Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011.

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-52512

Coyote Resources, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-5874196

|

||

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

||

|

5490 Longley Lane, Reno, Nevada 89511

|

89511

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(775) 846-8398

|

|

|

(Registrant's Telephone Number, Including Area Code)

|

|

|

Securities registered under Section 12(b) of the Act:

|

|

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

None

|

None

|

|

Securities registered under Section 12(g) of the Act:

|

|

|

Common Stock, Par Value $.001

(Title of Class)

|

|

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated file, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of June 30, 2011, approximately $31,502,000.

As of April 12, 2012, there were 46,502,120 shares of the issuer's $.001 par value common stock issued and outstanding.

Documents incorporated by reference. There are no annual reports to security holders, proxy information statements, or any prospectus filed pursuant to Rule 424 of the Securities Act of 1933 incorporated herein by reference.

1

EXPLANATORY NOTE

Coyote Resources Inc., a Nevada corporation (the “Registrant”) is filing this Amendment No. 1 (the “Amendment”) to its Annual Report on Form 10-K which was originally filed with the Securities and Exchange Commission (“SEC”) on April 16, 2012 (the “Original Form 10-K”) to incorporate certain restated financial information. As previously disclosed in the Registrant’s Current Report on Form 8-K filed on April 16, 2013, the Registrant’s Board of Directors concluded that the financial statements in the Original Form 10-K should not be relied on due to certain errors in correctly reporting the effects of derivative accounting required for certain of the Registrant’s convertible debt instruments. The Registrant has included the necessary restated financial information in Note 15 to the financial statements contained in this Amendment. Except for the restated financial information, all other information in this Amendment has not been updated to reflect events that occurred after April 16, 2012, the filing date of the Original Form 10-K. Accordingly, this Amendment should be read in conjunction with the Registrant’s filings made with the SEC subsequent to the filing of the Original Form 10-K. The Registrant has re-filed the entire Form 10-K in order to provide more convenient access to the amended information in context.

TABLE OF CONTENTS

PART I

|

Page

|

||||

PART II

PART III

PART IV

|

|

||||

2

FORWARD-LOOKING STATEMENTS

This Annual Report of Coyote Resources, Inc. on Form 10-K contains forward-looking statements, particularly those identified with the words “anticipates,” “believes,” “expects,” “plans,” “intends,” “objectives,” and similar expressions. These statements reflect management's best judgment based on factors known at the time of such statements. The reader may find discussions containing such forward-looking statements in the material set forth under “Management's Discussion and Analysis and Plan of Operations,” generally, and specifically therein under the captions “Liquidity and Capital Resources” as well as elsewhere in this Annual Report on Form 10-K. Actual events or results may differ materially from those discussed herein. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements.

PART I

Our Background. Coyote Resources, Inc. (“Coyote,” “We” or the “Company”), formerly, BLS Media, Inc., was incorporated in the State of Nevada on October 31, 2006 to conduct a business in the video production and media relations industry. On August 12, 2010, we entered into an Agreement and Plan of Merger with Coyote Resources, Inc., our wholly owned subsidiary (“Coyote Sub”) pursuant to which Coyote Sub merged with and into the Company and we changed our name to “Coyote Resources, Inc.” On that same date, we entered into a Debt Repayment Agreement with KMR Resources, Inc. (“KMR”), pursuant to which KMR agreed to repay us the amount due pursuant to a promissory note dated April 23, 2010, by assigning to us all of KMR’s rights to the Tonopah Extension Mine and the Golden Trend Property (“Asset Acquisition”). As a result of the Asset Acquisition, we changed management, entered the mining business, and ceased all activity in our former business. We have not undergone bankruptcy, receivership, or any similar proceeding.

Our Business. We are an early stage mining company led by an experienced management and focused on exploration of mineral properties. Our business plan is to acquire mining properties for exploration and development with the intent to bring the projects to feasibility at which time we will either contract out the operations or joint venture the project to qualified interested parties. Our main priority will be given to projects with near term cash flow potential, although consideration will be given to projects that may not be as advanced from a technical standpoint but demonstrate the potential for significant upside.

Our Properties.

Tonopah Extension Mine. The Tonopah Extension Mine is an exploration property located in south-central Nevada, midway between Reno and Las Vegas. The Tonopah mining district is centered on the town of Tonopah in Nye and Esmeralda Counties near the intersection of two major highways, one north-south and the other east-west. Our total land holdings comprise 958 acres of mineral rights and 368 acres of patented surface rights with additional holdings of 487 acres of patented surface rights for mining purposes within the Lambertucci Ranch holdings.

Golden Trend Property. The Golden Trend Property is an early stage exploration property located on the southwestern flank of the Cortez Mountains, approximately 70 miles southwest of Elko, Nevada in the Buckhorn mining district. A total of 111 contiguous, unpatented mining claims, located on land administered by the Bureau of Land Management comprise the property, totaling approximately 2230 acres. It is along the Cortez Trend and lies astride the Cortez Fault. We control 100% of the property through a lease with the property owner.

Business Strategy. Our strategy is to increase shareholder value through strategic acquisitions, exploration and development. We are currently focused on the development and exploitation of the Tonopah Extension Mine and the Golden Trend Property. We are also searching for possible joint-ventures that fit our strategic focus.

3

Competition. In the United States, there are numerous mining and exploration companies, both big and small. All of these mining companies are seeking properties of merit and funds. We will have to compete against such companies to acquire the funds to develop our mineral claims. The availability of funds for exploration is sometimes limited, and we may find it difficult to compete with larger and more well-known companies for capital. Even though we have the right to the minerals on our claims, we cannot guaranty that we will be able to raise sufficient funds in the future to maintain our mineral claims in good standing. Therefore, if we do not have sufficient funds for exploration, our claims might lapse and be staked by other mining interests. We may be forced to seek a joint venture partner to assist in the exploration of our mineral claims. In this case, there is the possibility that we may not be able to pay our proportionate share of the exploration costs and may be diluted to an insignificant carried interest.

