Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - Gramercy Property Trust Inc. | v344473_ex31-1.htm |

| EX-31.2 - CERTIFICATION - Gramercy Property Trust Inc. | v344473_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 1-32248

GRAMERCY PROPERTY TRUST INC.

(Exact name of registrant as specified in its charter)

| Maryland | 06-1722127 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 420 Lexington Avenue, New York, NY 10170 |

| (Address of principal executive offices) (Zip Code) |

| (212) 297-1000 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value | New York Stock Exchange | |

| Series A Cumulative Redeemable | ||

| Preferred Stock, $0.001 Par Value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of March 18, 2013, there were 60,737,604 shares of the Registrant’s common stock outstanding. The aggregate market value of common stock held by non-affiliates of the registrant (49,069,376 shares) at June 30, 2012, was $122,673,440. The aggregate market value was calculated by using the closing price of the common stock as of that date on the New York Stock Exchange, which was $2.50 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) amends the Annual Report on Form 10-K for the year ended December 31, 2012 (the “Original Form 10-K”) of Gramercy Property Trust Inc. filed with the Securities and Exchange Commission (the “SEC”) on March 18, 2013. This Form 10-K/A is being filed to include certain information that was to be incorporated by reference from our definitive proxy statement (pursuant to Regulation 14A under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) for our 2013 Annual Meeting of Stockholders (the “2013 Proxy Statement”). Because the 2013 Proxy Statement was filed more than 120 days after our fiscal year end, we are filing this Form 10-K/A to include Part III information in our Form 10-K. This Form 10-K/A hereby amends and restates in their entirety Items 10 through 14 of Part III of the Original Form 10-K as well as the cover page to remove the statement that information is being incorporated by reference from the 2013 Proxy Statement.

Except as otherwise expressly noted herein and the filing of related certifications, this Form 10-K/A does not amend any other information set forth in the Original Form 10-K, and we have not updated disclosures contained therein to reflect any events that occurred at a date subsequent to the date of the Original Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the Original Form 10-K and our other filings with the SEC.

Unless the context requires otherwise, all references to “Gramercy,” “our Company,” “we,” “our” and “us” mean Gramercy Property Trust Inc., a Maryland corporation, and one or more of its subsidiaries, including GPT Property Trust LP (our “Operating Partnership”).

GRAMERCY PROPERTY TRUST INC.

FORM 10-K/A

TABLE OF CONTENTS

| 10-K/A PART AND ITEM NO. | Page | |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 2 |

| ITEM 11. | EXECUTIVE COMPENSATION | 11 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 37 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 41 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 42 |

| PART IV | ||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 45 |

| i |

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

The following table and biographical descriptions set forth certain information with respect to the nominees for election as directors at the 2013 annual meeting of common stockholders and the nominee to be the Preferred Stock Director at the special meeting of the Preferred Stockholders, based upon information furnished by each director. Following biographical information for the director nominees and the preferred nominee, we have provided information regarding the specific experience, qualifications, attributes, or skills that have led us to determine that he should serve as a director on our Board of Directors.

| Name | Age | Director Since | ||

| Nominee Directors | ||||

| Allan J. Baum | 57 | 2004 | ||

| Gordon F. DuGan | 46 | 2012 | ||

| Marc Holliday | 46 | 2004 | ||

| Gregory F. Hughes | 50 | 2012 | ||

| Jeffrey E. Kelter | 58 | 2004 | ||

| Charles S. Laven | 61 | 2004 | ||

| Preferred Stock Director | ||||

| William H. Lenehan (1) | 36 | 2012 |

(1) Mr. Lenehan's term continues until the annual meeting, a special meeting held in lieu thereof or his successor is elected and qualifies; provided, however, that his term will automatically terminate if and when all arrears in dividends on the Series A Preferred Stock then outstanding are paid and full dividends thereon for the then current quarterly dividend period have been paid or declared and set apart for payment.

Nominees for Election

Allan J. Baum. Mr. Baum has served as one of our directors since August 2004. Mr. Baum also served as the Chairman of our Special Committee, and currently serves as a member of our Audit and Compensation Committees, and as our Lead Independent Director. Mr. Baum retired from Credit Suisse First Boston (“CSFB”) in 2002, where he was a Managing Director and head of the structured finance unit for commercial mortgage-backed securities. Prior to his ten years with CSFB, Mr. Baum served as a Vice President in the Real Estate Investment Bank of Citicorp, and held positions in the tax-exempt housing finance and taxable mortgage finance areas of Merrill Lynch. Mr. Baum also currently serves as a director of Community Development Trust, a for-profit, mission-oriented real estate investment trust. He previously served as Vice President of the Commercial Mortgage Securities Association. In addition, from May 2004 to May 2007, Mr. Baum served as a director for National Consumer Cooperative Bank, a cooperative financial institution which primarily provides financial services to eligible cooperative enterprises, and also served on its audit committee. Mr. Baum received a B.A. degree in Government/Urban Studies from Dartmouth College in 1978 and an M.B.A. in Finance from Columbia University Graduate School of Business in 1983. Mr. Baum's qualifications to serve on our Board of Directors include his executive experience at CSFB and Citicorp, his relevant experience serving on the boards and audit committees for a real estate investment trust and a financial institution and his extensive experience of over 20 years in commercial real estate investment banking.

| 2 |

Gordon F. DuGan. Mr. DuGan has been our Chief Executive Officer and served as one of our directors since July 2012. Mr. DuGan has over 20 years of senior management experience in the real estate industry. From June 2011 to June 2012, he served as Global Head of Equity Real Estate for Fixed Income Discount Advisory Company (“FIDAC”), a wholly-owned subsidiary of Annaly Capital Management (NYSE: NLY), a mortgage real estate investment trust (“REIT”). FIDAC specializes in managing residential and commercial mortgage loans and securities, managing collateralized debt obligation (“CDO”) liquidations and providing other financial services, and serves as the external manager for Chimera Investment Corporation (NYSE: CIM) and CreXus Investment Corp. (NYSE: CXS). From June 2010 to June 2011, Mr. DuGan served as Managing Partner of Northcliffe Asset Management (“Northcliffe”), which managed net leased commercial real estate on behalf of private investors. From May 2004 to July 2010, he was Chief Executive Officer of W. P. Carey & Co. LLC (NYSE: WPC) (“W. P. Carey”), a global investment firm with approximately $12.5 billion of assets under management, and considered to be one of the leading providers of net lease financing for corporate properties. Prior to that, Mr. DuGan served in various capacities with W.P. Carey, including President and Head of Investments. Mr. DuGan served as a director of W.P. Carey from 2002 through July 2010. Mr. DuGan also served as a director of Corporate Property Associates 17 — Global Incorporated from its formation in 2007 until July 2010. He served as a director of Corporate Property Associates 14 Incorporated from February 2005 until April 2006 and then from June 2007 through July 2008, Corporate Property Associates 15 Incorporated from 2005 through June 2010 and Corporate Property Associates 16 — Global Incorporated from December 2003 to July 2008. Mr. DuGan also served as a director of Corporate Property Associates 12 Incorporated from February 2005 to September 2006. He is a former member of the Board of NAREIT. Mr. DuGan is a member of the Advisory Boards of India 2020 Limited, a private equity firm investing in India, and of the Innocence Project. Mr. DuGan received his B.S. degree in Economics from the Wharton School at the University of Pennsylvania. Mr. DuGan's qualifications to serve on our Board of Directors include his extensive leadership skills and executive experience at FIDAC, Northcliffe and W. P. Carey, and his prior board experience.

