Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Second Quarter 2013 Investor Presentation Alliance Data Company Overview NYSE: ADS Exhibit 99.1

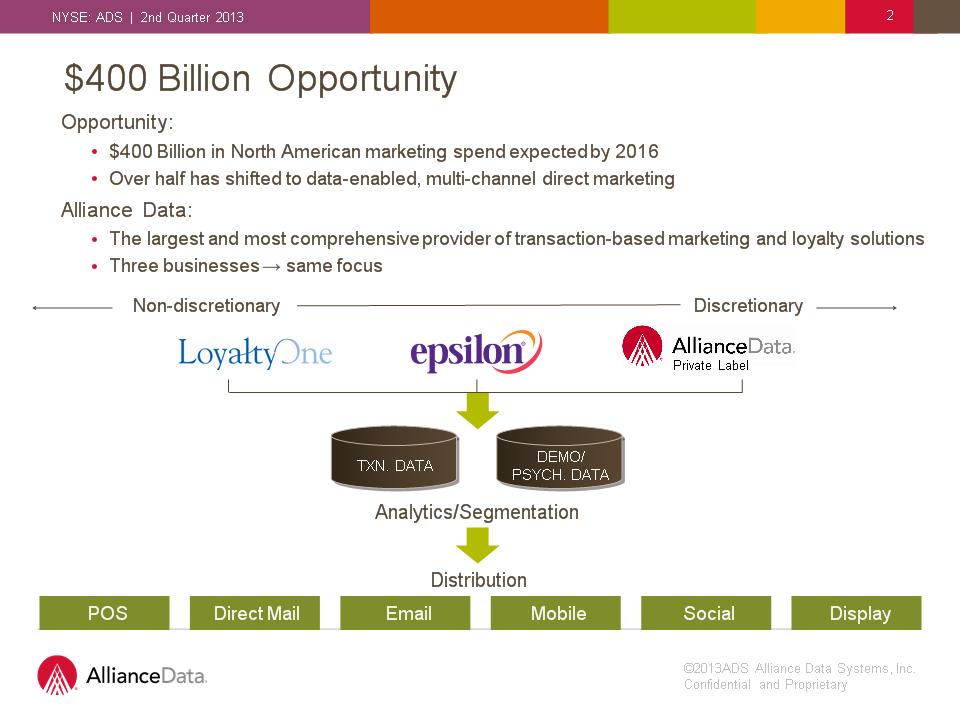

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * $400 Billion Opportunity Opportunity: $400 Billion in North American marketing spend expected by 2016 Over half has shifted to data-enabled, multi-channel direct marketing Alliance Data: The largest and most comprehensive provider of transaction-based marketing and loyalty solutions Three businesses → same focus Private Label Non-discretionary Discretionary Analytics/Segmentation Distribution TXN. DATA DEMO/ PSYCH. DATA POS Direct Mail Email Mobile Social Display

