Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUSQUEHANNA BANCSHARES INC | d535842d8k.htm |

Susquehanna Bancshares, Inc.

Investor Presentation

2nd Quarter 2013

Exhibit 99.1 |

Forward-Looking Statements

Forward-Looking Statements

During the course of this presentation, we may make projections and other

forward-looking statements regarding priorities and strategic objectives

of

Susquehanna Bancshares, Inc., as well as projected capital ratios, efficiency

ratios, net income and earnings. We encourage investors to understand

forward-looking statements to be strategic objectives rather than absolute

targets of future performance. We wish to caution you that these

forward- looking statements may differ materially from actual results

due to a number of

risks and uncertainties. For a more detailed description of the

factors that may

affect Susquehanna’s operating results, we refer you to our filings with the

Securities & Exchange Commission, including our annual report on

Form 10-K

for the year ended December 31, 2012 and Form 10-Q for the quarter ended

March 31, 2013. Susquehanna assumes no obligation to update the forward-

looking statements made during this presentation.

For more information, please visit our Web site at:

www.susquehanna.net

2 |

Who is

Susquehanna? Who is Susquehanna?

Corporate Overview

Super-community bank headquartered in

Lititz, PA

261 banking offices concentrated in Central

PA, Western MD, and Philadelphia and

Baltimore MSAs

37

largest U.S. commercial bank by assets

and 2

largest headquartered in PA

Experienced management team with extensive

market knowledge

Franchise is a diversified mix of consumer and

business customers, products and revenue

sources

Non-bank affiliates offering products and

services in:

Wealth management

Insurance brokerage and employee benefits

Commercial finance

Vehicle leasing

Selected Data as of 3/31/2013

Assets:

$18.0 billion

Deposits:

$12.7 billion

Loans & Leases:

$13.0 billion

Assets under management

$7.9 billion

and administration:

Market Cap:

>$2.1 billion*

Average daily volume (3 months)

>1 million shares

Institutional ownership

>

70%

Dividend yield

2.80%**

NASDAQ Listed

SUSQ

* Based on closing price on May 3, 2013

**Based on 1Q12 dividend of $.08 per share

3

th

nd |

Uniquely Positioned

Uniquely Positioned

Source: SNL Financial

Note: Regulatory branch and deposit data as of June 30, 2012; banks and thrifts with

deposits in counties SUSQ operates in PA/NJ/MD/WV Traditional branches only,

as defined by SNL 4

Rank

Institution

Branch Count

Total Deposits

in Market

($000)

Total Market

Share (%)

1

Wells Fargo & Co.

373

41,021,142

15.3%

2

PNC Financial Services Group Inc.

357

27,078,388

10.1%

3

Bank of America Corp.

224

25,599,340

9.5%

4

M&T Bank Corp.

292

23,873,751

8.9%

5

Toronto-Dominion Bank

164

19,136,622

7.1%

6

Royal Bank of Scotland Group Plc

177

17,058,543

6.3%

7

Susquehanna Bancshares Inc.

262

12,569,634

4.7%

8

Fulton Financial Corp.

187

9,428,543

3.5%

9

Banco Santander SA

176

8,654,240

3.2%

10

National Penn Bancshares Inc.

110

5,622,573

2.1%

11

BB&T Corp.

68

4,051,430

1.5%

12

Beneficial Mutual Bancorp Inc. (MHC)

61

3,645,268

1.4%

13

First Niagara Financial Group Inc.

63

2,684,122

1.0%

14

Metro Bancorp Inc.

33

2,106,159

0.8%

15

Citigroup Inc.

26

2,015,670

0.8%

Total

(1-15)

2,573

204,545,425

76.1%

Total

(1-248)

3,970

268,686,154

100.0%

Deposit Market Share: Counties of Operation

Top 3 market share in 12

counties

Top 5 market share in half the

MSAs where we do business

Largest locally based

community bank

Increased share in 14 out of

22 MSAs from 2011 to 2012

Significant opportunities exist

to gain market share |

Building on Momentum

Building on Momentum

Regional structure that empowers local community bankers with

the authority, incentives and products they need to drive loan

growth, particularly in consumer lending and small business and

middle-market banking

Peer leading net interest margin to be defended by further

improving funding costs, including continued core deposit

growth, and ongoing active balance sheet management

Growing fees as a percentage of total revenues by investing in

non-bank businesses, building full client relationships and

maximizing significant untapped cross-sell potential

Committed to continuous delivery model improvement, after

streamlining expense structure and improving efficiency in 2012

Strong capital position and focus on growing returns enhances

ability to execute on organic and strategic growth opportunities

5

1.

