Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOPFED BANCORP INC | d521391d8k.htm |

Acquisition of Sumner Bank & Trust

Investor Presentation

April 2013

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

Exhibit 99.1 |

|

|

|

|

|

7

Significantly enhances our presence in the Nashville MSA with the addition of 3

branches and 3 loan production offices

Expansion into markets with attractive demographics and growth profiles

Local leadership has been retained and will lead our efforts in these new

markets

Utilizes our enhanced infrastructure allowing for significant cost savings

Improves our deposit mix and net interest margin

Includes attractive retail mortgage business

Strategic

Considerations

Financial

Considerations

Transaction Rationale

Cash transaction priced at 111% of tangible book value as of December 31,

2012 Significantly earnings accretive; $0.25 -

$0.30 per share with fully-implemented

cost savings

Moderate tangible book value dilution; $0.63 -

$0.70 per share with earn-out in

under 2.5 years

$2.1 million in cost savings; 20% of expenses (40% when excluding mortgage

business)

Pro forma capital ratios will be levered, but remain strong

|

8

Sumner Bank & Trust is a $184 million asset-sized bank

headquartered in Gallatin, Tennessee, operating three

branches and three loan production offices in the

Nashville MSA

Branches are all located in Sumner County

Loan production offices located in Williamson,

Madison and Wilson counties

Sumner Bank & Trust was organized in 2005 to meet the

need in Sumner County for a true community bank

owned by local shareholders

Sumner is led by a strong, experienced management

team

Sumner currently has $4.3 million of SBLF Preferred

Stock outstanding, which HopFed will retain

Sumner has a growing and profitable retail mortgage

banking business

Overview of Sumner Bank & Trust

Overview of Sumner Bank & Trust

Corporate Overview

GAAP Balance Sheet (12/31/2012)

GAAP Performance Metrics (12/31/2012)

Headquarters:

Gallatin, TN

Chief Executive Officer:

Michael Wayne Cook

Employees (FTE):

64

Corporation Type:

C-Corporation

Assets:

$184.0 million

Cash & Securities:

$54.1 million

Gross Loans:

$121.6 million

Total Deposits:

$157.6 million

Tangible Common Equity:

$12.2 million

SBLF Preferred Equity:

$4.3 million

Efficiency Ratio (LTM):

85.9%

Return on Average Assets (LTM):

0.67%

Net Interest Margin (LTM):

3.38%

Pre-Tax Income (LTM):

$1.1 million

NPAs / Assets:

3.46%

TCE Ratio:

6.63%

Source: SNL Financial |

9

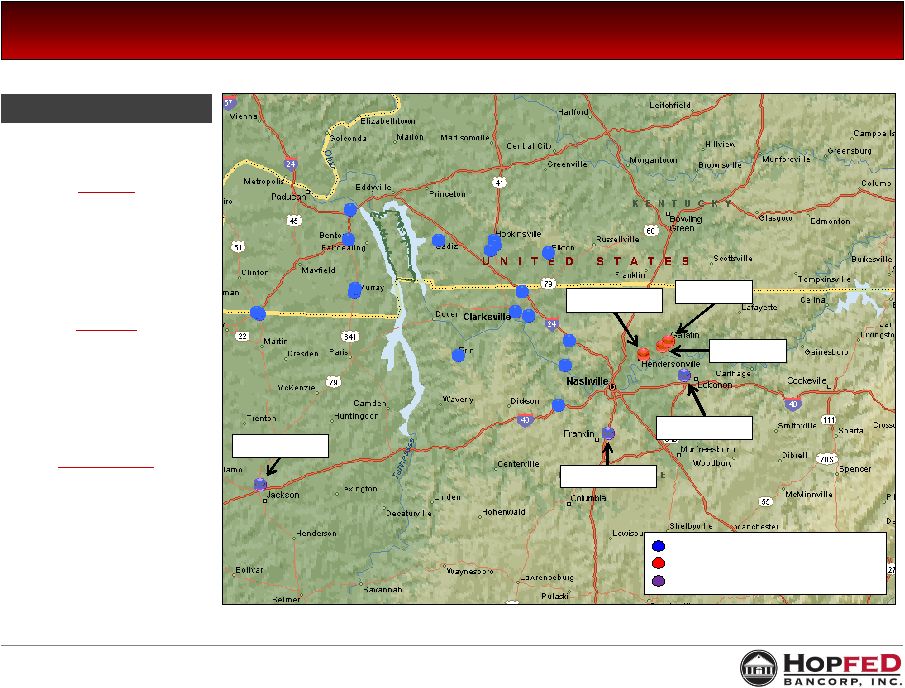

Pro Forma Branch Map

Gallatin I

780 Browns Lane

Gallatin, TN 37066

2012 Deposits:

$55,306

2011 Deposits:

$46,531

Gallatin II

240 W Broadway

Gallatin, TN 37066

2012 Deposits:

$55,848

2011 Deposits:

$56,364

Hendersonville

255 Indian Lake Blvd

Hendersonville, TN 37075

2012 Deposits:

$28,083

2011 Deposits:

$16,039

HopFed Bancorp (18)

