Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d538286d8k.htm |

Investor Presentation

May 2013

48,000 employees

200 offices

70 countries

1 global platform

Exhibit 99.1 |

Table of Contents

2

I.

Company Description

II.

Global Growth Strategy

III.

Financial Overview

IV.

Appendix |

Company

Description |

Shareholder opportunity

•

Leading global markets positions

•

Consolidator in a consolidating industry

•

Productivity and margin expansion

Premier global investment manager

•

LaSalle Investment Management provides outstanding

performance for global real estate investors

•

Investment expertise including core, value-add,

opportunistic investing across property types

•

More than 300 institutional clients worldwide

Shareholder value

•

Strong cash-generating business model

•

Revenue growth

•

Investment-grade balance sheet

•

Effective tax and interest expense management

Global real estate services

•

Strategic, fully integrated services for real estate

owners, occupiers and investors

•

Productivity and cost solutions for corporate clients

•

Industry

leader

recognized

for

deep

market

knowledge

and execution

Creating real value for clients and our firm

4 |

Jones

Lang Wootton founded

1783

1968

1997

1999

LaSalle Partners

founded

LaSalle Partners initial

public offering

LaSalle Partners and Jones

Lang Wootton merge to create

Jones Lang LaSalle

Integrated global platform

(NYSE ticker “JLL”)