Take share, drive

organic loan growth

2.

Defend Margin

3.

Grow fee revenue

4.

Maintain efficiency

5.

Accelerate capital

generation and returns

Opportunity

Susquehanna |

Core

Deposit Growth Commercial and Consumer

Loan Growth

Expand Fee Income as a % of

Total Revenue

Differentiated Customer

Experience

Elevate Employee Engagement

Focus for 2013

Focus for 2013

6

Technology and mobile delivery

Retail and commercial products

enhancements

Enhance C&I talent and capacity

Increase cross-sell

Talent and leadership

development

Process review and

improvements

Objectives

Selected Initiatives |

1st

Quarter 2013 Highlights 1st Quarter 2013 Highlights

GAAP EPS of $0.23

Increase of 64% from $0.14 in 1Q12

Steady organic loan growth

Commercial loans increased 1.7% linked quarter, 10.7% YOY

Consumer loans increased 2.0% linked quarter, 10.8% YOY

Construction loans decreased by 8.1% linked quarter, 21.6% YOY

Total loans and leases grew 0.8% linked quarter, 3.8% YOY

Continued core deposit growth

Core deposits grew 1.1% linked quarter, 5.7% YOY

Strong net interest margin

1Q 2013 net interest margin of 3.97%

Solid credit quality metrics

NPAs at 0.97% of loans, leases and foreclosed real estate

Strong coverage ratio with allowance representing 171% of nonaccrual loans

and leases

7 |

Momentum:

Loan Growth

Total Loans 12/31/2007

Total Loans 3/31/2013

8

$8.8 Billion

$13.0 Billion

Organic Loan CAGR:

3.3%

Strong Loan Growth Momentum

Total loans and leases grew 3.8% since March 31, 2012

1Q 2013 loan and lease originations were up 35% from 1Q 2012

|

Asset

Quality Continues to Improve 9

Net Charge-Offs / Average Loans & Leases (%)

NPAs / Loans & leases + foreclosed real estate (%)

ALLL / Nonaccrual loans & leases (%)

99

171

0.62

1.33

2.26

0.97 |

Positioned For Further Growth

10

Pennsylvania Market

Delaware Valley Market

Maryland Market

Includes Baltimore and four of the

nation’s 45 most-affluent counties

including no. 5, Howard County.

Growth opportunities fueled by world-

leading education, health care and

research institutions, as well as major

federal agencies and contractors.

The 16 counties comprising the company’s Pennsylvania Market, the 10 counties

comprising the company’s Delaware Valley Market and the 13 counties comprising the company’s Maryland Market

are

listed

in

the

“Additional

Materials”

slides

at

the

conclusion

of

this

presentation

Foundation for growth with stable

commercial and retail banking base

providing ample deposits.

Home to distribution hubs for global

retailers, manufacturers and

distributors serving Northeast and

Mid-Atlantic markets.

Includes Philadelphia and

the state’s four most-affluent

counties.

Growth opportunities fueled by

world-leading education, health

care and research institutions. |

Market Opportunity

Market Opportunity

11

HOME MARKET:

METRO GROWTH MARKETS:

Central PA

Philadelphia

Baltimore

2007

2012

2012

2012

Total Deposits

$55.5 B

$65.3 B

18% Growth

$128.5 B

$63.0 B

in Current Market

SUSQ Deposits

$2.2 B

$5.9 B

170% Growth

$3.0 B

$1.2 B

Rank/Market Share

#9 / 3.9%

#5 / 9.0%

#8 / 2.4%

#7 / 1.9%

Primary Competitors

PNC, M&T, Fulton

TD, RBS, PNC

M&T, PNC, BB&T

Median Household Income

$50,976

$58,051

$62,687

Estimated Household Income

19.7%

23.1%

22.8%

Growth from 2011-2016

Population

3.6 M

3.7 M

3.5% Growth

5.3 M

2.7 M

Estimated Population

3.1%

1.8%

2.3%

Growth from 2011-2016

# of Businesses with

135,105

222,902

102,402

< $10M in Sales

1

Source: FDIC Deposit Market Share Report

2

Source: SNL, ESRI. Household Income data reported for Philadelphia and

Baltimore metro markets represents Philadelphia-Camden-Wilmington and Baltimore-Towson MSAs, respectively

3

Source: SNL, ESRI

4

Source: The Nielsen Company

5

16

counties

comprising

Susquehanna’s

Pennsylvania

Market.

