Attached files

| file | filename |

|---|---|

| 8-K - BROOKLINE BANCORP, INC. 8-K - BROOKLINE BANCORP INC | a50627641.htm |

Exhibit 99.1

Brookline Bancorp, Inc. 2013 Annual Meeting of Stockholders BUILDING ON WHO WE ARE.

AGENDA 1.Welcoming

Remarks 2.Introductions 3.Procedural Matters Relating to the Conduct of

the Annual Meeting 4.Presentation of the Three Proposals before the

Annual Meeting 5.Opening of Polls and Balloting 6.Closing of Polls

7.Report of the Inspector of Elections 8.Adjournment of Formal Portion

of the Annual Meeting 9.Annual Report of the Company 10.General Question

and Answer Period

AGENDA 1.Welcoming

Remarks 2.Introductions 3.Procedural Matters Relating to the Conduct of

the Annual Meeting 4.Presentation of the Three Proposals before the

Annual Meeting 5.Opening of Polls and Balloting 6.Closing of Polls

7.Report of the Inspector of Elections 8.Adjournment of Formal Portion

of the Annual Meeting 9.Annual Report of the Company 10.General Question

and Answer Period

Brookline Bancorp, Inc. 2013 Annual Meeting of Stockholders BUILDING ON WHO WE ARE.

FORWARD-LOOKING

STATEMENTS Certain statements in this presentation that are not

historical facts may constitute forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, and are

intended to be covered by the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements

involve risks and uncertainties. These statements include, among others,

statements regarding our strategy, evaluations of future interest rate

trends and liquidity, expectations as to growth in assets, deposits and

results of operations, success of acquisitions, future operations,

market position, financial position, and prospects, plans and objectives

of management. You should not place undue reliance on the Company’s

forward-looking statements. You should exercise caution in interpreting

and relying on forward-looking statements because they are subject to

significant risks, uncertainties and other factors which are, in some

cases, beyond the Company’s control. Forward-looking statements are

based on the current assumptions and beliefs of management and are only

expectations of future results. The Company’s actual results could

differ materially from those projected in the forward-looking statements

as a result of, among other factors, changes in interest rates;

competitive pressures from other financial institutions; the effects of

continued weakness in general economic conditions on a national basis or

in the local markets in which the Company operates, including changes

that adversely affect borrowers’ ability to service and repay our loans;

changes in the value of securities in the Company’s investment

portfolio, changes in loan default and charge-off rates, the adequacy of

loan loss reserves, decreases in deposit levels necessitating increased

borrowing to fund loans and investments; changes in government

regulation, as well as the other risks and uncertainties detailed in the

Company’s Annual Report on Form 10-K, as updated by the Company’s

Quarterly Reports on Form 10-Q and other filings submitted to the

Securities and Exchange Commission. Forward looking statements speak

only as of the date on which they are made. The Company does not

undertake any obligation to update any forward-looking statement to

reflect circumstances or events that occur after the date the

forward-looking statements are made.

FORWARD-LOOKING

STATEMENTS Certain statements in this presentation that are not

historical facts may constitute forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, and are

intended to be covered by the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements

involve risks and uncertainties. These statements include, among others,

statements regarding our strategy, evaluations of future interest rate

trends and liquidity, expectations as to growth in assets, deposits and

results of operations, success of acquisitions, future operations,

market position, financial position, and prospects, plans and objectives

of management. You should not place undue reliance on the Company’s

forward-looking statements. You should exercise caution in interpreting

and relying on forward-looking statements because they are subject to

significant risks, uncertainties and other factors which are, in some

cases, beyond the Company’s control. Forward-looking statements are

based on the current assumptions and beliefs of management and are only

expectations of future results. The Company’s actual results could

differ materially from those projected in the forward-looking statements

as a result of, among other factors, changes in interest rates;

competitive pressures from other financial institutions; the effects of

continued weakness in general economic conditions on a national basis or

in the local markets in which the Company operates, including changes

that adversely affect borrowers’ ability to service and repay our loans;

changes in the value of securities in the Company’s investment

portfolio, changes in loan default and charge-off rates, the adequacy of

loan loss reserves, decreases in deposit levels necessitating increased

borrowing to fund loans and investments; changes in government

regulation, as well as the other risks and uncertainties detailed in the

Company’s Annual Report on Form 10-K, as updated by the Company’s

Quarterly Reports on Form 10-Q and other filings submitted to the

Securities and Exchange Commission. Forward looking statements speak

only as of the date on which they are made. The Company does not

undertake any obligation to update any forward-looking statement to

reflect circumstances or events that occur after the date the

forward-looking statements are made.

