Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - GLOBAL BRASS & COPPER HOLDINGS, INC. | d367030dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 20, 2013

Registration No. 333-177594

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 8

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GLOBAL BRASS AND COPPER HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3350 | 06-1826563 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

475 N. Martingale Road Suite 1050

Schaumburg, IL 60173

(847) 240-4700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Scott B. Hamilton

General Counsel

Global Brass and Copper Holdings, Inc.

475 N. Martingale Road Suite 1050

Schaumburg, IL 60173

(847) 240-4700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Lawrence G. Wee Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, New York 10019 (212) 373-3000 |

LizabethAnn R. Eisen Andrew J. Pitts Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, New York 10019-7475 (212) 474-1000 |

Approximate date of commencement of proposed sale to the public: As promptly as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(2)(3) | ||||

| Common Stock, $0.01 par value per share |

10,781,000 | $17.00 | $183,277,000 | $24,992.16 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(a) under the Securities Act. |

| (2) | Includes 1,406,000 shares which the underwriters have the right to purchase pursuant to their option to purchase additional shares. |

| (3) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. May 20, 2013.

9,375,000 Shares

GLOBAL BRASS AND COPPER HOLDINGS, INC.

Common Stock

This is an initial public offering of shares of common stock of Global Brass and Copper Holdings, Inc. All of the 9,375,000 shares to be sold in this public offering will be sold by the selling stockholder identified in this prospectus. Global Brass and Copper Holdings, Inc. will not receive any proceeds from this offering.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $15.00 and $17.00. We have been approved to list our common stock on the New York Stock Exchange under the symbol “BRSS”.

See “Risk Factors” on page 23 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||

| Initial public offering price |

$ | $ | ||||

| Underwriting discount |

$ | $ | ||||

| Proceeds, before expenses, to the selling stockholder |

$ | $ | ||||

To the extent that the underwriters sell more than 9,375,000 shares of common stock, the underwriters have the option to purchase up to an additional 1,406,000 shares from the selling stockholder at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2013.

| Goldman, Sachs & Co. | Morgan Stanley |

| William Blair | KeyBanc Capital Markets | |||

Prospectus dated , 2013.

Table of Contents

Prospectus

| Page | ||||

| 1 | ||||

| 16 | ||||

| 23 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

60 | |||

| 113 | ||||

| 138 | ||||

| 147 | ||||

| 174 | ||||

| 177 | ||||

| 179 | ||||

| 185 | ||||

| 187 | ||||

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES FOR NON-U.S. HOLDERS |

189 | |||

| 193 | ||||

| 198 | ||||

| 198 | ||||

| 198 | ||||

| F-1 | ||||

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

Unless otherwise specified or the context requires otherwise:

The term “Global Brass and Copper Holdings” refers to Global Brass and Copper Holdings, Inc. and not to any of its subsidiaries;

The term “Global Brass and Copper” refers to Global Brass and Copper, Inc., the principal operating subsidiary of Global Brass and Copper Holdings, and not to any of its subsidiaries or direct or indirect parent companies;

The terms “we,” “us,” “our,” “GBC” and the “Company” refer collectively to Global Brass and Copper Holdings, its subsidiaries and its predecessors;

The term “KPS” refers to KPS Capital Partners, LP; and

The term “Halkos” refers to Halkos Holdings, LLC, the current owner and direct parent of Global Brass and Copper Holdings. Halkos is the selling stockholder in this offering.

The use of these terms is not intended to imply that Halkos, Global Brass and Copper Holdings and Global Brass and Copper or its predecessors are not separate and distinct legal entities.

Amounts and percentages appearing in this prospectus have been rounded to the amounts shown for convenience of presentation. Accordingly, the total of each column of amounts may not be equal to the total of the relevant individual items.

Industry and Market Data

This prospectus includes industry data that we obtained from periodic industry publications and internal company surveys. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. In addition, this prospectus includes market share and industry data that we prepared primarily based on our knowledge of the industry and industry data. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position relative to our competitors are approximated and based on the above-mentioned third-party data and internal analysis and estimates and have not been verified by independent sources. Unless otherwise noted, all information regarding our market share is based on the latest available data. Information herein based on management’s belief or estimate is based upon management’s experience working in, and knowledge of, the metals industry, as well as management’s review of public disclosure of other participants in the metals industry and information provided by industry associations.

Trademarks

This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

Table of Contents

This summary highlights material information appearing elsewhere in this prospectus. Because this is a summary, it may not contain all of the information that you should consider before investing in the common stock of Global Brass and Copper Holdings, par value $0.01 per share, which we refer to as the “common stock”, and you should carefully read this entire prospectus, including our consolidated financial statements and related notes and the information presented under the caption “Risk Factors”.

Our Company

We are a leading, value-added converter, fabricator, distributor and processor of specialized copper and brass products in North America. We engage in metal melting and casting, rolling, drawing, extruding and stamping to fabricate finished and semi-finished alloy products from processed scrap, copper cathode and other refined metals. Our products include a wide range of sheet, strip, foil, rod, tube and fabricated metal component products that we sell under the Olin Brass, Chase Brass and A.J. Oster brand names. Our products are used in a variety of applications across diversified end markets, including the building and housing, munitions, automotive, transportation, coinage, electronics/electrical components, industrial machinery and equipment and general consumer end markets. We access these end markets through direct mill sales, our captive distribution network and third-party distributors. We believe the diversity of our product portfolio, the breadth of our value-added customer services, our vertical integration and our technical expertise underpin the long-standing relationships we have with our broad customer base. Over the past three years, we have significantly enhanced our profitability and operational flexibility, which we believe positions us to benefit from growth in customer demand across the majority of the key end markets we service as macroeconomic conditions improve. In addition, we expect to capitalize on new market and product growth opportunities, which we are currently pursuing.

We service over 1,700 customers in 28 countries across 5 continents. We employ approximately 1,900 people and operate 11 manufacturing facilities and distribution centers across the United States, Puerto Rico and Mexico to service our North American customers. Through our 80% owned joint venture in China and our 50/50 joint venture in Japan, together with sales offices in China and Singapore, we supply our products in China and throughout Asia, where we believe we are positioned to take advantage of the region’s expanding copper, brass strip and foil market. We service our European customers through distribution arrangements in the United Kingdom and Germany.

Our leading market positions in each of our operating segments allow us to achieve attractive operating margins. Our strong operating margins are a function of four key characteristics of our business: (1) we earn a premium margin over the cost of metal because of our value-added processing capabilities, patent-protected technologies, and first-class service; (2) we have strategically shifted our product portfolio toward value-added, higher margin products; (3) we are driving a lean cost structure through fixed and variable cost reductions, process improvements, and workforce flexibility initiatives; and (4) we employ our “balanced book” approach to substantially reduce the financial impact of metal price volatility on our earnings and operating margins. We have undertaken substantial cost reduction activities since our formation in 2007, which have reduced our fixed costs, improved our net working capital balances, and improved our competitive positioning which has increased operating margins.

Our financial performance is primarily driven by metal conversion economics, not by the underlying movements in the price of copper and the other metal we use. Through our balanced book

1

Table of Contents

approach, we match the timing, quantity and price of our metal sales with the timing, quantity and price of our replacement metal purchases. This practice substantially reduces the financial impact of metal price movements on our earnings and operating margins.

