Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Actavis, Inc. | d541119dex993.htm |

| EX-99.1 - EX-99.1 - Actavis, Inc. | d541119dex991.htm |

| 8-K - 8-K - Actavis, Inc. | d541119d8k.htm |

Creating a Global Specialty Pharmaceutical Leader

The Combination of Actavis and Warner Chilcott

May 20, 2013

Exhibit 99.2 |

Important Information For Investors And Shareholders

2

This communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities or a solicitation of any vote

or

approval.

New

Actavis

will

file

with

the

Securities

and

Exchange

Commission

(the

“SEC”)

a

registration

statement

on

Form S-4, each of Actavis and Warner Chilcott will file with the SEC a proxy

statement and each of New Actavis, Actavis and Warner Chilcott will file

with the SEC other documents with respect to the proposed transaction. In addition, a definitive proxy

statement/prospectus will be mailed to shareholders of Actavis and Warner

Chilcott. INVESTORS AND SECURITY HOLDERS OF ACTAVIS AND WARNER

CHILCOTT ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND

OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors

and security holders will be able

to

obtain

free

copies

of

the

registration

statement

and

the

proxy

statement/prospectus

(when

available)

and

other

documents filed with the SEC by New Actavis, Actavis and Warner Chilcott through

the website maintained by the SEC at http://www.sec.gov.

on Actavis’

internet

website

at

www.actavis.com

or

by

contacting

Actavis’

Investor

Relations

Department

at

(862)

261-7488.

Copies of the documents filed with the SEC by Warner Chilcott will be available

free of charge on Warner Chilcott’s internet website at www.wcrx.com or

by contacting Warner Chilcott’s Investor Relations Department at (973) 442-3200.

Actavis,

Warner

Chilcott,

their

respective

directors

and

certain

of

their

executive

officers

may

be

considered

participants

in

the

solicitation of proxies in connection with the proposed transaction.

Information about the directors and executive officers of Warner Chilcott is

set forth in its Annual Report on Form 10-K for the year ended December 31, 2012, which was filed with the

SEC on February 22, 2013, its Quarterly Report on Form 10-Q for the quarter

ended March 31, 2013, which was filed with the SEC on May 10, 2013, its proxy

statement for its 2013 annual meeting of stockholders, which was filed with the SEC on April 5,

2013, and certain of its Current Reports on Form 8-K, which were filed with the

SEC on May 2, 2013 and May 8, 2013. Information about the directors and

executive officers of Actavis is set forth in its Annual Report on Form 10-K for the year

ended December 31, 2012, which was filed with the SEC on February 28, 2013, its

Quarterly Report on Form 10-Q for the quarter ended March 31, 2013,

which was filed with the SEC on May 7, 2013, its proxy statement for its 2013 annual meeting of

stockholders, which was filed with the SEC on March 29, 2013, and certain of its

Current Reports on Form 8-K, which were filed with the SEC on January

29, 2013 and May 13, 2013. Other information regarding the participants in the proxy solicitations and

a description of their direct and indirect interests, by security holdings or

otherwise, will be contained in the proxy statement/prospectus and other

relevant materials to be filed with the SEC when they become available.

.

Copies of the documents filed with the SEC by New Actavis and Actavis will be

available free of charge |

Actavis Cautionary Statement Regarding

Forward-Looking Statements

3

Statements contained in this communication that refer to Actavis’ estimated or anticipated future

results or other non-historical facts are forward-looking statements that reflect

Actavis’ current perspective of existing trends and information as of the date of this communication.

