Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a50630032ex99_1.htm |

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a50630032.htm |

Exhibit 99.2

|

THOMSON REUTERS STREETEVENTS

|

|

EDITED TRANSCRIPT

|

|

MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

|

EVENT DATE/TIME: MAY 09, 2013 / 01:00PM GMT

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

1

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles MAXIMUS, Inc. - VP, Corporate Communications

David Walker MAXIMUS, Inc. - CFO

Rich Montoni MAXIMUS, Inc. - President and CEO

Bruce Caswell MAXIMUS, Inc. - President & General Manager, Health Services

CONFERENCE CALL PARTICIPANTS

Charles Strauzer CJS Securities - Analyst

James Naklicki Citigroup - Analyst

Richard Close Avondale Partners - Analyst

Brian Kinstlinger Sidoti & Company - Analyst

Frank Sparacino First Analysis Securities - Analyst

PRESENTATION

Operator

Greetings and welcome to the MAXIMUS fiscal 2013 second-quarter conference call. At this time all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. (Operator Instructions) As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you, Ms. Miles; you may begin.

Lisa Miles - MAXIMUS, Inc. - VP, Corporate Communications

Good morning. Thank you for joining us on today's conference call. I would like to point out that we have posted a presentation to our website under the Investor Relations page to assist you in following along with today's call.

With me today is Rich Montoni, Chief Executive Officer; and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions, and actual events or results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings.

We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

And with that, I'll turn the call over to Dave.

David Walker - MAXIMUS, Inc. - CFO

Thanks, Lisa, and good morning. We are pleased to report another solid quarter of financial results.

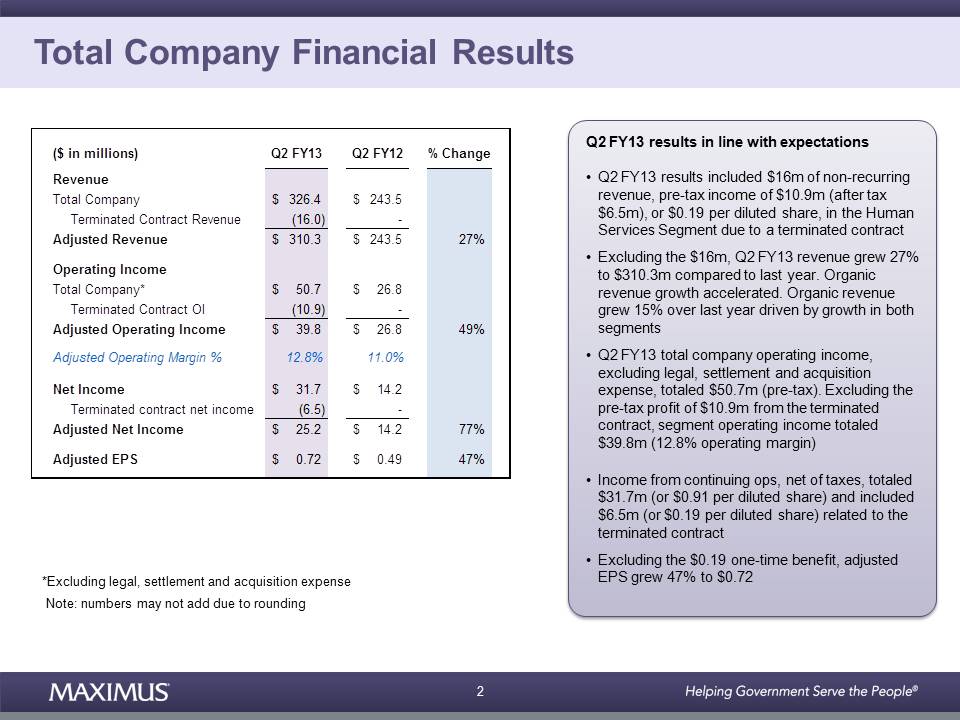

As noted in today's press release, second-quarter results included $16 million of nonrecurring revenue in the human services segment and pretax income of $10.9 million, which on a tax-effected basis is $6.5 million or $0.19 per diluted share. As a reminder, we filed an 8-K on February 26, disclosing the termination of a contract as part of a broad statewide initiative to focus resources on a smaller number of programs. The recognized revenue in profit relate to deferred revenue associated with the PSI acquisition. We recommend that investors exclude this one-time, non-cash revenue in profit, as it is not indicative of current and ongoing operations.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

2

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

As I walk through the financial results, I will provide both the reported GAAP number as well as the normalized results that exclude this nonrecurring item. So let's get started. This morning, MAXIMUS reported total Company revenue for the fiscal second quarter of $326.4 million. Excluding the $16 million of revenue from the terminated contract, fiscal second-quarter revenue grew 27% to $310.3 million compared to the same period last year, driven by the PSI acquisition and organic growth, as expected.

Organic revenue growth in the quarter accelerated. Organic revenue grew 15% over the prior-year period due to solid expansion across both segments and in our international operations.

Moving on to operating margin, total Company operating income, excluding legal, settlement, and acquisition expense (technical difficulty) excluding the $10.9 million in pretax profit from the discontinued contract, segment operating income totaled $39.8 million, which reflects a 12.8% total Company operating margin for our fiscal second quarter of 2013.

On the bottom line, earnings were in line with our expectations. For the second quarter, income from continuing operations, net of taxes, totaled $31.7 million or $0.91 per diluted share. This includes the one-time benefit of $6.5 million, net of taxes, or $0.19 per diluted share related to the contract termination. Excluding the $.19, adjusted diluted earnings per share in the second fiscal quarter of 2013 increased 47% to $0.72, compared to $0.49 reported last year.

