Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Xhibit Corp. | Financial_Report.xls |

| EX-14.1 - Xhibit Corp. | ex14-1.htm |

| EX-23.1 - Xhibit Corp. | ex23-1.htm |

| EX-32.2 - Xhibit Corp. | ex32-2.htm |

| EX-32.1 - Xhibit Corp. | ex32-1.htm |

| EX-31.1 - Xhibit Corp. | ex31-1.htm |

| EX-14.2 - Xhibit Corp. | ex14-2.htm |

| EX-31.2 - Xhibit Corp. | ex31-2.htm |

| EX-10.15 - Xhibit Corp. | ex10-15.htm |

| EX-10.17 - Xhibit Corp. | ex10-17.htm |

| EX-10.18 - Xhibit Corp. | ex10-18.htm |

| EX-10.14 - Xhibit Corp. | ex10-14.htm |

| EX-10.19 - Xhibit Corp. | ex10-19.htm |

| EX-10.20 - Xhibit Corp. | ex10-20.htm |

| EX-10.16 - Xhibit Corp. | ex10-16.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-52678

Registrant, State of Incorporation, Address and Telephone Number

XHIBIT CORP.

(a Nevada corporation)

80 E. Rio Salado Parkway, Suite 115

Tempe, AZ 85281

(602) 281-3554

I.R.S. Employer Identification Number: 20-0853320

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of Registrant’s Common Stock held by non-affiliates was $49,649,512 based on a $3.65 average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter (June 29, 2012).

As of March 25, 2013, there were 67,439,298 shares of the Registrant's $0.0001 par value Common Stock outstanding.

Xhibit Corp.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2012

TABLE OF CONTENTS

|

Page

|

||||

|

PART I

|

||||

|

Item 1.

|

Business

|

1

|

||

|

Item 1A.

|

Risk Factors

|

21

|

||

|

Item 1B.

|

Unresolved Staff Comments

|

49

|

||

|

Item 2.

|

Properties

|

49

|

||

|

Item 3.

|

Legal Proceedings

|

49

|

||

|

Item 4.

|

Mine Safety Disclosures

|

49

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

49

|

||

|

Item 6.

|

Selected Financial Data

|

51

|

||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

51

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

57

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

57

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

57

|

||

|

Item 9A.

|

Controls and Procedures

|

57

|

||

|

Item 9B.

|

Other Information

|

59

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

59

|

||

|

Item 11.

|

Executive Compensation

|

62

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

64

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

64

|

||

|

Item 14.

|

Principal Accountant Fees and Services

|

65

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

67

|

||

|

Signatures

|

66

|

Item 1. Business

References in this annual report to “the Company,” “we,” “us,” and “our,” refer to Xhibit Corp., unless the context indicates otherwise. Information on our websites listed in this Report is not a part of this Report.

Cautionary Statement Regarding Forward-Looking Information

Forward-Looking Statements

Disclosures included in this Form 10-K contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “anticipate,” “plan,” “believe,” “seek,” “estimate,” “expect,” “could,” and words of similar meanings and include, without limitation, statements about the expected future business and financial performance of Xhibit Corp. such as financial projections, any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks, and changes in circumstances that are difficult to predict. Investors and others should consider the cautionary statements and risk factors discussed in Item 1A below. Actual outcomes and results may differ materially from these expectations and assumptions because of changes in political, economic, business, competitive, market, regulatory, and other factors. Xhibit Corp. undertakes no obligation to update publicly or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

BACKGROUND AND HISTORY

Xhibit Interactive, LLC (“LLC” or "Interactive") was organized on July 18, 2011 as a Nevada limited liability company. On August 9, 2011, LLC entered into a Unit Exchange Agreement whereby the members of SpyFire Interactive, LLC doing business as Lead Revolution (“Lead Revolution”) and Stacked Digital, LLC (“Stacked”) exchanged 100% of their membership units for 18,292,319 of LLC’s Units. Concurrent with this transaction, Lead Revolution and Stacked became wholly-owned subsidiaries of LLC. LLC, through its subsidiaries, is an online marketing and advertising company providing targeted and measurable online advertising campaigns and programs for a broad base of advertisers and advertising agency customers. LLC enables marketers to advertise and sell their products and services through major online marketing channels including display advertising and affiliate marketing networks.

On January 20, 2012, LLC formed a subsidiary domiciled in Bosnia called Bosnia Xhibit d.o.o. (“Bosnian Sub”). The Bosnian Sub had no operations or activities until July 2012 when it hired five software programmers and developers from ABC Internet Media, a company formed and controlled by Dzenis Softic, LLC's Chief Technology Officer, who was serving as a consultant at the time. LLC believes the Bosnian sub provides it with the best opportunity for a more economical solution to have an “in-house” product development team.

On May 24, 2012, LLC acquired Social Bounce LLC ("Bounce"), a social media and online game development company founded on August 2, 2011 and majority owned by our CEO, as its third operating subsidiary. Bounce was acquired to obtain domain names and social media/online gaming properties to consolidate with the operations of the other subsidiaries of LLC. Bounce had nominal assets and no operations prior to May 24, 2012. On August 30, 2012, Bounce was merged into LLC and Bounce ceased to exist.

On June 4, 2012, Xhibit Corp., f/k/a NB Manufacturing, Inc., a Nevada corporation ("Xhibit", “Company” or the "Registrant"), NB Manufacturing Subsidiary, LLC, a Nevada limited liability company (the "Merger Sub"), and LLC consummated a merger (the “Merger”) whereby LLC became a wholly owned subsidiary of Xhibit.

Registrant was incorporated on September 19, 2001 in the State of Nevada pursuant to a U.S. Bankruptcy Court Chapter 11 Reorganization Plan for New Bridge Products, Inc., confirmed on June 17, 2002 (CASE NO. 00-13546-ECF-RIN). It had been a shell corporation since inception until the Merger. Immediately prior to the completion of the Merger, the Registrant did not conduct any business operations and had minimal assets and liabilities.

Pursuant to the Merger, the Registrant issued 55,383,452 shares of its common stock to holders of Units of LLC at a rate of 1.2641737582 shares of the Registrant's common stock for each LLC Unit. Immediately following the Merger, the Registrant had 66,583,676 shares of common stock outstanding and no warrants or options outstanding. The former members of LLC owned 83.2% of the Registrant's outstanding securities, and the Registrant's shareholders owned 16.8% of the Registrant's outstanding securities.

On June 29, 2012, Xhibit formed a new subsidiary, FlyReply Corp. (“FlyReply”) which began development of a product which provides turn-key cloud based marketing CRM solutions on a subscription basis to customers.

On September 24, 2012, Xhibit acquired various intellectual property assets owned by several individuals and private companies giving it the right to the source code, software, database, websites and domain names previously owned or operated by Radio Connect, LLC, Twit Yap, LLC and Star Connect, LLC which the Company now refers to as its Twit Yap social media properties. The Company obtained these assets for a total issuance of approximately 700,000 shares of common stock.

