Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST FINANCIAL SERVICE CORP | v345252_8k.htm |

Shareholder Meeting May 15, 2013 1

This presentation contains forward - looking statements, including statements about beliefs and expectations based on the information available to, and assumptions and estimates made by, management as of the date made. These forward - looking statements cover, among other things, anticipated future revenue, expenses, capital ratios, and the future plans and prospects of First Federal Savings Bank. For a discussion of the risks and uncertainties that may cause actual results to differ from these expectations and our other forward - looking statements, refer to First Financial Service Corporation’s 2012 Annual Report on Form 10 - K, including the “Risk Factors” section, and other periodic reports filed with the Securities and Exchange Commission. Forward - looking statements speak only as of the date they are made, and First Financial Service Corporation undertakes no obligation to update them in light of new information or future events 2

Progress for 2012 Major Objectives for 2013 Question and Answer 3

Our Heart Is In Everything we Do! For Associates with the Passion to Serve. Helping Every Customer Succeed! 4

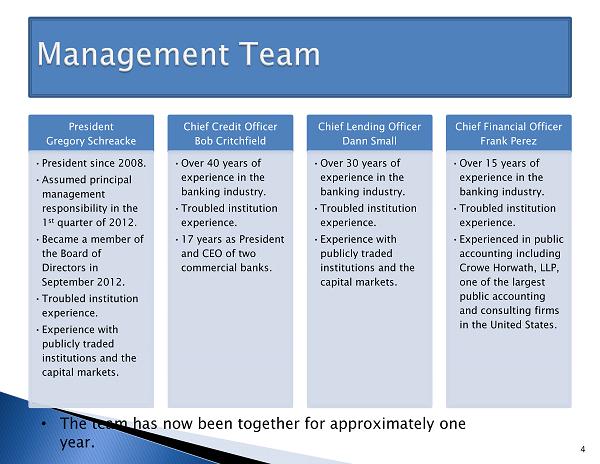

President Gregory Schreacke • President since 2008. • Assumed principal management responsibility in the 1 st quarter of 2012. • Became a member of the Board of Directors in September 2012. • Troubled institution experience. • Experience with publicly traded institutions and the capital markets. Chief Credit Officer Bob Critchfield • Over 40 years of experience in the banking industry. • Troubled institution experience. • 17 years as President and CEO of two commercial banks. Chief Lending Officer Dann Small • Over 30 years of experience in the banking industry. • Troubled institution experience. • Experience with publicly traded institutions and the capital markets. Chief Financial Officer Frank Perez • Over 15 years of experience in the banking industry. • Troubled institution experience. • Experienced in public accounting including Crowe Horwath, LLP, one of the largest public accounting and consulting firms in the United States. • The team has now been together for approximately one year. 4

Chief Retail Officer Anne Moran • Chief Retail Officer Since 1999. • Responsible for our retail sales and service culture, our full service retail locations, call center, marketing, and our retail products and services. Chief Operations Officer Charles Chaney • EVP and Chief Operating Office since 1999. • Joined the bank in 1976 • Responsible for loan and deposit operations, information technology, and facilities management. Director of Human Resources Susan Simmons • Director of Human Resources for the past 16 years. • Board member of the Elizabethtown Society for Human Resource Management(SHRM) • Board Member for the Kentucky Society for Human Resource Management. Risk Management Tanya Deneen • Responsible for management of the departments of internal audit and internal loan review. • Overseeing the development of the bank’s consumer compliance program. • Reports directly to the Board of Directors. • The team has now been together for approximately one year. 5

Our associates are key to everything we do. ◦ Take care of our associates. Best place to work Eight Years in a Row. ◦ Take care of customers. ◦ Take care of community. ◦ Take care of our shareholders. 7

Significant progress was accomplished in 2012 and this positive momentum is carrying into 2013. This progress places the Company in a strong position coming out of the credit cycle. 8

Return the Company to a Safe and Sound Position through: ◦ Problem asset resolution. Lowering overall risk profile. ◦ Capital restoration. ◦ Structure for future profitability. 9

Return the Company to a Safe and Sound Position through: ◦ Problem asset resolution. Lowering overall risk profile. ◦ Capital restoration. ◦ Structure for future profitability. 10

Significant time and resources allocated towards problem asset resolution. ◦ Dedicated special asset personnel with experience. Problem asset workouts. Problem loan structuring. Property management. Asset disposition. Asset Quality Remediation was our top priority. 11

Significant progress has been made. ◦ Non - performing loans $43 million reduction. 71% improvement from the peak. 12

13 10,000 20,000 30,000 40,000 50,000 60,000 70,000 In Thousands

Significant progress has been made. ◦ Non - performing loans. $43 million reduction. 71% improvement from the peak. ◦ Non - performing assets. $48 million reduction. 57% improvement from the peak. 14

