Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DITECH HOLDING Corp | d536091d8k.htm |

| EX-99.1 - EX-99.1 - DITECH HOLDING Corp | d536091dex991.htm |

First

Quarter 2013 Earnings Presentation May 9, 2013

Exhibit 99.2 |

Forward-Looking Statements and Non-GAAP

Financial Measures

1

This document contains forward-looking statements, including forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements concerning Walter Investment's plans, beliefs, objectives, expectations and intentions

and other statements that are not historical or current facts. Forward-looking statements are based

on Walter Investment's current expectations and involve risks and uncertainties that could cause

actual results to differ materially from those expressed or implied in such forward-looking statements. In addition, these

statements are based on a number of assumptions that are subject to change. Accordingly, actual

results may be materially higher or lower than those projected. The inclusion of such projections

herein should not be regarded as a representation by Walter Investment that the projections will prove to be correct. This

document speaks only as of this date. Walter Investment disclaims any duty to update the information

herein except as otherwise required by law.

Factors that could cause Walter Investment's results to differ materially from current expectations or

affect the Company’s ability to achieve anticipated core earnings and EBITDA include, but

are not limited to: •

Regulatory changes and changes in delinquency and default rates that could adversely affect the costs of

our businesses such that they are higher than expected; •

Prepayment speeds, delinquency and default rates of the portfolios we service;

•

Our inability to achieve anticipated incentive fees, which are subject to certain factors beyond the

Company’s control and which are difficult to estimate with any degree of certainty in

advance; •

The achievement of anticipated volumes and margins from the origination of both forward and reverse

mortgages, which can be affected by multiple factors, many of which are beyond our control;

•

Assumptions with regard to the HARP eligible population of the portfolios we service, customer take up

rates, our recapture rates, the origination margins for HARP refinancing and anticipated changes

to the HARP program which may increase competition; •

Assumptions with regard to contributions from originations are also subject to the integration of the

ResCap origination and capital markets platforms, and the organizational structure, capital

requirements and performance of the business after the acquisition; •

The closing of various business and asset acquisitions on schedule, and the addition of new business in

2013; •

The timely and efficient transfer of assets acquired to the Company’s platforms and the efficient

integration of the acquired businesses, including achievement of synergies related thereto;

•

The accuracy of our expectations regarding the value of, and contributions from, acquired MSRs, related

intangibles and other assets, including the accuracy of our assumptions as to the performance of

the assets we acquire, which are subject to and affected by many factors, some of which are beyond our control, and

could differ materially from our estimates;

•

Errors in our financial models or changes in assumptions could result in our estimates and expectations

being materially inaccurate which may adversely affect our earnings;

•

The effects of competition on our existing and potential future business;

•

Our ability to service our existing or future indebtedness;

•

Other factors that may affect the Company’s earnings or costs; and

•

Other factors relating to our business in general as detailed in Walter Investment's 2012 Annual Report

on Form 10-K and other periodic reports filed with the U.S. Securities and Exchange

Commission. To

supplement Walter Investment’s consolidated financial statements prepared in accordance with GAAP and to better reflect period-over-period comparisons,

Walter Investment uses non-GAAP financial measures of performance, financial position, or cash flows

that either exclude or include amounts that are not normally excluded or included in the most

directly comparable measure, calculated and presented in accordance with GAAP. Non-GAAP financial measures do not replace

and are not superior to the presentation of GAAP financial results, but are provided to (i) measure the

Company’s financial performance excluding depreciation and amortization costs, corporate and

MSR facility interest expense, transaction and merger integration-related costs, certain other non-cash adjustments, the net impact

of the consolidated Non-Residual Trust VIEs and certain other items including, but not limited to

pro-forma synergies, (ii) provide investors a means of evaluating our core operating

performance and (iii) improve overall understanding of Walter Investment’s current financial performance and its prospects for the future.

Specifically, Walter Investment believes the non-GAAP financial results provide useful

information to both management and investors regarding certain additional financial and business

trends relating to financial condition, operating results and cash flows. In addition, management uses these measures for reviewing financial

results and evaluating financial performance and cash flows. The non-GAAP adjustments for all

periods presented are based upon information and assumptions available as of the date of this

presentation. Reconciliations can be found in the Appendix to this presentation and our press release dated May 9, 2013.

