Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DC Industrial Liquidating Trust | d540084d8k.htm |

Exhibit 99.1

First Quarter 2013

Supplemental Reporting Package

| Table of Contents

|

The following supplements Industrial Income Trust Inc.’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2013, as filed with the Securities and Exchange Commission (the “SEC”) on May 7, 2013, which is available at www.industrialincome.com. As used herein, the terms “IIT,” the “Company,” “we,” “our,” or “us” refer to Industrial Income Trust Inc.

| Overview | 2 | |||

| Quarterly Highlights | 3 | |||

| Consolidated Statements of Operations | 4 | |||

| Consolidated Balance Sheets | 5 | |||

| Consolidated Statements of Cash Flows | 6 | |||

| Funds from Operations | 7 | |||

| Selected Financial Data | 8 | |||

| Portfolio Overview | 9 | |||

| Lease Expirations & Top Customers | 11 | |||

| Acquisitions | 12 | |||

| Debt | 13 | |||

| Unconsolidated Joint Ventures | 14 | |||

| Definitions | 15 | |||

This supplemental information contains forward-looking statements that are based on IIT’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties, including, without limitation, IIT’s ability to consummate additional acquisitions and otherwise execute on its investment strategy, the availability of affordable financing, IIT’s ability to identify and time investments that will generate attractive returns for investors and those risks set forth in the “Risk Factors” section of IIT’s Annual Report on Form 10-K for the year ended December 31, 2012, as amended or supplemented by the Company’s other filings with the SEC. Any of these statements could prove to be inaccurate, and actual events or IIT’s investments and results of operations could differ materially from those expressed or implied. To the extent that IIT’s assumptions differ from actual results, IIT’s ability to meet such forward-looking statements, including its ability to consummate additional acquisitions and financings, to invest in a diversified portfolio of quality real estate investments, and to generate attractive returns for investors, may be significantly hindered. You are cautioned not to place undue reliance on any forward-looking statements. IIT cannot assure you that it will attain its investment objectives.

1

| Overview

|

IIT is an industrial real estate investment trust that is focused on acquiring and operating high-quality distribution warehouses that serve as key logistics centers for corporate tenants. IIT’s core strategy is to continue building a national platform of institutional quality industrial properties by targeting markets that have high barriers to entry, proximity to a large demographic base, and/or access to major distribution infrastructure. IIT acquired its first building on June 30, 2010.

As of March 31, 2013, IIT owned, either directly or through unconsolidated joint ventures, a portfolio that included 226 industrial buildings totaling approximately 44.4 million square feet with 429 customers in 21 major industrial markets throughout the U.S with a weighted-average remaining lease term (based on square feet) of 5.6 years. Of the 226 industrial buildings we owned and managed as of March 31, 2013:

| • | 217 industrial buildings totaling approximately 42.0 million square feet comprised our operating portfolio, which was 95% occupied (95% leased). |

| • | 9 industrial buildings totaling approximately 2.4 million square feet comprised our development portfolio. |

Public Earnings Call

We will host a public conference call on Thursday, May 23, 2013 to review quarterly operating and financial results for the quarter ended March 31, 2013. Dwight Merriman, Chief Executive Officer, and Tom McGonagle, Chief Financial Officer, will present operating and financial data and discuss the Company’s corporate strategy and acquisition activity. The conference call will take place at 11:00 a.m. MDT and can be accessed by dialing (800) 410-4177. To access a replay of the call, contact Dividend Capital at (866) 324-7348.

Contact Information

Industrial Income Trust Inc.

518 Seventeenth Street, 17th Floor

Denver, Colorado 80202

Telephone: (303) 228-2200

Attn: Thomas G. McGonagle, Chief Financial Officer

2

| Quarterly Highlights

|

The following is an overview of our first quarter 2013 financial and operating results:

| • | During the quarter ended March 31, 2013, we acquired seven industrial buildings comprising approximately 1.3 million square feet for an aggregate total purchase price of approximately $91.6 million, exclusive of transfer taxes, due diligence expenses, and other closing costs. |

| • | Our net operating income(1) was $38.2 million for the quarter ended March 31, 2013, as compared to net operating income of $16.6 million for the same period in 2012. Same store net operating income(1) increased 2.7% to $16.2 million for the quarter ended March 31, 2013, up from $15.8 million for the same period in 2012. |

| • | Our net loss attributable to common stockholders was $10.9 million, or $0.08 per share, for the quarter ended March 31, 2013. These results include the effects of acquisition-related expenses of $2.7 million, or $0.02 per share. This compares to a net loss attributable to common stockholders of $6.9 million, or $0.10 per share, which included $3.1 million, or $0.04 per share, of acquisition-related expenses for the same period in 2012. |

| • | We had Company-defined Funds from Operations(2) of $21.0 million, or $0.15 per share, for the quarter ended March 31, 2013 as compared to $8.7 million, or $0.12 per share, for the same period in 2012. |

We are currently in the acquisition phase of our life cycle and our operating results are primarily impacted by the timing of our acquisitions and the equity raised through our public offerings. Accordingly, our operating results for the quarters ended March 31, 2013 and 2012 are not directly comparable, nor are our operating results for the quarters ended March 31, 2013 and 2012 indicative of those expected in future periods. We expect that our revenues and operating expenses will continue to increase in future periods as a result of continued growth in our current portfolio and as a result of the additive effect of anticipated future acquisitions of industrial properties.

