Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - OUTERWALL INC | d524882dex312.htm |

| EX-31.1 - EX-31.1 - OUTERWALL INC | d524882dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

Commission File Number: 000-22555

COINSTAR, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3156448 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1800 114th Avenue SE, Bellevue, Washington | 98004 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 425-943-8000

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.001 par value

Name of each exchange on which registered: The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.: Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.: Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No x

The aggregate market value of the registrant’s common equity held by non-affiliates of the registrant as of June 30, 2012 (the last business day of the registrant’s most recently completed second fiscal quarter), based upon the closing price as reported in the NASDAQ Global Select Market System, was approximately $2.1 billion.

The number of shares outstanding of the registrant's Common Stock as of April 24, 2013 was 28,097,710 shares.

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

INDEX

| Page | ||||||

| PART III |

||||||

| Item 10. |

2 | |||||

| Item 11. |

6 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

32 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

36 | ||||

| Item 14. |

37 | |||||

| PART IV |

||||||

| Item 15. |

39 | |||||

-i-

Table of Contents

EXPLANATORY NOTE

Coinstar, Inc. is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend its Annual Report on Form 10-K for the fiscal year ended December 31, 2012 (the “Form 10-K”), as filed with the Securities and Exchange Commission (“SEC”) on February 8, 2013, for the purpose of including the information that was to be incorporated by reference to its definitive proxy statement relating to its 2013 Annual Meeting of Stockholders. This Amendment hereby amends Part III, Items 10 through 14. We are also including as exhibits the certifications required under Section 302 of the Sarbanes-Oxley Act of 2002.

Except as otherwise expressly stated herein, this Amendment does not reflect events occurring after the date of the Form 10-K, nor does it modify or update the disclosure contained in the Form 10-K in any way other than as required to reflect the amendments discussed above and reflected below. Accordingly, this Amendment should be read in conjunction with the Form 10-K and Coinstar’s other filings made with the SEC on or subsequent to February 8, 2013.

Unless the context requires otherwise, the terms “Coinstar,” the “Company,” “we,” “us” and “our” refer to Coinstar, Inc. and its subsidiaries.

-1-

Table of Contents

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Board Composition

As of April 24, 2013, the Board of Directors was composed of eight members, divided into three classes as follows:

| Name |

Age | Term Expiring in |

Audit Committee |

Compensation Committee |

Nominating and Governance Committee | |||||||||

| Arik A. Ahitov |

37 | 2013 | * | * | ||||||||||

| Deborah L. Bevier |

62 | 2014 | * | * | ||||||||||

| Nelson C. Chan |

51 | 2015 | * | |||||||||||

| Nora M. Denzel |

50 | 2013 | * | |||||||||||

| J. Scott Di Valerio |

50 | 2015 | ||||||||||||

| David M. Eskenazy |

50 | 2014 | ** | |||||||||||

| Robert D. Sznewajs |

66 | 2014 | * | ** | ||||||||||

| Ronald B. Woodard |

70 | 2013 | ** | * | ||||||||||

| * | Member |

| ** | Chairperson |

Arik A. Ahitov has been a director of Coinstar since May 2008. In October 2010, Mr. Ahitov joined First Pacific Advisors (an investment company). He is a senior vice president and research analyst for the Small/Mid-Cap Absolute Value Investment Strategy, which includes the FPA Capital Fund and FPA Hawkeye Strategy. From September 2004 to May 2010, he was a vice president and portfolio manager at Shamrock Capital Advisors, Inc. (a registered investment advisor). He also has experience in consulting and investment banking.

Having originally joined our Board of Directors as a representative of a major stockholder, Mr. Ahitov continues to bring a strong stockholder perspective to our Board of Directors. In addition, Mr. Ahitov’s sharp analytical skills, deep financial understanding, and his prior consulting and investment banking experiences provide a unique perspective regarding Coinstar’s opportunities and challenges.

Deborah L. Bevier has been a director of Coinstar since August 2002 and has served as the Board of Directors’ non-employee Chair since October 2008. Ms. Bevier has been a principal of DL Bevier Consulting LLC (an organizational and management consulting firm) since May 2004. Ms. Bevier also served as president of Waldron Consulting, a division of Waldron & Co. (an organizational and management consulting firm), from July 2004 to April 2006. Prior to that time, from 1996 until 2003, Ms. Bevier served as a director, president, and chief executive officer of Laird Norton Financial Group and its predecessor companies (an independent financial advisory services firm). From 1973 to 1996, Ms. Bevier held numerous leadership positions with KeyCorp (a bank holding company), including chairman and chief executive officer of Key Bank of Washington. Ms. Bevier currently serves on the board of directors of F5 Networks, Inc. (a global application delivery networking company). She previously served on the board of directors of Fisher Communications, Inc. (a media and communications company) from July 2003 to December 2010 and Puget Sound Bank (a commercial bank) from August 2006 to June 2008.

Ms. Bevier has over 35 years of experience with both public and private companies in areas relevant to Coinstar, including finance, banking, management, and organizational operations. Ms. Bevier’s experience as a director of public companies in the communications, media, and global application delivery networking industries is particularly valuable to Coinstar’s business. In addition to Ms. Bevier’s broad background, she brings extensive experience to our Board of Directors, particularly in the areas of corporate governance and executive compensation.

Nelson C. Chan has been a director of Coinstar since July 2011, and following the Annual Meeting of Stockholders, he will succeed Ms. Bevier as non-employee Chair of our Board of Directors. Mr. Chan served as chief executive officer of Magellan Corporation (a portable GPS navigation consumer electronics company) from December 2006 to August 2008. From 1992 to 2006, he held various management positions at SanDisk Corporation (a manufacturer and supplier of flash brand data storage products), including executive vice president and general manager, consumer business. Mr. Chan is

-2-

Table of Contents

currently a director of Affymetrix Inc. (a genetic analysis company) and Synaptics, Inc. (a developer of consumer interface solutions). Mr. Chan was a member of the board of directors of Silicon Laboratories (an analog-intensive mixed-signal semiconductor company), from 2007 to 2010. Mr. Chan also serves on the board of directors of several private companies.

Mr. Chan brings a wealth of experience to our Board of Directors, including his expertise in building technology companies. Having held numerous senior management positions with other leading companies, including chief executive officer at Magellan Corporation, Mr. Chan has strong operational, financial, and analytical skills. In addition, as a result of his service as a director of several other public companies, Mr. Chan brings valuable corporate governance and strategic insights to our Board of Directors.

Nora M. Denzel was appointed to the Board of Directors on January 31, 2013. From February 2008 through August 2012, Ms. Denzel held various management positions at Intuit Inc. (a provider of business and financial management solutions software), including senior vice president of marketing, big data and social, and senior vice president and general manager of the employee management solutions business unit. From August 2000 to February 2006, Ms. Denzel served as senior vice president of the software global business unit and the storage and consulting divisions at Hewlett-Packard Company (a software and technology hardware provider). From February 1997 to August 2000, Ms. Denzel served as senior vice president, product operations, at Legato Systems Inc. (a data storage management software company). Ms. Denzel served as director, global storage software, at International Business Machines Corporation (a technology services, enterprise software and systems provider) from June 1984 to February 1997. Ms. Denzel served as a director of Overland Storage, Inc. (a provider of data management and protection products and services) from 2007 to 2013. Ms. Denzel is a member of the board of directors of Telefonaktiebolaget L.M. Ericsson (a telecommunications equipment and services provider) and Saba Software, Inc. (a provider of learning and talent management solutions software and services).

Ms. Denzel brings to our Board of Directors a unique skill set and insight from her background in enterprise software, engineering, social product design, and marketing. Her experience as a senior business and technology executive at global organizations, such as Intuit, Hewlett-Packard, and IBM provide her with special knowledge in customer experience and competitive considerations.