Strategic M&A establishes premier market position

2008

The Staubach Company and

Jones Lang LaSalle combine operations

Largest merger in JLL history transforms

U.S. local markets position

King Sturge (est. 1760) and Jones Lang LaSalle merge EMEA operations

Enhances strength and depth of service capabilities in the UK and EMEA

1760

14% compound annual

revenue growth rate since

1999 merger

2011

5 |

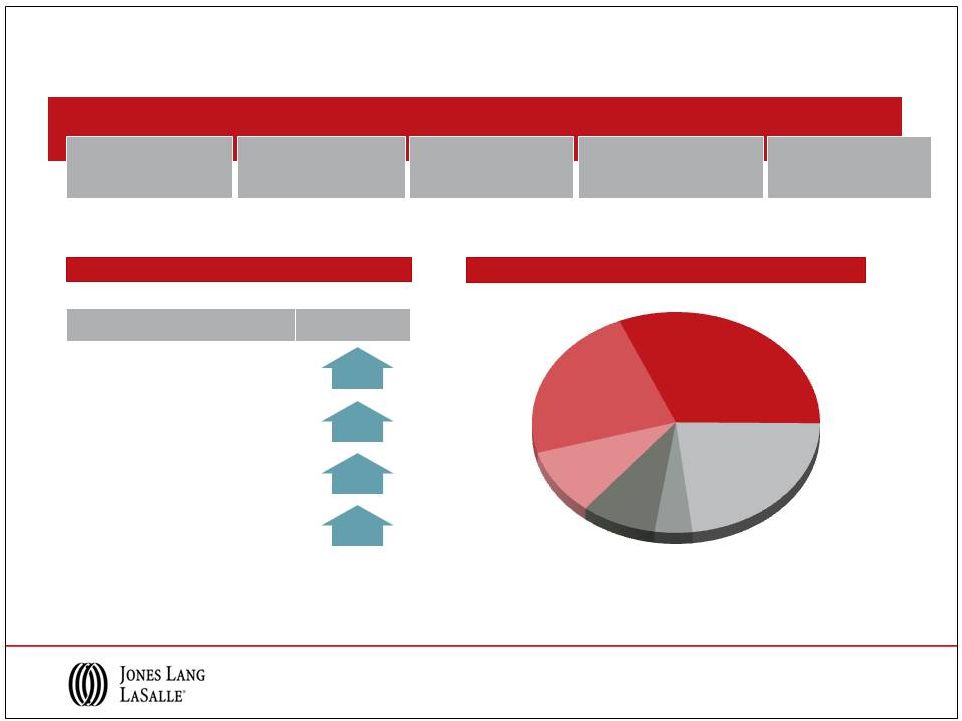

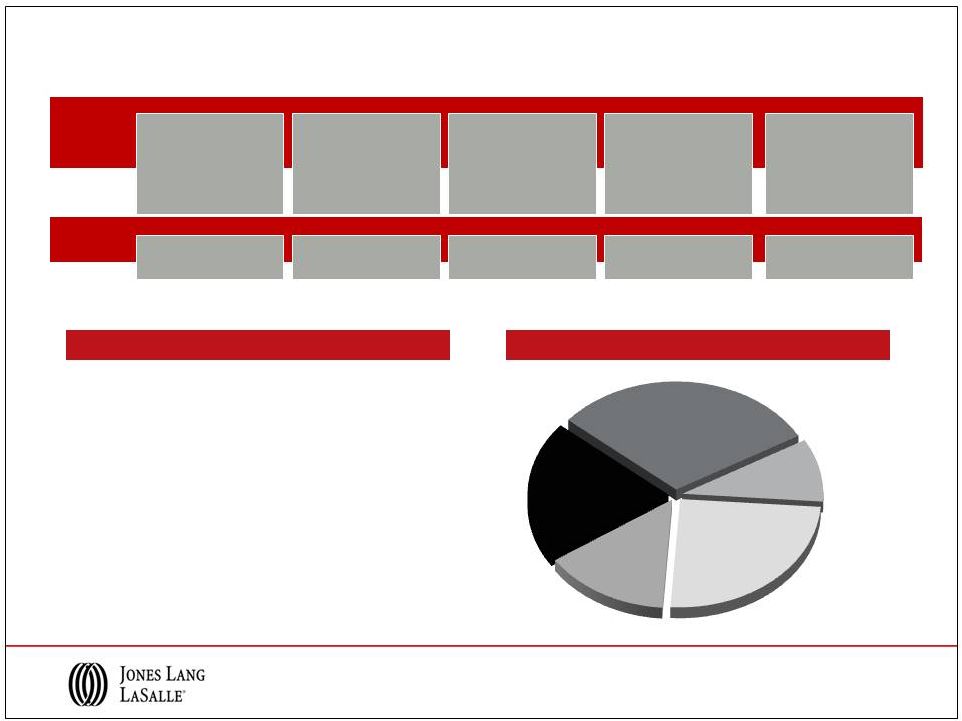

Delivering integrated services globally

2012 Fee Revenue = $3.6B

Global Distribution

Leasing

Advisory

& Other

LaSalle Inv. Mgmt.

Property & Facility

Mgmt.

Project &

Development

Services

Capital Markets

Other

United Kingdom

France

Germany

Other

Europe

Japan

Greater China

(incl. Hong Kong)

Australia

India

Singapore

EMEA

Asia Pacific

Americas

43%

5%

3%

4%

6%

7%

10%

13%

4%

3%

2%

United

States

6

10%

36%

14%

10%

23%

7% |

Repositioning Creates Opportunity: Trends from 2002 to 2012

Growth in a consolidating industry

Jones Lang LaSalle ($ in millions)

Fee Revenue

Adjusted Operating Income

Market Cap

1

~4x

$3,640

$860

2002

2012

~5x

$340

$67

2002

2012

~5x

$3,836

$786

2002

2012

(1) Based on peak share price in each year

7

Toward

centralized

decisions

Toward

larger,

global

service

providers

Toward

cross-border

investing

Toward

market

share

growth

for

established

brands

Trend

Opportunity

Complex corporate real estate portfolio decisions benefit

from JLL’s expertise

Few players possess JLL’s breadth of service

and reach

Global platform and deep research create opportunities for

cross-border investor clients

High-quality brand, reputation and platform attract

and retain top talent |

JLL

3-Year Performance Market Trends

Emerging markets to

lead global expansion

Demand for

local and global services

Outsourcing growth

continues

Top asset managers win

investor mandates

Industry

consolidation

(1)

Other Financing Activities include change in working capital, debt issue costs and

share activity related to taxes on stock awards Market share

expansion drives growth and cash generation 3-Year Cash from Earnings =

$962M New

Acquisitions

Deferred Acquisition

Obligations

Co-Investment

Other Financing

Activities¹

Dividends

CapEx

8

Metric

Growth

Revenue

34%

Adjusted Net Income

48%

Adjusted EBITDA

29%

Adjusted EPS

45%

23%

32%

23%

4%

8%

10% |

Global

Growth Strategy |

G5 global growth strategy

G4

G2

G3

G1

Build our local and

regional leasing

and capital

markets business

Capture the leading

share of global

capital flows for

investment sales

Strengthen our winning

positions in Corporate

Solutions

Grow LaSalle Investment

Management’s leadership

position

10

G5

CONNECTIONS:

