Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d523079d8k.htm |

Financial

Results Financial Results

First Quarter 2013

First Quarter 2013

Exhibit 99.1 |

1

Forward Looking Statements |

Q1 2013

Highlights & Recent Events 2

Earnings

•

Adjusted net income of $60M

Credit

Recent Events

Capital

•

Strong capital ratios: Common Equity Tier One ratio at 12.4%

•

$1.7B in excess of CET1 over current well-capitalized threshold

•

Tangible Book Value/Share at March 31, 2013: $31.21

Strong margins: Popular, Inc. 4.39%, BPPR 5.18%

•

Continued improvement across key metrics

Excluding

bulk

sale

and

covered

loans:

NPLs

declined

by

$42M,

NCOs

down

$20M

$58M

adjusted

provision

lowest

in

this

credit

cycle

Total

NPL

inflows

decreased

by

$60M

to

lowest

level

in

three

years

Total

NPL-to-Loans

ratio

decreased

by

193

bps

to

4.86%

Total

NPA-to-Assets

ratio

decreased

by

164

bps

to

3.84%

•

Successful EVERTEC IPO highlights significant value of BPOP stake and results in

partial monetization in early Q2

•

Puerto Rico government retirement system measures signed into law; other

important initiatives completed or in process

•

Bulk sale further accelerates credit-quality improvements |

NPA Sale

Substantially De-risked Balance Sheet •

Pricing:

Purchase price: $338M (34% of UPB)

Book Value of assets sold: $509M¹

$92M in cash received at closing

•

Deal structure:

Included $392M in commercial and construction NPLs, $108M in residential and

commercial OREOs and $9M of other loans

Sold to a third party financial group

Retained 24.9% interest in the acquiring entity, ensuring we participate in any

upside

Provided

$247M

in

seller

financing

to

entity

to

fund

a

portion

of

purchase

price,

costs-to-complete amounts and expenses of certain projects, working capital and

other items

•

Deal structure is similar to 2011 NPL sale transaction, which has performed well:

Credit facilities have been substantially repaid sooner than expected

Value of our JV interest has appreciated

3

¹

Excludes $25 Million of OREO properties sold that are subject to post closing conditions and

therefore did not qualify for derecognition for accounting purposes.

|

EVERTEC IPO

4

•

“EVTC”

commenced trading on April 12 on NYSE

Transaction

Overview

Additional

Value

Q2 Impact on

Balance Sheet

•

BPOP retaining stake of 33.5% (26.5M shares) following IPO

•

Value of $530M based on the public offering price of $20 versus

our pro-forma book value after IPO of $75M

•

Bank holding company will receive approximately $254M in cash

from IPO proceeds and repayment of EVERTEC debt held by

Popular

•

After-tax gain will increase Common Equity Tier 1

Price highlights significant value of BPOP stake

Overall EVERTEC enterprise value of $2.3B, IPO equity value of $1.6B

Offering upsized to $505M

Sold 8.8M shares and will record after-tax gain of $169M in Q2

|

Addressing Key

Areas of Shareholder Focus •

Reducing

non-performing

assets

(excluding

covered

loans)

Total NPAs down by $885M or 42% YoY

Total NPLs held in portfolio declined $631M or 38% YoY

–

NPL declines of $498M in commercial,

$66M in mortgage and $43M in

legacy

Reduced NPL HFS balance to $18M from $672M in Q4 2010

5

Credit

TARP

•

TARP repayment

EVERTEC IPO and NPA sale continued to improve the company’s

position for shareholder-friendly exit from TARP, which remains

subject to regulatory approval |

Financial Summary

(unaudited) 6

¹

Includes $8.8 million of negative valuation adjustments on loans held for sale, which were

transferred to held-in-portfolio subsequent to the sale ²Includes tax

benefit related to EVERTEC minority ownership of $31.6 million ¹

²

$ in thousands (except per share data)

US GAAP

Non GAAP

In thousands, except per share amount

Actual

NPA Sale

Adjusted

Q4 2012

Adjusted

Variance

Net interest income

$345,347

$345,347

$350,411

($5,064)

