Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORRSTOWN FINANCIAL SERVICES INC | d534170d8k.htm |

Investor Presentation

May

2013

Orrstown Financial Services, Inc.

Exhibit 99 |

2

This

presentation

may

contain

forward-looking

statements

as

defined

in

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-

looking

statements

are

statements

that

include

projections,

predictions,

expectations,

or

beliefs

about

events

or

results

or

otherwise

are

not

statements

of

historical

facts,

including

statements

related

to

improving

credit,

improving

core

fundamental

operations,

improving

operational

efficiency,

cost

savings,

growing

core

earnings

through

expense

reduction

and

revenue

growth,

investments

in

revenue

generating

lines

of

business,

preserving

capital,

serving

shareholder

returns,

expanding

core

funding,

converting

non-performing

assets

to

earning

assets,

being

well

positioned

for

selective

loan

growth,

our

target

efficiency

ratio

in

the

next

36

months,

our

initiatives

meeting

return

on

capital

minimums,

and

strong

reserve

coverage.

Actual

results

and

trends

could

differ

materially

from

those

set

forth

in

such

statements

and

there

can

be

no

assurances

we

will:

improve

credit,

improve

core

fundamental

operations,

improve

operational

efficiency,

achieve

cost

savings,

grow

core

earnings,

grow

our

revenues,

reduce

expenses,

expand

our

business,

preserve

capital,

provide

the

return

that

our

shareholders

may

expect,

expand

core

funding,

convert

non-performing

assets

to

earning

assets,

grow

our

loan

portfolio,

achieve

our

target

efficiency

ratio

in

the

next

36

months,

or

that

our

initiatives

will

meet

return

on

capital

minimums

or

that

our

reserves

will

be

adequate.

Factors

that

could

cause

actual

results

to

differ

from

those

expressed

or

implied

by

the

forward-looking

statements

include,

but

are

not

limited

to,

the

following:

ineffectiveness

of

the

Company's

business

strategy

due

to

changes

in

current

or

future

market

conditions;

the

effects

of

competition,

including

industry

consolidation

and

development

of

competing

financial

products

and

services;

changes

in

laws

and

regulations,

including

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act;

interest

rate

movements;

changes

in

credit

quality;

inability

to

raise

capital

under

favorable

conditions,

volatilities

in

the

securities

markets,

deteriorating

economic

conditions,

and

other

risks

and

uncertainties,

including

those

detailed

in

Orrstown

Financial

Services,

Inc.'s

Form

10-K

for

the

fiscal

year

ended

December

31,

2012

and

2011

and

Form

10-Qs

for

the

quarters

ended

March

31,

2012,

June

30,

2012,

September

30,

2012

and

March

31,

2013,

and

other

filings

made

with

the

Securities

and

Exchange

Commission.

The

statements

are

valid

only

as

of

the

date

hereof

and

Orrstown

Financial

Services,

Inc.

disclaims

any

obligation

to

update

this

information.

Forward Looking Information |

3

Orrstown Financial Services, Inc.

$1.2 billion in assets

Headquartered in Shippensburg, PA

21 locations in Pennsylvania and Maryland

•

9 branches in Cumberland

•

7 branches in Franklin

•

4 branches in Perry

•

1 branch in Washington

Customer-focused business model with

nearly 100 years of success

In addition to community banking

services, provides trust & investment

services to individuals, businesses, non-

profits and municipalities (over $1 billion

of trust assets as of March 31, 2013)

Trades on the NASDAQ under the symbol

“ORRF” |

4

Seasoned Leadership Team

Thomas

R.

Quinn,

Jr.

has

served

as

President,

Chief

Executive

Officer

and

Director

of

Orrstown

Financial

Services,

Inc.

and

of

Orrstown

Bank

since

May

2009.

Mr.

Quinn

joined

the

Bank

in

March

2009

as

President-elect

and

served

in

that

capacity

until

he

was

appointed

President

and

Chief

Executive

Officer.

