Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - CVR Refining, LP | d536567dex51.htm |

| EX-8.1 - EX-8.1 - CVR Refining, LP | d536567dex81.htm |

| EX-1.1 - EX-1.1 - CVR Refining, LP | d536567dex11.htm |

| EX-23.1 - EX-23.1 - CVR Refining, LP | d536567dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 13, 2013

Registration No. 333-187631

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CVR Refining, LP

(Exact name of registrant as specified in its charter)

| Delaware | 2911 | 37-1702463 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

2277 Plaza Drive, Suite 500

Sugar Land, TX 77479

(281) 207-3200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John J. Lipinski

2277 Plaza Drive, Suite 500

Sugar Land, Texas 77479

(281) 207-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mike Rosenwasser E. Ramey Layne Vinson & Elkins L.L.P. 666 Fifth Avenue, 26th Floor New York, New York 10103 Tel: (212) 237-0000 Fax: (212) 237-0100 |

Sean T. Wheeler Keith Benson Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, TX 77002 Tel: (713) 546-5400 Fax: (713) 546-5401 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Aggregate Offering Price per Unit(2) |

Proposed Maximum Aggregate Offering Price(3) |

Amount of Registration Fee(4) | ||||

| Common units representing limited partner interests |

13,800,000 | $33.73 | $465,474,000 | $63,491 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,800,000 common units issuable upon exercise of the underwriters’ option to purchase additional common units. |

| (2) | Calculated in accordance with Rule 457(c) on the basis of the high and low sales price of the common units on May 8, 2013. |

| (3) | Estimated solely for the purpose of calculating the registration fee. |

| (4) | The Registrant previously paid $13,640 of the total registration fee in connection with the previous filing of this Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 13, 2013

CVR Refining, LP

12,000,000 Common Units

Representing Limited Partner Interests

We are offering 12,000,000 common units representing limited partner interests in us. Our common units are listed on the New York Stock Exchange under the symbol “CVRR.” On May 10, 2013, the last reported sales price of our common units was $33.68 per common unit. We will use the net proceeds from this offering to redeem from CVR Refining Holdings, LLC a number of common units equal to the number of common units sold in this offering.

To the extent that the underwriters sell more than 12,000,000 common units, the underwriters have the option to purchase up to an additional 1,800,000 common units at the public offering price less the underwriting discounts and commissions.

Investing in our common units involves risks. See “Risk Factors” on page 19 of this prospectus to read about the factors you should consider before buying our common units.

The underwriters expect to deliver the common units to purchasers on or about , 2013.

| Price to Public |

Underwriting |

Proceeds to CVR Refining, LP | ||||

| Per Common Unit |

$ | $ | $ | |||

| Total |

$ | $ | $ |

| (1) | See “Underwriting” for additional information regarding underwriter compensation. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | ||||||

| Barclays | Citigroup | Jefferies | ||||

| UBS Investment Bank | J.P. Morgan |

| SunTrust Robinson Humphrey |

The date of this prospectus is , 2013.

Table of Contents

Table of Contents

| 1 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| OUR CASH DISTRIBUTION POLICY AND RESTRICTIONS ON DISTRIBUTIONS |

25 | |||

| 27 | ||||

| 28 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

29 | |||

| 32 | ||||

| 40 | ||||

| 42 | ||||

| 56 | ||||

| 58 | ||||

| 71 | ||||

| 72 | ||||

| 77 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| A-1 |

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by or on behalf of us or any other information to which we have referred you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. Neither the delivery of this prospectus nor sale of our common units means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy our common units in any circumstances under which the offer or solicitation is unlawful.

Trademarks, Trade Names and Service Marks

This prospectus includes trademarks belonging to CVR Energy, Inc., including COFFEYVILLE RESOURCES® and the CVR Refining logo, each of which is registered or for which we are applying for federal registration with the United States Patent and Trademark Office. This prospectus also contains trademarks, service marks, copyrights and trade names of other companies.

Industry and Market Data

The data included in this prospectus regarding the refining industry, including trends in the market and our position and the position of our competitors within the refining industry, is based on a variety of sources, including independent industry publications, government publications and other published independent sources, information obtained from customers, distributors, suppliers, trade and business organizations and publicly available information (including the reports and other information our competitors file with the Securities and Exchange Commission, which we did not participate in preparing and as to which we make no representation), as well as our good faith estimates, which have been derived from management’s knowledge and experience in the areas in which our business operates. Estimates of market size and relative positions in a market are difficult to develop and inherently uncertain. Accordingly, investors should not place undue weight on the industry and market share data presented in this prospectus.

i

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus and the documents that we incorporate by reference herein. You should carefully read the entire prospectus, including “Risk Factors” and the documents we incorporate by reference herein, before making an investment decision. Unless otherwise indicated, the information in this prospectus assumes that the underwriters do not exercise their option to purchase additional common units. References in this prospectus to “CVR Refining, LP” as well as “Partnership,” we,” “our,” “us” or like terms when used in a context relating to periods prior to December 31, 2012, refer to the petroleum refining and related logistics business of CVR Energy, Inc. (“CVR Energy”). When used in a context relating to subsequent periods, “CVR Refining, LP” as well as “Partnership,” we,” “our,” “us” or like terms refer to CVR Refining, LP and its consolidated subsidiaries unless the context otherwise requires or where otherwise indicated. References to “CVR Refining GP” or “our general partner” refer to CVR Refining GP, LLC, an indirect wholly-owned subsidiary of CVR Energy. References to “Coffeyville Resources” refer to Coffeyville Resources, LLC, a wholly-owned subsidiary of CVR Energy. References to “CVR Refining Holdings” refer to CVR Refining Holdings, LLC, a wholly-owned subsidiary of Coffeyville Resources. You should also see the “Glossary of Selected Industry Terms” contained in Annex A for definitions of some of the terms we use to describe our business and industry and other terms used in this prospectus.

