Attached files

| file | filename |

|---|---|

| EX-31.4 - EXHIBIT - Liberty Global, Inc. | lgi-20121231xex_314forka.htm |

| EX-31.5 - EXHIBIT - Liberty Global, Inc. | lgi-20121231xex_315forka.htm |

| EX-31.6 - EXHIBIT - Liberty Global, Inc. | lgi-20121231xex_316forka.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K/A

(Amendment No. 1)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2012 | ||

OR

Commission file number 000-51360

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Liberty Global, Inc.

(Exact name of Registrant as specified in its charter)

State of Delaware | 20-2197030 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

12300 Liberty Boulevard, Englewood, Colorado | 80112 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (303) 220-6600

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Series A Common Stock, par value $0.01 per share | NASDAQ Global Select Market | |

Series B Common Stock, par value $0.01 per share | NASDAQ Global Select Market | |

Series C Common Stock, par value $0.01 per share | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: none

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer, accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

Large Accelerated Filer þ | Accelerated Filer ¨ | Non-Accelerated Filer ¨ | Smaller Reporting Company ¨ | |||

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $12.3 billion.

The number of outstanding shares of Liberty Global, Inc.’s common stock as of February 8, 2013 was: 141,342,038 shares of Series A common stock; 10,191,436 shares of Series B common stock; and 105,261,420 shares of Series C common stock.

Liberty Global, Inc. (LGI) is filing this Amendment No. 1 on Form 10-K/A (the Form 10-K/A) to amend its Annual Report on Form 10-K for the fiscal year ended December 31, 2012 (the Form 10-K), which was filed with the Securities and Exchange Commission (the SEC) on February 13, 2013. The purpose of this Form 10-K/A is to disclose the information required in Part III, Items 10 through 14 of the Form 10-K. Accordingly, LGI hereby amends and replaces in their entirety Items 10 through 14 of the Form 10-K. In addition, as required by Rule 12b-15, LGI’s principal executive officer, principal financial officer and principal accounting officer are providing Rule 13a-14(a)/15(d)-14(a) certifications. Accordingly, LGI is also amending Item 15 of the Form 10-K to include such currently dated certifications as Exhibits.

Except as described above, this Form 10-K/A does not amend, update or change any other items or disclosures in the Form 10-K, including any of the financial information disclosed in Parts II and IV of the Form 10-K.

In the following text, the terms, “we,” “our,” “our company” and “us” may refer, as the context requires, to LGI or collectively to LGI and its subsidiaries.

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

Our board of directors currently consists of 11 directors, divided among three classes. Directors in each class serve staggered three-year terms. Our Class I directors, whose term will expire at the annual meeting of our stockholders in the year 2015, are John P. Cole, Jr., Richard R. Green and David E. Rapley. Our Class II directors, whose term will expire at the annual meeting of our stockholders in the year 2013, are Miranda Curtis, John W. Dick, J.C. Sparkman and J. David Wargo. Our Class III directors, whose term will expire at the annual meeting of our stockholders in the year 2014, are Michael T. Fries, Paul A. Gould, John C. Malone and Larry E. Romrell. If any director should become unable to serve as a director of our company for any reason before re-election, a substitute nominee will be designated by our board of directors.

Below is the biographical information with respect to the 11 directors of our company, including the age of each person, the positions with our company or principal occupation of each person, individual skills and experiences, certain other directorships held and the year each person became a director of our company. The number of shares of our common stock beneficially owned by each director, as of March 31, 2013, is set forth in Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters—Security Ownership of Management. As indicated in the biographies, our board believes the skills and experiences of each of our directors qualify them to serve as one of our directors.

John P. Cole, Jr., 83, has served as a director of LGI since June 2005 and is a member of the compensation and nominating and corporate governance committees of our board. He was a director of UnitedGlobalCom, Inc., and its predecessors (UGC), from March 1998 until UGC's business combination with our predecessor, LGI International, Inc. (LGI International). From February 1999 to September 2003, he was also a member of the supervisory board of UGC's publicly held subsidiary, United Pan-Europe Communications NV (UPC). His prior public company board experience also includes serving as a director of Century Communications Corp., at the time a large United States (U.S.) multiple cable system operator, from October 1997 to October 1999 when it was acquired by another corporation.

Mr. Cole has over 40 years of experience in U.S. legal/regulatory and government affairs. In 1966, he co-founded the Washington, D.C. law firm of Cole, Raywid and Braverman LLP, which specialized in all aspects of communications and media law. As a senior partner in the firm, Mr. Cole focused his legal expertise in the area of cable television regulation. Mr. Cole retired as a partner in 2007 following his firm's merger with the law firm of Davis Wright Tremaine LLP. Mr. Cole is a graduate of Auburn University (B.S. Industrial Management) and George Washington University School of Law.

Mr. Cole's significant executive and legal experience as a founder and long-time senior partner of a law firm, his more than 10 years of service as a director or supervisory board member of U.S. and international cable television companies and his particular knowledge and experience in cable television regulation contribute to our board's consideration of legal and regulatory developments and risks in the countries in which we operate and strengthen our board's collective qualifications, skills and attributes.

Miranda Curtis, 57, has served as a director of LGI since June 2010 and is a member of the succession planning committee of our board. Until March 31, 2010, Ms. Curtis was the President of our Liberty Global Japan division. She served as Senior Vice President of our predecessor, LGI International, and President of its Asia division from March 2004 to June 2005.

Ms. Curtis has over 30 years of experience in the international media and telecommunications industry, starting with the international distribution of programming for the BBC before moving to the United Kingdom (U.K.) cable industry. She joined

III-1

the predecessor of our subsidiary, Liberty Media International Holdings, LLC (LMINT), in 1992 when it was formed as the international division of Tele-Communications, Inc. (TCI). Thereafter, she assumed executive positions of increasing responsibility at this company, with a primary focus on business development and the management of complex international distribution and content joint ventures. As Executive Vice President (1996 – 1999) and then President (1999 – 2004) of LMINT, she oversaw all cable and programming investments of TCI and subsequently the company then known as Liberty Media Corporation (now known as Liberty Interactive Corporation) (LIC) in Japan, the U.K. and Continental Europe. She was responsible for the negotiation, oversight and management of the joint venture with Sumitomo Corporation that led to the formation of Jupiter Telecommunications Co., Ltd. (J:COM), the largest multiple cable system operator in Japan, and Jupiter TV Co., Ltd., a leading provider of content services to the Japanese cable and satellite industries, as well as other content ventures in Europe and Asia. Ms. Curtis' employment with our company terminated following the sale of substantially all of our investments in Japan in February 2010.

Ms. Curtis' public company board experiences include serving as a non-executive director of Telewest Communications plc (1998 – 2002), at the time the second largest multiple cable system operator in the U.K., Flextech plc (1998 – 2000), at the time a leading supplier of basic tier channels to the U.K. pay television market, J:COM (2005 – March 2010), and National Express Group plc, an international public transport group (2008 – 2011). She was also a member of the compensation committee for each of Telewest Communications plc and J:COM. Currently, she is a director of the U.K. public company Marks & Spencer plc, a retailer of clothing and home products, and chairman of the board of Waterstones Booksellers Ltd, a book retailer. She is also a member of the Board of Governors of the Institute for Government, a non-profit organization in the U.K. working to increase government effectiveness, and is involved in a number of philanthropic organiations. She is a graduate of the University of Durham, England.

Ms. Curtis' significant business and executive background in the media and telecommunication industries and her particular knowledge of, and experience with all aspects of international cable television operations and content distribution contribute to our board's consideration of operational developments and strategies and strengthen our board's collective qualifications, skills and attributes.