OVERVIEW OF THE COMPANY

Explanatory Note

Unless otherwise indicated or the context otherwise requires, all references below in this report on Form 10-K to "we," "us" and the "Company" are to Xhibit Corp., a Nevada corporation, and its subsidiaries, FlyReply Corp., a Nevada corporation, and Xhibit Interactive, LLC, a Nevada limited liability company, and Xhibit Interactive's subsidiaries SpyFire Interactive, LLC, Stacked Digital, LLC and Xhibit Bosnia d.o.o.

Regardless of the medium used, a successful advertisement requires both placement in a widely viewed “location” (e.g. a Superbowl ad) and with an attractive “pitch” so viewers remember the product (e.g. the Energizer Bunny for batteries or the GEICO lizard for insurance). Most online marketing and advertising companies seek to convince their customers that they have the best “location” to reach their intended audiences. For example, Facebook touts its extensive number of users and encourages advertisers to access its platform to reach this audience. Its strategy is to provide an attractive location for online advertising but it generally does not get involved in assisting with the customization or targeting of the advertising message itself.

Other than targeting the best “location”, there are a wide array of companies devoted to designing and improving websites to attract online customers; preparing advertising slogans and developing “buzz words” to attract the online surfer to those websites designed to sell products or services; providing consulting to get a customer’s name higher on the list provided by Google of similar product or service providers; developing internet marketing campaigns which may include cutting edge graphics and video and; offering brief single paragraph postings of products or services.

The numerous companies focused on assisting with the content of the advertising as opposed to the location of that message or content generally focus on their particular market niche instead of providing an integrated strategy combining quality website development with a well-targeted cutting edge ad campaign. These disparate market solutions force the consumer to “quarterback” the numerous online marketing service providers; making it more difficult to develop a cohesive unified approach to online advertising.

Xhibit has located and integrated a “one stop shop” service approach by positioning a talented group of employees which it believes are capable of releasing a broad spectrum of software, creativity, and customized media to capitalize on the growing digital advertising market in ways management believes no other company has done. Management believes that Xhibit is well positioned for the market shift from offline advertising to digital advertising and the benefits of streamlined cloud based solutions as it has the expertise and experience in digital advertising and a strong base of clients committed to this form of advertising. (Xhibit uses the term “cloud based” to refer to web and app based access to server side software delivered over a network of servers and platforms, where users are not required to install Xhibit’s software on their computer, phone, tablet or laptop to access the software).

Xhibit is a cloud based technology development company with its primary historical focus on digital advertising, and a recently expanded focus on online and mobile social media, games and CRM (customer relationship management) solutions. Xhibit and its Lead Revolution (now AdBind) brand provide the synergies required for a full service ad agency with interactive design and development, digital advertising and marketing solutions across various channels of search engine, social media, display, email, and mobile markets. Xhibit refers to this model as the Three D’s - Design, Development, and Distribution. Both through the advertising of Lead Revolution (now AdBind) and its publisher network, this operation has generated tens of millions of impressions (where someone views an ad), over one million unique clicks (where someone clicks on an ad), over fifty thousand leads (where someone provides contact information in response to an ad) and up to thirty five hundred sales per month, creating significant value for its customers who benefit from the advertising through improved notoriety and sales. With over 15 years of digital media experience provided by its founders, Xhibit's divisions understand the needs of their advertisers and both the integrated software and creative solutions that is required of a full service digital ad agency. From branding products and campaigns from start to finish, app development, and website engineering, to generating impressions, clicks, or actual leads and sales for their customers, Xhibit provides a single source for all its advertisers' needs. These internal advertiser and ad agency relationships offer a potential additional source of revenue for Xhibit's social media and games currently under development. Xhibit will not need to outsource ad agency solutions when it has developed its proprietary social media and online games, as Xhibit through AdBind already has proven advertising and marketing experience and relationships with top tier brands, such as Capitol Records, The Beach Boys, Spirit Airlines, Chrome Data Solutions, and Ernst Benz, and provides services to other ad networks and agencies such as XL Marketing, which conduct promotional advertising for many other leading brands. Management believes the combination of an ad agency (developing the ad campaign), advertising solutions, and a software development company (tracking the results of the advertising developed) creates a synergistic and unique platform to launch Xhibit's own intellectual property under development.

Xhibit currently has approximately 60 customers that it regularly provides services to and approximately 80 customers that it periodically services. Approximately 90% of its revenue is generated by ad distribution campaigns, and 10% from interactive development and other services. Revenue from ad campaigns and customized ads is contingent on performance. Interactive development is paid on an hourly or per project contract basis as a service. No revenue is currently being generated by either social media or online gaming products as these are currently under development. In 2012, the Company had one customer, XL Marketing, that accounted for approximately 35% of its revenue. The majority of the Company’s revenues in 2012 came from other advertising agencies or small private companies who wished to develop a digital advertising presence but services are also provided to advertisers including branding, creative strategy development, website design, advertising and marketing consultation, and advertising campaign management. Currently, the majority of revenue is coming from the advertising and sale of three nutraceutical products: weight loss; colon cleansing and green coffee supplement.

Xhibit customers are primarily businesses, brand advertisers and the advertising agencies that service these groups. Xhibit conducts performance-based advertising campaigns and programs where advertisers pay only for advertising that generates a customer lead or product sale. We target campaigns to reach the online consumers most likely to make purchases or request further information. The emphasis is on trending consumer products or services to maximize margins and rate of success.

We generate the audiences for our advertisers' campaigns through internal publishing resources and our member base of publishers, a term that refers to individuals, businesses or large corporations that serve ads to an audience through a variety of means. A publisher can serve ads through a website the publisher owns or a website from whom it purchases ad space. A publisher can also be an individual who purchases ads from a company that owns a mobile app, or a company that has a newsletter it sends out to clients displaying or promoting advertisements.

Xhibit provides access to participate in large-scale advertiser and advertising agency campaigns that many publishers may not have access to on their own, enhanced advertising results through campaign optimization, branding, licensed targeting and detailed analytics. Xhibit often utilizes its ad agency and interactive development expertise to fine tune or enhance ad campaigns to optimize results and seek to generate the maximum return on advertisers' investment.

Industry

Marketing has evolved significantly in recent years, driven by changes in media consumption, real-time engagement through social media and pervasive mobile connectivity through tablets and smart phones. For marketers today, delivering relevant, meaningful and timely communications is more challenging than ever, as consumers are interacting with brands offline and online through interactive channels such as email, mobile, Twitter, Facebook and websites. This new era of the hyper-connected and empowered consumer requires organizations to develop a cross-channel view of their customers to drive real-time, relevant engagement and positive return on marketing investment.

