Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hi-Crush Inc. | d536377d8k.htm |

| EX-99.1 - EX-99.1 - Hi-Crush Inc. | d536377dex991.htm |

Investor Presentation

May 2013

Exhibit 99.2 |

Forward Looking Statements

Some of the information in this news release may contain forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”).

Forward-looking

statements

give

our

current

expectations

and

may

contain

projections

of

results

of

operations

or

of

financial

condition,

or

forecasts

of

future

events.

Words

such

as

“may,”

“assume,”

“forecast,”

“position,”

“predict,”

“strategy,”

“expect,”

“intend,”

“plan,”

“estimate,”

“anticipate,”

“could,”

“believe,”

“project,”

“budget,”

“potential,”

or “continue,”

and similar

expressions are used to identify forward-looking statements. They can be

affected by assumptions used or by known or unknown risks or uncertainties.

Consequently, no forward-looking statements can be guaranteed. When considering these

forward-looking

statements,

you

should

keep

in

mind

the

risk

factors

and

other

cautionary

statements

in

Hi-Crush’s

reports

filed

with the Securities and Exchange Commission (“SEC”), including those

described under Item 1A of Hi-Crush’s Form 10-K for the fiscal

year ended December 31, 2012 and any subsequently filed Form 10-Q. Actual results may vary materially. You are

cautioned not to place undue reliance on any forward-looking statements. You

should also understand that it is not possible to predict

or

identify

all

such

factors

and

should

not

consider

the

risk

factors

in

our

reports

filed

with

the

SEC

or

the

following

list

to

be a complete statement of all potential risks and uncertainties. Factors

that could cause our actual results to differ materially from

the

results

contemplated

by

such

forward-looking

statements

include:

the

volume

of

frac

sand

we

are

able

to

sell;

the

price

at which we are able to sell frac sand; the outcome of any pending litigation;

changes in the price and availability of natural gas or electricity; changes

in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are

expressly qualified in their entirety by the foregoing cautionary statements.

Hi-Crush’s forward looking statements speak only as of the date

made and Hi-Crush undertakes no obligation to update or revise its forward-looking statements, whether as a result

of new information, future events or otherwise.

