Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Samson Oil & Gas LTD | v340257_8k.htm |

| EX-99.1 - EX-99.1 - Samson Oil & Gas LTD | v340257_ex99-1.htm |

March 2013

DISCLAIMER This presentation has been prepared by Samson Oil & Gas Limited and contains information about the Company which may not be complete and should be read in conjunction with its disclosures on the ASX and filings with the Securities and Exchange Commission. The presentation contains forward - looking information within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), including statements regarding potential drilling programs, the success of the company's business, as well as statements that include the words "believe, expect, anticipate" or similar expressions. Such forward - looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Samson Oil & Gas Limited to differ materially from those implied or expressed by such forward - looking statements. A description of the risks and uncertainties that are generally attendant to Samson and its industry, as well as other factors that could affect Samson’s financial results, are included in the Company's report to the U.S. Securities and Exchange Commission on Form 10 - K, which is available at www.sec.gov/edgar/searchedgar/webusers.htm. This presentation was prepared as of March 31st and Samson Oil & Gas Limited assumes no responsibility to update the information included herein for events occurring after the date hereof. This presentation does not constitute an offer to subscribe to an issue and recipients of the presentation are required to conduct their own analysis of the material contained herein prior to making a decision to trade Samson’s securities and is only made available to entities who have executed a non disclosure/non trading agreement with Samson. NYSE: SSN ASX: SSN 2

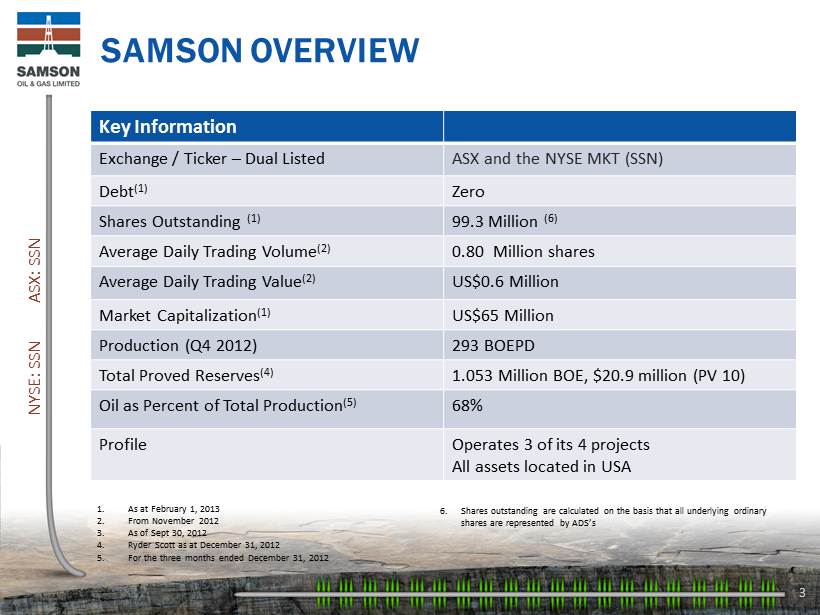

SAMSON OVERVIEW NYSE: SSN ASX: SSN 3 Key Information Exchange / Ticker – Dual Listed ASX and the NYSE MKT (SSN) Debt (1) Zero Shares Outstanding (1) 99.3 Million (6) Average Daily Trading Volume (2) 0.80 Million shares Average Daily Trading Value (2) US$0.6 Million Market Capitalization (1) US$65 Million Production (Q4 2012) 293 BOEPD Total Proved Reserves (4) 1.053 Million BOE, $20.9 million (PV 10) Oil as Percent of Total Production (5) 68% Profile Operates 3 of its 4 projects All assets located in USA 1. As at February 1, 2013 2. From November 2012 3. As of Sept 30, 2012 4. Ryder Scott as at December 31, 2012 5. For the three months ended December 31, 2012 6. Shares outstanding are calculated on the basis that all underlying ordinary shares are represented by ADS’s

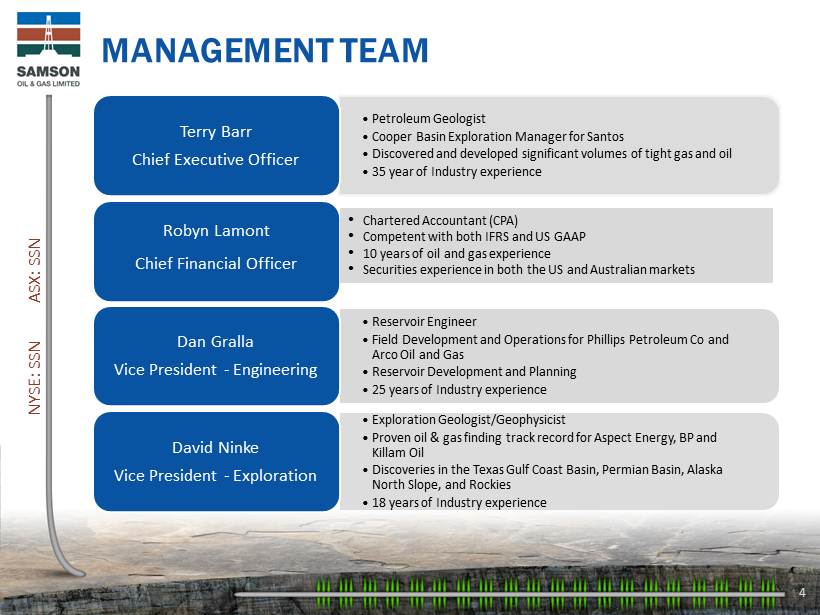

MANAGEMENT TEAM NYSE: SSN ASX: SSN 4 • Petroleum Geologist • Cooper Basin Exploration Manager for Santos • Discovered and developed significant volumes of tight gas and oil • 35 year of Industry experience Terry Barr Chief Executive Officer Robyn Lamont Chief Financial Officer • Reservoir Engineer • Field Development and Operations for Phillips Petroleum Co and Arco Oil and Gas • Reservoir Development and Planning • 25 years of Industry experience Dan Gralla Vice President - Engineering • Exploration Geologist/Geophysicist • Proven oil & gas finding track record for Aspect Energy, BP and Killam Oil • Discoveries in the Texas Gulf Coast Basin, Permian Basin, Alaska North Slope, and Rockies • 18 years of Industry experience David Ninke Vice President - Exploration • Chartered Accountant (CPA ) • Competent with both IFRS and US GAAP • 10 years of oil and gas experience • Securities experience in both the US and Australian markets

