Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Addus HomeCare Corp | d538414d8k.htm |

Coordinated

Personal Home Care A pre-acute

solution

to

the

post-acute

problem

SM

JMP Securities Research Conference

May 14, 2013

Exhibit 99.1 |

Forward-Looking Statements

The following information contains, or may be deemed to contain,

forward-looking statements. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and depend

on circumstances that may or may not occur in the future. The future

results of Addus may vary from the results expressed in, or implied by,

the following forward-looking statements, possibly to a material degree,

and historical results may not be an indication of future performance.

For a discussion of some of the important factors that could cause Addus'

results to differ from those expressed in, or implied by, the following

forward-looking

statements,

please

refer

to

Addus’

most

recent

Annual

Report on Form 10-K, and its Quarterly Reports on Form 10-Q, each of

which is available at www.SEC.gov, particularly the Sections entitled “Risk

Factors”. Addus undertakes no obligation to update or revise any

forward-looking statements, except as may be required by law.

2 |

It is

the primary mission of Addus HealthCare to improve the health and well being of our

consumers through the provision of quality, cost-effective home and community based

services. We will accomplish our goals by fostering an environment in which our

employees enthusiastically support and advance our mission.

Reward for accomplishing our mission includes pride in our organization, contribution

to the community and a reasonable profit.

Mission |

Investment Highlights

Large & Growing Market

Broad Range of Services and Payors

Positioned to Excel under Healthcare Reform

History of Growth through Acquisition

Multiple Organic Growth Opportunities

Differentiated, Coordinated Care Model

Experienced Management Team

Significant Operational Scale Across

National Footprint |

Addus

Dual

Advantage

TM

The New Paradigm

Long-term care risk makes it essential that

health plan dual eligible members live safely

and healthfully at home as long as possible…

5 |

About

Addus Who is Addus?

Comprehensive provider of home and

community based services, which are

primarily social in nature, focused

primarily on the Dual Eligible population:

Personal Care

Private Duty

Adult Day Service

Founded in 1979

14,000+ employees

26,000+ consumers (many dual eligible)

2012 Revenues of $244.3 million

Diversified payor base (200+ payors)

