Attached files

| file | filename |

|---|---|

| EX-4.4 - EX-4.4 - TAMINCO Corp | d426208dex44.htm |

| EX-5.1 - EX-5.1 - TAMINCO Corp | d426208dex51.htm |

| EX-1.1 - EX-1.1 - TAMINCO Corp | d426208dex11.htm |

| EX-23.4 - EX-23.4 - TAMINCO Corp | d426208dex234.htm |

| EX-23.1 - EX-23.1 - TAMINCO Corp | d426208dex231.htm |

| EX-10.17 - EX-10.17 - TAMINCO Corp | d426208dex1017.htm |

| EX-10.16 - EX-10.16 - TAMINCO Corp | d426208dex1016.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 5, 2013

Registration No. 333-185244

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TAMINCO CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 2860 | 45-4031468 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Two Windsor Plaza, Suite 411

7540 Windsor Drive

Allentown, Pennsylvania 18195

(610) 366-6730

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Edward Yocum

Executive Vice President and General Counsel

Two Windsor Plaza, Suite 411

7540 Windsor Drive

Allentown, Pennsylvania 18195

(610) 366-6730

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Joshua N. Korff, Esq. Taurie M. Zeitzer, Esq. Michael Kim, Esq. Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Michael Kaplan, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(2) | ||||

| Common Stock, $0.001 par value per share |

18,157,895 | $20.00 | $363,157,902 | $49,535(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 2,368,421 shares which may be sold pursuant to the Underwriters’ over-allotment option. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Of this amount, $40,920 has been previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated April 5, 2013

PRELIMINARY PROSPECTUS

15,789,474 Shares

Taminco Corporation

Common Stock

$ per share

This is an initial public offering of our common stock. We are offering 15,789,474 shares of our common stock.

After the completion of this offering, funds affiliated with Apollo Global Management, LLC will continue to own a majority of the voting power of our outstanding common stock. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange (“NYSE”). See “Principal Stockholders.”

We expect the public offering price to be between $18.00 and $20.00. Currently, no public market exists for the shares. We intend to apply to list our common stock on the NYSE under the symbol “TAM.”

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 15 of this prospectus.

| Per Share | Total | |||||||

| Price to public |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

The underwriters have an option to purchase up to an additional 2,368,421 shares from certain selling stockholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock against payment on or about , 2013.

| Citigroup | Goldman, Sachs & Co. | Credit Suisse | J.P. Morgan |

| Deutsche Bank Securities | Jefferies | Morgan Stanley | UBS Investment Bank | |||

| C&Co/PrinceRidge | ING | KBC Securities USA, Inc. | Lebenthal Capital Markets |

| Rabobank International | SMBC Nikko | Apollo Global Securities | ||

The date of this prospectus is , 2013

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 15 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 48 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

49 | |||

| 69 | ||||

| 73 | ||||

| 97 | ||||

| 103 | ||||

| 124 | ||||

| 126 | ||||

| 128 | ||||

| 133 | ||||

| 138 | ||||

| MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

140 | |||

| 144 | ||||

| 151 | ||||

| 151 | ||||

| 151 | ||||

| 152 | ||||

| F-1 | ||||

We have not authorized anyone to provide any information other than that contained in this prospectus or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

Dealer Prospectus Delivery Obligations

Until , 2013 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

i

Table of Contents

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors,” our consolidated financial statements and related notes, and supplemental pro forma financial information included elsewhere in this prospectus, before making an investment decision.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Taminco,” “the Company,” “we,” “our,” and “us” refer collectively to Taminco Corporation and its consolidated subsidiaries for the Successor Period (as defined below) and to Taminco Group Holdings S.à r.l. for the Predecessor Period (as defined below).

The consolidated financial statements for 2012 are presented in this prospectus for two periods: January 1 through February 14, 2012, which relates to the period immediately preceding the Acquisition (as defined below) and the year ended December 31, 2012. Prior to the Acquisition, Taminco Corporation had no operations or activity other than transaction costs related to the Acquisition. See “—Summary Historical Consolidated Financial Information” for more information. For a list of certain industry terms used herein, see “Appendix A: Glossary of Technical Terms.”

Our Company

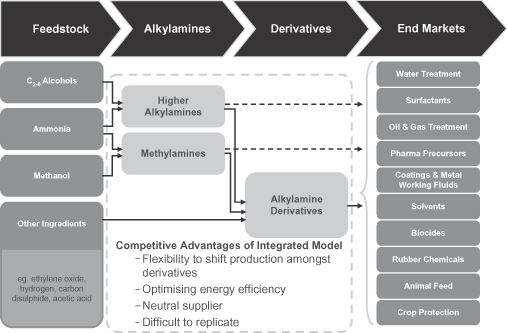

We are the world’s largest pure play producer of alkylamines and alkylamine derivatives. Our products are used by our customers in the manufacturing of everyday products primarily for the agriculture, water treatment, personal & home care, animal nutrition and oil & gas end-markets. Our products provide these goods with a variety of ancillary characteristics required for optimal performance, such as neutralizing acidity, and removing contaminants. We have an extensive offering of differentiated value-added products that typically represent a small portion of our customers’ overall costs and are sold into diversified, global end-markets that benefit from favorable underlying economic and population growth trends. We currently operate in 19 countries with seven production facilities and, as of December 31, 2012, had an installed production capacity of 1,272 kt. According to the report issued by Arthur D. Little Benelux S.A./N.V. (the “ADL Report”), we hold the #1 or #2 market position globally in the vast majority of the chemicals we produce, including an approximately 50% and 75% share of certain products, respectively, in North America and Europe. During the pro forma year ended December 31, 2012, eight of our products accounted for more than 57% of our revenue, with six of the eight products holding a leading global market position. During the pro forma year ended December 31, 2012, through our worldwide network of production facilities, we sold 48% of our volume in North America, 36% of our volume in Europe, and 16% of our volume in the emerging markets (7% in Latin America and 9% in Asia). Furthermore, we expect to increase the portion of our volume from the Americas and Asia with our recent capital investments. As a result of our leading market positions, attractive end-markets, and significant recent capital investments, we believe we are well positioned for significant growth over the coming years. In the pro forma year ended December 31, 2012, we generated revenue of $1,116 million, Adjusted EBITDA of $240 million, and Adjusted EBITDA margin of 22%. See “—Summary Historical Consolidated Financial Information” for a discussion and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Alkylamines are organic compounds produced through the reaction of an alcohol with ammonia. The immediate results of these processes are the production of methylamines and higher alkylamines, which can then be further reacted with other chemicals to produce alkylamine derivatives. Our products are primarily used in the agriculture, water treatment, personal & home care, animal nutrition and oil & gas end-markets, which combined accounted for approximately 79% of our volume during the pro forma year ended December 31, 2012. Our end-markets tend to be non-cyclical and benefit from strong underlying fundamentals such as increasing global population, urbanization of emerging markets and rising income levels.

