Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d515712d8k.htm |

| EX-99.1 - TRANSCRIPT OF CONFERENCE CALL OF THE MOSAIC COMPANY - MOSAIC CO | d515712dex991.htm |

The Mosaic Company

Earnings

Conference

Call

–

3rd

Quarter

Fiscal

2013

March 28, 2013

Jim Prokopanko, President and Chief Executive Officer

Larry

Stranghoener,

Executive

Vice

President

and

Chief

Financial

Officer

Laura Gagnon, Vice President Investor Relations

Exhibit 99.2 |

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform

Act

of

1995.

Such

statements

include,

but

are

not

limited

to,

statements

about

future

financial

and

operating results. Such statements are based upon the current beliefs and

expectations of The Mosaic Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties include but are

not limited to the predictability and volatility of, and customer expectations

about, agriculture, fertilizer, raw material, energy and transportation

markets that are subject to competitive and other pressures and economic and

credit market conditions; the level of inventories in the distribution channels

for crop nutrients; changes in foreign currency and exchange rates;

international trade risks; changes in government policy; changes in environmental

and other governmental regulation, including greenhouse gas regulation,

implementation of the numeric water quality standards for the discharge of

nutrients into Florida waterways or possible efforts to reduce the flow of

excess

nutrients

into

the

Mississippi

River

basin

or

the

Gulf

of

Mexico;

further

developments

in

judicial

or

administrative proceedings, or complaints that Mosaic’s operations are

adversely impacting nearby business operations or properties; difficulties

or delays in receiving, increased costs of or challenges to necessary

governmental permits or approvals or increased financial assurance requirements;

resolution of global tax audit activity; the effectiveness of the

Company’s processes for managing its strategic priorities; the ability of Mosaic,

Ma’aden and SABIC to agree upon definitive agreements relating to the

prospective joint venture for the Wa’ad Al Shamal

Phosphate

Project,

the

final

terms

of

any

such

definitive

agreements,

the

ability

of

the

joint

venture

to

obtain project financing in acceptable amounts and upon acceptable terms, the

future success of current plans for the

joint

venture

and

any

future

changes

in

those

plans;

adverse

weather

conditions

affecting

operations

in

Central

Florida or the Mississippi River basin or the Gulf Coast of the United States, and

including potential hurricanes, excess rainfall or drought; actual costs of

various items differing from management’s current estimates, including,

among others, asset retirement, environmental remediation, reclamation or other

environmental regulation, or Canadian resources taxes and royalties;

accidents and other disruptions involving Mosaic’s operations, including

brine inflows at its Esterhazy, Saskatchewan potash mine and other potential mine

fires, floods, explosions, seismic events or releases of hazardous or

volatile chemicals, as well as other risks and uncertainties reported from

time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual

results may differ from those set forth in the forward-looking statements.

