Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRSTMERIT CORP /OH/ | a8kq12013.htm |

| EX-99.1 - EXHIBIT - FIRSTMERIT CORP /OH/ | ex991_q12013.htm |

First Quarter 2013 Earnings Conference Call Supplemental Information April 23, 2013 FIRSTMERIT Corporation

Forward-Looking Statements Disclosure This presentation may contain forward-looking statements relating to present or future trends or factors affecting the banking industry, and specifically the financial condition and results of operations, including without limitation, statements relating to the earnings outlook of the Corporation, as well as its operations, markets and products. Actual results could differ materially from those indicated. Among the important factors that could cause results to differ materially are interest rate changes, continued softening in the economy, which could materially impact credit quality trends and the ability to generate loans, changes in the mix of the Corporation's business, competitive pressures, changes in accounting, tax or regulatory practices or requirements, the Corporation's ability to realize the synergies and benefits contemplated by the acquisition of Citizens Republic Bancorp, Inc., a Michigan corporation (“Citizens”) Citizens, such as it being accretive to earnings and expanding the Corporation's geographic presence, in the time frame anticipated or at all, and those risk factors detailed in the Corporation's periodic reports and registration statements filed with the Securities and Exchange Commission. The Corporation undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. 2

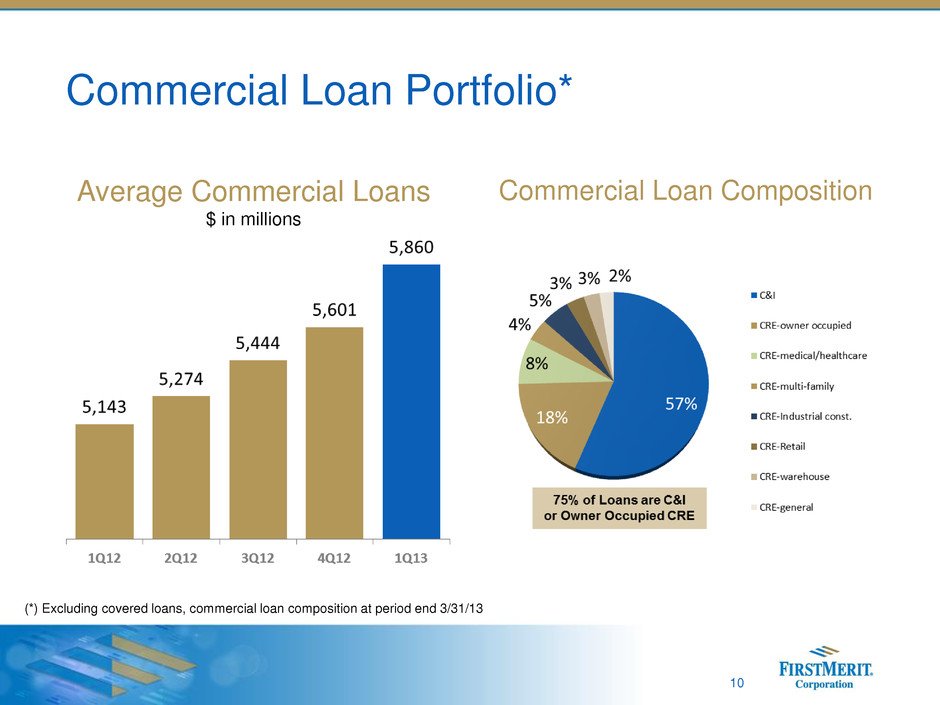

3 56th consecutive quarter of profitability Net income of $37.3 million/$0.33 per diluted share • Return on average assets of 1.01% • Return on average equity of 8.83% Dividend of $0.16 per share Solid asset quality results • NCO ratio at 0.27% • NPA ratio at 0.59% Average commercial* loan growth of $259.3 million, or 4.63%, compared with 4Q12 Average core deposit growth of $285.4 million, or 2.81%, compared with 4Q12 Robust tangible common equity ratio of 8.03% at 3/31/13 1Q 2013 Highlights (*) Excluding covered loans