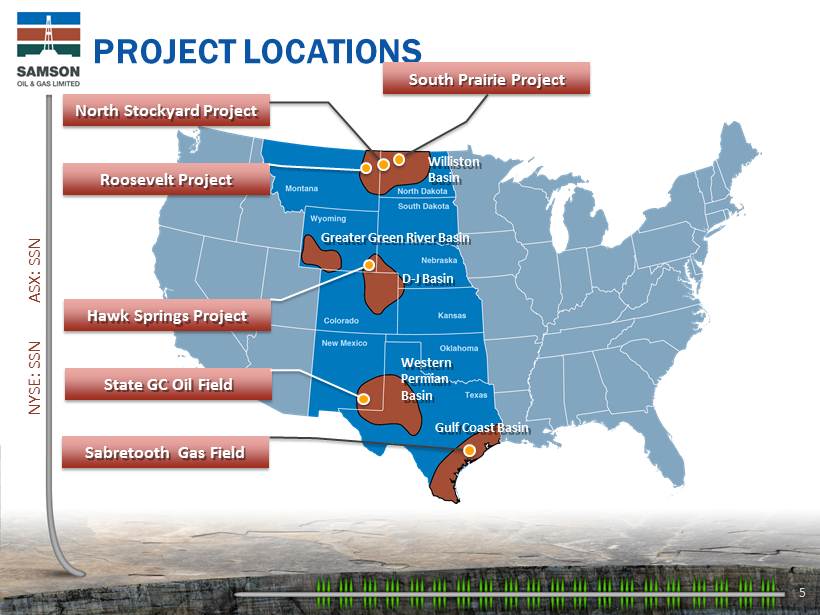

PROJECT LOCATIONS NYSE: SSN ASX: SSN 5 North Stockyard Project Roosevelt Project Hawk Springs Project State GC Oil Field Sabretooth Gas Field Williston Basin Greater Green River Basin D - J Basin Western Permian Basin Gulf Coast Basin South Prairie Project

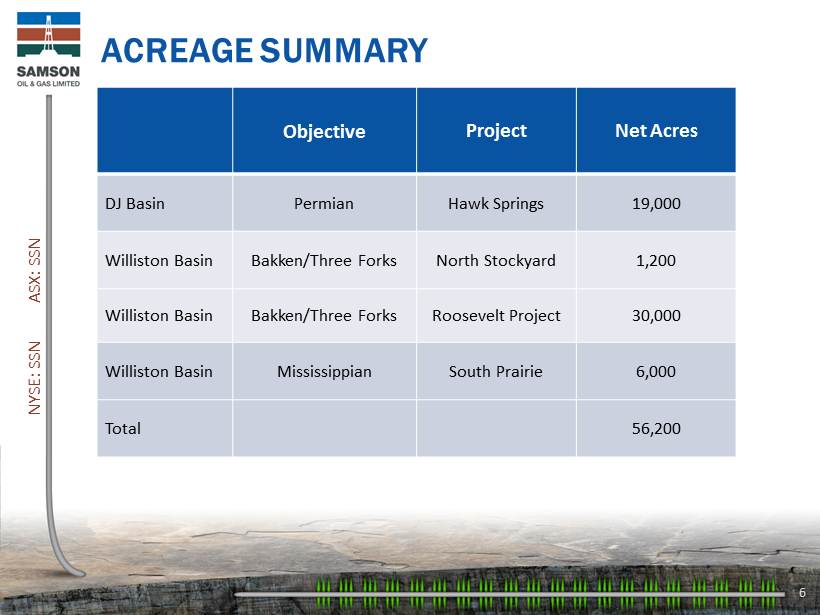

ACREAGE SUMMARY Objective Project Net Acres DJ Basin Permian Hawk Springs 19,000 Williston Basin Bakken /Three Forks North Stockyard 1,200 Williston Basin Bakken /Three Forks Roosevelt Project 30,000 Williston Basin Mississippian South Prairie 6,000 Total 56,200 NYSE: SSN ASX: SSN 6

2013 PLAN NYSE: SSN ASX: SSN 7 » NORTH STOCKYARD » Initiate 6 well, 160 acre infill program » Potential for 14 Bakken and Three Forks wells » HAWK SPRINGS PROJECT » Niobrara » Monitor production performance of first well (Defender). » Revise frac design in response to 9 foot effective fracture half length. » Closure pressure was much higher than anticipated and proppant selection was therefore incorrect. » Re frac two to three zones with ceramic is planned for March » Permian » Farmout Bluff Federal & American Eagle tests. » ROOSEVELT PROJECT » Observe the Continental Abercrombie well production. » Participate in the next Continental Resources well (Q1 2013) » Drill offset to Abercrombie well if EUR exceeds 350 Mbbls . » SOUTH PRAIRIE » Drill initial exploratory well.

NORTH STOCKYARD FIELD NORTH DAKOTA BAKKEN/THREE FORKS

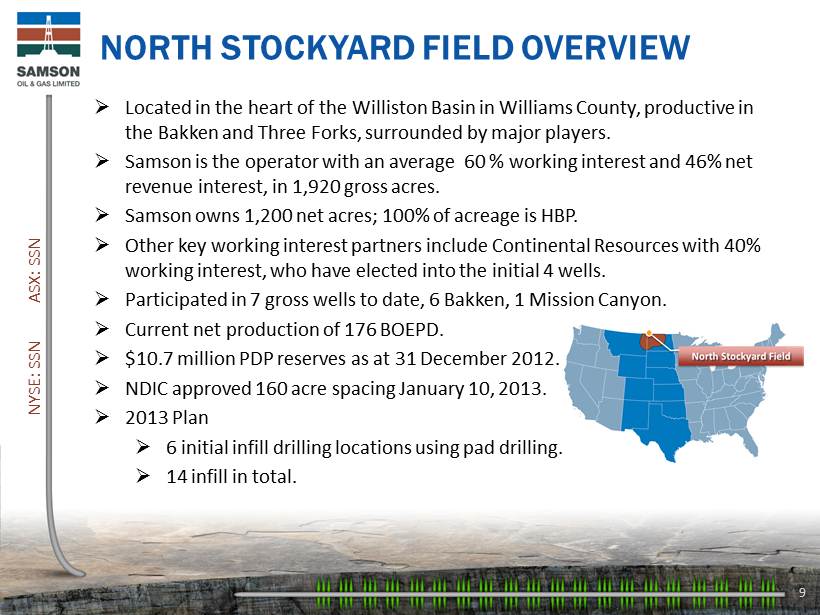

NORTH STOCKYARD FIELD OVERVIEW NYSE: SSN ASX: SSN 9 » Located in the heart of the Williston Basin in Williams County, productive in the Bakken and Three Forks, surrounded by major players. » Samson is the operator with an average 60 % working interest and 46% net revenue interest, in 1,920 gross acres. » Samson owns 1,200 net acres; 100% of acreage is HBP. » Other key working interest partners include Continental Resources with 40% working interest, who have elected into the initial 4 wells. » Participated in 7 gross wells to date, 6 Bakken , 1 Mission Canyon. » Current net production of 176 BOEPD. » $10.7 million PDP reserves as at 31 December 2012. » NDIC approved 160 acre spacing January 10, 2013. » 2013 Plan » 6 initial infill drilling locations using pad drilling. » 14 infill in total.

