Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | a13-10630_18k.htm |

| EX-99.1 - EX-99.1 - AMAG PHARMACEUTICALS, INC. | a13-10630_1ex99d1.htm |

Exhibit 99.2

|

|

AMAG PHARMACEUTICALS 1Q13 Financial Results April 23, 2013 |

|

|

FORWARD LOOKING STATEMENTS 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein which do not describe historical facts, including but not limited to: (i) our statement that AMAG is well positioned for growth in 2013 and beyond; (ii) the expanded label opportunity for Feraheme; (iii) expectations regarding IV iron referrals and patient and physician behaviors; (iv) the potential for approval and potential launch of the supplemental new drug application in the U.S. and the timing and potential regulatory submission in the EU for Feraheme/Rienso for the broad iron deficiency anemia indication; (v) statements regarding our GI launch planning; (vi) statements regarding the potential size and expansion of the U.S. IV iron market opportunity and patient population; (vii) our expected financial results for 2013, including revenues, operating expenses and cost of goods sold; (viii) our expected cash and investments balance for 2013; (ix) our plans to expand the reach of Feraheme to new indications and geographic territories; (x) our business development activities and plans to execute transactions; (xi) strategies driving Feraheme volume growth; (xii) the emergence of shifting practice patterns in the IV iron market; (xiii) our expectation to increase our market share of the IV iron market in 2013; and (xiv) statements regarding our expectation to deliver on financial guidance, are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include: (1) uncertainties regarding, and our dependence on third parties for, our and Takeda's ability to successfully compete in the intravenous iron replacement market both in the US and outside the US, including the EU, (2) uncertainties regarding our ability to successfully and timely complete our clinical development programs and obtain regulatory approval for Feraheme/Rienso in the broader IDA indication both in the US and outside of the US, including the EU, (3) the possibility that significant safety or drug interaction problems could arise with respect to Feraheme/Rienso, (4) uncertainties regarding the manufacture of Feraheme/Rienso, (5) uncertainties relating to our patents and proprietary rights both in the US and outside the US, (6) the risk of an Abbreviated New Drug Application (ANDA) filing following the FDA’s draft bioequivalence recommendation for ferumoxytol, and (7) other risks identified in our Securities and Exchange Commission (SEC) filings, including our Annual Report on Form 10-K for the year ended December 31, 2012 and subsequent filings with the SEC. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements |

|

|

AGENDA Topic Speaker Opening Remarks Bill Heiden, CEO Financial Highlights & Outlook Frank Thomas, COO Commercial Progress Greg Madison, CCO Expansion Opportunities and Closing Remarks Bill Heiden, CEO 3 |

|

|

FIRST QUARTER 2013 HIGHLIGHTS Strong financial performance 16% increase in total revenue vs. 1Q12 19% increase in U.S. Feraheme net sales driven by volume and net revenue per gram growth 24% decrease in operating expenses vs. 1Q12 Record non-dialysis provider demand – 29,500 grams 11% increase, E.I. 110 vs. 1Q12 Very strong growth in hospital segment – largest segment of non-dialysis IV iron market sNDA accepted for broad IDA indication; October 21, 2013 PDUFA Excellent progress preparing for the potential launch in the broader IDA indication New chief commercial officer, Greg Madison Extensive business development activities 4 |

|

|

FINANCIAL OVERVIEW Frank Thomas, Chief Operating Officer |

|

|

FERAHEME – ON A SOLID GROWTH TRAJECTORY 6 *Excludes reduction of reserves for product returns and Medicaid in 2012 (in millions) +14% volume growth +5% price growth vs. 1Q2012 +17% volume growth -5% price decline vs. 2011 |

