Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Alliance Bancorp, Inc. of Pennsylvania | v341874_8k.htm |

Exhibit 99.1

Annual Meeting Alliance Bancorp, Inc. of Pennsylvania We Build Relationships That Last ® April 24, 2013

Alliance Bancorp, Inc. of Pennsylvania 2 FORWARD LOOKING STATEMENTS This presentation contains certain forward - looking statements (as defined in the Private Securities Litigation Reform Act of 1995). In the normal course of business, we, in an effort to help keep our shareholders and the public informed about our operations, may from time to time issue or make certain statements, either in writing or orally, that are or contain forward - looking statements, as that term is defined in the U.S. federal securities laws. Generally, these statements relate to business plans or strategies, projected or anticipated benefits from acquisitions made by or to be made by us, projections involving anticipated revenues, earnings, profitability or other aspects of operating results or other future developments in our affairs or the industry in which we conduct business. Forward - looking statements may be identified by reference to a future period or periods or by the use of forward - looking terminology such as “anticipate,” “believe,” “expect,” “intend, “plan,” “estimate” or similar expressions. Although we believe that the anticipated results or other expectations reflected in our forward - looking statements are based on reasonable assumptions we can give no assurance that those results or expectations will be attained. Forward - looking statements involve risks, uncertainties and assumptions (some of which are beyond our control) and as a result actual results may differ materially from those expressed in forward - looking statements. You should not put undue reliance on any forward - looking statements. Forward - looking statements speak only as of the date they are made and we undertake no obligation to update them in light of new information or future events except to the extent required by federal securities laws. For a more detailed description of outcomes described in these forward - looking statement or the factors that may affect our operating results, please refer to our filings with the Securities and Exchange Commission, including our Annual Report on Form 10 - K for the year ended December 31, 2012.

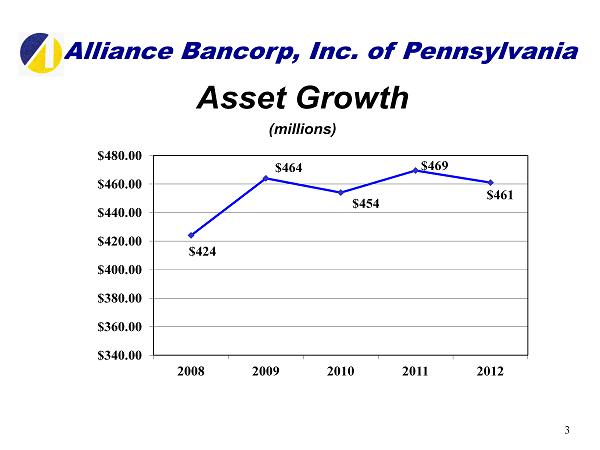

Alliance Bancorp, Inc. of Pennsylvania 3 Asset Growth (millions) $424 $464 $454 $ 469 $461 $340.00 $360.00 $380.00 $400.00 $420.00 $440.00 $460.00 $480.00 2008 2009 2010 2011 2012

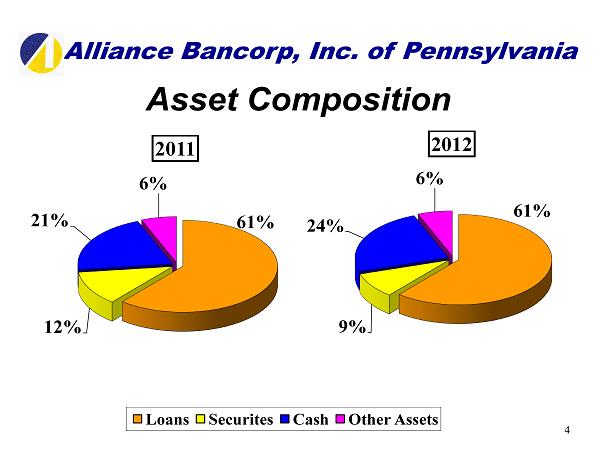

Alliance Bancorp, Inc. of Pennsylvania 4 Asset Composition 61% 12% 21% 6% 2011 Loans Securites Cash Other Assets 61% 9% 24% 6% 2012

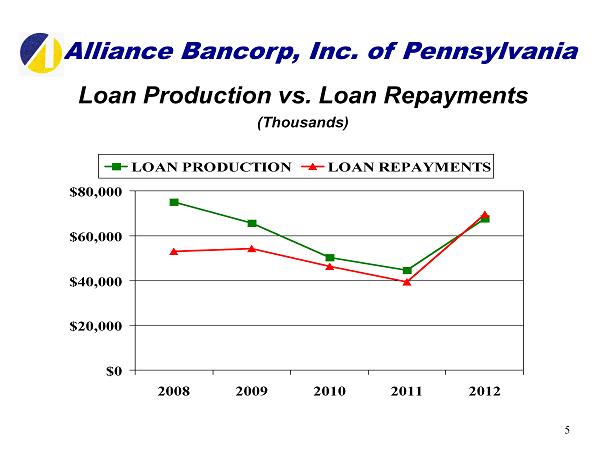

Alliance Bancorp, Inc. of Pennsylvania 5 Loan Production vs. Loan Repayments (Thousands) $0 $20,000 $40,000 $60,000 $80,000 2008 2009 2010 2011 2012 LOAN PRODUCTION LOAN REPAYMENTS

