Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CarParts.com, Inc. | d540794d8k.htm |

1

U.S. Auto Parts Network, Inc.

Leading online source for automotive aftermarket parts and repair information

Investor Presentation

May 20, 2013

Exhibit 99.1 |

Safe

Harbor 2 |

Company History

Launched first internet site selling

automotive Collision Line

Launches a network of sites catered to

various consumer segments

Company begins significantly

expanding its private label engine line

JC Whitney completely

integrated

1995

2000

2010

2005

2006

2011

Launch AutoMD /

Acquires JC Whitney

Adds Accessories Line

USAP founded to serve local

collision shops in Los Angeles

IPO (NASDAQ: PRTS)

Uniquely positioned to

capitalize on market growth.

2/2007

2008

2012

Acquires PartsBin

Adds Engine Line

3

10/2007

Hires Shane Evangelist

Raised $16.5M in

capital

2013

Initiated Site

Consolidation |

Competitive Advantages

Low Customer Acquisition Cost

4

Nearly

12

million

unique

monthly

visitors

to

USAP’s

websites

Less

than

a

$7

customer

acquisition

cost

(“CAC”)

Efficient Supply Chain

Over 29,000 private

label collision SKUs

Over 9,500 private

label engine SKUs

Over 3,000 private

label accessory SKUs

Over 1.5M branded

SKUs

Robust

supply

chain

consisting

of

both

branded

and

private

label

products

Nearly

50%

of

product

sales

directly

sourced

from

Asia |

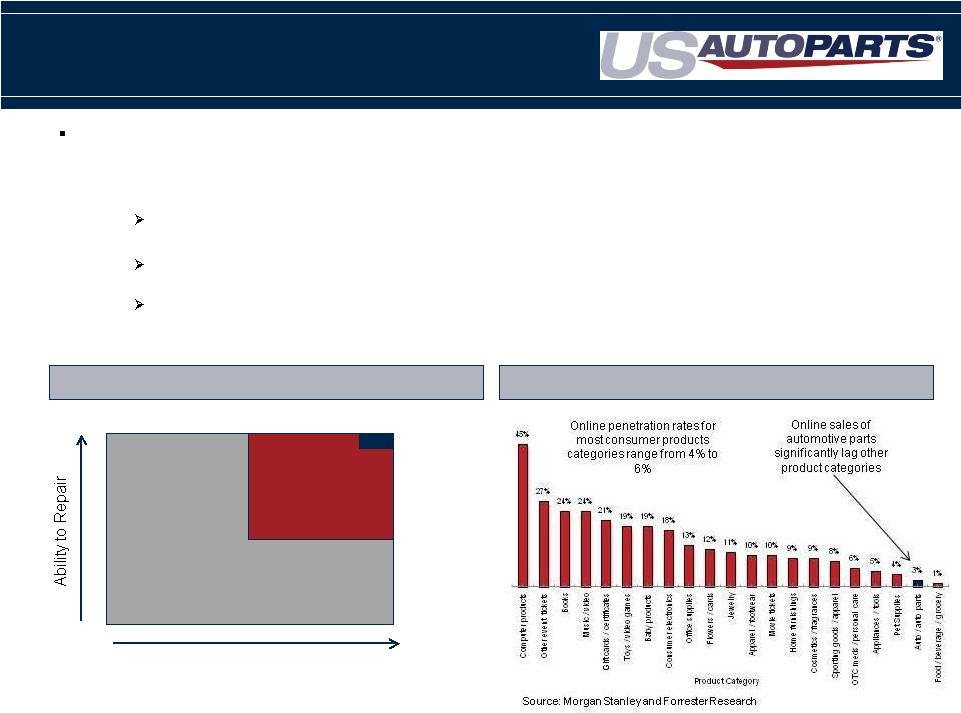

Online sales of automotive parts and accessories continue to grow

–

Google has experienced a 6 year compound annual growth rate (“CAGR”) of

28% in queries for automotive

parts

before

conversion

increases

which

are

between

5%-10%

annually

-

making

real

online

growth closer to 35% annually

Mobile queries increased 100% and 800% for cellphones and tablets, respectively,

from Sept. 11 to Sept. 12 Online Market is Vibrant and Growing

Aftermarket e-Commerce Overview

Source: Google

5

Source: eBay filings, press releases |

Online penetration for auto parts has trailed penetration rates of other consumer

product categories for two reasons:

1)

Auto parts are traditionally bought by demographics that have lower internet

penetration at home and less of a propensity to purchase products

online Internet penetration will grow at home but, more importantly, mobile

devices will drive online buying going forward 2)

Shopping for auto parts online can be difficult for consumers

The complexity required to buy an auto part (applications and attributes) has

limited consumption online because consumers

need

to

feel

comfortable

that

they

have

found

the

“right”

part

Online retailers have made vast improvements to the online shopping

experience •

The continued growth of website conversion rates over the last five years

demonstrates the progress that online retailers have made to make consumers

feel comfortable Size and Penetration of Online Automotive Parts

Aftermarket e-Commerce Overview

6

Low Automotive Online Sales Penetration

Source: AAIA

Estimate based on AAAI Fact book -

$85B in parts, $70B in labor

* Excludes eBay

Automotive Aftermarket by Segment

Desire to Repair

High

Low

$155B

Do-It-For-Me

$45B

Do-It-Yourself

(USAP Target Market)

$3.1B-$4.0B

Online Sales*

High |

7

Broad Product Offering Across the

Auto Parts Spectrum

Brake Discs

Catalytic

Converters

Radiators

Headers

Oxygen

Sensors

Alternators

Exhaust

Driveshaft

Fuel Injection /

Delivery

Lamps

Mirrors

Bumpers

Hoods

Tailgates

Doors

Grills

Wheels

Window

Regulators

Seat Covers

Car Covers

Floor Mats /

Carpeting

Cold Air

Intakes

Vent Visors

Tonneau

Covers

Nerf Bars

Bug Shields

Car Bras

Body Parts

Engine Parts

Performance & Accessories

*Represents online mix, **Source; AAIA Factbook Research

21%

40%

39%

$15B

$15B

Revenue*

Overall Market**

$50B |

USAP’s ability to competitively price products while maintaining healthy

margins is a function of the Company’s ability to leverage its robust

supply chain The Company is working to increase margins by shifting its

product mix toward increased private label and

in-stock

products

-

current

margins

range

from

29%

-

31%

The

Company

sources

product

directly

from

over

250

factories

in

Asia

Margin %

In-Stock

Private Label

(Asia Sourced)

Branded

(U.S. Sourced)

40% -

70%

25% -

40%

10% -

25%

Drop Shipped

Current Mix

49%

51%

Current Mix

63%

37%

75%

25%

Goal

60%

40%

Goal

USAP’s Supply Chain Creates Pricing Advantage

8 |

US

Auto Parts Dominant Reach- Largest

Pure Play Internet Retailer

(some overlap of monthly visitors across websites)

9 |

USAP’s Current Operating Environment

10

After eight consecutive quarters of 20% revenue and EBITDA growth, USAP’s

financial performance has been impacted by decreased visitors driven by two

main factors: 1.

Reduced SEO Traffic:

Changes made by search engines have impacted traffic

Addressing the loss in traffic by consolidating websites

2.

Margin Compression: Increased competition has hurt pricing, impacting marketing

spend Marketing spend is based on variable contribution from each SKU.

As overall margin has compressed,

marketing spend on a year-over-year (“YoY”) basis has lead to

lower traffic Addressing margin compression by increasing private label

mix * YoY web orders for top USAP sites that comprise 82% of total

sales Paid Traffic

(5%)

Organic

Traffic

(16%)

-40.0%

-30.0%

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

-30.0%

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

-40.0%

Year over Year Order Impact from Site Traffic and Conversion*

YoY Traffic Impact

YoY Conversion Impact

YoY Orders |

$153.4

$176.3

$262.3

$327.1

$304.0

$65.4

2008

2009

2010

2011

2012

Q1-13

$5.2

$13.5

$19.5

$16.3

$9.4

$1.5

2008

2009

2010

2011

2012

Q1-13

11

Sales & Adjusted EBITDA

Consolidated Sales¹

Consolidated Adjusted EBITDA²

($ In Millions)

($ In Millions)

1.

