Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - BLACKHAWK NETWORK HOLDINGS, INC | d303586dex231.htm |

| EX-10.27 - EX-10.27 - BLACKHAWK NETWORK HOLDINGS, INC | d303586dex1027.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 15, 2013

Registration No. 333-187325

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BLACKHAWK NETWORK HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 6199 | 43-2099257 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

6220 Stoneridge Mall Road

Pleasanton, CA 94588

(925) 226-9990

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

David E. Durant

Secretary and General Counsel

Blackhawk Network Holdings, Inc.

6220 Stoneridge Mall Road

Pleasanton, CA 94588

(925) 226-9990

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Anthony J. Richmond Kathleen M. Wells Latham & Watkins LLP 140 Scott Drive Menlo Park, CA 94025 Telephone: (650) 328-4600 Facsimile: (650) 463-2600 |

Jay Clayton Sarah P. Payne Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 Telephone: (212) 558-4000 Facsimile: (212) 558-3588 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated April 15, 2013

10,000,000 Shares

CLASS A COMMON STOCK

This is an initial public offering of the Class A common stock of Blackhawk Network Holdings, Inc. All of the 10,000,000 shares of Class A common stock are being sold by our existing stockholders, including our parent company, Safeway Inc., or Safeway. The selling stockholders will receive all of the net proceeds from the sale of the shares of our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price of our Class A common stock will be between $20.00 and $22.00 per share. Our Class A common stock has been approved for listing on the NASDAQ Global Select Market under the symbol “HAWK.”

Following this offering, we will have two classes of authorized common stock: Class A common stock and Class B common stock. Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Each share of our Class B common stock entitles its holder to ten votes on all matters to be voted on by stockholders generally. Holders of our Class A and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. Our parent company, Safeway, will hold 39,315,772 shares of Class B common stock, representing 75.7% of our total outstanding shares of common stock, 93.8% of our total outstanding shares of Class B common stock, and 91.6% of the combined voting power of our outstanding common stock upon completion of this offering, assuming that the underwriters do not exercise their option to purchase additional shares. The shares being sold in this offering will represent 19.3% of our total outstanding shares of common stock immediately following this offering.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, may elect to comply with certain reduced public company reporting requirements in future reports after the completion of this offering.

See “Risk Factors” beginning on page 18 to read about factors you should consider before buying shares of the Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | See “Underwriting.” |

To the extent that the underwriters sell more than 10,000,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 1,500,000 shares from the selling stockholders at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2013.

| Goldman, Sachs & Co. | BofA Merrill Lynch | Citigroup | Deutsche Bank Securities |

| Barclays | BMO Capital Markets | Credit Suisse | ||

| Piper Jaffray | Raymond James | Wells Fargo Securities |

Prospectus dated , 2013

Table of Contents

Table of Contents

|

Table of Contents

| Page | ||||

| 1 | ||||

| 16 | ||||

| 18 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 55 | ||||

| 58 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

62 | |||

| 91 | ||||

| 115 | ||||

| 121 | ||||

| 137 | ||||

| 145 | ||||

| 147 | ||||

| 156 | ||||

| 159 | ||||

| 164 | ||||

| 169 | ||||

| 169 | ||||

| 169 | ||||

| F-1 | ||||

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in our Class A common stock, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we, the selling stockholders nor the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Industry and Market Data

This prospectus includes industry data and forecasts that we obtained from industry publications and surveys, public filings and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our ranking, market position and market estimates are based on independent industry publications, third-party forecasts and management’s estimates and assumptions about our markets and our internal research. We have not independently verified such third-party information nor have we ascertained the underlying economic assumptions relied upon in those sources, and we

i

Table of Contents

cannot assure you of the accuracy or completeness of such information contained in this prospectus. Such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus.

Trademarks, Service Marks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. We do not intend for our use or display of other companies’ trademarks, service marks, trade names or products in this prospectus to imply relationships with, or endorsement or sponsorship of us by, these other companies. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references do not constitute a waiver of any rights that might be associated with the respective trademarks, service marks or trade names.

ii

Table of Contents

This summary highlights selected information included elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements and notes thereto included elsewhere in this prospectus. Because it is abbreviated, this summary is not complete and does not contain all of the information that you should consider before investing in our Class A common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes thereto included elsewhere in this prospectus. Unless the context otherwise requires, “Blackhawk Network Holdings, Inc.,” “Blackhawk,” “the Company,” “we,” “us” and “our” refer to Blackhawk Network Holdings, Inc. and its subsidiaries, and the terms “Safeway,” “Parent” and “Safeway Inc.” refer to our parent company, Safeway Inc., and its consolidated subsidiaries other than us.

Business

Overview

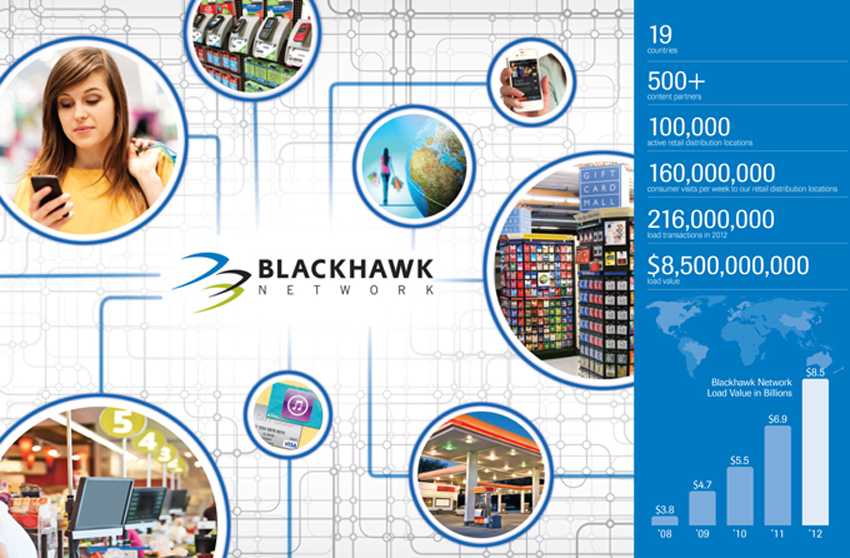

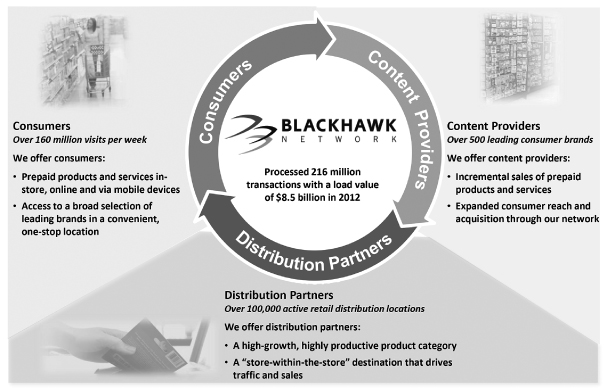

Blackhawk is a leading prepaid payment network utilizing proprietary technology to offer a broad range of gift cards, other prepaid products and payment services in the United States and 18 other countries. We believe our extensive payment network provides significant benefits to our three primary constituents: consumers who purchase the products and services we offer, content providers who offer branded gift cards and other prepaid products that are redeemable for goods and services, and distribution partners who sell those products. For consumers, we provide convenience by offering a broad variety of quality brands and content at retail distribution locations and online, enhanced by customer promotions and loyalty incentive programs that may be offered by our distribution partners. For our content providers, we drive incremental sales by providing access to millions of consumers and creating new customer relationships. For our distribution partners, we provide a significant, high-growth and highly productive product category that drives incremental store traffic and customer loyalty. Our technology platform allows us to efficiently and seamlessly connect our network participants and offer new products and services as payment technology evolves. We believe the breadth of our distribution network and product content, combined with our consumer reach and technology platform, create powerful network effects that enhance value for our constituents and fuel growth in our business.

