Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VEREIT, Inc. | v341408_8k.htm |

American Realty Capital Properties, Inc. Stockholder Letter Fourth Quarter 2012 and Subsequent Events

American Realty Capital Properties, Inc. Stockholder Letter Dear Stockholder: n 2012 and the fi rst quarter of 2013, American Realty Capital Properties (NASDAQ: ARCP) made signifi cant progress in meeting all of its primary goals: completed a transformative merger with ARCT III; outperformed its peer group; announced its sixth consecutive quarterly dividend; executed on its acquisition program at prices accretive to its dividend; continued to build out its equity base, completing two equity offerings and fi ling a universal shelf; increased its credit facility. This has enabled ARCP to solidify its unique and highly competitive position within the net lease sector. The Company had an outstanding 2012 and Q1 2013, and we could not be more enthusiastic about the year ahead. We will continue to maintain a high quality real estate investment vehicle and provide our investors durable dividends, principal protection and the opportunity for outsized asset appreciation. Our focus will remain on aggregating properties accretive to our dividend, growing our earnings, and increasing our dividend. Let’s review 2012 highlights, Q4 2012 achievements and what is in store for 2013. 2012 and Q1 2013 in Review • Returned nearly 38% in 2012, surpassing our triple net peers and the broader markets by a signifi cant margin (See Exhibit A) • By the fi rst quarter of 2013, had announced 6 consecutive quarterly dividend increases since our IPO • Purchased 58 properties, totaling 1.4 million square feet, for a total purchase price of $131.8 million at an average cap rate of 9.7% in 2012. YTD 2013, acquired approximately $40 million and placed an additional $167 million under contract • Completed two follow-on equity offerings totaling approximately $60 million through early January 2013 • Achieved fl exible capital options through the fi ling of a $500 million universal shelf registration and entered into an “at-the-market” program • Automatic shelf registration fi led and acheivement of “well-known seasoned issuer” status (WKSI) • Completed a transformative merger in February 2013, totaling approximately $3.1 billion enterprise value, with ARCT III • Increased existing credit facility to $1.65 billion, subject to customary conditions with the option to exercise our “accordion” feature to $2.5 billion Completion of ARCT III Merger In December 2012, ARCP and ARCT III executed a merger agreement under which ARCP agreed to acquire all of the outstanding shares of ARCT III. This transformative transaction was approved by both companies’ boards of directors and stockholders and the merger closed on February 28, 2013. ARCP has now become one of the largest publicly-traded net lease REITs and one of the largest publicly-traded REITs in the U.S. This successful combination enhances our real estate portfolio quality, further diversifi es our asset base, and creates a net lease portfolio with high credit quality tenants of long-term and mid-term lease durations. The signifi cantly increased enterprise value of $3.1 billion offers the potential to lower the cost of our equity and debt capital, positions us for future MSCI and Russell Index inclusions, and moves us closer to achieving an investment grade credit rating. ARCP expects to realize $48 million in operating cost savings over a fi ve-year period. Common Stock Performance ARCP returned almost 8% for the fourth quarter on a total return basis – outperforming the MSCI, its triple net peers and the broader equity markets by wide margins of 444 to 556 bps. For the 12 month period ended December 31, 2012, ARCP returned nearly 38% on a total return basis, again outperforming its peers, the REIT index and the broader equity markets by more than 13% to 21%. ARCP gained another 140 basis points of total return through the close of its merger on February 28, 2013. (See Exhibit B) EXHIBIT B Total Return Performance* 2012 4th Quarter 2012 Merger Close* ARCP 37.6% 7.9% 39.0% Triple Net Peers 24.1% 3.3% 38.0% MSCI US REIT Index 17.8% 2.5% 23.7% Russell 2000 Index 16.3% 1.9% 25.0% * 1-Yr and 4th Quarter as of 12/31/2012. Merger close performance range from 1/1/2012 through 2/28/2013. Peer universe includes O, NNN, LSE, LXP, EPR, ADC, GTY and OLP. Earnings Post-merger, ARCP reaffi rmed previously issued preliminary pro forma 2013 and 2014 adjusted earnings guidance. In this instance, earnings are best represented by adjusted funds from operations (“AFFO”). ARCP’s AFFO is expected to range between $0.91 and $0.95 per share (fully diluted) in 2013. ARCP’s AFFO is expected to range between $1.06 and $1.10 per share (fully diluted) in 2014. Thus, AFFO per share is projected to grow by 16% from 2013 to 2014. ARCP has and will continue to grow earnings through rental growth and through accretive acquisitions, while further diversifying its tenant base and property portfolio. Property Portfolio Highlights (Exhibit C) ARCP has maintained a consistent investment strategy of purchasing single tenant, net leased real estate focused on investment grade rated and other credit worthy corporate tenants1. Currently, post-merger, the average weighted remaining lease term is 11.5 years. With the consummation of the merger, our (1) “Investment grade” is a determination made by major credit rating agencies, and “credit-worthy” tenants are as determined by us based on our own understanding of the tenant’s fi nancial condition after employing our underwriting procedures. EXHIBIT A ARCP 1-Year Total Return Performance* * As of 12/31/2012. Peer universe includes O, NNN, LSE, LXP, EPR, ADC, GTY and OLP.

