Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTMORELAND COAL Co | f8k_041013i701.htm |

Investor Presentation April 2013 Westmoreland Coal Company westmoreland.com NASDAQ:WLB

Westmoreland Coal Company 1 Disclaimer Forward Looking Statements This document may contain “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. They are statements neither of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include political, economic, business, competitive, market, weather and regulatory conditions and the following: Changes in our postretirement medical benefit and pension obligations and the impact of the recently enacted healthcare legislation; Changes in our black lung obligations, changes in our experience related to black lung claims, and the impact of the recently enacted healthcare legislation; Our potential inability to expand or continue current coal operations due to limitations in obtaining bonding capacity for new mining permits; Our potential inability to maintain compliance with debt covenant and waiver agreement requirements; The potential inability of our subsidiaries to pay dividends to U.S. due to restrictions in our debt arrangements, reductions in planned coal deliveries or other business factors; Risks associated with the structure of our power plants' contracts with its lenders, coal suppliers and power purchaser, which could dramatically affect the overall profitability of our power plants; The effect of Environmental Protection Agency inquiries and regulations on the operations of power plants; The effect of prolonged maintenance or unplanned outages at our operations or those of our major power generating customers; Future legislation and changes in regulations, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; and Other factors as described in “Risk Factors” found in our Annual Report on Form 10-K. Any forward-looking statements made by us in this document speak only as of the date on which they are made. Factors or events that could cause our actual results to differ may emerge from time-to-time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law.

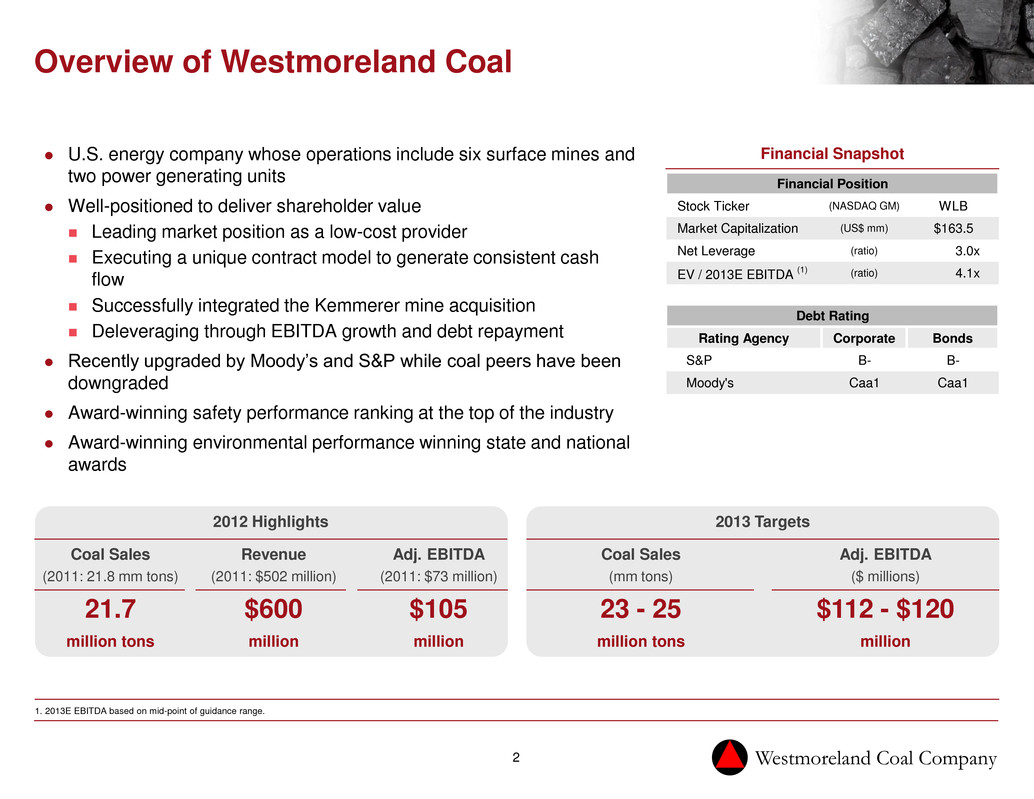

Westmoreland Coal Company 2 Financial Snapshot 2012 Highlights Coal Sales (2011: 21.8 mm tons) 21.7 million tons Revenue (2011: $502 million) $600 million Adj. EBITDA (2011: $73 million) $105 million 2013 Targets Coal Sales (mm tons) 23 - 25 million tons Adj. EBITDA ($ millions) $112 - $120 million Overview of Westmoreland Coal U.S. energy company whose operations include six surface mines and two power generating units Well-positioned to deliver shareholder value Leading market position as a low-cost provider Executing a unique contract model to generate consistent cash flow Successfully integrated the Kemmerer mine acquisition Deleveraging through EBITDA growth and debt repayment Recently upgraded by Moody’s and S&P while coal peers have been downgraded Award-winning safety performance ranking at the top of the industry Award-winning environmental performance winning state and national awards Financial Position Stock Ticker (NASDAQ GM) WLB Market Capitalization (US$ mm) $163.5 Net Leverage (ratio) 3.0x EV / 2013E EBITDA (1) (ratio) 4.1x Debt Rating Rating Agency Corporate Bonds S&P B- B- Moody's Caa1 Caa1 1. 2013E EBITDA based on mid-point of guidance range.

