Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - HARROW HEALTH, INC. | immy_8k.htm |

Exhibit 99.1

Imprimis Pharmaceuticals,

Inc.

Inc.

“Positioned to Monetize One of the Largest

Databases of Compounded Drug Formulations”

Databases of Compounded Drug Formulations”

April 2013

Mark L. Baum, C.E.O.

1

Safe Harbor Statement

The Company cautions you that the statements included in this presentation are not a description of historical

facts and are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. These include statements regarding the Company’s

interpretation of the results of its Phase 3 clinical trial for Impracor™, the Company’s ability to obtain regulatory

approval to market Impracor™, the Company’s potential benefits arising from the Company’s relationship with

Professional Compounding Centers of America, Inc., the Company’s ability to leverage compounded generic

drugs to create a development pipeline and otherwise pursue its business plan and the Company’s ability to

leverage its Accudel™ technology in the development of potential product candidates.

facts and are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. These include statements regarding the Company’s

interpretation of the results of its Phase 3 clinical trial for Impracor™, the Company’s ability to obtain regulatory

approval to market Impracor™, the Company’s potential benefits arising from the Company’s relationship with

Professional Compounding Centers of America, Inc., the Company’s ability to leverage compounded generic

drugs to create a development pipeline and otherwise pursue its business plan and the Company’s ability to

leverage its Accudel™ technology in the development of potential product candidates.

These forward-looking statements are based on management’s current expectations, estimates, forecasts and

projections about the Company and are subject to risks and uncertainties that could cause actual results and

events to differ materially from those stated in the forward-looking statements. Actual results may differ materially

from those set forth in this presentation due to the risks and uncertainties inherent in the Company’s business,

including, without limitation: the outcome of the final analyses of the data from the past and future Phase 3 clinical

trial may vary from the Company’s initial conclusions; the FDA may not agree with the Company’s interpretation

of such results or may challenge the adequacy of the Company’s future Impracor™ clinical trial design or the

execution of the same clinical trials; the FDA may continue to require the Company to complete additional clinical

trials for Impracor™ before the Company can submit a 505(b)(2) NDA application; the results of any future clinical

trials may not be favorable and the Company may never receive regulatory approval for Impracor™; and the

Company’s possible need to raise additional funding to complete its product development plans.

projections about the Company and are subject to risks and uncertainties that could cause actual results and

events to differ materially from those stated in the forward-looking statements. Actual results may differ materially

from those set forth in this presentation due to the risks and uncertainties inherent in the Company’s business,

including, without limitation: the outcome of the final analyses of the data from the past and future Phase 3 clinical

trial may vary from the Company’s initial conclusions; the FDA may not agree with the Company’s interpretation

of such results or may challenge the adequacy of the Company’s future Impracor™ clinical trial design or the

execution of the same clinical trials; the FDA may continue to require the Company to complete additional clinical

trials for Impracor™ before the Company can submit a 505(b)(2) NDA application; the results of any future clinical

trials may not be favorable and the Company may never receive regulatory approval for Impracor™; and the

Company’s possible need to raise additional funding to complete its product development plans.

More detailed information about the Company and the risk factors that may affect the realization of forward-

looking statements is set forth in the Company’s filings with the Securities and Exchange Commission, including

its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q filed with the SEC. Such documents

may be read free of charge on the SEC’s web site at www.sec.gov.

looking statements is set forth in the Company’s filings with the Securities and Exchange Commission, including

its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q filed with the SEC. Such documents

may be read free of charge on the SEC’s web site at www.sec.gov.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

date hereof, given these risks and uncertainties. All forward-looking statements are qualified in their entirety by

this cautionary statement and the Company undertakes no obligation to revise or update this presentation to

reflect events or circumstances after the date hereof.

date hereof, given these risks and uncertainties. All forward-looking statements are qualified in their entirety by

this cautionary statement and the Company undertakes no obligation to revise or update this presentation to

reflect events or circumstances after the date hereof.

© Imprimis Pharmaceuticals, Inc. | *

2

Imprimis Overview

© Imprimis Pharmaceuticals, Inc. | *

3

Imprimis Snapshot

© Imprimis Pharmaceuticals, Inc. | *

• Approx. $19.5M in cash1

• Nominal debt; no preferred instruments

• Phase 3 topical NSAID pivotal to start mid 2013

• Exclusive commercial rights to PCCA development IP

• 10,000+ drug formulations

• 10+ drug delivery technologies

• Vast market “unmet need” database

• Accudel™ targeted drug delivery platforms

• Experienced science and management teams

1) Cash position at December 31, 2012 ($10M), and net proceeds $(9.5M) of public offering and over-allotment exercise February/March, 2013

4

Imprimis Overview

© Imprimis Pharmaceuticals, Inc. | *

Low Risk

Low Margin

505(b)(2) … Lower Risk | Higher Margin

We develop proprietary drug assets using the 505(b)(2) pathway

5

Less Development Time & Lower Cost

|

Application

|

505(b)(1) NDA

|

505(b)(2) NDA

|

505(j) ANDA

|

|

New Chemical Entity

(NCE) |

Yes

|

Yes/No

(Rely on RLD and Prior Investigation)

|

No

(RLD is off patent)

|

|

New Indication

|

Yes

|

Yes

|

No

|

|

New Form/Dose

|

Yes

|

Yes

|

No

|

|

Required Data for

Approval |

• Complete Pharmacology

• Complete Preclinical

Safety, including long term carcinogenicity in 2 species • Complete analytical

development and quality manufacturing • Complete Phase 1-3

clinical trials |

• Data from published literature

• FDA findings on efficacy/safety of

approved drug/formulation • Studies to support change

• Dermal/Eye Safety (topical drugs)

• Clinical Efficacy/Safety

• CMC (3 registration batches with

stability data) |

• Bioequivalence

|

• 505(b)(2) products can have Orange Book-listed patents, can enjoy 30-month protection against

generic competitors; NCE (5 yrs); Orphan Drug (7 yrs); Pediatric Extension (6 mos.)

generic competitors; NCE (5 yrs); Orphan Drug (7 yrs); Pediatric Extension (6 mos.)

