Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ABRAXAS PETROLEUM CORP | axas8k040813.htm |

Canaccord Genuity Road Show

April 2013

Exhibit 99.1

2

The information presented herein may contain predictions, estimates and other

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although

the Company believes that its expectations are based on reasonable

assumptions, it can give no assurance that its goals will be achieved.

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although

the Company believes that its expectations are based on reasonable

assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those

included in the forward-looking statements include the timing and extent of

changes in commodity prices for oil and gas, the need to develop and replace

reserves, environmental risks, competition, government regulation and the

ability of the Company to meet its stated business goals.

included in the forward-looking statements include the timing and extent of

changes in commodity prices for oil and gas, the need to develop and replace

reserves, environmental risks, competition, government regulation and the

ability of the Company to meet its stated business goals.

Forward-Looking Statements

3

Ø Exposure to "core" acreage in U.S. oil resource plays

Ø Significant, low-cost exposure to other emerging NAM oil resource plays

Premier

Position

Position

Value +

Growth

Growth

Ø Low decline legacy production provides solid foundation

Ø “Manufacturing” model in repeatable resource plays leads to visible growth

Proven

Operator

Operator

Ø Deep technical and geological / geophysical staff

Ø Company owned rig in Bakken + pad drilling = efficient, low cost operator

Oil

Weighted

Weighted

Ø 66% crude oil and liquids weighted by reserves(1)

Ø Nearly 100% of 2013E capital directed towards growing production from oil resource plays

(1) On reserve basis as of 12/31/12

Experienced

Leadership

Leadership

Ø Senior management with 32 average years of industry experience

Ø Highly qualified directors with significant energy industry and board experience

Abraxas Highlights

4

Headquarters........................ San Antonio

Employees............................... 101

Shares outstanding(1)……......... 92.7mm

Market cap(2) ……………………... $214mm

Bank debt net of cash(3)………. $111mm

PV-10(4)……………………………….. $316.9

mm

mm

(1) As of 3/31/13

(2) As of 3/31/13

(3) As of 12/31/12

(4) As of 12/31/12 Uses 12/31/12 SEC Pricing of $95.14/bbl oil and $2.86/mcf gas

(5) Based on December 31, 2012 reserves and annualized daily net production for the quarter ended December 21, 2012

EV/BOE(2,4)………………………… $11.19

Proved Reserves(4).…………..... 30.1mmboe

% Oil/Liquids……………… ~66%

% Proved developed….. ~48%

Production(3).……………………… 4,147boepd

R/P Ratio(5)………………………… 19.9x

2013E CAPEX………………………. $70mm

NASDAQ: AXAS

Corporate Profile

5

Proved Reserves (mmboe): 30.1

• Proved Developed: 48%

• Liquids: 66%

Abraxas Petroleum Corporation

Alberta, Canada

Williston:

Bakken / Three Forks

Powder River Basin:

Niobrara, Turner

Midland/Eastern Shelf:

Emerging Cline, Wolfcamp

Eagle Ford Shale

CBP: Conventional

Delaware Basin:

Montoya/Devonian/Miss Gas,

Shallow Oil, Emerging Hz. Oil

Shallow Oil, Emerging Hz. Oil

Rocky Mountain

Gulf Coast

Permian Basin

Canada

Pekisko

Eastern Shale

Basin: Duvernay

Basin: Duvernay

High Quality Assets

Core

Non

Core

Core

WolfBone

Uinta / Wind River /

Green River Dry Gas

Green River Dry Gas

6

Production(2) - 4,147 boepd

(1) Net proved reserves as of December 31, 2012

(2) Daily net production for the quarter ended December 31, 2012

Reserve / Production Summary

High-quality, Long-Lived, Oil Weighted Assets

High-quality, Long-Lived, Oil Weighted Assets

7

(1) Proved, Probable, Possible PV-10 based off December 31, 2012 reserves and SEC pricing of $95.13/bbl oil and $2.86/mcf gas

(2) Building, Rig & Other PP&E (workover rigs, misc equipment, etc) based off net book value as of December 31, 2012.