J. Scott Di Valerio has served as our Chief Executive Officer and as one of our directors since April 2013. He served as our Chief Financial Officer from March 2010 until March 2013, after having joined the Company in January 2010 to work on transition matters prior to his appointment as Chief Financial Officer. Mr. Di Valerio served as president of the Americas for Lenovo Group Limited (a personal computer and technology products and services company) from December 2007 to January 2009. Previously, he served as corporate vice president, OEM division for Microsoft Corporation (a software and technology company) from 2005 to 2007, and as its corporate vice president, finance and administration and chief accounting officer from 2003 to 2005. In addition, Mr. Di Valerio served as corporate vice president, corporate controllership, for The Walt Disney Company (an entertainment company) from 2001 to 2003 and as chief financial officer for Mindwave Software Inc. (a software and technology company) during 2000. He also served in various roles, including as partner, at PricewaterhouseCoopers LLP (and its predecessors) from 1985 to 2000. Mr. Di Valerio is a certified public accountant (inactive).

Through his experience as Coinstar’s Chief Financial Officer and in his new position as Chief Executive Officer effective April 1, 2013, Mr. Di Valerio brings intimate knowledge of Coinstar’s financial and day-to-day operations to our Board of Directors. In addition, through his prior financial and management experience, Mr. Di Valerio has a broad understanding of the financial, operational, and strategic issues facing companies such as Coinstar.

David M. Eskenazy has been a director of Coinstar since August 2000. Mr. Eskenazy has served as chief financial officer for Aegis Senior Communities (a senior living management company specializing in assisted living and memory care) since August 2009. He served as a principal in Esky Advisors LLC (a business advisory services firm) from October 2008 to March 2010. He served as the chief operating officer of Investco Financial Corporation (a real estate development and management company in the Puget Sound region) from April 2008 to September 2008 and as chief investment officer from January 2007 to March 2008. From October 1987 to November 2006, he held a number of financial positions, ultimately serving as executive vice president and chief operating officer at R.C. Hedreen Co. (a hotel development and investment firm). Prior to that, he served on the audit staff of Peat Marwick Mitchell & Co. (an accounting firm). Mr. Eskenazy is a certified public accountant (inactive).

-3-

Table of Contents

Having served as an independent director of Coinstar since 2000 and chairperson of the Audit Committee since 2001, Mr. Eskenazy possesses a wealth of historical Coinstar institutional knowledge. In addition, with his over 25 years of finance, investment, and accounting experience, he brings deep investment management experience and an understanding of complex accounting to our Board of Directors.

Robert D. Sznewajs has been a director of Coinstar since August 2002. From January 2000 to April 2013, Mr. Sznewajs served as president, chief executive officer, and a member of the board of directors of West Coast Bancorp (a bank holding company). He was also a member of the board of directors of the Portland Branch of the Federal Reserve Bank of San Francisco from January 2004 to December 2009. Mr. Sznewajs is a certified public accountant (inactive).

Mr. Sznewajs brings valuable leadership experience to the Board of Directors, having served in multiple board and executive leadership positions at public and private companies. Mr. Sznewajs also brings to our Board a valuable understanding of accounting functions, financial operations, and retail consumers, as well as a general appreciation for the current economic, business, and governance issues facing public companies from the perspective of a board member and chief executive officer.

Ronald B. Woodard has been a director of Coinstar since August 2001. Mr. Woodard is a director of MagnaDrive Corporation (an industrial magnetic coupling manufacturer) and was its chairperson from June 2006 to August 2010. Mr. Woodard cofounded MagnaDrive in April 1999 after a 32-year career with The Boeing Company (an aerospace firm), where he held numerous positions, including president of The Boeing Commercial Airplane Group. Mr. Woodard is currently a director of AAR Corp. (a provider of aftermarket support to the aviation and aerospace industry), Knowledge Anywhere (an online provider of employee training), and the Shaw Island School Board, and, in June 2010, he became a lifetime member of the board of directors of the Seattle Symphony. Mr. Woodard was also a director of Continental Airlines, Inc. (a commercial airline company), from May 2003 to December 2010, and served as chair of the board of directors of the Seattle Symphony for 11 years (with his most recent three-year term as chair ending in June 2007).

With Mr. Woodard’s years of experience at The Boeing Company and his years of board service, including his current board positions, he brings valuable commercial insight and experience to our Board of Directors. His role at The Boeing Company and his continued engagement in the aerospace industry provide him with valuable experience in complex public company dynamics, including international operations. In addition, having served as an independent director of Coinstar during a time of significant growth, Mr. Woodard has a valuable historical perspective regarding Coinstar’s business.

Executive Officers

The following table sets forth the name, age, and position of each of our executive officers as of April 24, 2013:

| Name |

Age | Position | ||

| J. Scott Di Valerio |

50 | Chief Executive Officer | ||

| Galen C. Smith |

36 | Chief Financial Officer | ||

| Donald R. Rench |

46 | Chief Legal Officer, General Counsel, and Corporate Secretary | ||

| Maria D. Stipp |

45 | Chief Customer Officer | ||

| Anne G. Saunders |

51 | President, Redbox | ||

| Michael J. Skinner |

59 | President, Coin |

J. Scott Di Valerio has served as our Chief Executive Officer and as one of our directors since April 2013. He served as the Chief Financial Officer from March 2010 until March 2013, after having joined the Company in January 2010 to work on transition matters prior to his appointment as Chief Financial Officer. In addition to his leadership of the finance organization, Mr. Di Valerio served as president of the Americas for Lenovo Group Limited (a personal computer and technology products and services company) from December 2007 to January 2009. Previously, he served as corporate vice president, OEM division for Microsoft Corporation (a software and technology company) from 2005 to 2007, and as its corporate vice president, finance and administration, and chief accounting officer from 2003 to 2005. In addition, Mr. Di Valerio served as corporate vice president, corporate controllership for The Walt Disney Company (an entertainment company) from 2001 to 2003 and as chief financial officer for Mindwave Software Inc. (a software and technology company) during 2000. He also served in various roles, including as partner, at PricewaterhouseCoopers LLP (and its predecessors) from 1985 to 2000. Mr. Di Valerio is a certified public accountant (inactive).

-4-

Table of Contents

Galen C. Smith has served as our Chief Financial Officer since April 2013. Previously, he served as Senior Vice President of Finance of Redbox Automated Retail, LLC (“Redbox”), Coinstar’s wholly-owned subsidiary, from May 2011 to March 2013. From January 2010 to May 2011, Mr. Smith served as Coinstar’s Corporate Vice President, Finance, and Treasurer. From September 2009 to January 2010, he served as Coinstar’s Senior Director of Finance and Treasurer, and from June 2009 to August 2009, he served as Coinstar’s Director of Finance. Prior to joining Coinstar, Mr. Smith was an investment banker at Morgan Stanley & Co. (a global financial services firm) in the consumer and retail investment banking group from August 2007 to May 2009.

Donald R. Rench has served as our Chief Legal Officer since April 2011, as our General Counsel since August 2002, and as our Corporate Secretary since March 2002. Mr. Rench served as our corporate counsel from March 2000 through August 2002. From October 1997 through March 2000, Mr. Rench served as corporate counsel for NetManage, Inc., formerly Wall Data, Inc. (a software company). Prior to that, Mr. Rench was an attorney in private practice in Cincinnati, Ohio.

Maria D. Stipp has served as our Chief Customer Officer since June 2011. From February 2004 to April 2011, Ms. Stipp held several positions at Activision Blizzard, Inc. (a video game publisher), most recently as executive vice president and general manager of the owned properties business unit. From February 2001 to February 2004, Ms. Stipp served as vice president of sales at Vivendi Universal Games (a developer, publisher, and distributor of interactive entertainment). Ms. Stipp previously held sales leadership positions at Miller Brewing Company (a beverage brewing company) and Kellogg Sales Company (a packaged food company).