Even when a commercially viable ore body is discovered, we cannot guaranty that competition in refining the ore will not exist. Other companies may have long-term contracts with refining companies, thereby inhibiting our ability to process our ore and eventually market it. At this point in time, we do not have any contractual agreements to refine any potential ore we may discover on our mineral claims.

The exploration business is highly competitive and highly fragmented, dominated by both large and small mining companies. Success will largely depend on our ability to attract talent from the mining field and our ability to fund our operations. We cannot guaranty that our mineral expansion plans will be realized.

Intellectual Property. We do not presently own any copyrights, patents or trademarks. We own the Internet domain name www.coyoteresourcesinc.com. Under current domain name registration practices, no one else can obtain an identical domain name, but someone might obtain a similar name, or the identical name with a different suffix, such as “.org”, or with a country designation. The regulation of domain names in the United States and in foreign countries is subject to change, and we could be unable to prevent third parties from acquiring domain names that infringe or otherwise decrease the value of our domain names.

Governmental Regulation. We are committed to complying, and, to our knowledge, are in compliance, with all governmental and environmental regulations. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which future legislation and regulation could cause additional expense, capital expenditures, restrictions, and delays in the exploration of our properties.

Our activities are not only subject to extensive federal, state, and local regulations controlling the mining of, and exploration for, mineral properties, but also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions, and delays in the exploration of our properties, the extent of which cannot be predicted. Permits may also be required from a variety of regulatory authorities for many aspects of mine operation and reclamation. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards, existing laws, and regulations that may entail greater or lesser costs and delays depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraint affecting our properties that would preclude the economic development or operation of any specific property.

It is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed exploration operations; costs associated with minimizing surface impact; water treatment and protection; reclamation activities, including rehabilitation of various sites; on-going efforts at alleviating the mining impact on wildlife; and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide not to proceed with exploration on any of our mineral properties.

We are prepared to engage professionals, if necessary, to ensure regulatory compliance, but in the near term we expect our activities to require minimal regulatory oversight. If we expand the scope of our activities in the future, it is reasonable to expect expenditures on compliance to rise.

Research and Development. We are not currently conducting any research and development activities, nor have we during the last two fiscal years, other than property explorations and assessments.

Employees. As of April 12, 2012, we have no significant employees other than our sole officer. We plan to outsource independent consultants on a consulting basis to conduct the work programs on our mineral properties in order to carry out our plan of operations.

4

Facilities. Our executive offices are located at 5490 Longley Lane, Reno, Nevada 89511, where we occupy approximately 150 square feet of office space. We lease our offices from Telesto Nevada, Inc. in exchange for $800 per month on a month to month basis. We believe that our current office space and facilities are sufficient to meet our present needs and do not anticipate the need to secure any additional space.

Internet Website. Our Internet website, which is located at www.coyoteresourcesinc.com, describes our properties, management, and information regarding our industry.

Legal Proceedings. There are no legal actions pending against us nor are any legal actions contemplated by us at this time.

We have a limited operating history, and if we are not successful in growing our business, we may have to scale back or even cease our ongoing business operations.

Our company has a limited operating history and must be considered in the exploration stage. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to generate revenues or operate on a profitable basis. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. If our business plan is not successful and we are not able to operate profitably, investors may lose some or all of their investment in our company.

We have no revenues to sustain our operations.

We are currently developing our business and have generated no revenues. We are not able to predict whether we will be able to develop and exploit the Tonopah Extension Mine and the Golden Trend Property and generate any revenues. If we are not able to complete the successful development of our properties, generate significant revenues and attain sustainable operations, then our business will fail.

We have a history of net losses which will continue and which may negatively impact our ability to achieve our business objectives.

For the period from inception (October 31, 2006) to December 31, 2011, we have a net loss of $2,277,838. We cannot guaranty that we will be able to generate any significant revenues or that our future operations will result in net income. We may not ever be able to operate profitability on a quarterly or annual basis in the future. Our failure to generate and increase our revenues will harm our business. If the amount of time it takes for us generate revenues is longer than we anticipate or our operating expenses exceed our expectations, our operating results will suffer and our business may fail.

Our auditors have expressed substantial doubt regarding our ability to continue operations as a “going concern.” Investors may lose all of their investment if we are unable to continue operations and generate revenues, or if we do not raise sufficient funds.

We will seek to raise additional funds to meet our working capital needs principally through the additional sales of our securities. However, we cannot guaranty that we will be able to obtain sufficient additional funds, or that such funds, if available, will be obtainable on terms satisfactory to us. If we do not raise sufficient funds, we may not be able to continue operations. As a result, our auditors believe that substantial doubt exists about our ability to continue operations.

We need additional financing to execute our business plan.

We need substantial additional funds to effectuate our business plan and fund the development and exploitation of the Tonopah Extension Mine and the Golden Trend Property. We will seek additional funds through public or private equity or debt financing, joint ventures and/or from other sources. There are no assurances that funding will be available on favorable terms or at all. If additional funding is not obtained, we will need to reduce, defer or cancel programs, planned initiatives, or overhead expenditures to the extent necessary. The failure to fund our operating and capital requirements could have a material adverse effect on our business, financial condition and results of operations.

5

Additional capital may be costly or difficult to obtain.

Additional capital, whether through the offering of equity or debt securities, may not be available on reasonable terms or at all. If we are unable to obtain required additional capital, we may have to curtail our plans and, further, we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business. We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

There are numerous exploration and development risks associated with our industry.

The business of exploration for minerals and mining involves an extremely high degree of risk. Few properties that are explored are ultimately developed into producing mines. We cannot guaranty that our mineral exploration and development activities will result in the discovery, development, or production of a commercially viable ore body. The economics of developing gold and other mineral properties are affected by many factors, including capital and operating costs, variations of the grade of ore mined, fluctuating mineral markets, costs of processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes to extract metal from ore, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. We cannot guaranty that the funds required for exploration and development can be obtained. The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately foreseen or predicted, such as market fluctuations, the global marketing conditions for precious and base metals, the proximity and capacity of milling facilities, mineral markets, and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting minerals, and environmental protection.

Because of the speculative nature of exploration of natural resource properties, there is substantial risk that we will not find commercially viable gold ore deposits.