1

Table of Contents

We currently operate seven plants worldwide dedicated to the production of alkylamines and alkylamine derivatives, including two larger facilities in each of the United States and Europe that are among the world’s largest methylamine and higher alkylamines production facilities, a joint-venture facility with Mitsubishi Gas Chemical Company and certain of its affiliates (the “MGC Group”) in China, and two other 100% Taminco-owned facilities in China.

We are also in the process of pursuing numerous growth projects to further bolster our global footprint and leverage our strategic advantages. Our currently budgeted future investments include significantly extending production capacity at our Pace, Florida methylamine facility by the end of 2014 and further development of other derivative capacity. In total, we have spent $136 million in growth capital expenditures over the past three years, which is more than we have spent in any similar historical period. We expect to realize significant growth in our financial results from these investments.

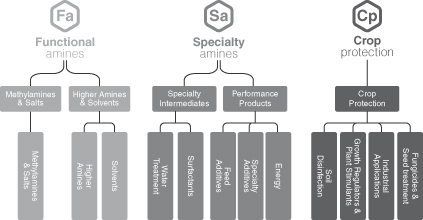

We are organized into three segments: Functional Amines, Specialty Amines, and Crop Protection.

| • | Functional Amines. This segment serves the needs of external customers that use our alkylamines products as the integral element in their chemical processes for the production of formulated products applied in a variety of end-markets such as agriculture, personal & home care, animal nutrition, and oil & gas. Through this segment, we also produce basic amines, which are captively used as building blocks to produce our downstream derivatives through our Specialty Amines and Crop Protection segments, serving a variety of attractive, non-cyclical end-markets. Approximately 30% of the Functional Amines production is used internally and forms the basis of our vertically integrated model. In the pro forma year ended December 31, 2012, the Functional Amines segment accounted for 51% of Adjusted EBITDA. |

| • | Specialty Amines. This segment sells alkylamine derivatives for use in the water treatment, personal & home care, oil & gas and animal nutrition end-markets, and specialty additives for use in the pharmaceutical, industrial coatings and metal working fluid end-markets. This segment is downstream from the Functional Amines segment and uses that segment’s production as one of its key raw materials. The Specialty Amines segment’s customers are typically large, multinational enterprises who are leading players in their industry. In the pro forma year ended December 31, 2012, the Specialty Amines segment accounted for 33% of Adjusted EBITDA. |

| • | Crop Protection. This segment sells alkylamine derivatives, active ingredients and formulated products for use in the agriculture and crop protection end-markets. The majority of the segment’s customers range from multinational crop protection and agricultural enterprises to large local farms. In the pro forma year ended December 31, 2012, the Crop Protection segment accounted for 16% of Adjusted EBITDA. |

Our Strengths

We believe the following competitive strengths, in addition to our industry leading alkylamine production technology, have been instrumental to our success and position us well for future growth and strong financial performance.

Serve strong end-markets with attractive global growth prospects

Our products are generally sold into large end-markets with attractive global growth prospects. We develop products mainly for use in the agriculture, water treatment, personal & home care, animal nutrition, and oil & gas end-markets. These targeted end-markets, which have been relatively resistant to economic downturns, represent over $1.0 trillion in market value as of 2012 and are projected by ADL to grow by an average of 6% per year from 2012 to 2016 (with certain of these end-markets expected to grow at 7% per year).

2

Table of Contents

A steadily increasing world population, rising income levels (particularly in the emerging markets), increasing global urbanization and an aging global population are expected to help continue driving strong demand in our key end-markets. In the pro forma year ended December 31, 2012, approximately 79% of our volume was generated from these key end-markets and we expect that to increase over the next few years.

Market leader in global amines industry targeting niche markets with very few competitors

We focus exclusively on the production of alkylamines and alkylamine derivatives and have not entered into the production of other chemical products. According to the ADL Report, we are the world’s largest pure play producer of alkylamines and alkylamine derivatives, as we hold the #1 position in alkylamine and methylamine production in North America and the #2 position in alkylamine and methylamine production in Europe.

We benefit from long-standing relationships with blue-chip, industry-leading companies in each of our key end-markets, as well as from low customer churn (our average customer relationship among our top 10 customers is thirteen years). Overall, we believe our market position provides us with a stable and flexible platform for profitable operation and positions us to capitalize on growth opportunities quickly.

We believe that our extensive expertise and technology, our existing investments in profitable, vertically integrated manufacturing facilities, and our current set of product registrations from environmental, health and safety regulatory authorities give us a significant advantage over our competitors and new entrants. We also find it advantageous that some of our competitors have chosen to enter into certain downstream products that we do not manufacture and that compete directly with their customers.

Significant room for near-term growth due to recent capital investments

Our vertically integrated business model is one of our key strengths, differentiating us from almost all of our competitors. As we have succeeded with this model in Europe, we recently completed our vertically integrated production model in the United States, which we believe ideally positions us to capture growth in several attractive end-markets, including oil & gas (driven by shale gas demand), water treatment, feed additives, and crop protection. These recent investments in derivative capacity in the United States (AAA, DIMLA, and DMAPA, which are important production inputs for several end-markets) have large growth potential. These investments increased our derivatives capacity by 11% and further distanced ourselves from the nearest competitor in each of these product lines.

In addition, as a result of our competitive cost position and recent capacity additions at our United States-based plants and our Latin America-based sales force, we believe we are well positioned to fully serve the Latin American market, which has limited local competition.

Demonstrated financial resilience through various economic environments

For the past several years, our revenue, gross profit and Adjusted EBITDA have been growing throughout various economic environments. Due to our resilient end-markets and the integral nature of alkylamines and their derivatives to our customers, we are less vulnerable to economic cycles. In addition, we benefit from being able to grow sales volume with a limited addition of fixed costs as a result of our vertically integrated global production model. Also, we have relatively low maintenance capital expenditure requirements, which allow us to easily maintain high cash flow conversion rates in any economic environment.

As an example of our resilient end-markets, during the 2008 to 2009 economic downturn, our volume declined only 7%, compared to an average decline of 20% for the specialty chemical industry according to the ADL Report, and our Adjusted EBITDA grew 20% in that same time period. We strongly believe that our end-markets will continue to grow in various economic environments given their resilient nature.

3

Table of Contents

Ability to pass through raw material price increases

We believe one of the key reasons for our historical success is our ability to manage fluctuating raw material prices by passing through the majority of price changes to our customers. During the pro forma year ended December 31, 2012, our top four raw materials (methanol, ethylene oxide, ammonia and acetone) accounted for 37% of our total cost of sales. Our main raw materials are readily available commodity chemicals. Approximately half of our total revenue for the pro forma year ended December 31, 2012 was generated from contracts that allow cost increases for key raw materials to be directly passed through to customers (“CPT Contracts”).

