Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST NIAGARA FINANCIAL GROUP INC | a8-k41913q1erdeck.htm |

First Quarter 2013 Earnings Highlights April 19, 2013 Gary M. Crosby Interim President & Chief Executive Officer Gregory W. Norwood Chief Financial Officer

Safe Harbor Statement Any statements contained in this presentation regarding the outlook for FNFG’s business and markets, such as projections of future earnings performance, statements of FNFG’s plans and objectives, forecasts or market trends and other matters, are forward-looking statements based on FNFG’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,” “will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, FNFG claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events. Certain factors could cause FNFG’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this presentation. These factors include the factors discussed in Part I, Item 1A of FNFG’s 2012 Annual Report on Form 10-K under the heading “Risk Factors” and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive. 2

1Q13 Financial Summary • GAAP EPS of $0.17 included $0.01 in charges due to recent executive departures • Net interest income 2 decreases modestly QOQ – NIM compression offset by 8% increase in average earning asset growth – NIM down 3 bps QOQ to 3.39% from 3.42%2 in 4Q. Decline due to ongoing downward re-pricing of loans, offset by lower than expected cash flows in the CMO portfolio and lower deposit costs – Interest-bearing deposit cost down 4 bps QOQ to 25 bps • Noninterest income decreases 3% QOQ – Mortgage banking declines $1.6 million on lower gain-on-sale revenue – Wealth management increases 7% QOQ on strong AUM growth – Seasonal decline in deposit service charges and lower NSF activity – Seasonal increase in insurance revenues • Operating expenses decline by $3.7 million QOQ excluding $6.3 million in charges related to two recently announced executive departures – Focus on expense management leads to saves in personnel costs, marketing, technology and professional services expenses – Seasonal increase in payroll taxes and merit increases drive salaries and benefits higher QOQ • Positive operating leverage generated QOQ (1) Excludes merger and acquisition integration expenses and restructuring charges. Operating results represent non-GAAP measures. Refer to the Appendix for further details. (2) Excludes $16 million adjustment to accelerate premium amortization in 4Q12 on prepayments on our Collateralized Mortgage Obligations (CMO). 3 Income Statement ($MM) 4Q12 1Q13 GAAP Net Interest Income 252.3$ 266.1$ Accelerated CMO premium amortization 16.3 - Operating Net interest income 268.6 266.1 Noninterest Income 91.8 89.3 Total Operating Revenue 360.4 355.4 Noninterest Operating Expenses (1) 235.1 237.7 Pre-tax Preprovision Income (1), (2) 125.3 117.8 Provision for loan losses 22.0 20.2 Pretax Operating Income (1), (2) 103.3 97.6 Income taxes 27.9 30.3 Net Operating Income (1), (2) 75.4$ 67.3$ Nonoperating income, net of tax - - Add. premium amort. on securities portfolio, net of tax 11.6 - Nonoperating expenses, net of tax 2.6 - Net Income 61.1$ 67.3$ Preferred stock dividend 7.5 7.5 Net Income Available to Common 53.6$ 59.7$ Operating Earnings Per Diluted Share (1), (2) 0.19$ 0.17$ GAAP Earnings Per Diluted Share 0.15$ 0.17$ Key Ratios Adjusted Net Interest Margin(2) 3.42% 3.39% Return on Average Tangible Assets (1), (2) 0.89% 0.80% Pretax preprovision ROA (1), (2) 1.37% 1.30% Return on Average Tangible Common Equity (1), (2) 13.57% 12.05% Efficiency Ratio (1), (2) 65.24% 66.86%

