

|

Note payable

|

50,000 | - | 1,700,000 | |||||||||

|

Net cash provided by (used in) financing activities

|

700,000 | 1,065,000 | 7,517,600 | |||||||||

|

INVESTING ACTIVITIES:

|

||||||||||||

|

Net cash paid on acquisition of BHSL (Note 2)

|

- | - | (2,192,569 | ) | ||||||||

|

Net cash received on reverse acquisition (Note 2)

|

7,515 | 7,515 | ||||||||||

|

Intellectual property licence

|

- | (500,000 | ) | - | ||||||||

|

Purchase of equipment

|

- | (144,331 | ) | (245,718 | ) | |||||||

|

Proceeds from disposition of assets

|

- | - | 2,728 | |||||||||

|

Website development costs

|

(14,632 | ) | (50,815 | ) | (133,477 | ) | ||||||

|

Net cash provided by (used in) investing activities

|

(7,117 | ) | (695,146 | ) | (2,561,521 | ) | ||||||

|

Currency translation adjustments

|

(931 | ) | 226 | 5,156 | ||||||||

|

INCREASE IN CASH AND CASH EQUIVALENTS

|

3,381 | 13,178 | 67,136 | |||||||||

|

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD

|

63,755 | 218,416 | - | |||||||||

|

CASH AND CASH EQUIVALENTS, END OF PERIOD

|

67,136 | 231,594 | 67,136 | |||||||||

|

Supplemental disclosure of cash flow information:

|

||||||||||||

|

Income tax paid

|

- | - | - | |||||||||

|

Interest paid

|

- | - | - | |||||||||

See accompanying notes to the interim consolidated financial statements

F-6

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 1 – INCORPORATION, NATURE AND CONTINUANCE OF OPERATIONS

Biologix Hair Inc. (formerly T&G Apothecary, Inc.) (the “Company” or “Biologix Nevada”) was incorporated under the laws of the State of Nevada, U.S.A. on January 18, 2011. The Company was in the business of developing and marketing a 100% USDA Certified Organic personal care product line for women. However, as described below, the Company has recently changed its primary business focus to the development and commercialization of a hair therapy system. The Company has limited operations and in accordance with ASC 915, is considered a development stage company that had no revenues from inception to date. The Company has a December 31 year-end.

Effective January 9, 2013, the Company acquired 100% of the issued and outstanding shares of Biologix Hair Inc. (“Biologix Florida”), a company incorporated on October 4, 2011 in the state of Florida, U.S.A. in exchange for 26,430,000 post-split shares of the Company’s common stock and resulting in a reverse acquisition. On December 13, 2012, the Company changed its name from T&G Apothecary, Inc. to Biologix Hair Inc. to better reflect its new business. Upon the completion of the acquisition, the former shareholders of Biologix Florida held 47% of the Company’s issued and outstanding common stock and the composition of the board of directors has been changed by the majority of existing board members of Biologix Florida. As a result, the transaction was accounted for as a reverse acquisition for accounting purpose, as Biologix Florida was deemed to be the acquirer, and the interim consolidated financial statements are a continuation of the financial statements of Biologix Florida. As a result of these transactions, the business combination resulted in the combined Company having 56,630,000 issued and outstanding common shares. The Company and its subsidiaries resulted from the reverse acquisition are collectively referred to as the “Company”. See Note 2 (c).

The Company has incurred accumulated deficit of $28,707,763 to March 31, 2013 and has no source of revenue. The continuity of the Company’s future operations is dependent upon its ability to obtain financing and profitable operations from its establishment of Hair Therapy Centers. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The Company intends to continue relying upon the issuance of equity securities to finance its operations. However there can be no assurance it will be successful in raising the funds necessary to maintain operations, or that a self-supporting level of operations will ever be achieved. The likely outcome of these future events is indeterminable. The financial statements do not include any adjustment to reflect the possible future effect on the recoverability and classification of the assets or the amounts and classification of liabilities that may result should the Company cease to continue as a going concern.

F-7

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 2 – ACQUISITIONS

(a) Cranium Technologies Ltd.

Effective November 1, 2011, Biologix Florida acquired 100% of the outstanding common shares of Cranium Technologies Ltd. for total cash consideration in the amount of $5,000. As Cranium does not have any viable operation at the time of acquisition, the transaction does not constitute a business combination.

As the acquisition does not qualify as a business combination, with no assets and liabilities as at the date of acquisition, the consideration paid has been considered to be a transaction cost which has been expensed.

(b) Intellectual Property License (BHSL)

Biologix Florida entered into an Intellectual Property License Agreement (the “License Agreement”) on December 9, 2011 with BHSL, whereby Biologix Florida was granted an exclusive, perpetual license to market, sell and distribute the Invention (“Hair Growth Process”), being all formulae, products, processes, and technical know-how for the stimulation of hair growth and treatment of hair loss developed, owned or controlled by Hair Research and Science Est, (“HRSE”) and Licensed Intellectual Property relating to the Invention, within North America, Central America and the Caribbean, including all sovereign and non-sovereign areas therein. In full consideration of all rights granted, Biologix Florida agreed to pay to BHSL $250,000 within 30 days of signing of the License Agreement and $750,000 by January 30, 2012, and subject to a full due diligence review of the Invention and the Licensed Intellectual Property. As at December 31, 2011, Biologix Florida had not yet completed the related full due diligence review of the above noted Invention and recorded the related consideration commitment as prepaid expense and accounts payable and accrued liabilities of $1,000,000, respectively.