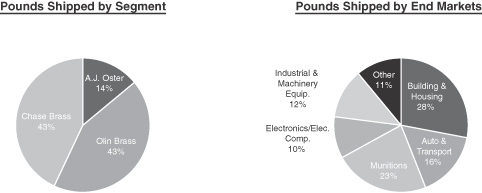

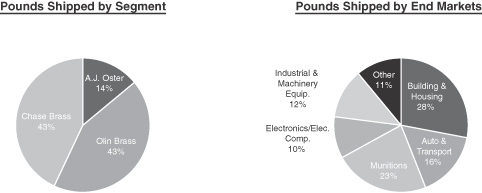

For the year ended December 31, 2012, we shipped 503.2 million pounds of products, and we generated net sales of $1,650.5 million, adjusted sales (as defined in note 4 under “Summary Historical Consolidated Financial Data”) of $524.9 million, net income attributable to Global Brass and Copper Holdings, Inc. of $12.5 million and Consolidated Adjusted EBITDA (as defined in note 5 under “Summary Historical Consolidated Financial Data”) of $115.4 million. Our U.S. operations generated 94% of our total net sales in the year ended December 31, 2012. The following charts show our pounds shipped by our three operating segments and our pounds shipped by key end market for the year ended December 31, 2012.

For the year ended December 31, 2012:

| Note: | For the Chase Brass segment, pounds shipped by end markets in the above chart reflects management’s allocation among end markets of pounds shipped by Chase Brass to distributors, job shops and forging shops. In addition, management estimates that approximately 50% of the Company’s pounds shipped to the electronics/electrical components end market are directly associated with the building sector. |

2

Table of Contents

Segments Overview

We have three operating segments: Olin Brass, Chase Brass and A.J. Oster.

|

|

| ||||

| Description |

• Leading manufacturer, fabricator and converter of specialized copper and brass sheet, strip, foil, tube and fabricated products |

• Leading manufacturer and supplier of brass rod |

• Leading distributor and processor of copper and brass products | |||

| • #1 North American Position (by 2012 pounds shipped) |

• #1 or #2 North American Position (by 2012 pounds shipped) |

• #1 North American Position (by 2012 pounds shipped) | ||||

| Key Products / Services |

• Produces 55 copper-based alloys, including 15 high performance alloys (“HPAs”), which provide superior strength, conductivity and formability |

• Produces nine brass alloys which provide superior strength and corrosion resistance, sold under the Blue Dot® brass rod brand name |

• Network of strategically located distribution centers, providing inventory management, distribution and value-added metal processing services to customers | |||

| • Over the past 3 years, approximately 14-18% of Olin Brass’s copper-based products have been sold to A.J. Oster |

• Holds exclusive rights for the production and sale of lead-free brass rod in North America, sold under the Green Dot™ rod and Eco Brass® alloy brand names |

• Over the past 3 years, approximately 70% to 80% of A.J. Oster’s copper-based products have been sourced from Olin Brass | ||||

| • Products sold throughout the U.S., Puerto Rico, Mexico, Asia and Europe |

• Products sold throughout the U.S., Mexico and Canada |

• Products sold throughout the U.S., Puerto Rico and Mexico | ||||

| Key End Markets |

• Munitions, Automotive, Coinage, Building and Housing, Electronics/Electrical Components |

• Building and Housing, Transportation, Electronics/Electrical Components, Industrial Machinery and Equipment and Distribution |

• Building and Housing, Automotive, Electronics/Electrical Components | |||

| Operations |

• 4 strategically located sites in the U.S. and 1 in China |

• 1 strategically located manufacturing site and 1 warehouse facility in the U.S. |

• 4 strategically located sites in the U.S., 1 in Puerto Rico and 1 in Mexico | |||

| • Marketing and sales joint venture office in Japan

• Sales office in Singapore

• 1,382 employees; 1,344 in the U.S. and 38 in Asia each as of December 31, 2012 |

• 316 employees as of December 31, 2012 |

• 268 employees as of December 31, 2012 | ||||

3

Table of Contents

Our Competitive Strengths

Market Leader in Key Industrial Segments. We believe we have leading market positions in the industry sectors served by each of our three operating segments. Management estimates that our strategically located plants represent approximately 40% of North American capacity for copper and copper-alloy sheet, strip and plate (“SSP”) and brass rod production, supplying over 1,700 customers with over 15,000 stock keeping units (“SKUs”), with approximately 10%, 24% and 66% of those SKUs being sold by Chase Brass, Olin Brass and A.J. Oster, respectively. We believe our customers value our ability to provide a diverse range of products, many of which are exclusively offered by us. For example, at Olin Brass, we produce 55 alloys (including 15 HPAs), which, management estimates, based on available market information, is nearly twice as many types of alloys as produced by our closest competitor. Our ability to provide high quality product in varying quantities at attractive prices and in a timely manner to meet the product needs of our customers has resulted in long-standing customer relationships, many of whom we have served for more than 30 years. Our leading market positions and scale also enable us to negotiate favorable arrangements with our suppliers. During 2012, we operated at approximately 57-65% capacity utilization across our portfolio of facilities. As a result, we believe it would require a significant investment to become a substantial new participant in the industry, and any such investment might not yield attractive returns for a significant period of time.

Exposure to Cyclical, End Market and New Product Growth. In 2012, approximately 49% of our pounds shipped served end markets principally influenced by new residential construction, repair and remodeling activity and light vehicle sales in the United States. Our operations are well-positioned to take advantage of the recovery that we believe is underway in the U.S. housing market. According to management estimates, U.S. housing starts are expected to grow from 740,000 in 2012 at a compound annual growth rate (“CAGR”) of 13.1% through 2015. According to management estimates, U.S. existing home sales are expected to grow from 4.1 million in 2012 at a CAGR of 6.1% through 2015. We also believe there is considerable growth potential in the U.S. automotive sector. According to management estimates, North American light vehicle production is forecast to grow from 14.9 million in 2012 at a CAGR of 4.5% through 2015. Additionally, we believe further growth will be driven by demand for our new products. We hold exclusive production and sales rights for “lead-free” Eco Brass® rod and control the licensing of Eco Brass® ingot in North America. This “lead-free” alloy can be used to make products that comply with recently enacted Federal legislation that will require a reduction of lead content in all drinking water and plumbing devices in January 2014. In addition, we believe that the Company is well positioned to become an industry leader in anti-microbial copper products through its CuVerro product line. In 2011, Olin Brass completed the Federal and state registration processes necessary to market its CuVerro™ materials as having anti-microbial properties and has licensed more than a dozen exclusive component manufacturers to market CuVerro™ products to the healthcare industry. We believe there is significant opportunity for us to expand our customer base to include companies that develop copper products for use in the healthcare, food service and other industries, replacing stainless steel and aluminum. We also anticipate a significant increase in the size of the coinage market if the U.S. transitions to the $1 coin and eliminates the dollar bill. As a certified supplier to the United States Mint, we expect to capture a material portion of this new demand. Finally, we currently believe that demand levels for rod and strip products in the U.S. are significantly below historical averages and that with the expected continued recovery in our key end-markets, we will observe significant increases in demand for our products. Given our current installed operating capacity and associated utilization rates, we believe we can meet this increase in demand with very low capital investment.

