Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

[ X ]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2012

or

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Transition Period from ____________ to ____________

Commission File Number 033-03275-D

____________

ENSURGE, INC.

(Name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation or organization)

|

87-0431533

(I.R.S. Employer Identification No.)

|

|

1046 East University

Mesa, Arizona

(Address of Principal Executive Offices) |

85203121

(Zip Code)

|

Issuer's Telephone Number 480-459-5833

Securities Registered Pursuant to Section 12(b) of the Exchange Act: None

Securities Registered Pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange. [ ] Yes [X] No

Note – Checking the box above will not relieve any registrant to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

Accelerated filer

|

|

|

Non-accelerated filer (Do not check if a smaller reporting company)

|

Smaller reporting company R

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2012 was approximately $8,284,682. The registrant had issued and outstanding 34,038,726 shares of its common stock on May 16, 2013.

ENSURGE, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2012

|

PART I

|

||

|

ITEM 1.

|

BUSINESS

|

1

|

|

ITEM 2.

|

PROPERTIES

|

7

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

7

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

7

|

|

PART II

|

||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

8

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

9

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

9 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 11 |

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

11

|

|

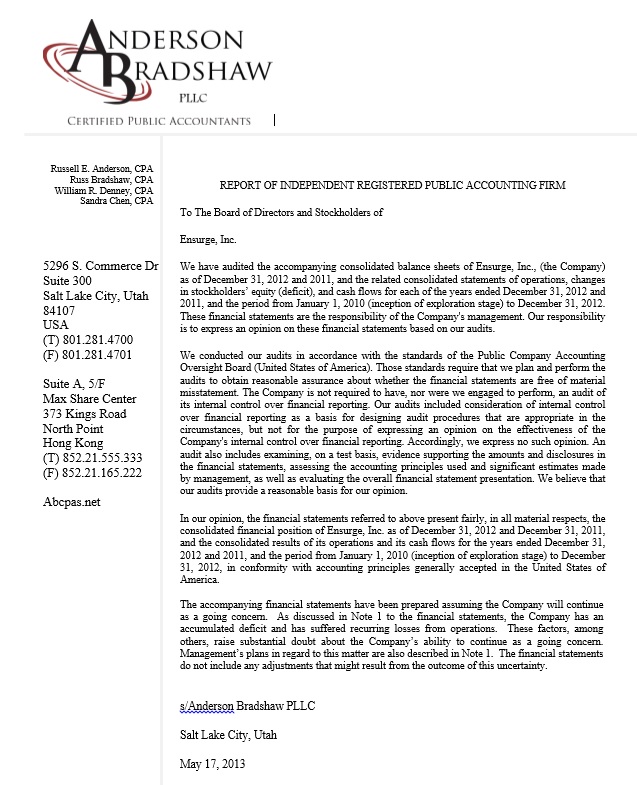

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

12

|

|

|

BALANCE SHEETS

|

13

|

|

|

STATEMENTS OF OPERATIONS

|

14

|

|

|

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

|

15

|

|

|

STATEMENTS OF CASH FLOWS

|

16

|

|

|

NOTES TO FINANCIAL STATEMENTS

|

17

|

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

27

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

27

|

|

ITEM 9B.

|

OTHER INFORMATION

|

27

|

|

PART III

|

||

|

ITEM 10.

|

DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

|

28

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

30

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

33

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

34

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

34

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

35

|

|

SIGNATURES

|

36

|

|

|

EXHIBIT INDEX

|

37

|

Forward-Looking Statements and Associated Risks

This Report, including all documents incorporated herein by reference, includes certain “forward-looking statements” within the meaning of that term in Section 13 or 15(d) of the Securities Act of 1934, and Section 21E of the Exchange Act, including, among others, those statements preceded by, followed by or including the words “believes,” “expects,” “anticipates” or similar expressions.

These forward-looking statements are based largely on the Company’s current expectations and are subject to a number of risks and uncertainties. The Company’s actual results could differ materially from these forward-looking statements. Important factors to consider in evaluating such forward-looking statements include:

|

·

|

changes in the Company’s business strategy or an inability to execute its strategy due to unanticipated changes in the market,

|

|

·

|

the Company’s ability to raise sufficient capital to meet operating requirements,

|

|

·

|

various competitive factors that may prevent the Company from competing successfully in the marketplace, and

|

|

·

|

changes in external competitive market factors or in the Company’s internal budgeting process which might impact trends in the Company’s results of operations.

|

In light of these risks and uncertainties, there can be no assurance that the events contemplated by the forward-looking statements contained in this Report will, in fact, occur.

PART I

|

ITEM 1.

|

BUSINESS

|

Ensurge, Inc., a Nevada corporation (the “Company”) is a gold processing and mining company.

General - Development of Business

The Company was incorporated under the name Sunwalker Development, Inc. in the State of Utah on March 28, 1985, and was subsequently re-incorporated in Nevada on September 14, 1999. The Company was formed for the purpose of providing a business framework within which capital could be raised and business opportunities, with profit potential, could be sought. From the period of inception until December 31, 1989, the Company operated as a development stage corporation. Effective February 1, 1990, the Company began permanent operations in the mining industry with emphasis on decorative rock used in landscaping.

In 1990, the Company acquired a mining property located in Morristown (near Wickenburg), Arizona. In 1994 and 1995, the Company sold all of its assets and ceased active operations.

Effective October 7, 1999, the Company merged with ECenter, Inc, a Utah corporation. Subsequently, the Company changed its name to iShopper.com, Inc. As a result of the merger, the Company had two wholly-owned subsidiaries: Outbound Enterprises, Inc. and iShopper Internet Services, Inc. In November 1999, the Company refocused its efforts into becoming an Internet holding company. In September 2000, Outbound Enterprises discontinued its operations. In December 2000, iShopper Internet Services discontinued its operations. On January 31, 2000, the Company entered into a sales agreement with Digital Commerce Bank, Inc. to purchase its assets. This sales agreement was finalized January of 2002.

On November 1, 1999, the Company purchased NowSeven.com, Inc. for a total of 1,667 shares of the Company’s common stock. NowSeven.com, Inc. has discontinued its operations.

On January 31, 2000, the Company purchased Stinkyfeet.com, Inc. for 13 shares of the Company’s common stock and cash of $40,000. Stinkyfeet.com, Inc. was discontinued in December 2002.

On April 4, 2000, the Company purchased Uniq Studios, Inc. for 2,500 shares of the Company’s common stock and options to purchase 833 shares of common stock at $7.60 per share. Effective November 2001 Uniq Studios, Inc. discontinued its operations.

On April 7, 2000, the Company purchased Totalinet.net, Inc. for 333 shares of common stock. Effective December 5, 2000 Totalinet.net, Inc. discontinued its operations.

On May 31, 2000, the Company purchased Atlantic Technologies International, Inc. for 397 shares of common stock. Effective April 27, 2001, Atlantic Technologies International, Inc. discontinued its operations.

1

On May 31, 2000, the Company purchased Internet Software Solutions, Inc. for 167 shares of common stock. Effective April 27, 2001, Internet Software Solutions, Inc. discontinued its operations.

On June 1, 2000, the Company purchased KT Solutions, Inc. for 833 shares of common stock and options to purchase 417 additional shares of the Company’s common stock. Effective April 1, 2001, the Company sold KT Solutions Inc. to Knowledge Transfer Systems, Inc. for 13,333 shares of common stock.

On October 18, 2000, the Company changed its name from iShopper.com, Inc. to Ensurge, Inc.