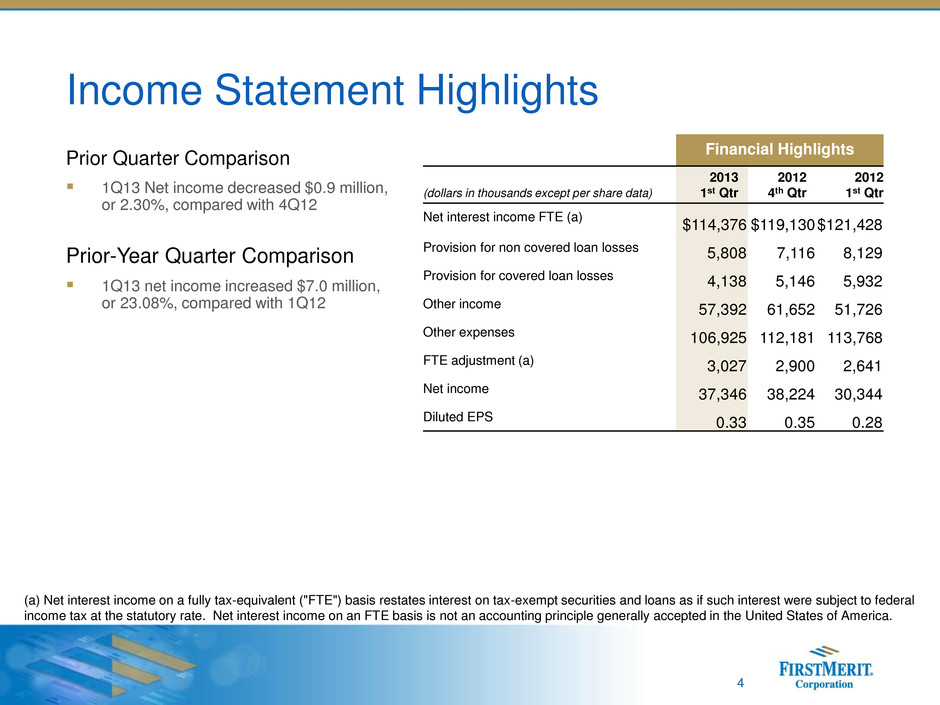

4 Income Statement Highlights Financial Highlights (dollars in thousands except per share data) 2013 1st Qtr 2012 4th Qtr 2012 1st Qtr Net interest income FTE (a) $114,376 $119,130 $121,428 Provision for non covered loan losses 5,808 7,116 8,129 Provision for covered loan losses 4,138 5,146 5,932 Other income 57,392 61,652 51,726 Other expenses 106,925 112,181 113,768 FTE adjustment (a) 3,027 2,900 2,641 Net income 37,346 38,224 30,344 Diluted EPS 0.33 0.35 0.28 Prior Quarter Comparison 1Q13 Net income decreased $0.9 million, or 2.30%, compared with 4Q12 Prior-Year Quarter Comparison 1Q13 net income increased $7.0 million, or 23.08%, compared with 1Q12 (a) Net interest income on a fully tax-equivalent ("FTE") basis restates interest on tax-exempt securities and loans as if such interest were subject to federal income tax at the statutory rate. Net interest income on an FTE basis is not an accounting principle generally accepted in the United States of America.

