Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST MIDWEST BANCORP INC | mar148k.htm |

Annual Meeting of Stockholders Chicago, IL May 14, 2013 ®

Welcome and Opening Remarks Michael L. Scudder President and CEO

* Introduction of Officers and Independent Auditors

Reports on Procedural Matters

* Items of Business Election of Directors Advisory Vote on Appointment of Independent Registered Public Accounting Firm Advisory Vote on Executive Compensation Approval of Amendments to the First Midwest Bancorp, Inc. Omnibus Stock and Incentive Plan

Election of Directors to Serve Until 2016

Continuing Directors Serving Until 2014 John F. Chlebowski, Jr. Retired President and CEO Lakeshore Operating Partners, LLC (Bulk Liquid Distribution Firm) Peter J. Henseler President Wise Consulting Group Inc. (Strategy and Management Consulting Firm) Phupinder S. Gill CEO CME Group Inc. (Global Derivatives Marketplace and Exchange) Ellen A. Rudnick Executive Director Polsky Center for Entrepreneurship University of Chicago Booth School of Business (Graduate School of Business) Michael J. Small President and CEO Gogo, Inc. (Airborne Communications Service Provider) *

* Barbara A. Boigegrain General Secretary and CEO General Board of Pension and Health Benefits Of The United Methodist Church (Pension, Health and Welfare Benefit Trustee and Administrator) Robert P. O’Meara Chairman of the Board First Midwest Bancorp, Inc. Continuing Directors Serving Until 2015

* Brother James Gaffney, FSC President Lewis University (Leading Catholic and Lasallian University) Michael L. Scudder President and CEO First Midwest Bancorp, Inc. J. Stephen Vanderwoude Retired Chairman and CEO Madison River Communications (Operator of Rural Telephone Companies) Patrick J. McDonnell President and CEO The McDonnell Company LLC (Business Consulting Company) John L. Sterling Director Sterling Lumber Company (Hardwood Lumber Supplier and Distributor) Vote For Director Nominees To Serve Until 2016

Advisory Vote To Appoint Ernst & Young LLP As Independent Registered Public Accounting Firm

Advisory Vote To Approve Executive Compensation

Approval of Amendments to the First Midwest Bancorp, Inc. Omnibus Stock and Incentive Plan

Voting and Results

Adjournment

Management Presentation

Michael L. Scudder First Midwest Bancorp, Inc. President & Chief Executive Officer Looking Back Over 30 Years Operating and Strategic Overview

* Forward Looking Statements This presentation may contain, and during this presentation our management may make, statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. Forward-looking statements include, among other things, statements regarding our financial performance, business prospects, future growth and operating strategies, objectives and results. Actual results, performance or developments could differ materially from those expressed or implied by these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, among others, those discussed in our Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission, copies of which will be made available upon request. With the exception of fiscal year end information previously included in our Annual Report on Form 10-K, the information contained herein is unaudited. Except as required by law, we undertake no duty to update the contents of this presentation after the date of this presentation.

* Non-GAAP Disclaimer This presentation contains GAAP financial measures and, where management believes it to be helpful in understanding the Company’s results of operations or financial position, non-GAAP financial measures. Where non-GAAP financial measures are used, the most directly comparable GAAP financial measure, as well as the reconciliation to the most directly comparable GAAP financial measure can be found in the Company’s current quarter earnings release or Quarterly Report on Form 10-Q, which can be found on the Company’s website at www.firstmidwest.com/secfilings. Non-GAAP financial measures in this presentation include core operating earnings and pre-tax, pre-provision return on risk weighted average assets. Both of these measures are useful in understanding the performance and trends of the Company’s core franchise over time without respect to investment securities gains/losses, taxes, provisions expense and OREO losses, each of which can significantly vary from quarter to quarter, and therefore may distort the Company’s underlying performance.