During the fiscal year 2012 and on March 7, 2012, Biologix Florida completed its related due diligence review of the above noted Invention and signed an amendment to the License Agreement whereby the payment of the consideration was extended to March 31, 2012. Biologix Florida made cash payment of $500,000 with the remaining balance of $500,000 settled by the common shares of Biologix Florida at a value of $0.25 per share for 2,000,000 common shares on April 18, 2012. (Also see Note 9). Upon the completion of the payments, Biologix Florida charged the considerations paid to in-process research and development (“IPR&D”) expenditures.

On April 11, 2012, BHSL entered into an amended Intellectual Property Purchase and Sale Agreement with HRSE whereby BHSL acquired certain Intellectual Property, including processes and formulae for the stimulation of hair growth and treatment of hair loss, for consideration in the amount of $10,100,000. $100,000 was paid upon execution of the agreement and $10,000,000 in the form of a promissory note bears interest rate of 3% per annum with following maturity date:

|

●

|

$2,000,000 on or before July 31st, 2012;

|

|

●

|

$3,000,000 on or before December 31, 2012; and

|

|

●

|

$5,000,000 on or before July 31, 2013.

|

F-8

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 2 – ACQUISITION (cont’d...)

(b) Intellectual Property License (BHSL) (cont’d...)

On April 19, 2012, Biologix Florida, through a Share Purchase Agreement entered into with the shareholders of the BHSL, acquired 100% of the issued and outstanding shares of BHSL for total consideration of $9,200,000. Pursuant to the Share Purchase Agreement, the consideration payment schedule was as follows:

|

1.

|

$2,100,000 cash payment within 30 days following the execution of the Share Purchase Agreement (paid);

|

|

2.

|

$3,900,000 payment in the form of a promissory note payable by April 19, 2014 (See Note 7); and

|

|

3.

|

An aggregate of 4,000,000 shares of Biologix Florida’s common stock with a fair value based on Biologix Florida’s recently announced financing of $0.80 per share (issued).

|

Upon the completion of the Share Purchase Agreement and in accordance with FASB ASC 805 Business Combinations, Biologix Florida determined that the above noted Share Purchase Agreement transaction does not constitute a business combination, and accordingly, has accounted for it as an asset acquisition. The operations of BHSL have been included in the consolidated financial statements from the date of acquisition. The total purchase consideration has been measured at fair value of $8,450,713:

|

Cash consideration

|

$ | 2,100,000 | ||

|

Promissory note payable

|

3,150,713 | |||

|

Shares consideration

|

3,200,000 | |||

|

Fair value of total purchase considerations

|

$ | 8,450,713 |

$3,900,000 promissory note has been measured at fair value of $3,150,713 on the date of acquisition, using discounted cash flow method. The fair market interest rate is 12.5%, which is the interest rate that was payable on comparable notes.

The following table summarizes BHSL’s assets and liabilities acquired on the acquisition date:

|

Cash

|

$ | 7,431 | ||

|

Receivable

|

75,100 | |||

|

IPR&D expense - Intellectual Property

|

17,679,530 | |||

|

Taxes payable

|

(8,610 | ) | ||

|

Due to Hair & Research Science Est.

|

(9,272,102 | ) | ||

|

Accounts payable and accrued liabilities

|

(30,636 | ) | ||

|

Total considerations

|

$ | 8,450,713 |

The Company intended to further engage an arm’s length party to conduct R&D of the Hair Growth Process in order to unify the various components of the current formula into a single formulation that has been tested for consistency at various temperatures, thus creating a predictable and reliable matrix for industrial manufacture, long term storage and transport (see Note 10). The engaged arm’s length party will also conduct extensive controlled testing in accordance with the requirements of the FDA, Health Canada and the European Medicines Agency in preparation for the anticipated pre-clinical trials. Hence, the Licensed Intellectual Property acquired in this asset acquisition is deemed for use in R&D activities as recognized as an in-process research and development (“IPR&D”) project.

F-9

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 2 – ACQUISITION (cont’d...)

(b) Intellectual Property License (BHSL) (cont’d...)

Pursuant to ASC 730-10, such assets are capitalized only if they have alternative future uses; otherwise, such assets are expensed. For an asset acquired in an asset acquisition for use in R&D activities to have an alternative future use, the following two criteria need to be met: (a) it is reasonably expected that the Company will use the asset acquired in the alternative manner and anticipates economic benefit from that alternative use, and (b) the Company’s use of the asset acquired is not contingent on further development of the asset subsequent to the acquisition date (that is, the asset can be used in the alternative manner in the condition in which it existed at the acquisition date). As the Company’s use of the Intellectual Property is contingent on further development and approval for the anticipated pre-clinical trials, it is deemed to have no alternative future use. Therefore, the costs allocated to acquire IPR&D in the above noted asset acquisition of $17,679,530 and the aforementioned $1,000,000 paid to BHSL were expensed as IPR&D expense accordingly.