The online advertising industry is highly fragmented. Advertisers, ad networks, e-mail service providers, data tracking companies, search engine marketing (SEM) firms, media placement agencies, and publishers all provide a different and often conflicting service. Disconnect among participants creates significant inefficiency along the supply chain. This presents an opportunity for a full-service digital ad agency to deliver a streamlined, integrated suite of interactive advertising and promotional services to a wide range of advertisers and publishers.

Market Opportunity for Interactive Marketing

Consumers increasingly use email, mobile, social media and websites to access information and interact with brands. Media consumption is shifting from offline channels to interactive channels, as evidenced by Forrester's finding that in 2010, 33% of weekly media consumption among U.S. adults occurred through the Internet (Source: Forrester, U.S. Interactive Marketing Forecast , 2011 to 2016, August 24, 2011, as updated September 7, 2011). This is driving marketers to increase the percentage of advertising spending on interactive marketing. According to Forrester's U.S. Interactive Marketing Forecast, 2011 To 2016 , U.S. marketers plan to increase spending on interactive channels (defined as display, search, email, mobile and social media) as a percentage of total advertising spending from 16% in 2011 to 26% in 2016, creating a projected $77 billion market in the United States by 2016, of which email, mobile and social media marketing is expected to grow from approximately $4.8 billion in 2011 to nearly $15.7 billion by 2016, representing a compound annual growth rate of 27%. In addition to this large U.S. market opportunity, management believes the addressable market outside the United States presents an even greater opportunity based on comparisons of population, Internet usage, mobile adoption and e-commerce spending. Key opportunities by channel include:

|

·

|

Email. Email remains the primary channel for interactive marketers given its compelling return on investment and ubiquity of use. According to a 2011 Direct Marketing Association report, email marketing returned an estimated $40.56 for every dollar spent on it in 2011, the highest return on investment among all marketing channels (Source: Direct Marketing Association, The Power of Direct Marketing , 2011-2012 Edition, October 2011). Forrester projects the overall market for U.S. email marketing will grow from $1.5 billion in 2011 to $2.5 billion in 2016, representing a compound annual growth rate of 10% (Source: Forrester, U.S. Interactive Marketing Forecast , 2011 to 2016, August 24, 2011, as updated September 7, 2011).

|

|

·

|

Mobile. Mobile marketing provides compelling benefits, such as location-based data as well as a channel for real-time engagement with customers. Given the mobile channel's ability to generate immediate response, it can be an effective way to acquire new customers and obtain permission for communication through other marketing channels. According to Forrester, U.S. mobile marketing spending is expected to grow from $1.7 billion in 2011 to $8.2 billion in 2016, representing a compound annual growth rate of 38% (Source: Forrester, U.S. Interactive Marketing Forecast , 2011 to 2016, August 24, 2011, as updated September 7, 2011).

|

|

·

|

Social. The rapid emergence of social media has fundamentally changed the way consumers interact with each other and with brands. Facebook has announced it has over 800 million active users, and Twitter has announced it has over 175 million members. These leading social media networks enable marketers to interact and engage in real time with consumers. According to Forrester, U.S. social media marketing spending is expected to grow from $1.6 billion in 2011 to $5.0 billion in 2016, representing a compound annual growth rate of 26% (Source: Forrester, U.S. Interactive Marketing Forecast , 2011 to 2016, August 24, 2011, as updated September 7, 2011). According to a Nielson repost in August 2010, the time spent playing online games in the United States surpassed the time spent on email.

|

|

·

|

Sites. Email, mobile and social media drive website traffic, which is a critical component of interactive marketing campaigns as it not only enables marketers to obtain permission for further communications, but also provides the means by which conversion occurs to generate sales. Websites provide marketers with tools such as web forms to collect customer information and online conversion tracking to create customer data-driven targeting rules to personalize landing pages and microsites.

|

|

·

|

Emergence of the App Economy. In order to provide users with a wider range of engaging experiences, social networks and mobile operating systems have opened their platforms to developers, transforming the creation, distribution and consumption of digital content. We refer to this as the "App Economy." In the App Economy, developers can create applications accessing unique features of the platforms, distribute applications digitally to a broad audience and regularly update existing applications. Social networking sites and mobile application stores have become mass market consumer destinations where content is easy to find, immediately accessible and always available. Growth in the number and quality of applications has driven further increases in social network and mobile usage.

|

|

·

|

Social graph and viral distribution. At the core of social networks is the social graph, a digital mapping of a social network user's real-world connections that can be used to promote social interaction and sharing among the users. By leveraging the social graph, high quality social applications that deliver compelling value for social network users and have mass appeal can achieve significant levels of adoption rapidly via viral growth.

|

|

·

|

Proliferation of mobile. There is significant demand for applications on mobile platforms such as Apple iOS and Google Android. As smart phones, tablets and other increasingly powerful connected devices have proliferated worldwide, application developers have leveraged the much greater distribution opportunity and emerging social connectivity of mobile devices. Games are the most popular category of applications on smartphones, representing approximately half of the time spent on smartphone applications in the United States, according to a May 2011 report by Flurry Analytics, a market data and analytics firm.

|

|

·

|

Rapid Growth of Free-to-Play Games. Most social games are free to play and generate revenue through the in-game sale of virtual goods. According to In-Stat, a market intelligence firm, the worldwide market for the sale of virtual goods was $7.3 billion in 2010 and is expected to more than double by 2014. Compared to pay-to-play business models, the free-to-play approach tends to attract a wider audience of players, thereby increasing the number of players who have the potential to become paying users. By attracting a larger audience, the free-to-play model also enables a higher degree of in-game social interaction, which enhances the game experience for all players.

|

Market Challenges

Most organizations understand that effective email marketing and cross-channel, interactive marketing can drive customer engagement, increase sales and improve return on marketing investment. However, organizations often lack the technology, infrastructure and expertise needed to plan, automate, deliver and optimize data-driven interactive marketing campaigns and real-time communications across interactive channels. Marketers considering the adoption or expansion of email and cross-channel, interactive marketing programs face many challenges, including the following:

|

·

|

Difficulty in Integrating Data to Create a Single, Unified View of Each Consumer. With the proliferation of consumer data generated by social media, web analytics and e-commerce, it is difficult for organizations to integrate these disparate data sources to create a single, unified view that reflects a collective knowledge of each consumer, including previous interactions and preferences, in order to effectively target and deliver personalized and relevant communications.

|

|

·

|

Complexity in Effectively Engaging Consumers Across Multiple Channels. Engaging consumers has become increasingly difficult in today's media-saturated environment, requiring marketers to provide increasingly personalized and relevant communications. Organizations require data management and interaction technologies that enable them to leverage cross-channel insights to drive relevant communications. Non-relevant content and poorly timed communications may result in interactions that fail to produce positive return on investment, tarnish brand image or alienate consumers.