On February 15, 2001, the Company completed a 5-for-1 forward split. This provided each shareholder with five shares for every one share owned. Prior to the split the Company had 14,386,775 shares issued and outstanding and subsequent to the split the Company had 71,933,875 issued and outstanding. The accompanying financial statements reflect the split.

Effective May 8, 2006, the Company approved a 1-for-3,000 reverse split of its common stock. The Company did not reverse any certificates that were for less than 100 shares or any certificates that were for more than 100 shares to an amount below 100 shares. The accompanying financial statements have been presented to reflect this reverse stock split.

On June 19, 2006, the Company entered into an agreement with Portsmith Partner of Nevada, Inc., a stockholder of the Company (“Portsmith”), whereby Portsmith agreed to assume the debt of the subsidiaries of the Company, which totaled $2,614,380. In return for this obligation, the Company issued 5,000 shares of common stock to Portsmith. In a related transaction, on September 28, 2006, the Company sold all the shares of stock of all of its subsidiaries to Portsmith. This transaction has been treated as a non-monetary transaction with a related party shareholder and the effects are reported through Stockholders’ Deficit.

Business Plan

In late 2009, the controlling shareholders of Ensurge, Inc. brought in new management and Directors to develop and implement a strategy for gold production in Brazil. During the first quarter of 2010, a new strategy was developed.

Since the time of that transition, Ensurge has raised $2.7 million from new equity investors and $1.3 million in debt to enable management to begin the implementation of the business plan.

The plan focuses on ownership or royalty rights to operating mines by providing financing needs, purchasing new equipment or a combination of both with the establishment of contractual agreements to construct metallurgical plants to recover gold. After extensive evaluation of gold mining in numerous regions of Brazil, Ensurge has settled on the Cuiaba Gold Belt in Mato Grosso State to implement its strategy.

Gold was first discovered in Cuiaba in 1719 and mining has been ongoing since that time along an important geological structure that runs 100 miles from Cuiaba southwest to Pocone, on the edge of the Pantanal (perhaps the world’s largest wetlands area). There are over 50 currently operating gold mines along the Cuiaba Gold Belt. Primarily only small family owned companies known locally as Garimpeiros operated in the region.

2

The gold formations along the Cuiaba Gold Belt are quartz veins that outcrop and dip at approximately 30 degrees from the surface. In addition to the primary vein structures, there are also perpendicular veins that appear to have been formed during periods of secondary stress.

The gold is typically found at the contact of the quartz veins and the host rock and presents itself as “free” gold. Grain size is often very fine (40% less than 100 mesh and 20% less than 200 mesh), with the remainder characterized as “coarse gold”. Owing to the unusual grain size distribution of the gold, recovery of the gold in these mines has been very low, typically 25-50%. The crude methods of gold recovery, utilizing hammer mills and ball mills to crush the ore and cyclones and centrifuges to concentrate the ore and finally mercury amalgamation to recover gold, have been responsible for the poor recoveries.

We believe with less than half the gold that has been mined over the past three centuries having been recovered, there is significant opportunity to recover gold from operating mines and tailings.

Business Strategy and Growth

Ensurge management seeks to reduce the risk of gold production. Specifically, it believes that by obtaining contractual rights to current gold mining operations and to reprocess existing tailings along the Cuiaba Gold Belt, it can:

|

|

·

|

Eliminate, or significantly reduce exploration risk. Ownership opportunities with existing mine operators allows the Company to participate in operations and revenues immediately. Also, these mine owners have existing tailings which we will reprocess. The tailings impoundments are readily visible and the size (tonnage) can be quickly determined using GPS technology and satellite images.

|

|

|

·

|

Enjoy lower than typical capital costs. In most traditional mining operations, significant capital investment is required to develop and mine a deposit, transport ore to a processing plant, where it is crushed and processed to recover gold. The Company will provide new equipment to increase current operations and increase recoveries. As part of the ownership we will reprocess tailings which have already been mined and crushed.

|

|

|

·

|

Enjoy lower than typical operating costs. As we have reviewed operating costs within this region, we have determined costs to be lower as compared to costs within the US. Since tailings have already been mined and crushed, there will be no labor or energy costs (or high maintenance costs) for mining or crushing. Management believes energy and labor costs will be less than in initial mining operations resulting in savings on not only up-front mining development costs but ongoing costs.

|

Crude Recovery Technology Creates Ensurge Opportunity

Typically, gold recovery facilities along the Cuiaba Gold Belt employ crude methods of gravity separation. Run of mine ore is first crushed in hammer mills or jaw crushers to reduce the run of mine ore to 3” or smaller size. Crushed ore is then sent to ball mills for further size reduction, to approximately 200 mesh or less. The discharge of the ball mills is then subjected to gravitational gold concentration using cyclones and centrifugal drum concentrators. Ensurge has contracted with a third party consulting engineering company to assist in technical assessment of opportunities, has estimated that recovery of gold in concentrate represents about 50% of the gold contained in ore. The remaining 50% of the gold is discharged to tailings. Modern metallurgical processing methods typically recover 85-90% of gold contained in ore. It is the 50% of gold that is discharged to tailings that is one of the targets for Ensurge development, along with ownership opportunities. Until actual mining operations begin, the amount of the gold recoverable from the tailings will be unknown and we will not know if it will be economical to recover such gold.

3

Competition

In the Cuiaba-Pocone region of Mato Grosso Brazil, Ensurge management is not aware of any other company currently seeking to acquire tailings, however, large mining companies continue to be interested in this region, but many of the large international mining companies have determined there is not a large enough opportunity for them to be interested in this region. This is so, in part, management believes, because major international mining companies that are coming to Brazil to develop gold mining operations are focusing on exploration in grass roots environs or near existing major gold producing mines with the hopes of finding “bonanza” type deposits.

However, management believes that if Ensurge is successful in implementing its strategy, competition will be drawn to the area and it will become more difficult and more expensive to obtain Contractual Agreements with the local garimpeiros. With hundreds of garimpeiro operations in the Cuiaba-Pocone region, Ensurge management believes it will be able to secure additional agreements for the next several years, even in the face of new competition.

We believe we have developed a unique business model but recognize that there are very little barriers for others to copy our business model and we offer no new technology or position in the mining industry that will prevent existing gold producers or other companies from recreating our business model. We believe our best competitive position is being one of the first to seek out the smaller mines in Brazil to reprocess their tailings.

Environmental Standards

The Company is not at this time involved in any project that would adversely affect the environment.

Employees

As of December 31, 2012, the Company has 2 fulltime employees and 1 part time employee.

ITEM 1A. Risk Factors

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

Our disclosure and analysis in this report contains forward-looking information that involves risks and uncertainties and actual results could differ materially from those predicted in any such forward-looking statements. Except for historical information, all of the statements, expectations and assumptions contained in the foregoing are forward-looking statements. The realization of any or all of these expectations is subject to a number of risks and uncertainties and it is possible that the assumptions made by management may not materialize. Statements may involve risks and uncertainties; actual results may differ from the forward-looking statements. Sentences or phrases that use such words as “believes,” “anticipates,” “plans,” “may,” “hopes,” “can,” “will,” “expects,” “is designed to,” “with the intent,” “potential” and others indicate forward-looking statements, but their absence does not mean that a statement is not forward-looking. No assurance can be given that the results in any forward-looking statements will be achieved and actual results could be affected by one or more factors, which could cause them to differ materially. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act.

