Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Amplify Energy Corp. | a13-12774_18k.htm |

| EX-99.2 - EX-99.2 - Amplify Energy Corp. | a13-12774_1ex99d2.htm |

| EX-23.1 - EX-23.1 - Amplify Energy Corp. | a13-12774_1ex23d1.htm |

| EX-99.4 - EX-99.4 - Amplify Energy Corp. | a13-12774_1ex99d4.htm |

| EX-23.2 - EX-23.2 - Amplify Energy Corp. | a13-12774_1ex23d2.htm |

| EX-99.5 - EX-99.5 - Amplify Energy Corp. | a13-12774_1ex99d5.htm |

| EX-99.3 - EX-99.3 - Amplify Energy Corp. | a13-12774_1ex99d3.htm |

| EX-99.6 - EX-99.6 - Amplify Energy Corp. | a13-12774_1ex99d6.htm |

Exhibit 99.1

|

|

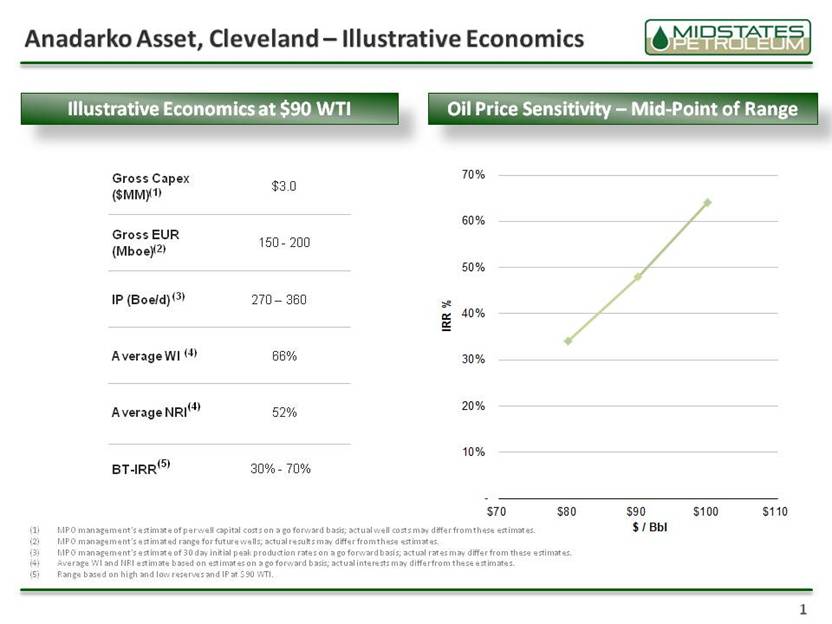

Anadarko Asset, Cleveland – Illustrative Economics Illustrative Economics at $90 WTI Oil Price Sensitivity – Mid-Point of Range Illustrative Economics at $90 WTI Oil Price Sensitivity – Mid-Point of Range Gross Capex ($MM)(1) $3.0 Gross EUR (Mboe)(2) 150 -200 IP (Boe/d) (3) 270 – 360 Average WI (4) 66% Average NRI (4) 52% BT-IRR (5) 30% -70% (1) MPO management’s estimate of per well capital costs on a go forward basis; actual well costs may differ from these estimates. (2) MPO management’s estimated range for future wells; actual results may differ from these estimates. (3) MPO management’s estimate of 30 day initial peak production rates on a go forward basis; actual rates may differ from these estimates. (4) Average WI and NRI estimate based on estimates on a go forward basis; actual interests may differ from these estimates. (5) Range based on high and low reserves and IP at $90 WTI. 1 |