Attached files

| file | filename |

|---|---|

| EX-21.1 - LIST OF SUBSIDIARIES - Lustros Inc. | lustros_10k-ex021.htm |

| EX-31.02 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3102.htm |

| EX-32.01 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3202.htm |

| EX-31.01 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3101.htm |

| EX-32.01 - CERTIFICATION - Lustros Inc. | lustros_10k-ex3201.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Lustros Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-K

_________________

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ________________.

Commission File Number: 000-30215

LUSTROS, INC.

(Exact name of Registrant as Specified in its Charter)

| Utah | 45-5313260 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

9025 Carlton Hills Blvd. Santee, CA 92071 | |

| (Address of principal Executive Offices, including ZIP code) | |

|

619-449-4800 Registrant’s telephone number, including area code | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of Each Class | Name of each exchange on which registered |

| None | None |

| Securities registered pursuant to Section 12(g) of the Act: | |

| Common stock, $0.001 par value | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes ý No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding twelve months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer¨ | Accelerated Filer ¨ | |

|

Non-accelerated Filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

The aggregate market value of the Issuer's voting and non-voting common equity held by non-affiliates of the registrant, as of December 31, 2012, computed by reference to the closing price of such common equity on the Over-The-Counter Bulletin Board as of December 31, 2012, the end of the Registrant’s most recently completed fiscal year was $39,892,650.

On April 12, 2013, the Registrant had 90,153,286 outstanding shares of common stock (“Common Stock”), $.001 par value.

LUSTROS, INC.

TABLE OF CONTENTS

| Item 1 | BUSINESS | 1 |

| Item 1A | RISK FACTORS | 4 |

| Item 1B | UNRESOLVED STAFF COMMENTS | 4 |

| Item 2 | PROPERTIES | 4 |

| Item 3 | LEGAL PROCEEDINGS | 6 |

| Item 4 | MINE SAFETY DISCLOSURES | 6 |

| Item 5 | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 7 |

| Item 6 | SELECTED FINANCIAL DATA | 9 |

| Item 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 9 |

| Item 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 13 |

| Item 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 14 |

| Item 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 15 |

| Item 9A | CONTROLS AND PROCEDURES | 15 |

| Item 9B | OTHER INFORMATION | 17 |

| Item 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 19 |

| Item 11 | EXECUTIVE COMPENSATION | 26 |

| Item 12 | SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 28 |

| Item 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 30 |

| Item 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES | 31 |

| Item 15 | EXHIBITS, FINANCIAL STATEMENTS SCHEDULES | 33 |

| i |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| · | The availability and adequacy of our cash flow to meet our requirements; |

| · | Economic, competitive, demographic, business and other conditions in our local and regional markets; |

| · | Changes or developments in laws, regulations or taxes in our industry; |

| · | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

| · | Competition in our industry; |

| · | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| · | Changes in our business strategy, capital improvements or development plans; |

| · | The availability of additional capital to support capital improvements and development; and |

| · | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this report to “Company”, “we”, “us”, “our” and “LSTS” are references to Lustros, Inc., a Utah corporation, formerly known as Power-Save Energy Company, (“Lustros”), and, unless the context indicates otherwise, also includes our subsidiary, Lustros Chile SpA (“Lustros Chile”), and their majority-owned subsidiaries as described in greater detail below under the caption “Business.” All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

| ii |

| Item 1 | BUSINESS |

Formation and History

Lustros, Inc. ("Lustros", and together with its consolidated subsidiaries, the "Company"), formerly Power-Save Energy Company, is a Utah corporation. Power-Save Energy Company was the successor corporation of Mag Enterprises, Inc., incorporated on July 30, 1980. On September 10, 1993, an Amendment to the Articles of Incorporation was filed to change the name from Mag Enterprises, Inc. to Safari Associates, Inc. On September 12, 2006, an Amendment to the Articles of Incorporation was filed to change the name from Safari Associates, Inc. to Power-Save Energy Company (the “Company”). On April 9, 2012, the Company announced its name change from Power-Save Energy Company to Lustros, Inc.

On March 9, 2012, the Company acquired all of the outstanding capital stock and rights to acquire capital stock of Bluestone, S.A., a Chilean corporation (“Bluestone”), in exchange for 60,000,000 shares of its common stock (the "Bluestone Acquisition"). Bluestone's principal asset was a 60% equity interest in Sulfatos Chile, S.A. ("Sulfatos"), which it acquired in February 2012.

For accounting purposes, the Company has treated the Bluestone Acquisition as a reverse acquisition with Bluestone as the acquiring entity and Lustros as the acquired entity. As a result, the Company's financial statements reflect the financial information of Bluestone prior to March 9, 2012 and the combined entity on and after March 9, 2012.

On March 25, 2012, the Company sold the assets and liabilities (including the "Power-Save" name) of its renewable energy and energy savings product business in which it had engaged prior to the Bluestone Acquisition, to the former management of the Company (the "Power Save Sale"). See Note 4--Bluestone Acquisition and Power Save Sale.

On June 25, 2012, the Company created a new subsidiary, Mineraltus S.A. (“Mineraltus”), a Chilean corporation, to extract copper from the tailings (waste products) of expired copper mines to secure the raw materials to manufacture high quality, feed-grade copper sulfate. The Company owns 80% of Mineraltus.

On August 22, 2012, the Company formed Lustros Chile SPA as a 100% owned subsidiary, for the purpose of acting as a Chilean entity holding company for the Company’s Chilean subsidiaries Sulfatos (60%), Mineraltus (80%), and Bluestone.

Business Description

The Company is a pre-revenue development stage company that intends to market and sell high quality food-grade copper sulfate obtained by processing copper ores and tailings at Company-owned processing facilities in Chile.

Copper Sulfate Uses and Market

Copper Sulfate (CuSO4) is a value-added product derived from copper ore. Copper Sulfate is one of the most flexible and reliable tools a farmer can use as it is an important industrial chemical and is widely used to treat a range of problems.

Demand for Copper Sulfate is increasing rapidly due to its use as a natural growth stimulant in animals, as well as in prevention of Escherichia coli, commonly known as E. coli, and listeria. A comprehensive list of uses for Copper Sulfate is available at http://www.copper.org/applications/compounds/table_a.html.

The food-grade Copper Sulfate industry is a $1.2 billion dollar industry growing at approximately 15% per year. Currently, more than 50% of global production is made from copper scrap that contains toxins, such as Dioxin, which are no longer accepted by many countries such as Canada, Australia, and Brazil. Other important consumer countries are expected to follow in rejecting copper that contains toxins.

| 1 |

Lustros produces Copper Sulfate directly from mineral-rich ore, making it an ideal food-grade Copper Sulfate to be used for agricultural purposes. There is strong interest from companies in Brazil, Canada, Colombia, New Zealand, Peru and Chile to purchase our food-grade Copper Sulfate in quantities exceeding our potential production capacity.