4

Risk Factors

Certain factors that may affect our business and could cause actual results to differ materially from those expressed in any forward-looking statements include the following.

We are a start-up company with limited operating history, limited revenue and have to rely on our ability to raise capital to fund operations and there can be no assurance we will ever reach profitability or be able to continue to raise capital to fund operations.

With the commencement of our new business plan, we have limited operating history and experience in mining on which to make an investment decision. Failure to implement the business strategy could materially adversely affect our business, financial condition and results of operations. Through December 31, 2012, the Company’s business has not shown a profit in operations and has generated no revenue. There can be no assurance we will achieve or attain profitability or be able to raise sufficient capital to stay in business. If we cannot achieve operating profitability or raise capital, we may not be able to meet our working capital requirements, which could have a material adverse effect on our business operating results and financial condition resulting in the loss of an investors’ entire investment in us.

We need substantial additional capital to grow and fund our present and planned business and business strategy.

Our current and planned operations contemplate funding with milestones of at least $5,000,000 in 2013. Failure to meet these funding milestones may have a significant adverse effect on our growth and anticipated revenues and we may have to curtail our business strategy. If we receive less funding than planned, we will have to revise our business model and reduce proposed expansion. Without significant funding, we will not be able to execute on our business operations and may be forced to cease operations. At this time, there can be no assurance we will be able to obtain the funding we need and even if we obtain such funding that it will be on terms and conditions favorable to us and our existing shareholders. Without funding we will not be able to proceed with planned operations or meet existing obligations.

5

Our business operations are unproven and we do not know if we will be able to produce gold in commercial economic amounts which would result in our inability to stay in business.

There is no assurance of success in being able to extract gold from the tailings or even if we are able to extract gold that we can do so in quantities that will produce profits. The inability to operate a mining company or extract gold in economic quantities will have a substantial negative effect on our business and could result in our inability to stay operating.

All of our operations will be in Brazil and we will be subject to its laws and rules in relation to our operation. Additionally, we will be dependent on contracts with local mines and the rules and regulations related thereto. The costs of operating in Brazil will be substantial and create many uncertainties as to its laws and rules with which management are not familiar. Although we have retained attorneys and advisors in Brazil, no member of management is familiar with operations in Brazil and we will be dependent on third parties for guidance. The operations in Brazil and its rules and regulations create uncertainty for us and may have a negative effect on our business and will increase our costs.

Our auditor’s “Going Concern” qualification in our financial statements might create additional doubt about our ability to stay in business, which could result in a total loss on investment by our shareholders.

Our accompanying financial statements have been prepared assuming that we will continue as a “going concern.” As discussed in Notes to the financial statements, we have no revenues, have incurred a loss from operations and have negative operating cash flows since inception. These issues raise substantial doubt about our ability to continue as a “going concern.” Our ability to stay in business will, in part, depend on our ability to raise additional funding. Our financial statements do not include any adjustment that might result from the outcome of this uncertainty.

Our business is highly dependent on the price of gold.

During 2012 the price of gold continued to increase, however, there is no certainty that it will maintain these prices. Our business plan provides some ability to offset the decrease in the price of gold, but if it drops to a certain price level it will make our operations difficult to continue profitably.

We conduct business internationally, which exposes us to additional risks

Our international operations expose us to certain additional risks, including:

|

·

|

Different political and regulatory conditions;

|

|

·

|

Currency fluctuations;

|

|

·

|

Adverse tax consequences;

|

|

·

|

Difficulty in staffing international subsidiary operations;

|

|

·

|

Dependence on other economies;

|

6

|

ITEM 2.

|

PROPERTIES

|

The Company does not own any real property and uses executive office space. The address is 1046 East University, Mesa, Arizona 85203. Currently monthly rent obligations are less than $1,000 per month and we are on a month to month basis. The Company’s management believes its current office facility is sufficient for its current operations. As we expand operations to Brazil, we may look to opening offices in Brazil, but do not anticipate any offices until we commence construction and/or production from a tailings operation.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

On March 25, 2013 a Complaint was filed against Ensuge, by Randall K. Edwards and Gaia, Silva, Gaede & Associates in the amount of $74,924 and $18, 627, respectively. These are liabilities, which are part of accounts payable, for services performed, however, due to lack of funding the Company has not been able to pay these amount owed.

We are not currently aware of any legal proceedings that we believe will have a material adverse effect on our financial condition or results of operations.

|

ITEM 4.

|

MINING SAFETY DISCLOSURE

|

We have not engaged in any mining activities except for taking core samples, which were taken by a 3rd party consulting firm, and consequently have no mining safety issues.

7

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Price Range of Common Stock

The Company’s common stock trades on the OTC Bulletin Board under the symbol “ESGI.OB”. The following table sets forth the range of the high and low bid quotations of the Company’s common stock for the fiscal quarters indicated, as reported by OTC. Quotations represent inter-dealer prices, without retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

HIGH

|

LOW

|

|||||||

|

2012

|

||||||||

|

First Quarter

|

$

|

1.05

|

$

|

0.25

|

||||

|

Second Quarter

|

0.40

|

0.16

|

||||||

|

Third Quarter

|

0.25

|

0.14

|

||||||

|

Fourth Quarter

|

0.25

|

0.06

|

||||||

|

2011

|

||||||||

|

First Quarter

|

$

|

4.25

|

$

|

2.00

|

||||

|

Second Quarter

|

7.90

|

2.00

|

||||||

|

Third Quarter

|

10.01

|

2.00

|

||||||

|

Fourth Quarter

|

6.50

|

0.51

|

||||||

Approximate Number of Equity Security holders

On April 30, 2013 there were 406 stockholders of record of the Company’s common stock. Because many of such shares are held by brokers and other institutions on behalf of shareholders, the Company is unable to estimate the total number of stockholders represented by these record holders. As of May 8, 2013, our common stock had a bid and ask price of $0.02 and $0.03.

Dividends

The Company does not presently pay dividends on its common stock. The Company intends for the foreseeable future to continue the policy of retaining earnings, if any, to finance the development and growth of its business.

Recent Sales of Unregistered Securities

In February 2010 and March 2010, the Company sold an aggregate of 2,100,000 shares of common stock to investors for an aggregate purchase price of $525,000 in a private placement. In July 2010, the Company received $560,000 in exchange for warrants exercisable for the right to purchase 4,000,000 shares of the Company’s common stock in a private placement. In December 2010, the Company sold an aggregate of 1,000,000 shares of common stock and 500,000 warrants exercisable for $1 to investors for an aggregate purchase price of $500,000 in a private placement. In December 2010, the Company received $800,000 in exchange for warrants exercisable for the right to purchase 1,600,000 shares of the Company’s common stock in a private placement. These transactions were exempt from registration pursuant to Section 4(2) of the Securities Act.

8

During 2011 the Company issued 252,000 shares of common stock in exchange for services valued at $126,000.

During 2011 warrants in the amount of 611,000 were exercised into 2,986,385 shares of common stock.

March 2, 2012, the Company accepted $380,000 in private placement funds from accredited investors in exchange for units consisting of seven hundred sixty thousand (760,000) shares of the Company’s common stock, plus three hundred eighty thousand (380,000) warrants with an exercise price of $1.00.

During November 2012 the Company negotiated an extension of its notes payable of $1,100,000. As payment to extent these two notes the Company issued a total of 900,000 shares to the note holders.

