Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST HORIZON CORP | d522703d8k.htm |

Exhibit 99.1

FIRST QUARTER 2013

FINANCIAL SUPPLEMENT

If you need further information, please contact:

Aarti Bowman, Investor Relations

901-523-4017

aagoorha@firsthorizon.com

FHN TABLE OF CONTENTS

|

Page | ||

| First Horizon National Corporation Segment Structure |

3 | |

| Performance Highlights |

4 | |

| Consolidated Results |

||

| Income Statement |

||

| Summary Results |

6 | |

| Income Statement |

7 | |

| Other Income and Other Expense |

8 | |

| Balance Sheet |

||

| Period End Balance Sheet |

9 | |

| Average Balance Sheet |

10 | |

| Net Interest Income |

11 | |

| Average Balance Sheet: Yields and Rates |

12 | |

| Charges for Restructuring, Repositioning, & Efficiency Initiatives |

13 | |

| Mortgage Servicing Rights |

14 | |

| Business Segment Detail |

||

| Segment Highlights |

15 | |

| Regional Banking |

16 | |

| Capital Markets |

17 | |

| Corporate |

18 | |

| Non-Strategic |

19 | |

| Capital Highlights |

20 | |

| Asset Quality |

||

| Asset Quality: Consolidated |

21 | |

| Asset Quality: Regional Banking and Corporate |

23 | |

| Asset Quality: Non-Strategic |

24 | |

| Rollforwards of Nonperforming Loans and ORE Inventory |

25 | |

| Portfolio Metrics |

26 | |

| Non-GAAP to GAAP Reconciliation |

27 | |

| Glossary of Terms |

28 | |

Other Information

This financial supplement contains forward-looking statements involving significant risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking information. Those factors include general economic and financial market conditions, including expectations of and actual timing and amount of interest rate movements including the slope of the yield curve, competition, customer and investor responses to these conditions, ability to execute business plans, geopolitical developments, recent and future legislative and regulatory developments, natural disasters, and items mentioned in this financial supplement and in First Horizon National Corporation’s (“FHN”) most recent press release, as well as critical accounting estimates and other factors described in FHN’s recent filings with the SEC. FHN disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

Use of Non-GAAP Measures

Certain ratios are included in this financial supplement that are non-GAAP, meaning they are not presented in accordance with generally accepted accounting principles (“GAAP”) in the U.S. FHN’s management believes such ratios are relevant to understanding the capital position and results of the Company. The non-GAAP ratios presented in this financial supplement are tangible common equity to tangible assets, tangible book value per common share, tier 1 common to risk weighted assets, adjusted tangible common equity to risk weighted assets, and net interest margin adjusted for fully taxable equivalent (“FTE”). These ratios are reported to FHN’s management and Board of Directors through various internal reports. Additionally, disclosure of non-GAAP capital ratios provides a meaningful base for comparability to other financial institutions as demonstrated by their use by the various banking regulators in reviewing the capital adequacy of financial institutions. Non-GAAP measures are not formally defined by GAAP or codified in the federal banking regulations, and other entities may use calculation methods that differ from those used by FHN. Tier 1 capital is a regulatory term and is generally defined as the sum of core capital (including common equity and instruments that can not be redeemed at the option of the holder) adjusted for certain items under risk based capital regulations. Also a regulatory term, risk weighted assets includes total assets adjusted for credit risk and is used to determine regulatory capital ratios. Refer to the tabular reconciliation of non-GAAP to GAAP measures and presentation of the most comparable GAAP items on page 27 of this financial supplement.

2

|

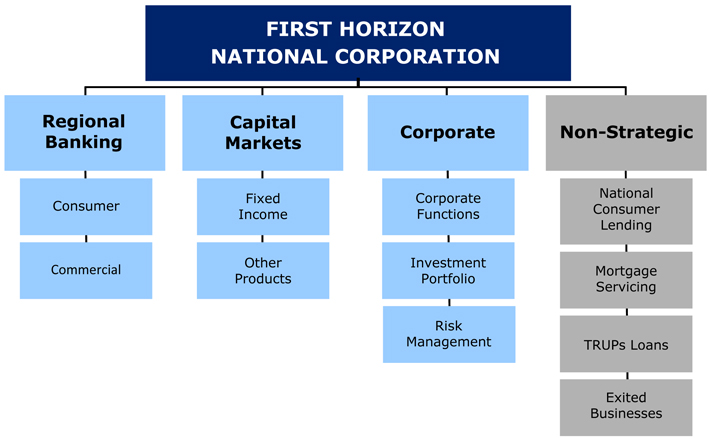

FIRST HORIZON NATIONAL CORPORATION SEGMENT STRUCTURE |

|

3

FHN PERFORMANCE HIGHLIGHTS

(First Quarter 2013 vs. Fourth Quarter 2012)

Consolidated

| • | Net income available to common shareholders was $41.0 million, or $.17 per diluted share, compared to $40.7 million, or $.17 per diluted share in prior quarter |

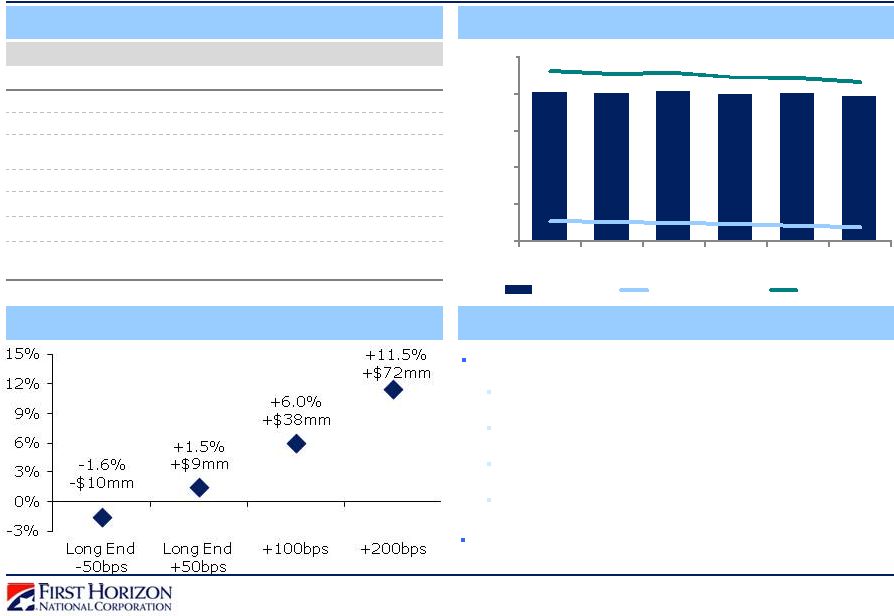

| • | NII decreased in first quarter to $161.4 million from $170.6 million; NIM decreased to 2.95 percent from 3.09 percent |

| • | The decrease in NII is primarily attributable to a decline in loan balances (loans to mortgage companies and non-strategic loan portfolios), a decrease in commercial loan fees, a lower yielding securities portfolio, and the impact of day variance |

| • | The decrease in NIM is driven by excess cash held at the Fed, an increase in the average trading portfolio, declining yields on the investment portfolio, lower commercial loan fees, and a decline in loans to mortgage companies |

| • | Noninterest income (including securities gains) was $156.4 million in first quarter compared to $146.4 million in fourth quarter |

| • | Increase largely driven by higher fixed income sales revenue within capital markets in first quarter and fourth quarter negative valuation of an equity investment, partially offset by a first quarter decline in deposit fees |

| • | Noninterest expense was $240.5 million in first quarter compared to $271.4 million in fourth quarter |

| • | Decrease primarily driven by severance costs associated with the voluntary separation program (“VSP”) in fourth quarter and a reduction of pension related expenses resulting from the freeze of the pension plans on December 31, 2012 |

| • | Period-end loans were $15.9 billion for the first quarter compared to $16.7 billion in fourth quarter |

| • | Decrease in the loan portfolio is primarily driven by a decline within the bank in loans to mortgage companies coupled with continued run-off within the non-strategic portfolios |

| • | Average core deposits declined to $15.7 billion in first quarter from $15.8 billion in fourth quarter, period-end declined 3 percent to $15.7 billion |

Regional Banking

| • | Net interest income was $145.1 million in first quarter, down from $153.1 million in fourth quarter |

| • | The decrease in NII is primarily attributable to lower loan balances (loans to mortgage companies), a decline in commercial loan fees, and the impact of day variance |

| • | The decrease in NIM is largely due to a decrease in loan fees coupled with an increase in lower yielding consumer installment and commercial loan balances |

| • | Provision credit was $2.5 million in first quarter compared to $1.2 million in prior quarter |

| • | Noninterest income was $59.1 million in first quarter compared to $64.1 million in fourth quarter |

| • | Deposit fee income decreased primarily due to seasonality in non-sufficient funds (“NSF”) fees |

| • | Noninterest expense decreased to $128.7 million in first quarter from $144.1 million in fourth quarter largely driven by a decline in pension related expenses, other personnel expenses due to head count reductions, and seasonally lower advertising costs from sponsorships |

Capital Markets

| • | Fixed income sales revenue increased to $68.0 million in first quarter from $65.6 million in fourth quarter |

| • | Fixed income average daily revenue (“ADR”) was $1.1 million in first and fourth quarters |

| • | Noninterest expenses increased to $61.7 million in first quarter from $57.5 million in prior quarter |

| • | The expense increase was due to an increase in variable compensation costs and the FICA reset |

Corporate

| • | NII was negative $7.7 million in first quarter compared to negative $8.2 million in fourth quarter |

| • | Estimated duration of the securities portfolio was 3.9 years in first quarter compared to 3.4 years in fourth quarter |

| • | Noninterest income was $7.9 million in first quarter compared to $6.0 million in prior quarter |

| • | Increase resulting from higher deferred compensation driven by market conditions; changes in income are mirrored by changes in deferred compensation expense |

| • | Noninterest expense decreased to $17.6 million in first quarter from $36.1 million in prior quarter |

| • | Fourth quarter expense includes $18.3 million of Restructuring, Repositioning and Efficiency Initiatives, primarily severance related costs associated with the VSP |

Non-Strategic

| • | NII decreased to $20.2 million in first quarter from $21.5 million in fourth quarter due to continued run-off of the loan portfolio |

| • | Provision expense increased to $17.5 million in first quarter from $16.2 million in prior quarter |

| • | Noninterest income increased to $12.8 million in first quarter from $3.9 million in fourth quarter |

| • | First quarter includes a $2.4 million gain from the reversal of a previous LOCOM adjustment associated with a TRUP loan payoff |

| • | Fourth quarter includes a $4.7 million negative valuation adjustment related to an equity investment |

| • | Noninterest expense was $32.6 million in first quarter, compared to $33.6 million in the prior quarter |

| • | First quarter includes a $5.2 million loss accrual related to pending legal matters compared to a $4.3 million loss accrual in fourth quarter |

| • | The active repurchase pipeline decreased to $258.9 million in first quarter from $333.8 million in fourth quarter |

| • | The pipeline of repurchase/make whole requests, substantially all of which relate to requests from Fannie/Freddie, were $200.6 million as of the end of the first quarter down from $267.3 million in prior quarter |

| • | Weighted average base servicing fee for legacy mortgage banking and legacy equity lending (HELOCs and ILs) were 34 basis points and 50 basis points, respectively |

4

FHN PERFORMANCE HIGHLIGHTS (continued)

(First Quarter 2013 vs. Fourth Quarter 2012)