BASIS OF

PRESENTATION GAAP The Company's consolidated financial statements have

been prepared in conformity with generally accepted accounting

principles (“GAAP”) as set forth by the FASB in its Accounting Standards

Codification and through the rules and interpretive releases of the SEC

under the authority of federal securities laws. Non-GAAP Financial

Measures The Company uses certain non-GAAP financial measures, such as

net earnings from operations, operating earnings per share, operating

ROE, operating ROA, the allowance for loan and lease losses as a

percentage of originated loans and leases, tangible stockholders’

equity, tangible book value per common share and tangible stockholders’

equity to tangible assets. These non-GAAP financial measures provide

information for investors to effectively analyze financial trends of

ongoing business activities, and to enhance comparability with peers

across the financial services sector. A detailed reconciliation table of

the Company's GAAP to the non-GAAP measures is included in the Company’s

April 24, 2013 press release.

BASIS OF

PRESENTATION GAAP The Company's consolidated financial statements have

been prepared in conformity with generally accepted accounting

principles (“GAAP”) as set forth by the FASB in its Accounting Standards

Codification and through the rules and interpretive releases of the SEC

under the authority of federal securities laws. Non-GAAP Financial

Measures The Company uses certain non-GAAP financial measures, such as

net earnings from operations, operating earnings per share, operating

ROE, operating ROA, the allowance for loan and lease losses as a

percentage of originated loans and leases, tangible stockholders’

equity, tangible book value per common share and tangible stockholders’

equity to tangible assets. These non-GAAP financial measures provide

information for investors to effectively analyze financial trends of

ongoing business activities, and to enhance comparability with peers

across the financial services sector. A detailed reconciliation table of

the Company's GAAP to the non-GAAP measures is included in the Company’s

April 24, 2013 press release.