Please

refer

to

the

market

definitions

set

forth

in

the

“Additional

Materials”

slides

at

the

conclusion

of

this

presentation.

6

Philadelphia Metro = Bucks, Burlington, Camden, Chester, Delaware, Gloucester,

Montgomery and Philadelphia counties 7

Baltimore Metro = Anne Arundel, Baltimore, Baltimore (City), Carroll, Harford and

Howard counties 6

7

5

1

2

2

3

4 |

Momentum:

Defending Net Interest Margin

Momentum:

Defending Net Interest Margin

12

Active Balance Sheet Management

Focus on core deposit growth

FHLB debt prepayment (4Q 2011)

Trust preferred and sub debt redemption

(3Q/4Q 2012)

Countering the Headwinds

Increase low cost core deposits

$400+ million in high rate CD’s maturing in 2013

Additional opportunities to reduce funding costs

may still exist

*

Peer company information is average of peer data per SNL Financial. Identification of peer

companies is included in the “Additional Materials” at the conclusion of this presentation. |

Strong Core Deposit Growth

Strong Core Deposit Growth

13

$8.9 Billion

$12.7 Billion

Organic Core Deposit CAGR:

7.8%

Total Deposits 12/31/2007

Total Deposits 3/31/2013

Strong Core Deposit Growth Momentum

Core deposits now account for 71% of total deposits

Core deposit growth of 5.7% since March 31, 2012

Cost of deposits decreased from 2.86% for 4Q 2007 to 0.52% for 1Q 2013

|

Momentum:

Growing Fee Revenue

Momentum:

Growing Fee Revenue

14

March 31,

December 31,

March 31,

2012

2012

2013

Service charges on deposit accounts

7,674

$

9,158

$

8,672

$

Vehicle origination and servicing fees

1,924

3,746

3,354

Wealth management commisions and fees

11,602

11,882

12,390

Commisions on property and casualty insurance sales

5,058

3,749

4,542

Other comissions and fees

4,643

6,680

5,237

Income from bank-owned life insurance

1,472

1,603

1,850

Mortgage banking revenue

3,513

4,835

4,110

Fee Revenue ($000) - Quarter Ending |

Momentum:

Efficiency Focus Benefits Core Performance

15

Successfully lowered efficiency ratio from 66.83% for 2011 to 60.37% for

2012 Achieved desired cost savings of $58 million from acquisitions and core

Susquehanna operations

Opportunity

exists

to

optimize

delivery

model,

including

planned

investments

in

technology and web/mobile banking

*Efficiency ratio excludes net realized gain on acquisition, merger related expenses and loss on

extinguishment of debt. Please refer to the calculations on the slides titled “Non-GAAP Reconciliation” at the

conclusion of this presentation.

|

Momentum:

Capital Generation and Returns

Momentum:

Capital Generation and Returns

Capital ratios remain strong

•

Support continued organic growth

•

Position for changing regulatory landscape

•

Increase quarterly cash dividends to shareholders

•

Consider strategic M&A opportunities

16

Tangible

Common

Equity

Tier 1

Common /

RWA

Tier 1

Leverage

Tier 1

Risk-Based

Total

Risk-Based

Mar. 31, 2012

8.22%

10.20%

9.23%

11.34%

12.88%

Management

Minimum

Target

7.50%

8.00%

6.00%

9.50%

11.50%

1

The tangible common equity ratio is a non-GAAP based financial measure.

Please refer to the calculations and management’s reasons for using this measure on the slide titled

“Non-GAAP Reconciliation”

at the conclusion of this presentation.