Largest

payor

-

64%

of

2012

total

revenues

6

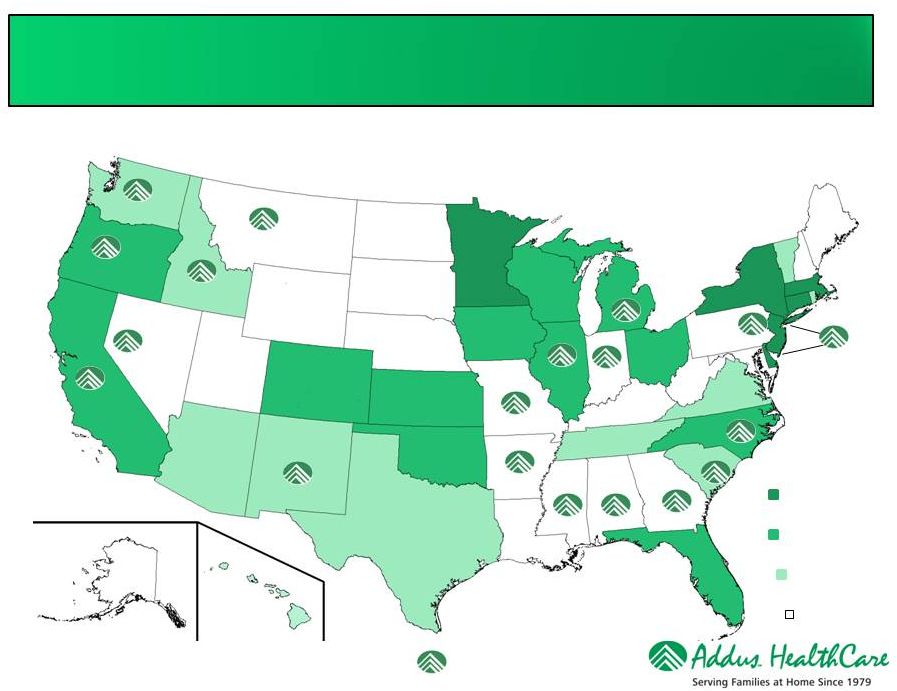

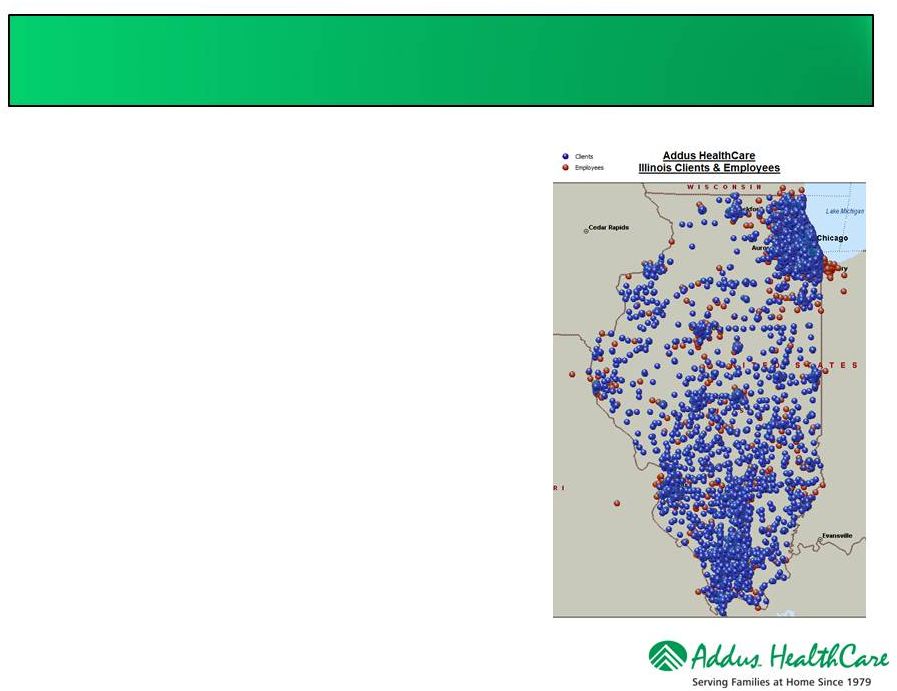

98 Locations Across 20 States

Key Facts: |

Who We

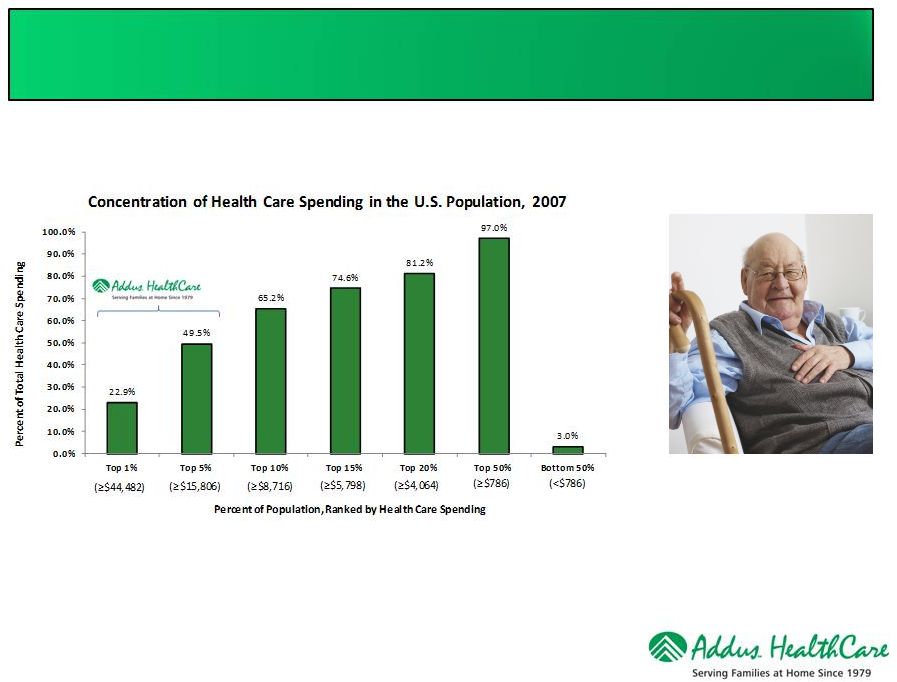

Serve Focusing on the Dual Eligible Population

Addus focuses on the top 5% in terms of resource needs and expenditures!