• 505(b)(2) Development Budget Comparison: $2-7M versus $100M+ for (b)(1)

© Imprimis Pharmaceuticals, Inc. | 6

6

Imprimis Development Model

© Imprimis Pharmaceuticals, Inc. | *

Imprimis Brings Innovation

from Pharmaceutical Compounders

to the >$300B U.S. Pharmaceutical Industry

Pharmaceutical

Compounders

1%

99%

7

PCCA Strategic Relationship

• Professional Compounding Centers of America

(PCCA) is the largest compounding pharmacy

organization in North America

(PCCA) is the largest compounding pharmacy

organization in North America

1. Supply chemicals, equipment, accredited training, software,

and business/pharmacy consulting assistance

and business/pharmacy consulting assistance

• Over 3,900 pharmacy businesses/chains worldwide

• PCCA relationship gives Imprimis exclusive access to:

1. Proprietary and proven drug formulations

2. Proprietary and proven drug delivery technologies

(Lipoderm® and others)

(Lipoderm® and others)

3. Market data (>100,000 inbound calls per year)

4. Analytics

• Our strategic relationship is exclusive

• PCCA invested $4M into Imprimis at $4.80 per share

Risk Mitigated

Proprietary Drug Pipeline

+

© Imprimis Pharmaceuticals, Inc. | *

8

Imprimis Vision

© Imprimis Pharmaceuticals, Inc. | *

Drive Shareholder Value

• Monetize vast PCCA IP

and development assets

• Selective internal

development

development

• Partner

• Out-license

Improve Patient Care

• Novel drug administration

• Reduce or eliminate

negative side effect

profiles

negative side effect

profiles

• Increase therapeutic

benefit to patients

benefit to patients

9

Monetizing the PCCA Relationship

Step 1: Opportunity Matrix

X Axis: Drug Administration

Y Axis: Health Categories

• Competition

• Dollar Size

• Number of Annual RX

Internally Develop

Partner, Out-License

10

Improving Patient Care:

Impracor™ Phase 3

Topical NSAID

Impracor™ Phase 3

Topical NSAID

© Imprimis Pharmaceuticals, Inc. | *

11

The Case for a Topical NSAID

|

|

Oral NSAIDs

|

Topical NSAIDs

|

|

Efficacy in Acute Soft Tissue Injuries

|

Good

|

Good

|

|

Efficacy in Osteoarthritis

|

Good

|

Good

|

|

Incidence of Adverse Events

|

High

|

Low

|

|

GI Safety (Stomach)

|

Poor

|

Good

|

|

Hepatic Safety (Liver)

|

Poor

|

Good

|

|

Renal Safety (Kidney)

|

Poor

|

Good

|

|

Cardiovascular Safety (Heart)

|

Poor

|

Good

|

© Imprimis Pharmaceuticals, Inc. | *

Resultant Complications from Systemic (Oral) NSAID Use

• 16,000 deaths (US/yr)

• 100,000 hospitalizations (US/yr)

12

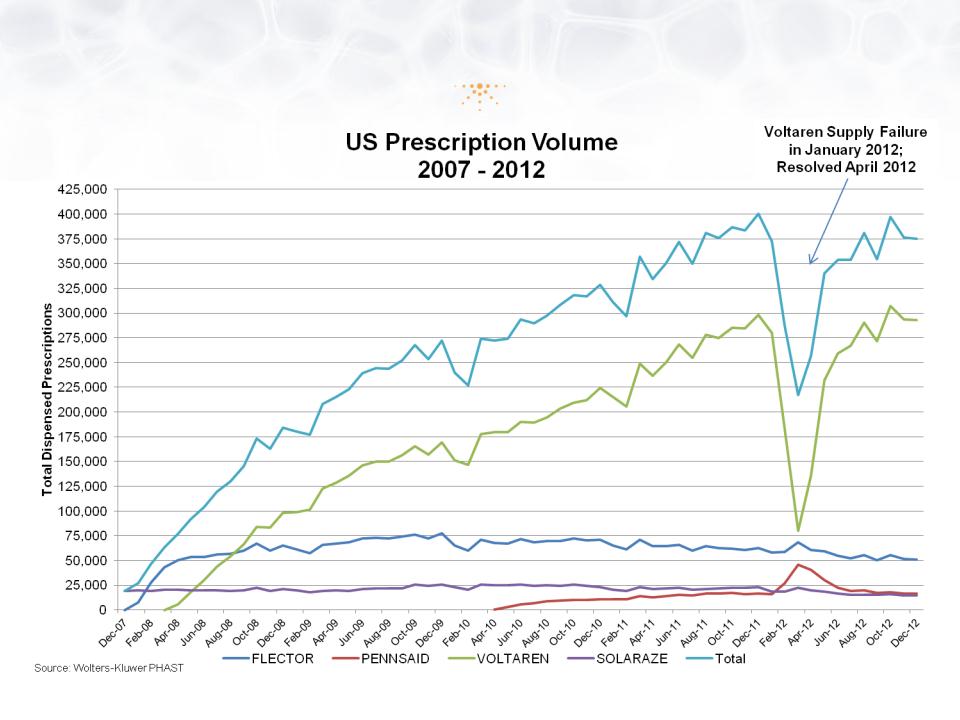

The Topical NSAID Market

© Imprimis Pharmaceuticals, Inc. | 13

13

The Case for Impracor™

© Imprimis Pharmaceuticals, Inc. | *

• Market Analysis:

• The $10B+ US NSAID Market is Transitioning to Topicals

• Voltaren Gel (1% diclofenac) has ~75% Rx share

• Despite Suboptimal Products, U.S. Topical NSAID Market is Growing

• 2016 Topical NSAID Market Possibly >$1B

• There is a compelling unmet need for an effective semi-solid NSAID

|

Factor

|

Impracor™

|

Voltaren®

|

|

Delivery Technology

|

Patented Accudel™ Micelles

|

None; Alcohol

|

|

Per Dose Quantity

|

3g

|

4g

|

|

Dose Frequency

|

BID (2X Daily)

|

QID (4X Daily)

|

|

API

|

10% Ketoprofen

|

1% Diclofenac

|

|

COX Selectivity

|

Cox 1

|

Cox 2

|

|

Smell

|

Neutral

|

Insect Repellant

|

|

Tactile

|

Smooth

|

Greasy

|

14

Impracor™ Phase 3 Program

Initial Phase 3 Trial

• Removing subjects who should not have entered the trial: p=0.038

• Remove subjects who did not comply with the protocol: p=0.034

New Acute Pain Clinical Trials to Achieve FDA Approval

• Two adequate and well controlled acute pain trials

• Analgesic Solutions (Dr. Nathaniel Katz) design/execute program

• Use patented tools and methods to reduce placebo effect

• Rapid trial enrollment from “banking” of qualified patients

• Seek “sprains, strains and joint pain” label

• Could be the only acute pain topical NSAID (if FDA approved)

