Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - China Network Media, Inc. | v339317_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - China Network Media, Inc. | v339317_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - China Network Media, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 333-152539

CHINA NETWORK MEDIA INC.

(Exact name of registrant as specified in its charter)

| Delaware | 32-0251358 | |

| (State or other jurisdiction of | (I.R.S Employer Identification No.) | |

| incorporation or organization) | ||

|

Room 205, Building A No. 1 Torch Road, High-Tech Zone Dalian, China |

116023 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +86 (411) 3973-1515

| Securities registered under Section 12(b) of the Act: |

| Title of each class: | Name of each exchange on which registered: | |

| None | None |

| Securities registered under Section 12(g) of the Act: |

| None |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2012: $0.

As of March 26, 2013, there were approximately 60,145,232 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS

| PAGE | ||

| PART I | ||

| Item 1. | Business. | 4 |

| Item 1A. | Risk Factors. | 12 |

| Item 1B. | Unresolved Staff Comments. | 12 |

| Item 2. | Properties. | 12 |

| Item 3. | Legal Proceedings. | 12 |

| Item 4. | Mine Safety Disclosures. | 12 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 13 |

| Item 6. | Selected Financial Data. | 13 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | 14 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 24 |

| Item 8. | Financial Statements and Supplementary Data. | 25 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 26 |

| Item 9A. | Controls and Procedures. | 26 |

| Item 9B. | Other Information. | 27 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 28 |

| Item 11. | Executive Compensation. | 30 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 30 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 31 |

| Item 14. | Principal Accounting Fees and Services. | 31 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules. | 33 |

| SIGNATURES | 34 | |

| 2 |

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management, any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to the combined business of China Network Media Inc. and its consolidated subsidiaries. “SEC” refers to the Securities and Exchange Commission.

In addition, unless the context otherwise requires and for the purposes of this Report only:

| ● | “Closing Date” means October 29, 2012; |

| ● | “Dalian Tianyi” refers to our variable interest entity Dalian Tianyi Culture Development Co., Ltd., a PRC limited company; |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| ● | “HK Science& Technology” refers to our subsidiary Science & Technology World Website Hong Kong Media Holding Co., Ltd., a Hong Kong company; |

| ● | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| ● | “MGYS” refers to Metha Energy Solutions Inc., a Delaware corporation; |

| ● | “PRC” and “China” refers to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan and the special administrative regions of Hong Kong and Macau; |

| ● | “PRC Operating Subsidiaries” and “PRC Operating Entities” refers to “Science & Technology (Dalian)” and “Dalian Tanyi”; |

| ● | “Renminbi” and “RMB” refers to the legal currency of China; |

| ● | “Science & Technology Media” refers to Science & Technology World Website Media Group Co., Ltd., a British Virgin Islands company; |

| ● | “Science & Technology Holding” refers to Science & Technology World Website Media Holding Co., Ltd., a British Virgin Islands company; |

| ● | “Science & Technology Trading” or “WFOE” refers to our indirect subsidiary of Science & Technology World Website Trade (Dalian) Co., Ltd., a PRC limited company; |

| ● | “Science & Technology (Dalian)” refers to our variable interest entity Science & Technology World Network (Dalian) Co., Ltd., a PRC limited company; |

| ● | “SEC” refers to the Securities and Exchange Commission; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| ● | “U.S. dollars,” “dollars,” “US$,” “$” and “USD” refers to the legal currency of the United States. |

| 3 |

PART I

Item 1. Business.

Business Overview

We operate our business through our subsidiaries and variable interest entities in China. We operate a multi-languages portal website that serves to the technology industry and provides advertising opportunities to the companies through our diverse business network in China; we well-positioned our business in the science and technology field and currently operate our website through three different versions in Chinese, English and Japanese. Right now, we have 34 domestic channels including every province, city, autonomous region, cities with independent planning status, Hong Kong, Macau and Tai Wan. We also set up two online communicating platforms which are BBS and Blog, for our clients to freely share information on the website.

We mainly provide online platform to business entrepreneurs/corporations with a B2B marketplace that can help our customers:

| · | establish their brand image through online magazine, online corporate multimedia advertisement, executives interviews, institutional alliances and flexible membership package that tailor made based on what our customers need. |

| · | set up company online exhibition to introduce their products to the public, where they have our tailor-made corporate introduction and factory facilities online show room; |

| · | B2B product purchase platform for companies and end-users; |

| · | online job opportunity section for corporate clients; and |

| · | corporate blogs. |

We also offer a range of business management software, internet infrastructure services and export-related services, and provide educational services to incubate enterprise management and e-commerce professionals.

Besides our various service models that we provide to enterprises customers, we also provide “home-oriented” online experience to our technicians, science and technology professionals, where they can easily find information related to their work, job opportunities within the technology industry, moreover, they can also meet friends, professionals through our website. BBS is part of our service that users can upload and download software and data, read news and bulletins, and exchange messages with other users either through email or in public message board.

We currently derive a substantial portion of our revenues from online advertising services. Our advertising solutions present corporate users with attractive opportunities to combine the visual impact and engagement of traditional television-like multimedia advertisements and online magazines with the interactivity and precise targeting capabilities of the Internet. We strive to promote a novel and unique advertising environment on our website to attract technology enterprises.

We were mainly focus on the technology development, and clients marketing in 2010 and 2011. During the past two years, we have positioned ourselves in a fast growing industry – Internet. Despite said above, we also work closely with traditional media channels, such as magazine, TV channels. So far, we have built a steady relationship with four major Chinese magazines: 315online, China Brand, China High-Tech zone and Dalian Machinery.

Moreover, we also work closely with WO 3G mobile TV, which is a new media channel through mobile that developed by Liaoning broadcast TV and China Unicom, which is the second largest mobile phone operator in China. With the new strategic cooperation with 3G, we will therefore, have a new platform for entrepreneurs, local government or any entities that have the needs to advertise their business and corporate cultures through a new channel.

We are a team combined with passionate employees and a perceiving management team, since the beginning of our business, our company has spent great effort on the website and market development in 2010 and 2011.

During the past two years, we have attracted clients from different industries: governments, academic institutions, OEM, Environmental technology firms, and other high-tech companies.