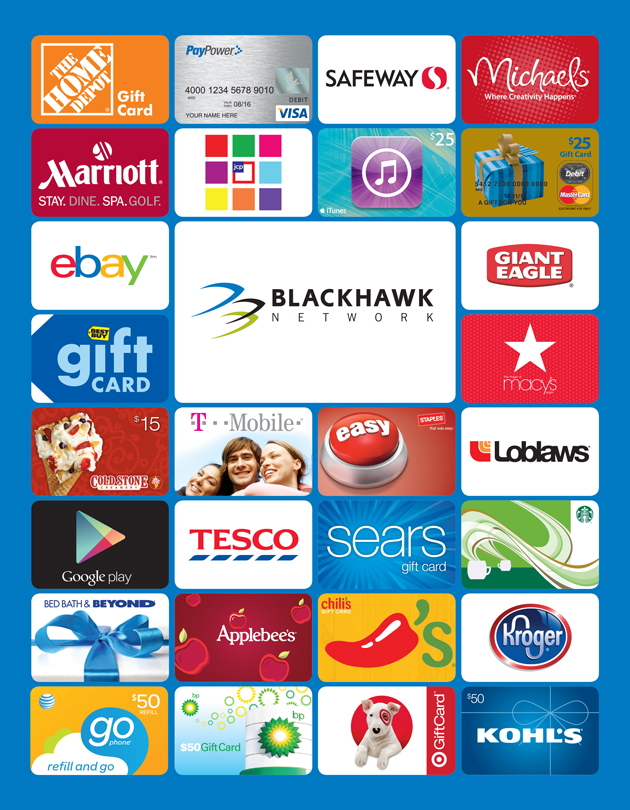

We are one of the largest third-party distributors of gift cards in the world based on the total value of funds loaded on the cards we distribute, which we refer to as load value. Our extensive network connects to more than 500 content providers and over 100,000 active retail distribution locations, providing access to over 160 million consumer visits per week. In addition, we sell physical and electronic gift cards to consumers through both leading online distributors and our website, GiftCardMall.com. In fiscal year 2012, we processed a total load value of $8.5 billion and over 216 million load transactions.

We offer gift cards from leading consumer brands such as Amazon.com, Applebee’s, iTunes, Lowe’s, Macy’s and Starbucks and from payment networks such as American Express, MasterCard and Visa. We also distribute prepaid telecom products offered by leading prepaid wireless telecom brands. In addition, we distribute general purpose reloadable, or GPR, cards provided by Green Dot and NetSpend, the industry leaders in this product category, as well as PayPower, our own GPR card. REloadit, our proprietary reload network, allows consumers to reload funds onto certain of their previously purchased GPR cards. Our content provider relationships allow us to provide what we believe is the most extensive selection of gift card brands and prepaid products in a single shopping

1

Table of Contents

location for consumers seeking to purchase prepaid products both as gifts and for their own use. In 2012, our gift card products represented approximately 84% of total revenues.

We distribute our products across multiple high-traffic channels such as grocery, convenience, specialty and online retailers. Grocery is our largest channel and enjoys a high volume of frequent visits from all consumer demographics. Our distribution network includes nine of the top ten, and approximately 90% of the aggregate grocery store locations operated by the top 50, conventional grocery retailers in the United States and Canada as reported by Supermarket News on January 30, 2012. These grocery retailers include Ahold, Giant Eagle, Kroger, Loblaws, Publix and Safeway. We also distribute our products in specialty retailers such as Bed Bath & Beyond, Lowe’s and Staples, in convenience stores such as QuikTrip and Wawa, and in other retailers such as JCPenney and Kohl’s. In addition to the United States, we distribute our products in 18 other countries, including Canada, the United Kingdom and Australia. We are expanding in Brazil and Korea and we also plan to begin selling in China in 2013. Our international business accounted for approximately 15% of our total revenues in 2012. Because of the wide array of quality content we offer and the high-growth, highly productive characteristics of our product category, we have been able to develop strong relationships with our distribution partners, generally with multi-year contracts containing varying degrees of exclusivity.

We have invested over $100 million in our proprietary technology platform which connects content providers, distribution partners and transaction processors, and allows consumers to easily load, reload, redeem and manage prepaid cards. We believe our technology capabilities provide us with significant competitive advantages and cannot be easily replicated.

We have experienced significant growth since our inception in 2001 as we expanded our network. From 2008 through 2012, our revenues grew from $362 million to $959 million and our Adjusted net income grew from $22.7 million to $50.3 million, representing a compound annual growth rate, or CAGR, of 27.6% and 22.1%, respectively.

Industry Overview

As paper-based forms of payment have declined over the last several decades, card-based and other electronic forms of payment have increased significantly, with the development of different types of payment products and services to address specific consumer needs. Gift cards and other prepaid products represent a large and quickly growing segment within the continuing shift toward electronic payments. Prepaid products accounted for an estimated $483 billion of load value in the United States in 2011 and are expected to grow at a projected 12% CAGR from 2011 to 2015 according to Mercator Advisory Group’s “U.S. Prepaid Cards Market Forecasts, 2012-2015” research report.

Consumers increasingly view gift cards as convenient self-use products that often provide many advantages over traditional cash, debit and credit payment methods. This trend towards self-use is redefining the scope of the addressable market in the gift card category.

Digital products and mobile payments are also emerging as the “next generation” in prepaid technology, facilitating convenience and accessibility for consumers. Many merchants now offer prepaid products that can be purchased online and then delivered electronically either to the purchaser or to a gift recipient through email or social media. Mobile digital wallet applications are also being offered to provide consumers greater convenience and flexibility by using their mobile phone as a payment device at the point of sale. Worldwide mobile payment transactions are expected to grow to $617 billion in 2016 from $172 billion in 2012, according to Gartner’s “Forecast: Mobile Payment, Worldwide, 2009-2016” May 2012 research report. As mobile digital wallets continue to gain more

2

Table of Contents

widespread adoption, consumers will demand integrated solutions for management of their prepaid products. Platforms that can provide digital market participants with critical prepaid functionality and connectivity between consumers, retailers and payments networks will be best positioned to share in the rapid growth of this opportunity for mobile digital wallets.

Our Competitive Strengths

Leading Distribution. We have developed a network of over 100,000 active retail distribution locations across multiple channels, providing us with frequent access to a large number of consumers. Our diversified distribution capabilities include grocery stores, convenience stores and specialty and online retailers. The combination of our broad consumer reach, investments in retail store displays and our customized value-add services, such as merchandising, marketing programs and direct-to-store fulfillment, results in a highly productive third-party prepaid distribution program.