Alliance Bancorp, Inc. of Pennsylvania 6 Loan Portfolio Composition 41% 49% 5% 3% 2% 2011 Single - Family RE Commercial Real Estate Construction Business Consumer 44% 47% 4% 3% 2% 2012

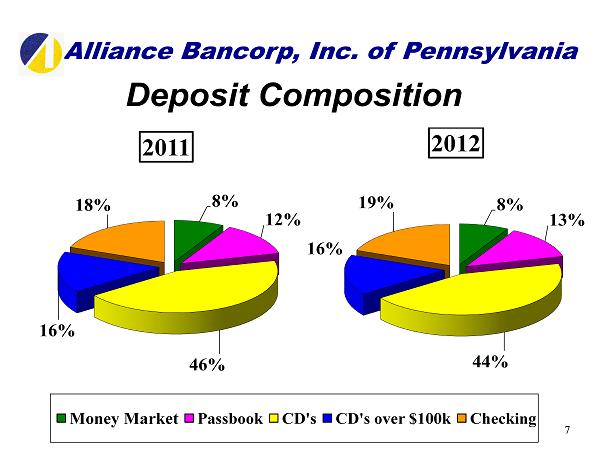

Alliance Bancorp, Inc. of Pennsylvania 7 Deposit Composition 8% 12% 46% 16% 18% 2011 Money Market Passbook CD's CD's over $100k Checking 8 % 13% 44% 16% 19% 2012

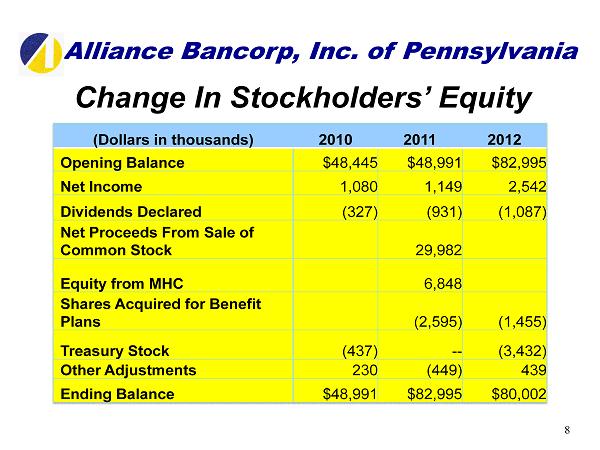

Alliance Bancorp, Inc. of Pennsylvania 8 Change In Stockholders ’ Equity (Dollars in thousands) 2010 2011 2012 Opening Balance $48,445 $48,991 $82,995 Net Income 1,080 1,149 2,542 Dividends Declared (327) (931) (1,087) Net Proceeds From Sale of Common Stock 29,982 Equity from MHC 6,848 Shares Acquired for Benefit Plans (2,595) (1,455) Treasury Stock (437) -- (3,432) Other Adjustments 230 (449) 439 Ending Balance $48,991 $82,995 $80,002

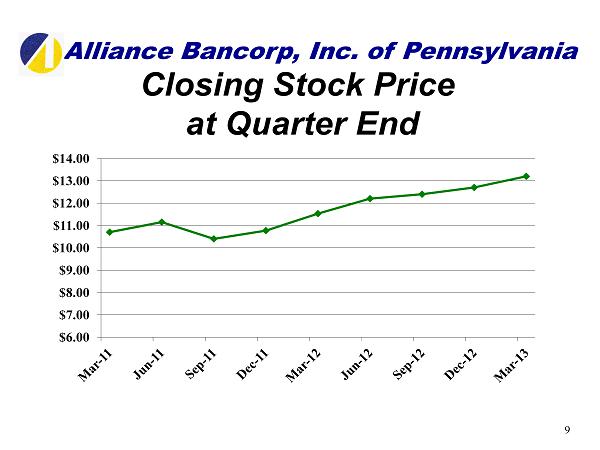

Alliance Bancorp, Inc. of Pennsylvania 9 Closing Stock Price at Quarter End $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 $13.00 $14.00

Alliance Bancorp, Inc. of Pennsylvania 10 Operating Yields and Costs 5.64% 5.08% 4.64% 4.24% 3.92% 3.32% 2.57% 1.66% 1.12% 0.87% 2.32% 2.51% 2.98% 3.12% 3.05% 2008 2009 2010 2011 2012 Interest Income Interest Expense Net Interest Spread