Our mission is to develop a worldwide online platform for science and technology companies. Our company believes the network can change the world, bring people, corporate from miles away into one online world to share, to work, to communicate.

| 4 |

Our Corporate History and Background

We were founded as Instructor, Inc. , a development stage company, that was incorporated on April 18, 2008 under the laws of the State of Delaware. Effective October 12, 2009, we changed our name to Metha Energy Solutions Inc.

On the Closing Date, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with (i) Science & Technology Holding, (ii) Science & Technology Media, (iii) the shareholders of Science & Technology Holding (the “Science & Technology Shareholders”) and (iv) our former principal shareholder pursuant to which we acquired all of the outstanding capital stock of Science & Technology Media from Science & Technology Holding in exchange for the issuance of 50,000,000 shares of our common stock to the Science & Technology Shareholders (the “Share Exchange”). The shares issued to the Science & Technology Shareholders in the Share Exchange constituted approximately 95% of our issued and outstanding shares of common stock as of and immediately after the consummation of the Share Exchange. In connection with the closing, 10,000,000 shares of our common stock held by our former principal shareholder have been cancelled. As a result of the Share Exchange, Science & Technology Media became our wholly owned subsidiary and Wei Jiang and HuiAn Peng became our principal stockholders.

The transaction was regarded as a reverse merger whereby Science & Technology Media was considered to be the accounting acquirer as it retained control of the Company after the Share Exchange.

Science & Technology World Website Media Group Co., Ltd was organized under the laws of the British Virgin Islands on February 15, 2011 to serve as a holding company for our PRC operations. On September 16, 2011, Science & Technology Media established HK Science and Technology in Hong Kong to serve as an intermediate holding company.

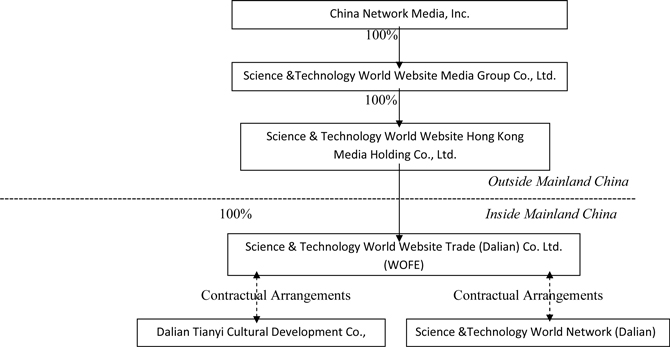

On January 20, 2012, HK Science and Technology established WFOE in the PRC. On January 21, 2012, the WFOE respectively entered into a series of agreements with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders (the “Contractual Arrangements”). The relationship with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders are governed by the Contractual Arrangements. The Contractual Arrangements is comprised of a series of agreements, including Exclusive Technical Consulting Service Agreements and Operating Agreements, through which WFOE has the right to advise, consult, manage and operate Dalian Tianyi and Science & Technology (Dalian), and collect 85% of their respective net profits. The shareholders of Dalian Tianyi and Science & Technology (Dalian) have granted WFOE, under the Exclusive Equity Interest Purchase Agreement, the exclusive right and option to acquire all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian). Furthermore, the shareholders of Dalian Tianyi and Science & Technology (Dalian) is under the procedure of pledging all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian) to WFOE under the Exclusive Equity Interest Pledge Agreement, and through the Exclusive Equity Interest Pledge Agreement, WFOE can collect the remaining 15% of Dalian Tianyi and Science & Technology (Dalian)’s respective net profits. According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology (Dalian), they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology (Dalian).

HK Science and Technology and WFOE are considered foreign investor and foreign invested enterprise respectively under PRC law. As a result, HK Science and Technology and WFOE are subject to limitations under PRC law on foreign ownership of Chinese companies. According to the Catalogue of Industries for Guiding Foreign Investment (2011 Revision) (the “Catalogue”), there are four kinds of industries which are encouraged, permitted, restricted and prohibited for foreign investment. The primary business of Dalian Tianyi and Science & Technology (Dalian) are within the category in which foreign investment is currently restricted. The Contractual Arrangements with Dalian Tianyi and Science & Technology (Dalian) allow the Company to substantially control Dalian Tianyi and Science & Technology (Dalian) through WFOE without any equity relationship.

According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology (Dalian), they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology (Dalian).

As a result of the Contractual Arrangements, under generally accepted accounting principles in the United States, or U.S. GAAP, Science & Technology Media is considered the primary beneficiary of Dalian Tianyi and Science & Technology (Dalian) (“VIEs”) and thus consolidates their results in its consolidated financial statements.

Science & Technology Holding is a corporation organized under the laws of British Virgin Islands on February 15, 2011. It was the sole shareholder of Science & Technology Media.

Our corporate structure is set forth below:

| 5 |

Corporate Information

Our principal executive offices are located at Room 205, Building A, No. 1, Torch Road, Hi-tech Zone, Dalian, China, 116023, the People’s Republic of China. Our telephone number at this address is +86 (411) 39731515.

Our Competitive Strengths

We believe that the following strengths contribute to our success and differentiate us from our competitors:

We are well positioned in a highly fragmented and competitive market. Our China-based website for technology allows us to utilize cost-competitive domestic labor and resources to manage costs, provides a close proximity to our customers to better understand and service their needs and allows us to have real time updates on prevailing market conditions in China.

We run our business with an attractive and various business models. We provide a broad range of services to entrepreneurs and corporations that include online exhibition, online magazine, online corporate multimedia advertisement, Executives interviews, institutional alliances and flexible membership package that is tailor made based on what our customers need.

We have development strong business relationship with local enterprises throughout China, and business professionals, we also work closely with main media press. We work closely with major scientifically magazines, local governments, major media channels, and high-tech enterprises throughout China from different industry. So far, we have built a steady relationship with four major Chinese magazines: 315online, China Brand, China High-Tech Zone and Dalian Machinery. We also work closely with WO (UMTS/3G network service brand by China Unicom) 3G mobile TV, which is a new mobile media that developed by Liaoning broadcast TV and China Unicom (China Unicom is the second largest mobile phone operator in the country).