Breadth of Product and Service Offerings. We believe that our payment network offers consumers the most extensive assortment of gift cards and other prepaid products and payment services available in a single shopping location. We currently offer multiple categories of prepaid products and services, including gift cards, prepaid telecom cards and handsets, and GPR cards and reload services, with access to over 500 consumer brands, retailers and other merchants. The breadth of product categories and depth of our offerings in each category diversify our revenue streams and position us to benefit from shifting consumer trends.

Innovation. We have a history of innovation, driven by our strong commitment to consumer research and new product testing. We pioneered the distribution of gift cards through third-party retail channels. We launched GiftCardMall.com, a third-party online site for the sale of prepaid products. We have also developed innovative capabilities and services to integrate prepaid products with mobile applications. Our open platform can support a broad range of retailers, financial institutions, social networks and digital wallets. We also operate in the secondary gift card market through Cardpool, a gift card exchange that enables consumers to sell unused gift cards at a discount for cash and purchase gift cards at a discount. We believe that our broad-based industry knowledge in combination with our dedication to consumer research and our proprietary technology platform will allow us to continue to innovate and enhance the value of our network for all participants.

Proprietary and Scalable Technology. We have a vertically integrated infrastructure, which includes our proprietary switching and redemption, processing, settlement and e-commerce systems. We believe that owning and operating our own technology platform provides us with economic and time-to-market advantages when introducing new products, features and network participants. Our systems are designed to be highly scalable and reliable, which enables us to respond to rising demand while ensuring high-quality service for our network participants.

Strong Network Effects. The combination of our broad range of products and leading consumer brands, our extensive footprint of high-traffic distribution partners and our frequent access to a large consumer base creates strong, self-reinforcing network effects. We believe the growth in our product offerings, our distribution partners and our consumer base enhance the value we deliver to all network participants. We believe our network would be difficult to replicate and allows us to drive innovation, create new prepaid products and services and adapt to evolving payment technologies.

Experienced Management Team. Our senior management team has extensive experience across a wide range of disciplines relevant to the payments industry, including technology, distribution, retail program management and financial services.

3

Table of Contents

Our Growth Strategy

Increase Productivity of Our Distribution Partners. We believe there is a significant opportunity to enhance the productivity of our distribution partners, which will lead to greater sales at existing retail locations and drive incremental revenue for our business. We have developed best practices based on our distribution partners’ performance over time and we utilize these best practices to help our distribution partners measure and increase their productivity. Several of these best practices include development of expanded retail displays, use of our marketing programs and direct-to-store fulfillment solutions, and the inclusion of prepaid card purchases in our distribution partners’ loyalty and rewards programs.

Expand Our Content, Products and Services. We believe we have the opportunity to increase our revenues by expanding the breadth of our content as well as the types of products and services that we offer.

| Ÿ | Content. We believe there is meaningful opportunity to expand the content that is currently available at our points of distribution. For example, we are expanding our localization initiatives to deliver a customized mix of prepaid products tailored to individual markets, such as local restaurants, merchants and service providers. We have found that the introduction of new or expanded content often increases the sales from our fixtures. |

| Ÿ | Products and Services. We believe there is an opportunity to expand the types of products and services we offer to consumers. For example, we have developed innovative capabilities and services to integrate prepaid products with mobile applications. We believe that we will be an important provider of gift card solutions for a broad set of digital payment offerings which are being developed by major and emerging technology companies, payment networks, financial institutions, retailer networks and third-party service providers. We are also expanding our Cardpool business by introducing card acquisition in grocery and other distribution channels and integrating Cardpool technology with our mobile application. |

Continue to Develop International Markets. We continue to expand our business in countries with strong growth potential and the appropriate payment and retail infrastructure to support prepaid products. For example, we have replicated the U.S. model in Canada, where we offer prepaid products through leading grocery and convenience stores. We also have international operations in Australia, the United Kingdom and other countries in the European Union, where we have contracted with leading distribution partners. We are expanding in a number of countries including Brazil and Korea and we also plan to begin selling in China in 2013.

Expand Our U.S. Distribution. We believe there is opportunity to expand our distribution to new retail partners in the United States. The strength of our network, the variety of our offered brands and the breadth of our products have made our displays a destination for consumers. In addition, we believe our products and services have created a highly profitable product category for many of our existing distribution partners, which presents a compelling value proposition for other potential distribution partners.

Leverage Our Technology and Distribution Infrastructure to Drive Cost Efficiency. We believe that we have the opportunity to lower our costs through scale efficiencies, improved systems, cost discipline and continued process improvements. For example, as the overall scale of our operations has grown over the past three years, our processing and services expense has declined as a percentage of total revenues. We will continue to use established business processes to identify and execute initiatives to increase back-end integration and leverage infrastructure to increase the efficiency of our core prepaid card business.

4

Table of Contents

Our Relationship with Safeway

We are currently approximately 96% owned by Safeway, and Safeway will continue to hold shares of Class B common stock representing a significant majority of the combined voting power of our outstanding common stock upon completion of this offering. Safeway is also one of our largest distribution partners. Please see “Certain Relationships and Related Party Transactions” and “Principal and Selling Stockholders.”

Recent Developments—First Quarter Results

Our consolidated financial statements for the quarter ended March 23, 2013 are not yet available. The following expectations regarding our results for this period are solely management estimates based on currently available information. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to these preliminary financial data and, accordingly, does not express an opinion or any other form of assurance with respect to these data.

We expect that for the quarter ended March 23, 2013:

| Ÿ | Our total operating revenues will be $185.1 million; and |

| Ÿ | Our net income will be between $0.1 million and $0.3 million. |

Key operating results for the quarter ended March 23, 2013 are expected to be as follows:

| Ÿ | Load value: $1.6 billion (compared to $1.3 billion for the quarter ended March 24, 2012); |

| Ÿ | Commissions and fees as a % of load value: 9.0% (compared to 9.2% for the quarter ended March 24, 2012); |

| Ÿ | Distribution partner commissions paid as a % of commissions and fees: 66.4% (compared to 64.5% for the quarter ended March 24, 2012); and |

| Ÿ | Number of load transactions: 36.8 million (compared to 32.7 million for the quarter ended March 24, 2012). |

Our actual results may differ from these expectations.

We expect our total operating revenues for the quarter ended March 23, 2013 to be $185.1 million, an increase of 22.1% from total operating revenues of $151.5 million for the quarter ended March 24, 2012. This increase was due primarily to an increase in load value of 23.0%, partially offset by a 20 basis point (0.2 percentage point) decline in commissions and fees as a percentage of load value, which is within the range of historical quarterly fluctuations that we experienced in fiscal year 2012.

We expect distribution partner commissions paid as a percentage of commissions and fees for the quarter ended March 23, 2013 to increase by 190 basis points (1.9 percentage points) from distribution partner commissions paid as a percentage of commissions and fees for the quarter ended March 24, 2012. The majority of this expected increase (approximately 100 basis points or 1.0 percentage points) was the result of increased commissions paid to Safeway pursuant to the amendment of our distribution partner agreements with Safeway, and the remainder was due to changes to the distribution partner mix and the territories in which our products are sold. We presently expect that these factors will continue to influence the percentage of commissions and fees paid to distribution partners in fiscal 2013.

5

Table of Contents

We expect our net income for the quarter ended March 23, 2013 to be between $0.1 million and $0.3 million compared to net income of $2.9 million for the quarter ended March 24, 2012. This change was due primarily to an increase in distribution partner commissions paid as a percentage of commissions and fees, increased marketing expenses net of marketing revenues and increased distribution partner program development expenses.