|

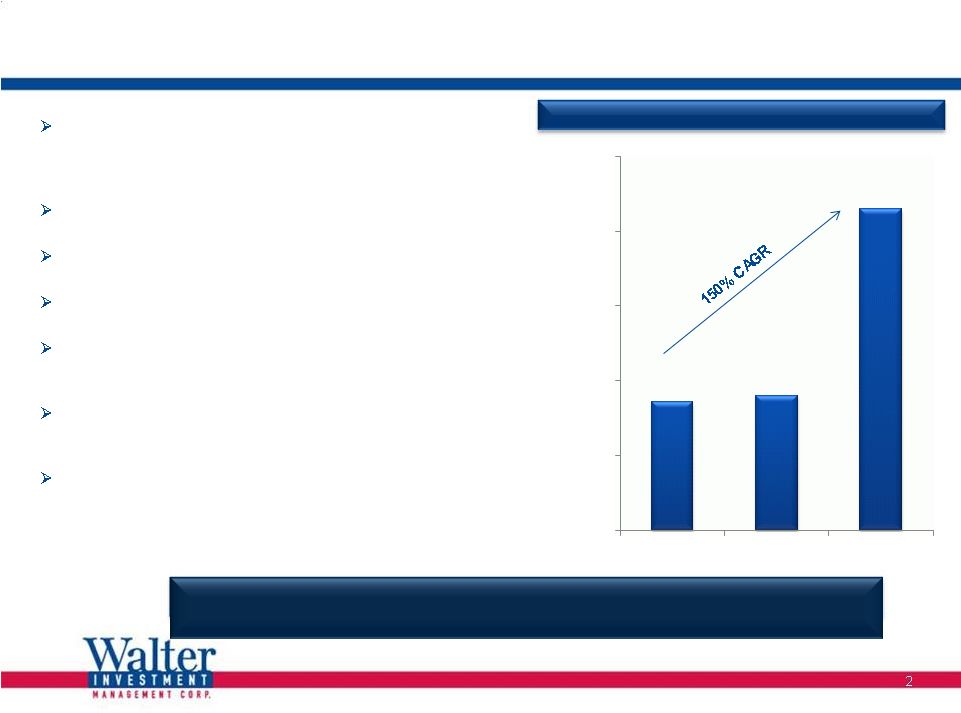

Q1

2013 Highlights Generated record quarterly financial results, with

GAAP Net Income of $27.7 million, or $0.73 per

diluted share, $1.50 of Core EPS and $140 million

of AEBITDA

Completed the acquisition of the ResCap

originations and capital markets platforms

Completed the acquisitions of the ResCap and

Bank of America MSRs

Acquired $12.2 billion UPB of reverse MSRs from

Wells Fargo

Total serviced UPB of $215 billion and nearly 2

million accounts at March 31; increased 150% as

compared to Q1 2012

Achieved a four STAR designation from Fannie

Mae for the 2012 program year for overall servicing

performance

Added approximately $2 billion of warehouse

capacity and $825 of incremental term loan

borrowings

2

($ in billions)

(1)

Includes both forward and reverse servicing portfolios

$86

$90

$215

$-

$50

$100

$150

$200

$250

Q1 2012

Q4 2012

Q1 2013

Significant

Growth

in

UPB

Serviced

(1)

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

March

31,

2013

Form

10-Q

and

other

filings

with

the

SEC,

for

important

information

regarding

Forward-Looking

Statements

and

the

use

of

Non-GAAP

Financial

Measures.