|

|

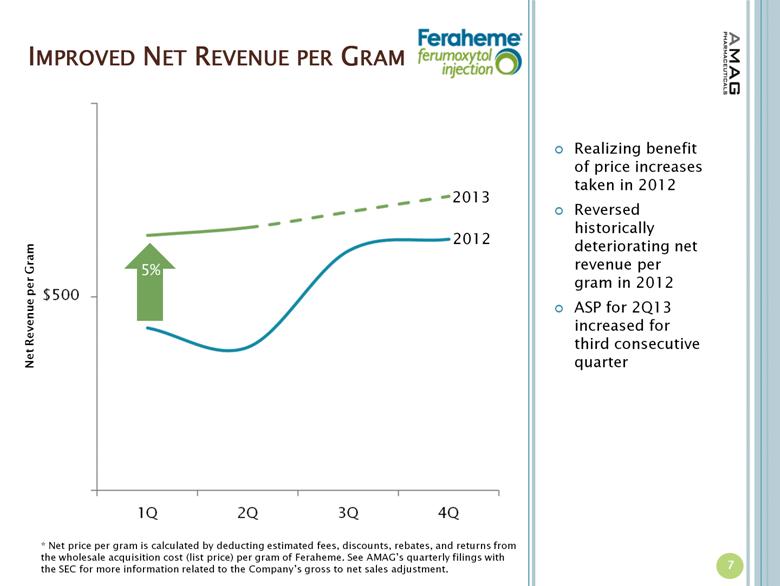

IMPROVED NET REVENUE PER GRAM Realizing benefit of price increases taken in 2012 Reversed historically deteriorating net revenue per gram in 2012 ASP for 2Q13 increased for third consecutive quarter 7 2013 2012 5% Net Revenue per Gram * Net price per gram is calculated by deducting estimated fees, discounts, rebates, and returns from the wholesale acquisition cost (list price) per gram of Feraheme. See AMAG’s quarterly filings with the SEC for more information related to the Company’s gross to net sales adjustment. |

|

|

FIRST QUARTER FINANCIAL HIGHLIGHTS ($ in millions, except per share ) 1Q13 1Q12 Growth Total Revenues $17.9 $15.5 16% Net Feraheme US Product Revenues $15.6 $13.1* 19% Feraheme Gross Margin % of product sales $12.8 82% $10.5* 77% 23% R&D Expenses $5.4 $12.5 (57%) SG&A Expenses $14.0 $13.2 5% Net Loss ($3.9) ($12.4) (69%) Loss Per Basic Share ($0.18) ($0.58) (69%) Cash and investments $217.1 $217.9 (<1%) 8 *Excludes $0.5 million reduction of reserves for product returns |

|

|

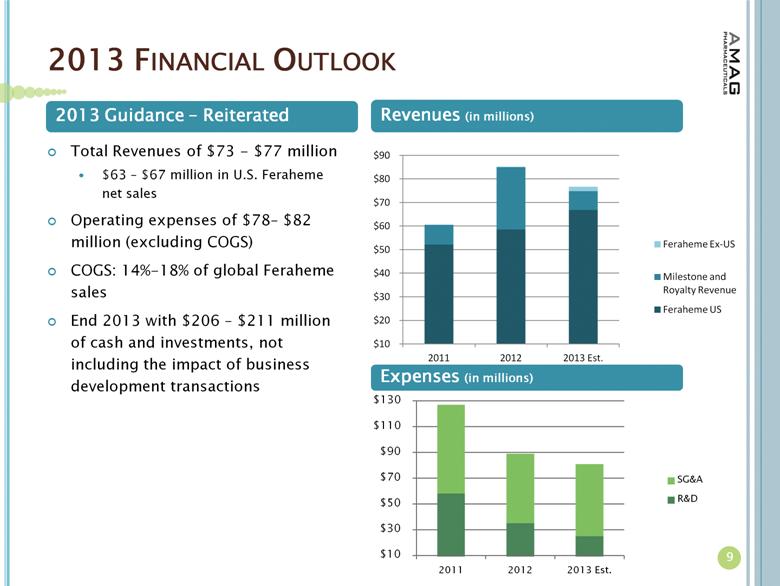

2013 FINANCIAL OUTLOOK 9 Expenses (in millions) Total Revenues of $73 - $77 million $63 – $67 million in U.S. Feraheme net sales Operating expenses of $78– $82 million (excluding COGS) COGS: 14%-18% of global Feraheme sales End 2013 with $206 – $211 million of cash and investments, not including the impact of business development transactions 2013 Guidance – Reiterated Revenues (in millions) |