In connection with the above noted asset acquisition, the Company made significant estimates and assumptions regarding the fair values of the elements of an asset acquisition as of the date of acquisition, including the fair values of due to Hair & Research Science Est. The Company also refined these estimates over a measurement period not to exceed one year to reflect new information obtained about facts and circumstances that existed as of the acquisition date that, if unknown, would have affected the measurement of the amounts recognized as of that date. If the Company is required to retroactively adjust provisional amounts that the Company has recorded for the fair values of assets and liabilities in connection with acquisitions, these adjustments could have a material impact on our financial condition and results of operations.

(c) Reverse Acquisition - Biologix Nevada

In connection with the reverse acquisition described in Note 1 and prior to the acquisition, Biologix Nevada had no business and did not meet the definition of a business under ASC 805, “Accounting for Business Combinations”. Accordingly, the reverse acquisition of Biologix Nevada by Biologix Florida has been accounted for as a capital transaction, in respect of which the net assets of Biologix Nevada on January 9, 2013 were accounted for as a recapitalization of Biologix Florida. A breakdown of Biologix Nevada’s net assets as at January 9, 2013 is as follows:

|

January 9, 2013

|

||||

|

Cash

|

$ | 7,515 | ||

|

Promissory note receivable – Biologix Florida

|

325,000 | |||

|

Accounts payable

|

(5,168 | ) | ||

|

Net assets acquired

|

$ | 327,347 | ||

The obligation to repay the $325,000 promissory note formerly payable from Biologix Florida to the Company was terminated promptly upon execution of the Share Exchange Agreement.

F-10

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Consolidation

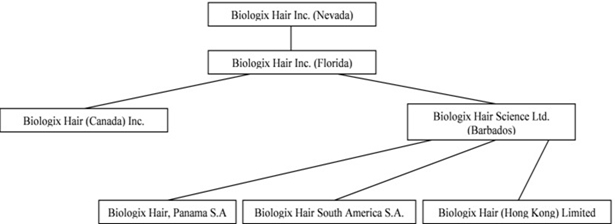

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, Biologix Florida, Biologix Canada and BHSL, and BHSL’s wholly owned subsidiaries Biologix Hair, Panama S.A. (“Biologix Panama”), Biologix Hair South America S.A. (“Biologix South America”) and Biologix Hair (Hong Kong) Limited (“Biologix HK”).

These consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“US GAAP”). All significant inter-company transactions and balances have been eliminated upon consolidation.

Cash and Cash Equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. As at March 31, 2013, the Company has cash and cash equivalents in the amount of $56,409 (December 31, 2012 - $44,577) which are over the federally insured limit. As at March 31, 2013 and December 31, 2012, the Company has $Nil of cash equivalents.

Deferred cost

The consideration commitment on the Intellectual Property License with BHSL are deferred until the completion of the due diligence at which time the cost will be charged to operation as IPR&D expense.

Website Development Costs

In accordance with ASC 350-50, “Website Development Costs”, the Company capitalizes qualifying website development costs. Costs incurred during the application development stage as well as upgrades and enhancements that result in additional functionality are capitalized. Accordingly, direct costs incurred during the application stage of development are capitalized and amortized over the estimated useful life of three years, the expected period of benefit. Fees incurred for website hosting are expensed over the period of the benefit. Costs of operating a website are expensed as incurred.

Property and Equipment

Property and equipment consists of computer equipment, furniture and equipment and leasehold improvements which are carried at cost, net of accumulated depreciation and impairment loss. Amortization is recorded on the straight line method at the following rates:

|

Furniture and equipment

|

3 years

|

|

Leasehold improvements

|

2 years

|

|

Computer equipment

|

2 years

|

Amortization will commence once the property and equipment is put in use. The property and equipment is written down to its net realizable value if it is determined that its carrying value exceeds estimated future benefits to the Company.

F-11

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Acquired In-Process Research and Development

In accordance with ASC 730-10, the initial costs of rights to acquired IPR&D projects acquired in an asset acquisition are expensed as IPR&D unless the project has an alternative future use. These costs include initial payments incurred prior to regulatory approval in connection with research and development collaboration agreements that provide rights to develop, manufacture, market and/or sell pharmaceutical products. The fair value of IPR&D projects acquired in a business are capitalized and accounted for as indefinite-lived intangible assets until the underlying project receives regulatory approval, at which point the intangible asset will be accounted for as definite-lived intangible assets, or discontinuation, at which point the intangible asset will be written off. Development costs incurred after the acquisition are expensed as incurred. Indefinite- and definite-lived assets are subject to impairment reviews.

Stock-Based Compensation

The Company adopted ASC Topic 718-10, Compensation - Stock Compensation - Overall, to account for its stock options and similar equity instruments issued. Accordingly, compensation costs attributable to stock options or similar equity instruments granted are measured at the fair value at the grant date, and expensed over the expected vesting period. ASC Topic 718-10 requires excess tax benefits be reported as a financing cash inflow rather than as a reduction of taxes paid.

Warrant Issuance and Note Conversion Feature

In accordance with ASC 470-20, Debt with conversions and other options, the proceeds from the notes were allocated based on the relative fair values of the notes without the warrants issued in conjunction with the notes and of the warrants themselves at the time of issuance. The Company recorded the allocated value of the warrants at the time of issuance as additional paid-in capital and as a debt discount to the notes. The Company amortize the debt discount as interest expense over the life of the note. Additionally, as a result of issuing the warrants with the convertible notes, a beneficial conversion option is recorded as a debt discount reflecting the incremental conversion option intrinsic value of the conversion option provided to the holders of the notes. The Company also amortize this debt discount as interest expense over the life of the notes. The intrinsic value of each conversion option was calculated as the difference between the effective conversion price and the fair value of the common stock, multiplied by the number of shares into which the note is convertible.