Our net income for the quarter ended March 23, 2013 is expected to include an aggregate amount of approximately $4.8 million of net interest expense, income tax expense and depreciation and amortization. Our net income for the quarter ended March 23, 2013 is also expected to include an aggregate amount of approximately $2.5 million ($1.6 million after-tax) in stock-based compensation expense, distribution partner mark-to-market expense, change in fair value of contingent consideration and amortization of intangibles. For the quarter ended March 24, 2012, the comparable amount of net interest expense, income tax expense and depreciation and amortization was $5.5 million, and the comparable amount of stock-based compensation expense, distribution partner mark-to-market expense, change in fair value of contingent consideration and amortization of intangibles was $1.7 million ($1.1 million after-tax).

The foregoing preliminary first quarter results constitute forward looking statements. Actual results may vary materially from the information contained in these forward-looking statements based on a number of factors. Please refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements” in this prospectus for additional information.

Risk Factors

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully under the caption “Risk Factors,” and include risks under the headings “Risks Related to Our Business and Industry,” “Risks Related to Our Ongoing Relationship with Safeway” and “Risks Related to this Offering and Ownership of Our Class A Common Stock.”

Corporate Information

We were founded in 2001 as a division of Safeway. We were incorporated in Delaware as Blackhawk Network, Inc. in 2006 and changed our name to Blackhawk Network Holdings, Inc. later that year. Our principal executive offices are located at 6220 Stoneridge Mall Road, Pleasanton, California 94588, and our telephone number at that location is (925) 226-9990. Our website is www.blackhawknetwork.com. The information available on or that can be accessed through our website is not incorporated by reference into and is not a part of this prospectus and should not be considered to be part of this prospectus.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we become a large accelerated filer, which means that we have been public for at least 12 months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last day of our then most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and references herein to “emerging growth company” shall have the meaning associated with such term in the JOBS Act.

6

Table of Contents

The Offering

| Class A common stock offered by the selling stockholders, including Safeway |

10,000,000 shares | |

| Option to purchase additional shares of Class A common stock |

The selling stockholders, including Safeway, have granted the underwriters a 30-day option to purchase up to an aggregate of 1,500,000 additional shares of our Class A common stock. | |

| Class A common stock to be outstanding after this offering |

10,000,000 shares (11,500,000 shares if the underwriters’ option to purchase additional shares is exercised in full). | |

| Class B common stock to be outstanding after this offering |

41,903,464 shares (40,403,464 shares if the underwriters’ option to purchase additional shares is exercised in full). | |

| Voting power of Class A common stock outstanding after giving effect to this offering |

2.3% (2.8% if the underwriters’ option to purchase additional shares is exercised in full). | |

| Voting power of Class B common stock outstanding after giving effect to this offering |

97.7% (97.2% if the underwriters’ option to purchase additional shares is exercised in full). | |

| Voting rights |

Following this offering, we will have two classes of authorized common stock: Class A common stock and Class B common stock. Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Each share of our Class B common stock entitles its holder to ten votes on all matters to be voted on by stockholders generally. | |

| Holders of our Class A and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. Please see “Description of Capital Stock.” | ||

| Use of proceeds |

We will not receive any of the net proceeds from the sale of Class A common stock by the selling stockholders in this offering. Please see “Principal and Selling Stockholders.” | |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page 18 and all other information set forth in this prospectus before deciding to invest in our Class A common stock. | |

| Listing and trading symbol |

Our Class A common stock has been approved for listing on the NASDAQ Global Select Market under the symbol “HAWK.” | |

7

Table of Contents

The number of shares of Class A and Class B common stock to be outstanding after this offering is based on 51,508,755 shares of common stock outstanding as of April 2, 2013, adjusted to include:

| Ÿ | an estimated 374,286 shares of Class B common stock (of which 149,940 shares will be sold in the offering as Class A common stock) that will be issued as a result of the net exercise of a warrant in respect of 750,000 shares at an exercise price of $10.52 per share, which is contingent upon the completion of this offering (calculated based on the assumed initial public offering price of $21.00 per share, which represents the midpoint of the estimated offering price range set forth on the cover of this prospectus); and |

| Ÿ | 20,423 shares of Class B common stock issuable upon the exercise of outstanding options at a weighted average exercise price of approximately $6.78 per share, which will be sold in the offering as Class A common stock. |

The number of shares of Class A and Class B common stock to be outstanding after this offering excludes:

| Ÿ | an aggregate of up to 1,122,449 shares of Class B common stock issuable upon the exercise of additional warrants outstanding, at a weighted average exercise price of approximately $16.30 per share, of which 185,204 shares are vested but not yet exercisable, and 937,245 shares will become vested only upon future achievement of performance-based vesting requirements and exercisable with the passage of time; |

| Ÿ | an aggregate of 2,250,000 shares of Class A common stock issuable upon the exercise of warrants issued on April 2, 2013 with a weighted average exercise price of $20.00 per share, which will become exercisable on the earlier of 181 days after the date of this prospectus and a change in control, and an additional 15,306 shares of Class A common stock issuable upon the exercise of a warrant that we are contractually required to issue, which will have an exercise price of $20.00 per share and will become exercisable on the earlier of 181 days after the date of this prospectus and a change in control; |

| Ÿ | 3,467,777 shares of Class B common stock issuable upon the exercise of options outstanding at a weighted average exercise price of approximately $14.52 per share; |

| Ÿ | 646,000 shares of Class B common stock subject to stock appreciation rights outstanding at a weighted average exercise price of approximately $18.50 per share, which will be settled in shares of our Class B common stock; |

| Ÿ | 116,900 unvested restricted stock units outstanding, which will be settled in shares of our Class B common stock; |

| Ÿ | an additional 304,118 shares of Class B common stock reserved for future issuance under our Second Amended and Restated 2006 Restricted Stock and Restricted Stock Unit Plan, or the 2006 Plan, and our Amended and Restated 2007 Stock Option and Stock Appreciation Right Plan, or the 2007 Plan, which will become available for issuance as shares of Class A common stock under our 2013 Equity Incentive Award Plan after completion of this offering; and |

| Ÿ | an additional 3,000,000 shares of Class A common stock that will be reserved for future issuance under our 2013 Equity Incentive Award Plan, which will become effective immediately prior to the completion of this offering. |

Conventions that Apply to this Prospectus

Except as otherwise indicated, all information in this prospectus assumes:

| Ÿ | an initial public offering price of $21.00 per share (which represents the midpoint of the estimated offering price range set forth on the cover of this prospectus); |

| Ÿ | no exercise of the underwriters’ option to purchase additional shares from the selling stockholders; |

| Ÿ | the implementation of a 1-for-2 reverse stock split of our common stock effective as of April 1, 2013, applied retroactively to all numbers of common shares and per common share data; |

8

Table of Contents

| Ÿ | the filing of our amended and restated certificate of incorporation, which will occur immediately prior to the completion of this offering; and |

| Ÿ | the reclassification of shares of common stock held by our stockholders of record as of immediately prior to the completion of this offering into shares of Class B common stock on a share-for-share basis. |

When the selling stockholders consummate sales of Class B common stock in this offering, the shares of Class B common stock sold will automatically convert into shares of Class A common stock on a share-for-share basis. As a result, purchasers of our common stock in this offering will only receive Class A common stock, and only Class A common stock is being offered by this prospectus. Shares of Class B common stock that are not sold by the selling stockholders will remain Class B common stock unless otherwise converted into shares of Class A common stock as described under “Description of Capital Stock.”