He

served

as

President

and

Chief

Executive

Officer

of

Fifth

Third

Bancorp’s

South

Florida

Affiliate

from

2005

to

July

2008,

and

in

a

variety

of

executive

positions

with

Citigroup

and

its

affiliates

from

1992

to

2005.

Mr.

Quinn

is

a

graduate

of

Edinboro

University

of

Pennsylvania.

Thomas R. Quinn Jr.

President & CEO

David

P.

Boyle

has

served

as

Executive

Vice

President

and

Chief

Financial

Officer

of

Orrstown

Financial

Services,

Inc.

and

Orrstown

Bank

since

August

2012.

Mr.

Boyle

graduated

from

Westminster

College

with

a

degree

in

Business

Administration

and

Accounting.

Mr.

Boyle

worked

as

an

Accountant

for

four

years

at

a

Big

Four

accounting

firm

following

graduation

before

entering

the

banking

field

in

1990

as

Vice

President,

Controller

at

Wayne

Bancorp,

Inc.,

in

Wooster,

Ohio.

As

his

career

progressed

at

Wayne

Bancorp,

Inc.,

Mr.

Boyle

was

named

Chief

Financial

Officer

in

1995;

President,

Chief

Operating

Officer

in

1999;

and

Chairman,

President

and

Chief

Executive

Officer

in

2001.

His

most

recent

position

was

Executive

Vice

President,

Chief

Performance

Officer

at

PNC.

David P. Boyle

Executive VP & CFO

Jeffrey

M.

Seibert

began

as

a

Management

Trainee

and

progressed

through

roles

of

increasing

responsibility

prior

to

joining

Peoples

State

Bank

("Peoples")

in

1994.

He

worked

for

Peoples,

and

its

successor,

Community

Banks

of

Harrisburg

as

Senior

Lender,

Chief

Credit

Officer,

and

Managing

Director

of

Banking

Services.

Mr.

Seibert

served

as

Chief

Operating

Officer

of

Susquehanna

Bank,

PA,

Managing

Director

of

Commercial

Banking,

and

finally

President

of

the

Pennsylvania

Division.

Jeffrey M. Seibert

EVP & COO

Years Experience

Previous Experience

23 Years

22 Years

David D. Keim

Executive VP & Chief

Risk Officer

David

D.

Keim

oversees

the

Enterprise

Risk

Management

function

of

the

Bank

and

is

responsible

for

the

leadership,

innovation,

governance,

and

management

necessary

to

identify,

evaluate,

mitigate,

and

monitor

the

Bank's

operational

and

strategic

risk.

A

graduate

of

Drexel

University

and

the

Stonier

Graduate

School

of

Banking,

Mr.

Keim

spent

the

majority

of

his

career

in

south

central

Pennsylvania

at

Susquehanna

Bank

in

roles

of

increasing

responsibility

focused

on

risk

management.

Robert G.

Coradi

Senior VP & Chief

Credit Officer

32 Years

41+

Years

25 Years

Robert

G.

Coradi

is

based

out

of

the

Bank's

North

Pointe

Operations

Center

in

Chambersburg,

PA

and

oversees

the

credit

administration

functions

of

the

organization.

With

25

years

of

banking

experience

and

having

held

various

positions

such

as

Senior

Credit

Officer,

Chief

Operating

Officer

and

President

&

Chief

Executive

Officer,

Mr.

Coradi

brings

extensive

experience

and

knowledge

to

his

position

at

Orrstown

Bank.

Mr.

Coradi

attended

Penn

State

University

where

he

earned

his

Bachelor's

degree

in

Finance

with

a

Minor

in

Economics

and

he

attained

his

MBA

from

Mt.

St.