Anne G. Saunders has served as President of Redbox since August 2012. From 2009 to 2012, Ms. Saunders served as executive vice president and chief marketing officer of Knowledge Universe (a global education company). Prior to joining Knowledge Universe, Ms. Saunders worked at Bank of America Corporation (a bank holding company and financial holding company), where she held the position of senior vice president, consumer bank executive from 2008 to 2009 and senior vice president, brand executive from 2007 to 2008. Prior to that, Ms. Saunders held various senior leadership positions at Starbucks Corporation (a specialty coffee retailer), including senior vice president, global brand and vice president, wireless initiatives, and at AT&T Wireless Services, Inc. (a wireless and data services company).

Michael J. Skinner has served as President of our Coin business since May 2009. Mr. Skinner also served as Vice President and General Manager of E-Payment Services from August 2008 through May 2010, and as Vice President and General Manager of our Coin business from August 2008 until May 2009. From January 2007 to July 2008, Mr. Skinner served as our Senior Vice President of Entertainment Services. From December 2004 to January 2007, Mr. Skinner served as Director of Sales & Marketing of E-Payment Services. Before joining Coinstar, Mr. Skinner served as director of Client Services for Crestwood Associates (a full-service market research firm) from 2002 to 2004. From 1998 to 2002, Mr. Skinner founded Elkhorn Consulting (a consulting firm that provided strategic and business development services). Prior to 1998, Mr. Skinner served as executive vice president of Sales and Marketing for PIA Merchandising Inc. (a retail merchandising company).

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires Coinstar’s directors, officers, and beneficial holders of more than 10% of a registered class of Coinstar’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. To our knowledge, all of the applicable directors, officers, and beneficial holders of more than 10% of the Company’s stock complied with all of the Section 16(a) reporting requirements applicable to them with respect to transactions during fiscal year 2012, except that we inadvertently filed one report late on behalf of Saul M. Gates and one report late on behalf of Maria D. Stipp, each of which related to one transaction.

Code of Conduct and Code of Ethics

Coinstar’s Board of Directors has adopted a Code of Ethics that applies to its Chief Executive Officer, Chief Financial Officer, principal accounting officer, and controller (or persons performing similar functions) and a Code of Conduct that applies to all directors, officers, and employees of the Company. A copy of each is available on the Investor Relations section of Coinstar’s website at www.coinstarinc.com. Substantive amendments to and waivers from either regarding executive officers and directors, if any, will be disclosed on the Investor Relations section of Coinstar’s website.

-5-

Table of Contents

Audit Committee

The Board of Directors has established a standing Audit Committee. Membership of the Audit Committee is determined annually by the Board of Directors. Adjustments to committee assignments may be made at any time. As of April 24, 2013, membership of the Audit Committee was as set forth above under “Board Composition.”

The Board of Directors has determined that each member of the Audit Committee meets the independence and financial literacy requirements of the SEC and Nasdaq. The Board has also determined that Messrs. Eskenazy and Sznewajs are “audit committee financial experts” under SEC rules, have accounting or related financial management experience, and are financially sophisticated under the Nasdaq Listing Rules.

| Item 11. | Executive Compensation. |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis describes the 2012 compensation program for our “Named Executive Officers,” which include:

| • | Paul D. Davis, our Chief Executive Officer through March 31, 2013; |

| • | Gregg A. Kaplan, our President and Chief Operating Officer through March 31, 2013; |

| • | J. Scott Di Valerio, our Chief Financial Officer through March 31, 2013, and our Chief Executive Officer as of April 1, 2013; |

| • | Donald R. Rench, our Chief Legal Officer, General Counsel, and Corporate Secretary; and |

| • | Anne G. Saunders, the President of Redbox as of August 27, 2012. |

The Compensation Committee, which is composed of all independent directors, designed our program to ensure that our compensation practices further the shared interests of stockholders and management to attract, hire, retain, and motivate the people needed to achieve our performance goals.

Executive Summary

We experienced strong results in several key areas for fiscal year 2012, including:

| • | We continued to achieve our key objective of profitable growth. For fiscal year 2012 compared to fiscal year 2011, revenue from continuing operations increased by over 19% to over $2.2 billion and core diluted earnings per share (“Core Diluted EPS”) from continuing operations grew by 32% to $4.83 (Core Diluted EPS is a non-GAAP (generally accepted accounting principles) financial measure; for reconciliation to diluted EPS from continuing operations (the most comparable GAAP measure) and other information on this measure, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Non-GAAP Financial Measures—Core Diluted EPS from Continuing Operations” on page 36); |

| • | For fiscal year 2012 compared to fiscal year 2011, our free cash flow from continuing operations increased to $255.9 million (free cash flow from continuing operations is a non-GAAP financial measure; for reconciliation to net cash provided by operating activities (the most comparable GAAP measure) and other information on this measure, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Non-GAAP Financial Measures—Free Cash Flow from Continuing Operations” on page 37); |

| • | We announced our digital partnership with Verizon and, in the fourth quarter, Redbox InstantTM by Verizon launched its public product; |

| • | We closed the transaction with NCR Corporation (“NCR”) to acquire NCR’s self-service entertainment DVD kiosk business at the end of the second quarter; |

| • | Our Coin business announced a successful test with PayPal that gives consumers the opportunity to load coin and currency into their PayPal accounts; and |

-6-

Table of Contents

| • | We signed studio agreements with Universal, Sony, and Warner Home Video that provide content for our Redbox consumers. |

Compensation for our Named Executive Officers during 2012 reflected the Company’s growth and performance and our pay-for-performance philosophy:

| • | Base salary increases for 2012 were modest and ranged from 4.4% to 6.7% to remain competitive. |

| • | Cash bonuses earned under our 2012 Incentive Compensation Plan ranged from 125% to 129% of target as a result of the Company’s achievement of $263.4 million in core direct contribution margin (“Core DCM”) and $2.202 billion in revenue in 2012 (both measures calculated as described below under the discussion of “Short-Term Incentives”) and as a result of the management team’s and/or the individual’s performance. |

| • | The aggregate value of all annual equity awards granted to each of our Named Executive Officers ranged from $450,000 to $1,800,000 (based on performance-based restricted stock awards at target, where applicable), reflecting our emphasis on long-term compensation and our philosophy of aligning the interests of our executives with the interests of stockholders. Performance-based restricted stock awards for 2012 performance were earned at 132.75% of target as a result of the Company’s level of achievement of $469.7 million in core adjusted earnings before interest, taxes, depreciation and amortization (“Core Adjusted EBITDA”) from continuing operations and core return on invested capital (“Core ROIC”) of 22.6% in 2012 (both measures calculated as described below under the discussion of “Long-Term Incentives”) (Core Adjusted EBITDA from continuing operations is a non-GAAP financial measure; for reconciliation to income from continuing operations (the most comparable GAAP measure) and other information on this measure, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Non-GAAP Financial Measures—Free Cash Flow from Continuing Operations” on page 37). |

Over the last few years, the Compensation Committee has taken several actions and also continued several long-standing practices that it believes reflect its pay-for-performance philosophy and contribute to good corporate governance, including:

| • | adopting a recoupment policy (also known as a “clawback policy”) covering incentive compensation paid to executives (please refer to the related discussion under “Policy on Reimbursement of Incentive Payments”); |

| • | formalizing an annual process to assess risks associated with our compensation policies and programs; |

| • | increasing stock ownership guidelines for our executives (please refer to the related discussion under “Officer Stock Ownership Guidelines”); |

| • | retaining discretion to adjust amounts payable under various compensation components; |

| • | approving change of control benefits for executives that place stronger emphasis on “double-trigger” benefits and do not include any tax gross-ups (please refer to the related discussions under “Severance and Change of Control” in this “Compensation Discussion and Analysis” and under “Elements of Post-Termination Compensation and Benefits” in “Named Executive Officer Compensation”); |

| • | establishing caps of 200% of target and 150% of target under the short-term incentive program and the long-term performance-based restricted stock program, respectively; |

| • | providing limited perquisites (please refer to related discussion under “Other Benefits and Perquisites”); and |

| • | hiring compensation consultants directly to assist the Compensation Committee in its compensation decisions. |

Coinstar experienced significant growth and strong financial performance during Mr. Davis’s tenure as Chief Operating Officer in 2008 and then Chief Executive Officer starting in 2009. As a review of financial results from continuing operations over the last five years indicates, our revenue and Core Diluted EPS from continuing operations have grown by more than 235%, delivering on the Company's overall objective of profitable growth, as illustrated in the graphs below.