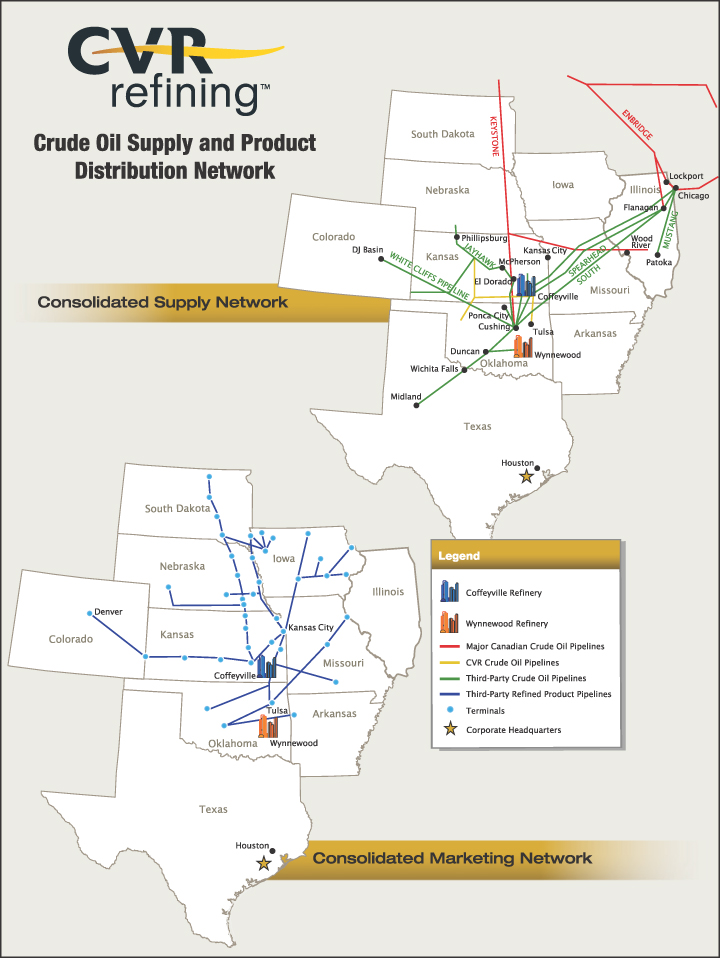

Overview

We are an independent downstream energy limited partnership with refining and related logistics assets that operates in the mid-continent region. We own two of only seven refineries in the underserved Group 3 of the PADD II region of the United States. We own and operate a 115,000 barrels per day (“bpd”) complex full coking medium-sour crude oil refinery in Coffeyville, Kansas and a 70,000 bpd medium complexity crude oil refinery in Wynnewood, Oklahoma capable of processing 20,000 bpd of light sour crude oils (within its 70,000 bpd capacity). In addition, we also control and operate supporting logistics assets including approximately 350 miles of owned pipelines, over 125 owned crude oil transports, a network of strategically located crude oil gathering tank farms, and over 6.0 million barrels of owned and leased crude oil storage capacity. The strategic location of our refineries, combined with our supporting logistics assets, provide us with a significant crude oil cost advantage relative to our competitors. Furthermore, our Coffeyville and Wynnewood refineries are located approximately 100 miles and 130 miles, respectively, from the crude oil hub at Cushing, Oklahoma, and have access to inland domestic and Canadian crude oils that are priced based on the price of West Texas Intermediate crude oil (“WTI”). For the year ended December 31, 2012 and three months ended March 31, 2013, the crude oil consumed at the refineries was at a discount to the price of WTI of $2.26 per barrel and $4.98 per barrel, respectively.

Our refineries’ complexity allows us to optimize the yields (the percentage of refined product that is produced from crude oil and other feedstocks) of higher value transportation fuels (gasoline and diesel). Complexity is a measure of a refinery’s ability to process lower quality crude oil in an economic manner. Our two refineries’ capacity weighted average complexity is 11.5. As a result of key investments in our refining assets, our Coffeyville refinery’s complexity increased to 12.9 in 2012 from 10.3 in 2005. Our management team, which joined us in 2005 in connection with the Coffeyville refinery acquisition, has also achieved significant increases in this refinery’s crude oil throughput rate since the acquisition. Our Wynnewood refinery, which we acquired in December 2011, currently has a complexity of 9.3, and we expect to spend approximately $50 million on a hydrocracker project that will increase the conversion capability and the ultra-low sulfur diesel (“ULSD”) yield of the refinery.

We currently gather approximately 50,000 bpd of price-advantaged crudes from our gathering area, which includes Kansas, Nebraska, Oklahoma, Missouri and Texas. In aggregate, these crudes have been sourced at a discount to WTI because of our proximity to the sources of crude oil, existing logistics infrastructure and quality differences. We also have 35,000 bpd of contracted capacity on the Keystone and Spearhead pipelines that allows us to supply price-advantaged Canadian and Bakken crudes to our refineries.

1

Table of Contents

Since the beginning of 2011, WTI crude has priced at a considerable discount to the price of Brent crude oil (“Brent”). Other imported waterborne crude oils, and crude oil produced on-shore and off-shore in the Gulf Coast region are priced based on the price of Brent. This price advantage for the crudes that we refine is the result of increasing mid-continent domestic and Canadian crude oil production, decreasing North Sea production, economic transportation infrastructure limitations, and geopolitical factors. We expect WTI to continue to trade at a discount to Brent over the long term, but anticipate that this discount will vary over time. For example, the recent reversal of the Seaway crude oil pipeline to make it flow from Cushing to the Gulf Coast and the ongoing and planned capacity expansion of the pipeline will ameliorate some of the current transportation infrastructure limitations by increasing mid-continent producers’ ability to transport crude oil to Gulf Coast refiners in an economic manner and may reduce the robust Brent-WTI price differential. Over time, continued increases in mid-continent domestic and Canadian crude oil production, ongoing infrastructure constraints that limit the amount of crude that can be transported through the more economic pipeline network as opposed to rail or truck and continuing decline in North Sea production should continue to support wider Brent-WTI price differentials.

The following table shows average crude oil price differentials of WTI as compared to Brent, WTI to Mars Blend (“Mars”), Western Canada Select (“WCS”) to WTI, West Texas Sour (“WTS”) to WTI, and WTI priced in Midland, Texas (“WTI at Midland”) to WTI for the three months ended March 31, 2013 and for the year ended December 31, 2012.

| Average Differential ($ per barrel) | ||||||||

| Three Months

Ended March 31, 2013 |

Year Ended December 31, 2012 |

|||||||

| WTI—Brent(1) |

$ | (19.58 | ) | $ | (18.72 | ) | ||

| WTI—Mars(1) |

(14.86 | ) | (12.78 | ) | ||||

| WCS—WTI(1) |

(27.19 | ) | (22.42 | ) | ||||

| WTS—WTI(1) |

(6.41 | ) | (5.43 | ) | ||||

| WTI at Midland—WTI(1)(2) |

(3.42 | ) | (4.06 | ) | ||||

| (1) | NYMEX WTI, WTS, Mars, WCS and Brent average prices from Bloomberg over the time periods stated above. |

| (2) | WTI at Midland average prices from Argus Media over the time periods stated above. |

Our logistics businesses have grown substantially since 2005. We have grown our crude oil gathering system from 7,000 bpd in 2005 to approximately 50,000 bpd currently. The system is supported by approximately 350 miles of owned pipelines associated with our gathering operations, over 125 crude oil transports and associated storage facilities located along our pipelines and third-party pipelines for gathering crude oil purchased from independent crude oil producers in Kansas, Nebraska, Oklahoma, Missouri and Texas. We have a 145,000 bpd pipeline system that transports crude oil from our Broome Station tank farm to our Coffeyville refinery as well as a total of 6.0 million barrels of owned and leased crude oil storage capacity, including approximately 6% of the total crude oil storage capacity at Cushing. Crude oil is transported to our Wynnewood refinery via two separate third-party pipelines and received into storage tanks at terminals located at or near the refinery. Our crude oil gathering and pipeline systems provide us with price advantages relative to the price of WTI.

Customers for our refined products primarily include retailers, railroads and farm cooperatives and other refiners/marketers in Group 3 of the PADD II region because of their relative proximity to our refineries and pipeline access. We sell bulk products to long-standing customers at spot market prices based on a Group 3 basis differential to prices quoted on the New York Mercantile Exchange (“NYMEX”), which are reported by industry market related indices such as Platts and Oil Price Information Service. We also have a rack marketing business supplying product through tanker trucks directly to customers located in proximity to our Coffeyville and Wynnewood refineries, as well as to customers located at throughput terminals on refined products distribution

2

Table of Contents

systems run by Magellan Midstream Partners L.P. (“Magellan”) and NuStar Energy, LP, (“NuStar”). Rack sales are at posted prices that are influenced by competitor pricing and Group 3 spot market differentials. Additionally, our Wynnewood refinery supplies jet fuel to the U.S. Department of Defense. In addition, our Coffeyville refinery sells a by-product of its refining operations, petroleum coke (“pet coke”), to an affiliate, CVR Partners, LP (“CVR Partners”), pursuant to a multi-year agreement. For the year ended December 31, 2012, our two largest customers accounted for approximately 10% and 9% of our sales and approximately 48% of our sales were made to our ten largest customers.

We generated refining margin of $1,614.2 million and $468.2 million, net income of $595.3 million and $275.4 million and Adjusted EBITDA of $1,176.2 million and $309.9 million for the year ended December 31, 2012 and the three months ended March 31, 2013, respectively. For a reconciliation of refining margin and Adjusted EBITDA to the most directly comparable GAAP measures, see “—Non-GAAP Financial Measures.”