We play an important role in our customers’ value chains but our products represent a relatively small percentage of our customers’ overall cost structures. Because of the value of our products, for the portion of sales that are not generated under CPT Contracts, we are often able to pass through raw material price increases to our customers through market-based sales contracts that are typically renegotiated quarterly. Positive market dynamics and our relative insulation from raw material price volatility have historically enabled us to maintain profitability in each of our segments. We have also deployed a strategic sourcing approach for critical raw materials, which, coupled with our CPT Contracts and market-based contracts, significantly mitigates the impact of raw material volatility on our margin.

Attractive product pipeline with significant value creation opportunities

We have a strong track record of identifying and exploiting growth opportunities for new applications of our existing products. We also have expertise in new product development and we are the preferred partner for many of our key customers to jointly develop new amine-based derivative products. Our current pipeline includes several products covering each of our key end-markets that we expect will reach the market in the next few years and represents significant incremental revenue opportunities. We have a suite of products in development that are nearing realization, such as the expected launch during the course of 2013 of Tenaz, a proprietary formulation of bio available silicate that is used as a plant fortifier. Our research and development is focused on five key application areas: surfactants, water treatment, oil & gas, feed additives and crop protection. Our patent portfolio is actively managed and contains 76 patents as of December 31, 2012.

Well-positioned to continue exploiting fast growing emerging markets in partnership with blue-chip customer base

With manufacturing operations and sales operations in China, sales offices in several Latin American countries and manufacturing operations in North America which can serve Latin America cost effectively, we believe we have a strong platform for further growth in these regions. Our joint venture with the MGC Group in Nanjing provides us with a base for expanding high value-added amine derivative products in China in the coming years. According to the ADL Report, Brazil is one of the largest markets in the world for crop protection and herbicide systems, and our operations in the region are positioned towards serving that growing agriculture market. In addition, recent expansion at our U.S. operations provide us with fully-vertically integrated amine derivatives manufacturing facilities that will help meet demand for our higher value-added products in Latin America. We have a number of strong relationships as a trusted supplier to global industry leaders within our key developed end-markets. We will continue to leverage these relationships in order to grow alongside our customers in these and other emerging markets.

Industry leading margins and cash flow generation

We believe we have been maintaining industry leading margins and strong cash flow generation throughout economic cycles as a result of our low cost position, leadership role in niche markets, and scalable fixed cost structure. Our ability to mitigate raw material pricing fluctuations provides stability to our margins. Our EBITDA

4

Table of Contents

margin has averaged approximately 20.1% over the period from 2007 to 2012, compared to approximately 17.9% for our industry peers over the same period according to the ADL Report. As a testament to our competitive strength, our cash flow conversion, measured by EBITDA minus capital expenditures divided by EBITDA, has averaged approximately 73% over the period from 2007 to 2012, compared to approximately 66% for our industry peers according to the ADL Report.

Proven management and employee culture with meaningful employee equity ownership

We believe that our management team is among the deepest and most experienced in the chemical industry. On average, the tenure of our executive management team is 16 years with the Company and 18 years in the chemical industry. Our management team has been responsible for developing and executing our strategy that has generated consistent year-over-year sales and Adjusted EBITDA growth. We believe our employees have developed a unique culture in which each employee throughout the entire company is aligned, focused and holds each other accountable to achieve goals that drive value creation for all of our stakeholders. Our employee ownership pool is deep with approximately 42 individual employees owning equity in the Company. As of December 31, 2012, employees owned over 10% of the shares in our Company on a fully diluted basis before giving effect to this offering.

Our Strategy

Our long-term growth drivers revolve around our continued ability to work closely with market industry leaders and to further expand into emerging markets through the principal strategies outlined below.

Capitalize on key fundamental drivers of our end-markets

The primary end-markets we serve have strong exposure to numerous positive, non-cyclical macroeconomic trends. According to ADL, key factors, including a steadily increasing world population, a growing middle class in emerging markets, clean water scarcity, and enhanced oil & gas recovery techniques (especially driven by the shale gas demand in the United States), will continue to drive strong demand for agriculture, water treatment, personal & home care, animal nutrition and oil & gas products. ADL projects that the agriculture, water treatment, personal & home care, animal nutrition and oil & gas end-markets will grow by 6%, 6%, 7%, 5% and 8%, respectively, per annum from 2012 to 2016, or on average 6%. We believe we are well positioned and intend to utilize our best-in-class business optimization and manufacturing processes to meet our customers’ increased supply needs in light of this anticipated growth in end-market demand.

Continue to partner with industry leaders to provide foundation for future growth

We currently have strong positions in each of our key end-markets, which we have achieved in part due to our strong customer relationships with leading global companies in each of those markets. A fundamental element of our strategy is to continue to work directly with our core customers to develop new products and new applications for our existing products that address their specific needs. In addition, we deploy a more customer-focused marketing approach, rather than a more traditional product-based approach. Our specialized sales force includes 29 professionals and six marketing managers with individual responsibility for particular end user markets in various regions. In addition, we employ approximately 35 other commercial professionals, including divisional managers, product managers and new business development specialists. We believe that a deeper understanding of customer needs will better enable our marketing professionals to identify future sources of demand for our products and, working in close cooperation with our research and development function, address that demand through product innovation. As a result, we believe our customer-focused approach will make us a more attractive partner and allow us to achieve greater penetration of our end-markets.

5

Table of Contents

Leverage platform to expand emerging market presence

We have strong, leading positions in our product markets in North America and Europe as a result of our commitment to strategic capital investments and selective acquisitions. We expect to leverage this success to capture a significant portion of our future growth in demand from Asia and Latin America. One of our strategic priorities is to position ourselves for profitable growth in these markets. We currently have two production facilities in China serving the animal nutrition end-market as well as a joint venture with the MGC Group to manufacture amines and amine derivatives. We plan to use our facilities, including our joint venture, as a platform for further expansion in Asia, including potentially in the fast-growing markets of Malaysia, Indonesia, India and Vietnam, and become a partner of choice for our customers in that region by leveraging our high-quality products, standards and technical expertise and moving closer to end users. We plan to capture global growth through our continuous investment in the U.S., which also serves as a platform for export to Latin America. In addition, our joint venture with the MGC group is expected to capture growth in Asia, primarily in China. We believe our technological and process knowledge should give us a significant advantage over our competitors in that region. As we grow in Asia, we are very focused on pursuing growth opportunities and selective acquisitions that are attractive from a margin profile.

Further expand our vertically integrated model

Our vertically integrated business model is one of our key strengths, differentiating us from almost all of our competitors. Our vertically integrated model focuses on both the alkylamine and their associated derivatives, versus just focusing on the alkylamines, which some of our competitors do. By having a fully integrated value-chain we are able to maintain a sustainable low cost position, benefiting from energy optimization, limited recycling needs, optimized logistics, and a limited number of well positioned world-scale production units.