Not Applicable.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

Results of Operations

We had no revenues for 2012 and 2011. During 2012, the Company entered into a letter of intent with a mine owner in Pocone, Mato Grosso, Brazil, which was subject to funding the project prior to year end. The Company has not been able to secure funding and the letter of intent has expired. The Company is continuing to seek funding and once established will work to reestablish a new letter of intent. However, it has been very difficult to raise capital with in the current markets.

The Company is continuing to look for opportunities to create revenue, which included pursuing acquisitions or joint ventures.

General and administrative expenses for the year ended December 31, 2012 and 2011 were $9,501,196 and $17,013,472, respectively. These costs are made up of audit, legal, salary and consulting fees, along with travel expenses looking for acquisitions.

Interest expense was $498,937 and $1,191,333 for the years ended December 31, 2012 and 2011, respectively. All of the interest expense is loan interest from the notes payable the Company has incurred over the years. Included in the interest expense are warrants that were given as part of the loan agreement. The warrants were valued at the current market price as of the date of loans.

Interest income for the year ended December 31, 2012 and 2011 were, respectively, $230 and $1,492. This income is from interest bearing cash bank accounts.

The warrant derivative income or expense for the years ended December 31, 2012 and 2011 were, respectively, gain of $10,433,970 and of $6,317,140. The warrant derivative day-one loss for the years ended December 31, 2012 and 2011 were, respectively, $0 and $9,608,171.

9

Liquidity and Capital Resources

We are a start-up company with limited operating history, limited revenue and have to rely on our ability to raise capital to fund operations and there can be no assurance we will ever reach profitability or be able to continue to raise capital to fund operations. With the commencement of our new business plan, we have limited operating history and experience in mining on which to make an investment decision. Failure to implement the business strategy could materially adversely affect our business, financial condition and results of operations. Through December 31, 2012, the Company’s business has not shown a profit in operations and has generated no revenue. If we cannot achieve operating profitability or raise capital, we may not be able to meet our working capital requirements, which could have a material adverse effect on our business operating results and financial condition resulting in the loss of an investors’ entire investment in us.

We need substantial additional capital to grow and fund our present and planned business and business strategy. Our current and planned operations contemplate funding with milestones of at least $5,000,000 in 2013. Failure to meet these funding milestones may have a significant adverse effect on our growth and anticipated revenues and we may have to curtail our business strategy. If we receive less funding than planned, we will have to revise our business model and reduce proposed expansion. Without significant funding, we will not be able to execute on our business operations and may be forced to cease operations. At this time, there can be no assurance we will be able to obtain the funding we need and even if we obtain such funding that it will be on terms and conditions favorable to us and our existing shareholders. Without funding we will not be able to proceed with planned operations or meet existing obligations.

The Company has financed its operations to date primarily through private placements of equity securities and current sales. During 2010, the Company sold an aggregate of 3,100,000 shares of common stock to investors for an aggregate purchase price of $1,025,000 in a private placement. The Company received $1,360,000 in exchange for warrants exercisable for the right to purchase 5,600,000 shares of the Company’s common stock in a private placement. The holder of these warrants may at any time exercise the warrants for common stock with no additional cash outlay. In August 2011 the Company entered into a 90 day note payable in the amount of $500,000. During October 2011 the Company entered into a 12 month note payable for $1,100,000, which proceeds were used to pay off early the 90 day note and operating capital. March 2, 2012, the Company accepted $380,000 in private placement funds from accredited investors in exchange for units consisting of seven hundred sixty thousand (760,000) shares of the Company’s common stock, plus three hundred eighty thousand (380,000) warrants with an exercise price of $1.00. During November 2012 the Company entered into several 12 month notes payable for an aggregate of $150,000. During November 2012, the Company negotiated an extension of two notes payable. The principal was increased from $550,000 to $756,250, or a total of $1,512,500. As part of this negotiation to extend the note, the Company agreed to pay a total of 900,000 shares of common stock. This inflow of cash will be used by the Company for research and develop mining ventures in South America.

The Company has made progress in creating relationships with Corporate and Tax Council, Banks, and Engineering firms within Brazil. We will have to raise additional capital to fund projects and would anticipate dilution to current investors as we seek additional equity capital.

10

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

Not Applicable.

|

ITEM 8.

|

FINANCIAL STATEMENTS

|

The following constitutes a list of Financial Statements included in Part III of this Report beginning at page 16 of this Report:

ENSURGE, INC.

INDEX TO FINANCIAL STATEMENTS

|

Page

|

|

|

Report of Independent Registered Public Accounting Firm

|

12

|

|

Consolidated Balance Sheets – December 31, 2012 and 2011

|

13

|

|

Consolidated Statements of Operations – for the Years Ended December 31, 2012 and 2011

|

14

|

|

Consolidated Statements of Changes in Stockholders’ Deficit – for the Years Ended December 31, 2012 and 2011

|

15

|

|

Consolidated Statements of Cash Flows – for the Years Ended December 31, 2012 and 2011

|

16

|

|

Notes to Financial Statements

|

17-26

|

11

12

|

|

|

|

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

CONSOLIDATED BALANCE SHEET

DECEMBER 31, 2012 AND 2011

|

2012

|

2011 | |||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

$ | 15,252 | $ | 214,517 | ||||

|

Total Current Assets

|

15,252 | 214,517 | ||||||

|

Fixed assets (net of depreciation)

|

49,451 | 57,936 | ||||||

|

Total Other Assets

|

49,451 | 57,936 | ||||||

|

Total Assets

|

$ | 64,703 | $ | 272,453 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Trade accounts payable

|

$ | 171,750 | $ | 36,214 | ||||

|

Accrued liabilities

|

171,875 | - | ||||||

|

Accrued interest payable

|

14,771 | 18,333 | ||||||

|

Notes payable

|

1,662,500 | 1,100,000 | ||||||

|

Proceeds for common stock to be issued

|

1,360,000 | 1,360,000 | ||||||

|

Warrants derivative liability

|

903,142 | 11,128,157 | ||||||

|

Total Current Liabilities

|

4,284,038 | 13,642,704 | ||||||

|

Stockholders' Deficit

|

||||||||

|

Common stock - $0.001 par value; 100,000,000 shares authorized; 34,038,726 and 32,348,726 shares outstanding, respectively

|

34,038 | 32,348 | ||||||

|

Additional paid-in-capital

|

55,209,889 | 46,494,730 | ||||||

|

Accumulated deficit

|

(23,315,973 | ) | (23,315,973 | ) | ||||

|

Exploration stage deficit

|

(36,147,289 | ) | (36,581,356 | ) | ||||

|

Total Stockholders' Deficit

|

(4,219,335 | ) | (13,370,251 | ) | ||||

|

Total Liabilities and Stockholders' Deficit

|

$ | 64,703 | $ | 272,453 | ||||

The accompanying notes are an integral part of these financial statements.