Foreign Currency Translation

The Company’s functional currency and presentation currency is the U.S. dollars. Biologix Canada’s functional currency is Canadian dollars. Biologix Florida, BHSL, Biologix HK, Biologix Panama and Biologix South America’s functional currency are all U.S. dollars.

Transactions in a currency other than the functional currency (“foreign currency”) are measured in the respective functional currencies of the Company and its subsidiaries and are recorded on initial recognition in the functional currencies at exchange rates approximating those ruling at the transaction dates. Exchange gains and losses are recorded in the statements of income and comprehensive income.

F-12

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Foreign Currency Translation (cont’d…)

Assets and liabilities of the Company and its subsidiaries are translated into the U.S. dollars at exchange rates at the balance sheet date, equity accounts are translated at historical exchange rate and revenues and expenses are translated by using the average exchange rates. Translation adjustments are reported as cumulative translation adjustments and are shown as a separate component of other comprehensive income in the statements of stockholders’ equity.

Basic Net Income (Loss) per Share

Basic earnings per share is calculated using the weighted average number of shares outstanding during the year. The Company has adopted ASC Topic 260-10, Earnings per Share - Overall, and uses the treasury stock method to compute the dilutive effect of options, warrants and similar instruments. Under this method, the dilutive effect on earnings per share is recognized on the use of the proceeds that could be obtained upon exercise of options, warrants and similar instruments. It assumes that the proceeds would be used to purchase common shares at the average market price during the period. Diluted loss per share is equal to basic loss per share as any possible dilutive instruments are anti-dilutive.

Income Taxes

The Company accounts for income taxes under the provisions of ASC Topic 740-10, Income Taxes, which requires the Company to recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company’s financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the temporary differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. The effect on deferred income tax assets and liabilities of a change in income tax rates is included in the period that includes the enactment date. Valuation allowances are established when necessary to reduce deferred income tax assets to the amount expected to be realized.

Long-lived Assets Impairment

Long-term assets of the Company are reviewed for impairment whenever events or circumstances indicate that the carrying amount of assets may not be recoverable, pursuant to guidance established in ASC 360-05, Impairment or Disposal of Long-Lived Assets.

Management considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations (undiscounted and without interest charges). If impairment is deemed to exist, the assets will be written down to fair value. Fair value is generally determined using a discounted cash flow analysis.

F-13

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Use of Estimates

The preparation of the Company's consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Significant items subject to such estimates and assumptions include fair values of the elements of an asset acquisition as of the date of acquisition; asset impairments; useful lives for depreciation, depletion, and amortization; current and deferred income taxes; and fair value of financial instruments. Estimates are based on facts and circumstances believed to be reasonable at the time; however, actual results could differ from those estimates.

Fair Value of Financial Instruments

The estimated fair values for financial instruments under ASC Topic 825-10, Financial Instruments, are determined at discrete points in time based on relevant market information. These estimates involve uncertainties and cannot be determined with precision. The estimated fair value of the Company’s financial instruments includes cash and cash equivalents, accounts payable and accrued liabilities, amounts due to related parties, promissory and convertible promissory notes. The carrying value of these financial instruments approximates their fair value based on their liquidity or their short-term nature. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments due to their short term nature.

The Company adopted ASC Topic 820-10, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value in US GAAP, and expands disclosures about fair value measurements.ASC Topic 820-10 does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. The fair value hierarchy distinguishes between assumptions based on market data (observable inputs) and an entity’s own assumptions (unobservable inputs). The hierarchy consists of three levels:

|

Level one – Quoted market prices in active markets for identical assets or liabilities;

|

|

Level two – Inputs other than level one inputs that are either directly or indirectly observable; and

|

Level three – Unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use.

As at March 31, 2013 and December 31, 2012, the fair value of cash and cash equivalents was measured using Level one inputs.

F-14

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Recently Adopted Accounting Standards

In May 2011, the FASB issued ASU 2011-04, “Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs”, which is effective for annual reporting periods beginning after December 15, 2011. This guidance amends certain accounting and disclosure requirements related to fair value measurements. Additional disclosure requirements in the update include: (1) for Level 3 fair value measurements, quantitative information about unobservable inputs used, a description of the valuation processes used by the entity, and a qualitative discussion about the sensitivity of the measurements to changes in the unobservable inputs; (2) for an entity’s use of a nonfinancial asset that is different from the asset’s highest and best use, the reason for the difference; (3) for financial instruments not measured at fair value but for which disclosure of fair value is required, the fair value hierarchy level in which the fair value measurements were determined; and (4) the disclosure of all transfers between Level 1 and Level 2 of the fair value hierarchy. The Company adopted ASU 2011-04 on January 1, 2012 and the adoption did not have a material effect on the Company’s consolidated financial position or results of operations.