Westmoreland Coal Company 3 Company timeline 1854 Westmoreland Coal Company formed 2001 Begins acquiring current western surface operations 2007 - 2010 New management team initiates low-cost standardized platform 1992 Begins divesting eastern coal operations to position for the future 2009 Indian Coal Tax Credit Agreement 2006 Acquires 100% of the ROVA power plants 2009 Heritage health benefit obligations significantly reduced Feb 2011 Issuance of $150 mm 10.75% notes Jan 2012 Kemmerer Mine acquisition; issues $125 million 10.75% notes July 2012 Enters 5-year $20 mm revolving credit facility

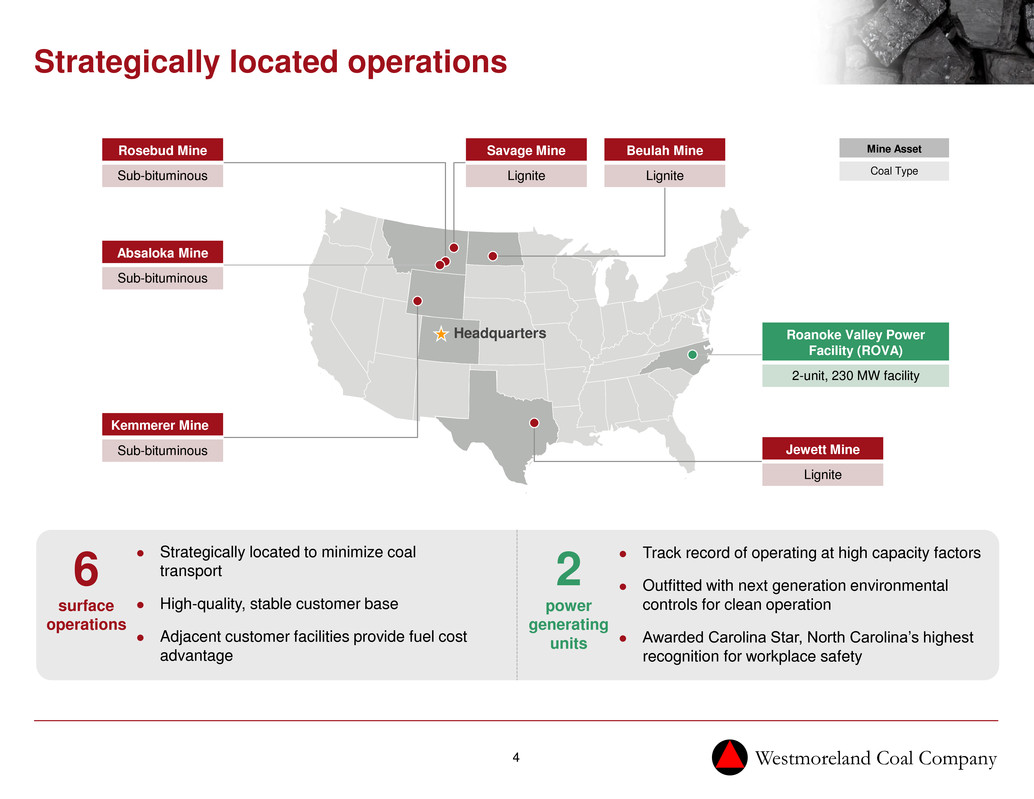

Westmoreland Coal Company 4 Headquarters 6 surface operations Strategically located to minimize coal transport High-quality, stable customer base Adjacent customer facilities provide fuel cost advantage Jewett Mine Lignite Beulah Mine Lignite Roanoke Valley Power Facility (ROVA) 2-unit, 230 MW facility Kemmerer Mine Sub-bituminous Rosebud Mine Sub-bituminous Savage Mine Lignite Mine Asset Coal Type Absaloka Mine Sub-bituminous Track record of operating at high capacity factors Outfitted with next generation environmental controls for clean operation Awarded Carolina Star, North Carolina’s highest recognition for workplace safety 2 power generating units Strategically located operations

Westmoreland Coal Company 5 Investment highlights Implemented operational turnaround achieving record performance in 2012 Non-core asset sales could provide rapid deleveraging or acquisition funding Potential to reduce legacy liability position as economy improves Strong Financial Performance Coal will remain the primary fuel source for U.S. power generation Coal-to-natural gas switching expected to subside as natural gas prices stabilize Favorable Market Outlook Operations adjacent to customer facilities provide fuel cost advantage Predictable cash flows reduce exposure to coal price volatility High quality, stable customer base under cost-plus contracts Unique Operational Model Proven track record of executing and integrating acquisitions Committed to growing reserves through strategic acquisitions Award-winning safety and environmental performance Focused Management Team