© Imprimis Pharmaceuticals, Inc. | *

Phase 3 Clinical Trials Planned - Mid 2013

Initial Trial Data - Q1 2014

15

Impracor™ Commercialization

• Capture existing compounded topical ketoprofen market

• Doctors prefer FDA approved product

• Patients prefer insurance reimbursement

• Potentially more margin for pharmacies for FDA-approved

product

product

• Option to utilize PCCA member network to launch in US

• Out-license and compete against Voltaren in the large and

growing US topical NSAID market

growing US topical NSAID market

• Benefit from format, feel, potency, dosing & smell

advantages

advantages

© Imprimis Pharmaceuticals, Inc. | *

16

Impracor™ Intellectual Property

FDA Exclusivity

• FDA protection with up to 3 years of new drug exclusivity

• “Paragraph IV” claims can prevent generics for up to 30 months

*** FDA “High Hurdles” for Topical Generics

• Voltaren™ - off exclusivity and off patent for years - no generics

• There are currently no generics in the topical NSAID market:

• FDA Guidance: Voltaren™ generics must complete clinical studies prior to ANDA

• Generic drug companies are not in the business of conducting clinical trials

• Conclusion: Bioequivalence for an ANDA for topical drugs is difficult to establish

USPTO Protections

• Core Accudel™ US/Canadian patents issued

• New Impracor™ packaging applications filed

© Imprimis Pharmaceuticals, Inc. | *

17

Executive Team and

Select Financial Data

Select Financial Data

© Imprimis Pharmaceuticals, Inc. | *

18

Management Team Snapshot

Strong operational and management experience within our leadership group

Compensation weighted in equity

Chief Executive Officer: Mark L. Baum, J.D.

15+ Years of Senior Executive Experience; Founder/President, YesRx.com (1999)

Founder of 3 private investment funds; Restructured numerous companies (private-to-public)

Responsible for Restructuring Imprimis, including ~$24M new equity investment and PCCA transaction

President: Balbir Brar, D.V.M., Ph.D.

25 Years of Senior Drug Development Experience

Senior Positions: Lederle/Wyeth, SmithKline & Beckman, and Allergan

Drugs: Botox, Ketorolac (Cataracts), Restasis (Dry Eye), Lumigam, Latisse, Alphagan and 8 other drugs

Chief Medical Officer: Joachim P.H. Schupp, M.D.

Senior Positions: Ciba-Geigy, Novartis, ProSanos, Adventrx, Apricus Biosciences

Senior Positions: Ciba-Geigy, Novartis, ProSanos, Adventrx, Apricus Biosciences

Drugs: Voltaren line extensions, Apligraf, Femara, Exjade and Sandoglobulin

VP, Accounting and Public Reporting: Andrew R. Boll

8+ years of experience in small capitalization company financial reporting; focus on restructured businesses

Led forensic-type accounting and financial reporting of historical Imprimis records during restructuring

© Imprimis Pharmaceuticals, Inc. | *

19

Clinical and Regulatory Team Snapshot

Senior Regulatory Advisor: Lee S. Simon, M.D.

FDA Division Director of Analgesic, Anti-Inflammatory & Ophthalmologic Drug Products (2001-2003)

Served on multiple FDA advisory committees; 12 years as an NIH funded investigator

FDA Division Director of Analgesic, Anti-Inflammatory & Ophthalmologic Drug Products (2001-2003)

Served on multiple FDA advisory committees; 12 years as an NIH funded investigator

Senior consultant to Pharmacia/Searle on COX-2 development

Two terms on the BOD of the American College of Rheumatology; 110 Original Publications

Senior Clinical Advisor: Roy D. Altman, M.D.

Professor of Medicine, Division of Rheumatology/Immunology at UCLA ; 35+ yrs clinical experience

Founding Member/Past President of the Osteoarthritis Research Society International

Chairman for the Design and Conduct of Clinical Trials in Osteoarthritis as well as the Chairman on

Clinical Trials in Osteoarthritis; Over 200 juried manuscripts and over 60 books

Clinical Trials in Osteoarthritis; Over 200 juried manuscripts and over 60 books

Edited the 4th edition of Osteoarthritis: Diagnosis and Management.

Co-editor :Seminars in Arthritis and Rheumatism and Editor and Chief of Osteoarthritis and Cartilage

Senior Clinical Advisor: Marc C. Hochberg, M.D.

Faculty, The Johns Hopkins University SOM & University of Maryland SOM

Head of the Division of Rheumatology and Clinical Immunology at University of Maryland SOM

Focus on clinical epidemiology of musculoskeletal diseases, osteoarthritis and osteoporosis

PI of NIH and Dep’t Vet. Affairs funded studies, and is a Co-investigator on several other studies

Senior Regulatory Advisor: Allan M. Green, M.D., PhD, J.D.

Physician, Attorney, Inventor and Research Scientist

Operating and Management Experience with Numerous Biomedical Companies

Of Counsel to Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

Teaches Food and Drug Law at Boston College Law School

© Imprimis Pharmaceuticals, Inc. | *

20

Capital Structure

|

|

Capital Structure

March 14, 2013

(Unaudited)

|

Percent

|

|

Common Shares

|

8,888,250

|

82.58%

|

|

Total Restricted Stock Units

|

200,000

|

1.86%

|

|

Total Options & Warrants - Weighted Avg. Ex. Price $5.49

|

1,675,487

|

15.56%

|

|

Total Common Shares - Diluted

|

10,763,737

|

100.00%

|

|

|

|

|

© Imprimis Pharmaceuticals, Inc. | *

21

Summary

© Imprimis Pharmaceuticals, Inc. | *

• Imprimis is a Company with Vision

• Unique Drug Development Model

• Near Term Catalysts

• Robust and Compelling Development Assets

• Key Strategic Relationships

• Cash Resources to Execute

• Highly Capable Team

22

Questions & Discussion

Imprimis Pharmaceuticals, Inc.

Delivering Safe, Effective and Direct Solutions

FOR MORE INFORMATION CONTACT:

Mark L. Baum, J.D.