Sulfatos Chile – Processing Plant Subsidiary

Our first Copper Sulfate plant is engineered to process 180,000 tons of raw materials and yield 8,064 tons of food-grade Copper Sulfate per year.

Our Copper Sulfate facility is expected to begin processing 5,000 tons of material per month in the second fiscal quarter of 2013. The current capacity of 15,000 tons per month is expected to commence upon receiving permits for unlimited production by the end of the fiscal year ending 2013. We expect to receive cash flow from this phase beginning in the third fiscal quarter of 2013. The cash flow from this phase is expected to provide the funds needed for the expansion of an additional 25,000 tons per month plant.

Mining Interests

| Claims/Mining Properties | Location | Entity | Ownership Interest |

| Anica Copper Mines | Anico Project, Illapel | Sociedad Sulfatos Chile, S.A. | 60.00% |

Raw Material Sources

Sulfatos Chile SA owns the 1,325 hectare (3,275 acres) Anica copper mine that is our primary source of raw material. Local family miners also represent a large opportunity for potential supply of quality raw material at discounted prices.

Mineraltus – Tailings Treatment Subsidiary

Chile produces 3.5 million tons of copper per year, with 280 million tons of new tailings generated each year. There are over 800 mines with significant tailing deposits in Chile, 50% of which are abandoned. Chile recently enacted a law requiring all mines to present a closure plan that includes treatment of tailings. This law also increases the fines associated with unclosed plants substantially.

Mineraltus SA can clean up these tailings at a substantial profit, charging the government and private mine owners for the clean-up and taking mineral rights on the abandoned tailings.

Initial Tailings Operation: Congo Project

This fully permitted project consists of 80.4 hectares of land, providing approximately 2.4 million tons of copper tailings. Post-clean up, Lustros will retain 21.2 hectares of usable land in the Santiago metropolitan area for real-estate development projects.

During the next twelve months, the Company plans to satisfy its cash requirements through revenues from operations, existing cash and financing commitments and additional equity financings.

Employees

As of the date of this filing, we currently have four management level employees who work for Lustros, Inc. (two are employed full time and two are employed on a part-time basis and are not compensated). Sulfatos Chile employs 51 full-time employees.

| 2 |

We may require additional employees in the future as we expand our operations. There is intense competition for capable, experienced personnel and there is no assurance we will be able to obtain new qualified employees when required.

Competition

The Company is a pre-revenue development stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could have an adverse impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Government Regulations and Permits

Our mineral exploration and processing activities are subject to extensive foreign laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Mineral exploration and processing is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations.

Various permits from government bodies are required for mining and processing operations to be conducted; no assurance can be given that such permits will be received. Permits for exploration and development are administered by the Chilean National Geological and Mining Service (SERNAGEOMIN). Environmental compliance is assured via the offices of the National Environmental Committee (CONAMA). Claim titles are recorded at the local Mining Conservator in Copiapo.

We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder. There are no current orders or directions relating to us with respect to the foregoing laws and regulations.

We have obtained or have pending applications for those licenses, permits or other authorizations currently required in conducting our exploration and other programs, but may from time to time need to apply for new, or renew our current, licenses, permits or other authorizations to continue our business or expand our operations.

Environmental Regulation

In connection with mining, production and exploration activities, we are subject to extensive federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species. Potential areas of environmental consideration for mining companies, including ours include but are not limited to, acid rock drainage, cyanide containment and handling, contamination of water courses, dust and noise. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. These laws are continually changing and, in general, are becoming more restrictive. Additionally, we may be subject to liability for pollution or other environmental damages that we may elect not to insure against due to prohibitive premium costs and other reasons.

| 3 |

Chile’s environmental law (Law No 19.300), which regulates all environmental activities in the country, was first published in March 1994. An exploration project or field activity cannot be initiated until its potential impact to the environment is carefully evaluated. This is documented in Article 8 of the environmental law and is referred to as the Sistema de Evaluación de Impacto Ambiental (SEIA).

The SEIA is administered and coordinated on both regional and national levels by the Comisión Regional del Medio Ambiente (COREMA) and the Comisión Nacional del Medio Ambiente (CONAMA), respectively. The initial application is generally made to COREMA, in the corresponding region where the property is located, however in cases where the property might affect various regions the application is made directly to the CONAMA. Various other Chilean government organizations are also involved with the review process, however, most documentation is ultimately forwarded to CONAMA, which is the final authority on the environment and is the organization that issues the final environmental permits.

Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

| Item 1A | RISK FACTORS |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| Item 1B | UNRESOLVED STAFF COMMENTS |

None.

| Item 2 | PROPERTIES |

Our corporate office is located at 9025 Carlton Hills Blvd., Santee, California 92071. This facility is a 1,530 square foot administrative office space, which we have leased through September 30, 2017 at a leasing cost of $1,912.50 per month. Our telephone number at this facility is 619-449-4800. It is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our operations. We do not foresee any significant difficulties in obtaining any required additional facilities. We do not presently own any real property in the United States.

Sulfatos Chile has offices in Santiago, Chile located at Doña Isabel 1101, Pudahuel, Santiago, Chile that are leased at a cost of 250,000 CLP or approximately $522 per month. It is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our operations in Chile. We do not foresee any significant difficulties in obtaining any required additional facilities. Additionally, through Sulfatos Chile we hold interests in the Anico Copper Mine mining property described below, and we own the property on which the processing plant is located, 835 hectares in Fundo Puerto Oscuro, Comuna de Canela, Province of Choapa, Los Vilos, Chile.

| 4 |

Operating Mine Interests

Sulfatos Chile

On September 15, 2010, Santa Teresa Minerals and Minera Anica Ltda. formed the Chilean corporation, “Sulfatos Chile, S.A.” Santa Teresa Minerals sold its 60% interest in Sulfatos Chile S.A. to our subsidiary, Bluestone, in February 2012. Bluestone now owns 60% of Sulfatos Chile S.A., which owns the Anico Copper Mine and mining claims to Anico 1/5, and plans to extract copper sulfate and operate a copper sulfate production facility at the Anico Copper Mine which is currently under construction. Copper sulfate is a byproduct of copper mining that is used in industrial processes, livestock feed, and aerospace industries.