4

Table of Contents

Significant Expected Profit Growth through Volume Increases. Since our formation in 2007, we have implemented various cost reduction initiatives and workforce flexibility programs focused on reducing our fixed and non-metal variable costs. We believe the largely automated nature of our operations at our Chase Brass facility and the absence of defined benefit pension obligations or retiree healthcare obligations have contributed to a lean, flexible cost structure, which should position us to achieve strong operating margins going forward. Specifically:

| • | During 2012, we operated at approximately 57-65% capacity utilization across our portfolio of facilities. As such, we have available operating capacity that we can bring online quickly to respond to increased demand for our products and value-added services; |

| • | We believe we can increase production at our facilities with minimal change in our fixed costs and without significant additional capital investment; and |

| • | We believe we have the financial capacity and balance sheet strength to meet the working capital requirements that would accompany production increases in response to growing customer demand. |

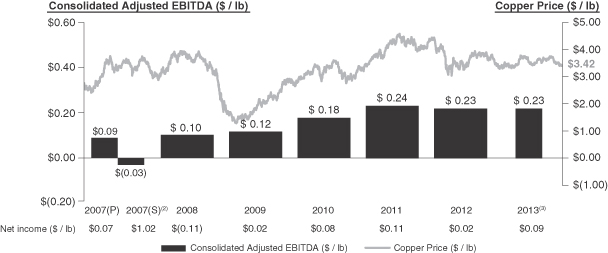

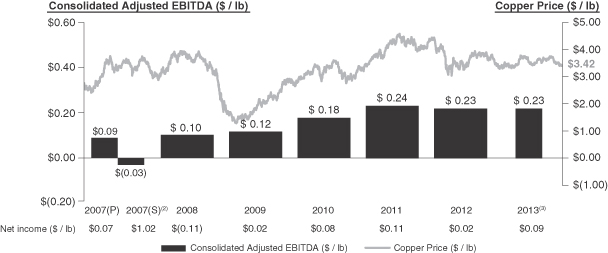

Since our formation in 2007, we have consistently improved our Consolidated Adjusted EBITDA per pound, a metric that management monitors to assess our profitability and operating efficiency, from $0.10 per pound for the year ended December 31, 2008 to $0.23 per pound for the year ended December 31, 2012.

Margin and Cash Flow Profile Insulated from Metal Price Volatility. Approximately 70%-75% of our cost structure consists of variable metal costs, for which we use our balanced book approach to substantially reduce the financial impact of metal price volatility on our earnings and operating margins. Our business model is principally based on the conversion and fabrication of the metal we purchase into finished and semi-finished alloy products. Our financial performance is driven by metal conversion economics (i.e., the prices we charge for our products and value-added services and our ability to control our operating costs); we do not seek to profit from movements in underlying metal prices. Through our balanced book approach, we match the timing, quantity and price of our metal sales with the timing, quantity and price of our replacement metal purchases. Our balanced book approach allows us to substantially reduce the financial impact of metal price volatility on our earnings and operating margins. Our balanced book approach and low fixed cost position has allowed us to generate substantial cash flows. For the three months ended March 31, 2013, net cash used in operating activities was $5.1 million, and in the three months ended March 31, 2012, we generated net cash provided by operating activities of $31.8 million. For the fiscal years ended December 31, 2012, 2011 and 2010, we generated net cash provided by operating activities of $81.9 million, $64.8 million and $69.4 million, respectively. In addition, we have low capital expenditure requirements. We estimate annual capital expenditures from 2013 to 2017 to range between $25 million to $30 million per annum, of which $20 million to $24 million per annum will consist of capital improvements or replacement of existing capital items. Our total capital expenditures as a percentage of our adjusted sales have ranged from approximately 2% to 4% for the last three fiscal years.

Net income attributable to Global Brass and Copper Holdings, Inc. per pound was $0.09 and $0.11 for the three months ended March 31, 2013, and 2012, respectively. Net income (loss) attributable to Global Brass and Copper Holdings, Inc. per pound was $0.02, $0.11, $0.08, $0.02 and $(0.11) for the years ended December 31, 2012, 2011, 2010, 2009 and 2008, respectively. Net income attributable to Global Brass and Copper Holdings, Inc. per pound was $1.02 for the successor period from October 10, 2007 to December 31, 2007, and net income per pound of our predecessor was $0.07 for the predecessor period from January 1, 2007 to November 18, 2007.

5

Table of Contents

As illustrated in the following chart, we have increased our historical Consolidated Adjusted EBITDA(1) per pound over the period from 2007 to the first quarter 2013, despite relatively volatile underlying copper prices:

Source: Copper prices from the London Metal Exchange reported by Bloomberg

(1) See note 5 to “Summary Historical Consolidated Financial Data” for the calculation of Consolidated Adjusted EBITDA and a reconciliation to net income (loss) attributable to Global Brass and Copper Holdings, Inc., which is the most directly comparable U.S. GAAP financial measure to Consolidated Adjusted EBITDA.

(2) We acquired the worldwide metals business of Olin Corporation on November 19, 2007. As a result, the 2007 fiscal year is composed of a predecessor period from January 1, 2007 to November 18, 2007 (represented by “2007(P)” in the chart above), and a successor period from the date of our formation, October 10, 2007, to December 31, 2007 (represented by “2007(S)” in the chart above). We had no material operations or assets prior to November 19, 2007. Data for the period from January 1, 2007 to November 18, 2007 are based on books and records provided to us by Olin Corporation in connection with the acquisition, we believe were prepared on a basis consistent with Olin Corporation’s accounting policies and procedures and have not been subject to an audit or review. Data for the predecessor period of 2007 are not prepared using our accounting policies and procedures, do not reflect the application of purchase accounting (which has been applied to the successor period financial statements) and also do not reflect the allocation of Olin Corporation selling, general and administrative expenses to the metals business unit. We believe that the unaudited financial information for the predecessor period of 2007 may be useful to investors for purposes of illustrating trends in our business. Although we have no reason to believe that the unaudited financial information for the predecessor period of 2007 is materially deficient, there is a risk that this unaudited financial information may contain errors that might have been detected in a review or audit process or might have been different if prepared in accordance with our policies and procedures instead of those of Olin Corporation. See note 5 to “Summary Historical Consolidated Financial Data” and note (a) to the reconciliation table contained in such note and “Risk Factors—Risks Related to Our Business—You should not place undue reliance on the selected financial and other information of our predecessor as of November 18, 2007 and for the period from January 1, 2007 to November 18, 2007, which are summarized in this prospectus”.

(3) For the three months ended March 31, 2013.

Over the past three years, we have demonstrated the ability to generate significant operating cash flow despite the relatively difficult operating environment. Our strong cash flow generation has enabled us to significantly reduce our leverage from approximately 7.9x gross debt to Consolidated Adjusted EBITDA upon formation in 2007 to 3.4x as of December 31, 2012. Our debt reduction achievements have also been delivered while distributing dividends to our shareholders. We believe we will continue to generate significant operating cash flow, which will provide us the opportunity to deploy future excess cash flow to fund dividends or value-enhancing acquisitions. We will continue to manage our capital with financial discipline with the objective of maximizing value for our shareholders.

Highly Experienced Management Team. Since our formation in 2007, we have assembled a highly experienced management team, which combines our predecessor’s legacy experience with new team members who have many years of relevant industry experience. The members of our senior

6

Table of Contents

management team have, on average, over 26 years of metals industry experience. Since our formation, our senior management team has implemented a new business strategy and successfully transformed the cost structure and operating strategy of the business. Our management team has also instilled a culture that promotes performance excellence with a strong focus on driving profitability and, as a direct result, our operational and financial performance has improved significantly since 2007.