(858) 433-2816 - Direct

mark@imprimispharma.com

© Imprimis Pharmaceuticals, Inc. | *

23

Appendix - Investment

Summary & Support

Summary & Support

© Imprimis Pharmaceuticals, Inc. | A1

24

Accudel™ Topical

Delivery Technology

Delivery Technology

© Imprimis Pharmaceuticals, Inc. | A2

25

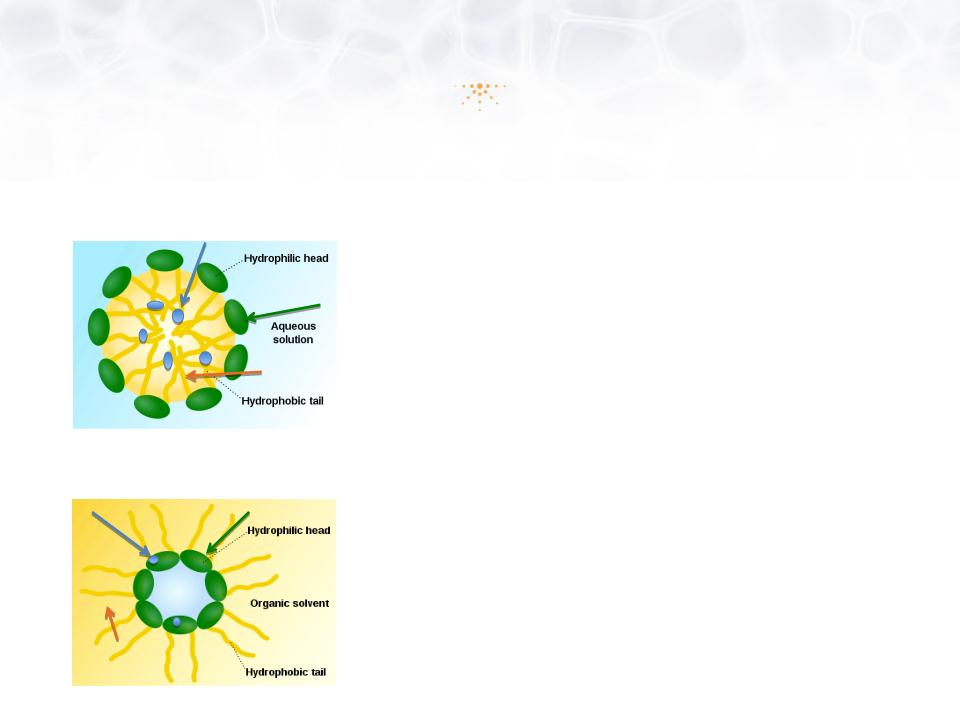

Introduction to Accudel™

Pluronic Lecithin Organogel (PLO) Platform

Lipophillic APIs

Hydrophillic APIs

Pluronic Phase

Lecithin Phase

• Accudel™ is a cream that “carries” drugs

through the skin, penetrating to the problem site

through the skin, penetrating to the problem site

• Pluronic Lecithin Organogel (PLO) drug carrier

• Accommodates different size molecules and large

quantities of active drugs

quantities of active drugs

• Works with drugs with different physicochemical

properties

properties

• Quickly absorbed and aesthetically pleasing

• Low toxicity and biodegradable; components are

non-immunogenic and are “Generally Regarded

As Safe” (GRAS) by the US FDA

non-immunogenic and are “Generally Regarded

As Safe” (GRAS) by the US FDA

• Thermodynamically stable, insensitive to moisture

and resistant to microbial contamination

and resistant to microbial contamination

Drug

© Imprimis Pharmaceuticals, Inc. | A3

Lecithin Phase

Drug

Pluronic Phase

26

Introduction to Accudel™

In Vitro Penetration Data for Impracor™ and

European Marketed Products (Fastum®, Ketum®, Oruvail®)

European Marketed Products (Fastum®, Ketum®, Oruvail®)

• 63% - 70% of ketoprofen in Impracor that was available for

release diffused through the membrane (0.45 m Nylon) of a

Franz Cell Apparatus within 4 hoursi.

release diffused through the membrane (0.45 m Nylon) of a

Franz Cell Apparatus within 4 hoursi.

• (Fastum, Ketum, Oruvail) 2.5% topical ketoprofen were tested

in a Franz Cell Apparatus (Silicon membrane). Less than 20%

of ketoprofen present in the formulation was made available to

diffuse out of the formulation into the receptor phase in the un-

ionized formii.

in a Franz Cell Apparatus (Silicon membrane). Less than 20%

of ketoprofen present in the formulation was made available to

diffuse out of the formulation into the receptor phase in the un-

ionized formii.

i. DPT Study Report TC.0706.01

ii. Thesis Tettey-Amlalo, Dec 2005

Faculty of Pharmacy Rhodes University, Grahamstown

© Imprimis Pharmaceuticals, Inc. | A4

27

Impracor™ Topical

NSAID

Competition and Market

NSAID

Competition and Market

© Imprimis Pharmaceuticals, Inc. | A5

28

The Problem With Oral NSAIDs

Solution is to deliver NSAIDs topically to the specific site of pain or inflammation

Fact: Extremely Large Population Uses NSAIDs

• 70 Million prescriptions for NSAIDs each year in US (Wiegard in Medscape)

• Regularly used by more than 60M Americans (Arch Intern Med. 2005;165:171-177)

• 70% of all 65+ Year Olds Take NSAIDs Weekly

• Usage of oral NSAIDs is increasing

Result: Toxicity to Gastro Intestinal (GI) Tract, Kidneys and Liver

• Over 100,000 per year are hospitalized from NSAID complications

• Hospitalizations alone cost more than $2B per year

• Over 16,000 deaths every year from GI NSAID complications

• NSAID GI Toxicity - the 15th most common cause of death in US

Widespread Usage With Serious Side Effects

© Imprimis Pharmaceuticals, Inc. | A6

29

Competitive Landscape

10% Ketoprofen

Cream

1 gram

3 x per day =

3 grams/day

3 x per day =

3 grams/day

Safe / Cutaneous

Elegant Formulation

Convenient / Cream

Accudel Delivery System

Local AEs 1-2%

Local AEs 1-2%

Seeking acute

musculoskeletal pain label

musculoskeletal pain label

IMPRACOR

(Imprimis)

1.3% Diclofenac

epolamine

epolamine

10 x 14 cm patch

2 x per day

2 x per day

Fixed one size patch

Adherence issues

Not to be worn in water

Local AEs 11%

Acute soft tissue

injury (positive data

in ankle sprain)

injury (positive data

in ankle sprain)

FLECTOR PATCH

(Pfizer/IBSA)

1% Diclofenac

sodium

2-4 gram

4 x per day =

16 grams/day

16 grams/day

Large Quantities

Sticky / Greasy

Odor / Staining

Local AEs 7%

Chronic OA of hand

and knee

and knee

VOLTAREN GEL

(Endo/Novartis)

1.5% Diclofenac

sodium

40 drops of liquid

(10 drops to each of 4 sides of knee)

(10 drops to each of 4 sides of knee)

3-4 x per day =

160 drops/day

160 drops/day

Dimethyl sulfoxide

(DMSO); Safety concerns

(DMSO); Safety concerns

Complicated application

Causes garlic taste/breath

Local AEs 47%

Chronic OA of knee

PENNSAID

(Covidien/Nuvo)

© Imprimis Pharmaceuticals, Inc. | A7

30

Ketoprofen vs. Ibuprofen

“Meta-analysis of 26 trials (n=2,853) … showed that Ketoprofen was

significantly better than all other topical NSAIDs. In terms of efficacy,

Ketoprofen was significantly better than ibuprofen, felbinac, piroxicam and

indomethacin.”

significantly better than all other topical NSAIDs. In terms of efficacy,

Ketoprofen was significantly better than ibuprofen, felbinac, piroxicam and

indomethacin.”