Source: Kaiser Family Foundation calculations using data from U.S. Department of Health

and Human Services, Agency for Healthcare Research and Quality, Medical Expenditure

Panel Survey (MEPS), 2007 7 |

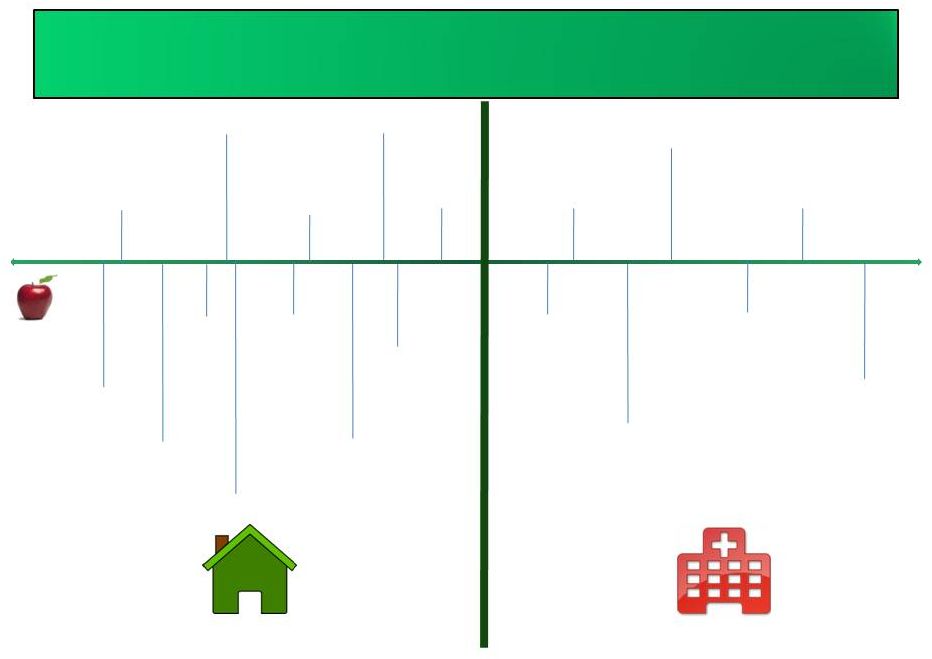

Companionship

$

Healthy

Living -

Eat

an Apple ¢

Telephone

Reassurance ¢

Personal

Emergency

Response

(PERS) ¢¢

Friendly

Visiting

¢¢

Meals at

Home ¢¢

Transportation ¢¢

Adult Day Services ¢¢

Personal Care $

Case

Management $

Home Health $

Hospice $$

Home

Physicians

$$

Ambulance/

ER $$$

Hospital Stay

$$$$

Hospital

Intensive Care

$$$$

Rehab Facility

$$$$

Psychiatric

Inpatient $$$$$

Nursing Home

$$$$$

Sub-Acute

Facilities $$$$$

Pre-Acute

Acute

Where are we in the Continuum of Care? |

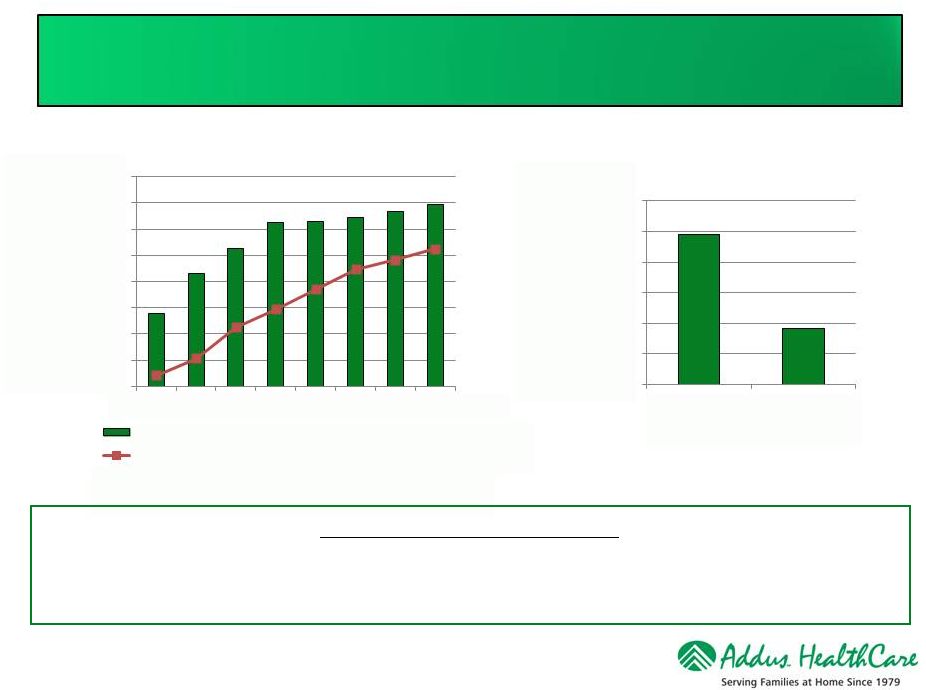

Long-Term Care Expenditures

.

SOURCE: KCMU and Urban Institute analysis of HCFA/CMS-64 data. June 2011

Growth in Medicaid Long Term Care Expenditures

Medicaid Spending Per Beneficiary

Source: Kassner, Reinhard, Fox-Grage, Houser, Accius,

Coleman and Milne. AARP Public Policy Institute: “A

Balancing Act: State Long-Term Care Reform,”July 2008

9

THE LANDSCAPE IS SHIFTING

States are shifting responsibility for care to health plans and managed care

Focus on managing and coordinating care for the costly dual eligible population

$0.00

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

$70.00

$80.00

1990

1995

2000

2002

2004

2006

2008

2009

Insitutional Care Expenditures(Billions)

Home & Community Based Services Expenditures (Billions)

$24,500

$9,200

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