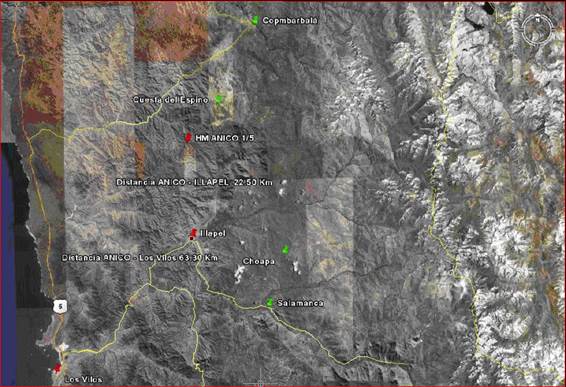

Map Showing Location of Anico Copper Mine

The Anico Copper Mine is located in the la Cuarta region, 22 kilometers northeast of the community of Illapel in the fourth region of the Choapa Province. Illapel is located on a plain along the side of the Illapel River, approximately 57 km northeast from Los Vilos and approximately 144 km south from Ovalle. The Anico Copper Mine is located at latitude North 31 degrees, 25 minutes, 6953 seconds, longitude East, 71 degrees, 10 minutes, 588 seconds, with UTM coordinates of 6.521.208 meters North, 293.319 meters East. The Anico Copper Mine is approximately 22 km by conventional roadways, from Illapel, on the road leading to Combarbalá, past the Auco sector, following the road that leads to Cocou, then to Culen Creek, where Anico Copper Mine is located.

History

Registered in 1999 as Anico 1/5, the property consists of 25 hectares, which was contributed to Sulfatos Chile S.A. by Minera Anica Ltda. The property has been exploited since 2008, extracting approximately 400 tons of raw material per month with an average copper grade of approximately 3% per cubic ton. Prior to Sulfatos Chile’ acquisition of the property in September of 2010, sales of the raw material had been made to refineries of the Empresa Nacional de Mineria (ENAMI), Chile’s state owned minerals company, approximately 20 kilometers away.

The last geological study on the mine was made in April 2008. The property is without known reserves and the proposed program is exploratory in nature.

| 5 |

Current Activity

Through Sulfatos Chile, we are in the process of constructing a copper sulfate production facility that will extract copper sulfate from raw material extracted from the Anico Copper Mine or purchased in bulk. The permits for this facility have been received and we anticipate that the construction will be completed in the second fiscal quarter of 2013. We estimate the total cost of this facility to be approximately $9.5 million when complete.

On February 21, 2011, a lease offer with purchase option agreement was formalized between Sulfatos Chile and the property owners of the plant site. The lease with option to purchase has a term of 10 years and includes the water rights of 2 liters per second. This agreement has been superseded by a purchase agreement executed on March 31, 2011. The total purchase price for 835 hectares in Fundo Puerto Oscuro, Comuna de Canela, Province of Choapa, Los Vilos, Chile is 280 million Chilean Pesos (currently $585,040 US) payable over 2 years. 100 million Chilean Pesos (currently $217,276 USD) was paid upon signing and 90 million Chilean Pesos ($183,882 USD) was due one year after signing and 90 million Chilean Pesos (currently $183,882 USD) is due two years after signing. We have not yet made the second or third payments under this agreement. The seller of the property has agreed to delay these payments until a future date to be determined by the parties.

| Item 3 | LEGAL PROCEEDINGS |

In September 21, 2011, Chris Frye filed a lawsuit against the Company in California Superior Court alleging, among other things, breach of contract surrounding the Company’s CBS Television solar project. Chris Frye also filed a cross-complaint in a New Mexico action filed by Uni-Rac involving a similar subject matter. The Company vigorously denies all allegations and insists the lawsuit is an attempt on Chris Frye’s part to evade paying an outstanding invoice owed to the Company. The California Suit has since been dismissed in its entirety and the cross-complaint in New Mexico has been dismissed as well. Chris Frye and Power-Save have joined forces to combat Uni-Rac in the New Mexico portion of the case, which is reduced to a dispute of less than $200,000 regarding the racking supplied in relation to the CBS project. The liabilities of the Company relating to this lawsuit, including the cost of defense, were assumed by Michael Forster and SLO 3 Holdings, Inc. in connection with their purchase of the assets of the Company's renewable energy and energy savings business in March 2012. Assuming they have the financial capacity to pay any judgments and the costs of defense, the Company should have no liability with respect to this lawsuit.

The Company is engaged in litigation in the Supreme Court in the County of Westchester, New York, Index No. 11139/2009, in the matter Steeneck v. Power-Save and Engelbrecht. The claim was brought before the Court on or about May 8, 2009, although the defendants were never notified of the action until September 2012. Putting aside pleading in the alternative (duplicative claims under different legal theories for the same acts/omissions to act) the claim appears to be for approximately $200,000. As reported on Form 8-K filed with the Commission on January 18, 2013, the Company was informed that on January 10, 2013 the Court filed and entered a Decision & Order stating that the statute of limitations of the action had expired and that the plaintiff is not entitled to the relief that was sought. The plaintiff’s motion was denied and the case is now marked as disposed by the court.

Other than the foregoing, we know of no material, existing or pending legal proceedings against the Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

| Item 4 | MINE SAFETY DISCLOSURES |

As of December 31, 2012, we were a development stage company and had not engaged in any actual mining activities that would result in mining violations.

| 6 |

PART II

| Item 5 | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Common Stock is currently traded on the OTCQB under the symbol “LSTS.” Our symbol was previously “LSLD” from March 9, 2012 until January 10, 2013 when our symbol was changed to our current symbol “LSTS.” Prior to the Bluestone Acquisition, our symbol was “PWSV”. The market represented by the OTCQB is limited and the price for our Common Stock quoted on the OTCQB is not necessarily a reliable indication of the value of our Common Stock.

The following table sets forth the high and low bid prices for shares of our Common Stock for the period from January 1, 2011 to December 31, 2012, as reported on the OTCQB. Quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Common Stock | ||||||||

| High | Low | |||||||

| 2012: | ||||||||

| Fourth Quarter | $ | 1.50 | $ | 0.66 | ||||

| Third Quarter | $ | 1.72 | $ | 1.06 | ||||

| Second Quarter | $ | 2.48 | $ | 0.60 | ||||

| First Quarter (March 9-March 31) | $ | 1.53 | $ | 0.41 | ||||

| First Quarter (January 1-March 8)* | $ | 1.01 | $ | 0.11 | ||||

| High | Low | |||||||

| 2011*: | ||||||||

| Fourth Quarter | $ | 1.22 | $ | 0.26 | ||||

| Third Quarter | $ | 1.75 | $ | 0.35 | ||||

| Second Quarter | $ | 2.76 | $ | 0..35 | ||||

| First Quarter | $ | 4.19 | $ | 1.12 | ||||

*The share prices from January 1, 2012 through March 8, 2012 and the 2011 Fiscal Year share prices for the Common Stock of the Company reflect pre-Bluestone Acquisition reverse merger share prices.