A cornerstone of our expansion strategy is the extension of our vertically integrated business and production approach to all our operations around the world. We are already vertically integrated to a high degree in our European operations, in particular at our facility in Ghent and more recently in the United States, where we have completed new derivative units at our St. Gabriel and Pace facilities. We have announced significant methylamine capacity expansion at Pace to be completed by the end of 2014 that will further increase our leadership in North America.

Furthermore, through our joint venture with the MGC Group, we produce amine derivatives in China to pursue profitable growth downstream. Equally important to our performance is the continuous pursuit of production efficiencies and regular debottlenecking projects, which yield significant benefits in exchange for modest capital expenditures. As part of the philosophy behind our vertically integrated business model, we will continue to seek and implement best-in-class process optimization and efficiency gains within each of our facilities and apply that expertise throughout our global operations.

Continue to develop new processes, markets and products to enhance growth and profitability

Another key element of our strategy is to capitalize on our technological leadership to develop new processes, new products and new applications for our existing products. Working closely with our customers to better understand our end-markets and our customers’ individual requirements, we will seek to continue developing new products that increase the overall value of our customers’ offerings. We will also focus on providing more efficient alternatives to existing formulations, using a wide range of technologies including green technologies for our solvents, plant physiologies for our agriculture products and genomics screening for our feed additives. In addition, we will seek to maintain and improve our knowledge of market trends and developments in order to find new and innovative applications for our existing products. Our product pipeline currently includes developments which we expect to reach our customers in the next few years in each of our key end-markets. We are focused on developing products which provide improved performance and, in most cases, represent safer, non-toxic and “greener” alternatives to existing chemicals.

6

Table of Contents

Our Principal Stockholder

Apollo Investment Fund VII, L.P. and its parallel funds (the “Apollo Funds”) collectively have committed capital of approximately $14.7 billion and are our principal stockholders.

The Apollo Funds are affiliates of Apollo Global Management, LLC (together with its subsidiaries, “Apollo”). Founded in 1990, Apollo is a leading global alternative investment manager with over 22 years experience managing investments across all economic environments in companies, both domestically and internationally. As of December 31, 2012, Apollo employed approximately 250 investment professionals and had offices in New York, Houston, Los Angeles, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai.

Apollo has total assets under management of approximately $113 billion as of December 31, 2012, of which approximately $38 billion is invested in the private equity business. Over the past 23 years, funds affiliated with Apollo have been large investors in industrial assets and a builder of businesses, nurturing the growth of several chemical companies in particular. The chemical industry is one of Apollo’s largest focus areas and it has completed 13 major transactions in the chemical industry since its funding, all with positive returns and most with full or partial realizations. Selected investments by funds affiliated with Apollo relevant to us include Lyondell Basell, Momentive Performance Materials, Berry Plastics, Covalence Specialty Materials Corp., Borden Chemical, Compass Minerals and United Agri Products, as well as numerous other prior investments in chemical businesses.

Our Formation

Our business was formed through the carve-out from Union Chimique Belge (“UCB”) in 2003. On December 15, 2011, an affiliate of Apollo Global Management, LLC entered into a share purchase agreement (the “Acquisition”) with the previous sponsor pursuant to which Taminco Global Chemical Corporation acquired all of the issued share capital of Taminco Group Holdings S.à r.l. and its subsidiaries. The Acquisition was consummated on February 15, 2012.

Risk Factors

Our business is subject to numerous risks and uncertainties including those highlighted in the section titled “Risk Factors” immediately following this summary. Some of these risks include the following, among others:

| • | our substantial indebtedness could adversely affect our financial health and our ability to raise additional capital, and prevent us from fulfilling our obligations under our existing agreements; |

| • | our debt agreements contain restrictions that limit our flexibility in operating our business, which may lead to default under our debt agreements; |

| • | an increase in energy costs, in particular natural gas costs, or a disruption in the supply of energy for our operations may significantly increase operational costs; |

| • | the price and availability of raw materials, energy and equipment, and our inability to pass on increased costs to customers may significantly increase operational costs; |

| • | a loss of major customers would result in a decline in our revenues; |

| • | a lack of commercial viability of our new products and products under development could harm our results of operations; and |

| • | changes in macroeconomic conditions could adversely affect our business. |

7

Table of Contents

After consummation of this offering, funds affiliated with Apollo will continue to control a majority of our common stock. As a result, we will be a “controlled company” within the meaning of the applicable stock exchange corporate governance standards and we will qualify for, and intent to rely on, exemptions from certain stock exchange corporate governance requirements. As a result, we will not have a majority of independent directors and our nominating/corporate governance and compensation committees will not consist entirely of independent directors and we will not be required to have an annual performance evaluation of the nominating/corporate governance and compensation committees. See “Risk Factors—Risks Relating to This Offering and Ownership of Our Common Stock—Following the offering, we will be classified as a “controlled company” and, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements” for more information on the risks we face in connection with the Apollo Fund’s ownership of a majority of our common stock.

Additional Information

We were incorporated on December 12, 2011 in the state of Delaware. Our principal executive offices in the U.S. are located at Two Windsor Plaza, Suite 411, 7540 Windsor Drive, Allentown, Pennsylvania 18195, and the telephone number there is (610) 366-6730. Our website address is www.taminco.com. The contents of and information contained on our website do not form a part of this prospectus.

Recent Developments

Senior Securities Credit Facilities Amendment

On January 23, 2013, Taminco Global Chemical Corporation entered into an amendment to its Senior Secured Credit Facilities (“Amendment No. 2”). This amendment resulted in a 0.75% reduction in interest rates effective as of January 23, 2013 on the outstanding term loans and revolving credit facility. As a result of this amendment reducing the interest rate on our Senior Secured Credit Facilities, we expect our cash flow generation to improve.

Amendment to Non-recourse Factoring Facility

On March 28, 2013, we entered into an amendment to the Non-recourse Factoring Facility, which extends the term to December 31, 2017 and increases the limit from €100 million to €150 million.