Nursing Home

Home Care |

Total $300

Billion in annual spending for dual eligible enrollees in 2007 Funding for both programs

administered through the States 26 States have indicated they will participate

over the next 3 years Each State will decide on the size, nature and timing of the

pilots Approximately 9 million are “Duals”

Bids are being solicited from multiple “Managed Care Companies”

Stated Objectives:

Dual Eligible

What is the Opportunity?

Medicare Program

Populations 65+ years

Hospital Services (Part A)

–

Post Acute Care SNF / Rehab

Professional Services (Part B)

–

Post acute Home Care Services

Prescription Services (Part D)

Duals Represent 36% of Total Medicare Spending

Medicaid Programs

Generally populations 65+ years w Income limits

Home Based Personal Care

Long term Nursing Home Care

Duals Represent 39% of Total Medicaid Spending

69% of Medicaid Spending is for Long Term Care

10

–

Eliminate service duplication / streamline administration

–

Keep member functioning in the home environment

–

Avoid / lower the cost for Acute Care services

Pilot Program Features / Objectives

Sources: Kaiser Commission on Medicaid and the Uninsured, April 2011 |

MCO

Plans/Programs already implemented

2013 Implementation

Plans

2014 Implementation

Plans

No Implementation

Plans

Addus location(s)

Source: Kaiser Commission on Medicaid and the Uninsured, May 2012

States Pursuing a Dual Program |

Health

Plan’s Worst Nightmare 12

Home Personal Care

$9,200/year

Emergency Room

$1,700/visit

Acute Care Hospital

$12,320/stay

Rehab Facility

$18,600/stay

Nursing Home

$42,000/year

Vs.