| (1) | See “Selected Financial Data” below for additional information regarding net operating income and same store net operating income, as well as “Definitions” below for a reconciliation of net operating income to GAAP net loss. |

| (2) | See “Funds from Operations” below for a reconciliation of GAAP net loss to Company-defined FFO, as well as “Definitions” below for additional information. |

3

| Consolidated Statements of Operations

|

| For the Quarter Ended March 31, | ||||||||

| (in thousands, except per share data) |

2013 | 2012 | ||||||

| Revenues: |

||||||||

| Rental revenues |

$ | 51,254 | $ | 22,272 | ||||

|

|

|

|

|

|||||

| Total revenues |

51,254 | 22,272 | ||||||

|

|

|

|

|

|||||

| Operating expenses: |

||||||||

| Rental expenses |

13,083 | 5,646 | ||||||

| Real estate-related depreciation and amortization |

27,282 | 10,545 | ||||||

| General and administrative expenses |

1,661 | 1,323 | ||||||

| Asset management fees, related party |

4,532 | 2,105 | ||||||

| Acquisition-related expenses, related party |

958 | 1,753 | ||||||

| Acquisition-related expenses |

1,771 | 1,386 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

49,287 | 22,758 | ||||||

|

|

|

|

|

|||||

| Operating income (loss) |

1,967 | (486 | ) | |||||

| Other expenses: |

||||||||

| Equity in loss of unconsolidated joint ventures |

1,286 | 952 | ||||||

| Interest expense and other |

11,598 | 5,424 | ||||||

|

|

|

|

|

|||||

| Total other expenses |

12,884 | 6,376 | ||||||

| Net loss |

(10,917 | ) | (6,862 | ) | ||||

| Net loss attributable to noncontrolling interests |

— | — | ||||||

|

|

|

|

|

|||||

| Net loss attributable to common stockholders |

$ | (10,917 | ) | $ | (6,862 | ) | ||

|

|

|

|

|

|||||

| Weighted-average shares outstanding |

141,484 | 70,648 | ||||||

|

|

|

|

|

|||||

| Net loss per common share - basic and diluted |

$ | (0.08 | ) | $ | (0.10 | ) | ||

|

|

|

|

|

|||||

4

| Consolidated Balance Sheets

|

| (in thousands) |

March 31, 2013 | December 31, 2012 | ||||||

| ASSETS |

||||||||

| Net investment in real estate properties |

$ | 2,200,207 | $ | 2,122,941 | ||||

| Investment in unconsolidated joint ventures |

99,293 | 96,490 | ||||||

| Cash and cash equivalents |

32,975 | 24,550 | ||||||

| Restricted cash |

2,838 | 1,926 | ||||||

| Straight-line rent receivable |

14,558 | 12,277 | ||||||

| Tenant receivables, net |

3,066 | 2,185 | ||||||

| Notes receivable |

3,612 | 5,912 | ||||||

| Deferred financing costs, net |

9,781 | 10,259 | ||||||

| Due from transfer agent |

9,749 | 6,438 | ||||||

| Deferred acquisition costs |

9,701 | 4,504 | ||||||

| Other assets |

3,605 | 7,466 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,389,385 | $ | 2,294,948 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND EQUITY |

||||||||

| Accounts payable and accrued expenses |

$ | 15,680 | $ | 13,514 | ||||

| Tenant prepaids and security deposits |

16,528 | 20,711 | ||||||

| Intangible lease liability, net |

17,684 | 12,941 | ||||||

| Debt |

1,144,302 | 1,195,218 | ||||||

| Due to affiliates |

3,021 | 3,945 | ||||||

| Distributions payable |

22,105 | 19,568 | ||||||

| Other liabilities |

3,942 | 2,970 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,223,262 | 1,268,867 | ||||||

| Total stockholders’ equity |

1,166,122 | 1,026,080 | ||||||

| Noncontrolling interests |

1 | 1 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 2,389,385 | $ | 2,294,948 | ||||

|

|

|

|

|

|||||

5

| Consolidated Statements of Cash Flows

|

| For the Three Months Ended March 31, |

||||||||

| (in thousands) |

2013 | 2012 | ||||||

| Operating activities: |

||||||||

| Net loss |

$ | (10,917 | ) | $ | (6,862 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: |

||||||||

| Real estate-related depreciation and amortization |

27,282 | 10,545 | ||||||

| Equity in loss of unconsolidated joint venture |

1,286 | 952 | ||||||

| Straight-line rent and amortization of above- and below-market leases |

(1,227 | ) | (846 | ) | ||||

| Bad debt expense |

133 | 366 | ||||||

| Other |

375 | 259 | ||||||

| Changes in operating assets and liabilities |

402 | (2,560 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

17,334 | 1,854 | ||||||

|

|

|

|

|

|||||

| Investing activities: |

||||||||

| Real estate acquisitions |

(94,322 | ) | (162,414 | ) | ||||

| Acquisition deposits |

(5,700 | ) | (4,250 | ) | ||||

| Capital expenditures |

(5,926 | ) | (411 | ) | ||||

| Investment in unconsolidated joint ventures |

(1,711 | ) | (17,022 | ) | ||||

| Distribution from unconsolidated joint ventures |

— | 500 | ||||||

| Other |

(116 | ) | 334 | |||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(107,775 | ) | (183,263 | ) | ||||

|

|

|

|

|

|||||

| Financing activities: |

||||||||

| Repayments of mortgage notes |

(744 | ) | (711 | ) | ||||

| Proceeds from lines of credit |

25,000 | 120,400 | ||||||

| Repayments of lines of credit |

(75,000 | ) | (120,150 | ) | ||||

| Financing costs paid |

(121 | ) | (121 | ) | ||||

| Proceeds from issuance of common stock |

179,406 | 234,901 | ||||||

| Offering costs for issuance of common stock |

(16,407 | ) | (22,611 | ) | ||||

| Distributions paid to common stockholders |

(10,554 | ) | (4,775 | ) | ||||

| Redemptions of common stock |

(2,714 | ) | (1,476 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

98,866 | 205,457 | ||||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

8,425 | 24,048 | ||||||

| Cash and cash equivalents, at beginning of period |

24,550 | 12,934 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, at end of period |