13

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2012 AND 2011

|

From Inception of

|

||||||||||||

|

Exploration Stage

|

||||||||||||

|

January 1, 2010

|

||||||||||||

|

through

|

||||||||||||

|

2012

|

2011

|

December 31,

2012

|

||||||||||

|

Sales

|

$ | - | $ | - | $ | - | ||||||

|

Expenses

|

||||||||||||

|

General and administrative

|

9,501,196 | 17,013,472 | 29,649,635 | |||||||||

|

Total Expenses

|

9,501,196 | 17,013,472 | 29,649,635 | |||||||||

|

Operating Loss

|

(9,501,196 | ) | (17,013,472 | ) | (29,649,635 | ) | ||||||

|

Other income (expense)

|

||||||||||||

|

Gain (Loss) on derivative

|

10,433,970 | 6,317,140 | 7,159,537 | |||||||||

|

Derivative day-one loss

|

- | (9,608,171 | ) | (11,970,479 | ) | |||||||

|

Interest expense

|

(498,937 | ) | (1,191,333 | ) | (1,690,270 | ) | ||||||

|

Interest income

|

230 | 1,492 | 3,558 | |||||||||

|

Net Income (Loss)

|

$ | 434,067 | $ | (21,494,344 | ) | $ | (36,147,289 | ) | ||||

|

Basic Net Gain (Loss) Per Common Share

|

$ | 0.01 | $ | (0.73 | ) | |||||||

|

Basic Weighted Average Common Shares Outstanding

|

33,006,622 | 29,548,448 | ||||||||||

| Diluted Net Gain (Loss) Per Common Share | (0.01 | ) | (0.53 | ) | ||||||||

| Diluted Weighted Average Common Shares Outstanding | 41,358,316 | 40,298,726 | ||||||||||

The accompanying notes are an integral part of these financial statements.

14

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FROM INCEPTION OF EXPLORATION STAGE

JANUARY 1, 2010 TO DECEMBER 31, 2012

| Additional | Total | |||||||||||||||||||

| Common Stock |

Paid-in

|

Accumulated

|

Stockholders

|

|||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit

|

Deficit

|

||||||||||||||||

|

Balance - January 1, 2010, Inception of Exploration Stage

|

26,035,341 | $ | 26,035 | $ | 23,266,514 | $ | (23,315,973 | ) | $ | (23,424 | ) | |||||||||

|

Stock sold for cash

|

3,100,000 | 3,100 | 891,800 | - | 894,900 | |||||||||||||||

|

Stock issued for services

|

2,350,000 | 2,350 | 1,049,150 | - | 1,051,500 | |||||||||||||||

|

Purchase and cancel

|

||||||||||||||||||||

|

treasury stock

|

(2,000,000 | ) | (2,000 | ) | (58,000 | ) | - | (60,000 | ) | |||||||||||

|

Option expense

|

- | - | 1,152,469 | - | 1,152,469 | |||||||||||||||

|

Warrants

|

- | - | (213,521 | ) | - | (213,521 | ) | |||||||||||||

|

Net (Loss)

|

- | - | - | (15,087,012 | ) | (15,087,012 | ) | |||||||||||||

|

Balance - December 31, 2010

|

29,485,341 | 29,485 | 26,088,412 | (38,402,985 | ) | (12,285,088 | ) | |||||||||||||

|

Stock issued as exercise of warrants

|

2,986,385 | 2,986 | 5,396,791 | - | 5,399,777 | |||||||||||||||

|

Stock issued for services

|

252,000 | 252 | 745,548 | - | 745,800 | |||||||||||||||

|

Stock cancelled

|

(375,000 | ) | (375 | ) | 375 | - | - | |||||||||||||

|

Option expense

|

- | - | 14,263,604 | - | 14,263,604 | |||||||||||||||

|

Net (Loss)

|

- | - | - | (21,494,344 | ) | (21,494,344 | ) | |||||||||||||

|

Balance - December 31, 2011

|

32,348,726 | $ | 32,348 | $ | 46,494,730 | $ | (59,897,329 | ) | $ | (13,370,251 | ) | |||||||||

|

Stock sold for cash

|

760,000 | 760 | 170,284 | - | 171,044 | |||||||||||||||

|

Stock issued for services

|

30,000 | 30 | 14,970 | - | 15,000 | |||||||||||||||

|

Stock issued for interest expense

|

900,000 | 900 | 89,100 | - | 90,000 | |||||||||||||||

|

Option expense

|

- | - | 8,440,805 | - | 8,440,805 | |||||||||||||||

|

Net Income

|

- | - | - | 434,067 | 434,067 | |||||||||||||||

|

Balance - December 31, 2012

|

34,038,726 | $ | 34,038 | $ | 55,209,889 | $ | (59,463,262 | ) | $ | (4,219,335 | ) | |||||||||

The accompanying notes are an integral part of these financial statements.

15

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2012 AND 2011

|

From Inception of

|

||||||||||||

|

Exploration Stage

|

||||||||||||

|

January 1, 2010

|

||||||||||||

|

Through

|

||||||||||||

|

2012

|

2011

|

December 31, 2012

|

||||||||||

|

Cash Flows From Operating Activities

|

||||||||||||

|

Net loss

|

$ | 434,067 | $ | (21,494,344 | ) | $ | (36,147,289 | ) | ||||

|

Adjustments to reconcile net gain to net cash used in operating activities:

|

||||||||||||

|

Common stock and options issued for services

|

8,455,805 | 16,078,905 | 26,738,679 | |||||||||

|

Warrant derivative liability

|

(10,433,971 | ) | (6,317,140 | ) | (7,159,538 | ) | ||||||

|

Amortization of debt discount

|

110,000 | - | 110,000 | |||||||||

|

Stock issued for interest

|

90,000 | - | 90,000 | |||||||||

|

Non-cash interest expense

|

302,500 | - | 302,500 | |||||||||

|

Derivative day-one loss

|

- | 9,608,171 | 11,970,479 |

|

Depreciation expense

|

8,485 | 954 | 9,439 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Increase (decrease) in trade accounts payable

|

135,536 | (179,237 | ) | 163,064 | ||||||||

|

Increase (decrease) in accrued expenses

|

(3,562 | ) | - | (3,562 | ) | |||||||

|

Increase (decrease) in accrued liabilities

|

171,875 | 18,333 | 171,875 | |||||||||

|

Net Cash Used in Operating Activities

|

(729,265 | ) | (2,284,358 | ) | (3,750,758 | ) | ||||||

|

Cash Flows From Investing Activities

|

||||||||||||

|

Investment in fixed assets

|

- | (58,890 | ) | (58,890 | ) | |||||||

|

Investment in mining rights project

|

- | 310,829 | - | |||||||||

|

Net Cash Provided (Used) by Investing Activities

|

- | 251,939 | (58,890 | ) | ||||||||

|

Cash Flows From Financing Activities

|

||||||||||||

|

Proceeds from notes payable

|

150,000 | 1,600,000 | 1,750,000 | |||||||||

|

Repayments of notes payable

|

- | (500,000 | ) | (500,000 | ) | |||||||

|

Proceeds from exercise of warrants for

|

||||||||||||

|

common stock to be issued

|

- | - | 1,360,000 | |||||||||

|

Purchase treasury stock

|

- | - | (60,000 | ) | ||||||||

|

Proceeds from issuance of common stock

|

380.000 | - | 1,274,900 | |||||||||

|

Net Cash Provided (Used) by Financing Activities

|

530,000 | 1,100,000 | 3,824,900 | |||||||||

|

Net Increase (decrease) in Cash

|

(199,265 | ) | (932,419 | ) | 15,252 | |||||||

|

Cash at Beginning of Period

|

214,517 | 1,146,936 | - | |||||||||

|

Cash at End of Period

|

$ | 15,252 | $ | 214,517 | $ | 15,252 | ||||||

| Non-Cash Investing and Financing Activities | ||||||||||||

| None |

The accompanying notes are an integral part of these financial statements.

16

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

NOTE 1–SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Liquidation – On October 16, 2000, iShopper.com, Inc. changed its name to Ensurge, Inc. Ensurge, Inc. is referred to herein as the Company. On January 1, 2002, the Company began liquidation of its assets. During 2009 the Company started a new phase of operations with the mining industry; accordingly, the accompanying financial statements are presented on a GAAP basis of accounting, rather than on a liquidation basis.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts in the financial statements and accompanying notes. Actual results could differ from those estimates.