(3) Tax assessment of AXAS surface ownership in 162 acres Coke, TX; 613 acres Scurry, TX. Purchase price of AXAS 1,769 acres in San Patricio, TX; 12,178 acres Pecos, TX; 582 acres McKenzie, ND & Condos; 50 acres DeWitt, TX.

(4) Bank debt as of 12/31/12. WC Deficit as of 12/30/12 - excludes derivative assets and liabilities

Base NAV

8

II. Executing Our Plan

9

Strategic Plan

(1) Excluding building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA)

10

Strategic Plan - Successful Execution

(1) As of 12/31/2011

(2) Excluding building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA)

(3) Net of Nordheim divestitures

11

Budget Changes

§ Company has narrowed drilling focus to two core oily areas: Bakken and Eagle Ford

§ Company focus on Bakken and Eagle Ford oil consistent with industry activity and asset quality

§ “Held-by-production” positions in Permian and Powder River Basin provide medium-to-longer term flexibility

($ in millions)

12

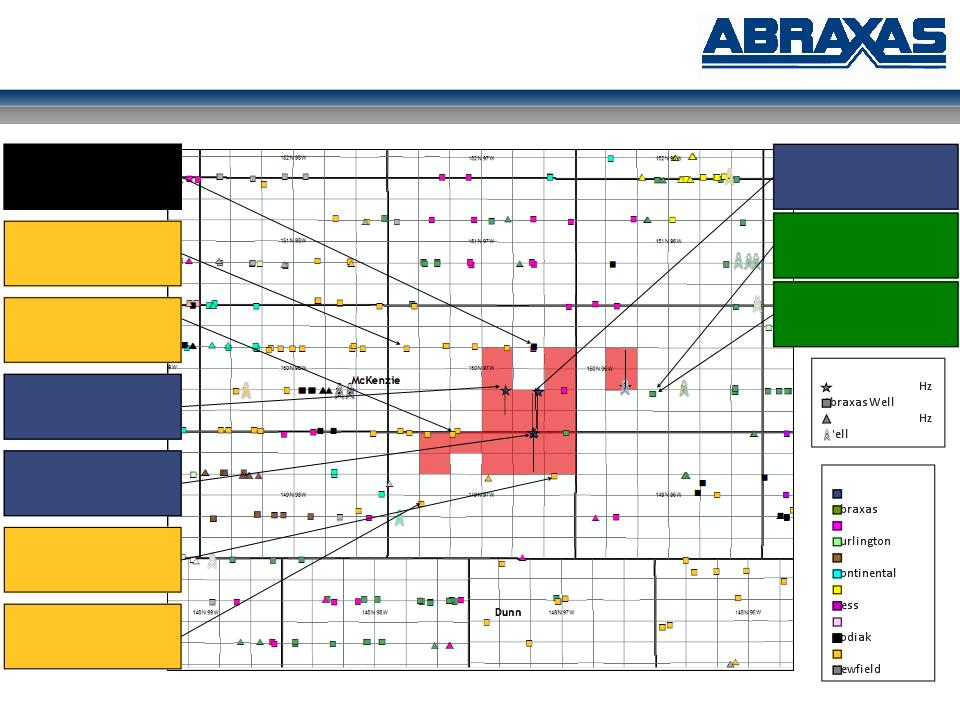

Non-Op Bakken Divestiture Plan

§ On February 20, 2013, Abraxas announced that it had

retained E-Spectrum Advisors (an affiliate of Energy

Spectrum Advisors Inc.) to market its non-operated

Bakken and Three Forks assets in North Dakota and

Montana

retained E-Spectrum Advisors (an affiliate of Energy

Spectrum Advisors Inc.) to market its non-operated

Bakken and Three Forks assets in North Dakota and

Montana

§ Asset Details:

▫ >14,000 net acres in Billings, Burke, Divide, Dunn,

McKenzie, Stark and Williams Counties, ND and

Richland, Roosevelt and Sheridan Counties, MT

McKenzie, Stark and Williams Counties, ND and

Richland, Roosevelt and Sheridan Counties, MT

▫ 99% of acreage is held-by-production

▫ ~400 boepd

▫ Diverse and experienced operator base including:

Oasis Petroleum, Continental, ExxonMobil / XTO /

Denbury, Whiting, Fidelity E&P, Hess, Statoil /

Brigham, Citation, Petro-Hunt and others.