$ | 32,975 | $ | 36,982 | ||||

|

|

|

|

|

|||||

6

| Funds from Operations (1)

|

Our first quarter 2013 Company-defined FFO of $0.15 per share increased 21.1% from $0.12 per share for the first quarter 2012. However, the timing of our acquisitions in any period, combined with the level of equity raised has, and could have, an impact, upwards or downwards of a penny or two on our Company-defined FFO in any given quarter. There can be no assurances that the current level of Company-defined FFO will be maintained.

| For the Quarter Ended | ||||||||

| (in thousands, except per share data) |

Q1 2013 | Q1 2012 | ||||||

| Net loss |

$ | (10,917 | ) | $ | (6,862 | ) | ||

|

|

|

|

|

|||||

| Net loss per common share |

$ | (0.08 | ) | $ | (0.10 | ) | ||

|

|

|

|

|

|||||

| Reconciliation of net loss to FFO: |

||||||||

| Net loss |

$ | (10,917 | ) | $ | (6,862 | ) | ||

| Add (deduct) NAREIT-defined adjustments: |

||||||||

| Real estate-related depreciation and amortization |

27,282 | 10,545 | ||||||

| Real estate-related depreciation and amortization of unconsolidated joint venture |

1,860 | 1,553 | ||||||

|

|

|

|

|

|||||

| FFO |

$ | 18,225 | $ | 5,236 | ||||

|

|

|

|

|

|||||

| FFO per common share |

$ | 0.13 | $ | 0.07 | ||||

|

|

|

|

|

|||||

| Reconciliation of FFO to Company-defined FFO: |

||||||||

| FFO |

$ | 18,225 | $ | 5,236 | ||||

| Add (deduct) Company-defined adjustments: |

||||||||

| Acquisition costs |

2,729 | 3,139 | ||||||

| Acquisition costs of unconsolidated joint venture |

58 | 307 | ||||||

|

|

|

|

|

|||||

| Company-defined FFO |

$ | 21,012 | $ | 8,682 | ||||

|

|

|

|

|

|||||

| Company-defined FFO per common share |

$ | 0.15 | $ | 0.12 | ||||

|

|

|

|

|

|||||

| Weighted-average shares outstanding |

141,484 | 70,648 | ||||||

|

|

|

|

|

|||||

| (1) | See “Definitions” below for additional information regarding Funds from Operations (“FFO”) and Company-defined FFO. |

7

| Selected Financial Data

|

The following table presents selected consolidated financial information, which has been derived from our condensed consolidated financial statements. The information presented below is only a summary and does not provide all of the information contained in our historical condensed consolidated financial statements, including the related notes thereto, and as such, you should read it in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our condensed consolidated financial statements and notes thereto included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2013.