Noninterest Income & Expense Summary 4 (1) Excludes merger and acquisition integration expenses and restructuring charges. Operating results represent non-GAAP measures. Refer to the Appendix for further details. Noninterest Income 4Q12 1Q13 Change $ Notes Deposit Service Charges 26.3$ 24.8$ (1.5)$ Seasonality and lower NSF activity Insurance Commission 15.5 16.4 0.9 Revenues up as a disproportionate portion of policy renewals occur in Q1 Merchant and Card Fees 11.9 11.3 (0.6) Seasonal decline in customer activity Wealth Management Services 12.0 12.8 0.8 Mortgage Banking 8.1 6.4 (1.6) 20% decline driven by 30% decline in GOS margin Capital Markets 7.1 6.0 (1.1) Decline in swap transactions from all time high in Q4 Leading and Leasing 3.7 3.9 0.2 Bank Owned Life Insurance 3.0 3.5 0.4 Other Income 4.1 4.2 0.1 Total Nonintereset Income 91.8$ 89.3$ (2.5)$ Noninterest Expense 1 4Q12 1Q13 Change $ Notes Salaries & Benefits 111.0$ 115.8$ 4.8$ Seasonal payroll taxes and merit increases drive the $4.8M increase Occupancy & Equipment 27.6 28.0 0.4 $1M related to consolidation of four branches Technology and Communications 28.3 27.1 (1.1) Vendor sourcing initiatives Marketing and Advertising 9.3 4.3 (4.9) Focus on product campaigns Professional Services 11.2 9.6 (1.6) Vendor sourcing initiatives Am rtization of Intangibles 14.2 14.1 (0.1) FDIC Premiums 9.2 8.9 (0.3) Other Expense 24.4 29.7 5.4 Includes $6.3M charge related to executive departures in Q1 Total Nonintereset Expense 235.1$ 237.7$ 2.6$ QOQ Growth driven by repapering of HSBC customers, focus on recurring revenue stream at the platform, and build out of our advisory business QOQ

4.0 4.0 3.8 3.7 2.4 2.7 2.7 2.6 0.3 0.3 0.3 0.3 0.2 0.3 0.3 0.3 0.1 0.3 0.5 0.7 $0.0 $3.0 $6.0 $9.0 2Q12 3Q12 4Q12 1Q13 Indirect Auto Credit Card Other Consumer Home Equity Residential RE 4.3 4.6 4.8 5.0 6.5 6.8 6.9 7.2 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2Q12 3Q12 4Q12 1Q13 CRE C&I Continued Momentum in Loan Growth Average Commercial Loans Average Consumer Loans $10.8 $6.9 $7.6 $ billions $ billions Double-digit annualized growth across each region in commercial portfolio Double-digit growth in Equipment Finance and core lending units (Middle Market, CRE, Business Banking) Pipeline remains strong; Commercial line utilization flat to Q4 Indirect auto continues positive loan generation momentum and expands dealer network $11.4 $7.6 $11.7 $12.2 $7.7 5

31% 11% 13% 38% -2% -6% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% Middle Market Business Banking CRE Equipment Finance Capital Markets Others 10% 29% 30% 25% -2% 50% -10% 0% 10% 20% 30% 40% 50% 60% NY WPA EPA NE Specialized Lending Tri State Robust Commercial Loan Growth Across Regions Notes: Average balances. Growth rates are annualized. Specialized lending includes capital markets and community development. Balances do not include small business loans that roll up into retail segment. QOQ Commercial Growth by Region QOQ Commercial Growth by Business Unit $5.6 $1.4 $1.9 $2.2 $0.6 $3.3 $2.6 $4.2 $0.7 $0.6 $0.3 Average Loan Balance (billions) 6 $0.04

Consumer Finance Results Reflect Ongoing Momentum 7 4Q12 1Q13 QOQ ∆ Indirect Auto Period end loan balance $601 $818 36% Origination Volume $213 $263 23% Origination Yield 3.43% 3.34% -9 bps # of dealers 952 1024 11% % of used units 68% 70% 2% Credit Card Period end loan balance $315 $298 -5% Purchase Volume $259 $224 -14% Interchange Fee Income $4.8 $4.3 -11% Total Accounts (Units) 266,297 277,343 4% Mortgage Banking Origination Volume – Total $610 $527 -14% Retail Origination Volume $548 $493 -10% HFS Lock Volume $412 $363 -12% Application Volume $711 $783 10% • Indirect Auto Momentum Continues Net origination yield of 3.34%, down 9 bps QOQ $263 million in originations in 1Q13, up $50 million QOQ Average FICO of 735 on new originations during the quarter 70% of originations are for used vehicles Facilitates balance sheet rotation at attractive ROAs • Credit card platform Seasonality drives transaction volume lower to $224 million Targeted direct mail campaign boosted account acquisition 12,000 new accounts opened in Q1 with 50% activation rate Improves Transactor /Saver/Borrower ratio and fee income opportunity • Mortgage Banking Mortgage banking revenues decline 20% QOQ as GOS margins declined 30% 93% of originations in Q1 were retail; Application volumes increase 10% Strategic focus: on-boarding lenders, leveraging capacity, HARP opportunity, branch referrals $ in millions