Asset Quality

| • | Allowance as a percentage of loans ratio was 167 basis points in first quarter compared to 166 basis points in prior quarter |

| • | Total reserves decreased to $265.2 million from $277.0 million in fourth quarter |

| • | Reserve decrease driven by continued stabilization of the commercial portfolio |

| • | Provision expense was flat at $15.0 million in the first quarter |

| • | Net charge-offs were $26.7 million in first quarter compared to $19.8 million in prior quarter |

| • | Annualized net charge-offs increased to 67 basis points of average loans from 48 basis points in prior quarter |

| • | Prior quarter charge-offs included a favorable adjustment for lower loss estimate for discharged bankruptcies based on loan-level data obtained from new appraisals in the fourth quarter |

| • | Total 30+ delinquencies were $106.6 million in first quarter compared to $123.1 million in prior quarter |

| • | Consumer real estate loans in the non-strategic segment was the major contributor to this decline |

| • | Nonperforming assets (“NPAs”) declined slightly from prior quarter |

| • | The decline in commercial nonperforming loans (“NPLs”) through payments, charge-offs, resolutions and the sale of a TRUP loan, was more than offset by the increase in the NPLs held-for-sale |

| • | Foreclosed real estate declined to $32.7 million in first quarter compared to $41.8 million in the prior quarter |

| • | Troubled debt restructurings (“TDRs”) were $550.9 million at the end of first quarter compared with $550.6 million prior quarter |

Taxes

| • | First quarter includes $6.2 million of positive effect from permanent tax benefits primarily related to tax credit investments, life insurance, and tax exempt interest |

| • | Fourth quarter includes $24.6 million of positive effect from permanent tax benefits |

| • | $17.0 million related to discrete period tax items |

| • | $7.6 million in permanent tax benefits primarily related to tax credit investments, life insurance, and tax exempt interest |

Capital and Liquidity

| • | Paid $0.05 per share dividend April 1, 2013 |

| • | Increased stock repurchase program to $300 million; Repurchased shares costing $30.0 million in first quarter |

| • | Repurchased shares costing $205.1 million since the program’s inception in fourth quarter 2011 |

| • | Volume weighted average price for all share repurchases under the stock repurchase program of $8.81 per share (before $.03 per share broker commission) |

| • | Issued $100 million (approximately $96 million net of offering costs) of Series A Non-Cumulative Perpetual Preferred Stock; Paid quarterly dividend of $1.2 million on April 10, 2013 |

| • | Capital ratios (regulatory capital ratios estimated based on period-end balances) |

| • | 8.21 percent for tangible common equity to tangible assets |

| • | 13.50 percent for Tier 1 |

| • | 16.03 percent for Total Capital |

| • | 10.59 percent for Tier 1 Common |

5

FHN CONSOLIDATED SUMMARY RESULTS

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||

| Income Statement Highlights |

||||||||||||||||||||||||||||

| Net interest income |

$ 161,382 | $ 170,598 | $ 173,465 | $ 172,675 | $ 171,929 | (5)% | (6)% | |||||||||||||||||||||

| Noninterest income |

156,403 | 151,143 | 163,538 | 153,842 | 202,113 | 3 % | (23)% | |||||||||||||||||||||

| Securities gains/(losses), net |

24 | (4,700) | - | 5,065 | 328 | NM | NM | |||||||||||||||||||||

| Total revenue |

317,809 | 317,041 | 337,003 | 331,582 | 374,370 | * | (15)% | |||||||||||||||||||||

| Noninterest expense |

240,540 | 271,361 | 263,169 | 527,177 | 321,994 | (11)% | (25)% | |||||||||||||||||||||

| Provision for loan losses |

15,000 | 15,000 | 40,000 | 15,000 | 8,000 | * | 88 % | |||||||||||||||||||||

| Income/(loss) before income taxes |

62,269 | 30,680 | 33,834 | (210,595) | 44,376 | NM | 40 % | |||||||||||||||||||||

| Provision/(benefit) for income taxes |

17,730 | (12,914) | 5,260 | (88,178) | 10,570 | NM | 68 % | |||||||||||||||||||||

| Income/(loss) from continuing operations |

44,539 | 43,594 | 28,574 | (122,417) | 33,806 | 2 % | 32 % | |||||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

430 | (12) | 108 | 487 | (435) | NM | NM | |||||||||||||||||||||

| Net income/(loss) |

44,969 | 43,582 | 28,682 | (121,930) | 33,371 | 3 % | 35 % | |||||||||||||||||||||

| Net income attributable to noncontrolling interest |

2,813 | 2,901 | 2,875 | 2,844 | 2,844 | (3)% | (1)% | |||||||||||||||||||||

| Net income/(loss) attributable to controlling interest |

42,156 | 40,681 | 25,807 | (124,774) | 30,527 | 4 % | 38 % | |||||||||||||||||||||

| Preferred stock dividends |

1,188 | - | - | - | - | NM | NM | |||||||||||||||||||||

| Net income/(loss) available to common shareholders |

$ 40,968 | $ 40,681 | $ 25,807 | $ (124,774) | $ 30,527 | 1 % | 34 % | |||||||||||||||||||||

| Common Stock Data |

||||||||||||||||||||||||||||

| Diluted EPS from continuing operations |

$ 0.17 | $ 0.17 | $ 0.10 | $ (0.50) | $ 0.12 | * | 42 % | |||||||||||||||||||||

| Diluted EPS |

$ 0.17 | $ 0.17 | $ 0.10 | $ (0.50) | $ 0.12 | * | 42 % | |||||||||||||||||||||

| Diluted shares (thousands) |

242,799 | 246,132 | 248,306 | 249,104 | 255,369 | (1)% | (5)% | |||||||||||||||||||||

| Period-end shares outstanding (thousands) |

241,225 | 243,598 | 247,134 | 248,810 | 252,667 | (1)% | (5)% | |||||||||||||||||||||

| Cash dividends declared per share |

$ 0.05 | $ 0.01 | $ 0.01 | $ 0.01 | $ 0.01 | NM | NM | |||||||||||||||||||||

| Balance Sheet Highlights (Period-End) |

||||||||||||||||||||||||||||

| Total loans, net of unearned income (Restricted - $.1 billion) (a) |

$ 15,889,670 | $ 16,708,582 | $ 16,523,783 | $ 16,185,763 | $ 15,971,330 | (5)% | (1)% | |||||||||||||||||||||

| Total deposits |

16,204,467 | 16,629,709 | 16,228,111 | 16,117,443 | 16,935,170 | (3)% | (4)% | |||||||||||||||||||||

| Total assets (Restricted - $.1 billion) (a) |

25,166,427 | 25,520,140 | 25,739,830 | 25,492,955 | 25,678,969 | (1)% | (2)% | |||||||||||||||||||||

| Total liabilities (Restricted - $.1 billion) (a) |

22,566,700 | 23,010,934 | 23,207,942 | 22,978,549 | 23,004,796 | (2)% | (2)% | |||||||||||||||||||||

| Total equity |

2,599,727 | 2,509,206 | 2,531,888 | 2,514,406 | 2,674,173 | 4 % | (3)% | |||||||||||||||||||||

| Asset Quality Highlights |

||||||||||||||||||||||||||||

| Allowance for loan losses (Restricted - $3.7 million) (a) |

$ 265,218 | $ 276,963 | $ 281,744 | $ 321,051 | $ 346,016 | (4)% | (23)% | |||||||||||||||||||||

| Allowance / period-end loans |

1.67 % | 1.66 % | 1.71 % | 1.98 % | 2.17 % | |||||||||||||||||||||||

| Net charge-offs |

$ 26,745 | $ 19,781 | $ 79,307 | $ 39,965 | $ 46,335 | 35 % | (42)% | |||||||||||||||||||||

| Net charge-offs (annualized) / average loans |

0.67 % | 0.48 % | 1.92 % | 1.01 % | 1.16 % | |||||||||||||||||||||||

| Non-performing assets (NPA) |

$ 418,385 | $ 419,369 | $ 450,391 | $ 466,873 | $ 511,320 | * | (18)% | |||||||||||||||||||||

| NPA % (b) |

1.81 % | 1.84 % | 2.15 % | 2.32 % | 2.56 % | |||||||||||||||||||||||

| Key Ratios & Other |

||||||||||||||||||||||||||||

| Return on average assets (annualized) (c) |

0.73 % | 0.69 % | 0.45 % | (1.96)% | 0.53 % | |||||||||||||||||||||||

| Return on average common equity (annualized) (d) |

7.48 % | 7.20 % | 4.59 % | (21.06)% | 5.15 % | |||||||||||||||||||||||

| Net interest margin (e) (f) |

2.95 % | 3.09 % | 3.15 % | 3.16 % | 3.12 % | |||||||||||||||||||||||

| Fee income to total revenue (g) |

49.22 % | 46.98 % | 48.53 % | 47.12 % | 54.03 % | |||||||||||||||||||||||

| Efficiency ratio (h) |

75.69 % | 84.34 % | 78.09 % | 161.45 % | 86.08 % | |||||||||||||||||||||||

| Book value per common share |

$ 9.16 | $ 9.09 | $ 9.05 | $ 8.92 | $ 9.42 | |||||||||||||||||||||||

| Tangible book value per common share (f) |

$ 8.51 | $ 8.44 | $ 8.41 | $ 8.28 | $ 8.78 | |||||||||||||||||||||||

| Adjusted tangible common equity to risk weighted assets (f) (i) |

9.88 % | 9.93 % | 10.03 % | 9.97 % | 10.88 % | |||||||||||||||||||||||

| Market capitalization (millions) |

$ 2,576.3 | $ 2,414.1 | $ 2,379.9 | $ 2,152.2 | $ 2,622.7 | |||||||||||||||||||||||

| Full time equivalent employees |

4,381 | 4,507 | 4,585 | 4,619 | 4,629 | |||||||||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | Restricted balances parenthetically presented are as of March 31, 2013. |

| (b) | NPAs related to the loan portfolio over period-end loans plus foreclosed real estate and other assets. |

| (c) | Calculated using net income. |

| (d) | Calculated using net income available to common shareholders. |

| (e) | Net interest margin is computed using total net interest income adjusted for FTE. |

| (f) | Refer to the Non-GAAP to GAAP Reconciliation on page 27 of this financial supplement. |

| (g) | Ratio excludes securities gains/(losses). |

| (h) | Noninterest expense divided by total revenue excluding securities gains/(losses). |

| (i) | Current quarter is an estimate. |

6

FHN CONSOLIDATED INCOME STATEMENT

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||

| Interest income |

$ 186,399 | $ 196,199 | $ 200,516 | $ 200,735 | $ 201,503 | (5) | % | (7) | % | |||||||||||||||||||||

| Less: interest expense |

25,017 | 25,601 | 27,051 | 28,060 | 29,574 | (2) | % | (15) | % | |||||||||||||||||||||

| Net interest income |

161,382 | 170,598 | 173,465 | 172,675 | 171,929 | (5) | % | (6) | % | |||||||||||||||||||||

| Provision for loan losses (a) |

15,000 | 15,000 | 40,000 | 15,000 | 8,000 | * | 88 | % | ||||||||||||||||||||||

| Net interest income after provision for loan losses |

146,382 | 155,598 | 133,465 | 157,675 | 163,929 | (6) | % | (11) | % | |||||||||||||||||||||

| Noninterest income: |

||||||||||||||||||||||||||||||

| Capital markets (b) |

79,163 | 72,483 | 80,773 | 74,913 | 106,743 | 9 | % | (26) | % | |||||||||||||||||||||