| For the Quarter Ended March 31, |

||||||||

| (in thousands, except per share data) |

2013 | 2012 | ||||||

| Operating data: |

||||||||

| Rental revenues from same store operating properties(1) |

$ | 21,578 | $ | 20,576 | ||||

| Rental revenues from other properties(1) |

29,676 | 1,696 | ||||||

|

|

|

|

|

|||||

| Total rental revenues |

51,254 | 22,272 | ||||||

|

|

|

|

|

|||||

| Rental expenses from same store operating properties(1) |

5,344 | 4,774 | ||||||

| Rental expenses from other properties(1) |

7,739 | 872 | ||||||

|

|

|

|

|

|||||

| Total rental expenses |

13,083 | 5,646 | ||||||

|

|

|

|

|

|||||

| NOI from same store operating properties |

16,234 | 15,802 | ||||||

| NOI from other properties |

21,937 | 824 | ||||||

|

|

|

|

|

|||||

| Total NOI(2) |

$ | 38,171 | $ | 16,626 | ||||

|

|

|

|

|

|||||

| Less straight-line rents |

$ | (2,282 | ) | $ | (1,694 | ) | ||

| Plus amortization of above market leases, net |

1,055 | 848 | ||||||

|

|

|

|

|

|||||

| Cash NOI(2) |

$ | 36,944 | $ | 15,780 | ||||

|

|

|

|

|

|||||

| Distributions declared per common share |

$ | 0.15625 | $ | 0.15625 | ||||

|

|

|

|

|

|||||

| Cash flow data: |

||||||||

| Net cash provided by operating activities |

$ | 17,334 | $ | 1,854 | ||||

| Net cash used in investing activities |

$ | (107,775 | ) | $ | (183,263 | ) | ||

| Net cash provided by financing activities |

$ | 98,866 | $ | 205,457 | ||||

| Capital expenditures |

$ | 5,926 | $ | 411 | ||||

| Portfolio data (as of period end): |

||||||||

| Number of consolidated buildings |

197 | 111 | ||||||

| Number of unconsolidated buildings |

29 | 25 | ||||||

|

|

|

|

|

|||||

| Total number of buildings |

226 | 136 | ||||||

|

|

|

|

|

|||||

| Rentable square feet of consolidated buildings |

38,205 | 19,640 | ||||||

| Rentable square feet of unconsolidated buildings |

6,182 | 5,074 | ||||||

|

|

|

|

|

|||||

| Total rentable square feet |

44,387 | 24,714 | ||||||

|

|

|

|

|

|||||

| Total number of customers |

429 | 258 | ||||||

| Percent occupied of operating portfolio |

95 | % | 95 | % | ||||

| Percent occupied of total portfolio |

91 | % | 90 | % | ||||

| Percent leased of operating portfolio |

95 | % | 96 | % | ||||

| Percent leased of total portfolio |

91 | % | 91 | % | ||||

Total NOI significantly increased for the quarter ended March 31, 2013 as compared to the same prior year period, primarily due to an increase in “other properties” from the acquisition of additional properties. Same store NOI increased by 2.7% for the quarter ended March 31, 2013 as compared to the same prior year period, primarily due to increases in rental revenues from base rent increases, higher occupancy levels at certain properties, and the receipt of an early termination fee. The increase in rental revenues was partially offset by an increase in rental expenses from higher real estate taxes and repair and maintenance expenses at certain properties.

| (1) | See “Definitions” below additional information regarding “same store operating properties” and “other properties.” |

| (2) | See “Definitions” below for a reconciliation of net operating income to GAAP net loss and for a reconciliation of cash net operating income to GAAP net loss. |

8

| Portfolio Overview

|

During the first quarter of 2013, we continued to expand and strengthen our presence in our target markets by acquiring primarily quality, functional industrial buildings with generic features designed for flexibility and for high acceptance by a wide range of customers. As of March 31, 2013, the weighted-average age of our buildings (based on square feet) was 14.1 years.

| Number of Buildings |

Rentable Square Feet | Occupied Rate |

Leased Rate |

Annualized Base Rent | Percent of Annualized Base Rent |

|||||||||||||||||||||||||||||||

| Market |

Total | Consolidated | Total | Consolidated | Total | Consolidated | ||||||||||||||||||||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||||||||||||||||||||||

| Operating Properties: |

||||||||||||||||||||||||||||||||||||

| Atlanta |

13 | 5,154 | 5,154 | 94.6 | 94.6 | $ | 13,918 | $ | 13,918 | 7.9 | % | 8.7 | % | |||||||||||||||||||||||

| Austin |

7 | 748 | 748 | 93.0 | 93.0 | 3,776 | 3,776 | 2.2 | 2.4 | |||||||||||||||||||||||||||

| Baltimore / D.C. |

17 | 2,395 | 2,176 | 97.6 | 97.6 | 12,303 | 11,564 | 7.0 | 7.3 | |||||||||||||||||||||||||||

| Chicago |

17 | 3,602 | 2,589 | 84.6 | 85.0 | 11,812 | 9,633 | 6.7 | 6.1 | |||||||||||||||||||||||||||

| Dallas |

27 | 3,746 | 2,917 | 93.7 | 94.2 | 13,117 | 10,134 | 7.5 | 6.4 | |||||||||||||||||||||||||||

| Houston |

23 | 2,315 | 2,315 | 83.6 | 85.7 | 10,289 | 10,289 | 5.8 | 6.5 | |||||||||||||||||||||||||||

| Indianapolis |

6 | 2,248 | 2,248 | 91.3 | 91.3 | 10,065 | 10,065 | 5.7 | 6.3 | |||||||||||||||||||||||||||

| Inland Empire |

12 | 4,117 | 2,065 | 99.3 | 100.0 | 17,146 | 9,062 | 9.7 | 5.7 | |||||||||||||||||||||||||||

| Los Angeles |

4 | 448 | 448 | 90.0 | 90.0 | 2,698 | 2,698 | 1.5 | 1.7 | |||||||||||||||||||||||||||

| Maryland |

2 | 995 | 995 | 100.0 | 100.0 | 3,965 | 3,965 | 2.3 | 2.5 | |||||||||||||||||||||||||||

| Memphis |

6 | 2,176 | 2,176 | 100.0 | 100.0 | 6,151 | 6,151 | 3.5 | 3.9 | |||||||||||||||||||||||||||

| New Jersey |

8 | 1,579 | 1,579 | 100.0 | 100.0 | 7,898 | 7,898 | 4.5 | 5.0 | |||||||||||||||||||||||||||

| Pennsylvania |

23 | 3,704 | 3,704 | 95.3 | 95.3 | 16,355 | 16,355 | 9.3 | 10.3 | |||||||||||||||||||||||||||

| Phoenix |

4 | 3,154 | 2,851 | 100.0 | 100.0 | 16,459 | 15,515 | 9.3 | 9.8 | |||||||||||||||||||||||||||

| Portland |

21 | 1,423 | 747 | 90.4 | 90.4 | 5,847 | 3,521 | 3.3 | 2.2 | |||||||||||||||||||||||||||

| Salt Lake City |

4 | 1,140 | 1,140 | 96.9 | 96.9 | 5,268 | 5,268 | 3.0 | 3.3 | |||||||||||||||||||||||||||

| San Francisco Bay Area |

5 | 823 | 823 | 100.0 | 100.0 | 3,954 | 3,954 | 2.2 | 2.5 | |||||||||||||||||||||||||||

| Seattle / Tacoma |

7 | 1,110 | 1,110 | 91.5 | 100.0 | 4,211 | 4,211 | 2.4 | 2.6 | |||||||||||||||||||||||||||

| South Florida |

10 | 995 | 995 | 100.0 | 100.0 | 7,386 | 7,386 | 4.2 | 4.6 | |||||||||||||||||||||||||||

| Tampa |

1 | 147 | 147 | 100.0 | 100.0 | 889 | 889 | 0.5 | 0.5 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Subtotal Operating |