Our Competitive Strengths

We have a number of competitive strengths that we believe will help us to successfully execute our business strategy:

Strategically Located Refineries with Advantageous Access to Crude Oil Supply. We believe that the location of our refineries and logistics assets enable us to access lower cost mid-continent domestic sweet and sour and various light and heavy grade Canadian crude oils, allowing us to improve our realized margins. For the three months ended March 31, 2013, 7.6% of the crude oil processed at our refineries was WTS, 80.4% was domestic sweet with the remainder comprised of various light and heavy grade Canadian crude oils. Historically, we have purchased crude oil at a discount to WTI as a result of our location. From the beginning of 2007 through March 31, 2013, we realized an average discount of $3.48 per barrel of crude oil purchased for our refineries when compared to the average WTI price per barrel over the same period. More recently, the increase of the discount at which a barrel of WTI traded relative to Brent has allowed refineries, such as ours, that are capable of sourcing and utilizing crude oil that is priced by reference to WTI, to realize relatively lower crude oil costs and benefit from the refined product prices resulting from higher Brent prices.

Supporting Logistics Assets that Provide Competitive Cost Advantages. We believe that our network of pipelines, crude oil transports and storage facilities allow us to source domestically produced sweet and sour crudes to our refineries in a price-advantaged manner. Since 2005, our management team has grown our local gathering system from 7,000 bpd to approximately 50,000 bpd currently and it now supplies approximately one-fourth of our refineries’ crude.

Attractive Refined Products Supply/Demand Dynamics. Our refineries are located in the cost advantaged area of the PADD II region known as Group 3. Our combined production capacity represents approximately 22% of our region’s refining capacity. Since the mid-1990s, demand for refined products in the PADD II region has exceeded regional production, resulting in a need for imports from other regions, specifically from the Gulf Coast region. We benefit from the fact that the market prices in our region typically include a premium equivalent to the logistics cost for Gulf Coast suppliers to ship products into our region. Over the five-year period ended December 31, 2012, the PADD II Group 3 2-1-1 benchmark crack spread (defined as two barrels of crude producing one barrel of gasoline and one barrel of ULSD/heating oil) premium to the NYMEX 2-1-1 has been approximately $0.29 per barrel.

Substantial Refinery Operating Flexibility. Since June 2005, we have significantly expanded the variety of crude grades we are able to process at our Coffeyville refinery. Our Coffeyville refinery can now process up to 25,000 bpd of heavy sour, which was unable to be processed through our Coffeyville refinery at the time of its acquisition. Since our acquisition of the Wynnewood refinery in December 2011, we have increased the variety

3

Table of Contents

of crude grades that the refinery can process and plan to upgrade a hydrocracker unit at the refinery. Our proximity to, and substantial storage capacity at, the crude oil trading hub in Cushing, Oklahoma minimizes the likelihood of an interruption to our supply and facilitates optimal crude oil purchasing and blending. We maintain capacity on the Spearhead and Keystone pipelines from Canada to Cushing and also operate a crude gathering system serving Kansas, Nebraska, Oklahoma, Missouri and Texas, which allows us to acquire quality crudes at a discount to WTI. This combination of access to price-advantaged domestic and Canadian crude oils allows us to capitalize on changing market conditions and optimize our crude oil supply. In addition, our access to the mid-continent gas liquids hub of Conway, Kansas allows us to further increase our refining margins by purchasing and blending natural gasoline and butanes.

Strong Refinery Operating Track Record. Since 2005, we have invested over $700 million to modernize our Coffeyville refinery and to meet more stringent federal and state environmental, health and safety requirements. As a result of these investments, we have achieved significant increases in our Coffeyville refinery crude throughput rate from less than 90,000 barrels per stream day (“bpsd”) prior to June 2005 up to approximately 124,000 bpsd in the first quarter of 2013. In early 2012, we successfully and safely completed the second phase of our turnaround at Coffeyville at a total cost of approximately $89 million, which includes the costs of the first phase which occurred in the fourth quarter of 2011. In December 2012 we completed a major turnaround at our Wynnewood refinery, the first since we acquired this refinery in 2011, at a total cost of approximately $103 million. The next turnarounds of our Coffeyville and Wynnewood refineries are scheduled to begin in late 2015 and 2016, respectively.

Synergistic Relationship with CVR Partners. Our relationship with CVR Partners provides us with a number of operational advantages. We have the ability to purchase hydrogen from CVR Partners’ nitrogen fertilizer facility, which provides an important hydrogen supply redundancy to our Coffeyville refinery. We also share a number of utilities with CVR Partners, such as steam and water utilities, which reduces the direct operating expenses of running our Coffeyville refinery. In addition, pursuant to a long-term agreement, CVR Partners purchases 100% of the pet coke that we produce at our Coffeyville refinery, thereby assuring a guaranteed source of demand for this by-product of our refining operations.

Experienced Management Team. The operations members of our senior management team average over 35 years of refining industry experience and, in coordination with our broader management team, have increased operating income and created stockholder value since the acquisition of Coffeyville Resources in June 2005. Mr. John J. Lipinski, our Chief Executive Officer, has over 40 years of experience in the refining industry, and prior to joining us in connection with the acquisition of Coffeyville Resources in June 2005, was in charge of a 550,000 bpd refining system. Mr. Stanley A. Riemann, our Chief Operating Officer, has over 39 years of experience, including running one of the largest fertilizer manufacturing systems in the United States and its petroleum operations. Mr. Robert W. Haugen, our Executive Vice President, Refining Operations, has more than 30 years of experience, serving in numerous engineering, operations, marketing and management positions in the refining, petrochemical and nitrogen fertilizer industries. Mr. Wyatt E. Jernigan, our Executive Vice President, Crude Oil Acquisition and Petroleum Marketing, has more than 35 years of experience in the areas of crude oil and petroleum products as they relate to trading, marketing, logistics and asset development. Mr. Christopher G. Swanberg, our Vice President, Environmental, Health and Safety has over 32 years of experience in various positions within the petroleum refining industry. Mr. David L. Landreth, our Vice President, Economics and Planning, has more than 30 years’ experience in refining and petrochemicals in areas relating to crude, feedstock, product and process optimization, commercial activities, acquisitions and capital utilization.

Our Business Strategy

Our objectives are to provide attractive total returns to unitholders by focusing on business results and total distributions, optimizing our crude supply, pursuing organic growth opportunities and possible acquisitions and maintaining a conservative financial position.

4

Table of Contents

Focus on Business Results and Total Distributions. We expect to focus on optimizing our business results and maximizing total distributions, rather than attempting to manage our results with a focus on minimum distributions. We do not intend to maintain excess distribution coverage in order to stabilize our quarterly distributions or to otherwise reserve cash for future distributions. The board of directors of our general partner has adopted a policy under which we will distribute all of the available cash we generate each quarter as described in “Our Cash Distribution Policy and Restrictions on Distributions.” In addition, our general partner has a non-economic interest in us and no incentive distribution rights, and, accordingly, our unitholders will receive 100% of our cash distributions.

Focus on Optimizing Our Crude Supply. Our strategic location and the complexity of each of our refineries allow us to receive and process a variety of light, heavy, sweet and sour crude oils from the United States and Canada, many of which have historically priced at a discount to WTI. Our management team continues to leverage our location, logistics infrastructure and operational flexibility to optimize our crude oil purchases and minimize our crude oil costs. In addition, we are expanding our gathering system to further increase our ability to purchase crude at a discount to WTI.