Mary's

College

with

a

Finance

Concentration. |

5

Market Area

Currently operating 21 full-service

locations along the Route 81

corridor from Washington County,

Maryland through Franklin,

Cumberland and Perry Counties,

Pennsylvania

The combined population of the

current market area is

approximately 580,000 as of June

30, 2012

The current combined market has

over $9.7 billion in total deposits as

of June 30, 2012

Orrstown has over a billion in

deposits as of June 30, 2012 or

approximately 11.7% of the total

market share

3 contiguous counties to the East

represent growth markets of

approximately $15 billion in

deposits

Harrisburg is approximately 70

miles from Baltimore, 90 miles

from Philadelphia and 95 miles

from Washington D.C. |

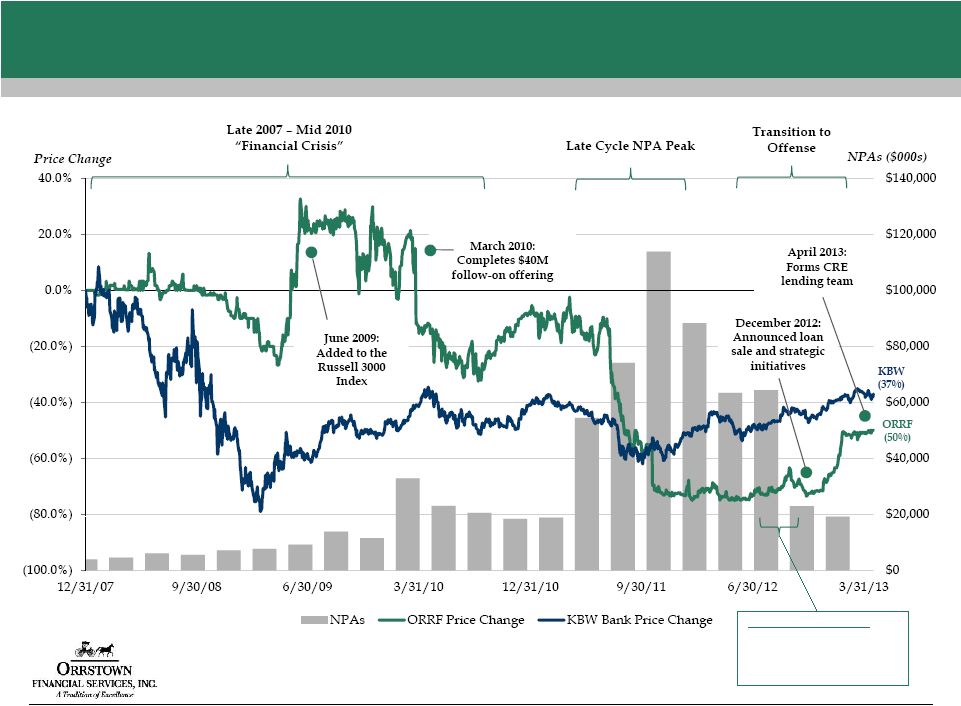

6

Timeline of Events

Significant Staffing Hires:

8/14/12 -

Jeffrey Seibert, COO

8/29/12 -

David Boyle, CFO

9/25/12 –

David Keim, CRO

11/5/12 -

Robert Coradi , CCO

Note: Non-Performing assets defined as nonaccrual loans, restructured

loans, loans past due 90 days or more and still accruing, and real estate owned. |

7

Future Strategic Initiatives

Completing Credit Turnaround

•

Asset quality remediation, including loan workouts, additional structural

enhancements, and multiples sales of non performing assets to

third parties have driven an 83% reduction in non performing

assets from December 31, 2011 •

Asset

quality

metrics

are

now

more

comparable

to

“pre-crisis”

levels

Improving Fundamental Operations

•

Grow earnings through expense reduction and revenue expansion

•

“Operation Bottom Line”

announced in December 2012 will drive improved operational efficiency

through targeted cost savings initiatives and investments in

revenue generating lines of business •

Returned to profitability in the fourth quarter of 2012 and remained

profitable in the first quarter of 2013

Franchise Expansion

Management Team Accountable for Results

Preserve and Continue to Grow Capital Position

Financial Discipline Serving Shareholder Returns

|

8

Summary Financial Highlights

1.