|

|

FERAHEME PERFORMANCE Greg Madison, Chief Commercial Officer |

|

|

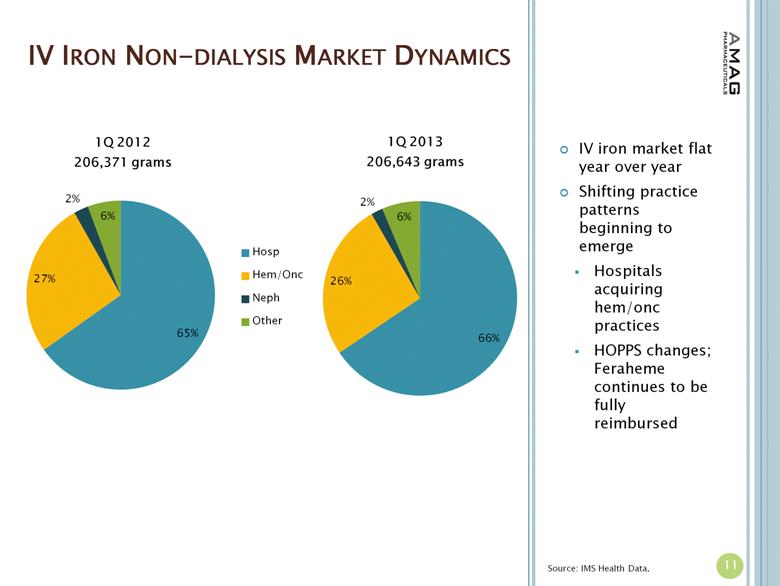

IV IRON NON-DIALYSIS MARKET DYNAMICS 11 IV iron market flat year over year Shifting practice patterns beginning to emerge Hospitals acquiring hem/onc practices HOPPS changes; Feraheme continues to be fully reimbursed Source: IMS Health Data. |

|

|

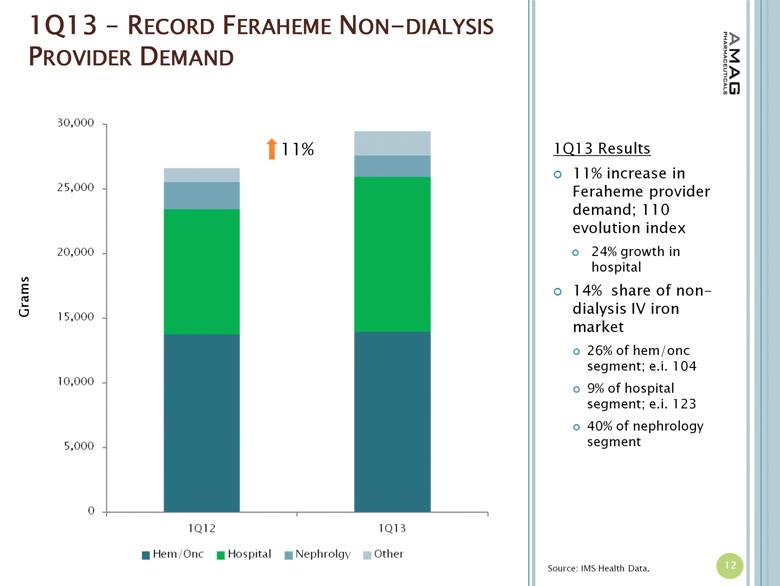

1Q13 – RECORD FERAHEME NON-DIALYSIS PROVIDER DEMAND 12 Source: IMS Health Data. 11% Grams 1Q13 Results 11% increase in Feraheme provider demand; 110 evolution index 24% growth in hospital 14% share of non-dialysis IV iron market 26% of hem/onc segment; e.i. 104 9% of hospital segment; e.i. 123 40% of nephrology segment |