Marc Holliday. Mr. Holliday has served as one of our directors since August 2004 and was our President and Chief Executive Officer from August 2004 until October 2008. Mr. Holliday served on our Special Committee and also has served on our Investment Committee from August 2004 until June 2010. Mr. Holliday became our consultant after stepping down from his positions as our President and Chief Executive Officer from October 2008 until April 2009. Mr. Holliday is the Chief Executive Officer and a director of SL Green Realty Corp. (NYSE: SLG) or SL Green. He served as Chief Investment Officer of SL Green from July 1998, when he joined SL Green, through 2003 and was named its President until April 2007, when Andrew Mathias, our former Chief Investment Officer, was promoted to that position, and elected to its board of directors in 2001. Prior to joining SL Green, he was Managing Director and Head of Direct Originations for New York-based Capital Trust (NYSE: CT), a mezzanine finance company. While at Capital Trust, Mr. Holliday was in charge of originating direct principal investments for the firm, consisting of mezzanine debt, preferred equity and first mortgages. From 1991 to 1997, Mr. Holliday served in various management positions, including Senior Vice President at Capital Trust's predecessor company, Victor Capital Group, a private real estate investment bank specializing in advisory services, investment management, and debt and equity placements. Mr. Holliday received a B.S. degree in Business and Finance from Lehigh University in 1988, and a M.S. degree in Real Estate Development from Columbia University in 1990. Mr. Holliday's qualifications to serve on our Board of Directors include his extensive executive experience as Chief Executive Officer at SL Green, as our former President and Chief Executive Officer, his long-time leadership skills in various management positions of various companies, as well as his deep exposure in the real estate industry.

Gregory F. Hughes. Mr. Hughes previously served as our Chief Credit Officer from 2004 to 2008. From November 2010 to present, Mr. Hughes has served as a Principal for Roscommon Capital Limited Partnership, a financial advisory and investment firm. Mr. Hughes also served as the Chief Operating Officer of SL Green from 2007 to 2010 and its Chief Financial Officer from 2004 to 2010, responsible for finance, capital markets, investor relations and administration. From 2002 to 2003, prior to joining SL Green, Mr. Hughes was Managing Director and Chief Financial Officer of the private equity real estate group at JP Morgan Partners. From 1999 to 2002, Mr. Hughes was a Partner and Chief Financial Officer of Fortress Investment Group, an investment and asset management firm, which managed a real estate private equity fund of approximately $900 million and a NYSE listed real estate investment trust with assets in excess of $1.3 billion. While at Fortress Investment Group, Mr. Hughes was actively involved in evaluating a broad range of real estate equity and structured finance investments and arranged various financings to facilitate acquisitions and fund recapitalizations. Mr. Hughes also served as Chief Financial Officer of Wellsford Residential Property Trust and Wellsford Real Properties, where he was responsible for the firm’s financial forecasting and reporting, treasury and accounting functions, capital markets and investor relations. While at Wellsford Residential Property Trust, Mr. Hughes was involved in numerous public and private debt and equity offerings and during his tenure Wellsford Residential Property Trust became one of the first real estate investment trusts to obtain an investment grade rating. From 1985 to 1992, Mr. Hughes worked at Kenneth Leventhal & Co., a public accounting firm specializing in real estate and financial services. Mr. Hughes received a B.S. degree in Accounting from the University of Maryland and is a Certified Public Accountant. Mr. Hughes' qualifications to serve on our Board of Directors include his extensive experience serving as an officer for various public companies and his financial and accounting skills as a Certified Public Accountant.

| 3 |

Jeffrey E. Kelter. Mr. Kelter has served as one of our directors since August 2004. Mr. Kelter also serves as the Chairman of our Compensation Committee, as well as a member of our Nominating and Corporate Governance and Investment Committees. Mr. Kelter also served on our Special Committee. Mr. Kelter has been a senior partner of KTR Capital Partners since 2004. From 1997 to 2004, Mr. Kelter was President and Chief Executive Officer and a trustee of Keystone Property Trust (“Keystone”), an industrial REIT. Keystone merged during the third quarter of 2004 with and into a joint venture between ProLogis and affiliates of investment companies managed by Eaton Vance Management. Mr. Kelter had been President and a trustee of Keystone from its formation in December 1997 and was appointed Chief Executive Officer in December 1998. He has over 20 years of experience in all phases of commercial real estate including development and third-party management. Prior to forming Keystone, he served as President and Chief Executive Officer of Penn Square Properties, Inc. (“Penn Square”) in Philadelphia, Pennsylvania, a real estate company which he founded in 1982. At Penn Square, he developed, owned, managed and leased more than 4.5 million square feet of office and warehouse projects throughout the Pennsylvania and New Jersey markets. Mr. Kelter received a B.A. from Trinity College. Mr. Kelter's qualifications to serve on our Board of Directors include his executive experience as President and Chief Executive Officer of Keystone and Penn Square, and his vast experience of over 20 years in commercial real estate.

Charles S. Laven. Mr. Laven has been one of our directors since August 2004. In addition, Mr. Laven is the Chairman of our Nominating and Corporate Governance Committee, as well as a member of our Audit and Compensation Committees. Mr. Laven has been the President of Forsyth Street Advisors LLC, a New York based company specializing in real estate finance and consulting, since July 2003. From 1991 to 2003, Mr. Laven was a partner of Hamilton, Rabinovitz, & Alschuler, Inc. (“HR&A”), a financial, policy and management consulting firm focusing on complex housing finance, real estate, economic development and strategic planning problems. Prior to his 12 years with HR&A, Mr. Laven served as principal of Caine Gressel Midgley Slater Incorporated and, from 1981 to 1982, served as principal of Charles Laven and Associates. Mr. Laven also currently serves as chairman of the Urban Homesteading Assistance Board and as a director for Citizens Housing and Planning Council. In addition, Mr. Laven served on the board of directors of Madison Harbor Balanced Strategies, Inc., a real estate fund, from December 2003 to October 2004. Mr. Laven holds a B.S. degree in Architectural Design from the Massachusetts Institute of Technology. From 1980 to 1981, Mr. Laven was a Loeb Fellow in Advanced Environmental Affairs at the Harvard University School of Design. Mr. Laven is an Adjunct Professor of Real Estate at Columbia University's Graduate School of Architecture Planning and Preservation and has been a member of the faculty of Columbia University since 1981. Mr. Laven's qualifications to serve on our Board of Directors include his extensive leadership skills and executive experience at Forsyth Street Advisers LLC and HR&A, his intellectual acumen as a Columbia faculty member and his prior board experience at various companies and organizations.