Service fees & other oper. income

109,018

109,018

150,249

(41,231)

Gain on sale of investments, loans & trading profits

(65,177)

(72,087)

6,910

19,576

(12,666)

FDIC loss-share expense

(26,266)

(26,266)

(36,824)

10,558

Gross revenues

362,922

(72,087)

435,009

483,412

(48,403)

Provision for loan losses (excluding covered loans)

206,300

(148,823)

57,477

86,256

(28,779)

Provision for loan losses

(covered WB loans)

17,556

17,556

(3,445)

21,001

Total provision

223,856

(148,823)

75,033

82,811

(7,778)

Net revenues

139,066

(220,910)

359,976

400,601

(40,625)

Personnel costs

115,989

115,989

116,325

(336)

Other operating expenses

200,261

37,051

163,210

180,422

(17,212)

Total operating expenses

316,250

37,051

279,199

296,747

(17,548)

Income before tax

(177,184)

(257,961)

80,777

103,854

(23,077)

Income tax (benefit) expense

(56,877)

(77,388)

20,511

19,914

597

Net (loss) income

($120,307)

($180,573)

$60,266

$83,940

($23,674)

EPS

($1.18)

$0.81

NIM

4.39%

4.41%

Tangible book value per share (quarter end)

$31.21

$32.55

Market price (quarter end)

$27.60

$20.79

Q1 2013 |

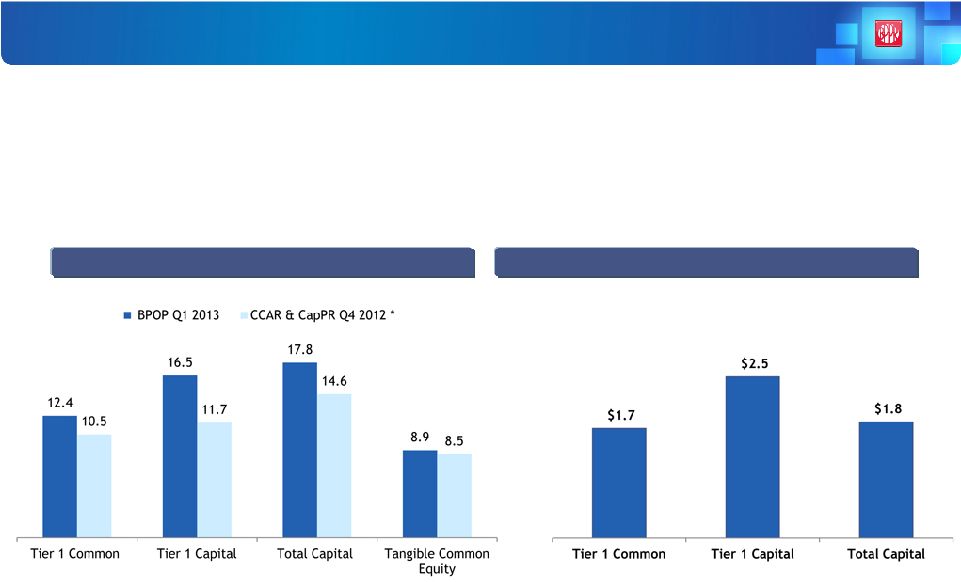

Capital

Remains Strong Post-NPA Sale 7

Current Risk Weighted Assets are approximately $23.6 billion

Capital Ratios %

Excess Capital ($ in billions)

**Excess

capital

over

“well

capitalized”

Basel

I

threshold

*Averages

for

30

bank

holding

Companies

with

$50

billion

or

more

of

total

consolidated assets, consisting of 19 firms included in Comprehensive Capital Analysis

and Review (CCAR) and 11 firms included in Capital Plan Review (CapPR).