John W. Dick, 75, has served as a director of LGI since June 2005 and is a member of the audit and the nominating and corporate governance committees of our board. He was a director of UGC from March 2003 until UGC's business combination with our predecessor, LGI International. Prior to that, he was a member of the supervisory board of UGC's publicly held subsidiary, UPC, from May 2001 to September 2003. Mr. Dick has over 40 years of experience as a founder, director and chairman of public and private companies in a variety of industries, including real estate, automotive, telecommunications, oil exploration and international shipping based in a number of countries and regions, including the U.S., Canada, Europe, Australia, Russia, China and Africa.

Currently, Mr. Dick serves as a director and non-executive chairman of the board of O3B Networks Ltd., a private company which is building a new fiber-quality, satellite-based, global internet backbone connecting telecommunications operators and internet service providers in emerging markets with the networks of developed countries. He also served as a director of Austar United Communications Ltd., then an Australian public company (Austar) and one of our subsidiaries from 2002 until its sale in 2012. In addition, Mr. Dick was a director and non-executive chairman of the board of Terracom Broadband, a private company that developed and operated a fiber-based internet network and a digital cellular network in Rwanda, and following its purchase by Terracom Broadband, of Rwandatel, the incumbent telephone company in Rwanda, until the sale of these companies in 2007. From 1984 to December 2007, he was a director and non-executive chairman of the board of Hooper Industries Group, a privately held U.K. group consisting of: Hooper and Co (Coachbuilders) Ltd. (building special bodied Rolls Royce and Bentley motorcars), Hooper Industries (China) (providing industrial products and components to Europe and the U.S.) and, until 2002, MetroCab UK (manufacturing London taxicabs) and Moscab (a joint venture with the Moscow city government to produce Metrocabs for Russia). Mr. Dick is a graduate of Wheaton College, Illinois (B.A. Political Science and Economics) and University of Toronto School of Law.

Mr. Dick's extensive business background in a variety of industries and countries and his particular knowledge as an experienced board member of various entities that have evaluated and developed business opportunities in international markets contributes to our board's consideration of strategic options and strengthen our board's collective qualifications, skills and attributes.

Michael T. Fries, 50, has served as President, Chief Executive Officer and Vice Chairman of the Board of LGI since June 2005. He was Chief Executive Officer of UGC from January 2004 until the businesses of UGC and LGI International were combined under LGI.

Mr. Fries has over 25 years of experience in the cable and media industry, starting with the investment banking division of PaineWebber Incorporated where he specialized in domestic and international transactions for media companies before joining the management team of UGC's predecessor in 1990 shortly after its formation. As Senior Vice President, Business Development of UGC's predecessor from 1990 to 1995, Mr. Fries was responsible for managing its global acquisitions and new business development functions, which included investing in, acquiring or launching multichannel distribution or programming businesses

III-2

in over 20 countries around the world. From 1995 to 1998, he was President of the Asia/Pacific division and, among other duties, managed the formation and operational launch of Austar's business and subsequent flotation of its stock. He was promoted to President and Chief Operating Officer in 1998 and Chief Executive Officer of UGC in 2004. During this period, he oversaw UGC's growth across all business units and geographic territories into a leading international broadband communications provider. He also managed UGC's financial and strategic initiatives, including various transactions with LIC, then known as Liberty Media Corporation, and LGI International from 1998 to 2005 that led up to and culminated in the formation of LGI.

In addition to serving as a director of UGC and its predecessor from 1999 to 2005, Mr. Fries was Chairman of the supervisory boards of two of its publicly held European subsidiaries, UPC (1998 – 2003) and Priority Telecom NV (2002 – 2006). He also served as executive chairman of Austar from 1999 until 2003 and thereafter as non-executive chairman of Austar until its sale in 2012. Mr. Fries is a director of Cable Television Laboratories, Inc., a non-profit cable television industry research and development consortium (CableLabs®), The Cable Center, the non-profit educational arm of the U.S. cable industry, and various other non-profit and privately held corporate organizations. He serves as the Telecom Governor of the World Economic Forum. Mr. Fries received his B.A. from Wesleyan University (where he is a member of the President's Advisory Council) and his M.B.A. from Columbia University.

Mr. Fries' significant executive experience building and managing international distribution and programming businesses, in-depth knowledge of all aspects of our current global business and responsibility for setting the strategic, financial and operational direction for our company contribute an insider's perspective to our board's consideration of the strategic, operational and financial challenges and opportunities of our business, and strengthen our board's collective qualifications, skills and attributes.

Paul A. Gould, 67, has served as a director of LGI since June 2005 and is the chair of the audit committee and a member of the nominating and corporate governance and the succession planning committees of our board. He was a director of UGC from January 2004 until UGC's business combination with our predecessor, LGI International.

Mr. Gould has nearly 40 years of experience in the investment banking industry. He is a Managing Director of Allen & Company, LLC, a position that he has held for more than the last five years, and is a senior member of Allen & Company's mergers and acquisitions advisory practice. In that capacity, he has served as a financial advisor to many Fortune 500 companies, principally in the media and entertainment industries. Mr. Gould joined Allen & Company in 1972. In 1975, he established Allen Investment Management, which manages capital for endowments, pension funds and family offices.

Mr. Gould is also an experienced board member, having served on the boards of several public companies, including DIRECTV (2009 – 2010), LIC (and its predecessor) (2001 – 2009), Discovery Holding Company (2005 – 2009), The DirecTV Group, Inc. (2009), On Command Corporation (2002 – 2003) and Sunburst Hospitality Corporation (1996 – 2001). Currently, he is a director of Ampco-Pittsburgh Corporation, Discovery Communications, Inc. and the private company O3B Networks Limited. His committee experience includes audit, executive, compensation, corporate governance and investment. In addition, Mr. Gould serves on the board of trustees of Cornell University, where he is a member of its executive committee and chair of its investment committee; serves as an overseer for Weill Cornell Medical College and serves on the boards of the Wildlife Conservation Society, where he is the chair of its investment committee, and the New School University. He is also a member of the advisory committee to the International Monetary Fund's investment committee. He attended Cornell University and received his B.S. (Biochemistry) from Fairleigh Dickinson University.

Mr. Gould's extensive background in investment banking and as a public company board member and his particular knowledge and experience as a financial advisor for mergers and acquisitions and in accounting, finance and capital markets contribute to our board's evaluation of acquisition, divestiture and financing opportunities and strategies and consideration of our capital structure, budgets and business plans, provide insight into other public company board practices and strengthen our board's collective qualifications, skills and attributes.

Richard R. Green, 75, has served as a director of LGI since December 2008 and is a member of the nominating and corporate governance committee of our board. For over 20 years, Mr. Green served as President and Chief Executive Officer of CableLabs® before retiring in December 2009. While at CableLabs®, Mr. Green oversaw the development of DOCSIS technology, the establishment of common specifications for digital voice and the deployment of interactive television, among other technologies for the cable industry. Prior to joining CableLabs®, he was a Senior Vice President at PBS (1984 – 1988), where he was instrumental in establishing PBS as a leader in high definition television and digital audio transmission technology, and served as a Director of CBS's Advanced Television Technology Laboratory (1980 – 1983), where he managed and produced the first high definition television programs in December 1981, among other accomplishments. Mr. Green is the author of over 55 technical papers on a variety of topics. In 2012, Mr. Green received the Charles F. Jenkins Lifetime Achievement Award from the Academy of Television Arts & Sciences for the Primetime Emmy Engineering Awards.