OVERVIEW •Strong

growth •Acquisition integrations on target •Fortress balance sheet

•Exceptional asset quality •Ongoing enhancement of funding base •Strong

core earnings •Continued capital strength

OVERVIEW •Strong

growth •Acquisition integrations on target •Fortress balance sheet

•Exceptional asset quality •Ongoing enhancement of funding base •Strong

core earnings •Continued capital strength

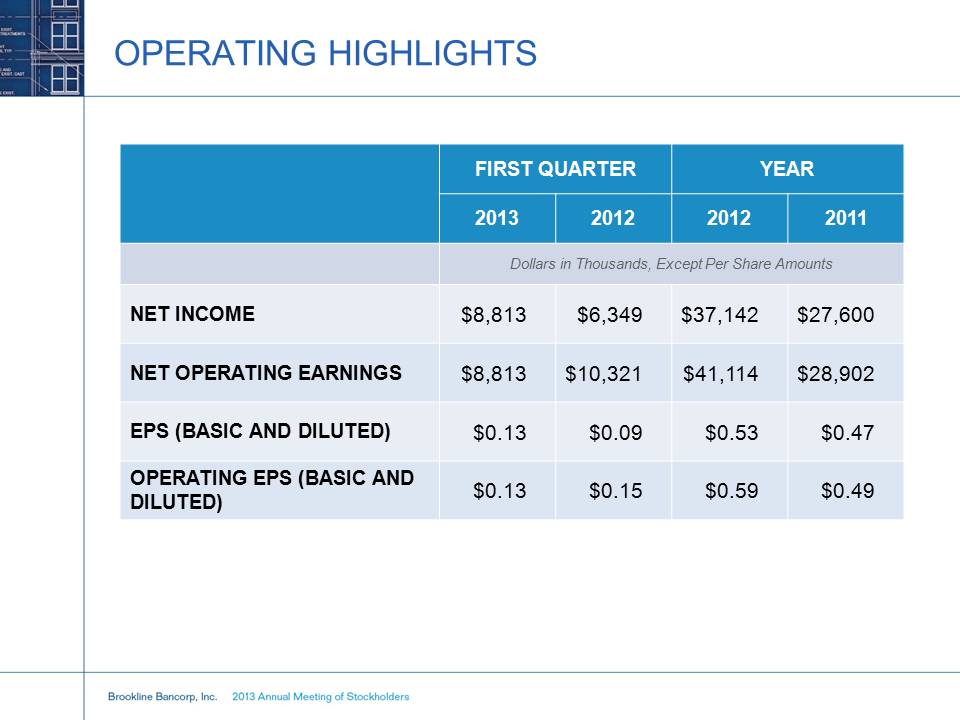

OPERATING HIGHLIGHTS

FIRST QUARTER YEAR 2013 2012 2012 2011 Dollars in Thousands, Except Per

Share Amounts NET INCOME $8,813 $6,349 $37,142 $27,600 NET OPERATING

EARNINGS $8,813 $10,321 $41,114 $28,902 EPS (BASIC AND DILUTED) $0.13

$0.09 $0.53 $0.47 OPERATING EPS (BASIC AND DILUTED) $0.13 $0.15 $0.59

$0.49

OPERATING HIGHLIGHTS

FIRST QUARTER YEAR 2013 2012 2012 2011 Dollars in Thousands, Except Per

Share Amounts NET INCOME $8,813 $6,349 $37,142 $27,600 NET OPERATING

EARNINGS $8,813 $10,321 $41,114 $28,902 EPS (BASIC AND DILUTED) $0.13

$0.09 $0.53 $0.47 OPERATING EPS (BASIC AND DILUTED) $0.13 $0.15 $0.59

$0.49

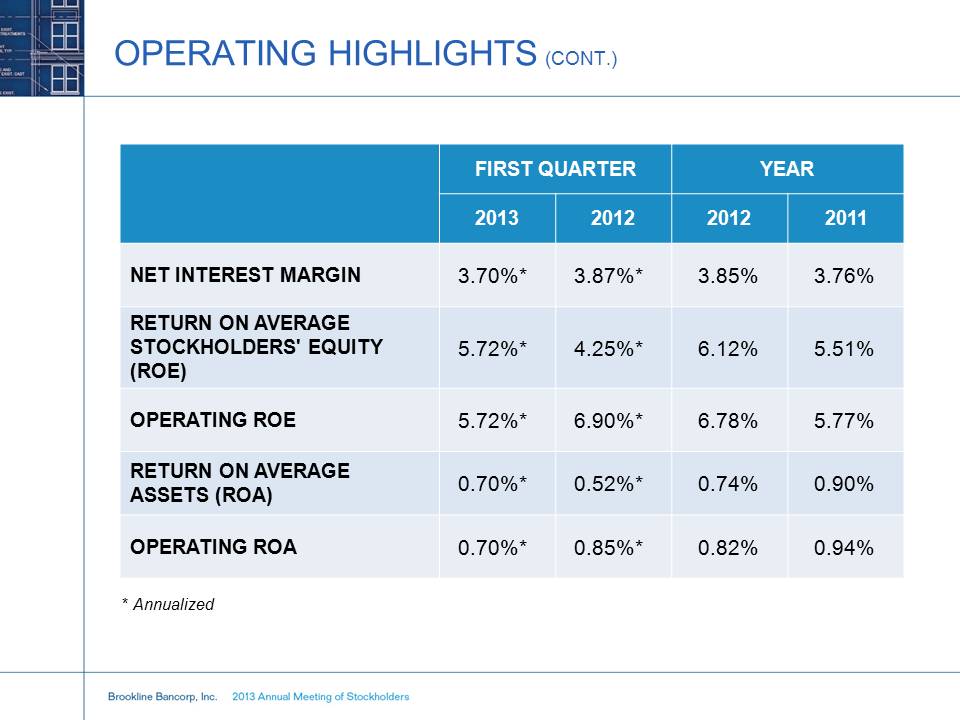

OPERATING HIGHLIGHTS

(CONT.) FIRST QUARTER YEAR 2013 2012 2012 2011 NET INTEREST MARGIN

3.70%* 3.87%* 3.85% 3.76% RETURN ON AVERAGE STOCKHOLDERS' EQUITY (ROE)