In June 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income, which is effective for annual reporting periods beginning after December 15, 2011. ASU 2011-05 will become effective for the Company on January 1, 2012. This guidance eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity. In addition, items of other comprehensive income that are reclassified to profit or loss are required to be presented separately on the face of the financial statements. This guidance is intended to increase the prominence of other comprehensive income in financial statements by requiring that such amounts be presented either in a single continuous statement of income and comprehensive income or separately in consecutive statements of income and comprehensive income.

The Company adopted ASU 2011-05 on January 1, 2012 and the adoption did not have a material impact on the Company’s financial position or results of operations.

In September 2011, the Financial Accounting Standards Board (“FASB”) issued ASU 2011-08, “Intangibles – Goodwill and Other (Topic 350), Testing Goodwill for Impairment”. ASU 2011-08 amends the required annual impairment testing of goodwill by providing an entity an option to first assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If, after assessing the totality of events and circumstances, an entity determines it is not more likely than not that the fair value of a reporting unit is less than its carrying amount, then performing the two-step impairment test under Topic 350-24 and Topic 350-20-35-9 is unnecessary. However, if an entity concludes otherwise, then it is required to perform the impairment testing under Topic 350-24 by calculating the fair value of the reporting unit and comparing the results with the carrying amount. If the fair value exceeds the carrying amount, then the entity must perform the second step test of measuring the amount of the impairment test under Topic 350-20-35-9. An entity has the option to bypass the qualitative assessment and proceed directly to the two step goodwill impairment test. Additionally, the entity has the option to resume with the qualitative testing in any subsequent period. The Company adopted ASU 2011-08 on January 1, 2012 and the adoption did not have a material effect on the Company’s consolidated financial position or results of operations.

F-15

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d…)

Recent Accounting Pronouncements

In December 2011, the FASB issued ASU 2011-11, “Balance Sheet (Topic 210), Disclosures about Offsetting Assets and Liabilities”. The guidance in this update requires the Company to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The pronouncement is effective for fiscal years and interim periods beginning on or after January 1, 2013 with retrospective application for all comparative periods presented. The Company’s adoption of the new standard is not expected to have a material effect on the Company’s consolidated financial position or results of operations.

In July, 2012, the FASB issued ASU 2012-02, “Intangibles – Goodwill and Other (Topic). ASU 2012-02 amends the required annual impairment testing of indefinite-lived intangible assets by providing an entity an option to first assess qualitative factors to determine whether it is more likely than not that the fair value of the indefinite-lived asset is less than its carrying amount. If, after assessing the totality of events and circumstances, an entity determines it is not more likely than not that the fair value of the indefinite-lived asset is less than its carrying amount, then performing the two-step impairment test under Topic 350-30 is unnecessary. However, if an entity concludes otherwise, then it is required to perform the impairment testing under Topic 350-30-35-18F by calculating the fair value of the reporting unit and comparing the results with the carrying amount. If the fair value exceeds the carrying amount, then the entity must perform the second step test of measuring the amount of the impairment test under Topic 350-30-35-19. An entity has the option to bypass the qualitative assessment and proceed directly to the two step goodwill impairment test. Additionally, the entity has the option to resume with the qualitative testing in any subsequent period. The pronouncement is effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012 and early adoption is permitted. The Company’s adoption of the new standard is not expected to have a material effect on the Company’s consolidated financial position or results of operations.

In February 2013, the FASB issued ASU 2013-02, "Comprehensive Income (Topic 220), Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income". The amendments do not change the current requirements for reporting net income or other comprehensive income in financial statements. However, the amendments require an entity to provide information about the amounts reclassified out of accumulated other comprehensive income by component. In addition, an entity is required to present, either on the face of the statement where net income is presented or in the notes, significant amounts reclassified out of accumulated other comprehensive income by the respective line items of net income but only if the amount reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period. For other amounts that are not required under U.S.GAAP to be reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures required under U.S. GAAP that provide additional detail about those amounts. The pronouncement is effective for fiscal years and interim periods ending after December 15, 2012. The adoption of this pronouncement is not expected to have a material effect on the Company's consolidated financial position or results of operations.

F-16

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 4 – PREPAID EXPENSES AND DEPOSIT

|

March 31,

2012

|

December 31,

2012

|

|||||||

|

Current

|

||||||||

|

Deposits and advances

|

1,000 | 1,000 | ||||||

|

Prepaid rent

|

174,729 | 224,025 | ||||||

|

Employee advances

|

- | 25,657 | ||||||

|

Prepaid expenses and deposit – current

|

175,729 | 250,682 | ||||||

|

Non-current

|

||||||||

|

Prepaid rent

|

- | 31,270 | ||||||

|

Prepaid expenses and deposit – non-current

|

- | 31,270 | ||||||

NOTE 5 – PROPERTY AND EQUIPMENT

Property and equipment at March 31, 2013 and December 31, 2012 were summarized as follows:

|

March 31, 2013

|

Cost

$

|

Accumulated

Amortization

$

|

Net book

Value

$

|

||||||||||

|

Computer equipment

|

17,124 | 5,351 | 11,773 | ||||||||||

|

Furniture and equipment

|

93,536 | 33,219 | 60,317 | ||||||||||

|

Leasehold improvements

|

125,968 | 64,619 | 61,349 | ||||||||||

| 236,628 | 103,189 | 133,439 | |||||||||||

|

December 31, 2012

|

Cost

$

|

Accumulated

Amortization

$

|

Net book

Value

$

|

||||||||||

|

Computer equipment

|

17,124 | 4,281 | 12,843 | ||||||||||

|

Furniture and equipment

|

93,536 | 26,574 | 66,962 | ||||||||||

|

Leasehold improvements

|

125,968 | 51,694 | 74,274 | ||||||||||

| 236,628 | 82,549 | 154,079 | |||||||||||

During the three months ended March 31, 2013, $20,640 (2012: $18,264) amortization expense was charged to operations. During the year ended December 31, 2012, $82,549 amortization expense was charged to operations. During the year ended December 31, 2012 the Company recognized loss on disposition of the asset of $6,362.