Transitional first quarter produced strong financial results, with new

business

additions

establishing

a

solid

foundation

for

growth

in

2013. |

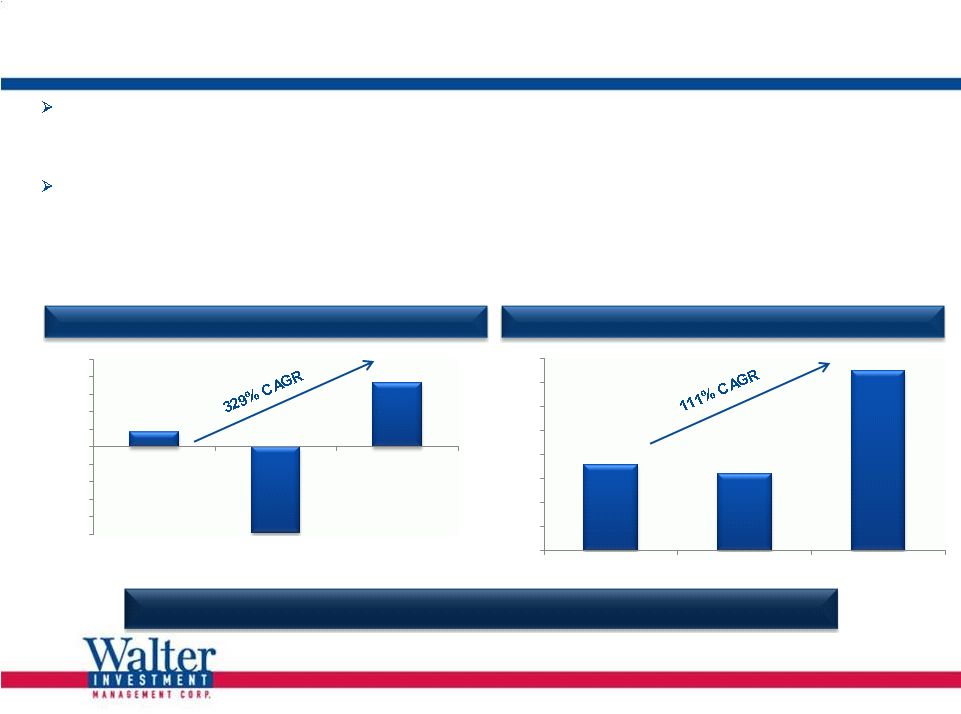

Q1

2013 Consolidated Financial Results GAAP net income of $27.7 MN, or $0.73 per

diluted share •

Total revenues of $291.8 MN, $139.0 MN higher than prior year period

•

Strong

level

of

incentive

and

performance

fees

at

$30.3

MN,

$7.3

MN

higher

than

the

previous

year

period

•

Strong contributions from Reverse Mortgage and Originations

Core earnings after tax of $56.5 MN, or $1.50 per diluted share,

an increase of $35.9 MN or $0.79 per

share compared to Q1 2012

•

New servicing portfolio additions are earning attractive margins

•

Solid, growing contributions from new business segments

•

Core

earnings

deducts

$27.7

million

of

depreciation,

amortization

and

MSR

related

fair

value

adjustments;

compares

to

$4.7

million

in

prior

year

period;

excludes

step

up

depreciation

and

amortization

of

$21.0

million

3

Q1 2012

Q1 2013

Q4 2012

$0.71

$0.64

$1.50

$-

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

Q1 2012

Q4 2012

Q1 2013

Record earnings and growth in the first quarter of 2013.

$0.17

($0.98)

$0.73

$(1.00)

$(0.80)

$(0.60)

$(0.40)

$(0.20)

$-

$0.20

$0.40

$0.60

$0.80

$1.00

Core EPS

GAAP EPS

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our March 31, 2013 Form 10-Q and other filings with the SEC, for important

information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

|

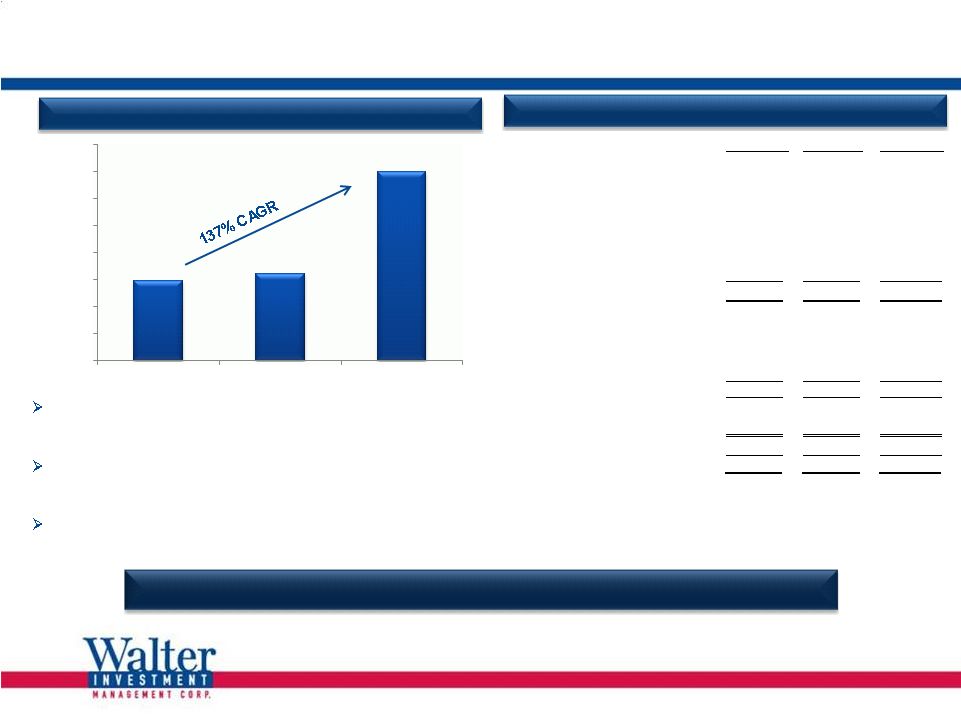

Q1

2013 EBITDA and Core Earnings Adjustments 4

Note:

Columns may not total due to rounding.

(1)

Includes MSR related fair value adjustments , excludes step-up

depreciation and amortization.

Servicing AEBITDA growth driven by recent

acquisitions, and strong results in incentive,

performance-based and ancillary fees

Reverse Mortgage AEBITDA driven by record

origination volumes and strong cash gain on sale

margins

Originations AEBITDA includes value of growing

loans HFS and locked pipeline volume

$59.1

$64.1

$140.0

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

Q1 2012

Q4 2012

Q1 2013

($ In millions except per share amounts)

Q1 2012

Q4 2012

Q1 2013

Servicing

37

$

36

$

64

$

ARM

3

5

4

Insurance

11

11

9

Loans and Residuals

6

6

6

Reverse Mortgage

-

8

19

Originations

-

(2)

36

Other

2

-

1

AEBITDA

59

$

64

$

140

$

Less:

Depreciation and Amortization

(1)

(5)

(6)

(28)

Interest Expense

(20)

(17)

(23)

Other

(1)

(5)

3

Pre-tax core earnings

33

$

36

$

93

$

After-tax core earnings

21

$

23

$

57

$

Diluted shares outstanding

29.0

34.9

37.6

Core EPS

0.71

$

0.64

$

1.50

$

Adjusted EBITDA by Segment / Core Earnings

Adjusted EBITDA

Significant AEBITDA growth translates into solid Core Earnings.