217 | 42,019 | 36,927 | 94.6 | % | 95.1 | % | $ | 173,507 | $ | 156,252 | 98.5 | % | 98.3 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Development Properties: |

||||||||||||||||||||||||||||||||||||

| Baltimore / D.C. |

1 | 457 | 457 | 60.5 | 60.5 | 1,669 | 1,669 | 0.9 | 1.1 | |||||||||||||||||||||||||||

| Chicago |

1 | 264 | 264 | 38.3 | 38.3 | 555 | 555 | 0.3 | 0.3 | |||||||||||||||||||||||||||

| Inland Empire |

3 | 805 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Los Angeles |

1 | 305 | 305 | — | — | — | — | — | — | |||||||||||||||||||||||||||

| New Jersey |

1 | 252 | 252 | 49.9 | 49.9 | 428 | 428 | 0.3 | 0.3 | |||||||||||||||||||||||||||

| Orange County |

1 | 198 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| San Francisco Bay Area |

1 | 87 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Subtotal Development |

9 | 2,368 | 1,278 | 21.2 | % | 21.2 | % | $ | 2,652 | $ | 2,652 | 1.5 | % | 1.7 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Portfolio |

226 | 44,387 | 38,205 | 90.7 | % | 91.2 | % | $ | 176,159 | $ | 158,904 | 100.0 | % | 100.0 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

9

| Portfolio Overview

|

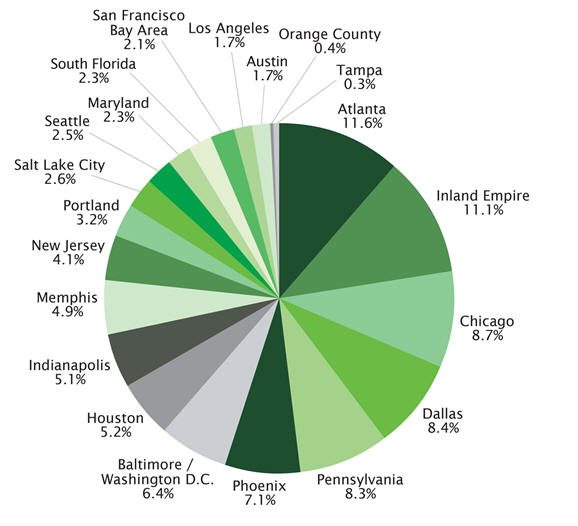

As of March 31, 2013, we owned and managed a well diversified industrial portfolio located in 21 major markets throughout the U.S. Approximately 35%, 34%, and 31%, respectively, of our portfolio was located in the West, East, and Central regions of the U.S.

Market by Total Rentable Square Feet

as of March 31, 2013

10

| Lease Expirations & Top Customers

|

We continue to expand our portfolio and diversify our customer base. As of March 31, 2013, we had 226 industrial buildings occupied by 429 customers with 468 leases, up from 219 industrial buildings occupied by 414 customers with 449 leases as of December 31, 2012.

Lease Expirations

During the first quarter of 2013, we leased approximately 1.4 million square feet, including 0.6 million square feet related to new leases and expansions, and 0.8 million square feet related to renewals. Expansions represented approximately 11% of the total leasing activity for the quarter.

| Number of Leases |

Occupied Square Feet | Percent of Occupied Square Feet |

Annualized Base Rent | Percent of Annualized Base Rent |

||||||||||||||||||||||||||||||||

| Year |

Total | Consolidated | Total | Consolidated | Total | Consolidated | Total | Consolidated | ||||||||||||||||||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||||||||||||||||||||||

| Remainder of 2013(1) |

64 | 2,794 | 2,410 | 6.9 | % | 6.8 | % | $ | 12,402 | $ | 10,698 | 7.0 | % | 6.7 | % | |||||||||||||||||||||

| 2014 |

72 | 4,015 | 2,530 | 10.0 | 7.1 | 18,501 | 11,707 | 10.5 | 7.4 | |||||||||||||||||||||||||||

| 2015 |

91 | 4,508 | 4,387 | 11.2 | 12.3 | 19,862 | 19,463 | 11.3 | 12.3 | |||||||||||||||||||||||||||

| 2016 |

59 | 4,571 | 4,271 | 11.4 | 12.0 | 21,236 | 19,815 | 12.1 | 12.5 | |||||||||||||||||||||||||||

| 2017 |

49 | 3,137 | 3,036 | 7.8 | 8.5 | 14,974 | 14,520 | 8.5 | 9.1 | |||||||||||||||||||||||||||

| 2018 |

37 | 4,822 | 4,747 | 12.0 | 13.4 | 21,297 | 21,088 | 12.1 | 13.3 | |||||||||||||||||||||||||||

| 2019 |

26 | 3,473 | 2,934 | 8.6 | 8.3 | 19,312 | 17,470 | 11.0 | 11.0 | |||||||||||||||||||||||||||

| 2020 |

17 | 1,450 | 1,182 | 3.6 | 3.3 | 6,780 | 5,943 | 3.8 | 3.7 | |||||||||||||||||||||||||||

| 2021 |

15 | 4,242 | 3,322 | 10.5 | 9.4 | 18,193 | 15,246 | 10.3 | 9.6 | |||||||||||||||||||||||||||

| 2022 |

14 | 3,334 | 3,334 | 8.3 | 9.4 | 14,349 | 14,349 | 8.1 | 9.0 | |||||||||||||||||||||||||||

| Thereafter |

24 | 3,909 | 3,367 | 9.7 | 9.5 | 9,253 | 8,605 | 5.3 | 5.4 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total occupied |