Return

on

average

tangible

equity

is

a

non-GAAP-based

financial

measure

calculated

using

non-GAAP-based

amounts,

including

management’s

definition

of

tangible

assets

and

tangible

equity.

The

most

directly

comparable

GAAP-based

measure

is

return

on

average

equity.

2.

The

efficiency

ratio

expresses

noninterest

expense

as

a

percentage

of

tax

equivalent

net

interest

income

and

noninterest

income,

excluding

securities

gains,

goodwill

impairment,

and

other

non-recurring

items.

3.

The

ratio

of

tangible

common

equity,

or

TCE,

to

tangible

assets,

or

TA,

is

a

non-GAAP-based

financial

measure.

In

order

to

calculate

tangible

common

equity

and

tangible

assets,

the

Company’s

management

subtracts

intangible

assets

from

both

common

equity

and

assets.

The

most

directly

comparable

GAAP-based

measure

is

the

ratio

of

stockholders’

equity

to

assets.

4.

NPAs

defined

as

nonaccrual

loans,

restructured

loans,

loans

past

due

90

days

or

more

and

still

accruing,

and

real

estate

owned.

5.

NPLs

include

nonaccrual

loans,

restructured

loans,

loans

past

due

90

days

or

more

and

still

accruing.

Second

consecutive

quarter of

profitability

(51% increase

from previous

quarter)

(Dollars in 000s, except per share data)

2013Q1

Balance Sheet:

2008

2009

2010

2011

2012

Total Assets

$1,051,783

$1,196,432

$1,511,722

$1,444,097

$1,232,668

$1,197,038

Total Gross Loans

820,468

881,074

966,986

967,993

711,601

681,928

Total Deposits

757,368

915,170

1,188,377

1,216,902

1,085,039

1,044,297

Total Equity

103,347

110,886

160,484

128,197

87,694

88,849

Results of Operations:

Net Income (Loss)

$13,103

$13,373

$16,581

($31,964)

($38,454)

$1,560

Diluted EPS

$2.03

$2.07

$2.17

($3.98)

($4.77)

$0.19

Return on Average Assets

1.38%

1.19%

1.21%

(2.11%)

(2.84%)

0.52%

Return on Average Equity

13.20%

12.48%

11.22%

(20.33%)

(35.22%)

7.12%

Return on Average Tangible Equity

(1)

17.02%

15.73%

13.19%

(9.17%)

(35.40%)

7.34%

Net Interest Margin

3.93%

3.66%

3.73%

3.66%

3.12%

3.07%

Efficiency Ratio

(2)

56.7%

58.9%

54.9%

55.2%

72.2%

84.3%

Noninterest Expense/ Average Assets

2.97%

2.81%

2.67%

3.98%

3.21%

3.69%

Capital Adequacy:

Tang. Common Equity / Tang. Assets

(3)

7.97%

7.65%

9.38%

8.81%

7.05%

7.36%

Total Risk-based Capital Ratio

10.9%

11.4%

14.8%

13.0%

12.2%

12.8%

Asset Quality:

NPAs / Assets

(4)

0.68%

0.96%

1.22%

7.88%

1.86%

1.61%

Loan Loss Reserves/ NPLs

(5)

109.6%

106.2%

92.5%

39.2%

110.1%

126.7%

Loan Loss Reserves/ Gross Loans

0.87%

1.26%

1.66%

4.53%

3.29%

3.25%

Year Ended December 31, |

9

Fundamental Operations

Net Interest Margin

•

Use current market opportunities to

expand core funding

•

Convert NPAs to earning assets

•

Require pricing discipline amid

competitors leading with price

Loan Growth

•

Expansion on key lines of business (C&I,

medical and professional)

•

Well positioned near substantial markets

allowing for selective loan growth

Increasing Fee Income

•

Target leveraging both deposit and loan

customers

•

Both wealth management lines and

transaction fees

Efficiency Ratio

•

Branch optimization and expansion –

disciplined return on invested capital

approach

•

Utilize experiences of new management

team members

•

Continual upgrading of employee talent

level

–

driving

revenue

will

lower

efficiency ratio

•

“Operation

Bottom

Line”:

58%

-

62%

target efficiency ratio in the next 36

months

Earnings Summary

1.