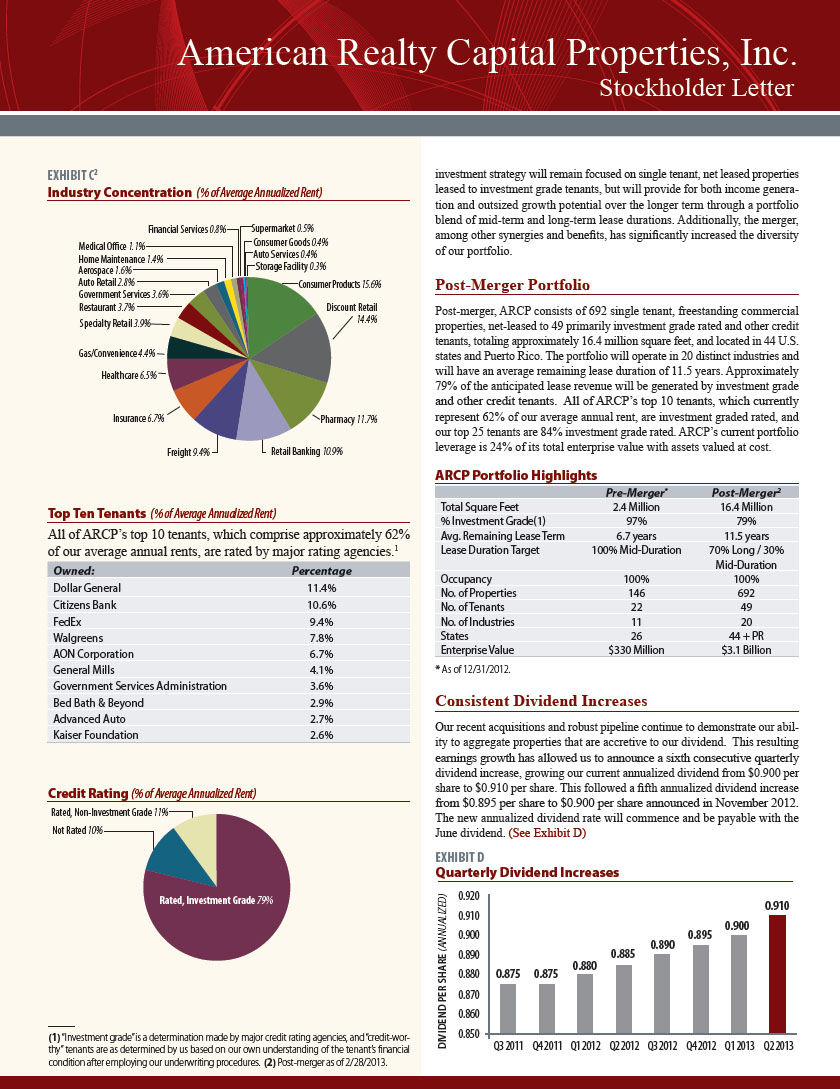

American Realty Capital Properties, Inc. Stockholder Letter EXHIBIT C2 DIVIDEND PER SHARE _ANNUALIZED_ Industry Concentration (% of Average Annualized Rent) Home Maintenance 1.4% Medical O_ ce 1.1% Financial Services 0.8% Supermarket 0.5% Consumer Goods 0.4% Auto Services 0.4% Storage Facility 0.3% Auto Retail 2.8% Aerospace 1.6% Pharmacy 11.7% Government Services 3.6% Discount Retail 14.4% Consumer Products 15.6% Healthcare 6.5% Gas/Convenience 4.4% Insurance 6.7% Specialty Retail 3.9% Freight 9.4% Retail Banking 10.9% Top Ten Tenants (% of Average Annualized Rent) All of ARCP’s top 10 tenants, which comprise approximately 62% of our average annual rents, are rated by major rating agencies.1 Owned: Percentage Dollar General 11.4% Citizens Bank 10.6% FedEx 9.4% Walgreens 7.8% AON Corporation 6.7% General Mills 4.1% Government Services Administration 3.6% Bed Bath & Beyond 2.9% Advanced Auto 2.7% Kaiser Foundation 2.6% (1) “Investment grade” is a determination made by major credit rating agencies, and “credit-worthy” tenants are as determined by us based on our own understanding of the tenant’s fi nancial condition after employing our underwriting procedures. (2) Post-merger as of 2/28/2013. Credit Rating (% of Average Annualized Rent) Rated, Non-Investment Grade 11% Not Rated 10% Rated, Investment Grade 79% investment strategy will remain focused on single tenant, net leased properties leased to investment grade tenants, but will provide for both income generation and outsized growth potential over the longer term through a portfolio blend of mid-term and long-term lease durations. Additionally, the merger, among other synergies and benefi ts, has signifi cantly increased the diversity of our portfolio. Post-Merger Portfolio Post-merger, ARCP consists of 692 single tenant, freestanding commercial properties, net-leased to 49 primarily investment grade rated and other credit tenants, totaling approximately 16.4 million square feet, and located in 44 U.S. states and Puerto Rico. The portfolio will operate in 20 distinct industries and will have an average remaining lease duration of 11.5 years. Approximately 79% of the anticipated lease revenue will be generated by investment grade and other credit tenants. All of ARCP’s top 10 tenants, which currently represent 62% of our average annual rent, are investment graded rated, and our top 25 tenants are 84% investment grade rated. ARCP’s current portfolio leverage is 24% of its total enterprise value with assets valued at cost. ARCP Portfolio Highlights Pre-Merger* Post-Merger2 Total Square Feet 2.4 Million 16.4 Million % Investment Grade(1) 97% 79% Avg. Remaining Lease Term 6.7 years 11.5 years Lease Duration Target 100% Mid-Duration 70% Long / 30% Mid-Duration Occupancy 100% 100% No. of Properties 146 692 No. of Tenants 22 49 No. of Industries 11 20 States 26 44 + PR Enterprise Value $330 Million $3.1 Billion Consistent Dividend Increases Our recent acquisitions and robust pipeline continue to demonstrate our ability to aggregate properties