We also undertake big events to spread out our brand name. And therefore, earn the opportunities with other major media companies and enterprises. For example, from June to November in year of 2012, we have worked on the events called “China Brand image spokesman competition” During the 21st century, Chinese brands are about to step into a new age. To set up a well-known brand, a company would need a high quality image spokesman to represent its product besides the high quality of its product. The aim of this contest is to select high quality image spokesman for emerging national brand, the advisory institutions for this contest include General Administration of Quality Supervision, Inspection and Quarantine of PRC, China Enterprise Confederation, China Enterprise Directors Association, China Radio and Television Association and China Council for the Promotion of Famous Brand Strategy. After local selection and final contest, a hundred brand image spokesmen will be chosen as winners of this contest. We have set up a team to deal with the work of contest design, operation, promotion and sponsorship. Local contest will be held by different local enterprises who have related qualifications and our authorization. The income of this event is mainly from the sponsorship of the final contest, endowment of co-organizers, sponsor from exclusive product enterprise, and 500,000 RMB from each enterprise who undertake the local contest.

We have an experienced management and operational teams with extensive market knowledge. Our management team and key operations and technical personnel have extensive management skills, relevant operational experience and industry knowledge. We have created and maintained a stable management team and have been able to retain our core management and key technical personnel since our inception. We believe that our management team’s experience, longstanding customer relationships and in depth knowledge of the Chinese market will enable us to continue our successful execution of expansion strategies and take advantage of market opportunities that may arise.

Multi-language website provides potential opportunities to attract clients from all over the world. We have currently operated our website through 3 languages: Chinese, English and Japanese. We believe with our multi-language portal website, more audience from the world will be able to learn, to communicate, and share information through our website.

| 6 |

Our Growth Strategy

Our mission is to become the primary source of technology information, knowledge, products platform for the Chinese population across any Internet-enabled device and moreover, we hope we can attract international technology professionals and enterprises through our multi-languages website. We intend to achieve our mission by expanding our content library and user base, enhancing our brand and improving our business model. More specifically, we plan to implement the following strategies:

| · | Increase the breadth and depth of our online technology content library. We have more than 25 in-house editors to collect and translate the most updated news through the world. However, we believe the long-term strategy of having a global growth is by improving the strength and capability to collect prompt information in time, and therefore, turning ourselves into one of the Chinese top online news channel. |

| · | Further enhance our brand recognition. We have a limited history that have not yet built adequate exposure in our business, with that said, we will dedicate more effort on company brand management through a cost effective way, such as promoting our brand through our strategic cooperation partners, high-technology product representative agent, carrying out important social events with famous media channels and brands. |

| · | Expand and diversify our revenue sources. Our current revenue is mainly generated from online advertising for our customers through membership sales model. With the increase of our market share, brand recognition, and technology development, we will be able to work with most high-tech companies to develop a stable and active online trading platform , therefore, we will derive a new revenue stream from the trading platform (please refer to “our business and service” section for more information). |

| · | New stream to generate revenue through 3G Mobile TV. As the 2008 Olympic competition was rebroadcasted on mobile TV at the first time, the new media such as mobile TV created a new space for advertising business. This new opportunity is critical with the development of mobile, moreover, smart phone users. |

The 12th Five-Year Plan issued by China’s Ministry of Industry and Information Technology (MIIT) established aggressive development targets for the China telecommunications industry from 2011 to 2015. During this time, China’s mobile communications user base will reach more than 1.1 billion with total Internet users climbing to 600 million, representing a 40% penetration rate (www.iresearchchina.com).

Therefore, as analyzed above, we have targeted this market as a new potential platform for our service to our clients, that will create a new location to advertise their business on a smart phone. We are working closely with WO 3G mobile TV, which is a new mobile media that developed by Liaoning broadcast TV and China Unicom, the second largest mobile phone operator in the country.

| · | Expand our online network infrastructure and optimize our services. In order to improve website hits, we have revised our website from time to time to provide the most user-oriented set up for our web page to make it more in line with general practice for a website, but also exaggerate our advantages and diversity of the website. |

| · | Recruit additional qualified employees and enhance our research and development capabilities. In connection with the expansion of our business, we plan to continue recruiting more highly qualified individuals to conduct our operations of our website while maintaining the consistency and quality of the services that we deliver. We also plan to recruit more high profile personnel in our research and development department and invest in enhancing our research and development capabilities to be more competitive. Where appropriate, we will also endeavor to partner with domestic and international companies in order to expand our technological capabilities. |

Our Services

We currently generate our revenue through our diverse advertisement package to our business clients. To be our customers, the companies need to have the three distinct criteria:

| • | The member companies need to have its own technology created and have innovative project or have had significant success in the technology industry; |

| • | The member companies are reputable in their industry, and can influence the whole industry with their reputation; |

| • | The member companies have fine product quality and recognized brand in the industry. |

| 7 |

We have classified our service package as follow (Service fee in RMB):

| Executive vice president | Vice president | Executive director | Director | |||||

| Fee/ year | 500,000 | 300,000 | 150,000 | 80,000 | ||||

| Service Item | ||||||||

| Front page ad | 3 years,20MM* 50mm | 2 years,20MM* 50MM | 2 years,20MM* 50MM | 1 year,20MM* 50MM | ||||

| Online exhibition display | 3 years | 2 years | 2 years | 1 year | ||||

| Multi-language online profile | 3 years | 2 years | 2 years | 1 year | ||||

| setup trading platform | 3 years | 2 years | 2 years | 1 year | ||||

| Job recruiting | 3 years | 2 years | 2 years | 1 year | ||||

| online magazine advertisement | 3 years | 2 years | 1 year | 1 year | ||||

| annual conference, submit | at least once a year | at least once a year | at least once a year | Twice a year | ||||

| Make special subject | Yes | Yes | Yes | Yes | ||||

| Keyword for searching engine | 1 year | 1 year | 1 year | 6 months | ||||

| design website | Yes | Yes | Yes | NO | ||||

| referral business | first year | first year | first year | Yes | ||||

| Discount on subsidiary for S&T | Yes | Yes | Yes | Yes | ||||

| articles on traditional magazine | 2 to 3 | 2 | 1( within 5000 words) | 1(within 2500 words) |

Detailed explanation for our service items:

Front page ad: front page advertisement for our membership companies on our website;

Online exhibition display: display our membership companies’ products and corporate profile on our website;

Multilanguage online profile: develop the membership company’s corporate profile with more than one language. They can choose to develop their corporate profile in English, Japanese or other languages;

Setup trading platform: help our membership company to setup an online trading section on our website under the online trading section;

Job recruiting: setup a corporate recruiting section on our website for our membership companies, to help them recruit new employees from our website resources;