Differentiate and Sustain |

Full-year Capital Markets & Leasing market volumes

2013 Leasing volumes projected flat to 2012 levels

2013 Capital Market volumes projected up 10% -

15% on 2012

11

Q1 2013 v. Q1 2012

FY 2013 v. FY 2012

Market Volumes

Market Volumes

Capital Markets

Americas

9%

15-20%

EMEA

28%

Flat

Asia Pacific

26%

10-15%

Total

20%

10-15%

Q1 2013 v. Q1 2012

FY 2013 v. FY 2012

Gross Absorption

Gross Absorption

Leasing

Americas (U.S. only)

5%

0-5%

EMEA (Europe only)

-2%

Flat

Asia Pacific (select markets)

-17%

-5-10%

Total

Flat

Flat |

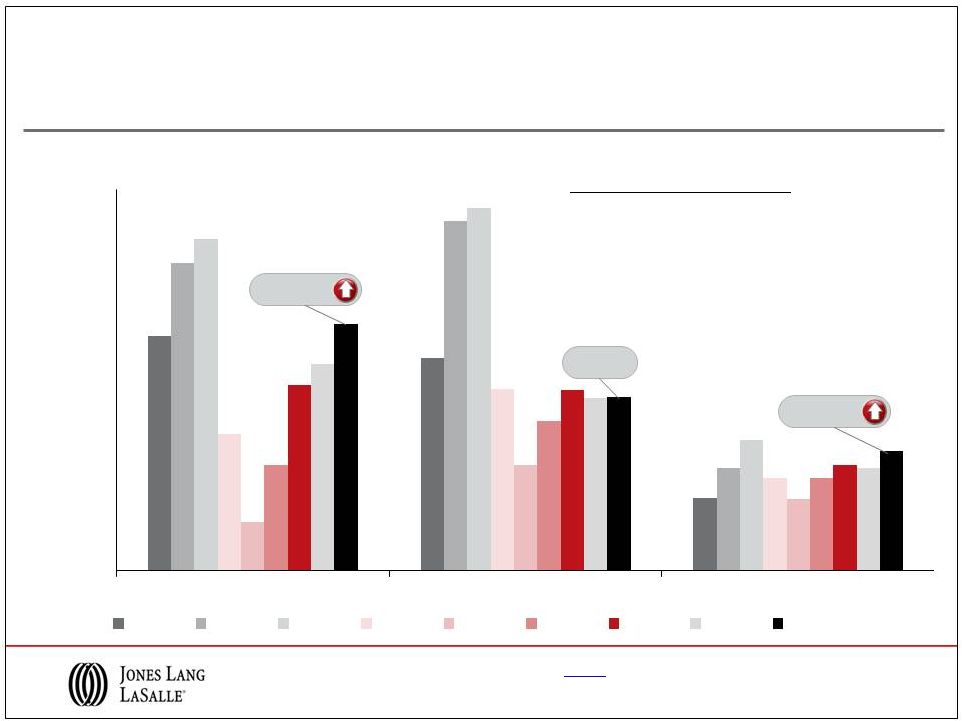

($ in

billions) Global capital flows for investment sales

* EMEA: In US$ terms, unchanged in Euro terms.

Source: Jones Lang LaSalle, April 2013

Direct Commercial Real Estate Investment, 2005-2013

2013 volumes projected up 10-15% on 2012

Projection updates as of Q1:

Americas:

Unchanged

EMEA:

Up 5% from previous forecast

Asia Pacific:

Previous forecast was up 15%

+15-20%

Click here

to see the JLL Global Market

Perspective

12

0

50

100

150

200

250

300

350

Americas

EMEA

Asia Pacific

2005

2006

2007

2008

2009

2010

2011

2012

2013 Projection

Flat

+10-15% |

Asia

Pacific EMEA

Americas

Leasing

Capital Markets

Scale and leadership in Leasing and Capital Markets

Market Outlook

Overall, Leasing volumes projected flat to 2012 levels

2013 Capital Markets volumes projected up

10%-15% on 2012

JLL Revenue

($ in millions)