Management Presentation Michael L. Scudder Looking Back Over 30 Years Operating and Strategic Overview Mark G. Sander Strategy Execution Michael L. Scudder Closing Remarks *

Looking Back Over 30 Years

Taking A Moment To Proudly Reflect On... How Far We Have Come Market Cap: From $50 million to $1 Billion Asset Size: From $1.4 Billion to $8.1 Billion Colleagues: 1,120 to 1,700 The Impact We Have Had on Our Clients and Communities *

* And Celebrate 30 Years

* Remembering the Road Traveled

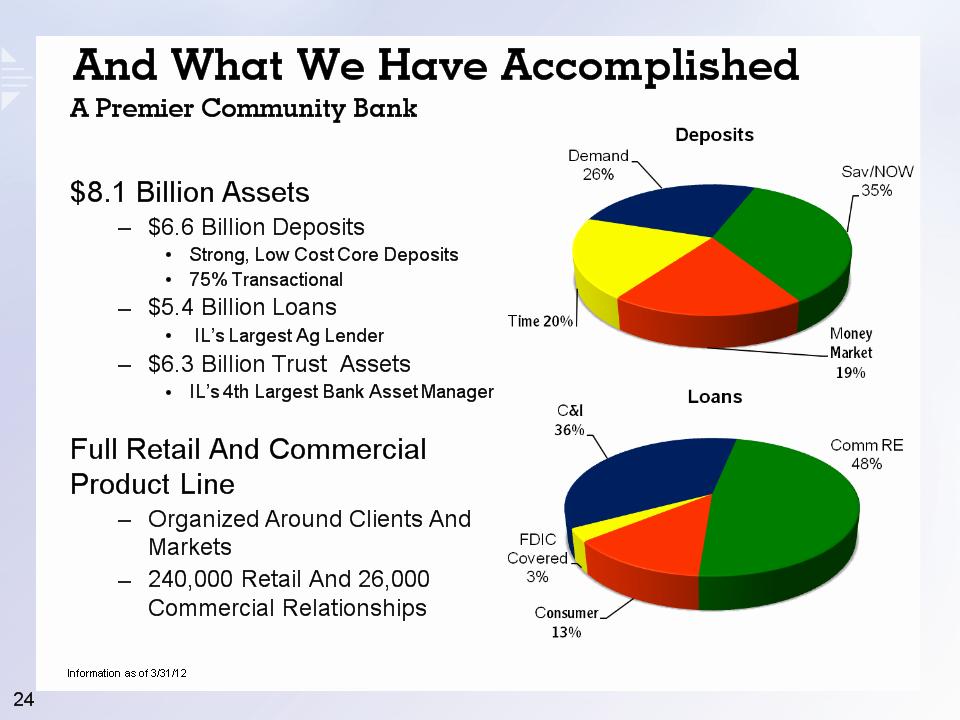

24 $8.1 Billion Assets $6.6 Billion Deposits Strong, Low Cost Core Deposits 75% Transactional $5.4 Billion Loans IL’s Largest Ag Lender $6.3 Billion Trust Assets IL’s 4th Largest Bank Asset Manager Full Retail And Commercial Product Line Organized Around Clients And Markets 240,000 Retail And 26,000 Commercial Relationships Information as of 3/31/12 And What We Have Accomplished A Premier Community Bank

* * 1 As of 12/31/12 And What We Have Accomplished Operating in Premier Markets 70 Plus Years Of Community Banking Headquartered In Suburban Chicago #8 Suburban Market Share Retail Banking Platform 1 Approximately 95 Locations $73 Million Average Deposits/Branch Over 1,000 Employees

Looking Back, the Magnitude of 2008 Deepest Recession Since Great Depression Severe Losses Experienced Disproportionate Impact on Banking Industry Capital Markets Frozen, TARP Created Immense Regulation Reputation Tarnished A Sobering Reality With Far Reaching and Uncertain Impact *

* Remediate Liquidate & Originate Originate Positioning Execution FDIC FDIC & M&A M&A Defensive Deployment Credit Growth Capital 2008 - 2011 2012 2013 2014

Throughout, Our Mission Has Been Constant We are in the business of helping clients achieve financial success throughout their economic life… We believe that only if each of us, those dealing directly with clients as well as those who support client contact people, assumes personal responsibility for the financial success of every client … We further believe that in fulfilling clients’ financial needs we are … creating value for ourselves and the company. The financial success of our clients, thusly, will define our success as well as the Company. *