•

Tier 1 Common Equity capital ratio of 12.4% in Q1 exceeds current

well-capitalized guideline by $1.7B

**

** |

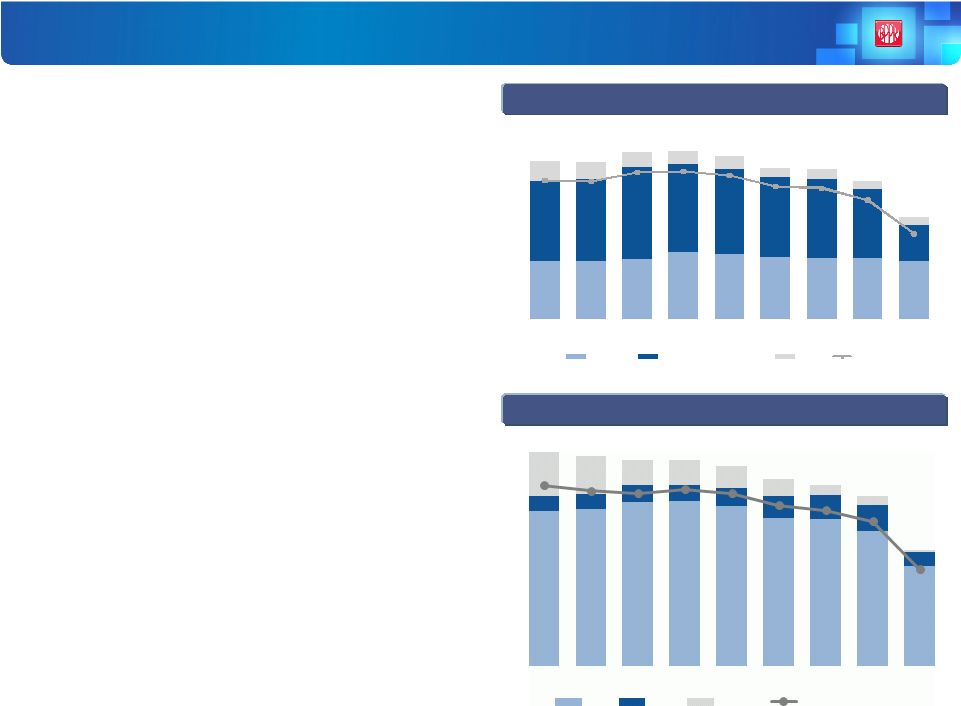

Asset Sale

Strengthens Credit Quality •

Non-performing loans held-in-portfolio are down by

$375M or 26% QoQ and $631M or 38% YoY

•

NPL to Loans at 4.86% in Q1 13 vs. 6.79% in Q4 12,

and 8.21% in Q1 12

•

Remaining NPLs are mostly in PR mortgages and to

lesser extent in US commercial loans

•

Non-performing assets declined by $565M or 32%

QoQ and $885M or 42% YoY

•

Decline of $112M in OREO to $155M was mainly

driven by bulk sale, which included $58M and $50M

in commercial and mortgage OREO, respectively

Non-Performing Loans HIP ($M)

Non-Performing Assets ($M)

7.9%

7.9%

8.4%

8.4%

8.2%

7.6%

7.5%

6.8%

4.9%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Mortgage

Commercial & Construction

Other

NPL/Loans (HIP)