Focus on Growth Opportunities. We intend to pursue opportunities to grow our business both organically and through acquisitions.

| • | Organic Growth Projects. We plan to continue to make investments to enhance the operating flexibility and profitability of our refineries. We intend to pursue organic growth projects at our refineries to improve the yield of transportation fuels we produce and the efficiency of our business, which we expect to improve profitability. For example, we plan to undertake process and catalyst modifications of an existing hydrocracker unit at our Wynnewood refinery, as well as to add a hydrogen plant, that will increase the conversion capability and the ULSD yield of the refinery. We also plan to make investments in our logistics operations, including trucking, storage, and pipeline facilities, to enhance our crude oil sourcing flexibility (target growth of around 10% per year) and to reduce related crude oil purchasing and delivery costs. |

| • | Evaluate Accretive Acquisition Opportunities. We will selectively pursue accretive acquisitions. In evaluating acquisitions, we will consider, among other factors, sustainable performance of the targeted assets through the refining cycle, access to advantageous sources of crude oil supplies, attractive supply and demand market fundamentals, access to distribution and logistics infrastructure and potential operating synergies. |

Maintain a Conservative Financial Position. We intend to maintain a conservative total debt level. We plan to retain significant financial flexibility during periods of volatile commodity prices by maintaining a number of sources of liquidity, including cash on hand, our $400 million asset-backed revolving credit facility, and our $150 million senior unsecured revolving credit facility with Coffeyville Resources. We intend to prudently finance our growth capital expenditures on a long term basis with a mix of debt and equity to continue to maintain a conservative total debt level. We may fund expansion capital expenditures, on an interim basis, with our $150 million intercompany credit facility, and thereafter issue term indebtedness and equity securities to finance such growth capital expenditures on a long term basis. See “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Liquidity and Capital Resources” contained in our Quarterly Report on Form 10-Q for the three months ended March 31, 2013, which is incorporated herein by reference. Additionally, we manage our operations prudently with a focus on maintaining sufficient liquidity to meet unforeseen capital needs. As of March 31, 2013 we had approximately $1.05 billion of available liquidity, comprised of $525.1 million of cash on hand, $372.8 million available for borrowing under our $400 million asset-backed revolving credit facility (net of $27.2 million of outstanding letters of credit) (the “Amended and Restated ABL Credit Facility”) and $150 million available for borrowing under our $150 million senior unsecured revolving credit facility with Coffeyville Resources. In addition, we have financial flexibility resulting from trade credit from our crude oil suppliers and our Crude Oil Supply Agreement (the “Vitol Agreement”) with

5

Table of Contents

Vitol Inc. (“Vitol”), which helps reduce the amount of working capital required in our refinery operations. For the year ended December 31, 2012 and three months ended March 31, 2013, we obtained approximately 64% and 66%, respectively, of the crude oil for our Coffeyville refinery under the Vitol Agreement, which was amended and restated in August 2012 to include the provision of crude oil intermediation services for our Wynnewood refinery and to extend the initial term of the agreement. For the three months ended March 31, 2013, we obtained 83% of the crude oil for our Wynnewood refinery under the Vitol Agreement.

Industry Overview

Crude oil refining is the process of separating the hydrocarbons present in crude oil for the purpose of converting them into marketable finished, or refined, petroleum products such as gasoline, diesel, jet fuel, asphalt and other products. Refining is primarily a margin-based business where the crude oil and other feedstocks and refined products are commodities with fluctuating prices. In order to increase profitability, it is important for a refinery to maximize the yields of high value finished products and to minimize the costs of feedstocks and operating expenses, and to do so without compromising safety and environmental performance.

According to the Energy Information Administration (the “EIA”), as of January 1, 2012, there were 134 oil refineries operating in the United States. High capital costs, historical excess capacity and environmental regulatory requirements have limited the construction of new refineries in the United States over the past 30 years. Domestic operating refining capacity has increased approximately 4% between January 1982 and January 2012, from 16.1 million bpd to 16.7 million bpd, according to the EIA. Much of this increase in capacity is generally the result of efficiency measures and moderate expansions at various refineries, known as “capacity creep,” but some significant expansions at existing refineries have occurred as well. During this same time period, more than 120 generally smaller and less efficient refineries were closed.

According to the EIA, total demand for refined products in Group 3 of the PADD II region, where we operate, was over 330 million barrels in 2011. The refining capacity in this region is currently insufficient to meet the demand for refined products. Refining capacity in Group 3 decreased approximately 22% between January 1982 and January 2012, from approximately 1.1 million bpd to approximately 850,000 bpd. The refined product volumes that are necessary to satisfy the demand in excess of Group 3 production are primarily sourced from domestic refineries located outside of the PADD II region, particularly from the Gulf Coast. According to the EIA, due to product supply shortfalls within Group 3, net receipts of gasoline and distillate from domestic sources outside of Group 3 comprised approximately 13% and 14%, respectively, of demand for these products on average over the 2007—2011 period.

The volume of crude oil moving by pipeline from PADD III to PADD II has steadily declined in recent years, as pipeline receipts of Canadian oil sands crude oil and production from domestic oil plays continue to increase. According to the EIA, Canadian crude oil imports into the PADD II region averaged 1.7 million bpd in August 2012, up 41% over August 2010 volumes. The PADD II Group 3 refiners also have access to the growing crude oil supply forecasted to come from North Dakota’s Bakken shale, as well as from the Permian Basin, Anadarko Basin, DJ Basin and other regional liquids plays. According to ITG Investment Research, an independent research firm, liquids production from the Permian, Bakken, Anadarko Basin (which includes the Mississippi Lime, Granite Wash and Cleveland Tonkawa, among others) and DJ Basin (primarily the Niobrara) is expected to double from approximately 2.5 million bpd at the end of 2011 to more than 4.0 million bpd by the end of 2015 and increase to approximately 5.5 million bpd by 2024.

Conflicts of Interest and Fiduciary Duties

Our general partner has a legal duty to manage us in good faith. However, the officers and directors of our general partner also have fiduciary duties to manage our general partner in a manner beneficial to its indirect

6

Table of Contents

owner, CVR Energy. As a result, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and CVR Energy, on the other hand. Our partnership agreement limits the liability and reduces the duties owed by our general partner to our unitholders. Our partnership agreement also restricts the remedies available to our unitholders for actions that might otherwise constitute a breach of our general partner’s duties. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and each unitholder is treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties under Delaware law.

For a more detailed description of the conflicts of interest and the duties of our general partner, see “Conflicts of Interest and Fiduciary Duties.” For a description of other relationships with our affiliates, see “Certain Relationships and Related Transactions, and Director Independence” contained in our Annual Report on Form 10-K for the year ended December 31, 2012 (our “2012 Annual Report”).

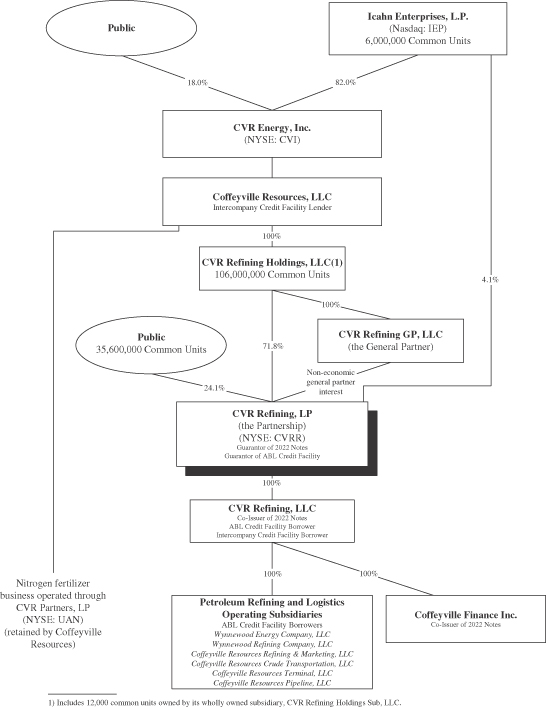

Our Relationship with CVR Energy and Icahn Enterprises, L.P.

Immediately before this offering, CVR Refining Holdings, an indirect wholly-owned subsidiary of CVR Energy, owns 100% of our general partner and approximately 81% of our common units. Following this offering, CVR Refining Holdings will own approximately 73% of our common units (or approximately 72% if the underwriters exercise in full their option to purchase additional common units).