2 |

Our

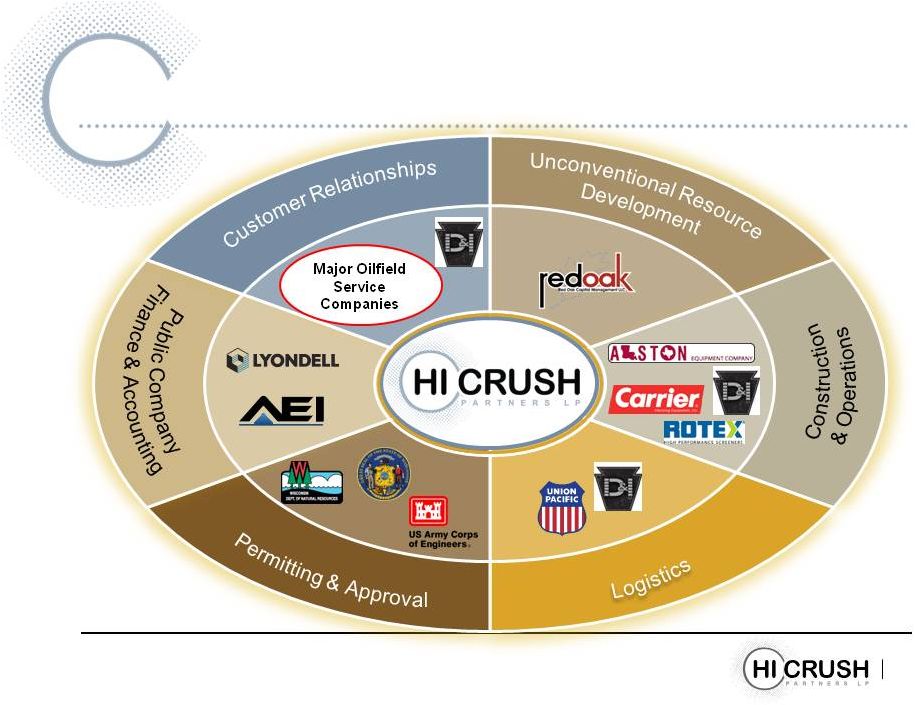

Platform for Growth 3

Increasing Northern

White sand usage

Constraints on

supply growth

Increased drilling

and completion

efficiencies

Market favors API

spec, consistently

high quality sand

Lowest-cost producer

53.9 million ton

reserve base with

significant cost

structure advantages

Fixed price /

volume contracts

with 2.9 years

weighted

average life

Tenured

relationships with

customers

Strong Industry

Fundamentals

High Quality

Reserve Base

Industry

Leading Cost

Advantage

Long-Term,

Contracted

Cashflow

State-of-the-art,

efficient and

modern plant

design

Rail logistics

capabilities |

4

Extensive expertise in

developing sand mining

and processing facilities

Substantial management

ownership incentivized

by distribution growth

Increased volume

Contributions from

sponsor

Organic expansion

Acquisitions

Maximizing Opportunities for Unit Holders

Strong balance

sheet and

contractual cashflow

Cost of capital

advantage via MLP

structure

Experienced

Management

Financial

Flexibility

Multiple

Growth

Opportunities |

5

Leveraging Trends

Integration

with Customer

Supply Chain

Increased

Logistics

Capabilities

Dynamics of market continue to change

Premium white sand continues to gain share of proppant market

Flexibility and scale to meet customer volume and timing needs

Proppant

providers

must

be

able

to

“spec-in”

immediately

Barriers to entry continue to expand

Industry is ripe for consolidation |

Platform for the Future

6

Long-Term,

Contracted

Cashflow

High Quality

Reserve Base

Strong

Industry

Fundamentals

Industry

Leading Cost

Advantage

Multiple

Growth

Opportunities

Experienced

Management

Financial

Flexibility

Integration

with Customer

Supply Chain

Increased

Logistics

Capabilities |

Transaction Summary

7

•

Exercised accordian

•

Transaction expected to

close in Q2 2013

•

Key management joins

Hi-Crush team

D&I has strong balance sheet, no

debt (post close), maintenance

capital spending of $2M/year

D&I earns 85% of its revenue from

frac sand sales

2008 D&I operating income of

negative $279K; 2012 D&I operating

income of $18.7M

2008 D&I revenue of $2.8M; 2012

D&I revenue of $105.3M

Considerations

•

$125M purchase price

•

$95M cash

•

1.579M units priced at

$19/unit |

8

Integrated Model, Flexibility of MLP Structure

Expected DPU Impact for HCLP Unit Holders

Preliminary View

Minimal costs to integrate operations;