2 |

Third Quarter Financial Highlights

$0.81 Reported EPS

$0.88* Adjusted, excluding notable items

$2.2 billion

$419 million

* See reconciliation on page 17

0

0

Net Sales

Phosphates

Potash

$1,502

$758

$216

$197

Operating Earnings

3 |

•

Pent up demand with 2012

US Corn exports down

52% year over year

•

The likely case builds back

one-half of the inventory

drawdown this year

•

Long-term outlook remains

strongly positive

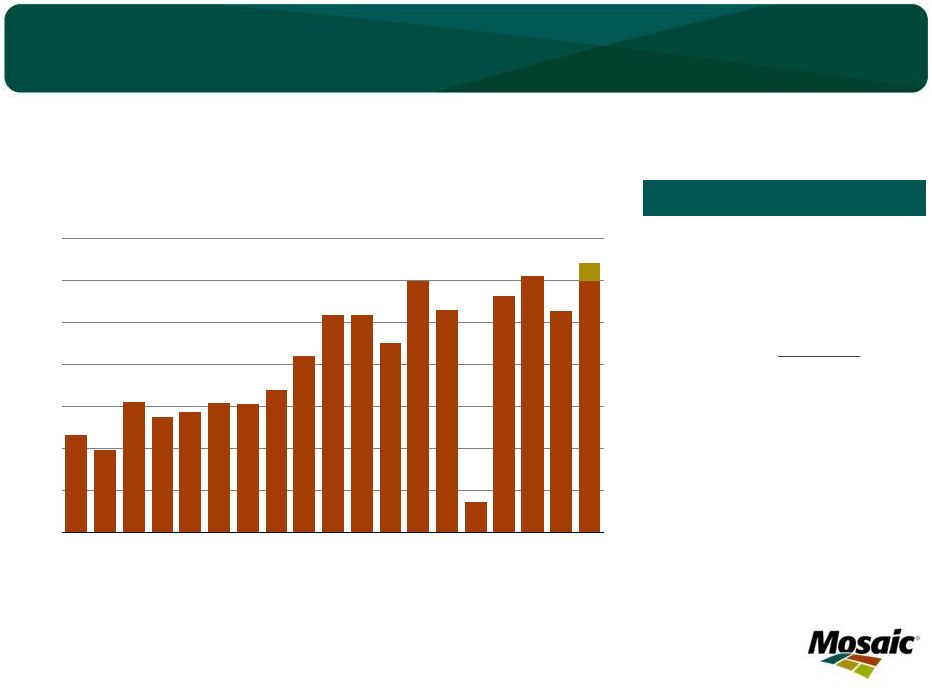

Commodity Prices Likely to Remain Elevated

Considerations

606

579

493

406

468

461

425

436

512

568

545

531

495

Mil Tonnes

World Grain & Oilseed Stocks

Source: USDA and Mosaic

4 |

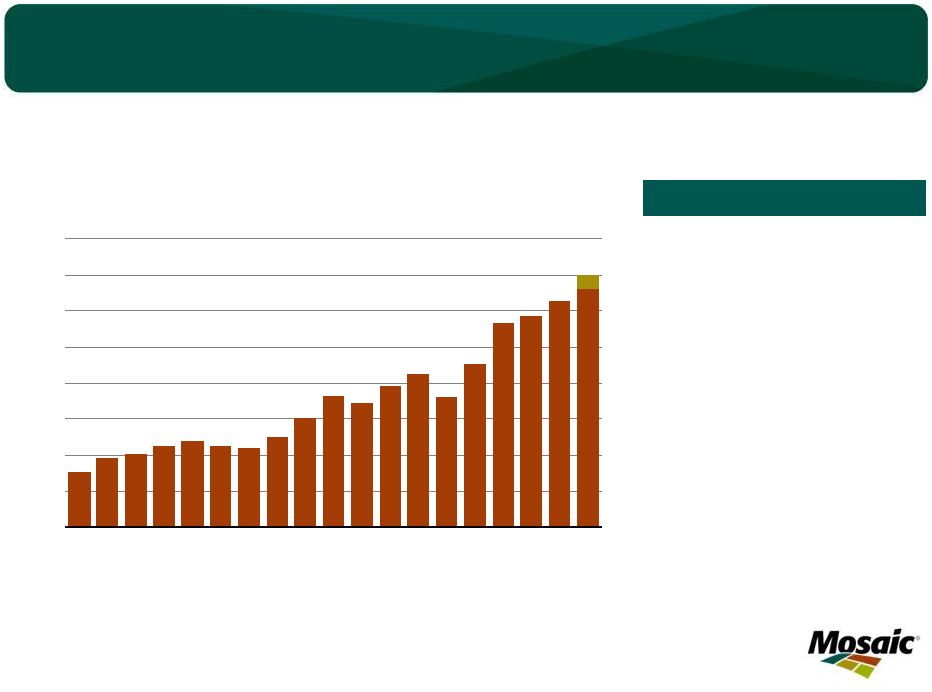

•

Better than expected

baseload demand from

China and India:

•

China imports of ~4.5

mmt

in

FH

2013

•

India imports of 4.0-

4.5 mmt in CY 2013

•

Positive prospects in nearly

all other regions

2013 K Shipments on Track with Forecasts

2013 Potash Shipments

55

52

29

53

56

51

55-57

25

30

35

40

45

50

55

60

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12E

13F

Mil Tonnes

KCl

World Potash Shipments

Source: Fertecon and Mosaic

5 |

•

Strong Western

Hemisphere demand with

rising prices

•

India not back in the

market until end of fiscal

2013

2013 P Shipments on Track with Forecasts

51

48

53

58

59

61

63-65

30

35

40

45

50

55

60

65

70

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12E13F

Mil Tonnes

DAP/MAP/MES/TSP

Source: Fertecon and Mosaic

Global Phosphate Product Shipments

2013 Phosphate Shipments

6 |

Ma’aden Joint Venture

•

Aligns with our growth strategy

•

Attractive returns on invested capital

•

Low-cost producer

•

Logistically advantaged to Asian countries

•

Opportunity to participate in future projects

•

Diversifies sources of phosphate rock

7 |

Financial Results Review |

9

Unchanged Capital Priorities

Maintain Investment Grade Rating

Improve Balance Sheet Structure

Less cash

More debt

Ample capacity for share repurchases

Use of Cash: Priorities

Finance Organic Growth & Maintain Dividend

Strategic Investments

Additional Returns to Shareholders

Class A share resolution unlikely until later

in the summer |

Financial Guidance Summary

Category

Guidance –

Fiscal 2013

Potash

Q4

Sales

volume

2.3

–

2.6

million

tonnes

Q4

MOP

selling

price

$350

-

$380

per

tonne

Q4 Operating rate above 85 percent

Q4

Gross

margin

rate

in

range

of

40

-

45%

Phosphates

Q4 Sales volume 2.6 -

2.9 million tonnes

Q4

DAP

selling

price

$475

-

$505

per

tonne