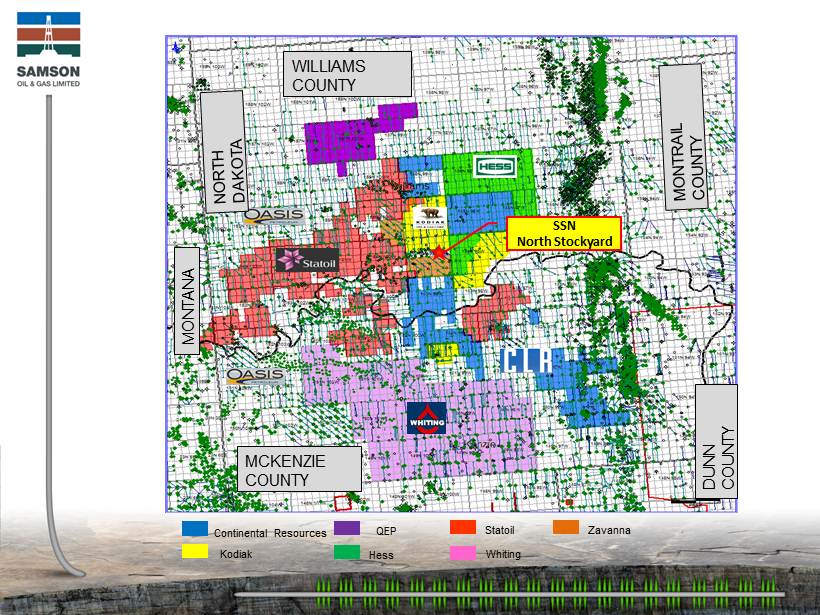

Continental Resources Kodiak Hess QEP Statoil Whiting Zavanna SSN North Stockyard MONTANA WILLIAMS COUNTY MCKENZIE COUNTY DUNN COUNTY

NYSE: SSN ASX: SSN 11 NORTH STOCKYARD, WILLISTON BASIN » FIELD DEVELOPMENT » Bakken and Three Forks objectives » 6,000 ft. Horizontal development. » IP rates up to 3,000 BOEPD. » Rates have shown dramatic improvement as the Bakken technology developed. » SSN working interest around 30% in producing wells. » PARTITION AGREEMENT » Samson owned 30% in 3,840 acres. » Operator and their partners owned 30 %. » Continental Resources owns 40% acquired from Samson Resources (and were not involved in the partition agreement). » Operator has delayed infill development while it pursues the HBP on its larger portfolio. » Operator has therefore proposed and executed an acreage swap south to north. » As a consequence Samson now owns 60% in northern 3 sections and will be operator, whilst retaining 30% in the 7 producing wells.

NORTH STOCKYARD PDP RESERVES 31 DECEMBER 2012* Well Gross EUR Net EUR Net NPV 10 Bakken Pool 1.4 MMSTB 0.3 MMSTB $ 11.6 million Mission Canyon Pool 122MSTB 32 MSTB $0.96 million Total 1.5 MMSTB 0.34 MMSTB $12.5 million NYSE: SSN ASX: SSN 12 *Prepared by Ryder Scott

NORTH STOCKYARD PROVED RESERVES 31 DECEMBER 2012 Net EUR NPV 10 PDP 0.34 MMSTB $12.5 million PUD # 0.34 MMSTB $4.1 million Total Proved 0.64 MMSTB $15.7 million NYSE: SSN ASX: SSN 13 # Includes only 2 of the 14 in - fill wells because 160 acre spacing order was post December 31.

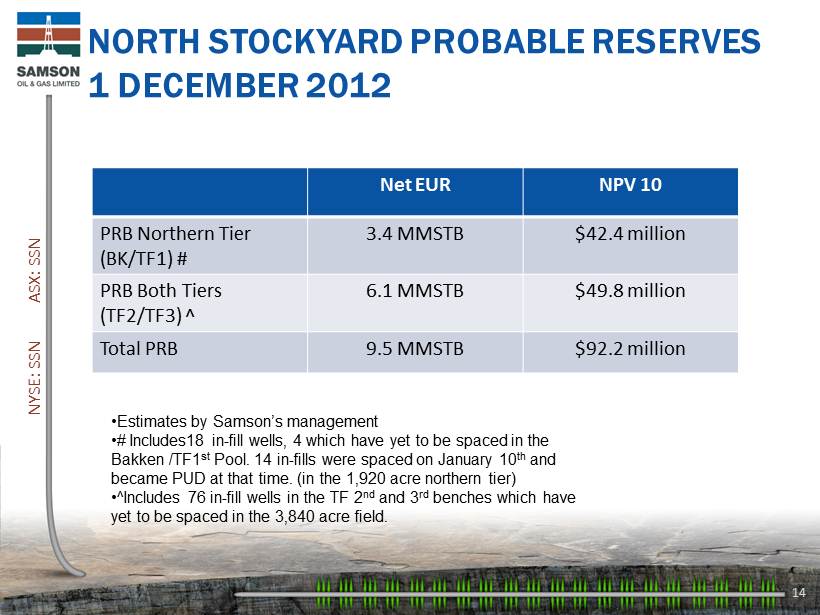

NORTH STOCKYARD PROBABLE RESERVES 1 DECEMBER 2012 Net EUR NPV 10 PRB Northern Tier (BK/TF1) # 3.4 MMSTB $42.4 million PRB Both Tiers (TF2/TF3) ^ 6.1 MMSTB $49.8 million Total PRB 9.5 MMSTB $92.2 million NYSE: SSN ASX: SSN 14 • Estimates by Samson’s management • # Includes18 in - fill wells, 4 which have yet to be spaced in the Bakken /TF1 st Pool. 14 in - fills were spaced on January 10 th and became PUD at that time. (in the 1,920 acre northern tier) • ^Includes 76 in - fill wells in the TF 2 nd and 3 rd benches which have yet to be spaced in the 3,840 acre field.