-7-

Table of Contents

|

|

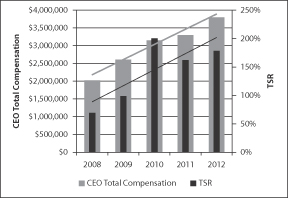

In determining compensation for our Named Executive Officers, the Compensation Committee has worked to align the objectives of our executive compensation programs (outlined in the sections below) with our growth and performance. Over the last five years, the trend line for our CEO Total Compensation* has been similar to that of our indexed total stockholder return (“TSR”)*, demonstrating our commitment to pay for performance, as illustrated in the graph below.

| * | For purposes of this graph, (a) CEO Total Compensation includes the total annual compensation reported in the “2012 Summary Compensation Table” for our Chief Executive Officer and has been adjusted to include the final fair market value of performance-based restricted stock that has been actually earned for each individual grant and (b) TSR is defined as the increase in our stock price, indexed at December 31, 2007 at 100% and measured as of December 31 of each subsequent year. |

Objectives of Compensation Programs

Our executive compensation programs are designed to attract, motivate, and retain executives critical to our long-term success and the creation of stockholder value. The decisions by the Compensation Committee concerning the specific compensation elements and total compensation paid or awarded to our Named Executive Officers for 2012 were made with the following objectives in mind:

| • | “total” compensation—the Compensation Committee believes that executive compensation packages should take into account the competitiveness of each component of compensation and also total direct compensation, which includes base salary, short-term (cash) and long-term (equity) incentives, and benefits; |

| • | “pay-for-performance”—the Compensation Committee believes that a significant portion of executive compensation should be determined based on Company performance as compared to quantitative and qualitative performance goals set at the beginning of each year to ensure accountability and to motivate executives to achieve a higher level of performance; |

| • | “at-market” compensation—the Compensation Committee believes that executive total direct compensation should generally be near the median (but below the 75th percentile) of compensation in the market and considers the market data from published surveys and a similarly situated peer group of companies (as detailed below) in order to attract and retain the most qualified candidates; |

-8-

Table of Contents

| • | "at-risk” compensation—the Compensation Committee believes that the allocation among the different forms of compensation should vary based on the position and level of responsibility; for example, those executives with the greater ability to influence Company performance will have a higher level of at-risk compensation in the form of an increased percentage of total compensation in stock options, time-based restricted stock, performance-based restricted stock, and performance-based short-term incentives; |

| • | “stockholder aligned” compensation—the Compensation Committee believes that equity compensation awarded to executives (consisting of a mix of stock options, time-based restricted stock, and performance-based restricted stock) should be a significant portion of each executive’s compensation, should assist in the retention of our executives, and should further the shared interests of our executives and stockholders; |

| • | “fair” compensation—the Compensation Committee believes that executive compensation levels should be perceived as fair, both internally and externally; and |

| • | “tax deductible” compensation—the Compensation Committee believes that we should maximize the tax deductibility of compensation paid to executives, as permitted under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), but may approve components of executive compensation that will not meet the requirements of Section 162(m) in order to attract, motivate, and retain executives. |

The executive compensation program objectives for 2012 were established based on discussions among the Compensation Committee, management, and outside consultants. The Compensation Committee reviews the compensation program objectives annually when determining the next year’s executive compensation.

Executive Compensation Process

Benchmarking of Compensation

In order to attract and retain the most qualified candidates and depending on the executive’s position and/or the component of compensation, the Compensation Committee generally set 2012 Named Executive Officer total direct compensation (consisting of base salary, short-term incentives, and long-term incentives) near the median of the aggregate market survey and proxy data that the Compensation Committee reviewed, with the exception of Mr. Di Valerio and Ms. Saunders, whose 2012 total direct compensation was set between the median and the 75th percentile of the aggregate survey and proxy data. Mr. Di Valerio’s compensation reflects his prior experience at large companies and the breadth of his leadership responsibilities for finance, information technology, and supply chain management. Ms. Saunders’s compensation reflects her broad general management and marketing leadership experience prior to assuming her role at Redbox.

For 2012 Named Executive Officer compensation, the Compensation Committee retained Towers Watson as a compensation consultant to conduct a total direct compensation analysis for executives and to make recommendations for changes based on our pay philosophy, business objectives, and stockholder expectations. Towers Watson conducted a competitive market analysis that included published national survey sources of similarly sized companies augmented by proxy data of companies with revenues of similar size to the Company. The data gathered included 25th percentile, 50th percentile (median), and 75th percentile base salary and actual cash compensation levels as well as 50th percentile and 75th percentile long-term incentive and total direct compensation levels. Specifically, Towers Watson provided data from the following surveys (survey data is provided in aggregate form; survey participants on an individual position basis were not identifiable) and the proxy data for the peer companies listed below, updated to January 1, 2012 by an annualized rate of 2.9%:

| • | 2011 Mercer Executive Compensation Survey Report (for companies with $1 billion to $2.5 billion in revenues); |

| • | 2011/2012 Towers Watson Data Services Survey Report on Top Management Compensation (for companies with $500 million to $2.5 billion in revenues); |

| • | 2011 Towers Watson Executive Compensation Database (for companies with $1 billion to $3 billion in revenues); and |

| • | 2011 Radford Global Technology Survey (for companies with $1 billion to $3 billion in revenues). |

-9-

Table of Contents

The 2012 peer group was identical to the 2011 peer group and was composed of the following companies:

| The Brink’s Company | Netflix, Inc. | |

| Diebold, Incorporated | RealNetworks, Inc. | |

| GameStop Corp. | Scientific Games Corporation | |

| International Game Technology | TiVo Inc. | |

Role of Executive Officers

In 2012, Mr. Davis, with support from the Company’s human resources and finance departments, prepared and provided recommendations to the Compensation Committee on the following items: base salaries for executives (excluding himself), the design of the 2012 short-term and long-term incentive plans for executives, and the grant value of equity awards provided to executives (excluding himself). Mr. Davis considered several factors when making these recommendations as outlined below in the “Elements of In-Service Compensation and Benefits” section. Following 2012 year-end, Mr. Davis reviewed the results of the Company with the Compensation Committee and provided the Compensation Committee with recommendations on individual performance incentives for executives (excluding himself).

Elements of Compensation

Elements of In-Service Compensation and Benefits

Compensation paid to our Named Executive Officers in 2012 consisted of the following primary components:

| • | base salary; |

| • | short-term (cash) incentives; and |

| • | long-term (equity) incentives. |

We pay base salaries in order to attract and retain executives as well as to provide a base of cash compensation for employment for the year. We pay short-term incentives to reward executives for individual and team performance and for achieving key measures of corporate performance. We pay long-term incentives in order to retain executives as well as to align the interests of executives directly with the long-term interests of our stockholders.