Q4 Operating rate above 85 percent

Q4 Gross margin rate flat to Q3’FY13

Capital Expenditures

$1.5

-

$1.6

billion

Canadian Resource Taxes

and Royalties

$270

-

$330

million

SG&A

$420

-

$440

million

Effective Tax Rate*

Mid 20-percent range

* For the second half of fiscal 2013

10 |

|

Third Quarter Financial Performance

In millions, except per share amounts

Three Months Ended

February 28,

2013

February 29,

2012

Net Sales

$2,241

$2,190

Gross Margin

$568

$522

% of net sales

25%

24%

Net Earnings

$345

$273

% of net sales

15%

13%

Diluted EPS

$0.81

$0.64

Effective Tax Rate

24.0%

24.5%

Cash Flow Provided by Operations

$371

$405

Cash and Cash Equivalents

$3,323

$3,202

12 |

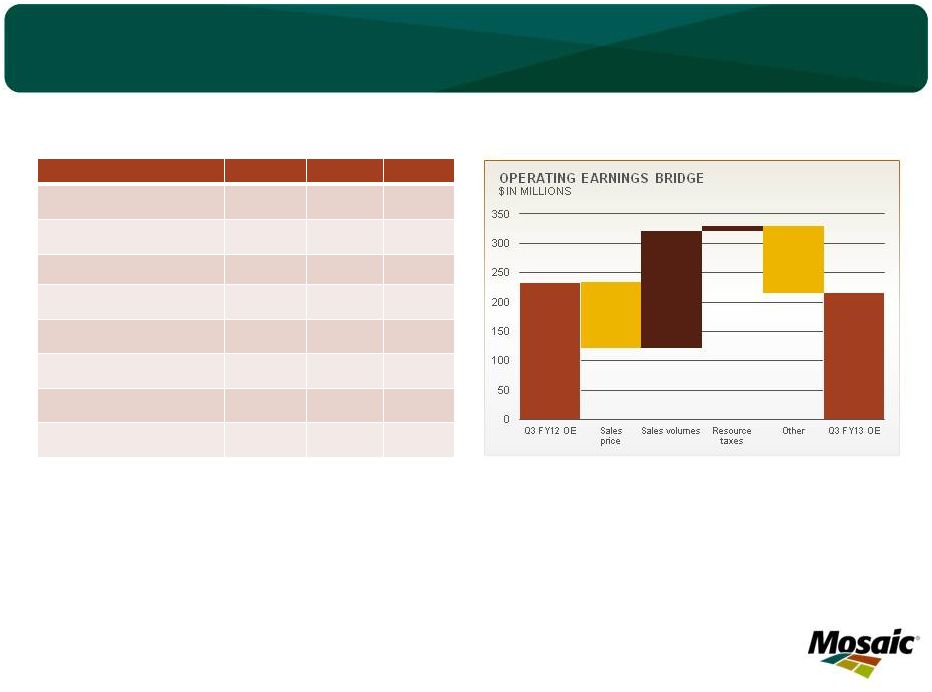

Potash Segment Highlights

In millions, except MOP price

Q3 FY13

Q2 FY13

Q3 FY12

Net sales

$758

$780

$553

Gross Margin

$308

$355

$270

Percent of net sales

41%

46%

49%

Operating earnings

$216

$316

$234

Sales volumes

1.8

1.5

1.1

Production volume

2.0

1.8

1.8

Production operating rate

78%

76%

79%

Avg MOP selling price

$385

$443

$453

Third quarter highlights:

1. Gross margin rate reflects lower average MOP selling price, unfavorable

$24 impact of mark to market of derivatives, and higher depreciation expense

and increased labor expenses in preparation of new capacity ramp-up.

2. Operating earnings include a $42 million charge related to the settlement

of potash anti-trust litigation. 13 |

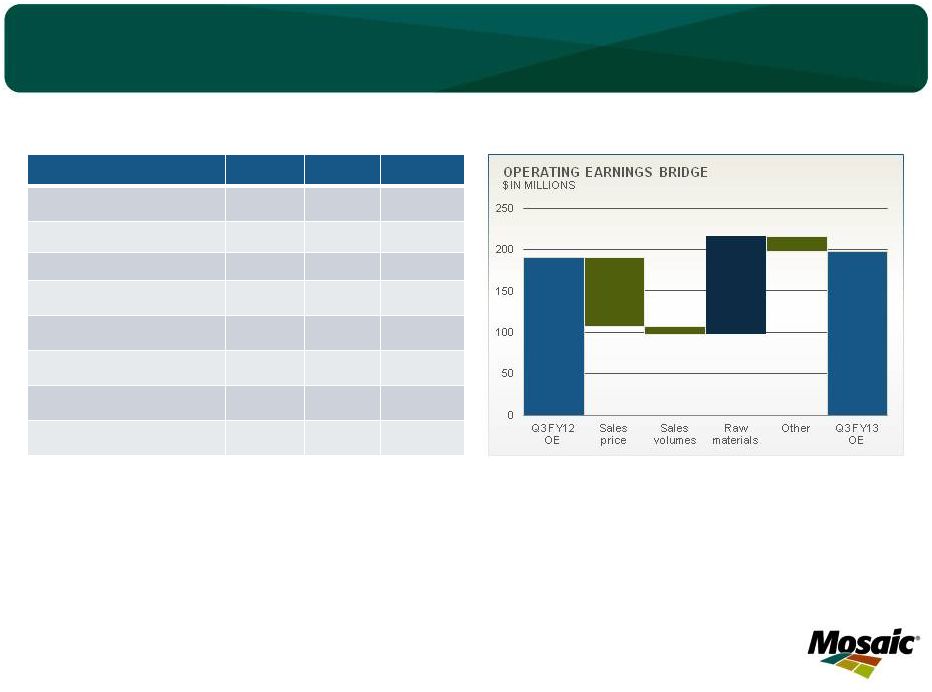

Phosphates Segment Highlights

In millions, except DAP price

Q3 FY13

Q2 FY13

Q3 FY12

Net sales

$1,502

$1,762

$1,652

Gross Margin

$266

$318

$259

Percent of net sales

18%

18%

16%

Operating earnings

$197

$245

$190

Sales volumes

2.6

3.0

2.6

NA production volume

(a)