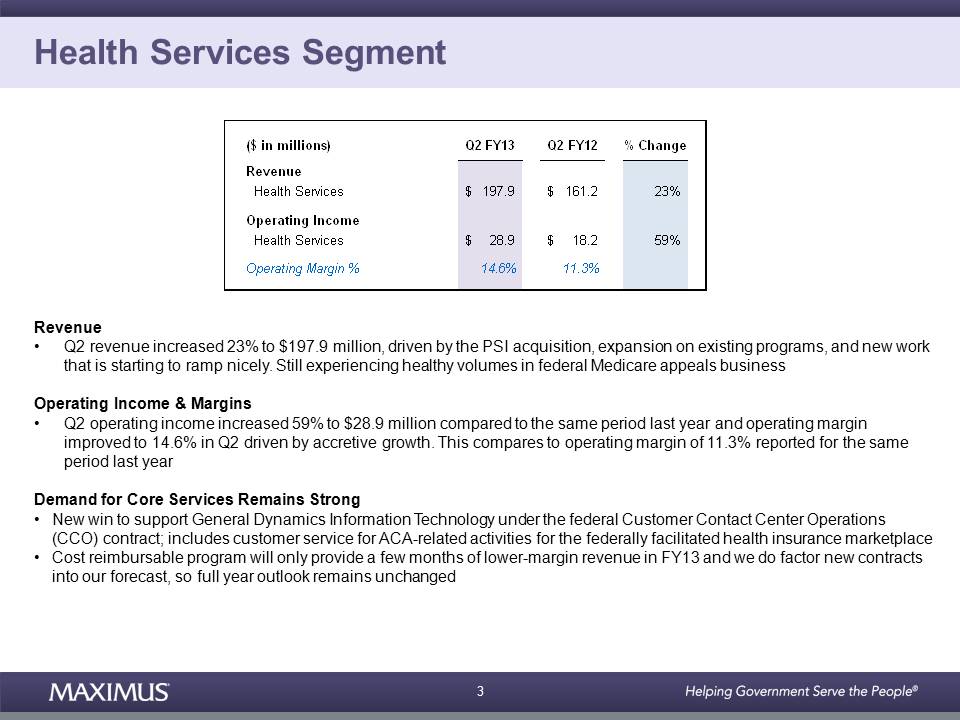

Let's jump into results by segment, starting with Health Services. For the second quarter, Health Services revenue increased 23% to $197.9 million compared to the same period last year, driven by the PSI acquisition, expansion on existing programs, and new work that is starting to ramp up nicely. And as we mentioned last quarter, we also continue to experience healthy volumes in our federal Medicare repeals business.

Operating income for the Health Services segment increased 59% to $28.9 million compared to $18.2 million reported for the same period last year. Operating margin improved to 14.6% in the second quarter of fiscal 2013, driven by accretive growth. This compares to 11.3% reported in the prior-year period.

And, lastly, the Health Services segment continues to benefit from strong demand in our core service areas, as demonstrated by the new win to support General Dynamics as a subcontractor under the federal Customer Contact Center Operations Contract. This work includes customer service activities for the federally facilitated health insurance marketplace.

Since this cost-reimbursable program is expected to provide only a few months of lower-margin revenue in fiscal 2013, and because we factor identified new contracts in our forecast, our full-year outlook remains unchanged. The team is currently in contract negotiations, so at this time we are unable to disclose additional contractual details, including contract size and length.

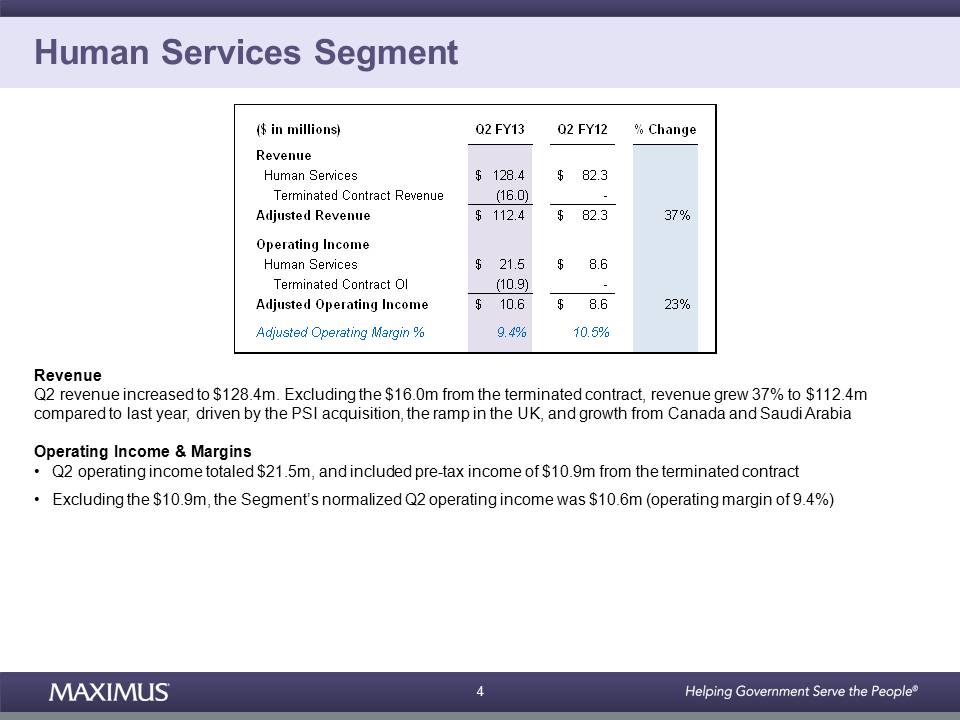

Now let's turn our attention to financial results for Human Services. For the second fiscal quarter, revenue for the Human Services segment increased to $128.4 million compared to last year. Excluding the $16 million in nonrecurring revenue from the contract termination, the top line grew 37% to $112.4 million.

For the second quarter, revenue increases for the Human Services segment were driven by the PSI acquisition; the ongoing ramp-up in the UK; as well as growth from our international operations, including Canada and Saudi Arabia. Human Services operating income for the fiscal second quarter totaled $21.5 million and included pretax profit from the contract termination of $10.9 million.

Excluding the $10.9 million in one-time pretax income, the segment's normalized second-quarter operating income was $10.6 million, delivering an operating margin of 9.4%. This compares to operating income of $8.6 million and an operating margin of 10.5% reported for the same period last year.

For the second quarter of fiscal year 2013, ongoing profit improvements from new programs ramping up in the UK, Canada, and Saudi Arabia offset expected margin decreases in Australia.

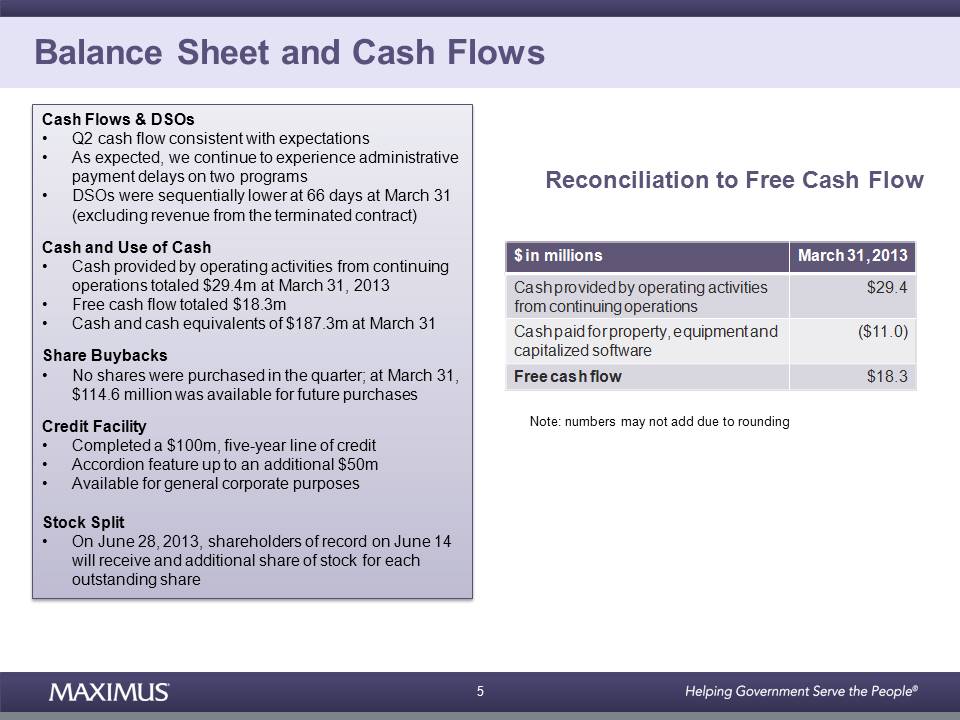

Moving on to cash flow and balance sheet items, cash flow in the fiscal second quarter was consistent with our expectations. However, as I mentioned (technical difficulty), we have two sizable programs with slower payments due to administrative delays.