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

March

31,

2013

Form

10-Q

and

other

filings

with

the

SEC,

for

important

information

regarding

Forward-Looking

Statements

and

the

use

of

Non-GAAP

Financial

Measures. |

Servicing Segment Overview

Stable, recurring servicing fees plus incentive,

performance-based, ancillary and other fees

Segment pre-tax core earnings of 15 bps of average UPB

Weighted average contractual servicing fee of 28 bps

Net run-off rate of 20%, better than expectations

5

Net revenue and fees of $139.7 million; includes incentives

of $20.4 million, 37% greater than Q1 2012; net of $17.4

million of amortization and change in fair value of servicing

rights

GAAP Income before income taxes of $36.1 million

Pre-tax core earnings of $52.1 million

$86

$77

$201

1,036,096

961,042

1,914,441

0

500,000

1,000,000

1,500,000

2,000,000

$0

$25

$50

$75

$100

$125

$150

$175

$200

$225

Q1 2012

Q4 2012

Q1 2013

UPB

UNITS

Please

refer

to

the

introductory

slides

of

this

presentation,

as

well

as

additional

disclosures

in

the

Appendix

and

in

our

March

31,

2013

Form

10-Q

and

other

filings

with

the

SEC,

for

important

information

regarding

Forward-Looking

Statements

and

the

use

of

Non-GAAP

Financial

Measures.

$ in billions

$ in millions

$76

$72

$122

$15

$20

$9

$11

$15

$0

$25

$50

$75

$100

$125

$150

$175

Q1 2012

Q4 2012

Q1 2013

Contractual

Incentive

Ancillary

$103

$157

$100

$20

Total Segment UPB and Number of Accounts

Breakdown of Servicing Revenue

Portfolio

Earnings |

Portfolio Run-off/Net Disappearance Rates

6

Q4 2012

Q1 2013

MH

12%

12%

All GSE

16%

21%

Total

15%

20%

BAC

22%

ResCap

26%

FNMA sub-serviced

15%

(1)

Quicken Loans solicits FNMA sub-serviced portfolio for HARP

refinancings. Under agreement with Quicken and FNMA,

sub-servicing rights for recaptured loans are returned to Green Tree

within 60-90 days of

refinancing. Run-off rates shown above assumes sub-servicing is

returned in same month as refinancing. Loans in process of return at

3/31/2013 were $2.8 BN UPB and $5.2 BN UPB at 12/31/2012. Uptick in Q1 2013

for GSE portfolio due to addition of BofA and ResCap portfolios

Disappearance rates for BofA and ResCap reflect February & March

activity: Adjusted

For

Timing

Difference

on

Recapture

of

Quicken

Loans

(1)

Q1 2013 GSE by Portfolio

•

Gross disappearance approximates net disappearance due to minimal recapture

activity during these two months

•

Actual disappearance lower than recent history and projections

•

Opportunity to reduce net disappearance rates as Originations recapture pipeline

builds

•

Portfolios performing better than acquisition models

|

Reverse Segment Overview

Originated $968 million of UPB in Q1

•

18% through Retail channel

•

82% through Correspondent and Wholesale channels

•

Average cash gain on sale margin of 325 bps

•

Issued over $900 million of HECM securitizations

Originations pipeline going into Q2 remains strong; shift

from fixed to ARM product is already occurring; margins

remain firm

7

Servicing

Originations

Servicing portfolio doubled with the reverse MSR

acquisition from Wells Fargo

$825 million of servicing added through originations versus

disappearance of 7% on average UPB of $13.5 billion

Pre-tax servicing margins of 50%

Funded Volume (UPB)

$ in millions

Servicing Portfolio* (UPB)

$ in billions

* Proforma for announced acquisition of MSRs, closed effective April 1,

2013. Income before income taxes of $12.1 million

Pre-tax core earnings of $18.4 million

Segment Profitability

$235

$275

$354

$298

$316

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

$12.9

$25.0

Q4 2012

Q1 2013*

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our March 31, 2013 Form 10-Q and other filings with the SEC, for

important information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

|

Originations Segment Overview

Quickly ramped originations volumes during the quarter,

principally in consumer direct channel:

Applications soared from $0.3 billion in Q4 2012 to

$2.2 billion in Q1 2013 in the Consumer Lending

channel ($0.5 billion in Business Lending)

$375 million of funded originations during the quarter

compared to $95 million in Q4 2012

Locked Pipeline of $1.9 billion as of March 31, 2013

HARP eligible population, marketing programs,

anticipated recapture rates and ramp in pipeline support

expectations for full year

Average margin on originated product of 4.07%

driven

by attractive HARP margins

Extension of HARP program will increase eligible

population:

~200,000 loans in serviced portfolio currently ineligible

due to delinquencies in last 12 months

~40,000

of

these

currently

ineligible

loans

have

only

been

delinquent

once

or

twice

in

the

last

12

months

8

Originations Highlights

$ in billions

(1)

Includes

mark-to-market

on

loans

held

for

sale

and

IRLC

net

of

expected

fallout.