19% 21% -13% 56% 19% NY WPA EPA NE Total Bank Retail: Focus on Checking Account Growth 8 1. DDA and interest-bearing checking. Average balances. 2. Growth rates annualized. Transactional deposits represent 32% of total deposits Interest-bearing deposit cost down 4 bps QOQ to 25 bps Interest-bearing checking deposits up 19% annualized from Q4 Double-digit growth in NY, WPA & NE EPA decline due to seasonal decrease in muni checking deposits New checking sales per branch up 15% QOQ Mobile banking initiative launched in 1Q13 ~20% of online customers have signed up for mobile banking services Remote deposit capture launch planned in 2013 Branch incentive enhancement driving early success in cross-referrals to consumer finance business and AUM 4 branches consolidated in Q1; 5 expected in Q2 Transactional Deposits as a Percentage of Total Deposits1 QOQ Growth in Interest-Bearing Checking Deposits2 $2.6 $0.6 $0.6 $0.6 $4.4 Note: Dollar value represents 1Q average balance in billions 28.0% 29.6% 30.9% 31.8% 32.2% 1Q12 2Q12 3Q12 4Q12 1Q13

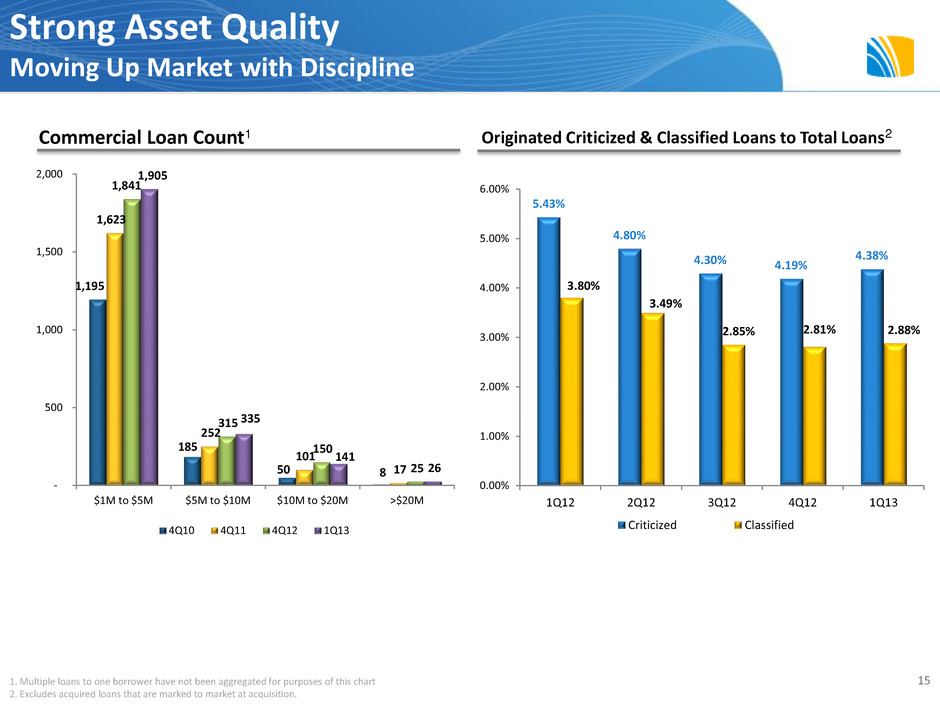

Credit Quality – Originated Portfolio • Net charge-offs of 27 bps; compared to 35 bps in full year 2012 • Provision of $9.8 million in excess of NCOs to support originated loan growth – $728 million in organic loan growth – Coverage ratio of originated allowance / originated loans consistent with prior quarters – Reserve build reduced EPS by $0.02 in Q1 • NPLs of 1.03% down 4 bps QOQ; NPL dollars flat QOQ • Criticized loans equaled 4.4% of total originated loans in 1Q13, down from 5.4% YOY; Classified loans decreased from 3.8% of total originated loans in 1Q12 to 2.9% in 1Q13 9 $ in millions 1Q12 4Q12 1Q13 Provision for loan losses $15.5 $21.4 $18.9 Net Charge-offs $8.6 $7.6 $9.1 NCOs/ Average Loans 0.34% 0.24% 0.27% Nonperforming Originated Loans $114.2 $143.1 $145.6 NPLs / Loans – Originated 1.09% 1.07% 1.03% Total Originated Loans $10,517 $13,372 $14,100 Allowance – Originated $125.1 $161.0 $170.7 Allowance / Loans – Originated 1.19% 1.20% 1.21% Criticized1 $571.3 $560.6 $618.2 Criticized as a % of Total Originated Loans 5.4% 4.2% 4.4% Classified2 $399.7 $376.3 $406.3 Classified as a % of Total Originated Loans 3.8% 2.8% 2.9% Note: Originated loans represent loans excluding acquired loans (i.e), loans originated under First Niagara ownership. 1. Loans classified as special mention, substandard or doubtful. 2. Loans classified as substandard or doubtful.

