Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Thryv Holdings, Inc. | a13-11693_18k.htm |

Exhibit 99.1

|

|

Dex Media, Inc. Investor call Peter McDonald, CEO Dee Jones, CFO May 7, 2013 |

|

|

Forward-Looking Statements Certain statements contained in this document regarding the benefits of the transaction, future growth potential, timing, effects of the transaction, synergies or other attributes of the combined company, Dex Media, Inc.(“Dex Media”), and any other statements not constituting historical fact are "forward-looking statements" subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Where possible, the words "believe," "expect," "anticipate," "intend," "should," "will," "would," "planned," "estimated," "potential," "goal," "outlook," "may," "predicts," "could," or the negative of such terms, or other comparable expressions, as they relate to Dex Media or its management, have been used to identify such forward-looking statements. All forward-looking statements reflect only on Dex Media’s current beliefs and assumptions with respect to future business plans, prospects, decisions and results, and are based on information currently available to Dex Media. Accordingly, the statements are subject to significant risks, uncertainties and contingencies, which could cause Dex Media’s actual operating results, performance or business plans or prospects to differ materially from those expressed in, or implied by, these statements. Factors that could cause actual results to differ materially from current expectations include risks and other factors described in Dex One Corporation's and SuperMedia Inc.'s publicly available reports filed with the Securities and Exchange Commission, which contain discussions of various factors that may affect the business or financial results of the combined company. Such risks and other factors, which in some instances are beyond Dex Media's control, include: the continuing decline in the use of print directories; increased competition, particularly from existing and emerging digital technologies; ongoing weak economic conditions and continued decline in advertising sales; the ability to collect trade receivables from customers to whom they extend credit; the ability to generate sufficient cash to service its debt; the company’s ability to comply with the financial covenants contained in its debt agreements and the potential impact to operations and liquidity as a result of restrictive covenants in such debt agreements; the company’s ability to refinance or restructure its debt on reasonable terms and conditions as might be necessary from time to time; increasing interest rates; changes in the company’s and the company’s subsidiaries credit ratings; changes in accounting standards; regulatory changes and judicial rulings impacting the company’s businesses; adverse results from litigation, governmental investigations or tax related proceedings or audits; the effect of labor strikes, lock-outs and negotiations; successful realization of the expected benefits of acquisitions, divestitures and joint ventures; the ability to maintain agreements with major Internet search and local media companies; the reliance on third-party vendors for various services; and other events beyond the company’s control that may result in unexpected adverse operating results. With respect to the merger, important factors could cause actual results to differ materially from those indicated by forward-looking statements included herein, including, but not limited to: the risk that anticipated cost savings, growth opportunities and other financial and operating benefits as a result of the transaction may not be realized or may take longer to realize than expected; the risk that benefits from the transaction may be significantly offset by costs incurred in integrating the companies, including, coordinating geographically separate organizations, integrating business cultures, which could prove to be incompatible, difficulties and costs of integrating information technology systems; and the potential difficulty in retaining key officers and personnel. Dex Media is not responsible for updating the information contained in this document beyond the publication date, or for changes made to this document by wire services or Internet service providers. |

|

|

PETER MCDONALD - CEO |

|

|

National Presence 2012 pro-forma $2.7 billion dollar business $460 million in Digital Revenue 665,000 clients 2,700 Marketing Consultants |

|

|

Strategy Be the trusted partner helping local businesses grow through effective marketing solutions. |