|

|

·

|

Inability of Disparate Point Solutions to Address Marketers' Emerging Needs. Many solutions are designed to only address specific marketing channels or use cases. These siloed point solutions create significant cost inefficiencies and limitations in integrating data in a timely manner among solutions and interactive marketing channels. These solutions often lack the flexibility, cross-channel functionality and scalability to meet marketers' evolving needs as their programs grow in scale and sophistication. This problem is exacerbated as organizations increase the number of channels they use to communicate and interact with consumers.

|

|

·

|

Complex Security and Infrastructure Requirements. Given the critical nature of interactive communications such as fraud alerts, e-statements and time-sensitive offers, organizations require 24/7 application availability, high-volume transaction processing, sophisticated security controls and a significant amount of data storage. To meet these requirements internally, organizations must make significant investments in technical expertise, complex infrastructure, advanced security measures and data storage.

|

|

·

|

Changing Deliverability and Regulatory Standards. To ensure marketing communications reach their intended recipients, marketers must understand and adhere to the complex and constantly-evolving permission and delivery standards of leading ISPs and telecommunication providers. In addition, organizations must maintain compliance with state, federal and international laws governing the delivery of mobile and email messages, including the U.S. CAN-SPAM Act and foreign governments' privacy and permission laws and regulations.

|

Business Strategy

Xhibit seeks to become the first digital advertising and online social media/game development company to effectively combine social media, online and mobile games, and cloud based CRM solutions in a seamless package which more effectively combines advertising with these modern mediums of communication and entertainment. The Company believes that it can achieve this by providing a more captivating user experience with less intrusive ads than the competition and more effectively capturing additional revenue capabilities in the digital delivery process. Management believes that other social networks currently lose a significant amount of revenue from brokered advertising that is purchased by other ad agencies simply because many social networks lack the ad agency experience and have chosen not to develop this business model. Many social networks provide limited support to even their high-end clients.

Instead of merely providing an agnostic conduit for an advertisement developed by a client which may not produce its intended results, Xhibit provides the expertise to design or re-design a client’s advertisements or to develop an advertising campaign which is targeted at and appeals to the intended audience.

Many companies are concerned about the actual value of social media and mobile advertising. Management believes that combining social media and online games with result-driven advertising reduces that concern for advertisers. The Company also believes that integrating social media with performance-based advertising can help change the paradigm from how much a company wants to spend on advertising to how much they want to earn with a measurable return on investment. Management also believes that this change will help remove the current concerns many have with social media and its role in the marketplace.

Xhibit's business model is to create multiple solutions for advertisers to connect to their consumers through various pathways by (a) cost effectively building quality member and customer bases through Xhibit’s captivating websites, social networks, games and apps, and giving businesses the ability to target and reach a higher quality and more receptive customer; and (b) providing companies a better and more robust ability to connect with their existing customer base through innovative cloud based solutions, such as FlyReply.com. Management believes Xhibit will connect businesses with the ability to serve ads to these multiple member bases, while at the same time providing scalable and attractive business to business solutions, advertising, ad agency and marketing capabilities to its business customers. The Company believes it will serve as a one-stop-shop, connecting advertisers to millions of prospective users and members. Management believes Xhibit's business model is more efficient than those of traditional online ad agencies, social networks or game developers, which rely on numerous outside partners to provide services for which they get no additional revenues. Xhibit believes it can leverage its synergistic business model to reduce costs and deliver quality products to market quickly. Furthermore, management believes Xhibit's ability to immediately monetize any of its internal social networks, apps and games under development with its digital ad agency and advertiser relationships provides the Company with a distinct competitive advantage.

Xhibit plans to obtain members from its content-rich domains, interactive games, apps, and social network initiatives. The Company believes it has six primary ways to enhance revenues and profit over time: (a) increase the number of Xhibit-owned social networks, interactive games, and apps and grow the member bases within those products; (b) market its FlyReply.com service which has now completed all beta testing to customers using other services; (c) increase the amount of digital ad agency customers and advertisers it works with; (d) provide plug and play monetization vehicles, such as ads that can be pulled from a cloud based environment, and easily integrated into third party mobile apps, games, social networks, high traffic websites, and other potential clients in the digital space; (e) increase the number of high quality publishers in its ad agency; and (f) increase the value of campaigns run through the ad agency by opportunistically focusing on trending consumer products such as its recently launched nutraceuticals business with higher margins than other products or services it advertises.

Xhibit intends to use its existing advertising network and future social networks as a platform to market social games thereby creating synergies that do not rely primarily on third-party social network providers such as Facebook. Key elements of this strategy include:

· Cross Pollination of Markets. Xhibit's focus will seek to create synergies between advertising companies and social media, allowing advertisers to expand market reach, and developing a subscriber base with grass roots support for both social media and game apps and web based properties that are developed.

· Win New Clients by Expanding Direct and Indirect Sales. Xhibit believes the market for interactive advertising solutions is large and underserved, and the Company will continue making significant investments to pursue this global market opportunity. To acquire new clients, Xhibit will continue to expand its distribution channels of advertising and marketing service providers. Xhibit will continue to employ an opportunistic strategy tailored for each market and industry as the Company expands such as in the consumer products/nutraceuticals industries.

· Increase Revenue From Existing Clients. With clients in many markets and industries, Xhibit expects to have a significant opportunity to sell additional applications, development, and advertising to existing clients and expand their use of emerging interactive channels such as mobile and social media.

· Launch Social Networks, Apps and Games. Xhibit will continue to invest in building social networks and games to expand the genres of media offered, further engaging with existing users and attracting new ones.

· Increase Monetization of Games. Xhibit plans to offer increased selection, better merchandising and more payment options to increase the sales of virtual goods once its online games have been developed. Management believes that players will purchase these virtual goods to extend their play sessions, personalize their game environments, accelerate their progress or send unique gifts to their friends. Xhibit also plans to continue to pursue additional revenue opportunities from advertising, including branded virtual goods and sponsorships.

· Increase Monetization of Social Networks and Apps. Assuming it successfully develops its social network, Xhibit plans to offer items of interest to its social network members through more targeted ads within the site and through advertisements in optional newsletters that individuals "opt-in" to. Xhibit also plans to provide multiple payment options for goods purchased within the social networks. For example, if someone is using a social app to purchase a movie ticket within the website or app, the member may have the option to use "platform" points, PayPal, credit cards, or other forms of payment.

· Selectively Pursue Acquisitions. Xhibit can expand its business through acquisitions, primarily in terms of product. The Company will explore acquisition opportunities of companies and technologies to expand the functionality of product solutions, provide access to new clients or markets or both.