Base Salary. Base salaries for our executives are determined by evaluating a number of factors, including:

| • | the responsibilities of the position; |

| • | the strategic value of the position; |

| • | the experience, skills, and performance of the individual filling the position; |

| • | market data for comparable positions, with base salaries generally targeted near the median; and |

| • | the other elements of compensation and the overall value of total direct compensation. |

Base salaries are reviewed annually and are effective on or about March 1 of the new fiscal year. The Compensation Committee may adjust base salaries from time to time to recognize changes in individual performance, promotions, and competitive compensation levels.

In January 2012, the Compensation Committee established 2012 base salaries for the Named Executive Officers who were executives of the Company at that time. Ms. Saunders’s base salary was established at the time of her hire in August of 2012. The Compensation Committee approved the following 2012 base salaries:

| Named Executive Officer |

2012 Base Salary | Percentage Increase Over 2011 Base Salary |

||||||

| Paul D. Davis |

$ | 800,000 | 6.7% | |||||

| Gregg A. Kaplan |

500,000 | 5.3% | ||||||

| J. Scott Di Valerio |

500,000 | 5.3% | ||||||

| Donald R. Rench |

355,000 | 4.4% | ||||||

| Anne G. Saunders |

400,000 | N/A | ||||||

-10-

Table of Contents

As previously noted, although we generally set compensation, including base salaries, near the median of market data, the base salaries for Mr. Di Valerio and Ms. Saunders were set between the median and the 75th percentile of market data to reflect their extensive prior experience and the responsibilities and expectations of their positions at the Company and Redbox, respectively.

Short-Term Incentives. The 2012 short-term incentives awarded to our Named Executive Officers were awarded under the 2012 Incentive Compensation Plan and consisted of a cash bonus to reward executives for performance during the 2012 fiscal year. The structure of the 2012 Incentive Compensation Plan, identical to the structure of the 2011 Incentive Compensation Plan, was as follows:

| • | 80% was based on the Company’s achievement of certain performance measures described below; and |

| • | 20% was based on the Compensation Committee’s discretion after evaluating the management team’s and/or the individual’s performance. |

As noted above, the Compensation Committee believes that those executives who have a greater ability to influence Company performance should have a higher level of at-risk compensation. Accordingly, target bonus amounts varied by position. In 2012, the Compensation Committee increased the short-term incentive target award for Mr. Davis by 10%, from 80% of base salary to 90% of base salary, consistent with our objectives of providing pay-for-performance, at-risk compensation, and at-market compensation. Target award percentages for the other Named Executive Officers remained the same. As a result, target award percentages for 2012 as compared to 2011 were as follows:

| Named Executive Officer |

2011 Target Award as Percentage of Base Salary |

2012 Target Award as Percentage of Base Salary* |

||||||

| Paul D. Davis |

80% | 90 | % | |||||

| Gregg A. Kaplan |

70% | 70 | % | |||||

| J. Scott Di Valerio |

60% | 60 | % | |||||

| Donald R. Rench |

50% | 50 | % | |||||

| Anne G. Saunders |

N/A | 60 | % | |||||

| * | Target awards were based on the executive’s actual base salary for the year. Ms. Saunders’s bonus payout was annualized per her new hire agreement. |

As previously noted, although we generally set compensation, including short-term incentive targets, near the median of market data, the short-term incentive target for Ms. Saunders was set between the median and the 75th percentile of market data to reflect her extensive prior experience and the responsibilities and expectations of her position at Redbox.

Corporate Performance Component

In 2012, the Compensation Committee chose to measure our short-term incentives based on overall results, as well as results from core activities, both of which are indicative of our ongoing performance. We define our core activities as those associated with our primary operations, while our non-core activities are primarily nonrecurring events or events that we do not control. For further information regarding core activities and non-core activities, please reference our Annual Report under “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Non-GAAP Financial Measures—Core and Non-Core Results” on page 35.

For the 80% attributable to the achievement of corporate performance measures, the Compensation Committee reviewed the following performance measures, each weighted equally:

| • | Core DCM, defined as net income from core activities before taxes and stock-based compensation; and |

| • | revenue. |

-11-

Table of Contents

These measures were recommended by management and approved by the Compensation Committee in 2012 to continue the focus on net earnings in coordination with our strategic objective of profitable growth. The tables below show the level of achievement and the related level of payout (between 0% and 200%) attributable to each measure. Amounts are interpolated for achievement between the levels provided in the tables.

| Core DCM Achievement |

Payout % | |||

|

Amount |

% of Target |

|||

| $187,200,000 |

90.0% | 0% | ||

| $191,360,000 |

92.0% | 25% | ||

| $194,480,000 |

93.5% | 50% | ||

| $197,600,000 |

95.0% | 75% | ||

| $200,720,000 |

96.5% | 90% | ||

| $208,000,000 |

100.0% | 100% | ||

| $218,400,000 |

105.0% | 110% | ||

| $228,800,000 |

110.0% | 130% | ||

| $239,200,000 |

115.0% | 165% | ||

| $249,600,000 |

120.0% | 200% | ||

| Revenue Achievement |

Payout % | |||

|

Amount |

% of Target |

|||

| $2,138,312,000 |

94.0% | 0% | ||

| $2,161,060,000 |

95.0% | 25% | ||

| $2,183,808,000 |

96.0% | 50% | ||

| $2,217,930,000 |

97.5% | 75% | ||

| $2,274,800,000 |

100.0% | 100% | ||

| $2,331,670,000 |

102.5% | 125% | ||

| $2,365,792,000 |

104.0% | 150% | ||

| $2,388,540,000 |

105.0% | 175% | ||

| $2,411,288,000 |

106.0% | 200% | ||

In February 2013, the Compensation Committee determined that after adjustments related to the NCR asset acquisition, the Company achieved $263.4 million of Core DCM for a payout of 200% attributable to this measure, and $2.202 billion of revenue for a payout of 63.4% attributable to this measure, resulting in an aggregate payout under the tables above of 131.7% of the portion of each Named Executive Officer’s target award for this component of the 2012 Incentive Compensation Plan. Core DCM is calculated inclusive of bonus expenses.

Management Team and/or Individual Performance Component

For the 20% attributable to the Compensation Committee’s discretion after evaluating the management team’s and/or the individual’s performance, the Compensation Committee considered the recommendations of the Chief Executive Officer for all participating executives (excluding himself) and conducted its own evaluation of the Chief Executive Officer. The following table summarizes the factors evaluated by the Compensation Committee for each Named Executive Officer and the percentage payout approved by the Compensation Committee for this component of the plan.

| Named Executive Officer |

Management Team/Individual Performance Factors |

Payout % | ||

| Paul D. Davis |

Led strong full-year Company financial results; achieved our key objective of profitable growth; continued enhancement of leadership team at multiple levels; key involvement in the assessment of management talent and succession planning; completed several key partnership agreements. | 110% | ||

| Gregg A. Kaplan |

In addition to COO role, served as Interim President of Redbox for part of the year; key contributor to the effective transition to new Redbox President; key involvement in the development of new business concepts and ventures. | 100% | ||

| J. Scott Di Valerio |

Key leader in the NCR asset acquisition and agreements for Redbox Instant by Verizon; solid performance as Interim President of Redbox for part of the year; continued leadership in ensuring a strong finance and accounting function; strong performance in talent selection and development; executive champion of automation and SAP. | 120% | ||