Preferred Stock Director

Beginning with the fourth quarter of 2008, our Board of Directors elected not to pay the quarterly Series A Preferred Stock dividends of $0.50781 per share. As of December 31, 2012, we had accrued Series A preferred stock dividends for over six quarters which, pursuant to the terms of our charter, permits the holders of the Series A Preferred Stock to elect an additional director to our Board of Directors. In October 2011 we received a written communication from a holder of the Series A Preferred Stock representing more than 20% of the total number of the Series A Preferred Stock requesting, as permitted by Article First, Section 10 of the Articles Supplementary designating the Series A Preferred Stock, that we call a special meeting of the holders of the Series A Preferred Stock to elect a new director. At a special meeting held on December 13, 2012, the holders of the Series A Preferred Stock elected William H. Lenehan to serve on our Board of Directors until the 2013 annual meeting of stockholders, a special meeting held in lieu thereof or his successor is elected and qualifies; provided, however, that the term of such director will automatically terminate if and when all arrears in dividends on the Series A Preferred Stock then outstanding are paid and full dividends thereon for the then current quarterly dividend period have been paid or declared and set apart for payment.

William H. Lenehan. Mr. Lenehan has served as the Preferred Stock Director since January 2012. He also has served as a special advisor to the board of Evoq Properties, Inc. since June 2012. From June 2011 to December 2011, Mr. Lenehan was the Interim Chief Executive Officer of MI Developments, Inc., a real estate operating company, and served as a member of the Board of Directors of MI Developments, Inc. and its Strategic Review Committee. From August 2001 to February 2011, Mr. Lenehan was an investment professional at Farallon Capital Management, L.L.C. in the real estate group, where he was involved with numerous private equity investments in the real estate sector, including office buildings, residential land, resort communities, mixed use properties and retail properties. Mr. Lenehan has served as a director and an audit committee member of Stratus Properties Inc. (NASDAQ: STRS), a real estate development company, since May 2012. Mr. Lenehan has a B.A. in economics and classics from Claremont McKenna College. Mr. Lenehan's qualifications to serve on our Board of Directors include his extensive real estate investment and management experience and public company director experience.

| 4 |

Biographical Information Regarding Executive Officers Who Are Not Directors

Benjamin P. Harris. Mr. Harris has been our President since August 2012, and served as our Chief Investment Officer from July 2012 until August 2012. Mr. Harris served as the Head of U.S. Net Lease Investments for FIDAC from June 2011 to June 2012 and has over 10 years of experience sourcing, underwriting and closing sale-leaseback and net lease transactions. Mr. Harris served as the Head of US Investments of Northcliffe from October 2010 to June 2011, and as Head of US Investments of W. P. Carey from September 2005 to October 2010. Mr. Harris joined W. P. Carey in June 1998 as an analyst in its Finance Department and moved to the United States investment department in 1999, and was promoted to Second Vice President in March 2000. He became Vice President in 2001, Director and First Vice President in 2002, Executive Director in 2003, Head of US Investments in September 2005 and Managing Director in March 2006. Mr. Harris graduated with joint degrees from the University of King's College and Dalhousie University in Canada. He is a CFA charter holder and a member of the New York Society of Securities Analysts. Mr. Harris also serves on the board of the New York Philharmonic. Mr. Harris is 38 years old.

Jon W. Clark. Mr. Clark has been our Chief Financial Officer and Treasurer since April 2009. He has also been our Chief Accounting Officer since March 2009. Prior to his election as our Chief Accounting Officer, Mr. Clark served as our Vice President and Controller from June 2007 until March 2009. Mr. Clark was previously employed by the Company’s external manager (the “Manager”) from June 2007 until April 24, 2009. Prior to joining the Manager, Mr. Clark was a Director at BlackRock Financial Management where he managed the accounting and finance department for real estate debt products. During that time, Mr. Clark also served as Assistant Treasurer at Anthracite Capital, Inc., which was a publicly traded mortgage REIT that specialized in subordinate commercial mortgage-backed securities. He joined Blackrock Financial Management in 2000. Prior to joining BlackRock Financial Management, Mr. Clark was a Vice President at Cornerstone Properties, Inc. (acquired by Equity Office Properties in 2000) where he established its internal audit department. Mr. Clark is a Certified Public Accountant and obtained his public accountancy experience as a manager in the national real estate practices of Arthur Andersen LLP and BDO Seidman LLP. Mr. Clark holds a B.B.A. degree in Accountancy from Western Michigan University. Mr. Clark is 44 years old.

Michael G. Kavourias. Mr. Kavourias was our Executive Vice President and Chief Legal Officer from April 2009 and our Secretary effective from March 2012, in each case, until March 31, 2013, when Mr. Kavourias’ term of employment with us ended. Mr. Kavourias was responsible for asset management, special servicing, enforcements and remedial actions, restructuring and workouts and the negotiation, documentation and closing of loan investments and managing our relationships with outside law of our commercial real estate finance business, which operates under the name Gramercy Finance. Previously, Mr. Kavourias had served as our Senior Vice President and Transaction Counsel from October 2005 until March 2008. Prior to that, Mr. Kavourias was a Special Counsel in the Real Estate Department in Cadwalader, Wickersham & Taft LLP's New York office (“Cadwalader”), where he concentrated on commercial real estate financing and representing major financial institutions, investment banks and commercial banks. Prior to joining Cadwalader in 2000, Mr. Kavourias was a Special Counsel in the Real Estate Structured Finance Department of Rosenman & Colin LLP. Prior to that, Mr. Kavourias was the managing partner in a boutique real estate law firm, which he co-founded in 1994. Mr. Kavourias began his career in 1989 as an associate at Thacher Proffitt & Wood's Real Estate Group. He attended New York University and received his J.D. from St. John's University, where he was a Thomas More Scholar and member of the Law Review. Mr. Kavourias is a Certified Public Accountant and practiced public accounting from 1984 to 1986 with Price Waterhouse prior to attending law school. Mr. Kavourias has substantial experience in the origination and sale and purchase of commercial mortgage loans and mezzanine financing, as well as a wide range of experience in the sale and acquisition of commercial and residential real estate. Mr. Kavourias is 49 years old.

Our Board of Directors and Its Committees

Our Board of Directors currently consists of seven members. Each of our directors serves for a term that lasts until the next annual meeting of common stockholders or special meeting of Preferred Stockholders, as applicable, and until their successor, if any, is duly elected or appointed and qualifies. Six of our directors are subject to annual election by holders of our common stock and one of our directors is elected by our Preferred Stockholders. Accordingly, our common stockholders will be asked to elect six directors at our annual meeting and our Preferred Stockholders will be asked to elect one director at our special meeting.

| 5 |

Our Board of Directors has affirmatively determined that Messrs. Allan J. Baum, Jeffrey E. Kelter, Gregory F. Hughes and Charles S. Laven, representing a majority of its members, are independent of our management, as such term is defined by the rules of the NYSE and the SEC. Our Board of Directors does not affirmatively determine whether Mr. William H. Lenehan is independent under the listing standards of the NYSE, the applicable rules promulgated by the SEC or our director independence standards. In determining director independence, our Board of Directors considers all relevant facts and circumstances, the NYSE listing standards, as well as our director independence criteria. Under the NYSE listing standards, no director qualifies as independent unless our Board of Directors affirmatively determines that the director has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. No arrangement or understanding exists between any director or executive officer and any other person or persons pursuant to which any director or executive officer was, or is, to be selected as a director or nominee.