|

|

Targeting accounts, with differentiated strategy, message and tactics Tracking progress against growth & volume goals across all segments STRATEGIES DRIVING DOUBLE-DIGIT VOLUME GROWTH 13 |

|

|

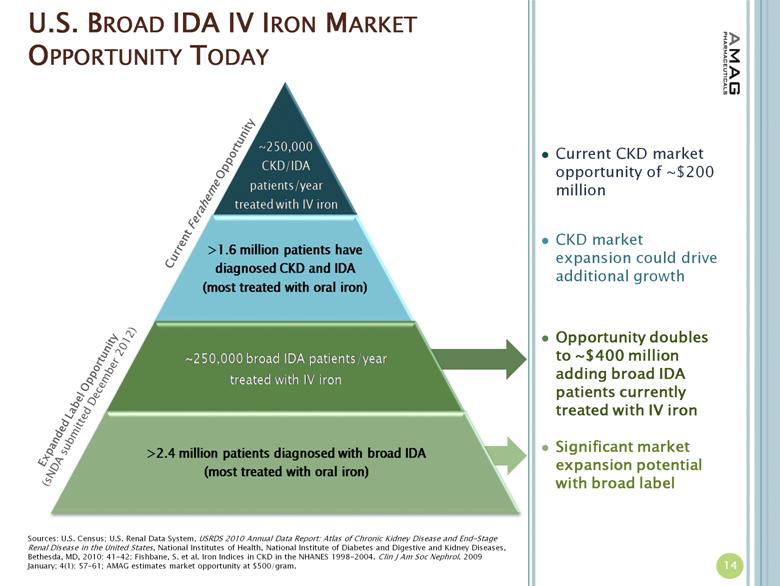

U.S. BROAD IDA IV IRON MARKET OPPORTUNITY TODAY Current Feraheme Opportunity Sources: U.S. Census; U.S. Renal Data System, USRDS 2010 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2010: 41-42; Fishbane, S. et al. Iron Indices in CKD in the NHANES 1998-2004. Clin J Am Soc Nephrol. 2009 January; 4(1): 57–61; AMAG estimates market opportunity at $500/gram. Current CKD market opportunity of ~$200 million CKD market expansion could drive additional growth Opportunity doubles to ~$400 million adding broad IDA patients currently treated with IV iron Significant market expansion potential with broad label 14 Expanded Label Opportunity (sNDA submitted December 2012) |