Oasis Petroleum, Continental, ExxonMobil / XTO /

Denbury, Whiting, Fidelity E&P, Hess, Statoil /

Brigham, Citation, Petro-Hunt and others.

§ If the Company is successful in achieving an acceptable

price for these assets, the proceeds will be used to pay

down the Company’s revolver and redeployed into its

core operated Bakken and Eagle Ford assets

price for these assets, the proceeds will be used to pay

down the Company’s revolver and redeployed into its

core operated Bakken and Eagle Ford assets

Overview

Asset Map

13

Liquidity and Long-Term Debt

§ YE-12 credit facility availability of $37 million ($113 million drawn on$150 million line), plus $2mm cash = $39mm liquidity

▫ Wall Street median consensus 2013E outspend of ~$27mm

▫ Liquidity coverage 1.5x

§ Credit facility recently raised to $155 million

§ Company plans to continue to pay down credit facility borrowings using divestiture proceeds

▫ $2.9mm received in March 2013 Oil & Gas Clearinghouse Auction; remaining Oklahoma dry gas properties and additional royalty interests in ND

and MT to be auctioned in May

and MT to be auctioned in May

▫ Ongoing non-op Bakken acreage process

Liquidity Bridge: 1/1/2012 to 4/5/2013

(1) Based on Wall Street median estimates

Outlook

|

($ in millions)