Our Board of Directors held nine meetings during fiscal year 2012. During fiscal year 2012, each of the directors then serving on our Board of Directors attended at least 75% aggregate of (i) the total number of meetings of our Board of Directors while they were on our Board of Directors and (ii) the total number of meetings of the committees of our Board of Directors on which directors served. In addition, our directors also met several times in strategic sessions to discuss our overall strategic business plan and operating expense infrastructure. The non-executive directors also regularly hold executive sessions in which our management does not participate. For a discussion of the leadership structure of our Board of Directors and its role in risk oversight, see “Corporate Governance Matters” in this report.

Audit Committee. We have a standing Audit Committee, consisting of Messrs. Hughes (Chairman), Baum and Laven, each of whom is “independent” within the meaning of the rules of the NYSE and the SEC and each of whom meet the financial literacy standard required by the rules of the NYSE. Our Board of Directors has determined that Mr. Gregory F. Hughes is an “audit committee financial expert” as defined in rules promulgated by the SEC under the Sarbanes-Oxley Act of 2002, as amended. Our Audit Committee is responsible for, among other things, engaging our independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of their audit engagement, approving professional services to be provided by the independent registered public accounting firm, reviewing the independence of the auditors, considering the range of audit and non-audit fees, reviewing the adequacy of our internal controls, accounting and reporting practices and assessing the quality and integrity of our consolidated financial statements. The function of our Audit Committee is oversight. Our management is responsible for the preparation, presentation and integrity of our financial statements and for the effectiveness of internal control over financial reporting. Management is responsible for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures that provide for compliance with accounting standards and applicable laws and regulations. Our independent registered public accounting firm is responsible for planning and carrying out a proper audit of our annual financial statements, reviews of our quarterly financial statements prior to the filing of each Quarterly Report on Form 10-Q, annually auditing management's assessment of the effectiveness of internal control over financial reporting and other procedures. Our Board of Directors has adopted a written charter for our Audit Committee, a copy of which is available on our website at www.gptreit.com. Additional information regarding the functions performed by our Audit Committee is set forth in the “Audit Committee Report” included in this report. Our Audit Committee held five meetings during fiscal year 2012.

Compensation Committee. We have a standing Compensation Committee, consisting of Messrs. Kelter (Chairman), Baum and Laven, each of whom is “independent” within the meaning of the rules of the NYSE. Our Compensation Committee is responsible for, among other things: (1) reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and such other executive officers that may be designated by our Chief Executive Officer, evaluating the performance of such officers in light of such goals and objectives, and determining and approving the compensation of such officers based on these evaluations; (2) approving the compensation of our other executive officers; (3) recommending to our Board of Directors for approval the compensation of the non-employee directors; (4) administering the issuance of any award under our Amended and Restated 2004 Equity Incentive Plan (our “2004 Equity Incentive Plan”) and our 2012 Inducement Equity Incentive Plan; and (5) reviewing the Compensation Discussion and Analysis for inclusion in the 2013 Proxy Statement. Compensation decisions for our executive officers and directors are made by our Compensation Committee. Our Compensation Committee has retained FTI Consulting, Inc. (“FTI”) as our compensation consultant to provide it with relevant market data concerning the marketplace, our peer group and other compensation developments. See “Executive Compensation — Compensation Discussion and Analysis.” Our Board of Directors has adopted a written charter for our Compensation Committee, a copy of which is available on our website at www.gptreit.com. Our Compensation Committee held three meetings during fiscal year 2012.

Nominating and Corporate Governance Committee. We have a standing Nominating and Corporate Governance Committee, consisting of Messrs. Laven (Chairman), Baum and Hughes, each of whom is “independent” within the meaning of the rules of the NYSE. Our Nominating and Corporate Governance Committee is responsible for, among other things, assisting our Board of Directors in identifying individuals qualified to become Board members, recommending to our Board of Directors the director nominees to be elected at each annual meeting of stockholders, recommending to our Board of Directors the directors to serve on each of our Board of Directors' committees, developing and recommending to our Board of Directors the corporate governance principles and guidelines applicable to our company and directing our Board of Directors in an annual review of its performance. Our Board of Directors has adopted a written charter for our Nominating and Corporate Governance Committee, a copy of which is available on our website at www.gptreit.com. Our Nominating and Corporate Governance Committee held one meeting during fiscal year 2012. All of the nominees were re-elected at our 2011 annual meeting of stockholders.

| 6 |

Investment Committee. We have a standing Investment Committee currently consisting of Messrs. Lenehan (Chairman) (who joined the Investment Committee effective July 1, 2012), DuGan and Kelter. Mr. Roger M. Cozzi, our former Chief Executive Officer, served as Chairman of our Investment Committee until June 30, 2012. All real estate investments, dispositions and financings must be approved by a credit committee consisting of our most senior officers, including the affirmative vote of our Chief Executive Officer. Real estate investments and dispositions at a loss (based on book value at the time of sale) having a transaction value greater than $20.0 million must also be approved by the Investment Committee of our Board of Directors. Our full board of directors must approve all such transactions having a value greater than $50.0 million. Additionally, the Investment Committee of our Board of Directors must approve non-recourse financings greater than $20.0 million and our full Board of Directors must approve all recourse financings, regardless of amount, and non-recourse financings greater than $50.0 million. Our Investment Committee held one meeting during fiscal year 2012.

Special Committee. In addition to the standing committees of our Board of Directors, in June 2011, our Board of Directors established a Special Committee to direct and oversee an exploration of strategic alternatives available to us subsequent to the execution of the collateral transfer and settlement agreement (the “Settlement Agreement”) for the Gramercy Asset Management division assets. The Special Committee considered the feasibility of raising debt or equity capital, the possibility of a strategic combination of us, a strategic sale of our assets, or modifying our business plan, including making additional debt repurchases or investing our available capital outside of our CDOs. At the direction of the special committee, we engaged Wells Fargo Securities, LLC to act as our financial advisor and to assist in the process. The members of the Special Committee consisted of Messrs. Baum, Kelter and Holliday. On June 13, 2012, we announced that our Board of Directors, following an extensive review of strategic alternatives, approved a new investment strategy focusing on single tenant net lease investments and appointed Gordon F. DuGan as our Chief Executive Officer. Our Special Committee held eight meetings during fiscal year 2012.