|

|

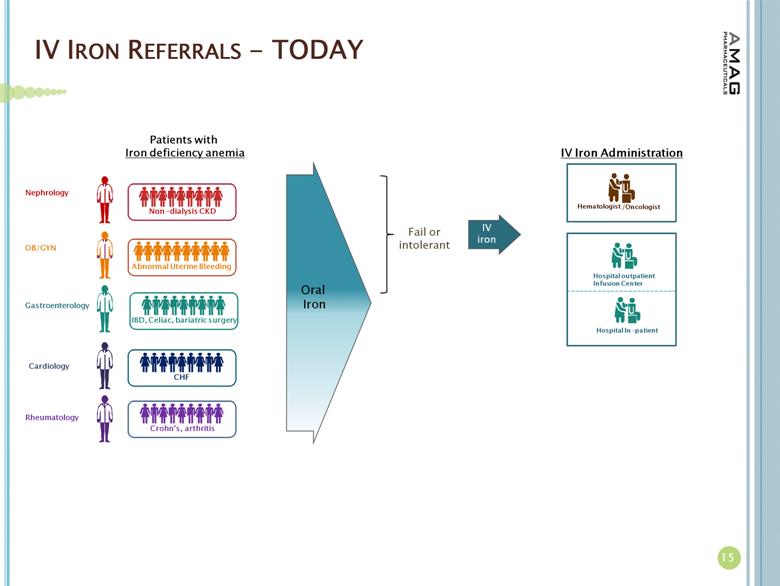

IV IRON REFERRALS - TODAY 15 Patients with Iron deficiency anemia IV iron Fail or intolerant Oral Iron IBD, Celiac, bariatric surgery Gastroenterology Abnormal Uterine Bleeding OB/GYN Crohn’s, arthritis Rheumatology CHF Cardiology Non - dialysis CKD Nephrology IV Iron Administration Hematologist /Oncologist Hospital outpatient Infusion Center Hospital In - patient |

|

|

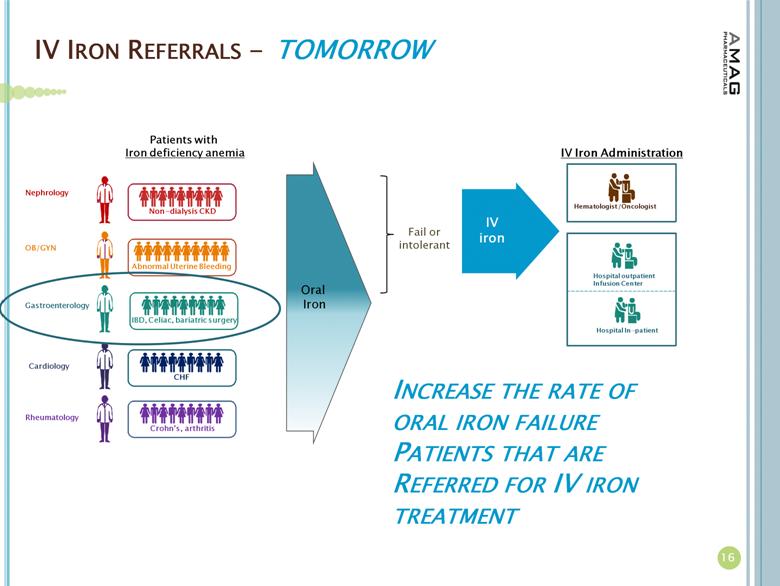

IV IRON REFERRALS - 16 Patients with Iron deficiency anemia Fail or intolerant Oral Iron IV iron TOMORROW IBD, Celiac, bariatric surgery Gastroenterology Abnormal Uterine Bleeding OB/GYN Crohn’s , arthritis Rheumatology CHF Cardiology Non - dialysis CKD Nephrology INCREASE THE RATE OF ORAL IRON FAILURE PATIENTS THAT ARE REFERRED FOR IV IRON TREATMENT IV Iron Administration Hematologist /Oncologist Hospital outpatient Infusion Center Hospital In - patient |