|

Jan 1, 2012

|

|

Mar 31, 2012

|

|

Jun 30, 2012

|

|

Sep 30, 2012

|

|

Dec 31, 2012

|

|

Apr 5, 2013

|

||||||

|

Credit Facility Line

|

|

$125

|

|

|

$125

|

|

+15

|

$140

|

|

|

$140

|

|

+10

|

$150

|

|

+5

|

$155

|

|

Less: Borrowings

|

|

115

|

|

|

115

|

|

+10

|

125

|

|

+9

|

134

|

|

-21

|

113

|

|

NA

|

|

|

Availability

|

|

$10

|

|

|

$10

|

|

+5

|

$15

|

|

-9

|

$6

|

|

+31

|

$37

|

|

NA

|

|

|

Plus: Cash

|

|

-

|

|

|

-

|

|

|

0

|

|

+3

|

3

|

|

-1

|

2

|

|

NA

|

|

|

Liquidity

|

|

$10

|

|

|

$10

|

|

+5

|

$15

|

|

-6

|

$9

|

|

+30

|

$39

|

|

NA

|

|

§ Sold Alberta Basin properties and

Nordheim Eagle Ford interest for

~$22mm

Nordheim Eagle Ford interest for

~$22mm

§ Removed $10mm capex /quarter

limitation

limitation

§ Negative current ratio /

covenant waiver

covenant waiver

§ $12.4mm gas hedge monetization during

quarter

quarter

§ Negative current ratio / covenant waiver

§ Implementation of $10mm capex /

quarter restriction and $7.5mm liquidity

quarter restriction and $7.5mm liquidity

§ Borrowing base raised to $155

mm

mm

§ Removed $7.5mm liquidity

covenant and Raven debt from all

debt calculations

covenant and Raven debt from all

debt calculations

14

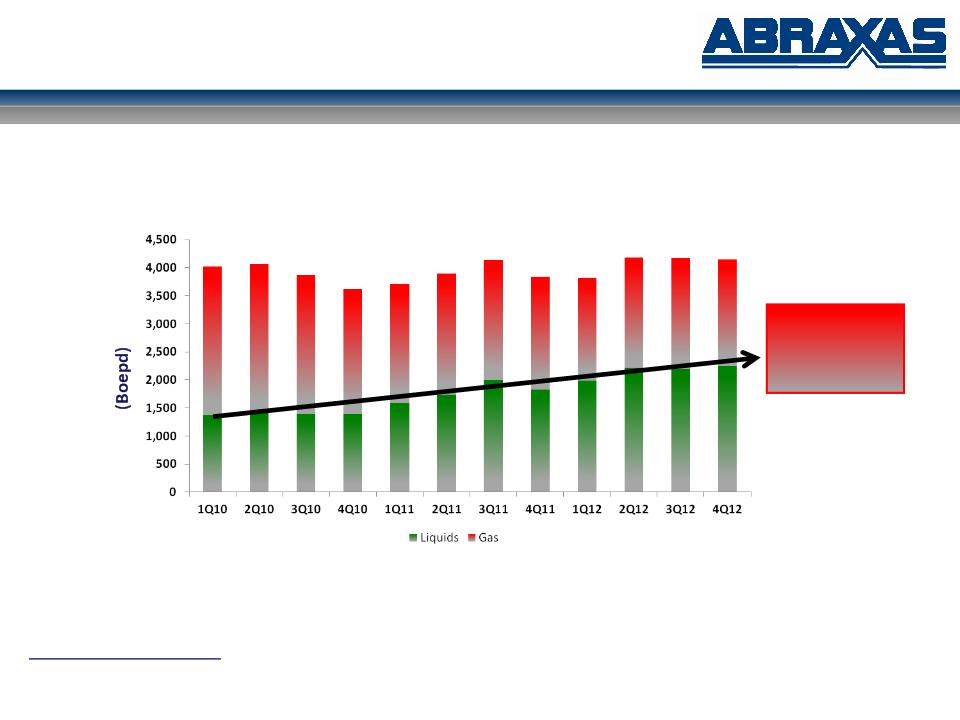

(1) Includes AXAS’ share of Blue Eagle’s production (50% in Q1 and Q2 2011, 41% in Q3 2011 and 35% in Q4 2011, Q1 2012 and Q2 2012)

Oil/NGL % 34% 35% 36% 39% 43% 44% 48% 48% 52% 53% 53% 54%

Production Net to AXAS(1)

65% Liquids

Growth Since

1Q10

Growth Since

1Q10

Refocusing on Oil and Liquids

15

Bakken / Three Forks

Positioned in a Core Area (NorthFork)

Positioned in a Core Area (NorthFork)

Operator

Petro-Hunt

QEP

Slawson

SM

XTO

Other

Symbology

Hz

Permit

Permit

Hz

Rig

Rig

SM

Nelson 15-11H

20 Stages

24-hr IP rate: 994 bbl/d, 1,417 mcf/d

XTO

Lund 26-18SH

22 Stages

24-hr IP rate: 1,252 bbl/d, 2,300

mcf/d

mcf/d

Abraxas

Stenehjem 27-34-1H

17 Stages

24-hr IP rate: 862 bbl/d, 1,365 mcf/d

Abraxas

Jore Federal 2-11-3H

35 Stages

24-hr IP rate: 761 bbl/d, 1,759 mcf/d

XTO

Badlands Federal 21X-13

24 Stages

24-hr IP rate: 1,029 bbl/d, 1,458

mcf/d

mcf/d

XTO

Mariana Trust 12X-20H

Recently Completed

Results Pending

Abraxas

Ravin 26-35-1H

23 Stages

24-hr IP rate: 1,008 bbl/d, 1,342 mcf/d

Burlington

Morgan 21-28MBH-2NH

13 Stages

24-hr IP rate: 2,004 bbl/d, 3,328 mcf/d

Burlington

Kirkland 21-28MBH

12 Stages

24-hr IP rate: 2,325 bbl/d, 4,411 mcf/d

___________________________________

Source: HPDI. Horizontal wells drilled since 1/2010

XTO

Lundin 11-4SH

16 Stages

24-hr IP rate: 878 bbl/d, 1,535 mcf/d

16

Bakken / Three Forks

Positioned in a Core Area (Harding)

Positioned in a Core Area (Harding)

Operator

Whiting

XTO

Zavanna

Zenergy

Other

Symbology

Hz

Permit

Permit

Hz

Rig

Rig

Zenergy

Cayko 22-27H

30 Stages

24-hr IP Rate: 923 bbl/d, 767 mcf/d

Zenergy

Helm 19-30HTF

30 Stages

24-hr IP Rate: 758 bbl/d, 766 mcf/d

Zenergy

Flynn 33-34TF H

Recently Completed

Results Pending

Whiting

Langwald 31-17-1H

Recently Completed

Results Pending

Whiting

Miller 34-8-1H

Recently Completed

Results Pending

Brigham (Statoil)

Sundheim 26-35 2H

Recently Completed

Results Pending

Brigham (Statoil)

Sundheim 26-35-1H

Recently Completed

Results Pending

___________________________________

Source: HPDI. Horizontal wells drilled since 1/2010

17

Focused on successful execution of long lateral horizontals:

§ Reducing costs with pad operations

§ Maintain flexibility & consistency with Company owned drill rig

and in-house team

and in-house team

§ Maintain lateral in the target zone to ensure effective depletion

§ Plug and Perf a large number of stages to maximize drainage

§ Flow back prudently to avoid damaging the formation

The Lillibridge Completion in the North Fork Area

|

Well

|

Objective

|

Lat. Length

|

Stages

|

30-day IP (boepd)

|

Well Cost ($mm)

|

Status

|

|

Ravin 26-35 1H

|

Three Forks

|

10,000

|

23

|

391

|

$13.0

|

Producing

|

|

Stenehjem 27-34 1H

|

Middle Bakken

|

6,000

|

17

|

688

|

$11.5

|

Producing

|

|

Jore Federal 2-11 3H

|

Three Forks

|

10,000

|

35

|

510

|

$8.7

|

Producing

|

|

Ravin 26-35 2H

|

Middle Bakken

|

10,000

|

16

|

421

|

$10.5(1)

|

Producing

|

|

Ravin 26-35 3H

|

Middle Bakken

|

10,000

|

26

|

NA

|

$10.4(1)

|

Significantly outperforming

|

|

Lillibridge 4H

|

Three Forks

|

8,472

|

28

|

NA

|

NA

|

TD/Cased - 50 ft flare through target

|

|

Lillibridge 3H

|

Middle Bakken

|

10,000

|

28

|

NA

|

NA

|

TD/Cased

|

|

Lillibridge 1H, 2H

|

MB, TF

|

10,000

|

28

|

NA

|

NA

|

Intermediate Casing set

|

Bakken / Three Forks

Focused on Execution

Focused on Execution

(1) Does not deduct settlement with third party service provider

18

Bakken / Three Forks

Outperforming Type Curve (NorthFork)

Outperforming Type Curve (NorthFork)

|

Single Well Economics

|

|

|

EUR (Mboe)

|

~462

|

|

Commodity

Split |

80% oil

8% NGLs

11% gas

|

|

D&C Cost

|

$8.5mm

|

|

Type Curve Parameters

|

|

|

di (%)

|

99

|

|

b

|

1.5

|

|

dm (%)

|

7

|

|

GOR (scf/bbl)

|

1,150

|

19

Eagle Ford

Positioned in a Core Area (WyCross)

Positioned in a Core Area (WyCross)

Operator

EOG

Murphy

Swift

Talisman

Other

Symbology

Hz

Permit

Permit

Hz

Rig

Rig

Carrizo

J Rayes B Unit 11H

17 Stages

24-hr IP rate: 626 bbl/d, 624 mcf/d

Carrizo

J Rayes 21H

22 Stages

24-hr IP rate: 879 bbl/d, 276 mcf/d

EOG

San Miguel B Unit 4H

5,845 ft Lateral

24-hr IP rate: 1,213 bbl/d, 495

mcf/d

mcf/d

EOG

Four K Partners 2H

4,736 ft Lateral

24-hr IP rate: 973 bbl/d, 429 mcf/d

Comstock

Cutter Creek 1H

17 Stage Buda completion

24-hr IP rate: 575 bbl/d, 188 mcf/d

Comstock

Cutter Creek 2H

16 Stages

24-hr IP rate: 471 bbl/d, 422 mcf/d

Comstock

Cutter Creek A 1H

15 Stages

24-hr IP rate: 696 bbl/d, 413 mcf/d

Abraxas

Cobra B 1H

19 Stages

24-hr IP rate: 907 bbl/d, 308 mcf/d

Abraxas

Cobra 1H

18 Stages

24-hr IP rate: 1,050 bbl/d, 696 mcf/d

Abraxas

Mustang 1H

19 Stages

24-hr IP rate: 1,086 bbl/d, 689 mcf/d

Chesapeake

Peeler MCM E 3H

6,238 ft Lateral

24-hr IP rate: 857 bbl/d, 164 mcf/d

Chesapeake

Peeler MCM D 4H

6,217 ft Lateral

24-hr IP rate: 694 bbl/d, 924 mcf/d

___________________________________

Source: HPDI. Horizontal wells drilled since 1/2010

20

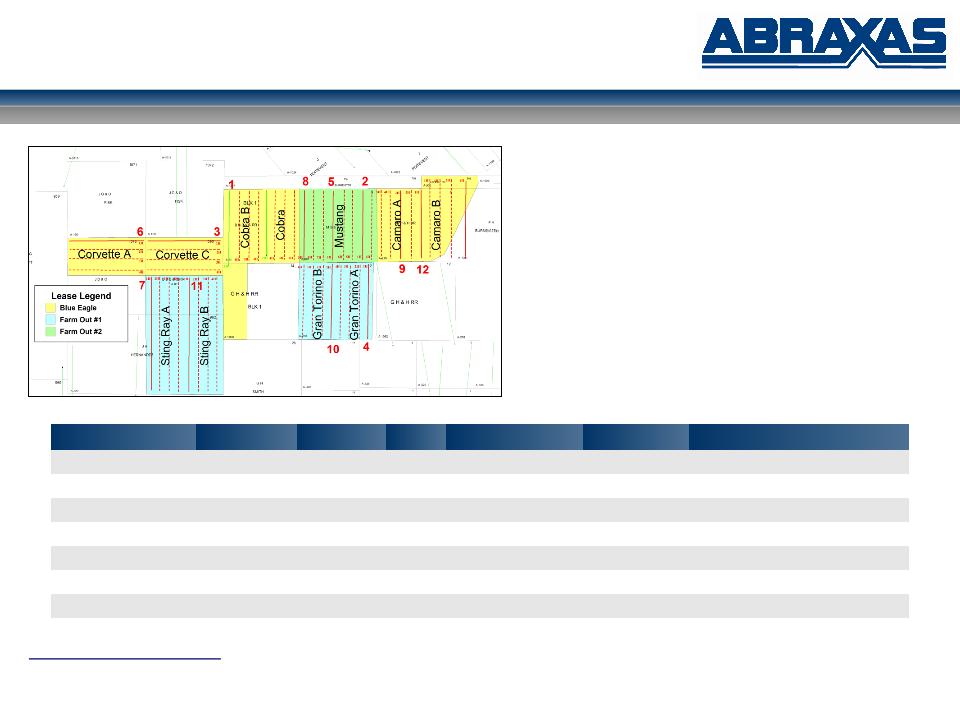

Eagle Ford

Outperforming Type Curve (WyCross)

Outperforming Type Curve (WyCross)

Focused on aggressive completions on long horizontals:

§ Continuous drilling program with same rig crew

§ Intense focus on Geosteering each well in zone

§ Plug & perf completion with aggressive frac technique

§ Continuously correlate results to identify frac points and

maximize completion

maximize completion

§ Restrict choke on flowback to minimize reservoir damage and

extend life of well

extend life of well

|

Well

|

Objective

|

Lat. Length

|

Stages

|

30-day IP (boepd)

|

Well Cost ($mm)

|

Status

|

|

Cobra 1H

|

Eagle Ford

|

5,000

|

18

|

957

|

$10.1

|

Producing

|

|

Cobra B 1H

|

Eagle Ford

|

5,000

|

19

|

592

|

$6.6

|

Producing

|

|

Mustang 1H

|

Eagle Ford

|

5,000

|

19

|

1,152

|

$8.3

|

Producing

|

|

Corvette C 1H

|

Eagle Ford

|

5,000

|

20

|

867

|

$6.1

|

Producing

|

|

Gran Torino A 1H

|

Eagle Ford

|

5,000

|

21

|

790

|

$7.0

|

Producing

|

|

Mustang 3H

|

Eagle Ford

|

5,000

|

18

|

NA

|

$6.2

|

Outperforming Type Curve

|

|

Mustang 2H

|

Eagle Ford

|

5,000

|

~19

|

NA

|

NA

|

Completing

|

|

Sting Ray A 1H

|

Eagle Ford

|

7,500

|

~28

|

NA

|

NA

|

Drilling

|

21

Eagle Ford

Outperforming Type Curve

Outperforming Type Curve

|

Single Well Economics

|

|

|

EUR (Mboe)

|

~575

|

|

Commodity

Split |

70% oil

11% NGLs

20% gas

|

|

D&C Cost

|

$7.0mm

|

|

Type Curve Parameters

|

|

|

di (%)

|

99.11

|

|

b

|

1.3

|

|

dm (%)

|

7

|

|

GOR (scf/bbl)

|

1,000

|

22

Abraxas’ “Hidden” Gas Portfolio

§ Three Primary Regions (Trends): South Texas (Edwards), Delaware Basin (Montoya, Devonian),

PRB (Turner)

PRB (Turner)

§ Previously booked PUDs now PRUDs - Edwards & Delaware Basin

▫ 23 gross / 18.6 net identified locations

▫ $87.9 million of net investment

▫ 57.6 net bcfe

▫ Assumed F&D = $1.53

§ Total identified total natural gas resource potential (PUD/PRUD/PSUD)

▫ 124 gross / 63 net identified locations

▫ $339+ million of net investment

▫ 128.1+ net bcfe

▫ Assumed F&D = $2.65

23

Additional Development Areas

24

Appendix

25

Converse / Niobrara Counties, Wyoming

§ Gross / Net Acres:

▫ 29,170 / 21,540

▫ Primarily in Converse & Niobrara Counties

▫ ~4,300 net acres in Campbell County

▫ ~90% held by production

§ Historical Activity:

▫ 13 wells (2000 - 2011)

▫ 8 horizontal / 5 vertical

§ Recent Activity:

▫ Hedgehog State 16-2H (Crossbow)

▫ Cum production (11 mos): 112.8 MBoe

▫ 49% Oil / NGLs

Brooks Draw:

Sage Grouse 3H:

(Cum Oil 25 MBbl / 50 MBbl EUR)

Prairie Falcon 3H (Niobrara)

Recent Industry Activity:

74 Permits

8 Completions

Porcupine Field:

Hedgehog State 16-2H (Turner)

PRB - Stacked Pay Opportunities

26

Spires Ranch (Nolan County)

§5,640 gross/net acres; 920 HBPd

§Monitoring industry activity

§Geologic evaluation

§Logged shales through Spires 89 1H

Millican Reef (Coke County)

§6,725 gross/net acres

§Monitoring industry activity

§Geologic evaluation

Permian Basin - Emerging Hz

27

EOG Strikes Oil in Duvernay's East Shale Basin

“New public data for EOG’s Duvernay horizontal at 1-20-38-28W4 showed a peak calendar

-day rate to date of 239 boe/d for December. Oil comprised 88% of the wellhead

production stream…We believe there is a possibility EOG is restricting rates or testing the

well, meaning it could be producing the well intermittently through the months.

-day rate to date of 239 boe/d for December. Oil comprised 88% of the wellhead

production stream…We believe there is a possibility EOG is restricting rates or testing the

well, meaning it could be producing the well intermittently through the months.

The reported rates are in the ballpark of our Eagle Ford West oil type curve peak rate of

~300 boe/d. Under Crown royalties, the Eagle Ford West type curve results in a break-even

price of $82/boe and a per-well NPV of $1 million, assuming a $9 million well cost.”