1

Capital generation has benefited from leading ROATE and 30-35%

dividend payout ratio

Growing capital strength ensures ability to execute on capital

allocation priorities |

|

Building on Momentum

Building on Momentum

Regional structure that empowers local community bankers with

the authority, incentives and products they need to drive loan

growth, particularly in consumer lending and small business and

middle-market banking

Peer leading net interest margin to be defended by further

improving funding costs, including continued core deposit

growth, and ongoing active balance sheet management

Growing fees as a percentage of total revenues by investing in

non-bank businesses, building full client relationships and

maximizing significant untapped cross-sell potential

Committed to continuous delivery model improvement, after

streamlining expense structure and improving efficiency in 2012

Strong capital position and focus on growing returns enhances

ability to execute on organic and strategic growth opportunities

18

1.

Take share, drive

organic loan growth

2.

Defend Margin

3.

Grow fee revenue

4.

Maintain efficiency

5.

Accelerate capital

generation and returns

Opportunity

Susquehanna |

Additional Materials |

Executive Leadership Team

Executive Leadership Team

20 |

Critical Mass in Attractive Markets

Critical Mass in Attractive Markets

1

The 16 counties comprising the company’s Pennsylvania Market, the 10 counties

comprising the company’s Delaware Valley Market and the 13 counties

comprising

the

company’s

Maryland

Market

are

listed

in

the

“Additional

Materials”

slides

at

the

conclusion

of

this

presentation

2

Company data as of 3/31/13. Percentages based on internal company

commercial and retail market allocations. Excludes leases and tax free loans and brokered and inter-company deposits.

3

FDIC June 30 deposit market share data as reported by SNL Financial for the counties

comprising each of the company’s three markets. 4

U.S. Census Bureau’s American Community Survey of median household income by

county Pennsylvania Market

21

Susquehanna

Bank

Market

1

Pennsylvania

Delaware

Valley

Maryland

Branches

119

76

66

Loans as % of total

48%

23%

29%

Deposits as % of total

43%

30%

27%

Deposit market share (rank)

9.0%

(5

th

)

2.7%

(8

th

)

4.5%

(6

th

)

7.6%

(6

th

)

1.3%

(9

th

)

3.8%

(6

th

)

3.9%

(9

th

)

1.2%

(12

th

)

4.2%

(7

th

)

Foundation for growth with stable

commercial and retail banking base

providing ample deposits.

Home to distribution hubs for global retailers,

manufacturers and distributors serving

Northeast and Mid-Atlantic markets.

Includes Philadelphia and the state’s four

most-affluent counties.

4

Growth opportunities fueled by world-leading

education, health care and research institutions.

Includes Baltimore and four of the nation’s

45 most-affluent counties including no. 5,

Howard County.

4

Growth opportunities fueled by world-leading

education, health care and research institutions,

as well as major federal agencies and

contractors.

2

2

3

2012

2011

2007

Maryland Market

Delaware Valley Market |

1st

Quarter 2013 Financial Highlights 1st Quarter 2013 Financial Highlights

(Dollars in thousands, except earning per share data)

3/31/2013

12/31/2012

3/31/2012

Balance Sheet:

Loans and Leases

12,999,703

$

12,894,741

$

12,521,669

$

Deposits

12,691,432

$

12,580,046

$

12,563,541

$

Income Statement:

Net interest income

149,206

$

155,304

$

134,123

$

Pre-tax pre-provision income *

74,121

$

75,262

$

64,762

$

Provision for loan and lease losses

12,000

$

13,000

$

19,000

$

GAAP Net Income

42,399

$

43,174

$

23,474

$

GAAP EPS

0.23

$

0.23

$

0.14

$

Quarterly Performance Highlights

22

* Core: Excludes merger-related expenses, net gain on acquisition and loss on

extinguishment of debt |

Quarterly Loan and Lease

Originations

Quarterly Loan and Lease

Originations

Average

Balance*

($ in Millions)