CORPORATE GOVERNANCE MATTERS

This section contains information about a variety of our corporate governance policies and practices. In this section, you will find information about how we are complying with the NYSE's corporate governance rules that were approved by the SEC. We are committed to operating our business under strong and accountable corporate governance practices. Our Board of Directors reviews these guidelines and other aspects of our corporate governance periodically. You are encouraged to visit the corporate governance section of the “Investor Relations — Corporate Governance” page of our corporate website at www.gptreit.com to view or to obtain copies of our committee charters, code of business conduct and ethics, corporate governance principles and director independence standards. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this report or any other report or document we file with or furnish to the SEC. You may also obtain, free of charge, a copy of the respective charters of our committees, code of business conduct and ethics, corporate governance principles and director independence standards by directing your request in writing to Gramercy Property Trust Inc., 420 Lexington Avenue, New York, New York 10170-1881, Attention: Investor Relations. Additional information relating to the corporate governance of our company is also included in other sections of this report.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth procedures by which our Board of Directors carries out its responsibilities. Among the areas addressed by the Corporate Governance Guidelines are director qualification standards, director responsibilities, director access to management and independent advisors, director compensation, director orientation and continuing education, management succession, annual performance evaluation of our Board of Directors, management responsibilities and meeting procedures. These guidelines meet or exceed the listing standards adopted by the NYSE, on which our common stock is listed. Our Nominating and Corporate Governance Committee is responsible for assessing and periodically reviewing the adequacy of the Corporate Governance Guidelines and will recommend, as appropriate, proposed changes to our Board of Directors.

| 7 |

Board of Directors Leadership Structure

Our Board of Directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. It understands that there is no single, generally accepted approach to providing board leadership and that given the dynamic and competitive environment in which we operate, the right board leadership structure may vary as circumstances warrant.

Our Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of our Board of Directors. Currently, we have not appointed a Chairman. However, our Board of Director consists of a majority of independent and non-executive directors and our Board of Directors has appointed Mr. Baum, one of our independent directors, as Lead Independent Director to coordinate the activities of our Board of Directors and to assure effective corporate governance in managing the affairs of our Board of Directors and us. These independent and non-executive directors, under the leadership and coordination of the Lead Independent Director, meet regularly in executive session without the presence of management or interested directors in order to promote discussion among the independent and non-executive directors and to assure independent oversight of management. Our Lead Independent Director (i) presides at all meetings of the independent directors and any Board of Directors meeting when the Chief Executive Officer is not present, including executive sessions of the independent and non-executive directors, (ii) approves and informs the Chief Executive Officer as to the quality and timeliness of information sent to our Board of Directors and the appropriateness of meeting agenda items, (iii) serves as the primary liaison between the independent and non-executive directors and the Chief Executive Officer, (iv) holds a principal role in the evaluation of our Board of Directors and the evaluation of the Chief Executive Officer, (v) recommends to our Board of Directors and its committees the hiring and retention of any consultants that report directly to our Board of Directors, (vi) responds directly to stockholder questions or inquiries directed to the Lead Independent Director or the independent and non-executive directors as a group, (vii) upon request and when appropriate, ensures he is available for direct communication with major stockholders, and (viii) performs other duties as our Board of Directors may from time to time delegate. In addition, our Board committees, which oversee critical matters such as the integrity of our financial statements, the compensation of executive management, and the development and implementation of corporate governance policies, each consist entirely of independent directors. Therefore, our Board of Directors believes that its majority independent composition and the strength of our independent and non-executive directors, under the leadership and coordination of the Lead Independent Director, provide effective corporate governance at our Board of Directors level and independent oversight of both our Board of Directors and our executive officers. The current leadership structure, when combined with the functioning of the independent and non-executive director component of our Board of Directors and our overall corporate governance structure, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs. As part of its annual self-assessment, our Board of Directors will consider whether the current leadership structure continues to be optimal for us and our stockholders.

Board of Directors' Role in Risk Oversight

Our Board of Directors is responsible for the oversight of our risk management. Our Board of Directors is involved in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management by our Board of Directors and its committees. In particular, our Board of Directors administers its risk oversight function through (i) the review and discussion of regular periodic reports to our Board of Directors and its committees on topics relating to the risks that we face, including, among others, market conditions, tenant/borrower concentrations and credit worthiness, leasing activity and expirations, loan defaults and maturities, liquidity, compliance with debt covenants, management of debt maturities, access to debt and equity capital markets, existing and potential legal claims against us and various other legal, regulatory, accounting, and strategic matters relating to our business, (ii) the required approval by our Board of Directors (or a committee thereof) of significant transactions and other decisions, including, among others, acquisitions and dispositions of properties, originations and acquisitions of loans, new borrowings and the appointment and retention of our senior management, (iii) the direct oversight of specific areas of our business by the Compensation, Audit and Nominating and Corporate Governance Committees, and (iv) regular periodic reports from our auditors and other outside consultants regarding various areas of potential risk, including, among others, those relating to our qualification as a REIT for tax purposes and our internal control over financial reporting. Our Board of Directors also relies on management to bring significant matters impacting us to its attention.

| 8 |

Our Board of Directors oversees and monitors our risk management framework and actively reviews risks that may be material to us. As part of this oversight process, our Board of Directors regularly receives reports from management on areas of material risk to us. Our Board of Directors receives these reports from the appropriate sources within our company to enable it to understand our risk identification, risk management and risk mitigation strategies. To the extent applicable, our Board of Directors and its committees coordinate their risk oversight roles. Our Board of Directors recognizes that it is not possible to identify all of the risks that may affect us or to develop processes and controls to eliminate or mitigate their occurrence or effects. As part of its regular oversight of us, our Board of Directors interacts with and reviews reports from, among others, our executive officers, our chief compliance officer, our independent registered public accounting firm, our outside corporate counsel, our compensation consultant and a variety of other financial and other advisors, as appropriate, regarding risks faced by us and applicable risk controls. Our Board of Directors may, at any time and in its discretion, change the manner in which they conduct risk oversight. The goal of these processes is to achieve serious and thoughtful board-level attention to our risk management process and framework, the nature of the material risks we face and the adequacy of our risk management process and framework designed to respond to and mitigate these risks.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics as required by the listing standards of the NYSE that applies to our directors and executive officers and our employees. The Code of Business Conduct and Ethics was designed to assist our directors and executive officers and our employees in complying with the law, in resolving moral and ethical issues that may arise and in complying with our policies and procedures. Among the areas addressed by the Code of Business Conduct and Ethics are compliance with applicable laws, conflicts of interest, use and protection of our company's assets, confidentiality, communications with the public, accounting matters, records retention, fair dealing, discrimination and harassment and health and safety. A copy of the Code of Business Conduct and Ethics is accessible, free of charge at our website, www.gptreit.com. If we grant waivers from or make amendments to the Code of Business Conduct and Ethics that are required to be disclosed pursuant to the Exchange Act or applicable listing requirements, we will make those disclosures on our website within four business days following the date of such waiver or amendment.

Audit Committee Financial Expert

Our Board of Directors has determined that our Audit Committee has at least one “audit committee financial expert,” as defined in Item 407(d)(5) of SEC Regulation S-K, such expert being Gregory F. Hughes, and that he is “independent,” as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act. Our Board of Directors has determined that Mr. Hughes is an “audit committee financial expert” as defined in rules promulgated by the SEC under the Sarbanes-Oxley Act of 2002, as amended.

Communications with Our Board of Directors

We have a process by which stockholders and/or other parties may communicate with our Board of Directors, our Lead Independent Director, our independent and non-executive directors as a group or our individual directors (including the independent and non-executive directors). Any such communications may be sent to our Board of Directors, our Lead Independent Director or any named individual director (including the independent and non-executive directors), by U.S. mail or overnight delivery and should be directed to the Secretary at Gramercy Property Trust Inc., 420 Lexington Avenue, New York, New York 10170-1881, who will forward such communications on to the intended recipient or recipients. Our Chief Legal Officer and our General Counsel will review each communication received in accordance with this process to determine whether the communication requires immediate action. These officers will forward all appropriate communications received, or a summary of such communications, to the appropriate member(s) of our Board of Directors. However, we reserve the right to disregard any communication that our Chief Legal Officer and our General Counsel determine is unduly hostile, threatening or illegal, does not reasonably relate to us or our business, or is similarly inappropriate. These officers have the authority to disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications. Any such communications may be made anonymously.