Sumner Bank & Trust Branch (3)

Sumner Loan Production Office (3)

For the period ended June 30, 2012

(Dollars in Thousands)

Branch Summary

Hendersonville

Gallatin I

Gallatin II

Jackson

Franklin

Lebanon

Source: SNL Financial |

10

$10.04 per share or $14.3 million in cash

Subject to possible increase or reduction based on Sumner performance

Transaction Value

SBLF Preferred Stock

Transaction Overview

Anticipated Closing

Sumner SBLF Preferred Stock will be exchanged for shares of HopFed

Preferred Stock and will be subject to the same terms as Sumner agreed

to with the U.S. Department of the Treasury

Third Quarter 2013

Price to tangible book value of 111%

Core deposit premium of 1.2%

Price to LTM earnings per share of 14.6x

Valuation Multiples

(as of 12/31/12)

Credit Mark

Transaction Expenses

Estimated at $1.5 million

$3.0

million

or

approximately

47%

of

NPAs

($1.8

million

on

loans

and

$1.2 million on OREO) |

11

June 2010 Equity Offering Use of Proceeds: Organic Growth; Opportunistic

Acquisitions; General Corporate Purposes; Repurchase of

TARP Existence of MOU until November 2012 prevented more timely

repurchase of TARP and related warrant and removed HopFed from M&A

arena; we repurchased TARP on December 19, 2012. HFBC Stock Price Since Common

Stock Offering Source: SNL Financial

Pricing as of April 11, 2013

6/16/10:

Closing

of

$32.3

M follow-on common stock

offering at $8.65 (split-

adjusted)

7/21/11:

OTS

transfers

authority to Federal

Reserve and OCC

10/10/12:

MOU

is

terminated between

the OCC and Heritage

Bank

11/21/12:

MOU

is

terminated between

Federal Reserve and

HopFed Bancorp, Inc.

1/16/13:

Repurchased

warrants relating to TARP

2/12/13:

Announce

acquisition of Sumner

Bank & Trust

5/21/12:

Initial

OCC

exam commences

8/6/12:

Signed

NDA

to

explore

Sumner

ac

quisition

12/19/12:

Repurchase

TARP at par

$5.00

$6.00

$7.00

$8.00

$9.00

$10.00

$11.00

$12.00

6/16/10

9/16/10

12/16/10

3/16/11

6/16/11

9/16/11

12/16/11

3/16/12

6/16/12

9/16/12

12/16/12

3/16/13 |

12

Current Market Area

Attractive Market Demographics

HopFed’s Current Market Area

18 branches in Western Kentucky and

Middle Tennessee

Focus in the cities of:

•

Hopkinsville, KY (3 branches, $198M in

deposits, #3 market share)

•

Murray, KY (2 branches, $113M in deposits,

#3 market share)

•

Fulton, KY (2 branches, $146M in deposits,

#1 market share)

•

Clarksville, TN (3 branches, $64M in deposits,

#10 market share)

Transaction bolsters presence in attractive

Nashville MSA

3 bank branches located in two cities within

Sumner County

•

Gallatin, TN (2 branches, $111M in deposits,

#3 market share)

•

Hendersonville, TN (1 branch, $28M in

deposits, #13 market share)

Loan production offices in Wilson and

Williamson counties

Nashville, TN MSA

Source: SNL Financial

Note: Branch deposit and market share data as of June 30, 2012

Note: Acquired branches/LPO’s are located in the highlighted counties

2012

Population

2012 Median

Median Value

2012

Change

Household

Owner Occupied

County (Seat)

Population

2000-2012

Income

Housing Unit

Kentucky:

Christian (Hopkinsville)

75,855

5.0%

$36,568

$137,536

Marshall (Lewisburg)

31,778

5.5

37,915

141,622

Calloway (Murray)

38,066

11.4

35,859

97,429

Todd (Elkton)

12,571

5.0

33,039

82,288

Trigg (Cadiz)

14,586

15.8

40,026

105,937

Fulton (Hickman)

6,752

-12.9

30,749

59,111

Kentucky Total

179,608

6.3%

$36,471

$120,377

Tennessee:

Montgomery (Clarksville)

179,558

33.2%

$47,627

$145,102

Cheatham (Ashland City)

39,446

9.8

50,105

136,390

Houston (Erin)

8,438

4.3

36,908

85,864

Obion (Union City)

31,739

-2.2

36,299

87,182

Weakley (Dresden)

35,141

0.7

32,538

88,160

Tennessee Total

294,322

19.6%

$44,629

$129,191

Market Total

473,930

14.2%

$41,537

$125,851

2012

Population

2012 Median

Median Value

2012

Change

Household

Owner Occupied

County (Seat)

Population

2000-2012

Income

Housing Unit

Robertson (Springfield)

67,683

24.3%

$45,984

$146,778

Sumner (Gallatin)

165,950

27.2

52,233

178,732

Wilson (Lebanon)

118,990

34.0

56,555

175,577

Rutherford (Murfreesboro)