|

|

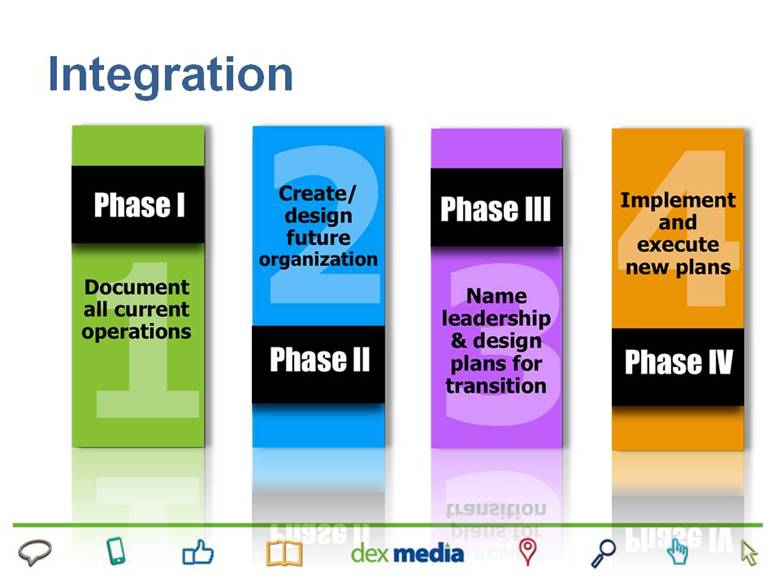

Integration |

|

|

DEE JONES- CFO |

|

|

Merger Financial Highlights Cost Synergies $150M - $175M annual by 2015 Extension of debt terms SuperMedia term loan – 1 year Dex One 3 silos – 26 months Preservation of Tax Attributes and Benefits |

|

|

Revenue, Expense and EBITDA¹ performance $363 $349 $330 $312 $293 40.8% 41.3% 41.5% 37.5% 38.2% SuperMedia Dex One $345 $334 $320 $301 $288 43.5% 42.2% 42.8% 44.2% 41.2% Continued focus on cost reductions |

|

|

Adjusted Net Debt² Dex One SuperMedia Significant debt reductions in both companies |

|

|

Advertising Sales Trend SuperMedia Dex One Improved trend in digital clients Digital penetration growth in existing print clients |

|

|

Q&A |

|

|

APPENDIX |

|

|

SuperMedia Inc. Schedule A Reconciliation of Non-GAAP Measures Debtor and Debtor-In-Possession Three Months Ended March 31, 2013 and 2012 (dollars in millions) Unaudited 3 Mos. Ended 3/31/13 3 Mos. Ended 3/31/12 Net Income - GAAP $40 $62 Add/subtract non-operating items: Provision for income taxes 23 26 Interest expense, net 38 46 Gains on early extinguishment of debt (5) - (28) Operating Income 101 106 Depreciation and amortization 31 40 EBITDA (non-GAAP) (1) 132 146 Adjustments: Severance costs (6) 3 2 Merger transaction costs (7) 6 - Post-employment benefits amortization (8) (29) - Adjusted EBITDA (non-GAAP) (2) $112 $148 Operating Revenue $293 $363 Operating Income margin (3) 34.5% 29.2% Impact of depreciation and amortization 10.6% 11.0% EBITDA margin (non-GAAP) (4) 45.1% 40.2% Impact of adjustments -6.9% 0.6% Adjusted EBITDA margin (non-GAAP) (4) 38.2% 40.8% Notes: (1) EBITDA is a non-GAAP measure that represents earnings before interest, taxes, gains on early extinguishment of debt, depreciation and amortization. (2) Adjusted EBITDA is a non-GAAP measure that adjusts EBITDA for certain unique costs. (3) Operating Income margin is calculated by dividing Operating Income by Operating Revenue. (4) EBITDA and Adjusted EBITDA margin is calculated by dividing EBITDA and Adjusted EBITDA by Operating Revenue. (5) Gains on early extinguishment of debt represents the gains associated with the purchase of a portion of the Company's debt below par value. (6) Severance costs are associated with headcount reductions. (7) Merger tranasation costs are costs associated with the proposed merger transaction with Dex One. (8) This adjustment includes a $32 million credit to expense related to a deferred pretax gain of $257 million ($161 million after-tax) associated with plan amendments to post-employment benefits and amortization of unrecognized net losses of $3 million related to other post-employment benefits. |