Balance

Originations

Balance

Originations

Balance

Originations

Balance

Originations

Balance

Originations

Commercial

1,708

$

115

$

1,847

$

206

$

1,870

$

167

$

1,898

$

226

$

1,996

$

224

$

Real Estate - Const & Land

863

95

936

74

899

101

859

92

797

137

Real Estate - 1-4 Family Res

2,033

68

2,262

101

2,279

86

2,274

72

2,266

57

Real Estate - Commercial

3,872

191

4,350

110

4,315

121

4,276

136

4,295

206

Real Estate - HELOC

1,013

52

1,128

88

1,169

93

1,209

89

1,235

113

Tax-Free

346

53

379

22

390

55

430

4

427

3

Consumer Loans

736

96

764

116

794

110

810

104

820

114

Commercial Leases

287

76

306

79

299

81

289

85

287

78

Consumer Leases

367

43

376

65

424

86

512

167

644

138

VIE

187

-

180

-

173

-

168

-

162

-

Total

11,412

$

789

$

12,528

$

862

$

12,612

$

900

$

12,725

$

975

$

12,929

$

1,070

$

1Q13

4Q12

3Q12

2Q12

1Q12

23

*By collateral type |

Loan

Mix & Yield Loan Mix & Yield

24

*By collateral type

$ in millions

Avg Bal QTR*

INT % QTR

Commercial

$ 1,708

5.24%

$ 1,847

5.43%

$ 1,870

5.31%

$ 1,898

5.35%

$ 1,996

5.28%

Real Estate -

Const & Land

863

5.60%

936

5.66%

899

5.64%

859

5.90%

797

6.05%

Real Estate -

1-4 Family Res

2,033

5.27%

2,262

5.26%

2,279

5.03%

2,274

4.97%

2,266

4.91%

Real Estate -

Commercial

3,872

5.46%

4,350

5.78%

4,315

5.60%

4,276

5.51%

4,295

5.43%

Real Estate -

HELOC

1,013

3.98%

1,128

3.81%

1,169

3.82%

1,209

3.74%

1,235

3.68%

Tax-Free

346

5.60%

379

5.45%

390

5.40%

430

5.47%

427

5.10%

Consumer Loans

736

5.33%

764

5.21%

794

5.02%

810

4.95%

820

4.77%

Commercial Leases

287

7.98%

306

7.72%

299

7.48%

289

7.50%

287

7.56%

Consumer Leases

367

4.73%

376

4.60%

424

4.30%

512

4.11%

644

3.88%

VIE

187

4.47%

180

4.46%

173

4.42%

168

4.39%

162

4.36%

Total Loans

$11,412

5.29%

$12,528

5.33%

$12,612

5.23%

$12,725

5.18%

$12,929

5.03%

1Q13

4Q12

3Q12

2Q12

1Q12 |

CRE

and Construction Composition 25

At March 31, 2013

Industrial/Manufacturing, 2%

Recreational, 1%

Multi-Family, 5%

Commercial Construction,

5%

Mixed Use, 5%

Hotels -

Motels, 6%

Warehouse, 6%

Land, 7%

Residential, 9%

Other, 13%

Service, 9%

Retail, 15%

Office, 17% |

Asset

Quality ($ in Millions)

Asset Quality

($ in Millions)

($ in million)

1Q12

2Q12

3Q12

4Q12

1Q13

NPL's Beginning of Period

156.5

$

133.5

$

127.3

$

118.4

$

97.8

$

New NonAccruals

22.3

34.5

17.3

19.0

23.1

Cure/Exits/Other

(28.8)

(16.8)

(6.2)

(21.5)

1.5

Gross Charge-Offs

(11.0)

(17.3)

(15.8)

(15.4)

(15.5)

Transfer to OREO

(5.5)

(6.6)

(4.2)

(2.7)

(3.5)

NPL's End of Period

133.5

$

127.3

$

118.4

$

97.8

$

103.4

$

26

Non Accruals

TDRs |

Asset

Quality ($ in Millions)

Asset Quality

($ in Millions)

27

Past due 90 days or more

Past Due 30-89 days

OAEM

Substandard |

Investment Securities

Investment Securities

$ in millions

EOP Balance

QTR Yield

Total Investment Securities

$2,757

$2,866

$2,908

$2,730

$2,553

Duration (years)

3.6

3.6

3.6

3.6

3.6

Yield

3.09%

2.92%

2.69%

2.59%

2.64%

Unrealized Gain/(Loss)