468 | 40,255 | 35,520 | 100.0 | % | 100.0 | % | $ | 176,159 | $ | 158,904 | 100.0 | % | 100.0 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Customers

Of the 429 customers as of March 31, 2013, there were no customers that individually represented more than 10% of total annualized base rent. The following table reflects our 10 largest customers, based on annualized base rent, which occupied an aggregate 11.6 million square feet as of March 31, 2013:

| Customer |

Percent of Total Annualized Base Rent |

Percent of Total Occupied Square Feet |

||||||

| Amazon.com, LLC |

7.7 | % | 6.1 | % | ||||

| Home Depot USA INC. |

5.9 | 5.8 | ||||||

| Hanesbrands, Inc. |

3.3 | 3.3 | ||||||

| Belkin International |

3.0 | 2.0 | ||||||

| Solo Cup Company |

2.2 | 3.7 | ||||||

| GlaxoSmithKlein |

1.9 | 1.6 | ||||||

| Harbor Freight Tools |

1.4 | 1.9 | ||||||

| Bunzl Distribution USA, Inc. |

1.3 | 1.4 | ||||||

| Phillips-Van Heusen Corporation |

1.3 | 2.1 | ||||||

| FedEx Corporation |

1.3 | 0.9 | ||||||

|

|

|

|

|

|||||

| Total |

29.3 | % | 28.8 | % | ||||

|

|

|

|

|

|||||

| (1) | Includes eight month-to-month leases. |

11

| Acquisitions

|

During the first quarter of 2013, we acquired seven industrial buildings comprising approximately 1.3 million square feet for an aggregate purchase price of approximately $91.6 million, exclusive of transfer taxes, due diligence expenses, and other closing costs. The following table summarizes our acquisitions completed during the first quarter 2013:

| ($ in thousands) |

Acquisition Date |

Market |

Number of Buildings |

Rentable Square Feet |

Total Purchase Price |

|||||||||||

| Clifton Distribution Center |

2/6/2013 | New Jersey | 1 | 231,000 | $ | 26,100 | ||||||||||

| Hayward Distribution Center |

2/14/2013 | San Francisco Bay | 1 | 102,000 | 9,600 | |||||||||||

| Valley View Business Center |

3/25/2013 | Dallas | 2 | 209,000 | 12,200 | |||||||||||

| York Distribution Center II |

3/27/2013 | Pennsylvania | 1 | 603,000 | 31,671 | |||||||||||

| Andover Distribution Center |

3/29/2013 | Seattle / Tacoma | 2 | 163,000 | 12,050 | |||||||||||

|

|

|

|

|

|

||||||||||||

| Total consolidated properties |

7 | 1,308,000 | $ | 91,621 | ||||||||||||

|

|

|

|

|

|

||||||||||||

12

| Debt

|

Summary of Debt

As of March 31, 2013, we had approximately $1.1 billion of consolidated indebtedness, which was comprised of borrowings under our unsecured line of credit and term loan, and our mortgage note financings. Our consolidated debt had a weighted-average remaining term of approximately 7.4 years. The following is a summary of our consolidated debt as of March 31, 2013:

| (in thousands) |

Stated Interest Rate at March 31, 2013 |

Initial Maturity Date | Balance as of March 31, 2013 |

|||||||

| Unsecured line of credit |

2.20 | % | August 2015 | $ | 25,000 | |||||

| Unsecured term loan(1) |

2.15 | % | January 2018 | 200,000 | ||||||

| Fixed-rate mortage notes |

4.27 | % | June 2015 - November 2023 | 910,222 | ||||||

| Variable-rate mortgage note |

2.20 | % | May 2015 | 9,080 | ||||||

|

|

|

|

|

|||||||

| Total / weighted-average mortgage notes |

4.25 | % | 919,302 | |||||||

|

|

|

|

|

|||||||

| Total consolidated debt |

$ | 1,144,302 | ||||||||

|

|

|

|||||||||

| Fixed-rate debt |

4.27 | % | 80 | % | ||||||

| Variable-rate debt |

2.16 | % | 20 | % | ||||||

|

|

|

|

|

|||||||

| Total / weighted-average |

3.84 | % | 100 | % | ||||||

|

|

|

|

|

|||||||

Scheduled Principal Payments of Debt

As of March 31, 2013, the principal payments due on our consolidated debt during each of the next five years and thereafter were as follows:

| (in thousands) |

Line of Credit (2) | Unsecured Term Loan |

Mortgage Notes |

Total | ||||||||||||

| Remainder of 2013 |

$ | — | $ | — | $ | 2,231 | $ | 2,231 | ||||||||

| 2014 |

— | — | 4,582 | 4,582 | ||||||||||||

| 2015 |

25,000 | — | 50,677 | 75,677 | ||||||||||||

| 2016 |

— | — | 17,655 | 17,655 | ||||||||||||

| 2017 |

— | — | 59,572 | 59,572 | ||||||||||||

| Thereafter |

— | 200,000 | 782,806 | 982,806 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total principal payments |