We cannot guaranty that any of the claims we explore or acquire will contain commercially exploitable reserves of gold minerals. Exploration for natural resources is a speculative venture involving substantial risk. Hazards such as unusual or unexpected geological formations and other conditions often result in unsuccessful exploration efforts. Success in exploration is dependent upon a number of factors including, but not limited to, quality of management, quality and availability of geological expertise and availability of exploration capital. Due to these and other factors, no assurance can be given that our exploration programs will result in the discovery of new mineral reserves or resources.

We may not have access to all of the supplies and materials we need for exploration, which could cause us to delay or suspend operations.

Demand for drilling equipment and limited industry suppliers may result in occasional shortages of supplies, and certain equipment such as drilling rigs that we need to conduct exploration activities. We have not negotiated any long term contracts with any suppliers of products, equipment or services. If we cannot find the trained employees and equipment when required, we will have to suspend or curtail our exploration plans until such services and equipment can be obtained.

We have no known ore reserves and we cannot predict when and if we will find commercial quantities of mineral ore deposits. The failure to identify and extract commercially viable mineral ore deposits will affect our ability to generate revenues.

We have no known ore reserves and there can be no assurance that any of the mineral claims we are exploring contain commercial quantities of gold or silver. Even if we identify commercial reserves, we cannot predict whether we will be able to mine the reserves on a profitable basis, if at all.

Competition in the gold mining industry is highly competitive and we cannot guaranty that we will be successful in acquiring leases.

The gold mining industry is intensely competitive. We compete with numerous individuals and companies, including many major gold exploration and mining companies that have substantially greater technical, financial, and operational resources and staffs. Accordingly, there is a high degree of competition for desirable mining leases, suitable properties for mining operations, and necessary mining equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will be completed. There are other competitors that have operations in the Nevada area and the presence of these competitors could harm our ability to acquire additional leases.

6

Government regulation and environmental regulatory requirements may impact our operations.

Failure to comply with applicable environmental laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations, and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on us and cause increases in capital expenditures or require abandonment or delays in development of new mining properties.

Decreases in prices of precious metals would reduce the value of our properties.

The value of our exploration properties is directly related to the market price of precious metals. The market price of various precious metals fluctuates widely and is affected by numerous factors beyond the control of any mining company. These factors include industrial and jewelry fabrication demand, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar and other currencies, interest rates, gold sales and loans by central banks, forward sales by gold producers, global or regional political, economic or banking crises, and a number of other factors. If the gold price drops dramatically, the value of our exploration properties will decrease. The selections of a property for exploration or development, and the dedication of funds necessary to achieve such purposes are decisions that must be made long before the first revenues from production will be received, if ever. Price fluctuations between the time that such decisions are made and the commencement of production can have a material adverse effect on the economics of a mine, and can eliminate or have a material adverse impact on the value of the properties.

The price of gold can be volatile.

Gold prices historically have fluctuated widely and are affected by numerous factors outside of our control, including industrial and retail demand, central bank lending, sales and purchases of gold, forward sales of gold by producers and speculators, levels of gold production, short-term changes in supply and demand because of speculative hedging activities, confidence in the global monetary system, expectations of the future rate of inflation, the strength of the US dollar (the currency in which the price of gold is generally quoted), interest rates, and global or regional political or economic events. The potential profitability of our operations is directly related to the market price of gold. A decline in the market price of gold would materially affect the value of our assets. A decline in the market price of gold may also require us to write-down any mineral reserves that we might book, which would negatively impact our financial position.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

We are substantially dependent upon the continued services of Dr. Earl Abbott. We do not have any key person life insurance or disability insurance on him. While Dr. Abbott expects to spend the majority of his time assisting us and our business, there can be no assurance that his services will remain available to us. If Dr. Abbott’s services are not available to us, we will be materially harmed. While Dr. Abbott is a significant stockholder and considers his investment of time and money of significant personal value, we cannot guaranty that he will remain with us. Our success is also largely dependent on our ability to hire highly qualified personnel. This is particularly true in the highly technical business such as mineral exploration. These individuals are in high demand and we may not be able to retain the personnel we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Failure to hire key personnel when needed, or on acceptable terms, to carry out our exploration and mining programs would harm our business.

Because the probability of many of the individual mining prospects explored will not show commercially viable amounts of gold ore deposits, substantial amounts of funds spent on exploration will not result in identifiable reserves.

The probability of our exploration program identifying individual prospects having commercially significant reserves cannot be predicted. It is likely that many of the properties explored will not contain any commercially significant reserves. As such substantial funds will be spent on exploration which may identify only a few, if any, claims having commercial development potential.

7

Our mining claims could be contested which would add significant costs and delays to our exploration programs.

Our mining property rights currently consist of a number of unpatented mining claims. The validity of unpatented mining claims and staked claims are often uncertain and are always subject to contest. Unpatented mining claims are generally considered subject to greater title risk than patented mining claims, or real property interests that are owned in fee simple. If our claims on a particular property are successfully challenged, we may not be able to develop or retain our interests on that property, which could reduce our future revenues.

Mining operations are subject to extensive federal and state regulation which increases the costs of compliance and possible liability for non-compliance.

Mining is subject to extensive regulation by state and federal regulatory authorities. State and federal statutes regulate environmental quality, safety, exploration procedures, reclamation, employees’ health and safety, use of explosives, air quality standards, pollution of stream and fresh water sources, noxious odors, noise, dust, and other environmental protection controls as well as the rights of adjoining property owners. We believe that we are currently operating in compliance with all known safety and environmental standards and regulations applicable to our Nevada properties. However, there can be no assurance that our compliance could be challenged or that future changes in federal or Nevada laws, regulations or interpretations thereof will not have a material adverse affect on our ability to resume and sustain exploration operations.

Mining operations are subject to various risks and hazards which could result in significant costs or hinder ongoing operations.

The business of gold mining is subject to certain types of risks, including environmental hazards, industrial accidents, and theft. We intend to carry insurance against certain property damage loss (including business interruption) and comprehensive general liability insurance. While we hope to maintain insurance consistent with industry practice, it is not possible to insure against all risks associated with the mining business, or prudent to assume that insurance will continue to be available at a reasonable cost. We have not obtained environmental liability insurance because such coverage is not considered by management to be cost effective.