Our Growth Strategy

Participate in Demand Recovery as Economic Conditions Strengthen. Our premium products and services have allowed us to achieve leading positions across a number of attractive end markets. In addition, we maintain strong relationships with a diverse set of customers across those end markets. As U.S. macroeconomic conditions continue to improve, we expect to see increased activity in many of our key end markets, especially building and housing, automotive, coinage and industrial machinery and equipment, which we expect will drive increased demand for our products and services. In the beginning of 2013, the U.S. housing market has experienced a recovery from the sharp downturn that began in 2007. We believe that our available production capacity will allow us to effectively and efficiently respond to increasing demand.

Capitalize on Growth Opportunities for Our Existing Products and Services. We believe there are opportunities to expand the supply of our existing products and services in several key high-value end markets. Examples include:

| • | Lead-free and Low-lead Plumbing Products. New regulations designed to reduce lead content in drinking water plumbing devices provide a key opportunity for future growth. Chase Brass is a premier provider of specialized lead-free products and low-lead alloys. Recently enacted Federal legislation in the United States (the Reduction of Lead in Drinking Water Act, which was patterned after legislation enacted in California and Vermont) will require the reduction of lead content in all drinking water plumbing devices beginning in January 2014. This legislation presents a significant growth opportunity for Chase Brass. Our Eco Brass® products meet Federal, California and Vermont standards and can be used to produce cast, machined and forged faucet parts. We currently supply major faucet, valve and fitting manufacturers who produce multiple products using machined Eco Brass® parts. |

| • | Transition to the Dollar Coin. On September 20, 2011, the Currency Optimization Innovation and National Savings Act, or “COINS Act”, was introduced in the U.S. House of Representatives, which is intended to modernize the U.S. currency system by replacing $1 notes with $1 coins and result in average savings of $184 million per year (based on 2011 Government Accountability Office estimates). On January 31, 2012, the COINS Act was also introduced in the U.S. Senate. Despite a recently announced substantial reduction in $1 coin production over the next couple of years, we anticipate a significant increase in the size of the coinage market if the U.S. transitions to the $1 coin and eliminates the dollar bill. As a certified supplier to the United States Mint, we expect to capture a material portion of this new demand. |

Pursue New Growth Opportunities. We have identified a number of important trends in key growth markets which we believe will drive significant incremental growth for our company, including:

| Ÿ | Anti-microbial Applications. Olin Brass is well positioned to become a leader in commercializing anti-microbial copper products through its CuVerro™ anti-microbial product line. The U.S. Environmental Protection Agency (“EPA”) recently recognized that copper is inherently capable of neutralizing potentially harmful viruses and bacteria and began accepting registrations of copper-alloys with anti-microbial properties. Olin Brass manufactures several such alloys, which were |

7

Table of Contents

| EPA-registered in 2011, and we believe there is significant opportunity for us to expand our customer base to include companies that develop copper products for use in the healthcare, food service, heating, ventilation and air conditioning industries, replacing stainless steel and aluminum. Olin Brass has completed the Federal and state registration processes necessary to market its CuVerro™ materials as having anti-microbial properties. |

| • | Renewable Energy Applications: Renewable energy is a fast growing and attractive sector, with significant long-term growth potential. Copper, copper-alloy and brass products are used in renewable energy technologies, including lithium batteries and solar power applications such as photovoltaic cells. We believe increasing demand for renewable energy applications will be a key opportunity for further growth. |

In addition, we plan to continue to identify opportunities to extend our existing range of products and services through ongoing investment in technology research and development through our Materials Research Laboratory. The Materials Research Laboratory is a world-renowned copper-alloy research, manufacturing and production innovation lab and is responsible for numerous patents held by our Company and also by our customers. The Materials Research Laboratory was instrumental in developing patented products such as CopperBond®, CopperBond® XTF, and other unique foil products such as C7025 for computer disk drives.

Pursue Strategic Opportunities to Expand Our Business. The North American copper and brass distribution industry includes numerous small, regional players. We believe future industry consolidation and possible strategic acquisitions in key growth markets, notably Asia, will provide opportunities to increase our presence in these markets and to create shareholder value. In addition, we may pursue, strategic acquisition and/or partnership opportunities to increase the breadth and distribution of our product portfolio and metal distribution services in the future.

8

Table of Contents

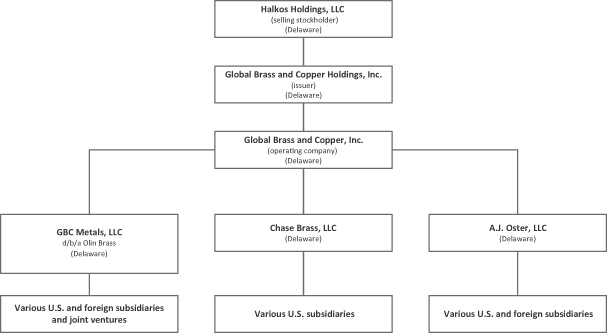

Organizational Structure

The chart below is a summary of our organizational structure as of March 31, 2013. All entities depicted are currently (and will be following this offering) 100% owned subsidiaries, except for Global Brass and Copper Holdings which is currently a wholly-owned subsidiary of Halkos. Halkos is selling all of the Global Brass and Copper Holdings shares that will be sold in this offering.

Industry Overview

North American Copper and Copper-alloy SSP and Rod. Improvements in the financial and economic markets since 2008 and 2009 have encouraged a rebound in demand for copper and copper-alloy SSP and rod, primarily driven by greater activity in the building and housing and automotive end markets. During the softening housing market in 2007 and the ensuing economic downturn in 2008 and 2009, demand for SSP and rod products deteriorated significantly. However, prior to the economic downturn, demand for SSP and rod products in North America had been relatively stable over the period from 2001 to 2007.

While the recovery from the recent economic downturn has been uneven and at times slower than desired, as economic conditions improve and activity in key end markets strengthens, we anticipate that demand for copper and copper-alloy SSP and rod products will increase. We also expect to see a greater shift in demand toward low-lead and lead-free copper and brass products driven by new government regulation, such as the Reduction of Lead in Drinking Water Act. This regulatory shift represents a significant growth opportunity for North American manufacturers of lead-free materials, many of whom, including us, are already experiencing increased demand for high quality, lead-free and low-lead products. In addition, we believe that there are a number of growth opportunities that could create significant incremental demand for copper and copper-alloy SSP products, including coinage, anti-microbial fixtures, and renewable energy applications (such as lithium batteries and solar applications).

9

Table of Contents

Distribution Centers. Metal distribution centers and processors play a critical supply-chain role between metal production mills and end-users, especially between mills that manufacture large volumes and end-users who require smaller volumes, inventory management and processing services. The North American copper and brass distribution industry includes several large players, including us, and many smaller participants. We believe a large distribution business with a low fixed-cost structure will generally benefit from economies of scale, a more robust distribution network, a more diversified product portfolio and the ability to provide higher-quality, value-added services relative to smaller competitors. In addition, a distribution center with greater scale can typically operate on shorter lead times and provide on-time delivery and smaller quantities of a wide variety of products. Over the longer term, we believe the role of the metal distribution industry will become increasingly important as both primary metal producers and end-users look to outsource their metal processing and inventory management needs to value-added metal distribution centers. We anticipate smaller competitors will consolidate over time in order to remain competitive.