Online magazine advertisement: we help our membership companies to design and display their own corporate magazine on our website;

Annual conference/submit: we organize conferences for more than one time in a year; the topic for each conference can vary. The membership companies will be invited to join the conference we organize;

Make special subject: our firm can compose an article based on a specific topic for our membership company that related to their corporate business, such as CEO interview; corporate interview;

Keyword for searching engine: we can set the name of our membership client’s firm as the keyword in the our search engine, so when any individual or corporate wants to search any information on our website, the keyword will show up immediately;

Design website: we provide website design service to our membership company;

Referral business: we introduce business for our membership company within our website;

Discount on subsidiary for S&T: if our membership company wants to be an alliance of Science and Technology (Dalian), we can give discount to them for being an alliance;

Articles on traditional magazine: we can write one or more articles related to our membership client to introduce their corporate culture, corporate information or the CEO stories;

Our innovative business model that differentiate us from other advertising companies:

| 8 |

Online Exhibition

The “Online-Expo” of the Company is a brand-new mode of product exhibition. We put our members product information on the internet through this window based on actual exhibition locations; it is a percept complement to the “International High-tech product exhibition of Dalian”. Each exhibiter has its own web page, and all information about the exhibiter and its products are available to internet users on the page. According to actual exhibition, we divide the “Internet Expo” into 14 sections, including software, electronics, internet, cartoon, manufacture, biology, medicine, communications, automobile, energy, environmental protection, aerospace, new material and agriculture.

We have set up an integral database for every single exhibiter on the “Internet Expo,” all the data such as exhibition information; daily turnover and the attention rate of the product are available on their respective web page.

Business Mode of Software and Information Service

The Company has established a team to deal with software R&D and outsource services; these groups realize our website’s daily technique upgrade and also support related R&D of “The Internet of things” industry. At the meanwhile the company is seeking for cooperation with other companies, we take on all kinds of software outsource services. These services shall add extra profit to our company.

Online Trading Platform

The Company has a self-contained online transaction platform for technology products. It caters for the needs of most of the internet users who are likely to make technology product deals on the internet. But, some of the new products cannot be shown on the internet because of its own characteristics. We also have a professional team to deal with the promotion of these kinds of product, and we will knit a distribution net all over the Chinese mainland and main cities overseas.

Our Company has a strict product selecting procedure. Before we introduce a product to customers, we will verify the qualification of the manufacturing enterprise and make a series test of the products’ function and performance. Furthermore, we work directly with enterprises to cut down the number of intermediate links, so as to enhance the price advantage of the products.

In the near future, we plan to work together with our clients on marketing their products, and derive a new channel to make profit of our business.

There are two main operating procedures that we will consider: one is exclusive distribution of technology product and the other one is equity participation program. When we adopt the first strategy, we will buy out all the distribution right of a product in a specific area from a company; on top of that we will put this product on our promotion network. Our revenue comes from the price difference of the product.

When it comes to the second procedure, we will select a product which is likely to have a vigorous momentum in the future. We will cooperate with the manufacturing enterprise through cash investment, technology investment or other cooperative mode. As stated, we will act as a shareholder of the company we invested in and participant the business operation of this enterprise. Our revenue comes from the profit distribution of the enterprise.

Our Customers

We started generate revenue in 2010. We target companies that:

a. need to have its own technology created and have innovative project or have had significant success in the technology industry;

b. are reputable in their industry, and can influence the whole industry with their reputation;

c. have fine product quality and recognized brand in the industry.

We have various customers that come from different industries, such as: logistics, energy, social society, healthcare, construction, machinery, clothing, food and retailing and so forth. Our revenue increased approximately 5 times in 2012, in comparison with 2011, attributed to our aggressive marketing strategy.

Sales and Marketing

Sales to customers in China account for all of our revenue. We target our sales efforts primarily in major leading companies in China; however, we tend to focus on the local companies in Dalian and Northeast China for the beginning of our business, and then start to get in touch with companies throughout all China. We have developed and strive to maintain a diversified sales network that allows us to effectively market products and services to our customers. Our sales and marketing team currently consists of 15 employees. At the meanwhile we engage some part-time workers who don’t need to been paid regular income to help us to expand our business market. Our executive management team is also actively involved in business development and in managing our key client relationships.

| 9 |

Research and Development

Because of the nature of our business, we are required to improve our technology ability in a high frequency in order to compete with other business competitors in the business.

Since the beginning of our operation in 2010, we have striven to work on our website by increase the input of our database, develop new channels and functions on our website, create new platform for job recruitment, trading through different industries, and design, edit, and publish online journals and carried out other activities to dramatically enlarge our service capability.

We have upgraded our website three times in the past a year and half, made great effort of each time:

End of 2010 to January 2011, we managed to setup and create the Science & Technology website; In 7 months later, we upgraded our website with the development of network construction and database; from the beginning of 2012, we have setup clear strategy and timeline on what we will develop and how we will upgrade our website in order to improve our existing services and further broaden our product offering. We will also recruit more highly qualified experts to enhance its capability.

Competition

Our business model is to provide our B2B platform to technology enterprises, and our revenue is generated from advertisement business through our membership payment model. We believe that we have the unique business model; however, we still acknowledge the competition from the advertising market in china. Our competitor includes companies that provide the same advertising portal website to B2B customers and also the portal website that provide services to individuals, the large internet companies such as : Sohu.com, Sina.com, Baidu.com and others. We also face competition from large online video advertisers such as.Youku.com, Tudou.com and 56.com and others.

Traditional media channel (magazine, newspapers, and radio), telecommunications, street showcase, billboard, frame and public transport advertising companies are also our competitors.

Factors and Trends Affecting our Business

The internet and internet-related markets in China continued to evolve rapidly during 2012. According to an annual report issued by the China Internet Network Information Center (“CNNIC”), the total number of internet users in China had reached 564 million by the end of December 2012, an increase of 50.9 million from the end of 2011. The number of mobile internet users in China had reached 420 million by the end of December 2012, with a growth rate of 18.1% from 2011. Mobile internet is becoming the top channel for Internet users to access websites in China. We believe that this large and expanding user base will continue to provide significant opportunities for our company to expand our product offerings and to explore new revenue streams.