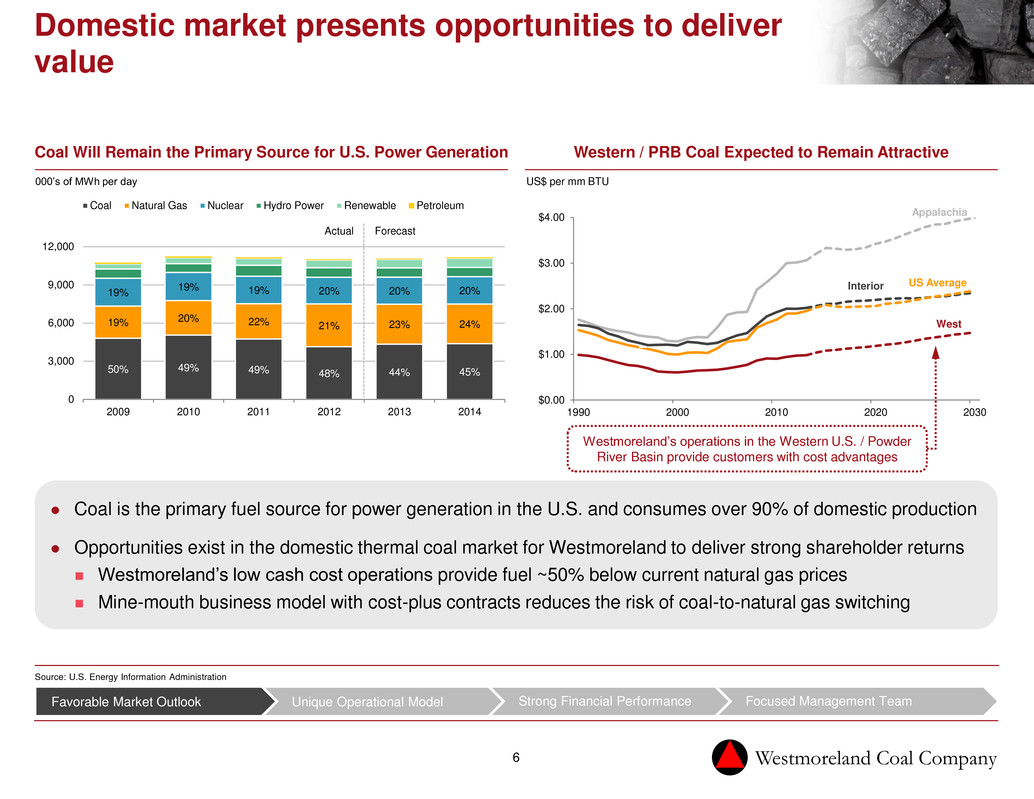

Westmoreland Coal Company 6 Coal is the primary fuel source for power generation in the U.S. and consumes over 90% of domestic production Opportunities exist in the domestic thermal coal market for Westmoreland to deliver strong shareholder returns Westmoreland’s low cash cost operations provide fuel ~50% below current natural gas prices Mine-mouth business model with cost-plus contracts reduces the risk of coal-to-natural gas switching Appalachia Interior West US Average $0.00 $1.00 $2.00 $3.00 $4.00 1990 2000 2010 2020 2030 Western / PRB Coal Expected to Remain Attractive US$ per mm BTU Coal Will Remain the Primary Source for U.S. Power Generation Source: U.S. Energy Information Administration 000’s of MWh per day Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team 50% 49% 49% 48% 44% 45% 19% 20% 22% 21% 23% 24% 19% 19% 19% 20% 20% 20% 0 3,000 6,000 9,000 12,000 2009 2010 2011 2012 2013 2014 Coal Natural Gas Nuclear Hydro Power Renewable Petroleum Actual Forecast Domestic market presents opportunities to deliver value Westmoreland’s operations in the Western U.S. / Powder River Basin provide customers with cost advantages

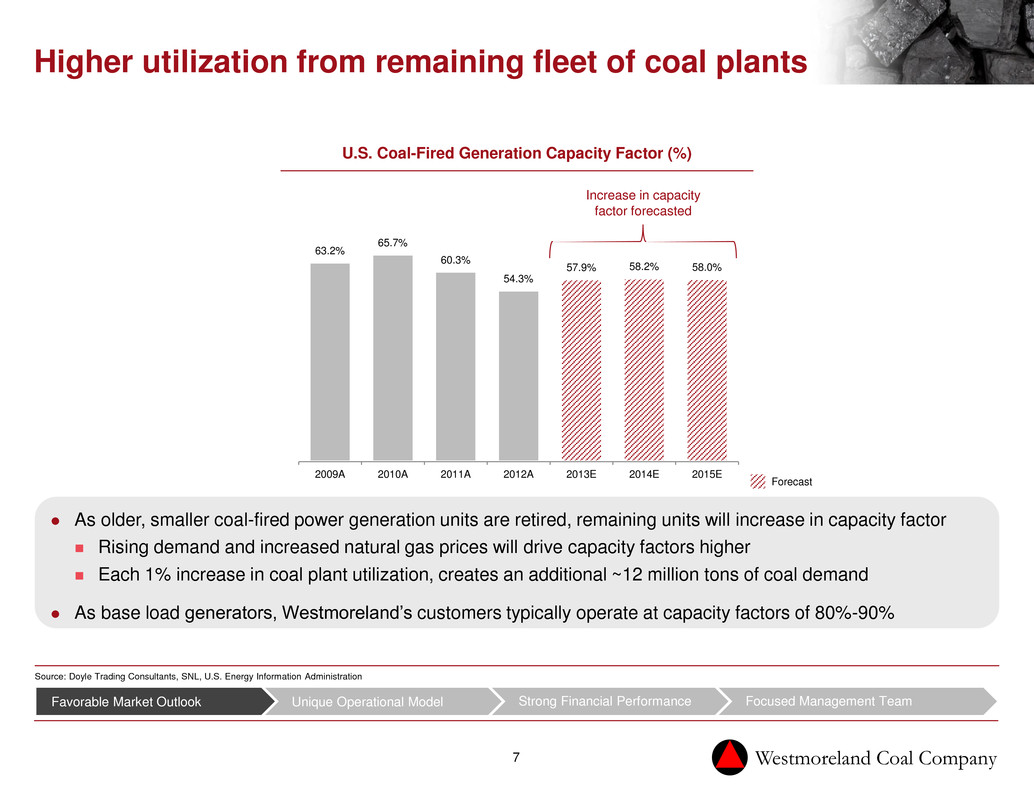

Westmoreland Coal Company 7 As older, smaller coal-fired power generation units are retired, remaining units will increase in capacity factor Rising demand and increased natural gas prices will drive capacity factors higher Each 1% increase in coal plant utilization, creates an additional ~12 million tons of coal demand As base load generators, Westmoreland’s customers typically operate at capacity factors of 80%-90% Source: Doyle Trading Consultants, SNL, U.S. Energy Information Administration U.S. Coal-Fired Generation Capacity Factor (%) 63.2% 65.7% 60.3% 54.3% 57.9% 58.2% 58.0% 2009A 2010A 2011A 2012A 2013E 2014E 2015E Increase in capacity factor forecasted Forecast Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Higher utilization from remaining fleet of coal plants