**

*

* July 2008: Staubach Company acquired, annual revenue = $375 million

**May 2011: King Sturge acquired, annual revenue -

$260 million

13

$241

$373

$500

$638

$760

$830

$227

$247

$173

$203

$236

$250

$125

$133

$108

$159

$192

$198

2007

2008

2009

2010

2011

2012

$114

$61

$38

$84

$136

$169

$339

$196

$107

$141

$229

$235

$104

$60

$58

$81

$95

$109

2007

2008

2009

2010

2011

2012

$593

$781

$753

$1,000

$1,188

$1,278

$557

$317

$203

$306

$460

$513 |

Global outsourcing propels Corporate Solutions

Competitive Advantages

Global

Position

Transformational

outsourcing

Space

optimization

Portfolio transparency

Energy

management

Expertise across services & geographies to capitalize on market trends

JLL’s world-class capabilities

2012 JLL Client Wins

Scalable platform

Transaction

management

Single point of

accountability

Energy &

sustainability

Integrated Service

Wins

58

Wins

48

Expansions

39

Renewals

47

Large Corporations

Middle Market

14 |

Competitive Advantages

Diversified global

platform

Core, Value Add,

Opportunistic,

Public Equity

300+

institutional clients

Consistent client

services delivery model

Financial backing

of well-capitalized

parent company

Proven performance history with long-standing client relationships

($ millions)

2005 to 2012 Advisory Fees

Assets Under Management

Q1 2013 AUM = $48B

Performance drives LaSalle Investment Management

Building Advisory Fees in

Healthy Markets

Global Financial

Crisis

Stabilized

Advisory Fees

($ billions)

Fund Management $16.4

Public Securities $9.8

Separate Accounts $21.5

15

$128

$178

$245

$278

$242

$238

$245

$228

$0

$100

$200

$300

2005

2006

2007

2008

2009

2010

2011

2012 |

Consolidating industry leads to JLL opportunity

Transformative Results

The Staubach

Company

King Sturge

Meghraj

Trinity Funds

Management

Strategy

Establish leading U.S. local

market tenant rep position

Strengthen local market

scale, particularly in the UK

Augment India corporate business

with leading local presence

Gain scale and credibility

in Australia for LaSalle

Purchase Price

$613 million

£197 million

$60 million

A$9 million

Payment

Structure

36% upfront;

64% deferred over 5 years

50% upfront;

50% deferred over 5 years

50% upfront:

50% deferred over 5 years

100% upfront

EBITDA

multiple

8.0x notional,

7.0x on PV basis

7.5x notional,

7.0x on PV basis

7.5x

4.0x

Strategic

Align with

G5 strategy

Enhance service

delivery for clients

Cultural

alignment

Meet

financial goals

Financial

Profit growth to

shareholders

Neutral to accretive

EBITDA multiples

EPS accretive within

12-18 months

Maintain investment

grade strength

16 |

Financial Overview |

Note:

2012 and 2011 adjusted for restructuring and intangible amortization. 2012

Fee

Revenue

Adjusted

Net Income

$245M

Adjusted

EPS

$5.48

Adjusted

EBITDA

$436M

Adjusted EBITDA

Margin

12.0%

Gross revenue : $3.9B

2011

$215M

$4.83

$395M

11.7%

$3.4B

US GAAP: $164M

US GAAP: $3.70

EBITDA: $339M

EBITDA margin: 9.5%

Gross Revenue: $3.6B

US GAAP: $208M

US GAAP: $4.63

EBITDA: $391M

EBITDA margin: 9.9%

6% revenue growth against strong prior-year quarter,

record first quarter revenue

Healthy Capital Markets & Hotels performance and

continued growth in Property & Facility Management

Q1 2013 Real Estate Services Adjusted EBITDA up

26% to $34M

Focus on market share growth and improved

productivity across the firm

$3.6B

Consolidated earnings scorecard

Q1 2013 Performance & Priorities

2012 Revenue Contribution

Americas

LIM

Asia Pacific

EMEA

18

44%

27%

22%

7%

Margin is calculated on a fee revenue basis. |

Q1 2013 Real Estate Services revenue

($ in millions; % change in USD

over Q1 2012)

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes

gross contract costs.

19

Leasing

$152.3

2%

$48.9

3%

$28.0

(16%)

$229.2

0%

Capital Markets & Hotels

$38.7

39%

$58.2

48%

$23.8

10%

$120.7

36%

Property & Facility

Management

$108.5

7%

$42.7

0%

$99.9

4%

$251.1

4%

Fee Revenue

$89.4

4%

$40.4

(2%)

$82.3

11%

$212.1

5%

Project & Development

Services

$37.9

(4%)

$56.0

11%

$19.7

13%

$113.6

6%

Fee Revenue

$37.7

(5%)

$24.1

0%

$15.3

4%

$77.1

(2%)