Real Estate Owned Expenses include OREO expenses, gains and losses.

2.

“Adjusted Earnings”

is a non-GAAP-based financial measure calculated using

non-GAAP-based amounts, including

management’s

definition

of

“non-core”

items.

3.

The efficiency ratio expresses noninterest expense as a percentage of tax

equivalent net interest income and noninterest income, excluding

securities gains, goodwill impairment, and other non-recurring items (excludes

other litigation expenses for 3/31/13 and 12/31/12).

For the Quarter Ended,

(Dollars in 000s)

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

Net Interest Income (FTE)

$12,265

$11,494

$10,129

$9,574

$8,954

$8,562

Noninterest Income

7,379

6,191

7,027

4,880

5,164

4,432

Noninterest Expense

30,486

10,883

10,733

11,133

10,600

10,949

Pre-Tax/ Pre-Provision Income (FTE)

($10,842)

$6,802

$6,423

$3,321

$3,518

$2,045

Non-core Items:

(Less)

Realized Gain on Securities

$3,025

$2,231

$2,595

($2)

-

$122

+

Goodwill Impair. & Intang. Amt.

19,500

52

52

52

52

52

+

Collection and Problem Loan

477

719

579

593

407

182

+

Other Litigation Charges

-

-

-

-

80

371

+

Real

Estate

Owned

Expenses

(1)

368

376

100

230

128

43

"Adjusted"

Earnings

(2)

$6,478

$5,718

$4,559

$4,198

$4,185

$2,571

"Adjusted" PTPP Return on Assets

1.76%

1.59%

1.28%

1.29%

1.34%

0.86%

Efficiency

Ratio

(3)