CVR Energy (NYSE: CVI) is a publicly traded Delaware corporation which indirectly owns the general partner and approximately 70% of the common units of CVR Partners (NYSE: UAN), a publicly-traded limited partnership that is an independent producer and marketer of upgraded nitrogen fertilizers in the form of ammonia and urea ammonium nitrate (“UAN”). Icahn Enterprises, L.P. (“Icahn Enterprises”) (NASDAQ: IEP), a master limited partnership which holds interests in operating subsidiaries engaged in various industries, is the holder of 82% of the common stock of CVR Energy. An affiliate of Icahn Enterprises owns approximately 2.7% of our common units. An affiliate of Icahn Enterprises may purchase up to 2,000,000 common units from CVR Refining Holdings in a concurrent privately negotiated transaction at a price per common unit equal to the price per common unit paid by the public in this offering.

About Us

CVR Refining, LP was formed in Delaware in September 2012. Our principal executive offices are located at 2277 Plaza Drive, Suite 500, Sugar Land, Texas 77479, and our telephone number is (281) 207-3200. Our website address is www.cvrrefining.com. Information contained on our website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus. We make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the “SEC”), available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC.

Risk Factors

An investment in our common units involves risks associated with our business, our partnership structure and the tax characteristics of our common units. Please see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” You should carefully consider these risk factors together with all other information included in this prospectus.

7

Table of Contents

Recent Developments

Initial Public Offering

On January 23, 2013, we completed our initial public offering of 24,000,000 common units priced at $25.00 per unit. Of the common units issued, 4,000,000 units were purchased by an affiliate of Icahn Enterprises. Additionally, on January 30, 2013, the underwriters closed their option to purchase an additional 3,600,000 common units at a price of $25.00 per unit. The common units, which are listed on the New York Stock Exchange (“NYSE”), began trading on January 17, 2013 under the symbol “CVRR.” Following the closing of the initial public offering, common units held by public holders represented approximately 19% of all outstanding limited partner interests (including common units held by an affiliate of Icahn Enterprises, representing approximately 2.7% of all outstanding limited partner interests), while CVR Refining Holdings held common units approximating 81% of all outstanding limited partner interests in addition to owning CVR Refining GP, LLC, our general partner.

The net proceeds to us from the initial public offering were approximately $653.6 million, after deducting underwriting discounts and commissions and offering expenses. Approximately $253.0 million of the net proceeds were used to redeem all of the outstanding 10.875% second lien senior secured notes due 2017 (the “2017 Notes”), $160.0 million is being used to prefund certain maintenance and environmental capital expenditures through 2014, $54.0 million were used to fund the turnaround expenses at the Wynnewood refinery in the fourth quarter of 2012, $85.1 million was distributed to Coffeyville Resources and the remaining proceeds have been, or will be, used for general corporate purposes. Prior to the closing of the initial public offering, we distributed approximately $150.0 million of cash on hand to Coffeyville Resources.

Intercompany Credit Facility

On January 23, 2013, prior to the closing of our initial public offering, we entered into a new $150.0 million senior unsecured revolving credit facility (the “intercompany credit facility”) with Coffeyville Resources as the lender to be used to fund growth capital expenditures. The intercompany credit facility is for a term of six years and bears interest at a rate of LIBOR plus 3% per annum.

Issuance of 2022 Notes

On October 23, 2012, CVR Refining, LLC (“CVR Refining”) and Coffeyville Finance Inc. (“Finance”), our wholly-owned subsidiaries, completed the issuance of $500 million in aggregate principal amount of 6.500% Second Lien Senior Secured Notes due 2022 (the “2022 Notes”) in a private placement. We used $348.0 million of the net proceeds from the sale of the Notes to finance the purchase of $323.0 million aggregate principal amount of notes tendered in a cash tender offer and consent solicitation for the outstanding 9.0% First Lien Senior Secured Notes due 2015 (the “2015 notes”) issued by Coffeyville Resources and Finance. We used a portion of the remaining net proceeds from the 2022 Notes offering to fund the redemption of the remaining $124.1 million of outstanding 2015 Notes and to settle accrued interest of approximately $1.6 million through November 23, 2012. Upon redemption of the 2017 Notes, the collateral securing the 2022 Notes was released and Coffeyville Resources ceased being a guarantor of the 2022 Notes.

8

Table of Contents

Organizational Structure

The following chart illustrates our organizational structure and the organizational structure of CVR Energy after giving effect to this offering (assuming the underwriter’s option to purchase additional common units is not exercised), and assuming an affiliate of Icahn Enterprises purchases 2,000,000 from CVR Refining Holdings in a concurrent privately negotiated transaction):

9

Table of Contents

THE OFFERING

| Issuer |

CVR Refining, LP |

| Common units offered |

12,000,000 common units. |

| Option to purchase additional common units |

We have granted the underwriters a 30-day option to purchase up to an additional 1,800,000 common units. |

| Common units outstanding before and after this offering |

147,600,000 common units. |

| Use of proceeds |

We will use the net proceeds of this offering to redeem from CVR Refining Holdings a number of common units equal to the number of common units sold in this offering. See “Use of Proceeds.” |

| We will use the net proceeds from any exercise of the underwriters’ option to purchase additional common units to redeem an equal number of common units from CVR Refining Holdings. Accordingly, this offering will not change the number of common units outstanding. |

| Immediately before this offering, CVR Refining Holdings directly owned 119,988,000 common units and indirectly owned an additional 12,000 common units, representing an approximate 81% limited partner interest in us. Following this offering, CVR Refining Holdings will own 108,000,000 common units, or 106,200,000 common units if the underwriters exercise in full their option to purchase additional common units, representing an approximate 73% or 72% limited partner interest in us, respectively. |

| In addition, an affiliate of Icahn Enterprises may purchase up to 2,000,000 common units from CVR Refining Holdings in a concurrent privately negotiated transaction at a price per common unit equal to the price per common unit paid by the public in this offering. |

| Cash distributions |

Within 60 days after the end of each quarter, beginning with the quarter ending March 31, 2013, we expect to make distributions to unitholders of record on the applicable record date. On April 30, 2013, the board of directors of our general partner declared a cash distribution of $1.58 per common unit, which includes available cash for the period from January 23, 2013, the closing date of our IPO, through March 31, 2013. The distribution will be paid on May 17, 2013 to unitholders of record on May 10, 2013. Accordingly, purchasers of common units in this offering will not receive the distribution in respect of the first quarter of 2013. |

| Our general partner’s current policy is to distribute all of the available cash we generate each quarter. Available cash for each quarter will be determined by the board of directors of our general partner following the end of such quarter. We expect that available cash for each quarter |

10

Table of Contents

| will generally equal our Adjusted EBITDA for the quarter, less cash needed for debt service, reserves for maintenance and environmental capital expenditures, and reserves for expenses associated with our major scheduled turnarounds. Our general partner may also determine that it is appropriate to reserve cash for future operating or capital needs. |

| We do not intend to maintain excess distribution coverage for the purpose of maintaining stability or growth in our quarterly distribution or to otherwise reserve cash for distributions, and we do not intend to incur debt to pay quarterly distributions. Further, it is our intent, subject to market conditions, to finance growth capital externally, and not to reserve cash for unspecified potential future needs. |

| Because our policy is to distribute an amount equal to all available cash we generate each quarter, our unitholders have direct exposure to fluctuations in the amount of cash generated by our business. We expect that the amount of our quarterly distributions, if any, will vary based on our earnings during each quarter. As a result, our quarterly distributions, if any, will not be stable and will vary from quarter to quarter as a direct result of variations in, among other factors, (i) our operating performance, (ii) earnings caused by, among other things, fluctuations in the prices of crude oil and other feedstocks and the prices we receive for finished products, changes to working capital or capital expenditures and (iii) cash reserves deemed necessary or appropriate by our general partner. Such variations in the amount of our quarterly distributions may be significant. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. Our general partner may change our distribution policy at any time. Our partnership agreement does not require us to pay distributions to our unitholders on a quarterly or other basis. |

| Subordinated units |

None. |

| Incentive Distribution Rights |

None. |

| Issuance of additional units |

Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our unitholders. Please read “Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Partnership Interests.” |

| Limited voting rights |

Our general partner manages us and operates our business. Unlike the holders of common stock in a corporation, our unitholders have only limited voting rights on matters affecting our business. Our unitholders have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the unitholders holding at least 66 2/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon completion of this offering, as the owner of CVR Refining |