forecast $2M in G&A, $2M in

maintenance capex/year

Accretive in early years

Expected to raise distribution paid for

Q4 2013 on anticipated Q2 2013 close

Initiating 2014 distribution guidance of

low double digit growth over 2013

Two operating segments for

accounting purposes

10-12%

increase

$0.475

Q3 2013

Q4 2013

2014 |

Expands Market Share

Enhances Logistics Capabilities

Achieves Broad Synergies

Leverages Value-added Services

Compelling Growth for HCLP Unit Holders

Transaction Delivers Benefits, Creates Value

9

•

Deepens existing relationships and adds new customers

•

Operates largest distribution network in Marcellus & Utica

•

Creates more robust platform for products; adds additional rail expertise

•

Increases sales and margins; expands network into other basins

•

Flexibility in pricing model; in-basin system |

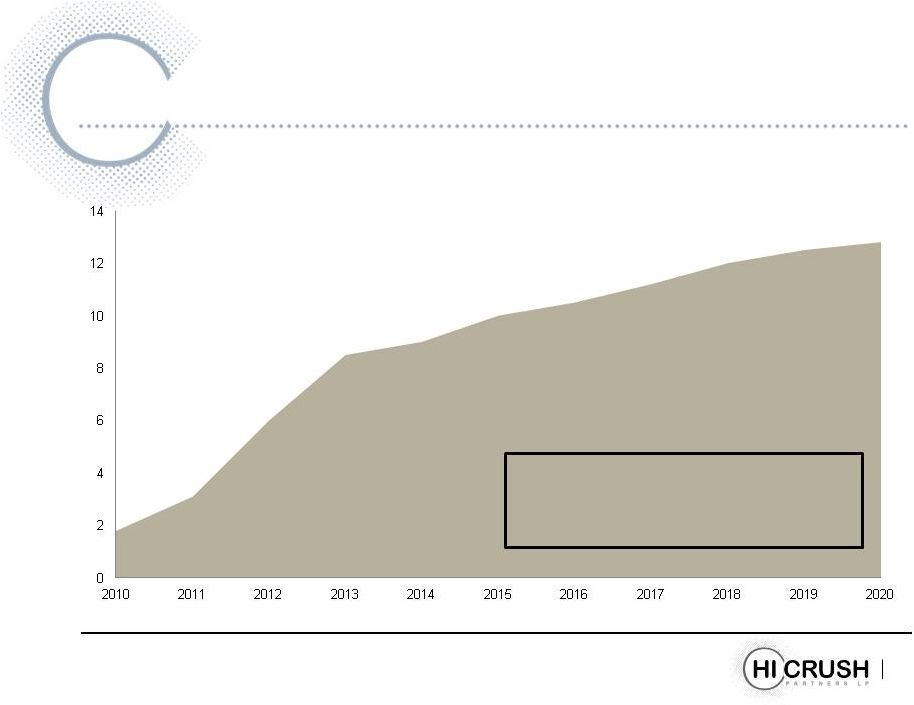

Rapid Growth in Demand for Raw Sand

Proppant Consumed by Volume

Source: The Freedonia Group, March 1, 2012

Raw sand projected to increase as a percentage of proppant market, averaging at

least 75% by volume 10

4.6

16.7

23.8

31.5

1.5

0.0

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

45.0

2001

2006

2011

2016

2021

Raw Frac Sand

Resin-Coated Sand

Ceramics

Other

Million Tons

2.1

6.3

21.7

30.7

40.2

$34

$82

$68

$54

$40

Raw Frac Sand Price |

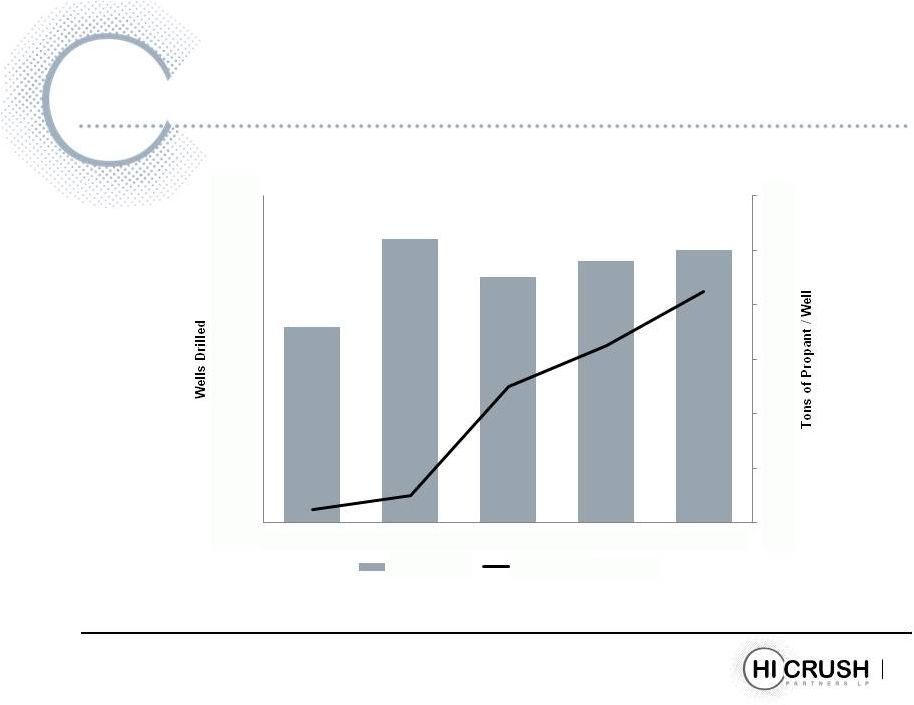

11

Increase in Proppant Intensity

Source: The Freedonia Group.

0

200

400

600

800

1000

1200

0

10,000

20,000

30,000

40,000

50,000

60,000

2001

2006

2011

2016E

2021E

Wells Drilled

Tons of Proppant / Well |

Marcellus Production Doubles 2011-2015

12

Bcf/d

Source: Wood Mackenzie (December 2012)

D&I has 3x as many distribution

outlets in Marcellus as closest

competitor |

Utica Permitting Accelerates

Source: Ohio Department of Natural Resources

13

D&I has 2x as many terminals in

Utica as closest competitor |

Logistics Flexibility Critical

14

Shale Basins

Current Shale Plays

Prospective Shale Plays

Sandstone

Formations

Access to all major US oil

and gas basins

Shipping to all major US

shale plays

Direct loading of unit trains

Collaborative relationship

with Union Pacific

Augusta Facility

Wyeville Facility |

Expanding Our Logistics Reach

15

Augusta Facility

Wyeville Facility

Sandstone

Formations

Eleven destination terminals across

Marcellus & Utica

Network of 5 Midwest origin

transload terminals, serviced by rail

Attractive long-term supply

agreement

Links supply with nearby terminal

facilities

Relationships with multiple

railroads

Shale Basins

Current Shale Plays

Prospective Shale Plays

D&I Facilities |

Further Improve Customer Service

16

Delivery Choice

•

FOB plant, FOB destination

High Quality Sand

•

Best quality delivered where, when

and how customer wants it

Superior Value

•

Best price for quality from lowest-

cost producer

Focused Execution

•

Links suppliers with low-cost, high-

service logistics system

Flexible,

Integrated

Supplier of

Choice |

Confidence in Ability to Execute

17

Clear

benefits

for

both

companies’