General Services

General Services

Xhibit derives revenue from the business divisions described below. These business divisions are presented on a worldwide basis and include ad agency services, advertising and media, as well as owned and operated businesses, which are described in more detail below. For information regarding the operating performance of these divisions, see "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Ad Agency

Xhibit's ad agency services, described below, have historically been offered through its Lead Revolution (now AdBind) and Xhibit Interactive brands. With the combination of a pay-for-performance model built on licensed technology platforms, marketing expertise, and a large, quality advertising network, the Company provides advertisers all of the consulting, strategy, and turn-key solutions needed to promote their companies or products in a digital environment. Combining these resources with its interactive technology development capabilities allows Xhibit to deliver a complete spectrum of services to advertisers.

In July 2012, Xhibit launched, through Lead Revolution, multiple pricing models designed around maximizing the customers' return on investment. Display advertising placements are offered on several pricing models including cost-per thousand-impression ("CPM"), whereby customers pay based on the number of times the target audience is exposed to the advertisement, cost-per-click ("CPC"), whereby payment is triggered only when an interested individual clicks on a customer's advertisement; and cost-per-action ("CPA"), whereby payment is triggered only when a specific, pre-defined action is performed by an online consumer, such as a person who completes an online advertisement containing a multi-question form on an advertiser-hosted website. When that person completes the form per the stated contract, AdBind earns payment from the advertiser. Management believes that AdBind has been able to generate its highest returns from CPAs, and further believes it will be able to generate revenues from CPCs in the near future.

AdBind, a bidding advertising network connecting advertisers to ad publishing vehicles across various media channels, is still being tested and under development. AdBind provides an open environment whereby advertisers can be connected to other online publishers (this term refers to those businesses which prepare online “newsletters” tailored to specific industries) to further increase their overall advertising exposure while growing more rapidly. These publishers can quickly view payments and conversion statistics to assess the effectiveness of every advertiser relationship and advertisement, and advertisers can quickly gauge the quality and potential of each third-party publisher relationship in the marketplace, allowing them to maximize the performance and scale of their online advertising campaigns.

AdBind has over one hundred online third-party publishers that advertisers can access in its advertising network. It also partners with third-party website publishers and applies a licensed technology platform and industry expertise to deliver customers' display ad campaigns to the appropriate pages of publisher partners' websites. These publishers enroll on AdBind’s website (adbind.com) and are attracted by “word of mouth” referrals and some paid for advertising. Publishers are demanding lucrative opportunities to prepare quality ads. Furthermore, publishers are demanding fair compensation for their efforts. AdBind fulfills this need by offering publishers high-quality, fully optimized ad campaigns coupled with competitive payout packages. AdBind works with reputable advertisers that offer quality products and services in relevant markets, giving publishers access to ads for these quality products and services more likely to appeal to consumers. Unlike most digital ad agencies, the Company is able to test campaigns prior to deployment.

We work closely with ad agencies such as XL Marketing which only pays us for the results we achieve. In December 2012, the Company hired 5 new employees based in Salt Lake City and began marketing and distributing a proprietary line of consumer nutraceutical products using its AdBind digital advertising network. We often develop campaigns involving online advertisements, hosted by the advertiser, that require the completion of a multi-question form by its customer. For each form completed, or other quantifiable action by the customer, we are paid a stated fee.

Advertisers can reach targeted online users on a large scale, using a variety of online display ad units across this entire network of publishers, customized content channels, or a select number of websites and portals where AdBind is authorized to sell inventory on a single-site basis. Audiences are also targeted based on the demographic and behavioral tracking composition of sites within the network and technical information such as geographic location, browser type, connection speed, ISP or top-level domain (.com, .edu, etc.). In addition, the proprietary behavioral targeting capabilities available through AdBind and provided by third-party companies allow advertisers to retarget users who have recently visited their sites or to display highly relevant ads based on anonymous profiles based on consumers' recent online behavior such as web browsing and interaction with ads across AdBind's network.

AdBind delivers a variety of display ad units to the web pages of online display advertising from network publishers and tracks them to evaluate success against the goals of the advertising programs. With traditional banner ads, interstitials, text links, and other online ad units, this technology maximizes the impact of marketing campaigns by identifying the most effective placement for each type of campaign.

The Company is in the process of researching and developing its own proprietary software to track and analyze the delivery and effectiveness of display ads. Until such technology is viable and operational, we intend to utilize third party vendors with commercially available technology. Currently, AdBind has contracted with HitPath and LinkTrust to provide the technology necessary to effectively monitor and evaluate the ads provided through the AdBind network. The HitPath and LinkTrust platforms that we use provide prompt data on a real-time basis regarding our ads, including affiliate tracking and analytics, publisher management, revenue tracking and campaign analysis.

Xhibit also executes a wide variety of rich media applications, including in-stream and in-banner video ads, providing even greater visual and auditory impact for an advertisers' online display marketing campaigns.

The benefits that AdBind’s customers enjoy in display and other web advertising include, but are not limited to: flexible pricing models; the ability to target and reach significant numbers of online consumers in a way that complements media buys on portals and other large websites; and the ability to improve online advertising performance while the campaigns are still running by optimizing at site, placement and creative levels, based on both response to ads and the resulting conversions.

Publishers in AdBind’s display advertising network enjoy efficient and effective monetization of their online advertising inventory, including: participation in large-scale advertiser and advertising agency campaigns they may not be able to access on their own; enhanced monetization through AdBind’s campaign optimization experience; and detailed analytics.

Key Customers

Our business does not have clients which enter into long term contracts and substantially all of our customers either have contracts which can be terminated immediately or are not in writing. These contracts are often implemented through “insertion orders” which relate specifically to each campaign required by a customer. In 2012, the Company maintained a fairly high concentration of revenues generated by a small number of customers. In 2012, approximately 82% of our revenue was generated from our 10 largest customers, all of which were revenues generated from ad distribution services. Our Interactive division currently provides direct services to clients such as The Beach Boys, Capitol Records, Chrome Data Solutions and Ernst Benz. We anticipate that the Interactive customer base will continue to grow and that future revenues generated from ad distribution will be earned from a significantly larger client base thus reducing the concentration of revenue sources but there is no assurance this concentration of risk will decrease. There is no assurance that any customer we had in 2012 will remain a customer in 2013.

XL Marketing

The Company serves as an advertiser for the ad agency XL Marketing. While there is no written contract for these services, the parties operate pursuant to specified terms and conditions and related insertion orders. In 2012, XL Marketing accounted for approximately 35% of the Company’s total revenue and was its largest customer.

AdCafe

During 2012, AdCafe accounted for approximately 14% of total revenues. In June of 2012, the Company and AdCafe agreed to cancel the contract as the gross profit margins associated with this agreement were nominal.

Nutraceutical Business

On December 1, 2012, we entered into a Marketing Services Agreement with WAT Works, LLC, a Utah limited liability company (“WAT Works”). We also hired five employees (including a 50% equity holder in WAT Works) at salaries ranging from $7,500 to $11,000 per month plus a bonus pool of five percent (5%) of EBIDTA generated by these five at will employees in the consumer nutraceutical products industry. Our agreement with WAT Works engaged it to select products developed by third party formulators and manufacturers and assist us in marketing this line of health and wellness related consumer products and services. We agreed to pay WAT Works its direct costs in delivering these services, which included reimbursement for rent (as they operate out of an office in Salt Lake City, Utah), reimbursement for manufacturing and formulation costs paid to a third party, and payment of a contractor for sales tracking software development. This Marketing Services Agreement is exclusive but terminable at will at any time and is on a month to month basis.

