Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20130425.htm |

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20130425.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20130425.htm |

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20130425.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20130425.htm |

EXHIBIT 99.4

Occidental Petroleum Corporation

First Quarter 2013 Earnings Conference Call

April 25, 2013

1

First Quarter 2013 Earnings - Highlights

• Core Income - $1.4 billion in 1Q13 vs. $1.6 billion in

1Q12 or $1.5 billion in 4Q12.

1Q12 or $1.5 billion in 4Q12.

– EPS $1.69 (diluted) vs. $1.92 (diluted) in 1Q12 or $1.83 in 4Q12.

– Compared to 4Q12, current quarter results reflected higher

realized oil prices, reduced operating expenses in the oil and

gas business and higher earnings in the midstream segment,

which were offset by lower volumes in the Middle East/North

Africa, as a result of planned maintenance turnarounds, and

higher DD&A rates.

realized oil prices, reduced operating expenses in the oil and

gas business and higher earnings in the midstream segment,

which were offset by lower volumes in the Middle East/North

Africa, as a result of planned maintenance turnarounds, and

higher DD&A rates.

2

See Significant Items Affecting Earnings in the Investor Relations Supplemental Schedules

2

Variance Analysis - 1Q13 vs. 4Q12

• Higher realized oil prices and

lower operating expenses offset

by lower Middle East/North Africa

volumes and higher DD&A rates.

lower operating expenses offset

by lower Middle East/North Africa

volumes and higher DD&A rates.

• Lower sales volumes in Middle

East / North Africa, mostly due to

timing of liftings, as well as the

effects of the maintenance

turnarounds in Qatar and full cost

recovery under a contract in

Oman, reduced 1Q13 earnings by

~$200 million after tax, compared

to 4Q12.

East / North Africa, mostly due to

timing of liftings, as well as the

effects of the maintenance

turnarounds in Qatar and full cost

recovery under a contract in

Oman, reduced 1Q13 earnings by

~$200 million after tax, compared

to 4Q12.

• Costs associated with the

turnarounds, pipeline disruptions

in Colombia and other factors

further reduced our earnings by

about $30 million after tax.

turnarounds, pipeline disruptions

in Colombia and other factors

further reduced our earnings by

about $30 million after tax.

• These lower volumes and costs

reduced the oil and gas earnings

by ~$450 million on pre-tax basis.

reduced the oil and gas earnings

by ~$450 million on pre-tax basis.

($ in millions)

Core Results for

1Q13 of $1.9 B vs.

$2.5 B in 1Q12 or

$2.3 B in 4Q12.

1Q13 of $1.9 B vs.

$2.5 B in 1Q12 or

$2.3 B in 4Q12.

First Quarter 2013 Earnings - Oil & Gas Segment

3

4

• 1Q13 production costs were $13.93 per barrel,

compared with $14.99 per barrel for FY 2012.

compared with $14.99 per barrel for FY 2012.

– Lower costs were attributable to our domestic operations

where production costs were $3.37 per barrel lower in the first

quarter of 2013 from the full year of 2012, already beating our

previous guidance.

where production costs were $3.37 per barrel lower in the first

quarter of 2013 from the full year of 2012, already beating our

previous guidance.

– In our Middle East/North Africa operations, operating costs

increased about $2.50 per barrel on a sequential quarterly

basis. This increase was due to the planned maintenance

turnaround in our Qatar North Dome and South Dome fields

and to a lesser extent, the planned turnaround in Dolphin.

increased about $2.50 per barrel on a sequential quarterly

basis. This increase was due to the planned maintenance

turnaround in our Qatar North Dome and South Dome fields

and to a lesser extent, the planned turnaround in Dolphin.

First Quarter 2013 Earnings - Oil & Gas Segment

Production Costs

Production Costs

4

5

1Q13 1Q12 4Q12

• Oil and Gas Production (mboe/d) 763 755 779

• Approximately 13,000 barrels of the total sequential decrease in quarterly production

came from Qatar and Dolphin where the planned maintenance impacted production.

came from Qatar and Dolphin where the planned maintenance impacted production.

• The turnarounds were executed successfully and production has returned to normal

levels

levels

• Domestic production was 478 mboe/d, an increase of 3 mboe/d from 4Q12 and the

tenth consecutive quarterly domestic volume record for the company.

tenth consecutive quarterly domestic volume record for the company.

– Production was 5% higher than 1Q12.