8

Table of Contents

THE OFFERING

| Common stock offered |

15,789,474 shares. |

| Common stock to be outstanding after this offering |

65,228,438 shares. |

| Listing |

We intend to apply to list our common stock on the NYSE under the symbol “TAM.” |

| Over-allotment option |

The underwriters have an option to purchase up to an additional 2,368,421 shares from certain selling stockholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus. |

| Use of proceeds |

Assuming an initial public offering price of $19.00 per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus, we estimate that the net proceeds to us from the sale of our common stock in this offering will be $281 million, after deducting estimated underwriting discounts and commissions and offering expenses. We will not receive any proceeds from sales by the selling stockholders pursuant to the over-allotment option to purchase additional shares. |

| We intend to use the net proceeds received by us in this offering, along with readily available cash, to (i) redeem all of the outstanding $250 million principal amount of our PIK Toggle Notes, (ii) pay the redemption premiums and fees in connection with the redemption of the foregoing indebtedness, (iii) pay interest of approximately $7 million, representing interest payable from December 18, 2012 through the anticipated prepayment date that the indebtedness will be redeemed and (iv) pay a $35 million fee in connection with the termination of the Management Consulting Agreement with Apollo. For additional information, see “Use of Proceeds” and “Certain Relationships and Related Party Transactions—Management Consulting Agreement.” |

| Dividend policy |

We do not currently anticipate paying dividends on our common stock following this offering. Any declaration and payment of future dividends to holders of our common stock may be limited by restrictive covenants in our debt agreements, and will be at the sole discretion of our board of directors and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that our board of directors deems relevant. See “Dividend Policy,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition, Liquidity and Capital Resources,” and “Description of Capital Stock.” |

| Risk factors |

For a discussion of risks relating to the Company, our business and an investment in our common stock, see “Risk Factors” and all other information set forth in this prospectus before investing in our common stock. |

9

Table of Contents

| Conflicts of interest |

Affiliates of Apollo Global Securities, LLC own more than 10% of our outstanding common stock. Because Apollo Global Securities, LLC is an underwriter for this offering, it is deemed to have a “conflict of interest” within the meaning of FINRA Rule 5121(f)(5)(B). In addition, affiliates of Apollo Global Securities, LLC will be deemed to receive more than 5% of net offering proceeds and will have a “conflict of interest” pursuant to Rule 5121(f)(5)(C)(ii). Accordingly, this offering is being made in compliance with the requirements of FINRA Rule 5121. Since Apollo Global Securities, LLC is not primarily responsible for managing this offering, pursuant to FINRA Rule 5121, the appointment of a qualified independent underwriter is not necessary. Apollo Global Securities, LLC will not confirm sales to discretionary accounts without the prior written approval of the customer. |

Except as otherwise indicated, all information in this prospectus reflects:

| • | the completion of a 9.0824 for 1 stock split; and |

| • | our amended and restated certificate of incorporation and amended and restated bylaws, pursuant to which the provisions described under “Description of Capital Stock” are operative. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | no exercise of the underwriters’ option to purchase up to 2,368,421 additional shares of common stock from certain selling stockholders; and |

| • | the initial offering price of $19.00 per share, which represents the midpoint of the range set forth on the cover page of this prospectus. |

Except as otherwise indicated, all information with respect to our outstanding common stock that we present in this prospectus does not give effect to:

| • | 3,525,415 shares of our common stock issuable upon the exercise of outstanding options as of December 31, 2012 at a weighted average exercise price of $6.23 per share; or |

| • | 5,000,000 shares of common stock reserved for future issuance under our 2013 LTIP Plan that we intend to adopt in connection with this offering. |

10

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The following table presents our summary historical consolidated financial data and operating statistics. The consolidated statement of operations data and cash flow data for the years ended December 31, 2012, 2011 and 2010 and the consolidated balance sheet data as of the years ended December 31, 2012 and 2011 have been derived from our audited consolidated financial statements included elsewhere in this prospectus.

The consolidated financial statements for 2012 are presented for two periods: January 1 through February 14, 2012 (the “Predecessor Period”), which relates to the period immediately preceding the Acquisition, and the year ended December 31, 2012 (the “Successor Period”). The results of the Successor Period are not comparable to the results of the Predecessor Period due to the difference in the basis of presentation of purchase accounting as compared to historical cost. The consolidated statement of operations data for the period January 1, 2012 to February 14, 2012 are derived from the audited financial statements of the Predecessor Period included elsewhere in this prospectus, and the consolidated statement of operations data for the year ended December 31, 2012 are derived from the audited financial statements of the Successor Period included elsewhere in this prospectus. Prior to the Acquisition, Taminco Corporation had no operations or activity other than transaction costs related to the Acquisition.

11

Table of Contents

The summary historical consolidated financial information should be read in conjunction with “Risk Factors,” “Selected Historical Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Financial Information” and our financial statements and related notes thereto included elsewhere in this prospectus. Historical results are not necessarily indicative of results that may be expected for any future period.

| Pro Forma year ended December 31, 2012 |

Successor(1) | Predecessor(2) | ||||||||||||||||||||

| Year ended December 31, 2012 |

January 1 through February 14, 2012 |

Year ended December 31, |

||||||||||||||||||||

| (In millions, other than per share information) | 2011 | 2010 | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||

| Net sales |

$ | 1,116 | $ | 972 | $ | 144 | $ | 1,123 | $ | 951 | ||||||||||||

| Cost of sales |

928 | 810 | 111 | 906 | 757 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

188 | 162 | 33 | 217 | 194 | |||||||||||||||||

| Selling, general and administrative expense |

58 | 52 | 66 | 49 | 52 | |||||||||||||||||

| Research and development expense |

10 | 9 | 1 | 12 | 13 | |||||||||||||||||

| Other operating expense |

8 | 49 | 1 | 16 | 2 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income |

112 | 52 | (35 | ) | 140 | 127 | ||||||||||||||||

| Interest expense, net |

79 | 70 | 8 | 75 | 74 | |||||||||||||||||

| Other non-operating (income) expense, net |

13 | 11 | 2 | 1 | (2 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before income taxes and results from companies consolidated under equity method |

20 | (29 | ) | (45 | ) | 64 | 55 | |||||||||||||||

| Income tax expense (benefit) |

15 | (3 | ) | 9 | 32 | 33 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from continuing operations before earnings from equity method investments |

5 | (26 | ) | (54 | ) | 32 | 22 | |||||||||||||||

| Loss from companies consolidated under equity method |

2 | 2 | — | 2 | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) for the period |

$ | 3 | $ | (28 | ) | $ | (54 | ) | $ | 30 | $ | 22 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings per share: |