During the first quarter of 2013 a majority of our revenues have been generated by these five employees from the sales of a weight loss product, colon cleanser and green coffee supplement. Sales have been made in the United States, Australia and South Africa. We initially relied on a formulary which had an agreement with WAT Works but have recently entered into our own purchase agreement with Equinox Nutraceuticals ("Equinox"). We do not manufacture these nutraceuticals but rely on third party manufacturers. Equinox is not “GMP Certified” nor are any of our product formularies. We could have liability for distribution of products that fail to meet minimum quality control standards both from regulatory agencies and consumers. Although we are seeking to obtain products liability and business interruption insurance we do not have coverage at the present time and there is no assurance we will obtain it.

As the profit margins for sale of these products is far higher than online marketing of education, home business or other services we have traditionally advertised, we have re-directed our advertising resources to this sector. This focus on consumer nutraceutical products has resulted in a dramatic decline in revenue we generate through ad agencies such as XL Marketing which has been replaced through direct internet sales to the consumer of nutraceutical products.

While the nutraceutical products sector has proved lucrative it has significantly impacted our cash flow. See “RISK FACTORS- RISKS RELATED TO OUR NEW NUTRACEUTICALS SALES BUSINESS” for a further discussion of the risk factors related to this business sector.

Web and Technology Development

Xhibit Interactive

Xhibit through its subsidiary Xhibit Interactive, LLC, offers a diverse foundation of custom high-powered digital design and development services with disciplined strategic planning and execution for website design. Utilizing mixed mediums of creative ideation, consumer interaction and technology, Interactive brings expertise and influence to the next generation of digital media. From engaging social and motion driven websites to cross platform 3D game development (for internal use only) and mobile apps, Interactive offers comprehensive full service integrated solutions to clients as well as internal technological developments. Upon receiving a request for proposal, Interactive utilizes the user experience studies in project execution detailed below to determine optimal client predictions on price points. Xhibit Interactive quotes its services on a project basis and invoices its customers at predetermined project milestones as negotiated in its agreements.

Smarter Integration

Interactive leverages rich media infused websites, games and mobile applications delivered across web, mobile and tablet platforms to provide seamless social experiences that result in the ultimate consumer reach. Utilizing web and app technology together synchronously, it provides a cohesive experience no matter what device consumers are viewing content on. Interactive core competencies include:

|

●

|

Digital branding

|

|

●

|

Content strategy

|

|

●

|

Optimal design for web and mobile technology

|

|

●

|

Rich media interactive design

|

|

●

|

Game development (for internal use only)

|

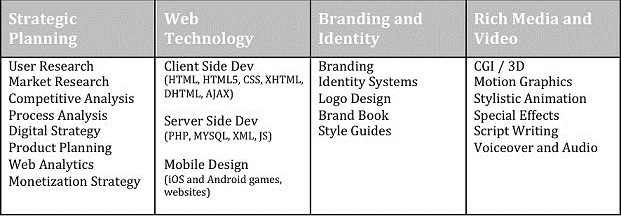

Capabilities and Full Service Solutions (shown in the chart below)

Project Development Process

In developing projects for clients, Interactive uses the following stages of development:

Planning. The initial stage of project inception in which the client and Interactive team meet to discuss goal setting expectations, potential risks, and brainstorming.

|

·

|

Project Management – Organizes overall project timelines and allocates internal and external team resources that are dedicated for the life of the project; analyzes potential risks and works with account manager to understand client needs;

|

|

·

|

User Experience – In depth studies to analyze client demographics and determine how to talk to the expected users; determines the most optimal workflow to predict user behaviors by creating site maps and information architecture through wireframes or rapid prototypes; and

|

|

·

|

Branding and Content Strategy – Utilizes user experience studies to determine valuable content and deliver the best message or products; writes copy and sets tonal direction.

|

Design. The first stage in which visual design is implemented. Utilizing the strategies outlined above, Xhibit generates visuals that optimize each project.

|

·

|

Creative Direction – Sets overall visual concept and oversees progress and development to ensure optimal goals;

|

|

·

|

Production Design – Graphic design that creates overall project look and feel; and

|

|

·

|

Rich Media Design – Creates highly interactive content such as motion graphics, video production, animation, and 3D computer graphics.

|

Development. The final stage in which the projects are developed.

|

·

|

Client Side Development – Creates all front-end development utilizing HTML5, HTML, CSS, XHTML, DHTML, C++, Objective C, .Net and AJAX;

|

|

·

|

Server Side Development – Creates all back-end development with complex database and server administration utilizing PHP, MYSQL, JS and XML; and

|

|

·

|

Rich Media Development – Develops the highly interactive concepts designed in the previous phase utilizing 3D, motion and Flash.

|

Marketing and Maintenance. While the Company does not currently do so, in the future we expect to generate additional revenue sources via the following management and maintenance programs:

|

·

|

Client Pay Per Click Campaigns – Fees earned from managing clients’ online ad campaigns through pay per click placements; and

|

|

·

|

Maintenance – Monthly and annual recurring contracts that provide project updates and other various client requests.

|

Business Expansion Plans

Direct Client Relationships. Interactive has several ongoing direct relationships including providing services to Chrome Data Solutions, The Beach Boys and Capitol Records and is seeking additional direct clients as the bulk of its business presently comes through other ad agencies.

Strategic Relationships. Interactive is seeking to create more strategic relationships with ongoing agencies of record that need interactive, advertising or other resources Interactive can provide. Interactive will provide the interactive development for these clients and help with new business pitches; the intent is to sign exclusive agreements to award Interactive all the interactive and advertising business of such agencies.

Nurturing Existing Clients. Interactive will continue upselling current return clients for additional interactive work, and setting existing monthly retainers for dedicated hours.

Further Development. We will continue to develop more internal applications and properties.

Cloud Based CRM Solutions

FlyReply 1.0 was first launched in July 2012. Soon after its launch, management began working on its 2.0 version of FlyReply to be an industry competitor. FlyReply 2.0 is now live as of March 15, 2013 and FlyReply has become a more complete cloud marketing software suite. FlyReply offers companies a way to monetize existing customer bases with interactive communication over social, email and mobile systems. FlyReply not only helps companies communicate with their customers over multiple channels in one system, but it helps companies learn more about the engagement and behaviors of their customers in social media and email. FlyReply gathers these vast data points into one easy to use cloud interface. FlyReply is a combination of proprietary technology and licensed third party technology including PowerMTA (a multithreaded message transfer agent software program) to ensure the highest level of delivery.