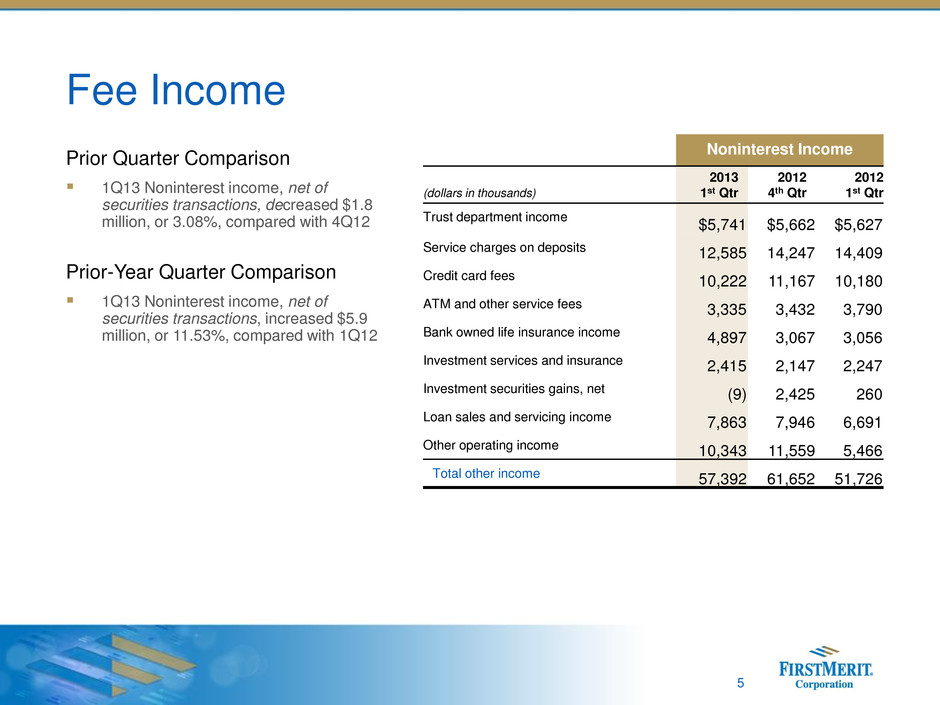

Fee Income 5 Prior Quarter Comparison 1Q13 Noninterest income, net of securities transactions, decreased $1.8 million, or 3.08%, compared with 4Q12 Prior-Year Quarter Comparison 1Q13 Noninterest income, net of securities transactions, increased $5.9 million, or 11.53%, compared with 1Q12 Noninterest Income (dollars in thousands) 2013 1st Qtr 2012 4th Qtr 2012 1st Qtr Trust department income $5,741 $5,662 $5,627 Service charges on deposits 12,585 14,247 14,409 Credit card fees 10,222 11,167 10,180 ATM and other service fees 3,335 3,432 3,790 Bank owned life insurance income 4,897 3,067 3,056 Investment services and insurance 2,415 2,147 2,247 Investment securities gains, net (9) 2,425 260 Loan sales and servicing income 7,863 7,946 6,691 Other operating income 10,343 11,559 5,466 Total other income 57,392 61,652 51,726