| Mortgage banking |

9,373 | 8,287 | 10,373 | 9,889 | 23,341 | 13 | % | (60) | % | |||||||||||||||||||||

| Deposit transactions and cash management |

27,656 | 30,952 | 30,352 | 30,123 | 28,741 | (11) | % | (4) | % | |||||||||||||||||||||

| Trust services and investment management |

6,328 | 5,979 | 6,055 | 6,477 | 5,808 | 6 | % | 9 | % | |||||||||||||||||||||

| Brokerage, management fees and commissions |

9,348 | 8,980 | 8,699 | 8,759 | 8,496 | 4 | % | 10 | % | |||||||||||||||||||||

| Insurance commissions |

600 | 804 | 946 | 830 | 568 | (25) | % | 6 | % | |||||||||||||||||||||

| Securities gains/(losses), net (c) |

24 | (4,700) | - | 5,065 | 328 | NM | (93) | % | ||||||||||||||||||||||

| Gain on divestiture |

- | - | - | - | 200 | NM | NM | |||||||||||||||||||||||

| Other (d) |

23,935 | 23,658 | 26,340 | 22,851 | 28,216 | 1 | % | (15) | % | |||||||||||||||||||||

| Total noninterest income |

156,427 | 146,443 | 163,538 | 158,907 | 202,441 | 7 | % | (23) | % | |||||||||||||||||||||

| Adjusted gross income after provision for loan losses |

302,809 | 302,041 | 297,003 | 316,582 | 366,370 | * | (17) | % | ||||||||||||||||||||||

| Noninterest expense: |

||||||||||||||||||||||||||||||

| Employee compensation, incentives, and benefits |

139,184 | 161,813 | 153,970 | 149,616 | 175,458 | (14) | % | (21) | % | |||||||||||||||||||||

| Repurchase and foreclosure provision (e) |

- | - | - | 250,000 | 49,256 | NM | NM | |||||||||||||||||||||||

| Operations services |

8,070 | 8,123 | 8,702 | 9,477 | 9,127 | (1) | % | (12) | % | |||||||||||||||||||||

| Occupancy |

12,822 | 12,363 | 13,059 | 11,486 | 12,119 | 4 | % | 6 | % | |||||||||||||||||||||

| Legal and professional fees |

11,171 | 11,971 | 12,295 | 8,417 | 6,067 | (7) | % | 84 | % | |||||||||||||||||||||

| FDIC premium expense |

6,011 | 7,299 | 7,532 | 6,801 | 6,336 | (18) | % | (5) | % | |||||||||||||||||||||

| Computer software |

10,076 | 10,333 | 10,260 | 9,960 | 9,465 | (2) | % | 6 | % | |||||||||||||||||||||

| Contract employment and outsourcing |

9,039 | 9,052 | 10,187 | 10,844 | 11,115 | * | (19) | % | ||||||||||||||||||||||

| Equipment rentals, depreciation, and maintenance |

7,820 | 7,910 | 7,931 | 7,789 | 7,616 | (1) | % | 3 | % | |||||||||||||||||||||

| Foreclosed real estate |

1,439 | 1,995 | 2,968 | 1,908 | 4,170 | (28) | % | (65) | % | |||||||||||||||||||||

| Communications and courier |

4,437 | 4,613 | 4,722 | 4,484 | 4,499 | (4) | % | (1) | % | |||||||||||||||||||||

| Miscellaneous loan costs |

996 | 924 | 577 | 1,298 | 1,327 | 8 | % | (25) | % | |||||||||||||||||||||

| Amortization of intangible assets |

928 | 979 | 979 | 979 | 973 | (5) | % | (5) | % | |||||||||||||||||||||

| Other (d) |

28,547 | 33,986 | 29,987 | 54,118 | 24,466 | (16) | % | 17 | % | |||||||||||||||||||||

| Total noninterest expense |

240,540 | 271,361 | 263,169 | 527,177 | 321,994 | (11) | % | (25) | % | |||||||||||||||||||||

| Income/(loss) before income taxes |

62,269 | 30,680 | 33,834 | (210,595) | 44,376 | NM | 40 | % | ||||||||||||||||||||||

| Provision/(benefit) for income taxes (f) |

17,730 | (12,914) | 5,260 | (88,178) | 10,570 | NM | 68 | % | ||||||||||||||||||||||

| Income/(loss) from continuing operations |

44,539 | 43,594 | 28,574 | (122,417) | 33,806 | 2 | % | 32 | % | |||||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

430 | (12) | 108 | 487 | (435) | NM | NM | |||||||||||||||||||||||

| Net income/(loss) |

44,969 | 43,582 | 28,682 | (121,930) | 33,371 | 3 | % | 35 | % | |||||||||||||||||||||

| Net income attributable to noncontrolling interest |

2,813 | 2,901 | 2,875 | 2,844 | 2,844 | (3) | % | (1) | % | |||||||||||||||||||||

| Net income attributable to controlling interest |

42,156 | 40,681 | 25,807 | (124,774) | 30,527 | 4 | % | 38 | % | |||||||||||||||||||||

| Preferred stock dividends |

1,188 | - | - | - | - | NM | NM | |||||||||||||||||||||||

| Net income/(loss) available to common shareholders |

$ 40,968 | $ 40,681 | $ 25,807 | $ (124,774) | $ 30,527 | 1 | % | 34 | % | |||||||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | 3Q12 includes approximately $30 million associated with the implementation of regulatory guidance related to discharged bankruptcies. |

| (b) | 1Q13 includes a $2.4 million gain from a LOCOM reversal associated with a TRUP loan payoff within the non-strategic segment. |

| (c) | 4Q12 includes a $4.7 million negative valuation adjustment related to an equity investment. 2Q12 includes a $5.1 million gain on sale of venture capital investment. |

| (d) | Refer to the Other Income and Other Expense table on page 8 for additional information. |

| (e) | 2Q12 includes a $250.0 million charge to the repurchase and foreclosure provision primarily related to a revision in estimate based on information received from Fannie Mae. |

| (f) | 4Q12 includes $17.0 million in tax benefits related to discrete period tax items. |

7

FHN OTHER INCOME AND OTHER EXPENSE

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||||||||||

| Other Income |

||||||||||||||||||||||||||||||||||||||

| Bank owned life insurance |

$ | 5,472 | $ | 5,081 | $ | 4,293 | $ | 4,659 | $ | 4,772 | 8 % | 15 % | ||||||||||||||||||||||||||

| Bankcard income |

4,882 | 5,766 | 5,298 | 5,705 | 5,615 | (15)% | (13)% | |||||||||||||||||||||||||||||||

| ATM and interchange fees |

2,384 | 2,724 | 2,579 | 2,669 | 2,556 | (12)% | (7)% | |||||||||||||||||||||||||||||||

| Other service charges |

3,086 | 3,167 | 3,263 | 3,212 | 3,293 | (3)% | (6)% | |||||||||||||||||||||||||||||||

| Electronic banking fees |

1,562 | 1,610 | 1,589 | 1,632 | 1,706 | (3)% | (8)% | |||||||||||||||||||||||||||||||

| Letter of credit fees |

1,499 | 1,192 | 1,072 | 1,560 | 1,334 | 26 % | 12 % | |||||||||||||||||||||||||||||||

| Deferred compensation (a) |

1,593 | 396 | 1,966 | (1,020) | 3,119 | NM | (49)% | |||||||||||||||||||||||||||||||

| Other |

3,457 | 3,722 | 6,280 | 4,434 | 5,821 | (7)% | (41)% | |||||||||||||||||||||||||||||||

| Total |

$ | 23,935 | $ | 23,658 | $ | 26,340 | $ | 22,851 | $ | 28,216 | 1 % | (15)% | ||||||||||||||||||||||||||

| Other Expense |

||||||||||||||||||||||||||||||||||||||

| Litigation and regulatory matters |

$ | 5,170 | $ | 4,300 | $ | 6,760 | $ | 22,100 | $ | 153 | 20 % | NM | ||||||||||||||||||||||||||

| Advertising and public relations |

3,947 | 5,915 | 4,121 | 3,153 | 4,250 | (33)% | (7)% | |||||||||||||||||||||||||||||||

| Tax credit investments (b) |

2,972 | 4,198 | 5,635 | 4,214 | 4,608 | (29)% | (36)% | |||||||||||||||||||||||||||||||

| Other insurance and taxes (c) |

3,046 | 3,078 | 1,327 | 3,130 | 3,199 | (1)% | (5)% | |||||||||||||||||||||||||||||||

| Travel and entertainment |

1,848 | 2,058 | 2,009 | 2,435 | 1,864 | (10)% | (1)% | |||||||||||||||||||||||||||||||

| Customer relations |

1,278 | 1,348 | 1,027 | 1,348 | 855 | (5)% | 49 % | |||||||||||||||||||||||||||||||

| Employee training and dues |

1,254 | 1,171 | 1,032 | 1,230 | 1,092 | 7 % | 15 % | |||||||||||||||||||||||||||||||

| Supplies |

1,055 | 1,021 | 881 | 817 | 1,033 | 3 % | 2 % | |||||||||||||||||||||||||||||||

| Bank examination costs |

828 | 816 | 816 | 800 | 799 | 1 % | 4 % | |||||||||||||||||||||||||||||||

| Loan insurance expense |

540 | 552 | 578 | 636 | 589 | (2)% | (8)% | |||||||||||||||||||||||||||||||

| Federal services fees |

282 | 27 | 323 | 328 | 321 | NM | (12)% | |||||||||||||||||||||||||||||||

| Other (d) |

6,327 | 9,502 | 5,478 | 13,927 | 5,703 | (33)% | 11 % | |||||||||||||||||||||||||||||||

| Total |

$ | 28,547 | $ | 33,986 | $ | 29,987 | $ | 54,118 | $ | 24,466 | (16)% | 17 % | ||||||||||||||||||||||||||

NM - Not meaningful

| (a) | Amounts driven by market conditions and are mirrored by changes in deferred compensation expense which is included in employee compensation expense. |

| (b) | 3Q12 includes a $1.5 million impairment of an investment. |

| (c) | 3Q12 includes a $1.8 million positive adjustment to franchise taxes. |

| (d) | 3Q12 includes a $1.8 million gain related to clean-up calls for first lien securitizations. 2Q12 includes a $3.4 million increase in ancillary expenses associated with legacy mortgage wind-down activities and $2.8 million related to the write-off of unrecoverable servicing advances. |