F-17

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 6 – WEBSITE DEVELOPMENT COSTS

|

March 31, 2013

|

Cost

$

|

Accumulated

Amortization

$

|

Net book

Value

$

|

|||||||||

|

Website development

|

144,177 | 46,881 | 97,296 | |||||||||

|

December 31, 2012

|

Cost

$

|

Accumulated

Amortization

$

|

Net book

Value

$

|

|||||||||

|

Website development

|

129,545 | 35,273 | 94,272 | |||||||||

During the three months ended March 31, 2013, $11,608 (2012: $7,306) amortization expense was charged to operations. During the year ended December 31, 2012, $35,273 amortization expense was charged to operations.

NOTE 7 – PROMISSORY AND CONVERTIBLE PROMISSORY NOTES

|

March 31,

|

December 31,

|

|||||||

|

2013

|

2012

|

|||||||

| $ | $ | |||||||

|

Promissory and convertible promissory notes - face value

|

||||||||

|

(a) Promissory note

|

||||||||

|

(b) Convertible promissory note (Unionashton)*

|

1,155,829 | 1,155,829 | ||||||

| 200,000 | 200,000 | |||||||

| 50,000 | 50,000 | |||||||

| 50,000 | - | |||||||

| 100,000 | - | |||||||

|

(c) Convertible promissory note (HRSE)*

|

9,540,000 | 9,540,000 | ||||||

|

(d) Promissory note (BHSL acquisition)

|

3,900,000 | 3,900,000 | ||||||

|

(e) Promissory note (Biologix Nevada)

|

- | 325,000 | ||||||

| 14,995,829 | 15,170,829 | |||||||

|

Effective interest rate - 12.5%

|

(1,538,712 | ) | (1,538,712 | ) | ||||

|

Net present value

|

13,457,117 | 13,632,117 | ||||||

|

Payment

|

(200,000 | ) | (100,000 | ) | ||||

|

Interest accretion

|

1,550,195 | 736,153 | ||||||

| 14,807,312 | 14,268,270 | |||||||

|

Current portion

|

11,504,439 | 7,604,595 | ||||||

|

Non-current portion

|

3,302,873 | 6,663,675 | ||||||

| 14,807,312 | 14,268,270 | |||||||

F-18

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 7 – PROMISORRY AND CONVERTIBLE PROMISSORY NOTES (cont’d ...)

The total amount of principal plus accrued interest are all convertible into common shares (“Common Shares”) of the Company. Each Common Share so issued will for these purposes be valued based on a conversion price (the “Conversion Price”) equal to: (i) if the Company is a privately held company upon the Notice of Conversion, the greater of (a) $1 per Common Share and (b) the price per Common Share of most recent private placement of securities completed by the Company as at the applicable maturity date less 20%; or (ii) if upon the Notice of Conversion the Company is a public company whose securities are listed on a stock exchange or quoted on an over-the-counter quotation system (whether directly or resulting from a Capital Reorganization), the greater of (a) $1 per Common Share and (b) a price per Common Share equal to the average daily closing price of the Common Shares during the 10 day period beginning on the date of the Notice of Conversion, less 20%.

a) Promissory note

On December 23, 2011, the Company signed a promissory note for $400,000. The loan bears interest at 5% per annum commencing on the day the principal sum is advanced to the Company and is due on or before December 31, 2012. On March 12, 2012 the $400,000 was applied to the subscription of 1,600,000 common of the Company at a value of $0.25 per share. Interest in the amount of $4,384 was accrued as at March 12, 2012.

b) Convertible Promissory notes – Honeywagon & Unionashton

On June 5, 2012 the Company signed a promissory note with Honeywagon Holdings Ltd. (“Honeywagon”) for $400,000 due and payable on or before August 6, 2012. The loan bears interest at 10% for the period ending August 6, 2012, payable on maturity. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share. Interest in the amount of $36,721 was accrued as at August 1, 2012.

The fair value of the convertible promissory note is $391,837 on the date of issuance, with $5,388 representing the value net of tax impact ascribed to the creditors’ option to convert the principal amount into common shares of the Company and classified as additional paid-in capital and with the equal amoun$8,163 t charged to profit and loss and interest expense on August 1, 2012 (see below).

On June 26, 2012 the Company signed a promissory note with Honeywagon for an additional $200,000 due and payable on or before August 27, 2012. The loan bears interest at 10% for the period ending August 27, 2012, payable on maturity. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share. Interest in the amount of $11,613 was accrued as at August 1, 2012. The fair value of the convertible promissory note is $195,918 on the date of issuance, with $2,694 representing the value net of tax impact ascribed to the creditors’ option to convert the principal amount into common shares of the Company and classified as additional paid-in capital and with $4,082 charged to profit and loss and interest expense on August 1, 2012 (see below).