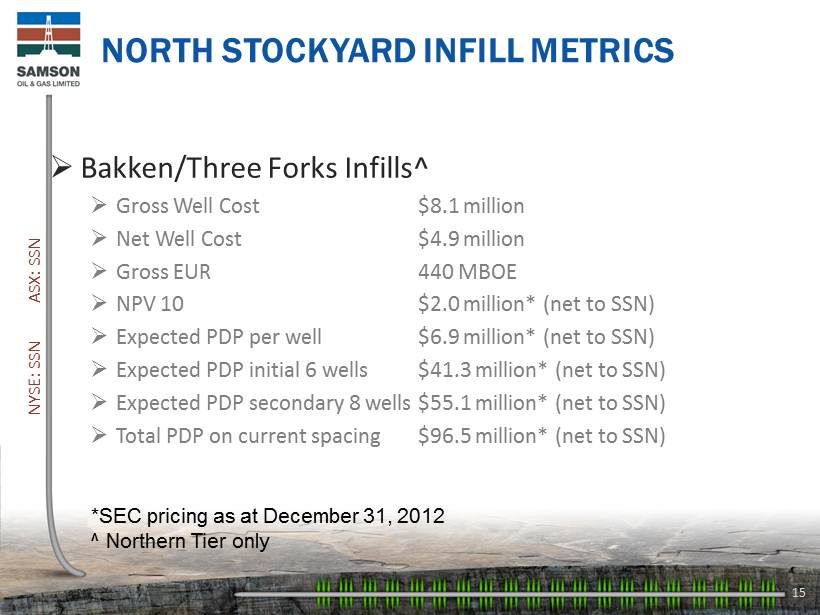

NORTH STOCKYARD INFILL METRICS » Bakken /Three Forks Infills ^ » Gross Well Cost $8.1 million » Net Well Cost $4.9 million » Gross EUR 440 MBOE » NPV 10 $2.0 million* (net to SSN) » Expected PDP per well $6.9 million* (net to SSN) » Expected PDP initial 6 wells $41.3 million* (net to SSN) » Expected PDP secondary 8 wells $55.1 million* (net to SSN) » Total PDP on current spacing $96.5 million* (net to SSN) NYSE: SSN ASX: SSN 15 *SEC pricing as at December 31, 2012 ^ Northern Tier only

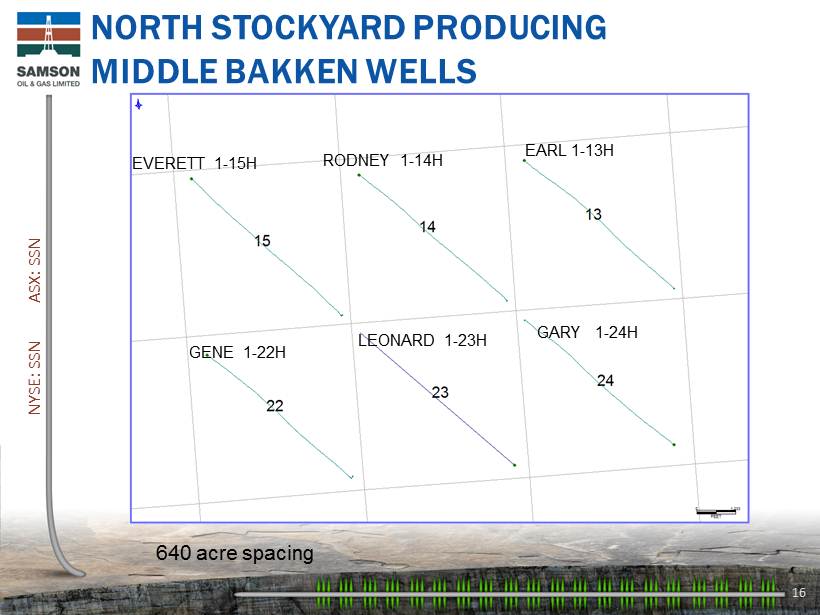

NYSE: SSN ASX: SSN 16 NORTH STOCKYARD PRODUCING MIDDLE BAKKEN WELLS EVERETT 1 - 15H RODNEY 1 - 14H EARL 1 - 13H GENE 1 - 22H LEONARD 1 - 23H GARY 1 - 24H 640 acre spacing

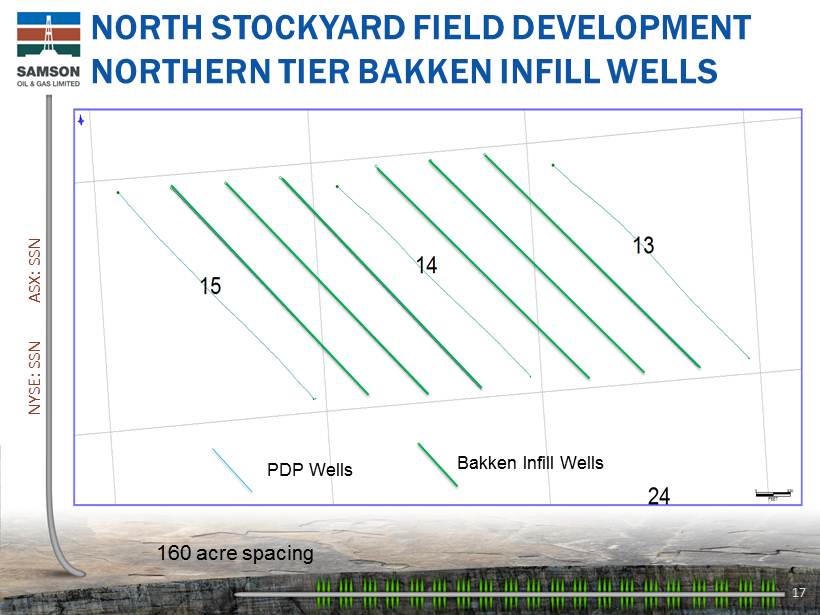

NYSE: SSN ASX: SSN 17 NORTH STOCKYARD FIELD DEVELOPMENT NORTHERN TIER BAKKEN INFILL WELLS Bakken Infill Wells 160 acre spacing PDP Wells

NYSE: SSN ASX: SSN 18 NORTH STOCKYARD FIELD DEVELOPMENT NORTHERN TIER THREE FORKS INFILL WELLS Three Forks Infill Wells 160 acre spacing PDP Wells

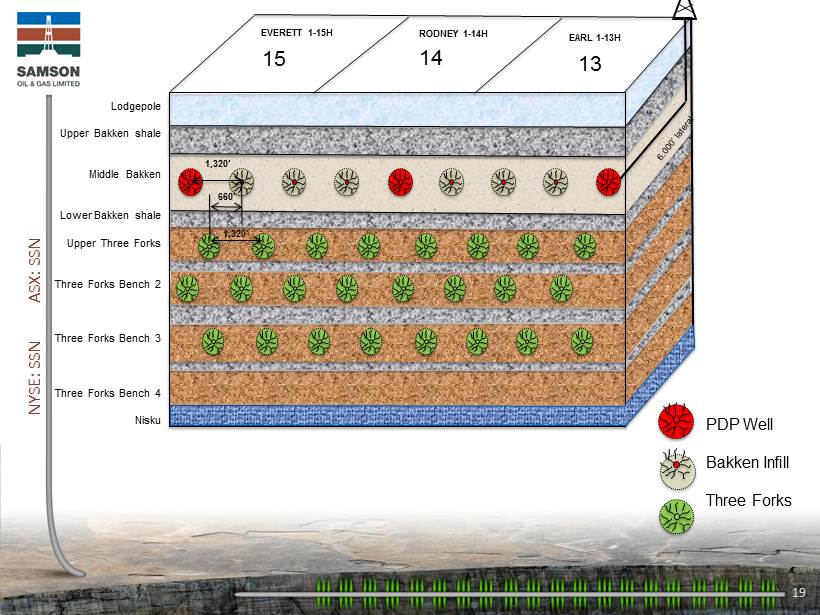

NYSE: SSN ASX: SSN 19 PDP Well Bakken Infill Three Forks Lodgepole Upper Bakken shale Middle Bakken Lower Bakken shale Upper Three Forks Three Forks Bench 2 Three Forks Bench 3 Three Forks Bench 4 Nisku 15 14 13 1,320’ 660’ 1,320’ EVERETT 1 - 15H RODNEY 1 - 14H EARL 1 - 13H