Global Supply of SSP and Alloy Rod Products. North American SSP and alloy rod consumers have historically developed long-term supply relationships with domestic SSP and alloy rod manufacturers and suppliers that offer a broad range of high quality products, that are able to respond quickly to product orders, and that provide on-time, frequent delivery in small batch sizes. Accordingly, our management believes North American consumer demand has largely been satisfied by North American SSP and alloy rod producers. Offshore supply of SSP and alloy rod products has historically contributed a small proportion of total North American supply.

Competition. We compete with other companies on price, service, quality and product breadth and availability of products both domestically and internationally. We believe we have been able to compete effectively because of our high levels of service, breadth of product offering, knowledgeable and trained sales force, modern equipment, strategically located facilities, geographic dispersion, operational economies of scale and sales volume.

The North American market for brass and copper strip and sheet and brass rod consists of a few large participants and a few smaller competitors for Olin Brass and Chase Brass and a number of smaller competitors for A.J. Oster.

Based on available market data, we believe the largest competitors to each of our operating segments in the markets in which we operate are the following:

| • | Olin Brass: Aurubis and PMX Industries, Inc. (manufacturing of copper and copper-alloys in the form of strip, sheet and plate). |

| • | Chase Brass: Mueller Industries, Inc. (manufacturing of brass rod). |

| • | A.J. Oster: ThyssenKrupp Materials NA, Copper and Brass Sales Division (distribution and processing of copper, brass, stainless and aluminum products); and Wieland Metals, Inc. (re-roll mill and service center for copper and copper-alloy strip). |

Based on the data published by Copper Development Association Inc., Copper and Brass Servicenter Association, Inc. (both independent industry associations) and management estimates, as of December 31, 2012, the Olin Brass segment accounted for 35.2% of North American shipments (including shipments to A.J. Oster) of copper and brass alloys in the form of sheet, strip and plate; the Chase Brass segment accounted for 47.7% of North American domestic shipments of brass rod; and the A.J. Oster segment accounted for 33.3% of North American shipments of copper and brass, sheet and strip products from distribution centers and rerolling facilities.

10

Table of Contents

Recent Transactions

Issuance of the Senior Secured Notes and the Refinancing of the Term Loan Facility

On June 1, 2012, we completed a refinancing, which included the issuance of $375.0 million in aggregate principal amount of 9.50% Senior Secured Notes due 2019 (the “Senior Secured Notes”) by Global Brass and Copper, Inc. The Senior Secured Notes are guaranteed by Global Brass and Copper Holdings, Inc. and substantially all of Global Brass and Copper’s existing and future wholly-owned U.S. subsidiaries. The Senior Secured Notes are secured by a senior-priority security interest in our fixed assets and by a junior-priority security interest in our accounts receivable and inventory.

We used a portion of the proceeds from the Senior Secured Notes to repay in full the $266.5 million of principal outstanding under our prior $315.0 million five-year senior term loan facility (the “Term Loan Facility”), which we refer to as the “Term Loan Refinancing.” In the Term Loan Refinancing, we paid our lenders a total of $275.5 million, including the $266.5 million of principal, an early repayment premium of $8.0 million and accrued and unpaid interest of $1.0 million, and we recognized a $19.6 million loss on extinguishment of debt.

Amendment of the ABL Facility

Concurrently with the issuance of the Senior Secured Notes and the Term Loan Refinancing on June 1, 2012, we amended the agreement governing our $150.0 million asset-based revolving loan facility (the “2010 ABL Facility”, and, as currently amended, the “ABL Facility”) to:

| • | increase the commitments under the facility to $200.0 million; |

| • | extend the maturity of the ABL Facility to June 1, 2017; |

| • | permit the Transactions (as defined below); |

| • | lower the applicable margin and unused line fee under the ABL Facility; |

| • | permit us to make additional acquisitions, investments, restricted payments, asset sales and debt incurrences if certain conditions are satisfied; |

| • | increase the inventory loan limit for the borrowing base; |

| • | adjust certain reporting requirements and collateral audit requirements to make them less restrictive; and |

| • | reduce the excess availability threshold which requires us to test our fixed charge coverage ratio covenant. |

We refer to these amendments collectively as the “ABL Amendment”.

Distribution to Halkos

In connection with the offering of the Senior Secured Notes, the Term Loan Refinancing and the ABL Amendment, we used a portion of the net proceeds of the issuance of the Senior Secured Notes, together with cash on hand, to make a cash distribution of $160.0 million to Halkos, which we refer to as the “Parent Distribution”. Halkos distributed the proceeds of the Parent Distribution pro rata to its equityholders (which include certain of our officers and directors) in accordance with the terms of its operating agreement.

We refer to the Term Loan Refinancing, the ABL Amendment and the Parent Distribution collectively as the “Transactions”.

11

Table of Contents

Risk Factors

An investment in shares of our common stock involves risks. Below is a summary of certain key risk factors that you should consider in evaluating an investment in shares of our common stock. This list is not exhaustive. Please read the full discussion of these risks and other risks described under the caption “Risk Factors” beginning on page 23 of this prospectus.

| • | downturns or cyclical economic conditions affecting the markets in which our products are sold, including the housing and commercial construction markets; |

| • | our ability to continue implementing our balanced book approach to substantially reduce the impact of fluctuations in metal prices on our earnings and operating margins; |

| • | shrinkage from processing operations and metal price fluctuations, particularly copper; |

| • | limitations on our ability to access raw materials, particularly copper; |

| • | fluctuations in commodity and energy prices and costs; |

| • | our ability to maintain sufficient liquidity as commodity and energy prices rise; |

| • | our ability to continue our operations internationally and the risks applicable to international operations; |

| • | our ability to continue to comply with the covenants in our debt agreements and service our indebtedness; |

| • | government regulations relating to our products and services, including new legislation relating to derivatives and the elimination of the dollar bill; and |

| • | our ability to remediate any material weaknesses in our internal control over financial reporting as we become subject to public company requirements. |

Global Brass and Copper Holdings

Global Brass and Copper Holdings was incorporated in Delaware on October 10, 2007. Global Brass and Copper Holdings acquired the worldwide metals business of Olin Corporation on November 19, 2007. The principal executive offices of Global Brass and Copper Holdings are located at 475 N. Martingale Road, Suite 1050, Schaumburg, IL 60173, and the telephone number is (847) 240-4700.

We also maintain an internet site at http://www.gbcholdings.com. Our website and the information contained in that website or connected to that website will not be deemed to be incorporated into this prospectus or the registration statement of which this prospectus forms a part, and you should not consider it part of this prospectus or rely on any such information in making your decision whether to purchase our common stock.

KPS Capital Partners, LP and Halkos Holdings, LLC

KPS Capital Partners, LP is a leading middle market private equity firm with $6.0 billion of assets under management. KPS seeks to realize significant capital appreciation through controlling equity investments in manufacturing and industrial companies going through a period of transition. The KPS investment strategy is based upon partnering with top management teams to materially and permanently improve the operations of a company, and then growing the company, either organically or through strategic acquisitions. The KPS investment strategy and its portfolio companies are

12

Table of Contents

described in detail at the KPS website: www.kpsfund.com. The KPS website and the information contained in that website or connected to that website will not be deemed to be incorporated into this prospectus or the registration statement of which this prospectus forms a part, and you should not consider it part of this prospectus or rely on any such information in making your decision whether to purchase our common stock.