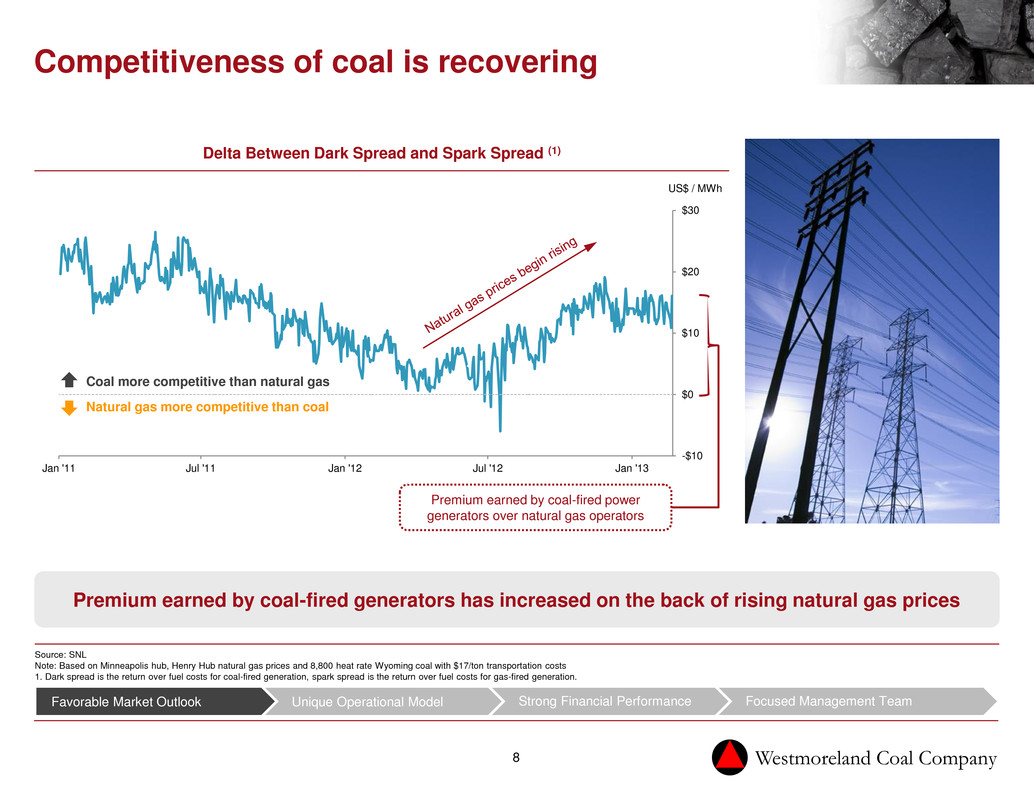

Westmoreland Coal Company 8 -$10 $0 $10 $20 $30 Jan '11 Jul '11 Jan '12 Jul '12 Jan '13 Source: SNL Note: Based on Minneapolis hub, Henry Hub natural gas prices and 8,800 heat rate Wyoming coal with $17/ton transportation costs 1. Dark spread is the return over fuel costs for coal-fired generation, spark spread is the return over fuel costs for gas-fired generation. Coal more competitive than natural gas Natural gas more competitive than coal US$ / MWh Premium earned by coal-fired power generators over natural gas operators Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Competitiveness of coal is recovering Delta Between Dark Spread and Spark Spread (1) Premium earned by coal-fired generators has increased on the back of rising natural gas prices

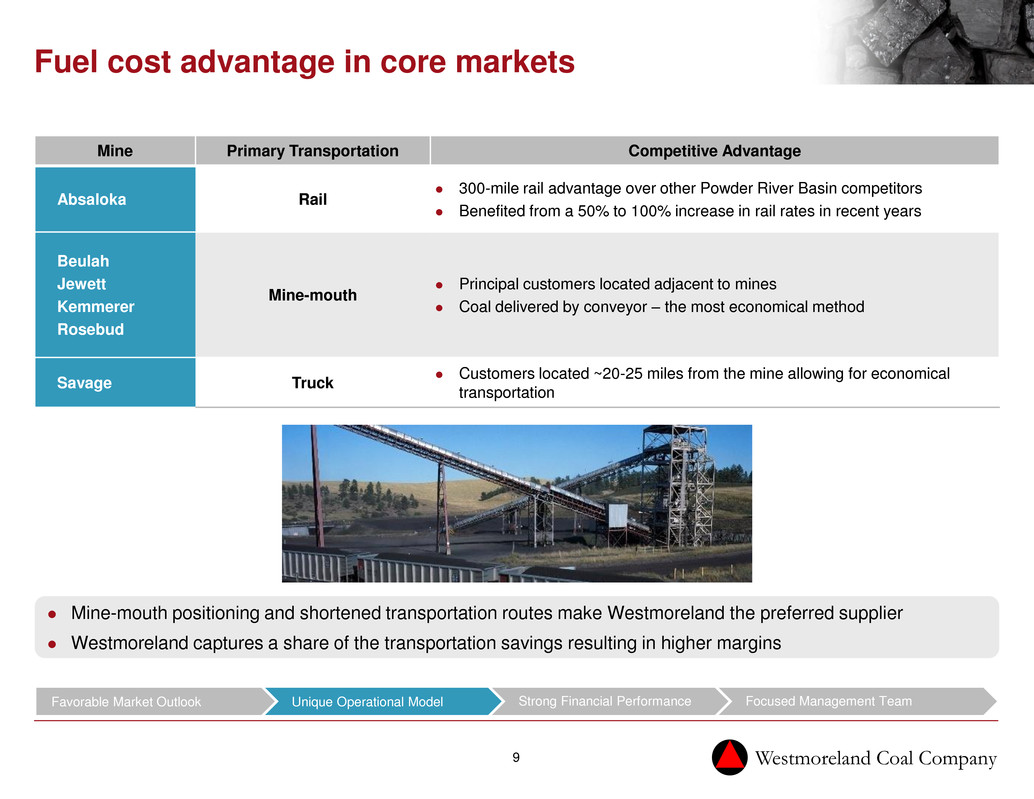

Westmoreland Coal Company 9 Mine Primary Transportation Competitive Advantage Absaloka Rail 300-mile rail advantage over other Powder River Basin competitors Benefited from a 50% to 100% increase in rail rates in recent years Beulah Jewett Kemmerer Rosebud Mine-mouth Principal customers located adjacent to mines Coal delivered by conveyor – the most economical method Savage Truck Customers located ~20-25 miles from the mine allowing for economical transportation Mine-mouth positioning and shortened transportation routes make Westmoreland the preferred supplier Westmoreland captures a share of the transportation savings resulting in higher margins Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Fuel cost advantage in core markets