Ambulance

$1,000/ride

Total Episodic Cost &

one-year of Nursing

Home

$75,620

Sources: Consumer Health Ratings.com

CMS.gov

The Choice is Obvious! |

Addus

Dual Advantage TM

A Powerful Resource

No one knows more about the member…

No one is in a better position to

positively effect

health outcomes… …Than the Addus Home Care Aide

13 |

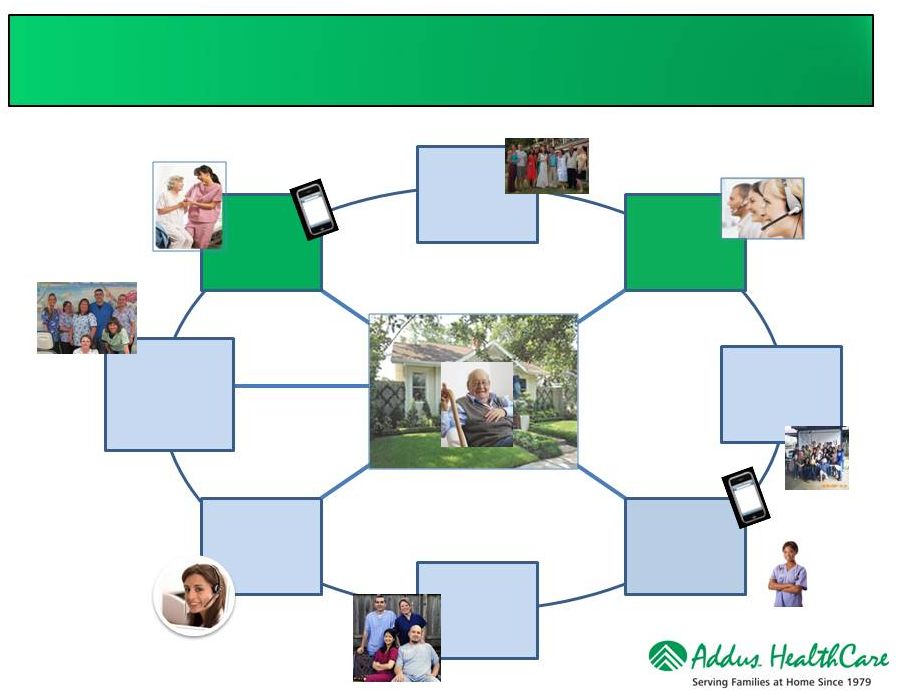

Home

Care Integrated Clinical Strategy Begins In The Home

Addus

Home Care

Aide

Client Primary

Care Health

Providers

Addus

Call Center

Health Plan

Case

Manager

14

Community-

Based

Providers &

Pharmacies

Interdisciplinary

Care Team

Community-Based

Resources &

Advocacy Groups

Family |

Addus

Dual

Advantage

TM

A Model for Extending the Reach of Health Plan Case Managers

15

Serving the dual eligible population at home:

•

Complicated

•

Logistics intense

•

Highly transactional

•

Requires disciplined processes

Provides tremendous opportunity for

case management extension! |

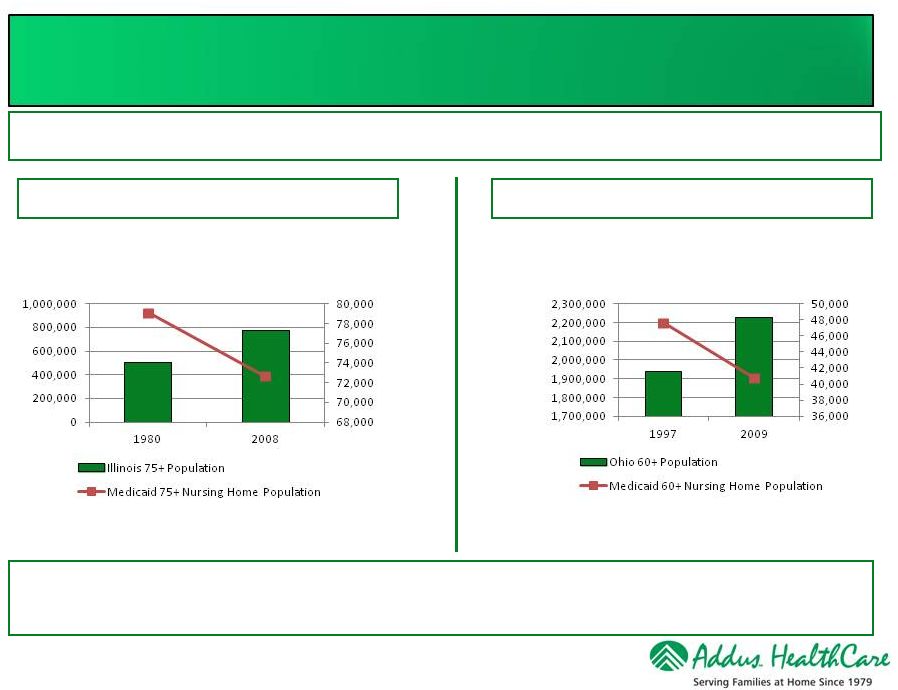

Source:

CCP Cost Effectiveness: Comparison of CCP growth with Nursing Facility Prevalence Reductions

HCBS Strategies Inc. February 10, 2010

Illinois Residents Age 75+

Total Population vs. Nursing Home Residents

Source: Coming of Age: Tracking the Progress and Challenges of Delivering Long-Term

Services and Supports in Ohio

Scripps Gerontology Center, Miami University of Ohio, June 2011

Ohio Residents Age 60+

Total Population vs. Nursing Home Residents

Scripps Gerontology Center Study

HCBS Strategies Study

Nursing home admissions fell, in spite of rising populations; substantial savings

The home is the lowest cost setting in which to provide care, and is preferred

by consumers and families

Home Care Programs Improve Outcomes |

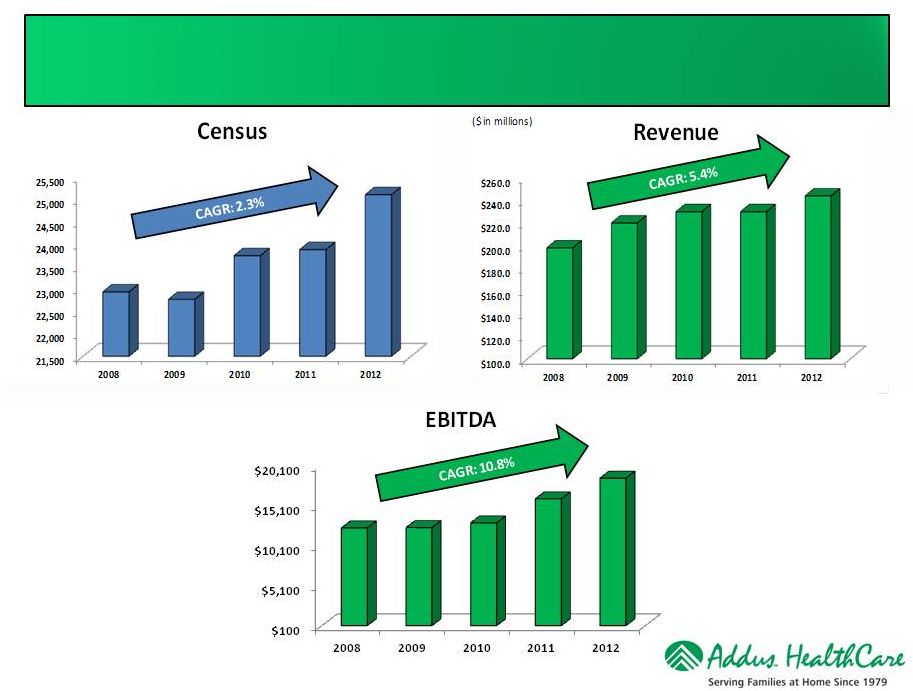

Census

-

Revenue

-

EBITDA

Trends

17

We define Adjusted EBITDA as earnings before

discontinued operations, preferred stock dividends,

reevaluation of contingent consideration, interest

expense, taxes, depreciation, amortization, and stock-

based compensation expense. Adjusted EBITDA is a

performance measure used by management that is not

calculated in accordance with generally accepted

accounting principles in the United States (GAAP). It

should not be considered in isolation or as a substitute for

net income, operating income or any other measure of

financial performance calculated in accordance with GAAP.