KPS Special Situations Fund II, L.P., KPS Special Situations Fund II (A), L.P., KPS Special Situations Fund III, L.P. and KPS Special Situations Fund III (A), L.P. (collectively, the “KPS Funds”) are affiliates of KPS and are the majority members of Halkos Holdings, LLC. Halkos owns all of the outstanding shares of Global Brass and Copper Holdings prior to this offering and is the selling stockholder.

13

Table of Contents

The Offering

| Common stock offered |

9,375,000 shares, all of which are being offered by the selling stockholder. | |

| Underwriters’ option to purchase additional common stock from the selling stockholder |

Up to 1,406,000 shares. | |

| Shares of our common stock to be outstanding immediately following this offering |

21,110,000 shares. | |

| Use of proceeds |

All of the shares being offered in this offering are being offered by the selling stockholder. We will not receive any proceeds in this offering. | |

| Dividends |

Following this offering, we intend to pay quarterly cash dividends. Any dividends or changes to our dividend policy will be made at the discretion of the Board of Directors and will depend on many factors, including those enumerated in the section entitled “Dividend Policy”. | |

| Principal Stockholders |

Upon consummation of this offering, Halkos will own approximately 55.6% of the voting stock of Global Brass and Copper Holdings (48.9% if the underwriters exercise in full their option to purchase additional shares). If Halkos beneficially owns more than 50% of such voting stock after the completion of this offering, we will avail ourselves of the “controlled company” exemptions under the rules of the New York Stock Exchange. Otherwise, we expect to comply with such NYSE rules, subject to the prescribed phase-in provisions. | |

| Lock-up Agreements |

The selling stockholder and the officers and directors of Global Brass and Copper Holdings will be subject to customary lockup agreements with a duration of 180 days. See “Underwriting”. | |

| Listing |

We have been approved to list our common stock on the New York Stock Exchange under the trading symbol “BRSS”. | |

Other Information About This Prospectus

Except as otherwise indicated, all information in this prospectus (including the information set forth under “—The Offering” above):

| • | assumes no exercise of the underwriters’ option to purchase additional shares; |

| • | reflects a 211,100 to-1 stock split, which we refer to as the “stock split,” which will become effective after the effective date of this registration statement and prior to the completion of this offering; |

| • | does not give effect to 1,111,053 shares of common stock reserved for future issuance under our Global Brass and Copper Holdings, Inc. 2013 Omnibus Equity Incentive Plan, which we refer to as the “2013 Plan”; and |

| • | does not give effect to 338,979 shares of our common stock issuable under equity awards granted in connection with this offering under the 2013 Plan. |

14

Table of Contents

In connection with this offering, 104,444 non-qualified stock options, 74,219 shares of restricted stock and 98,441 performance shares will be granted to certain members of management and our board. Of these grants, an aggregate of 69,629 non-qualified stock options, 32,812 shares of restricted stock and 65,627 performance shares will be granted to our named executive officers and an aggregate of 34,815 non-qualified stock options, 16,407 shares of restricted stock and 32,814 performance shares will be granted to other members of our management. An aggregate of 25,000 shares of restricted stock will be granted to four of our directors. In addition, an aggregate of 61,875 shares of restricted stock will be granted to certain other executive officers and other employees. None of the equity awards to be granted in connection with this offering will be vested or exercisable within 60 days after the date of the completion of this offering. Unless otherwise noted specifically, all percentage ownership statistics in this prospectus and as-adjusted or pro forma share outstanding amounts do not give effect to such awards.

The 104,444 non-qualified stock options vest over a three-year period on the first through third anniversaries of the closing date of this offering. The total estimated fair value is $0.8 million, and we estimate that the amount amortized to selling, general and administrative (“SG&A”) expense during any one year will be $0.3 million. Fair value is estimated using the Black-Scholes option pricing model. We used the following inputs for the option pricing model:

| • | The grant price and market value for these non-qualified stock options was assumed to be $16.00, the mid-point of the range set forth on the cover page of this prospectus. |

| • | Volatility and expected term assumptions were estimated using an average of 10 publicly traded peers (AK Steel, Allegheny Technologies, Carpenter Technology, Commercial Metals, Encore Wire, Kaiser Aluminum, Materion, Mueller Industries, Reliance Steel & Aluminum and Worthington Industries). We assumed the volatility to be 55% and the expected term to be six years. |

| • | We selected a U.S. Treasury bond rate of 0.93% consistent with the expected term assumption. |

| • | A dividend rate of $0.0375 per quarter was assumed. |

Of the 136,094 total shares of restricted stock, 49,219 shares of restricted stock issued to management will vest over three years after the closing date of this offering, 61,875 shares issued to certain executive officers and other employees will vest on the first anniversary of the closing date of this offering and 25,000 shares issued to four of our directors will vest 218 days after the closing date of this offering. The fair value was determined by multiplying the midpoint of the price range for this offering set forth on the cover page of this prospectus, $16.00, by the 136,094 shares of restricted stock issued, resulting in an estimated aggregate fair value of $2.2 million. The annual amount estimated to be amortized to SG&A expense in respect of the three-year vesting shares of restricted stock will be $0.3 million per year. The entire $1.0 million value of the one-year vesting shares to employees will be amortized to SG&A expense during the year after the closing date of this offering. The estimated $0.4 million value of the shares issued to the four directors will be amortized during the 218-day vesting period.

The 98,441 performance shares will vest over three years based on our achievement of return on net assets targets by the end of the 2013 fiscal year, as described in more detail under “Compensation Discussion and Analysis—IPO Equity Grants.” For purposes of calculating the amount of SG&A expense, we have assumed a 100% vesting amount based on the performance criterion, yielding an aggregate estimated fair value for the performance shares (based on the $16.00 midpoint of the price range) of $1.6 million. We estimate the amount amortized to SG&A during the first, second and third years will be $1.0 million, $0.4 million and $0.2 million, respectively.

15

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

Set forth below is summary historical consolidated financial data of our business, as of the dates and for the periods indicated. The summary historical consolidated financial data as of March 31, 2013 and for the three months ended March 31, 2013 and 2012 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements, and in the opinion of our management, reflect all adjustments, including normal recurring adjustments, necessary for a fair presentation of the results for those periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full year. The summary historical consolidated financial data as of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2010 has been derived from our audited consolidated financial statements not included in this prospectus.

The number of common shares used in the calculation of historical net income attributable to Global Brass and Copper Holdings, Inc. per common share in the summary historical consolidated financial data below does not give effect to the planned 211,100-to-1 stock split to be effected after the effective date of this registration statement and prior to the completion of this offering. The number of common shares used in the calculation of pro forma net income attributable to Global Brass and Copper Holdings, Inc. per common share does give effect to the planned 211,100-to-1 stock split to be effected after the effective date of this registration statement and prior to the completion of this offering, but does not give effect to the 338,979 shares issuable under the equity awards to be granted in connection with this offering, since as of the date of this offering none of those awards will be vested or exercisable within 60 days after the date of the completion of this offering.

The summary historical consolidated financial data should be read in conjunction with the information about the limitations on comparability of our financial results, including as a result of acquisitions. See “Selected Historical Consolidated Financial Data”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Risk Factors” and the consolidated financial statements and related notes included elsewhere in this prospectus.