8

FHN CONSOLIDATED PERIOD-END BALANCE SHEET

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||||

| Investment securities |

$ 3,190,219 | $ 3,061,808 | $ 3,123,629 | $ 3,264,866 | $ 3,296,603 | 4 % | (3)% | |||||||||||||||||||||||

| Loans held-for-sale |

390,874 | 401,937 | 410,550 | 424,051 | 431,905 | (3)% | (10)% | |||||||||||||||||||||||

| Loans, net of unearned income (Restricted - $.1 billion) (a) |

15,889,670 | 16,708,582 | 16,523,783 | 16,185,763 | 15,971,330 | (5)% | (1)% | |||||||||||||||||||||||

| Federal funds sold |

33,738 | 34,492 | 12,425 | 44,961 | 18,732 | (2)% | 80 % | |||||||||||||||||||||||

| Securities purchased under agreements to resell |

732,696 | 601,891 | 517,263 | 480,543 | 595,973 | 22 % | 23 % | |||||||||||||||||||||||

| Interest-bearing cash (b) |

431,182 | 353,373 | 440,916 | 484,430 | 761,098 | 22 % | (43)% | |||||||||||||||||||||||

| Trading securities |

1,397,746 | 1,262,720 | 1,204,366 | 1,361,717 | 1,238,041 | 11 % | 13 % | |||||||||||||||||||||||

| Total earning assets |

22,066,125 | 22,424,803 | 22,232,932 | 22,246,331 | 22,313,682 | (2)% | (1)% | |||||||||||||||||||||||

| Cash and due from banks (Restricted- $.2 million) (a) |

275,262 | 469,879 | 355,978 | 330,931 | 349,604 | (41)% | (21)% | |||||||||||||||||||||||

| Capital markets receivables |

533,306 | 303,893 | 791,190 | 377,496 | 522,001 | 75 % | 2 % | |||||||||||||||||||||||

| Mortgage servicing rights, net |

109,102 | 114,311 | 120,537 | 129,291 | 142,956 | (5)% | (24)% | |||||||||||||||||||||||

| Goodwill |

134,242 | 134,242 | 134,242 | 134,242 | 134,242 | * | * | |||||||||||||||||||||||

| Other intangible assets, net |

21,772 | 22,700 | 23,679 | 24,659 | 25,638 | (4)% | (15)% | |||||||||||||||||||||||

| Premises and equipment, net |

299,740 | 303,273 | 305,346 | 311,753 | 314,903 | (1)% | (5)% | |||||||||||||||||||||||

| Real estate acquired by foreclosure (c) |

54,672 | 60,690 | 70,779 | 69,603 | 78,947 | (10)% | (31)% | |||||||||||||||||||||||

| Allowance for loan losses (Restricted - $3.7 million) (a) |

(265,218) | (276,963) | (281,744) | (321,051) | (346,016) | (4)% | (23)% | |||||||||||||||||||||||

| Derivative assets |

274,332 | 292,472 | 334,025 | 340,810 | 340,337 | (6)% | (19)% | |||||||||||||||||||||||

| Other assets (Restricted - $1.6 million) (a) |

1,663,092 | 1,670,840 | 1,652,866 | 1,848,890 | 1,802,675 | * | (8)% | |||||||||||||||||||||||

| Total assets (Restricted - $.1 billion) (a) |

$ 25,166,427 | $ 25,520,140 | $ 25,739,830 | $ 25,492,955 | $ 25,678,969 | (1)% | (2)% | |||||||||||||||||||||||

| Liabilities and Equity: |

||||||||||||||||||||||||||||||

| Deposits: |

||||||||||||||||||||||||||||||

| Savings |

$ 6,498,832 | $ 6,705,496 | $ 6,608,534 | $ 5,979,874 | $ 6,615,289 | (3)% | (2)% | |||||||||||||||||||||||

| Other interest-bearing deposits |

3,740,257 | 3,798,313 | 3,468,367 | 3,565,873 | 3,500,445 | (2)% | 7 % | |||||||||||||||||||||||

| Time deposits |

988,375 | 1,019,938 | 1,063,380 | 1,109,163 | 1,142,249 | (3)% | (13)% | |||||||||||||||||||||||

| Total interest-bearing core deposits |

11,227,464 | 11,523,747 | 11,140,281 | 10,654,910 | 11,257,983 | (3)% | * | |||||||||||||||||||||||

| Noninterest-bearing deposits |

4,454,045 | 4,602,472 | 4,569,113 | 4,833,994 | 4,969,597 | (3)% | (10)% | |||||||||||||||||||||||

| Total core deposits (d) |

15,681,509 | 16,126,219 | 15,709,394 | 15,488,904 | 16,227,580 | (3)% | (3)% | |||||||||||||||||||||||

| Certificates of deposit $100,000 and more |

522,958 | 503,490 | 518,717 | 628,539 | 707,590 | 4 % | (26)% | |||||||||||||||||||||||

| Total deposits |

16,204,467 | 16,629,709 | 16,228,111 | 16,117,443 | 16,935,170 | (3)% | (4)% | |||||||||||||||||||||||

| Federal funds purchased |

1,361,670 | 1,351,023 | 1,350,806 | 1,417,590 | 1,487,469 | 1 % | (8)% | |||||||||||||||||||||||

| Securities sold under agreements to repurchase |

488,010 | 555,438 | 443,370 | 363,400 | 313,765 | (12)% | 56 % | |||||||||||||||||||||||

| Trading liabilities |

781,306 | 564,429 | 516,970 | 470,631 | 567,571 | 38 % | 38 % | |||||||||||||||||||||||

| Other short-term borrowings (e) |

186,898 | 441,201 | 856,958 | 1,094,179 | 181,570 | (58)% | 3 % | |||||||||||||||||||||||

| Term borrowings (Restricted - $.1 billion) (a) |

2,197,864 | 2,226,482 | 2,263,238 | 2,294,224 | 2,340,706 | (1)% | (6)% | |||||||||||||||||||||||

| Capital markets payables |

461,333 | 296,450 | 574,201 | 203,548 | 361,018 | 56 % | 28 % | |||||||||||||||||||||||

| Derivative liabilities |

199,999 | 202,269 | 225,084 | 235,490 | 234,188 | (1)% | (15)% | |||||||||||||||||||||||

| Other liabilities |

685,153 | 743,933 | 749,204 | 782,044 | 583,339 | (8)% | 17 % | |||||||||||||||||||||||

| Total liabilities (Restricted - $.1 billion) (a) |

22,566,700 | 23,010,934 | 23,207,942 | 22,978,549 | 23,004,796 | (2)% | (2)% | |||||||||||||||||||||||

| Equity: |

||||||||||||||||||||||||||||||

| Common stock (f) |

150,766 | 152,249 | 154,459 | 155,506 | 157,917 | (1)% | (5)% | |||||||||||||||||||||||

| Capital surplus (f) |

1,461,292 | 1,488,463 | 1,517,488 | 1,528,161 | 1,560,343 | (2)% | (6)% | |||||||||||||||||||||||

| Undivided profits |

748,427 | 719,672 | 681,460 | 658,157 | 785,361 | 4 % | (5)% | |||||||||||||||||||||||

| Accumulated other comprehensive loss, net (g) |

(151,639) | (146,343) | (116,684) | (122,583) | (124,613) | 4 % | 22 % | |||||||||||||||||||||||

| Preferred stock |

95,624 | - | - | - | - | NM | NM | |||||||||||||||||||||||

| Noncontrolling interest (h) |

295,257 | 295,165 | 295,165 | 295,165 | 295,165 | * | * | |||||||||||||||||||||||

| Total equity |

2,599,727 | 2,509,206 | 2,531,888 | 2,514,406 | 2,674,173 | 4 % | (3)% | |||||||||||||||||||||||

| Total liabilities and equity |

$ 25,166,427 | $ 25,520,140 | $ 25,739,830 | $ 25,492,955 | $ 25,678,969 | (1)% | (2)% | |||||||||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | Restricted balances parenthetically presented are as of March 31, 2013. |

| (b) | Includes excess balances held at Fed. |

| (c) | 1Q13 includes $22.0 million of foreclosed assets related to government insured mortgages. |

| (d) | 1Q13 average core deposits were $15.7 billion. |

| (e) | 3Q12 and 2Q12 include increased FHLB borrowings as a result of deposit fluctuations and an increase in loans to mortgage companies. |

| (f) | Decrease relates to shares purchased under the share repurchase program. |

| (g) | 4Q12 change primarily driven by annual benefit plan remeasurement. |

| (h) | Consists of preferred stock of subsidiary. |

9

FHN CONSOLIDATED AVERAGE BALANCE SHEET

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||||

| Earning assets: |

||||||||||||||||||||||||||||||

| Loans, net of unearned income: |

||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) |

$ 8,199,249 | $ 8,330,961 | $ 8,237,939 | $ 7,712,551 | $ 7,709,856 | (2)% | 6 % | |||||||||||||||||||||||

| Income CRE |

1,105,669 | 1,174,127 | 1,192,905 | 1,236,016 | 1,255,713 | (6)% | (12)% | |||||||||||||||||||||||

| Residential CRE |

55,798 | 63,647 | 79,107 | 94,531 | 111,823 | (12)% | (50)% | |||||||||||||||||||||||

| Consumer real estate |

5,644,275 | 5,757,724 | 5,819,620 | 5,864,713 | 5,874,049 | (2)% | (4)% | |||||||||||||||||||||||

| Permanent mortgage |

801,000 | 788,428 | 805,580 | 776,440 | 810,701 | 2 % | (1)% | |||||||||||||||||||||||

| Credit card and other |

291,221 | 288,412 | 277,154 | 276,017 | 279,150 | 1 % | 4 % | |||||||||||||||||||||||

| Total loans, net of unearned income |

16,097,212 | 16,403,299 | 16,412,305 | 15,960,268 | 16,041,292 | (2)% | * | |||||||||||||||||||||||

| Loans held-for-sale |

392,272 | 403,750 | 413,625 | 425,176 | 424,086 | (3)% | (8)% | |||||||||||||||||||||||

| Investment securities: |

||||||||||||||||||||||||||||||

| U.S. treasuries |

44,107 | 43,909 | 42,551 | 42,424 | 40,088 | * | 10 % | |||||||||||||||||||||||

| U.S. government agencies |

2,818,958 | 2,774,175 | 2,894,104 | 2,981,090 | 2,802,651 | 2 % | 1 % | |||||||||||||||||||||||

| States and municipalities |

15,255 | 17,169 | 17,970 | 18,005 | 18,070 | (11)% | (16)% | |||||||||||||||||||||||

| Other |

216,860 | 222,058 | 220,324 | 223,924 | 224,000 | (2)% | (3)% | |||||||||||||||||||||||

| Total investment securities |

3,095,180 | 3,057,311 | 3,174,949 | 3,265,443 | 3,084,809 | 1 % | * | |||||||||||||||||||||||

| Capital markets securities inventory |

1,308,969 | 1,250,423 | 1,189,852 | 1,327,596 | 1,277,372 | 5 % | 2 % | |||||||||||||||||||||||

| Mortgage banking trading securities |

17,486 | 18,844 | 20,112 | 22,841 | 25,797 | (7)% | (32)% | |||||||||||||||||||||||

| Other earning assets: |

||||||||||||||||||||||||||||||

| Federal funds sold |

24,173 | 24,701 | 28,229 | 25,465 | 12,337 | (2)% | 96 % | |||||||||||||||||||||||

| Securities purchased under agreements to resell |

754,630 | 586,258 | 531,914 | 606,554 | 620,635 | 29 % | 22 % | |||||||||||||||||||||||

| Interest-bearing cash (c) |

653,712 | 522,529 | 402,378 | 518,124 | 821,113 | 25 % | (20)% | |||||||||||||||||||||||

| Total other earning assets |

1,432,515 | 1,133,488 | 962,521 | 1,150,143 | 1,454,085 | 26 % | (1)% | |||||||||||||||||||||||

| Total earnings assets (Restricted - $.1 billion) (a) |

22,343,634 | 22,267,115 | 22,173,364 | 22,151,467 | 22,307,441 | * | * | |||||||||||||||||||||||

| Allowance for loan losses (Restricted - $4.0 million) (a) |

(270,385) | (306,583) | (309,810) | (336,642) | (372,264) | (12)% | (27)% | |||||||||||||||||||||||

| Cash and due from banks (Restricted - $.7 million) (a) |

348,581 | 349,002 | 339,098 | 337,366 | 351,760 | * | (1)% | |||||||||||||||||||||||