Westmoreland Coal Company 10 95% 95% 63% Majority of mine contracts run through the 2020’s ROVA power generating station has a long-term off-take agreement All electricity generated is contracted through 2019 and 2020 of sales under cost-plus or cost-indexed contracts of coal sales under long-term contracts of sales contracts include fixed cost reimbursement if tons are reduced Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Stable cash flows through long-term, cost plus contracts

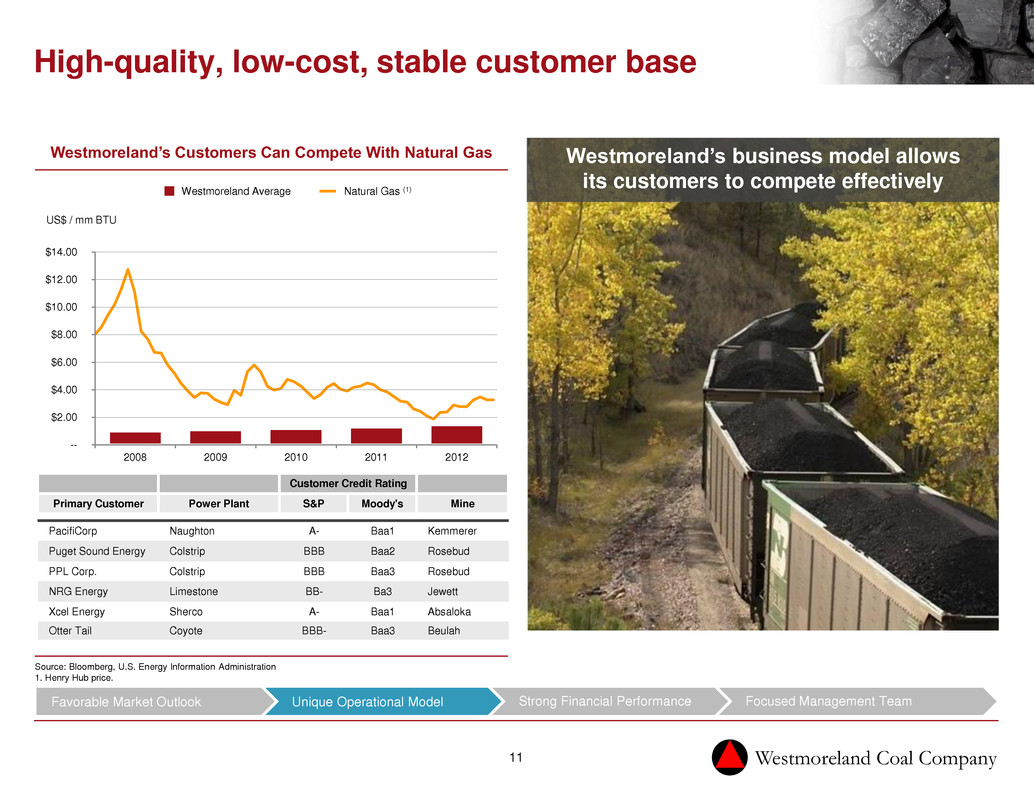

Westmoreland Coal Company 11 High-quality, low-cost, stable customer base Westmoreland’s business model allows its customers to compete effectively -- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 2008 2009 2010 2011 2012 US$ / mm BTU Source: Bloomberg, U.S. Energy Information Administration 1. Henry Hub price. Westmoreland’s Customers Can Compete With Natural Gas Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Westmoreland Average Natural Gas (1) Customer Credit Rating Primary Customer Power Plant S&P Moody's Mine PacifiCorp Naughton A- Baa1 Kemmerer Puget Sound Energy Colstrip BBB Baa2 Rosebud PPL Corp. Colstrip BBB Baa3 Rosebud NRG Energy Limestone BB- Ba3 Jewett Xcel Energy Sherco A- Baa1 Absaloka Otter Tail Coyote BBB- Baa3 Beulah