-12-

Table of Contents

| Named Executive Officer |

Management Team/Individual Performance Factors |

Payout % | ||

| Donald R. Rench |

Led the legal team in successful completion of several important contracts, including the joint venture agreements for Redbox Instant by Verizon, the acquisition agreement for the NCR assets and agreements in support of Redbox TicketsTM; led the reorganization of the legal function. | 120% | ||

| Anne G. Saunders |

Strong transition into President of Redbox role; improved the organizational structure for Redbox marketing and customer experience functions. | 100% | ||

Total Payouts

Overall, the total cash bonuses paid to our Named Executive Officers under the 2012 Incentive Compensation Plan ranged from 125% to 129% of each of their respective target bonus amounts. Total individual cash bonuses paid to each of the participants for 2012 consisted of the following:

| Named Executive Officer |

Company Performance |

Management Team / Individual Performance |

Total Bonus | |||||||||

| Paul D. Davis |

$ | 751,298 | $ | 156,877 | $ | 908,175 | ||||||

| Gregg A. Kaplan |

365,923 | 69,462 | 435,385 | |||||||||

| J. Scott Di Valerio |

313,649 | 71,446 | 385,095 | |||||||||

| Donald R. Rench |

185,798 | 42,323 | 228,121 | |||||||||

| Anne G. Saunders |

252,864 | 48,000 | 300,864 | |||||||||

Long-Term Incentives. Long-term incentives awarded in 2012 to our Named Executive Officers (other than Ms. Saunders) consisted of equity compensation in the form of stock options, time-based restricted stock awards, and performance-based restricted stock awards. Due to Ms. Saunders’s mid-year start date, the Compensation Committee approved her initial equity award in the form of time-based restricted stock. Going forward, it is anticipated that Ms. Saunders’s long-term incentive mix will be consistent with that of the other Named Executive Officers. All long-term incentive grants to the Named Executive Officers are approved by the Compensation Committee. Annual long-term incentive grants are typically granted at the beginning of the service period for which the awards are granted (e.g., the long-term incentive grants for performance in 2012 were made in February 2012) in order to motivate and retain the executive for the upcoming year. The Compensation Committee also periodically makes promotional or new hire equity grants.

The Compensation Committee believes that stock ownership is an essential tool to align the interests of our executives and stockholders. Generally, the higher the level of the executive’s position, the greater the percentage of long-term incentives granted in the form of stock options, time-based restricted stock, and performance-based restricted stock, which we consider to be at-risk compensation. The Compensation Committee believes that a percentage of total compensation should be at risk in terms of Company performance to maintain strong stockholder alignment. Based on this philosophy, the Compensation Committee began granting performance-based restricted stock in 2007. For 2012, the Compensation Committee granted the same mix of annual long-term incentive compensation that it has over the last few years to our Named Executive Officers (excluding Ms. Saunders), consisting of:

| • | 30% stock options; |

| • | 20% time-based restricted stock; and |

| • | 50% performance-based restricted stock. |

The Compensation Committee determined the total dollar value of long-term compensation delivered to the Named Executive Officers based on an evaluation of the following factors (without assigning a relative weight to any one particular factor):

| • | the past performance at the Company and anticipated contribution by the executive; |

| • | the equity awards required from a competitive point of view to attract and/or retain the services of a valued executive; |

-13-

Table of Contents

| • | the market data for comparable positions provided by Towers Watson, with long-term compensation generally targeted between the median and the 75th percentile of the market data; |

| • | the relative total stockholder return over time of the Company compared to peer companies and market indexes; |

| • | the value of equity awards already held by the executive; |

| • | the value of long-term incentives as a percentage of total direct compensation; |

| • | the realized and realizable value of total compensation over the prior two years; and |

| • | the other elements of compensation and the current overall value and potential future value of total direct compensation. |

The total dollar value of long-term incentive compensation was converted into the number of shares subject to each type of award based on the mix of long-term incentives described above, using the closing price of our common stock on the date of grant or, for stock options, the Black-Scholes value of our stock options as of the date of grant. The total dollar value of target long-term incentive compensation delivered to the Named Executive Officers for 2012 was as follows:

| Named Executive Officer |

Total Dollar Value | |||

| Paul D. Davis |

$ | 1,800,000 | ||

| Gregg A. Kaplan |

1,100,000 | |||

| J. Scott Di Valerio |

900,000 | |||

| Donald R. Rench |

400,000 | |||

| Anne G. Saunders |

450,000 | |||

Stock Options and Time-Based Restricted Stock Awards

The Named Executive Officers were granted the following stock options and time-based restricted stock awards in 2012:

| Named Executive Officer |

Time-Based Restricted Stock |

Stock Options | ||||||

| Paul D. Davis |

6,330 | 20,111 | ||||||

| Gregg A. Kaplan |

3,868 | 12,290 | ||||||

| J. Scott Di Valerio |

3,165 | 10,055 | ||||||

| Donald R. Rench |

1,406 | 4,469 | ||||||

| Anne G. Saunders |

8,799 | N/A | ||||||

All annual stock options and time-based restricted stock awards to our Named Executive Officers (excluding Ms. Saunders) for 2012 were granted in February 2012. Ms. Saunders was granted a time-based restricted stock award at the time of her hire in August 2012.

All stock options and time-based restricted stock awards granted to the Named Executive Officers in 2012 vest (and are no longer subject to forfeiture, as applicable) in equal annual installments over the period from the date of grant until the fourth anniversary of the date of grant. The stock options have a term of ten years.

The exercise price for all stock option grants is set at the closing price of our common stock on the date of grant. We do not have, nor do we intend to have, a program, plan, or practice to time stock option grants to our existing executives or to new executives in coordination with the release of material nonpublic information for the purpose of affecting the value of executive compensation.

Performance-Based Restricted Stock Awards

As noted above, the performance-based restricted stock awards (at target) constituted 50% of the total dollar value of long-term incentive compensation delivered to each Named Executive Officer for 2012 (excluding Ms. Saunders). Executives received performance-based restricted stock awards in February 2012 for 2012 compensation.

The Compensation Committee annually reviews the structure of its performance-based restricted stock awards to ensure that the focus is on the right measures to incentivize executives and create value for our stockholders. As a result of that review, in 2012, the Compensation Committee determined to replace the revenue measure applicable to the 2011 performance-based restricted stock awards with Core Adjusted EBITDA from continuing operations, and the awards were subject to the achievement of the following measures, weighted as follows:

-14-

Table of Contents

| • | 50% based on Core Adjusted EBITDA from continuing operations; and |

| • | 50% based on Core ROIC. |

The Compensation Committee chose to measure long-term incentives based on results from core activities, which is indicative of our ongoing performance. As explained above in the discussion of our short-term incentives, we define our core activities as those associated with our primary operations. The Compensation Committee replaced the revenue measure with Core Adjusted EBITDA from continuing operations to place greater emphasis on profitability. Core ROIC is defined as net operating profit after taxes (“NOPAT”) for core activities for the fiscal year (2012) divided by invested capital. For purposes of calculating NOPAT, we apply a 40% corporate tax rate. Invested capital is defined as net debt plus total stockholder equity, averaged for the most recent two fiscal years (2011 and 2012).*

| * | For ease of understanding, formulas for our Core ROIC calculation are presented below: |

| Core = ROIC |

NOPAT Invested Capital |

|||

| NOPAT = |

(Income from continuing operations from core activities before taxes – Interest income + Interest expense) x (1 – Corporate tax rate) | |||

| Invested Capital = |

Total stockholder equity + Net Debt | |||

| Net Debt = |

(short- and long-term debt and capital lease obligations) – (cash and cash equivalents – cash identified for settling our payable to retail partners in relation to our Coin kiosks) | |||

The performance-based restricted stock awards were earned depending on the level of achievement of the performance goals. The tables below show the level of achievement and the related level of payout (between 50% and 150%) attributable to each measure. Amounts are interpolated for achievement between the levels provided in the tables.