9

Table of Contents

Summary Consolidated Financial Data

The following tables present a summary of our consolidated financial data and other operational and financial data for the periods ended on or as of the dates indicated. You should read this information together with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements, related notes and other financial information included elsewhere in this prospectus. This summary of our consolidated financial data is not intended to replace the financial statements and is qualified in its entirety by the financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of our future results.

We use a 52- or 53-week fiscal year ending on the Saturday closest to December 31, and our fiscal quarters consist of three 12-week periods and one 16- or 17-week period. The fiscal years presented in the tables below consist of the 53-week period ended January 3, 2009, or 2008, and the 52-week periods ended January 2, 2010, or 2009, January 1, 2011, or 2010, December 31, 2011, or 2011, and December 29, 2012, or 2012. As used in this prospectus, italicized terms reference line items appearing in our consolidated financial statements.

10

Table of Contents

We derived the statement of operations data for 2010, 2011 and 2012 and the balance sheet data for 2011 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the statement of operations data for 2008 and 2009 and the balance sheet data for 2008, 2009 and 2010 from our audited consolidated financial statements (which we adjusted for the impact of redeemable equity) not included in this prospectus.

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| CONSOLIDATED STATEMENT OF INCOME DATA: |

||||||||||||||||||||

| OPERATING REVENUES: |

||||||||||||||||||||

| Commissions and fees |

$ | 327,874 | $ | 419,086 | $ | 499,260 | $ | 639,633 | $ | 786,552 | ||||||||||

| Program, interchange, marketing and other fees(1) |

26,909 | 70,225 | 64,611 | 87,551 | 103,432 | |||||||||||||||

| Product sales |

7,030 | 14,682 | 13,858 | 24,622 | 69,085 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating revenues |

361,813 | 503,993 | 577,729 | 751,806 | 959,069 | |||||||||||||||

| OPERATING EXPENSES: |

||||||||||||||||||||

| Distribution partner commissions |

207,786 | 266,254 | 315,087 | 410,781 | 510,789 | |||||||||||||||

| Processing and services |

56,805 | 81,303 | 95,694 | 117,263 | 137,105 | |||||||||||||||

| Sales and marketing |

47,918 | 69,472 | 84,131 | 101,581 | 129,285 | |||||||||||||||

| Costs of products sold |

6,438 | 13,502 | 12,167 | 22,655 | 66,572 | |||||||||||||||

| General and administrative |

21,220 | 24,180 | 33,685 | 39,404 | 38,513 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

340,167 | 454,711 | 540,764 | 691,684 | 882,264 | |||||||||||||||

| OPERATING INCOME(1) |

21,646 | 49,282 | 36,965 | 60,122 | 76,805 | |||||||||||||||

| OTHER INCOME (EXPENSE): |

||||||||||||||||||||

| Interest and other income |

3,146 | 1,507 | 789 | 1,536 | 1,297 | |||||||||||||||

| Interest expense |

(155 | ) | — | (70 | ) | (5 | ) | (11 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| INCOME BEFORE INCOME TAX EXPENSE |

24,637 | 50,789 | 37,684 | 61,653 | 78,091 | |||||||||||||||

| INCOME TAX EXPENSE |

9,107 | 24,032 | 18,496 | 25,154 | 30,199 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INCOME BEFORE ALLOCATION TO NON-CONTROLLING INTEREST |

15,530 | 26,757 | 19,188 | 36,499 | 47,892 | |||||||||||||||

| Add: Loss attributable to non-controlling interest (net of tax) |

— | — | — | — | 273 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INCOME ATTRIBUTABLE TO BLACKHAWK(1) |

$ | 15,530 | $ | 26,757 | $ | 19,188 | $ | 36,499 | $ | 48,165 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EARNINGS PER SHARE: |

||||||||||||||||||||

| Basic |

$ | 0.31 | $ | 0.53 | $ | 0.38 | $ | 0.71 | $ | 0.93 | ||||||||||

| Diluted |

$ | 0.31 | $ | 0.52 | $ | 0.37 | $ | 0.70 | $ | 0.93 | ||||||||||

| Weighted average shares outstanding—basic |

50,423 | 50,583 | 50,615 | 50,225 | 50,045 | |||||||||||||||

| Weighted average shares outstanding—diluted |

50,423 | 50,773 | 50,998 | 50,877 | 50,045 | |||||||||||||||

11

Table of Contents

The following table presents consolidated balance sheet data as of year-end 2008, 2009, 2010, 2011 and 2012 on an actual basis and as of year-end 2012 on an as adjusted basis to give effect to the reclassification of outstanding shares of our common stock, the termination of all redemption rights held by equity holders and the reclassification of Warrant and common stock liabilities and Redeemable equity to Stockholders’ equity. In addition, upon completion of this offering, we will be required to record an expense with respect to the equity instruments held by certain distribution partners in an amount equal to the excess of the initial public offering price per share multiplied by the relevant number of equity securities over the amount previously expensed, with an offsetting increase in Stockholders’ equity. The amount of this non-cash expense is estimated to be $2.4 million in the aggregate (assuming the midpoint of the estimated offering price range set forth on the cover of this prospectus).

| As of Year-End | ||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 Actual |

2012 Pro Forma As Adjusted(2) |

|||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEET DATA(3): |

||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash(4) |

$ | 217,315 | $ | 46,118 | $ | 70,454 | $ | 162,642 | $ | 181,633 | $ | 181,771 | ||||||||||||

| Overnight cash advances to Parent(5) |

199,000 | 541,000 | 504,000 | 598,157 | 495,000 | 495,000 | ||||||||||||||||||

| Settlement receivables(6) |

136,139 | 146,000 | 179,221 | 249,028 | 510,853 | 510,853 | ||||||||||||||||||

| Total assets |

665,725 | 909,808 | 973,690 | 1,301,301 | 1,533,711 | 1,531,912 | ||||||||||||||||||

| Settlement payables(6) |

525,109 | 686,485 | 767,898 | 990,436 | 1,231,429 | 1,231,429 | ||||||||||||||||||

| Notes payable to Parent |

30,917 | 56,486 | 10,568 | 17,915 | — | — | ||||||||||||||||||

| Warrant and common stock liabilities(7) |

10,712 | 16,528 | 22,801 | 24,943 | 26,675 | — | ||||||||||||||||||

| Total liabilities |

643,950 | 856,126 | 897,754 | 1,186,434 | 1,436,064 | 1,406,875 | ||||||||||||||||||

| Redeemable equity |

6,561 | 21,913 | 26,632 | 30,112 | 34,997 | — | ||||||||||||||||||

| Total stockholders’ equity |

15,214 | 31,769 | 49,304 | 84,755 | 62,650 | 125,037 | ||||||||||||||||||

| (1) | In 2009 and 2011, we entered into contract amendments with two of our issuing banks that substituted or adjusted a program management fee for monthly card fees on our proprietary Visa gift cards. Under GAAP, we recognized as revenue fees of $23.4 million in 2009 and $4.4 million in 2011 when we entered into these amendments. A portion of the fees recognized in 2009 and 2011 related to cards sold in earlier years. For further analysis of this item and others, please see footnote (b) in the “Reconciliation of Non-GAAP Measures” table as well as the discussion of Adjusted operating revenues, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income in footnote 7 to the “Other Operational and Financial Data” table. |