On a sequential basis, our DSOs were lower at 66 days, excluding the revenue from the terminated contract, which is well within our expected range. Cash provided by operating activities from continuing operations totaled $29.4 million for the quarter, and we generated free cash flow of $18.3 million.

As a quick reminder, we calculate free cash flow by taking cash provided by operating activities of $29.4 million, less capital expenditures related to PP&E and capitalized software of $11 million. This gets you to free cash flow of $18.3 million for the second quarter.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

3

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

At March 31, we had $187.3 million in cash and cash equivalents, of which approximately 70% is held overseas. During the quarter, MAXIMUS did not repurchase any shares of common stock. At March 31, 2013, we had $114.6 million available for future repurchases under our Board-authorized share repurchase program.

Also during the quarter, MAXIMUS completed a $100 million five-year line of credit with an accordion feature, which could provide up to an additional $50 million. The credit facility is available for general corporate purposes, such as working capital, acquisitions, dividends, and share repurchases. This loan line provides us with sensibly priced debt to take advantage of market opportunities, both domestically or internationally. So we are very pleased to wrap up this process that supports our long-term growth objectives, and we feel great about our continued relationship with SunTrust and expanded relationship with Bank of America and HSBC.

Subsequent to quarter end, we announced a 2 for 1 stock split that will take effect at the end of June. On June 28, 2013, shareholders of record on June 14, 2013, will receive an additional share of stock for each outstanding share. The stock split reaffirms our confidence in the business and our commitment to maximize shareholder value.

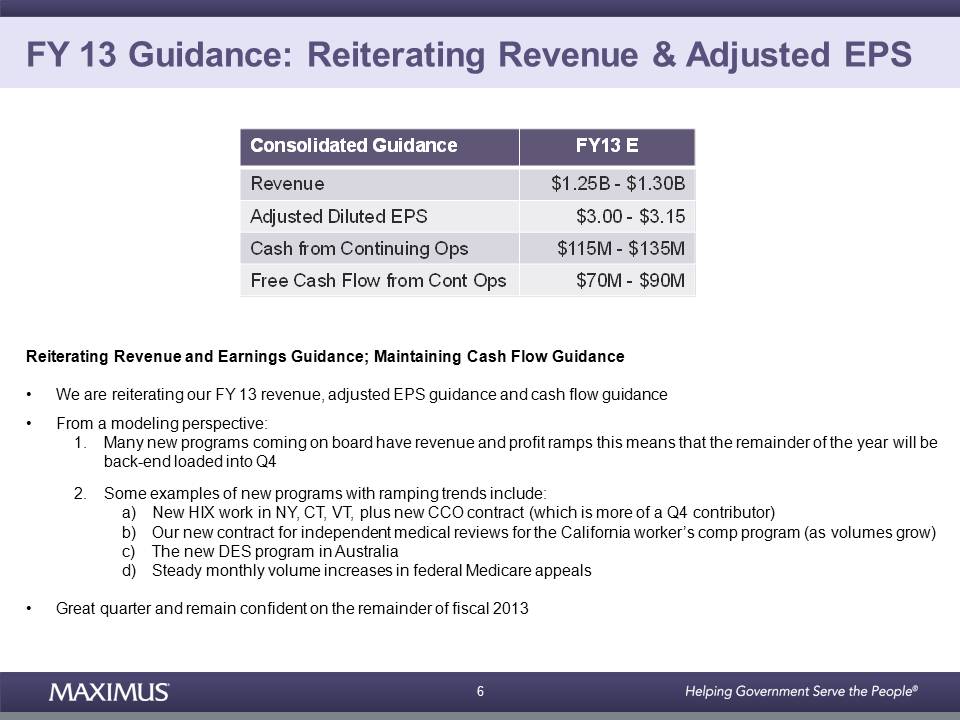

And lastly, we are reiterating our fiscal 2013 revenue, earnings, and cash flow guidance. As a reminder, we still expect fiscal 2013 revenue to range between $1.25 billion and $1.30 billion. And on the bottom line, we still expect adjusted diluted EPS from continuing operations to range between $3.00 and $3.15.

We continue to expect cash provided by operating activities derived from continuing operations to be in the range of $115 million to $135 million, and we expect free cash flow from continuing operations to be in the range of $70 million to $90 million. From a modeling perspective, it's important to remind everyone that we have a number of programs coming on board that have revenue and profit ramp-ups, which means that the remainder of the year will be backend loaded into Q4.

A couple examples of new programs include all of our new health insurance exchange work, including the work in New York, Connecticut, Vermont; plus the new CCO contract, which is more of a Q4 event. We also have revenue and profit ramping up as volume builds over time on our new contract for independent medical reviews for the California Workers' Comp program, as well as for our new DES program in Australia. And lastly, we still expect to see steady monthly growth in volumes in our federal appeals business for at least the remainder of the fiscal year.

And lastly, we are really pleased with the results in the quarter, and we remain confident in our full-year outlook. And with that, I'll hand it over to Rich.

Rich Montoni - MAXIMUS, Inc. - President and CEO

Thank you, David, and good morning, everyone. This quarter's solid financial results keep us on track to support our growth trajectory for the remainder of the fiscal year and beyond. While we have several new awards to share with you today, we are also pleased to report that our startup programs are progressing largely as planned.

MAXIMUS remains on track for exceptional top- and bottom-line growth in fiscal 2013 as we seek to expand our health and human services operations, both in the US and abroad. We continue to maintain an optimistic outlook on our growth potential and capitalize on opportunities to deliver value to our shareholders.

Let's start off this morning with an update on our health operations. We are very pleased to share that we have received award notification for a five-year renewal of our MassHealth contract with the Commonwealth of Massachusetts. Under the MassHealth program, this is what we do. We provide general eligibility and program participation customer service to Medicaid members and providers. We enroll Medicaid participants into managed care health plans. We enroll and credential providers, and we provide other services on the Commonwealth's behalf.

The scope of work is largely unchanged under the new contract. We are currently in final contract negotiations with the client and will provide additional details once the contract is signed. But clearly, we are very pleased to have the opportunity to continue to serve the great Commonwealth of Massachusetts.

In the United States, health care reform remains our largest growth driver, and we continue to add new contracts to our growing portfolio of work related to the Affordable Care Act. In the federal market, we are seeing expected pickup in procurements on the federally facilitated exchange, also known as the Health Insurance Marketplace.

We are very pleased to be part of the team selected by the Centers from Medicare and Medicaid Services for the Contract Center Operations contract. As David mentioned, MAXIMUS is a subcontractor to General Dynamics Information Technology, and under the contract we will handle ACA-related inquiries across the United States and its territories.