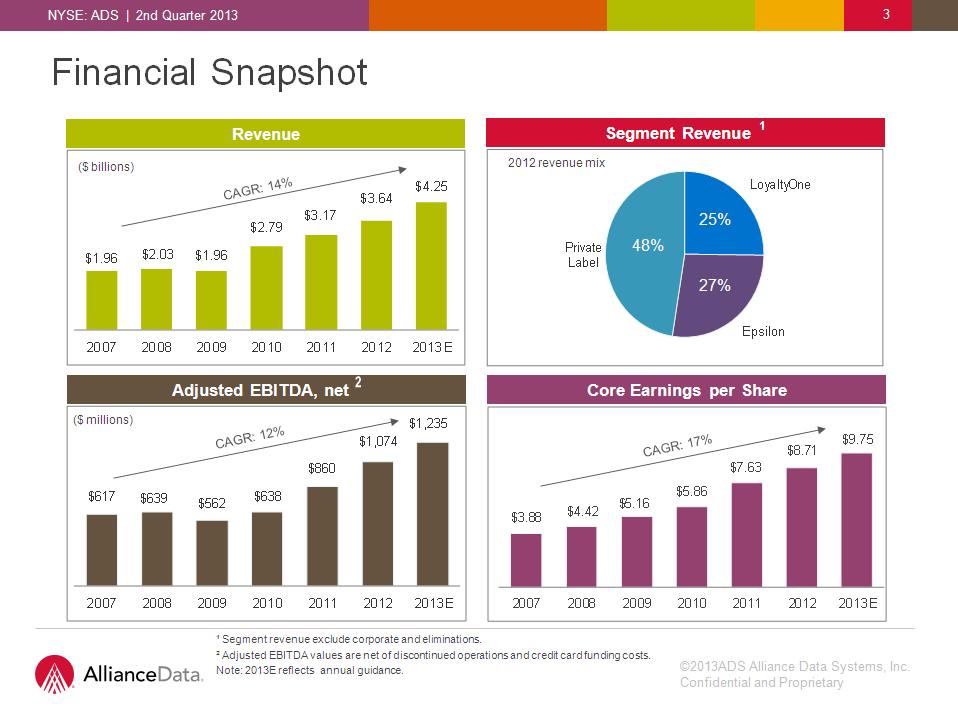

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Financial Snapshot Revenue CAGR: 14% ($ billions) Core Earnings per Share CAGR: 17% Segment Revenue 1 2012 revenue mix ¹ Segment revenue exclude corporate and eliminations. ² Adjusted EBITDA values are net of discontinued operations and credit card funding costs. Note: 2013E reflects annual guidance. Adjusted EBITDA, net 2 ($ millions) CAGR: 12% 48% 25% 27%