Forward looking statements generally will be accompanied by words such as “anticipate,”

“believe,” “plan,” “could,” “should,” “estimate,”

“expect,” “forecast,” “outlook,” “guidance,”

“intend,” “may,” “might,” “will,” “possible,” “potential,” “predict,” “project,” or other similar words,

phrases or expressions. It is important to note that Actavis’ goals and expectations are not

predictions of actual performance. Actual results may differ materially from Actavis’

current expectations depending upon a number of factors affecting Actavis’ business, Warner Chilcott’s

business and risks associated with acquisition transactions. These factors include, among others, the

inherent uncertainty associated with financial projections; restructuring in connection with,

and successful close of the acquisition of Warner Chilcott; subsequent integration of the

acquisition of Warner Chilcott and the ability to recognize the anticipated synergies and benefits of the acquisition; the receipt of

required regulatory approvals for the acquisition of Warner Chilcott (including the approval of

antitrust authorities necessary to complete the acquisition); the anticipated size of the

markets and continued demand for Actavis’ and Warner Chilcott’s products; the impact of

competitive products and pricing; access to available financing (including financing for the

acquisition of Warner Chilcott) on a timely basis; maintaining a position in the Standard &

Poor’s 500; the risks of fluctuations in foreign currency exchange rates; the risks and uncertainties

normally incident to the pharmaceutical industry, including product liability claims and the

availability of product liability insurance on reasonable terms; the difficulty of predicting

the timing or outcome of pending or future litigation or government investigations; periodic

dependence on a small number of products for a material source of net revenue or income; variability

of trade buying patterns; changes in generally accepted accounting principles; risks that the

carrying values of assets may be negatively impacted by future events and circumstances; the

timing and success of product launches; the difficulty of predicting the timing or outcome of product development efforts

and regulatory agency approvals or actions, if any; market acceptance of and continued demand for

Actavis’ and Warner Chilcott’s products; costs and efforts to defend or enforce

intellectual property rights; difficulties or delays in manufacturing; the availability and pricing

of third party sourced products and materials; successful compliance with governmental regulations

applicable to Actavis’ and Warner Chilcott’s facilities, products and/or businesses;

changes in the laws and regulations affecting, among other things, pricing and reimbursement of

pharmaceutical products; changes in tax laws or interpretations that could increase Actavis’ consolidated tax liabilities;

the loss of key senior management or scientific staff; and such other risks and uncertainties detailed

in Actavis’ periodic public filings with the Securities and Exchange Commission, including

but not limited to Actavis’ Annual Report on form 10-K for the year ended

December 31, 2012 and from time to time in Actavis’ other investor communications. Except as

expressly required by law, Actavis disclaims any intent or obligation to update or revise these

forward-looking statements.

|

Warner Chilcott Cautionary Statement Regarding

Forward-Looking Statements

4

This communication contains forward-looking statements, including statements concerning the

proposed transaction with Actavis, our industry, our operations, our anticipated financial

performance and financial condition and our business plans, growth strategy and product development efforts. These statements constitute

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. The words “may,”

“might,” “will,” “should,” “estimate,” “project,” “plan,” “anticipate,” “expect,” “intend,” “outlook,” “believe” and other similar

expressions are intended to identify forward-looking statements. Readers are cautioned not

to place undue reliance on these forward-looking statements, which speak only as of their dates. These

forward-looking statements are based on estimates and assumptions by our management that, although

we believe to be reasonable, are inherently uncertain and subject to a number of risks and

uncertainties. The following represent some, but not necessarily all, of the factors that could cause actual results to differ from

historical results or those anticipated or predicted by our forward-looking statements: the timing

to consummate the proposed transaction with Actavis; the risk that a condition to closing of

the proposed transaction with Actavis may not be satisfied; the risk that a regulatory approval that may be required for the proposed

transaction with Actavis is delayed, is not obtained or is obtained subject to conditions that are not

anticipated; New Actavis’ ability to achieve the synergies and value creation contemplated

by the proposed acquisition; New Actavis’ ability to promptly and effectively integrate Actavis’ and Warner Chilcott’s businesses; the

diversion of management time on transaction-related issues; our substantial indebtedness,

including increases in the LIBOR rates on our variable-rate indebtedness above the

applicable floor amounts; competitive factors and market conditions in the industry in which we operate, including the approval and

introduction of generic or branded products that compete with our products; our ability to protect our

intellectual property; a delay in qualifying any of our manufacturing facilities that produce

our products, production or regulatory problems with either our own manufacturing facilities or those of third party

manufacturers, packagers or API suppliers upon whom we may rely for some of our products or other

disruptions within our supply chain; pricing pressures from reimbursement policies of private