$30.8

$40.8

$61.9

$57.1

$50.6

1Q13

4Q12

3Q12

2Q12

1Q12

28 |

Deposit

Mix & Cost by Product Deposit Mix & Cost by Product

$ in millions

Avg Bal QTR

INT % QTR

Demand

$1,688

0.00%

1,922

$

0.00%

1,938

$

0.00%

1,945

$

0.00%

1,918

$

0.00%

Interest Bearing Demand

4,990

0.46%

5,480

0.39%

5,537

0.35%

5,803

0.33%

5,895

0.32%

Savings

930

0.14%

1,005

0.13%

1,003

0.11%

1,019

0.11%

1,049

0.11%

Certificates of Deposits

3,747

1.29%

4,065

1.13%

4,111

1.17%

3,835

1.21%

3,778

1.21%

Total Interest-Bearing Deposits

$9,667

0.75%

10,550

$

0.65%

10,651

$

0.64%

10,657

$

0.62%

10,722

$

0.62%

Core Deposits/Total

Loans(excluding VIE)/Deposits

99.0%

1Q12

67.0%

98.9%

3Q12

67.3%

98.8%

2Q12

67.4%

1Q13

70.1%

101.0%

4Q12

69.6%

99.6%

29 |

Borrowing Mix & Cost

Borrowing Mix & Cost

30

$ in millions

Avg Bal QTR

INT % QTR (excludes SWAP expense)

Short-Term Borrowings

$ 642

0.27%

$ 726 0.29%

$ 749

0.28%

$ 811 0.26%

$ 817

0.25%

FHLB Advances

985

0.21%

1,082 0.33%

1,073

0.35%

1,167 0.36%

1,155

0.33%

Long Term Debt

674

5.11%

686 4.93%

727

4.85%

561 1.19%

509

3.28%

Total Borrowings

$2,301

1.66%

$2,494 1.58%

$2,549

1.62%

$2,539 0.51%

$2,481

0.91%

Off Balance Sheet Swap Impact

675

0.74%

675 0.70%

675

0.69%

675 0.71%

927

0.73%

Total Borrowing Cost

Avg Borrowings / Avg Total

Assets

14.1%

1Q13

1.64%

13.8%

2.40%

2Q12

2.28%

14.0%

1Q12

4Q12

1.22%

14.1%

3Q12

2.31%

14.1% |

Quarterly Fee Revenue

Quarterly Fee Revenue

31

March 31,

June 30,

September 30,

December 31,

March 31,

2012

2012

2012

2012

2013

Service charges on deposit accounts

7,674

$

8,583

$

9,013

$

9,158

$

8,672

$

Vehicle origination and servicing fees

1,924

2,226

2,470

3,746

3,354

Wealth management commisions and fees

11,602

12,297

11,923

11,882

12,390

Commisions on property and casualty insurance sales

5,058

3,930

3,158

3,749

4,542

Other comissions and fees

4,643

4,800

5,387

6,680

5,237

Income from bank-owned life insurance

1,472

1,631

1,726

1,603

1,850

Mortgage banking revenue

3,513

4,343

5,113

4,835

4,110

Net realized gain (loss) on sales of securities

385

1,361

31

(103)

406

Net impairment losses recognized in earnings

(144)

-

-

(97)

(388)

Other

3,388

640

4,840

2,319

2,471

Total*

39,515

$

39,811

$

43,661

$

43,772

$

42,644

$

Noninterest Income ($000)