| (2) | Assumes an initial public offering price of $21.00 per share (the midpoint of the price range set forth on the cover of this prospectus) and an offering date of December 29, 2012 for purposes of calculating as adjusted consolidated balance sheet data and gives effect to the reclassification of outstanding shares of our common stock, the termination of all redemption rights held by equity holders and the reclassification of Warrant and common stock liabilities and Redeemable equity as Stockholders’ equity. In addition, upon completion of this offering, we will be required to record an expense with respect to the equity instruments held by certain distribution partners in an amount equal to the excess of the initial public offering price per share multiplied by the relevant number of equity securities over the amount previously expensed, with an offsetting increase in Stockholders’ equity. The amount of this non-cash expense is estimated to be $2.4 million in the aggregate, with a tax benefit of $0.6 million (calculated based on the midpoint of the estimated offering price range set forth on the cover of this prospectus). Certain selling stockholders will exercise stock options, resulting in an increase to Additional paid-in capital of $0.1 million. For a sensitivity analysis of the total stockholders’ equity and total capitalization based on various assumed initial public offering prices, please see “Capitalization.” |

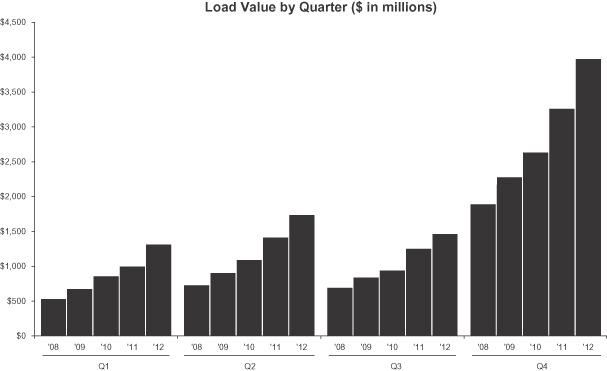

| (3) | A significant portion of gift card sales occurs in late December of each year as a result of the holiday selling season. The timing of December holiday sales, cash inflows from our distribution partners and cash outflows to our content providers results in significant but temporary increases in our Cash, cash equivalents and restricted cash, Overnight cash advances to Parent, Settlement receivables and Settlement payables balances at the end of each fiscal year relative to normal period end balances. In 2012, the average monthly balances of Cash, cash equivalents and restricted cash was $50.1 million and the average daily balance of Overnight cash advances to Parent was $146.3 million. For additional information about the effects of seasonality on our business, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quarterly Results of Operations and Seasonality.” |

12

Table of Contents

| (4) | Includes $8.5 million, $8.7 million, $8.8 million, $9.0 million and $9.0 million of restricted cash at year-end 2008, 2009, 2010, 2011 and 2012, respectively. We maintain this cash balance in an escrow account in accordance with a stock purchase agreement with one of our distribution partners. This cash will become unrestricted and available for general corporate use upon the completion of this offering. |

| (5) | Overnight cash advances to Parent represent cash amounts that are borrowed from us by Safeway and invested by it on an overnight basis for our benefit. |

| (6) | Settlement receivables represent the amounts due from our distribution partners for funds collected at the point of sale related to any of our prepaid products. Settlement payables represent the amounts that are due to our content providers or issuing banks. |

| (7) | Warrant and common stock liabilities represent the potential cash settlement obligation to certain distribution partners under put rights for equity instruments they hold. For additional information about the balance sheet classification of such rights, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Equity Instruments Issued to Distribution Partners.” |

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except percentages, average load transaction value and selling stores) |

||||||||||||||||||||

| OTHER OPERATIONAL AND FINANCIAL DATA: |

||||||||||||||||||||

| Load value(1) |

$ | 3,839,695 | $ | 4,684,505 | $ | 5,511,596 | $ | 6,914,373 | $ | 8,474,285 | ||||||||||

| Commissions and fees as a % of load value(2) |

8.5 | % | 8.9 | % | 9.1 | % | 9.3 | % | 9.3 | % | ||||||||||

| Distribution partner commissions paid as a % of commissions and fees(3) |

63.4 | % | 63.5 | % | 63.1 | % | 64.2 | % | 64.9 | % | ||||||||||

| Number of load transactions(4) |

109,940 | 134,633 | 154,551 | 184,245 | 216,214 | |||||||||||||||

| Average load transaction value(5) |

$ | 34.93 | $ | 34.79 | $ | 35.66 | $ | 37.53 | $ | 39.19 | ||||||||||

| Selling stores(6) |

52,600 | 50,700 | 59,900 | 75,800 | 100,700 | |||||||||||||||

| Adjusted operating revenues(7) |

$ | 164,574 | $ | 226,148 | $ | 265,716 | $ | 337,512 | $ | 448,280 | ||||||||||

| Adjusted EBITDA(7) |

$ | 38,507 | $ | 52,921 | $ | 59,793 | $ | 78,109 | $ | 99,702 | ||||||||||

| Adjusted EBITDA margin(7) |

23.4 | % | 23.4 | % | 22.5 | % | 23.1 | % | 22.2 | % | ||||||||||

| Adjusted net income(7) |

$ | 22,679 | $ | 26,846 | $ | 28,265 | $ | 38,920 | $ | 50,337 | ||||||||||

| (1) | Represents the total dollar amount of value loaded (including reloads) onto any of our prepaid products during the period. |

| (2) | Represents the total amount of Commissions and fees recognized during the period as a percentage of Load value for the same period. |

| (3) | Represents Distribution partner commissions expense divided by Commissions and fees revenue during the period. |

| (4) | Represents the total number of load transactions (including reloads) for all of our prepaid products during the period. |

| (5) | Represents Load value divided by Number of load transactions during the period. |

| (6) | Represents the approximate number of retail store locations selling one or more of our cards during the latest fiscal quarter within the period presented. |

| (7) | Adjusted operating revenues, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income are non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flow that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. These measures, however, should be considered in addition to, and not as a substitute for or superior to, operating revenues, operating income, operating margin, cash flows, or other measures of the financial performance prepared in accordance with GAAP. |

| We regard Adjusted operating revenues, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income as useful measures of operational and financial performance of the business. We regard Adjusted EBITDA margin as an important financial metric that we use to evaluate the operating efficiency of our business. Adjusted EBITDA and Adjusted net income measures are prepared and presented to eliminate the effect of items from EBITDA and net income that we do not consider indicative of our core operating performance within the period presented. Adjusted operating revenues are prepared and presented to eliminate the prior period effect or effects of certain provisions contained in contract amendments with our proprietary Visa gift card issuing banks and to eliminate the commissions paid to our distribution partners. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of Adjusted operating revenues. Our Adjusted operating revenues, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income may not be comparable to similarly titled measures of other organizations because other organizations may not calculate these measures in the same manner as we do. You are encouraged to evaluate our adjustments and the reasons we consider them appropriate. |

| We believe Adjusted operating revenues, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income are useful to evaluate our operating performance for the following reasons: |

| Ÿ | adjusting our operating revenues for the issuing bank contract amendment fees and the commissions paid to our distribution partners is useful to understanding our operating margin; |