Topical NSAIDs for acute pain: a meta-analysis

Lorna Mason, R Andrew Moore*, Jayne E Edwards, Sheena Derry and Henry J McQuay

BMC Family Practice 2004, 5:10

The Impracor Solution

Ketoprofen vs. Diclofenac

The proportion of participants experiencing successful treatment with topical

ketoprofen in seven clinical studies was 73% (251/346, range 57% to 89%)

ketoprofen in seven clinical studies was 73% (251/346, range 57% to 89%)

The proportion of participants experiencing successful treatment with topical

diclofenac in three clinical studies was 52% (166/319, range 39% to 92%)

diclofenac in three clinical studies was 52% (166/319, range 39% to 92%)

Ketoprofen is a Superior Active Ingredient

© Imprimis Pharmaceuticals, Inc. | A8

Topical NSAIDs for acute pain in adults.

Massey T, Derry S, Moore RA, McQuay HJ

Cochrane Database Syst Rev. 2010;6:CD007402

31

Relative COX-1/COX-2 Selectivity

Vane S J Thorax 2000;55:S3-S9

5-50 fold

COX-2

COX-2

selective

<5-fold

COX-2

selective

COX-2

selective

-3

-2

-1

0

1

2

3

© Imprimis Pharmaceuticals, Inc. | A9

32

Additional Impracor™

Clinical Materials

Clinical Materials

© Imprimis Pharmaceuticals, Inc. | A10

33

Topical NSAIDs in Acute OA Knee Pain Model

© Imprimis Pharmaceuticals, Inc. | A11

|

|

Ketoprofen 20% Patch

(ENDO)

|

Ketoprofen Transfersome

Gel, Diractin™ (IDEA) |

Diclofenac Solution

Pennsaid™ (Nuvo) |

|

Phase

|

3

|

2/3

|

2

|

|

Study Dates

|

Aug 2006 - May 2007

|

Jul 2003 - Jan 2004

|

Jul 2010 - Mar 2011

|

|

# of Subjects/ Age

|

309 / above 18 years

|

397/ above 40 years

|

248 / 18 -80 years

|

|

Regimen/ Duration

|

Ketoprofen Patch applied o.d.

4 weeks

|

110 mg ketoprofen b.i.d. (n=138)

6 weeks

(1 placebo capsule b.i.d.

100 mg celecoxib capsule b.i.d.)

|

1.3 mL applied to front, back and sides of knee

b.i.d. (n=84) Vehicle and placebo controlled

4 weeks

|

|

Selection

|

Diagnosis of knee (unilateral or bilateral),

CRO: PPD |

Morning stiffness < 30’, crepitus, at least 3 on

Likert’s 5 point scale, not on NSAIDS |

Patients using NSAIDs underwent a 1-week

washout This was a non-flare study

|

|

Primary Endpoint

|

WOMAC (pain) week 2

|

WOMAC (pain ) week 6•

|

WOMAC (pain ) week 4

|

|

Secondary Endpoints

|

Pain Intensity/ relief (diary)

WOMAC (function), Rescue Medication,

quality of sleep, lost days of work. Pat./Phys. global assessment |

WOMAC (function)-week 6.

Patient global assessment (5 Point Likert)•

|

WOMAC (stiffness) , WOMAC (function), WOMAC

(pain on walking) - - week 4 Patient global assessment

Pain assessment 11 point scale

|

|

Conclusions

|

ITT Primary Endpoint met: Significant

differences vs placebo (p=0.014). All secondary endpoints met. Previously two Phase 3 sprain/strain trials failed, program discontinued. ENDO 10Q 2007 |

WOMAC pain LS mean reduction - 18.2 (-22.1 to -

14.3), -20.3 (-24.3 to -16.2) and -9.9 (-13.9 to - 5.8) osteoarthritis (p <0.01) All WOMAC subscale scores were normalized to

a scale of 0 to 100 by dividing the sum subscale score by the number of questions of each score. Ann Rheum Dis. 2007; 66(9): 1178-83. Swissmedic approval based on single study |

WOMAC pain reduction (5-Point Likert) from

baseline (-3.9 [- 4.8 to -2.9]) compared with vehicle -control solution (-2.5 [- 3.3 to -1.7]; p = 0.023) or the placebo solution (-2.5 [-3.3 to -1.7]; p = 0.016). CMAJ • AUG. 17, 2004; 171 (4) 5 Phase 3 trials have achieved all 3 primary end

points in OA. |

34

Retrospective Analysis of 1st Phase 3 Study

p = 0.038

mITT ** (n=326)

Study Design Error

ITT * (n=361)

Mean reduction from baseline in mm (100 mm Visual Analogue Scale)

mm

“Once randomized, you’re analyzed” p = 0.087

* ITT = Intent-to-treat (ITT) population

** mITT = Modified ITT of ITT patients - 35 met study entry criteria, but were excluded from ITT due to exclusionary criteria:

(1) misdiagnosis, (30) positive drug screen, (4) other lab values at baseline making the patient ineligible for the trial

(1) misdiagnosis, (30) positive drug screen, (4) other lab values at baseline making the patient ineligible for the trial

*** mPP = Modified per protocol (mPP) analysis of mITT patients -- who complied with the protocol? (52) improperly dosed,

(22) no valid Day 3 primary endpoint assessment, and (4) were misdiagnosed

(22) no valid Day 3 primary endpoint assessment, and (4) were misdiagnosed

Design & Execution Optimization Lead to Statistical Significance (p = <0.05)

mPP *** (n=250)

Study Mgmt Errors

p = 0.034

© Imprimis Pharmaceuticals, Inc. | A12

Change from baseline

in pain intensity

during daily activities

over the past 24

hours on Day 3 Visit

(Day 3, +1 or +2 days)

in pain intensity

during daily activities

over the past 24

hours on Day 3 Visit

(Day 3, +1 or +2 days)