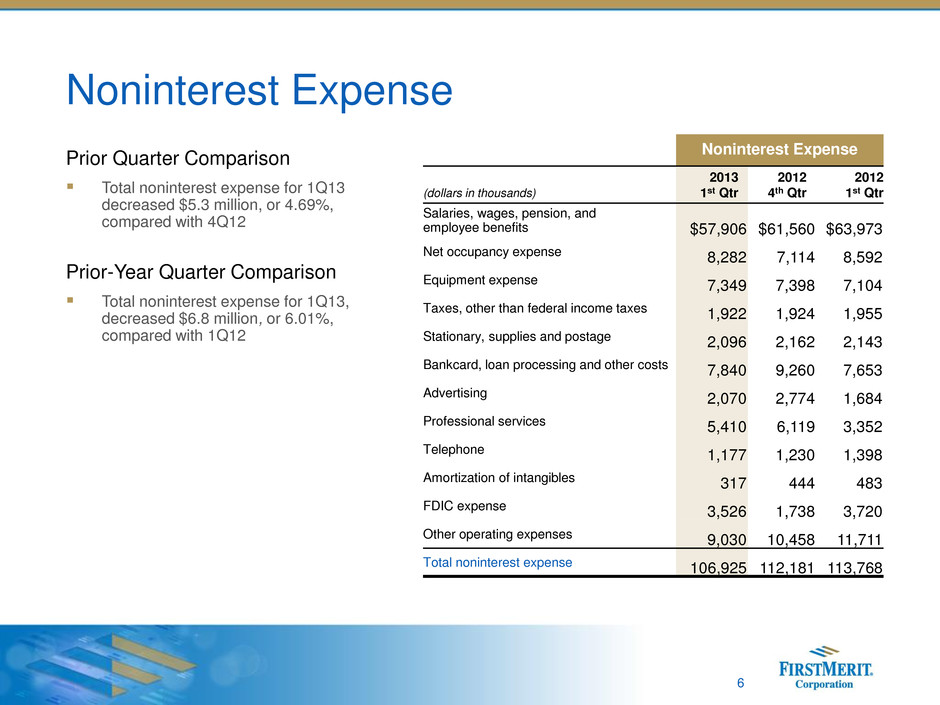

Noninterest Expense 6 Noninterest Expense (dollars in thousands) 2013 1st Qtr 2012 4th Qtr 2012 1st Qtr Salaries, wages, pension, and employee benefits $57,906 $61,560 $63,973 Net occupancy expense 8,282 7,114 8,592 Equipment expense 7,349 7,398 7,104 Taxes, other than federal income taxes 1,922 1,924 1,955 Stationary, supplies and postage 2,096 2,162 2,143 Bankcard, loan processing and other costs 7,840 9,260 7,653 Advertising 2,070 2,774 1,684 Professional services 5,410 6,119 3,352 Telephone 1,177 1,230 1,398 Amortization of intangibles 317 444 483 FDIC expense 3,526 1,738 3,720 Other operating expenses 9,030 10,458 11,711 Total noninterest expense 106,925 112,181 113,768 Prior Quarter Comparison Total noninterest expense for 1Q13 decreased $5.3 million, or 4.69%, compared with 4Q12 Prior-Year Quarter Comparison Total noninterest expense for 1Q13, decreased $6.8 million, or 6.01%, compared with 1Q12

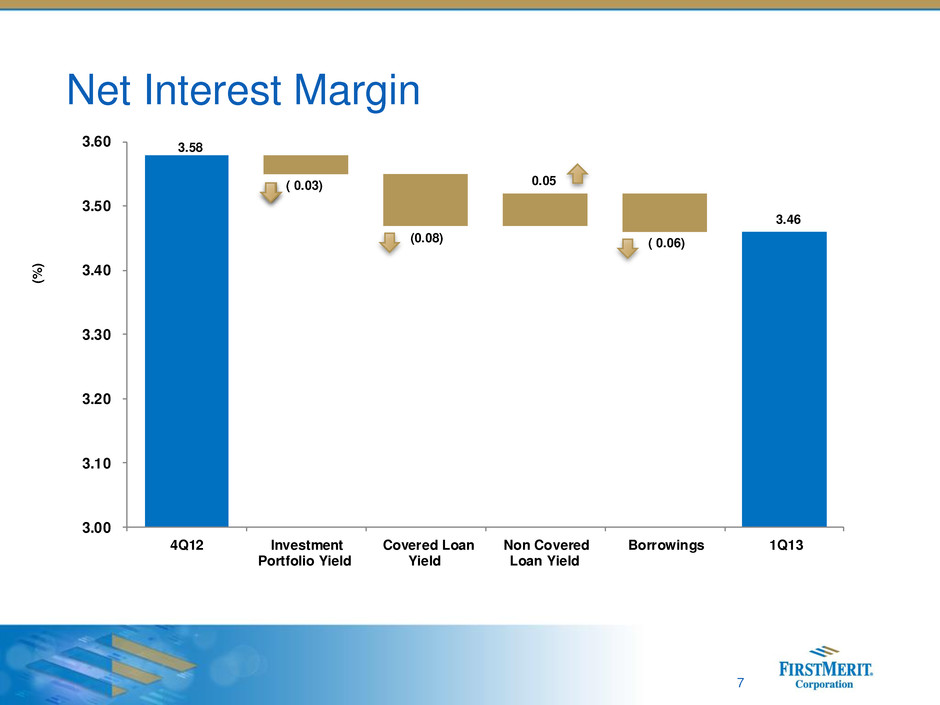

Net Interest Margin 7 3.58 ( 0.03) (0.08) 0.05 ( 0.06) 3.46 3.00 3.10 3.20 3.30 3.40 3.50 3.60 4Q12 Investment Portfolio Yield Covered Loan Yield Non Covered Loan Yield Borrowings 1Q13 (% )