25,000 | 200,000 | 917,523 | 1,142,523 | ||||||||||||

| Unamortized premium on assumed debt |

— | — | 1,779 | 1,779 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 25,000 | $ | 200,000 | $ | 919,302 | $ | 1,144,302 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | We entered into LIBOR-based forward-starting interest rate swap agreements to hedge LIBOR on the unsecured term loan. The forward-starting interest rate swaps have an effective date of January 14, 2014 and will fix LIBOR at 0.98%, with an all-in interest rate ranging from 2.68% to 3.43%, depending on our consolidated leverage ratio. The forward-starting interest rate swaps will expire in October 2017. |

| (2) | The line of credit matures in August 2015 and may be extended pursuant to two one-year extension options, subject to certain conditions. |

13

| Unconsolidated Joint Ventures

|

We enter into joint ventures primarily for purposes of jointly investing in, developing, and acquiring industrial properties located in major U.S. distribution markets. The following table summarizes the Company’s unconsolidated joint ventures:

| Investment in Unconsolidated Joint Ventures as of |

||||||||||||||||

| (in thousands, except buildings) |

Percent Ownership |

Number of Buildings |

March 31, 2013 |

December 31, 2012 |

||||||||||||

| Institutional Joint Ventures: |

||||||||||||||||

| IIT North American Industrial Fund I Limited Partnership |

51 | % | 29 | $ | 94,279 | $ | 94,636 | |||||||||

| Other Joint Ventures: |

||||||||||||||||

| Park 355 DC II |

75 | % | — | (1) | 2,713 | — | ||||||||||

| Valley Parkway |

50 | % | — | (1) | 2,301 | 1,854 | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

29 | $ | 99,293 | $ | 96,490 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

IIT North American Industrial Fund I Limited Partnership

We have a 51% ownership interest in an unconsolidated joint venture with a subsidiary of a highly-rated, investment grade institutional investor. As of March 31, 2013, the unconsolidated joint venture owned 29 industrial buildings totaling 6.2 million square feet in eight major industrial markets throughout the U.S. with an aggregate purchase price of approximately $380 million. The following table summarizes financial information for the IIT North American Industrial Fund I Limited Partnership:

| For the Quarter Ended March 31, | ||||||||

| (in thousands, except number of buildings) |

2013 | 2012 | ||||||

| Operating data: |

||||||||

| Total revenues |

$ | 6,192 | $ | 6,164 | ||||

| Total operating expenses |

(6,683 | ) | (6,403 | ) | ||||

| Net loss |

(2,522 | ) | (1,867 | ) | ||||

| Other data (as of period end): |

||||||||

| Number of buildings |

29 | 25 | ||||||

| Total rentable square feet |

6,182 | 5,074 | ||||||

| Customers |

33 | 32 | ||||||

| As of March 31, 2013 |

As of December 31, 2012 |

|||||||

| Balance sheet data: |

||||||||

| Net investment in real estate properties |

$ | 374,154 | $ | 373,634 | ||||

| Cash and cash equivalents |

4,521 | 5,929 | ||||||

| Total assets |

397,507 | 396,347 | ||||||

| Debt |

206,578 | 204,652 | ||||||

| Total liabilities |

211,520 | 209,596 | ||||||

| Total equity |

185,987 | 186,751 | ||||||

| (1) | Each joint venture is developing one building. The building is currently under construction. |

14

| Definitions

|

Annualized Base Rent. Annualized base rent is calculated as monthly base rent (cash basis) per the terms of the lease as of March 31, 2013, multiplied by 12, and accounts for any tenant concessions.

Consolidated Portfolio. The consolidated portfolio excludes properties owned through our unconsolidated joint venture.

Development Portfolio. The development portfolio includes buildings acquired with the intention to reposition or redevelop, or buildings recently completed which have not yet reached stabilization. We generally consider a building to be stabilized on the earlier to occur of the first anniversary of a building’s completion or a building achieving 90% occupancy.

Funds from Operations (“FFO”) and Company-Defined FFO. We believe that FFO and Company-defined FFO in addition to net loss and cash flows from operating activities, as defined by GAAP, are useful supplemental performance measures that our management uses to evaluate our operating performance. However, these supplemental, non-GAAP measures should not be considered as an alternative to net loss or to cash flows from operating activities as an indication of our performance and are not intended to be used as a liquidity measure indicative of cash flow available to fund our cash needs, including our ability to make distributions to our stockholders. No single measure can provide users of financial information with sufficient information and only our disclosures read as a whole can be relied upon to adequately portray our financial position, liquidity, and results of operations. In addition, other REITs may define FFO and similar measures differently and choose to treat acquisition-related costs and potentially other accounting line items in a manner different from us due to specific differences in investment and operating strategy or for other reasons.

FFO. As defined by the National Association of Real Estate Investment Trusts (“NAREIT”), FFO is a non-GAAP measure that excludes certain items such as real estate-related depreciation and amortization. We believe FFO is a meaningful supplemental measure of our operating performance that is useful to investors because depreciation and amortization in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. We use FFO as an indication of our operating performance and as a guide to making decisions about future investments.