|

|

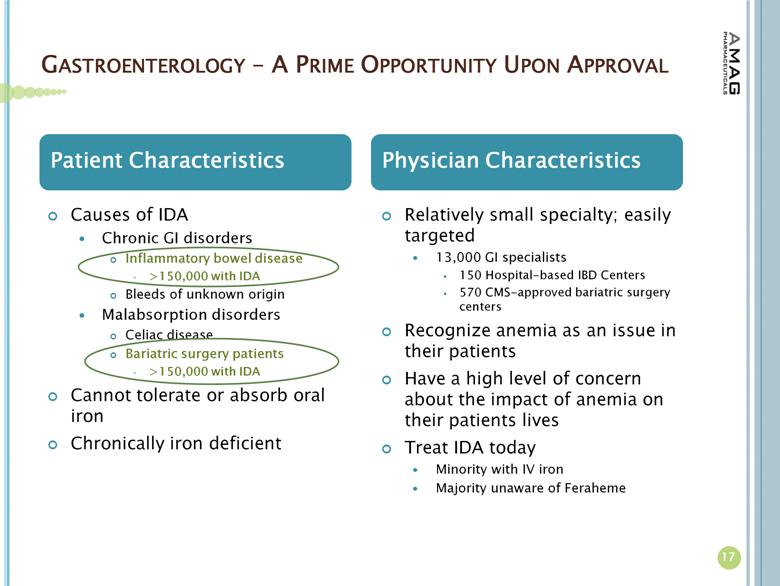

GASTROENTEROLOGY – A PRIME OPPORTUNITY UPON APPROVAL 17 Causes of IDA Chronic GI disorders Inflammatory bowel disease >150,000 with IDA Bleeds of unknown origin Malabsorption disorders Celiac disease Bariatric surgery patients >150,000 with IDA Cannot tolerate or absorb oral iron Chronically iron deficient Relatively small specialty; easily targeted 13,000 GI specialists 150 Hospital-based IBD Centers 570 CMS-approved bariatric surgery centers Recognize anemia as an issue in their patients Have a high level of concern about the impact of anemia on their patients lives Treat IDA today Minority with IV iron Majority unaware of Feraheme Patient Characteristics Physician Characteristics |

|

|

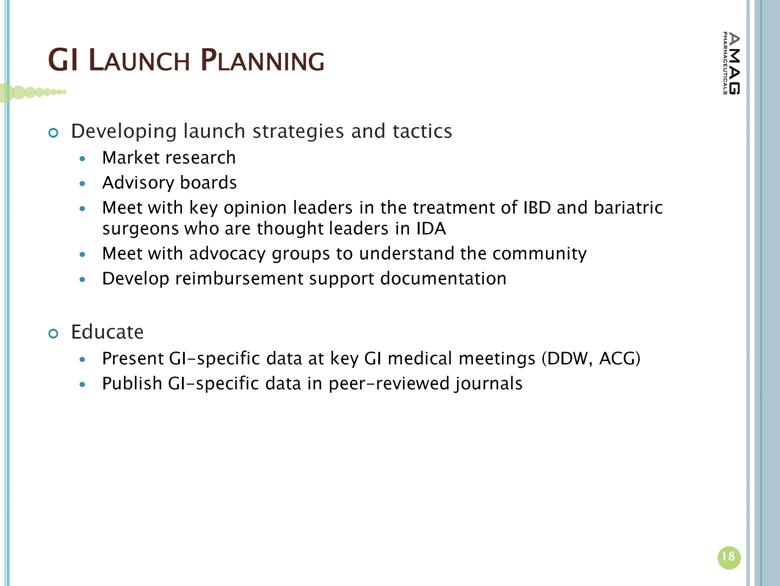

GI LAUNCH PLANNING Developing launch strategies and tactics Market research Advisory boards Meet with key opinion leaders in the treatment of IBD and bariatric surgeons who are thought leaders in IDA Meet with advocacy groups to understand the community Develop reimbursement support documentation Educate Present GI-specific data at key GI medical meetings (DDW, ACG) Publish GI-specific data in peer-reviewed journals 18 |