*Excludes Net realized gain on acquisitions |

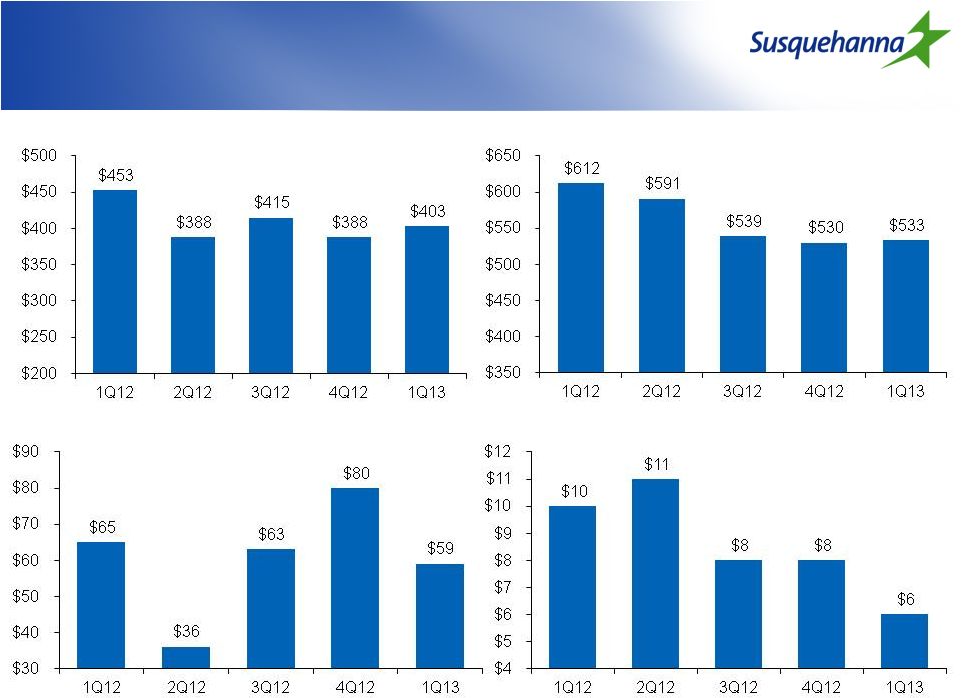

Earnings Drivers

Earnings Drivers

($000)

1Q12

2Q12

3Q12

4Q12

1Q13

Avg. interest-earning assets

$14,065,583

$15,332,806

$15,537,037

$15,604,029

$15,642,309

Net interest margin (FTE)

3.94%

4.10%

3.92%

4.06%

3.97%

Net interest income

$134,123

$152,670

$149,142

$155,304

$149,206

Noninterest income

39,515

39,811

43,661

43,772

42,644

Total revenue

173,638

192,481

192,803

199,076

191,850

Noninterest expense

108,876*

118,157*

115,959*

123,814*

117,729

Pre-tax, pre-provision income

64,762*

74,324*

76,844*

75,262*

74,121

Provision for loan losses

19,000

16,000

16,000

13,000

12,000

Pre-tax income

$45,762*

$58,324*

$60,844*

$62,262*

$62,121

* Core: Excludes merger-related expenses, net gain on acquisition and loss on

extinguishment of debt 32

2013 Financial Targets

FTE margin

3.90%

Loan growth

5.00%

Deposit growth

6.00%

Non-interest income growth

8.00%

Non-interest expense growth

-2.00%

Tax rate

31.00%

Note:

The

growth

percentages

included

in

these

financial

targets

are

based

upon

2012

reported numbers and not core numbers. |

Susquehanna Bank Markets

Susquehanna Bank Markets

33

Pennsylvania Market:

Adams, PA

Berks, PA

Centre, PA

Cumberland, PA

Dauphin, PA

Lancaster, PA

Lebanon, PA

Lehigh, PA

Luzerne, PA

Lycoming, PA

Northampton, PA

Northumberland, PA

Schuylkill, PA

Snyder, PA

Union, PA

York, PA

Maryland Market:

Allegany, MD

Anne Arundel, MD

Baltimore, MD

Bedford, PA

Berkley, WV

Carroll, MD

Franklin, PA

Fulton, PA

Garrett, MD

Harford, MD

Howard, MD

Washington, MD

Worcester, MD

Delaware Valley Market:

Atlantic, NJ

Bucks, PA

Burlington, NJ

Camden, NJ

Chester, PA

Cumberland, NJ

Delaware, PA

Gloucester, NJ

Montgomery, PA

Philadelphia, PA

Baltimore

City,

MD |

Peer

Companies Peer Companies

34

Associated Banc-Corp

BancorpSouth, Inc.

City National Corporation

Commerce Bancshares, Inc.

Cullen/Frost Bankers, Inc.

F.N.B. Corporation

First Horizon National Corporation

First Niagara Financial Group, Inc.

FirstMerit Corporation

Fulton Financial Corporation

Hancock Holding Company

IBERIABANK Corporation

People's United Financial, Inc.

Prosperity Bancshares, Inc.