As We Stand Here Today Transitioned Through the Storm, Improving Our Risk Profile Strengthened and Aligned Our Business, Organization Continue to Adapt to a Changing Environment Industry Still Has a Difficult Road Ahead, Know What it Takes Slow Recovery, Continued Low Rates Evolving Regulation We Are Well Positioned *

Mark G. Sander First Midwest Bancorp, Inc. Senior Executive Vice President & Chief Operating Officer Strategy Execution

Our Priorities * Proactive Credit Remediation Strengthening Our Core Business Prudent Capital Management Transitioning Through 2012, Building Momentum

* Strengthening Income Quarter Ended Quarter Ended Quarter Ended Quarter Ended Quarter Ended Quarter Ended Select Financial Data 2012 2012 2012 2012 2013 2013 March 31 June 30 September 30 December 31 March 31 March 31 March 31 June 30 September 30 December 31 March 31 March 31 March 31 June 30 September 30 December 31 $ Improved Net Income (Loss) $ 7.9 $ 6.3 $ (47.8) $13.0 $14.6 85% Core Earnings $28.6 $31.2 $31.5 $28.2 $29.1 2% Loan Loss Provision $18.2 $22.5 $ 111.8 $ 5.6 $ 5.7 69% Net Interest Margin 3.88% 3.88% 3.83% 3.84% 3.77% (3%) Efficiency Ratio 65% 61% 69% 74% 67% (3%) Earnings Grow Stronger Through Improved Risk Profile $s in millions

Accelerated Remediation on $225 million in Nonperforming and Performing, Potential Problem Assets Recorded Losses of $99 million $172 million in loans sold to 3rd Parties, 62% Performing, Potential Problems Underlying Rationale Environment Stabilized, Affords Greater Clarity Business Momentum and Strong Capital Levels Provide Flexibility Sharpen Organizational Focus Strengthens Future Earnings, Reduces Event Risk Uncertainty Weighing On Market Improving Credit Risk Profile Accelerated Credit Remediation Actions Actions Reduce Uncertainty, Positions Company to Perform Well Received By Investors *

* Proactive Remediation Significantly Improved Risk Profile 32% Down 50% $s in millions Nonperforming Assets Performing Potential Problem Loans

* Build and Diversify Our Lending Platforms Maximize Our Efficiency, Invest in Our Business Grow Our Fee Based Business Lines Mission Focus Manage Risk Strengthening Our Core Business Key Strategies