Company-defined FFO. Similar to FFO, Company-defined FFO is a non-GAAP measure that excludes real estate-related depreciation and amortization, and also excludes non-recurring acquisition-related costs (including acquisition fees paid to the Advisor) and a non-recurring loss from the early extinguishment of debt, each of which are characterized as expenses in determining net loss under GAAP. The purchase of operating properties is a key strategic objective of our business plan focused on generating operating income and cash flow in order to make distributions to investors. However, as the corresponding acquisition-related costs are paid in cash, all paid and accrued acquisition-related costs negatively impact our operating performance and cash flows from operating activities during the period in which properties are acquired. In addition, if we acquire a property after all offering proceeds from our public offerings have been invested, there will not be any offering proceeds to pay the corresponding acquisition-related costs. Accordingly, unless the Advisor determines to waive the payment or reimbursement of these acquisition-related costs, then such costs will be paid from additional debt, operational earnings or cash flow, net proceeds from the sale of properties, or ancillary cash flows. As such, Company-defined FFO may not be a complete indicator of our operating performance, especially during periods in which properties are being acquired, and may not be a useful measure of the long-term operating performance of our properties if we do not continue to operate our business plan as disclosed.

We are currently in the acquisition phase of our life cycle. Management does not include historical acquisition-related expenses in its evaluation of future operating performance, as such costs are not expected to be incurred once our acquisition phase is complete. In addition, management does not include a non-recurring loss from the early extinguishment of debt in its evaluation of future operating performance as the transaction that resulted in the loss was driven by factors relating to the capital markets, rather than factors specific to the on-going operating performance of our properties. We use Company-defined FFO to, among other things: (i) evaluate and compare the potential performance of the portfolio after the acquisition phase is complete, and (ii) evaluate potential performance to determine exit strategies. We believe Company-defined FFO could facilitate a comparison to other REITs that are not engaged in acquisition activity and have similar operating characteristics as us. We believe investors are best served if the information that is made available to them allows them to align their analyses and evaluation with these same performance metrics used by management in planning and executing our business strategy. We believe that these performance metrics will assist investors in evaluating the potential performance of the portfolio after the completion of the acquisition phase. However, these supplemental, non-GAAP measures are not necessarily indicative of future performance and should not be considered as an alternative to net loss or to cash flows from operating activities and are not intended to be used as a liquidity measure indicative of cash flow available to fund our cash needs. Neither the SEC, NAREIT, nor any regulatory

15

| Definitions

|

body has passed judgment on the acceptability of the adjustments used to calculate Company-defined FFO. In the future, the SEC, NAREIT, or a regulatory body may decide to standardize the allowable adjustments across the non-traded REIT industry at which point we may adjust our calculation and characterization of Company-defined FFO.

GAAP. Generally accepted accounting principles used in the United States.

Net Operating Income (“NOI”) and Cash NOI. We define (i) NOI as GAAP rental revenues less GAAP rental expenses and (ii) cash NOI as NOI (as previously defined), excluding non-cash amounts recorded for straight-line rents and the amortization of above and below market leases. We consider NOI and cash NOI to be appropriate supplemental performance measures. We believe NOI and cash NOI provide useful information to our investors regarding our financial condition and results of operations because NOI and cash NOI reflects the operating performance of our properties and excludes certain items that are not considered to be controllable in connection with the management of the properties, such as depreciation and amortization, acquisition-related expenses, general and administrative expenses, equity in loss of unconsolidated joint ventures, interest expense, and accounting adjustments for straight-line rent and the amortization of above and below market leases. However, NOI and cash NOI should not be viewed as an alternative measure of our financial performance since it excludes such expenses, which could materially impact our results of operations. Further, our NOI and cash NOI may not be comparable to that of other real estate companies as they may use different methodologies for calculating NOI and cash NOI. Therefore, we believe net loss, as defined by GAAP, to be the most appropriate measure to evaluate our overall performance. Refer to the reconciliation below of our GAAP net loss to NOI and cash NOI.

| For the Quarter Ended March 31, | ||||||||

| (in thousands) |

2013 | 2012 | ||||||

| Reconciliation of GAAP net loss to NOI: |

||||||||

| GAAP net loss |

$ | (10,917 | ) | $ | (6,862 | ) | ||

| Real estate-related depreciation and amortization |

27,282 | 10,545 | ||||||

| General and administrative expenses |

1,661 | 1,323 | ||||||

| Asset management fees |

4,532 | 2,105 | ||||||

| Acquisition costs |

2,729 | 3,139 | ||||||

| Other expenses |

12,884 | 6,376 | ||||||

|

|

|

|

|

|||||

| NOI |

$ | 38,171 | $ | 16,626 | ||||

|

|

|

|

|

|||||

| Straight-line rents |

(2,282 | ) | (1,694 | ) | ||||

| Amortization of above market leases, net |

1,055 | 848 | ||||||

|

|

|

|

|

|||||

| Cash NOI |

$ | 36,944 | $ | 15,780 | ||||

|

|

|

|

|

|||||

Occupied Rate / Leased Rate. The occupied rate reflects the square footage with a paying customer in place. The leased rate includes the occupied square footage and additional square footage with leases in place that have not yet commenced.

Operating Portfolio. The operating portfolio includes stabilized properties.

Same Store Operating Properties. The same store portfolio includes operating properties owned for the entirety of both the current period and prior period for which the operations have been stabilized. Properties that do not meet the same store criteria are included in “other properties” in “Selected Financial Data” above. The same store operating portfolio for the quarters ended March 31, 2013 and 2012 included 91 buildings.

Total Portfolio. The total portfolio includes both our consolidated and unconsolidated properties and assumes 100% ownership of our unconsolidated properties.

16