managed care organizations and other third party payors, government sponsored health systems and regulatory reforms, and

the continued consolidation of the distribution network through which we sell our products; changes in

tax laws or interpretations that could increase our consolidated tax liabilities; government

regulation, including U.S. and foreign health care reform, affecting the development, manufacture, marketing and sale of

pharmaceutical products, including our ability and the ability of companies with whom we do business

to obtain necessary regulatory approvals; adverse outcomes in our outstanding litigation,

regulatory investigations or arbitration matters or an increase in the number of such matters to which we are subject; the loss of key

senior management or scientific staff; our ability to manage the growth of our business by

successfully identifying, developing, acquiring or licensing new products at favorable prices

and marketing such new products; our ability to obtain regulatory approval and customer acceptance of new products, and continued customer

acceptance of our existing products; and the other risks identified in our periodic filings including

our Annual Report on Form 10-K for the year ended December 31, 2012, and from

time-to-time in our other investor communications. We caution you that the foregoing list of important factors is not exclusive. In

addition, in light of these risks and uncertainties, the matters referred to in our

forward-looking statements may not occur. We undertake no obligation to publicly update or

revise any forward-looking statement as a result of new information, future events or otherwise, except as may be required by law.

|

The

Benefits of Combining Actavis and Warner Chilcott •

Creates Top 20 global pharmaceutical company by sales with

substantial presence in generics and branded products

•

Actavis Specialty Brands Pro Forma 2013 Revenues of ~$3bn

•

Augments Actavis Specialty Brands business in core areas of

Women’s Health and Urology

-

Expands portfolio into Gastroenterology and Dermatology

•

Expect substantial operational synergies coupled with tax savings

from overall tax structure benefits

-

Redomicile as an Irish plc

•

Expected to be immediately accretive to non-GAAP earnings and

strong operating cash flow provides opportunity to de-lever balance

sheet

•

Expected to enhance combined company’s credit profile

5 |

Proposed Transaction Terms

•

43% premium to the unaffected share price**

•

Pro Forma Warner Chilcott ownership of ~23%

•

Anticipated to close by the end of 2013, subject to customary

conditions including regulatory reviews and shareholder approvals

•

Actavis Management to lead combined company

0.160 shares of “New Actavis”

equity

+ Assumption of $3.4 billion Warner Chilcott’s Net Debt

$8.5 billion Total Consideration*

6

*

Based on the closing share price of ACT of $125.50 on May 17, 2013. **

Under the terms of the Transaction Agreement, at closing Warner Chilcott shareholders will receive 0.160 shares of New Actavis for each Warner Chilcott share

they own, which equates to a value of $20.08 per Warner Chilcott share based on Actavis' closing

share price of $125.50 on May 17, 2013. This represents a 43 percent premium compared to

Warner Chilcott's $14.00 per share volume-weighted average trading price for the 30-day period ending on May 9, 2013 (the day

before Warner Chilcott disclosed it was engaged in preliminary discussions with Actavis) and a 34%

premium to $15.01 being the price on May, 9 2013. Based on the price of Actavis shares

on May, 9 2013 of $106.81 the value per share would represent a premium of 14% to $15.01.