– Almost all of the net sequential quarterly increase came from production in the

Permian.

Permian.

– Liquids production was flat compared to 4Q12, reflecting a drop in production in

our Long Beach operations resulting from the effect of lower spending on our

production sharing contract there, slightly lower production elsewhere in

California in the steam flood operations, offset by higher production in other

areas, mainly in the Permian and Williston.

our Long Beach operations resulting from the effect of lower spending on our

production sharing contract there, slightly lower production elsewhere in

California in the steam flood operations, offset by higher production in other

areas, mainly in the Permian and Williston.

First Quarter 2013 Earnings - Oil & Gas Segment

Production Volumes

Production Volumes

Details regarding country-specific production levels available in the IR Supplemental Schedules

5

6

• Latin America volumes were 31 mboe/d, which was 1 mboe/d

lower compared to 4Q12 and 5 mboe/d higher than 1Q12.

lower compared to 4Q12 and 5 mboe/d higher than 1Q12.

– The reduction from 4Q12 was due to a heightened level of insurgent

activity impacting production.

activity impacting production.

• In the Middle East / North Africa, volumes were 254 mboe/d,

a decrease of 18 mboe/d from 4Q12 and 20 mboe/d from 1Q12.

a decrease of 18 mboe/d from 4Q12 and 20 mboe/d from 1Q12.

– A planned maintenance turnaround in Qatar reduced production

13 mboe/d.

13 mboe/d.

– The impact of full cost recovery and other factors affecting production

sharing and similar contracts reduced 1Q13 production volumes by an

additional 5 mboe/d compared to 4Q12.

sharing and similar contracts reduced 1Q13 production volumes by an

additional 5 mboe/d compared to 4Q12.

• Middle East/North Africa sales volumes were further lower

than production volumes in the first quarter of 2013 due to

the timing of liftings.

than production volumes in the first quarter of 2013 due to

the timing of liftings.

First Quarter 2013 Earnings - Oil & Gas Segment

Production Volumes

Production Volumes

Details regarding country specific production levels available in the IR Supplemental Schedules

6

7

First Quarter 2013 Earnings - Oil & Gas Segment

1Q13 1Q12

Reported Segment Income ($mm) $1,920 $2,504

WTI Oil Price ($/bbl) $94.37 $102.93

Brent Oil Price ($/bbl) $112.64 $118.35

NYMEX Gas Price ($/mcf) $3.37 $2.83

Oxy’s Realized Prices

Worldwide Oil ($/bbl) $98.07 $107.98

-9% year-over-year

Worldwide NGLs ($/bbl) $40.27 $52.51

-23% year-over-year

US Natural Gas ($/mcf) $3.08 $2.84

+8% year-over-year

7

8

• Realized oil prices for 1Q13 represented 104% of the

average WTI price and 87% of the average Brent price.

average WTI price and 87% of the average Brent price.

• Realized NGL prices were 43% of the average WTI price

and realized domestic gas prices were 91% of the average

NYMEX price.

and realized domestic gas prices were 91% of the average

NYMEX price.

• At current global prices, a $1 per bbl change in oil prices

affects our quarterly earnings before income taxes by

$37 mm and $7 mm for a $1 per bbl change in NGL prices.

affects our quarterly earnings before income taxes by

$37 mm and $7 mm for a $1 per bbl change in NGL prices.

• A change in domestic gas prices of 50 cents per mmBTUs

affects quarterly pre-tax earnings by about $30 mm.

affects quarterly pre-tax earnings by about $30 mm.

• These price change sensitivities include the impact of

production-sharing and similar contract volume changes.

production-sharing and similar contract volume changes.

First Quarter 2013 Earnings - Oil & Gas Segment

Realized Prices

Realized Prices

8

9

• Taxes other than on income, which are generally related to

product prices, were $2.63 per boe for 1Q13, compared with

$2.39 per boe for the full year of 2012.

product prices, were $2.63 per boe for 1Q13, compared with

$2.39 per boe for the full year of 2012.

– The 2013 amount includes California greenhouse gas expense of

$0.05 per barrel.

$0.05 per barrel.

• 1Q13 exploration expense was $50 mm.

– We expect 1Q13 exploration expense to be about $100 mm for seismic

and drilling in our exploration programs.

and drilling in our exploration programs.