16

Table of Contents

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||

| 2013 | 2012(7) | 2012 | 2011(7) | 2010(7) | ||||||||||||||||

|

(in millions, except share, per share and per pound data) |

||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 445.0 | $ | 443.4 | $ | 1,650.5 | $ | 1,779.1 | $ | 1,658.7 | ||||||||||

| Cost of sales |

398.1 | 393.4 | 1,467.3 | 1,583.5 | 1,496.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

46.9 | 50.0 | 183.2 | 195.6 | 162.0 | |||||||||||||||

| Selling, general and administrative expenses |

19.7 | 17.9 | 92.7 | 69.4 | 68.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

27.2 | 32.1 | 90.5 | 126.2 | 93.1 | |||||||||||||||

| Third party interest expense(1) |

9.9 | 9.8 | 39.7 | 40.0 | 22.6 | |||||||||||||||

| Related party interest expense(2) |

— | — | — | — | 2.5 | |||||||||||||||

| Loss on extinguishment of debt |

— | — | 19.6 | — | — | |||||||||||||||

| Other expense, net |

0.2 | 0.3 | 0.1 | 0.4 | 0.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before provision for income taxes and equity income |

17.1 | 22.0 | 31.1 | 85.8 | 67.2 | |||||||||||||||

| Provision for income taxes |

6.0 | 8.2 | 19.2 | 31.4 | 26.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before equity income |

11.1 | 13.8 | 11.9 | 54.4 | 40.6 | |||||||||||||||

| Equity income, net of tax |

0.4 | 0.3 | 1.0 | 0.9 | 1.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

11.5 | 14.1 | 12.9 | 55.3 | 42.1 | |||||||||||||||

| Less: Net income attributable to noncontrolling interest |

0.1 | 0.1 | 0.4 | 0.2 | 0.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to Global Brass and Copper Holdings, Inc.(1) |

$ | 11.4 | $ | 14.0 | $ | 12.5 | $ | 55.1 | $ | 41.6 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Historical Per Share Data (Pre-Stock Split): |

||||||||||||||||||||

| Historical net income attributable to Global Brass and Copper Holdings, Inc. per common share(3) |

$ | 113,880 | $ | 139,930 | $ | 125,210 | $ | 551,320 | $ | 416,330 | ||||||||||

| Number of common shares used in historical calculation |

100 | 100 | 100 | 100 | 100 | |||||||||||||||

| Pro Forma Per Share Data (Post-Stock Split): |

||||||||||||||||||||

| Pro forma net income attributable to Global Brass and Copper Holdings, Inc. per common share(1)(3) |

$ | 0.54 | $ | 0.55 | $ | 0.40 | $ | 2.61 | $ | 1.97 | ||||||||||

| Number of common shares used in pro forma calculation |

21,110,000 | 21,110,000 | 21,110,000 | 21,110,000 | 21,110,000 | |||||||||||||||

17

Table of Contents

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2013 | 2012(7) | 2012 | 2011(7) | 2010(7) | ||||||||||||||||

|

(in millions, except share, per share and per pound data) |

||||||||||||||||||||

| Cash flow data: |

||||||||||||||||||||

| Cash flows (used in) provided by operating activities |

$ | (5.1 | ) | $ |

31.8 |

|

$ | 81.9 | $ | 64.8 | $ | 69.4 | ||||||||

| Cash flows used in investing activities |

(2.9 | ) | (3.7 | ) | (20.4 | ) | (22.3 | ) | (11.9 | ) | ||||||||||

| Cash flows provided by (used in) financing activities |

|

10.2 |

|

|

(1.1 |

) |

(96.8 | ) | (8.3 | ) | (49.6 | ) | ||||||||

| Other data: |

||||||||||||||||||||

| Pounds shipped |

131.5 | 132.9 | 503.2 | 510.0 | 554.1 | |||||||||||||||

| Adjusted sales(4) |

$ | 139.6 | $ | 137.1 | $ | 524.9 | $ | 530.5 | $ | 538.5 | ||||||||||

| Adjusted sales per pound shipped |

$ | 1.06 | $ | 1.03 | $ |

1.04 |

|

$ | 1.04 | $ | 0.97 | |||||||||

| Consolidated Adjusted EBITDA(5) |

$ | 30.1 | $ | 32.8 | $ | 115.4 | $ | 122.6 | $ | 99.0 | ||||||||||

| Consolidated Adjusted EBITDA per pound shipped |

$ | 0.23 | $ | 0.25 | $ | 0.23 | $ | 0.24 | $ | 0.18 | ||||||||||

| Total capital expenditures |

$ | 3.1 | $ | 3.7 | $ | 20.4 | $ | 22.4 | $ | 11.9 | ||||||||||

| As of March 31, | As of December 31, | |||||||||||||||||||

| 2013 | 2012 | 2011(7) | 2010(7) | |||||||||||||||||

| (in millions) |

||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash |

|

$ | 15.8 | $ | 13.9 | $ | 49.5 | $ | 15.5 | |||||||||||

| Total assets |

|

576.5 | 502.7 | 548.7 | 537.7 | |||||||||||||||

| Total debt(6) |

|

400.0 | 389.5 | 303.6 | 306.2 | |||||||||||||||

| Total liabilities |

|

613.5 | 550.5 | 466.0 | 509.2 | |||||||||||||||

| Total (deficit) equity |

|

(37.0 | ) | (47.8 | ) | 82.7 | 28.5 | |||||||||||||

| (1) | We used a portion of the net proceeds of the Senior Secured Notes offering that we completed on June 1, 2012 to make the Parent Distribution. Our pro forma net income attributable to Global Brass and Copper Holdings, Inc. per common share reflects a reduction in our net income attributable to the interest expense incurred on the portion of the Senior Secured Notes that were used to fund the Parent Distribution. Assuming an interest rate of 9.50%, which is the actual interest rate of the Senior Secured Notes, and a statutory U.S. federal income tax rate of 35%, had the Parent Distribution been completed on January 1, 2012, our net income attributable to Global Brass and Copper Holdings, Inc. would have decreased by $2.5 million to $11.5 million for the three months ended March 31, 2012 and $4.1 million to $8.4 million for the year ended December 31, 2012. The effect of the issuance of the Senior Secured Notes and the Parent Distribution is fully reflected in the results presented for the three months ended March 31, 2013. |

| (2) | Represents interest on the related party term loan credit facility described in “Certain Relationships and Related Party Transactions”. |

| (3) | The number of common shares used in the calculation of historical net income attributable to Global Brass and Copper Holdings, Inc. per common share does not give effect to the planned 211,100-to-1 stock split to be effected after the effective date of this registration statement and prior to the completion of this offering. The number of common shares used in the calculation of pro forma net income attributable to Global Brass and Copper Holdings, Inc. per common share does give effect to such stock split, but does not give effect to the 338,979 shares issuable under the equity awards to be granted in connection with this offering, since as of the date of this offering none of those awards will be vested or exercisable within 60 days after the date of the completion of this offering. |

| (4) | Adjusted sales is a non-GAAP financial measure. For more information regarding adjusted sales, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures—Adjusted Sales”. Adjusted sales is defined as net sales less the metal component of net sales. Adjusted sales represents the value-added revenue we derive from our conversion and fabrication operations. Management uses adjusted sales on a consolidated basis to monitor the revenues that are generated from our value-added conversion and fabrication processes excluding the |

18

Table of Contents

| effects of fluctuations in metal costs, reflecting our toll sales and our balanced book approach for other sales. We believe that presenting adjusted sales is informative to investors because it shows our ability to generate revenue from conversion and fabrication. The following table shows a reconciliation of net sales to adjusted sales: |

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2013 | 2012(7) | 2012 | 2011(7) | 2010(7) | ||||||||||||||||

| (in millions) |

||||||||||||||||||||

| Net sales |

$ | 445.0 | $ | 443.4 | $ | 1,650.5 | $ | 1,779.1 | $ | 1,658.7 | ||||||||||

| Metal component of net sales |

305.4 | 306.3 | 1,125.6 | 1,248.6 | 1,120.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted sales |

$ | 139.6 | $ | 137.1 | $ | 524.9 | $ | 530.5 | $ | 538.5 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (5) | Consolidated EBITDA and Consolidated Adjusted EBITDA are non-GAAP financial measures. For more information regarding our EBITDA-based measures, including their limitations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures—EBITDA-Based Measures”. |

We define Consolidated EBITDA as net income (loss) attributable to Global Brass and Copper Holdings, Inc., adjusted to exclude interest expense, provision for (benefit from) income taxes and depreciation and amortization expense. We also present Segment EBITDA elsewhere in this prospectus.