Advisory,

Consulting & Other

$24.1

5%

$39.1

2%

$18.5

5%

$81.7

3%

Total RES Operating

Revenue

$361.5

6%

$244.9

12%

$189.9

2%

$796.3

7%

Fee Revenue

$342.2

5%

$210.7

11%

$167.9

4%

$720.8

6%

Americas

EMEA

Asia Pacific

Total RES |

2012

Fee

Revenue

Operating Income

$168M

Operating Income

Margin

10.1%

EBITDA

$210M

EBITDA Margin

12.7%

Gross revenue : $1.7B

2011

$163M

10.8%

$201M

13.4%

$1.5B

Revenue growth driven by Capital Markets &

Hotels, market share gains continued

EBITDA margin expansion; 7.3% in Q1 2013 vs

6.7% in Q1 2012

Solid Leasing pipelines for remainder of 2013;

conversion dependent on client confidence

$1.7B

Americas Real Estate Services

Q1 2013 Performance & Priorities

2012 Revenue Contribution

20

United

States

92%

Brazil 3%

Canada 2%

Mexico 1%

Other

Americas 2%

Note: Margin is calculated on a fee revenue basis. See Appendix for calculation

of fee revenue. EBITDA margin for 2012 and 2011 would have been ~13.0%

after adjusting 2012 compensation expense for the Staubach acquisition payment and adjusting 2011

compensation expense for the elimination of SOP. |

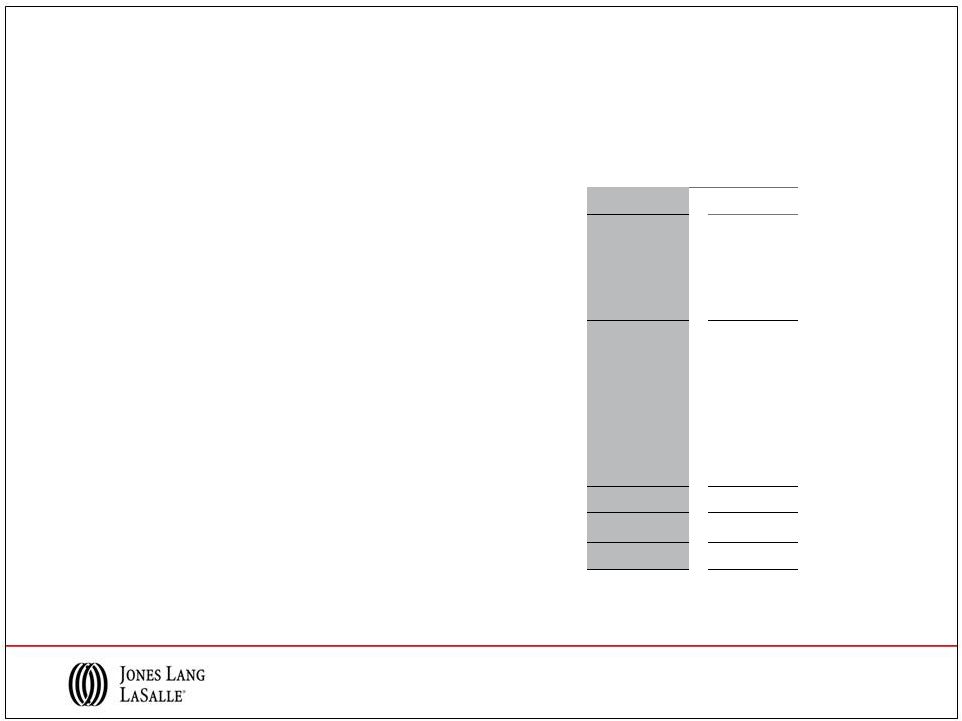

2012

Fee

Revenue

Operating Income

$58M

Operating Income

Margin

6.2%

EBITDA

$75M

EBITDA Margin

8.0%

Gross revenue : $1.0B

2011

$39M

4.4%

$57M

6.5%

$888M

Revenue growth driven by Capital Markets &

Hotels and, geographically, by Russia and the UK

Positive Q1 2013 EBITDA vs. loss in Q1 2012;

driven by 2012 cost actions and productivity

initiatives

Continue to improve margins through 2013 with

focus on technology, innovation and productivity

$936M

EMEA Real Estate Services

Q1 2013 Performance & Priorities

2012 Revenue Contribution

Note: Operating income has been adjusted to exclude $5 million of King Sturge

intangibles amortization. Margin is calculated on a fee revenue

basis. See Appendix for calculation of fee revenue. 21

U.K. 41%

France 17%

Germany

12%

Russia 4%

Spain 4%

Netherlands

3%

Belgium 3%

Italy 2%

MENA 2%

Other EMEA

12% |

2012

Fee

Revenue

Operating Income

$65M

Operating Income

Margin

8.4%

EBITDA

$78M

EBITDA Margin

10.0%

Gross revenue : $876M

2011

$66M

9.3%

$78M

11.0%

$731M

Revenue growth led by annuity fees in Property &

Facility Management and transactional growth in

Capital Markets & Hotels

Geographically, Q1 2013 growth driven by Hong

Kong, China and Southeast Asia

Winning Corporate Solutions business continues to

generate profitable, recurring revenue

$781M

Asia Pacific Real Estate Services

Q1 2013 Performance & Priorities

2012 Revenue Contribution

Note:

Margin

is

calculated

on

a

fee

revenue

basis.

See

Appendix

for

calculation

of

fee

revenue.

22

Australia

31%

Greater

China (inc.

Hong Kong)

26%

India 13%

Japan 14%

Singapore

6%

Thailand 2%

New Zealand

2%

Other

Asia

6% |

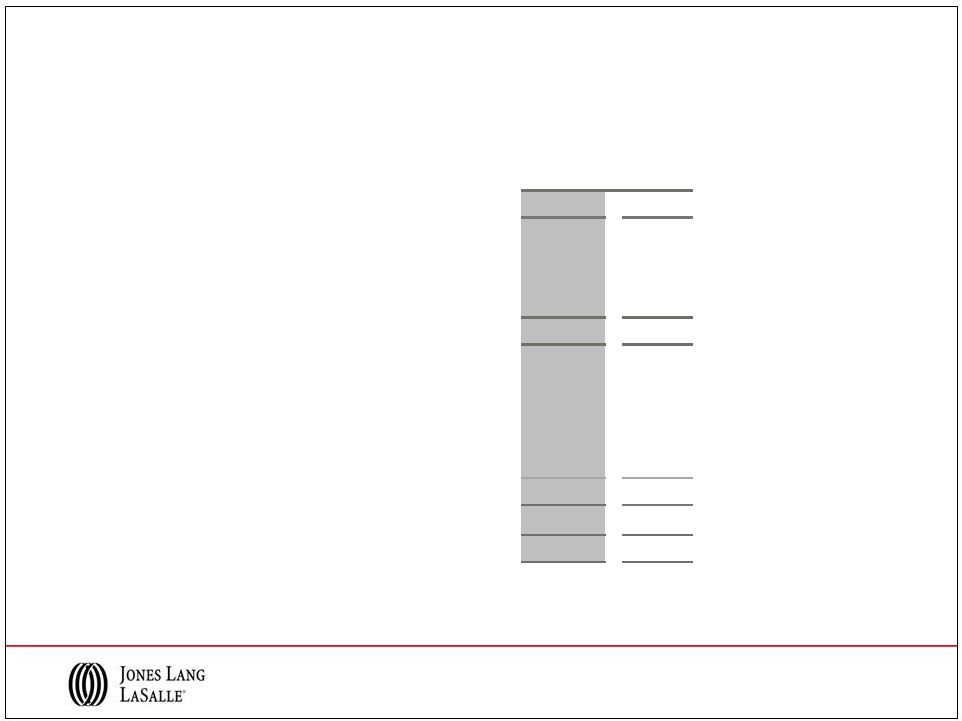

2012

Fee

Revenue

Operating Income

$72M

Operating Income

Margin

25.2%

EBITDA

$74M

EBITDA Margin

25.9%

2011

$57M

20.7%

$60M

21.7%

$275M

Stabilized advisory fees provide strong base for

financial performance

Improved investment activity and capital raising

provide potential for advisory fee growth

Strong incentive fees and equity earnings of $20M

in Q1 2012 compares with $5M in Q1 2013

Expect significantly lower incentive fees for FY

2013 compared with FY 2012

$285M

LaSalle Investment Management

Q1 2013 Performance & Priorities

Q1 2013 Assets Under Management

($ in billions)

Note: AUM data reported on a one-quarter lag.

23

U.K.