63.9%

67.7%

72.7%

75.1%

73.2%

81.4%

Net Interest Margin

3.45%

3.37%

2.96%

3.10%

3.00%

3.07% |

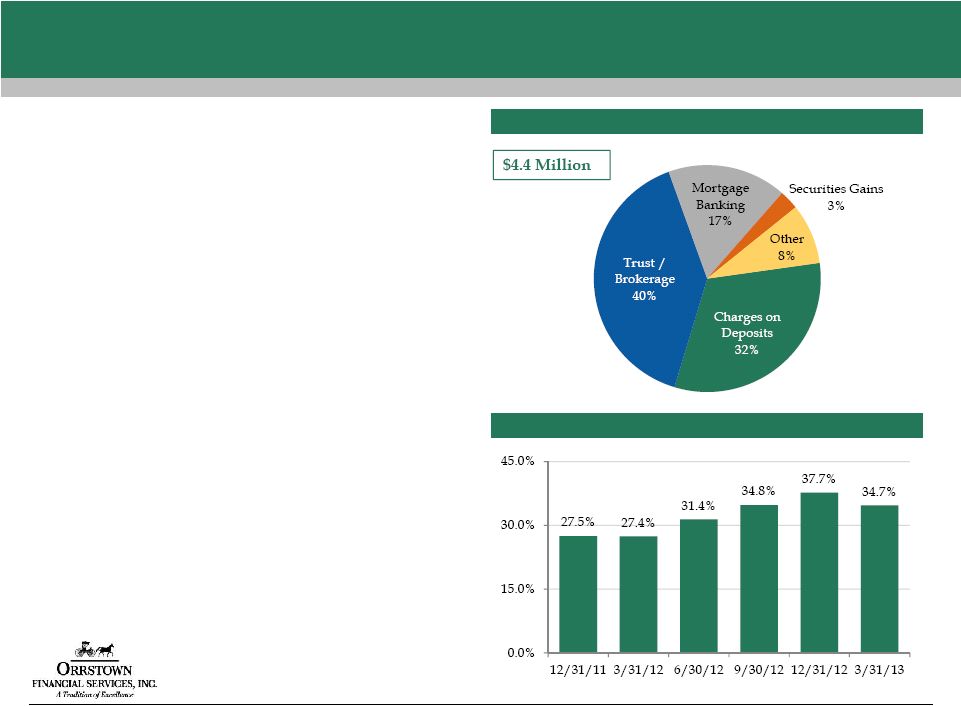

10

Diverse and Growing Revenue Stream

2013Q1 Noninterest Income Composition

•

Non-interest income continues to be

a stable and significant source of

revenue

•

Mortgage banking favorably

influenced by continued low interest

rate environment and greater

stability in the real estate market

•

Orrstown Financial Advisors

continues to generate solid trust and

brokerage revenue

•

Overall, favorable market conditions,

combined with new business

opportunities has led to an enhanced

revenue stream

Noninterest Income / Total Revenue (%)

(1)

1.

Note: noninterest income excludes gain on securities, total revenue

includes net interest income and noninterest income (excluding gain on securities) |

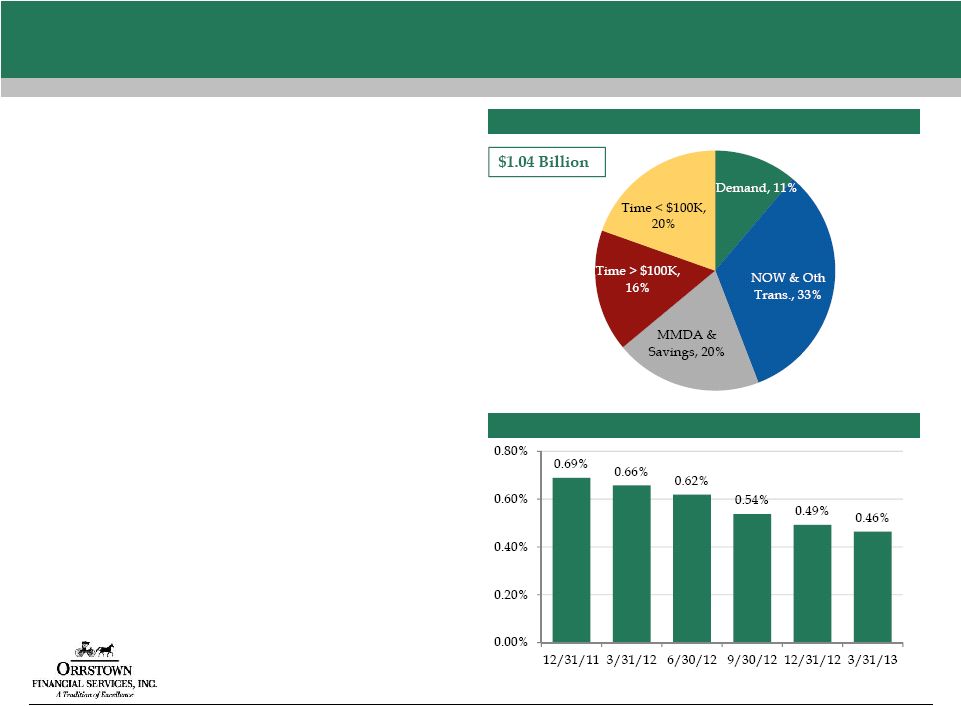

11

Deposit Franchise

Deposit Composition (3/31/13)

•

Significant deposit franchise -

with

over 83% “core “

•

Limited use of wholesale and

brokered deposits

•

Effectively managing the cost of

deposits which declined to 0.46% for

the quarter ended March 31, 2013

Cost of Total Deposits (%) |

12

Capital Position

•

Regulatory Capital levels are solidly

above “well capitalized”