|

Warner Chilcott Overview

•

Leading specialty pharmaceutical company

-

$2.4 billion LTM 3/31/13 Revenue

-

Spun out of Warner Lambert in 1996

•

Corporate HQ in Dublin, Ireland

-

~2,100 employees; ~1,500 based in the United States, Puerto

Rico and Canada

-

US headquarters: Rockaway, NJ

-

R&D & Manufacturing in Puerto Rico, Northern Ireland, Ireland,

Germany

•

Focused on women’s healthcare, gastroenterology, urology, and

dermatology branded pharmaceutical therapeutic categories

7 |

Financially Compelling Combination

Enhances

Financial

Potential

Through

Expected

Operational

and Tax

Synergies

•

Strong combined revenues of approximately $11 billion

•

Expected to be more than 30% accretive to Actavis non-GAAP

earnings for 2014, including anticipated synergies

•

Significant combined operating cash flow generation

•

Expect substantial operational synergies and savings coupled

with tax savings

Creates

Platform for

Further

Growth

•

All-stock transaction results in overall de-leveraging

•

Enhances borrowing capacity with substantial cash flow

contribution from anticipated synergies and tax savings

•

Increased specialty branded / Gx mix allows ACT to compete

with larger pharmaceutical companies

8 |

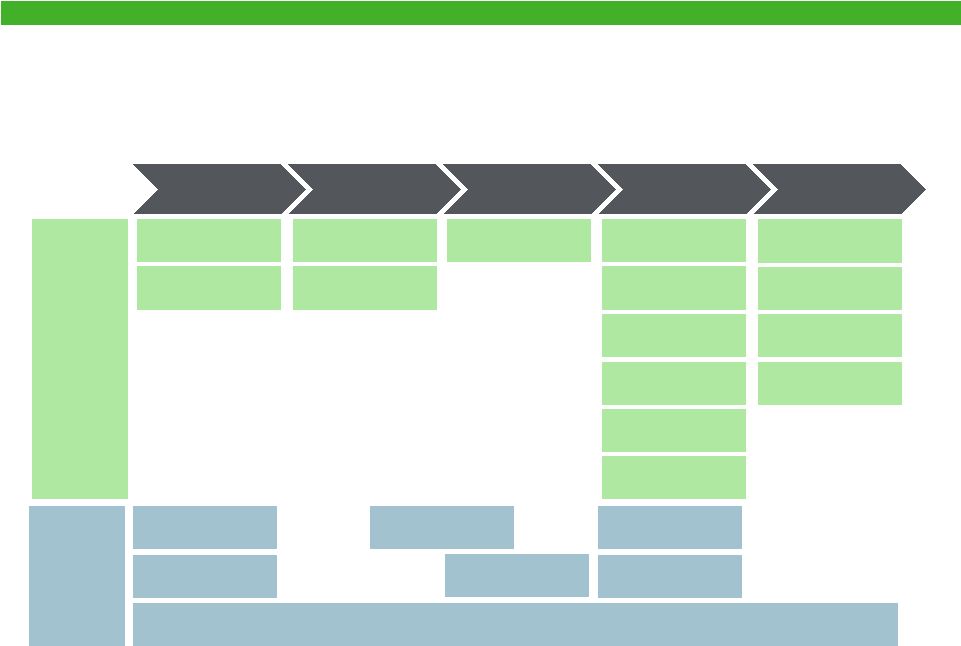

Commercially Compelling Combination

Enhances

Specialty

Brands Scale

•

Achieves Actavis strategic goal to build multi-billion dollar

Specialty Brands business

•

Creates Top 3 U.S. specialty pharmaceutical company

and Top 20 global pharmaceutical company by sales

Enhanced

Women’s

Health and

Urology

Franchises;

Adds GI,

Dermatology

Presence

•

Premier Women’s Health player in U.S. -

Expands

Portfolio

•

Adds Gastroenterology and Dermatology franchises and

sales infrastructure

•

Expands Urology portfolio

•

Stronger Pipeline –

25 total development projects

-

15 Women’s Health products

-

Several Urology, Gastroenterology, Dermatology

products

Enhances

Branded /

Generics Mix

•

Diversifies ACT’s 2013E Specialty / Generic mix from 7%

standalone to ~ 25% pro forma

9 |

Actavis Specialty Brands

Urology

10

Women’s Health |

Well Positioned in Attractive Therapeutic Categories

Dermatology

Urology

Gastroenterology

Women’s Health

Warner Chilcott

11 |

Stronger Combined Specialty Brands Franchise

Women’s Health

Urology

GI and

Dermatology

12 |

Combined Women’s Health Pipeline

Phase 1

Phase 2

Phase 3

NDA

Approved

Canada

US

Global

US

PDUFA:

Dec. ‘13

RoW

US

Global

Global

Global

US

PDUFA

July ‘13

US

US

Approved

Apr 2013

Approved

May 2013

Product

Indication

Actavis

Esmya®

Fibroids

Actavis

Progestin Patch

Contraception

Actavis (Uteron)

Diafert®

Infertility

Actavis (Uteron)