Mr. Green is a director of Shaw Communications, Inc. (Shaw), a telecommunications company based in Canada, where he is also a member of the human resources and compensation committee, and a director of Jones/NCTI, a Jones Knowledge Company, which is a workforce performance solutions company for individuals and broadband companies. He is also a member of the board

III-3

of directors of several non-profit institutions, including the Space Sciences Institute, and he serves as an honorary board member of The Cable Center. In addition, he is a member of the Federal Communications Commission's Technical Advisory Council, a fellow of the Society of Motion Picture and Television Engineers, a senior fellow of Silicon Flatirons, a center for law, technology and entrepreneurship at the University of Colorado, and an adjunct professor at such University and is affiliated with the University of Denver. He previously was a member of the International Telecommunication Union, a United Nations consultative committee charged with the responsibility for recommending worldwide standards for advanced television services and past Chairman of Study Group 9 of such committee. Mr. Green received his B.S. (Physics) from Colorado College, his M.S. (Physics) from the State University of New York and a Ph.D. from the University of Washington, where he specialized in astrophysics.

Mr. Green's extensive professional and executive background and his particular knowledge and experience in the complex and rapidly changing field of technology for broadband communications services contribute to our board's evaluation of technological initiatives and challenges and strengthen our board's collective qualifications, skills and attributes.

John C. Malone, 72, has served as Chairman of the Board and a director of LGI since its inception and is a member of the executive and the succession planning committees of our board. He was President, Chief Executive Officer and Chairman of the Board of our predecessor, LGI International, from March 2004 to June 2005. Mr. Malone has served as a director of UGC and its predecessors since November 1999.

Mr. Malone is an experienced business executive, having served as the Chief Executive Officer of TCI for over 25 years until its acquisition by AT&T Corporation in 1999. During that period, he successfully led TCI as it grew through acquisitions and construction into the largest multiple cable system operator in the U.S., invested in and nurtured the development of unique cable television programming, including the Discovery Channel, QVC and Starz/Encore, expanded through joint ventures into international cable operations in the U.K. (Telewest Communications plc), Japan (J:COM) and other countries, and invested in new technologies, including high speed internet, alternative telephony providers, wireless personal communications services and direct-to-home satellite.

Currently Mr. Malone is chairman of the board and a director of Liberty Media Corporation (formerly named Liberty Spinco, Inc.) (LMC), which owns interests in a broad range of media, communications and entertainment businesses, and of LIC, which owns interests in a broad range of video and online commerce businesses. He has held these positions with LMC, LIC and their predecessor companies since 1990 and was also Chief Executive Officer of LIC (then known as Liberty Media Corporation) from August 2005 to February 2006. His other public directorships currently include Discovery Communications, Inc., Expedia, Inc. and Sirius XM Radio, Inc. Mr. Malone has also been a director of Ascent Capital Group, Inc. (2010 – 2012), Live Nation Entertainment, Inc., where he was also interim chairman of the board (2010 – 2011), DIRECTV, where he was also chairman of the board (2009 – 2010), IAC/InterActiveCorp. (2006 – 2010), Discovery Holding Company (2005 – 2008), The DirecTV Group, Inc. (2008 – 2009) and The Bank of New York Company, Inc. (2005 – 2007).

Mr. Malone serves on the boards of several non-profit companies, including the CATO Institute. He is chairman emeritus of CableLabs®, and honorary board member of The Cable Center, and served as director of the National Cable Television Association from 1974 to 1977 and 1980 to 1993. Mr. Malone holds a bachelor's degree in electrical engineering and economics from Yale University and a master's degree in industrial management and a Ph.D. in operations research from Johns Hopkins University.

Mr. Malone's proven business acumen as a long time chief executive of large, complex organizations and his extensive knowledge and experience in the cable television, telecommunications, media and programming industries are a valuable resource to our board in evaluating the challenges and opportunities of our global business and our strategic planning and strengthen our board's collective qualifications, skills and attributes.

David E. Rapley, 71, has served as a director of LGI since June 2005 and is the chair of the nominating and corporate governance committee and a member of the succession planning committee of our board. He was a director of our predecessor, LGI International, from May 2004 to June 2005.

Mr. Rapley has over 30 years of experience as a founder, executive, manager and as a director of various engineering firms. He founded Rapley Engineering in 1985 and, as its President and Chief Executive Officer, oversaw its development into a full service engineering firm at the time of its sale to VECO Corporation in 1998. Following the sale, Mr. Rapley served as Executive Vice President, Engineering of VECO, an Alaska-based firm providing engineering, design, construction and project management services to the energy, chemical and process industries domestically and internationally, until his retirement in December 2001. Currently, Mr. Rapley is a director of Merrick & Co., a private firm providing engineering and other services to domestic and international clients, and was its Vice Chairman until December 2011. From 2008 to 2011, Mr. Rapley was also chairman of the board of Merrick Canada ULC. Mr. Rapley has authored technical papers on engineering processes and computer systems. He is a graduate of Hendon College of Technology (England), with a degree in mechanical engineering.

III-4

Mr. Rapley is also a director of LMC and of LIC. He has been a director of LMC, LIC and their predecessors since 2002. He currently serves on LMC's compensation committee and is the chairman of its nominating and governance committee, and he currently serves on LIC's audit committee and its compensation committee and is the chairman of its nominating and governance committee.

Mr. Rapley's significant professional and business background as an engineer, entrepreneur and executive contributes to our board's consideration of technological initiatives and challenges and strengthens our board's collective qualifications, skills and attributes.

Larry E. Romrell, 73, has served as a director of LGI since June 2005 and is a member of the compensation and nominating and corporate governance committees of our board. He was a director of our predecessor, LGI International, from May 2004 to June 2005. Mr. Romrell has over 30 years of experience in the telecommunications industry. He was an Executive Vice President of TCI from January 1994 to March 1999, when it was acquired by AT&T Corporation, and a Senior Vice President of TCI from 1991 to 1994. Prior to becoming an executive officer at TCI, Mr. Romrell was President and Chief Executive Officer of WestMarc Communications, Inc., a subsidiary of TCI engaged in the cable television and common carrier microwave communications businesses, and held various executive positions with that company (formerly known as Western Tele-Communications, Inc.) for almost 20 years, including when it was a separate public company. As an executive at TCI, Mr. Romrell oversaw TCI's investments in and development of companies engaged in other telecommunications businesses, including At Home Corporation (@Home), a provider of high speed multimedia internet services, and Teleport Communications Group Inc. (TCG), a competitive local exchange carrier.

Mr. Romrell is an experienced public company board member, having served on the boards of Ascent Capital Group, Inc.'s predecessor (2000 – 2003), TV Guide, Inc. (and predecessor) (1996 – 2000), Arris Group, Inc. (2000 – 2003), General Communication Inc. (1980 – 2001), as well as @Home and TCG. He currently is a director of LMC and LIC, positions he has held with LMC, LIC and their predecessors since 2001, and serves on the audit and nominating and governance committees of each of LMC's and LIC's boards. Formerly, he was a member of the compensation committee of LIC's board. Mr. Romrell is involved in numerous philanthropic activities. Mr. Romrell's extensive business background and his particular knowledge and experience in telecommunications technology and board practices of other public companies contribute to our board's consideration of operational and technological developments and strategies, provide insight into other public company board practices and strengthen our board's collective qualifications, skills and attributes.

J.C. Sparkman, 80, has served as a director of LGI since June 2005 and is the chair of the compensation committee and a member of the nominating and corporate governance and the succession planning committees of our board. He was a director of our predecessor, LGI International, from November 2004 to June 2005. Mr. Sparkman has over 30 years of experience in the cable television industry. He was Executive Vice President and Chief Operating Officer of TCI for eight years until his retirement in 1995. During his over 26 years with TCI, he held various management positions of increasing responsibility, overseeing TCI's cable operations as that company grew through acquisitions, construction of new networks and expansion of existing networks into the largest multiple cable system operator in the U.S. at the time of his retirement. In September 1999, he co-founded Broadband Services, Inc., a provider of asset management, logistics, installation and repair services for telecommunications service providers and equipment manufacturers domestically and internationally. He served as chairman of the board and Co-Chief Executive Officer of Broadband Services until December 2003.