MTM

and

FV

gains

are

generally

expected

to

convert

to

realized

gains

within

55

to

70

days.

Q1 2013 Origination Economics

($MN)

Cash - Points, Fees, Gain on Sale

$3.4

Pipeline Value

(1)

$71.4

Subtotal Cash / Near Cash Revenue

$74.8

Servicing

Asset

$1.3

Total Originations Revenue

$76.1

Note: Applications defined as services ordered/submission to operations in Consumer

Lending and Registrations in Business Lending.

$-

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

Q1

Q2(e)

Q3(e)

Q4(e)

Funded Volume Consumer Lending

Application Volume Consumer Lending

Consumer Lending Originations Volume (UPB) |

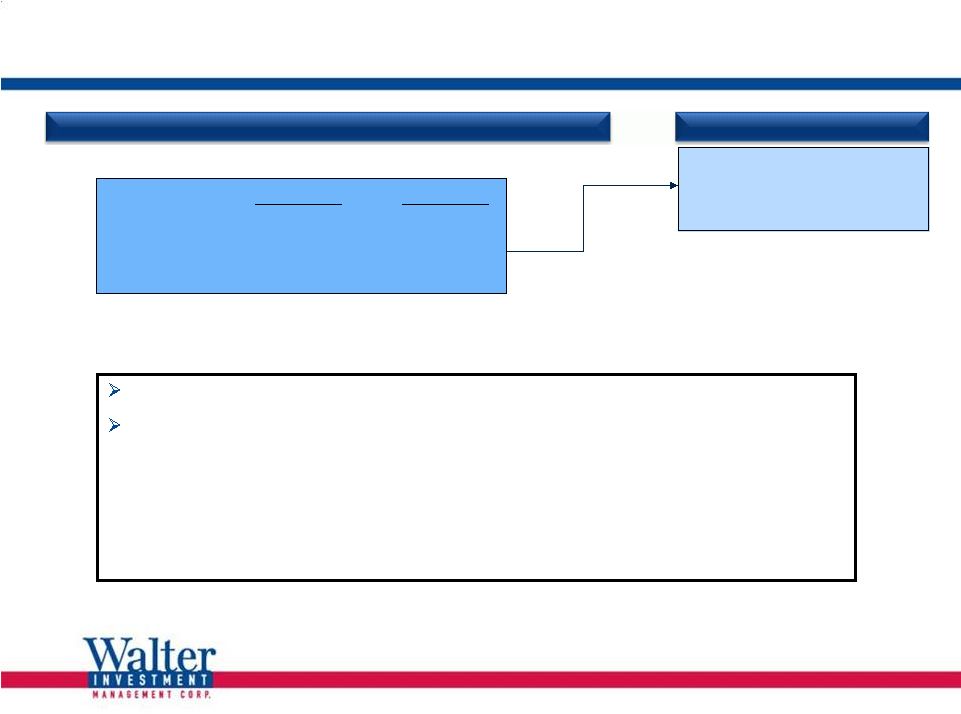

•

Converted one subservicing

opportunity to contract and

boarded a pilot program

•

One subservicing

opportunity withdrawn by

the client from the market at

this time

Market Overview and Pipeline

Economic conditions and outlook continue

to be favorable

Sector drivers remain positive

•

Outsource non-core

•

Reduce costs

•

Compliance

•

Capital efficiency

•

HARP extension

Asset prices remain attractive

Capital continues to flow to the sector

“Middle innings”

of aggregation phase;

sizeable $1 trillion plus opportunity

available

Strong client diversification

Short lull in activity in Q4 2012 /

Q1 2013 due to significant

transactions

Expect to build pipeline for

remainder of 2013

Exclusive pipeline of $10 billion

9

Pipeline expected to build after short lull driven by significant

transactions in Q4 2012 and Q1 2013.

Active Pipeline* of $300 BN UPB

Market Overview

Current

Active Pipeline

$10 BN

(Exclusive)

$300 BN

(Active)

*

“Pipeline” refers to opportunities or potential opportunities in the market for products

within our strategic profile that we have identified as targets to add to our servicing portfolio through either the

acquisition of MSR or sub-servicing contracts. In each case we have contacted the seller or

its representative to register our interest, or are currently engaged in discussions or negotiations directly

with the seller or its representative. The status of “pipeline opportunities” varies from

early stage contact through exclusive negotiations. There can be no guarantee that any of the opportunities in our

pipeline will result in purchases or contracts added by the Company. |

2013

Outlook Estimated

Adjusted

EBITDA

(1) Using mid-point of 2013 range.