•

Simple capital structure –

no trust

preferred, TARP or holding company

debt

•

Common dividend was suspended in

2011 to preserve capital

•

Deferred tax valuation allowance of

$20.3 million taken in 2012 combined

with recent profitability implies future

potential upside to capital ratios

3/31/13 Capital Ratios (%) |

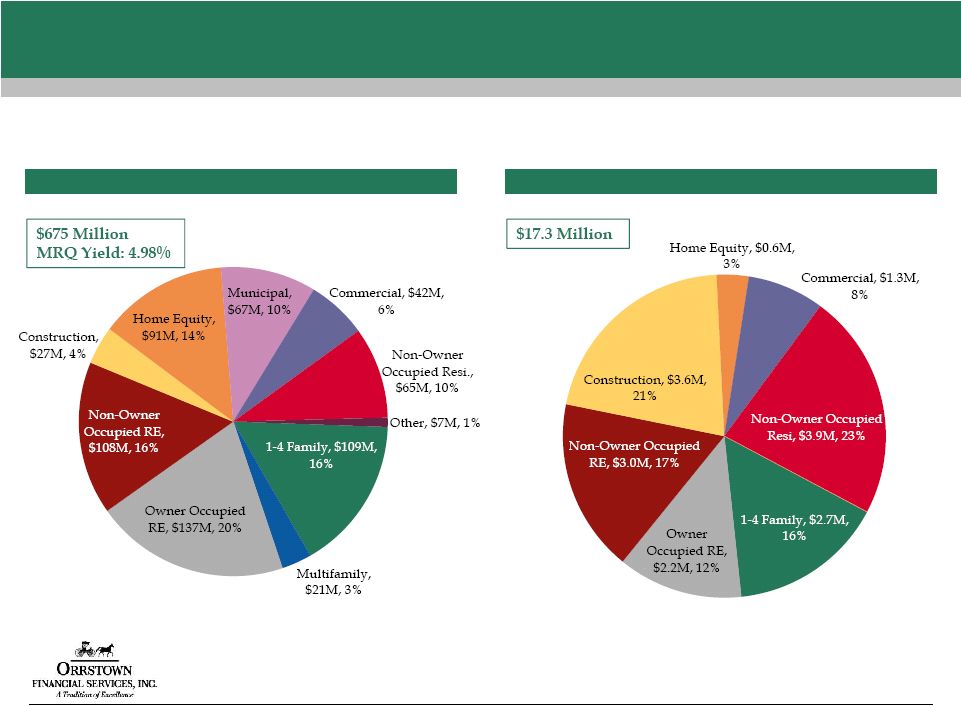

13

Diversified Loan Portfolio

Loans Held for Investment Composition (3/31/13)

Non-Performing Loans by Type

(3/31/13)

(1)

1.

NPLs include nonaccrual loans, restructured loans and still accruing,

loans past due 90 days or more and still accruing. |

14

Aggressive Sale of Problem Assets

•

Fourth

quarter

2012

loan

sale

of

172

distressed

commercial

loans

with

a

book

balance

of

$45.6

million

significantly

reduced

non-performing

asset

levels

•

OREO

exits

have

balanced

capital

considerations

as

well

as

substantial

“soft

costs”

in

holding

NPA Inflows Continue to Slow

Future CRE and A&D will be Limited and Targeted

Strong Reserve Coverage

•

The

allowance

for

loan

losses

totaled

$21.9

million

at

March

31,

2013,

or

approximately

3.3%

of

gross

loans

and

127%

of

NPLs

Completing Credit Turnaround

Significant Reduction in NPAs

•

Asset quality issues were addressed quickly and

aggressively in 2012

•

“Risk Assets”

totaled $19.2 million at March 31,

2013, a 83% reduction from $113.8 million at

December 31, 2011

•

Risk Assets to assets of 1.61% as of March 31,

2013 is now in-line with peers and more

comparable to pre-crisis levels

•

Renegotiated loans (or “TDRs”) substantially

“cured”

in 2012

Note: Non-Performing assets defined as nonaccrual loans, restructured

loans and still accruing, loans past due 90 days or more and still accruing, and real estate owned. |