This key win is an important step in our longer-term strategies of growing our federal book of business and winning our fair share of health reform work. As we mentioned last quarter, there are two additional federal RFPs related to the exchange that are right in our sweet spot.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

4

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

These RFPs are currently in the procurement cycle, and the date of award for both is uncertain at this time. The first RFP is for the eligibility support functions of the marketplace, and the other is for the eligibility appeals work in the marketplace. We have submitted bids for both of the contracts, but for competitive reasons, we are not in a position to share any additional details related to the potential value or if we've bid as a prime or sub for these programs.

As a reminder, a vendor cannot win both contracts.

We are also very pleased to report that we've made further progress in the state-based exchange market, with two new contracts to support state exchange efforts in Vermont and California. In Vermont, we recently signed a contract amendment to expand our Green Mountain Care customer support center to include the customer support center operations for Vermont Health Connect, the state's health benefits exchange.

This new work builds upon a 17-year partnership with the Department of Vermont Health Access, and expands our customer support center operations in the state. The one-year amendment started on May 1, 2013, and is valued at an estimated $12.5 million. Following the initial contract period, the state may exercise an additional one-year option period.

In California, the state has announced its intent to award MAXIMUS with a small but strategic contract to provide supplemental support to the state's health insurance exchange operations, known as Covered California. As I mentioned on our last call, California has elected to use public workers to staff its HIX customer service centers.

However, under this new contract, MAXIMUS will provide training to approximately 850 individuals associated with the service centers, including external partners. The MAXIMUS Center for Health Literacy will also provide services to ensure that all customer correspondence, forms, and other program materials are easy to understand by the population served under Covered California.

Looking beyond the early years of HIX operations, we expect to see some states that initially elect a federal or partnership exchange to transition to their own state-based exchange. These scenarios will present additional BPO opportunities for MAXIMUS down the road. We firmly believe that health care reform will be a long-term, multi-year growth driver, particularly as different health insurance marketplaces evolve over time.

Internationally, we continue to see promising opportunities to grow our health services business. As early as 2014, we could see RFP activity in our existing markets outside the US. These markets are where our current offerings have traditionally been in the welfare-to-work business.

We are very excited about these emerging new opportunities that are right in our wheelhouse of core capabilities. This is really the next step in the natural progression of our land, execute, and expand strategy for introducing our core health offerings to current markets where we enjoy a history of demonstrated success and strong brand reputation.

Moving now to our human services operations in the US, MAXIMUS has launched operations under a new contract with the New York City Human Resources Administration. Through new employment service centers in the Bronx and Staten Island, MAXIMUS is providing assessment, work readiness, job placement and retention, and other support services to participants in public programs, as well as noncustodial parents and foster care youth. We are pleased to expand our workforce services business line into an important region like New York City.

The human services segment is also benefiting from recent federal regulations. As a result of the CMS requirements for independent oversight on large, federally funded programs, we are also starting to see an increase in our independent verification and validation -- or IV&V -- consulting practice.

MAXIMUS provides oversight services to make sure a large integration projects meet cost, time, and quality objectives. And recent wins include contracts with Pennsylvania, Ohio, and Oregon. While these engagements are typically smaller, they can be helpful in positioning MAXIMUS for future work downstream.

Turning now to our international welfare-to-work operations, I recently returned from a trip to the UK, where I joined our employees in celebrating our first five years of operations in the UK. The UK team has done an excellent job to position MAXIMUS as a recognized leader and proven provider of employment services within the welfare-to-work market.

Our current work program contract is performing to our expectations, and we look forward to the next set of performance metrics. Just recently, the Department of Work and Pensions announced they will now release the performance statistics on June 27, 2013, slightly later than the previously announced timing of late May. Following this report, we anticipate the UK government will start planning for the potential reallocation of work to hire performing vendors. However, we currently don't expect any shift of work until calendar 2014.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

5

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

In Saudi Arabia, our pilot program is running successfully as we continue to place jobseekers in long-term, sustainable employment. The initial pilot program is set to end in August, but we are cautiously optimistic that our strong performance will help extend our contract beyond the one-year pilot.

In fact, we are hopeful that it can grow in a meaningful fashion over the coming years. The team's strong performance to date sets a solid platform as additional opportunities to deliver our core services develop over the longer term in this promising market.

Moving onto rebids, we started fiscal year 2014 with 14 contracts with a total value of approximately $475 million up for rebid. As you may recall, our Texas Medicaid enrollment and MassHealth contracts made up the lion's share, with a combined value of approximately $320 million.

So with an award notification on both of these contracts, we are pleased to win our two largest rebids this year. We did lose a child support rebid, which was valued at just under $5 million a year on price.

Net net, we are still having a great year from a rebid perspective and on track to win 90%-plus. At this point we now have five rebids remaining with a total contract value of just under $50 million.

Turning now to new sales award in the pipeline. We had a really strong quarter of new sales awards. At March 31, we had $886 million of year-to-date new signed awards, of which $700 million was signed in the second quarter. In addition, our awarded but unsigned contracts totaled approximately $425 million. These are contracts where we have received notification of award and are in contract negotiations, but we have not yet signed. At March 31, our total sales pipeline of opportunities was $2.3 billion, which was slightly lower than last quarter, driven mostly by contracts moving out of the pipe and into the award categories.

As David mentioned, cash in the quarter continues to be strong, with the majority held overseas. We have an active M&A program where we continue to maintain an approach towards the opportunities that complement our growth strategy.

Subsequent to quarter end, we announced a 2 for 1 stock split, which will take place at the end of June. The decision to split the stock demonstrates our ongoing confidence in the Company, our superior market positioning, and a positive outlook related to the many emerging opportunities we see across our business.

In summary, our focus on delivering high-quality, value-added services to our government clients in the areas of health and human services has generated significant growth over the last several years for MAXIMUS. This growth performance keeps us on a solid path for achieving our long-term goals of securing our fair share of health-care reform in the US, growing our federal operations, and expanding our global operations. The management team remains committed to offering the highest quality of services to our clients, growing the business with new work, and building long-term shareholder value.

And with that, let's open it up for questions. Operator?

QUESTION AND ANSWER

Operator

(Operator Instructions). Charles Strauzer, CJS.

Charles Strauzer - CJS Securities - Analyst

Two questions for you. The first question is, when you look at the guidance, and if you maybe can expand on that -- obviously, you are reaffirming but not raising the guidance. And you have had a couple of good quarters so far to start the year. Can you give a little more color behind that? Is it just wanting to be more conservative here with these contracts still ramping?

Rich Montoni - MAXIMUS, Inc. - President and CEO

Good morning, Charlie. This is Rich. As it relates to guidance -- and, yes, we are very, very pleased with the quarter. I think it was a solid quarter, and we are very pleased to overdeliver by $0.02, which is roughly 3% better than our expectations on the quarter, so we need to put it in perspective.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

6

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

The other point that I would make is that as we go through our process here, and we do it every quarter when we print actual results; we take a look at the rest of the year, and what we delivered in the quarter; we look at what were the actual results versus expectations. We look at the pipeline from a bottoms-up perspective, and we factor that into our view -- our revised view of full-year guidance.