First Quarter 2013 Earnings - Oil & Gas Segment

Taxes, Exploration Expense and DD&A

Taxes, Exploration Expense and DD&A

9

10

* Higher energy and feedstock costs

Guidance

Variance Analysis - 1Q13 vs. 4Q12

• The sequential quarterly

decrease was due to higher

ethylene costs and increased

competitive activity, particularly

in the domestic caustic soda

markets, partially offset by

higher VCM and PVC prices.

decrease was due to higher

ethylene costs and increased

competitive activity, particularly

in the domestic caustic soda

markets, partially offset by

higher VCM and PVC prices.

• Chemical segment earnings

in 2Q13 is expected to be

~$170 mm, benefiting from

higher seasonal demand in

the construction and

agricultural market segments.

in 2Q13 is expected to be

~$170 mm, benefiting from

higher seasonal demand in

the construction and

agricultural market segments.

($ in millions)

Results in 1Q13 of $159 mm

vs. $180 mm in 4Q12 and

$184 mm in 1Q12

vs. $180 mm in 4Q12 and

$184 mm in 1Q12

First Quarter 2013 Earnings - Chemical Segment

10

11

Variance Analysis - 1Q13 vs. 4Q12

• Over 70 % of the

sequential quarterly

increase resulted from

improved marketing and

trading performance.

sequential quarterly

increase resulted from

improved marketing and

trading performance.

• The remainder of the

increase came from

improved margins in the

gas processing and power

generation businesses

and higher earnings from

foreign pipelines.

increase came from

improved margins in the

gas processing and power

generation businesses

and higher earnings from

foreign pipelines.

($ in millions)

First Quarter 2013 Earnings - Midstream Segment

Results for 1Q13 were

$215 mm vs. $75 mm

in 4Q12 and $131 mm

in 1Q12.

$215 mm vs. $75 mm

in 4Q12 and $131 mm

in 1Q12.

11

12

• The worldwide effective tax rate on core income was 38% for

the 1Q13.

the 1Q13.

– included a benefit resulting from the relinquishment of an international

exploration block.

exploration block.

• Our 4Q12 U.S. and foreign tax rates are included in the

Investor Relations Supplemental Schedules.

Investor Relations Supplemental Schedules.

• We expect our combined worldwide tax rate in 2Q13 to

increase to about 41%.

increase to about 41%.

First Quarter 2013 Earnings - Income Taxes

12

13

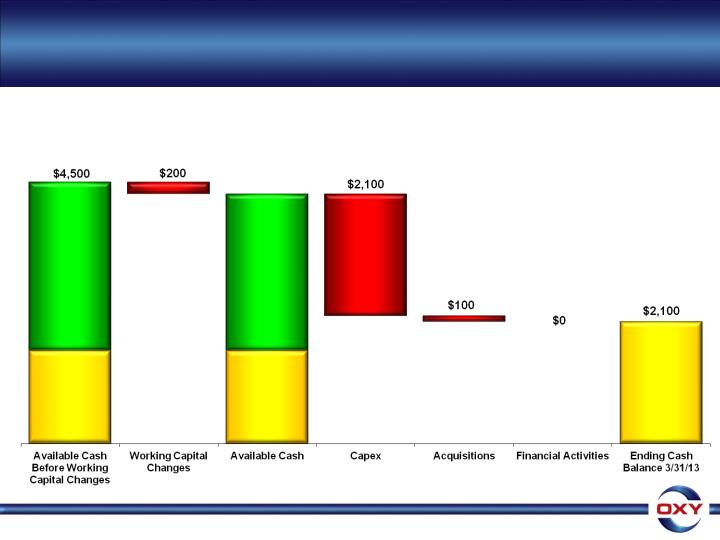

First Quarter 2013 Earnings - 2013 Cash Flow

• In 1Q13, we generated $2.9 billion of cash flow from operations before changes in

working capital. Working capital changes reduced our cash flow from operations by

approximately $200 million to $2.7 billion.

working capital. Working capital changes reduced our cash flow from operations by

approximately $200 million to $2.7 billion.

($ in millions)

Cash Flow

From

Operations

before

Working

Capital

changes

From

Operations

before

Working

Capital

changes

$2,900

Beginning

Cash $1,600

12/31/12

Cash $1,600

12/31/12

Cash Flow

From

Operations

$2,700

From

Operations

$2,700

$4,300

Beginning

Cash $1,600

12/31/12

Cash $1,600

12/31/12

13

14

• Capital expenditures for 1Q13 were $2.1 billion.