$14.6

Continental

Europe

$4.5

North

America

$11.9

Asia

Pacific

$6.9

Public

Securities

$9.8 |

24

Strong balance sheet position

•

Investment

grade

balance

sheet;

Baa2

/

BBB-

(Stable)

•

Healthy net debt position after Q1 2013 incentive

compensation payments

•

Semi-annual dividend increased by 10%

to $0.22 per share from $0.20 per share

–

Payment date June 14, 2013

•

Modest Q1 Capital Spending

–

Cap Ex

$13M

–

Deferred Acquisition Payments

$ 3M

–

Co-Investment

$ 7M

Balance Sheet

Q1

Q4

$ millions

2013

2012

Cash

$ 133

$ 152

Short Term Borrowings

38

32

Credit Facility

470

169

Net Bank Debt

$ 375

$ 49

LT Senior Notes

275

275

Deferred Acquisition

Obligations

220

214

Total Net Debt

$ 870

$ 538

Q1 2013 Highlights

Low debt cost: Q1 2013 net interest expense of $7.9M

Credit facility capacity of $1.1B

Diversified funding sources with $275M, 4.4% coupon Long Term

Senior Notes issued in Q4 2012 |

Jones

Lang LaSalle Integrated global

services

Industry-leading

research and market

expertise

Superior client

relationship

management

Strong

brand

Investment-grade

balance sheet

Solid performance in growth opportunities

JLL actions for continued success

Optimism returning to global markets

Leverage global positions to grow market share and

continue client success in local markets

Increase productivity and manage costs to improve margin

Continue to invest strategically to capitalize

on market consolidation

Maintain financial strength and flexibility to respond to

opportunities and challenges

On-going industry consolidation

trends continue

Continuing growth in

corporate outsourcing

Steady institutional capital flows

into global real estate

25 |

Appendix |

as of

Q1 2013 Leasing Values

Source: Jones Lang LaSalle

Asia Pacific

EMEA

Americas

as of Q1 2013

Capital Values

JLL

Property

Clocks

SM

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Values

bottoming out

Capital Values

falling

Paris, Beijing

Madrid

Brussels

Shanghai

London

Frankfurt

Moscow

Berlin, San Francisco

Washington DC, Toronto

Amsterdam

Dallas

Mexico City, Sydney

New York, Chicago, Sao Paulo

Boston, Los Angeles, Stockholm

Houston

Hong Kong

Seoul

Tokyo

Singapore

Mumbai

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Washington DC

New York

Johannesburg

Istanbul, Tokyo

Boston

Los Angeles, Dubai

San Francisco

Houston

Brussels, Singapore, Shanghai

Dallas,

London

Paris

Milan

Frankfurt

Moscow

Berlin

Stockholm

Amsterdam, Sao Paulo

Chicago,

Madrid

Mexico City

Toronto

Beijing

Hong

Kong

Seoul

Mumbai

Sydney

Rome

27 |

FY 2012 Real Estate Services revenue

($

in

millions;

%

change

in

USD

over

FY

2011)

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross

contract costs.

28

Leasing

$829.6

9%

$250.0

6%

$198.2

3%

$1,277.8

7%

Capital Markets & Hotels

$168.5

24%

$235.1

3%

$109.3

15%

$512.9

12%

Property & Facility

Management

$458.7

31%

$155.2

5%

$398.4

9%

$1,012.3

17%

Fee Revenue

$375.0

14%

$155.2

5%

$319.9

12%

$850.1

12%

Project & Development

Services

$182.9

3%

$219.8

21%

$83.5

3%

$486.2

10%

Fee Revenue

$182.1

2%

$106.5

11%

$67.2

13%

$355.8

7%

Advisory,

Consulting & Other

$107.0

9%

$189.1

6%

$86.1

6%

$382.2

7%

Total RES Operating

Revenue

$1,746.7

15%

$1,049.2

8%

$875.5

7%

$3,671.4

11%

Fee Revenue

$1,662.2

11%

$935.9

5%

$780.7

10%

$3,378.8

8%

Americas

EMEA

Asia Pacific

Total RES |

Q1 2013 Real Estate Services revenue

($

in

millions;

%

change

in

local

currency

over

Q1

2012)

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). Fee revenue presentation of

Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross

contract costs.

29

Leasing

$152.3

2%

$48.9

4%

$28.0

(15%)

$229.2

0%

Capital Markets & Hotels

$38.7

39%

$58.2

50%

$23.8

12%

$120.7

37%

Property & Facility

Management

$108.5

7%

$42.7

0%

$99.9

8%

$251.1

6%

Fee Revenue

$89.4

5%

$40.4

(2%)

$82.3

14%

$212.1

7%

Project & Development

Services

$37.9

(4%)

$56.0

11%

$19.7

17%

$113.6

7%

Fee Revenue

$37.7

(4%)

$24.1

0%

$15.3

7%

$77.1

(1%)

Advisory,

Consulting & Other

$24.1

6%

$39.1

3%

$18.5

7%

$81.7

5%

Total RES Operating

Revenue

$361.5

6%

$244.9

13%

$189.9

5%

$796.3

8%

Fee Revenue

$342.2

5%

$210.7

12%

$167.9

7%

$720.8

7%

Americas

EMEA

Asia Pacific

Total RES |

Fee revenue / expense reconciliation

Note: Consolidated Revenue and Fee Revenue exclude Equity earnings (losses).