And there are, in fact, quarters where we do raise guidance based upon that detailed analysis. In fact, that's what we did just last quarter.

The other point that's very important to remember is that this year is very backend loaded, and it's a great opportunity to have. And the backend load is really due to the growth that we are experiencing today that we experienced in this second quarter, that we'll experience in the third quarter, and on going into the fourth quarter.

And at this time we have an unprecedented number of startups, and that's ramping revenue and profit as the year builds. And many of these startups we've mentioned in the prepared remarks. So we still have a lot of ground to cover, Charlie. So when we add it all up, we conclude that our existing guidance squarely remains the right place to be.

Charles Strauzer - CJS Securities - Analyst

Excellent. And then just a quick question -- my second question would be just on the organic growth rate. It was very strong in the quarter. Could you break that down a little bit by each segment, too, as well what the organic growth rates were?

David Walker - MAXIMUS, Inc. - CFO

Charlie, we don't provide organic growth rate by segment, but I would say that it's been strong in both segments.

Operator

James Naklicki, Citigroup.

James Naklicki - Citigroup - Analyst

My first question is on the human services segment. Results there were a little bit lighter than what I was looking for on a revenue and earnings basis. Can you talk about what the drivers were there?

David Walker - MAXIMUS, Inc. - CFO

It's actually consistent with our expectation. If you look year over year, we saw some softness coming mainly out of MAXNetWork, and we've talked about that in previous quarters.

And just to add a little flavor to that, the lower margin contribution from Australia has really resulted in some required changes from the government. The government modified the documentation process for claims when we put people into employment, which is not unusual for these programs to evolve over time. And the last few quarters they have increased the regulatory oversight to support billings and outcomes for vendors across the board. So it's not just MAXIMUS. It's that whole marketplace.

As we've shared in prior quarters, we've invested more resources, added more staff. So naturally we wanted to increase our efforts to ensure that we meet the new requirements and still maintain our top rating -- rated standing. The department has also modified all vendor contracts to reflect these changes, so it's a permanent change. Our Australian contracts, in context, are still some of the best-performing, and I'd also say that we found the government to be a good partner who is fair and equitable.

James Naklicki - Citigroup - Analyst

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

7

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

Okay. Thanks. And just one follow-up on the state-based health exchange opportunities that you're pursuing. Could you give us a point of reference as to how many you are actually pursuing?

And then one other on the same topic is, what was the HIX revenue for the quarter, if we include Minnesota, New York, and Connecticut?

Rich Montoni - MAXIMUS, Inc. - President and CEO

This is Rich Montoni. I'm going to ask Bruce Caswell, who has joined us today -- and as you know, Bruce runs our health business -- I'm going to ask you to answer part one. We haven't disclosed separately the HIX revenue in the quarter, so we'll have to decline on that one for the moment. But Bruce, could you talk about the HIX-based activity?

Bruce Caswell - MAXIMUS, Inc. - President & General Manager, Health Services

Sure. Absolutely. So James, it's probably important to segment it into two components. One is those states that are state-based exchanges, and as you know, there's 17 states and the District of Columbia that are doing state-based exchanges that still have active service center RFPs out.

There's only a small handful of those remaining, because, of course, time is running short, and those awards need to be completed and vendors need to get underway. And we don't disclose specific contracts that we are bidding on. But as we have said before, we remain active and focused on that marketplace, and so we are active participants in those remaining procurements.

And we also, however, are being selective. We recognize that there is limited capacity in the industry. We want to ensure that we are picking our spots correctly. So don't expect us to bid all of them.

Secondly, though, many states -- and this is maybe not well known in the industry, but for states that are in the federally facilitated exchange, and there's 34 of them, that doesn't mean that their obligations are complete on the state side. So there are things that they need to do to modify their existing systems and business processes to meet requirements of the Act, such as the No Wrong Door requirement, so that individuals who are applying -- not just at the federal level -- can also apply through existing state/county offices, or existing websites, and so forth.

A number of components of those operations which MAXIMUS has responsibility in those states. So we would expect organic growth opportunities in existing states to help them become compliant with the requirements of the Act at the federal level. So those would be two dynamics to continue to watch as we move through the summer months.

Rich Montoni - MAXIMUS, Inc. - President and CEO

And, James, I want to add one point to the other question that you asked. It's interesting as it relates to the state-based health insurance exchange work. Some of that work is very, very difficult to bifurcate from our existing contracts. In fact, in some cases, it's simply an add-on to our existing work. So it's virtually not practical to sort out the two. Next question, please.

Operator

(Operator Instructions). Richard Close, Avondale Partners.

Richard Close - Avondale Partners - Analyst

Quick question. I want to focus in on the appeals. I think you mentioned you expect that to be strong through the remainder of the current year. I'm curious your expectations of the appeals opportunity. Any impact on, one, the Part A, Part B CMS rule that is currently seeking comments there, so a proposed rule on that part. And then also, too, any impact from the RAC rebid process that is currently progressing?

Rich Montoni - MAXIMUS, Inc. - President and CEO

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

8

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

Thanks, Richard. We're going to ask Bruce Caswell to respond to your questions.

Bruce Caswell - MAXIMUS, Inc. - President & General Manager, Health Services

Sure. And good morning, Richard. Thanks for the questions. They are good ones, and I guess I'd begin with the question about the ability for hospitals to bill under Part B for otherwise previously billed -- or previously incurred Part A costs.

So first of all, I'd like to note that our analysis suggests that those -- we call those B of A -- Part B of A appeals. The volume that we see from those is about 10% to 15% of the overall RAC appeals that we receive. So that's a meaningful statistic to put in the context of the overall appeals business.

And as you've noted, we're only a couple of months under the new interim rule. So it's very early to see if this is going to change the hospitals' behaviors in a meaningful way. It's important to note, of course, that Part A pays more than Part B. So hospitals, generally, we've seen, continue to bill initially under Part A, because they then have 12 months to rebill under Part B if they are not successful in that process.

And even for hospitals that then choose to re-bill under Part B, there will be a portion -- probably not as great a portion, but a portion of those that will turn into appeals as well. So at this point, too early to tell if there is any significant impact, but we've not seen anything material to reflect a change in behavior on behalf of the hospitals as a result of that proposed interim final rule.

Turning to the RAC re-procurements, as you are well aware, those are coming up in 2014. I think our view would be that when they get re-procured, because CMS is realigning the regions to align with the MAC regions, you could have some transitional, call it, lumpiness, as if contracts change and vendors have to reposition into new regions, and start up operations, and so forth.

But fundamentally, we don't expect the vendors in those areas to change their behavior or become any, really, less aggressive in terms of the business that they're going after. So if you wanted to extend -- and this is purely theorizing a little bit -- in a competitive environment where margins may be under pressure for those RAC vendors because they are paid a contingency, if anything, you could theorize they may step up the level of aggressiveness in going after claims in order to minimize the absolute impact on their profitability. But it's too early to tell at this point.