5.72%* 4.25%* 6.12% 5.51% OPERATING ROE 5.72%* 6.90%* 6.78% 5.77% RETURN

ON AVERAGE ASSETS (ROA) 0.70%* 0.52%* 0.74% 0.90% OPERATING ROA 0.70%*

0.85%* 0.82% 0.94% * Annualized

OPERATING HIGHLIGHTS

(CONT.) FIRST QUARTER YEAR 2013 2012 2012 2011 NET INTEREST MARGIN

3.70%* 3.87%* 3.85% 3.76% RETURN ON AVERAGE STOCKHOLDERS' EQUITY (ROE)

5.72%* 4.25%* 6.12% 5.51% OPERATING ROE 5.72%* 6.90%* 6.78% 5.77% RETURN

ON AVERAGE ASSETS (ROA) 0.70%* 0.52%* 0.74% 0.90% OPERATING ROA 0.70%*

0.85%* 0.82% 0.94% * Annualized

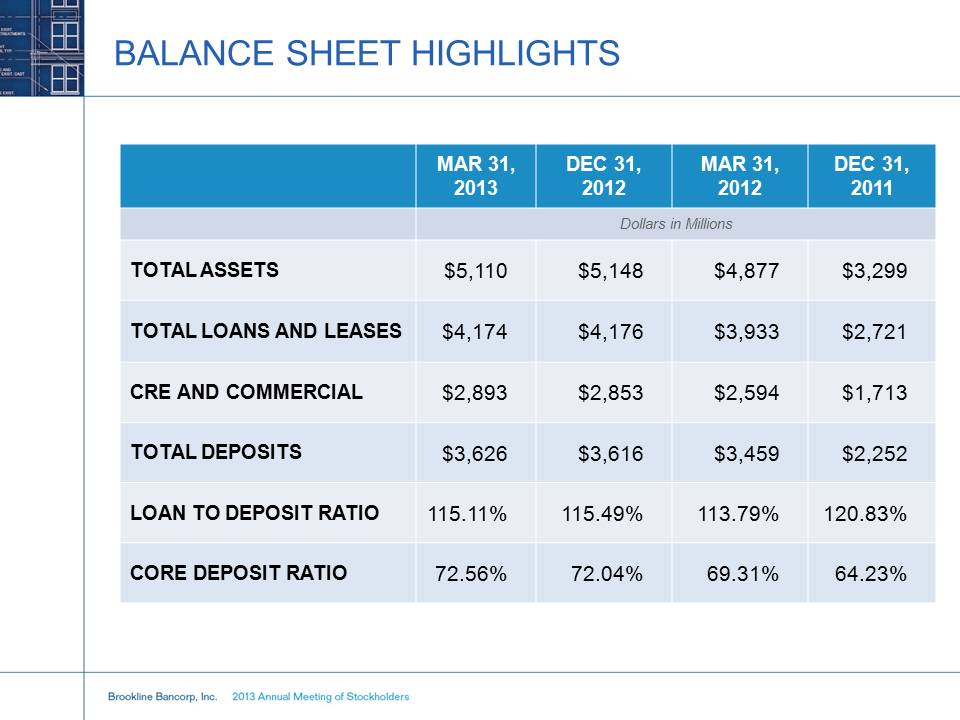

BALANCE SHEET

HIGHLIGHTS MAR 31, 2013 DEC 31, 2012 MAR 31, 2012 DEC 31, 2011 Dollars

in Millions TOTAL ASSETS $5,110 $5,148 $4,877 $3,299 TOTAL LOANS AND

LEASES $4,174 $4,176 $3,933 $2,721 CRE AND COMMERCIAL $2,893 $2,853

$2,594 $1,713 TOTAL DEPOSITS $3,626 $3,616 $3,459 $2,252 LOAN TO DEPOSIT

RATIO 115.11% 115.49% 113.79% 120.83% CORE DEPOSIT RATIO 72.56% 72.04%

69.31% 64.23%

BALANCE SHEET

HIGHLIGHTS MAR 31, 2013 DEC 31, 2012 MAR 31, 2012 DEC 31, 2011 Dollars

in Millions TOTAL ASSETS $5,110 $5,148 $4,877 $3,299 TOTAL LOANS AND