Signature Bank

TCF Financial Corporation

UMB Financial Corporation

Valley National Bancorp

Webster Financial Corporation

Wintrust Financial Corporation |

Non-GAAP Reconciliation

(Dollars and share data in thousands)

Non-GAAP Reconciliation

(Dollars and share data in thousands)

35

1Q13

4Q12

3Q12

2Q12

1Q12

Efficiency Ratio

Other expense

117,729

$

125,277

$

122,910

$

121,475

$

120,355

$

Less: Merger related expenses

0

(1,054)

(1,500)

(3,318)

(11,479)

Loss on extinguishment of debt

0

(409)

(5,451)

0

0

Noninterest operating expense (numerator)

117,729

$

123,814

$

115,959

$

118,157

$

108,876

$

Taxable-equivalent net interest income

153,021

$

159,332

$

152,948

$

156,416

137,837

Other income

42,644

43,772

43,661

39,811

39,515

Denominator

195,665

$

203,104

$

196,609

$

196,227

$

177,352

$

Efficiency ratio

60.17%

60.96%

58.98%

60.21%

61.39%

Tangible Common Ratio

End of period balance sheet data

Shareholders' equity

2,639,489

$

2,595,909

$

2,584,682

$

2,544,730

$

2,512,584

$

Goodwill and other intangible assets

(1)

(1,266,610)

(1,263,563)

(1,263,361)

(1,267,630)

(1,268,582)

Tangible common equity (numerator)

1,372,879

$

1,332,346

$

1,321,321

$

1,277,100

$

1,244,002

$

Assets

17,967,174

$

18,037,667

$

18,106,730

$

18,040,009

$

17,807,026

$

Goodwill and other intangible assets

(1)

(1,266,610)

(1,263,563)

(1,263,361)

(1,267,630)

(1,268,582)

Tangible assets (denominator)

16,700,564

$

16,774,104

$

16,843,369

$

16,772,379

$

16,538,444

$

Tangible common ratio

8.22%

7.94%

7.84%

7.61%

7.52%

(1)

Net of applicable deferred income taxes

The efficiency ratio is a non-GAAP based financial measure. Management

excludes merger-related expenses and certain other selected items when

calculating this ratio, which is used to measure the relationship of operating expenses to revenues.

The tangible common ratio is a non-GAAP based financial measure using non-GAAP based

amounts. The most directly comparable GAAP-based measure is the ratio of common

shareholders’ equity to total assets. In order to calculate tangible common shareholders equity and assets, our

management subtracts the intangible assets from both the common shareholders’ equity and total

assts. Tangible common equity is then divided by the tangible assets to arrive at the

ratio. Management uses the ratio to assess the strength of our capital position. |

Non-GAAP Reconciliation

(Dollars and share data in thousands)

Non-GAAP Reconciliation

(Dollars and share data in thousands)

36

1Q13

4Q12

3Q12

2Q12

1Q12

Return on Average Tangible Equity

Income statement data

Net income

42,399

$

43,174

$

36,732

$

37,793

$

23,473

$

Amortization of intangibles, net of taxes at 35%

2,124

2,127

2,169

2,211

1,789

Net tangible income (numerator)

44,523

$

45,301

$

38,901

$

40,004

$

25,262

$

Average balance sheet data

Shareholders' equity

2,614,319

$

2,597,254

$

2,562,092

$

2,537,250

$

2,348,326

$

Goodwill and other intangible assets

(1,312,662)

(1,311,192)

(1,315,071)

(1,320,658)

(1,132,344)

Tangible common equity (denominator)

1,301,657

$

1,286,062

$

1,247,021

$

1,216,592

$

1,215,982

$

Return on equity (GAAP basis)

6.58%

6.61%

5.70%

5.99%

4.02%

Effect of goodwill and other intangibles

7.29%

7.40%

6.71%

7.24%

4.34%

Return on average tangible equity

13.87%

14.01%

12.41%

13.23%

8.36%

Return on average tangible equity is a non-GAAP based financial measure calculated using

non-GAAP based amounts. The most directly comparable GAAP-based measure is return

on average equity. We calculate return on average tangible equity by excluding the balance of

intangible assets and their related amortization expense from our calculation of return on average

equity. Management uses the return on average tangible equity in order to review our core

operating results. Management believes that this is a better measure of our performance. In

addition, this is consistent with the treatment by bank regulatory agencies, which excludes goodwill

and other intangible assets from the calculation of risk-based capital ratios.

|