We are subject to the reporting requirements of federal securities laws, which is expensive.

We are a public reporting company in the U.S. and, accordingly, subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, or Exchange Act, and other federal securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission, or SEC, and furnishing audited reports to stockholders will cause our expenses to be higher than they would be if we remained a privately-held company.

If we fail to maintain the adequacy of our internal controls, our ability to provide accurate financial statements and comply with the requirements of the Sarbanes-Oxley Act could be impaired, which could cause our stock price to decrease substantially.

We have very limited personnel and resources to develop external reporting and compliance obligations that are required of a public company. If we are able to raise additional capital, we plan to obtain additional financial and accounting resources to support and enhance our ability to meet the requirements of being a public company. We will need to continue to improve our financial and managerial controls, reporting systems and procedures, and documentation thereof. If our financial and managerial controls, reporting systems, or procedures fail, we may not be able to provide accurate financial statements on a timely basis or comply with the Sarbanes-Oxley Act of 2002 as it applies to us. Any failure of our internal controls or our ability to provide accurate financial statements could cause the trading price of our common stock to decrease substantially.

8

Our common shares are thinly-traded, and you may be unable to sell at or near ask prices or at all if you need to sell your shares or otherwise desire to liquidate such shares.

We cannot predict the extent to which an active public market for our common stock will develop or be sustained due to a number of factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock may be particularly volatile given our status as a relatively small company with a thinly-traded “float” and lack of current revenues that could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

The market for our common shares may be characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will be more volatile than a seasoned issuer for the indefinite future. The potential volatility in our share price is attributable to a number of factors. First, as noted above, our common shares may be sporadically and/or thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our stockholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer that could better absorb those sales without adverse impact on its share price. Secondly, an investment in us is a speculative or “risky” investment due to our lack of revenues or profits to date and uncertainty of future market acceptance for current and potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer.

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through pre-arranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The occurrence of these patterns or practices could increase the volatility of our share price.

We do not anticipate paying any cash dividends.

We presently do not anticipate that we will pay any dividends on any of our capital stock in the foreseeable future. The payment of dividends, if any, would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends in the foreseeable future.

9

Our common stock may be subject to penny stock rules, which may make it more difficult for our stockholders to sell their common stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price of less than $5.00 per share. The penny stock rules require a broker-dealer, prior to a purchase or sale of a penny stock not otherwise exempt from the rules, to deliver to the customer a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules.

Volatility in our common stock price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

The sale of additional shares or other equity securities will result in additional dilution to our stockholders.

Our current cash is insufficient to meet our anticipated cash needs, and we require additional cash to fund our operations and any future developments. We may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities will result in additional dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

None.

Our Facilities. Our executive offices are located at 5490 Longley Lane, Reno, Nevada 89511, where we occupy approximately 150 square feet of office. We lease our offices from Telesto Nevada Inc. in exchange for $800 per month on a month to month basis. We believe that our current office space and facilities are sufficient to meet our present needs and do not anticipate the need to secure any additional space.

Further, we have a 100% interest in the following unpatented and patented mineral claims in Nevada as detailed below:

Tonopah Extension Mine. On August 12, 2010, we were assigned from KMR the rights to a Mining Lease and Option to Purchase Agreement (the "Tonopah Agreement") for certain patented lode mining claims in Esmeralda and Nye Counties of Nevada. The term of the lease is for five (5) years. We exercised the option to purchase for a total of $1,000,000 to be paid over a period of five (5) years, beginning with an initial payment of $10,000 on March 31, 2010. A 4% net smelter royalty is reserved. The purpose of the agreement is for the exploration for and development and mining of minerals.

10

The rights under the Tonopah Agreement include all the right, title and interest of the owner in the property, lands and mining claims including, but not limited to, the surface and subsurface, all ores, minerals, minerals and geothermal water, in and upon and under the property, all of the interests of owner in all easements and rights-of-way reserved or granted in, upon or pertaining to the property, together with any and all veins, lodes and mineral deposits now owned or acquired by Owner. The Tonopah Extension Mine consists of 956 acres of mineral rights, 368 acres of surface rights and 487 acres of surface rights for mining purposes. The Tonopah Extension Mine is without known reserves and is an exploration property. All of the claims listed on Schedule A of the Tonopah Agreement comprise the “Tonopah Extension Mine” and consist of all of the following patented lode mining claims:

|

Tonopah Extension Mine patented lode mining claims

|

|||

|

Mining Claim Name

|

Identification Number

|

||

|

Accidental

|

3167

|

Ruth #4 and #5

|

4624

|

|

Admiral Schley Lode

|

2400

|

Short Lode

|

2189

|

|

Admiral Dewey Lode

|

2400

|

Stella Lode

|

2782

|

|

Baby Fr. Lode

|

2782

|

Tiger Lode

|

2484

|

|

Bass Lode

|

2189

|

Tommy Lode

|

2400

|

|

Bear Lode

|

2484

|

Trenton Lode

|

2186

|

|

Bermuda

|

2188

|

Wall Street Lode

|

2521

|

|

Broad Lode

|

4245

|

Z.Z.Z. Lode

|

2295

|

|

C.B.Q. Lode (SW-1/2)

|

2193

|

Bob Tail Lode

|

3861

|

|

Cat’s Paw Lode (SW-1/3)

|

2187

|

Cabin Wedge

|

2400

|

|

Clara A. Lode

|

2400

|

Cash Boy Lode

|

2170

|

|

Denver Lode (SW-1/2)

|

2191

|

Egyptian Lode

|

2295

|

|

Denver

|

2521

|

||

|

Doctor Lode

|

2400

|

Ferris Baby (2/3)

|

2400

|

|

Estella Lode (SW-1/2)

|

2400

|

Homestead Lode

|

2400

|

|

Ferris Baby (SW-1/3)