35

New Impracor Phase 3 Program: 1H 2013

|

Old Phase 3 Trial

|

New Phase 3 Trial

|

|

Many sprains and strains trials have failed

|

• Acute OA flare (as a pain model) provides a more

reliable population with better chance for separation |

|

High placebo responses

|

• Utilize analgesia-specific proprietary implements and

methodologies to identify placebo responders |

|

Insufficient monitoring for patient eligibility

|

• Invest in trial design and management

• Use only experienced pain trial investigators

|

|

Patients were entered into the ITT up to 72 hours

after injury |

• OA flare model designed for NSAID “wash-out” and

immediate randomization of eligible patients |

|

People were allowed in if they had 6/10 pain level

over last 24 hours - regardless of pain at baseline |

• OA flare model has defined entry criteria for pain

intensity after NSAID “wash-out” and before randomization |

|

30 subjects used un-allowed drugs

|

• Local laboratory for eligibility (drugs, liver, kidney,

hematology) |

|

Major dosing compliance problems related to

smaller size of tube orifice vs. applicator card box |

• Provide scales and weigh tubes at any office visit

|

© Imprimis Pharmaceuticals, Inc. | A13

36

Initial Phase 3 Trial

|

Design:

|

Randomized, double-blind, placebo-controlled at 26 sites

|

|

Study Population:

|

Efficacy, n = 361

Uncomplicated acute soft tissue injuries

Ankle (n=97), Shoulder (n=87), Knee (n=59), Wrist (n=57), Elbow (n=30), Calf/Anterior Tibialis

(n=11), Hamstring/Quadriceps (n=8), Forearm (n=5), Biceps/Triceps (n=3), Hand (n=3) Safety, n = 364

Ranging in age from 18 - 75 years

|

|

Key Entry Criteria:

|

Injury occurred within 72 hours, pain intensity ≥ 60mm on 100 mm Visual Analogue Scale

(VAS); no intake of unallowable medication |

|

Dosing Regimen:

|

Impracor vs. Placebo (Vehicle) cream, 1g t.i.d. x 7 days

|

|

Primary Endpoint:

|

Change from baseline in pain intensity during daily activities on Day 3 office

visit (+1, +2 days) with 100 mm VAS measurement |

|

Secondary

Endpoints: |

• Change from baseline in three times daily pain intensity immediately prior to medication

• Various other treatment satisfaction and safety assessments

• Pharmacokinetics in subset of patients

|

Sprain-Strain Soft Tissue Study

© Imprimis Pharmaceuticals, Inc. | A14

37

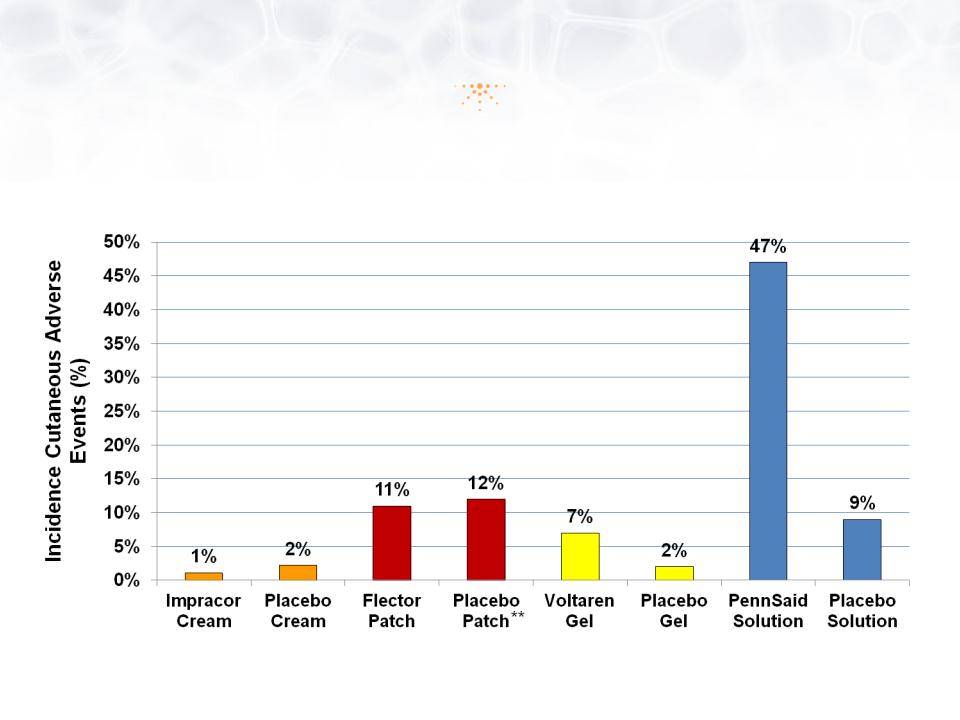

Safety: Low Incidence of Adverse Events

* Clinical Study Report: TDLP-110-001, September 2010

** Prescribing Information for Flector Patch, Voltaren Gel and Pennsaid Solution

• No related gastrointestinal (GI), cardiac, liver, or other serious AEs

• Low incidence of cutaneous AEs

© Imprimis Pharmaceuticals, Inc. | A15

1g, 3x daily

180mg, 2x daily

4g, 4x daily

40 drops, 4x daily

**

**

**

**

**

*

*

38

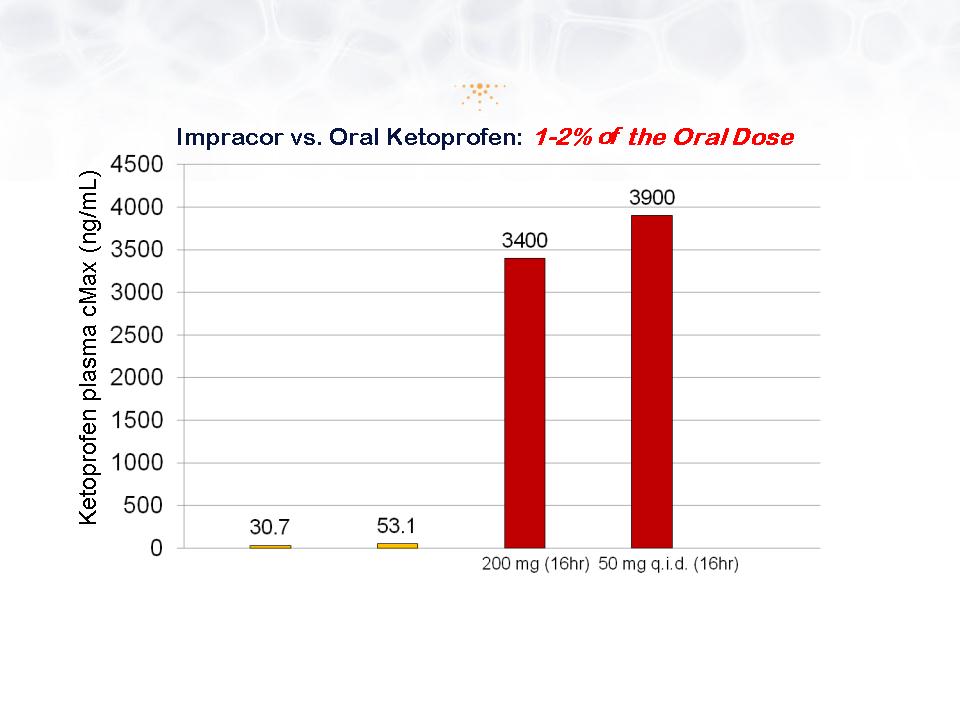

Pharmacokinetics: Low Systemic

Absorption

Absorption

* Cannavino, C. et al. Efficacy of Transdermal Ketoprofen in delayed onset muscular soreness,Clinical Journal of Sports Medicine, 13: 200-208,