that are accretive to our dividend. This resulting earnings growth has allowed us to announce a sixth consecutive quarterly dividend increase, growing our current annualized dividend from $0.900 per share to $0.910 per share. This followed a fi fth annualized dividend increase from $0.895 per share to $0.900 per share announced in November 2012. The new annualized dividend rate will commence and be payable with the June dividend. (See Exhibit D) EXHIBIT D Quarterly Dividend Increases Q3 2011 0.920 0.910 0.900 0.890 0.880 0.870 0.860 0.850 0.875 0.875 0.880 0.885 0.890 0.895 0.900 0.910 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013

American Realty Capital Properties, Inc. Stockholder Letter Acquisitions and Future Pipeline During the 12 months ended December 31, 2012, ARCP acquired 58 properties comprising approximately 1.4 million square feet, all 100% occupied, for an aggregate base purchase price of $131.8 million at an average capitalization rate of 9.7%. Q4’ 2012 acquisitions alone included three Family Dollar stores, one FedEx facility, one Fresenius dialysis center, 14 Advance Auto stores, two Walgreens stores and one Synovus Bank branch, which totaled $32.9 million, exclusive of closing costs, and increased the portfolio’s size, at cost, to $268.6 million. These 22 properties totaled over 200,000 square feet located in 10 states, and were acquired at an average capitalization rate of 9.0%. Acquisitions that have recently closed in March 2013 include a FedEx Ground distribution facility leased to a subsidiary of FedEx Corporation (NYSE: FDX), and a TD Bank offi ce building in Falmouth, Maine. The FedEx distribution facility encompasses 68,425 rentable square feet, is located in Lowell, Arkansas, and was purchased for $8.8 million at an average capitalization rate of 9.0%. The TD Bank offi ce building contains 143,030 rentable square feet and was purchased for $31.0 million at an average capitalization rate of 8.9%. With an attractive second quarter 2013 pipeline already assembled, we see no shortage of net lease acquisition opportunities with favorable pricing and will continue to add quality, credit tenants at yields accretive to ARCP’s dividend. To achieve our current FFO and AFFO guidance, we intend to acquire approximately $1.1 billion of assets in 2013, which is inclusive of approximately $200 million of assets already closed through February 28, 2013. An additional $167.0 million of acquisitions have been placed under contract and are expected to close within 60 days of the writing of this letter. Signifi cant Balance Sheet Initiatives We took several important steps in both Q4 2012 and the beginning of 2013 to position our balance sheet appropriately and increase our earnings. • Completed Follow-On Offering: On January 24, 2013, ARCP priced an underwritten public follow-on offering of 1,800,000 shares of common stock. The offering price to the public in the offering was $13.47 per share (before underwriting discounts and commissions). The offering closed on January 29, 2013, for a total share count