Basis of Presentation – Going Concern

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America, which contemplates continuation of the Company as a going concern. However, the Company has insufficient working capital and is sustaining losses, and therefore may be forced to discontinue operations. This fact raises substantial doubt about the Company’s ability to continue as a going concern. Management plans to raise additional capital to complete its business plan.

Business Condition – The Company has suffered losses from operations, has had negative cash flows from operating activities for all periods since inception and has a working capital deficiency of $4,219,335 at December 31, 2012. The Company has issued a private placement memorandum to obtain investors. During 2010, the Company sold an aggregate of 3,100,000 shares of common stock to investors for an aggregate purchase price of $894,900 in a private placement. The Company received $1,360,000 in exchange for warrants exercisable for the right to purchase 5,600,000 shares of the Company’s common stock in a private placement. In August 2011 the Company entered into a 90 day note payable in the amount of $500,000. During October 2011 the Company entered into a two 12 month notes payable for an aggregate of $1,100,000, which proceeds were used to pay off early the 90 day note and operating capital. During November 2012, the Company negotiated an extension of these two notes payable, which are due on March 15, 2013. The principal was increase from $550,000 per note to $756,250, or a total of $1,512,500. As part of this negotiation to extend the note, the Company agreed to pay a total of 900,000 shares of common stock.

March 2, 2012, the Company accepted $380,000 in private placement funds from accredited investors in exchange for units consisting of seven hundred sixty thousand (760,000) shares of the Company’s common stock, plus three hundred eighty thousand (380,000) warrants with an exercise price of $1.00. During November 2012 the Company entered into several 12 month notes payable for an aggregate of $150,000. The proceeds of the financing will be used to help the Company maintain operations and to fund the exploration of acquisitions in Brazil.

Principles of Consolidation – The financial statements have been consolidated with its wholly owned subsidiary, Ensurge Brazil, LTDA., which was incorporated in Sao Paulo, Brazil on April 18, 2011. Currently the Brazil entity has no assets, liabilities, revenues or expenses.

17

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

Stock-Based Compensation – Effective January 1, 2006, the Company adopted, “Share-Based Payment” (ASC Topic 718) requiring that compensation cost relating to share-based payment awards made to employees and directors be recognized in the financial statements. There were no options granted during the year ended December 31, 2012 and 2,200,000 options were granted during the year ended December 31, 2011. As part of the granting of these options and previous options vesting or time, there was recorded a cost of $8,440,804 and $14,263,604 and as payroll expense for the year ending December 31, 2012 and 2011, respectively. These expenses were stock-based compensation resulting from the application of ASC Topic 718 included in Statements of Operations. The cost of these and future awards will be measured at the grant date based on the calculated fair value of the award. The value of the portion of the award that is ultimately expected to vest is recognized as expense over the requisite service periods (generally the vesting period of the equity award) in the Company's Statements of Operations.

Prior to January 1, 2006, the Company accounted for its stock options issued to directors, officers and employees under ASC Topic 835 and related interpretations. Under ASC Topic 835, compensation expense is recognized if an option’s exercise price on the measurement date is below the fair value of the Company’s common stock. The Company also accounted for options and warrants issued to non-

employees in accordance with ASC Topic 718 which required these options and warrants to be accounted for at their fair value.

Basic and Diluted Earnings Per Share – Basic loss per common share is computed by dividing net loss by the weighted-average number of common shares outstanding during the period. Diluted loss per share is calculated to give effect to potentially issuable common shares which include stock options and stock warrants except during loss periods when those potentially issuable common shares would decrease loss per share. During 2012 the Company issued 1,690,000 common shares and 380,000 warrants as part of private placement funding, debt financing and services. During 2011 the Company issued 2,945,250 common shares and 1,900,000 warrants as part of a private placement funding.

Income Taxes – The Company recognizes an asset or liability for the deferred tax consequences of all temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements that will result in taxable or deductible amounts in future years when the reported amounts of the asset or liabilities are recovered or settled and for operating loss carry forwards. These deferred tax assets and liabilities are measured using the enacted tax rates that will be in effect when the differences are expected to reverse and the carry forwards are expected to be realized. Deferred tax assets are reviewed periodically for recoverability and a valuation allowance is provided as necessary.

Recently Enacted Accounting Standards – In June 2009 the FASB established the Accounting Standards Codification (“Codification” or “ASC”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in accordance with generally accepted accounting principles in the United States (“GAAP”). Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) issued under authority of federal securities laws are also sources of GAAP for SEC registrants. Existing GAAP was not intended to be changed as a result of the Codification, and accordingly the change did not impact our financial statements. The ASC does change the way the guidance is organized and presented.

18

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

Accounting Standards Update (“ASU”) No. 2011-09 through ASU No. 2013-07 which contain technical corrections to existing guidance or affect guidance to specialized industries or entities were recently issued. These updates have no current applicability to the Company or their effect on the financial statements would not have been significant.

NOTE 2 – INVESTMENT IN MINING RIGHTS

It is the Company’s policy to capitalize engineering costs associated with a project that is put under contract and amortize it over the life of the project. The Company will complete an impairment analysis at the end of each year. During 2012 and 2011, the Company had mining development and engineering expenses related to research of new projects of $106,592 and $932,850, respectively.

NOTE 3 – PROCEEDS FOR COMMON STOCK TO BE ISSUED

During 2012 the Company issued 30,000 shares of common stock in exchange for services valued at $15,000. The valuation was based on the market price at the date of services. During November 2012, the Company negotiated an extension of two notes payable. As part of this negotiation to extend the note, the Company agreed to pay a total of 900,000 shares of common stock. March 2, 2012, the Company accepted $380,000 in private placement funds from accredited investors in exchange for units consisting of seven hundred sixty thousand (760,000) shares of the Company’s common stock, plus three hundred eighty thousand (380,000) warrants with an exercise price of $1.00.

During 2011, the Company issued 252,000 shares of common stock in exchange for services valued at $745,800. The valuation was based on the market price at the date of services. The Company cancelled 375,000 shares of common stock, which had been issued as part of a consulting agreement. The conditions of the agreement were never fulfilled, so the agreement and the shares associated were cancelled. In August 2011 the Company entered into a 90 day note payable with interest and warrants payable. After the note was fully paid, the note holder decided to exercise the warrants, using the cashless exercise option of the agreement. As part of the cashless exercise the note holder received 2,945,250 shares of common stock.

19

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

During July 2010, the Company sold 4,000,000 warrants for $100 for the right to purchase 4,000,000 shares of common stock at $0.14 per share or $560,000. $560,100 was received in July for the warrants and the exercise of the warrants. In December 2010, the Company received $800,000 in exchange for warrants exercisable for the right to purchase 1,600,000 shares of the Company’s common stock in a private placement. The cash has been received, however the warrants have not been exercised thus the common stock has not been issued to the purchaser. The nature of this warrant requires the Company to record a Warrant Derivative Liability. The valuation of the derivative is determined using the lattice model.

NOTE 4 – WARRANT DERIVATIVE LIABILITY

As part of the warrants to be issued for common stock in Note 3, the nature of the warrant requires the Company to record a Warrant Derivative Liability in the amount of $903,142 and $11,128,157 at December 31, 2012 and 2011, respectively. The valuation of the derivative is determined using the lattice model. The lattice model is based on the price the stock is trading on the day the warrants are issued and again at the end of each quarter and year end. Due to the stock price having large swings, the warrant derivative liability has large swings also, which create large losses and gains.