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Business Segment Review

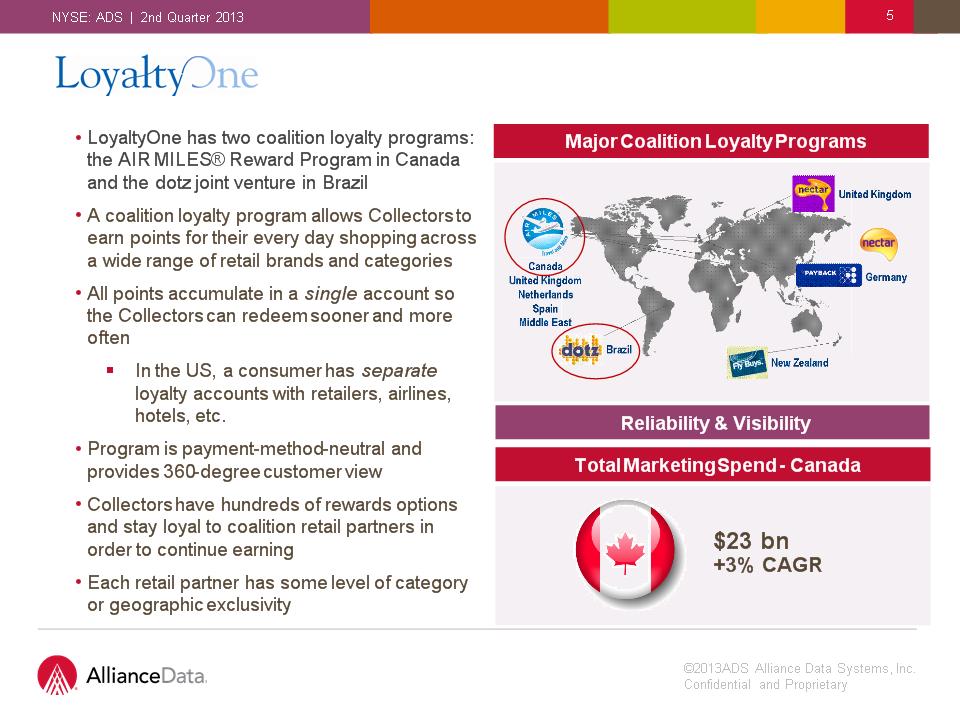

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Major Coalition Loyalty Programs Reliability & Visibility Total Marketing Spend - Canada $23 bn +3% CAGR LoyaltyOne has two coalition loyalty programs: the AIR MILES® Reward Program in Canada and the dotz joint venture in Brazil A coalition loyalty program allows Collectors to earn points for their every day shopping across a wide range of retail brands and categories All points accumulate in a single account so the Collectors can redeem sooner and more often In the US, a consumer has separate loyalty accounts with retailers, airlines, hotels, etc. Program is payment-method-neutral and provides 360-degree customer view Collectors have hundreds of rewards options and stay loyal to coalition retail partners in order to continue earning Each retail partner has some level of category or geographic exclusivity

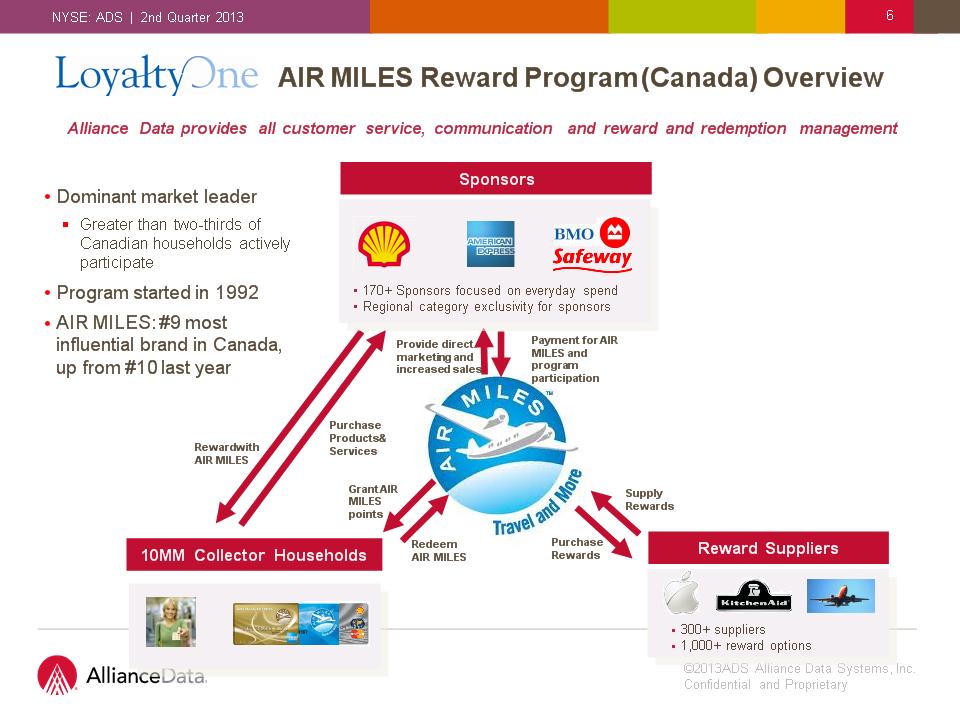

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * AIR MILES Reward Program (Canada) Overview 10MM Collector Households Reward Suppliers Grant AIR MILES points Redeem AIR MILES Purchase Rewards Supply Rewards Purchase Products & Services Reward with AIR MILES Provide direct marketing and increased sales Payment for AIR MILES and program participation 300+ suppliers 1,000+ reward options Sponsors 170+ Sponsors focused on everyday spend Regional category exclusivity for sponsors Alliance Data provides all customer service, communication and reward and redemption management Dominant market leader Greater than two-thirds of Canadian households actively participate Program started in 1992 AIR MILES: #9 most influential brand in Canada, up from #10 last year