However, China’s economy has been experiencing decelerating growth recently, with the result that many large advertisers were cautious regarding their spending on advertising in the face of this economy uncertainty. At the same time, we have been facing fierce competition arising from existing and new internet companies, which have been seizing advertising market share. We have noted that this macro-economic environment and increased competition has had some impact on our brand advertising business.

Due to above various factors, however, it is difficult for us at this point to predict growth trends for our brand advertising business through the end of 2013.

We continue to be pleased with, and optimistic regarding, its growth and potential profitable opportunity. Our performance in the first half reflects the resilience of the online media industry in China despite the weakening global macroeconomic environment and economic slowdown in China. It also reflects the ongoing strength of our online content and the successful expansion into other fast-growing segments of the industry.

We believe, as discussed above, that there are significant opportunities to explore new revenue streams related to the online internet advertising market, in that regard, we will need to catch up with our peer competitors with respect to penetration of new online functions and features.

| 10 |

Intellectual Property

We have recognized the material impact on how to protect our intellectual property.

Trademarks

We are registering the following trademark with the Trademark Office, State Administration for Industry and Commerce in the PRC:

| No. | Registration(Application) No. | Trademark | Applicant | Item Category | Application Date | |||||

| 1 | 10494489 and 10494470 |  |

Science & Technology (Dalian) |

35* 42* |

February 16, 2012 | |||||

| 2 | 10494453 and 10494499 | TWWTN | Science &Technology (Dalian) |

35* 42* |

February 16, 2012 |

*35: Product/service category:

1. Advertising; 2 advertising agency; 3 Advertising space for rent;4 Online advertising on the data communication network; 5 advertising planning; 6 advertising design; 7 advertising publication; 8 Rental for advertising time on communication media; 9 direct email advertising;10 provide models for advertising or promotion purpose

*42: Product/service category:

1. Computer software design; 2 transfer data and document into electronic media;3 help the others to create or maintain website; 4 packaging design; 5 Exterior design for industrial product;6 Fashion design; 7 artwork appraisal; 8.Written graphic arts design; 9 Computer programming; 10 Managing computer stations.

Domain Names

Dalian Tianyi owns five domain names, including www.twwtn.com, www.twwtn.cn, www.twwtn.net, www.twwtn.com.cn and www.twwtn.org.

Governmental Approval and Regulation

Patent

In accordance with the PRC Patent Law, the State Intellectual Property Office is responsible for administering patents in the PRC. The patent administration departments of provincial, autonomous region or municipal governments are responsible for administering patents within their respective jurisdictions.

The Chinese patent system adopts a "first to file" principle, which means that, where more than one person files a patent application for the same invention, a patent will be granted to the person who filed the application first. To be patentable, invention or utility models must meet three conditions: novelty, inventiveness and practical applicability. A patent is valid for 20 years in the case of an invention and 10 years in the case of utility models and designs. A third-party user must obtain consent or a proper license from the patent owner to use the patent. Otherwise, the use constitutes an infringement upon patent rights.

Trademarks

Registered trademarks in the PRC are protected by the Trademark Law of the PRC which came into effect in 1982 and was revised in 1993 and 2001 and the Regulations for the Implementation of Trademark Law of PRC which came into effect in 2002. A trademark can be registered in the PRC with the Trademark Office under the State Administration for Industry and Commerce, or the SAIC. The protection period for a registered trademark in the PRC is ten years starting from the date of registration and may be renewed if an application for renewal is filed within six months prior to expiration.

Copyright

Copyright in the PRC is protected by the Copyright Law of the PRC which was promulgated in 1990 and revised in 2001 and February 2010 and the Regulation for the Implementation of the Copyright Law of the PRC which came into effect in September 2002. Under the revised Copyright Law, copyright protections have been extended to information network and products transmitted on information network. Copyrights are reserved by the author, unless specified otherwise by the laws. According to Article 16 of the Copyright Law, if a work constitutes “work for hire”, the employer, instead of the employee, is considered the legal author of the work and will enjoy the copyrights of such “work for hire” other than rights of authorship. “Works for hire” include, (1) drawings of engineering designs and product designs, maps, computer software and other works for hire, which are created mainly with the materials and technical resources of the legal entity or organization with responsibilities being assumed by such legal entity or organization; (2) those works the copyrights of which are, in accordance with the laws or administrative regulations or under contractual arrangements, enjoyed by a legal entity or organization. The actual creator may enjoy the rights of authorship of such “work for hire.”

A copyright owner may transfer its copyrights to others or permit others to use its copyrighted works. Use of copyrighted works of others generally requires a licensing contract with the copyright owner. The protection period for copyrights in the PRC varies, with 50 years as the minimum. The protection period for a “work for hire” where a legal entity or organization owns the copyright (except for the right of authorship) is 50 years, expiring on December 31 of the fiftieth year after the first publication of such work.

| 11 |

Employees

As of December 31 2012, we had a total of 73 employees. We have paid the social insurance coverage for our full time employees for certain pension benefits, medical care, unemployment insurance, employee housing fund and other welfare benefits are provided to employees, which are carried out under PRC law. The following table shows the number of our employees by function.

| Function | Number Of Employees | |||

| Management | 7 | |||

| Technicians and Engineers | 13 | |||

| Editorials | 28 | |||

| Sales and Marketing | 15 | |||

| Accounting | 2 | |||

| Administration | 8 | |||

| Total | 73 | |||

We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. None of our employees is represented by a labor union.

Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to make monthly contributions to the plan for each employee at the rate of 20% of his or her average assessable salary. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Item 1A. Risk Factors.

Not applicable because we are a smaller reporting company.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We currently operate in the following facility under a lease agreement. The aggregate monthly payment under these leases is RMB 43,828 (approximately $6,929), as set forth on the table below:

| Facility | Address | Lessor | Space (Square Meters) | Monthly Rent | Lease Period | |||||||||

| Dalian (headquarters) | Room 205, Building A, No. 1, Torch Road, Hi-tech Zone, Dalian, China | Dalian Hi-Tech Enterprises Service Center | 1,440.92 | $ | 6,929 | May 1, 2012 to April 30, 2013 | ||||||||

Item 3. Legal Proceedings.

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not applicable.

| 12 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is currently traded on the OTCQB under the symbol “CNNM.” There is a limited trading market for our common stock.