Mr. Sparkman is an experienced public company board member. Since 1994, he has been a director of Shaw, and he is a member of the executive and human resources and compensation committees of Shaw's board. He is also a director and member of the compensation committee of Universal Electronics, Inc., a global leader in wireless control technology.

Mr. Sparkman's significant background as an executive and board member and his particular knowledge of, and experience with, all aspects of cable television operations contribute to our board's consideration of operational developments and strategies, provide insight into other public company board practices and strengthen our board's collective qualifications, skills and attributes.

J. David Wargo, 59, has served as a director of LGI since June 2005 and is a member of the audit and nominating and corporate governance committees of our board. He was a director of our predecessor, LGI International, from May 2004 to June 2005. Mr. Wargo has over 30 years of experience in investment research, analysis and management. He is the founder and President of Wargo & Company, Inc., a private company specializing in investing in the communications industry since 1993. Mr. Wargo is a co-founder and was a member of New Mountain Capital, LLC from 2000 to 2008. Prior to starting Wargo & Company, he was a managing director and senior analyst of The Putnam Companies (1989 – 1992), senior vice president and a partner in Marble Arch Partners (1985 – 1989) and senior analyst and a partner in State Street Research and Management Company (1978 – 1985). Mr. Wargo received his B.S. (Physics) and M.S. (Nuclear Engineering) from Massachusetts Institute of Technology and an M.B.A. from M.I.T.'s Sloan School of Management.

III-5

Mr. Wargo is also an experienced board member, having served on the boards of several public companies, including Discovery Holding Company (2005 – 2008), Fun Technologies Inc. (2007 – 2008), OpenTV Corp. (2002 – 2007), On Command Corporation (1998 – 2003), Gemstar-TV Guide International, Inc. (2000 – 2001) and TV Guide, Inc. (and predecessor) (1996 – 2000). He currently is a director of Discovery Communications, Inc., where he is also a member of the audit committee and chair of the nominating and corporate governance committee, and of Strayer Education, Inc., where he is chairman of the audit committee. His previous committee experience includes audit, compensation and corporate governance committees.

Mr. Wargo's extensive background in investment analysis and management and as a public company board member and his particular knowledge of, and experience with, finance and capital markets contribute to our board's consideration of our capital structure and evaluation of investment and financial opportunities and strategies, provide insight into other public company board practices and strengthen our board's collective qualifications, skills and attributes.

Executive Officers

Below are the executive officers of our company, their ages and a description of their business experience, including positions held with LGI.

Charles H.R. Bracken, 46, has served as an Executive Vice President since January 2012 and Co-Chief Financial Officer (Principal Financial Officer) since June 2005. From April 2005 to January 2012, Mr. Bracken served as a Senior Vice President. In addition, Mr. Bracken has served as a Co-Chief Financial Officer of UGC since February 2004 and is an officer of various other subsidiaries of LGI. He also served as the Chief Financial Officer of UGC Europe, Inc., now known as Liberty Global Europe, Inc., and its predecessors from November 1999 to June 2005. Mr. Bracken is a director of our subsidiary Telenet Group Holding NV, a Belgian public limited liability company (Telenet).

Bernard G. Dvorak, 53, has served as an Executive Vice President since January 2012 and Co-Chief Financial Officer (Principal Accounting Officer) since June 2005. From April 2005 to January 2012, Mr. Dvorak served as a Senior Vice President. In addition, Mr. Dvorak has served as an officer of various subsidiaries of LGI, including LGI International, since March 2004.

Michael T. Fries, 50, has served as our President, Chief Executive Officer and Vice Chairman of the Board of LGI since June 2005. Mr. Fries served as Chief Executive Officer of UGC from January 2004 to June 2005. Mr. Fries has served as a director of UGC and its predecessors since November 1999 and as President of UGC and its predecessors since September 1998. Mr. Fries has served in an executive capacity at LGI, UGC and its predecessors for over 20 years. For additional information on Mr. Fries' experience, see also —Directors above.

Bryan H. Hall, 50, has served as an Executive Vice President, General Counsel and Secretary since January 2012. Prior to joining LGI, Mr. Hall served as secretary and general counsel of Virgin Media Inc. from June 2004 until January 2011. While at Virgin Media Inc., Mr. Hall was responsible for all legal affairs affecting Virgin Media Inc., as well as matters concerning regulatory, competition, government affairs and media relations issues. From September 2000 to June 2004, Mr. Hall was a partner in the corporate department of the law firm Fried, Frank, Harris, Shriver & Jacobson LLP in New York, specializing in public and private acquisitions and acquisition financings.

Diederik Karsten, 56, has served as an Executive Vice President, European Broadband Operations, since January 2012. During 2011, Mr. Karsten served as Managing Director, European Broadband Operations. Mr. Karsten served as Managing Director, UPC Nederland BV, a subsidiary of Liberty Global Europe Holding BV (Liberty Global Europe) and its predecessors, from July 2004 to December 2010, where he was responsible for our broadband operations in the Netherlands. Prior to joining a predecessor of Liberty Global Europe, he served as chief executive officer of KPN Mobile, overseeing mobile telephony operations in the Netherlands, Germany, Belgium and other countries. Mr. Karsten is a director of Telenet.

John C. Malone, 72, has served as our Chairman of the Board and a director of LGI since inception. Mr. Malone served as President, Chief Executive Officer and Chairman of the Board of LGI International from March 2004 to June 2005, and as a director thereof since March 2004. Mr. Malone has served as a director of UGC and its predecessors since November 1999. Mr. Malone has served as chairman of the board and a director of LMC, LIC and their predecessors, since 1990 and Chief Executive Officer of LIC (then known as Liberty Media Corporation) from August 2005 to February 2006. Mr. Malone is also a director of Discovery Communications, Inc., Sirius XM Radio Inc., and Expedia, Inc. For additional information on Mr. Malone's experience, see also —Directors above.

Balan Nair, 47, has served as an Executive Vice President since January 2012 and our Chief Technology Officer since July 2007. From July 2007 to January 2012, he served as a Senior Vice President. Prior to joining our company, Mr. Nair served as Chief Technology Officer and Executive Vice President for AOL LLC, a global web services company, from 2006. Prior to his role at AOL LLC, Mr. Nair spent more than five years at Qwest Communications International Inc., most recently as Chief Information Officer and Chief Technology Officer. Mr. Nair is a director of Telenet and Adtran, Inc.

III-6

The executive officers named above will serve in such capacities until their respective successors have been duly elected and have been qualified or until their earlier death, resignation, disqualification or removal from office. There are no family relationships between any of our directors and executive officers, by blood, marriage or adoption.

Involvement in Certain Proceedings

During the past 10 years, none of our directors or executive officers was convicted in a criminal proceeding (excluding traffic violations or other minor offenses) or was a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement or were subsequently reversed, suspended or vacated) that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, laws respecting financial institutions or insurance companies, or laws prohibiting fraud, or was a party in any proceeding adverse to our company.

Except as stated below, during the past 10 years, none of our directors or executive officers has had any involvement in such legal proceedings as would be material to an evaluation of his or her ability or integrity.

On January 12, 2004, UGC's predecessor (Old UGC) filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code with the U.S. Bankruptcy Court for the Southern District of New York. On November 10, 2004, the U.S. Bankruptcy Court confirmed Old UGC's pre-negotiated plan of reorganization with UGC and IDT United LLC (in which UGC had an approximate 94% fully diluted interest and 33% common equity interest), which included the terms for restructuring of Old UGC's outstanding 10.75% Senior Discount Notes. Old UGC and IDT United owned all but approximately $25,000,000 or 2% of such Notes. Old UGC emerged from the Chapter 11 proceedings on November 18, 2004. Until August 2003, Mr. Fries was the President of Old UGC.