Holders

As of April 12, 2013, an aggregate of 90,153,286 shares of Common Stock were issued and outstanding and were held by approximately 472 holders of record, based on information provided by our transfer agent.

Recent Sales of Unregistered Securities

The authorized capital stock of Lustros consists of 100,000,000 shares of Common Stock, $0.001 par value per share, and 10,000,000 shares of Preferred Stock, par value of $0.001 per share, designated “Series A Preferred Stock.” Each share of Series A Preferred Stock is convertible at the option of the holder into 100 shares of Common Stock, and is entitled to 100 votes per share on all matters submitted to the shareholders of Lustros. On December 31, 2012, there were 88,369,618 shares of Common Stock and 0 shares of Series A Preferred Stock outstanding.

On March 9, 2012, Lustros issued and sold 60,000,000 shares of its Common Stock in the Bluestone Acquisition, in exchange for 100% of the outstanding stock of Bluestone. An Amended and Restated Share Exchange Agreement was reported on Form 8-K filed with the Commission on October 21, 2012.

In April 2012, Lustros issued and sold in a private placement: (i) to Zirk Engelbrecht 100,000 shares of Series A Preferred Stock in consideration for cash of $429,000 at the rate of $4.29 per share which was then applied to the settlement of indebtedness to Suprafin, Ltd. in the amount of $429,000 (See Note 6 - Debt), which shares were issued and registered in the name of Zirk Engelbrecht; and (ii) to Gonzalo Troncoso 75,000 shares of Series A Preferred Stock for cash in the amount of $4.29 per share. At the time of these purchases, Mr. Engelbrecht was Chief Executive Officer of the Company and Mr. Troncoso was President and Chief Operating Officer of the Company. These shares were subsequently converted into Common Stock in November 2012, as stated below.

| 7 |

In April 2012, Lustros issued and sold 5,000,000 shares of Common Stock in a private placement to two entities in consideration of $1,000,000 cash at the rate of $0.20 per share of which was then applied the settlement of indebtedness of $1,000,000. This indebtedness was working capital advances made by Angelique de Maison to Santa Teresa Minerals and assumed by Bluestone in the Sulfatos Acquisition. Ms. De Maison directed that 3,643,911 of these shares be issued in the name of Quatre Gats, an entity owned by Zirk Engelbrecht, Angelique de Maison, Gonzalo Troncoso and Trisha Malone, our Chief Financial Officer of the Company.

In June 2012, Lustros issued and sold 1,636,364 shares of its Common Stock in a private placement at $0.55 per share or net proceeds of $900,000.

In June 2012, Lustros issued and sold to Angelique de Maison 181,818 shares of Common Stock in consideration of $100,000 cash at the rate of $0.55 per shares which was then applied to the settlement of $100,000 of debt. This indebtedness was the remaining working capital advances assumed by Bluestone in the Sulfatos Acquisition.

In July 2012, Lustros issued and sold 727,272 shares of its Common Stock to a director in a private placement at $0.55 per share or net proceeds from the offering of $400,000.

In July and August 2012, Lustros issued and sold 352,941 shares of its Common Stock in a private placement at $0.85 per share or net proceeds from the offering of $300,000.

In November 2012, Mr. Engelbrecht converted 100,000 shares of Series A Preferred Stock into 10,000,000 shares of Common Stock, and Mr. Troncoso converted 75,000 shares of Series A Preferred Stock into 7,500,000 shares of Common Stock.

In December 2012, Lustros issued and sold to Magna Group, LLC 177,714 shares of Common Stock in consideration of the conversion of $160,000 of debt at the average rate of $0.90 per share.

Subsequent Issuances

In January 2013, Lustros issued and sold to Magna Group, LLC 68,670 shares of Common Stock in consideration of the conversion of $40,000 of debt at the average rate of $0.5825 per share.

In February 2013, Lustros issued and sold to Magna Group, LLC 357,120 shares of Common Stock in consideration of the conversion of $110,000 of debt at the average rate of $0.3080 per share.

In March 2013, Lustros issued and sold to Magna Group, LLC 357,878 shares of Common Stock in consideration of the conversion of $116,338 of debt at the average rate of $0.3251 per share.

On March 1, 2013, the Company and Global Investments I, LLC (“Global”) entered into a Stock Purchase Agreement, whereby Global agreed to purchase 818,182 shares of Common Stock at a purchase price of $0.55 per share.

On March 1, 2013, the Company and Angelique de Maison (“de Maison”) entered into a Stock Purchase Agreement, whereby de Maison agreed to purchase 181,818 shares of Common Stock at a purchase price of $0.55 per share.

Dividends

Our Board of Directors has not declared a dividend on our Common Stock since inception and presently anticipate that all earnings, if any, will be retained for development of our business and that no dividends on our common stock will be declared in the foreseeable future. Any future dividends will be subject to the discretion of our Board of Directors and will depend upon, among other things, future earnings, operating and financial condition, capital requirements, general business conditions and other pertinent facts. Therefore, there can be no assurance that any dividends on our common stock will be paid in the future.

| 8 |

| Item 6 | SELECTED FINANCIAL DATA |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| Item 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

References in this Annual Report to the “Company”, “we”, “us” or “our” refer to Lustros, Inc., a Utah corporation (“Lustros”), and its consolidated subsidiaries including, Bluestone, S.A, (“Bluestone”), Lustros Chile SpA (“Lustros Chile”), Mineraltus SA (“Mineraltus”) and Sulfatos Chile, S.A., (“Sulfatos Chile”). The following discussion of our financial condition and results of operations should be read in conjunction with the financial statements and related notes to the financial statements included elsewhere in this filing.

We are a pre-revenue development stage company that intends to market and sell the high quality food-grade copper sulfate obtained by processing copper ores and tailings at Company-owned processing facilities in Chile.

On March 9, 2012, Lustros acquired all of the outstanding capital stock and rights to acquire capital stock of Bluestone, S.A. a Chilean corporation ("Bluestone"), in exchange for 60,000,000 shares of its common stock (the "Bluestone Acquisition"). As of the closing, these shares represented 96.7% of Lustros' outstanding common stock. For financial reporting purposes, the Company has treated the Bluestone Acquisition as a reverse acquisition with Bluestone the acquiring entity and Lustros as the acquired entity. As a result, the Company's financial statements reflect the financial information of Bluestone prior to March 9, 2012 and the combined entity on and after March 9, 2012. Because Bluestone commenced operations in January 2012, there are no results of operations for Bluestone prior to that date.