2.1

2.1

2.0

Finished product operating rate

87%

86%

81%

Avg DAP selling price

$496

$544

$536

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

Third quarter highlights:

1. Year over year improvement in gross margin rate reflects lower raw

material costs, partially offset by lower finished phosphate product

prices. 2. Operating earnings include a $10 million asset retirement

obligation charge. 14 |

Raw

Material Cost Detail Mosaic is currently implementing a new inventory valuation

system. After implementation, Mosaic expects to include this information in

its performance data disclosures. Q3 FY13

Percent

Ammonia ($/MT)

Realized in COGS

$540

Average Purchase Price

$663

Sulfur ($/LT)

Realized in COGS

$181

Average Purchase Price

$173

Phosphate rock (used in production)

('000 metric tonnes)

US mined rock

3,137

88%

Purchased Miski Mayo rock

296

8%

Other purchased rock

144

4%

Total

3,577

100%

Average cost / tonne consumed rock

$65

15 |

Earnings

Sensitivity

to

Key

Drivers

(a)

FY13 Q3

Actual

Change

FY13 Q3

Margin %

Actual

% Impact on

Segment

Margin

Pre-Tax

Impact

EPS

Impact

Marketing

MOP Price ($/tonne)

(b)

$385

$50

40.7%

10.6%

$80

$0.14

Potash Volume

(million tonnes)

1.8

0.5

40.7%

16.9%

$128

$0.23

DAP Price ($/tonne)

$496

$50

17.7%

8.0%

$120

$0.21

Phosphate Volume

(million tonnes)

2.6

0.5

17.7%

5.1%

$76

$0.14

Raw Materials

Sulfur ($/lt)

$181

$50

17.7%

3.3%

$49

$0.09

Ammonia ($/tonne)

$540

$50

17.7%

1.8%

$26

$0.05

(a)

These factors do not change in isolation; actual results could vary from the above

estimates (b)

Assumes no change to KMAG pricing

16 |

Adjusted Earnings Reconciliation

Reconciliation of Net Income Attributable to Mosaic to Non-GAAP Adjusted Net

Income Attributable to Mosaic and Earnings per Share

17

Three months ended

February 28, 2013

(in millions, except per share amounts)

Net earnings attributable to Mosaic as reported

344.6

Pre-tax adjustments:

Potash antitrust settlement

41.8

Potash unrealized loss on derivatives in cost of goods sold

24.1

Foreign currency transaction gain

(32.3)

Phosphates ARO revision for closed facilities

10.0

Total pre-tax adjustments

43.6

Income tax effect of adjustments*

(10.9)

Non-GAAP adjusted net income attributable to Mosaic

377.3

Non-GAAP adjusted diluted earnings per share attributable to Mosaic

0.88

Weighted average common shares used in computing diluted earnings per share

427.1

* Estimated annual effective tax rate of 25% based on our guidance.

$

$

$

We report our financial results in conformity with U.S. generally accepted accounting principles

("GAAP"). However, we are providing non-GAAP adjusted net income and

non-GAAP adjusted earnings per share because certain items are customarily excluded by analyst in published estimates and

management believes, for purposes of comparability to financial performance in other periods and to

evaluate the Company's trends, that excluding the effects of these items is appropriate.

The adjusted amounts are not measures of financial performance under GAAP.

Adjusted net income and adjusted net income per diluted share should not be considered in isolation or

as a substitute for net income or earnings per diluted share, income from operations, cash

provided by operating activities or other income, profitability, cash flow or liquidity measures prepared under

U.S. GAAP. Because adjusted net income and adjust net income per diluted share exclude some but

not all items that affect net income and may vary among companies, the adjusted net income and

adjusted net income per diluted share amounts presented may not be comparable to similarly titled

measures of other companies.

|