~300 boe/d. Under Crown royalties, the Eagle Ford West type curve results in a break-even

price of $82/boe and a per-well NPV of $1 million, assuming a $9 million well cost.”

-- ITG, February 7, 2013

Alberta, Canada: Eastern Shale Basin

Recently Drilled

Neighboring Well

Neighboring Well

Duvernay:

§ Net Acres: 42,880 (100% WI)

▫ Crown: 32 Sections; five year leases

▫ Farm-out/option: 35 Sections; three year term

§ Represents a continuous, self sourced resource contained in a shaley organic rich low

permeability reservoir

permeability reservoir

§ Shale assessment and productivity expectations developed based on a review of

analogues (i.e. Eagle Ford, Kaybob, Pembina/ Willesden Green)

analogues (i.e. Eagle Ford, Kaybob, Pembina/ Willesden Green)

§ All critical shale parameters point to the Duvernay being an excellent source and

reservoir rock

reservoir rock

§ Available rock and completion data point to Canaxas lands containing volatile oil

hydrocarbons in place

hydrocarbons in place

Planned Activity:

§ Drill vertical pressure test

Canada - Duvernay

28

Canada - Duvernay

29

Edwards (South Texas)

§PDP: 10.3 bcfe (net)

§ Nordheim 2H: 7.0 bcfe gross

§ Keuster 1H: 10.5 bcfe gross

§ Previous risked offsetting PUD locations: 27.9 bcfe (net)

§ 11 gross / 7 net locations dropped to PRUD (SEC 5 year rule)

§7 gross / 5 net locations drilled / completed, yet to be frac’d: unbooked

§Edwards economics

§ New drill: $7.0 million well / 4.0 bcfe EUR / F&D $1.73/mcfe

§ 20% ROR at $4.30/mcfe realized price

§ Refrac: $0.7 million well / 0.5 bcfe EUR / F&D $1.40/mcfe

§ 20% ROR at $1.98/mcfe realized price

Montoya / Devonian (Delaware Basin, West Texas)

§PDP 28.0 bcfe (net)

§ Caprito 98 98 01U Devonian: 39.0 bcfe gross

§ Howe GU 5 1 Devonian: 31.7 bcfe gross

§Previous risked offsetting PUD locations: 29.7 bcfe (net)

§ 12 gross/ 6 net locations dropped to PRUD (SEC 5 year rule)

§Montoya economics

§ $5.0 million well / 6.6 bcfe EUR / F&D $.75/mcfe

§ 20% ROR at $3.16/mcfe realized price

§Devonian economics

§ $5.8 million well / 7.6 bcfe EUR / F&D $0.76/mcfe

§ 20% ROR at $2.51/mcfe realized price

Other

§Eagle Ford Shale, Yoakum: 1,908 net acres / ~24 net locations, unbooked

§PRB, Turner (~50% gas): 2 gross (1.7 net) PUD / 50 gross (13 net) PRUD locations,

40.6 bcfe (net)

40.6 bcfe (net)

§Delaware Basin, Hudgins Ranch: 3 gross / 2.6 net PSUD locations, 9.1 bcfe (net)

§Delaware Basin, Nine Mile Draw: 40 gross / 31 net PSUD locations, 18.0 bcfe (net)

§Wind River, Cow Hollow Field: 5 gross / .06 net PRUD locations, 0.7 bcfe (net)

§Williston Basin, Red River: 1 gross / .8 net PRUD location, 2.1 bcfe (net)

§Uinta, Chapita Wells, unbooked

(1) Net of purchase price adjustments

(2) PV10 calculated using strip pricing as of 5/1/12 = $2.29

2012 Ward County Acquisition

§Acquisition of Partners’ Interests in West Texas

§ Purchase Price $6.7mm(1)

§ PDP PV -15 $6.7mm(2)

§ Production 1,440 mcfepd

§ Reserves 7.613 bcfe

§ Production $4,650/mcfe/day

§ Reserves: $.88/mcfe

Abraxas’ “Hidden” Gas Portfolio

30

NASDAQ: AXAS