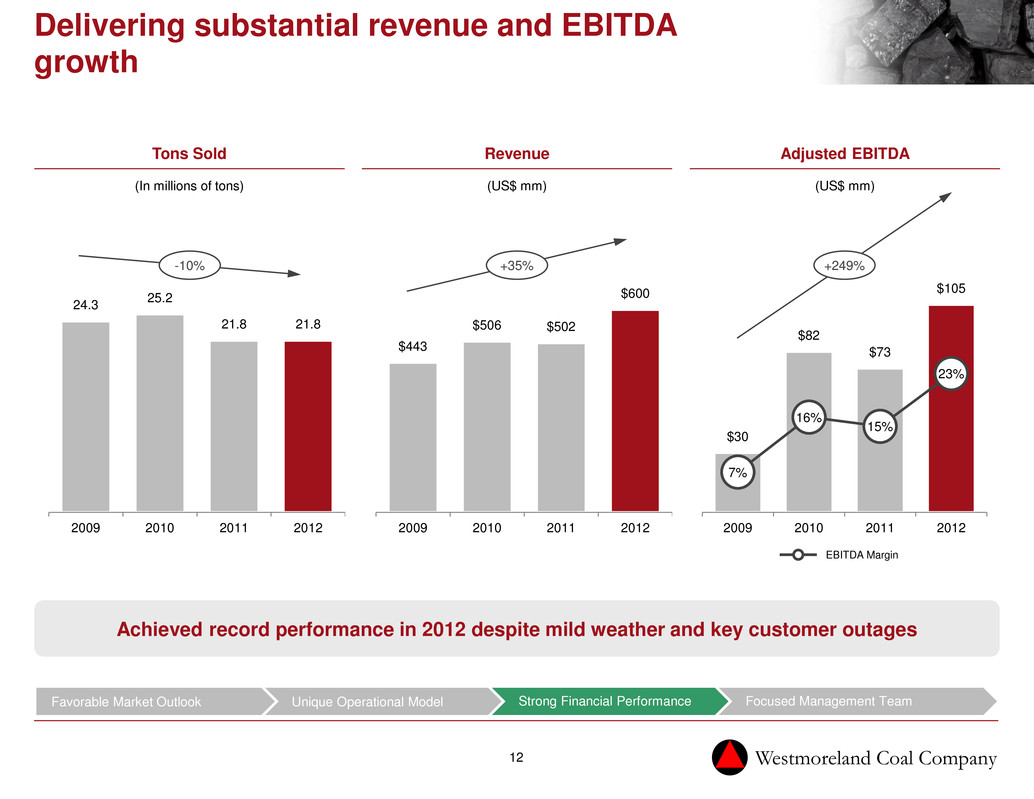

Westmoreland Coal Company 12 $30 $82 $73 $105 7% 16% 15% 23% 2009 2010 2011 2012 $443 $506 $502 $600 2009 2010 2011 2012 24.3 25.2 21.8 21.8 2009 2010 2011 2012 Tons Sold Revenue Adjusted EBITDA (In millions of tons) (US$ mm) (US$ mm) +249% +35% -10% Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Achieved record performance in 2012 despite mild weather and key customer outages Delivering substantial revenue and EBITDA growth EBITDA Margin

Westmoreland Coal Company 13 Substantial Free Cash Flow Growth Improved Balance Sheet Strength Optionality on Long-Term Liabilities 5.6x 7.6x 2.8x 3.3x 3.0x 2008 2009 2010 2011 2012 Net Debt / EBITDA (1) ($ millions) Source: Milliman 2012 Pension Funding Study 1. Net debt calculated as (total debt outstanding less cash and cash equivalents and debt service reserves) / Adj. EBITDA. 2. As at 31-Dec-12; includes cash on hand and revolving lines of credit. 0.2% (1.9%) 8.1% 7.8% 9.3% 2007 2008 2009 2010 2011 Change in US corporate pension liabilities due to decreases in interest and discount rates Strong free cash flow growth through: Operational improvements The Kemmerer mine acquisition $6 ($19) $28 $26 $73 2008 2009 2010 2011 2 12 Free Cash Flow ($ millions) Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Paid down $45 mm of debt in 2012 Total liquidity of $75 mm (2) Potential to rapidly delever through the sale of non-core ROVA power generation units Optionality on long-term liabilities as rising interest rates will reduce pension liabilities and further strengthen balance sheet Sustainable cash flows support debt repayment, liquidity