2003 and Clinical Study Report Project No. 990808, Phase 1/2 Study Report Aug 2007

2003 and Clinical Study Report Project No. 990808, Phase 1/2 Study Report Aug 2007

**Orudis ketoprofen extended release capsule/ Oruvail capsule prescription information

Impracor*

10% ketoprofen cream

Oruvail**

1g t.i.d. (48hr)

2g t.i.d. (48hr)

© Imprimis Pharmaceuticals, Inc. | A16

Orudis**

39

Clear Separation of Data Day 4 Onwards

Mean Change from Baseline in 3X/daily

Pain Intensity Prior to Medication (from Patient Diary)

Pain Intensity Prior to Medication (from Patient Diary)

All ITT patients (n=361)

* =.statistically significant

© Imprimis Pharmaceuticals, Inc. | A17

p = 0.041*

40

We Believe We Know What Body Part to Study

Day 7

n=77

p=0.0396

Knees and Adjacent Muscle Injuries

© Imprimis Pharmaceuticals, Inc. | A18

Average Change in Pain Intensity from Baseline

41

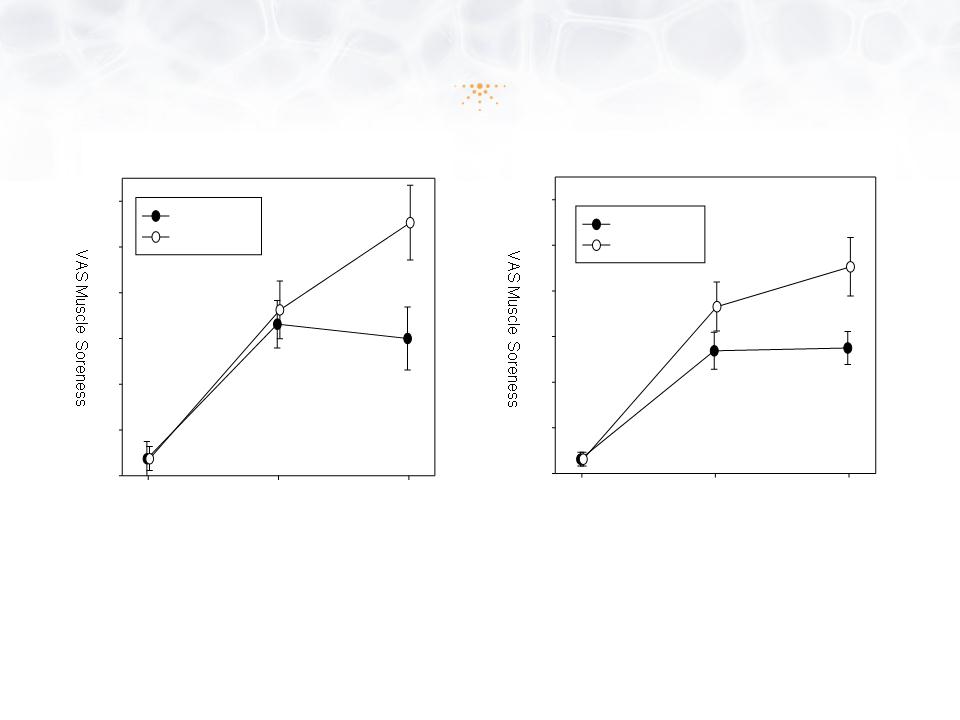

Phase 1/2 Study - Investigator IND Efficacy by Assessing DOMS

Cannavino, C. et al. Efficacy of Transdermal Ketoprofen in delayed onset muscular soreness,Clinical Journal of Sports Medicine, 13: 200-208, 2003

and Clinical Study Report Project No. 990808, Phase 1/2 Study Report Aug 2007

and Clinical Study Report Project No. 990808, Phase 1/2 Study Report Aug 2007

Time

0h

24h

48h

0

1

2

3

4

5

6

Impracor

Placebo

Time

0h

24h

48h

0

1

2

3

4

5

6

Impracor

Placebo

VAS muscle soreness means ± SE 0, 24 and 48 hours,

significantly less soreness in the Impracor vs placebo group

(p=0.0118) between 24 and 48 hours

significantly less soreness in the Impracor vs placebo group

(p=0.0118) between 24 and 48 hours

VAS muscle soreness means ± SE at 0, 24 and 48 hours.