|

2400

|

OK Fraction Lode

|

4397

|

|

General Mills Lode

|

2400

|

Sagebrush Lode

|

2400

|

|

Good Enough Fr. Lode

|

2782

|

ZZZZ Lode

|

2295

|

|

Georgia Lode

|

2484

|

CBQ

|

S#2193

|

|

Grace Lode

|

2782

|

Denver

|

S#2191

|

|

I.X.L. Lode, and IXL #1, #2, #4 Lodes

|

4245

|

Black Mascot

|

2178

|

|

Lottery Lode

|

2484

|

Burlington Lode

|

2194

|

|

Lucky Dog Fr. Lode

|

2521

|

Cabin Lode

|

2131

|

|

Paymaster

|

S #2190

|

Golden Anchor Lode

|

2177

|

|

Ruth

|

#3

|

Grand Truck Lode

|

2129

|

|

Merry Xmas

|

2400

|

Deming Lode

|

2129

|

|

New Jersey

|

2484

|

OK Lode

|

2130

|

|

Nilson Lode

|

2782

|

Keystone Lode

|

4272

|

|

Ore Lode

|

4607

|

Triplet Lode

|

2179

|

|

Oro #1 (2/3 of), #2, #3 (2/3 of)

|

4607

|

White Swan Lode

|

2400

|

|

Oro Fraction Lode

|

4607

|

||

|

Panther Lode

|

2484

|

||

|

Parker Fr. Lode

|

2877

|

||

|

Pensylvania Lode

|

2782

|

||

|

Pharo Lode

|

2484

|

||

|

Pittsburg Fr. Lode

|

2878

|

||

|

Quineseck Lode

|

2782

|

||

|

Red Rock Lode

|

2295

|

||

|

Red Rock #1 and #2 Lodes

|

2295

|

||

|

Rich & Rare Lode

|

2782

|

||

|

Rost Fr. Lode

|

2782

|

||

11

The small-scale map set forth below shows the location, bordered in red, and access to the Tonopah Extension Mine.

12

All necessary payments to retain our claims include payments to the owner pursuant to the Tonopah Agreement and payment of property taxes to the respective counties in Nevada. Pursuant to the Tonopah Agreement, we are responsible for making the following payments on the following dates to the owner:

|

Date

|

Payment Amount

|

|

September 15, 2012

|

$100,000.00

|

|

March 15, 2013

|

$100,000.00

|

|

September 15, 2013

|

$100,000.00

|

|

March 31, 2014

|

$150,000.00

|

|

March 31, 2014

|

$150,000.00

|

|

March 31, 2015

|

$200,000.00

|

We must also pay for property taxes on a quarterly basis to Nye County, Nevada and Esmeralda County, Nevada to retain our claims. Previously, the annual tax bill for Tonopah Extension Mine was $421.28 to Nye County and $846.00 to Esmeralda County, Nevada. We are not responsible for paying any other fees to retain our claims. As of the date of this report, we have made all required payments pursuant to the Tonopah Agreement

During the year ended December 31, 2011, we completed a drilling program on the Tonopah Extension property. Historical mill tailing on the surface of the patented mineral rights were tested by hollow stem auger drilling of 165 holes at 100 foot spacing for a total of 940 feet. A total of 467 samples were collected representing 711.1 feet of tailings. The samples were analyzed for silver and gold by cyanide extraction. Metallurgical studies were performed to prepare an economic model for a proposed heap leach project. We are currently reviewing our findings from the drilling program and evaluating our options with respect to a proposed tailings project at the Tonopah Extension Mine.

All work on this property was personally conducted or supervised by our President, Dr. Earl Abbott, who is qualified to conduct the proposed exploration work. Dr. Abbott is a Certified Professional Geologist and Qualified Person by the American Institute of Professional Geologists. Dr. Abbott is also a senior geologist with 40 years of experience in mineral exploration for large and small companies in the western United States, Alaska, Mexico, China, Africa, and Costa Rica

Golden Trend Property. On August 12, 2010, we were assigned the rights to a Mining Lease for certain unpatented mining claims (the "Mining Lease") in Eureka County, Nevada.

Pursuant to the Mining Lease, we own the rights to mine from 111 unpatented mining claims in Eureka County, Nevada. All of the claims listed on the Mining Lease comprise the “Golden Trend Property”. Golden Trend Property represents unpatented Federal lode mining claims which cover an area of approximately 2,230 acres. The lease term is ten (10) years and is subject to a net smelter return royalty on production at the rate of 3.0% of net smelter returns (NSR’s). An initial Advanced Minimum Royalty (AMR) of $45,000 was paid upon signing and additional AMR’s of $15,000 shall be paid at 6-month intervals. All AMR’s shall be recaptured before any NSR’s are paid from production. There is no annual work commitment. All claims listed on the Mining Lease are unpatented claims that are identified by the following names and identification numbers:

|

Claim Number

|

NMC Number

|

|

GT 1-20

|

680268-287

|

|

GT 21-36

|

680288-303

|

|

GT 37-42

|

680303-309

|

|

GT43-58

|

680310-325

|

|

GT 59-66

|

680326-333

|

|

GT 67-70

|

702491-494

|

|

GT 71-78

|

702495-502

|

|

GT 79-80

|

702503-504

|

|

GT 81-83

|

789943-945

|

|

GT 83-90

|

789946-952

|

|

CTZ 1-15

|

805848-862

|

|

CTZ 18-23

|

805863-868

|

13

In order to retain our rights to the claims in the Mining Lease, we need to make semi-annual payments of $15,000 to the lessor. We are also responsible for paying $15,000 in annual maintenance fees to the U.S. Department of the Interior, Bureau of Land Management. As of the date of this report, we have not incurred any significant costs on this property other than making all required payments pursuant to the Mining Lease.