On December 3, 2002, UGC's indirect subsidiary UPC, which later merged into our subsidiary Liberty Global Europe, filed a voluntary petition for reorganization under Chapter 11 of the United States Bankruptcy Code, together with a pre-negotiated plan of reorganization, in the United States District Court of the Southern District of New York. In conjunction with such filing, also on December 3, 2002, UPC commenced a moratorium of payments in the Netherlands under Dutch bankruptcy law with the filing of a proposed plan of compulsory composition or the “Akkoord” with the Amsterdam Court (Rechtbank) under the Dutch Faillissementswet. These actions were completed on September 3, 2003, when LG Europe acquired more than 99% of the stock of, and became a successor issuer to, UPC. Messrs. Fries, Cole and Dick were members of UPC's supervisory board.

On March 29, 2002, United Australia/Pacific, Inc. (UAP), then a subsidiary of UGC, filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the United States District Court for the Southern District of New York. UAP's reorganization closed on June 27, 2003, and UAP has since dissolved. Until February 11, 2002, Mr. Fries was a director and the President of UAP.

On March 28, 2001, an involuntary petition under Chapter 7 of the U.S. Bankruptcy Code was filed against Formus Communications, Inc. in the U.S. Bankruptcy Court for the District of Colorado. Such bankruptcy action was subsequently converted to a reorganization under Chapter 11 and closed on January 19, 2005. Mr. Dvorak was a director and Chief Executive Officer of Formus Communications, Inc. from September 2000 until June 2002.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the Exchange Act), requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% stockholders are required by SEC regulation to furnish us with copies of all Section 16 forms they file.

Based solely on a review of the copies of the Forms 3, 4 and 5 and amendments to those forms furnished to us with respect to our most recent fiscal year, or representations that no Forms 5 were required, we believe that all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were complied with during the year ended December 31, 2012.

Code of Business Conduct and Code of Ethics

We have adopted a code of business conduct that applies to all of our employees, directors and officers. In addition, we have adopted a code of ethics for our chief executive and senior financial officers, which constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 (the Sarbanes-Oxley Act). Both codes are available on our website at www.lgi.com.

III-7

Nominating and Corporate Governance Committee

Our board of directors has established a nominating and corporate governance committee, whose members are John P. Cole, Jr., John W. Dick, Paul A. Gould, Richard R. Green, David E. Rapley (chairman), Larry E. Romrell, J.C. Sparkman and J. David Wargo. See Item 13. Certain Relationships and Related Transactions and Director Independence—Director Independence below. The nominating and corporate governance committee identifies and recommends persons as nominees to our board of directors. The procedures by which our stockholders may recommend nominees to our board of directors is set out in our last proxy statement.

Audit Committee

Our board of directors has established an audit committee, whose members are John W. Dick, Paul A. Gould (chairman) and J. David Wargo. Our board of directors has determined that Messrs. Gould, Dick and Wargo are independent, as independence for audit committee members is defined in the Nasdaq Stock Market rules as well as the rules and regulations adopted by the SEC relating to independence of audit committee members. In addition, our board of directors has determined that more than one member of the committee, including its chairman, Mr. Gould, qualifies as an “audit committee financial expert” under applicable SEC rules and regulations. A description of their respective experiences is set forth under Directors above.

Item 11. EXECUTIVE COMPENSATION

We are an international provider of video, broadband internet and telephony services, with consolidated operations at December 31, 2012, serving 19.8 million customers across 13 countries, primarily in Europe and Chile. These customers subscribed to 34.8 million services, consisting of 18.3 million video, 9.2 million broadband internet and 7.3 million telephony service subscriptions. Our businesses operate in an environment marked by intense competition, extensive regulation and rapid technological change. We place great importance on our ability to attract, retain, motivate and reward talented executives who, faced with these challenges, can execute our strategy to drive stockholder value through strong organic growth, accretive mergers and acquisitions and prudent capital structure management.

In this section, we provide information and a discussion and analysis relating to the compensation of Michael T. Fries, our chief executive officer or CEO; Charles H.R. Bracken, our principal financial officer; and our three other most highly compensated executive officers at the end of 2012: Bernard G. Dvorak, our principal accounting officer, Diederik Karsten, our executive vice president, European Broadband Operations, and Balan Nair, our chief technology officer. We refer to these five individuals as our named executive officers or NEOs.

Compensation Discussion and Analysis

Overview of Compensation Process

The compensation committee of our board of directors was established for the purposes of assisting our board in discharging its duties relating to compensation of our executive officers and of administering our incentive plans. In furtherance of its purposes, our compensation committee is responsible for identifying our primary goals with respect to executive compensation, implementing compensation programs designed to achieve those goals, subject to appropriate safeguards to avoid unnecessary risk taking, and monitoring performance against those goals and associated risks. The chair of our compensation committee reports to our board of directors on annual compensation decisions and on the administration of existing programs and development of new programs. The members of our compensation committee are “independent directors” (as defined under the Nasdaq Stock Market rules), “non-employee directors” (as defined in Rule 16b-3 of the SEC's rules under the Exchange Act) and “outside directors” (as defined in Section 162(m) (Section 162(m)) of the Internal Revenue Code of 1986 and the regulations and interpretations promulgated thereunder (the Code)).

All compensation decisions with respect to our executive officers, including our NEOs, are made by our compensation committee. Decisions with respect to our CEO's compensation are made in private sessions of the committee without the presence of management. Our CEO is actively engaged in compensation decisions for our other members of senior management in a variety of ways, including recommending annual salary increases, annual performance goals and the level of target and/or maximum performance awards for his executive team and evaluating their performance. With the assistance of our Human Resources and Legal Departments, he is also involved in formulating the terms of proposed performance or incentive award programs for consideration by the compensation committee, evaluating alternatives and recommending revisions. Other senior officers, within the scope of their job responsibilities, participate in gathering and presenting to the compensation committee for its consideration data and legal, tax and accounting analyses relevant to compensation and benefit decisions.

In making its compensation decisions, the compensation committee ultimately relies on the general business and industry knowledge and experience of its members and the committee's own evaluation of company and NEO performance. From time to time, however, the committee will retain a compensation consultant to assist it in evaluating proposed changes in compensation

III-8

programs or levels of compensation and to provide comparative data. At our 2011 annual stockholders meeting, stockholders representing 90% of our shares entitled to vote and present at such meeting approved, on an advisory basis, the compensation of our NEOs, as disclosed in our proxy statement for our 2011 annual meeting of stockholders. As a result, since the vote, the compensation committee has not implemented any changes in our overall executive compensation program.

Compensation Philosophy and Goals

The compensation committee has two primary objectives with respect to executive compensation—motivation and retention—with the ultimate goal of long-term value creation for our stockholders.

▪ | To motivate our executives to maximize their contributions to the success of our company, we |

• | establish a mix of financial performance objectives based on our annual budgets and our medium-term outlook to balance short- and long-term goals and risks; |

• | establish individual performance objectives tailored to each executive's role in our company to ensure individual accountability; and |

• | pay for performance that meets or exceeds the established objectives. |

▪ | To ensure that we are able to attract and retain superior employees in key positions, we |

• | offer compensation that we believe is competitive with the compensation paid to similarly situated employees of companies in our industry and companies with which we compete for talent; and |

• | include vesting requirements and forfeiture provisions in our multi-year equity awards, including a service period during which earned performance awards are subject to forfeiture. |

▪ | To align our executives' interests with those of our stockholders, we |

• | emphasize long-term compensation, the actual value of which depends on increasing the stock value for our stockholders, as well as meeting financial and individual performance objectives; and |

• | require our executive officers to achieve and maintain significant levels of stock ownership, further linking our executives' personal net worth to long-term stock price appreciation for our stockholders. |

Setting Executive Compensation

To achieve the foregoing compensation objectives, the compensation packages provided to members of our senior management, including our NEOs, include three main components: base salary, annual cash performance awards and multi-year equity incentive awards. In addition, certain members of senior management, including our NEOs, may participate in our deferred compensation plan. Consistent with past practice, the three main components of compensation were also made available during 2012 to approximately 330 employees in the U.S. and Europe. The relative weighting of the components, the design of the performance and incentive awards and the overall value of the compensation package for individual employees varies based on the employee's role and responsibilities.