– 1Q13 capital spend was $440 million lower than 4Q12, with about half of the

decrease in the oil and gas business .

decrease in the oil and gas business .

• 1Q13 capital expenditures by segment were 80% in oil and gas,

15% in midstream and the remainder in chemicals.

15% in midstream and the remainder in chemicals.

• These and other net cash flows resulted in a $2.1 billion cash

balance at 3/31/13.

balance at 3/31/13.

First Quarter 2013 Earnings - 2013 Cash Flow

14

15

First Quarter 2013 Earnings -

Shares Outstanding, Debt/Capital, ROE & ROCE

Shares Outstanding, Debt/Capital, ROE & ROCE

Shares Outstanding (mm) 1Q13 3/31/13

Weighted Average Basic 804.7

Weighted Average Diluted 805.2

Shares Outstanding 805.6

1Q13 3/31/13

Debt / Capital 16%

Return on Equity* 13.4%

Return on Capital Employed* 11.4%

Note: Annualized; See attached GAAP reconciliation

15

16

First Quarter 2013 Earnings -

Key Performance Metrics - Production

Key Performance Metrics - Production

• Occidental’s domestic oil and gas segment produced record

volumes for the tenth consecutive quarter and continued to

execute on our liquids production growth strategy.

volumes for the tenth consecutive quarter and continued to

execute on our liquids production growth strategy.

• 1Q13 domestic production of 478 mboe/d, consisting of 342 mboe/d of liquids

and 817 mmcf/d of gas, an increase of 3 mboe/d vs. 4Q12.

and 817 mmcf/d of gas, an increase of 3 mboe/d vs. 4Q12.

Total Domestic

+23 mboe/d

production

growth

production

growth

Total Domestic Oil

Total Domestic Liquids

+20 mboe/d

production

growth

production

growth

+26 mboe/d

production

growth

production

growth

16

17

First Quarter 2013 Earnings - Capital Efficiency &

Operating Cost Reduction Program

Operating Cost Reduction Program

• We are executing a focused drilling program in our core

areas and to date we are running ahead of our full-year

objectives in our program to improve domestic operational

and capital efficiencies.

areas and to date we are running ahead of our full-year

objectives in our program to improve domestic operational

and capital efficiencies.

− For example, we have reduced both our domestic well and operating costs by

~19% relative to 2012.

~19% relative to 2012.

− This is ahead of our previously stated targets of 15% well cost improvement and

total oil and gas operating costs below $14/boe for 2013.

total oil and gas operating costs below $14/boe for 2013.

• While we are still in the early stages of this process and

making a longer-term projection is difficult, our goal is to

sustain the benefits realized to date, achieve additional

savings in our drilling costs and reach our 2011 operating

cost levels without a loss in production or sacrificing safety.

making a longer-term projection is difficult, our goal is to

sustain the benefits realized to date, achieve additional

savings in our drilling costs and reach our 2011 operating

cost levels without a loss in production or sacrificing safety.

• The purpose of these initiatives is to improve our return on

capital.

capital.

17

18

First Quarter 2013 Earnings - Capital Efficiency &

Operating Cost Reduction Program

Operating Cost Reduction Program

Production Costs ($/boe)

18

19

First Quarter 2013 Earnings - 2013 Domestic

Program

Program

• Three main objectives of 2013 domestic program.

• Delineate our core drilling areas in the Permian Basin

− Accumulated more than 1.7 million net acres covering both established

and emerging plays.

and emerging plays.

− Focused on delineating incremental opportunities in established plays

and testing potential of many emerging plays.

and testing potential of many emerging plays.

• Drive capital efficiency, particularly in our core drilling

programs.

programs.

− We believe the results of our capital efficiency improvement program are

not only scalable across our core programs but also sustainable.

not only scalable across our core programs but also sustainable.

• Enhance our cash margins through operating expense

reductions.

reductions.

19

20

First Quarter 2013 Earnings - 2013 Domestic

Program - Permian Basin

Program - Permian Basin

• Delineate our core areas in the Permian Basin

− $1.9 billion capital program to deliver growth from oil production

− ~2/3 of capital will be spent in non-CO2 business

• Expect to drill ~300 wells, 90% of which will be focused in four

plays: the Wolfberry, Yeso, Delaware sands and Wolfbone.

plays: the Wolfberry, Yeso, Delaware sands and Wolfbone.

• In addition to these four core programs, have opportunities in

several other emerging plays.

several other emerging plays.