On February 15, 2012, Bluestone purchased a 60% equity interest in Sulfatos Chile, S.A. from Santa Teresa Minerals S.A., a Chilean corporation ("Santa Teresa Minerals"). The purchase price for the equity interest was: (a) a 20% interest in Bluestone; (b) $2.2 million, with $1.1 million paid by assumption of a demand loan payable by Santa Teresa Minerals to Angelique de Maison, and the balance of $1.1 million to be paid in monthly installments from time to time upon demand by Santa Teresa Minerals. As of December 31, 2012, the entire purchase price has been paid. On October 16, 2012 Angelique de Maison entered into an agreement with Santa Teresa Minerals pursuant to which Santa Teresa Minerals waived and released any claim to any Equity Interests in Bluestone or Lustros and their affiliated companies, with Bluestone and Lustros Inc. express third party beneficiaries of that waiver and release. As such, Santa Teresa Minerals' 20% interest in Bluestone has been cancelled, and Bluestone is a wholly owned subsidiary of Lustros. This acquisition has been treated as an "asset purchase" for financial reporting purposes. Because the acquisition was between related parties, the purchase price has been allocated to additional paid-in capital and the assets and liabilities were carried over at historical costs. Results of operations for Sulfatos have been reflected in the Company's financial statements from the closing date.

| 9 |

On March 25, 2012, the Company sold the assets (including the "Power-Save" name) of its renewable energy and energy savings product business in which it had engaged prior to the Bluestone Acquisition, to the former management of the Company. The purchase price for the assets was the cancellation of obligations for unpaid salaries and other monies owed to prior management and the assumption by the buyer of certain liabilities of the Company related to the Power-Save business.

We will process copper ore at our copper sulfate processing plant in Puerto Oscuro, Chile. We will obtain the copper ore from our 1,325 hectare Anica copper mine or by purchase from local artisanal miners. Our copper sulfate facility is expected to begin processing 5,000 tons of material per month in the second quarter of 2013. The current plant capacity of 15,000 tons per month will occur upon receiving permits for unlimited production which we expect to receive in the fourth quarter of 2013. Cash flow from this first phase is expected to begin in the third quarter of 2013 and will fund future expansion for an additional 25,000 ton processing plant.

Our consolidated financial statements contain our accounts and those of our consolidated subsidiaries, all of which are wholly-owned at December 31, 2012 except for Sulfatos and Mineraltus, which we control. Due to the structure of our ownership interests in Sulfatos and Mineraltus, in accordance with generally accepted accounting principles, we consolidate the financial statements of Sulfatos and Mineraltus into our financial statements rather than present our ownership interests as equity investments. As such, the non-controlling interests in Sulfatos and Mineraltus are reflected as income attributable to minority interests in our consolidated statements of operations and as a component of stockholders’ equity on our consolidated balance sheet. Throughout this section, when we refer to “our” consolidated financial statements, we are referring to the consolidated results for us, our wholly-owned subsidiaries and the consolidated results of Sulfatos and Mineraltus, adjusted for non-controlling interests in Sulfatos and Mineraltus. All significant intercompany transactions and balances have been eliminated in the consolidation of our financial statements.

RESULTS OF OPERATIONS From Inception (January 26, 2012) to December 31, 2012

The following discusses results of operations from Inception (January 26, 2012) to December 31, 2012. There is no comparable historic financial information because Bluestone’s operations did not begin until January 2012.

Revenue from Inception (January 26, 2012) to December 31, 2012 was $54,902, most of which was earned from a one-time mining project completed for Casablanca Mining, the parent company of Santa Teresa Minerals. Gross profit from Inception (January 26, 2012) to December 31, 2012 was $54,902 respectively. We expect revenues to increase significantly after the full scale launch of our copper sulfate production facility in the second quarter of 2013.

Operating expenses from Inception (January 26, 2012) to December 31, 2012 were $4,370,574. Operating expenses were primarily associated with the operations of Sulfatos in the ordinary course of business as well as legal and accounting expenses required by a public company.

Due to the losses during the period the Company has not recorded a provision for income taxes. The Company will carry back any net operating loss to recover taxes paid in prior periods.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES.

As of December 31, 2012, our current liabilities exceeded our current assets by $2,497,941. Through December 31, 2012, we had cash in the amount of $277,565.

Cash Requirements

During the next twelve months, the Company plans to satisfy its cash requirements by income from operations, loans and the sale of debt and equity securities. There can be no assurance that the Company will be successful in raising the capital it requires through loans or the sale of securities. While directors, officers, and principal shareholders have provided funding to the Company throughout 2012, they have no commitment to provide additional funding.

| 10 |

Sulfatos Chile

The Company acquired property and equipment owned by Sulfatos Chile with a historical cost value of $7,331,655 in the Bluestone Acquisition in March 2012. The Company has spent an additional $1.1M in property and equipment purchases as of December 31, 2012 toward the completion of the copper sulfate processing plant in Puerto Oscuro, Chile. We expect the plant will be completed by end of the second quarter of 2013 and will cost an additional $450,000 in capital expenditures to complete.

Going forward, Sulfatos Chile expects to incur average monthly costs, of approximately $220,000 once it begins production at the copper sulfate processing plant. These costs will be paid for by income from operations.

Congo Project

On October 18, 2012, the Company entered into an agreement pursuant to which the Company acquired the land, laboratory, tailings and other assets of the closed mine of La Africana, commonly known as the "Congo Project”, in the Santiago, Chile metropolitan area. The land is approximately 81.2 hectares and contains an estimated 2.4 million tons of copper-rich tailings. The purchase price was $7 million payable as follows:

| · | $360,000 was paid in November 2012 for the right to use all assets and facilities; |

| · | $436,858 is payable upon completion of the copper sulfate processing plant on site no later than November 13, 2014 as the final payment for the assets; |

| · | $6,203,172 is payable in equal monthly installments of $77,540 beginning on July 1, 2013 for the lease of the Lo Aguirre main pit. SMP may request that the final 12 lease payments not be made by the Company in exchange for the return of 60.2 hectares of land at their option on or before date the 69th lease payment is made. |

The Company has agreed to remove the tailings and restore the value of the property so that it can be used for real estate development projects. The Company will separate the copper from the tailings with the intention of manufacturing an estimated 24,000 tons of food-grade, penta-hydrated copper sulfate. The Company plans to construct a copper sulfate processing plant on the property to process the tailings at an estimated cost of $6.2 million by November 2014.

Future Financing

We will continue to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund planned acquisitions and exploration activities.