10

Core Earnings Estimates

(1) At mid-point of EBITDA range.

(2) Depreciation

and

amortization

including

fair

value

adjustment

to

MSRs;

excludes

step

up

depreciation

and

Core Earnings estimates are based upon previously provided estimated AEBITDA and

other amounts as shown above. See Forward Looking Statements and

Definitions section. Note:

Columns may not total due to rounding.

Highlights

AEBITDA guidance reflects only existing business

Estimated Core EPS

$ in millions

($ In millions except per share amounts)

2012

Q1 2013

2013(e)

EBITDA

242

$

140

$

688

$

(1)

Less:

Depreciation and Amortization

(2)

(20)

(28)

(250)

Interest Expense

(3)

(77)

(23)

(115)

Other

(11)

3

(11)

Pre-tax core earnings

134

$

93

$

312

$

After-tax core earnings

83

$

57

$

190

$

Diluted shares outstanding

(3)

30.4

37.6

37.6

Core EPS

2.73

$

1.50

$

5.06

$

Pipeline opportunities

Market trends remain positive; still in middle innings

of aggregation phase with opportunities for stair-step

growth

High barriers to entry; few specialty servicers of size

and scale

Recent acquisitions ramp in profitability

amortization. 2013 amount is management’s estimate.

Core business continues to be well-positioned to drive

significant growth beyond 2013

$650 –

$725

$242

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our March 31, 2013 Form 10-Q and other filings with the SEC, for

important information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

(3) Based on current capital structure and rates.

|

Focus

on Sustainable, Profitable Growth (1)

Source: Inside Mortgage Finance.

11

Solid Financial

Fundamentals

Strong Pipeline

Differentiated

Operating Model

WAC is highly focused on delivering significant returns to shareholders

Strong Q1 2013 results

Strong margins across business lines

Significant leverage to results in 2013 and 2014 on acquired business

Regulatory, capital, operational, and compliance issues all remain catalysts for servicing

transfers

Secular shift continues, driving sustainability and growth

Trend of outsourced non-core assets continues

Robust active pipeline of $300 billion

Ramp in flow opportunities

Establishing new client relationships

Platform delivers value-added benefits to credit owners

Ancillary businesses (ARM, Insurance) deliver additional value and drive increased revenue

Addition of Reverse Mortgage and Originations businesses further diversify revenue streams

High level of compliance drives preferred partner status

Cyclical and

Secular Industry

Shift

•

•

•

•

•

•

•

•

•

•

•

•

• |

Appendix |

Use

of Non-GAAP Measures 13

Generally Accepted Accounting Principles ("GAAP") is the term used to refer to the standard

framework of guidelines for financial accounting. GAAP includes the standards, conventions, and

rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to

reporting financial results in accordance with GAAP, the Company has provided non-GAAP financial

measures, which it believes are useful to help investors better understand its financial

performance, competitive position and prospects for the future.

Core earnings (pre-tax and after-tax), core earnings per share and Adjusted EBITDA are

financial measures that are not in accordance with GAAP. See the Definitions included in

this document for a description of how these items are reported and see the Non-GAAP Reconciliations for a reconciliation of these

measures to the most directly comparable GAAP financial measures. The

Company believes that these Non-GAAP Financial Measures can be useful to investors because they provide a means by which investors can evaluate the

Company’s underlying key drivers and operating performance of the business, exclusive of certain

adjustments and activities that investors may consider to be unrelated to the underlying

economic performance of the business for a given period.

The Company manages the business based upon the achievement of core earnings, Adjusted EBITDA and

similar targets and has designed certain management incentives based upon the achievement of

pre-tax income and Adjusted EBITDA in order to assess the underlying operational performance of the continuing

operations of the business for the year and to have a basis to compare underlying operating results to

prior and future periods.

Since core earnings (pre-tax and after-tax) and core earnings per share measure the

Company’s financial performance excluding certain depreciation and amortization costs

related to acquisitions, transaction and merger integration-related costs, share-based compensation expense, certain other non-cash

adjustments, and the net impact of the consolidated Non-Residual Trust VIEs, they may not reflect

all amounts associated with our results as determined in accordance with GAAP.

Adjusted EBITDA measures the Company’s financial performance excluding depreciation and

amortization costs, corporate and MSR facility interest expense, transaction and merger

integration-related costs, share-based compensation expense, certain other non-cash adjustments, the net impact of the consolidated

Non-Residual Trust VIEs and certain other items, including, but not limited to pro-forma

synergies, they may not reflect all amounts associated with our results as determined in

accordance with GAAP.