Rich Montoni - MAXIMUS, Inc. - President and CEO

And I would add, if the rebid process -- it's an if -- results in material reassignments amongst the RACs, then there could be a temporary pause as it relates to the claims, and hence, the appeals. But we would view that as temporary, Richard.

Bruce Caswell - MAXIMUS, Inc. - President & General Manager, Health Services

Is that helpful?

Richard Close - Avondale Partners - Analyst

I guess.

Rich Montoni - MAXIMUS, Inc. - President and CEO

Yes. Next question, please.

Operator

Brian Kinstlinger, Sidoti and Company.

Brian Kinstlinger - Sidoti & Company - Analyst

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

9

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

In relationship to your Saudi Arabia contract that is ending -- I think you provided -- in a couple of months, what is your expectation afterward? Are you already in negotiations for a much larger piece, given this is a pilot project? Tell us, is the customer happy with your performance? Just maybe give us a sense of down the road how you see that contract playing out.

Rich Montoni - MAXIMUS, Inc. - President and CEO

We do believe that our performance has been solid. We do believe the client respects our performance and values our contribution. As you would expect, we are in active negotiations to hopefully extend that contract and possibly to expand the scope and the size of the work we do for that country.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. And then of your $886 million of bookings for the year so far, I'm curious. How much is from new projects or expansion of existing programs versus re-competes?

And then specifically, on Vermont, you announced that contract. How much of that is expansion from the old contract? So maybe give us a sense of what HIX is adding as a percentage of that.

Rich Montoni - MAXIMUS, Inc. - President and CEO

I think the pipeline dynamics are very interesting, and I think you hit on something that is key. I'm going to defer to Bruce in a minute as it relates to Vermont per se to give you some qualitative aspects of how much we think is new.

But the majority of the pipeline is attributable to new work, which I think is great news. And I really think that's an important factor as we think about our expectations, not only for the rest of the year, but it starts to give us -- sets the table for fiscal 2014 as well. So the majority of the pipeline is attributable to new work. Bruce, any comments on Vermont, per se?

Bruce Caswell - MAXIMUS, Inc. - President & General Manager, Health Services

Yes. We mentioned that the value that is in the about $12 million range on an annual basis. And it's actually fairly substantial -- I think it more than doubles the size of the current work that we do in the state. So I would just say that if you are looking as an indicator of that effect, that's a fairly good representation.

Rich Montoni - MAXIMUS, Inc. - President and CEO

Next question, please.

Operator

(Operator Instructions). Frank Sparacino, First Analysis.

Frank Sparacino - First Analysis Securities - Analyst

Bruce, I just wanted to go back on the state exchanges and just get a better sense from your perspective. When you look at the remaining state opportunity -- and I guess the opportunity associated with the state/federal partnerships, where are we at sort of in terms of those contracts being awarded?

And I'd like to get your perspective as well as where you thought we would be now. It seems like the states have been slower to move than I would have expected, but just wanted to get your perspective on that.

Rich Montoni - MAXIMUS, Inc. - President and CEO

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

10

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

Bruce?

Bruce Caswell - MAXIMUS, Inc. - President & General Manager, Health Services

Sure. I'd be happy to. I think that if you have followed it in the marketplace, there's been some -- a bit of consternation on behalf of the states in terms of a lack of information that's essential to finalize a lot of the planning and execution. I think some of those, if you will, gates have opened; and there is more dialogue going on, and in fact, there's testing now occurring between states and the federal data services hub, which I view as a positive sign.

But the reality is that states, just like the federal government, I think, are looking hard at what really constitutes day one operations and success on day one. So they're going to move forward. And there's no doubt that operations will open as scheduled, and it's managed; some manual workarounds and so forth are required to accomplish that. Certainly states are planning for that presently.

So as I mentioned in an answer to a prior question, time is drawing short for states that need to procure service center or call center operations for their state-based exchanges to complete that process. And we would expect that to draw to a close some time probably in the next 30 days.

And then for those states that will need supplemental services to be compliant with the requirements of the federally facilitated exchange, generally those are being handled through modifications to existing contracts and are well underway as well. So I'd say things are pacing as we would expect. Not without some glitches here and there where there's outstanding information still needed and workarounds that are being contemplated, but it's largely as we would expect at this point.

Rich Montoni - MAXIMUS, Inc. - President and CEO

Next question, please.

Operator

Richard Close, Avondale Partners.

Richard Close - Avondale Partners - Analyst

With respect to the credit facility and that announcement, how should we view that? Should we get the sense that there could be potentially a transaction more near-term rather than farther out? And then, I guess, a preference from your standpoint on potential M&A. Is it more focused in on international? And the health or human services areas?

Rich Montoni - MAXIMUS, Inc. - President and CEO

Richard, really the best answer comes from just a discussion of what our M&A situation is. And as we've discussed in the past, we are active from an M&A perspective. We have internal resources that help us sort out M&A opportunities that we view as strategic.

We would very much like to move forward with a transaction, provided it fits our strategic mindset. So we are looking at opportunities, and I'd say our primary focus right now is international in nature. What we'd really like to do is find an international opportunity in the health arena.

The majority of our work internationally is on the Human Services side and welfare-to-work. So you can look at our program in Australia. You can look at our program in the UK. Saudi Arabia we just mentioned. All of these are Human Services welfare-to-work opportunities.

Our view is once we establish ourselves as a valued provider and partner to that government, that we should be able to -- effectively to piggyback on that reputation, on that brand, and offer value in our complementary segment, our health segment. So we are looking -- taking a hard look at those established markets and looking for health opportunities. So we are active, we're interested, and signing this credit facility is an integral part of that strategy.

Richard Close - Avondale Partners - Analyst

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

11

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

Great. Thank you for that follow-up.

Rich Montoni - MAXIMUS, Inc. - President and CEO

You're welcome. And next question, please.

Operator

(Operator Instructions). Brian Kinstlinger, Sidoti and Company.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. I'm curious, with both the bids in for the federal procurement, why is it competitive not to tell us whether you bid sub or prime?

Rich Montoni - MAXIMUS, Inc. - President and CEO

That's a great question, Brian, and I'm going to ask Bruce Caswell to give us some insight on that one.

Bruce Caswell - MAXIMUS, Inc. - President & General Manager, Health Services

Sure. Yes, Brian, it is a great question. And fundamentally, in situations where we are a subcontractor, we obviously would have an obligation to the prime contractor, and they would control any kind of disclosure of that nature.

But in situations where we are the prime contractor -- and, really, I guess this could apply to both. These bids are bids that follow a process, as you're probably well aware, that often include a best and final offer, and negotiations, and so forth. And any kind of disclosure of that nature sends a signal to the other competitors in the market that can be quite meaningful to them in their strategies for that portion of the bid process that remains, like their best and final offer process. So we treat that information very confidentially as a consequence.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay. And then the follow-up is -- I wasn't quite clear on the answer on my first question. On the $886 million of actual awards year to date, and/or you can combine the $400 million and some odd contracts that hasn't been signed, but have been awarded. How much of that -- not the future pipeline -- has been new or expansion of work?