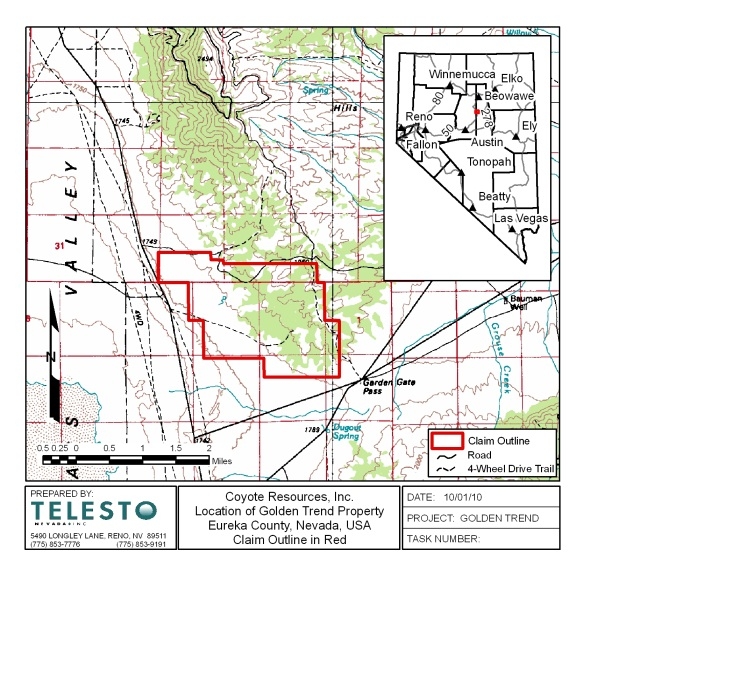

The Golden Trend Property is without known reserves and is an exploration property. The Golden Trend Property is located on the southwestern flank of the Cortez Mountains, approximately 70 miles southwest of Elko, Nevada in the Buckhorn mining district. A total of 111 contiguous, unpatented mining claims, located on land administered by the Bureau of Land Management comprise the property, totaling about 2230 acres. The property is located about 6 miles south-southeast of the portal of Barrick’s Cortez Hills/Pediment mine complex, currently under construction. It is along the Cortez Trend and lies astride the Cortez Fault.

Access to the property is obtained by driving south from the U.S. Interstate Highway 80 at the Crescent Valley exit on Nevada Highway 308 to the Pipeline Mine, then south on a gravel county road, the Grass Valley Road, to within a few hundred feet of the property. Access to the property can also be obtained by driving south from U.S. Interstate Highway 80 at Carlin on Nevada Highway 278, then west on a gravel county road to Garden Gate Pass which is within half a mile of the property boundary. Four wheel drive roads provide access within the property boundary. There is no plant and equipment on the property nor any other equipment or facilities on the property. The property is completely undeveloped. All water and power services must be developed. The nearest source of water and power is approximately five miles from the property. No reserve is known on the property and the proposed program is exploratory in nature.

The small-scale map set forth below shows the location, bordered in red, and access to the Golden Trend Property.

14

As of December 31, 2011, a detailed exploration timetable and budget has been formulated for the Golden Trend Property, but is not yet complete as we need additional financing to conduct any exploration programs that we develop. We cannot guaranty that we will be able to raise additional capital to fund exploration of the Golden Trend Property.

We are not currently a party to any legal proceedings.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information. Our common stock is quoted on the OTC Bulletin Board and OTCQB under the symbol "COYR". Since our change of business and name, our shares have only experienced trading activity since October 2010. For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

High ($)

|

Low ($)

|

|||||

|

Fiscal Year 2010

|

||||||

|

Fourth Quarter

|

$

|

1.85

|

$

|

0.80

|

||

|

Fiscal Year 2011

|

||||||

|

First Quarter

|

$

|

2.44

|

$

|

1.45

|

||

|

Second Quarter

|

$

|

1.98

|

$

|

0.95

|

||

|

Third Quarter

|

$

|

1.10

|

$

|

0.50

|

||

|

Fourth Quarter

|

$

|

0.60

|

$

|

0.05

|

||

Reports to Security Holders. We are a reporting company with the SEC. The public may read and copy any materials filed with the Securities and Exchange Commission at the Security and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may also obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-SEC-0330. The Securities and Exchange Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange Commission. The address of that site is http://www.sec.gov.

Holders. The approximate number of stockholders of record at April 12, 2012 was 19. The number of stockholders of record does not include beneficial owners of our common stock, whose shares are held in the names of various dealers, clearing agencies, banks, brokers and other fiduciaries.

Dividends. We currently anticipate that we will not declare or pay cash dividends on our common stock in the foreseeable future. We will pay dividends on our common stock only if and when declared by our board of directors. Our board of directors’ ability to declare a dividend is subject to restrictions imposed by Nevada law. In determining whether to declare dividends, the board of directors will consider these restrictions as well as our financial condition, results of operations, working capital requirements, future prospects and other factors it considers relevant.

15

Stock Split. In August 2010, we effected a 60-for-1 stock split of our common stock. All share numbers presented in this filing have been adjusted to reflect the stock split.

Securities Authorized For Issuance Under Equity Compensation Plans. The table below includes the following information as of December 31, 2011 for our 2011 Stock Option Plan.

|

Equity Compensation Plan Information

|

|||

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

|

Weighted-average exercise price of outstanding options, warrants and rights

(b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|

Equity compensation plans approved by security holders

|

0

|

0

|

5,000,000

|

|

Equity compensation plans not approved by security holders

|

0

|

0

|

0

|

|

Total

|

0

|

0

|

5,000,000

|

On March 17, 2011, our board of directors approved the Coyote Resources, Inc. 2011 Stock Option Plan (the “Plan”). The Plan permits flexibility in types of awards, and specific terms of awards, which will allow future awards to be based on then-current objectives for aligning compensation with increasing long-term shareholder value. Under the Plan, our board of directors can grant stock options, stock appreciation rights, restricted stock, stock units and performance units.

The Plan will terminate on March 17, 2021, unless all shares available for issuance have been issued, the Plan is earlier terminated by the board, of directors or the Plan is extended by an amendment approved by our shareholders. The aggregate number of shares of the common stock authorized for issuance as awards under the Plan is 5,000,000. The maximum aggregate number of shares of common stock subject to stock options, stock appreciation rights, restricted stock or stock unit awards which may be granted to any one participant in any one year under the Plan is 1,000,000.