customers

•

Hi-Crush leader in low-cost production operations

•

D&I market leader in customer service and

distribution

Improved platform for solutions

•

Complementary customer networks and high

quality sand open door for new business

Management experience integrating and improving

operations, achieving and exceeding targets

•

Supply chain management

•

Inventory consolidation

•

Billing and back office operations

2013-14

Preliminary Outlook

$M

Operating Income Increase

Cost to Integrate |

18

Stronger Together |

Transaction Creates Substantial Unit Holder Value

•

Access to biggest distribution network in Marcellus & Utica

Enhances Long-Term Revenue Growth and Margin Potential

•

More robust platform for products, replication across system

Achieves Broad Synergies

•

Rail expertise, increases sales and margins

Forges Clear Path to Grow Distributions

•

Compelling growth for HCLP unit holders

Continue To Have A Strong Balance Sheet

•

Conservative coverage, distribution growth

Transaction Summary

19 |

Multiple Future Opportunities

20

Contracting Wyeville capacity,

spot sales

Future contributions from

Augusta and sponsor-level

projects in development

Sponsor owns or has options

on additional acres of

undeveloped land

Industry ripe for consolidation

of small, private sand

companies

Incremental

Volume

Contributions

Organic

Expansion

M&A |

21

First Quarter 2013 |

Effective April 1 through December 31, 2013

•

Reduced price at Wyeville and Augusta facilities

Weighted average price for tons sold under long-term contracts will be

reduced less than 10% in 2013

•

Transfer 150,000 TPY from Augusta to Wyeville in Q2

•

Transfer additional 150,000 TPY from Augusta to Wyeville beginning in Q3

Amendment contains pricing mechanism to charge a premium each month if

required monthly volumes not taken

Strengthens and protects long-term relationship

Customer Contract Amendment

22 |

First Quarter Summary

23

Three Months

Three Months

Ended

Ended

March 31, 2013

March 31, 2012

Successor

Predecessor

Revenues

$

19,628

$

13,532

Cost of goods sold (including depreciation and depletion)

5,782

4,776

Gross profit

13,846

8,756

Operating costs and expenses:

General and administrative

2,719

1,487

Exploration expense

1

199

Accretion of asset retirement obligation

29

6

Income from operations

11,097

7,064

Other (income) expense:

Other income

-

-

Interest expense

314

928

Net income

$

10,783

$

6,136

Earnings per unit:

Common

units

–

basic

and

diluted

$

0.40

Subordinated

units

–

basic

and

diluted

$

0.40

Weighted average limited partner units outstanding:

13,644,094

13,640,351

Common

units

–

basic

and

diluted

Subordinated

units

–

basic

and

diluted |

First Quarter Summary

24

Three Months

Three Months

Ended

Ended

March 31, 2013

March 31, 2012

Successor

Predecessor

Reconciliation of distributable cash flow to net income:

Net income

$

10,783

$

6,136

Depreciation and depletion expense

273

179

Income tax expense

-

-

Interest expense

314

928

EBITDA

$

11,370

$

7,243

Less: Cash interest paid

(255)

Less: Maintenance and replacement capital

expenditures, including accrual for reserve

replacement (1)

(422)

Add: Accretion of asset retirement obligation

29

Add: Quarterly distribution from preferred interest in

Augusta

(2)

3,750

Distributable cash flow

$

14,472

(1) Maintenance and replacement capital expenditures, including accrual for reserve

replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton

sold during the period. Such expenditures include those associated with the replacement of equipment and sand reserves,

to the extent that such expenditures are made to maintain our long-term operating capacity.