Core earnings (pre-tax and after-tax), core earnings per share and Adjusted EBITDA involve

differences from segment profit (loss), income (loss) before income taxes, net income (loss),

basic earnings (loss) per share and diluted earnings (loss) per share computed in accordance with GAAP. Core earnings (pre-tax and

after-tax), core earnings per share and Adjusted EBITDA should be considered as

supplementary to, and not as a substitute for, segment profit (loss), income (loss) before

income taxes, net income (loss), basic earnings (loss) per share and diluted earnings (loss) per share computed in accordance with GAAP as a

measure of the Company’s financial performance. Any

non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for

GAAP earnings. Further, the non-GAAP measures presented by Walter Investment may be defined

or calculated differently from similarly titled measures of other companies.

Use

of

Core

Earnings

and

Adjusted

EBITDA

by

Management

Limitations

on

the

Use

of

Core

Earnings

and

Adjusted

EBITDA |

Definitions

Core Earnings This disclaimer applies to every usage of Core Earnings and related

terms such as Pre Tax Core Earnings, Core Earnings After Taxes and Core

Earnings Per Share (“EPS”) in this document. Core Earnings is a

metric that is used by management to exclude certain items in an attempt to provide a better

earnings per share metric to evaluate the Company’s underlying key drivers and

operating performance of the business, exclusive of certain adjustments and

activities that investors may consider to be unrelated to the underlying economic

performance of the business for a given period. Core Earnings excludes certain

depreciation and amortization costs related to business combination transactions,

transaction and merger integration-related costs, share-based compensation

expense, certain other non-cash adjustments, and the net impact of the

consolidated Non-Residual Trust VIEs. Core Earnings includes both cash and non-cash

gains from forward mortgage origination activities. Non-cash gains are

net of non-cash charges or reserves provided. Core Earnings excludes the impact of fair

value option (“FVO”) accounting and includes cash gains for reverse

mortgage origination activities. Core Earnings may also include other adjustments, as

applicable based upon facts and circumstances, consistent with the intent of

providing investors a means of evaluating our core operating performance.

14

Adjusted EBITDA This disclaimer applies to every usage of Adjusted EBITDA and related terms such as

Pro-Forma Adjusted EBITDA and AEBITDA in this document. Adjusted EBITDA is a

key performance metric used by management in evaluating the performance of our Company and its segments. Adjusted EBITDA

is generally presented in accordance with its definition in the Company’s senior secured credit

agreement, with certain exceptions, and represents income before income taxes, depreciation and

amortization, interest expense on corporate debt, transaction and integration related costs, the net effect of the non-residual VIEs and

certain other non-cash income and expense items. Adjusted EBITDA includes both cash and

non-cash gains from forward mortgage origination activities. Adjusted EBITDA excludes

the impact of fair value option (“FVO”) accounting and includes cash gains for reverse mortgage origination activities. Pro Forma Adjusted EBITDA

includes an adjustment to reflect pro-forma synergies in 2011 and 2012 and to reflect Green Tree

as having been acquired at the beginning of the year for periods prior to the actual

acquisition date. Adjusted EBITDA may also include other adjustments, as applicable based upon facts and circumstances, consistent with the

intent of providing investors a means of evaluating our core operating performance. The definition of

Adjusted EBITDA used in this document differs from the definition in the Company’s senior

secured credit agreement principally in that (i) the credit agreements include a pro forma adjustment for the projected EBITDA of

acquisitions that were made less than twelve months ago and (ii) the senior secured credit agreement

does not include the non-cash gains from forward mortgage origination activities in

Adjusted EBITDA.

2013 Estimated Adjusted EBITDA, 2013 Estimated Core Earnings and other amounts or metrics

that relate to future earnings projections are forward-looking and subject to significant

business, economic, regulatory and competitive uncertainties, many of which are beyond the control of Walter Investment and its

management, and are based upon assumptions with respect to future decisions, which are subject to

change. Actual results will vary and those variations may be material. Nothing in

this presentation should be regarded as a representation by any person that this target will be achieved and the Company undertakes no duty

to update this target. Please refer to the introductory slides of this presentation, as well as

additional disclosures in this Appendix and in our Form 10-K and other

filings with the SEC, for important information regarding Forward Looking Statements and the use of

Non-GAAP Financial Measures. |

Q1 2013 Segment Financial Performance

($ in millions)

Servicing

Asset

Receivables

Management

Insurance

Loans

and

Residuals

Reverse

Mortgage

Originations

Other

Eliminations

Total

Consolidated

Total revenues

$139.7

$10.2

$17.5

$36.9

$14.1

$76.1

$2.4

$(5.0)

$291.8

Total expenses

$103.3

$7.8

$10.0

$28.1

$38.8

$55.7

$42.1

$(5.0)

$280.8

Other gains

(losses)

$(0.2)

$ -

$ -

$(0.2)

$36.8

$ -

$(0.9)

$ -

$35.5

Income (loss)

before income

taxes

$36.1

$2.4

$7.6

$8.6

$12.1

$20.3

$(40.6)

$ -

$46.5

Core earnings

before income

taxes

$52.1

$4.0

$9.4

$9.3

$18.4

$21.9

$(22.4)

$ -

$92.6

Adjusted EBITDA

$64.1

$4.3

$9.4

$5.8

$19.5

$36.2

$0.8

$ -

$140.0

Note:

Columns may not total due to rounding.