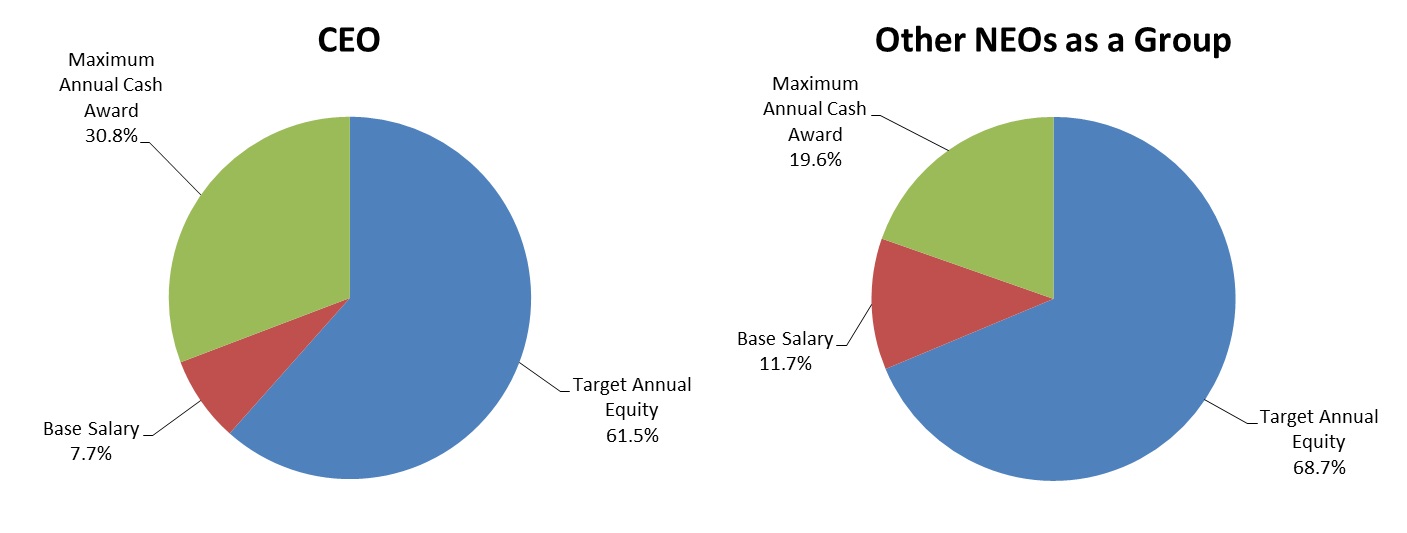

For members of our senior management, including our NEOs, the total value of the compensation package is most heavily weighted to performance and incentive awards because of the significance of the officers' roles and responsibilities to the overall success of our company. Further, multi-year equity incentive awards are the largest component of executive compensation, serving the goals of retention as well as alignment with stockholders' interests. As illustrated below based on 2012 compensation, the compensation committee's objective is for a substantial majority of each executive officer's total direct compensation (that is, base salary plus maximum annual cash performance award plus target annual equity incentive) to be comprised of the target value of his or her multi-year equity incentive awards.

III-9

Total Direct Compensation Opportunity

In approving the level of each compensation element for our executive officers, the compensation committee considers a number of factors, including:

▪ | the responsibilities assumed by the individual executive and the significance of his role to achievement of our financial, strategic and operational objectives; |

▪ | the experience, overall effectiveness and demonstrated leadership ability of the individual executive; |

▪ | the performance expectations set for our company and for the individual executive and the overall assessment by the compensation committee of actual performance; and |

▪ | retention risks at specific points in time with respect to individual executives. |

Elements of Our Compensation Packages

The implementation of our compensation approach—generally and for 2012 specifically—is described below.

Base Salary

General. Base salary represents the least variable element of our executives' compensation and is provided as an economic consideration for each executive's level of responsibility, expertise, skills, knowledge, experience and value to the organization. The base salary levels of Messrs. Fries, Bracken and Dvorak were initially set in 2005, along with the base salaries of our other executive officers at that time, taking into account each executive's salary level prior to the business combination of LGI International and UGC, as well as the factors referenced above. The base salary level of Mr. Nair was initially set in 2007 when he joined our company as an executive officer. Mr. Karsten's initial base salary level as an executive officer was set in connection with his promotion to that position effective January 1, 2011. Decisions with respect to increases in base salaries thereafter have been based on company-wide budgets and increases in the cost of living.

2012 Base Salaries. In February 2012, our compensation committee approved a 3% increase in the base salaries of each of our NEOs, except our CEO. This percentage increase was consistent with the budget authorization given to each of our department and business unit heads for aggregate salary increases for U.S. and corporate-level European employees in their department or unit. For our CEO, the compensation committee determined to cap his 2012 base salary at $1,000,000. The actual percentage salary increase varied among employees, other than our NEOs, as determined by their department or business unit head. The salary increases for all employees, including our NEOs, became effective April 1, 2012. Our NEOs' base salaries for 2012 are reflected in the “Salary” column of the Summary Compensation Table below. The base salaries reported for Mr. Bracken and Mr. Karsten in this Table have been converted to U.S. dollars based on the average exchange rate in effect for each respective year and reflect the variations of the applicable exchange rates.

Annual Cash Performance Awards

General. Annual cash performance awards pursuant to the Incentive Plan are one of the variable components of our executive officers' compensation packages designed to motivate our executives to achieve our annual business goals and reward them for superior performance.

III-10

Generally, at its first regular meeting following the end of each fiscal year, the compensation committee reviews with our CEO the financial performance of our company during the prior year, his performance, his evaluation of the performance of each of the other members of senior management (including our NEOs) participating in the prior year's annual cash performance award program and his recommendations with respect to their performance awards. The compensation committee determines whether our financial performance for the prior fiscal year has satisfied the base performance objective set by the compensation committee, which is a precondition to the payment of any award to our NEOs, and determines the percentage of the financial performance metric(s) that has been achieved. It then determines, in a private session, whether our CEO has met his individual performance goals for the year, his resulting annual performance rating, and the amount to be paid to him with respect to his performance award. The compensation committee also approves the amount to be paid to the other participants in the program, including our other NEOs, with respect to their performance awards. Generally at the same meeting, the compensation committee approves the terms of the annual cash performance award program for the current year including, in a private session, the maximum achievable performance award and individual performance goals for our CEO for the coming year.

Design of 2012 Annual Award Program. The general design of the 2012 annual cash performance award program (the 2012 Annual Award Program) is similar to the annual cash performance award program for 2011. In approving the 2012 Annual Award Program, the compensation committee modified the definition of operating cash flow, or OCF, to also exclude direct costs associated with dispositions. The compensation committee also modified the definition of operating free cash flow, or OFCF, to equal OCF less additions to property and equipment (instead of OCF less cash capital expenditures used for the 2011 program). The 2012 maximum achievable performance awards were unchanged for each of our NEOs.