15 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 In Thousands

Significant progress has been made. ◦ Non - performing loans. $43 million reduction. 71% improvement from the peak. ◦ Non - performing assets. $48 million reduction. 57% improvement from the peak. ◦ Substandard loans. $65 million reduction. 61% improvement from the peak. 16

17 20,000 40,000 60,000 80,000 100,000 120,000 In Thousands

NPA’s decline to $29 million. Improvement beyond quarter end. Sales contracts executed on properties after March 31, 2013. $ 5 million book value to close by June 30, 2013. $ 4 million book value to close by September 30, 2013. 18 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Non - performing assets

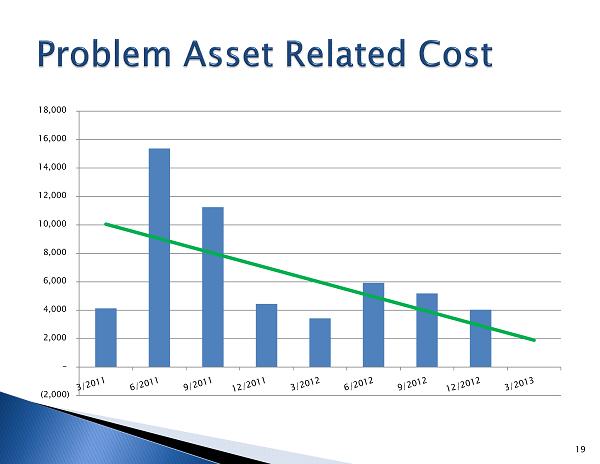

19 (2,000) - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000

Return the Company to a Safe and Sound Position through: ◦ Problem asset resolution. Lowering overall risk profile. ◦ Capital restoration. ◦ Structure for future profitability. 20

Place the Company in the strongest position to increase equity and reach the requirements of Regulatory Order. ◦ Two ways to increase the Bank’s capital ratio. ◦ Build capital through an asset reduction. Sold our four Southern Indiana branches. $115 million in deposits, $30 million in loans. Net gain on the sale of $3.1 million. A solid, profitable core Kentucky Franchise remains. Organic reduction in high cost deposits continue in lieu of Louisville branch sale. ◦ Time to stabilize credit quality, generate earnings to augment capital. 21

Private investors purchased our Capital Purchase Program Securities under TARP from the U.S. Treasury on 4/19/2013 . Improved credit quality, lower risk profile, and improved operations allowed the Company to attract investors. Earnings will begin to build capital further improving capital position. 22

23 7.08% 6.31% 5.95% 5.86% 5.90% 5.73% 6.50% 6.53% 6.84% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% Tier I Leverage Ratio – Positive Trend

24 11.43% 10.48% 9.94% 10.18% 10.70% 10.66% 11.88% 12.21% 12.33% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% Total Risk Based Capital Ratio – In Compliance with Order

Return the Company to a Safe and Sound Position through: ◦ Problem asset resolution. Lowering overall risk profile. ◦ Capital restoration. ◦ Structure for future profitability. 25

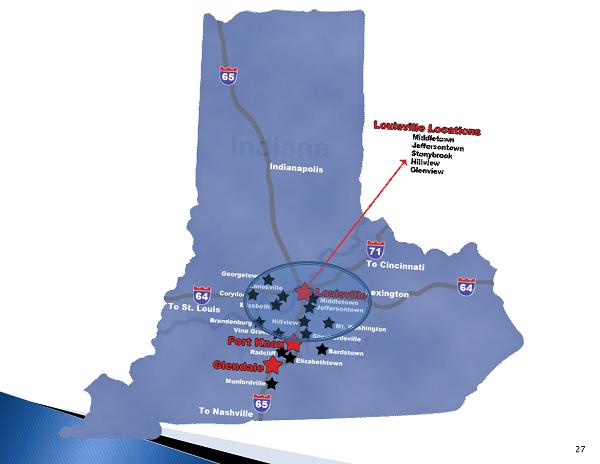

Great markets. Strong franchise. Leader in market share. Processes in place to attract retail and business customers. Experienced lending team combined with an experienced, professional retail team. Associates with their Heart in Everything they do. 26

27

Diversified industry base. Louisville is the 29 th Largest Metropolitan Statistical Area in the United States. Population over 1 million people. Favorable cost of living as well as quality of living. 28

UPS University of Louisville. Headquarters of several major brands: Churchill Downs Yum! Papa John’s Pizza Brown - Forman Corporation Jim Beam, Makers Mark Louisville Slugger Texas Roadhouse. Several Major and Regional Medical Facilities. 29