LEASES $4,174 $4,176 $3,933 $2,721 CRE AND COMMERCIAL $2,893 $2,853

$2,594 $1,713 TOTAL DEPOSITS $3,626 $3,616 $3,459 $2,252 LOAN TO DEPOSIT

RATIO 115.11% 115.49% 113.79% 120.83% CORE DEPOSIT RATIO 72.56% 72.04%

69.31% 64.23%

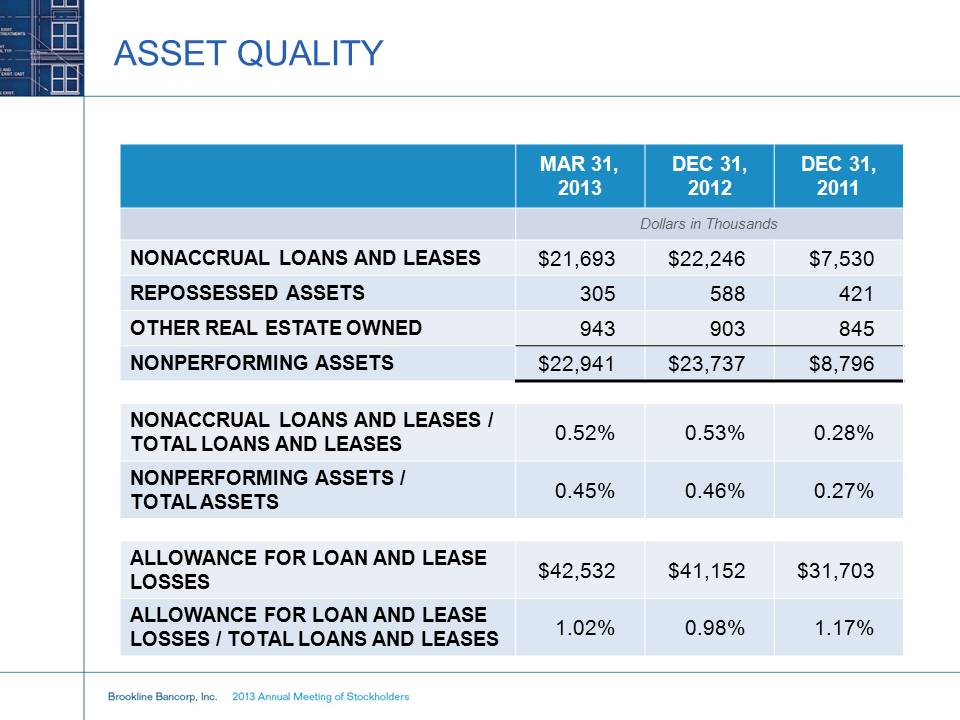

ASSET QUALITY MAR

31, 2013 DEC 31, 2012 DEC 31, 2011 Dollars in Thousands NONACCRUAL LOANS

AND LEASES $21,693 $22,246 $7,530 REPOSSESSED ASSETS 305 588 421 OTHER

REAL ESTATE OWNED 943 903 845 NONPERFORMING ASSETS $22,941 $23,737

$8,796 NONACCRUAL LOANS AND LEASES / TOTAL LOANS AND LEASES 0.52% 0.53%

0.28% NONPERFORMING ASSETS / TOTAL ASSETS 0.45% 0.46% 0.27% ALLOWANCE

FOR LOAN AND LEASE LOSSES $42,532 $41,152 $31,703 ALLOWANCE FOR LOAN AND

LEASE LOSSES / TOTAL LOANS AND LEASES 1.02% 0.98% 1.17%

ASSET QUALITY MAR

31, 2013 DEC 31, 2012 DEC 31, 2011 Dollars in Thousands NONACCRUAL LOANS

AND LEASES $21,693 $22,246 $7,530 REPOSSESSED ASSETS 305 588 421 OTHER

REAL ESTATE OWNED 943 903 845 NONPERFORMING ASSETS $22,941 $23,737

$8,796 NONACCRUAL LOANS AND LEASES / TOTAL LOANS AND LEASES 0.52% 0.53%