ROOSEVELT PROJECT MONTANA BAKKEN

ROOSEVELT OVERVIEW NYSE: SSN ASX: SSN 21 » Located in the Williston Basin in Roosevelt County, prospective for Bakken and Three Forks. » Samson is the operator with an average 66% working interest. » 30,000 net acres; 3% of acreage is HBP with the remainder expiring 2017. » Participated in 2 gross wells to date. One well outside of pressure cell, the other in a non dolomitic reservoir. » Current net production of 50 BOEPD. » Key upside opportunities: » Production performance under review. » Anticipate participation in two CLR wells across acreage boundary in Q1 2013.

2013 ROOSEVELT » Observe CLR’s Abercrombie production » Samson has a 2.6% working interest » Participate in the CLR Custer Fed 1 - 7 H » Samson has a 4.75% working interest » These wells along with Samson’s existing wells, Gretel II and Australia II will provide adequate engineering control for the further development of the core area NYSE: SSN ASX: SSN 22

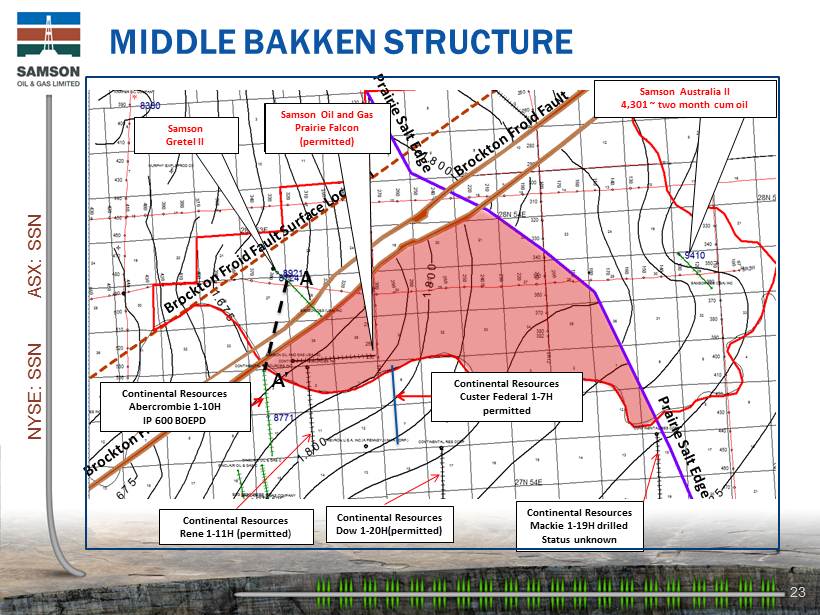

MIDDLE BAKKEN STRUCTURE NYSE: SSN ASX: SSN 23 Samson Gretel II Samson Australia II 4,301 ~ two month cum oil Continental Resources Mackie 1 - 19H drilled Status unknown Continental Resources Dow 1 - 20H(permitted) Continental Resources Rene 1 - 11H (permitted ) Continental Resources Abercrombie 1 - 10H IP 600 BOEPD Samson Oil and Gas Prairie Falcon (permitted) A A’ Continental Resources Custer Federal 1 - 7H permitted

NYSE: SSN ASX: SSN 24 DRILLING SPACING UNITS CONTINENTAL SPACING UNIT = SAMSON SPACING UNIT = Continental Resources Abercrombie 1 - 10H 36,757 bo to date Samson Gretel II Continental Resources Custer Federal 1 - 7H

HAWK SPRINGS PROJECT NORTHERN D - J BASIN, WYOMING

HAWK SPRINGS OVERVIEW NYSE: SSN ASX: SSN 26 » Located in the D - J Basin in Goshen County, Wyoming, prospective for Permian conventional oil and Niobrara unconventional oil » Samson is the operator with an average 40% working interest » Samson owns 19,000 net acres; 2% of acreage is HBP » Participated in 2 gross wells to date with 50 BOPD from Niobrara and one Permo - Penn test still in the process of being completed » Key upside opportunities » Conventional potential from excellent Permian reservoir » Niobrara productive but effective frac length problematic and requires further design refinement. » Closure pressure higher than expected and exceeds quartz sand specifications, that is requires a ceramic propannt to be effective. » Re - frac of two to three stages being planned for March using ceramic popannt

HAWK SPRINGS PROJECT » Drilled Defender, a horizontal Niobrara test » Funded by Halliburton. » Successfully drilled and multi - stage frac . » IP at 288 BOPD in February 2012. » Sustained production rate at around 50 BOPD. » Reservoir analysis suggests limited propped frac length (around 9 feet). » Drilled Spirit of America » Discovered excellent quality aeolian sand reservoirs in the Permian. NYSE: SSN ASX: SSN 27

HAWK SPRINGS PROJECT » Next steps » NIOBRARA » Continue evaluation of the Defender reservoir performance » Frac design can be improved » PERMIAN » Capitalize on positive results of SOA II. » Analysis of SOA leads to re - establishing 3D seismic prospects. » Can map excellent reservoir into a 4 way dip closure (Bluff Federal). » Drill Bluff Federal and American Eagle (Amplitude anomaly). NYSE: SSN ASX: SSN 28

SPIRIT OF AMERICA US34 #2 - 29 WELL NYSE: SSN ASX: SSN 29 9350’ Sand 9500’ Sand 9350’ Sand leak pt. 9300’ Sand Tight rock Tight rock 9300’ Sand 9350’ Sand (tight) anhydrite anhydrite shale 9350’ Sand 9500’ Sand (wet) 9300’ Sand leak pt. anhydrite Anhydrite/shale/ carbonate anhydrite anhydrite Anhydrite/shale/carbonate SOA #2 SOA #2 CARTOON DEPICTION OF SEISMIC SECTION A - A’ SHOWING 9500’ SAND JUXTAPOSED AGAINST 9300’ SAND A A’ shale X - Section A – A’ displaying 9300’ sand trap and the 9500’ sand leak point 9300’ Sand