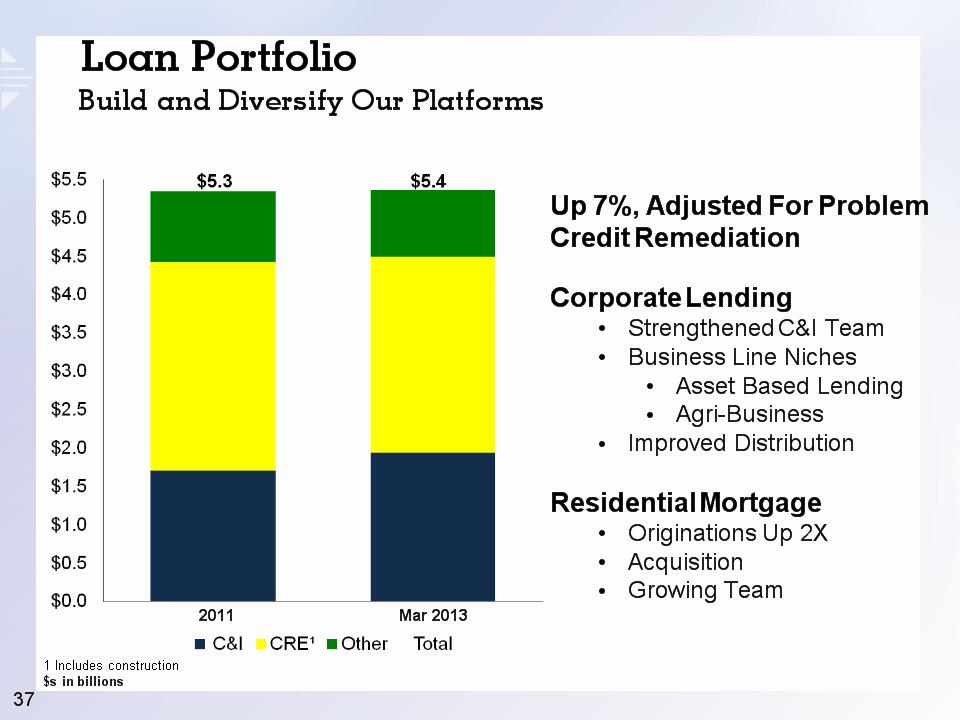

Loan Portfolio Build and Diversify Our Platforms 2011 $s in billions 32% Mar 2013 Up 7%, Adjusted For Problem Credit Remediation Corporate Lending Strengthened C&I Team Business Line Niches Asset Based Lending Agri-Business Improved Distribution Residential Mortgage Originations Up 2X Acquisition Growing Team 1 Includes construction *

Fee-Based Revenues Grow Our Business Lines, Build Momentum 2011 2012 $s in millions 1Q13 Annualized Leverage Our Strengths Mortgage Platform 1Q13 Volumes Up 2X Expanded Team Levering Branches Wealth Management Up 14% vs. 2011 Commercial Synergy Deposit Platform Product Alignment Expanded Offerings *

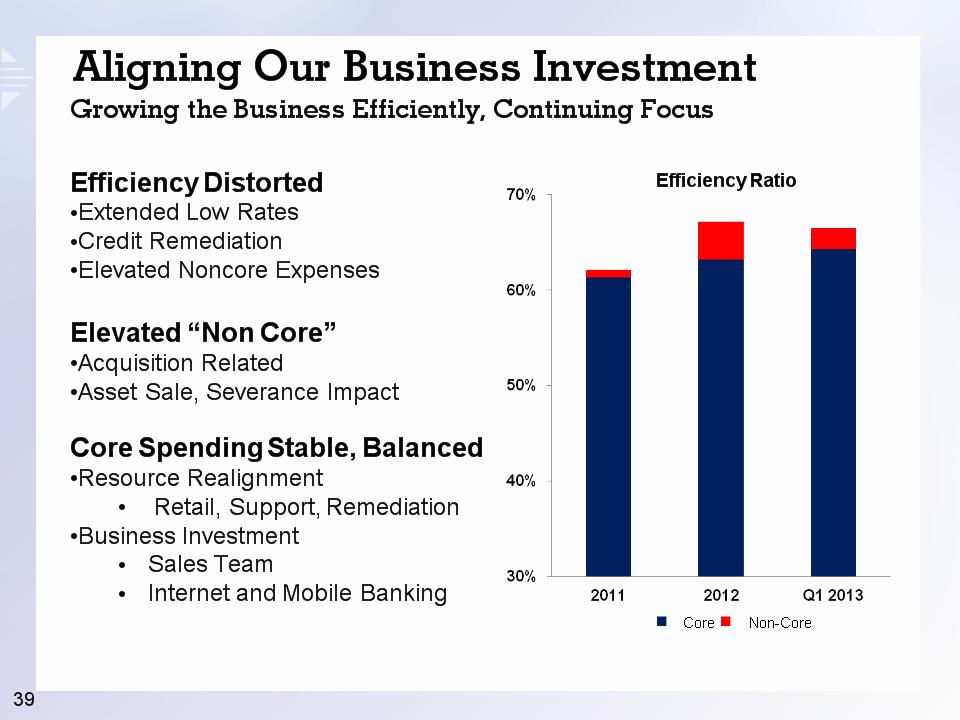

Core Aligning Our Business Investment Growing the Business Efficiently, Continuing Focus Efficiency Ratio Non-Core Efficiency Distorted Extended Low Rates Credit Remediation Elevated Noncore Expenses Elevated “Non Core” Acquisition Related Asset Sale, Severance Impact Core Spending Stable, Balanced Resource Realignment Retail, Support, Remediation Business Investment Sales Team Internet and Mobile Banking *

Invest in Our Business Mobile Banking Launch Strengthen Loyalty Greater Client Interaction Making Us More Competitive Drive Account Utilization & Engagement Colleague & Client Engagement Positioning To Meet Evolving Client Preference *