| Core Adjusted EBITDA From Continuing Operations Achievement |

||||||||

|

Amount |

% of Target |

Payout % |

||||||

| $ 412,802,500 | 93.5% | 50% | ||||||

| $ 419,425,000 | 95.0% | 75% | ||||||

| $ 426,047,500 | 96.5% | 90% | ||||||

| $ 441,500,000 | 100.0% | 100% | ||||||

| $ 463,575,000 | 105.0% | 110% | ||||||

| $ 485,650,000 | 110.0% | 130% | ||||||

| $ 498,264,286 | 112.9% | 150% | ||||||

|

Core ROIC Achievement |

||||||||

|

Amount |

% of Target |

Payout % |

||||||

| 16.23% | 94.9% | 50% | ||||||

| 16.67% | 97.5% | 75% | ||||||

| 17.10% | 100.0% | 100% | ||||||

| 17.88% | 104.6% | 125% | ||||||

| 18.66% | 109.1% | 150% |

If the minimum specified performance goals for 2012 had not been achieved, the performance-based restricted stock awards would have been forfeited. An executive could earn up to 150% of the target number of shares if the maximum specified performance goals for 2012 were achieved. Once the performance-based restricted stock awards for 2012 are earned, the shares begin to vest in equal annual installments over three years with the first installment vesting in 2013, provided the executive continues to provide services to us.

-15-

Table of Contents

The following table shows the number of performance-based shares of restricted stock that could have been earned by a Named Executive Officer for 2012, depending on the level of achievement of the performance goals (as noted above, Ms. Saunders did not receive a performance-based restricted stock award in 2012):

| Named Executive Officer |

Minimum | Target | Maximum | |||||||||

| Paul D. Davis |

7,912 | 15,825 | 23,737 | |||||||||

| Gregg A. Kaplan |

4,835 | 9,671 | 14,506 | |||||||||

| J. Scott Di Valerio |

3,956 | 7,912 | 11,868 | |||||||||

| Donald R. Rench |

1,758 | 3,516 | 5,274 | |||||||||

| Anne G. Saunders |

N/A | N/A | N/A | |||||||||

At its meeting in February 2013, the Compensation Committee determined that, after adjustment related to the NCR asset acquisition, as required by the terms of the awards, the Company achieved $469.7 million of Core Adjusted EBITDA from continuing operations for a payout of 115.5% attributable to this measure and 22.6% of Core ROIC for a payout of 150% attributable to this measure. Accordingly, the Compensation Committee established the total amount of shares of restricted stock earned by the Named Executive Officers under their respective performance-based restricted stock awards at 132.75% of target amounts.

Other Benefits and Perquisites. Executives may receive additional benefits and limited perquisites that are (a) similar to those offered to our employees generally or (b) in the Compensation Committee’s view, reasonable, competitive, and consistent with our overall executive compensation program. Perquisites are reviewed by the Compensation Committee when made. All of our executives are eligible for reimbursement for tax-planning assistance. We provide medical, dental, and group life insurance benefits to each executive, similar to those provided to all other employees. Also, as provided to all other employees, we match a portion of each executive’s contribution to his or her account in the Coinstar 401(k) retirement plan.

Upon her hire, Ms. Saunders was provided with benefits to assist with her relocation and transition, including a sign-on bonus of $100,000 and reimbursement of the following relocation-related expenses: costs associated with closing the sale of her home; moving expenses; and temporary housing; storage; use of a rental car; and a tax gross-up associated with the relocation expenses. 2012 compensation associated with the relocation-related expenses was subject to a tax gross-up of $1,550. The relocation package was commensurate with Ms. Saunders’s position and was intended to enable an effective transition into her role as President of Redbox. All transition benefits were subject to repayment should Ms. Saunders voluntarily resign within two years of her start date. Due to the timing of the relocation, Ms. Saunders will also receive relocation benefits in 2013.

Severance and Change of Control

Employment Agreements and Change of Control Agreements. We have employment agreements with Messrs. Davis, Kaplan, and Di Valerio and Ms. Saunders and have double-trigger change of control agreements with all of our Named Executive Officers, as described in the section below entitled “Elements of Post-Termination Compensation and Benefits” in “Named Executive Officer Compensation.” Executives who do not have an employment agreement serve at the will of the Board of Directors, enabling the Board to remove those executives whenever it is in our best interests, with full discretion on any severance package (excluding vested benefits). The Compensation Committee believes that the benefits provided under the employment agreements and change of control agreements are reasonable in light of all relevant circumstances, including each individual’s past employment experience, desired terms and conditions of employment, similar benefits offered by similarly situated peer group companies, and the strategic importance of the individual’s respective position, including stability and retention. The Compensation Committee believes that the employment agreements were necessary in order to attract and retain the executives and that the change of control agreements are necessary in order to retain and maintain stability among the executive group in the event of a potential or actual change of control. The Compensation Committee and outside consultants reviewed the employment agreements at the time they were entered into in order to determine current market terms for the particular executive.

Equity Awards. As described in more detail in the section below entitled “Elements of Post-Termination Compensation and Benefits” in “Named Executive Officer Compensation,” certain equity awards to our Named Executive Officers accelerate (in full or in part) upon certain transactions (single-trigger) or, in other cases, upon termination of employment after certain transactions (double-trigger). Since March 2010, equity awards granted to our Named Executive Officers have emphasized double-trigger benefits, with single-trigger benefits limited to a change of control that is not a company transaction or a change of control that is a company transaction, but in which awards are not assumed or substituted for. These arrangements are designed to facilitate the retention of critical employees during a transaction, to motivate management to obtain the best price for our Company, thereby aligning their interests with the interests of our stockholders, and to align with emerging governance trends. Under these arrangements, if an executive were to leave prior to the completion of a change of control, unvested awards held by the executive would terminate.

-16-

Table of Contents

Tax Gross-Ups. The Company does not provide Named Executive Officers with a tax gross-up to cover personal income taxes that may apply to any severance or change of control benefits.

Retention Arrangements

To help ensure the success of the transition after Coinstar acquired the remaining interests in Redbox in 2009, it was important for Mr. Kaplan to remain with the Company after the transaction. Accordingly, in 2009, we entered into a letter agreement, as amended, with Mr. Kaplan. In determining the retention amounts and terms for this agreement, the Compensation Committee considered prior long-term incentive arrangements at Redbox, existing compensation practices at the Company, and the importance of retaining key talent for the Redbox line of business. The letter agreement with Mr. Kaplan provided for the grant of a stock option in 2009 and certain annual cash payments in 2010, 2011, and 2012, subject to Mr. Kaplan’s continuous employment with the Company. The last payment under this arrangement in the amount of $294,349 was made to Mr. Kaplan on February 26, 2012. The letter agreement with Mr. Kaplan further provided that the vesting of the stock option would have accelerate if, before March 19, 2013, his employment or service relationship with the Company had been terminated by the Company without cause or by him with good reason.

Officer Stock Ownership Guidelines

Because we believe that stock ownership is an essential tool to align management and stockholder interests, we have had stock ownership guidelines in place for our executives since 2003. In December 2010, the Compensation Committee and Board of Directors approved revised stock ownership guidelines to increase the ownership levels required of our executives. Under these guidelines, the Chief Executive Officer must own shares of our common stock equal in value to three times (3x) his annual base salary and all other executives must own shares of our common stock equal in value to two times (2x) their annual base salary. Shares that count towards satisfaction of these guidelines include (a) fully vested shares owned directly or indirectly through immediate family members and (b) unvested restricted stock, including time-based restricted stock and performance-based restricted stock where the performance criteria has been achieved. The shares owned are valued at the greater of (i) the price at the time of purchase/acquisition or (ii) the current market value. Ownership is measured as of December 1 of each year. Executives as of the date the guidelines were adopted are expected to meet the guidelines by December 1, 2015. Persons becoming executives after the guidelines were adopted will have until December 1 of the fifth fiscal year after being deemed an executive to come into compliance. Executives must show progress of at least 20% per year toward the five-year stock ownership target until such target is met. All executives were in compliance with the officer stock ownership guidelines as of the last measurement date.