− Plan to drill 20-25 wells in the Bone Spring, Wolfcamp and Cline across

our acreage position

our acreage position

20

21

First Quarter 2013 Earnings - 2013 Domestic

Program - Permian Basin

Program - Permian Basin

Acreage in Select Permian Plays

(Thousands of Acres)

(Thousands of Acres)

|

Delaware Basin

|

Gross

|

Oxy Share

|

|

Avalon

|

340

|

120

|

|

Bone Spring 1 Sand

|

560

|

220

|

|

Bone Spring 2 Sand

|

530

|

210

|

|

Bone Spring 3 Sand

|

420

|

140

|

|

Wolfbone

|

180

|

55

|

|

Wolfcamp Shale

|

570

|

200

|

|

Delaware Shale

|

420

|

160

|

|

Penn Shale

|

320

|

120

|

|

Wabo

|

190

|

50

|

|

Yeso

|

230

|

60

|

|

Midland Basin

|

|

|

|

Cline Shale

|

390

|

160

|

|

Wolfcamp Shale

|

425

|

150

|

|

Wolfberry

|

280

|

100

|

|

Totals

|

4,855

|

1,745

|

21

22

First Quarter 2013 Earnings - 2013 Domestic

Program - Permian Basin

Program - Permian Basin

• Wolfberry

− Solid, core play for many years and represents the largest proportion of activity.

− Mix of infill wells in already established core areas, and step out wells in emerging

play areas.

play areas.

− Expect step out wells in these emerging areas to mirror the solid results we have

seen in drilling hundreds of Wolfberry wells in the last several years.

seen in drilling hundreds of Wolfberry wells in the last several years.

• Delaware sands

− ~25% of activity in 2013; Increased opportunity to enhance economics utilizing

horizontal drilling and completions to develop established tight-sand reservoirs.

horizontal drilling and completions to develop established tight-sand reservoirs.

− Expect to drill 12 horizontal wells this year.

• Emerging Yeso play in New Mexico

− Demonstrated encouraging results; expect to increase drilling activity by 30% from

2012 levels.

2012 levels.

22

23

First Quarter 2013 Earnings - 2013 Domestic

Program - Permian Basin

Program - Permian Basin

• Emerging Wolfbone play in Reeves County, Texas

− Throughout 2012, we were able to acquire a meaningful, contiguous acreage

position. We drilled a handful of wells in 2012 and will increase our activity this

year as we further delineate our acreage position.

position. We drilled a handful of wells in 2012 and will increase our activity this

year as we further delineate our acreage position.

− Multi-pay nature, mostly vertical wells, with several horizontal wells planned in

sweet spots of the multi-pay interval.

sweet spots of the multi-pay interval.

− Early results are encouraging; 30 day IP rates average 170 - 235 boepd.

− The key to success is a low cost structure.

− Drilling for less than a year in the Wolfbone and have already seen substantial

improvements in well costs.

improvements in well costs.

− As we build infrastructure and establish a steady program, we expect to see

further progress in our costs.

further progress in our costs.

23

24

First Quarter 2013 Earnings - 2013 Domestic

Program - Drive Capital Efficiency

Program - Drive Capital Efficiency

• Drive capital efficiency, particularly in core drilling programs.

• Four elements to our overall capital efficiency strategy.

− Locking in drilling programs.

− Modifying well objectives and design.

− Improving operational execution.

− Improving our contracting strategies.

• Achieved more than a 19 percent reduction in our well costs

relative to 2012 benchmark across our domestic assets.

relative to 2012 benchmark across our domestic assets.

•

− The most important improvements were achieved in the Williston, the

Wolfberry, and shale drilling at Elk Hills where costs have dropped by

32%, 20% and 22%, respectively.

Wolfberry, and shale drilling at Elk Hills where costs have dropped by

32%, 20% and 22%, respectively.

24

25

First Quarter 2013 Earnings - 2013 Domestic

Program - Capital Efficiency

Program - Capital Efficiency

• Locking in drilling programs.

• Results in significant efficiencies.

− Fit-for-purpose drilling rigs in each core area.

− Minimize the number of drill site contractors.

− Minimize drilling and mobilization times and rig move distances.

• Reduced rig-down times by 20%.

• In the Williston, our optimized drilling schedule designed to

minimize rig mobilizations has reduced move costs by 33%.

minimize rig mobilizations has reduced move costs by 33%.