15

Shareholder Focus –

ROI /Accretion

New Markets

Loan Production Offices and Full Service Branches

Branch Franchise Acquisitions

Whole Company Mergers

Each initiative will meet return on capital minimums

Transitioning to Offense -

Expansion Opportunities

•

Targeting attractive adjacent

markets

•

Expansion market customer base

allows for targeted line of business

growth |

16

Investment Highlights

Established South Central Pennsylvania bank

Deep and experienced Management team with strong operational ability

Aggressively dealt with asset quality issues, with ratios that are now

in-line with peers as a result of 2012 strategies

Strategic plans in place to drive core earnings growth, with a return to

profitability in

the

fourth

quarter

of

2012

and

sustained

profitability

in

the

first

quarter

of

2013

Well-positioned for future growth throughout the region

Compelling absolute and relative valuation |

Appendix |

18

Non-Performing Asset Summary

1.

Non-Performing Assets = Nonaccrual + OREO.

2.

“Risk Assets”

= Nonaccrual + Restructured and still accruing + 90 day past due and still

accruing + OREO. % Change Q1'13 vs.

(dollars in thousands)

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

Q1'12

Q4'12

Non-Accrual Loans

83,697

$

82,058

$

56,917

$

57,780

$

17,943

$

14,220

$

(83%)

(21%)

OREO

2,165

2,413

2,337

2,575

1,876

1,925

(20%)

3%

Non-Performing Assets

85,862

$

84,471

$

59,254

$

60,355

$

19,819

$

16,145

$

(81%)

(19%)

Restructured Loans Still Accruing

27,917

3,844

2,831

3,113

3,092

3,078

(20%)

(0%)

90+ Days Delinquent Still Accruing

-

2

1,275

923

-

-

(100%)

NA

Total "Risk Assets"

113,779

$

88,317

$

63,360

$

64,391

$

22,911

$

19,223

$

(78%)

(16%)

Loans 30-89 Past Due

6,723

$

6,501

$

6,219

$

5,435

$

3,578

$

6,069

$

Asset Quality Ratios:

Non-Accrual Loans / Loans

8.67%

9.13%

6.79%

7.19%

2.55%

2.11%

NPAs/Assets

(1)

5.95%

5.84%

4.46%

4.75%

1.61%

1.35%

NPAs /Loans + OREO

8.87%

9.37%

7.05%

7.49%

2.81%

2.39%

"Risk Assets" /Loans + OREO

11.76%

9.80%

7.54%

7.99%

3.25%

2.84%

"Risk Assets"/Assets

(2)

7.88%

6.10%

4.77%

5.07%

1.86%

1.61%

Allowance for Loan Losses/ Loans

4.53%

3.13%

4.32%

4.57%

3.29%

3.25%

Allowance for Loan Losses/ Non-Accrual Loans

52.2%

34.3%

63.7%

63.5%

129.1%

154.1%

Allowance for Loan Losses/ Non-Accrual + Restructured

39.2%

32.8%

60.6%

60.3%

110.1%

126.7% |

19

Asset Quality Trends

NPAs (Incl. TDRs) & 90+PD / Assets

(1)

Allowance for Loan Losses / Loans

Allowance for Loan Losses / NPLs

(2)

NCOs / Avg. Loans

Source SNL Financial, Peers consist of 19 exchange traded institutions

headquartered in the Mid-Atlantic with assets between $1.0 and $2.0 billion.

1.

Non-Performing

Assets

=

Nonaccrual

+

Restructured

and

still

accruing

+

90

day

past

due

and

still

accruing

+

OREO.

2.

Non-Performing Loans = Nonaccrual + Restructured and still accruing +

90 day past due and still accruing. |