Whistleblowing and Whistleblower Protection Policy

Our Audit Committee has established procedures for (1) the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and (2) the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. If you wish to contact our Audit Committee to report complaints or concerns relating to our financial reporting, you may do so in writing to the Chairman of our Audit Committee, c/o Secretary, Gramercy Property Trust Inc., 420 Lexington Avenue, New York, New York 10170-1881. Any such communications may be made anonymously.

| 9 |

Director Attendance at Annual Meetings

We encourage members of our Board of Directors to attend each annual meeting of stockholders. Mr. DuGan attended our annual meeting of stockholders held on December 13, 2012.

Identification of Director Candidates

Our Nominating and Corporate Governance Committee assists our Board of Directors in identifying and reviewing director candidates to determine whether they qualify for membership on our Board of Directors and for recommending to our Board of Directors the director nominees to be considered for election at our annual meetings of stockholders.

Each director candidate must have (i) education and experience that provides knowledge of business, financial, governmental or legal matters that are relevant to our business or to our status as a publicly-owned company, (ii) a reputation for integrity, (iii) a reputation for exercising good business judgment and (iv) sufficient available time to be able to fulfill his or her responsibilities as a member of our Board of Directors and of any committees to which he or she may be appointed.

In making recommendations to our Board of Directors, our Nominating and Corporate Governance Committee considers such factors as it deems appropriate. These factors may include judgment, skill, diversity, education, experience with businesses and other organizations comparable to our company, the interplay of the candidate's experience with the experience of other Board members, the candidate's industry knowledge and experience, the ability of a nominee to devote sufficient time to our affairs, any actual or potential conflicts of interest and the extent to which the candidate generally would be a desirable addition to our Board of Directors and any of its committees. Attributes that our Nominating and Corporate Governance Committee consider include: (i) prior experience on our Board of Directors and other relevant board level experience; (ii) real estate industry experience; (iii) transactional experience, especially within the real estate industry; (iv) relevant experience in property operations; (v) financial expertise; (vi) legal and/or regulatory experience; (vii) knowledge of and experience with corporate governance matters; (viii) experience with executive compensation matters; and (ix) prior experience in risk management.

While we do not have a formal written diversity policy, our Nominating and Corporate Governance Committee considers diversity of race, ethnicity, gender, age, cultural background, professional experiences and expertise and education in evaluating director candidates for Board membership. We believe that considerations of diversity are, and will continue to be, an important component relating to the composition of our Board of Directors as multiple and varied points of view contribute to a more effective decision-making process.

When considering current directors for re-nomination to our Board of Directors, our Nominating and Corporate Governance Committee takes into account the performance of each director. Our Nominating and Corporate Governance committee also reviews the composition of our Board of Directors in light of the current challenges and needs of our Board of Directors and us, and determines whether it may be appropriate to add or remove individuals after considering, among other things, the need for audit committee expertise and issues of independence, judgment, age, skills, background and experience.

Our Nominating and Corporate Governance Committee may solicit and consider suggestions of our directors or management regarding possible nominees. Our Nominating and Corporate Governance Committee may also procure the services of outside sources or third parties to assist in the identification of director candidates.

Our Nominating and Corporate Governance Committee may consider director candidates recommended by our stockholders. Our Nominating and Corporate Governance Committee will apply the same standards in considering candidates submitted by stockholders as it does in evaluating candidates submitted by members of our Board of Directors. Any recommendations by stockholders should follow the procedures outlined under “Stockholder Proposals” in the 2013 Proxy Statement and should also provide the reasons supporting a candidate's recommendation, the candidate's qualifications and the candidate's written consent to being considered as a director nominee. No director candidates were recommended by holders of our common stock for election at the 2013 annual meeting.

| 10 |

Executive Sessions of Independent and Non-Executive Directors

In accordance with the Corporate Governance Guidelines, the independent and non-executive directors serving on our Board of Directors generally meet in executive session after each regularly scheduled meeting of our Board of Directors or our Audit Committee without the presence of any directors or other persons who are part of our management. The executive sessions regularly are chaired by our Lead Independent Director.

Disclosure Committee

We maintain a Disclosure Committee consisting of members of our executive management and senior staff. The purpose of the Disclosure Committee is to oversee our system of disclosure controls, assist and advise the Chief Executive Officer and Chief Financial Officer in making the required certifications in SEC reports and evaluate our company's internal control function. The Disclosure Committee was established to bring together on a regular basis representatives from our core business lines and employees involved in the preparation of our financial statements to discuss any issues or matters of which the members are aware that should be considered for disclosure in our public SEC filings. The Disclosure Committee reports to our Chief Executive Officer and, as appropriate, to our Audit Committee. The Disclosure Committee meets quarterly and otherwise as needed.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC and the NYSE. Officers, directors and persons who own more than 10% of a registered class of our equity securities are required to furnish us with copies of all Section 16(a) forms that they file. To our knowledge, based solely on review of the copies of such reports furnished to us, all Section 16(a) filing requirements applicable to our executive officers, directors and persons who own more than 10% of a registered class of our equity securities were filed on a timely basis in 2012, accept that William H. Lenehan did not timely file a Form 3 to report his joining the board in January 2012.

| ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

This section discusses the principles underlying our executive compensation policies and decisions and the most important factors relevant to an analysis of these policies and decisions. It provides qualitative information regarding the manner and context in which compensation is awarded to, and earned by, our named executive officers and places in perspective the data presented in the tables and narrative that follow.

Throughout this report, the individuals who served as our Chief Executive Officer and Chief Financial Officer during our 2012 fiscal year, as well as the other individuals included in the "Summary Compensation Table" beginning on page 29, are referred to as the "named executive officers," or our "executives."

Overview

Summary of Actions Taken in Response to 2012 Say-on-Pay Vote

In response to the results of our Say-on-Pay shareholder responses for our 2012 annual meeting, our Board has authorized our company to develop the following new practices and policies for 2013 and beyond based upon the recommendation of our Compensation Committee and Nominating and Corporate Governance Committee:

| · | a shareholder outreach program to solicit reactions to our executive compensation program and corporate governance policies; | |

| · | specifically identified individual and corporate annual performance metrics to be used by our Compensation Committee to measure and quantify executive performance when determining annual incentive compensation bonuses; | |

| · | a policy to prohibit directors and officers from hedging, pledging and margining their shares of company stock; | |

| · | stock ownership guidelines for our chief executive officer to be based on a multiple of base salary; | |

| · | stock ownership guidelines for our non-employee directors to be based on multiples of the annual retainer for our non-employee directors; and | |

| · | a majority voting policy in the election of directors. |

| 11 |

Additionally, our new Chief Executive Officer, Gordon F. DuGan, has demonstrated his commitment to shareholders and the long-term success of the Company by:

| · | purchasing 1,000,000 shares of the Company’s stock with his own personal funds at the outset of his term on July 1, 2012; and |

| · | unilaterally waiving his right to receive payment of the $200,000 balance of his 2012 signing bonus. |

Executive Summary

2012 was a transformative year for us. During 2012, we (i) concluded a Board of Directors strategic review process by announcing a new business strategy focused on building value by deploying capital into income-producing net leased real estate, (ii) hired a new Chief Executive Officer, President and Managing Director to lead our implementation of the new business strategy and (iii) following completion by the new management team of a strategic review of our legacy assets and operations, commenced a process to exit the real estate finance business and sell our collateralized debt obligation (“CDO”) collateral management and sub-special servicing contracts to a third-party CDO manager and (iv) launched our asset management platform, which now provides third-party management services for approximately $1.7 billion of commercial properties leased primarily to regulated financial institutions and affiliated users.