Credit Quality: Acquired Portfolio • In 1Q13, provision on acquired loans was $0.9M compared to $0.2M in the prior quarter • Reclassified ~$10M of credit marks into accretable yield in 1Q13 • Credit mark of $149M equals 2.4% of remaining $6.1B acquired book; 30bps of tangible capital 10 * Acquired loans before associated credit discount. Refer to the ending balance sheet in our Q1 2013 press release tables for a reconciliation to total loans and leases. $ in millions NCC HNBC NAL HSBC Acquired NCC HNBC NAL HSBC Acquired Provision for loan losses (0.7) 1.0 (0.1) - 0.2 - 0.9 - - 0.9 Net charge-offs 0.2 1.1 0.0 - 1.3 - 1.2 - - 1.2 NCOs / Avg Loans 0.08% 0.08% Nonperforming loans 2.4 13.5 8.7 5.0 29.6 4.2 11.7 8.1 3.7 27.7 Total loans * 346 1,379 3,474 1,315 6,514 334 1,304 3,280 1,167 6,084 Allowance - 1.5 - 0.1 1.6 - 1.2 - 0.1 1.3 Credit discount on Acq loans 12.8 38.2 84.0 41.0 176.0 11.8 29.0 73.4 34.6 148.9 Credit discount / Acq loans 3.7% 2.8% 2.4% 3.1% 2.7% 3.5% 2.2% 2.2% 3.0% 2.4% Criticized 41.9 174.4 186.3 39.5 442.1 46.7 174.4 163.5 42.0 426.7 Classified 22.5 144.7 134.9 30.0 332.2 32.4 138.8 112.9 29.8 313.9 Accruing 90+ days delinquent 3.0 82.8 71.0 10.2 167.1 3.4 88.5 62.6 13.1 167.6 Q1 2013Q4 2012

6 1 % 7 1 % 5 2 % 5 5 % 5 8 % 6 1 % 40% 45% 50% 55% 60% 65% 70% 75% 80% 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13E 3Q13E 4Q13E FNFG Peer Median • 76% of CMBS book has a credit enhancement of 30+; 67% of CLO book has a credit enhancement of 25+ • Average credit securities rating of AA- exceeds traditional commercial banking lending relationships CMO $4.7 40% MBS $0.8 6% CMBS $1.9 16% CLO $1.6 13% ABS $1.0 8% CORP $0.9 8% MUNI $0.6 5% US Govt $0.4 3% Other $0.1 Investment Securities1 Portfolio as of March 31, 2013 11 Portfolio Stats – Q1’13 Market Value $12.2 B Yield 2.99% Average Rating AA Remaining RMBS Purchase Premium $78 M Remaining Premium as a % of RMBS Portfolio 1.5% Q1’13 Purchases Total $625 M Yield 2.5% Average Rating Aa2 1. Excludes FHLB and Federal Reserve Bank stock 2. Commercial assets include C&I and CRE loans plus CLO, CMBS, corporates and commercial ABS at amortized cost HSBC Pre-Closing Investment Activity Investment Security Mix (Book Value $11.8B) Commercial Assets2 to Total Deposits 92% of CMBS purchases completed before spreads began tightening Traditional Portfolio $6.5B; 55% Credit Securities $5.4B; 45%

2Q13 Outlook (as of April 19, 2013) Metric Street Median for 2Q13 * Management Commentary on Street Median Expectations Net Interest Margin T/E 3.31% Consistent with expectations Average Earning Assets $32.5B Consistent with expectations Noninterest income $95M Low single digit growth from 1Q13 levels Noninterest expenses $231M • Consistent with expectations • $10.8M in intangible amortization expense in Q2 Loan loss provision $24M • Consistent with expectations • NCO/originated loans +/- 35 bps of avg. originated loans Tax rate- GAAP NA ~32% Operating EPS $0.18 Consistent with expectations * Based on the computed median of all 15 analyst models where available and SNL Financial; as of April 18, 2013 12