Xhibit’s management believes that developing software, sites and games for a “cloud based” environment will allow for faster distribution, better accessibility and easier software updates when applicable. FlyReply was created to give companies and organizations a better connection to their customers and clientele.

Many companies are recognizing that in the fast-paced digital world they need to connect with their customers through social media. FlyReply’s full 2.0 version synergistically combines social media and email to help streamline a business's communication needs with its customer base, as well as allow these businesses to further monetize that customer base. FlyReply hopes to attract Fortune 500 companies by creating a best in class cloud based solution for their interactive marketing software needs.

Small businesses use interactive marketing software providers and ESPs to conveniently deliver professional email newsletters and advertising periodically to their customers. FlyReply’s user-friendly dashboard allows for robust tracking and analytics and engineered-to-measure engagement to further understand what correspondence appeals to different groups of customers.

FlyReply has pre-designed message templates tailored to various types of companies and organizations. FlyReply also allows for full HTML editing as well as an enhanced automated HTML editor for users to custom build or change messages to their specifications.

FlyReply helps reduce expensive postal mail costs by increasing social and email communication with a company's customers in a simple and easy-to-use interface. It allows businesses to learn more about their consumers through a proprietary and real-time behavioral tracking platform, based on actions from customer engagement, geographical IP tracking, and social media actions that track “reTweets”, shares, mentions, comments and gather unique customer data points through this engagement process. The online interface can track user engagement on a newsletter and easily allows businesses to create divisions based on engagement criteria such as, but not limited to, interest, gender, location, and age, in order to better target and provide more specific services and products of interests to the businesses' customers.

FlyReply currently has several customers. We charge a monthly subscription fee as the customer’s mailing list grows, based on the number of messages it sends per month. We expect that revenue will also come from customers interested in purchasing available premium services upgrades and ad agency solutions. Examples of successful ESP companies which are competitors of FlyReply’s business model are constantcontact.com and Exact Target. Management believes that the success of these rapidly growing businesses is indicative of FlyReply’s growth potential, but there is no assurance we will successfully implement our FlyReply marketing and sales strategy.

Ad Products Under Development

Once AdBind’s proprietary product AdMail is fully developed, management believes it will offer plug and play monetization vehicles, such as ads that can be pulled from the cloud based environment, and easily integrated into third party mobile apps, games, social networks, high traffic websites, and other potential clients in the digital space.

Initially, AdMail will be offered to FlyReply customers who can choose to "activate" AdMail within FlyReply. Once activated, this service will automatically insert third-party and non-competing ads into companies' and organizations' newsletters delivered from FlyReply. When users click on those ads managed by AdBind, revenue will be shared with the sender of the newsletter, generating additional revenue. A sophisticated artificial intelligence will automatically pair both the advertiser and the company sending the newsletter with the most mutually beneficial ads that are generating the highest conversions for the advertiser and highest engagement within the newsletter. AdMail is the first proprietary product of AdBind and is fully operational and just recently began seeking clients. Currently, we are providing AdMail services to Spirit Airlines but have generated negligible revenue as of March 31, 2013.

Many companies use excessive ads that are intrusive to the user's experience. Xhibit plans to utilize its expertise in digital marketing and create a less ad intrusive user environment and at the same time generate greater revenue with properly positioned and targeted advertising based on user engagement. Facebook has proven that social media is an excellent source of quality customer information and data, but Xhibit understands that targeting consumers more effectively can provide a less intrusive user experience. Xhibit plans to incentivize users to desire to engage in the social media site and the related advertising, by providing less intrusive ads and the same "free to use" web-based experience all people seek and enjoy.

Movie/Celebrity Focused Networks and Communities

The projects described below are currently under development and there can be no assurances they will ever come to fruition.

Xhibit is developing a celebrity following app that allows stars to personally record and distribute rich media content inside the app and simultaneously through Facebook, Twitter, and other social media platforms, while growing their fan bases all in one place. Xhibit acquired social media software, domain names and assets it has branded under the name TwitYap in September 2012 and has enhanced this intellectual property to prepare for the launch of its new celebrity following app. Management has not yet decided whether to use the TwitYap brand or rebrand the social media application under a new name.

The MovieSocial project is an interactive site and mobile app that allows users to explore the latest movie trailers, buy tickets, invite friends or find a movie partner, and earn exclusive points. It allows users to discuss, blog, and vote on movies and earn rewards and badges for that interaction. The MovieSocial platform is also designed to help production companies deliver movie trailer views to interested people throughout the site and mobile app, as well as through email and mobile traffic across Xhibit’s advertising channels on a performance basis.

These Xhibit built and owned communities are designed to become a way for people to connect with others across the world based on shared areas of interest. Management believes that growing social mobile and web communities allows for better targeted advertising and, with a large community, can add substantially to Xhibit’s and AdBind's advertising capabilities. User engagement and understanding consumers are key to advertising. Owning proprietary mobile apps and websites, coupled with its ad agency resources, is designed to give Xhibit the ability to maintain even higher quality and more targeted ad placements for its clients.

Online and Mobile Games

The projects described below are currently under development and there is no guarantee they will ever come to fruition.

Xhibit's management believes that social games represent a new form of entertainment that will continue to capture an increasing proportion of consumer leisure time. In addition, social games are the most popular applications on Facebook. The Company is basing its game development model on the premise that games and gaming have been, and will continue to be, a key driver of engagement on social networks, and increasingly on mobile platforms. Xhibit has several mobile and Facebook games under development. These games are a work in progress and there is no guarantee when or if they will be available to the public or as a Company offering or product. Angry Caveman is the game furthest along in the development process and Xhibit expects to have it ready for beta testing during the second quarter of 2013 but there is no assurance as to when this will be completed. None of the other games in development have working titles or planned launched dates. Xhibit’s web versions of these games are planned to require client side Flash to run but data is stored on servers through a remote location, whereas the mobile and tablet versions are planned to use a client side app to improve functionality.