Common Stock

Our Certificate of Incorporation authorizes the issuance of up to 100,000,000 shares of common stock, par value $0.001 per share. As of March 26, 2013, there were 172 stockholders of record holding an aggregate of 60,145,232 shares of common stock.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

We presently do not have any equity based or other long-term incentive programs. In the future, we may adopt and establish an equity-based or other long-term incentive plan if it is in the best interest of the Company and our stockholders to do so.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

On December 21, 2012, the Company granted equity awards of total shares of 3,680,422 to 73 employees, for the services rendered. The shares were issued on December 21, 2012. The total fair value of these shares at the date of grant was estimated to be $14,785.

On January 16, 2013 and January 17, 2013, the Company granted equity awards of 5,950 shares and 3,838,830 shares to 2 employees and 37 part-time consultants, respectively, for the services rendered or will render. The total fair value of these shares at the date of grant was estimated to be $15,445, which will be amortized in the services periods agreed with the consultants.

The shares above were offered and sold also in reliance upon exemptions from registration pursuant to Regulation S promulgated by the SEC under the Securities Act (“Regulation S”). The Company made the determination based upon the factors that such shareholders were not “U.S. Person” as that term is defined in Rule 902(k) of Regulation S under the Securities Act, that such shareholders were acquiring our securities, for investment purposes for their own respective accounts and not as nominees or agents, and not with a view to the resale or distribution thereof, and that the shareholders understood that the shares of our securities may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

Item 6. Selected Financial Data.

Not applicable because we are a smaller reporting company.

| 13 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The following discussion provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition for the fiscal years ended December 31, 2012, and December 31, 2011. The discussion should be read along with our financial statements and notes thereto contained elsewhere in this Report. The following discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements. See “Cautionary Statement On Forward-Looking Information.”

Overview

China Network Media Inc. is an emerging online media, search, community and mobile service group. We operate a multi-languages portal website that serves to the technology industry and provides advertising opportunities to the companies through our diverse business network in China. The Company currently operates its website through different versions in China.

As our main target, we provide online platform to business entrepreneurs and corporations with a B2B marketplace that can help our customers:

| · | Set their brand image through online magazine, online corporate multimedia advertisement, executives interviews, institutional alliances and flexible membership package that tailor made based on what our customers need. |

| · | Set up customer’s online exhibition to introduce their products to the public, where they have our tailor-made corporate introduction and factory facilities online show room; |

| · | B2B product purchase platform for companies and end-users; |

| · | Online job opportunity section for corporate clients; |

| · | Corporate blogs; |

We currently derive a substantial portion of our revenues from online advertising services. Our advertising solutions present corporate users with attractive opportunities to combine the visual impact and engagement of traditional television-like multimedia advertisements and online magazines with the interactivity and precise targeting capabilities of the Internet. We strive to promote a novel and unique advertising environment on our website to attract technology enterprises.

Science& Technology Media was organized under the laws of the British Virgin Islands on February 15, 2011 to serve as a holding company for our PRC operations.

On September 16, 2011, Science& Technology Media established HK Science and Technology in Hong Kong to serve as an intermediate holding company.

| 14 |

On January 20, 2012, HK Science and Technology established Science& Technology Trading in the PRC. Its purposes are, among others, a platform for online B2B service.

On January 21, 2012, the “WFOE” (“Science & Technology Trading”) respectively entered into a series of agreements with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders (“Contractual Arrangements”). The relationship with Dalian Tianyi, Science & Technology (Dalian) and their respective shareholders are governed by the Contractual Arrangements. The Contractual Arrangements is comprised of a series of agreements, including Exclusive Technical Consulting Service Agreements and Operating Agreements, through which Science & Technology Trading has the right to advise, consult, manage and operate Dalian Tianyi and Science & Technology (Dalian), and collect 85% of their respective net profits. The shareholders of Dalian Tianyi and Science & Technology (Dalian) have granted Science & Technology Trading, under the Exclusive Equity Interest Purchase Agreement, the exclusive right and option to acquire all of their equity interests respectively in Dalian Tianyi and Science &Technology (Dalian). Furthermore, the shareholders of Dalian Tianyi and Science & Technology (Dalian) are under the procedure of pledging all of their equity interests respectively in Dalian Tianyi and Science & Technology (Dalian) to Science & Technology Trading under the Exclusive Equity Interest Pledge Agreement, and through the Exclusive Equity Interest Pledge Agreement, Science & Technology Trading can collect the remaining 15% of Dalian Tianyi and Science & Technology (Dalian)’s respective net profits.

HK Science and Technology and WFOE are considered foreign investor and foreign invested enterprise respectively under PRC law. As a result, HK Science and Technology and WFOE are subject to limitations under PRC law on foreign ownership of Chinese companies. According to the Catalogue of Industries for Guiding Foreign Investment (2011 Revision) (the “Catalogue”), there are four kinds of industries which are encouraged, permitted, restricted and prohibited for foreign investment. The primary business of Dalian Tianyi and Science & Technology (Dalian) are within the category in which foreign investment is currently restricted. The Contractual Arrangements with Dalian Tianyi and Science & Technology (Dalian) allow the Company to substantially control Dalian Tianyi and Science & Technology (Dalian) through WFOE without any equity relationship.

According to the Power of Attorney executed by the shareholders of Dalian Tianyi and Science & Technology (Dalian), they exclusively authorized WFOE to perform and exercise any and all of the shareholder’s rights in Dalian Tianyi and Science & Technology (Dalian).

As a result of the Contractual Arrangements, under generally accepted accounting principles in the United States, or U.S. GAAP, the Company is considered the primary beneficiary of Dalian Tianyi and Science & Technology (Dalian) (“VIEs”) and thus consolidates their results in its consolidated financial statements from January 21, 2012 on.

Science & Technology World Website Media Holding Co., Ltd (“Science & Technology Holding”) is a corporation organized under the laws of British Virgin Islands on February 15, 2011. It was the sole shareholder of Science & Technology Media.

| 15 |

On October 29, 2012, Science & Technology Media entered into a Share Exchange Agreement by and among (i) Science & Technology Holding, (ii) the principal shareholders of China Network Media, Inc (“China Network Media”) (iii) China Network Media, Inc and (iv) the shareholders of Science &Technology Holding.