15

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our March 31, 2013 Form 10-Q and other filings with the SEC, for important

information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

|

Depreciation and Amortization

16

2013

Annual

Estimate

2013

Revised

Estimate

2013

Average

Per

Quarter

Q1 2013

Actual

2014

Estimate

Step-up

80.0

$

86.0

$

21.5

$

20.9

$

75.0

$

Origination Intangible

140.0

202.0

50.5

13.9

60.0

MSR

80.0

35.0

8.8

10.2

40.0

Fixed Asset

30.0

14.0

3.5

3.6

15.0

330.0

$

337.0

$

84.3

$

48.7

$

190.0

$

Amortization of origination

intangible expected to ramp

as originations volumes

ramp through the year.

Final classification shifted intangibles and related amortization from

MSR category to origination intangible category

Note:

Columns may not total due to rounding. |

Reconciliation of GAAP Income Before Income

Taxes to Non-GAAP Core Earnings

($ in millions, except per share amounts)

17

For the Three Months Ended

For the Three Months Ended

For the Three Months Ended

Core Earnings

March 31, 2012

December 31, 2012

March 31, 2013

Income/(loss) before income taxes

8.3

$

(55.1)

$

46.5

$

Add back:

Step-up depreciation and amortization

10.1

10.9

12.9

Step-up amortization of sub-servicing contracts

10.1

9.5

8.1

Non-cash fair value adjustments

-

2.6

3.5

Non-cash interest expense

1.1

4.2

3.0

Share-based compensation expense

4.7

3.0

2.7

Transaction and integration costs

1.4

9.2

16.3

Net impact of Non-Residual Trusts

(3.0)

3.3

(0.5)

Losses on extinguishment of debt

-

48.6

-

Other

0.5

0.1

0.1

Pre-tax core earnings

33.2

$

36.3

$

92.6

$

After-tax core earnings

20.6

$

22.5

$

56.5

$

Shares Outstanding

29.0

34.9

37.6

Core EPS

0.71

$

0.64

$

1.50

$

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our March 31, 2013 Form 10-Q and other filings with the SEC, for important

information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

|

Reconciliation of GAAP Income Before Income Taxes to

Non-GAAP Adjusted EBITDA

18

($ in millions)

For the Three Months Ended

For the Three Months Ended

For the Three Months Ended

Adjusted EBITDA

March 31, 2012

December 31, 2013

March 31, 2013

Income/(loss) before income taxes

8.3

$

(55.1)

$

46.5

$

Add:

Deprecation and amortization

12.0

13.4

30.4

Interest expense

21.5

21.4

26.2

EBITDA

41.8

(20.3)

103.1

Add:

Amortization and fair value adjustments of servicing rights

12.9

12.6

18.3

Transaction and integration-related costs

1.4

9.2

16.3

Non-cash share-based compensation expense

4.7

3.0

2.7

Non-cash fair value adjustment

-

2.6

3.5

Provision for loan losses

1.6

5.2

1.7

Residual Trusts cash flows

0.3

3.2

0.5

Losses on extinguishment of debt

-

48.6

-

Pro forma synergies

2.3

-

-

Sub-total

23.2

84.4

43.0

Less:

Non-cash interest income

(4.5)

(3.5)

(4.6)

Net impact of Non-Residual Trusts

(3.0)

3.3

(0.5)

Other

1.6

0.2

(1.0)

Sub-total

(5.9)

-

(6.1)

Adjusted EBITDA

59.1

$

64.1

$

140.0

$

Please refer to the introductory slides of this presentation, as well as additional disclosures in the

Appendix and in our March 31, 2013 Form 10-Q and other filings with the SEC, for important

information regarding Forward-Looking Statements and the use of Non-GAAP Financial Measures.

|

Reconciliation of Estimated 2013 Core Earnings

to Estimated GAAP Income Before Income Taxes

19

(1)

As presented on slide 10 of the First Quarter 2013 Earnings Presentation.

(2)

We do not predict special items that might occur in the future.

The amount reflected includes only actual amounts that

occurred in the first quarter of 2013.

(3)

Fair value adjustments are by their nature subject to multiple factors that could

materially change these amounts, many of which are beyond our

control. The amount reflected includes only actual amounts that occurred in the first quarter of 2013.

($ in millions)

Estimated pre-tax core earnings

(1)

312.0

$

Less:

Step up depreciation and amortization, including step up

amortization of sub-servicing contracts

(86.0)

Share-based compensation expense

(13.0)

Transaction and integration costs

(2)

(16.3)

Non-cash fair value adjustments for reverse mortgages

(3)

(3.5)

Non-cash interest expense

(12.0)

Other

(2)

0.5

Estimated income before income taxes

181.7

$ |