Invest in Our Business Brand Initiative Internally and Externally Focused Reinforce Our Culture & Drive Colleague Behaviors Create Brand Familiarity & Consideration Take Advantage Of Our Continued Momentum Drive Acquisition & Revenue Growth Controlled Marketing and Promotional Spend In Line With Peers, Historical Spend Reallocation of Marketing Dollars Launching April Thru December *

Michael L. Scudder First Midwest Bancorp, Inc. President & Chief Executive Officer Closing Remarks

Looking Forward Operating Environment Remains Difficult Low Interest Rates, Heavy Competition Growing Regulatory Compliance Evolving Fiscal and Regulatory Changing Consumer Preferences, Technology Adding Strategic Complexity Altering Product and Distribution Usage Dynamics Will Likely Drive Further Consolidation Building Momentum, Well Positioned *

Market Opportunities Ability to Leverage Infrastructure Environment will Create Opportunities Fewer FDIC, Shifting to Healthier Disciplined Approach Likely Consolidation Across Footprint 25 Banks < $500 Million; 27 Banks $500 million to $3 billion Well Positioned To Benefit Solid Reputation, Culture Strong Capital Experienced, Core Competency 5 Acquisitions Since 4Q09 Requires Patience and Discipline *

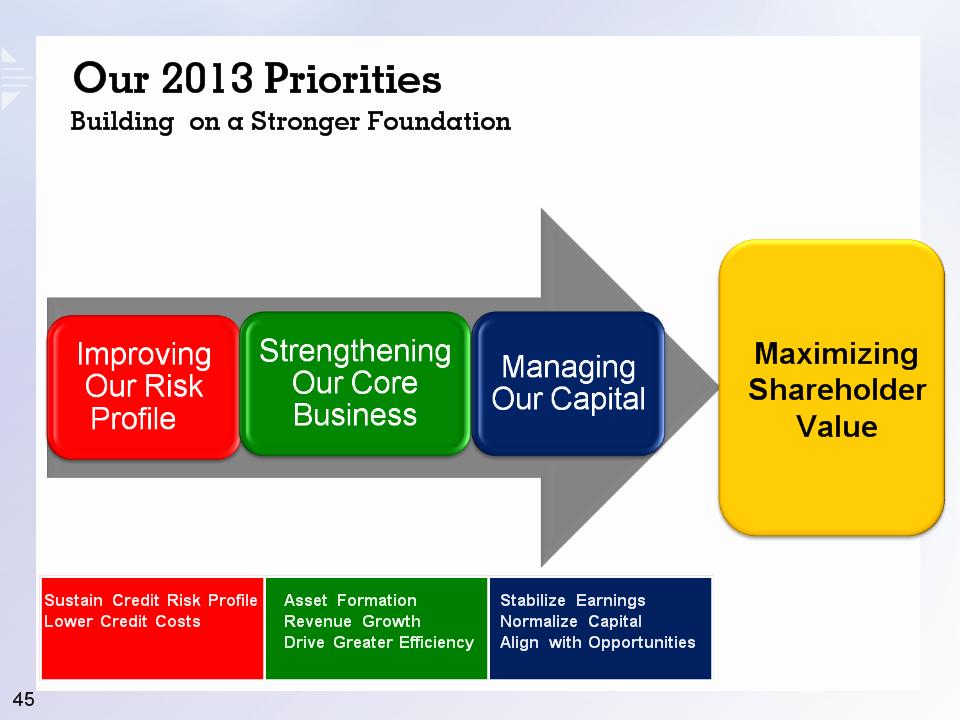

Maximizing Shareholder Value Our 2013 Priorities Building on a Stronger Foundation Asset Formation Revenue Growth Drive Greater Efficiency Stabilize Earnings Normalize Capital Align with Opportunities Sustain Credit Risk Profile Lower Credit Costs *

Managing Our Capital Well Capitalized, Normalizing Usage 13.7% 12.1% 11.9% Regulatory Well Capitalized Enabled By Stronger Earnings, Improved Risk Profile and Regulatory Clarity *

In Closing Well Positioned To Build Stronger Performance, Greater Returns Entering 2013 A Much Stronger Company We Have Advantages That Create Opportunities Strong Core Deposits Engaged, Enhanced Workforce Premier Markets, Growing Opportunities Significant Capital and Liquidity Execution on Our Priorities Will Enhance Value *

Questions

Thank You