The acquisition is being accounted for as a “reverse merger,” and Science & Technology Media is deemed to be the accounting acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the acquisition will be those of Science &Technology Media and its wholly owned subsidiaries and VIEs, and will be recorded at the historical cost, and the consolidated financial statements after completion of the acquisition will include the assets, liabilities and operation of China Network Media, Science & Technology Media and its wholly owned subsidiaries and VIEs from the closing date of the acquisition. As a result of the issuance of the shares of common stock pursuant to the Exchange Agreement, a change in control of occurred as a result of the acquisition.

In connection with the closing of the Exchange Agreement, Toft ApS, China Network Media’ principal shareholder, has cancelled its 10,000,000 shares of the common stock that it owned in China Network Media and issued 50,000,000 shares to shareholders of Science & Technology Holding, who acquired a majority interest in China Network Media in October 2012 for the purpose of the reverse acquisition of Science & Technology Media. Additionally, the existing officers and directors from China Network Media resigned from its board of directors and all officer positions effective immediately after the closing of the reverse merger. Accordingly, China Network Media appointed Mr. Jiang Wei, the former major shareholder of Science & Technology Holding as the Chairman of the Board and appointed Mr. Peng HuiAn, the former major of shareholder of Science & Technology Holding as the Chief Executive Officer.

China Network Media’ directors approved the Exchange Agreement and the transactions contemplated thereby. Simultaneously, the directors of Science & Technology Media also approved the Exchange Agreement and the transactions contemplated thereby.

Prior to the Exchange Agreement, China Network Media operated in the energy solution industry in New York City. China Network Media was formed as a corporation pursuant to the laws of the State of Delaware on April 18, 2008.

As a result of the Exchange Agreement, China Network Media acquired 100% of the processing and production operations of Science & Technology Media and its subsidiaries, the business and operations of which now constitutes its primary business and operations. Specifically, as a result of the Exchange Agreement on October 29, 2012:

| · |

China Network Media acquired and now owns 100% of the issued and outstanding shares of capital stock of Science &Technology Media, a British Virgin Islands holding company which controls Dalian Tianyi, Science &Technology (Dalian) and their telecommunications business;

|

| 16 |

| · |

China Network Media issued 50,000,000 shares of common stock to the shareholders of Science & Technology Media shareholders; and

| |

| · | Science & Technology Media were issued common stock of China Network Media constituting approximately 95.02% of the fully diluted outstanding shares. |

As a result of China Network Media’ reverse acquisition of Science & Technology Media, China Network Media has assumed the business and operations of Science & Technology Media with its principal activities engaged in the internet service business in the city of Dalian, Liaoning Province of the People’s Republic of China.

On December 3, 2012, China Network Media Inc. filed a Certificate of Amendment to its Articles of Incorporation to change its name from “Metha Energy Solutions Inc.” to “China Network Media Inc.”.

Critical Accounting Policies and Management Estimates

Our discussion and analysis of our financial condition and results of operations relates to our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. We believe the consolidation, revenue recognition, income taxes and uncertain tax positions, computation of net loss per share, determination of net accounts receivable, and determination of functional currencies represent critical accounting policies that reflect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

| 17 |

Principles of consolidation

The consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries and VIEs. Upon consolidation, all balances and transactions between the Company and its subsidiaries and VIEs have been eliminated.

Use of estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ from those estimates. Significant items subject to such estimates and assumptions include valuation allowances for receivables and recoverability of carrying amount and the estimated useful lives of long-lived assets.

Revenue Recognition

The Company recognizes revenue in accordance with ASC 605, Revenue Recognition. Revenues are recognized when the four of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the service has been rendered, (iii) the fees are fixed or determinable, and (iv) collectability is reasonably assured. The recognition of revenue involves certain management judgments. The amount and timing of our revenues could be materially different for any period if management made different judgments or utilized different estimates.

Online Membership Revenue

Online membership revenue includes revenue from members for brand advertising services as well as others services.

The Company has the arrangements with nonrefundable up-front fees model (“the Model”) to recognize revenue for the online membership business. We apply the Model, where a contract is signed to establish a fixed price for our services to be provided for a period of time as a membership enrollment, for a majority of our online membership revenue. Revenue is recognized ratably over the membership periods on a straight line basis, unless evidence suggests that the revenue is earned or obligations are fulfilled in a different pattern, over the contractual term of the arrangement or the expected period during which those specified services will be performed, whichever is longer. We provide advertisement placements to our advertising customers on our different Website channels and in different formats, which can include, among other things, banners, links, logos, buttons, rich media, pre-roll and post-roll video screens, pause video screens and content integration, as specified in the contracts with the members. The members can choose various on line services from the membership contracts based on their yearly membership.

For online membership revenue recognition, we recognize revenue when all revenue recognition criteria are met.

Others Revenues

Other revenues are primarily generated from online advertisement planning services which introduce our customer’s profile, product, and awareness promotion for their executive officers to build a better brand name for non-member companies. We follows the guidance of the Securities and Exchange Commission’s FASB Accounting Standards Codification No. 605 for revenue recognition for others revenues. The Company recognize others revenue when they are realized or realizable and earned. The Company considers revenue realized or realizable and earned when it has persuasive evidence of an arrangement that the services have been rendered to the customer, the sales price is fixed or determinable, the services are rendered and collectability is reasonably assured.

Income Taxes and Uncertain Tax Positions

Income Taxes

The Company follows ASC 740, Income Taxes, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates, applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company adopted ASC 740-10-25, which provides criteria for the recognition, measurement, presentation and disclosure of uncertain tax position. The Company must recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate resolution. Our estimated liability for unrecognized tax benefits, may be affected by changing interpretations of laws, rulings by tax authorities, changes and/or developments with respect to tax audits, and expiration of the statute of limitations. The outcome for a particular audit cannot be determined with certainty prior to the conclusion of the audit and, in some cases, appeal or litigation process. The actual benefits ultimately realized may differ from our estimates. As each audit is concluded, adjustments, if any, are recorded in our financial statements. Additionally, in future periods, changes in facts, circumstances, and new information may require us to adjust the recognition and measurement estimates with regard to individual tax positions. Changes in recognition and measurement estimates are recognized in the period in which the changes occur. The Company has elected to classify interest and penalties related to an uncertain tax position, if and when required, as part of income tax expense in the combined statements of operations. The Company did not recognize any additional liabilities for uncertain tax positions as a result of the implementation of ASC 740-10-25.

| 18 |

Accounts Receivable

Accounts receivable are recorded at net realizable value consisting of the carrying amount less an allowance for uncollectible accounts as needed. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in the Company’s existing accounts receivable. The Company determines the allowance based on aging data, historical collection experience, customer specific facts and economic conditions. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company did not have any off-balance-sheet credit exposure relating to its customers, suppliers or others. As of December 31, 2012 and December 31, 2011, management has determined that no allowance for doubtful accounts is required.