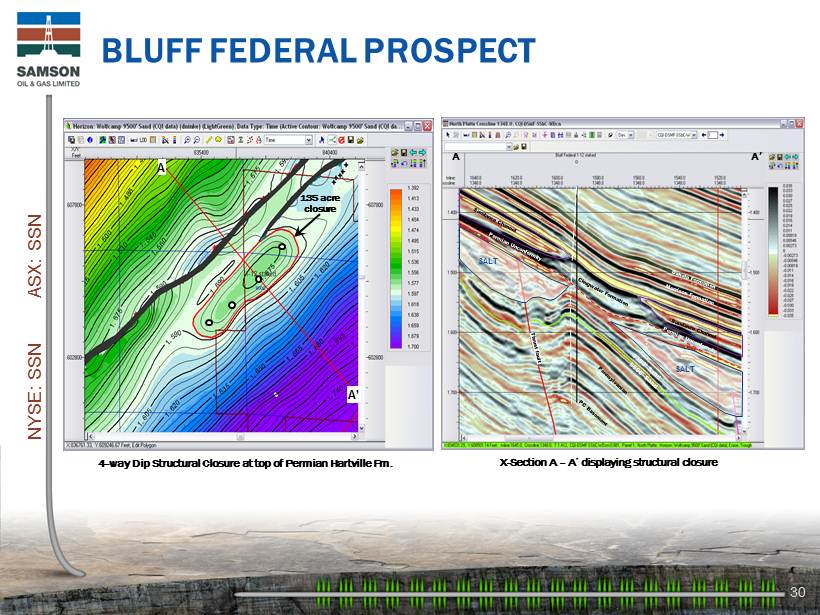

BLUFF FEDERAL PROSPECT NYSE: SSN ASX: SSN 30 A A’ A A’ SALT SALT X - Section A – A’ displaying structural closure 4 - way Dip Structural Closure at top of Permian Hartville Fm. 135 acre closure

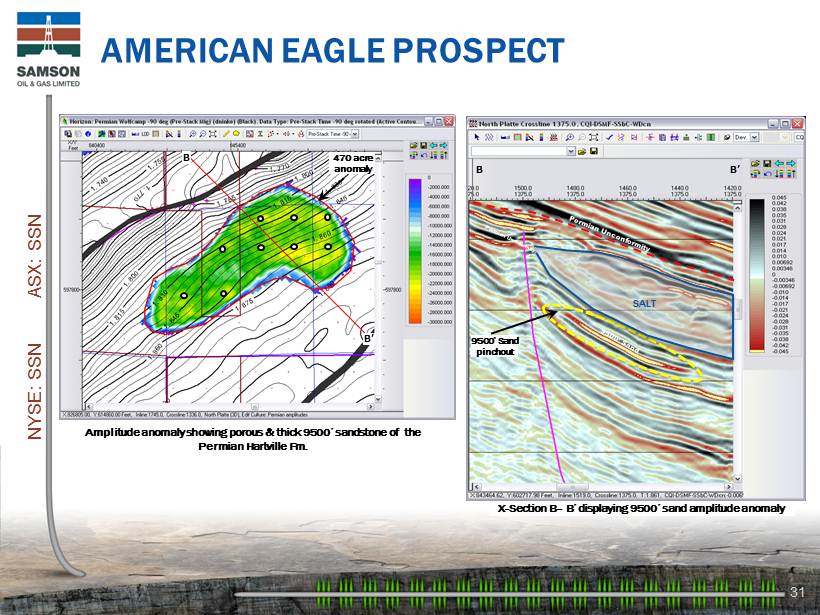

AMERICAN EAGLE PROSPECT NYSE: SSN ASX: SSN 31 470 acre anomaly SALT 9500’ Sand pinchout B B B’ B’ Amplitude anomaly showing porous & thick 9500’ sandstone of the Permian Hartville Fm. X - Section B – B’ displaying 9500’ sand amplitude anomaly

HAWK SPRINGS » PERMIAN » SOA 11 established excellent reservoir quality but water saturated. » 3D seismic explains trap failure due to an intersecting fault. » 20, 3D amplitude anomalies validated by SOA 11 results » Prospectivity therefore enhanced despite dry hole. » Contingent resource of 30 MMSTB. » Valued at $240 million (net to Samson post farmout ). » NIOBRARA » Initial well a “pioneer”. » Established maturity and oil saturation. » Technical analysis determined an inadequate frac length due to poor proppant selection. » Scope for 68, 160 acre net wells. » Contingent resource of 20.5 MMSTB. » Valued at $410 million (net to Samson post farmout ) NYSE: SSN ASX: SSN 32

SOUTH PRAIRIE PROJECT WILLISTON BASIN, NORTH DAKOTA

SOUTH PRAIRIE OVERVIEW NYSE: SSN ASX: SSN 34 » Located in the Williston Basin in Renville and Ward Counties, outside Bakken maturity but prospective for Mission Canyon » Stephens is the operator with an average 28% working interest » Samson owns an average 25% working interest in 25,040 acres or ~6,260 net acres » Key upside opportunities » Offset production establishes trapping mechanism » 3D seismic key to structural definition » Concept is to follow the Prairie Salt Edge where shallow structural closures were created by Prairie salt dissolution » Many producing Mission Canyon field analogs along the Salt Edge trend » 3 - D data being interpreted » First well planned first half 2013, net cost $250,000.

FORFAR PROSPECT NYSE: SSN ASX: SSN 35 » 1 st Prospect to be drilled off the new South Prairie 3 - D seismic survey » Glenburn reservoir of the Mission Canyon Formation » ~ 420 acre 4 - way dip structural closure » Structure has 20 - 30 feet of relief » Structure created by salt dissolution (similar to analog fields on trend) » Porosity attribute on seismic data over prospect is similar to nearby producing oil field » Potential for up to 10 vertical wells drilled on 40 acre spacing units » Wells are 4,700 feet deep, gross cost $1.1 million. » Contingent resource of 3 million barrels of oil gross. » Valued $15 million net to Samson .

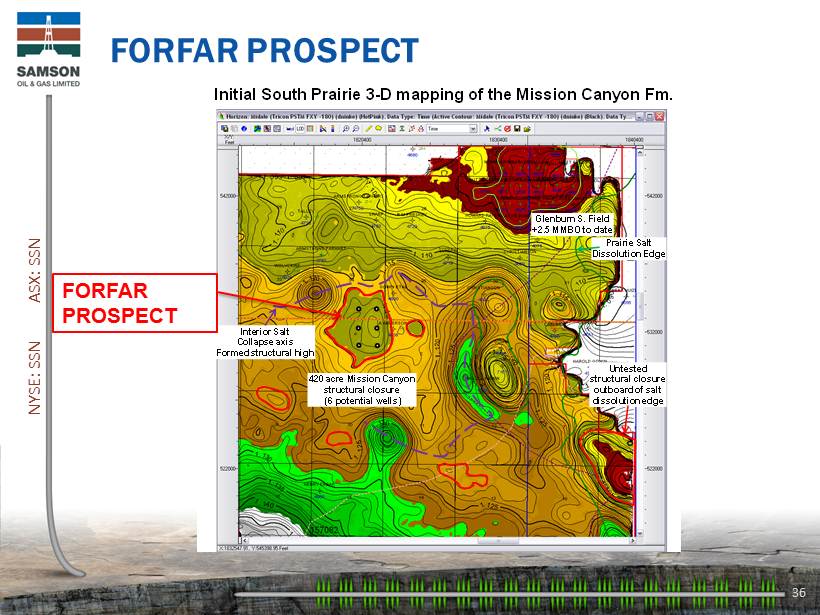

FORFAR PROSPECT NYSE: SSN ASX: SSN 36 420 acre Mission Canyon structural closure (6 potential wells) Initial South Prairie 3 - D mapping of the Mission Canyon Fm. Glenburn S. Field +2.5 MMBO to date Prairie Salt Dissolution Edge Interior Salt Collapse axis Formed structural high Untested structural closure outboard of salt dissolution edge FORFAR PROSPECT