||||||||||||||||||||||

| Basic |

$ | 0.05 | $ | (0.57 | ) | $ | (0.05 | ) | $ | 0.03 | $ | 0.02 | ||||||||||

| Diluted |

$ | 0.05 | $ | (0.57 | ) | $ | (0.05 | ) | $ | 0.03 | $ | 0.02 | ||||||||||

| Cash Flow Data: |

||||||||||||||||||||||

| Cash flows provided by (used in) operating activities |

N/M | $ | 10 | $ | 44 | $ | 117 | $ | 112 | |||||||||||||

| Cash flows provided by (used in) investing activities |

N/M | (214 | ) | (6 | ) | (75 | ) | (68 | ) | |||||||||||||

| Cash flows provided by (used in) financing activities |

N/M | 272 | — | (19 | ) | (22 | ) | |||||||||||||||

12

Table of Contents

| Pro Forma year ended December 31, 2012 |

Successor(1) | Predecessor(2) | ||||||||||||||||||||

| Year ended December 31, 2012 |

January 1 through February 14, 2012 |

Year ended December 31, | ||||||||||||||||||||

| (In millions, other than as indicated) | 2011 | 2010 | ||||||||||||||||||||

| Other financial and operating statistics: |

||||||||||||||||||||||

| Total volume (in kt) |

546 | 489 | 57 | 540 | 528 | |||||||||||||||||

| Adjusted EBITDA(3) |

240 | 210 | 30 | 229 | 203 | |||||||||||||||||

| Adjusted EBITDA margin(3) |

21.5 | % | 21.6 | % | 20.8 | % | 20.4 | % | 21.3 | % | ||||||||||||

| Capital improvement expenditures |

16 | 15 | 1 | 13 | 8 | |||||||||||||||||

| Growth capital expenditure |

41 | 36 | 5 | 41 | 54 | |||||||||||||||||

| Toxicology and regulatory capital expenditure |

8 | 8 | — | 7 | 5 | |||||||||||||||||

| Total capital expenditures |

65 | 59 | 6 | 61 | 67 | |||||||||||||||||

| As of December 31, | ||||||||||

| Successor(1) | Predecessor(2) | |||||||||

| (In millions) | 2012 | 2011 | ||||||||

| Balance Sheet Data: |

||||||||||

| Cash and cash equivalents |

$ | 67 | $ | 131 | ||||||

| Property, plant and equipment, net |

434 | 249 | ||||||||

| Total assets |

1,847 | 1,334 | ||||||||

| Long-term debt |

1,155 | 1,102 | ||||||||

| Total liabilities |

1,576 | 1,366 | ||||||||

| Stockholders’ equity |

271 | (32 | ) | |||||||

| (1) | Taminco Corporation, which had no operations or activity prior to the Acquisition on February 15, 2012 other than transaction costs related to the Acquisition. |

| (2) | Taminco Group Holdings S.à r.l. |

| (3) | We present Adjusted EBITDA and Adjusted EBITDA margin to enhance a prospective investor’s understanding of our results of operations and financial condition. EBITDA consists of profit for the period before interest, taxation, depreciation and amortization. Adjusted EBITDA consists of EBITDA and eliminates (i) transaction costs, (ii) restructuring charges, (iii) foreign currency exchange gains/losses, (iv) non-cash equity in earnings/losses of unconsolidated affiliates net of cash dividends received (as we receive cash only when these unconsolidated affiliates pay us a dividend, regardless of equity-based earnings), (v) stock option compensation and (vi) sponsor management and director fees and expenses (Successor Period only). Adjusted EBITDA margin reflects Adjusted EBITDA as a percentage of net sales. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. |

You should not consider Adjusted EBITDA or Adjusted EBITDA margin as an alternative to (a) operating profit or profit for the period, as reported in accordance with U.S. GAAP, as a measure of our operating performance, (b) cash flows from operating investing and financing activities as a measure to meet our cash needs or (c) any other measures of performance under generally accepted accounting principles. You should exercise caution in comparing Adjusted EBITDA and Adjusted EBITDA margin as reported by us to similar measures of other companies.

In evaluating Adjusted EBITDA, you should be aware that we are likely to incur expenses similar to the adjustments in this presentation in the future and that certain of these items could be considered recurring in nature. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by non-recurring items.

13

Table of Contents

We present Adjusted EBITDA and Adjusted EBITDA margin because we believe Adjusted EBITDA and Adjusted EBITDA margin are useful as supplemental measures in evaluating the performance of our operating businesses and provide greater transparency into our results of operations. Adjusted EBITDA should not be considered in isolation or as a substitute for net income or other statement of operations data prepared in accordance with U.S. GAAP.

Our management, including our chief operating decision makers, uses Adjusted EBITDA as a factor in evaluating the performance of our business. This measure is not recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP measures of performance. The most directly comparable financial measure presented in accordance with U.S. GAAP in our consolidated financial statements for Adjusted EBITDA is net income.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider Adjusted EBITDA either in isolation or as a substitute for analyzing our results as reported under U.S. GAAP. Some of these limitations include:

| • | it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often need to be replaced in the future and Adjusted EBITDA does not reflect any cash requirements that would be required for such replacements; |

| • | its does not reflect the interest expense, or the cash requirements necessary, to service interest or principal payments on our debt; |

| • | it does not reflect stock option expense or its potentially dilutive impact; |

| • | some of the exceptional items that we eliminate in calculating Adjusted EBITDA reflect cash payments that were made, or will be made in the future; and |

| • | other companies in our industry may calculate Adjusted EBITDA differently than we do, which limits its usefulness as a comparative measure. |

The following table provides reconciliations of net income (loss) to Adjusted EBITDA for the periods presented.

| Pro Forma year ended December 31, 2012 |

Successor | Predecessor | ||||||||||||||||||||

| Year ended

December 31, 2012 |

January 1 through February 14, 2012 |

Year ended December 31, |

||||||||||||||||||||

| (In millions) | 2011 | 2010 | ||||||||||||||||||||

| Net income (loss) attributable to Taminco |

$ | 3 | $ | (28 | ) | $ | (54 | ) | $ | 30 | $ | 22 | ||||||||||

| Income tax expense (benefit) |

15 | (3 | ) | 9 | 32 | 33 | ||||||||||||||||

| Interest expense, net |

79 | 70 | 8 | 75 | 74 | |||||||||||||||||

| Depreciation and amortization |

104 | 90 | 7 | 72 | 74 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

$ | 201 | $ | 129 | $ | (30 | ) | $ | 209 | $ | 203 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Transaction costs |

28 | 70 | — | 5 | 2 | |||||||||||||||||

| Restructuring charges |

— | — | — | 11 | — | |||||||||||||||||

| Foreign exchange gains (losses) |

4 | 4 | — | 2 | (2 | ) | ||||||||||||||||

| Sponsor management and director fees and expenses |

5 | 5 | — | — | — | |||||||||||||||||

| Losses of equity method investment |

2 | 2 | — | 2 | — | |||||||||||||||||

| Share-based compensation expense |

— | — | 60 | — | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 240 | $ | 210 | $ | 30 | $ | 229 | $ | 203 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

14

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before investing in our common stock. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition, results of operations or cash flows. If any of the following risks actually occurs, our business, financial condition, results of operations or cash flows would suffer. In such case, you may lose part or all of your investment.

Risks Relating to Our Business

Our substantial indebtedness could adversely affect our financial health and our ability to raise additional capital, and prevent us from fulfilling our obligations under our existing agreements.