|

|

DEX ONE CORPORATION RECONCILIATION OF NON-GAAP MEASURES Schedule B (unaudited) EBITDA and Adjusted EBITDA are not measurements of operating performance computed in accordance with GAAP and should not be considered as a substitute for net income prepared in conformity with GAAP. In addition, EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Management believes that these non-GAAP financial measures are important indicators of our operations because they exclude items that may not be indicative of, or related to, our core operating results, and provide a better baseline for analyzing our underlying business. Adjusted EBITDA for the three months ended March 31, 2013 is determined by adjusting EBITDA for (i) reorganization items, net, (ii) stock-based compensation expense and (iii) merger transaction and integration expenses. Adjusted EBITDA for the three months ended March 31, 2012 is determined by adjusting EBITDA for (i) gain on Debt Repurchases, net and (ii) stock-based compensation expense and long-term incentive program. Amounts in millions Three Months Ended March 31, Reconciliation of net income (loss) - GAAP to EBITDA and Adjusted EBITDA 2013 2012 Net income (loss) - GAAP $ (59.3) $ 57.6 Less: tax benefit (1.1) (1.2) Plus: interest expense, net 42.9 57.1 Plus: depreciation and amortization 89.5 103.7 EBITDA $ 72.0 $ 217.2 Plus: Reorganization items, net 35.9 - Less: Gain on Debt Repurchases, net - (68.8) Plus: Stock-based compensation expense and long-term incentive program 0.7 1.4 Plus: Merger transaction and integration expenses 10.2 - Adjusted EBITDA $ 118.8 $ 149.8 |

|

|

DEX MEDIA CORPORATION RECONCILIATION OF NON-GAAP MEASURES (cont'd) Schedule C (unaudited) Amounts in millions SuperMedia reconciliation of debt - GAAP to net debt (4) March 31, 2013 December 31, 2012 Debt - GAAP $ 1,442 $ 1,442 Less: Cash and cash equivalents (152) (105) Net debt $ 1,290 $ 1,337 Dex One reconciliation of debt - GAAP to net debt and net debt - eliminating fair value discount (3) (4) March 31, 2013 December 31, 2012 Debt - GAAP $ 1,964.7 $ 2,009.6 Less: Cash and cash equivalents (138.7) (172.0) Net debt 1,826.0 1,837.6 Fair value discount - 36.7 Net debt - eliminating fair value discount $ 1,826.0 $ 1,874.3 |

|

|

Endnotes (1) See schedules A and B for reconciliations of GAAP to non-GAAP adjusted EBITDA. (2) See schedule C for reconciliation of GAAP to non-GAAP Net debt and Net debt - eliminating fair value discount. (3) In conjunction with the adoption of fresh start accounting by Dex One, an adjustment was established to record Dex One outstanding debt at fair value on the Fresh Start Reporting Date. Dex One was required to record credit facilities at a discount as a result of their fair value on the Fresh Start Reporting Date. Therefore, the carrying amount of these debt obligations was lower than the principal amount due at maturity. This fair value adjustment had been amortized as an increase to interest expense until the filing for Chapter 11 on March 18, 2013. As a result of filing for Chapter 11 and Dex One credit facilities being classified as liabilities subject to compromise at March 31, 2013, Dex One recognized the remaining unamortized fair value adjustments associated with it’s credit facilities of $31.8 million as reorganization items on the unaudited condensed consolidated statement of operations for the three months ended March 31, 2013. Therefore, Dex One credit facilities are recorded at their aggregate principal amount due at March 31, 2013. (4) Net debt represents total debt less cash and cash equivalents on the respective date. Net debt – eliminating fair value discount eliminates the fair value discount as a result of fresh start accounting described in Note 3 and represents principal amounts due at maturity. (5) SuperMedia Advertising sales is an operating measure which consists of print directories published and digital sales for the period. In order to calculate a percentage change over prior periods, adjustments have been made to the prior year’s advertising sales in an attempt to create a same store sales metric. It is important to distinguish advertising sales from operating revenue, which on our financial statements is recognized under the deferral and amortization method. (6) Dex One Advertising sales is another non-GAAP statistical measure and consist of sales of advertising in print directories distributed during the period and Internet-based products and services with respect to which such advertising first appeared publicly during the period. The year over year change in ad sales is calculated by dividing the difference between ad sales in the current period and adjusted ad sales in the prior year divided by adjusted ad sales in the prior year. Adjustments might be made to prior year’s ad sales in an attempt to create a same store sales metric. (7) Bookings is a non-GAAP statistical measure that represents sales activity associated with our print directories and Internet-based marketing solutions during the period. Bookings associated with our local customers represent signed contracts during the period. Bookings associated with our national customers represent what has been published or fulfilled during the period. The year over year change in bookings is calculated by dividing the difference between bookings in the current period and bookings generated in the prior year divided by bookings generated in the prior year. |