Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MONARCH COMMUNITY BANCORP INC | d534387d8k.htm |

EXHIBIT 99.1

MONARCH COMMUNITY BANCORP, INC.

ANNOUNCES FIRST QUARTER LOSS

COLDWATER, MICHIGAN, May 3, 2013—Monarch Community Bancorp, Inc. (OTCQB:MCBF), the parent company of Monarch Community Bank, today announced a loss of $427,000 for the quarter ended March 31, 2013 compared to a loss of $501,000 for the same period in 2012. Basic and diluted losses per share for the quarter ended March 31, 2013 were ($.21) compared to basic and diluted losses per share of ($.25) for the same period in 2012.

Highlights of the quarter include the following:

| • | No provision in Allowance for Loan and Lease loss recorded for the period. |

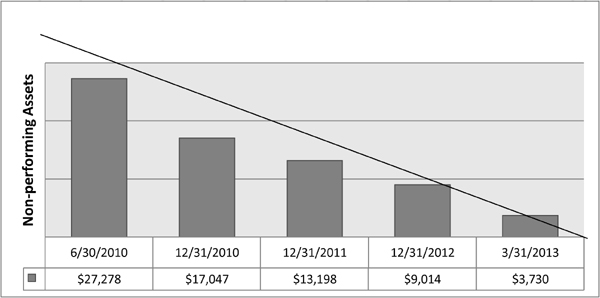

| • | A 59% decline in Non-performing assets from $9.0 million at December 31, 2012 to $3.7 million at March 31, 2013. |

| • | A 20 basis point improvement in the net interest margin of 3.55% for the quarter ending March 31, 2013, versus the same period in 2012. |

| • | An increase in gain on sale of loans of $332,000, from $288,000 for the 1st quarter of 2012 to $620,000 for the 1st quarter of 2013. |

| • | An increase in salaries and employee benefits of 23.77%, compared to the same period in 2012. |

The following Non-performing Assets graph illustrates the Bank’s continued progress in improving the quality of the loan portfolio:

“We are very pleased with the Bank’s progress,” stated Richard J. DeVries, President and CEO of Monarch Community Bank and Monarch Community Bancorp, Inc. “and anticipate that this will enhance our probability for success as we prepare to embark on a capital raise. With nine new residential loan production offices in place throughout Michigan and Indiana, and the recent expansion of our commercial lending staff, we believe the bank is well positioned for profitable growth.”

Total interest income decreased from $2.3 million in the first quarter of 2012 to $2.0 million in the first quarter of 2013. This $354,000 decrease is largely due to the decrease in earning assets from period to period, and reflects both normal loan amortizations as well as a reduction in higher risk loans. Total interest expense declined $258,000 from $633,000 in the first quarter of 2012 to $375,000 in the first quarter of 2013. This was due to the overall cost of funds decreasing by 40 basis points and due to a decrease in higher cost Federal Home Loan Bank advances. The combined effect of these changes in interest income and interest expense resulted in first quarter 2013 net interest income before the provision for loan losses decreasing $96,000 when compared to the same period in 2012.

The net interest margin for the first quarter of 2013 increased 20 basis points to 3.55% compared to 3.35% for the same period in 2012. The improvement in the margin continues to be largely due to the decline in cost of funds as management continues to monitor cost of funds.

Net interest income after the provision for loan losses decreased $68,000 for the three months ended March 31, 2013, compared to the same period in 2012. No provision for Allowance for Loan losses was required in the quarter ending March 31, 2013 compared to $28,000 for the same period a year ago. Non-performing assets totaled $3.7 million at the end of the first quarter of 2013, compared to $9.0 million at December 31, 2012, and $11.9 million at March 31, 2012. The Company recorded net charge offs of $390,000 for the quarter ended March 31, 2013 compared to a net charge off of $623,000 for the same period in 2012.

Non-interest income for the quarter ended March 31, 2013 increased $378,000, or 45%, from $840,000 to $1.2 million compared to the same period a year ago. This increase is largely attributable to an increase in the gain on sale of loans which is a result of the additional loan origination offices and the low rate environment.

Non-interest expense increased $237,000, or 8.2% for the quarter ended March 31, 2013 compared to the same period a year ago. The increase is primarily due to an increase in salaries and employee benefits and expenses associated with the additional loan origination offices.