Levosert®

IUD

Actavis (Uteron)

Estelle®

Oral Contraceptive

Actavis (Uteron)

Colvir

HPV

Actavis (Uteron)

Vaginate

Vaginal Infections

Actavis

Metronidazole Gel

Bacterial Vaginosis

Warner Chilcott

3042

Oral Contraceptive

Warner Chilcott

Minastrin 24 Fe

Oral Contraceptive

Warner Chilcott

3064

Oral Contraceptive

Warner Chilcott

3065

Oral Contraceptive

Warner Chilcott

3074

Oral Contraceptive

Warner Chilcott

3058

Contraceptive Ring

Warner Chilcott

3011

Hormone Therapy

13

PDUFA:

July ‘13 |

Combined Small Molecule Pipeline Overview

Preclinical

Phase I

Phase II

Phase III

NDA

Alyssa

Novel IUD

(Global)

Vaginate Vaginal

Infections

(Global)

Crinone®

2nd Generation

(U.S.)

Actavis

Warner

Chilcott

Colvir

HPV Lesions

(Global)

Metronidazole Gel

1.35

(US)

Estelle®

Novel OC

(Global)

Progestin Only Patch

Contraceptive

(Global)

Vaginal Ring

Contraceptive

(Global)

Esmya®

Uterine Fibroids

(U.S.)

Levosert®

IUD*

(U.S. + Canada)

Diafert®

Infertility

(U.S.)

Generess®

Fe

Contraceptive

(Canada)

Esmya®

Uterine

Fibroids

(Canada)

Levosert®

IUD*

(Europe)

Diafert®

Infertility

(Europe)

GI Products

Udenafil (BPH)

(Urology)

Sarecycline

(Derm)

Udenafil (ED)

(Urology)

WC2055

(Derm)

Portfolio of Women’s Health Products

Topical (ED)

(Urology)

14 |

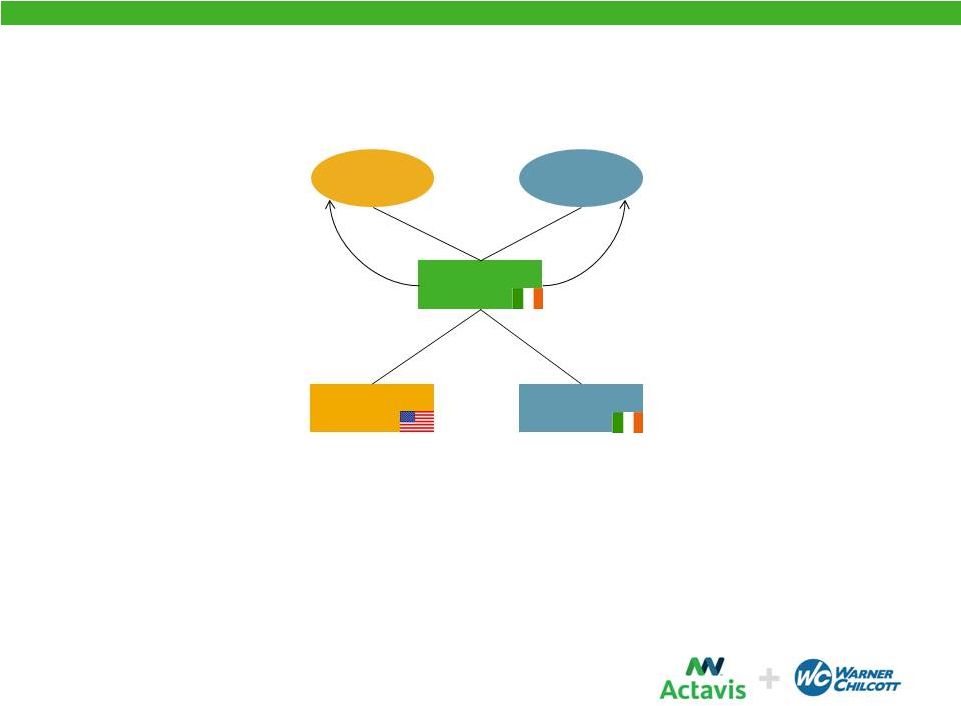

Corporate Redomicile

•

A newly formed Irish plc (“New Actavis”) acquires each of Actavis and

Warner Chilcott in exchange for shares

-

New

Actavis

is

the

publicly

traded

parent

company

(listed

in

the

U.S.