Property and equipment

Property and equipment mainly comprise computer equipment, hardware and office furniture. Property and equipment are recorded at cost less accumulated depreciation with no residual value.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

| Office and other equipment | 5 years |

| Computers | 3 years |

Depreciation expense is included in Selling and marketing expenses and general and administrative expenses.

When office equipment and electronic devices are retired or otherwise disposed of, resulting gain or loss is included in net income or loss in the year of disposition for the difference between the net book value and proceeds received thereon. Maintenance and repairs which do not improve or extend the expected useful lives of the assets are charged to expenses as incurred.

Foreign currency transactions and translations

An entity’s functional currency is the currency of the primary economic environment in which it operates, normally that is the currency of the environment in which the entity primarily generates and expends cash. Management’s judgment is essential to determine the functional currency by assessing various indicators, such as cash flows, sales price and market, expenses, financing and inter-company transactions and arrangements. The reporting currency of the Company is United States dollars (“U.S. dollars” or “$”), and the functional currency of HK Science & Technology is Hong Kong dollars (“HK dollar”). The functional currency of the Company’s PRC subsidiary and VIEs is the Renminbi (“RMB’), and PRC is the primary economic environment in which the Company operates. The reporting currency of these consolidated financial statements is the United States dollar.

| 19 |

For financial reporting purposes, the financial statements of the Company’s PRC subsidiary and VIEs, which are prepared using the RMB, are translated into the Company’s reporting currency, the United States dollar. Assets and liabilities are translated using the exchange rate at each balance sheet date. Revenue and expenses are translated using average rates prevailing during each reporting period, and shareholders' equity is translated at historical exchange rates. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income in owners’ equity.

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transactions. The resulting exchange differences are included in the determination of net loss of the consolidated financial statements for the respective periods.

The exchange rates used for foreign currency translation were as follows (US$1 = RMB):

| Period End | Average | |||||||

| 12/31/2012 | 6.3161 | 6.3198 | ||||||

| 12/31/2011 | 6.3647 | 6.4735 | ||||||

| 12/31/2010 | 6.6118 | 6.7788 | ||||||

No representation is made that the RMB amounts could have been, or could be, converted into U.S. dollars at the rates used in translation.

Translations adjustments resulting from this process are included in accumulated other comprehensive loss in the shareholder’s deficit were $34,712 and $26,375 as of December 31, 2012 and 2011, respectively.

Results of Operations for the Years Ended December 31, 2012 and 2011

The following table shows key components of the results of operations during the years ended December 31, 2012 and 2011:

| For the Year Ended | For the Year Ended | |||||||

| December 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Revenue | ||||||||

| - Third parties | $ | 357,170 | $ | 123,336 | ||||

| - Related parties | 26,372 | 6,363 | ||||||

| 383,542 | 129,699 | |||||||

| Cost of revenue | ||||||||

| - Third parties | 314,934 | 308,145 | ||||||

| - Related parties | 23,254 | 15,898 | ||||||

| 338,188 | 324,043 | |||||||

| Gross profit (loss) | 45,354 | (194,344 | ) | |||||

| Operating expenses: | ||||||||

| Research and development expenses | 78,140 | 56,807 | ||||||

| Selling and marketing expenses | 105,468 | 159,750 | ||||||

| General and administrative expenses | 978,034 | 379,590 | ||||||

| Total operating expenses | 1,161,642 | 596,147 | ||||||

| Loss from Operations | (1,116,288 | ) | (790,491 | ) | ||||

| Other income | 61,640 | 258 | ||||||

| Loss from operations before income taxes | (1,054,648 | ) | (790,233 | ) | ||||

| Provision for income taxes | - | - | ||||||

| Net loss | (1,054,648 | ) | (790,233 | ) | ||||

| Other comprehensive loss | ||||||||

| Foreign currency translation adjustment | $ | (8,337 | ) | $ | (18,924 | ) | ||

| Comprehensive loss | $ | (1,062,985 | ) | $ | (809,157 | ) | ||

| 20 |

Revenue

Total revenues were $383,542 for the year ended December 31, 2012, compared to $129,699 for the corresponding periods in 2011. The increase in total revenues from the year ended December 31, 2011 to the year ended December 31, 2012 was $253,843. The increases were mainly attributable to increases in online members to 30 with average contract price of $51,344 from 11 with average contract price of $25,205.

Costs and Expenses

Cost of revenue

Total cost of revenues was $338,188 for the year ended December 31, 2012, compared to $324,043 for the corresponding period in 2011. The increase in cost of revenues from the year ended December 31, 2011 to the year ended December 31, 2012 was $14,145. The main factors were that the labor cost increased $53,681 and the sales tax increased $15,842. At the same time, cooperation fee decreased $79,494 and other cost increased $24,116. The cooperation fee was mainly entered into in year 2011, which ceased in 2012 and caused the fluctuations between two periods.

Operating Expenses

Total operating expenses were $1,161,642 for the year ended December 31, 2012, compared to $596,147 for the corresponding period in 2011. The increase in operating expenses from the year ended December 31, 2011 to the year ended December 31, 2012 was $565,495. The increase was mainly attributable to a $465,157 increase in professional fees for the reverse merge in year 2012.

Research and Development Expenses

Research and development expenses mainly consist of personnel-related expenses incurred for costs associated with new research in new products and services, development and enhancement of existing products and services, and enhancement of our websites, which mainly include the development costs of online advertisement and maintenance costs after the website is available for marketing.

Research and development expenses were $78,140 for the year ended December 31, 2012, compared to $56,807 for the corresponding periods in 2011.The increase in research and development expenses from the year ended December 31, 2011 to the year ended December 31, 2012 was $21,333. The increase mainly was driven by increase in salary and benefits expenses, which was mainly attributable to increased headcount from 9 to 13 employees.

Sales and Marketing Expenses

Sales and marketing expenses mainly consist of advertising and promotional expenditures, salary and benefits expenses, sales commissions and travel expenses.