JC

Whitney

was

acquired

in

Aug

2010

adding

revenue

of

$39.1M

in

2010

and

$83.4M

in

2011.

Amounts

not

separately

disclosed

after

2011.

Adj. EBITDA Margin

3%

5%

8%

7%

3%

2%

Non-GAAP financial measure EBITDA consists of net income before (a) interest

expense, net; (b) income tax provisions; (c) amortization of intangible assets;

(d) depreciation and amortization. Adjusted EBITDA excludes restructuring

costs and other one time charges of $0.4M, $5.8M, $8.0M, $.7M and $0.5M in 2009, 2010,

2011, 2012 and Q1-13, respectively, stock based compensation of $2.9M, $3.3M,

$2.7M, $2.6M, $1.7M and $0.4M in 2008, 2009, 2010, 2011, 2012 and Q1-13

respectively. There were no restructuring or other one time charges in

2008. 2. |

1)

Improve Customer Experience

Continue to improve all customer touch points

Focus on two flagship sites, Autopartswarehouse and

JCWhitney

Ensure rich and unique content for our customers

2)

Increase Unique Visitors

Consolidate websites

3)

Increase Selection

Expand product offering within existing categories as

well as entering new categories

4)

Lower Prices

Launch disruptive price points through supply chain

efficiencies

5)

Be the Consumer Advocate for Auto Repair

Reduce consumer spending on vehicle repair and bring

transparency to the market place

Revenue

100%

Gross Margins

29% -

31%

Variable OPEX Costs

15%

Fixed Costs

0%

Incremental Flow Thru

14% -

16%

12

2013 Growth and Profitability

Revenue Growth

Incremental Flow Thru |

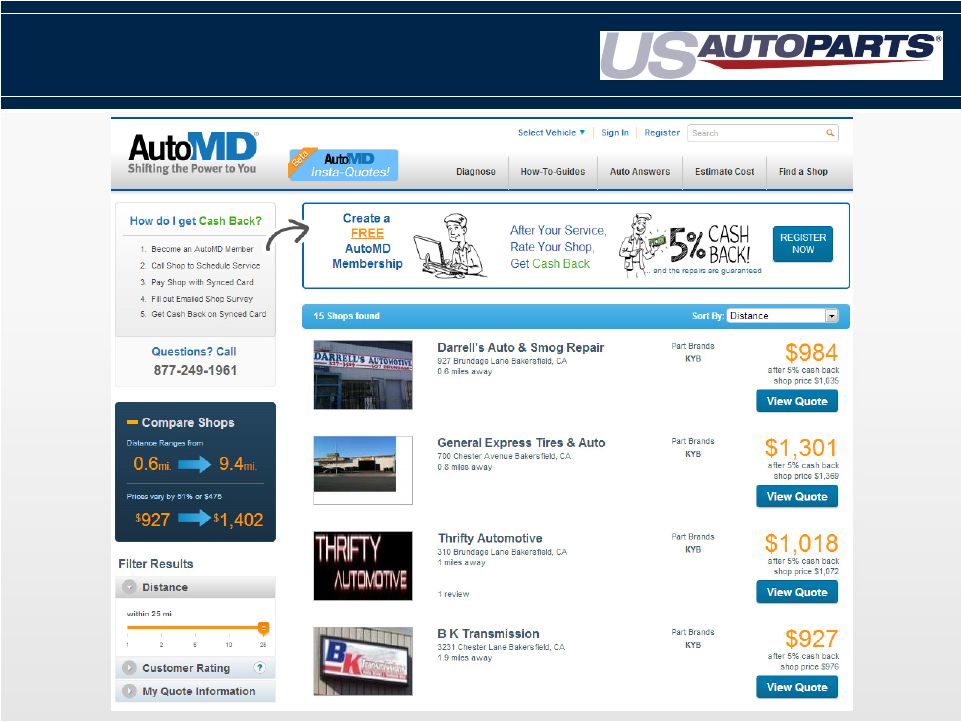

AutoMD-

Largest DIY Site

Repositioned to Target $140B DIFM Market

13 |

AutoMD –

Results page

14 |

Adjusted EBITDA

15

Thirteen Weeks Ended

March 30

March 31

(unaudited, amounts shown in thousands)