11

Table of Contents

| Holdings, CVR Energy will own approximately of 73% of our common units (or approximately 72% of our common units, if the underwriters exercise their option to purchase additional common units in full). This effectively gives CVR Energy the ability to prevent the removal of our general partner. In addition, an affiliate of Icahn Enterprises directly owns approximately 2.7% of our common units. Please read “The Partnership Agreement—Voting Rights.” |

| Limited call right |

If at any time our general partner and its affiliates (including CVR Energy and Icahn Enterprises) own more than 95% of the units, our general partner will have the right, but not the obligation, to purchase all, but not less than all, of the units held by unaffiliated unitholders at a price not less than their then-current market price, as calculated pursuant to the terms of our partnership agreement. If our general partner and its affiliates reduce their ownership percentage to below 70% of the outstanding units, the ownership threshold to exercise the call right will be permanently reduced to 80%. See “The Partnership Agreement—Call Right.” |

| Material federal income tax consequences |

For a discussion of the material federal income tax consequences that may be relevant to unitholders who are individual citizens or residents of the United States, please read “Material Tax Consequences.” |

| Exchange listing |

Our common units are listed for trading on the NYSE under the symbol “CVRR.” |

12

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED AND COMBINED FINANCIAL

AND OPERATING DATA

The summary historical combined financial information presented below under the caption Statement of Operations Data for the years ended December 31, 2010, 2011 and 2012 and the summary historical consolidated and combined financial information presented below under the caption Balance Sheet Data as of December 31, 2011 and 2012, have been derived from CVR Refining, LP’s audited consolidated and combined financial statements, which have been audited by KPMG LLP, our independent registered public accounting firm. The historical consolidated and combined financial data presented below has been derived from consolidated and combined financial statements that have been prepared using accounting principles generally accepted in the United States (“GAAP”). The summary historical condensed consolidated and combined financial information presented below under the caption Statement of Operations Data for the three months ended March 31, 2013 and 2012, and the summary historical condensed and consolidated financial information presented below under the caption Balance Sheet Data as of March 31, 2013, have been derived from our unaudited interim condensed consolidated and combined financial statements incorporated by reference into this prospectus from our quarterly report on Form 10-Q for the quarter ended March 31, 2013. The unaudited interim condensed consolidated and combined financial statements were prepared on a basis consistent with our audited consolidated financial statements. In our opinion, the unaudited interim condensed consolidated and combined financial statements include all adjustments necessary for the fair presentation of those statements. Our historical results are not necessarily indicative of future results and our results for the three months ended March 31, 2013 are not necessarily indicative of the results for the full 2013 fiscal year.

This data should be read in conjunction with, and is qualified in its entirety by reference to, the consolidated and combined financial statements and notes related thereto included in our 2012 Annual Report, and the unaudited interim condensed consolidated and combined financial statements and notes related thereto included in our Quarterly Report on Form 10-Q for the three months ended March 31, 2013. For a detailed discussion of the summary historical financial information and operating data contained in the following table, please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our 2012 Annual Report and Quarterly Report on Form 10-Q for the three months ended March 31, 2013, each of which is incorporated herein by reference.

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions, except per unit data and as otherwise indicated) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 3,905.6 | $ | 4,752.8 | $ | 8,281.7 | $ | 1,898.5 | $ | 2,274.0 | ||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Cost of product sold |

3,539.8 | 3,927.6 | 6,667.5 | 1,630.7 | 1,805.8 | |||||||||||||||

| Direct operating expenses(2) |

153.1 | 247.7 | 426.5 | 92.7 | 86.0 | |||||||||||||||

| Selling, general and administrative expenses |

43.1 | 51.0 | 86.2 | 20.2 | 18.6 | |||||||||||||||

| Depreciation and amortization |

66.4 | 69.8 | 107.6 | 26.3 | 28.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

$ | 103.2 | $ | 456.7 | $ | 993.9 | $ | 128.6 | $ | 335.6 | ||||||||||

| Other income (expense), net(3) |

(13.8 | ) | (1.5 | ) | (36.8 | ) | — | (26.0 | ) | |||||||||||

| Interest expense and other financing costs |

(49.7 | ) | (53.0 | ) | (76.2 | ) | (18.8 | ) | (14.2 | ) | ||||||||||

| Realized gain (loss) on derivatives, net |

(2.1 | ) | (7.2 | ) | (137.6 | ) | (19.1 | ) | (52.5 | ) | ||||||||||

| Unrealized gain (loss) on derivatives, net |

0.6 | 85.3 | (148.0 | ) | (128.1 | ) | 32.5 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss)(3) |

$ | 38.2 | $ | 480.3 | $ | 595.3 | $ | (37.4 | ) | $ | 275.4 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

13

Table of Contents

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions, except per unit data and as otherwise indicated) | ||||||||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

| Cash and cash equivalents(4) |

$ | 2.3 | $ | 2.7 | $ | 153.1 | $ | 525.1 | ||||||||||||

| Working capital |

138.7 | 384.7 | 382.6 | 866.2 | ||||||||||||||||

| Total assets |

1,072.8 | 2,262.4 | 2,258.5 | 2,693.3 | ||||||||||||||||

| Total debt, including current portion |

469.0 | 729.9 | 773.2 | 552.0 | ||||||||||||||||

| Total divisional equity/partners’ capital |

418.8 | 1,018.6 | 980.8 | 1,678.3 | ||||||||||||||||

| Cash Flow Data |

||||||||||||||||||||

| Net cash flow provided by (used in): |

||||||||||||||||||||

| Operating activities |

$ | 167.0 | $ | 352.7 | $ | 917.3 | $ | 145.0 | $ | 239.5 | ||||||||||

| Investing activities |

(21.1 | ) | (655.9 | ) | (119.8 | ) | (35.4 | ) | (44.6 | ) | ||||||||||

| Financing activities(4) |

(146.3 | ) | 303.6 | (647.1 | ) | (70.1 | ) | 177.0 | ||||||||||||

| Other Financial Data |

||||||||||||||||||||

| Capital expenditures for property, plant and equipment |

$ | 21.2 | $ | 68.8 | $ | 120.2 | $ | 35.5 | $ | 44.6 | ||||||||||

| Adjusted EBITDA(5) |

$ | 152.6 | $ | 577.3 | $ | 1,176.2 | $ | 143.0 | $ | 309.9 | ||||||||||

| Key Operating Data(1) |

||||||||||||||||||||

| Crude oil throughput (bpd)(6): |

||||||||||||||||||||

| Sweet |

89,746 | 83,538 | 130,414 | 110,636 | 156,725 | |||||||||||||||

| Medium |

8,180 | 1,704 | 21,334 | 24,982 | 14,757 | |||||||||||||||

| Heavy sour |

15,439 | 18,460 | 17,608 | 11,040 | 23,334 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total crude oil throughput |

113,365 | 103,702 | 169,356 | 146,658 | 194,816 | |||||||||||||||

| All other feedstocks and blendstocks |

10,350 | 5,231 | 10,791 | 8,727 | 9,774 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total throughput (bpd)(6) |

123,715 | 108,933 | 180,147 | 155,385 | 204,590 | |||||||||||||||

| Production (bpd)(6): |

||||||||||||||||||||

| Gasoline |

61,136 | 48,486 | 89,787 | 81,291 | 98,184 | |||||||||||||||

| Distillate |

50,439 | 45,535 | 72,804 | 62,329 | 83,841 | |||||||||||||||

| Other |

12,978 | 15,385 | 17,262 | 10,879 | 23,543 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total refining production (excluding internally produced fuel) |

124,553 | 109,406 | 179,853 | 154,499 | 205,568 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NYMEX 2-1-1 crack spread (per barrel)(7) |