$1,637

$1,682

$1,563

$1,550

$1,425

$1,738

$1,732

$1,625

$1,051

Metrics exclude covered loans

8

$2,257

$2,214

$2,168

$2,173

$2,108

$1,968

$1,911

$1,788

$1,223

7.1%

6.9%

6.8%

7.0%

6.8%

6.4%

6.2%

5.7%

3.8%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

NPLs

OREO

NPL HFS

NPAs/Total Assets |

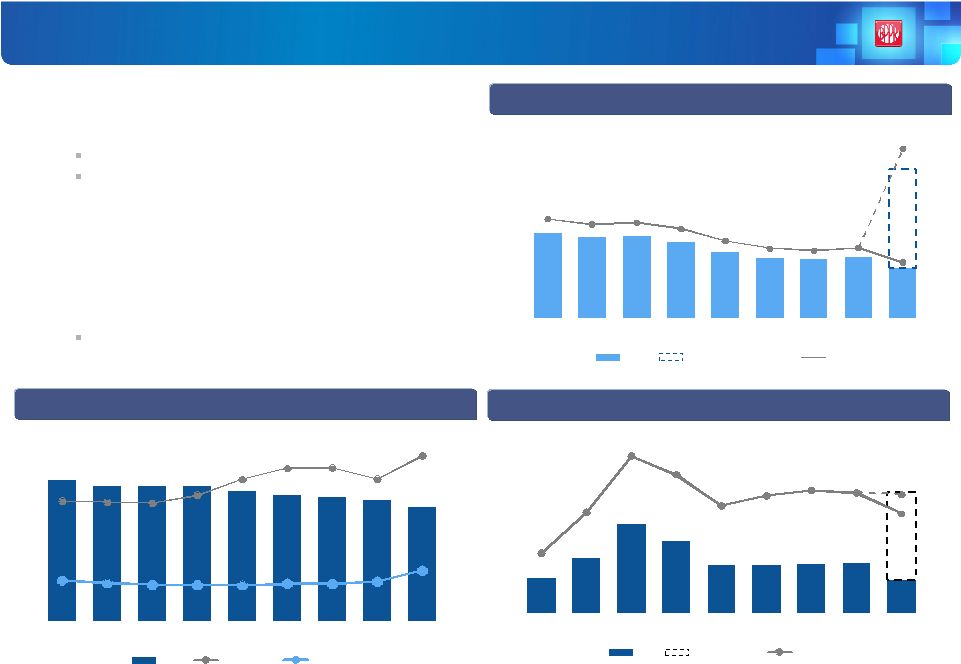

Total NPL

Inflows ($M) NPL Inflows at 3-Year Lows

•

Total NPL inflows decreased by $60 million QoQ,

driven by mortgage NPL inflows, and are at the

lowest level in three years

•

Commercial, construction and legacy NPL inflows

remained stable at lowest levels of credit cycle in

both PR and US

Mortgage NPL Inflows ($M)

Commercial, Construction & Legacy NPL Inflows ($M)

9

Excludes consumer loans

$67

$92

$87

$84

$55

$51

$52

$34

$26

$271

$273

$397

$333

$279

$231

$257

$210

$158

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

US Inflows

PR Inflows

-46%

($154M)

$9

$13

$10

$8

$6

$6

$10

$8

$5

$140

$154

$175

$232

$187

$166

$157

$167

$110

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

US Inflows

PR Inflows

$58

$79

$77

$76

$48

$45

$42

$26

$21

$131

$119

$222

$101

$93

$65

$100

$43

$48

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

US Inflows

PR Inflows

Metrics exclude covered loans |

Continuous

Improvement in Asset Quality •

NCOs include $163.1M related to NPA bulk sale

Excluding impact of the sale:

Decline of $20M vs. Q4 2012

NCO ratio under 2% for fourth consecutive quarter,

reaching 2008 levels

•

ALLL decreased 26 bps to 2.70% of loans, reflecting

improved credit performance

NPL reduction drove increase of ALLL/NPL to 56%

ALLL ($M), ALLL-to-NCO and ALLL-to-NPL Ratios

NCO ($M) and NCO-to-HIP Loan Ratio

Provision ($M) and Provision-to-NCO Ratio

10

Metrics exclude covered loans

$727

$690

$693

$690

$665

$649

$636

$622

$584

130%

129%

128%

137%

154%

165%

166%

154%

179%

44%

42%

40%

40%

40%

41%

41%

44%

56%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

ALLL

ALLL/NCO

ALLL/NPL

$60

$96

$151

$124

$83

$82

$84

$86

$58

$149

43%

72%

111%

98%

76%

83%

87%

86%

84%

71%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

PLL

NPL Sale PLL

PLL/NCO

$139

$133

$135

$126

$108

$98

$96

$101

$81

$163

2.74%

2.59%

2.64%

2.46%

2.13%

1.93%

1.87%

1.94%

4.66%

1.55%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

NCO

NPL Sale Charge-offs

NCO%

•

Provision increased to $206M; includes $149M related to the

effect of the sale

•

Provision to NCOs in BPPR of 91% |

Driving

Shareholder Value 11

Unique franchise in PR provides strong, stable revenue-generating capacity

Credit metrics continue to improve

NPA sale substantially accelerated de-risking

Strong capital position with excess Tier 1 Common Equity of $1.7B

After-tax gain of EVERTEC IPO will increase CET1 in Q2

Continue to build optionality for US operations and determine best path to

value creation

Actions drive us closer to TARP exit in the most shareholder-friendly fashion

|

Appendix

Appendix |

Who We Are

– Popular, Inc.