| Capital markets receivables |

121,891 | 114,771 | 168,806 | 100,408 | 91,430 | 6 % | 33 % | |||||||||||||||||||||||

| Premises and equipment, net |

299,846 | 303,921 | 306,709 | 312,313 | 317,621 | (1)% | (6)% | |||||||||||||||||||||||

| Derivative assets |

286,243 | 317,076 | 325,917 | 338,408 | 359,975 | (10)% | (20)% | |||||||||||||||||||||||

| Other assets (Restricted - $1.7 million) (a) |

1,948,417 | 1,925,664 | 2,085,670 | 2,111,315 | 2,144,410 | 1 % | (9)% | |||||||||||||||||||||||

| Total assets (Restricted - $.1 billion) (a) |

$ 25,078,227 | $ 24,970,966 | $ 25,089,754 | $ 25,014,635 | $ 25,200,373 | * | * | |||||||||||||||||||||||

| Liabilities and equity: |

||||||||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||||||||||||

| Savings |

$ 6,593,590 | $ 6,529,453 | $ 6,106,767 | $ 6,290,143 | $ 6,690,470 | 1 % | (1)% | |||||||||||||||||||||||

| Other interest-bearing deposits |

3,709,988 | 3,469,711 | 3,426,864 | 3,512,390 | 3,246,658 | 7 % | 14 % | |||||||||||||||||||||||

| Time deposits |

1,004,887 | 1,038,672 | 1,085,368 | 1,125,738 | 1,155,716 | (3)% | (13)% | |||||||||||||||||||||||

| Total interest-bearing core deposits |

11,308,465 | 11,037,836 | 10,618,999 | 10,928,271 | 11,092,844 | 2 % | 2 % | |||||||||||||||||||||||

| Certificates of deposit $100,000 and more |

516,785 | 514,543 | 570,415 | 675,688 | 660,256 | * | (22)% | |||||||||||||||||||||||

| Federal funds purchased |

1,479,316 | 1,538,970 | 1,448,347 | 1,523,974 | 1,681,983 | (4)% | (12)% | |||||||||||||||||||||||

| Securities sold under agreements to repurchase |

572,666 | 457,493 | 388,208 | 355,278 | 321,583 | 25 % | 78 % | |||||||||||||||||||||||

| Capital markets trading liabilities |

779,409 | 597,402 | 544,422 | 602,344 | 614,084 | 30 % | 27 % | |||||||||||||||||||||||

| Other short-term borrowings (d) |

209,376 | 272,578 | 967,303 | 377,075 | 182,083 | (23)% | 15 % | |||||||||||||||||||||||

| Term borrowings (Restricted - $.1 billion) (a) |

2,221,297 | 2,254,445 | 2,279,344 | 2,317,247 | 2,457,291 | (1)% | (10)% | |||||||||||||||||||||||

| Total interest-bearing liabilities |

17,087,314 | 16,673,267 | 16,817,038 | 16,779,877 | 17,010,124 | 2 % | * | |||||||||||||||||||||||

| Noninterest-bearing deposits |

4,441,411 | 4,770,935 | 4,660,529 | 4,696,844 | 4,623,457 | (7)% | (4)% | |||||||||||||||||||||||

| Capital markets payables |

91,539 | 81,941 | 116,680 | 73,312 | 71,180 | 12 % | 29 % | |||||||||||||||||||||||

| Derivative liabilities |

194,892 | 211,598 | 220,309 | 230,440 | 248,972 | (8)% | (22)% | |||||||||||||||||||||||

| Other liabilities |

683,596 | 689,782 | 744,871 | 556,446 | 565,445 | (1)% | 21 % | |||||||||||||||||||||||

| Equity |

2,579,475 | 2,543,443 | 2,530,327 | 2,677,716 | 2,681,195 | 1 % | (4)% | |||||||||||||||||||||||

| Total liabilities and equity (Restricted - $.1 billion) (a) |

$ 25,078,227 | $ 24,970,966 | $ 25,089,754 | $ 25,014,635 | $ 25,200,373 | * | * | |||||||||||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

NM - Not meaningful

* Amount is less than one percent.

| (a) | Restricted balances parenthetically presented are quarterly averages as of March 31, 2013. |

| (b) | Includes loans on nonaccrual status. |

| (c) | Includes excess balances held at Fed. |

| (d) | 2Q12 and 3Q12 include increased FHLB borrowings as a result of deposit fluctuations and an increase in loans to mortgage companies. |

10

FHN CONSOLIDATED NET INTEREST INCOME (a)

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||

| Interest Income: |

||||||||||||||||||||||||||||||

| Loans, net of unearned income (b) |

$ 154,955 | $ 163,693 | $ 165,368 | $ 162,698 | $ 163,070 | (5)% | (5)% | |||||||||||||||||||||||

| Loans held-for-sale |

3,502 | 3,732 | 3,808 | 3,628 | 3,738 | (6)% | (6)% | |||||||||||||||||||||||

| Investment securities: |

||||||||||||||||||||||||||||||

| U.S. treasuries |

8 | 11 | 11 | 39 | 66 | (27)% | (88)% | |||||||||||||||||||||||

| U.S. government agencies |

18,507 | 19,536 | 21,759 | 23,562 | 23,768 | (5)% | (22)% | |||||||||||||||||||||||

| States and municipalities |

23 | 6 | 65 | 63 | 76 | NM | (70)% | |||||||||||||||||||||||

| Other |

2,332 | 2,495 | 2,323 | 2,324 | 2,422 | (7)% | (4)% | |||||||||||||||||||||||

| Total investment securities |

20,870 | 22,048 | 24,158 | 25,988 | 26,332 | (5)% | (21)% | |||||||||||||||||||||||

| Capital markets securities inventory |

7,901 | 7,565 | 7,998 | 9,204 | 8,934 | 4 % | (12)% | |||||||||||||||||||||||

| Mortgage banking trading securities |

489 | 534 | 569 | 578 | 642 | (8)% | (24)% | |||||||||||||||||||||||

| Other earning assets: |

||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell |

105 | 182 | 165 | 115 | - | (42)% | NM | |||||||||||||||||||||||

| Interest-bearing cash |

364 | 287 | 202 | 280 | 446 | 27 % | (18)% | |||||||||||||||||||||||

| Total other earning assets |

469 | 469 | 367 | 395 | 446 | * | 5 % | |||||||||||||||||||||||

| Interest income |

$ 188,186 | $ 198,041 | $ 202,268 | $ 202,491 | $ 203,162 | (5)% | (7)% | |||||||||||||||||||||||

| Interest Expense: |

||||||||||||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||||||||||||

| Savings |

$ 4,397 | $ 4,617 | $ 4,764 | $ 4,744 | $ 5,619 | (5)% | (22)% | |||||||||||||||||||||||

| Other interest-bearing deposits |

1,145 | 1,268 | 1,455 | 1,655 | 1,518 | (10)% | (25)% | |||||||||||||||||||||||

| Time deposits |

4,217 | 4,639 | 5,169 | 5,541 | 5,916 | (9)% | (29)% | |||||||||||||||||||||||

| Total interest-bearing core deposits |

9,759 | 10,524 | 11,388 | 11,940 | 13,053 | (7)% | (25)% | |||||||||||||||||||||||

| Certificates of deposit $100,000 and more |

1,561 | 1,725 | 1,975 | 2,305 | 2,306 | (10)% | (32)% | |||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase |

1,200 | 1,196 | 1,096 | 1,114 | 1,223 | * | (2)% | |||||||||||||||||||||||

| Capital markets trading liabilities |

3,196 | 2,536 | 2,556 | 2,843 | 2,515 | 26 % | 27 % | |||||||||||||||||||||||

| Other short-term borrowings |

106 | 132 | 347 | 36 | 142 | (20)% | (25)% | |||||||||||||||||||||||

| Term borrowings |

9,195 | 9,488 | 9,689 | 9,822 | 10,335 | (3)% | (11)% | |||||||||||||||||||||||

| Interest expense |

25,017 | 25,601 | 27,051 | 28,060 | 29,574 | (2)% | (15)% | |||||||||||||||||||||||

| Net interest income - tax equivalent basis |

163,169 | 172,440 | 175,217 | 174,431 | 173,588 | (5)% | (6)% | |||||||||||||||||||||||

| Fully taxable equivalent adjustment |

(1,787) | (1,842) | (1,752) | (1,756) | (1,659) | 3 % | (8)% | |||||||||||||||||||||||

| Net interest income |

$ 161,382 | $ 170,598 | $ 173,465 | $ 172,675 | $ 171,929 | (5)% | (6)% | |||||||||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

(a) Net interest income adjusted to a fully taxable equivalent (“FTE”) basis.

(b) Includes loans on nonaccrual status.

11

FHN CONSOLIDATED AVERAGE BALANCE SHEET: YIELDS AND RATES

Quarterly, Unaudited

|

1Q13 |

4Q12 | 3Q12 | 2Q12 | 1Q12 | ||||||||||||||||

| Assets: |

||||||||||||||||||||

| Earning assets (a): |

||||||||||||||||||||

| Loans, net of unearned income: |

||||||||||||||||||||

| Commercial loans |

3.70 | % | 3.83 | % | 3.81 | % | 3.92 | % | 3.90 | % | ||||||||||

| Retail loans |

4.16 | 4.18 | 4.30 | 4.33 | 4.32 | |||||||||||||||

| Total loans, net of unearned income (b) |

3.89 | 3.98 | 4.01 | 4.09 | 4.08 | |||||||||||||||

| Loans held-for-sale |

3.57 | 3.70 | 3.68 | 3.41 | 3.53 | |||||||||||||||

| Investment securities: |

||||||||||||||||||||

| U.S. treasuries |

0.07 | 0.10 | 0.11 | 0.37 | 0.66 | |||||||||||||||

| U.S. government agencies |

2.63 | 2.82 | 3.01 | 3.16 | 3.39 | |||||||||||||||

| States and municipalities |

0.59 | 0.13 | 1.44 | 1.39 | 1.68 | |||||||||||||||

| Other |

4.30 | 4.49 | 4.22 | 4.15 | 4.33 | |||||||||||||||

| Total investment securities |

2.70 | 2.88 | 3.04 | 3.18 | 3.41 | |||||||||||||||

| Capital markets securities inventory |

2.41 | 2.42 | 2.69 | 2.77 | 2.80 | |||||||||||||||

| Mortgage banking trading securities |

11.19 | 11.34 | 11.31 | 10.12 | 9.96 | |||||||||||||||

| Other earning assets: |

||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell |

0.05 | 0.12 | 0.12 | 0.07 | - | |||||||||||||||

| Interest-bearing cash |

0.23 | 0.22 | 0.20 | 0.22 | 0.22 | |||||||||||||||

| Total other earning assets |

0.13 | 0.16 | 0.15 | 0.14 | 0.12 | |||||||||||||||

| Interest income/total earning assets |

3.40 | % | 3.55 | % | 3.64 | % | 3.67 | % | 3.65 | % | ||||||||||

| Liabilities: |

||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||

| Savings |

0.27 | % | 0.28 | % | 0.31 | % | 0.30 | % | 0.34 | % | ||||||||||

| Other interest-bearing deposits |

0.13 | 0.15 | 0.17 | 0.19 | 0.19 | |||||||||||||||

| Time deposits |

1.70 | 1.78 | 1.89 | 1.98 | 2.06 | |||||||||||||||

| Total interest-bearing core deposits |

0.35 | 0.38 | 0.43 | 0.44 | 0.47 | |||||||||||||||

| Certificates of deposit $100,000 and more |

1.23 | 1.33 | 1.38 | 1.37 | 1.40 | |||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase |