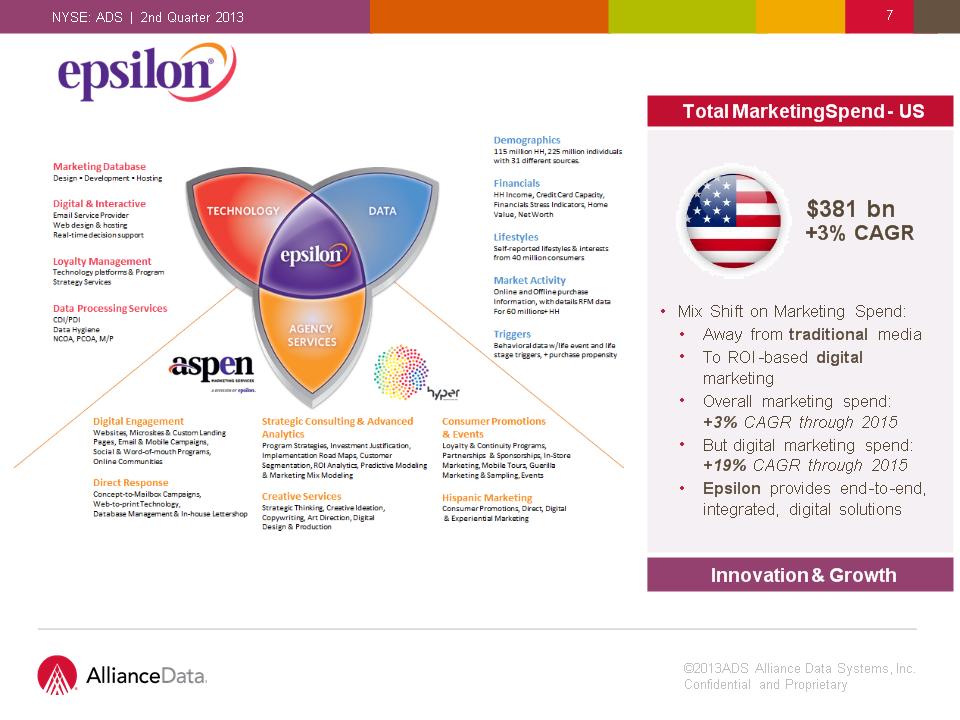

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Mix Shift on Marketing Spend: Away from traditional media To ROI-based digital marketing Overall marketing spend: +3% CAGR through 2015 But digital marketing spend: +19% CAGR through 2015 Epsilon provides end-to-end, integrated, digital solutions $381 bn +3% CAGR Innovation & Growth Total Marketing Spend - US