of 2,070,000, after the underwriters fully exercised their option to purchase an additional 270,000 shares of common stock at the public offering price. As a result, ARCP received total net proceeds of approximately $26.5 million, after deducting underwriting discounts, commissions and estimated expenses. • Launched “ATM” Program: In January 2013, ARCP launched its “at-themarket” equity offering (“ATM”) program in which it may from time to time offer and sell shares of its common stock having aggregate offering proceeds of up to $60.0 million. The ATM program allows us to issue small amounts of equity to match-fund our acquisitions with low issuance costs. The shares will be issued pursuant to ARCP’s $500.0 million universal shelf registration statement. As of February 28, 2013, ARCP issued 61,000 shares at a weighted average price per share of $13.48 for net proceeds of $0.8 million pursuant to the ATM program. A total of $59.2 million of shares of common stock remained available for issuance under the ATM program. • Increased Commitment on Facility: In March 2013, ARCP received additional commitments totaling $650.0 million to its existing credit facility which signifi cantly increases our fi nancial fl exibility. The additional commitments increase the total amount available to the Company to $1.65 billion, subject to customary conditions. The accordion feature of this credit facility has been increased to allow ARCP, with additional commitments, to borrow up to $2.5 billion. • Achieved Automatic Shelf Registration: ARCP fi led a $500.0 million universal automatic shelf registration and achieved “well known seasoned issuer” status (WKSI). The shelf registration increases our fi nancial fl exibility and access to capital market. • Locked in Favorable Financing: ARCP’s initial draw down of $515 million from its existing line was achieved at an extremely favorable fi xed rate of 2.45%. Value Creation ARCP continues to deliver value to its stockholders. The recent merger with ARCT III increased market recognition and bolstered already strong stock performance. We intend to build off of this positive momentum. As mentioned previously, we will continue to maintain a high quality real estate investment vehicle, providing our investors durable dividends, principal protection and the opportunity for signifi cant growth. A keen focus will be placed on buying accretive to cost, increasing our dividend and focusing on earnings growth. Let me close by saying thank you to all of our stockholders, old and new. It has been an exciting journey thus far, and we certainly appreciate your ongoing support. We believe we have a superior net lease REIT, complete with a best in class portfolio of high quality, primarily investment grade properties, a solid balance sheet and an experienced management team. As in all our investment programs, management’s interests remain closely aligned with those of our stockholders, and we stand fi rmly committed to putting our stockholders fi rst. Sincerely, Nicholas S. Schorsch Chairman & Chief Executive Officer