NOTE 5 COMMON STOCK WARRANTS AND OPTIONS

As of December 31, 2012 the Company had common stock warrants outstanding of 8,330,000 and outstanding options of 7,500,000. Warrants have a term of 5 years and options have a term of 10 years.

|

Options

|

Warrants

|

|||||||||||||||

|

12/31/2012

|

12/31/2011

|

12/31/2012

|

12/31/2011

|

|||||||||||||

|

Beg Bal

|

7,500,000 | 5,300,000 | 7,950,000 | 6,100,000 | ||||||||||||

|

Issued

|

- | 2,200,000 | 380,000 | 2,461,000 | ||||||||||||

|

Exercised

|

- | - | - | 611,000 | ||||||||||||

|

Cancelled

|

- | - | - | - | ||||||||||||

|

End Bal

|

7,500,000 | 7,500,000 | 8,330,000 | 7,950,000 | ||||||||||||

|

Exercisable

|

7,500,000 | 5,925,000 | 8,330,000 | 7,950,000 | ||||||||||||

Warrants – We have granted outstanding warrants for the purchase of a total of 8,330,000 shares of our common stock, all of which are exercisable anytime until their respective expiration dates

|

Date of issuance

|

Stock price at valuation date of December 31, 2012

|

Exercise price

|

Term

|

Risk free rate

|

Volatility

|

Value

|

# of Warrants

|

||||||||||||||||||

|

March 2, 2012

|

$ | 0.11 | $ | 1.00 |

5 Year

|

0.83 | % | 261 | % | $ | - | 380,000 | |||||||||||||

|

October 28, 2011

|

$ | 0.11 | $ | 1.00 |

5 Year

|

0.83 | % | 261 | % | $ | - | 1,900,000 | |||||||||||||

|

December 30, 2010

|

$ | 0.11 | $ | 0.50 |

5 Year

|

0.83 | % | 261 | % | $ | - | 1,600,000 | |||||||||||||

|

December 9, 2010

|

$ | 0.11 | $ | 1.00 |

5 Year

|

0.83 | % | 261 | % | $ | - | 450,000 | |||||||||||||

|

July 27, 2010

|

$ | 0.11 | $ | 0.14 |

5 Year

|

0.83 | % | 261 | % | $ | - | 4,000,000 | |||||||||||||

|

Total

|

$ | - | 8,330,000 | ||||||||||||||||||||||

The following is a summary of the Company’s stock warrants outstanding as of December 31, 2012, adjusted for any changes in the exercise price of the stock warrants:

|

Warrants Outstanding

|

Warrants Exercisable

|

||||||

|

Range of exercise price

|

Number Oustanding

|

Weighted Average Remaining Contractual Life (in years)

|

Weighted Average Exercise Price

|

Number Exercisable

|

Weighted Average Exercise Price

|

||

|

$0.14 to $1.00

|

8,330,000

|

3.26 years

|

$ 0.49

|

8,330,000

|

$ 0.49

|

||

|

Exercise Price

|

$0.14 to $1.00

|

||||||

|

Term

|

Five years

|

||||||

|

Volatility

|

261%

|

||||||

|

Dividends

|

0%

|

||||||

The following is a summary of the Company’s stock options outstanding as of December 31, 2012, adjusted for any changes in the exercise price of the stock options:

|

Options Outstanding

|

Options Exercisable

|

||||||

|

Range of exercise price

|

Number Oustanding

|

Weighted Average Remaining Contractual Life (in years)

|

Weighted Average Exercise Price

|

Number Exercisable

|

Weighted Average Exercise Price

|

||

|

$0.14 to $0.50

|

7,500,000

|

8.06 years

|

$ 0.25

|

7,500,000

|

$ 0.25

|

||

|

Exercise Price

|

$0.14 to $0.50

|

||||||

|

Term

|

Ten years

|

||||||

|

Volatility

|

261%

|

||||||

|

Dividends

|

0%

|

||||||

NOTE 6 – ISSUANCE OF STOCK

During 2012 the Company issued 30,000 shares of common stock in exchange for services valued at $15,000. The valuation was based on the market price at the date of services. During November 2012, the Company negotiated an extension of two notes payable. As part of this negotiation to extend the note, the Company agreed to pay a total of 900,000 shares of common stock. March 2, 2012, the Company accepted $380,000 in private placement funds from accredited investors in exchange for units consisting of seven hundred sixty thousand (760,000) shares of the Company’s common stock, plus three hundred eighty thousand (380,000) warrants with an exercise price of $1.00.

During 2011, the Company issued 252,000 shares of common stock in exchange for services valued at $745,800. The valuation was based on the market price at the date of services. The Company issued 2,945,250 shares of common stock as part of cashless exercise of warrants. These warrants were issued combined with a 90 day debt financing.

During 2011, 2,200,000 options were granted to officers at $0.50 per share. The value of $11,450,000 was charged to expense along with $2,813,604 related to the 2010 options. During 2012 $8,440,804 was charged to expense related to 2010 options. These valuations are based on the Black Sholes model; however the exercise price was based on the grant date fair market value of the common stock.

21

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

NOTE 7 – EQUITY TRANSACTIONS

During 2012 the Company issued 30,000 shares of common stock to Andrew Barwicki in exchange for services valued at $15,000 for investor relation consulting services. The valuation was based on the market price at the date of services.

During November 2012, the Company negotiated an extension of two notes payable. As part of this negotiation to extend the note, the Company agreed to pay a total of 900,000 shares of common stock.

March 2, 2012, the Company accepted $380,000 in private placement funds from accredited investors in exchange for units consisting of seven hundred sixty thousand (760,000) shares of the Company’s common stock, plus three hundred eighty thousand (380,000) warrants with an exercise price of $1.00. The Company believes the sale is exempt from registration, pursuant to Section 4(2) of the Securities Act of 1933 (as amended), as a private transaction not involving a public offering.

In January 2011, the Company entered into a contract with Cameron Associates, Inc. for investor relation consulting services. The Company paid Cameron Associates a one-time payment of 150,000 shares of the Company’s common stock.

In April 2011, the Company entered into an agreement with ProActive Capital Resources Group for consulting services with a one-time payment of 75,000 shares of the Company’s common stock.

In July 2011, the Company paid outstanding invoices using common stock to the Company’s legal counsel, Randal Edwards. The total amount paid was $13,500 at a price of $0.50 for a total of 27,000 shares of the Company’s common stock. However, we valued this transaction for the financial statements using the closing trade price on that day of $5.40 for total expense of $145,800.

During the month of July 2011, 375,000 shares of the Company’s common stock were returned to treasury, due to a consulting agreement which was not consummated.

In August 2011 the Company entered into two 90 day convertible Notes Payable for $280,500 each, from Bristol Investment Funds and St. George Investments. These notes also include 280,500 warrants each for a total of 561,000 warrants at an exercise price of $1.00 per share. Using the Lattice model, we valued these warrants based on the closing price of the market at $3.00 for additional interest expense of $1,122,000, which equates to an effective interest rate of 3,310%. During December 2011, these warrants were exercised using the cashless exercise provision within the agreement and a total of 2,945,250 shares of common stock were issued.