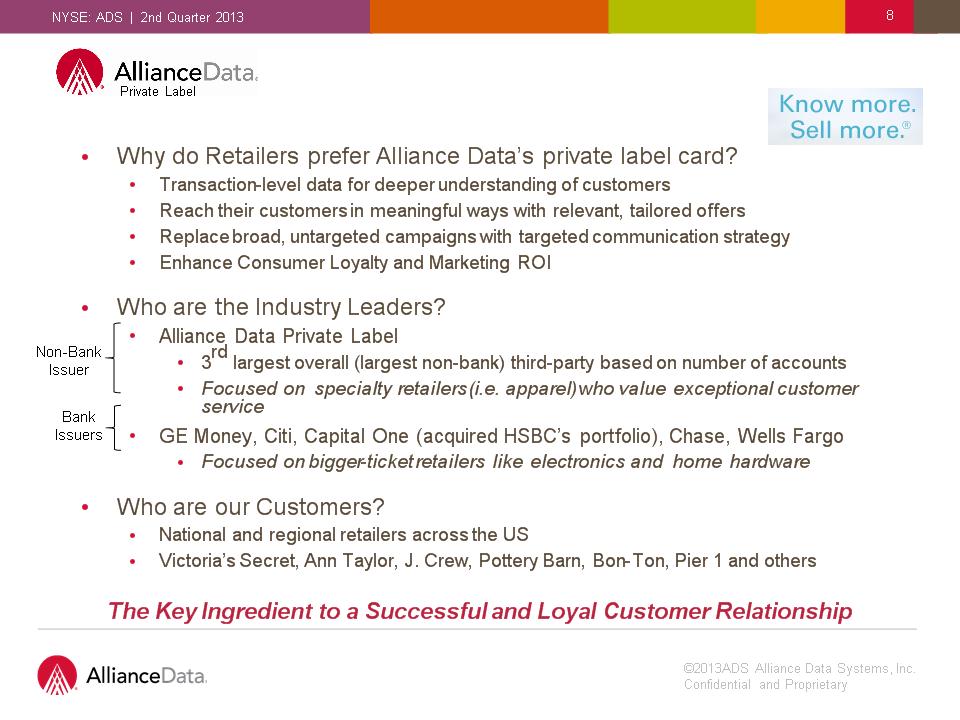

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Why do Retailers prefer Alliance Data’s private label card? Transaction-level data for deeper understanding of customers Reach their customers in meaningful ways with relevant, tailored offers Replace broad, untargeted campaigns with targeted communication strategy Enhance Consumer Loyalty and Marketing ROI Who are the Industry Leaders? Alliance Data Private Label 3rd largest overall (largest non-bank) third-party based on number of accounts Focused on specialty retailers (i.e. apparel) who value exceptional customer service GE Money, Citi, Capital One (acquired HSBC’s portfolio), Chase, Wells Fargo Focused on bigger-ticket retailers like electronics and home hardware Who are our Customers? National and regional retailers across the US Victoria’s Secret, Ann Taylor, J. Crew, Pottery Barn, Bon-Ton, Pier 1 and others The Key Ingredient to a Successful and Loyal Customer Relationship Bank Issuers Non-Bank Issuer Private Label

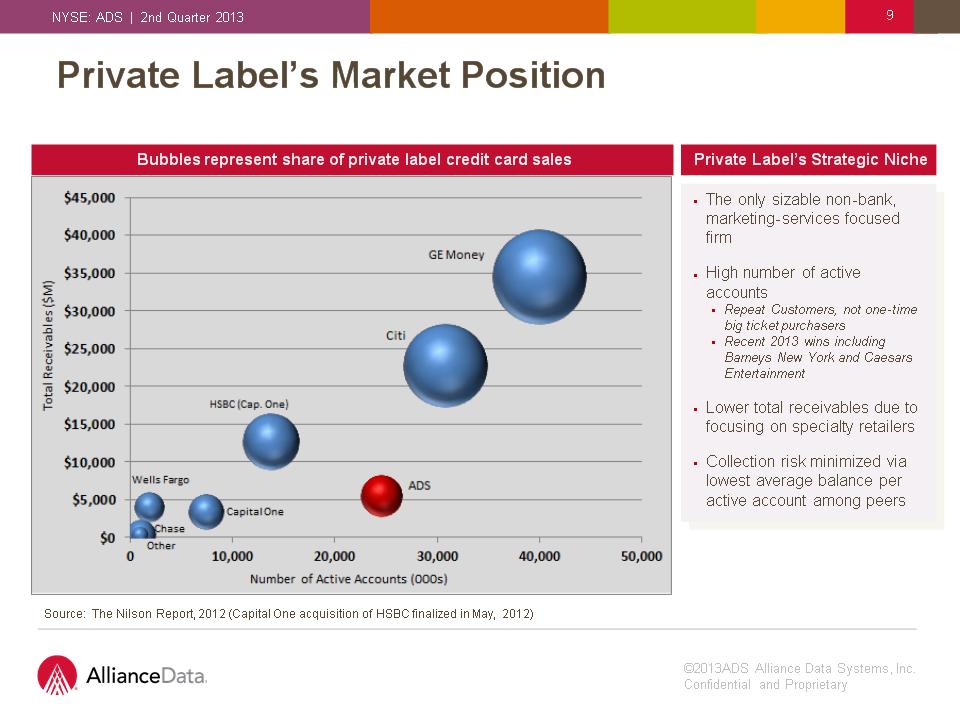

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Source: The Nilson Report, 2012 (Capital One acquisition of HSBC finalized in May, 2012) Private Label’s Market Position Private Label’s Strategic Niche The only sizable non-bank, marketing-services focused firm High number of active accounts Repeat Customers, not one-time big ticket purchasers Recent 2013 wins including Barneys New York and Caesars Entertainment Lower total receivables due to focusing on specialty retailers Collection risk minimized via lowest average balance per active account among peers Bubbles represent share of private label credit card sales