Other than these stock ownership guidelines, our executives are not required to hold our stock for a specific amount of time following exercise or vesting.

Hedging Policy; Pledging of Stock

Directors and executives are required to obtain pre-clearance from the Company before entering into any hedging transaction involving the Company’s securities, such as a zero-cost collar or forward sale contract. To date, no director or executive of the Company has requested such pre-clearance or entered into such a transaction. As of the filing date of this Amendment, no director or executive was engaged in pledging of Company common stock.

Tax Considerations

Section 162(m) of the Code imposes a $1 million limit on the amount that a publicly traded corporation may deduct for compensation paid to the Chief Executive Officer and the three other most highly compensated executives (other than the Chief Financial Officer) in a fiscal year. “Performance-based compensation” is excluded from this $1 million limit. Stock options and certain performance-based restricted stock awards granted to our executives pursuant to our equity compensation plans are designed to qualify for the performance-based exemption. While the Compensation Committee believes it is important to maximize the tax deductibility of compensation paid to our executives, the Compensation Committee has not adopted a policy that all compensation must be tax-deductible and qualified under Section 162(m). In order to maintain ongoing flexibility of our compensation programs, the Compensation Committee may from time to time approve incentive and other compensation that exceeds the $1 million limit.

Risk Assessment

In developing and reviewing the Company’s executive incentive programs, the Compensation Committee considered the business risks inherent in program designs to ensure that they do not induce executives to take unacceptable levels of business risk for the purpose of increasing their incentive plan awards at the expense of stockholder interests. The

-17-

Table of Contents

Compensation Committee is satisfied that the plan designs are conservative in this respect and that the compensation components work together as a check and balance to ensure that executive incentives are consistent with stockholder interests. The Compensation Committee believes that as a result of our use of different types of equity compensation awards, our use of both long- and short-term incentives with multiple performance measures, the implementation of our Policy on Reimbursement of Incentive Payments (as discussed below), the caps on our incentive payments at sustainable levels, and our stock ownership guidelines (as discussed below), the Company’s executive compensation program does not encourage our management to take unreasonable risks relating to the business.

2012 Say-on-Pay Vote

At our 2012 Annual Meeting of Stockholders, approximately 99% of the votes cast were cast in favor of the advisory vote on the compensation of our Named Executive Officers (not including abstentions or broker non-votes) (the “2012 Say-on-Pay Vote”). With the exception of Ms. Saunders, the 2012 Say-on-Pay Vote occurred after 2012 compensation decisions for Named Executive Officers had been made. Given the strong support from our stockholders in the 2012 Say-on-Pay Vote, the Compensation Committee determined that additional adjustments to the compensation of Named Executive Officers were not necessary.

Policy on Reimbursement of Incentive Payments

In March 2009, the Compensation Committee approved the Policy on Reimbursement of Incentive Payments, which provides that the Company may, in its discretion, require reimbursement of any annual incentive payment or long-term incentive payment to an executive officer or standing officer where: (a) the payment (in shares of the Company’s common stock or otherwise) was predicated upon achieving financial results that were subsequently the subject of a material restatement of the Company’s financial statements filed with the SEC; (b) the Board of Directors or the Compensation Committee determines that the individual engaged in intentional misconduct that caused or substantially caused the need for the restatement; and (c) a lower payment would have been made to the individual based upon the restated financial results. In each such case, the Company, in its discretion, may take one or more of the following actions: (i) cancel any or all outstanding annual incentive awards or long-term incentive awards held by such individual; (ii) demand that the individual return to the Company any or all cash amounts paid to the individual in settlement of an annual incentive award or any or all shares of the Company’s common stock issued to the individual in settlement of a long-term incentive award; and (iii) demand that the individual pay over to the Company any or all of the proceeds received by the individual upon the sale, transfer, or other transaction involving shares of the Company’s common stock issued in settlement of a long-term incentive award.

This policy applies and is effective with respect to any annual incentive plan established by the Company with a performance period commencing on or after January 1, 2009 and any long-term incentive awards granted by the Company on or after January 1, 2009.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Company has reviewed and discussed the Compensation Discussion and Analysis with management, and, based on such review and discussions, the Compensation Committee recommended to the Board of Directors of the Company that the Compensation Discussion and Analysis be included in this Amendment.

The Compensation Committee

Ronald B. Woodard, Chairperson

Arik A. Ahitov

Deborah L. Bevier

Nora M. Denzel*

| * | Ms. Denzel was appointed to the Board of Directors and to the Compensation Committee on January 31, 2013. Ms. Denzel did not attend any Compensation Committee meetings in 2012. |

-18-

Table of Contents

NAMED EXECUTIVE OFFICER COMPENSATION

2012 Summary Compensation Table

The following table shows for the fiscal year ended December 31, 2012, compensation earned by (1) our Chief Executive Officer, (2) our Chief Financial Officer, and (3) the other three most highly compensated individuals who served as executive officers, as of December 31, 2012 (the “Named Executive Officers”).

| Name and Principal Position |

Year | Salary | Bonus | Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

All Other Compensation |

Total | ||||||||||||||||||||||||

| Paul D. Davis (1) |

2012 | $ | 795,385 | $ | 156,877 | (2) | $ | 1,259,955 | (3) | $ | 545,290 | (4) | $ | 751,298 | (5) | $ | 9,892 | (6) | $ | 3,518,697 | ||||||||||||

| Chief Executive Officer and Director |

2011 | 741,667 | 142,400 | 1,154,967 | 492,572 | 538,035 | 10,051 | 3,079,692 | ||||||||||||||||||||||||

| 2010 | 683,333 | 61,500 | 1,014,979 | 648,979 | 401,144 | 9,133 | 2,819,068 | |||||||||||||||||||||||||

| Gregg A. Kaplan (7) |

2012 | $ | 498,077 | $ | 363,811 | (2) | $ | 769,963 | (3) | $ | 333,231 | (4) | $ | 365,923 | (5) | $ | 16,392 | (6) | $ | 2,347,397 | ||||||||||||

| President and Chief Operating Officer |

2011 | 470,833 | 664,502 | 664,959 | 283,599 | 298,866 | 10,531 | 2,393,290 | ||||||||||||||||||||||||

| 2010 | 446,667 | 1,708,179 | 559,959 | 358,054 | 262,211 | 9,800 | 3,344,870 | |||||||||||||||||||||||||

| J. Scott Di Valerio (8) |

2012 | $ | 498,077 | $ | 71,446 | (2) | $ | 629,949 | (3) | $ | 272,631 | (4) | $ | 313,649 | (5) | $ | 3,692 | (6) | $ | 1,789,444 | ||||||||||||

| Chief Financial Officer |

2011 | 470,833 | 67,800 | 559,925 | 238,823 | 256,171 | 10,077 | 1,603,629 | ||||||||||||||||||||||||

| 2010 | 428,076 | 40,500 | 419,979 | 278,975 | 264,168 | 16,600 | 1,448,298 | |||||||||||||||||||||||||

| Donald R. Rench |

2012 | $ | 354,058 | $ | 42,323 | (2) | $ | 279,914 | (3) | $ | 121,172 | (4) | $ | 185,798 | (5) | $ | 4,188 | (6) | $ | 987,453 | ||||||||||||

| Chief Legal Officer, General Counsel, and Corporate Secretary |