25

26

First Quarter 2013 Earnings - 2013 Domestic

Program - Capital Efficiency

Program - Capital Efficiency

• Modification of well objectives and designs.

• In our Wolfberry program:

• Two casing strings instead of three, which has saved ~$250,000 per well.

• Reduced costs by 47% per frac stage per Wolfberry well, without any

degradation in production.

degradation in production.

• At the Elk Hills shale program, running mostly slotted liners instead

of cemented liners, saving $1.5 million per well with no degradation

in production.

of cemented liners, saving $1.5 million per well with no degradation

in production.

• Reduced the amount of gel loading and resin coated sand thus

reducing completion costs.

reducing completion costs.

• Reduced drilling and completion times, and reduced and more

efficient use of materials and supplies.

efficient use of materials and supplies.

26

27

First Quarter 2013 Earnings - 2013 Domestic

Program - Capital Efficiency

Program - Capital Efficiency

• Improving operational execution.

• Numerous incremental changes in all businesses and significant

improvements in the Permian and Williston business units.

improvements in the Permian and Williston business units.

− Optimizing use of water in completion operations by using flowback and/or

produced water in stimulations, which is generating substantial savings.

produced water in stimulations, which is generating substantial savings.

• In the Williston, more of the wells we are drilling have been trouble

free, particularly due to improved directional tool reliability.

free, particularly due to improved directional tool reliability.

• Fundamental change in the way and the extent to which we use

contractors and outside consultants to manage and supervise our

drilling programs.

contractors and outside consultants to manage and supervise our

drilling programs.

− Heavier reliance on our own personnel for these tasks has already resulted in

efficiencies.

efficiencies.

27

28

First Quarter 2013 Earnings - 2013 Domestic

Program - Capital Efficiency

Program - Capital Efficiency

• Progress in the Williston, Permian and Elk Hills.

• Reduction in stimulation contract pricing and fluid hauling costs.

• Williston

− Reduced well costs from $10 million to $8.2 million currently, in the top quartile

in the play; Goal is $7.5 million per well.

in the play; Goal is $7.5 million per well.

− Focus on continuing development of our Russian Creek acreage where we plan

to drill 46 wells in 2013 concentrating on the “sweet spot” of our acreage.

to drill 46 wells in 2013 concentrating on the “sweet spot” of our acreage.

− Development will be mainly in the Middle Bakken, with other wells testing both

the Pronghorn and Three Forks formations.

the Pronghorn and Three Forks formations.

• Permian

− Wolfberry average well costs are down from $3.5 million to $2.6 million.

28

29

First Quarter 2013 Earnings - 2013 Domestic

Program - Operating Cost Reductions

Program - Operating Cost Reductions

• Enhancing cash margins through reductions in operating

costs

costs

• Additional steps specific to reducing our operating costs, especially

in the areas of downhole maintenance and workovers.

in the areas of downhole maintenance and workovers.

• Workover activity

− Eliminating inefficient workover rigs.

− Through better planning and scheduling, we are able to perform a similar number

of well servicing jobs as we did with a larger fleet.

of well servicing jobs as we did with a larger fleet.

− No production decline from these reductions.

• Repair and Maintenance activity

− More rigorous review of well repair candidates, subject to ongoing evaluations

based on market conditions.

based on market conditions.

29

30

First Quarter 2013 Earnings - 2013 Domestic

Program - Operating Cost Reductions

Program - Operating Cost Reductions

• Enhancing cash margins through reductions in operating

costs

costs

• Maintenance crews

− Evaluating and prioritizing most efficient crews.

− More direct on-location supervision, optimized scheduling and tighter controls over

spending limits and job approvals.

spending limits and job approvals.

− Reduced well intervention times and maintenance and workover costs.

• Surface operations

– Achieved efficiencies in use of chemicals, water handling and disposal

activities.

activities.

− Recycle more produced water, reducing sourcing and disposal costs and

handling water in a more environmentally conscious manner.

handling water in a more environmentally conscious manner.

− Working with suppliers to addressing the costs of supplies and services.

− Optimizing use of injectants and energy.

30

31

First Quarter 2013 Earnings - 2013 Domestic

Program - Operating Cost Reductions

Program - Operating Cost Reductions

• Enhancing cash margins through reductions in operating

costs

costs

– Compared to the 2012 levels, downhole maintenance and workover costs have

dropped 36% and surface operations by ~16%, contributing to a 19% reduction of

operating costs, on a BOE basis, across all domestic assets.

dropped 36% and surface operations by ~16%, contributing to a 19% reduction of

operating costs, on a BOE basis, across all domestic assets.