The Plan was ratified by our shareholders on July 20, 2011 at our 2011 Annual Meeting of Stockholders. As of December 31, 2011, we have not granted any stock options, stock appreciation rights or any other awards pursuant to the Plan. A copy of the Plan is attached as Exhibit 10.3 to our Current Report on Form 8-K filed with the SEC on March 22, 2011.

Recent Sales of Unregistered Securities. During the year ended December 31, 2011, we did not have any sales of unregistered securities, except for the following:

In August 2010, we entered into a Note and Warrant Purchase Agreement (the “Financing Agreement”) with Socially Responsible Wealth Management Ltd. (“SRWM”). Pursuant to the Financing Agreement, SRWM agreed to lend up to $2,000,000 to us in multiple installments in exchange for senior secured convertible promissory notes with a conversion price of $0.50 per share and five-year warrants to acquire shares of common stock at an exercise price of $0.75 per share in the amount of each installment.

16

On January 19, 2011, we borrowed an additional $100,000 from SRWM pursuant to the Financing Agreement. We issued a senior secured convertible promissory note to SRWM in the amount of $100,000. The note is due on August 13, 2013, or upon default, whichever is earlier, and bears interest at the annual rate of 10%. The note has an optional conversion feature by which SRWM can convert the principal and accrued interest into shares of our common stock at a conversion price of $0.50 per share. In connection with the note, SRWM also received warrants to purchase 100,000 shares of our common stock at a purchase price of $0.75 per share. The warrants expire five years from the date of the investment.

On March 17, 2011, we borrowed an additional $500,000 from SRWM pursuant to the Financing Agreement. We issued a senior secured convertible promissory note to SRWM in the amount of $500,000. The note has an optional conversion feature by which SRWM can convert the principal and accrued interest into shares of our common stock at a conversion price of $0.50 per share. The note is due on August 13, 2013, or upon default, whichever is earlier, and bears interest at the annual rate of 10%. In connection with the note, SRWM also received warrants to purchase 500,000 shares of our common stock at a purchase price of $0.75 per share. The warrants expire five years from the date of the investment.

On October 27, 2011 we issued a promissory note to an investor in exchange for $40,000. Per the terms of the note, the principal was due, together with interest at 12% per annum, on January 17, 2012. As of the date of this report, we have not paid the balance owed pursuant to the note, and the note is in default. We are currently in negotiations with the investor to extend the due date of the note.

The above referenced note and warrants were issued to SRWM in transactions that we believe satisfy the requirements of that exemption from the registration and prospectus delivery requirements of the Securities Act of 1933, which exemption is specified by the provisions of Regulation S promulgated pursuant to that act by the SEC.

Use of Proceeds of Registered Securities. There were no sales of registered securities during the year ended December 31, 2011.

Penny Stock Regulation. Trading of our securities will be in the over-the-counter markets which are commonly referred to as the “pink sheets” or on the OTC Bulletin Board. As a result, an investor may find it more difficult to dispose of, or to obtain accurate quotations as to the price of the securities offered.

Shares of our common stock will probably be subject to rules adopted the Securities and Exchange Commission that regulate broker-dealer practices in connection with transactions in “penny stocks”. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in those securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission, which contains the following:

|

·

|

a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

·

|

a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to violation to such duties or other requirements of securities’ laws;

|

|

·

|

a brief, clear, narrative description of a dealer market, including "bid" and "ask” prices for penny stocks and the significance of the spread between the "bid" and "ask" price;

|

|

·

|

a toll-free telephone number for inquiries on disciplinary actions;

|

|

·

|

definitions of significant terms in the disclosure document or in the conduct of trading in penny stocks; and

|

|

·

|

such other information and is in such form (including language, type, size and format), as the Securities and Exchange Commission shall require by rule or regulation.

|

17

Prior to effecting any transaction in penny stock, the broker-dealer also must provide the customer the following:

|

·

|

the bid and offer quotations for the penny stock;

|

|

·

|

the compensation of the broker-dealer and its salesperson in the transaction;

|

|

·

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

·

|

monthly account statements showing the market value of each penny stock held in the customer’s account.

|

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Holders of shares of our common stock may have difficulty selling those shares because our common stock will probably be subject to the penny stock rules.

Purchases of Equity Securities. None during the period covered by this report.

Item 6. Selected Financial Data.

Not applicable.

Critical Accounting Policy and Estimates. Our Management's Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources. These accounting policies are described at relevant sections in this discussion and analysis and in the notes to the financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2011.

The following discussion of our financial condition and results of operations should be read in conjunction with our audited financial statements for the year ended December 31, 2011.

For the year ended December 31, 2011, as compared to the year ended December 31, 2010.

Results of Operations

Revenues. We had no revenues for the years ended December 31, 2011 and 2010.

18

Operating Expenses. For the year ended December 31, 2011, our total operating expenses were $937,734, as compared to total operating expenses of $286,440 for the year ended December 31, 2010. For the year ended December 31, 2011, our total operating expenses consisted of exploration costs of $431,585, legal and professional fees of $234,442, which is attributed to the increased legal expenses and accounting expenses related to being a public company, officer compensation of $148,000, and general and administrative expenses of $123,707. By comparison, for the year ended December 31, 2010, our total operating expenses consisted of legal and professional fees of $176,730, officer compensation of $42,500, and general and administrative fees of $67,210. We expect that we will continue to incur significant exploration costs related to our mineral properties and legal and accounting expenses related to being a public company.

Other Expense. For the year ended December 31, 2011, our other expense consisted of interest expense in the amount of $102,846, amortization of debt discount of $600,000, and gain on derivative liability of $1,751,974. In comparison, for the year ended December 31, 2010, our other expense consisted of interest expense of $22,452, loss on fair value of warrants of $172,500, gain of $77,666 associated with the refinancing of notes payable, and loss on derivative liability of $630,633 related to our issuance of convertible notes payable.

Net Profit/Loss. For the year ended December 31, 2011, our net profit was $111,394, attributable to a substantial gain on derivative liabilities, as compared to the year ended December 31, 2010, in which our net loss was $1,094,299, attributable to a substantial loss on derivative liabilities. We expect to continue to incur net losses for the foreseeable future.