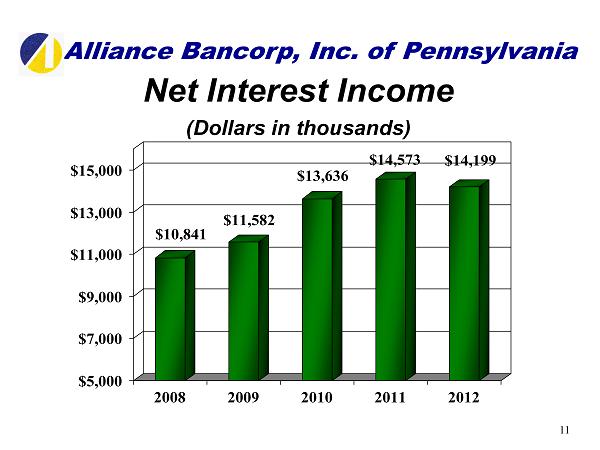

Alliance Bancorp, Inc. of Pennsylvania 11 Net Interest Income (Dollars in thousands) $10,841 $11,582 $13,636 $14,573 $14,199 $5,000 $7,000 $9,000 $11,000 $13,000 $15,000 2008 2009 2010 2011 2012

Alliance Bancorp, Inc. of Pennsylvania 12 Non - Performing Assets to Total Assets 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2008 2009 2010 2011 2012 1.65% 2.33% 4.17% 3.63% 1.67%

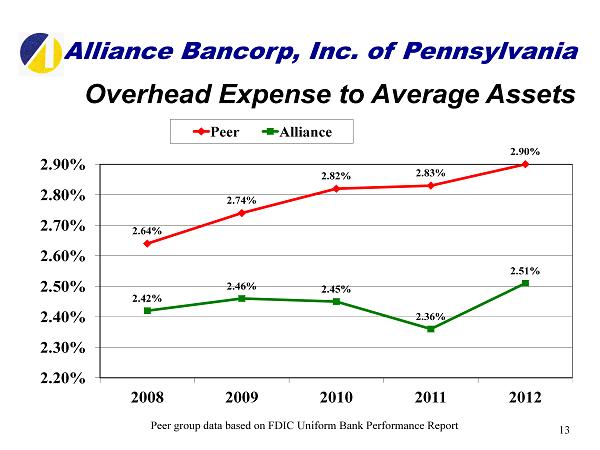

Alliance Bancorp, Inc. of Pennsylvania Peer group data based on FDIC Uniform Bank Performance Report 13 2.64% 2.74% 2.82% 2.83% 2.90% 2.42% 2.46% 2.45% 2.36% 2.51% 2.20% 2.30% 2.40% 2.50% 2.60% 2.70% 2.80% 2.90% 2008 2009 2010 2011 2012 Peer Alliance Overhead Expense to Average Assets

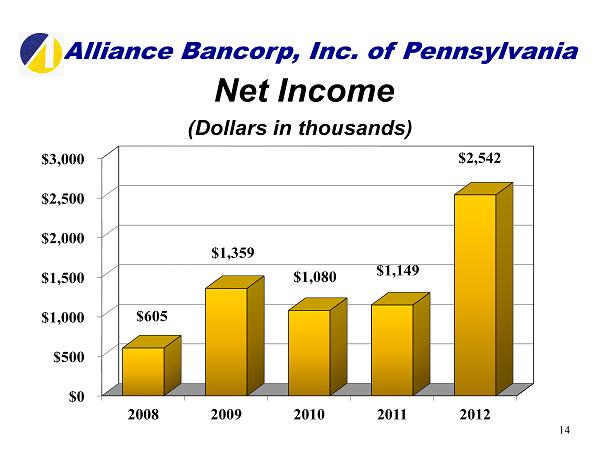

Alliance Bancorp, Inc. of Pennsylvania 14 Net Income (Dollars in thousands) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2008 2009 2010 2011 2012 $605 $1,359 $1,080 $1,149 $2,542

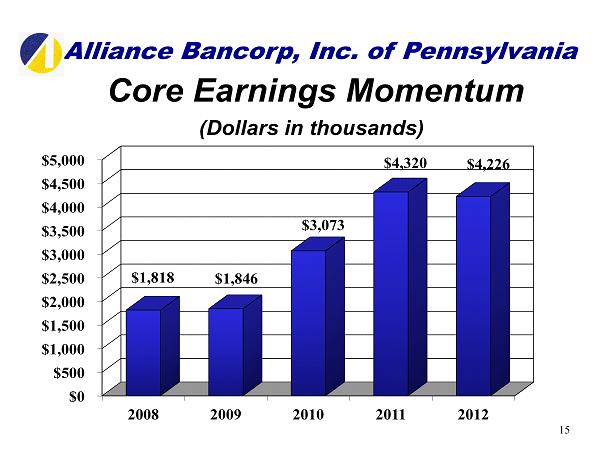

Alliance Bancorp, Inc. of Pennsylvania 15 Core Earnings Momentum (Dollars in thousands) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2008 2009 2010 2011 2012 $1,818 $1,846 $3,073 $4,320 $4,226

Annual Meeting Alliance Bancorp, Inc. of Pennsylvania April 24, 2013 Home of Customer First ® Banking