2013

2012

Net loss

(3,343)

$

(788)

$

Interest expense, net

185

199

Income tax provision

21

124

Amortization of intangible assets

106

340

Depreciation and amortization expense

3,638

3,747

EBITDA

607

3,622

Share-based compensation expense

409

584

Restructuring costs

498

-

Adjusted EBITDA

1,514

$

4,206

$

|

Income Statement

16

Thirteen Weeks Ended

March 30

March 31

(unaudited, amounts shown in thousands except per share data)

2013

2012

Net sales

65,405

$

87,436

$

Cost of sales

(1)

45,667

60,808

Gross profit

19,738

26,628

Operating expenses:

Marketing

11,191

13,450

General and administrative

4,687

5,870

Fulfillment

5,381

5,918

Technology

1,515

1,536

Amortization of intangible assets

106

340

Total operating expenses

22,880

27,114

Loss from operations

(3,142)

(486)

Other income (expense):

Other income, net

7

31

Interest expense

(187)

(209)

Total other expense, net

(180)

(178)

Loss before income tax provision

(3,322)

(664)

Income tax provison

21

124

Net loss

(3,343)

(788)

Other comprehensive (loss) income, net of tax:

Foreign currency translation adjustments

(6)

27

Unrealized gains on investments

-

25

Total other comprehensive (loss) income

(6)

52

Comprehensive loss

(3,349)

$

(736)

$

Basic and diluted net

loss per share (0.11)

$

(0.03)

$

Shares used in computation

of basic and diluted net loss per share

31,141

30,638

(1)

Excludes depreciation and amortization expense which is included in

marketing, general and administrative and fulfillment expense. |

Balance Sheet

17

(amounts in thousands, except par and liquidation value)

March 30

December 29

2013

2012

ASSETS

(Unaudited)

Current assets:

Cash and cash equivalents

1,297

$

1,030

$

Short-term investments

111

110

Accounts receivable, net of allowances of $242 and $221

at March 30, 2013 and December

29, 2012, respectively 7,040

7,431

Inventory

37,633

42,727

Deferred income taxes

44

39

Other current assets

3,310

4,176

Total current assets 49,435

55,513

Property and equipment, net

27,123

28,559

Intangible assets, net

3,120

3,227

Other non-current assets

1,669

1,578

Total assets 81,347

$

88,877

$

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

23,055

$

28,025

$

Accrued expenses

9,475

10,485

Revolving loan payable

12,125

16,222

Current portion of capital

leases payable 35

70

Other current liabilities

4,704

4,738

Total current liabilities 49,394

59,540

Capital leases payable, net of current portion

69

70

Deferred

income taxes 350

314

Other non-current

liabilities 1,711

1,309

Total liabilities 51,524

61,233

Commitments and contingencies

Stockholders' equity:

Series A convertible preferred stock, $0.001 par

value; $1.45 per

share liquidation value or aggregate of $5.8 million; 4000 and 0

shares issued and outstanding as

of 3/30/13 & 12/29/12 respectively Common

stock, $0.001 par value; 31,151 shares and 31,128 shares issued

4

-

and outstanding as of 3/30/13 and

12/29/12. respectively 31

31

Additional paid-in capital

165,305

159,781

Accumulated other comprehensive income

378

384

Accumulated deficit (135,895)

(132,552)

Total stockholders' equity

29,823

27,644

Total

liabilities and equity 81,347

$

88,877

$

|

Thank You

18

*

*

*

*

*

*

*

* |