($ in thousands) |

Condensed

Consolidated Statements of Income 18

($ in millions)

12/31/2008

12/31/2009

12/31/2010

12/31/2011

12/31/2012

3/31/2012

3/31/2013

Unaudited

Unaudited

Net Service Revenues

197.9

$

219.9

$

230.1

$

230.1

$

244.3

$

58.9

$

63.0

$

Cost of Service Revenues

(147.3)

(162.7)

(170.4)

(168.6)

(180.2)

(43.9)

(47.2)

General Administrative

(38.6)

(45.1)

(47.0)

(45.4)

(45.9)

(11.6)

(11.5)

Adjusted EBITDA

12.3

$

12.3

$

12.9

$

15.9

$

18.4

$

4.0

$

4.4

$

Gross Margin Percentage

25.6%

26.0%

25.9%

26.7%

26.2%

25.5%

25.1%

Adjusted EBITDA Percentage

6.2%

5.6%

5.6%

6.9%

7.5%

6.8%

7.0%

Year Ended

Three Months Ended

Continuing Operations

Notes: We define Adjusted EBITDA as earnings before discontinued operations, preferred

stock dividends, revaluation of contingent consideration, interest expense, taxes, depreciation, amortization,

and stock-based compensation expense. Adjusted EBITDA is a performance measure used by

management that is not calculated in accordance with generally accepted accounting principles in

the United States (GAAP). It should not be considered in isolation or as a substitute for net

income, operating income or any other measure of financial performance calculated in accordance

with GAAP.

Gross Margin percentage is defined as Net Service Revenues less Cost of Service Revenues

divided by Net Service Revenues. Adjusted EBITDA Percentage is defined as Adjusted

EBITDA divided by Net Service Revenues |

Select

Balance Sheet Information 19

Balances for 3/31/2013 are unaudited.

($ in millions)

Key Balances

12/31/2008

12/31/2009

12/31/2010

12/31/2011

12/31/2012

3/31/2013

Cash

6.1

$

0.5

$

0.8

$

2.0

$

1.7

$

17.8

$

Accounts receivable, net

49.2

70.5

71.0

72.4

71.3

60.6

Total Assets

135.7

161.3

166.9

154.7

149.9

151.4

Debt, including current maturities

63.2

49.2

45.2

31.5

16.5

-

Stock holders' equity

34.6

$

80.6

$

88.1

$

86.4

$

94.4

$

107.8

$

Debt to capital ratio

64.6%

37.9%

33.9%

26.7%

14.8%

0.0% |

Investment Highlights

Large & Growing Market

Broad Range of Services and Payors

Positioned to Excel under Healthcare Reform

History of Growth through Acquisition

Multiple Organic Growth Opportunities

Differentiated, Coordinated Care Model

Experienced Management Team

Significant Operational Scale Across

National Footprint |

EBITDA

Reconciliation 21

($ in millions)

12/31/2008

12/31/2009

12/31/2010

12/31/2011

12/31/2012

3/31/2012

3/31/2013

(2)

Net Income

(0.2)

$

(1.8)

$

6.0

$

(2.0)

$

7.6

$

0.6

$

13.3

$

Less: (Earnings) loss from discontinued operations

(2.5)

(2.4)

(1.7)

10.4

1.7

1.1

(10.6)

Net Income from continuing operations

(2.7)

(4.2)

4.3

8.4

9.3

1.7

2.7

Preferred stock dividends

4.3

5.4

-

-

-

-

Revaluation of contingent consideration

-

-

-

(0.5)

-

-

-

Interest Income

(0.2)

(2.3)

(0.2)

-

-

Interest Expense

5.7

6.8

3.2

2.5

1.7

0.4

0.2

Income Tax Expense

(0.5)

(0.1)

1.9

4.3

4.8

1.2

0.8

Depreciation and amortization

5.2

4.1

3.4

3.2

2.5

0.6

0.6

Stock based compensation expense

0.3

0.3

0.3

0.3

0.3

0.1

0.1

Adjusted EBITDA (1)

12.3

$

12.3

$

12.9

$

15.9

$

18.4

$

4.0

$

4.4

$

(1)

(2)

3/31/13 and 3/31/12 amounts are unaudited

Year Ended

Three Months Ended

We define Adjusted EBITDA as earnings before discontinued operations, preferred stock

dividends, revaluation of contingent consideration, interest expense, taxes,

depreciation, amortization, severance costs related to former chairman and stock-based

compensation expense. Adjusted EBITDA is a performance measure used by management that

is not calculated in accordance with generally accepted accounting principles in the United States (GAAP). It should not be considered in isolation or as a

Continuing Operations

substitute for net income, operating income or any other measure of financial performance

calculated in accordance with GAAP. |