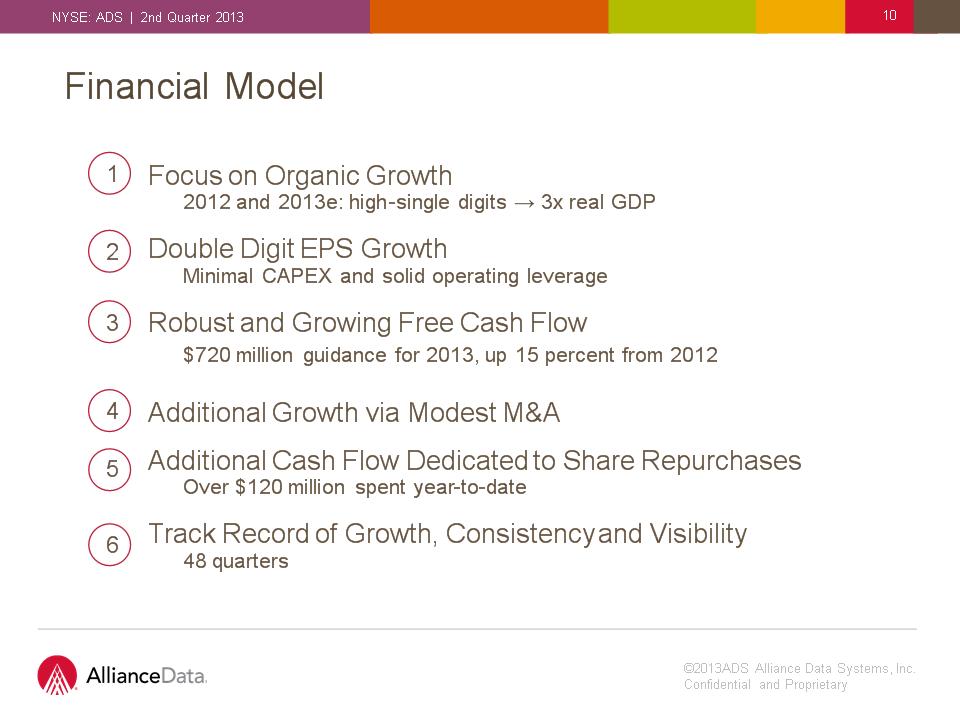

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Financial Model Focus on Organic Growth 2012 and 2013e: high-single digits → 3x real GDP Double Digit EPS Growth Minimal CAPEX and solid operating leverage Robust and Growing Free Cash Flow $720 million guidance for 2013, up 15 percent from 2012 Additional Growth via Modest M&A Additional Cash Flow Dedicated to Share Repurchases Over $120 million spent year-to-date Track Record of Growth, Consistency and Visibility 48 quarters 1 2 3 4 5 6