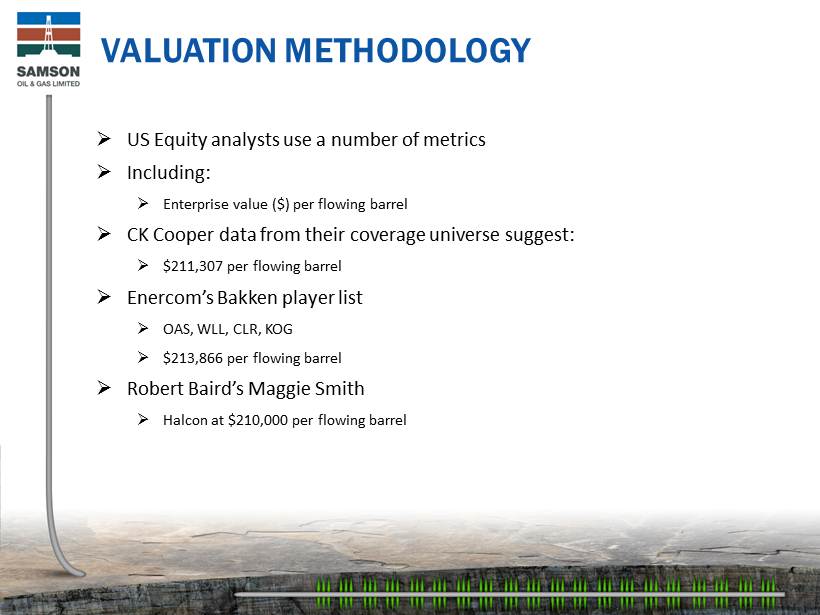

VALUATION METHODOLOGY » US Equity analysts use a number of metrics » Including: » Enterprise value ($) per flowing barrel » CK Cooper data from their coverage universe suggest: » $211,307 per flowing barrel » Enercom’s Bakken player list » OAS, WLL, CLR, KOG » $213,866 per flowing barrel » Robert Baird’s Maggie Smith » Halcon at $210,000 per flowing barrel

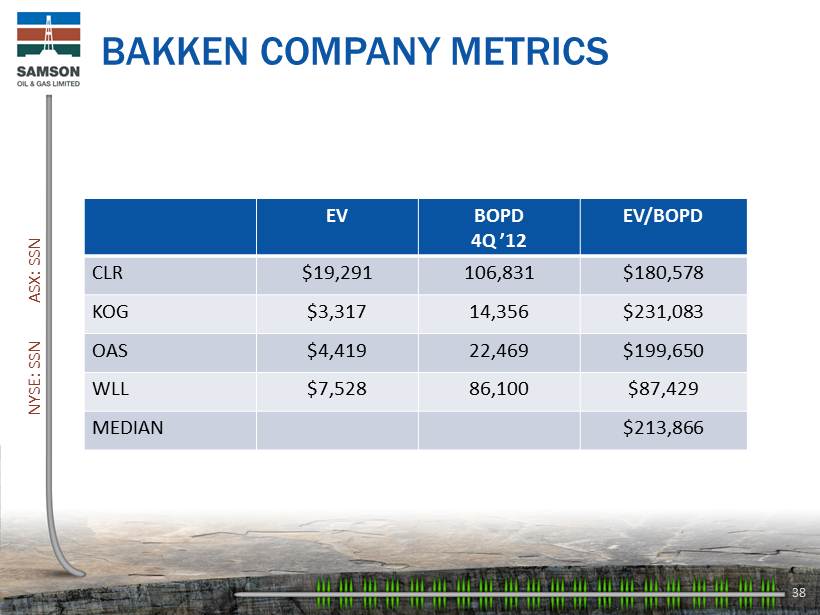

BAKKEN COMPANY METRICS NYSE: SSN ASX: SSN 38 EV BOPD 4Q ’12 EV/BOPD CLR $19,291 106,831 $180,578 KOG $3,317 14,356 $231,083 OAS $4,419 22,469 $199,650 WLL $7,528 86,100 $87,429 MEDIAN $213,866