13

Table of Contents

| Ÿ | EBITDA and Adjusted EBITDA are widely used by investors and securities analysts to measure a company’s operating performance without regard to items that can vary substantially from company to company and from period to period depending upon their financing, accounting and tax methods, the book value of their assets, their capital structures and the method by which their assets were acquired; |

| Ÿ | Adjusted EBITDA margin provides a measure of operating efficiency based on Adjusted operating revenues and without regard to items that can vary substantially from company to company and from period to period depending upon their financing, accounting and tax methods, the book value of their assets, their capital structures and the method by which their assets were acquired; |

| Ÿ | non-cash equity grants made to employees and distribution partners at a certain price and point in time do not necessarily reflect how our business is performing at any particular time and the related expenses are not key measures of our core operating performance; |

| Ÿ | the issuing bank contract amendment fee adjustments are necessary to adjust operating revenues, EBITDA and Net income to recognize the revenues from these fees as if the contract amendments had been in force in the previous years, which we believe better reflects our core operating performance during those periods; |

| Ÿ | intangible asset amortization expenses can vary substantially from company to company and from period to period depending upon the applicable financing and accounting methods, the fair value and average expected life of the acquired intangible assets, the capital structure and the method by which the intangible assets were acquired and, as such, we do not believe that these adjustments are reflective of our core operating performance; and |

| Ÿ | non-cash fair value adjustments to contingent business acquisition liability do not directly reflect how our business is performing at any particular time and the related expense adjustment amounts are not key measures of our core operating performance. |

| The following tables present a reconciliation of Total operating revenues to Adjusted operating revenues, a reconciliation of Net income to EBITDA and Adjusted EBITDA, a reconciliation of Operating income margin to Adjusted EBITDA margin and a reconciliation of Net income to Adjusted net income, in each case reconciling the most comparable GAAP measure to the adjusted measure, for each of the periods indicated. |

Reconciliation of Non-GAAP Measures:

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Adjusted operating revenues: |

||||||||||||||||||||

| Total operating revenues |

$ | 361,813 | $ | 503,993 | $ | 577,729 | $ | 751,806 | $ | 959,069 | ||||||||||

| Issuing bank contract amendment fee adjustment(b) |

10,547 | (11,591 | ) | 3,074 | (3,513 | ) | — | |||||||||||||

| Distribution partner commissions |

(207,786 | ) | (266,254 | ) | (315,087 | ) | (410,781 | ) | (510,789 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted operating revenues |

$ | 164,574 | $ | 226,148 | $ | 265,716 | $ | 337,512 | $ | 448,280 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

| Adjusted EBITDA: |

||||||||||||||||||||

| Net income |

$ | 15,530 | $ | 26,757 | $ | 19,188 | $ | 36,499 | $ | 47,892 | ||||||||||

| Interest and other income |

(3,146 | ) | (1,507 | ) | (789 | ) | (1,536 | ) | (1,297 | ) | ||||||||||

| Interest expense |

155 | — | 70 | 5 | 11 | |||||||||||||||

| Income tax expense |

9,107 | 24,032 | 18,496 | 25,154 | 30,199 | |||||||||||||||

| Depreciation and amortization |

5,344 | 7,889 | 11,126 | 15,123 | 18,431 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

26,990 | 57,171 | 48,091 | 75,245 | 95,236 | |||||||||||||||

| Adjustments to EBITDA: |

||||||||||||||||||||

| Employee stock-based compensation |

1,071 | 1,686 | 2,490 | 3,028 | 5,008 | |||||||||||||||

| Distribution partner mark-to-market expense(a) |

(101 | ) | 5,655 | 6,138 | 3,260 | 2,432 | ||||||||||||||

| Issuing bank contract amendment fee adjustment(b) |

10,547 | (11,591 | ) | 3,074 | (3,513 | ) | — | |||||||||||||

| Change in fair value of contingent consideration(c) |

— | — | — | 89 | (2,974 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 38,507 | $ | 52,921 | $ | 59,793 | $ | 78,109 | $ | 99,702 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA margin: |

||||||||||||||||||||

| Total operating revenues |

$ | 361,813 | $ | 503,993 | $ | 577,729 | $ | 751,806 | $ | 959,069 | ||||||||||

| Operating income |

$ | 21,646 | $ | 49,282 | $ | 36,965 | $ | 60,122 | $ | 76,805 | ||||||||||

| Operating margin |

6.0 | % | 9.8 | % | 6.4 | % | 8.0 | % | 8.0 | % | ||||||||||

| Adjusted operating revenues |

$ | 164,574 | $ | 226,148 | $ | 265,716 | $ | 337,512 | $ | 448,280 | ||||||||||

| Adjusted EBITDA |

$ | 38,507 | $ | 52,921 | $ | 59,793 | $ | 78,109 | $ | 99,702 | ||||||||||

| Adjusted EBITDA margin |

23.4 | % | 23.4 | % | 22.5 | % | 23.1 | % | 22.2 | % | ||||||||||

14

Table of Contents

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Adjusted net income: |

||||||||||||||||||||

| Net income |

$ | 15,530 | $ | 26,757 | $ | 19,188 | $ | 36,499 | $ | 47,892 | ||||||||||

| Employee stock-based compensation |

1,071 | 1,686 | 2,490 | 3,028 | 5,008 | |||||||||||||||

| Distribution partner mark-to-market expense(a) |

(101 | ) | 5,655 | 6,138 | 3,260 | 2,432 | ||||||||||||||

| Issuing bank contract amendment fee adjustment(b) |

10,547 | (11,591 | ) | 3,074 | (3,513 | ) | — | |||||||||||||

| Change in fair value of contingent consideration(c) |

— | — | — | 89 | (2,974 | ) | ||||||||||||||

| Amortization of intangibles(d) |

449 | 449 | 449 | 543 | 785 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total pre tax adjustments |

11,966 | (3,801 | ) | 12,151 | 3,407 | 5,251 | ||||||||||||||

| Tax expense on adjustments(e) |

(4,817 | ) | 3,890 | (3,074 | ) | (986 | ) | (2,806 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted net income |

$ | 22,679 | $ | 26,846 | $ | 28,265 | $ | 38,920 | $ | 50,337 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Distribution partner equity instruments are generally marked to market at each reporting date to fair value until the instrument is settled or expired. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Equity Instruments Issued to Distribution Partners.” |

| (b) | In 2009 and 2011, we entered into contract amendments with two of our issuing banks that substituted or adjusted a program management fee for monthly card fees on our proprietary Visa gift cards. Under GAAP, we recognized fee revenue of $23.4 million in 2009 and $4.4 million in 2011 when we entered into these amendments. A portion of the fees recognized in 2009 and 2011 related to cards sold in earlier years. Adjusted EBITDA and Adjusted net income for 2008 through 2011 have been adjusted to recognize the revenues from these fees as if the contract amendments had been in force in the previous years. The amount of revenues recognized over the periods presented in our non-GAAP financial measures is not different than the aggregate amount of revenues recognized under GAAP and presented in the audited financial statements. |

| (c) | Adjustments to reflect a contingent business acquisition liability at its estimated fair value. |

| (d) | Non-cash expense resulting from the amortization of intangible assets. |

| (e) | Assumes our statutory tax rate adjusted for certain amounts that are not deductible for tax purposes. |

15

Table of Contents

GLOSSARY OF INDUSTRY AND OTHER TERMS

Set forth below is a glossary of industry and other terms used in this prospectus:

“Active,” with respect to distribution partners, means distribution partners that have sold one or more of our cards during the latest fiscal quarter.