The key elements of the 2012 Annual Award Program were:

▪ | Sixty percent of each participant's maximum achievable performance award was based on achievement against financial performance metrics and 40% was based on individual achievement against defined performance goals. |

▪ | Two equally weighted financial performance metrics were used: |

• | 2012 budgeted revenue growth on a consolidated basis and, if applicable, operating unit basis; and |

• | 2012 budgeted OFCF growth on a consolidated basis and, if applicable, operating unit basis. |

▪ | For Messrs. Fries, Bracken and Dvorak, their financial performance metrics were based solely upon consolidated LGI performance, while Messrs. Karsten and Nair's financial performance metrics were based on both consolidated LGI performance (with a 1/3rd weighting) and our European Broadband division performance (with a 2/3rd weighting). |

▪ | The base performance objective for our NEOs required that either 40% of 2012 consolidated budgeted revenue growth or 40% of 2012 consolidated budgeted OFCF growth be achieved. |

For purposes of the 2012 Annual Award Program, OFCF was defined as OCF less additions to property and equipment. OCF is the primary measure used by our board and management to evaluate our company's operating performance and a key factor that is used to decide how to allocate capital and resources to our operating segments. The definition of OCF for these purposes is generally consistent with our definition of the term for public disclosure purposes: revenue less operating and selling, general and administrative expenses (excluding depreciation and amortization, stock-based compensation, provisions for litigation and impairment, restructuring, direct acquisition costs and other operating items).

Budgeted growth was determined by comparing actual 2011 results for the applicable metric to the amount budgeted for that metric in the 2012 consolidated and operating unit budgets approved by our board. For consolidated LGI, the 2012 budget provided for: (1) revenue of $11.3 billion, with growth over 2011 of $713 million or 6.7%, and (2) OFCF of $3.0 billion, with growth over 2011 of $208 million or 7.6%. For the European Broadband division, the 2012 budget provided for: (1) revenue of $7.7 billion, with growth over 2011 of $469 million or 6.5%, and (2) OFCF of $2.3 billion, with growth over 2011 of $146 million or 6.8%. The payout schedule for each financial metric is based on the percentage achievement against the 2012 budget, as adjusted for events during the performance period such as acquisitions, dispositions and changes in foreign currency exchange rates and accounting principles that affect comparability. The following table sets forth the performance against budget and related payouts approved by the compensation committee.

III-11

Corresponding % of Achievement of 2012 Budget | |||||||||||

Achievement of Budgeted Growth over 2011 | Revenue (50%Weighting) | OFCF (50% Weighting) | Payout (% of Weighted Portion of Maximum Bonus Amount) (1) | ||||||||

LGI | European Broadband Division | LGI | European Broadband Division | ||||||||

Over-Performance | ≥ 105.0% | ≥ 105.0% | ≥ 110.0% | ≥ 110.0% | 150.0 | % | |||||

100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0 | % | |||||

90.0% | 99.4% | 99.4% | 99.3% | 99.4% | 80.0 | % | |||||

80.0% | 98.7% | 98.8% | 98.6% | 98.7% | 60.0 | % | |||||

70.0% | 98.1% | 98.2% | 97.9% | 98.1% | 40.0 | % | |||||

60.0% | 97.5% | 97.6% | 97.2% | 97.5% | 20.0 | % | |||||

< 50.0% | < 96.8% | < 97.0% | < 96.5% | < 96.8% | — | % | |||||

(1) | Percentages shown represent the payout that would result if the specified performance levels were achieved for both the revenue and OFCF targets. If the performance level for revenue and OFCF were to differ, the payout would represent the sum of the percentages derived by multiplying 50% times each of the respective payout percentages for the revenue and OFCF targets, with a maximum payout of 100%. |

Notwithstanding the over-performance feature indicated in the table, the aggregate payout for financial performance remained capped at 60% of the maximum achievable performance award.

The payout schedule for the 40% of each participant's maximum achievable performance award allocated to individual performance was based on the annual performance rating received on a scale of 1.0 to 5.0, with a minimum rating of 3.0 required for any amount to be payable with respect to this portion of the award.

The compensation committee considered the following when it approved this design for the annual award programs in 2012:

▪ | Weighting financial performance metrics more heavily than individual performance goals should serve to reduce the level of subjectivity in determining final awards; |

▪ | Using two equally weighted financial metrics (budgeted revenue and OFCF growth), rather than a single metric, would provide incentives to drive revenue growth while controlling operating costs and capital expenditures; |

▪ | Including consolidated financial performance metrics for all participants, including those with operating unit responsibility, would serve to mitigate potential organizational risks; |

▪ | Including an over-performance provision would provide continuing incentive for above budget achievement; and |

▪ | Establishing a base performance objective as a gating factor for payment of any award to the NEOs should result in the payment qualifying as performance-based compensation under Section 162(m). There could be no assurance that the objective would be achieved, particularly in light of the increasingly competitive environment in which we operate. |

The maximum amount that each NEO could earn under the 2012 Annual Award Program approved by the compensation committee was unchanged from 2011 for all executives. The compensation committee did not establish target amounts payable.

2012 Performance. On December 31, 2012, the compensation committee reviewed our consolidated revenue and OFCF for 2012 based on the data available on that date, as adjusted in accordance with the 2012 Annual Award Program, versus our budgeted 2012 revenue and OFCF and determined that the base performance objective had been achieved. The compensation committee made this determination at year-end 2012 due to developments concerning the likely increase in U.S. individual tax rates in 2013. By doing so, this allowed the compensation committee to award the U.S. participants, including the U.S. NEOs, the earned portion of their maximum achievable 2012 annual award that was based on financial performance. In accelerating the payment of this portion of the 2012 Annual Award program, the compensation committee reserved the right to recoup any or all of such portion awarded to such U.S. participants to the extent that our company's consolidated revenue and OFCF for 2012 based on our company's audited 2012 financial results warranted the payment of a smaller cash award than that awarded on December 31, 2012, consistent with the compensations committee's discretion to reduce the amount of the award paid. The compensation committee did not address the 40% portion of the 2012 annual awards that was based on individual performance, leaving that decision for its first meeting in 2013.

III-12

At its meeting in March 2013, the compensation committee reviewed the actual consolidated revenue and OFCF for 2012 based on our audited 2012 financial results. It also considered whether to exercise its discretion to reduce the amount payable to any of our NEOs. The exercise of the compensation committee's discretion was in each case based on its assessment of our 2012 financial performance and the individual named executive officer's performance overall as compared to his 2012 performance goals, taking into account the payout schedules for financial and individual performance.

The compensation committee first considered the percentage of budgeted revenue and budgeted OFCF achieved in 2012 at the consolidated and operating unit level and the percentage of budgeted growth such amounts represented. For this purpose, the 2012 budget was adjusted in accordance with the terms of the 2012 Annual Award Program and for certain other unbudgeted events that the compensation committee, in its discretion and consistent with past practice, determined distorted performance against the financial performance metrics. These adjustments primarily were for (1) foreign currency exchange translations, (2) our acquisition of businesses in Poland and Puerto Rico, (3) the acquisition of programming assets in Latin America, (4) the disposal of our Australian operations and certain programming assets, (5) new taxes in the Netherlands and Hungary, (6) vendor finance payments, and (7) higher than anticipated litigation costs. For consolidated LGI, these adjustments resulted in a net decrease to budgeted revenue of 8.0% to $10.4 billion and budgeted OFCF of 9.5% to $2.7 billion. For the European Broadband division, budgeted revenue decreased by 9.5% to $7.0 billion and budgeted OFCF decreased by 9.9% to $2.1 billion. Actual 2012 revenue of our consolidated company and of the European Broadband division was less than budgeted, although over 99% of budgeted 2012 revenue and between 80% and 90% of budgeted 2012 revenue growth was achieved in each case. Actual 2012 OFCF was less than budgeted on a consolidated basis and more than budgeted for the European Broadband division, although over 99% of budgeted 2012 OFCF and over 90% of budgeted 2012 OFCF growth was achieved on a consolidated basis.

The following tables illustrate the compensation committee's financial performance and payout calculations (with "LGI" representing the consolidated company and "LGO" representing the European Broadband division).