30

Fort Knox $322 million increase in annual payroll. 1,188 Multi - family Units, 2,441 Single - family Units in E - Town MSA since 2007 E - Town MSA compensation increased 42.3% 2006 - 2011 UPS Zappos , Amazon Logistics Several Major and Regional Medical Facilities 31

Overall Sales Performance Member/Customer Sales Performance Top Dog Performer Smart Financial Credit Union Houston, TX 4.5884 Program Participant Since 5/1/2008 Runner Up First Federal Savings Bank Elizabethtown, KY 4.5882 Program Participant Since 5/1/2007 32 IN - Reflects the sale of the Indiana Branches in the graph

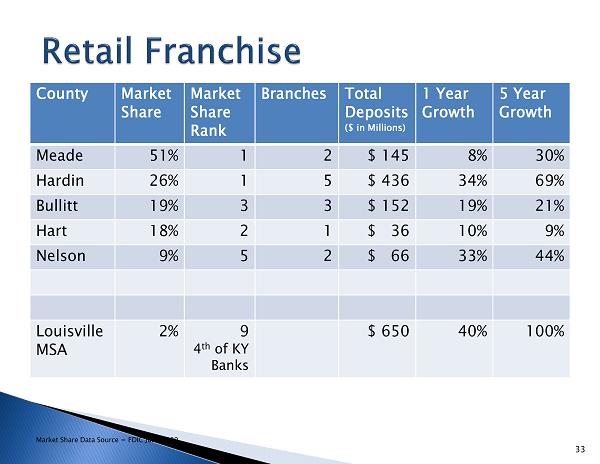

County Market Share Market Share Rank Branches Total Deposits ($ in Millions) 1 Year Growth 5 Year Growth Meade 51% 1 2 $ 145 8% 30% Hardin 26% 1 5 $ 436 34% 69% Bullitt 19% 3 3 $ 152 19% 21% Hart 18% 2 1 $ 36 10% 9% Nelson 9% 5 2 $ 66 33% 44% Louisville MSA 2% 9 4 th of KY Banks $ 650 40% 100% Market Share Data Source = FDIC June 2009 33

Leading Market Share with 22% Next Largest Competition 8% Strong Local Community Banking Presence in Five Counties Market Growth 5% Annually 22%

Branch business calling program and dedicated cash management specialist compliment Small Business Banking Team. ◦ Spotlight on Business. ◦ Quarterly Business Seminar Series. 35

Established a Small Business Banking team . • Focus on businesses with lending needs below $250,000. Enhanced our Commercial relationship management and credit team. • Expertise in commercial real estate. • Expertise commercial & i ndustrial cash flow lending. • Strengthen our lending foundation and experience. 36

Alan Grimble Senior Vice President CRM • 25 years experience. • Experienced in Commercial Real Estate, C&I Cash Flow, Commercial loan start up department manager. • Positions held: CEO, VP/Commercial Manager. Charles (Chuck) Darst Senior Vice President CRM • 27 years experience. • Experienced in Commercial Real Estate, Executive Management Team, and CEO. • Knows Louisville market inside and out. • Positions held: CRM, CEO, Vice President, Internal Auditor. James(Jimmy) Hunter Senior Vice President CRM • 13 years experience. • Experienced in Team Leader Commercial Real Estate, C&I, Credit Manager, Senior Credit Analysis. • Positions held: Vice President Commercial, Vice President Business Banking, Vice President/Senior Credit Analyst. G. Michael Mitchell Vice President CRM • 9 years experience. • Experienced in Middle Market, C&I, Private Banking, Business Banking, Cash Flow Analysis. • Positions held: Senior Commercial Credit PM, Portfolio Manager, Assistant Vice President, RM Commercial Real Estate. 38

Focus on profitability. ◦ Back in the lending business. ◦ Asset allocation toward diversified lending. ◦ Centralization of mortgage, consumer, and small business underwriting. Efficiency, more competitive, increased production. ◦ Fee Income Expansion. Mortgage loan sales. ◦ Business Banking. ◦ Efficiency focus. ◦ Additional fee based products and services. ◦ Making some progress. 38

39 In Thousands (14,000) (12,000) (10,000) (8,000) (6,000) (4,000) (2,000) - 3/2011 6/2011 9/2011 12/2011 3/2012 6/2012 9/2012 12/2012 3/2013 Quarterly Trends Improving

Progress for 2012 Major Objectives for 2013 Question and Answer 40

Return to Sustained Profitability. ◦ Primary Focus. Capital Restoration. Asset Quality Remediation. 41

Great Companies have the Will to Win! Set a goal to be the best! You have to Want to Win! -- Tom Brown

Progress for 2012 Major Objectives for 2013 Question and Answer 43

44