Rich Montoni - MAXIMUS, Inc. - President and CEO

My answer was intended to speak to the awards to date in this period. Not the pipeline, not the future awards, but the majority of the awards to date is new work. We have not -- and today we are not prepared to provide the specific metric, because historically we have not disclosed how much of that new versus rebid. But it's very important to note the majority of it is new work, Brian. Next question.

Operator

This concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

Rich Montoni - MAXIMUS, Inc. - President and CEO

Thank you, folks.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

12

|

MAY 09, 2013 / 01:00PM GMT, MMS - Q2 2013 MAXIMUS, Inc. Earnings Conference Call

|

|

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2013 Thomson Reuters. All Rights Reserved.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

|

|

© 2013 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

13

Slide: 1 Title: David N. Walker Chief Financial Officer and Treasurer May 9, 2013 Fiscal 2013 Second Quarter Earnings A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Slide: 2 Title: Total Company Financial Results Q2 FY13 results in line with expectationsQ2 FY13 results included $16m of non-recurring revenue, pre-tax income of $10.9m (after tax $6.5m), or $0.19 per diluted share, in the Human Services Segment due to a terminated contractExcluding the $16m, Q2 FY13 revenue grew 27% to $310.3m compared to last year. Organic revenue growth accelerated. Organic revenue grew 15% over last year driven by growth in both segments Q2 FY13 total company operating income, excluding legal, settlement and acquisition expense, totaled $50.7m (pre-tax). Excluding the pre-tax profit of $10.9m from the terminated contract, segment operating income totaled $39.8m (12.8% operating margin) Income from continuing ops, net of taxes, totaled $31.7m (or $0.91 per diluted share) and included $6.5m (or $0.19 per diluted share) related to the terminated contractExcluding the $0.19 one-time benefit, adjusted EPS grew 47% to $0.72 *Excluding legal, settlement and acquisition expense Note: numbers may not add due to rounding

Slide: 3 Title Health Services Segment Revenue Q2 revenue increased 23% to $197.9 million, driven by the PSI acquisition, expansion on existing programs, and new work that is starting to ramp nicely. Still experiencing healthy volumes in federal Medicare appeals businessOperating Income & MarginsQ2 operating income increased 59% to $28.9 million compared to the same period last year and operating margin improved to 14.6% in Q2 driven by accretive growth. This compares to operating margin of 11.3% reported for the same period last year Demand for Core Services Remains StrongNew win to support General Dynamics Information Technology under the federal Customer Contact Center Operations (CCO) contract; includes customer service for ACA-related activities for the federally facilitated health insurance marketplace Cost reimbursable program will only provide a few months of lower-margin revenue in FY13 and we do factor new contracts into our forecast, so full year outlook remains unchanged

Slide: 4 Title: Human Services Segment RevenueQ2 revenue increased to $128.4m. Excluding the $16.0m from the terminated contract, revenue grew 37% to $112.4m compared to last year, driven by the PSI acquisition, the ramp in the UK, and growth from Canada and Saudi ArabiaOperating Income & MarginsQ2 operating income totaled $21.5m, and included pre-tax income of $10.9m from the terminated contractExcluding the $10.9m, the Segment’s normalized Q2 operating income was $10.6m (operating margin of 9.4%)

Slide: 5 Title: Balance Sheet and Cash Flows Cash Flows & DSOsQ2 cash flow consistent with expectationsAs expected, we continue to experience administrative payment delays on two programs DSOs were sequentially lower at 66 days at March 31 (excluding revenue from the terminated contract)Cash and Use of CashCash provided by operating activities from continuing operations totaled $29.4m at March 31, 2013Free cash flow totaled $18.3m Cash and cash equivalents of $187.3m at March 31Share BuybacksNo shares were purchased in the quarter; at March 31, $114.6 million was available for future purchasesCredit FacilityCompleted a $100m, five-year line of creditAccordion feature up to an additional $50mAvailable for general corporate purposesStock SplitOn June 28, 2013, shareholders of record on June 14 will receive and additional share of stock for each outstanding share Reconciliation to Free Cash Flow Note: numbers may not add due to rounding

Slide: 6 Title: FY 13 Guidance: Reiterating Revenue & Adjusted EPS Reiterating Revenue and Earnings Guidance; Maintaining Cash Flow GuidanceWe are reiterating our FY 13 revenue, adjusted EPS guidance and cash flow guidanceFrom a modeling perspective:Many new programs coming on board have revenue and profit ramps this means that the remainder of the year will be back-end loaded into Q4Some examples of new programs with ramping trends include:New HIX work in NY, CT, VT, plus new CCO contract (which is more of a Q4 contributor)Our new contract for independent medical reviews for the California worker’s comp program (as volumes grow) The new DES program in AustraliaSteady monthly volume increases in federal Medicare appealsGreat quarter and remain confident on the remainder of fiscal 2013

Slide: 7 Title: Richard A. Montoni President and Chief Executive Officer May 9, 2013 Fiscal 2013 Second Quarter Earnings

Slide: 8 Title: On Track for Continued Growth in Fiscal 2013 Solid Q2 financial results support growth trajectory for the remainder of fiscal year 2013 and beyond Several new awards to share today and start-up programs are progressing largely as plannedOn track for exceptional top- and bottom-line growth in fiscal 2013, as we seek to expand our health and human services operations, both in the U.S. and abroadMaintain an optimistic outlook on growth potential and capitalize on opportunities to deliver value to shareholders

Slide: 9 Title: Health Services: Renewal of MassHealth Contract Received award notification for a five-year renewal of MassHealth Medicaid contractScope of work is largely unchanged; MAXIMUS:Provides general eligibility and program participation customer service to Medicaid members and providers Enrolls Medicaid participants into managed care health plans Enrolls and credentials providers Provides other services on the Commonwealth’s behalf. In final contract negotiations with the client

Slide: 10 Title: Health Care Reform Update: Federal Market Seeing the expected pick-up in procurements on the federally facilitated exchange, also known as the Health Insurance MarketplacePart of the team selected by CMS for the contact center operations contract:MAXIMUS is a subcontractor to General Dynamics Information Technology (GDIT) Under the contract, we will handle ACA-related inquires across the U.S. and territoriesImportant step in strategy of growing federal business and winning fair share of health reformTwo additional federal exchange RFPs in our sweet spot; award dates uncertainEligibility Support functions of the MarketplaceEligibility Appeals work in the Marketplace We have submitted bids for both contracts and for competitive reasons cannot share other detailsAs a reminder, a vendor cannot win both the Eligibility Support and Eligibility Appeals contractsHealth Care Reform remains our largest domestic growth driver and MAXIMUS continues to add new contracts to our growing portfolio of ACA-related work.