Franchise

•

Financial services company

•

Headquartered in San Juan, Puerto Rico

•

$37 billion in assets (top 50 bank holding company in

the U.S.)

•

$22 billion in total loans

1

•

$27 billion in total deposits

•

276 branches serving customers in Puerto Rico,

New York, California, Florida, Illinois, U.S. Virgin

Islands, and New Jersey

•

NASDAQ ticker symbol: BPOP

•

Market Cap: $2.8 billion

2

1

Excludes covered portfolio

²

As of March 31, 2013

*Doing business as Popular Community Bank.

Summary Corporate Structure

Assets = $36.9bn

Popular Auto,

Inc.

Banco Popular

de Puerto Rico

Popular

Securities, Inc.

Assets = $27.9 bn

Assets = $8.7bn

Banco Popular

North America*

Puerto Rico operations

Selected

equity

investments

(first

two

under

“corporate”

segment

and

third

under

PR):

Popular

Insurance, Inc.

Popular North

America, Inc.

U.S. banking operations

Transaction processing,

business processes outsourcing

33.5% stake

Adjusted EBITDA of $169.6

million for 2012

Dominican

Republic bank

19.99% stake

2012 approximate

income $114

million

PRLP 2011 Holdings

Construction and

commercial loans vehicle

24.9% stake

PR Asset Portfolio 2013-1

International, LLC

Construction, commercial

loans and OREOs vehicle

24.9% stake

13 |

14

Consolidated

Credit

Summary

(Excluding

Covered

Loans)

$ in millions

Q1 13

Q4 12

Q1 12

Loans Held in Portfolio (HIP)

$21,634

$20,984

$650

3.1%

$20,479

$1,155

5.7%

Performing HFS

183

258

(75)

(29.1%)

129

54

41.9%

NPL HFS

18

96

(78)

-81.3%

232

(214)

-92.3%

Total Non Covered Loans

21,835

21,338

$497

2.3%

20,840

$995

4.8%

Non-performing loans (NPLs)

$1,051

$1,425

($375)

-26.3%

$1,682

($632)

-37.5%

Commercial

$321

$665

($345)

-51.8%

$819

($498)

-60.8%

Construction

$51

$43

$8

17.5%

$69

($19)

-26.7%

Legacy

$36

$41

($5)

-12.1%

$79

($43)

-54.7%

Mortgage

$601

$630

($29)

-4.7%

$667

($66)

-10.0%

Consumer

$42

$46

($3)

-7.2%

$47

($5)

-10.6%

NPLs HIP to loans HIP

4.86%

6.79%

-1.9%

-28.5%

8.21%

-3.35%

-40.9%

Net charge-offs (NCOs)

$81

$101

($20)

-19.7%

$108

($27)

-25.1%

Commercial

$32

$49

($16)

-33.3%

$54

($22)

-40.4%

Construction

$0

($2)

$2

NM

($0)

$0

NM

Legacy

$2

$3

($1)

-44.0%

$4

($2)

-47.0%

Mortgage

$20

$20

($1)

-3.8%

$17

$2

12.1%

Consumer

$27

$31

($4)

-12.5%

$33

($6)

-17.6%

Write-downs bulk sale

$163

$0

$163

NM

$0

$163

NM

NCOs to average loans HIP

1.55%

1.94%

-0.4%

-20.1%

2.13%

-0.6%

-27.2%

Provision for loan losses (PLL)

1.10%

1

$86

($29)

(33.72%)

$83

($26)

(31.3%)

PLL to average loans HIP

1.66%

(0.6%)

(33.73%)

1.62%

(0.5%)

(30.9%)

PLL to NCOs

0.71x

1

0.86x

(0.15x)

(17.4%)

0.76x

(0.05x)

(6.58%)

Allowance for loan losses (ALL)

$584

$622

($37)

-6.1%

$665

($81)

-12.2%

ALL to loans

HIP

2.70%

2.96%

-0.3%

-8.9%

3.25%

-0.6%

-17.0%

ALL to NPLs HIP

55.54%

43.62%

11.9%

27.3%

39.53%

16.0%

40.5%

Q1 13 vs Q4 12

Q1 13 vs Q1 12

1

Excluding provision for loan losses and net write-downs related to the asset sale.