Critical Accounting Estimates and Policies

The discussion and analysis of our financial condition and plan of operations is based upon our financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates including, among others, those affecting revenue, the allowance for doubtful accounts, the salability of inventory and the useful lives of tangible and intangible assets. The discussion below is intended as a brief discussion of some of the judgments and uncertainties that can impact the application of these policies and the specific dollar amounts reported on our financial statements. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions, or if management made different judgments or utilized different estimates. Many of our estimates or judgments are based on anticipated future events or performance, and as such are forward-looking in nature, and are subject to many risks and uncertainties, including those discussed elsewhere in this Annual Report on Form 10-K. We do not undertake any obligation to update or revise this discussion to reflect any future events or circumstances.

| 11 |

We have identified below some of our accounting policies that we consider critical to our business operations and the understanding of our results of operations. This is not a complete list of all of our accounting policies, and there may be other accounting policies that are significant to us. For a detailed discussion on the application of these and our other accounting policies, see Note 2 to the financial statements, included in this Annual Report on Form 10-K.

Mining Properties and Equipment

The Company will follow the successful efforts method of accounting. All developmental costs will be capitalized. Depreciation and depletion of producing properties will be computed on the unit-of-production method based on estimated proved reserves. Repairs and maintenance will be expensed, while renewals and betterments will be generally capitalized.

At least quarterly, or more frequently if conditions indicate that long-term assets may be impaired, the carrying value of our properties will be compared to management's future estimated pre-tax cash flow from the properties. If undiscounted cash flows are less than the carrying value, then the asset value will be written down to fair value. Impairment of individually significant unproved properties will be assessed on a property-by-property basis, and impairment of other unproved properties is assessed and amortized on an aggregate basis.

Asset Retirement Obligation

The Company follows ASC 410, Asset Retirement and Environmental Obligations, which requires that an asset retirement obligation (“ARO”) associated with the retirement of a tangible long-lived asset be recognized as a liability in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated asset. The cost of the tangible asset, including the initially recognized ARO, is depleted, such that the cost of the ARO is recognized over the useful life of the asset. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted liability is accreted to its expected settlement value. The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate. To date, the Company estimates that an asset retirement obligation of $396,474 exists. Accordingly, a liability for this amount has been included in accounts payable and accrued liabilities.

Proven and Probable Reserves

The definition of proven and probable reserves is set forth in SEC Industry Guide 7. Proven reserves are reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. Probable reserves are reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. In addition, reserves cannot be considered proven and probable until they are supported by a feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable at the time of the reserve determination.

Mineral Acquisition Costs

The costs of acquiring land and mineral rights are considered tangible assets. Significant acquisition payments are capitalized. General, administrative and holding costs to maintain an exploration property are expensed as incurred. If a mineable ore body is discovered, such costs are amortized when production begins using the units-of-production method. If no mineable ore body is discovered or such rights are otherwise determined to have diminished value, such costs are expensed in the period in which the determination is made.

Exploration Costs

Exploration costs are charged to expense as incurred. Costs to identify new mineral resources, to evaluate potential resources, and to convert mineral resources into proven and probable reserves are considered exploration costs.

Design, Construction, and Development Costs

Certain costs to design and construct mine and processing facilities may be incurred prior to establishing proven and probable reserves. Under these circumstances, we classify the project as an exploration stage project and expense substantially all costs, including design, engineering, construction, and installation of equipment. Certain types of equipment, which have alternative uses or significant salvage value, may be capitalized. If a project is determined to contain proven and probable reserves, costs incurred in anticipation of production can be capitalized. Such costs include development drilling to further delineate the ore body, removing overburden during the pre-production phase, building access ways, constructing facilities, and installing equipment. If a project is not reliant on proven or probable reserves, we classify the project as a development stage project and capitalize substantially all construction in process costs, including design, engineering, construction, equipment and installation of equipment. Interest costs, if any, incurred during the development phase, would be capitalized until the assets are ready for their intended use. The cost of start-up activities and on-going costs to maintain production are expensed as incurred. Costs of abandoned projects are charged to operations upon abandonment.

| 12 |

If a project commences commercial production, amortization and depletion of capitalized costs is computed on a unit-of–production basis over the expected reserves of the project based on estimated recoverable resources.

Income Taxes

Accounting Standards Codification Topic No. 740 “Income Taxes” (ASC 740) requires the asset and liability method of accounting be used for income taxes. Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Future Financing

We may continue to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund planned acquisitions and exploration activities.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Recently Issued Accounting Pronouncements

In February 2013, the FASB issued authoritative guidance on the reporting of reclassifications out of accumulated other comprehensive income. The guidance requires an entity to present, either on the face of the statement where net income is presented or in the notes, significant amounts reclassified out of accumulated other comprehensive income by the respective line items of net income if the amount is reclassified to net income in its entirety in the same reporting period. The guidance is effective for fiscal years beginning after December 15, 2012, with early adoption permitted. The adoption of this guidance did not have a material effect on the Company’s financial condition, results of operations or cash flows.

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

| Item 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| 13 |

| Item 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

LUSTROS, INC. AND SUBSIDIARIES

Financial Statements

From Inception (January 26, 2012) to December 31, 2012

| Index to Financial Statements | Page |

| Report of Independent Registered Public Accounting Firm. | F-1 |

| Consolidated Balance Sheet as of December 31, 2012. | F-2 |

| Consolidated Statement of Operations from Inception (January 26, 2012) to December 31, 2012. | F-3 |

| Consolidated Statement of Stockholders' Equity from Inception (January 26, 2012) to December 31, 2012. | F-4 |

| Consolidated Statement of Cash Flows from Inception (January 26, 2012) to December 31, 2012. | F-5 |

| Notes to the Consolidated Financial Statements. | F-6 |

| 14 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Lustros, Inc.

We have audited the accompanying consolidated balance sheet of Lustros, Inc. and Subsidiaries (A Development Stage Company) (the “Company”) as of December 31, 2012 and the related consolidated statements of operations, stockholders’ equity and cash flows for the period from inception (January 26, 2012) through December 31, 2012. Lustros, Inc.’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Lustros, Inc. and subsidiaries (A Development Stage Company) as of December 31, 2012 and the results of its operations and its cash flows for the period from inception (January 26, 2012) through December 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ De Joya Griffith, LLC

Henderson, Nevada

April 13, 2013

| F-1 |

Lustros, Inc. and Subsidiaries

(A Development Stage Company)