When these results are applied to the relevant payout schedules, the total implied payout against the financial performance metrics exceeded 80% of the 60% portion of the maximum bonus attributable to financial performance. Therefore, the compensation committee approved payment of 84.3% of the 60% portion of each of Messrs. Fries, Bracken and Dvorak's maximum achievable award that was based on the financial performance and 88.6% of the 60% portion of each of Messrs. Karsten and Nair's maximum achievable award that was based on the financial performance. This approved payment amount was greater than the accelerated payment amount approved on December 31, 2012 for our NEOs employed in the U.S. and, therefore, no recoupment was required. As a result, the compensation committee approved an additional payment to these participants equal to the excess of the final approved payout amount for the 60% portion that was based on financial performance over the amount paid on December 31, 2012.

III-13

With respect to the remaining 40% of the maximum achievable awards, which was based on individual performance, at its March 2013 meeting, the compensation committee considered each NEO's performance against individual performance goals. The individual performance goals consisted of numerous qualitative measures, which included strategic, financial, transactional, organizational and/or operational goals tailored to the individual's role within LGI. In making its decision as to individual annual performance ratings, the compensation committee did not apply any particular weighting across the individual performance goals or relative to other considerations, nor did it require that the executive satisfy each of his goals.

Our CEO's performance goals were organized around four main themes: key operating budget targets and operational initiatives; liquidity, leverage and capital structure targets and initiatives; acquisition and disposition opportunities; and core initiatives for each functional group. In its evaluation of his 2012 performance, the compensation committee considered the various performance objectives that had been assigned to Mr. Fries and our company's accomplishments against those objectives. In this regard, the committee noted that our company had a number of significant performance accomplishments in 2012 under the leadership of Mr. Fries, including:

▪ | completion of the disposition of our Australian operations and the acquisition of cable operations in Puerto Rico; |

▪ | the launch of Horizon TV; |

▪ | the launch of a new corporate identity; |

▪ | the increased availability of ultra high-speed internet service in our service areas; |

▪ | the achievement of key budget metrics; |

▪ | the attainment of $5.3 billion of consolidated liquidity, including cash and cash equivalents of $3.1 billion at the parent and its non-operating subsidiaries; |

▪ | the completion of approximately $11 billion in debt financing transactions; |

▪ | the launch of a 4G wireless network in Chile; and |

▪ | the achievement of significant financial and operational performance guidance related to OCF and free cash flow growth, organic subscriber additions and equity repurchases. |

In reviewing Mr. Fries' performance, the committee considered both what had been accomplished and how such accomplishments had been obtained. The compensation committee also considered Mr. Fries' responsibilities with respect to overall corporate policy-making and management, in-depth knowledge of our operations and finances, the regulatory and organizational complexities in which we compete, as well as his strong leadership capabilities in delivering key long-term strategic objectives in a challenging global economy, his handling of unanticipated additional responsibilities and keeping the board of directors informed during the year.

With respect to the individual performance of our other NEOs, the compensation committee reviewed their performance with our CEO, giving much deference to our CEO's evaluation of their performance against their respective 2012 performance goals and the resulting annual performance ratings. The members of the compensation committee also have frequent interaction with each of these executives at meetings of the board of directors and events planned for the directors, which interaction assists in informing their judgment. The individual performance goals for the other NEOs related to their respective functional or operational areas of responsibility. Mr. Bracken's goals related to financial strategy, reducing financial risks, balance sheet efficiency, tax strategy, financial planning, and group leadership and coordination with other functional groups. Mr. Dvorak's goals related to projects on data management and integrity, consolidation of financial systems, integration of acquired companies from a consolidation, financial reporting and U.S. GAAP perspective, the internal audit processes, and cross-training programs for the group. Mr. Karsten's goals related to his management of our European Broadband division, including performance against financial and subscriber targets, group leadership and coordination with executive offices, the integration of acquired companies and expansion of services to businesses, execution of new product and service initiatives, and network upgrades and new builds. Mr. Nair's goals related to efficiencies in the procurement of customer equipment, network operations, development and implementation of new technologies for our services, management of capital expenditures, and analysis and development of new service options for customers.

III-14

Based on its evaluation of individual performance and its decisions with respect to the financial performance metrics, the compensation committee approved the payments to our NEOs with respect to their maximum achievable performance awards set forth in the table below. Percentages in the table represent percentages of the maximum achievable performance award.

2012 Annual Cash Performance Award | ||||||||||||

Name | Maximum Achievable Award | % Payout for Financial Performance (Revenue & OFCF)(60%) | % Payout for Individual Performance (40%) | Aggregate % of Maximum Award (100%) | Approved Award | |||||||

Michael T. Fries | $4,000,000 | 84.3% | 100% | 90.6% | $ | 3,622,000 | ||||||

Charles H.R. Bracken | $1,000,000 | 84.3% | 100% | 90.6% | $ | 906,000 | ||||||

Bernard G. Dvorak | $1,000,000 | 84.3% | 100% | 90.6% | $ | 906,000 | ||||||

Diederik Karsten | $1,000,000 | 88.6% | 100% | 93.2% | $ | 932,000 | ||||||

Balan Nair | $1,000,000 | 88.6% | 100% | 93.2% | $ | 932,000 | ||||||

The amounts paid to our NEOs under the 2012 Annual Award Program are reflected in the Summary Compensation Table below under the “Non-Equity Incentive Plan Compensation” column.

Equity Incentive Awards

General. Multi-year equity incentive awards, whether in the form of conventional equity awards or performance-based awards, have historically represented a significant portion of our executives' compensation. These awards ensure that our executives have a continuing stake in our company's success, align their interests with our stockholders and also serve the goal of retention through vesting requirements and forfeiture provisions.

Our compensation committee's approach to equity incentive awards for the senior management team places a significant emphasis on performance-based equity awards. Since 2010, the compensation committee's approach has been to set a target annual equity value for each executive, of which approximately two-thirds would be delivered in the form of an annual award of performance-based restricted share units (PSUs) and approximately one-third in the form of an annual award of stock appreciation rights (SARs). A similar approach was applied to equity incentive compensation for approximately 40 other key employees.

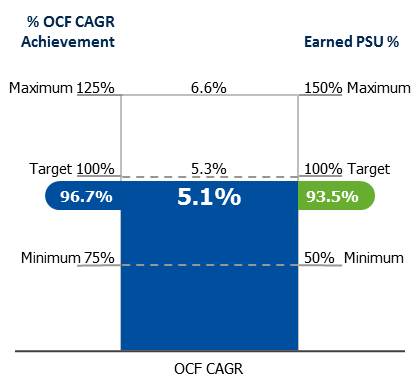

In connection with each year's award of PSUs, the compensation committee selects one or more performance measures for the ensuing two-year performance period. For the PSUs awarded to date, the compensation committee has selected as the performance measure growth in consolidated OCF, as adjusted for certain specified events that affect comparability, such as acquisitions, dispositions and changes in foreign exchange rates and accounting principles. In choosing OCF growth as the performance measure, the compensation committee's goal has been to ensure that the management team would be focused on maximizing performance against a variety of key financial metrics during the performance period by using a measure of performance that was different from those selected for the annual cash performance awards. Different performance measures may be selected for the awards in subsequent years.

The compensation committee also sets the performance targets corresponding to the selected performance measure(s) and a base performance objective that must be achieved in order for any portion of our NEOs' PSU awards to be earned. The level of achievement of the performance target within a range established by the compensation committee determines the percentage of the PSU award earned during the performance period, subject to reduction or forfeiture based on individual performance. Earned PSUs will then vest in two equal installments on March 31 and September 30 of the year following the end of the performance period. The PSU awards are subject to forfeiture or acceleration in connection with certain termination of employment or change-in-control events. Each year's award of SARs is made at the same time as awards are made under our annual equity grant program for employees (generally on or around May 1) and on terms consistent with our standard form of SAR award agreement, including a four-year vesting schedule.

In adopting this approach to equity incentive compensation, the compensation committee made the following observations: