Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VEREIT, Inc. | v340949_8k.htm |

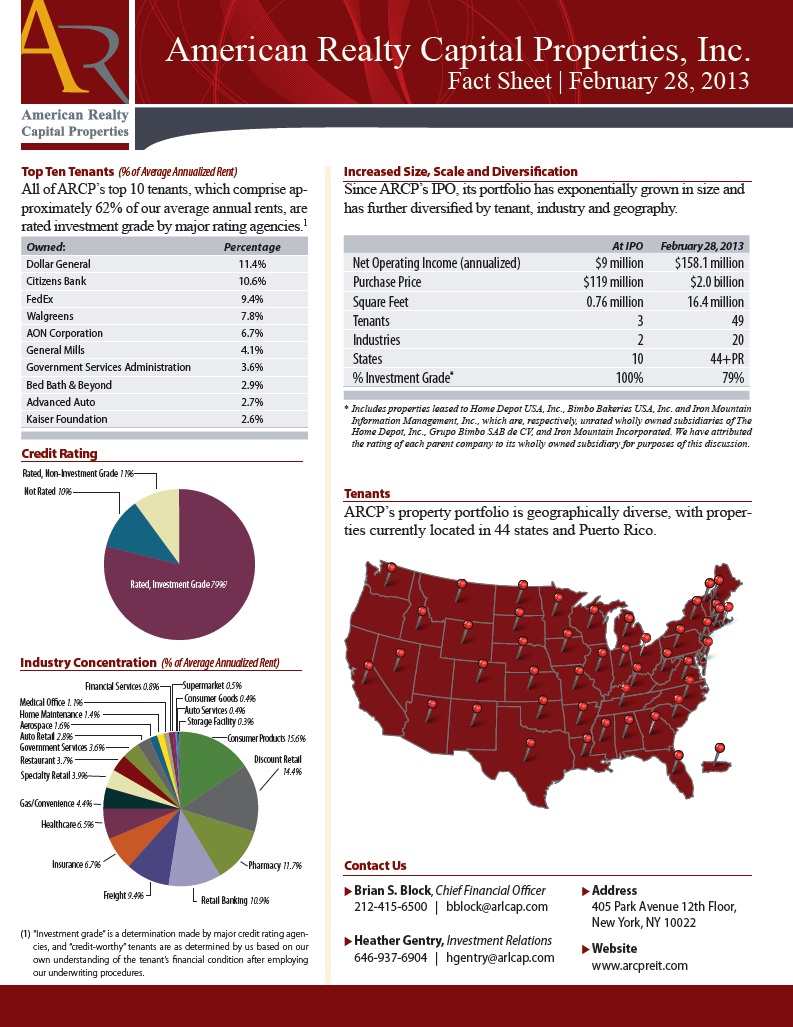

American Realty Capital Properties, Inc. Fact Sheet | February 28, 2013 American Realty Capital Properties, Inc. (NASDAQ: ARCP) is a leading real estate investment trust (“REIT”) that acquires, owns and operates single-tenant, freestanding commercial real estate properties. ARCP’s high-quality property portfolio is leased to primarily investment grade rated corporate tenants, occupying properties located at the corner of “Main & Main” and in other strategic locations.1 On February 28, 2013, ARCP completed its merger with American Realty Capital Trust III, Inc. Unlike other net lease REITs, ARCP focuses on acquiring both mid-term and long-term leases, which provide for both income generation and outsized growth potential over the longer term. The Company’s investment strategy emphasizes durable income delivered through dependable monthly dividends, purchasing properties at or below replacement cost, and diversifying by tenant, industry and geography.2 Q4 2012 ARCP Total Return Performance* 1-Yr 4th Quarter ARCP 37.57% 7.78% Triple Net Peers 24.14% 3.34% MSCI US REIT Index 17.77% 2.50% Russell 2000 Index 16.33% 1.85% S&P Small-Cap Index 16.35% 2.22% * As of 12/31/2012. Triple net peer universe includes: O, NN, LXP, LSE, ADC, EPR, GTY and OLP. (1) “Investment grade” is a determination made by major credit rating agencies, and “creditworthy” tenants are as determined by us based on our own understanding of the tenant’s financial condition after employing our underwriting procedures. (2) Dividends are not guaranteed. We may not be able to pay or maintain dividends and they are subject to change at any time. (3) Dividend increased from $0.895 per share to $0.90 per share effective with the March 2013 dividend. (4) Figure expressed as a percentage of average annual rent. Stock Attributes Ticker Symbol ARCP Equity Market Capitalization $2.4 Billion Total Common Shares 154.1 Million Outstanding Share Price $13.23 Monthly Dividend $0.07458 per share Annualized Dividend $0.895 per share3 Dividend Frequency Monthly Portfolio Attributes Number of Properties: 692 Number of States: 44+PR Number of Tenants: 49 Number of Industries: 20 Total Square Footage: 16.4 million Avg. Remaining Lease Term: 11.5 years Occupancy: 100% % Investment Grade Tenants: 79% 1,4 Regular Dividend Increases ARCP has raised its dividend five times since its IPO. $0.905 $0.900 $0.900 $0.895 $0.895 $0.890 $0.890 $0.885 $0.885 Share $0.880 Per $0.880 $0.875 $0.875 $0.875 $0.870 $0.865 $0.860 Q'3 2011 Q'4 2011 Q'1 2012 Q'2 2012 Q'3 2012 Q'4 2012 Q'1 2013

American Realty Capital Properties, Inc. Fact Sheet | February 28, 2013 Top Ten Tenants (% of Average Annualized Rent) All of ARCP’s top 10 tenants, which comprise approximately 62% of our average annual rents, are rated investment grade by major rating agencies.1 Owned: Percentage Dollar General 11.4% Citizens Bank 10.6% FedEx 9.4% Walgreens 7.8% AON Corporation 6.7% General Mills 4.1% Government Services Administration 3.6% Bed Bath & Beyond 2.9% Advanced Auto 2.7% Kaiser Foundation 2.6% Credit Rating Industry Concentration (% of Average Annualized Rent) Financial Services 0.8% Supermarket 0.5% Consumer Goods 0.4% Medical Office 1.1% Auto Services 0.4% Home Maintenance 1.4% Storage Facility 0.3% Aerospace 1.6% Auto Retail 2.8% Consumer Products 15.6% Government Services 3.6% Discount Retail Restaurant 3.7% Specialty Retail 3.9% 14.4% Gas/Convenience 4.4% Healthcare 6.5% Insurance 6.7% Pharmacy 11.7% Freight 9.4% Retail Banking 10.9% (1) “Investment grade” is a determination made by major credit rating agencies, and “credit-worthy” tenants are as determined by us based on our own understanding of the tenant’s financial condition after employing our underwriting procedures. Increased Size, Scale and Diversification Since ARCP’s IPO, its portfolio has exponentially grown in size and has further diversified by tenant, industry and geography. At IPO February 28, 2013 Net Operating Income (annualized) $9 million $158.1 million Purchase Price $119 million $2.0 billion Square Feet 0.76 million 16.4 million Tenants 3 49 Industries 2 20 States 10 44+PR % Investment Grade* 100% 79% * Includes properties leased to Home Depot USA, Inc., Bimbo Bakeries USA, Inc. and Iron Mountain Information Management, Inc., which are, respectively, unrated wholly owned subsidiaries of The Home Depot, Inc., Grupo Bimbo SAB de CV, and Iron Mountain Incorporated. We have attributed the rating of each parent company to its wholly owned subsidiary for purposes of this discussion. Tenants ARCP’s property portfolio is geographically diverse, with proper-ties currently located in 44 states and Puerto Rico. Contact Us Brian S. Block, Chief Financial Officer Address 212-415-6500 | bblock@arlcap.com 405 Park Avenue 12th Floor, New York, NY 10022 Heather Gentry, Investment Relations Website 646-937-6904 | hgentry@arlcap.com www.arcpreit.com