Consolidated Balance Sheet

(Audited)

| December 31, 2012 | ||||

| ASSETS | ||||

| Current Assets | ||||

| Cash | $ | 277,565 | ||

| Other receivables | 102 | |||

| Prepaid expenses | 224,777 | |||

| Inventory | 142,385 | |||

| VAT tax receivable | 573,541 | |||

| Total current assets | 1,218,369 | |||

| Other Assets | ||||

| Fixed asset, net | 4,647,816 | |||

| Mining property | 3,720,011 | |||

| Land | 585,040 | |||

| Congo right to use | 360,000 | |||

| Total other assets | 9,312,867 | |||

| TOTAL ASSETS | $ | 10,531,236 | ||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

| Liabilities | ||||

| Accounts payable | $ | 1,000,500 | ||

| Convertible note payable, net of $141,411 in unamortized discount | 205,589 | |||

| Notes payable | 684,292 | |||

| Notes payable - related party | 1,825,929 | |||

| Total liabilities | 3,716,310 | |||

| Long term liabilities | ||||

| Asset retirement obligations | 396,474 | |||

| Total long term liabilities | 396,474 | |||

| Total liabilities | 4,112,784 | |||

| Stockholders' Equity | ||||

| Preferred stock, $.001 par value, 10,000,000 shares authorized, no shares issued and outstanding | – | |||

| Common stock, $.001 par value, 100,000,000 shares authorized, 88,369,618 issued and outstanding | 88,369 | |||

| Additional paid in capital | 6,234,946 | |||

| Minority interest | 2,005,189 | |||

| Accumulated other comprehensive income | 1,217,828 | |||

| Deficit accumulated during development stage | (3,127,879 | ) | ||

| Total stockholders' equity | 6,418,453 | |||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 10,531,236 | ||

See notes to consolidated financial statements.

| F-2 |

Lustros, Inc. and Subsidiaries

(A Development Stage Company)

Consolidated Statement of Operations

(Audited)

Inception, (January 26, 2012) to December 31, 2012 | ||||

| Revenue | $ | 54,902 | ||

| Cost of goods sold | – | |||

| Gross profit | 54,902 | |||

| Operating expenses | ||||

| General and administrative | 2,050,798 | |||

| Depreciation | 85,712 | |||

| Payroll | 1,440,969 | |||

| Legal and accounting | 528,478 | |||

| Mining costs | 187,749 | |||

| Research & development | 76,868 | |||

| Total operating expenses | 4,370,574 | |||

| Loss from continued operations | (4,315,672 | ) | ||

| Interest expense | (71,321 | ) | ||

| Net loss | $ | (4,386,993 | ) | |

| Net loss attributable to minority interest | $ | (1,259,114 | ) | |

| Net loss attributable to Lustros, Inc. | $ | (3,127,879 | ) | |

| Loss per share, basic | $ | (0.07 | ) | |

| Weighted average common shares, basic | 60,966,183 | |||

Consolidated Statements of Comprehensive Income (Loss)

(Audited) Inception, (January 26, 2012) to December 31, 2012

Inception, (January 26, 2012) to December 31, 2012 | ||||

| Net loss | $ | (4,386,993 | ) | |

| Gain/(loss) on foreign currency conversion | 1,217,828 | |||

| Total comprehensive loss | $ | (3,169,165 | ) | |

See notes to consolidated financial statements.

| F-3 |

Lustros, Inc. and Subsidiaries

(A Development Stage Company)

Consolidated Statements of Stockholders’ Equity

(Audited)

| Number of Shares Outstanding, Preferred | Preferred Stock at Par Value | Number of Shares Outstanding, Common | Common Stock at Par Value | Additional Paid in Capital | Minority Interest in Sulfatos Chile | Other Comprehensive Income | Deficit Accumulated During Development Stage | Total Stockholders Equity/(Deficit) | |||||||||||||||||||

| Balance at January 26, 2012-inception | – | $ | – | – | $ | – | $ | – | $ | – | $ | – | $ | – | $ | – | |||||||||||

| Stocks issued to Founders | – | – | 60,000,000 | 60,000 | (60,000 | ) | – | – | – | – | |||||||||||||||||

| February 15, 2012 purchase of Sulfatos Chile | – | – | – | – | 2,696,455 | 3,264,303 | – | – | 5,960,758 | ||||||||||||||||||

| March 9, 2012 reverse merger adjustments | – | – | 2,856,426 | 2,856 | (27,491 | ) | – | – | – | (24,635 | ) | ||||||||||||||||

| Power-Save disposal adjustments | – | – | – | – | 41,496 | – | – | – | 41,496 | ||||||||||||||||||

| Stocks issued for cash | 175,000 | 175 | 7,898,395 | 7,898 | 3,441,927 | – | – | – | 3,450,000 | ||||||||||||||||||

| Stocks issued in preferred stock conversion | (175,000 | ) | (175 | ) | 17,500,000 | 17,500 | (17,325 | ) | – | – | – | – | |||||||||||||||

| Stocks issued for debt conversion | – | – | 177,714 | 178 | 159,822 | – | – | – | 160,000 | ||||||||||||||||||

| Stocks held in trust returned to treasury | – | – | (62,917 | ) | (63 | ) | 63 | – | – | – | – | ||||||||||||||||

| Gain on currency conversion | – | – | – | – | – | – | 1,217,828 | – | 1,217,828 | ||||||||||||||||||

| Net loss at December 31, 2012 | – | – | – | – | – | (1,259,114 | ) | – | (3,127,879 | ) | (4,386,993 | ) | |||||||||||||||

| Balance at December 31, 2012 | – | $ | – | 88,369,618 | $ | 88,369 | $ | 6,234,947 | $ | 2,005,189 | $ | 1,217,828 | $ | (3,127,879 | ) | $ | 6,418,454 | ||||||||||

See notes to consolidated financial statements.

| F-4 |

Lustros, Inc. and Subsidiaries

(A Development Stage Company)

Consolidated Statements of Cash Flows

(Audited)

Inception, (January 26, 2012) to December 31, 2012 | ||||

| Cash flows from operating activities | ||||

| Net loss | $ | (4,386,993 | ) | |

| Non-cash transactions to reconcile cash used in operations | ||||

| Depreciation and amortization | 85,712 | |||

| Amortization of original issued discount | 65,589 | |||

| Cash used in operations | ||||

| Increase in accrued interest included in notes payable | 5,732 | |||

| Increase in prepaid expenses | (176,254 | ) | ||

| Increase in asset retirement obligation | 14,860 | |||

| Increase in accounts payable | 933,702 | |||

| Total cash from operations | (3,457,652 | ) | ||

| Cash flows from investing activities | ||||

| Cash received in acquisition of Sulfatos Chile by Bluestone | 892,294 | |||

| Cash received in Power Save merger | 38,572 | |||

| Disposal of Power Save operations | (20,642 | ) | ||

| Purchase of fixed assets | (830,676 | ) | ||

| Total cash provided by investing activities | 79,548 | |||

| Cash from financing activities | ||||

| Proceeds from notes payable | 79,454 | |||

| Repayment of notes payable | (46,263 | ) | ||

| Proceeds from notes payable, related parties | 3,111,381 | |||

| Repayment of notes payable, related parties | (1,385,464 | ) | ||

| Proceeds from the issuance of stock | 1,921,000 | |||

| Total cash provided by financing activities | 3,680,108 | |||

| Effect if foreign currency exchange rate on cash | (24,439 | ) | ||

| INCREASE IN CASH | 277,565 | |||

| BEGINNING CASH | – | |||

| ENDING CASH | $ | 277,565 | ||

| Supplemental disclosure of cash flow information: | ||||

| Interest paid | $ | – | ||

| Income taxes paid | $ | – | ||

| Supplemental disclosure of non-cash investing activities: | ||||

| Related party notes transferred to convertible notes | $ | (300,000 | ) | |

| Shares issued in conversion on convertible note | $ | 160,000 | ||

| Related party notes settled with subscription to common stock | $ | 1,100,000 | ||