On July 17, 2012 the Company signed a promissory note with Honeywagon for an additional $100,000 due and payable on or before September 17, 2012. The loan bears interest at 10% for the period ending August 27, 2012, payable on maturity. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share.

F-19

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 7 – PROMISORRY AND CONVERTIBLE PROMISSORY NOTES (cont’d ...)

b) Convertible Promissory notes – Honeywagon & Unionashton (cont’d ...)

Interest in the amount of $2,420 was accrued as at August 1, 2012. The fair value of the convertible promissory note is $97,959 on the date of issuance, with $1,347 representing the value net of tax impact ascribed to the creditors’ option to convert the principal amount into common shares of the Company and classified as additional paid-in capital and with $2,041 charged to profit and loss and interest expense on August 1, 2012 (see below).

On August 1, 2012, the Company received an additional $300,000 from Honeywagon and replaced the aforementioned Promissory Notes including in the aggregate the principal sum of $700,000 and accrued interest in the amount of $50,754, with one for the principal sum of $1,050,754, due and payable on or before October 1, 2012. The loan bears interest at the rate of 10% for the period and shall be payable upon maturity. Interest in the amount of $105,075 was recorded for the period from August 1, 2012 to October 1, 2012. The fair value of the convertible promissory note is $1,029,310 on the date of issuance, with $14,153 representing the value net of tax impact ascribed to the creditors’ option to convert the principal amount into common shares of the Company and classified as additional paid-in capital and with $21,444 charged to profit and loss and interest expense at the date of assignment on October 1, 2012 (see below).

Pursuant to a convertible promissory note assignment agreement dated October 1, 2012 between Honeywagon and Unionashton Managment Ltd. (“Unionashton”), the promissory note in the amount of $1,050,754 plus accrued interest to October 1, 2012 of $105,075 for a total amount of $1,155,829 was assigned from Honeywagon to Unionashton and the Company replaced and signed a new convertible promissory note in the amount of $1,155,829, due and payable on demand. The loan bears interest at the rate of 5% per annum and shall be payable upon maturity. As additional consideration of the loans, the Company have granted Unionashton warrants to purchase an aggregate of 1,155,829 shares of the Company’s common share exercisable for a 5 year period at the Conversion Price per share. As a result, the aggregate principal value was allocated to the individual components on a relative fair value basis and the Company recorded $266,280 to additional paid-in capital as the fair value of the warrants, net of tax impact and $403,455 was charged to operations immediately as the convertible promissory note is due on demand (see Note 9 – warrants). Interest in the amount of $14,250 was accrued during the three months ended March 31, 2013 and cumulatively $28,817 was accrued as at March 31, 2013.

On November 14, 2012 the Company signed a promissory note for an additional $200,000 with Unionashton, due and payable on demand. The loan bears interest at 5%. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share. Interest in the amount of $2,466 was accrued during the three months ended March 31, 2013 and cumulatively $3,781 was accrued as at March 31, 2013.

On December 14, 2012 the Company signed a promissory note for an additional $50,000 due and payable on demand. The loan bears interest at 5%. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share. Interest in the amount of $617 was accrued during the three months ended March 31, 2013 and cumulatively $740 was accrued as at March 31, 2013.

F-20

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 7 – PROMISORRY AND CONVERTIBLE PROMISSORY NOTES (cont’d ...)

b) Convertible Promissory notes – Honeywagon & Unionashton (cont’d ...)

On January 4, 2013 the Company signed a promissory note for an additional $50,000 with Unionashton, due and payable on demand. The loan bears interest at 5%. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share. Interest in the amount of $596 was accrued as at March 31, 2013.

On January 16, 2013 the Company signed a promissory note for an additional $100,000 with Unionashton, due and payable on demand. The loan bears interest at 5%. Any interest and principal due under the promissory note is convertible, at the lenders option, into the Company’s common shares at the Conversion Price per share. Interest in the amount of $1,027 was accrued as at March 31, 2013.

c) Convertible promissory note – HRSE

On April 11, 2012 BHSL entered into an Intellectual Property Purchase and Sale Agreement with Hair Research and Science Est, (“HRSE”) whereby it acquired certain Intellectual Property, including processes and formulae for the stimulation of hair growth and treatment of hair loss, for consideration in the amount of $10,100,000 of Convertible Promissory Note. (See Note 2b).

On August 1, 2012, as the Company was unable to make the first term payment in full at due date, the Convertible Promissory Note with unpaid accrued interests of $9,090,833 became in default and due on demand. On August 1, 2012 (further amended on November 30, 2012), the Company entered into an Amending Agreement with HRSE to amend the Convertible Promissory Note, repayable as follow:

|

●

|

$1,040,000 on or before February 28, 2013;

|

|

●

|

$2,000,000 on or before June 30, 2013;

|

|

●

|

$3,000,000 on or before October 31, 2013; and

|

|

●

|

$3,500,000 on or before January 31, 2014.

|

The Convertible Promissory Note shall bear interest at the rate of 5% per annum and is payable by January 31, 2014. In the event that the Company become in default of the agreement, the Convertible Promissory Note shall bear interest at 12% per annum, which interest will be payable on demand. The Convertible Promissory Note and any accrued interest are convertible at any time into the Company’s common shares at the Conversion Price per share.