During 2010 and 2011, a time of acute financial stress for us, our Compensation Committee was challenged with the task of retaining the key senior and mid-level personnel required to maintain full-platform operations pending (i) resolution of our maturing Gramercy Realty mortgage and mezzanine debt obligations and (ii) completion of the Board’s strategic review process. We addressed this need primarily through selectively targeted guaranteed bonuses and time-vested equity grants to retain the key personnel required to keep both our Gramercy Realty and Gramercy Finance divisions fully operational. We believed that such extraordinary measures were necessary, appropriate and in the long-term best interests of our shareholders because they allowed us to (i) resolve our Gramercy Realty debt obligations from a position of strength and (ii) pursue a strategic review process that permitted potentially interested parties to value either or both of our Gramercy Realty and Gramercy Finance platforms.

Once our Board completed the strategic review process in mid-2012, our executive compensation focus shifted to (i) designing and implementing a competitive and comprehensive compensation program to attract a top-performing management team to implement our new net lease business strategy and (ii) expanding that program to include other key persons, like our Chief Financial Officer, that will play a critical and on-going role in successful execution of our new business strategy.

We believe that the compensation programs we adopted during 2012 achieved these goals by creating a strong alignment of management and stockholder interests.

Seventy-five percent of the equity awards granted to our new Chief Executive Officer and President in June 2012 are subject to the achievement of performance-based vesting hurdles based on absolute increases in our funds from operations (“FFO”) or stock price during the five-year vesting period in addition to continued employment. Seventy-five percent of the equity awards that we granted to our Chief Financial Officer and certain other senior officers in March 2013 are also subject to the achievement of performance based vesting hurdles over a five-year period. Similarly, the long term incentive plan (“LTIP”) units that we granted to our new management team in June 2012 and to our Chief Financial Officer and certain other senior officers in March 2013 require achievement of a minimum vesting hurdle of $5.00 per share (i.e., a 100% increase over our $2.50 per share price on June 29, 2012) and a maximum vesting hurdle of $9.00 per share (i.e., a 260% increase over our June 29, 2012 closing price) over the five-year term of the plan. For a more detailed description of these awards, see "Employment and Noncompetition Agreements" below.

Two actions taken by our new Chief Executive Officer, Gordon F. DuGan, merit particular attention.

First, immediately prior to commencing employment as our Chief Executive Officer on July 1, 2012, and as contemplated and required by his employment contract, Mr. DuGan purchased 1,000,000 shares of our common stock for an aggregate purchase price of $2.52 million or, $2.52 per share (i.e., the closing price of our stock on the New York Stock Exchange on the day prior to the date he agreed in writing to purchase such shares). Mr. DuGan used his personal funds to buy the 1,000,000 shares from the company, without any reimbursement or other financial assistance from us. As shown on the “Security Ownership of Certain Beneficial Owners and Management Table” beginning on page 42, the purchase not only made Mr. DuGan one of our largest common stock holders, but the number of shares he purchased was equal to the aggregate number of time-vested restricted stock (i.e., 250,000) and performance-based restricted stock units (i.e., 750,000) that he may earn over a five-year period under his employment contract.

| 12 |

Second, the five-year contract that we signed with Mr. DuGan in June 2012 entitled him to receive a one-time signing bonus of $400,000, with half paid in July 2012 and the remaining $200,000 (the “Unpaid CEO Signing Bonus”) payable in three equal annual installments on June 30 of 2013, 2014 and 2015. On April 25, 2013, at a quarterly meeting of our Board of Directors, Mr. DuGan advised the Board of his desire to unilaterally and unconditionally waive his right to receive all or any portion of his Unpaid CEO Signing Bonus. The Board accepted Mr. DuGan’s offer, and the parties orally agreed to modify Mr. Dugan’s employment contract to remove any obligation we have to pay the Unpaid CEO Signing Bonus to our Chief Executive Officer. Mr. DuGan indicated that his motivation for waiving his right to be paid the balance of his signing bonus was a desire to eliminate any notion that his ongoing compensation package included a “guaranteed” bonus component and that he preferred that he be judged and compensated for his and the company’s performance.

Much has been accomplished by us in the approximately ten months since we hired the new management team. During that period, we acquired or have under contract to purchase approximately 2.2 million square feet of office space, approximately 1.5 million square feet of industrial space and one truck terminal with 101 dock doors that collectively will generate approximately $20.0 million of annualized net operating income on a forward looking basis. Our pipeline for additional acquisitions remains strong, and we remain focused on growing our FFO through quality net lease investments.

In March 2013, we consummated the sale of our CDO management platform. Exiting the real estate finance business achieved a number of important objectives for us, including: (i) maximizing the value of the servicing business through the sale to a large servicing operation, (ii) simplifying our going-forward business and significantly reducing the ongoing management, general and administrative expenses through elimination finance related personnel costs and CDO servicing advance requirements, (iii) generating in excess of $50.0 million in liquidity previously invested in the CDO business and (iv) providing for potential future proceeds through the retention of the equity in the three CDOs.

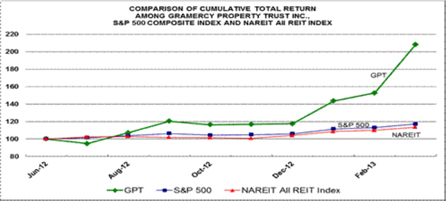

While our transformation to a company that builds value by deploying capital into income-producing net leased real estate is still in its early stages and much remains to be accomplished, the marketplace has responded favorably to the initial achievements of our management team. Over the past ten months, our share price has risen approximately 88% from $2.50 per share on June 29, 2012 to $4.71 on April 26, 2013. A chart illustrating our common stock’s total shareholder return (“TSR”) since our announced redirection as a company focused on investing in net lease real estate is set forth below.

Notwithstanding the accomplishment of these significant milestones since July 1, 2012 and our dramatic TSR over the past ten months, neither Mr. DuGan nor any other member of our new management team was eligible to receive (or did receive) any guaranteed or discretionary bonus for 2012. To the contrary, under the terms of their employment contracts, the new management team is not eligible to receive an annual incentive award until year-end 2013.