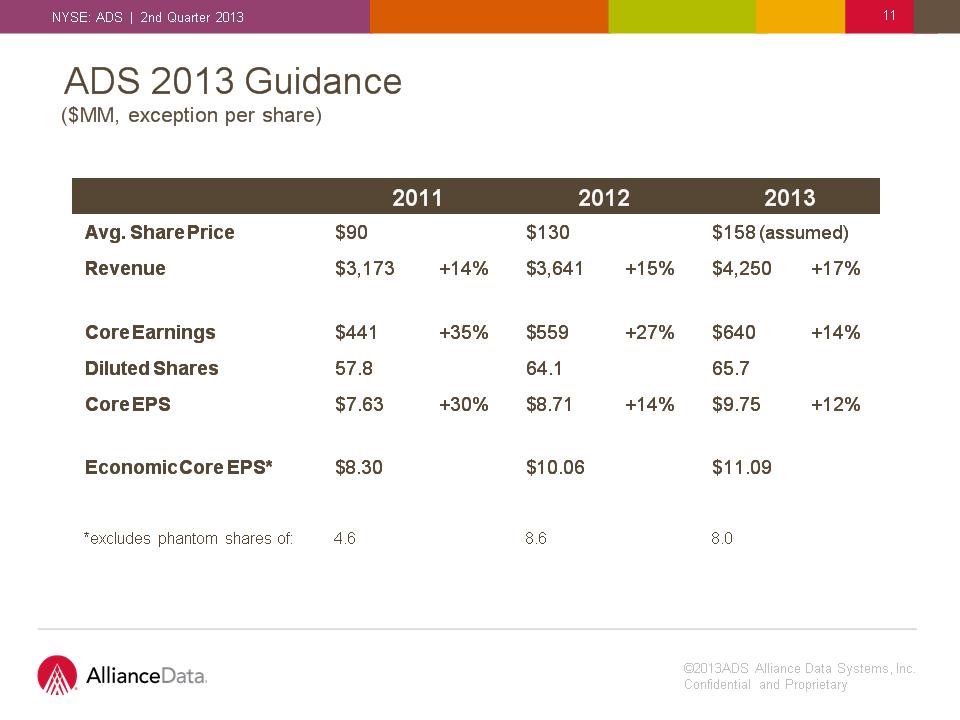

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * ADS 2013 Guidance ($MM, exception per share) 2011 2011 2012 2012 2013 2013 Avg. Share Price $90 $130 $158 (assumed) $158 (assumed) Revenue $3,173 +14% $3,641 +15% $4,250 +17% Core Earnings $441 +35% $559 +27% $640 +14% Diluted Shares 57.8 64.1 65.7 Core EPS $7.63 +30% $8.71 +14% $9.75 +12% Economic Core EPS* $8.30 $10.06 $11.09 *excludes phantom shares of: 4.6 8.6 8.0

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Safe Harbor Statement and Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “predict,” “project,” “would” and similar expressions as they relate to us or our management. When we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information currently available to us. Although we believe that the expectations reflected in the forward-looking statements are reasonable, these forward-looking statements are subject to risks, uncertainties and assumptions, including those discussed in our filings with the Securities and Exchange Commission. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statements contained in this presentation reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. We have no intention, and disclaim any obligation, to update or revise any forward-looking statements, whether as a result of new information, future results or otherwise, except as required by law. “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this presentation regarding Alliance Data Systems Corporation’s business which are not historical facts are “forward-looking statements” that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the most recently ended fiscal year. Risk factors may be updated in Item 1A in each of the Company’s Quarterly Reports on Form 10-Q for each quarterly period subsequent to the Company’s most recent Form 10-K.

©2013ADS Alliance Data Systems, Inc. Confidential and Proprietary NYSE: ADS | 2nd Quarter 2013 * Financial Measures In addition to the results presented in accordance with generally accepted accounting principles, or GAAP, the Company presents financial measures that are non-GAAP measures, such as constant currency financial measures, adjusted EBITDA, adjusted EBITDA margin, adjusted EBITDA net of funding costs, core earnings and core earnings per diluted share (core EPS). The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the Company’s reported GAAP results, provide useful information to investors regarding the Company’s performance and overall results of operations. These metrics are an integral part of the Company’s internal reporting to measure the performance of reportable segments and the overall effectiveness of senior management. Reconciliations to comparable GAAP financial measures are available in the accompanying schedules and on the Company’s website. The financial measures presented are consistent with the Company’s historical financial reporting practices. Core earnings and core earnings per diluted share represent performance measures and are not intended to represent liquidity measures. The non-GAAP financial measures presented herein may not be comparable to similarly titled measures presented by other companies, and are not identical to corresponding measures used in other various agreements or public filings.