22

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

During the month of October 2011 the Company entered into two twelve month convertible Notes Payable for $605,000 each, for a total funding of $1,210,000, with an initial issue discount of 10% and total proceeds of $1,100,000. These notes may be converted at a fixed price of $1.50 per share of the Company’s common stock. However, if the Company obtained other financing at a lower price, then the shares issued would be adjusted to reflect the price difference. These notes also include 950,000 warrants each for a total of 1,900,000 warrants at an exercise price of $1.00 per share and have a cashless exercise provision. In case of default the Note may be converted into common stock at $1.50 per share or 80% of the current market bid price, whichever is lower.

NOTE 8 – NOTES PAYABLE

During November 2012, the Company negotiated an extension of the two October 2011 notes payable. The principal was increased from $550,000 per note to $756,250, or a total of $1,512,500 with an annual interest rate of 10%.

During November 2012 the Company entered into several 12 month notes payable for an aggregate of $150,000, with an annual interest rate of 10%.

In August 2011 the Company entered into two 90 day convertible Notes Payable for $280,500 each, from Bristol Investment Funds and St. George Investments. These notes also include 280,500 warrants each for a total of 561,000 warrants at an exercise price of $1.00 per share. Using the Lattice model, we valued these warrants based on the closing price of the market at $3.00 for additional interest expense of $1,122,000, which equates to an effective interest rate of 3,310%. During December 2011, these warrants were exercised using the cashless exercise provision within the agreement and a total of 2,945,250 shares of common stock.

During the month of October 2011 the Company entered into two twelve month convertible Notes Payable for $605,000 each, for a total funding of $1,210,000, with an initial issue discount of 10% and total proceeds of $1,100,000, which are collateralized by all the assets of the Company. These notes may be converted at a fixed price of $1.50 per share of the Company’s common stock. However, if the Company obtained other financing at a lower price, then the shares issued would be adjusted to reflect the price difference. These notes also include 950,000 warrants each for a total of 1,900,000 warrants at an exercise price of $1.00 per share and have a cashless exercise provision. In case of default the Note may be converted into common stock at $1.50 per share or 80% of the current market bid price, whichever is lower. A total of $561,000 of these funds were used to pay back the 90 day convertible Notes Payable, which were paid in full on October 31, 2011.

NOTE 9 – PROVISION FOR INCOME TAXES

The Company has operating loss carry forwards of approximately $9,967,000 at December 31, 2012. The operating loss carry forwards expire from 2021 through 2032. Substantially all of the operating loss carry forwards are limited in the availability for use by the Company. The net deferred tax asset consisted of the following at December 31, 2012 and 2011:

23

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

|

Deferred Tax Asset

|

2012

|

2011

|

||||||

|

Operating loss carry forwards

|

$ | 4,383,290 | $ | 3,853,118 | ||||

|

Depreciation

|

- | - | ||||||

|

Total Deferred Tax Asset

|

4,383,290 | 3,853,118 | ||||||

|

Valuation Allowance

|

(4,383,290 | ) | (3,853,118 | ) | ||||

|

Net Deferred Tax Asset

|

$ | - | $ | - | ||||

During 2012 and 2011, the valuation allowance increased by $530,172 and $976,378, respectively, principally due to the operating losses.

The following is a reconciliation of the amount of tax benefit that would result from applying the federal statutory rate to pretax loss from continuing operations with the benefit from income taxes attributable to continuing operations:

|

2012

|

2011

|

|||||||

|

Income tax (benefit) at statutory rate (34%)

|

$ | (530,172 | ) | $ | (976,378 | ) | ||

|

Benefit of operating loss carry-forwards

|

- | - | ||||||

|

Expenses not currently deductible

|

- | - | ||||||

|

Change in valuation allowance

|

530,172 | 976,378 | ||||||

|

State tax (benefit), net of federal tax effect

|

- | - | ||||||

|

Net Benefit (Expenses) From Income Taxes

|

$ | - | $ | - | ||||

NOTE 10 – COMMITMENTS AND CONTINGENCIES

As part of our notes payable agreement, these parties are entitled to royalty payments per the terms of each agreement. These royalties are based upon the contract between the wholly owned subsidiary, Ensurge Brasil, LTDA, and the mine owner in Brazil. However, this contract has currently expired and the Company feels there is no further obligation or liabilities to either the mine owner or the note holders for these royalties.

NOTE 11 – LEGAL ISSUES

On March 25, 2013 a Complaint was filed against Ensurge, by Randall K. Edwards and Gaia, Silva, Gaede & Associates in the amount of $74,924 and $18,627, respectively. These are liabilities for services performed, however, due to lack of funding the Company has not been able to pay these amount owed. These liabilities are booked as part of accounts payable.

24

ENSURGE, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

NOTE 12 – SUBSEQUENT EVENTS

During April 2013, the Company entered into a 60 day note payable in the amount of $15,000, with an annual interest rate of 10%.

On May 8, 2013, in order to more fully devote his time and attention to the funding and opportunities of the Company’s Brazilian subsidiary, Ensurge Brasil LTDA, the Company has accepted the resignation of Jordan Estra as the Company’s Director and President/CEO and caused his appointment to the Board of Directors of its subsidiary Ensurge Brasil LTDA. The Company’s CFO, Jeff Hanks, shall be the Company’s acting President until replacement.

On May 9, 2013, the Company entered into a 6 month note payable in the amount of $23,000, with Workhorse Capital Leasing, LLC, with an annual interest rate of 22%.

On May 15, 2013, the Company entered into an agreement with Next View Capital, LP and Zadar, LLC, which have notes payable with an aggregate total of $ $1,512,500. As part of this agreement, these two notes will moved to the Company’s wholly owned subsidiary, Ensurge Brasil, LTDA, thereby releasing Ensurge, Inc. of this Liability. As part of this agreement the Company will issue 1,000,000 shares of common stock to each note holder.

The Company has reviewed subsequent events from the balance sheet date through the date the financial statements were issued, and have determined there were no other events to disclose.

25

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

None

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

(a) Evaluation of Disclosure Controls and Procedures. The Company’s chief executive officer and chief financial officer (principal financial officer), after evaluating the effectiveness of the Company’s “disclosure controls and procedures” (as defined in the Securities Exchange Act of 1934, Rules 13a-14(c) and 15-d-14(c)) as of December 31, 2012, have concluded that, as of the evaluation date, the Company’s disclosure controls and procedures were adequate and designed to ensure that material information relating to the Company and its subsidiaries would be made known to them by others within those entities.

(b) Changes in Internal Controls. There were no significant changes in the Company’s internal controls, or, to the Company’s knowledge, in other factors that could significantly affect these controls subsequent to the evaluation date.

Management’s Annual Report on Internal Control Over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Exchange Act Rule 13a-15(f). The Company’s internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Under the supervision and with the participation of the Company’s management, including its Chief Executive Officer and Chief Financial Officer, the Company conducted an evaluation of the effectiveness of its internal control over financial reporting based on the framework established by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) as set forth in Internal Control - Integrated Framework. During the course of this assessment, management identified a material weakness relating primarily to recording complex financial transactions.

The Company has a lack of staffing within its accounting department, in terms of the small number of employees performing its financial and accounting functions, which does not provide the necessary separation of duties. Management believes the lack of accounting and financial personnel amounts to a material weakness in its internal control over financial reporting and, as a result, at December 31, 2012 and on the date of this Report, its internal control over financial reporting is not effective. The Company will continue to evaluate the employees involved and the hiring of additional accounting staff. However, the Company will be unable to remedy this material weakness in its internal controls until the Company has the financial resources that allow the Company to hire additional qualified employees.