0.28% NONPERFORMING ASSETS / TOTAL ASSETS 0.45% 0.46% 0.27% ALLOWANCE

FOR LOAN AND LEASE LOSSES $42,532 $41,152 $31,703 ALLOWANCE FOR LOAN AND

LEASE LOSSES / TOTAL LOANS AND LEASES 1.02% 0.98% 1.17%

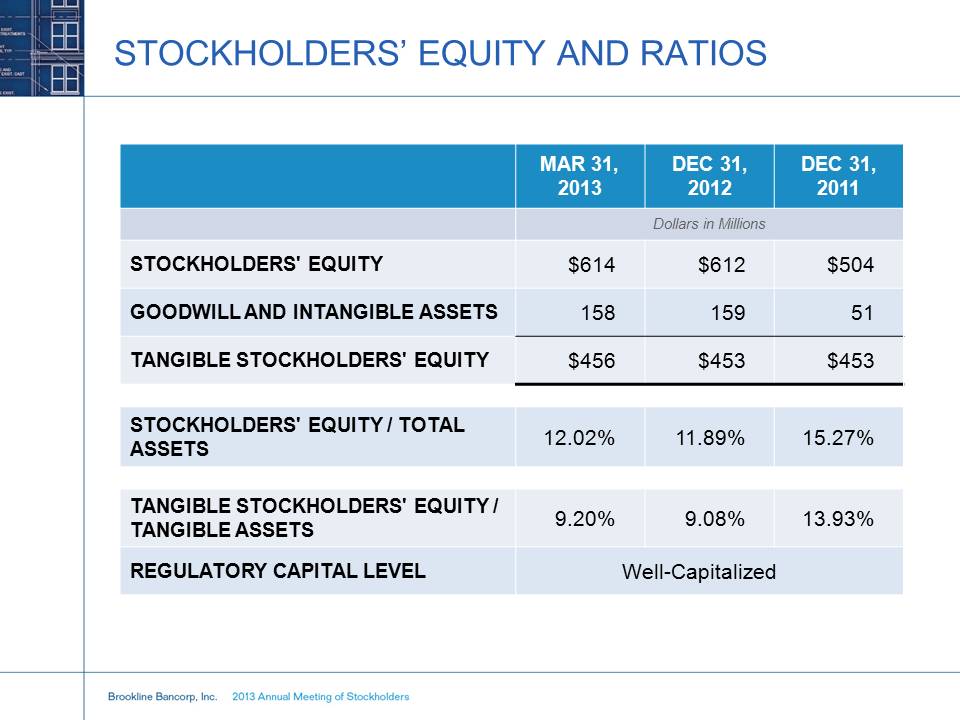

STOCKHOLDERS’ EQUITY

AND RATIOS MAR 31, 2013 DEC 31, 2012 DEC 31, 2011 Dollars in Millions

STOCKHOLDERS' EQUITY $614 $612 $504 GOODWILL AND INTANGIBLE ASSETS 158

159 51 TANGIBLE STOCKHOLDERS' EQUITY $456 $453 $453 STOCKHOLDERS' EQUITY

/ TOTAL ASSETS 12.02% 11.89% 15.27% TANGIBLE STOCKHOLDERS' EQUITY /

TANGIBLE ASSETS 9.20% 9.08% 13.93% REGULATORY CAPITAL LEVEL

Well-Capitalized

STOCKHOLDERS’ EQUITY

AND RATIOS MAR 31, 2013 DEC 31, 2012 DEC 31, 2011 Dollars in Millions

STOCKHOLDERS' EQUITY $614 $612 $504 GOODWILL AND INTANGIBLE ASSETS 158

159 51 TANGIBLE STOCKHOLDERS' EQUITY $456 $453 $453 STOCKHOLDERS' EQUITY

/ TOTAL ASSETS 12.02% 11.89% 15.27% TANGIBLE STOCKHOLDERS' EQUITY /

TANGIBLE ASSETS 9.20% 9.08% 13.93% REGULATORY CAPITAL LEVEL

Well-Capitalized

Brookline Bancorp, Inc. 2013 Annual Meeting of Stockholders BUILDING ON WHO WE ARE.