Over the past several months our management team has engaged in numerous formal and informal discussions with our stockholders to clarify our new business strategies and to solicit stockholder input on the new direction of the company. Almost uniformly, the stockholders we have engaged enthusiastically support our new business strategy and expressed a belief that there is a strong alignment of management and stockholder interests.

| 13 |

To more broadly measure and accurately determine stockholder sentiment, our Compensation Committee has engaged its external compensation consultant, FTI Consulting, Inc. (“FTI”), to contact our five largest stockholders in advance to our 2013 Annual Meeting to solicit stockholder input regarding, and their level of satisfaction with, our executive compensation practices. Our Compensation Committee will use the information obtained from this shareholder engagement when setting 2013 executive compensation guidelines, particularly with respect to the discretionary bonus portions thereof.

Objectives of Our Compensation Program

As a self-managed, integrated commercial real estate investment and asset management company, we operate in a highly competitive market. We seek to maintain a total compensation package that provides fair, reasonable and competitive compensation for our executives, while allowing us the flexibility to differentiate actual pay based on individual and organizational performance.

Our Compensation Committee, in consultation with our Chief Executive Officer and external compensation consultant, sets our compensation philosophy, which has been structured to achieve the following objectives:

| · | to attract and retain talented individuals capable of performing at a high level in a market that remains highly competitive and who have the motivation, experience and skills necessary to lead us effectively; |

| · | to provide performance-based compensation that creates a strong alignment of management and stockholder interest to create long-term stockholder value; |

| · | to motivate our executives to manage our business to meet and appropriately balance our short- and long-term objectives; |

| · | to hold executives accountable for their level of success in attaining specific goals set for them individually; |

| · | to maintain flexibility and discretion to allow us to recognize the unique characteristics of our operations and strategy, and our prevailing business environment, as well as changing labor market dynamics; and |

| · | to achieve an appropriate risk-reward balance in our compensation programs that does not incentivize unnecessary or excessive risk taking. |

Based on these objectives, we place significant emphasis on annual and long-term performance-based incentive compensation, including base salaries, annual cash and equity incentives and long-term equity-based incentive awards, which are designed to reward our executives based on the achievement of predetermined company and individual goals.

Our Compensation Committee is committed to the ongoing review and evaluation of the executive officer compensation levels and program. It is our Compensation Committee's view that compensation decisions are complex and best made after a deliberate review of company and individual performance, as well as industry compensation levels. Consistent with this view, our Compensation Committee annually assesses our performance within the context of the industry's overall performance and internal performance standards and evaluates individual executive officer performance relative to the performance expectations for their respective position and role within our company. In addition, our Compensation Committee benchmarks from time to time the total compensation provided to our executive officers to industry-based compensation practices. While it is our Compensation Committee's goal to provide compensation opportunities that reflect company and individual performance and that are competitive within industry standards, a specific target market position for executive officer pay levels has not been established.

Setting Executive Compensation

Our Compensation Committee determines compensation for our named executive officers and is comprised of three independent directors: Jeffrey E. Kelter (Chairman), Allan J. Baum and Charles S. Laven. Our Compensation Committee exercises independent discretion in respect of executive compensation matters and administers our 2004 Equity Incentive Plan and our 2012 Inducement Equity Incentive Plan (including reviewing and approving equity grants to our executives pursuant to these plans). Our Compensation Committee operates under a written charter adopted by our Board of Directors, a copy of which is available on our website at www.gptreit.com.

| 14 |

Our Compensation Committee has retained FTI Consulting, Inc. (“FTI”), an outside compensation consulting firm, to assist it in evaluating, formulating and benchmarking our compensation programs. FTI provides our Compensation Committee and Chief Executive Officer with relevant market data concerning the marketplace, our peer group and other compensation developments. FTI participates in our Compensation Committee meetings and meets with our named executive officers and certain of our directors. Our Compensation Committee has the authority to replace FTI or hire additional consultants at any time. It is important to understand that the compensation market data and ranges provide only a reference point for our Compensation Committee. Depending upon our business and individual performance results, a named executive officer's total direct compensation may be within, below or above the market range for that position. FTI also provides additional professional services, including strategic advisory and tax planning, to us and receives market-based compensation with respect to these services. In 2012, we paid approximately $76,000 to FTI in connection with such non-compensation based services.

Our Compensation Committee determines the total compensation and the allocation of such compensation among base salary, annual incentive awards and long-term incentive compensation as well as allocation of such items among cash and equity compensation for our Chief Executive Officer. With respect to the compensation of other named executive officers, our Compensation Committee solicits recommendations from our Chief Executive Officer regarding compensation and reviews his recommendations. We do not have a pre-established policy for the allocation between either cash and non-cash compensation or annual and long-term incentive compensation.

Our Compensation Committee met three times during 2012 to evaluate executive performance and to monitor market conditions in light of these goals and objectives, to solicit input from the compensation consultant on market practices and new developments and to review our compensation practices. During this decision making process, our Compensation Committee reviews tally sheets that detail each executive officer's compensation history. The tally sheets help our Compensation Committee to track changes in an executive officer's total direct compensation from year to year and to remain aware of the compensation historically paid to each executive officer. Ultimately, we rely upon our judgment about each of our named executive officers and not on formulas or short-term changes in business performance or our stock price. The key factors affecting our judgment are TSR, change in earnings and funds from operations, actual performance against the financial, operational and strategic goals we set at the beginning of the year, the nature and level of responsibility of each executive officer and the integrity and effort with which such executive officer conducts his responsibilities. Our Compensation Committee regularly reports to our Board of Directors.

What Our Compensation Program is Designed to Reward

Our Compensation Committee has designed our compensation program to (i) attract and retain talented individuals capable of performing at a high level in a market that remains highly competitive and who have the motivation, experience and skills necessary to lead our company effectively, (ii) provide performance-based compensation that creates a strong alignment of management and stockholder interest to create long-term stockholder value, (iii) motivate our executives to manage our business to meet and appropriately balance our short- and long-term objectives, (iv) hold executives accountable for their level of success in attaining specific goals set for them individually, (v) maintain flexibility and discretion to allow us to recognize the unique characteristics of our operations and strategy, and our prevailing business environment, as well as changing labor market dynamics, and (vi) achieve an appropriate risk-reward balance in our compensation programs that does not incentivize unnecessary or excessive risk taking. We expect to perform at the highest levels of the equity real estate investment trust (“REIT”) sectors. Our Compensation Committee rewards the achievement of our and the individual executive's specific annual, long-term and strategic goals. Our Compensation Committee measures performance on an absolute basis against financial and other measures and on relative basis by comparing our performance against other equity REITs generally and against the REIT industries specifically. Comparative performance is an important metric since market conditions may affect the ability to meet specific performance criteria.

Role of Executive Officers in Compensation Decisions

Our Chief Executive Officer annually reviews the performance of each of the other named executive officers. He also considers the recommendations of the compensation consultant. Based on this review and input, our Chief Executive Officer makes compensation recommendations to our Compensation Committee for all named executive officers other than himself, including recommendations for performance targets, base salary adjustments, the discretionary components of our short-term cash incentive compensation, and long-term equity-based incentive awards. Our Compensation Committee considers these recommendations along with data and input provided by its other advisors. Our Compensation Committee retains full discretion to set all compensation for the named executive officers.

| 15 |

2012 Advisory Vote to Approve Executive Compensation