on

NYSE)

-

Actavis shareholders and Warner Chilcott shareholders each receive shares in New

Actavis (Actavis shareholders on a one-for-one basis and Warner

Chilcott shareholders based on an exchange ratio of 0.160)

Actavis

Shareholders

New Actavis

Shares (~23%)

Warner Chilcott

Shareholders

Actavis

New

Actavis

New Actavis

Shares (~77%)

Warner Chilcott

15 |

Corporate Redomicile: Considerations

•

Receipt of New Actavis shares is taxable to Actavis

shareholders but expected to be tax free for U.S. federal

income tax purposes to Warner Chilcott shareholders

•

Regular U.S. merger process for ACT

-

Proxy/Registration Statement; Majority approval by Actavis

shareholders

-

One-for-one exchange ratio for Actavis shareholders

•

Warner Chilcott acquisition subject to approval of Irish

High Court and shareholder vote (Warner Chilcott

shareholders receive New Actavis shares in exchange

for Warner Chilcott shares)

16 |

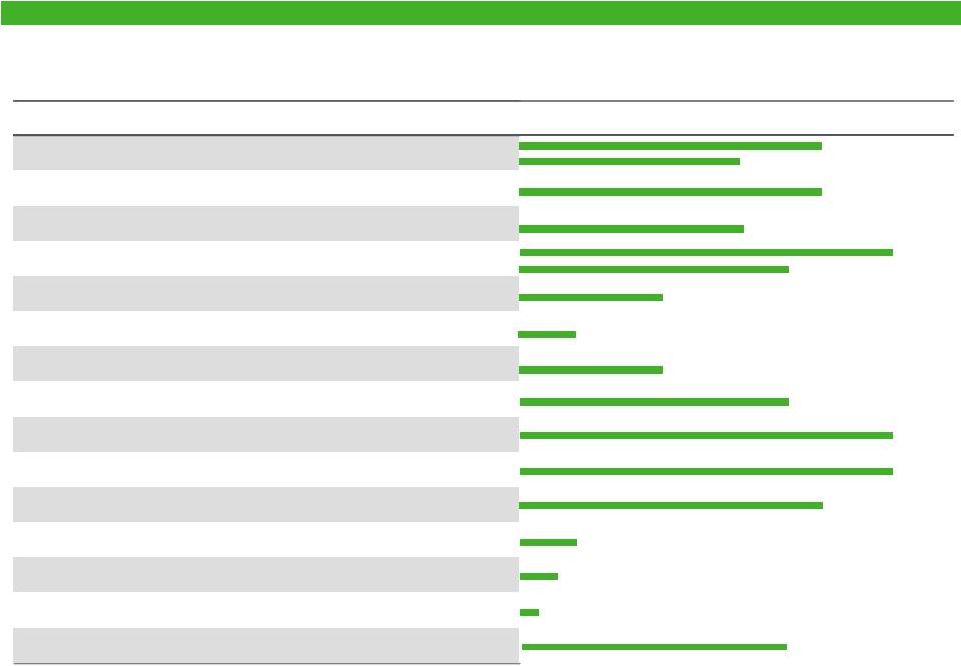

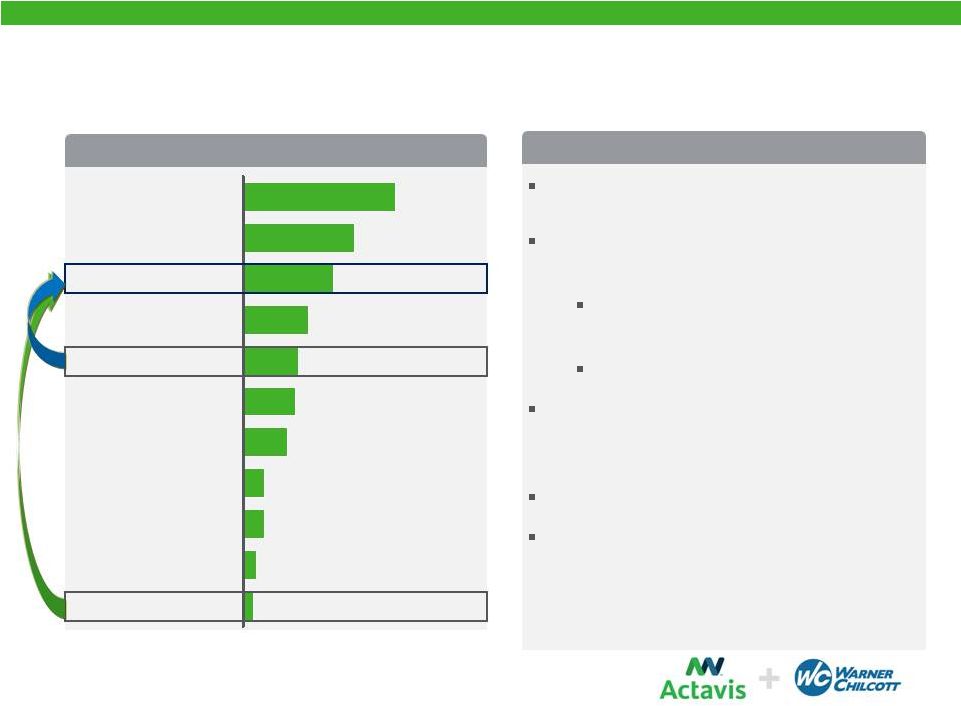

Achieving a Top 3 Position

Actavis

0.5

0.5

0.7

0.8

Jazz

1.7

Salix

Mylan

2.4

Endo

Valeant

2.5

Warner Chilcott

2.0

Allergan

2.9

Forest

Teva

5.9

Combined Co

4.3

2012 US Specialty Sales, $ Billions

~$3 billion Actavis Specialty Brands 2013

Pro Forma Revenues

Augments core areas of Women’s Health

and Urology

Premier Women’s Health player in

US

Larger Portfolio in Urology

Adds Gastroenterology and Dermatology

therapeutic categories and marketing

infrastructure

Enhances product development pipeline

Provides opportunities to bring combined

product portfolio to new and emerging

markets

Strong Growth Potential

17 |

Proposed Transaction Benefits Summary

Strong combined revenues of approximately $11 billion

Expected to be immediately accretive

More than $400 million in anticipated after-tax operational

synergies and related cost reductions, and tax savings

The majority of these are operational and are expected to be

realized in 2014, with full effect during 2015

These synergies exclude any potential revenue, manufacturing