•

Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue

and expense in JLL financial statements have been steadily increasing

•

Margins diluted as gross-accounting requirements increase revenue and costs without

corresponding profit •

Business managed on a “fee”

basis to focus on margin expansion in the base business

($ in millions)

2013

2012

Consolidated Revenue

856.0

$

813.3

$

Consolidated Operating Expenses

832.7

789.8

Adjusted Operating Income Margin

2.8%

3.2%

Gross Contract Costs:

Property & Facility Management

19.1

15.8

Project & Development Services

0.2

0.1

Total Gross Contract Costs

19.3

15.9

Property & Facility Management

2.3

1.4

Project & Development Services

31.9

26.3

Total Gross Contract Costs

34.2

27.70

Property & Facility Management

17.6

22.1

Project & Development Services

4.4

2.7

Total Gross Contract Costs

22.0

24.8

Consolidated Fee Revenue

780.5

$

744.3

$

Consolidated Fee-based Operating Expenses

757.2

$

721.4

$

Adjusted Operating Income Margin ("fee"-based)

3.1%

3.4%

Asia Pacific

Americas

EMEA

30 |

Reconciliation of GAAP net income to adjusted net income and

calculations of earnings per share

Three Months Ended

March 31,

($ in millions)

2013

2012

GAAP Net income attributable to common

shareholders

$ 13.2

$ 14.0

Shares (in 000s)

45,055

44,685

GAAP earnings per share

$ 0.29

$ 0.31

GAAP Net income attributable to common

shareholders

$ 13.2

$ 14.0

Restructuring and acquisition charges, net

2.4

6.7

Intangible amortization, net

0.4

1.6

Adjusted net income

$ 16.0

$ 22.3

Shares (in 000s)

45,055

44,685

Adjusted earnings per share

$ 0.36

$ 0.50

31 |

Three

Months Ended March 31,

($ in millions)

2013

2012

Operating Income

20.1

14.6

Restructuring and acquisition charges

3.2

9.0

Intangible amortization

0.6

2.1

Adjusted Operating Income

23.9

25.7

GAAP Net income attributable to common shareholders

13.2

$ 14.0

Interest expense, net of interest income

7.9

7.4

Provision for income taxes

4.4

4.8

Depreciation and amortization

19.1

19.7

EBITDA

$ 44.6

$ 45.9

Restructuring and acquisition charges

3.1

9.0

Adjusted EBITDA

$ 47.7

$ 54.9

Reconciliation of GAAP operating income to adjusted operating

income and net income to adjusted EBITDA

32 |

Forward-looking statements

33

Statements in this presentation regarding, among other things, future financial results

and performance, achievements, plans and objectives and dividend payments may be

considered forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks,

uncertainties and other factors which may cause actual results, performance,

achievements, plans and objectives of Jones Lang LaSalle to be materially

different from those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially include those discussed

under “Business,” “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and

Qualitative Disclosures about Market Risk,” “Cautionary Note Regarding

Forward-Looking Statements” and elsewhere in Jones Lang LaSalle’s

Annual Report on Form 10-K for the year ended December 31, 2012, in the Quarterly Report on

Form 10-Q for the quarter ended March 31, 2013 and in other reports filed with the

Securities and Exchange Commission. There can be no assurance that future

dividends will be declared since the actual declaration of future dividends, and

the establishment of record and payment dates, remains subject to final determination by the

Company’s Board of Directors. Statements speak only as of the date of this

presentation. Jones Lang LaSalle expressly disclaims any obligation or undertaking

to update or revise any forward-looking statements contained herein to reflect

any change in Jones Lang LaSalle’s expectations or results, or any change in events.

© Jones Lang LaSalle IP, Inc. 2013. All rights reserved. No part of this publication

may be reproduced by any means, whether graphically, electronically, mechanically

or otherwise howsoever, including without limitation photocopying and recording on

magnetic tape, or included in any information store and/or retrieval system without prior written

permission of Jones Lang LaSalle IP, Inc.

|