We use Consolidated EBITDA only to calculate Consolidated Adjusted EBITDA. Consolidated Adjusted EBITDA is Consolidated EBITDA, further adjusted to exclude extraordinary gains from the bargain purchase that occurred in the acquisition of the worldwide metals business of Olin Corporation, realized and unrealized gains and losses related to the collateral hedge contracts that were required under the asset-based revolving loan facility that we entered into at the time we acquired the worldwide metals business of Olin Corporation in November 2007 (the “2007 ABL Facility”), unrealized gains and losses on derivative contracts in support of our balanced book approach, unrealized gains and losses associated with derivative contracts related to electricity and natural gas costs, non-cash gains and losses due to lower of cost or market adjustments to inventory, non-cash LIFO-based gains and losses due to the depletion of a LIFO layer of metal inventory with lower base year costs, non-cash compensation expense related to payments made to members of our management by our parent, Halkos, loss on extinguishment of debt, non-cash income accretion related to the joint venture with Dowa Holdings Co. Ltd. (“Dowa”), KPS management fees, restructuring and other business transformation charges, specified legal and professional expenses and certain other items. We also present Segment Adjusted EBITDA elsewhere in this prospectus.

We present the above-described EBITDA-based measures because we consider them important supplemental measures and believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Nevertheless, our EBITDA based measures may not be comparable to similarly titled measures presented by other companies.

We present Consolidated Adjusted EBITDA as a supplemental measure of our performance because we believe it represents a meaningful presentation of the financial performance of our core operations, without the impact of the various items excluded, in order to provide period-to-period comparisons that are more consistent and more easily understood. Measures similar to Consolidated Adjusted EBITDA, including “EBITDA” (as defined in the agreement governing the ABL Facility) and “Adjusted EBITDA” (as defined in the indenture governing the Senior Secured Notes), are used to determine compliance with various financial covenants and tests.

Management uses Consolidated Adjusted EBITDA per pound in order to measure the effectiveness of the balanced book approach in reducing the financial impact of metal price volatility on earnings and operating margins, and to measure the effectiveness of our business transformation initiatives in improving earnings and operating margins. In addition, Segment Adjusted EBITDA is the key metric used by our chief operating decision maker to evaluate the business performance of our company in comparison to budgets, forecasts and prior year financial results, providing a measure that management believes reflects our core operating performance. For a full description of Segment Adjusted EBITDA, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures”.

19

Table of Contents

Below is a reconciliation of net income (loss) attributable to Global Brass and Copper Holdings, Inc. to Consolidated EBITDA and Consolidated Adjusted EBITDA:

| Successor | Predecessor | |||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, |

Year Ended December 31, | Period from October 10 to December 31, |

Period from January 1 to November 18, |

|||||||||||||||||||||||||||||||||

| 2013 | 2012(7) | 2012 | 2011(7) | 2010(7) | 2009(7) | 2008(7) | 2007(a)(7) | 2007(a) | ||||||||||||||||||||||||||||

| (in millions) |

||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to Global Brass and Copper Holdings, Inc. |

$ | 11.4 | $ | 14.0 | $ | 12.5 | $ | 55.1 | $ | 41.6 | $ | 10.2 | $ | (69.1 | ) | $ | 60.3 | $ | 44.0 | |||||||||||||||||

| Interest expense |

9.9 | 9.8 | 39.7 | 40.0 | 25.1 | 18.1 | 20.0 | 1.2 | — | |||||||||||||||||||||||||||

| Provision for (benefit from) income taxes |

6.0 | 8.2 | 19.2 | 31.4 | 26.6 | 2.2 | (45.4 | ) | (0.3 | ) | 0.4 | |||||||||||||||||||||||||

| Depreciation expense |

1.9 | 1.5 | 6.8 | 4.5 | 2.8 | 1.7 | 0.4 | — | 30.6 | |||||||||||||||||||||||||||

| Amortization expense |

— | — | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | — | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Consolidated EBITDA |

$ | 29.2 | $ | 33.5 | $ | 78.3 | $ | 131.2 | $ | 96.3 | $ | 32.4 | $ | (93.9 | ) | $ | 61.2 | $ | 75.0 | |||||||||||||||||

| Extraordinary gain from bargain purchase(b) |

— | — | — | — | — | — | (2.9 | ) | (60.7 | ) | — | |||||||||||||||||||||||||

| Loss (gain) on derivative contracts(c) |

— | (1.3 | ) | (1.6 | ) | 1.1 | 12.0 | 22.0 | (19.9 | ) | (2.4 | ) | 0.5 | |||||||||||||||||||||||

| Loss from lower of cost or market adjustment(d) |

— | — | 0.3 | — | — | — | 170.9 | — | — | |||||||||||||||||||||||||||

| Impact of inventory basis adjustment(e) |

— | — | — | — | — | (4.1 | ) | — | — | — | ||||||||||||||||||||||||||

| (Gain) loss from LIFO layer depletion(f) |

— | — | (4.8 | ) | (15.2 | ) | (21.0 | ) | 0.5 | — | — | (22.2 | ) | |||||||||||||||||||||||

| Non-cash accretion of income of Dowa joint venture(g) |

(0.2 | ) | (0.2 | ) | (0.7 | ) | (0.7 | ) | (0.7 | ) | (0.7 | ) | (0.7 | ) | — | — | ||||||||||||||||||||

| Loss on extinguishment of debt(h) |

— | — | 19.6 | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Non-cash Halkos profits interest compensation expense(i) |

— | — | 19.5 | 0.9 | 3.5 | — | — | — | — | |||||||||||||||||||||||||||

| Management fees(j) |

0.3 | 0.3 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | — | — | |||||||||||||||||||||||||||

| Restructuring and other business transformation charges(k) |

— | |

— |

|

— | — | 6.1 | 1.9 | 5.0 | — | — | |||||||||||||||||||||||||

| Specified legal/professional expenses(l) |

0.8 | 0.5 |

|

3.3 |

|

4.3 | 1.8 | 3.1 | 0.4 | — | — | |||||||||||||||||||||||||

| Other adjustments(m) |

— | — | 0.5 | — | — | — | — | — | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Consolidated Adjusted EBITDA |

$ | 30.1 | $ |

32.8 |

|

$ | 115.4 | $ | 122.6 | $ | 99.0 | $ | 56.1 | $ | 59.9 | $ | (1.9 | ) | $ | 53.3 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||