Appendix Non-GAAP Measures – This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP). The Company believes that these non-GAAP financial measures provide a meaningful comparison of the underlying operational performance of the Company, and facilitate investors’ assessments of business and performance trends in comparison to others in the financial services industry. In addition, the Company believes the exclusion of these non- operating items enables management to perform a more effective evaluation and comparison of the Company’s results and to assess performance in relation to the Company’s ongoing operations. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Where non-GAAP disclosures are used in this presentation, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial member, can be found in this Appendix. 13

14 Originated NPL to Loans by Loan Category1 Originated NCO to Total Loans by Loan Category1 1. Excludes acquired loans that are marked to market at acquisition. Strong Asset Quality 0.07% 0.10% 0.33% 0.45% 0.15% 0.10% 0.21% 0.19% 0.94% 0.64% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1Q12 2Q12 3Q12 4Q12 1Q13 CRE C&I RRE Home Equity Other Consumer 1.01% 0.94% 1.10% 1.08% 1.58% 1.67% 1.11% 1.07% 0.36% 0.41% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 1Q12 2Q12 3Q12 4Q12 1Q13 CRE C&I RRE Home Equity Other Consumer

15 Commercial Loan Count1 Originated Criticized & Classified Loans to Total Loans2 1. Multiple loans to one borrower have not been aggregated for purposes of this chart 2. Excludes acquired loans that are marked to market at acquisition. Strong Asset Quality Moving Up Market with Discipline 5.43% 4.80% 4.30% 4.19% 4.38% 3.80% 3.49% 2.85% 2.81% 2.88% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 1Q12 2Q12 3Q12 4Q12 1Q13 Criticized Classified 1,195 185 50 8 1,623 252 101 17 1,841 315 150 25 1,905 335 141 26 - 500 1,000 1,500 2,000 $1M to $5M $5M to $10M $10M to $20M >$20M 4Q10 4Q11 4Q12 1Q13

GAAP to non-GAAP Reconciliation 16 (in thousands, except per share amounts) 4Q12 1Q13 Total noninterest expense on operating basis (Non-GAAP) 235,106$ 237,666$ Merger and acquisition integration expenses 3,678 - Total reported noninterest expense (GAAP) 238,784$ 237,666$ Computation of pre-tax,pre-provision income: Net interest income 252,286$ 266,130$ Noninterest income 91,821 89,312 Noninterest expense (238,784) (237,666) Pre-tax, pre-provision income (GAAP) 105,323 117,776 Add back: accelerated CMO premium amortization 16,280 - Add back: non-operating noninterest expenses 3,678 - Pre-tax, pre-provision income (Non-GAAP) 125,281$ 117,776$ Reconciliation of pretax operating income to pretax net income: Pretax operating income (Non-GAAP) 103,281$ 97,576$ Nonoperating income, gross of tax (16,280) - Nonoperating expenses, gross of tax (3,678) - Pretax net income (GAAP) 83,323$ 97,576$ Reconciliation of net operating income to net income: Net operating income (Non-GAAP) 75,358$ 67,285$ Nonoperating income, net of tax (11,633) - Nonoperating expenses, net of tax (2,628) - Net income (GAAP) 61,097$ 67,285$ Reconciliation of Operating Diluted EPS to GAAP Diluted EPS: Operating Diluted EPS (Non-GAAP) 0.19$ 0.17$ Nonoperating income, net of tax (0.03) - Nonoperating expenses, net of tax (0.01) - Diluted EPS (GAAP) 0.15$ 0.17$ Reconciliation of operating efficiency ratio to reported efficiency ratio: Operating efficiency ratio (Non-GAAP) 65.24% 66.86% Nonoperating income, gross of tax 3.16 - Nonoperating expenses, gross of tax 1.07 - Reported efficiency ratio (GAAP) 69.39% 66.86% Reconciliation of noninterest expense on operating basis to reported noninterest expense:

17 GAAP to non-GAAP Reconciliation (continued) Quarter ended Quarter ended December 30, 2012 (in 000s) March 31, 2013 (in 000s) Computation of Average Tangible Assets: Total average assets 36,329,570$ 36,807,221$ Less: Average goodwill and other intangibles (2,619,322) (2,609,409) Average tangible assets 33,710,248$ 34,197,812$ Computation of Average Tangible Common Equity: Total average stockholders' equity 4,945,132$ 4,958,402$ Less: Average goodwill and other intangibles (2,619,322) (2,609,409) Less: Average preferred stockholders' equity (338,002) (338,002) Average tangible common equity 1,987,808$ 2,010,991$