and interest rate synergies or savings

Strong combined operating cash flow de-levers balance

sheet to below 3.0x debt to adjusted EBITDA immediately at

close

Favorable combined company tax rate of ~17%

Greater than 30% Accretive to 2014 Non-GAAP Earnings Per Share

18 |

New

Actavis – Growth Profile

Growth Drivers 2014 through 2016

Actavis Pharma

•

North American growth driven by strong PIV

portfolio and complex dosage forms

•

Drive growth in high-value markets

•

Optimize Global Commercial Network

Actavis Specialty Brands

•

Expanded product portfolio, therapeutic categories, pipeline

and geographic footprint

•

Execution on development, launches and next generation

strategies

•

Focused Biosimilar strategy

Actavis Global Operations

•

Supply Chain Optimization

•

Expand Anda distribution services

19 |

20 |

Statement Required by the Irish Takeover Rules

21

The directors of Warner Chilcott accept responsibility for the information contained in this

communication relating to Warner Chilcott and its Associates and the directors of Warner

Chilcott and members of their immediate families, related trusts and persons connected with them. To the

best of the knowledge and belief of the directors of Warner Chilcott (who have taken all reasonable

care to ensure such is the case), the information contained in this communication for which

they accept responsibility is in accordance with the facts and does not omit anything likely to

affect the import of such information. The

directors of Actavis accept responsibility for the information contained in this communication other than that relating to Warner Chilcott and its

Associates and the directors of Warner Chilcott and members of their immediate families, related

trusts and persons connected with them. To the best of the knowledge and belief of the

directors of Actavis (who have taken all reasonable care to ensure that such is the case), the information

contained in this communication, for which they accept responsibility, is in accordance with the facts

and does not omit anything likely to affect the import of such information.