Liquidity and Capital Resources. We had cash of $10,559, property and equipment of $333, net of $2,723 of accumulated depreciation, and unproven mineral properties of $1,194,910 as of December 31, 2011, making our total assets $1,205,802.

Our unproven mineral properties of $1,194,910, as of December 31, 2011, consist of our rights to the Tonopah Extension Mine and the Golden Trend Property in Nevada.

Our current liabilities were $347,208 as of December 31, 2011, which was represented by accounts payable and accrued expenses of $16,464, current portion of notes payable of $200,000, loans from stockholders of $57,000 and derivative liability of $73,744. Long-term notes payable as of December 31, 2011 were $1,869,726.

As of December 31, 2011, our long term notes payable of $1,869,726 consists of (i) convertible note payables totaling $1,100,000 of principal and $119,726 of interest pursuant to the Financing Agreement we entered into with SRWM in August 2010, (ii) $650,000 which is owed to Cliff ZZ L.L.C. pursuant to the Mining Lease and Option to Purchase Agreement between us and Cliff ZZ L.L.C. (the “Tonopah Agreement”).

Pursuant to the Financing Agreement, SRWM agreed to lend up to $2,000,000 to us in multiple installments in exchange for senior secured convertible promissory notes with a conversion price of $0.50 per share and five-year warrants to acquire shares of common stock at an exercise price of $0.75 per share in the amount of each installment. The First Installment of $500,000 was delivered on August 12, 2010, and we issued 500,000 warrants to the investor in connection with the First Installment. Included in the First Installment was the repayment of the April 22, 2010 note payable of $200,000 that was due to SRWM. This note is due, together with interest at the rate of 10% per annum on August 13, 2013.

On January 19, 2011, we borrowed an additional $100,000 from SRWM pursuant to the Financing Agreement. We issued a senior secured convertible promissory note to SRWM in the amount of $100,000. The note is due on August 13, 2013, or upon default, whichever is earlier, and bears interest at the annual rate of 10%. The note has an optional conversion feature by which SRWM can convert the principal and accrued interest into shares of our common stock at a conversion price of $0.50 per share. In connection with the note, SRWM also received warrants to purchase 100,000 shares of our common stock at a purchase price of $0.75 per share. The warrants expire five years from the date of the investment.

On March 17, 2011, we borrowed an additional $500,000 from SRWM pursuant to the Financing Agreement. We issued a senior secured convertible promissory note to SRWM in the amount of $500,000. The note is due on August 13, 2013, or upon default, whichever is earlier, and bears interest at the annual rate of 10%. The note has an optional conversion feature by which SRWM can convert the principal and accrued interest into shares of our common stock at a conversion price of $0.50 per share. In connection with the note, SRWM also received warrants to purchase 100,000 shares of our common stock at a purchase price of $0.75 per share. The warrants expire five years from the date of the investment.

As of December 31, 2011, we owed $1,100,000 of principal and $119,726 of interest pursuant to the Financing Agreement.

19

In connection with the assignment of the rights to the Tonopah Agreement, we assumed the balance of the purchase option of $990,000. We made three required payments in the aggregate amount of $140,000 to Cliff ZZ L.L.C. during the year ended December 31, 2011. The balance of the purchase option was $850,000 at December 31, 2011. Our required minimum payments vary per year with final payment due on March 15, 2015.

On October 27, 2011, we issued a promissory note to a shareholder in exchange for $40,000. Per the terms of the note, the principal was due, together with interest at 12% per annum, on January 17, 2012. As of the date of this report, we have not paid the balance owed pursuant to the note, and the note is in default. We are currently in negotiations with the investor to extend the due date of the note.

We had no other liabilities and no other long term commitments or contingencies as of December 31, 2011.

As of December 31, 2011, we had cash and cash equivalents of $10,559. In the opinion of management, available funds will not satisfy our working capital requirements to operate for the next twelve months. Our forecast for the period for which our financial resources will be adequate to support our operations involves risks and uncertainties and actual results could fail as a result of a number of factors.

Over the last six months we have been funding our operations through loans from a stockholder which we have used for working capital purposes.

On February 7, 2012, we issued a promissory note to the same shareholder in exchange for $20,000. Per the terms of the note, the principal was due, together with interest at 12% per annum, on May 7, 2012.

On March 6, 2012, we issued a promissory note to the same shareholder in exchange for $50,000. Per the terms of the note, the principal is due, together with interest at 12% per annum, on June 6, 2012.

On March 30, 2012, we issued a promissory note to the same shareholder in exchange for $25,000. Per the terms of the note, the principal is due, together with interest at 12% per annum, on June 6, 2012.

During 2012, we expect that the following will continue to impact our liquidity: (i) legal and accounting costs of being a public company; (ii) future payments to Cliff ZZ L.L.C. for the balance of the purchase option for the Tonopah Agreement and lease payments on the Golden Trend Property; (iii) expected expenses related to the development of the Golden Trend Property and the Tonopah Extensions Mine; (iv) anticipated increases in overhead and the use of independent contractors for services to be provided to us; and (v) expected payments to notes payable to the investor. We will need to obtain funds to pay those expenses. Other than those items specified above, we are not aware of any other known trends, events or uncertainties, which may affect our future liquidity.

In order to implement our business plan in the manner we envision, we need to raise additional capital. We cannot guaranty that we will be able to raise additional funds. Moreover, in the event that we can raise additional funds, we cannot guaranty that additional funding will be available on favorable terms.

We are not currently conducting any research and development activities. We do not anticipate conducting such activities in the near future. We intend to use independent contractors for certain services related to the Golden Trend Property and the Tonopah Extension Mine. We anticipate that we may need to purchase or lease additional equipment in order to conduct certain of our operations. However, as of the date of this report, we do not have any specific plans to purchase or lease additional equipment.

Off-Balance Sheet Arrangements. We have no off-balance sheet arrangements.

Not applicable.

20

The financial statements required by Item 8 are presented in the following order:

TABLE OF CONTENTS

|

Page

|

|

21

To the Board of Directors and Stockholders

Coyote Resources, Inc.