Xhibit believes that a player-centric approach is the key to success in social games. Games acquired and/or developed by Xhibit are designed to be:

|

●

|

Accessible by Everyone, Anywhere, Any Time. Xhibit intends to design games so that they are easy to learn, playable in short sessions and accessible on multiple platforms. They will operate as live services that can be played anytime and anywhere.

|

|

●

|

Social. Games are most engaging and fun when they are social. Xhibit intends to provide a community of players with simple ways to find their friends online and connect, play and share with them. In addition to leveraging the viral and social features provided by social networks, Xhibit designs and innovates social mechanics into its games.

|

|

●

|

Free. Xhibit's free-to-play model attracts a larger audience than a traditional pay-to-play approach. This enables a higher degree of social interaction and improves the game experience for all players. Players can choose to purchase virtual goods to enhance their game experience.

|

|

●

|

Fun. Xhibit intends for games to be fun and engaging by regularly delivering new content, features, quests, challenges and virtual goods that enhance the experience for players. As a result, the games are a perpetual source of play, evolving with a community of players over time. Players express their personalities by designing and customizing the appearances of their characters and building and decorating their own virtual presence and environments.

|

Social Games

Xhibit plans to follow the current popular trend of integrating its games through social media networks like Facebook and the emergence of the mobile operating systems to take advantage of the acceptance and popularity games have in those settings. Facebook, in particular, has been very receptive to third-party game developers and has published tutorials to encourage and promote such development. Accordingly, Xhibit expects to develop games that are compatible with the Facebook platform to help make its games operational on Facebook's site and consistent with what is accepted by its users. In addition, Xhibit is exploring the benefits of integrating its game structure with Facebook Credits, which is a payment method developed and used by Facebook. In the event new and additional social networks are developed and attain popularity, Xhibit expects to follow similar strategies to harmonize its games with their platforms.

Similarly, mobile operating systems have opened their platforms to developers, such as Xhibit, transforming the creation, distribution and consumption of digital content. Developers can create applications accessing unique features of the platforms, distribute applications digitally to a broad audience and regularly update existing applications. Social networking sites and mobile application stores have become mass market consumer destinations where content, like online games, is easy to find, immediately accessible and always available. Xhibit believes this represents a new form of entertainment that it can pursue to capture an increasing proportion of consumer leisure time, as it believes these types of social games will continue to be a key driver of engagement on social networks and mobile systems.

Xhibit intends to provide games as live services and will update them with fresh content and new features to make them more social, enhance player engagement and improve monetization. Xhibit can then analyze the data generated by players' game play and social interactions to guide the creation of new content and features. This ongoing feedback loop keeps games compelling and enhances the player experience.

Xhibit games will be designed to inspire and enable players to express their personalities by customizing the appearances of their characters and building and enhancing their environment. Players then invest time in the games in a variety of ways. Through activities, players advance in the game, which the industry refers to as leveling up. Players can choose to advance in the game by investing additional time, requesting help from their friends or purchasing virtual goods.

The Social Experience

The social design of Xhibit's games is at the core of the way players experience the games. Xhibit's games will encourage players to quickly connect to their friends when they start a game and to build and enhance these relationships throughout the game experience.

Virtual Goods

In most of Xhibit's games, players will earn virtual goods through game play, receive them as gifts or purchase them. Virtual goods are digital representations of real world goods. Through virtual goods players are able to extend their play sessions, enhance or personalize their game environments, accelerate their progress in games and share and trade with friends. A player's acquisition, gifting and purchase of virtual goods create social interaction that increases the player's engagement with games and with other players.

The primary revenue source from Xhibit games will be the sale of virtual currency that players use to buy in-game virtual goods. Some forms of virtual currency are earned through game play, while other forms can only be acquired for cash or, in some cases, by accepting promotional offers from Xhibit's advertising partners.

The following summary provides examples of the benefits received by players from the purchase of virtual goods:

|

●

|

Invest and Express. Many Xhibit games will offer players the opportunity to purchase decorative and functional items to personalize their game environment and express their individual taste or style.

|

|

●

|

Gift. Xhibit games will offer players the opportunity to purchase gifts for their friends. Other features will tie offline events to online social interactions and virtual goods purchases.

|

|

●

|

Contribute to Social Causes. Xhibit will enable players to contribute to charitable causes that they believe in by purchasing specially created virtual goods in-game.

|

Xhibit’s strategy is to follow the launch of its games with increased selection, additional merchandising and more payment options to increase the sale of its virtual goods. Its expectation is that players will purchase these goods to extend their play sessions, personalize their game environments, accelerate their progress or send unique gifts to their friends. While Xhibit has not yet determined which payment methods it will offer and accept, it is exploring the use of Facebook Credits, which allows users to pay for credits through Facebook and then apply them to particular applications such as online games. Xhibit is also considering offering a direct payment option through its own websites.

Advertising

A second revenue source for Xhibit games will be through advertising. Xhibit will pursue these additional revenue opportunities with offerings such as branded virtual goods and sponsorships.

Xhibit expects to utilize its advertising services and expertise to offer creative ways for marketers and advertisers to reach and engage with its players. The goal of our engagement-based advertising is to enhance the player experience while delivering real value to advertisers. Xhibit is looking to generate revenue through offerings such as:

|

●

|

Branded Virtual Goods and Sponsorships, where it would allow advertisers to brand its virtual goods and integrate advertising into its games;

|

|

●

|

Engagement Ads, where players could answer certain questions regarding engagement ads to earn virtual currency in the games; and

|

|

●

|

Mobile Ads, where ad-supported and ad-free paid download versions of games would be available for mobile users.

|

Xhibit Technology

Xhibit architecture is based on the standard F/OSS stack. Xhibit uses a PHP application, designed to run both on the standard Apache server, and also uses PHP FPM. This enables Xhibit to pick between using a standard Apache server, or, when scalability dictates, move to a multi-tier architecture using a faster web server, such as NginX. This will also enable Xhibit to divide its resources between front-end and application parts, and enable full load-balancing and high-availability scaling. This is the same web front-end that runs the world's heaviest use sites, with Facebook being a prime example.

The database is currently a standard GA MySQL instance, but Xhibit is able to quickly move to a more scalable implementation, like Percona XTraDB, and from there scale further either towards a multi-master MySQL deployment, or even towards a Gelera-enabled XtraDB Cluster if the need should arise. However, management believes its existing database is sufficient for the foreseeable future since regular multi-master multi-slave scalable MySQL has been proven in usage, and is capable of powering websites such as Twitter.

Xhibit's security is both perimeter based and also design based. Xhibit started with an industry-leading Cisco ASA firewall, but has also employed full database built-in security, and combined them in a system designed to protect all its mission-critical and confidential data. Also, for both database reasons, and for reasons regarding database stability, Xhibit does not deploy its database back-end in the cloud, but instead insists on hosting it all only on physical, dedicated servers, to which Xhibit, and only Xhibit, has full access and control. Finally, using the F/OSS software, management believes Xhibit is using the best tested and reviewed applications available.

In short, the entire system is a combination of a well-supported and widely deployed F/OSS stack, the same one running some of the biggest and the world's most visited websites, carefully integrated into Xhibit's custom system, and then tied together using Xhibit's in-house software, creating a hugely scalable, resilient and easy to expand architecture. Based on the best use-case scenarios used by the industry leaders, and then customized and optimized to suit Xhibit's needs, management believes that this system gives Xhibit all available advantages and puts Xhibit in a position to pursue all of its growth plans, while retaining control and also providing Xhibit with the security and the ability to fully customize it.

All Xhibit technologies are built with the principles of speed, reliability and easy scalability in mind. These goals are often obtained by utilizing a unique combination of custom-built software and reliable hardware with fail-safe mechanisms.