0.24 | 0.24 | 0.24 | 0.24 | 0.25 | |||||||||||||||

| Capital markets trading liabilities |

1.66 | 1.69 | 1.87 | 1.90 | 1.65 | |||||||||||||||

| Other short-term borrowings |

0.21 | 0.19 | 0.14 | 0.04 | 0.31 | |||||||||||||||

| Term borrowings (c) |

1.66 | 1.69 | 1.70 | 1.70 | 1.68 | |||||||||||||||

| Interest expense/total interest-bearing liabilities |

0.59 | 0.61 | 0.64 | 0.67 | 0.70 | |||||||||||||||

| Net interest spread |

2.81 | % | 2.94 | % | 3.00 | % | 3.00 | % | 2.95 | % | ||||||||||

| Effect of interest-free sources used to fund earning assets |

0.14 | 0.15 | 0.15 | 0.16 | 0.17 | |||||||||||||||

| Net interest margin |

2.95 | % | 3.09 | % | 3.15 | % | 3.16 | % | 3.12 | % | ||||||||||

Yields are adjusted to a fully taxable equivalent (“FTE”) basis. Refer to the Non-GAAP to GAAP Reconciliation on page 27 for reconciliation of net interest income (GAAP) to net interest income adjusted for impact of FTE - (non-GAAP).

| (a) | Earning assets yields are expressed net of unearned income. |

| (b) | Includes loans on nonaccrual status. |

| (c) | Rates are expressed net of unamortized debenture cost for term borrowings. |

12

FHN CHARGES FOR RESTRUCTURING, REPOSITIONING, & EFFICIENCY INITIATIVES

Quarterly, Unaudited

| (Thousands) |

1Q13 |

4Q12 | 3Q12 | 2Q12 | 1Q12 | |||||||||||||||

| By Income Statement Impact |

||||||||||||||||||||

| Noninterest income |

||||||||||||||||||||

| Mortgage banking (a) |

$ - | $ (348) | $ - | $ (2,287) | $ - | |||||||||||||||

| Gain on divestiture |

- | - | - | - | 200 | |||||||||||||||

| Noninterest expense |

||||||||||||||||||||

| Employee compensation, incentives, and benefits (b) |

819 | 18,128 | 2,730 | 2,191 | (152) | |||||||||||||||

| Occupancy |

438 | 180 | 41 | (219) | 44 | |||||||||||||||

| Legal and professional fees |

- | - | - | - | 15 | |||||||||||||||

| All other expense |

- | 17 | - | 12 | 5 | |||||||||||||||

| Total gain/(loss) before income taxes |

(1,257) | (18,673) | (2,771) | (4,271) | 288 | |||||||||||||||

| Income/(loss) from discontinued operations (c) |

735 | - | 180 | 485 | (96) | |||||||||||||||

| Net impact resulting from restructuring, repositioning, and efficiency initiatives |

$ (522) | $ (18,673) | $ (2,591) | $ (3,786) | $ 192 | |||||||||||||||

| (a) | Reflects adjustment due to contingencies associated with prior mortgage servicing sales. |

| (b) | Includes severance associated with the VSP during 1Q13 and 4Q12. |

| (c) | Includes amounts related to Msaver, First Horizon Insurance, and Highland Capital. |

13

FHN MORTGAGE SERVICING RIGHTS

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||

| First Liens |

||||||||||||||||||||||||||||||

| Fair value beginning balance |

$ 111,314 | $ 117,440 | $ 126,085 | $ 139,676 | $ 140,724 | |||||||||||||||||||||||||

| Reductions due to loan payments |

(5,374) | (5,592) | (6,050) | (6,665) | (5,499) | |||||||||||||||||||||||||

| Reductions due to exercise of cleanup calls |

(495) | - | (494) | - | - | |||||||||||||||||||||||||

| Changes in fair value due to: |

||||||||||||||||||||||||||||||

| Changes in valuation model inputs or assumptions (a) |

834 | (569) | (2,107) | (6,855) | 4,459 | |||||||||||||||||||||||||

| Other changes in fair value |

(88) | 35 | 6 | (71) | (8) | |||||||||||||||||||||||||

| Fair value ending balance |

$ 106,191 | $ 111,314 | $ 117,440 | $ 126,085 | $ 139,676 | (5) % | (24) % | |||||||||||||||||||||||

| Second Liens |

||||||||||||||||||||||||||||||

| Fair value beginning balance |

$ 196 | $ 205 | $ 215 | $ 222 | $ 231 | |||||||||||||||||||||||||

| Reductions due to loan payments |

(48) | (9) | (10) | (7) | (9) | |||||||||||||||||||||||||

| Changes in fair value due to: |

||||||||||||||||||||||||||||||

| Other changes in fair value |

45 | - | - | - | - | |||||||||||||||||||||||||

| Fair value ending balance |

$ 193 | $ 196 | $ 205 | $ 215 | $ 222 | (2) % | (13) % | |||||||||||||||||||||||

| HELOC |

||||||||||||||||||||||||||||||

| Fair value beginning balance |

$ 2,801 | $ 2,892 | $ 2,991 | $ 3,058 | $ 3,114 | |||||||||||||||||||||||||

| Reductions due to loan payments |

(125) | (91) | (102) | (79) | (76) | |||||||||||||||||||||||||

| Changes in fair value due to: |

||||||||||||||||||||||||||||||

| Other changes in fair value |

42 | - | 3 | 12 | 20 | |||||||||||||||||||||||||

| Fair value ending balance |

$ 2,718 | $ 2,801 | $ 2,892 | $ 2,991 | $ 3,058 | (3) % | (11) % | |||||||||||||||||||||||

| Total Consolidated |

||||||||||||||||||||||||||||||

| Fair value beginning balance |

$ 114,311 | $ 120,537 | $ 129,291 | $ 142,956 | $ 144,069 | |||||||||||||||||||||||||

| Reductions due to loan payments |

(5,547) | (5,692) | (6,162) | (6,751) | (5,584) | |||||||||||||||||||||||||

| Reductions due to exercise of cleanup calls |

(495) | - | (494) | - | - | |||||||||||||||||||||||||

| Changes in fair value due to: |

||||||||||||||||||||||||||||||

| Changes in valuation model inputs or assumptions (a) |

834 | (569) | (2,107) | (6,855) | 4,459 | |||||||||||||||||||||||||

| Other changes in fair value |

(1) | 35 | 9 | (59) | 12 | |||||||||||||||||||||||||

| Fair value ending balance |

$ 109,102 | $ 114,311 | $ 120,537 | $ 129,291 | $ 142,956 | (5) % | (24) % | |||||||||||||||||||||||

| (a) | Principally reflects changes in discount rates and prepayment speed assumptions, mostly due to changes in interest rates. |

14

FHN BUSINESS SEGMENT HIGHLIGHTS

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| (Thousands) | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | |||||||||||||||||||||||

| Regional Banking |

||||||||||||||||||||||||||||||

| Net interest income |

$ 145,097 | $ 153,070 | $ 150,308 | $ 147,767 | $ 146,636 | (5)% | (1)% | |||||||||||||||||||||||

| Noninterest income |

59,144 | 64,074 | 64,235 | 65,037 | 60,052 | (8)% | (2)% | |||||||||||||||||||||||

| Total revenues |

204,241 | 217,144 | 214,543 | 212,804 | 206,688 | (6)% | (1)% | |||||||||||||||||||||||

| Provision/(provision credit) for loan losses |

(2,485) | (1,227) | 2,927 | 4,828 | (7,426) | NM | 67 % | |||||||||||||||||||||||

| Noninterest expense |

128,713 | 144,100 | 141,641 | 143,378 | 140,643 | (11)% | (8)% | |||||||||||||||||||||||

| Income before income taxes |

78,013 | 74,271 | 69,975 | 64,598 | 73,471 | 5 % | 6 % | |||||||||||||||||||||||

| Provision for income taxes |

28,352 | 26,852 | 25,328 | 23,251 | 26,752 | 6 % | 6 % | |||||||||||||||||||||||

| Net income |

$ 49,661 | $ 47,419 | $ 44,647 | $ 41,347 | $ 46,719 | 5 % | 6 % | |||||||||||||||||||||||

| Capital Markets |

||||||||||||||||||||||||||||||

| Net interest income |

$ 3,847 | $ 4,248 | $ 4,753 | $ 5,608 | $ 5,680 | (9)% | (32)% | |||||||||||||||||||||||

| Noninterest income |

76,612 | 72,432 | 80,817 | 74,968 | 106,775 | 6 % | (28)% | |||||||||||||||||||||||

| Total revenues |

80,459 | 76,680 | 85,570 | 80,576 | 112,455 | 5 % | (28)% | |||||||||||||||||||||||

| Noninterest expense |

61,668 | 57,541 | 64,602 | 60,936 | 80,306 | 7 % | (23)% | |||||||||||||||||||||||

| Income before income taxes |

18,791 | 19,139 | 20,968 | 19,640 | 32,149 | (2)% | (42)% | |||||||||||||||||||||||

| Provision for income taxes |

7,123 | 7,182 | 7,898 | 7,403 | 12,238 | (1)% | (42)% | |||||||||||||||||||||||

| Net income |

$ 11,668 | $ 11,957 | $ 13,070 | $ 12,237 | $ 19,911 | (2)% | (41)% | |||||||||||||||||||||||

| Corporate |

||||||||||||||||||||||||||||||

| Net interest income/(expense) |

$ (7,717) | $ (8,179) | $ (5,268) | $ (4,706) | $ (5,309) | 6 % | (45)% | |||||||||||||||||||||||

| Noninterest income |

7,855 | 6,015 | 7,904 | 3,825 | 9,262 | 31 % | (15)% | |||||||||||||||||||||||

| Total revenues |

138 | (2,164) | 2,636 | (881) | 3,953 | NM | (97)% | |||||||||||||||||||||||

| Noninterest expense (a) |

17,587 | 36,104 | 21,534 | 19,138 | 22,373 | (51)% | (21)% | |||||||||||||||||||||||

| Income/(loss) before income taxes |

(17,449) | (38,268) | (18,898) | (20,019) | (18,420) | 54 % | 5 % | |||||||||||||||||||||||

| Benefit for income taxes |

(11,171) | (37,530) | (13,255) | (13,029) | (11,934) | 70 % | 6 % | |||||||||||||||||||||||

| Net loss |

$ (6,278) | $ (738) | $ (5,643) | $ (6,990) | $ (6,486) | NM | 3 % | |||||||||||||||||||||||

| Non-Strategic |

||||||||||||||||||||||||||||||

| Net interest income |

$ 20,155 | $ 21,459 | $ 23,672 | $ 24,006 | $ 24,922 | (6)% | (19)% | |||||||||||||||||||||||

| Noninterest income |

12,816 | 3,922 | 10,582 | 15,077 | 26,352 | NM | (51)% | |||||||||||||||||||||||

| Total revenues |

32,971 | 25,381 | 34,254 | 39,083 | 51,274 | 30 % | (36)% | |||||||||||||||||||||||

| Provision for loan losses |

17,485 | 16,227 | 37,073 | 10,172 | 15,426 | 8 % | 13 % | |||||||||||||||||||||||

| Noninterest expense (b) |

32,572 | 33,616 | 35,392 | 303,725 | 78,672 | (3)% | (59)% | |||||||||||||||||||||||

| Loss before income taxes |

(17,086) | (24,462) | (38,211) | (274,814) | (42,824) | 30 % | 60 % | |||||||||||||||||||||||

| Benefit for income taxes |

(6,574) | (9,418) | (14,711) | (105,803) | (16,486) | 30 % | 60 % | |||||||||||||||||||||||

| Loss from continuing operations |

(10,512) | (15,044) | (23,500) | (169,011) | (26,338) | 30 % | 60 % | |||||||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