273,378

50.2

51,533

149,005

Williamson (Franklin)

191,532

51.2

78,845

321,900

Maury (Columbia)

83,089

19.6

45,787

124,137

Dickson (Dickson)

50,144

16.2

41,711

127,735

Davidson (Nashville)

640,154

12.3

42,642

164,240

Cheatham (Ashland City)

39,446

9.8

50,105

136,390

Nashville MSA Total

1,630,366

25.3%

$50,828

$177,944 |

13

In April 2006 HopFed announced the acquisition of four branches with $65.5 million

in deposits and $34.5 million in loans in the Nashville MSA from AmSouth

Bancorporation Opened de novo branch offices in Clarksville, TN in December

2006, May 2007, and September 2007 HopFed Loan Composition by State

Kentucky and Tennessee Loan Mix Since 2005

Kentucky 6-Yr CAGR: -4.2%

Tennessee 6-Yr CAGR: 16.6%

Source: SNL Financial

KY Loans ($M)

$388.6

$414.2

$436.8

$432.3

$412.8

$385.4

$348.7

$321.0

$321.0

TN Loans ($M)

$12.7

$85.2

$144.3

$202.2

$238.4

$224.7

$218.9

$214.6

$336.3

Total Loans ($M)

$401.3

$499.4

$581.1

$634.5

$651.2

$610.0

$567.6

$535.6

$657.4

3%

17%

25%

32%

37%

37%

39%

40%

51%

97%

83%

75%

68%

63%

63%

61%

60%

49%

0%

25%

50%

75%

100%

2005

2006

2007

2008

2009

2010

2011

2012

Pro Forma w/

Sumner

Tennessee

Kentucky |

14

Demand

Deps.

12%

NOW and

ATS

19%

MMDA and

Savings

11%

Retail Time

28%

Jumbo

Time

30%

Demand

Deps.

12%

NOW and

ATS

40%

MMDA and

Savings

14%

Retail Time

13%

Jumbo

Time

21%

Demand

Deps.

12%

NOW and

ATS

23%

MMDA and

Savings

11%

Retail Time

26%

Jumbo

Time

28%

Pro Forma Deposit Composition

Heritage Bank

Sumner Bank & Trust

Pro Forma

Dollars in Thousands

For the period ended December 31, 2012

Heritage Bank

Sumner Bank & Trust

Pro Forma

Demand Deposits

94,083

$

12.4%

18,787

$

11.9%

112,870

$

12.3%

NOW and ATS

147,047

19.4%

62,837

39.9%

209,884

22.9%

MMDA and Savings

81,643

10.7%

21,418

13.6%

103,061

11.2%

Retail Time Deposits ( < $100K)

213,216

28.1%

20,672

13.1%

233,888

25.5%

Jumbo Time Deposits ( > $100K)

223,876

29.5%

33,874

21.5%

257,750

28.1%

Total Deposits

759,865

$

100.0%

157,588

$

100.0%

917,453

$

100.0%

Source: SNL Financial

Note: Data reflects bank level regulatory financials

|

15

Pro Forma Loan Composition

Heritage Bank

Sumner Bank & Trust

Pro Forma

Dollars in Thousands

For the period ended December 31, 2012

Heritage Bank

Sumner Bank & Trust

Pro Forma

Construction & Development

64,952

$

12.1%

9,699

$

8.0%

74,651

$

11.4%

Secured by Farmland

46,799

8.7%

327

0.3%

47,126

7.2%

1 - 4 Family Real Estate

203,764

38.0%

62,429

51.3%

266,193

40.5%

5+ Family Real Estate

33,056

6.2%

985

0.8%

34,041

5.2%

Commercial Real Estate

122,637

22.9%

34,695

28.5%

157,332

23.9%

Agricultural

17,448

3.3%

11

0.0%

17,459

2.7%

Commercial & Industrial

33,045

6.2%

11,734

9.6%

44,779

6.8%

Consumer

13,928

2.6%

1,835

1.5%

15,763

2.4%

Other

-

0.0%

10

0.0%

10

0.0%

Gross Loans and Leases

535,629

$

100.0%

121,725

$

100.0%

657,354

$

100.0%

(1) Includes $33.3 million in loans held for sale from the mortgage

business Source: SNL Financial; Note: Data reflects bank level

regulatory financials

(1)

C&D

12%

Farm

9%

1 -4

Family

38%

5+ Family

6%

Comm. RE

23%

Agriculture

3%

C&I

6%

Consumer

3%

C&D

8%

Farm

<1%

1 -

4

Family

51%

5+ Family

1%

Comm. RE

28%

Agriculture

<1%

C&I

10%

Consumer

2%

Other

<1%

C&D

11%

Farm

7%

1 -

4

Family

41%

5+ Family

5%

Comm. RE

24%

Agriculture

3%

C&I

7%

Consumer

2%

Other

<1% |

John E. Peck

President & Chief Executive Officer

(270) 887-8401

john.peck@bankwithheritage.com

Billy C. Duvall

SVP & Chief Financial Officer

(270) 887-8404

billy.duvall@bankwithheritage.com |