The fair value of the amended Convertible Promissory Note is $9,090,833 on the date of amendment (August 1, 2012), with $255,194 representing the value net of tax impact ascribed to the creditors’ option to convert the principal amount into common shares of the Company and classified as additional paid-in capital and with $8,750,574 classified as liability portion of the amended Convertible Promissory Note, calculated as the net present value using an interest rate of 12.5%, which is the market interest rate that was payable on comparable notes without the conversion feature. On February 28, 2013, as the Company was unable to make the first term payment in full at due date, the Convertible Promissory Note with unpaid accrued interests of $9,913,650 are in default and are now due on demand. An imputed interest of $701,905 was accrued during the three months ended March 31, 2013 and cumulatively $1,163,075 was accrued as at March 31, 2013. The Company is currently negotiating a new term with HRSE.

F-21

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 7 – PROMISORRY AND CONVERTIBLE PROMISSORY NOTES (cont’d ...)

d) Promissory note – BHSL acquisition

Pursuant to the acquisition of 100% of the shares of BHSL, the Company made a payment of $ 3,900,000 in the form of a non-interest bearing promissory note payable by April 19, 2014 (see Note 2b). The fair value of the promissory note payable is $3,150,713 at inception, calculated as the net present value using an interest rate of 12.5%, which is the interest rate that was payable on comparable notes. An imputed interest of $93,180 was accrued during the three months ended March 31, 2013 and cumulatively $352,160 was deemed to have been accrued as at March 31, 2013. As at March 31, 2013 the Company has made principal payments in the amount of $200,000 against the $3,900,000 promissory notes. See also Note 12.

e) Promissory note – Biologix Nevada

On October 15, 2012, Biologix Florida signed a promissory note for $300,000 due and payable to Biologix Nevada on or before January 1, 2013. On December 20, 2012, Biologix Nevada further advanced a promissory note of $25,000. The loans bear interest at 10% per annum, payable on maturity. The obligation to repay the promissory note plus interest terminated promptly upon execution of the Share Exchange Agreement on January 9, 2013. See also Note 1 and Note 2 (c).

NOTE 8 – RELATED PARTY TRANSACTIONS

Related party transactions not disclosed elsewhere in these consolidated financial statements are as follows:

|

Related party transactions with directors/executives or formal directors/executives and companies controlled by directors/executives or formal directors/executives:

|

|

Three

months

|

Three

months

|

|||||||

|

ended

|

ended

|

|||||||

|

March 31,

|

March 31,

|

|||||||

|

2013

|

2012

|

|||||||

| $ | $ | |||||||

|

Clinical research and reformulatio

|

79,118 | - | ||||||

|

Consulting and management fees

|

85,813 | 72,788 | ||||||

|

Professional fees

|

15,000 | 16,032 | ||||||

|

Wages and benefits

|

39,887 | - | ||||||

|

Website development and maintenance

|

55,290 | 87,668 | ||||||

| 275,108 | 176,488 | |||||||

F-22

BIOLOGIX HAIR INC.

(formerly T & G Apothecary, Inc.)

(A development stage company)

(As expressed in US dollars)

(Unaudited – prepared by management)

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 8 – RELATED PARTY TRANSACTIONS (cont’d ...)

|

Amounts due to related parties:

|

As at

|

As at

|

||||||

|

March 31,

|

December 31,

|

|||||||

|

2013

|

2012

|

|||||||

| $ | $ | |||||||

|

Ron Holland, CEO and a director

|

- | 45,683 | ||||||

|

Christian Gomez, former CFO and director

|

- | 3,000 | ||||||

|

Daniel Hunter, former President

|

- | 42,337 | ||||||

|

Donna Lieder, VP Clinician Licensing

|

660 | 32,210 | ||||||

|

H. H Research Partners Corp, a company controlled by VP Media Relations

|

5,013 | - | ||||||

|

Jolee Consulting Corp., a company controlled by a former VP of Shareholder Communications

|

- | 9,875 | ||||||

|

Richardo Faria, former CTO

|

- | 24,150 | ||||||

|

Dr. Diego Castresana, VP R&D of BHSL, former director

|

- | 10,000 | ||||||

|

MacDonald Tuskey, a principal is a former director of the Company

|

- | 22,234 | ||||||

| 5,673 | 189,489 | |||||||

These transactions were in the normal course of operations and were measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties.

NOTE 9 – STOCKHOLDERS’ EQUITY

Common stock

During the period ended December 31, 2011, the Company issued 10,000 common shares for $100 to a director of the Company at $0.01 per share.

On April 18, 2012 the Company issued 9,450,000 common shares at $0.05 per share pursuant to a private placement with total proceeds of $472,500; issued 6,220,000 common shares at $0.25 per share pursuant to a private placement with gross proceeds of $1,555,000, of which $400,000 was paid for by redemption of the promissory note on March 12, 2012, and commission expense of $10,000; and issued 2,000,000 common shares as settlement of debt at a value of $500,000, using a deemed value of $0.25 per share. See Note 2b.

On May 2, 2012, the Company issued 2,500,000 common shares at $0.8 per share pursuant to a private placement, with total proceeds of $2,000,000 and share issuance cost of $200,000.