Slide: 11 Title: Health Care Reform Update: State Market Signed two new contracts to support state HIXVermont: Contract amendment for customer support center for the state’s health benefits exchangeBuilds upon a 17-year partnership with the Department of Vermont Health Access and expands our customer support center operations in the state One-year, $12.5 million contract amendment started on May 1, 2013; has an additional one-year option periodCalifornia: Contract to provide supplemental support to the state’s HIX operationsCalifornia has elected to use public workers to staff its HIX customer service centers MAXIMUS will train approximately 850 individuals associated with the service centersThe MAXIMUS Center for Health Literacy will provide services to ensure that all consumer correspondence, forms, and other program materials are easy-to-understand by the populations served through the state HIX

Slide: 12 Title: Health Services: Future Growth Opportunities Domestically, states that initially elect a federal or partnership exchange may transition to state-based exchanges down the road; presents future opportunityHealth care reform will be a long-term, multi-year growth driver, as health insurance marketplaces evolve over time Internationally, many promising opportunities to grow our health businessExpect RFP activity (as early as 2014) in existing markets outside U.S. and where current offerings are focused on welfare-to-workThese emerging, new opportunities are right in our wheelhouse of core capabilitiesNatural progression of “land, execute and expand” strategy

Slide: 13 Title: Human Services: Growth in the U.S. Markets Launched a new contract with the New York City Human Resources AdministrationEmployment services centers in the Bronx and Staten IslandProvide assessment, work readiness, job placement and retention, and support services to participants in public programs, non-custodial parents and foster care youth As a result of a CMS requirement for independent oversight on large federally funded programs, seeing an increase in our Independent Verification and Validation (IV&V) consulting practice We provide oversight services to ensure that large integration projects meet cost, time and quality objectivesRecent wins in Pennsylvania, Ohio and Oregon Engagements are small, but can be helpful in positioning MAXIMUS for future work downstream

Slide: 14 Title: Human Services: International Update U.K. Work Programme contract meeting expectationsDepartment of Work and Pensions will release next performance statistics on June 27, 2013Expect the government will start planning for work reallocation, but expect shift of work to happen in 2014 Saudi Arabia pilot program running successfully Initial one-year pilot program is set to end in AugustTeam’s strong performance to-date sets solid platform as additional opportunities to deliver our core services develop over the long-term in this promising market

Slide: 15 Title: Contract Rebids Started fiscal year 2013 with 14 contracts with a total value of approximately $475 million up for rebidTexas Medicaid Enrollment and MassHealth contracts make up the lion’s share with a combined value of approximately $320 million With award notification on both of these contracts, pleased to win our two largest rebids Lost a child support rebid on price; it was valued at just under $5 million a year Still having a great year from a re-bid perspective and on track to win 90%-plus Five rebids remaining, with a total contract value of just under $50 million

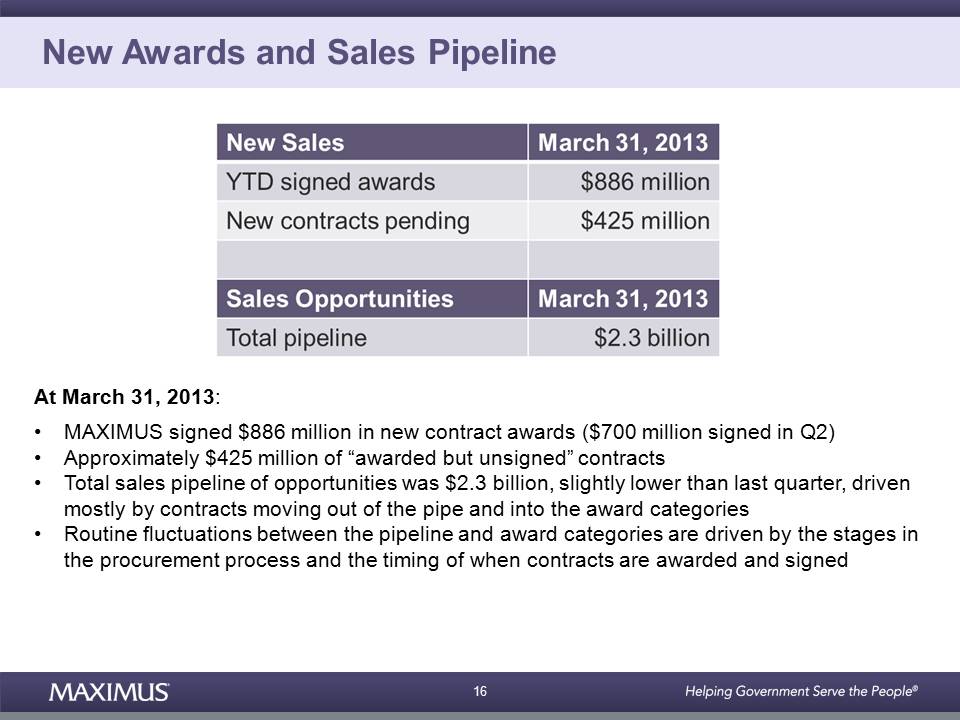

Slide: 16 Title: New Awards and Sales Pipeline At March 31, 2013:MAXIMUS signed $886 million in new contract awards ($700 million signed in Q2)Approximately $425 million of “awarded but unsigned” contractsTotal sales pipeline of opportunities was $2.3 billion, slightly lower than last quarter, driven mostly by contracts moving out of the pipe and into the award categories Routine fluctuations between the pipeline and award categories are driven by the stages in the procurement process and the timing of when contracts are awarded and signed

Slide: 17 Title: Use of Cash Cash in the quarter continues to be strong, with the majority held overseasActive M&A program with a very strategic approach towards opportunities that complement our growth strategySubsequent to quarter end, announced a two-for-one stock split, which will take place at the end of June and demonstrates our:Ongoing confidence in the Company Superior market positioning Positive outlook related to the many emerging opportunities we see across our business

Slide: 18 Title: Conclusion Focus on delivering high-quality, value-added services to government clientsStrong performance keeps us on a solid path for achieving our long-term goals of:Securing our fair share of health care reform work in the U.S.Growing our federal operationsExpanding our global operations We are committed to offering the highest quality of services to clients, growing the business with new work, and building long-term shareholder value

Slide: 19 Title: Non-GAAP Measures This presentation refers to non-GAAP financial measures, including free cash flows from operating activities, adjusted diluted earnings per share from continuing operations, organic growth, as well as revenues, operating income, net income and earnings per share excluding a terminated contract. To provide organic growth information, revenue in the prior year is compared to the current year without PSI revenues. We believe organic growth provides a useful basis for assessing the performance of the business excluding PSI. We have provided a reconciliation of free cash flow to operating cash flow from continuing operations. We believe that free cash flow from operations is a useful basis for investors to compare our performance across periods or across our competitors. Free cash flow show the effects of the Company’s operations and routine capital expenditure and exclude the cash flow effects of acquisitions, share repurchases, dividend payments and other financing transactions. We have provided a reconciliation to adjusted diluted earnings per share and operating income excluding legal, settlement and acquisition-related expenses and the benefits of the terminated contract. We have also provided a reconciliation between revenue and revenue excluding the terminated contract. We believe that these measures are a useful basis for assessing the Company’s performance excluding the effect of the terminated contract, the costs of acquiring PSI, and net legal and settlement expenses.The presentation of these non-GAAP numbers is not meant to be considered in isolation, nor as alternatives to net income, cash flows from operating activities, diluted earnings per share, revenue growth, operating income and operating margin as measures of performance.