“Average load transaction value” for any period means the total dollar amount of value loaded onto any of our prepaid products divided by the total number of load transactions (including reloads) for all our prepaid products during the relevant period.

“Closed loop gift cards” means prepaid cards that are accepted as payment by only a single merchant, affiliated merchants (including licensees and franchisees) or a limited group of merchants (such as a shopping mall gift card).

“Content providers” means those companies that supply the prepaid access products that we distribute.

“Conventional grocery retailer” means a retailer that sells a variety of food products, including some perishable items, such as meat, produce and dairy, as well as general merchandise, as distinct from a retailer that is generally an operator of supercenters, big box general merchandise stores, specialty retail food stores, niche retail food stores or warehouse outlets.

“Distribution partners” means the retail and online merchants in our network that sell the products we distribute.

“GPR cards” means general purpose reloadable open loop prepaid cards, which are cards that are registered by the cardholder with the issuing bank or licensed money transmitter after customer identification is performed.

“Issuing bank” means a depository financial institution that, as a member of a network card association, issues the bank-issued open loop products we distribute.

“Load transaction” means each transaction through our network in which a consumer loads funds onto the cards we distribute (including reloads).

“Load value” means the total dollar amount of value loaded onto any of our prepaid products (including reloads).

“Network-branded” means products that are branded by a network card association such as American Express, MasterCard or Visa.

“Open loop gift cards” are open loop prepaid cards that are non-reloadable and anonymous (that is, do not require registration by the cardholder).

“Open loop prepaid cards” means cards that are branded by a network card association such as American Express, MasterCard or Visa, and that are accepted as payment by multiple, unaffiliated retail merchants. Open loop prepaid cards can be either open loop gift cards or GPR cards.

“Open loop products” are open loop prepaid cards and other prepaid access products redeemable at multiple, unaffiliated retail merchants.

“PayPower GPR card” means the GPR card that is both branded and program-managed by us and is issued by one of our issuing banks.

16

Table of Contents

“Prepaid access product” means an electronic device or vehicle, such as a card, plate, code, number, electronic serial number, mobile identification number, personal identification number or other instrument that provides access to funds or the value of funds that have been paid in advance and can be retrievable and transferable at some point in the future, including closed loop gift cards, open loop gift cards, prepaid telecom cards and GPR cards.

“Prepaid telecom cards” means prepaid cards that may be redeemed for airtime usage on the network of a wired or wireless telecommunications provider.

“Program manage” means to provide program manager services.

“Program manager” means an entity that is principally responsible for marketing and distributing open loop products for sale by third-party retailers, on behalf of an issuing bank, and that may provide certain other services, either directly or through subcontractors, including customer service, card production and transaction processing services.

“Selling stores” means the number of retail store locations selling one or more of our cards during the latest fiscal quarter within the period presented.

17

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in shares of our Class A common stock. The occurrence of any of the events or circumstances described below or other adverse events could have a material adverse effect on our business, results of operations and financial condition. If such an event or circumstance were to occur, the trading price of our Class A common stock may decline and you may lose all or part of your investment. Additional risks or uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to Our Business and Industry

We may not be able to grow at historic rates in the future, if at all.

Our revenues have grown rapidly, increasing from $577.7 million in 2010 to $959.1 million in 2012, representing a compound annual growth rate of 28.8%. There can be no assurance that we will be able to continue our historic growth rates in future periods. Our ability to maintain and grow our business depends on a number of factors, many of which are outside our control. These include:

| Ÿ | changes in consumer preferences and demand for the products and services that we offer; |

| Ÿ | our ability to retain and attract new customers, both in-store and online; |

| Ÿ | our ability to maintain and expand our distribution network; |

| Ÿ | our ability to maintain and expand the supply and variety of products and services that we distribute and offer; |

| Ÿ | our ability to increase the productivity of our distribution partners’ stores, including through in-store execution of marketing, loyalty and merchandising programs; |

| Ÿ | our ability to anticipate and adapt to technological changes in the industry, as well as to develop new technologies to deliver our product and service offerings; |

| Ÿ | our ability to maintain our relationships with issuing banks and other industry participants; |

| Ÿ | pricing pressure in the face of increasing competition and other market forces; |

| Ÿ | regulatory changes or uncertainty that increase compliance costs, decrease the attractiveness of the products and services we offer or make it more difficult or less attractive for us, our distribution partners or our content providers, including issuing banks, to participate in our industry; and |

| Ÿ | consumer acceptance of our product and services offerings in international markets, and our ability to grow our international operations and manage related regulatory compliance and foreign currency risk. |

Even if we are successful in increasing our operating revenues through our various initiatives and strategies, we may experience a decline in growth rates and/or an increase in expenses, which could have a material adverse effect on our business, results of operations and financial condition.

Our operating revenues may decline if we lose one or more of our top distribution partners, fail to maintain existing relationships with our distribution partners or fail to attract new distribution partners to our network, or if the financial performance of our distribution partners’ businesses declines.

The success of our business depends in large part upon our relationships with distribution partners, including Safeway. During 2010, 2011 and 2012, Safeway was our largest distribution

18

Table of Contents

partner, measured by operating revenues, and represented approximately 16.6%, 14.5% and 12.2% of our operating revenues, respectively, and our top four largest distribution partners excluding Safeway (each also a conventional grocery retailer), represented approximately 35.8%, 36.4% and 35.6% of our operating revenues, respectively.

Many of our distribution partner agreements are subject to renewal every three to five years. Upon expiration of their agreements with us, our distribution partners may enter into relationships with our competitors instead of renewing their agreements with us, renew their agreements with us on less favorable terms or establish direct relationships with our content providers. There is no assurance that we will be able to continue our relationships with these distribution partners on the same terms, or at all, in future periods. Among other things, many of our distribution partner agreements, including our agreement with Safeway, contain varying degrees of exclusivity for us as the provider of prepaid products in their stores, and it is important to our competitive positioning to maintain those exclusive relationships. Our operating results could be materially and adversely affected if any of our significant distribution partners terminates, fails to renew or fails to renew on similar or more favorable terms, its agreement with us. In addition, exclusive relationships between potential distribution partners and our competitors as well as other commercial arrangements may make it difficult for us to attract new distribution partners to our network.

The success of our business also depends on the continued success of our distribution partners’ businesses. Accordingly, our operating results may fluctuate with the performance of our partners’ businesses, including their ability to maintain and increase consumer traffic in their stores.

We rely on our content providers for our product and service offerings, and the loss of one or more of our top content providers or a decline in demand for their products, or our failure to maintain existing exclusivity arrangements with content providers or to attract new content providers to our network, could have a material adverse effect on our business, results of operations and financial condition.

The success of our business depends, in large part, on our ability to offer a wide array of quality content. Our agreements with our content providers generally range from one to three years in length. There can be no assurance that we will be able to negotiate a renewal of those agreements on satisfactory terms or at all. Some of these agreements also permit the content providers to terminate their agreements with us prior to expiration if we fail to meet certain operational performance standards, among other reasons. In addition, we distribute the open loop gift and reloadable products of certain of our competitors, such as American Express, Green Dot and NetSpend. These content providers may choose to cease doing business with us for competitive or other reasons.