| Related party notes settled with subscription to preferred stock | $ | 429,000 | ||

| Net assets acquired in reverse merger with Power Save | $ | (63,207 | ) | |

| Net assets acquired in Sulfatos Chile acquisition | $ | 5,068,464 | ||

| Net assets disposed of in Power Save sale | $ | 62,138 | ||

| Effect of reverse merger with Power Save | $ | (24,635 | ) | |

| Contributed capital in Sulfatos Chile acquisition | $ | 2,696,455 | ||

| Contributed capital in Power Save sale | $ | 41,496 | ||

See notes to consolidated financial statements.

| F-5 |

LUSTROS, INC.

(A Development Stage Company)

NOTES TO AUDITED CONSOLIDATED

FINANCIAL STATEMENTS

Note 1 - Organization and Principal Activities

Organization and Description of Business

Lustros, Inc. ("Lustros", and together with its consolidated subsidiaries, the "Company"), formally Power-Save Energy Company, is a Utah corporation formed in 1980. The Company is a pre-revenue development stage company that intends to market and sell high quality food-grade copper sulfate obtained by processing copper ores and tailings at Company-owned processing facilities in Chile.

On March 9, 2012, Lustros acquired all of the outstanding capital stock and rights to acquire capital stock of Bluestone, S.A. a Chilean corporation (“Bluestone”), in exchange for 60,000,000 shares of its common stock (the "Bluestone Acquisition"). Bluestone's principal asset is a 60% equity interest in Sulfatos Chile, S.A. ("Sulfatos"), which it acquired in February 2012.

For accounting purposes, the Company has treated the Bluestone Acquisition as a reverse acquisition with Bluestone the acquiring entity and Lustros as the acquired entity. As a result, the Company's financial statements reflect the financial information of Bluestone prior to March 9, 2012 and the combined entity on and after March 9, 2012.

On March 25, 2012, the Company sold the assets (including the "Power-Save" name) of its renewable energy and energy savings product business in which it had engaged prior to the Bluestone Acquisition, to the former management of the Company (the "Power Save Sale"). See Note 4--Bluestone Acquisition and Power Save Sale.

On June 25, 2012, the Company created a new subsidiary, Mineraltus S.A. (“Mineraltus”), a Chilean corporation, to extract copper from the tailings (waste products) of expired copper mines to secure the raw materials to manufacture high quality, feed-grade copper sulfate. The Company owns 80% of Mineraltus.

On August 22, 2012, the Company formed Lustros Chile SpA as a 100% owned subsidiary, for the purpose of acting as a Chilean entity holding company for the Company’s Chilean subsidiaries Sulfatos, Mineraltus, and Bluestone.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The preparation of these consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts in the consolidated financial statements, including the estimated useful lives of tangible and intangible assets and the asset retirement obligation. Management believes the estimates used in preparing the financial statements are reasonable and prudent. Actual results could differ from these estimates.

Principles of Consolidation

The consolidated financial statements include the financial statements of Lustros, Inc., its subsidiaries Lustros Chile SpA, Mineraltus, Bluestone, and Sulfatos. All significant inter-company balances and transactions have been eliminated in consolidation.

| F-6 |

Foreign Currency Translation

The Company records foreign currency translation adjustments and transaction gains and losses in accordance with ASC 830, Foreign Currency Matters. The functional currency of Bluestone and its subsidiaries is the Chilean Peso ("CLP"). Assets and liabilities of Bluestone and its subsidiaries are translated into United States dollars at the exchange rates as of the balance sheet dates. Revenues and expenses of Bluestone and its subsidiaries are translated into United States dollars at average exchange rates in effect during the period. The resulting cumulative translation adjustments have been recorded as a component of comprehensive income (loss), included as a separate item in the statement of operations.

For purpose of these consolidated financial statements: (i) the exchange rate was $478.60 CLPs to 1 US dollar at December 31, 2012; and (ii) the average exchange rates were $492.50 CLPs to 1 US dollar during the twelve months ended December 31, 2012.

The Company is exposed to movements in foreign currency exchange rates. In addition, the Company is subject to risks including adverse developments in the foreign political and economic environment, trade barriers, managing foreign operations, and potentially adverse tax consequences. There can be no assurance that any of these factors will not have a material negative impact on the Company's financial condition or results of operations in the future.

Financial Instruments

The Company's financial instruments include cash and cash equivalents, and accounts payable and notes payable. At December 31, 2012, the carrying cost of these instruments approximated their fair value. The authoritative guidance for fair values establishes a three tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

Cash Equivalents

Cash equivalents include highly liquid investments with maturities of three months or less.

Inventory

Inventory, which consists primarily of raw copper ore and copper sulfate, is stated at the lower of cost or market. Cost is determined by the first-in, first-out (FIFO) method.

The Company evaluates the need to record adjustments for impairment of inventory.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and impairment. Land is not depreciated.

Depreciation is computed principally on the straight-line method over the estimated useful life of each type of asset which ranges from three to five years. Major improvements are capitalized, while expenditures for repairs and maintenance are expensed when incurred. The depreciation methods, and estimated remaining useful lives are reviewed at least annually. Upon classification of property and equipment as held for sale it is reviewed for impairment. The impairment charged to the income statement is the excess of the carrying value of the property and equipment over its expected fair value less costs to sell. Upon retirement or disposition, the related costs and accumulated depreciation are removed from the accounts, and any resulting gains or losses are credited or charged to income.

Mining Properties and Equipment

The Company will follow the successful efforts method of accounting. All developmental costs will be capitalized. Depreciation and depletion of producing properties will be computed on the unit-of-production method based on estimated proved reserves. Repairs and maintenance will be expensed, while renewals and betterments will be generally capitalized.

| F-7 |

At least quarterly, or more frequently if conditions indicate that long-term assets may be impaired, the carrying value of our properties will be compared to management's future estimated pre-tax cash flow from the properties. If undiscounted cash flows are less than the carrying value, then the asset value will be written down to fair value. Impairment of individually significant unproved properties will be assessed on a property-by-property basis, and impairment of other unproved properties is assessed and amortized on an aggregate basis.

Asset Retirement Obligation