The amount presented does not represent an actual reserve account or requirement to spend the

capital. (2) The

amount pertains to the first quarter performance of Augusta, on which we are entitled to receive a preferred distribution of $3,750. We have included

this amount in our distributable cash flow for the first quarter of 2013 as we received this

distribution on May 10, 2013, in advance of our first quarter 2013 cash distributions to our

common and subordinated unitholders, which will be paid on May 15, 2013. The amount is not reflected in our GAAP net income

because our investment in Augusta is accounted for under the cost method. In accordance with

that method, any distributions earned under our preferred interest are not recognized as

income until the cash is actually received by the Partnership. |

Production Costs per Ton Sold

25

Hi-Crush Partners LP

Production Cost per ton

Fiscal Quarter:

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

Predecessor

Successor

Combined

Sand Sold (tons)

126,036

206,557

222,658

316,599

186,957

191,446

378,403

248,158

312,730

Production costs ($ in thousands)

$ 2,192

$ 3,806

$ 4,597

$ 5,006

$ 2,644

$ 2,437

$ 5,081

$ 3,845

$ 5,509

Production costs per ton

$ 17.39

$ 18.43

$ 20.65

$ 15.81

$ 14.14

$ 12.73

$ 13.43

$ 15.49

$ 17.62

9 months

ended

12 months

ended

3 months

ended

6 months

ended

12 months

ended

12 months

ended

Year-To-Date:

9/30/2011

12/31/2011

3/31/2012

6/30/2012

9/30/2012

12/31/2012

3/31/2013

Predecessor

Successor

Combined

Sand Sold (tons)

126,036

332,593

222,658

539,257

726,214

191,446

917,660

1,165,818

1,255,890

Production costs ($ in thousands)

$ 2,192

$ 5,998

$ 4,597

$ 9,603

$ 12,247

$ 2,437

$ 14,684

$ 18,529

$ 19,441

Production costs per ton

$ 17.39

$ 18.03

$ 20.65

$ 17.81

$ 16.86

$ 12.73

$ 16.00

$ 15.89

$ 15.48

9 months ended |

Production Costs –

Non-GAAP Reconciliation

26

Hi-Crush Partners LP

GAAP Reconciliation of Production Costs to Cost of Goods Sold

Fiscal Quarter:

3Q 2011

4Q 2011

1Q 2012

2Q 2012

4Q 2012

1Q 2013

(Amounts in thousands)

Predecessor

Successor

Combined

Cost of goods sold

$ 2,498

$ 3,949

$ 4,776

$ 5,495

$ 3,065

$ 2,832

$ 5,897

$ 4,313

$ 5,782

Depreciation and depletion

(306)

(143)

(179)

(489)

(421)

(395)

(816)

(468)

(273)

Production costs

$ 2,192

$ 3,806

$ 4,597

$ 5,006

$ 2,644

$ 2,437

$ 5,081

$ 3,845

$ 5,509

3Q 2012 |

Appendix |

28

Corporate Structure

Avista Capital Partners

and Co-Investors

Management

Augusta

Facility

41.7% Common

LP

Operating Subsidiaries

(including Wyeville facility, D&I)

Public Unitholders

2.2% Common LP

12.1% Convertible Class B Units

44.0% Subordinated LP

Incentive Distribution Rights

39% Ownership

61% Ownership

Hi-Crush

Partners LP

(the Partnership)

Hi-Crush Proppants LLC

(Sponsor)

Hi-Crush GP LLC

(the General Partner)

Non-Economic

GP Interest

100% Ownership

100% Ownership

28

Undeveloped

Acreage

Preferred Interest in Augusta

($3.75 million expected quarterly

distributions) |

Wyeville: Our Foundation Asset

29

651 acres

High

quality

“Northern

White”

sand

•

Extensive coring program with third party

frac-specialized lab testing (StimLab and

PropTester)

53.9 million tons of proven recoverable reserves

•

Implied 37-year reserve life

On-site rail facilities accommodate unit trains (80+

cars) for superior logistics

Current plant output capacity of 1.6 million tons per

year

Modern Wet Plant

Access to Rail Line

Large, Contiguous

Deposit

Dry Plant Silos

Asset Overview

Overview |

Augusta: Growth Vehicle

30

Newly built facility completed in July 2012 on

approximately 1,000 acres

High quality Northern White sand

46.2 million tons of coarse grade sand

Efficient logistics capabilities with on-site

processing plant and rail

1.6 million tons per year capacity

Strong long-term take-or-pay contract profile with

investment grade customer base

Preferred interest in Augusta facility

•

Up to $3.75 million quarterly distributions

•

Convert to 20% common ownership in

Augusta if certain distribution thresholds

or other conditions are met

•

Waiver of assignment of customer

contract from Wyeville to Augusta

Augusta Asset Overview

Dry Plant

Rail Loadout

Wet Plant

Conveyor

Belt

Conveyor Belt Connecting Plants

On-Site Rail Logistics

Dry Plant and Rail

Loadout Storage Silos

Large, Contiguous Deposit |