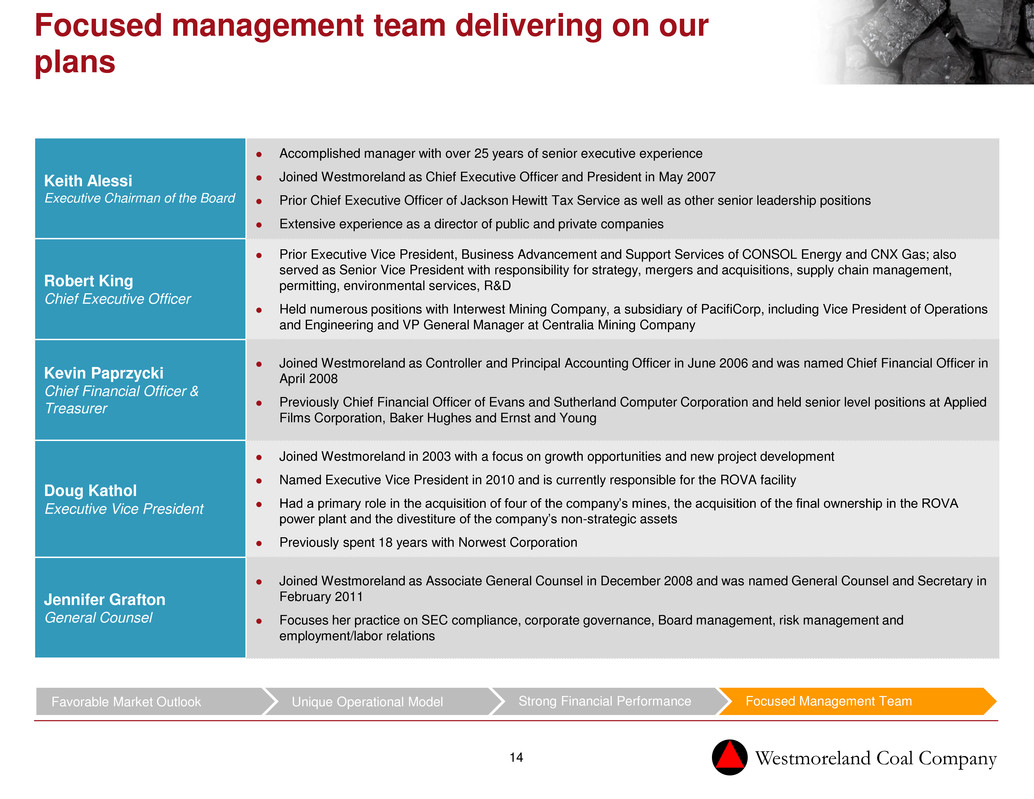

Westmoreland Coal Company 14 Focused management team delivering on our plans Keith Alessi Executive Chairman of the Board Accomplished manager with over 25 years of senior executive experience Joined Westmoreland as Chief Executive Officer and President in May 2007 Prior Chief Executive Officer of Jackson Hewitt Tax Service as well as other senior leadership positions Extensive experience as a director of public and private companies Robert King Chief Executive Officer Prior Executive Vice President, Business Advancement and Support Services of CONSOL Energy and CNX Gas; also served as Senior Vice President with responsibility for strategy, mergers and acquisitions, supply chain management, permitting, environmental services, R&D Held numerous positions with Interwest Mining Company, a subsidiary of PacifiCorp, including Vice President of Operations and Engineering and VP General Manager at Centralia Mining Company Kevin Paprzycki Chief Financial Officer & Treasurer Joined Westmoreland as Controller and Principal Accounting Officer in June 2006 and was named Chief Financial Officer in April 2008 Previously Chief Financial Officer of Evans and Sutherland Computer Corporation and held senior level positions at Applied Films Corporation, Baker Hughes and Ernst and Young Doug Kathol Executive Vice President Joined Westmoreland in 2003 with a focus on growth opportunities and new project development Named Executive Vice President in 2010 and is currently responsible for the ROVA facility Had a primary role in the acquisition of four of the company’s mines, the acquisition of the final ownership in the ROVA power plant and the divestiture of the company’s non-strategic assets Previously spent 18 years with Norwest Corporation Jennifer Grafton General Counsel Joined Westmoreland as Associate General Counsel in December 2008 and was named General Counsel and Secretary in February 2011 Focuses her practice on SEC compliance, corporate governance, Board management, risk management and employment/labor relations Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team

Westmoreland Coal Company 15 11 4 Reportable Incidents 100 121 25 5 Mine Citations Labor Grievances Successfully integrated Kemmerer mine acquisition The Kemmerer mine was acquired in January 2012 Added 118 million tons of reserves Significantly enhanced financial performance contributing $43 mm EBITDA in 2012 Nearby customers have designed their boilers based on the physical properties of Kemmerer’s coal Majority of production is committed and priced under cost-plus contracts minimizing downside exposure Signed new six-year labor agreement driving operational and productivity improvements 2011 (Pre-Acquisition) 2012 (Post-Acquisition) Key Operational Achievements Productivity (1) 18.7% Headcount 8.2% Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Kemmerer integration has exceeded expectations with strong improvements in both productivity and safety 1. Units per man hour.

Westmoreland Coal Company 16 553 423 425 390 368 1,177 2008 2009 2010 2011 2012 A B C D E 1.2 billion tons Substantial reserve and resource growth at minimal upfront cost, reaching 1.2 billion tons In millions of tons Mine Resources Estimated Life (1) (mm tons) (years) A Absaloka 609 223 B Rosebud 381 48 C Kemmerer 104 24 D Beulah 43 19 E Jewett 34 8 F Savage 5 18 Total 1,177 Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Continued reserve growth at minimal upfront cost ~625 mm tons of additional resources to be proven 1. Based on current production. Proven and Probable To be Proven

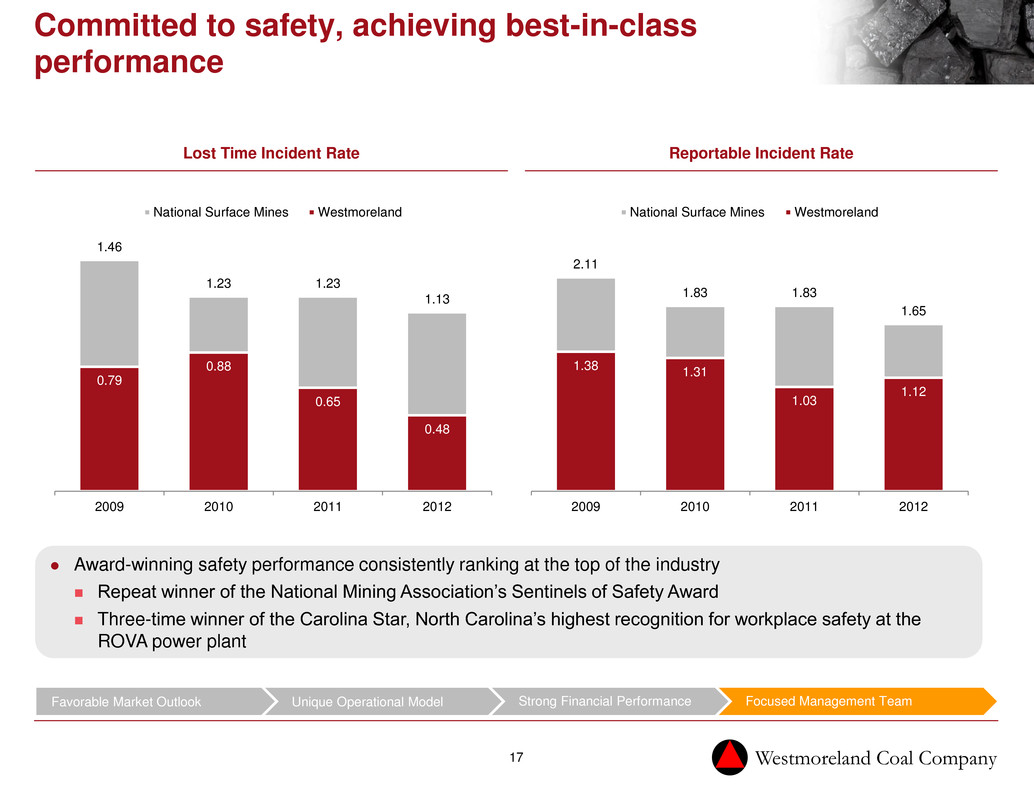

Westmoreland Coal Company 17 Reportable Incident Rate Lost Time Incident Rate Award-winning safety performance consistently ranking at the top of the industry Repeat winner of the National Mining Association’s Sentinels of Safety Award Three-time winner of the Carolina Star, North Carolina’s highest recognition for workplace safety at the ROVA power plant Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Committed to safety, achieving best-in-class performance 1.46 1.23 1.23 1.13 0.79 0.88 0.65 0.48 2009 2010 2011 2012 National Surface Mines Westmoreland 2.11 1.83 1.83 1.65 1.38 1.31 1.03 1.12 2009 201 2011 2012 National Surface Min s Westmoreland