$57

1 |

PR &

US Business 15

1

Excludes covered loans

$ in millions (unaudited)

Q1 13

Q4 12

Variance

Q1 13

Q4 12

Variance

Net Interest Income

$305

$309

($4)

$68

$68

$0

Non Interest Income

16

90

(74)

10

15

(5)

Gross Revenues

321

399

(78)

78

83

(5)

Provision (non-covered)

204

78

126

2

8

(6)

Provision (covered WB)

18

(3)

21

-

-

-

Provision for loan losses

222

75

147

2

8

(6)

Expenses

261

240

21

58

57

1

Tax (Benefit) Expense

(53)

19

(72)

1

1

0

Net (Loss) Income

($109)

65

($174)

$17

$17

$0

NPLs (HIP) ¹

$838

$1,192

($354)

$213

$233

($20)

NPLs (HIP + HFS) ¹

854

1,286

(432)

214

235

(21)

Loan loss reserve ¹

424

445

(21)

159

176

(17)

Assets

$27,863

$27,600

$263

$8,727

$8,652

$75

Loans (HIP)

19,278

18,959

319

5,688

5,751

(63)

Loans (HIP + HFS)

19,476

19,309

167

5,692

5,755

(63)

Deposits

20,946

20,989

(43)

6,121

6,076

45

NIM

5.18%

5.18%

0.00%

3.48%

3.51%

-0.03%

PR

US |

16

Recent PR Government Actions

•

Comprehensive Government Pension Plan Reform was enacted in April 2013. Main elements include:

Retirement age increased for some groups of employees

Employee contribution to the system will be increased to 10% from 8.275%

Active

public

employees

will

be

granted

future

benefits

based

on

a

defined

contribution

plan

which

will

be paid through a lifetime annuity

Reduction in Christmas bonus and elimination of summer bonus

•

Act 154 excise tax has been increased and fixed at 4%; also extended for five years

(approx. $600 million in additional annual revenues)

•

Completed Luis Muñoz Marín International Airport lease agreement with Aerostar

Holdings Upfront payment of $615 million and $240 million in capital improvement

commitments over the next 5 years

•

Puerto Rico Aqueduct and Sewer Authority (“PRASA”) announced a 67% rate increase

that will provide additional revenues to cover operational expenses

•

Promotion

of

Act

20-2012

-

Export

Services

&

Act

22-2012

-

Individual

Residents

Investors

Source: Government Development Bank of PR bgfpr.com, PR Finance

Housing Authority, PR Commissioner of Financial Institutions

|

Popular, Inc.

Credit Ratings •

Our senior unsecured ratings have been gradually improving since

2010:

Fitch:

BB-

Stable Outlook (Revised January 2013)

Moody’s:

B1

Stable Outlook (Revised December 2012)

S&P:

B+

Stable Outlook (No Change)

January 2013: Fitch raised to BB-

from B+; outlook revised to stable

December 2012: Moody’s downgraded BPOP by two notches to B1; stable outlook

assigned

April 2012: Moody’s placing most of the PR banks under review with the possibility

of downgrades, due to the state of the Puerto Rico economy

January 2012: Fitch raised BPOP’s outlook to positive

December

2011:

S&P

raised

its

ratings

on

BPPR

to

BB

from

BB-

and

changed

outlook to stable given revised bank criteria to regional banks

July 2011: S&P raised our senior unsecured rating by one notch to B+

As the P.R. economy stabilizes and our credit metrics improve, we should see

upward pressure on the ratings

17 |

Financial

Results Financial Results

First Quarter 2013

First Quarter 2013 |