Deutsche Bank Securities Inc. is acting exclusively for Warner Chilcott as financial advisor and is

not acting as financial advisor to anyone else in connection with the matters referred to in

this announcement and will not be responsible to anyone other than Warner Chilcott in connection

therewith for providing advice in relation to the matters referred to in this announcement. Deutsche

Bank Securities Inc. has delegated certain of its financial advisory functions and

responsibilities to Deutsche Bank AG, acting through its London branch. Deutsche Bank AG, acting through its

London branch is performing such delegated functions and responsibilities exclusively for Warner

Chilcott and is not acting as a financial adviser for any other person in connection with the

matters referred to in this announcement and will not be responsible to any such other person for

providing advice in relation to the matters referred to in this announcement. Deutsche Bank AG is

authorised under German Banking Law (competent authority: BaFin – Federal Financial

Supervisory Authority) and authorised and subject to limited regulation by the Financial Conduct

Authority. Details about the extent of Deutsche Bank AG’s authorization and regulation by the

Financial Conduct Authority are available on request BofA Merrill Lynch and Greenhill & Co.

are acting exclusively for Actavis and no one else in connection with the matters referred to in this

announcement and will not be responsible to anyone other than Actavis for providing the protections

afforded to clients of BofA Merrill Lynch or Greenhill & Co and for providing advice in

relation to the acquisition of Warner Chilcott, the contents of this announcement or any transaction or

arrangement referred to herein. The

statement that this acquisition is earnings accretive should not be interpreted to mean that the earnings per share in the current or any future

financial period will necessarily match or be greater than those for the relevant preceding period.

|

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the Irish Takeover Panel Act, 1997, Takeover

Rules 2007, as amended (the "Irish Takeover Rules"), if

any

person

is,

or

becomes,

'interested'

(directly

or

indirectly)

in,

1%,

or

more

of

any

class

of

'relevant

securities'

of

Warner

Chilcott

or

Actavis,

all 'dealings' in any 'relevant securities' of Warner Chilcott or Actavis

(including by means of an option in respect of, or a derivative referenced

to, any such 'relevant securities') must be publicly disclosed by not later than

3:30 p.m. (Dublin time) on the business day following the date of

the

relevant

transaction.

This

requirement

will

continue

until

the

date

on

which

the

Scheme

becomes

effective

or

on

which

the

'offer

period'

otherwise ends. If two or more persons co-operate on the basis of any

agreement, either express or tacit, either oral or written, to acquire an

'interest' in 'relevant securities' of Warner Chilcott or Actavis, they will be

deemed to be a single person for the purpose of Rule 8.3 of the Irish

Takeover Rules. Under the provisions of Rule 8.1 of the Irish Takeover

Rules, all 'dealings' in 'relevant securities' of Warner Chilcott by Actavis or ‘relevant

securities’

of Actavis by Warner Chilcott, or by any of their respective 'associates' must

also be disclosed by no later than 12 noon (Dublin time) on the business day

following the date of the relevant transaction. A disclosure table, giving

details of the companies in whose 'relevant securities' 'dealings' should be disclosed can be found on the Panel's

website at www.irishtakeoverpanel.ie.

'Interests in securities' arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an 'interest' by virtue of the ownership or control of securities, or by virtue

of any option in respect of, or derivative referenced to, securities.

Terms

in

quotation

marks

are

defined

in

the

Irish

Takeover

Rules,

which

can

also

be

found

on

the

Irish

Takeover

Panel's

website.

If

you

are

in any

doubt

as

to

whether

or

not

you

are

required

to

disclose

a

dealing

under

Rule

8,

please

consult

the

Panel's

website

at

www.irishtakeoverpanel.ie

or contact the Panel on telephone number +353 1 678 9020; fax number +353 1 678

9289. 22 |