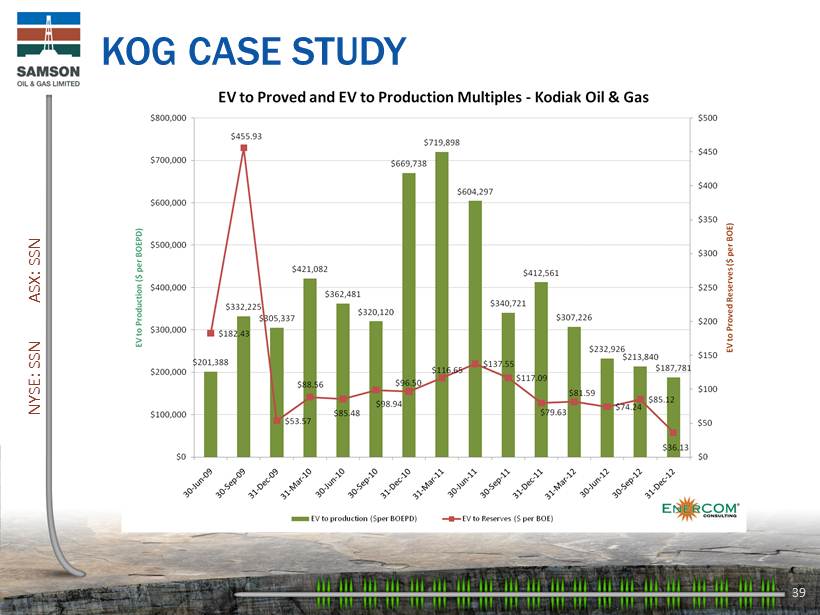

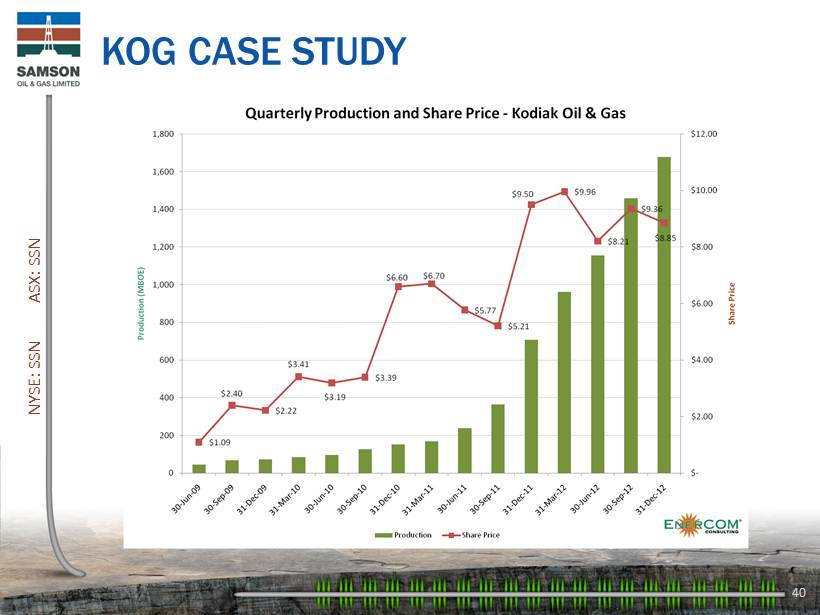

KOG CASE STUDY NYSE: SSN ASX: SSN 39

KOG CASE STUDY NYSE: SSN ASX: SSN 40

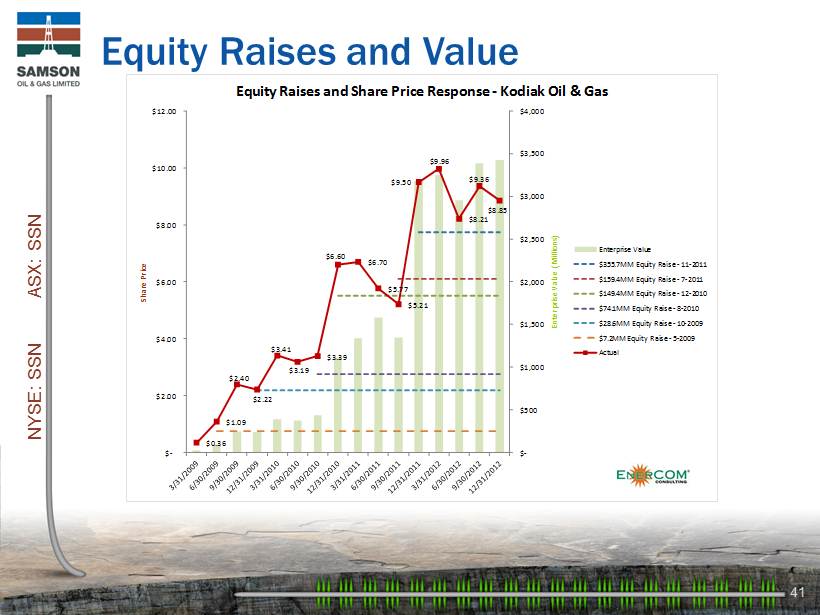

41 NYSE: SSN ASX: SSN Equity Raises and Value $0.36 $1.09 $2.40 $2.22 $3.41 $3.19 $3.39 $6.60 $6.70 $5.77 $5.21 $9.50 $9.96 $8.21 $9.36 $8.85 $ - $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $ - $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 Enterprise Value (Millions) Share Price Equity Raises and Share Price Response - Kodiak Oil & Gas Enterprise Value $355.7MM Equity Raise - 11 - 2011 $159.4MM Equity Raise - 7 - 2011 $149.4MM Equity Raise - 12 - 2010 $74.1MM Equity Raise - 8 - 2010 $28.6MM Equity Raise - 10 - 2009 $7.2MM Equity Raise - 5 - 2009 Actual

KOG CASE STUDY NYSE: SSN ASX: SSN 42 » Equity market “pre - valued” their production expansion, along with speculative take over possibilities. » Valuation peaked at $700,000 per flowing barrel . » Currently at around $230,000 per flowing barrel. (Compared to YE 2102 of $187,000)

SSN ANALOGY Production Rate EV YE 2012 (Actual) 219 BOEPD $41 million YE 2013 (Expected) 1,200 BOEPD $226 million YE 2014 (Expected) 1,600 BOEPD $301 million NYSE: SSN ASX: SSN 43 PRODUCTION METRIC $240,000 PER FLOWING BARREL Assumes 1 continuous rig infill program

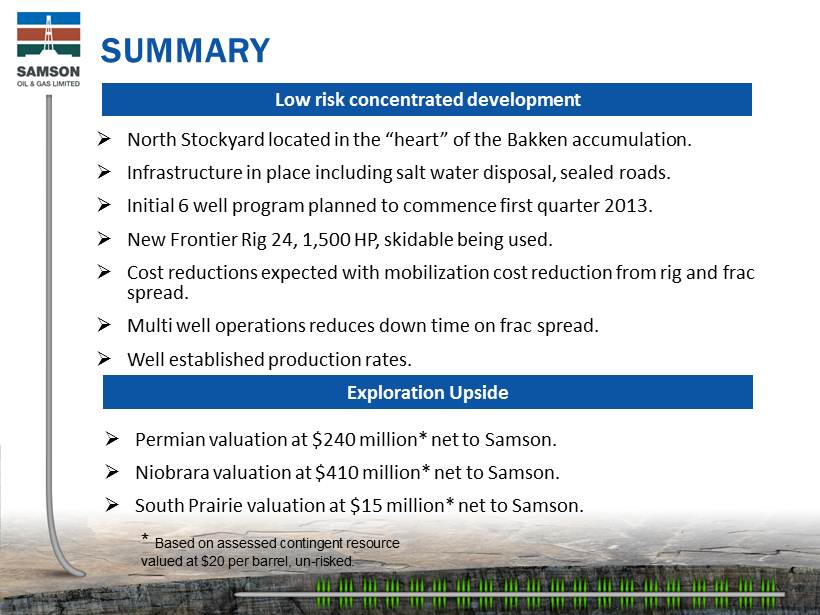

SUMMARY » North Stockyard located in the “heart” of the Bakken accumulation. » Infrastructure in place including salt water disposal, sealed roads. » Initial 6 well program planned to commence first quarter 2013. » New Frontier Rig 24, 1,500 HP, skidable being used. » Cost reductions expected with mobilization cost reduction from rig and frac spread. » Multi well operations reduces down time on frac spread. » Well established production rates. Low risk concentrated development Exploration Upside » Permian valuation at $240 million* net to Samson. » Niobrara valuation at $410 million* net to Samson . » South Prairie valuation at $15 million* net to Samson. * Based on assessed contingent resource valued at $20 per barrel, un - risked.