Asset Yields / Liability Costs* 8 (dollars in thousands) March 31, 2013 December 31, 2012 March 31, 2012 Total investment securities and federal funds sold 3,697,979 2.83% 3,686,815 2.89% 3,690,822 3.08% Non-Covered loans 8,735,307 3.88% 8,444,208 3.94% 7,781,449 4.27% Covered loans 960,619 6.39% 1,095,185 6.33% 1,436,430 5.73% Total loans 9,695,926 4.14% 9,539,393 4.22% 9,217,879 4.50% Total earning assets 13,408,789 3.78% 13,246,693 3.85% 12,935,184 4.10% Demand – non interest bearing 3,321,660 0.00% 3,306,444 0.00% 3,036,590 0.00% Demand – interest bearing 1,300,816 0.10% 1,122,796 0.09% 1,066,132 0.09% Savings and money market accounts 5,835,750 0.37% 5,743,599 0.36% 5,675,052 0.36% Certificates and other time deposits 1,331,558 0.63% 1,422,246 0.64% 1,694,247 0.84% Total deposits 11,789,784 0.26% 11,595,085 0.27% 11,472,021 0.31% Borrowings 1,198,521 0.99% 1,120,969 0.47% 1,072,374 0.53% Total interest bearing liabilities 9,666,645 0.45% 9,409,610 0.39% 9,507,805 0.44% (*) FTE average quarterly balances and yields/costs

Deposits* Average Core Deposits* $ in millions Average Total Deposits 9 (*) Core deposits include all deposits less certificates of deposit, average total deposit composition as of 3/31/13.

10 Average Commercial Loans $ in millions Commercial Loan Composition Commercial Loan Portfolio* (*) Excluding covered loans, commercial loan composition at period end 3/31/13

Credit Results – Excluding Covered Loans 11 (1) Gray bar represents $10.6 million of accruing consumer post chapter 7 bankruptcy loans reclassified to non performing based on guidance from the Office of the Comptroller of the Currency. NCO ratio excludes reclassification impact.

Capital Position 12 (dollars in thousands) March 31, 2013 December 31, 2012 March 31, 2012 Consolidated Total Equity $ 1,754,850 11.49 % $ 1,645,202 11.03 % $ 1,584,105 10.80 % Common Equity 1,654,850 10.84 % 1,645,202 11.03 % 1,584,105 10.80 % Tangible common equity (a) 1,188,751 8.03 % 1,178,785 8.16 % 1,116,304 7.86 % Tier 1 capital (b) 1,310,927 12.36 % 1,193,188 11.25 % 1,136,705 11.55 % Total risk-based capital (c) 1,443,776 13.61 % 1,325,971 12.5 % 1,260,065 12.80 % Leverage (d) 1,310,927 9.07 % 1,193,188 8.43 % 1,136,705 8.16 % (a) Common equity less all intangibles; computed as a ratio to total assets less intangible assets. (b) Shareholders’ equity less goodwill; computed as a ratio to risk adjusted assets, as defined in the 1992 risk based capital guidelines. (c) Tier 1 capital plus qualifying loan less allowance, computed as a ratio to risk adjusted assets as defined in the 1992 risk based capital guidelines. (d) Tier 1 capital computed as a ratio to the latest quarter’s average assets less goodwill.

First Quarter 2013 Earnings Conference Call Supplemental Information April 23, 2013 FIRSTMERIT Corporation