At December 31, 2012, we had $1,161 million of total indebtedness outstanding on a consolidated basis, all of which was secured. As of December 31, 2012, there were no borrowings outstanding under our revolving credit facility; however $3 million of the total capacity of $194 million was utilized to support outstanding letters of credit (as described under “Description of Indebtedness”). In addition, we had drawn $86 million under the Non-recourse Factoring Facility (as described under “Description of Indebtedness”). As of March 1, 2013, our annual debt service obligation is approximately $95 million. This amount includes principal and interest payments under the Senior Secured Credit Facilities and interest payments under the Second-Priority Senior Secured Notes and the PIK Toggle Notes. Additionally, principal payments of $400 million of Second-Priority Senior Secured Notes and $250 million of PIK Toggle Notes (which will be redeemed in connection with this offering) are due in 2020 and 2017, respectively. See “Description of Indebtedness” for more information on our indebtedness.

Our substantial indebtedness could:

| • | make it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the agreements governing our indebtedness; |

| • | require us to dedicate a substantial portion of our cash flow from operations to the payments on our indebtedness, thereby reducing the availability of our cash flow to fund acquisitions, working capital, capital expenditures, research and development efforts and other general corporate purposes; |

| • | expose us to the risk of increased interest rates, as borrowings under the Senior Secured Credit Facilities will be subject to variable rates of interest; |

| • | place us at a competitive disadvantage compared to certain of our competitors that have less debt; |

| • | limit our ability to borrow additional funds; |

| • | make us more vulnerable to downturns in our business or the economy; |

| • | limit our flexibility in planning for, or reacting to, changes in our operations or business; and |

| • | increase our vulnerability to and limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate. |

Also, we may still incur significantly more debt, which could intensify the risks described above.

15

Table of Contents

Our debt agreements contain restrictions that limit our flexibility in operating our business, which may lead to default under our debt agreements.

The agreements governing our existing indebtedness contain, and any future indebtedness of ours would likely contain, a number of covenants that impose significant operating and financial restrictions on us and our subsidiaries, including restrictions on our and our subsidiaries’ ability to among other things:

| • | incur additional debt or issue certain preferred shares; |

| • | pay dividends on or make distributions in respect of our common stock or make other restricted payments; |

| • | make certain investments; |

| • | sell certain assets; |

| • | create liens on certain assets; |

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| • | enter into certain transactions with our affiliates; and |

| • | designate our subsidiaries as unrestricted subsidiaries. |

As a result of these covenants, we are limited in the manner in which we conduct our business, and we may be unable to engage in favorable business activities or finance future operations or capital needs.

We have pledged and will pledge a significant portion of our assets as collateral under our Senior Secured Credit Facilities and Notes (as described under “Description of Indebtedness”). If repayment is accelerated, there can be no assurance that we will have sufficient assets to repay our indebtedness.

Under our Senior Secured Credit Facilities, we are required to satisfy and maintain specific financial ratios. Our ability to meet those financial ratios can be affected by events beyond our control, and there can be no assurance that we will meet those ratios. A failure to comply with the covenants contained in our Senior Secured Credit Facilities or our other indebtedness could result in an event of default under the facilities or the existing agreements, which if not cured or waived, could have a material adverse effect on our business, financial condition and results of operations. In the event of any default under our Senior Secured Credit Facilities or our other indebtedness, the lenders thereunder:

| • | will not be required to lend any additional amounts to us; |

| • | could elect to declare all borrowings outstanding, together with accrued and unpaid interest and fees, to be due and payable and terminate all commitments to extend further credit; or |

| • | require us to apply all of our available cash to repay those borrowings. |

Such actions by the lenders could cause cross defaults under our other indebtedness. If we are unable to repay those amounts, the lenders and noteholders under our Senior Secured Credit Facilities and the Notes could proceed against the collateral granted to them to secure that indebtedness.

Difficult and volatile conditions in the overall economy and in the capital, credit and commodities markets could materially adversely affect our financial position, results of operations and cash flows, and we do not know if these conditions will improve in the near future.

Our financial position, results of operations and cash flows could be materially adversely affected by continuation of difficult global economic conditions and significant volatility in the capital, credit and commodities markets and in the overall economy. These factors, combined with low levels of business and

16

Table of Contents

consumer confidence and increased unemployment, have precipitated a slow recovery from the global recession and concern about a return to recessionary conditions. The difficult conditions in these markets and the overall economy affect our business in a number of ways. For example:

| • | weak economic conditions, especially in our key markets in North America and Europe, could reduce demand for our products, impacting our revenues and margins; |

| • | as a result of the recent volatility in commodity prices, we may encounter difficulty in achieving sustained market acceptance of past or future price increases, which could have a material adverse effect on our financial position, results of operations and cash flows; |

| • | under difficult market conditions, there can be no assurance that borrowings under our revolving credit facility would be available or sufficient, and in such a case, we may not be able to successfully obtain additional financing on reasonable terms, or at all; |

| • | in order to respond to market conditions, we may need to seek waivers from various provisions in our Senior Secured Credit Facilities, and there can be no assurance that we can obtain such waivers at a reasonable cost, if at all; and |

| • | market conditions could result in our key customers experiencing financial difficulties and/or electing to limit spending, which in turn could result in decreased sales and earnings for us. |

We do not know if market conditions or the state of the overall economy will improve in the near future. In particular, a significant portion of our revenues are generated in Europe and in Euro. As a result, we could be adversely affected by the current economic crisis in Europe, particularly if such crisis worsens. We could also be affected if some or all European countries exit the Euro.

Our ability to obtain additional capital on commercially reasonable terms may be limited, which could reduce funds available for our operations and place us at a competitive disadvantage.

Although we believe that our cash, cash equivalents and short-term investments, as well as future cash from operations and availability under our revolving credit facility, will provide adequate resources to fund ongoing operating requirements, we may need to seek additional financing to compete effectively. Our debt ratings affect both our ability to raise capital and the cost of that capital. Future downgrades of our debt ratings may increase our borrowing costs and affect our ability to access the debt or equity markets on terms and in amounts that would be satisfactory to us.

If we are unable to obtain capital on commercially reasonable terms, it could:

| • | reduce funds available to us for purposes such as working capital, capital expenditures, research and development, strategic acquisitions and other general corporate purposes; |

| • | restrict our ability to introduce new products or capitalize on business opportunities; |

| • | increase our vulnerability to economic downturns and competitive pressures in the markets in which we operate; and |

| • | place us at a competitive disadvantage. |

We are dependent upon our lenders for financing to execute our business strategy and meet our liquidity needs. If our lenders are unable to fund borrowings under their credit commitments or we are unable to borrow, our business could be negatively impacted.

During periods of volatile credit markets, there is a risk that lenders, even those with strong balance sheets and sound lending practices, could fail or refuse to honor their credit commitments and obligations, including but not limited to extending credit up to the maximum permitted by a credit facility and otherwise accessing capital

17

Table of Contents

and/or honoring loan commitments. If our lenders are unable to fund borrowings under their revolving credit commitments or if we are unable to borrow, it could be difficult to replace our revolving credit facility on similar terms.