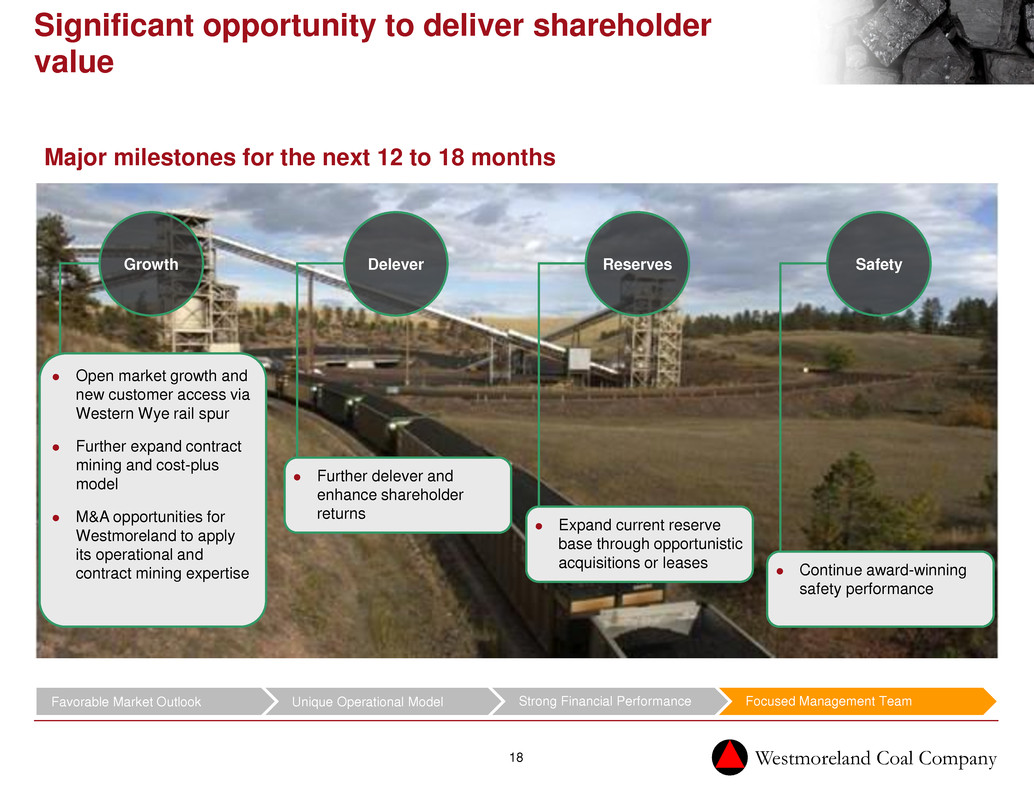

Westmoreland Coal Company 18 Significant opportunity to deliver shareholder value Delever Reserves Safety Major milestones for the next 12 to 18 months Growth Expand current reserve base through opportunistic acquisitions or leases Continue award-winning safety performance Open market growth and new customer access via Western Wye rail spur Further expand contract mining and cost-plus model M&A opportunities for Westmoreland to apply its operational and contract mining expertise Further delever and enhance shareholder returns Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team

Westmoreland Coal Company 19 0 50 100 150 200 $0 $5 $10 $15 $20 $25 May-11 Aug-11 Nov-11 Feb-12 May-12 Aug-12 Nov-12 Feb-13 Volu m e (Thousands) Sh ar e P ric e ( US $) Volume Westmoreland Share Price Peer Performance (Indexed) S&P upgrades credit rating to B- from CCC+, assigns stable outlook Announces lease of 2,557 acres of private coal (56.4 mm tons) adjacent to Rosebud Mine Enters into 5-yr US$20 mm revolving credit facility; amends leverage/coverage ratios providing increased flexibility Announces exchange offer for US$125 mm of 10.75% notes due in 2018 Moody's upgrades sr. secured notes from Caa2 to Caa1 Begins trading on NASDAQ Announces plan to acquire Kemmerer Mine from Chevron (118 mm tons of reserves) Savage Mine reaches new 4-yr labor agreement Completes acquisition of Kemmerer Mine (US$76.5 mm in cash, US$118 mm in assumed liabilities); issues US$125 mm of 10.75% senior secured notes due 2018 Acquires 8,800 acres of leases (158 mm tons) adjacent to Rosebud Mine Announces new 4-yr labor agreement at Absaloka Mine (1) Announces new labor agreement at Western Energy Company Announces new 6-yr labor deal at Kemmerer Mine Partners with Crow Tribe for 145 mm tons of additional resources 26% 26% (32%) (54%) (68%) (76%) (83%) (92%) Westmoreland Cloud Peak CONSOL Peabody Walter Arch Alpha James River Westmoreland’s Share Performance Relative Performance Since 2010 Source: Bloomberg, Company filings 1. Indexed peers include: Arch Coal, Alpha Natural Resources, Cloud Peak, CONSOL Energy, James River Coal, Peabody Energy, Walter Energy. Source: FactSet Favorable Market Outlook Unique Operational Model Strong Financial Performance Focused Management Team Outperforming its North American peers

Westmoreland Coal Company 20 Investor relations For investor relations please contact: Kevin Paprzycki Chief Financial Officer and Treasurer Westmoreland Coal Company 9540 South Maroon Circle Suite 200 Englewood, CO 80112 (720) 354-4489 Toll Free: (855) 922-6463