430 | (12) | 108 | 487 | (435) | NM | NM | |||||||||||||||||||||||

| Net loss |

$ (10,082) | $ (15,056) | $ (23,392) | $ (168,524) | $ (26,773) | 33 % | 62 % | |||||||||||||||||||||||

| Total Consolidated |

||||||||||||||||||||||||||||||

| Net interest income |

$ 161,382 | $ 170,598 | $ 173,465 | $ 172,675 | $ 171,929 | (5)% | (6)% | |||||||||||||||||||||||

| Noninterest income |

156,427 | 146,443 | 163,538 | 158,907 | 202,441 | 7 % | (23)% | |||||||||||||||||||||||

| Total revenues |

317,809 | 317,041 | 337,003 | 331,582 | 374,370 | * | (15)% | |||||||||||||||||||||||

| Provision for loan losses |

15,000 | 15,000 | 40,000 | 15,000 | 8,000 | * | 88 % | |||||||||||||||||||||||

| Noninterest expense |

240,540 | 271,361 | 263,169 | 527,177 | 321,994 | (11)% | (25)% | |||||||||||||||||||||||

| Income/(loss) before income taxes |

62,269 | 30,680 | 33,834 | (210,595) | 44,376 | NM | 40 % | |||||||||||||||||||||||

| Provision/(benefit) for income taxes |

17,730 | (12,914) | 5,260 | (88,178) | 10,570 | NM | 68 % | |||||||||||||||||||||||

| Income/(loss) from continuing operations |

44,539 | 43,594 | 28,574 | (122,417) | 33,806 | 2 % | 32 % | |||||||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

430 | (12) | 108 | 487 | (435) | NM | NM | |||||||||||||||||||||||

| Net income/(loss) |

$ 44,969 | $ 43,582 | $ 28,682 | $ (121,930) | $ 33,371 | 3 % | 35 % | |||||||||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

Certain previously reported amounts have been reclassified to agree with current presentation.

| (a) | 4Q12 includes $18.3 million related to Restructuring, Repositioning, and Efficiency initiatives, primarily severance related costs associated with the VSP. |

| (b) | 2Q12 includes $250.0 million charge to the repurchase and foreclosure provision primarily related to a revision in estimate based on information received from Fannie Mae. |

15

FHN REGIONAL BANKING

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | ||||||||||||||||||||||||

| Income Statement (thousands) |

||||||||||||||||||||||||||||||

| Net interest income |

$ 145,097 | $ 153,070 | $ 150,308 | $ 147,767 | $ 146,636 | (5)% | (1)% | |||||||||||||||||||||||

| Provision/(provision credit) for loan losses |

(2,485) | (1,227) | 2,927 | 4,828 | (7,426) | NM | 67 % | |||||||||||||||||||||||

| Noninterest income: |

||||||||||||||||||||||||||||||

| NSF / Overdraft fees (a) |

$ 10,031 | $ 13,586 | $ 13,038 | $ 12,265 | $ 11,284 | (26)% | (11)% | |||||||||||||||||||||||

| Cash management fees |

9,330 | 9,092 | 8,915 | 9,179 | 8,856 | 3 % | 5 % | |||||||||||||||||||||||

| Debit card income |

2,534 | 2,437 | 2,670 | 2,780 | 2,552 | 4 % | (1)% | |||||||||||||||||||||||

| Other |

4,909 | 4,912 | 4,770 | 4,925 | 5,135 | * | (4)% | |||||||||||||||||||||||

| Total deposit transactions and cash management |

26,804 | 30,027 | 29,393 | 29,149 | 27,827 | (11)% | (4)% | |||||||||||||||||||||||

| Brokerage, management fees and commissions |

9,348 | 8,979 | 8,700 | 8,758 | 8,496 | 4 % | 10 % | |||||||||||||||||||||||

| Trust services and investment management |

6,343 | 5,995 | 6,071 | 6,493 | 5,824 | 6 % | 9 % | |||||||||||||||||||||||

| Bankcard income |

4,691 | 5,556 | 5,029 | 5,504 | 5,457 | (16)% | (14)% | |||||||||||||||||||||||

| Other service charges |

2,873 | 2,951 | 3,060 | 3,021 | 3,086 | (3)% | (7)% | |||||||||||||||||||||||

| Miscellaneous revenue |

9,085 | 10,566 | 11,982 | 12,112 | 9,362 | (14)% | (3)% | |||||||||||||||||||||||

| Total noninterest income |

$ 59,144 | $ 64,074 | $ 64,235 | $ 65,037 | $ 60,052 | (8)% | (2)% | |||||||||||||||||||||||

| Noninterest expense: |

||||||||||||||||||||||||||||||

| Employee compensation, incentives, and benefits |

50,590 | 51,014 | 50,526 | 50,957 | 51,080 | (1)% | (1)% | |||||||||||||||||||||||

| Other (b) |

78,123 | 93,086 | 91,115 | 92,421 | 89,563 | (16)% | (13)% | |||||||||||||||||||||||

| Total noninterest expense |

128,713 | 144,100 | 141,641 | 143,378 | 140,643 | (11)% | (8)% | |||||||||||||||||||||||

| Income before income taxes |

$ 78,013 | $ 74,271 | $ 69,975 | $ 64,598 | $ 73,471 | 5 % | 6 % | |||||||||||||||||||||||

| Efficiency ratio (c) |

63.02 | % | 66.36 | % | 66.02 | % | 67.38 | % | 68.05 | % | ||||||||||||||||||||

| Balance Sheet (millions) |

||||||||||||||||||||||||||||||

| Average loans |

$ 12,237 | $ 12,397 | $ 12,221 | $ 11,650 | $ 11,533 | (1)% | 6 % | |||||||||||||||||||||||

| Average other earning assets |

53 | 58 | 69 | 63 | 51 | (9)% | 4 % | |||||||||||||||||||||||

| Total average earning assets |

12,290 | 12,455 | 12,290 | 11,713 | 11,584 | (1)% | 6 % | |||||||||||||||||||||||

| Average core deposits |

14,560 | 14,445 | 14,295 | 14,396 | 13,974 | 1 % | 4 % | |||||||||||||||||||||||

| Average other deposits |

517 | 515 | 570 | 676 | 660 | * | (22)% | |||||||||||||||||||||||

| Total average deposits |

15,077 | 14,960 | 14,865 | 15,072 | 14,634 | 1 % | 3 % | |||||||||||||||||||||||

| Total period-end deposits |

15,225 | 15,142 | 14,783 | 15,183 | 15,338 | 1 % | (1)% | |||||||||||||||||||||||

| Total period-end assets |

12,844 | 13,754 | 13,246 | 12,758 | 12,334 | (7)% | 4 % | |||||||||||||||||||||||

| Net interest margin (d) |

4.84 | % | 4.94 | % | 4.92 | % | 5.13 | % | 5.14 | % | ||||||||||||||||||||

| Net interest spread |

3.46 | 3.53 | 3.54 | 3.55 | 3.56 | |||||||||||||||||||||||||

| Loan yield |

3.75 | 3.83 | 3.88 | 3.91 | 3.95 | |||||||||||||||||||||||||

| Deposit average yield |

0.29 | 0.30 | 0.34 | 0.36 | 0.39 | |||||||||||||||||||||||||

| Key Statistics |

||||||||||||||||||||||||||||||

| Financial center locations |

171 | 171 | 173 | 173 | 174 | * | (2)% | |||||||||||||||||||||||

| Trust assets - total managed assets (millions) |

$ 3,920 | $ 3,948 | $ 3,917 | $ 3,837 | $ 3,472 | (1)% | 13 % | |||||||||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

Certain previously reported amounts have been reclassified to agree with current presentation.

| (a) | 1Q13 decline primarily attributable to seasonality in NSF fees. |

| (b) | 1Q13 decrease largely attributable to a decline in allocated Pension expense resulting from the freeze of the pension plans on December 31, 2012. |

| (c) | Noninterest expense divided by total revenue. |

| (d) | Net interest margin is computed using total net interest income adjusted for FTE. Refer to the Non-GAAP to GAAP Reconciliation on page 27 of this supplement. |

16

FHN CAPITAL MARKETS

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | ||||||||||||||||||||||||

| Income Statement (thousands) |

||||||||||||||||||||||||||||||

| Net interest income |

$ 3,847 | $ 4,248 | $ 4,753 | $ 5,608 | $ 5,680 | (9)% | (32)% | |||||||||||||||||||||||

| Noninterest income: |

||||||||||||||||||||||||||||||

| Fixed income |

67,953 | 65,560 | 74,488 | 68,399 | 99,112 | 4 % | (31)% | |||||||||||||||||||||||

| Other |

8,659 | 6,872 | 6,329 | 6,569 | 7,663 | 26 % | 13 % | |||||||||||||||||||||||

| Total noninterest income |

76,612 | 72,432 | 80,817 | 74,968 | 106,775 | 6 % | (28)% | |||||||||||||||||||||||

| Noninterest expense |

61,668 | 57,541 | 64,602 | 60,936 | 80,306 | 7 % | (23)% | |||||||||||||||||||||||

| Income before income taxes |

$ 18,791 | $ 19,139 | $ 20,968 | $ 19,640 | $ 32,149 | (2)% | (42)% | |||||||||||||||||||||||

| Efficiency ratio (a) |

76.65 | % | 75.04 | % | 75.50 | % | 75.63 | % | 71.41 | % | ||||||||||||||||||||

| Fixed income average daily revenue |

$ 1,133 | $ 1,093 | $ 1,182 | $ 1,086 | $ 1,599 | 4 % | (29)% | |||||||||||||||||||||||

| Balance Sheet (millions) |

||||||||||||||||||||||||||||||

| Average trading inventory |

$ 1,309 | $ 1,250 | $ 1,190 | $ 1,328 | $ 1,277 | 5 % | 3 % | |||||||||||||||||||||||

| Average other earning assets |

770 | 618 | 576 | 669 | 695 | 25 % | 11 % | |||||||||||||||||||||||

| Total average earning assets |

2,079 | 1,868 | 1,766 | 1,997 | 1,972 | 11 % | 5 % | |||||||||||||||||||||||

| Total period-end assets |

2,956 | 2,466 | 2,848 | 2,554 | 2,693 | 20 % | 10 % | |||||||||||||||||||||||

| Net interest margin (b) |

0.75 | % | 0.95 | % | 1.12 | % | 1.15 | % | 1.18 | % | ||||||||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

| (a) | Noninterest expense divided by total revenue. |

| (b) | Net interest margin is computed using total net interest income adjusted for FTE. Refer to the Non-GAAP to GAAP Reconciliation on page 27 of this supplement. |