Total assets were $196.7 million at March 31, 2013 compared to $190.3 million at December 31, 2012. Total loans decreased $5.4 million, or 4.2%, to $122.6 million at March 31, 2013 from $128.0 million at December 31, 2012. Deposits increased $7.0 million, or 4.0%, to $176.3 million during the first quarter from $169.5 million at of the end of 2012.

Stockholders’ equity decreased by $423,000 at March 31, 2013 compared to December 31, 2012. The Bank must meet certain minimum capital requirements to satisfy federal and state laws. Monarch Community Bank’s capital ratios for March 31, 2013 were as follows, tier 1 leverage ratio: 5.88% and total risk based ratio: 10.97%. In May of 2010, the Bank agreed with FDIC to develop a plan to increase its tier 1 leverage ratio to 9% and total risk based ratio to 11%. The Bank is pursuing all opportunities to raise capital and was considered well capitalized according to the FDIC definition as of March 31, 2013.

Monarch Community Bank is headquartered in Coldwater, Michigan and operates five full service retail offices in Branch, Calhoun and Hillsdale counties and nine loan production offices in Kalamazoo, Calhoun, Berrien, Ingham, Lenawee, Kent, Livingston and Jackson counties in Michigan and one in Steuben county, Indiana.

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934 as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of the Company, are generally identified by the use of words such as “believe,” “expect,” “intend,” “anticipate,” “estimate,” or “project” or similar expressions. The Company’s ability to predict results, or the actual effect of future plans or strategies, is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and the subsidiaries include, but are not limited to, changes in: interest rates; general economic conditions; legislative/regulatory changes; monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Federal Reserve Board; the quality and composition of the loan or securities portfolios; demand for loan products; deposit flows; competition; demand for financial services in the Company’s market areas; the Company’s implementation of evolving technologies; and accounting principles, policies, and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

For additional information, visit Monarch Community Bancorp’s website at www.monarchcb.com.

Contacts:

| Richard J. DeVries, CEO | Rebecca S. Crabill, CFO | |||

| (517) 279-3978 | (517) 279-3956 |

Monarch Community Bancorp, Inc.

Condensed Balance Sheet

(Unaudited)

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Assets | ||||||||

| Cash and cash equivalents |

$ | 44,559 | $ | 28,744 | ||||

| Securities |

15,712 | 15,398 | ||||||

| Loans |

124,201 | 130,045 | ||||||

| Other assets |

12,196 | 16,136 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 196,668 | $ | 190,323 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity | ||||||||

| Liabilities |

||||||||

| Deposits |

$ | 176,357 | $ | 169,460 | ||||

| Borrowings |

7,059 | 7,059 | ||||||

| Other liabilities |

3,208 | 3,337 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

186,624 | 179,856 | ||||||

| Stockholders’ equity |

10,044 | 10,467 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 196,668 | $ | 190,323 | ||||

|

|

|

|

|

|||||

Monarch Community Bancorp, Inc.

Condensed Statement of Income

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Interest Income |

1,951 | 2,305 | ||||||

| Interest Expense |

375 | 633 | ||||||

|

|

|

|

|

|||||

| Net Interest Income |

1,576 | 1,672 | ||||||

| Provision for Loan Losses |

— | 28 | ||||||

|

|

|

|

|

|||||

| Net Interest Income After Provision for Loan Losses |

1,576 | 1,644 | ||||||

| Noninterest Income |

1,218 | 840 | ||||||

| Noninterest Expense |

3,122 | 2,885 | ||||||

|

|

|

|

|

|||||

| Income—Before income taxes |

(328 | ) | (401 | ) | ||||

| Income Taxes |

— | — | ||||||

|

|

|

|

|

|||||

| Net Income |

$ | (328 | ) | $ | (401 | ) | ||

|

|

|

|

|

|||||

| Dividends and amortization of discount on preferred stock |

$ | 99 | $ | 100 | ||||

| Net Income (loss) available to common stock |

$ | (427 | ) | $ | (501 | ) | ||

|

|

|

|

|

|||||

| Earnings Per Share |

||||||||

| Basic |

$ | (0.21 | ) | $ | (0.25 | ) | ||

|

|

|

|

|

|||||

| Diluted |

$ | (0.21 | ) | $ | (0.25 | ) | ||

|

|

|

|

|

|||||