$ | 10.07 | $ | 26.33 | $ | 30.75 | $ | 27.53 | $ | 32.33 | ||||||||||

| PADD II Group 3 2-1-1 crack spread (per barrel)(7) |

$ | 10.01 | $ | 26.77 | $ | 30.28 | $ | 23.32 | $ | 29.59 | ||||||||||

| Refining margin per crude oil throughput barrel(5) |

$ | 8.84 | $ | 21.80 | $ | 26.04 | $ | 20.07 | $ | 26.71 | ||||||||||

| Refining margin per crude oil throughput barrel adjusted for FIFO impact(5) |

$ | 8.07 | $ | 21.12 | $ | 26.98 | $ | 18.62 | $ | 26.44 | ||||||||||

| Direct operating expenses (excluding major scheduled turnaround expenses) per crude oil throughput barrel(2)(5) |

$ | 3.67 | $ | 4.79 | $ | 4.89 | $ | 5.38 | $ | 4.91 | ||||||||||

| Gross profit (excluding major scheduled turnaround expenses and adjusted for FIFO impact) per crude oil throughput barrel(5) |

$ | 2.80 | $ | 14.49 | $ | 20.36 | $ | 11.28 | $ | 19.93 | ||||||||||

| (1) | We acquired WEC on December 15, 2011 and its results of operations are included from the date of acquisition. In addition, we incurred approximately $5.2 million and $11.0 million of transaction and integration costs related to the acquisition in 2011 and 2012, respectively. These transactions impact the comparability of the Summary Historical Operating Data. Key operating data includes WEC numbers for the period beginning December 16, 2011 through March 31, 2013. |

14

Table of Contents

| (2) | Direct operating expense is presented on a per crude oil throughput barrel basis. In order to derive the direct operating expenses per crude oil throughput barrel, we utilize the total direct operating expenses, which do not include depreciation or amortization expense, and divide by the applicable number of crude oil throughput barrels for the period. |

| (3) | The following are certain charges and costs incurred in each of the relevant periods that are meaningful to understanding our net income and in evaluating our performance due to their unusual or infrequent nature and are not otherwise presented above: |

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Loss on extinguishment of debt(a) |

$ | 16.6 | $ | 2.1 | $ | 37.5 | $ | — | $ | 26.1 | ||||||||||

| Wynnewood acquisition transaction fees and integration expense |

— | 5.2 | 11.0 | 3.7 | — | |||||||||||||||

| Major scheduled turnaround expense(b) |

1.2 | 66.4 | 123.7 | 21.0 | — | |||||||||||||||

| Share-based compensation, non-cash(c) |

11.5 | 8.9 | 18.5 | 1.8 | 3.5 | |||||||||||||||

| (a) | Represents for the year ended December 31, 2012, the write-off of deferred financing costs, unamortized premium and premiums paid upon the extinguishment of the 2015 Notes, which contributed to $33.4 million of the loss on extinguishment. Additionally, $4.1 million of the loss on extinguishment of debt was attributable to the write-off of a portion of previously deferred financing costs associated with ABL credit facility, which was replaced with an Amended and Restated ABL Credit Facility. For the year ended December 31, 2011, the write-off of a portion of previously deferred financing costs upon the replacement of the first priority credit facility with the ABL credit facility contributed to $1.9 million of the loss on extinguishment. Additionally, $0.2 million of the loss on extinguishment of debt was attributable to the write-off of previously deferred financing costs and unamortized original issue discount associated with the repurchase of $2.7 million of First Lien Notes. For the year ended December 31, 2010, a premium of 2.0% paid in connection with unscheduled prepayments and payoff of our tranche D term loan contributed $9.6 million of the loss on extinguishment. Additionally, $5.4 million of the loss on extinguishment of debt was attributable to the write-off of previously deferred financing costs associated with the payoff of the tranche D term loan. Concurrent with the issuance of the Old Notes, $0.1 million of third-party costs were immediately expensed. In December 2010, we made a voluntary unscheduled principal payment on our Old Notes resulting in a premium payment of 3.0% and a partial write-off of previously deferred financing costs and unamortized original issue discount totaling $1.6 million. The repurchase of the 2017 Notes resulted in a loss on extinguishment of debt of approximately $26.1 million for the three months ended March 31, 2013, which includes the write-off of previously deferred financing fees of $3.7 million and unamortized original issue discount of $1.8 million. |

| (b) | Represents expense associated with major scheduled turnarounds at the refineries. |

| (c) | Represents the impact of share-based compensation awards which are non-cash awards. |

| (4) | Prior to December 31, 2012, Coffeyville Resources provided cash as necessary to support our operations and retained excess cash generated by our operations. Historical cash received, or paid by, Coffeyville Resources on our behalf has been recorded as net contributions from, or net distributions to, parent, respectively, as a component of divisional equity in our historical consolidated and combined financial statements, and as a financing activity in our Combined Statement of Cash Flows. Net contributions from (distributions to) parent included in cash flows from financing activities were $(116.3) million, $110.6 million and $(651.6) million and, for the years ended December 31, 2010, 2011 and 2012, respectively. |

15

Table of Contents

| (5) | For a reconciliation to the most directly comparable GAAP financial measures, please see “—Non-GAAP Financial Measures” below. |

| (6) | Barrels per day is calculated by dividing the volume in the period by the number of calendar days in the period. Barrels per day as shown here is impacted by plant down-time and other plant disruptions and does not represent the capacity of the facilities’ continuous operations. |

| (7) | Data published by Platts and Oil Price Information Service and represents average pricing for the periods presented. |

Non-GAAP Financial Measures

Refining Margin Per Crude Oil Throughput Barrel. Refining margin per crude oil throughput barrel is a measurement calculated as the difference between net sales and cost of product sold (exclusive of depreciation and amortization) divided by our refineries’ crude oil throughput volumes for the respective periods presented. Refining margin per crude oil throughput barrel is a non-GAAP measure that should not be substituted for gross profit or operating income. Management believes this measure is important to investors in evaluating our refineries’ performance as a general indication of the amount above our cost of product sold that we are able to sell refined products. Our calculation of refining margin per crude oil throughput barrel may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. We use refining margin per crude oil throughput barrel as the most direct and comparable metric to a crack spread which is an observable market indication of industry profitability. A reconciliation of net sales to refining margin per crude oil throughput barrel for the periods presented is included below.

Refining Margin Per Crude Oil Throughput Barrel Adjusted for FIFO Impact. Refining margin per crude oil throughput barrel adjusted for FIFO impact is a measurement calculated as the difference between net sales and cost of product sold (exclusive of depreciation and amortization) adjusted for FIFO impacts divided by our refineries’ crude oil throughput volumes for the respective periods presented. Refining margin adjusted for FIFO impact is a non-GAAP measure that we believe is important to investors in evaluating our refineries’ performance as a general indication of the amount above our cost of product sold (taking into account the impact of our utilization of FIFO) that we are able to sell refined products. Our calculation of refining margin adjusted for FIFO impact may differ from calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Under our FIFO accounting method, changes in crude oil prices can cause fluctuations in the inventory valuation of our crude oil, work in process and finished goods, thereby resulting in favorable FIFO impacts when crude oil prices increase and unfavorable FIFO impacts when crude oil prices decrease. A reconciliation of net sales to refining margin per crude oil throughput barrel adjusted for FIFO impact is included below:

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions, except as otherwise indicated) | ||||||||||||||||||||

| Net sales |

$ | 3,905.6 | $ | 4,752.8 | $ | 8,281.7 | $ | 1,898.5 | $ | 2,274.0 | ||||||||||

| Less: cost of product sold (exclusive of depreciation and amortization) |

3,539.8 | 3,927.6 | 6,667.5 | 1,630.7 | 1,805.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Refining margin |

365.8 | 825.2 | 1,614.2 | 267.8 | 468.2 | |||||||||||||||

| FIFO impacts (favorable), unfavorable |

(31.7 | ) | (25.6 | ) | 58.4 | (19.3 | ) | (4.7 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Refining margin adjusted for FIFO impact |