|

|

BUILDING DISEASE STATE AWARENESS – IRON MATTERS 19 |

|

|

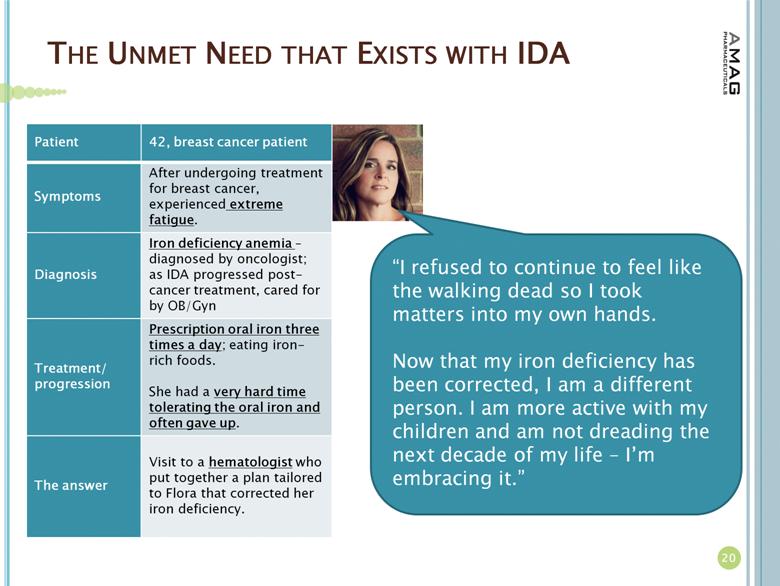

“I refused to continue to feel like the walking dead so I took matters into my own hands. Now that my iron deficiency has been corrected, I am a different person. I am more active with my children and am not dreading the next decade of my life – I’m embracing it.” THE UNMET NEED THAT EXISTS WITH IDA 20 : : Patient 42, breast cancer patient Symptoms After undergoing treatment for breast cancer, experienced extreme fatigue. Diagnosis Iron deficiency anemia – diagnosed by oncologist; as IDA progressed post-cancer treatment, cared for by OB/Gyn Treatment/ progression Prescription oral iron three times a day; eating iron-rich foods. She had a very hard time tolerating the oral iron and often gave up. The answer Visit to a hematologist who put together a plan tailored to Flora that corrected her iron deficiency. |

|

|

EXPANSION OPPORTUNITIES |

|

|

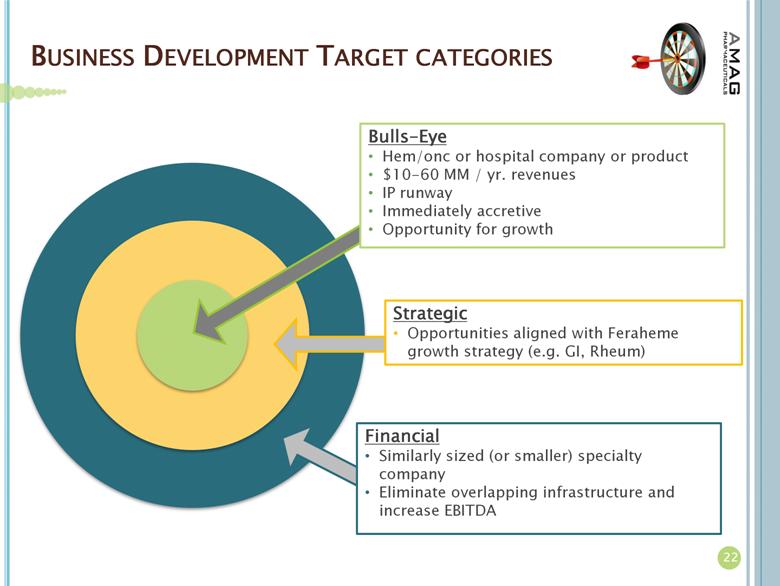

BUSINESS DEVELOPMENT TARGET CATEGORIES Bulls-Eye Hem/onc or hospital company or product $10-60 MM / yr. revenues IP runway Immediately accretive Opportunity for growth Strategic Opportunities aligned with Feraheme growth strategy (e.g. GI, Rheum) Financial Similarly sized (or smaller) specialty company Eliminate overlapping infrastructure and increase EBITDA 22 |

|

|

BUILDING OFF 1Q SUCCESS IN 2013 Achieve full year double-digit growth of Feraheme in CKD patient population Continue to realize increasing net revenue per gram of Feraheme sNDA Formal acceptance by FDA – 1Q13 Planned approval & launch – 4Q13 Pre-launch activities for potential broader IDA indication Execute one or more business development transaction(s) Deliver on financial guidance 23 |

|

|

AMAG PHARMACEUTICALS Well positioned for growth in 2013 and beyond |