An increase in energy costs, in particular natural gas costs, or a disruption in the supply of energy for our operations may significantly increase operational costs or adversely affect production.

The main energy sources used in our operations are natural gas and electricity. Natural gas in particular represents a significant part of our raw material and consumables expenses and any increase in the price of natural gas would significantly increase our costs and reduce our operating margin. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Drivers of Our Business—Raw Materials.”

Fluctuations in energy costs may be market-driven or government-driven. We do not hedge our natural gas costs. If we are not able to increase the prices we charge as a result of increases in natural gas and electricity prices, or if we are unable to pass on the full increase in electricity costs to our wholesale customers, our business and results of operations may be materially adversely affected. Although our financial conditions have not been materially impacted by recent fluctuations in natural gas prices, we may be negatively impacted by future price increases.

In addition, any disruption in the supply of energy may impair our ability to conduct our business and meet customer demands and may have a material adverse effect on our results of operations. Since the number of energy suppliers is generally limited, we may not be able to negotiate favorable terms when our energy supply agreements are up for renewal and we may be required to accept significant increases in the costs of our energy purchases. In Germany and the United States, we are dependent on monopolist and/or government-controlled companies for a significant portion of our electricity needs. Unexpected changes in a government’s policy of electricity supply may occur from time to time. Such changes may negatively impact our production capacity or our operating expenses and may materially adversely affect our business and results of operations.

Our production facilities can also be disrupted due to maintenance and routine shutdowns.

We derive a significant portion of our revenue from sales to several large customers, including chemical distributors, and significant reductions of sales to one or more of these customers could harm our business, financial condition and results of operations.

We derive a substantial amount of revenue from sales to several large customers, with our top 10 customers accounting for approximately 38% of our total revenue in the pro forma year ended December 31, 2012. Such loss of revenue could have an adverse impact on our future revenues. For more information, please see “—Risks Relating to Our Industry—We may face increasing competition, which could have a material adverse effect on our business and results of operations.” See “Business—Our Operations—Marketing and Sales.” The loss of, or significant reduction in demand from, one or more of these customers could have a material adverse effect on our business, financial condition and results of operations.

In addition, certain of our revenue is generated through sales to customers that are chemical distributors and that, in turn, sell our products to their customers. Sales of our products could decline if the performance of these customers deteriorates. Furthermore, because we do not have exclusive relationships with these customers, they may sell competitors’ products. There is a risk that these customers may give higher priority to the products of, or form alliances with, our competitors. If these customers do not continue to sell our products or to provide them with similar levels of promotional support as provided for our competitors’ products, our sales performance could decline and our business and results of operations could be materially adversely affected.

18

Table of Contents

We purchase our key raw materials and some of our equipment from a relatively limited number of suppliers. As a result, any disruption or delay in the supply could have a material adverse effect on our business.

We purchase methanol, ammonia, ethylene oxide and acetone from a relatively limited number of sources. See “Business—Our Operations—Raw Materials.” As a result, any disruption or delay in the supply of those materials from a particular supplier, or loss of a supplier where we are unable to find a suitable alternative, could force us to curtail our production and adversely affect our business.

Similarly, we are only able to purchase certain components of our production equipment from a limited number of contractors and suppliers. Any interruption in the operations of our suppliers and/or the inability to obtain timely delivery of key equipment of acceptable quality or significant increases in the prices of such equipment could result in material production delays, increased costs and reductions in shipments of our products, any of which could increase our operating costs, harm our customer relationships or have a material adverse effect on our business and results of operations.

We depend on a variety of raw materials, the prices of which may vary based on market conditions. Changes in raw material prices and our supply arrangement could materially adversely affect our business and results of operations.

The prices of the raw materials on which our business depends vary based on market conditions. In particular, the prices of certain raw materials, such as methanol and ammonia, are highly volatile. Increased costs of raw materials and/or their delivery that cannot be passed on to our customers through price increases impact our operating costs and liquidity and could have a material adverse effect on our cash flow, business and results of operations.

The main raw materials by volume used in the manufacture of alkylamines and their derivatives are methanol, ammonia, ethylene oxide and acetone. We depend upon raw materials supplied by third parties by pipeline, railcar, barge or truck. We typically enter into supply agreements for terms of one year or longer. Certain of these agreements are automatically renewable each year, subject to termination by either party upon as little as 30 days’ notice. In addition, certain of our supply arrangements are not subject to written contracts and therefore can be terminated by either party at any time. If our contractual relationships with our suppliers were terminated or were insufficient to meet our needs, or if we were otherwise unable to secure these or other necessary raw materials or to acquire them at commercially reasonable prices, then our business and results of operations could be materially adversely affected. In addition, there is a risk that the regulation of the transportation of ethylene oxide and ammonia may become more stringent, which could raise the cost of the raw materials. The supply of ethylene oxide has been constrained recently, which could impact availability and pricing of ethylene oxide in the future.

In addition, some of our current contracts allow us to purchase raw materials at advantageous prices. If our counterparties suffer financial problems or are for other reasons unable to fulfill their requirements under these contracts, or if we are unable to renew these contracts on the same or similar terms, then our business and results of operations could be materially adversely affected. In particular, we have a methanol supply contract with Methanex Methanol Company (“Methanex”) that contains favorable pricing and expires in 2019, but Methanex has invoked force majeure on a number of occasions in the last several years, resulting in a reduction in the amount of methanol supplied under the contract at the favorable price, and it is possible that Methanex may do so again in the future. When force majeure is invoked, we are required to source our methanol at higher prices, adversely impacting our margins and results.

For our production of solvents, such as dimethylformamide (“DMF”), access to low cost carbon monoxide (“CO”), is essential to profitability. As DMF is by far our largest solvent product, any disruption in access to low cost CO could have a material adverse effect on our business and results of operations.

19

Table of Contents

For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Drivers of Our Business—Raw Materials” and “Business—Our Operations—Raw Materials.”

We may not be able to pass on the costs of raw materials, energy or other inputs to customers in future contracts, which may have a material adverse effect on our business and results of operations.

Many of our current contracts with customers allow us to pass on much of any increase in the cost of our key raw materials, energy and other inputs to those customers as part of the price of the products they purchase. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Drivers of Our Business—Volume, Product Mix and Pricing.” When the terms of our current contracts with customers expire in the future, we may not be able to negotiate new contracts that allow us to pass the costs of inputs on to our customers and this may have a material adverse effect on our business and results of operations. While approximately 48% of our contracts for the pro forma year ended December 31, 2012 permit pass-throughs of key raw material increases, we have generally been able to pass along increases, subject to a time lag, in our other sales. We cannot assure you that we will be able to do so in the future. In addition, decreases in raw material costs are passed through to our customers, which may decrease our net sales.