– Total domestic operating cost per barrel dropped from $17.43 per barrel in 2012 to

$14.06 per barrel in 1Q13.

$14.06 per barrel in 1Q13.

– Expect on-going efforts will yield additional improvements going forward.

– The great success we have had to date in achieving capital efficiency and operating

expense reduction goals is the result of implementing literally thousands of ideas,

suggestions and decisions being made every day mainly at the field level.

expense reduction goals is the result of implementing literally thousands of ideas,

suggestions and decisions being made every day mainly at the field level.

– Personnel at every level have stepped up to achieve previously stated goals of

achieving 15% capital efficiency gains, and so far exceeding this goal, and reducing

our annualized operating expenses by a minimum of $450MM.

achieving 15% capital efficiency gains, and so far exceeding this goal, and reducing

our annualized operating expenses by a minimum of $450MM.

31

32

First Quarter 2013 Earnings - 2013 Domestic

Program - Summary

Program - Summary

• We are still in the early stages of this process and, therefore,

our data is based on a relatively small portion of our overall

program.

our data is based on a relatively small portion of our overall

program.

• In addition, we executed a relatively trouble-free drilling

program in the first quarter.

program in the first quarter.

• Given our results to date and our people's efforts in this

endeavor, we are cautiously optimistic we can sustain and

even further improve upon the results achieved to date.

endeavor, we are cautiously optimistic we can sustain and

even further improve upon the results achieved to date.

• Overarching goal is to make sure we achieve these

improvements without in any way compromising the safety

of our operations and of our people, and without impacting

our growth plans.

improvements without in any way compromising the safety

of our operations and of our people, and without impacting

our growth plans.

32

33

First Quarter 2013 Earnings - Dividends

• In February we increased our dividend 18.5% to an annual

rate of $2.56 per share, from the previous annual rate of

$2.16 per share.

rate of $2.56 per share, from the previous annual rate of

$2.16 per share.

• We have now increased our dividend every year for 11

consecutive years, and a total of 12 times during that

period.

consecutive years, and a total of 12 times during that

period.

• This 18.5% increase brings the 11-year compounded

dividend growth rate to 16% per year.

dividend growth rate to 16% per year.

33

34

First Quarter 2013 Earnings -

2013 Production Outlook

2013 Production Outlook

• Domestically, we continue to expect solid growth in our oil

production for the year.

production for the year.

− As a result of the nature and timing of our drilling program, such as

steam flood drilling in California, we expect 2Q13 liquids growth to be

modest with higher growth rates coming in the second half of the year.

steam flood drilling in California, we expect 2Q13 liquids growth to be

modest with higher growth rates coming in the second half of the year.

− Our base gas production did not decline as much as we had initially

expected in 1Q13. Estimating the production for the rest of the year

still remains challenging.

expected in 1Q13. Estimating the production for the rest of the year

still remains challenging.

− We expect to see modest declines in our gas production as a result

of our lower drilling on gas properties and natural decline, as well as

a number of gas plant turnarounds scheduled in our Permian business

the rest of the year.

of our lower drilling on gas properties and natural decline, as well as

a number of gas plant turnarounds scheduled in our Permian business

the rest of the year.

34

35

First Quarter 2013 Earnings -

2013 Production Outlook

2013 Production Outlook

• Internationally, excluding Iraq, at current prices we expect

production to be higher in 2Q13, back to around the 4Q12

levels, with the increase coming mainly from the resumption

of production in Qatar.

production to be higher in 2Q13, back to around the 4Q12

levels, with the increase coming mainly from the resumption

of production in Qatar.

− Iraq's production is directly correlated to quarterly spending levels,

which continue to be volatile.

which continue to be volatile.

− We expect international sales volumes also to get back to around the

4Q12 levels based on our current lifting schedule.

4Q12 levels based on our current lifting schedule.

35

• 1Q13 capital spending was $2.1 billion.

• We expect the second quarter rate to be higher.

• Our annual spending levels are unchanged and

expected to be in line with the $9.6 billion program

discussed on the 4Q12 conference call.

expected to be in line with the $9.6 billion program

discussed on the 4Q12 conference call.

First Quarter 2013 Earnings -

2013 Capital Outlook

36

36

First Quarter 2013 Earnings Conference Call

Q&A

37