17

FHN CORPORATE

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | ||||||||||||||||||||||||

| Income Statement (thousands) |

||||||||||||||||||||||||||||||

| Net interest income/(expense) |

$ (7,717) | $ (8,179) | $ (5,268) | $ (4,706) | $ (5,309) | 6 % | (45)% | |||||||||||||||||||||||

| Noninterest income |

7,825 | 6,015 | 7,904 | 3,825 | 8,934 | 30 % | (12)% | |||||||||||||||||||||||

| Securities gains, net |

30 | - | - | - | 328 | NM | (91)% | |||||||||||||||||||||||

| Noninterest expense (a) |

17,587 | 36,104 | 21,534 | 19,138 | 22,373 | (51)% | (21)% | |||||||||||||||||||||||

| Loss before income taxes |

$ (17,449) | $ (38,268) | $ (18,898) | $ (20,019) | $ (18,420) | 54 % | 5 % | |||||||||||||||||||||||

| Average Balance Sheet (millions) |

||||||||||||||||||||||||||||||

| Average loans |

$ 226 | $ 189 | $ 183 | $ 124 | $ 137 | 20 % | 65 % | |||||||||||||||||||||||

| Total earning assets |

$ 3,959 | $ 3,751 | $ 3,735 | $ 3,884 | $ 4,021 | 6 % | (2)% | |||||||||||||||||||||||

| Net interest margin (b) |

(.83) | % | (.85) | % | (.54) | % | (.50) | % | (.55) | % | ||||||||||||||||||||

NM - Not meaningful

| (a) | 4Q12 includes $18.3 million related to Restructuring, Repositioning, and Efficiency initiatives, primarily severance related costs associated with the VSP. |

| (b) | Net interest margin is computed using total net interest income adjusted for FTE. Refer to the Non-GAAP to GAAP Reconciliation on page 27 of this supplement. |

18

FHN NON-STRATEGIC

Quarterly, Unaudited

| 1Q13 Changes vs. | ||||||||||||||||||||||||||||||

| 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q12 | 1Q12 | ||||||||||||||||||||||||

| Income Statement (thousands) |

||||||||||||||||||||||||||||||

| Net interest income |

$ 20,155 | $ 21,459 | $ 23,672 | $ 24,006 | $ 24,922 | (6)% | (19)% | |||||||||||||||||||||||

| Noninterest income: |

||||||||||||||||||||||||||||||

| Mortgage warehouse valuation |

259 | (1,850) | (3,470) | 626 | 1,640 | NM | (84)% | |||||||||||||||||||||||

| Service fees |

12,145 | 12,967 | 13,778 | 14,984 | 17,202 | (6)% | (29)% | |||||||||||||||||||||||

| Change in MSR value - runoff |

(5,375) | (5,592) | (6,049) | (6,665) | (5,498) | 4 % | 2 % | |||||||||||||||||||||||

| Net hedging results |

1,982 | 2,097 | 4,486 | 1,833 | 9,065 | (5)% | (78)% | |||||||||||||||||||||||

| Miscellaneous revenue (a) |

3,811 | 1,000 | 1,837 | (766) | 3,943 | NM | (3)% | |||||||||||||||||||||||

| Total noninterest income |

12,822 | 8,622 | 10,582 | 10,012 | 26,352 | 49 % | (51)% | |||||||||||||||||||||||

| Securities gains/(losses), net (b) |

(6) | (4,700) | - | 5,065 | - | NM | NM | |||||||||||||||||||||||

| Noninterest expense: |

||||||||||||||||||||||||||||||

| Repurchase and foreclosure provision (c) |

- | - | - | 250,000 | 49,256 | NM | NM | |||||||||||||||||||||||

| Other expenses (d) |

32,572 | 33,616 | 35,392 | 53,725 | 29,416 | (3)% | 11 % | |||||||||||||||||||||||

| Total noninterest expense |

32,572 | 33,616 | 35,392 | 303,725 | 78,672 | (3)% | (59)% | |||||||||||||||||||||||

| Provision for loan losses (e) |

17,485 | 16,227 | 37,073 | 10,172 | 15,426 | 8 % | 13 % | |||||||||||||||||||||||

| Loss before income taxes |

$ (17,086) | $ (24,462) | $ (38,211) | $ (274,814) | $ (42,824) | 30 % | 60 % | |||||||||||||||||||||||

| Average Balance Sheet (millions) |

||||||||||||||||||||||||||||||

| Loans |

$ 3,634 | $ 3,817 | $ 4,008 | $ 4,186 | $ 4,371 | (5)% | (17)% | |||||||||||||||||||||||

| Loans held-for-sale |

354 | 344 | 333 | 330 | 316 | 3 % | 12 % | |||||||||||||||||||||||

| Trading securities |

17 | 19 | 20 | 23 | 26 | (11)% | (35)% | |||||||||||||||||||||||

| Mortgage servicing rights |

113 | 118 | 126 | 137 | 141 | (4)% | (20)% | |||||||||||||||||||||||

| Other assets |

257 | 266 | 286 | 304 | 336 | (3)% | (24)% | |||||||||||||||||||||||

| Total assets |

4,375 | 4,564 | 4,773 | 4,980 | 5,190 | (4)% | (16)% | |||||||||||||||||||||||

| Net interest margin (f) |

2.02 | % | 2.04 | % | 2.16 | % | 2.11 | % | 2.11 | % | ||||||||||||||||||||

| Efficiency ratio (g) |

98.77 | % | 111.75 | % | 103.32 | % | NM | 153.43 | % | |||||||||||||||||||||

| Mortgage Warehouse - Period-end (millions) |

||||||||||||||||||||||||||||||

| Ending warehouse balance (loans held-for-sale) |

$ 362 | $ 353 | $ 339 | $ 336 | $ 323 | 3 % | 12 % | |||||||||||||||||||||||

| Key Servicing Metrics (h) |

||||||||||||||||||||||||||||||

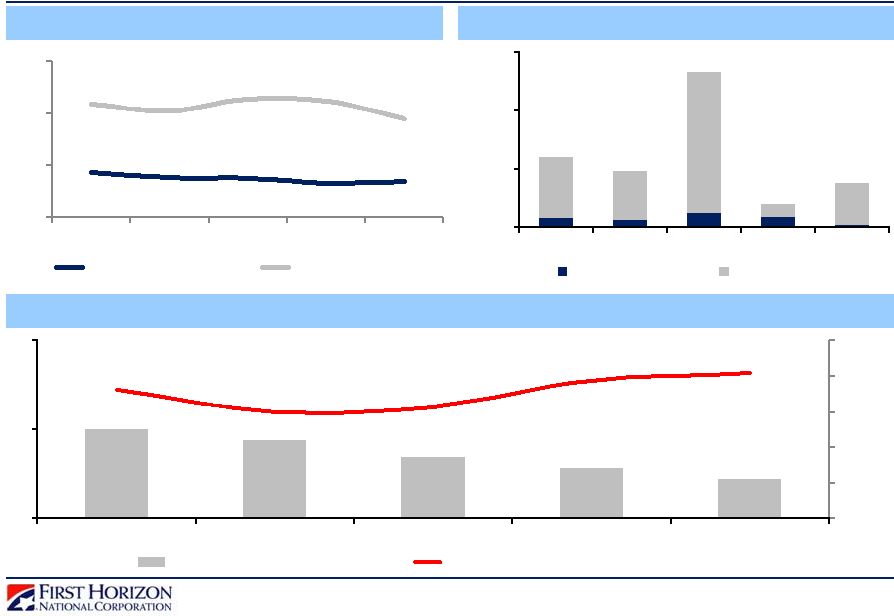

| Ending servicing portfolio (millions) (i) |

$ 17,055 | $ 18,071 | $ 19,149 | $ 20,331 | $ 21,610 | (6)% | (21)% | |||||||||||||||||||||||

| Average servicing portfolio (millions) (i) |

17,797 | 18,607 | 19,728 | 20,978 | 22,184 | (4)% | (20)% | |||||||||||||||||||||||

| Average number of loans serviced (i) |

104,874 | 110,175 | 115,987 | 121,818 | 128,068 | (5)% | (18)% | |||||||||||||||||||||||

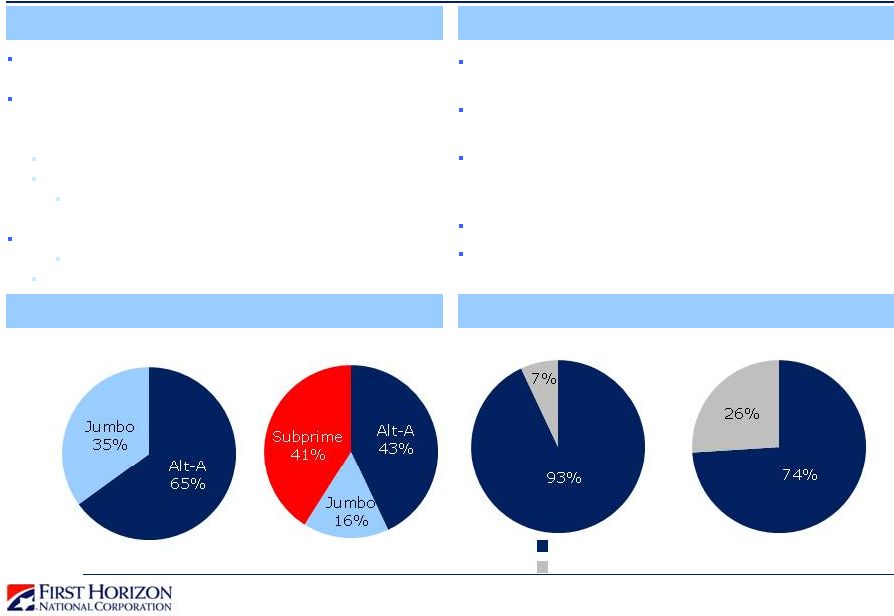

| Portfolio Product Mix (average) |

||||||||||||||||||||||||||||||

| GNMA (Ginnie) |

2 | % | 2 | % | 2 | % | 3 | % | 3 | % | ||||||||||||||||||||

| FNMA/FHLMC (Fannie/Freddie) |

31 | 32 | 33 | 35 | 35 | |||||||||||||||||||||||||

| Private |

60 | 59 | 59 | 57 | 57 | |||||||||||||||||||||||||

| Sub-total |

93 | 93 | 94 | 95 | 95 | |||||||||||||||||||||||||

| FHN permanent mortgage portfolio and warehouse |

7 | 7 | 6 | 5 | 5 | |||||||||||||||||||||||||

| Total |

100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||||||

| Other Portfolio Statistics |

||||||||||||||||||||||||||||||

| Servicing cost per loan (annualized) (j) |

$ 294.41 | $ 279.08 | $ 288.21 | $ 280.71 | $ 294.94 | |||||||||||||||||||||||||

| Servicing book value (bps) (k) (l) |

69 | 68 | 68 | 68 | 71 | |||||||||||||||||||||||||

| 90+ delinquency rate, excluding foreclosures (m) |

11.20 | % | 10.89 | % | 10.61 | % | 10.94 | % | 11.54 | % | ||||||||||||||||||||

NM - Not meaningful

Certain previously reported amounts have been reclassified to agree with current presentation.

| (a) | 1Q13 includes a $2.4 million gain from a LOCOM reversal associated with a TRUP loan payoff; 2Q12 includes a $2.3 million negative adjustment made as a result of contingencies related to prior servicing sales. |

| (b) | 4Q12 includes a $4.7 million negative valuation adjustment related to an equity investment. 2Q12 includes a $5.1 million gain on sale of venture capital investment. |

| (c) | 2Q12 represents $250.0 million charge to the repurchase and foreclosure provision primarily related to a revision in estimate based on new information received from Fannie Mae. |

| (d) | 2Q12 includes a $22.0 million loss accrual related to pending legal matters. |

| (e) | 3Q12 increase largely associated with the implementation of regulatory guidance related to discharged bankruptcies. |