Significantly less soreness in the Impracor vs placebo

(p=0.0104) between 24 and 48 hours

Significantly less soreness in the Impracor vs placebo

(p=0.0104) between 24 and 48 hours

No Adverse Events Reported

p=0.0118

p=0.0104

Either Active o (both legs) Placebo

n=16

1/2 Active/Placebo on R or L Legs

n=16

© Imprimis Pharmaceuticals, Inc. | A19

42

Additional Corporate

Information

Information

© Imprimis Pharmaceuticals, Inc. | A20

43

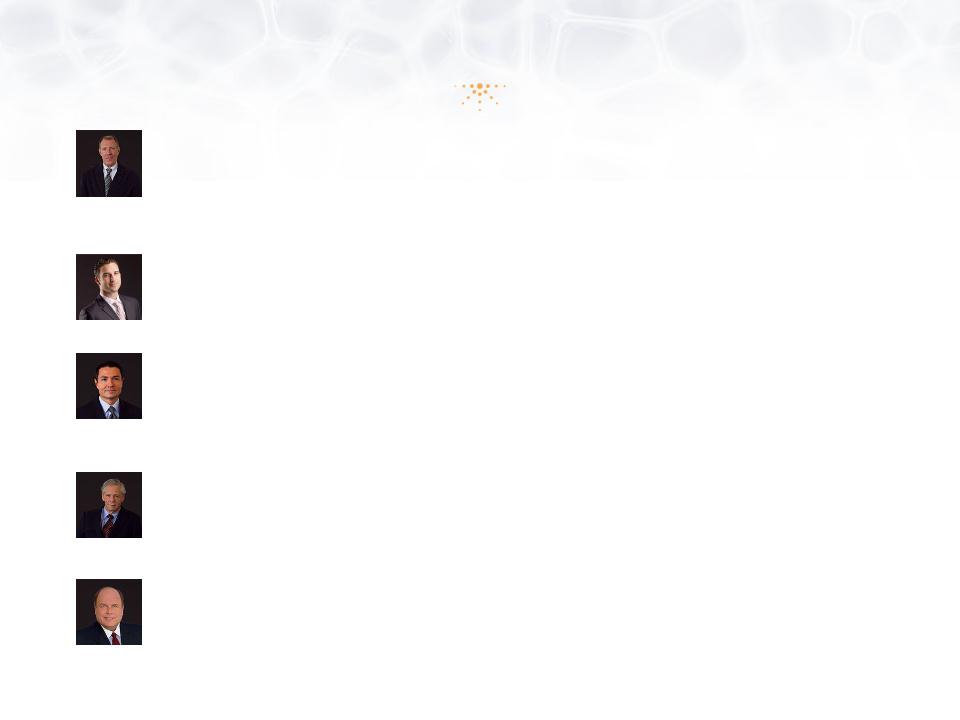

Board of Directors

Robert J. Kammer, D.D.S.

Managing Member of financial group that restructured Imprimis

Active Clinical Research & Consulting Practice

30+ Years Clinical Practice - Diplomate, American Board of Orofacial Pain

Retired Associate Professor & Course Director - Orofacial Pain, University of Colorado

Mark L. Baum, J.D.

15+ Years of Senior Executive Experience; Founder/President, YesRx.com (1999)

Founder of 3 private investment funds; Restructured numerous companies (private-to-public)

Responsible for Restructuring Imprimis, including $7.95M New Equity Investment and PCCA transaction

Paul Finnegan, M.D., M.B.A.

13+ Years Commercialization and Development Experience

Ops Experience: Avalon Ventures, Alexion, Pharmacia/Searle); Univ. of Chicago MBA

13+ Years Commercialization and Development Experience

Ops Experience: Avalon Ventures, Alexion, Pharmacia/Searle); Univ. of Chicago MBA

Senior Positions: Avalon Ventures, Alexion Pharmaceuticals, Pharmacia/Searle/Monsanto

Drugs: Celebrex, Bextra, Arthrotec, Soliris, Inspra and Aldactone/Soldactone

Jeff Abrams, M.D.

Founder and Director since 1998

Practicing primary care clinician for 20+ years

Co-developer of our Accudel drug delivery technology and Impracor topical NSAID

Stephen Austin, C.P.A.

Audit Committee Chairman; Board service on over 12 boards and related board committees

Partner at Swenson Advisors, LLP since May 1998

Manages audit, SEC, Sarbanes-Oxley and business consulting engagements with a focus on technology,

manufacturing, service, real estate, social media and non-profit organizations

manufacturing, service, real estate, social media and non-profit organizations

© Imprimis Pharmaceuticals, Inc. | A21

44

Balance Sheet

|

ASSETS

|

|

December 31, 2012

|

||

|

Current Assets

|

|

|

||

|

|

Cash and cash equivalents

|

$

|

10,035,615

|

|

|

|

Other assets

|

|

670,381

|

|

|

|

|

TOTAL ASSETS

|

$

|

10,705,996

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

||

|

|

Accounts payable and accrued expenses

|

$

|

709,559

|

|

|

|

|

TOTAL LIABILITIES

|

|

709,559

|

|

Stockholder’s Equity

|

|

|

||

|

|

Common stock, $0.001 par value, 395,000,000 shares

authorized, |

|

|

|

|

|

|

6,772,066 shares issued and outstanding

|

|

6,772

|

|

|

Additional paid-in capital

|

|

34,093,933

|

|

|

|

Deficit accumulated during the development stage

|

|

(24,104,268)

|

|

|

|

|

TOTAL STOCKHOLDERS' EQUITY

|

|

9,996,437

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

10,705,996

|

© Imprimis Pharmaceuticals, Inc. | A22

(Abbreviated)

45

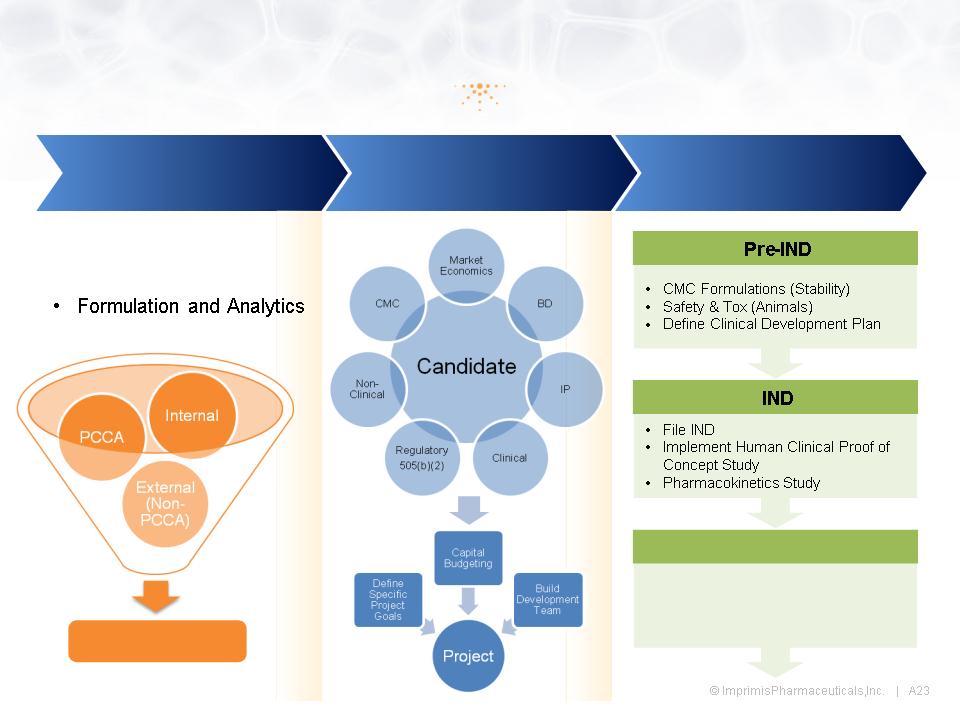

Imprimis Development Process

Ideas

Candidates

Projects

• Market Data

• Drug Master File

• Field Experience

• Out-License or Develop

• Complete Phase 3

• NDA via 505(b)(2)

• Market Launch/Partner

NDA & LAUNCH

Candidate

46