334.1 | 799.6 | 1,672.6 | 248.5 | 463.5 | |||||||||||||||

| Crude oil throughput(bpd) |

113,365 | 103,702 | 169,356 | 146,658 | 194,816 | |||||||||||||||

| Refining margin per crude oil throughput barrel |

$ | 8.84 | $ | 21.80 | $ | 26.04 | $ | 20.07 | $ | 26.71 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Refining margin per crude oil throughput barrel adjusted for FIFO impact |

$ | 8.07 | $ | 21.12 | $ | 26.98 | $ |

18.62 |

|

$ | 26.44 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

Table of Contents

EBITDA and Adjusted EBITDA. EBITDA represents net income before (i) interest expense and other financing costs, net of interest income, (ii) income tax expense and (iii) depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted for FIFO impacts (favorable) unfavorable; share-based compensation, non-cash; major scheduled turnaround expenses; loss on disposition of fixed assets; unrealized (gain) loss on derivatives, net; loss on extinguishment of debt and expenses associated with the Gary-Williams acquisition. We present Adjusted EBITDA because it is the starting point for our available cash for distribution. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be substituted for net income or cash flow from operations. Management believes that EBITDA and Adjusted EBITDA enables investors to better understand our ability to make distributions to our common unitholders, evaluate our ongoing operating results and allows for greater transparency in reviewing our overall financial, operational and economic performance. EBTIDA and Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define these terms differently. Below is a reconciliation of net income to EBITDA and EBITDA to Adjusted EBITDA for each of the periods presented:

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Net income (loss) |

$ | 38.2 | $ | 480.3 | $ | 595.3 | $ | (37.4 | ) | $ | 275.4 | |||||||||

| Add: |

||||||||||||||||||||

| Interest expense and other financing costs |

49.7 | 53.0 | 76.2 | 18.8 | 14.1 | |||||||||||||||

| Income tax expense |

— | — | — | — | — | |||||||||||||||

| Depreciation and amortization |

66.4 | 69.8 | 107.6 | 26.3 | 28.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 154.3 | $ | 603.1 | $ | 779.1 | 7.7 | 317.5 | ||||||||||||

| Add: |

||||||||||||||||||||

| FIFO impacts (favorable), unfavorable(a) |

(31.7 | ) | (25.6 | ) | 58.4 | (19.3 | ) | (4.7 | ) | |||||||||||

| Share-based compensation, non-cash |

11.5 | 8.9 | 18.5 | 1.8 | 3.5 | |||||||||||||||

| Loss on disposition of assets |

1.3 | 2.5 | — | — | — | |||||||||||||||

| Loss on extinguishment of debt |

16.6 | 2.1 | 37.5 | — | 26.1 | |||||||||||||||

| Wynnewood acquisition transaction fees and integration expenses |

— | 5.2 | 11.0 | 3.7 | — | |||||||||||||||

| Major scheduled turnaround expenses |

1.2 | 66.4 | 123.7 | 21.0 | — | |||||||||||||||

| Unrealized (gain) loss on derivatives, net |

(0.6 | ) | (85.3 | ) | 148.0 | 128.1 | (32.5 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 152.6 | $ | 577.3 | $ | 1,176.2 | $ | 143.0 | $ | 309.9 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | FIFO is our basis for determining inventory value on a GAAP basis. Changes in crude oil prices can cause fluctuations in the inventory valuation of our crude oil, work in process and finished goods thereby resulting in favorable FIFO impacts when crude oil prices increase and unfavorable FIFO impacts when crude oil prices decrease. The FIFO impact is calculated based upon inventory values at the beginning of the accounting period and at the end of the accounting period. |

Direct Operating Expenses (Excluding Major Scheduled Turnaround Expenses) Per Crude Oil Throughput Barrel. Direct operating expenses excluding major scheduled turnaround expenses per crude oil throughput barrel is a measurement calculated by excluding major scheduled turnaround expenses from direct operating expenses (exclusive of depreciation and amortization) divided by our refineries’ crude oil throughput volumes for the respective periods presented. Direct operating expenses excluding major scheduled turnaround

17

Table of Contents

expenses per crude oil throughput barrel is a supplemental measure of our performance that is not required by, nor presented in accordance with, GAAP. Management believes direct operating expenses excluding major scheduled turnaround expenses per crude oil throughput most directly represents ongoing direct operating expenses at our refineries. Below is a reconciliation of direct operating expenses to direct operating expenses excluding major scheduled turnaround expense for the periods presented:

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions, except as otherwise indicated) |

||||||||||||||||||||

| Direct operating expenses |

$ | 153.1 | $ | 247.7 | $ | 426.5 | $ | 92.7 | $ | 86.0 | ||||||||||

| Less: Major scheduled turnaround expense |

(1.2 | ) | (66.4 | ) | (123.7 | ) | (21.0 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Direct operating expenses excluding major scheduled turnaround expenses |

151.9 | 181.3 | 302.8 | 71.7 | 86.0 | |||||||||||||||

| Crude oil throughput(bpd) |

113,365 | 103,702 | 169,356 | 146,658 | 194,816 | |||||||||||||||

| Direct operating expenses (excluding major scheduled turnaround expenses) per crude oil throughput barrel |

$ | 3.67 | $ | 4.79 | $ | 4.89 | $ | 5.38 | $ | 4.91 | ||||||||||

Gross Profit (Excluding Major Scheduled Turnaround Expenses and Adjusted for FIFO Impacts) Per Crude Oil Throughput Barrel. Gross profit excluding major scheduled turnaround expenses and adjusted for FIFO impacts per crude oil throughput barrel is calculated as the difference between net sales, cost of product sold (exclusive of depreciation and amortization) adjusted for FIFO impacts, direct operating expenses (exclusive of depreciation and amortization) excluding scheduled turnaround expenses divided by our refineries’ crude oil throughput volumes for the respective periods presented. Gross profit excluding major scheduled turnaround expenses and adjusted for FIFO impacts is a non-GAAP measure that should not be substituted for gross profit or operating income. Management believes it is important to investors in evaluating our refineries’ performance and our ongoing operating results. Our calculation of gross profit excluding major scheduled turnaround expenses and adjusted for FIFO impacts per crude oil throughput may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. A reconciliation of net sales to gross profit excluding major scheduled turnaround expenses and adjusted for FIFO impacts for the periods presented is included below:

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2010 | 2011(1) | 2012 | 2012 | 2013 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in millions, except as otherwise indicated) | ||||||||||||||||||||

| Net sales |

$ | 3,905.6 | $ | 4,752.8 | $ | 8,281.7 | $ | 1,898.5 | $ | 2,274.0 | ||||||||||

| Cost of product sold |

3,539.8 | 3,927.6 | 6,667.5 | 1,630.7 | 1,805.8 | |||||||||||||||

| Direct operating expenses |

153.1 | 247.7 | 426.5 | 92.7 | 86.0 | |||||||||||||||

| Depreciation and amortization |

66.4 | 69.8 | 107.6 | 26.3 | 28.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

146.3 | 507.7 | 1080.1 | 148.8 | 354.2 | |||||||||||||||

| Add: |

||||||||||||||||||||

| Major scheduled turnaround expense |

1.2 | 66.4 | 123.7 | 21.0 | — | |||||||||||||||

| FIFO impacts (favorable)/unfavorable |

(31.7 | ) | (25.6 | ) | 58.4 | (19.3 | ) | (4.7 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit excluding major scheduled turnaround expenses and adjusted for FIFO impacts |

115.8 | 548.5 | 1,262.2 | 150.5 | 349.5 | |||||||||||||||

| Crude oil throughput(bpd) |

113,365 | 103,702 | 169,356 | 146,658 | 194,816 | |||||||||||||||

| Gross profit (excluding major scheduled turnaround expenses and adjusted for FIFO impact) per crude oil throughput barrel |

$ | 2.80 | $ | 14.49 | $ | 20.36 | $ | 11.28 | $ | 19.93 | ||||||||||

18

Table of Contents